1. Introduction

Global energy systems are accelerating toward a low-carbon transition. This transition is driving multidimensional transformations—technological innovation, market restructuring, and shifts in energy demand composition—while tightening the linkages and interactions among energy firms [

1,

2,

3,

4]. At the same time, the increasing frequency of major disruptive events—such as the global COVID-19 pandemic, escalating geopolitical conflicts, and heightened uncertainty over energy policy—has persistently jolted firms’ individual operating conditions and the networks connecting them, thereby markedly strengthening co-movement across the energy-firm cohort. As a leading global energy consumer and emitter of carbon, China is a pivotal player in the global energy landscape [

5,

6]. Against this backdrop, a systematic investigation of the mechanisms of risk connectedness among Chinese energy firms—and of the dynamic evolution of their risk connectedness under major events and external uncertainty shocks—has substantial theoretical significance for deepening our understanding of the complex relational logic of the energy system during the transition.

Scholars have sought to unpack the energy system’s complex interdependencies from multiple vantage points. Existing work can be grouped into three dimensions: first, the macro level, which reveals spillover effects across national energy markets at the global scale [

7,

8,

9]. For example, Wang et al. [

7] use a spillover index based on TVP-VAR together with wavelet coherence analysis to study price-volatility spillovers between global energy markets and China’s energy market. Second, the meso-level, which examines spillovers across energy submarkets within the energy market itself [

10,

11,

12,

13]. For instance, in Zhang and Chen [

13], a DCC-GARCH approach is applied to evaluate volatility and evolving correlations between crude oil, renewable energy, and aggregate commodities. Third, the micro level, which identifies firm-level risk spillovers among energy firms [

14,

15]. For example, Chen et al. [

15] apply exponential quantile regression and a tail-risk spillover model to construct a dynamic network of tail-risk transmission among China’s petroleum and petrochemical firms. However, existing studies lack a systematic comparison and integrated analysis of the linkages across the macro, meso, and micro levels, making it difficult to comprehensively depict the overall risk transmission process within the energy system. Consequently, the interactive effects and heterogeneous characteristics of risk spillovers across different levels remain to be further explored. To address this gap, we measure the inter-firm risk connectedness using the LASSO-VAR-DY framework and then extend the analysis to the industry and system levels, yielding a multi-layer “system-industry-firm” analytical framework. This constitutes the first contribution of the paper.

External uncertainty shocks to the energy system have increasingly become a focal concern in the literature. The research can be grouped into three strands: firstly, studies that rely on a single uncertainty index [

16,

17,

18,

19]. For example, An et al. [

18] construct a DAGM-CPU model from a dual-domain perspective to uncover the dual asymmetric features of climate policy uncertainty—driven risk spillovers in China’s energy markets. Additionally, analyze energy risk connectedness under the interaction of multiple uncertainty indices [

20,

21,

22], as seen in Dong et al. [

20], who employ a quantile vector autoregression to assess how extreme weather and policy uncertainty shape spillovers; and thirdly, event-based approaches [

23,

24,

25,

26], exemplified by Jia and Dong [

23], who use TVP-VAR-DY and TVP-SVAR-SV models, and partition COVID-19 into four phases, examine phase-specific spillover effects and determinants for clean-energy stocks. However, most studies treat indices and events in isolation rather than within a unified framework. To bridge this gap, we select representative events within the sample period to trace the evolution of internal risk connectedness in the energy system, develop a dual-track qualitative-quantitative research design, and further analyze how heterogeneity in sectors’ net risk-receiving positions conditions their impulse responses to uncertainty indices; together, these elements constitute the paper’s second contribution.

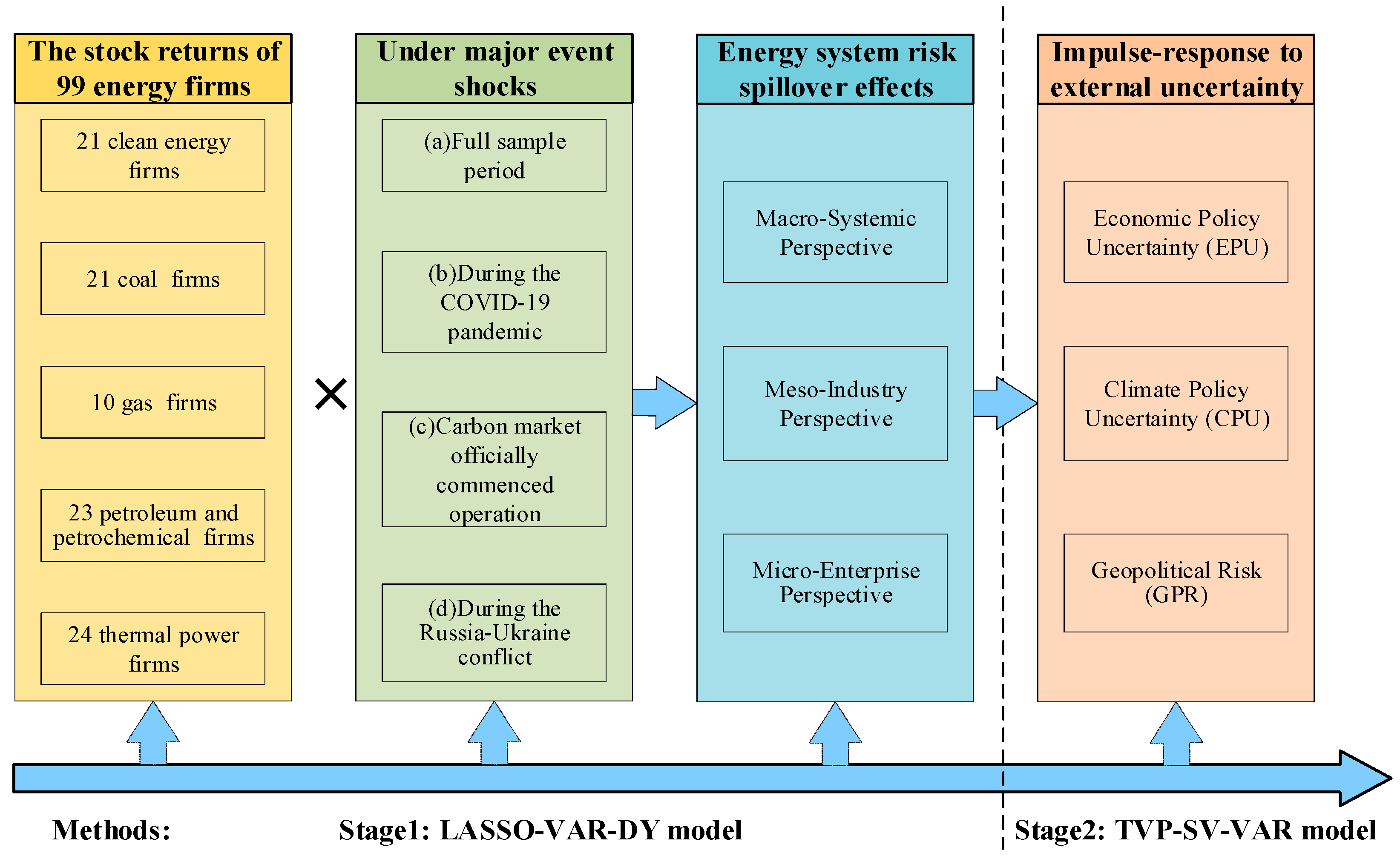

Taken together, this paper first employs the LASSO-VAR-DY approach to investigate the risk connectedness among 99 listed energy firms. Using multiple major events as the analytical framework, it identifies the dynamic changes in the energy system’s risk connectedness under event shocks. Further, it generalizes these effects to the industry level for analysis. Finally, we incorporate economic policy uncertainty (EPU), climate policy uncertainty (CPU), and geopolitical risk (GPR) as external uncertainty shocks and analyze the impulse responses of sectoral net risk-spillover inflows to these uncertainties (the research framework is shown in

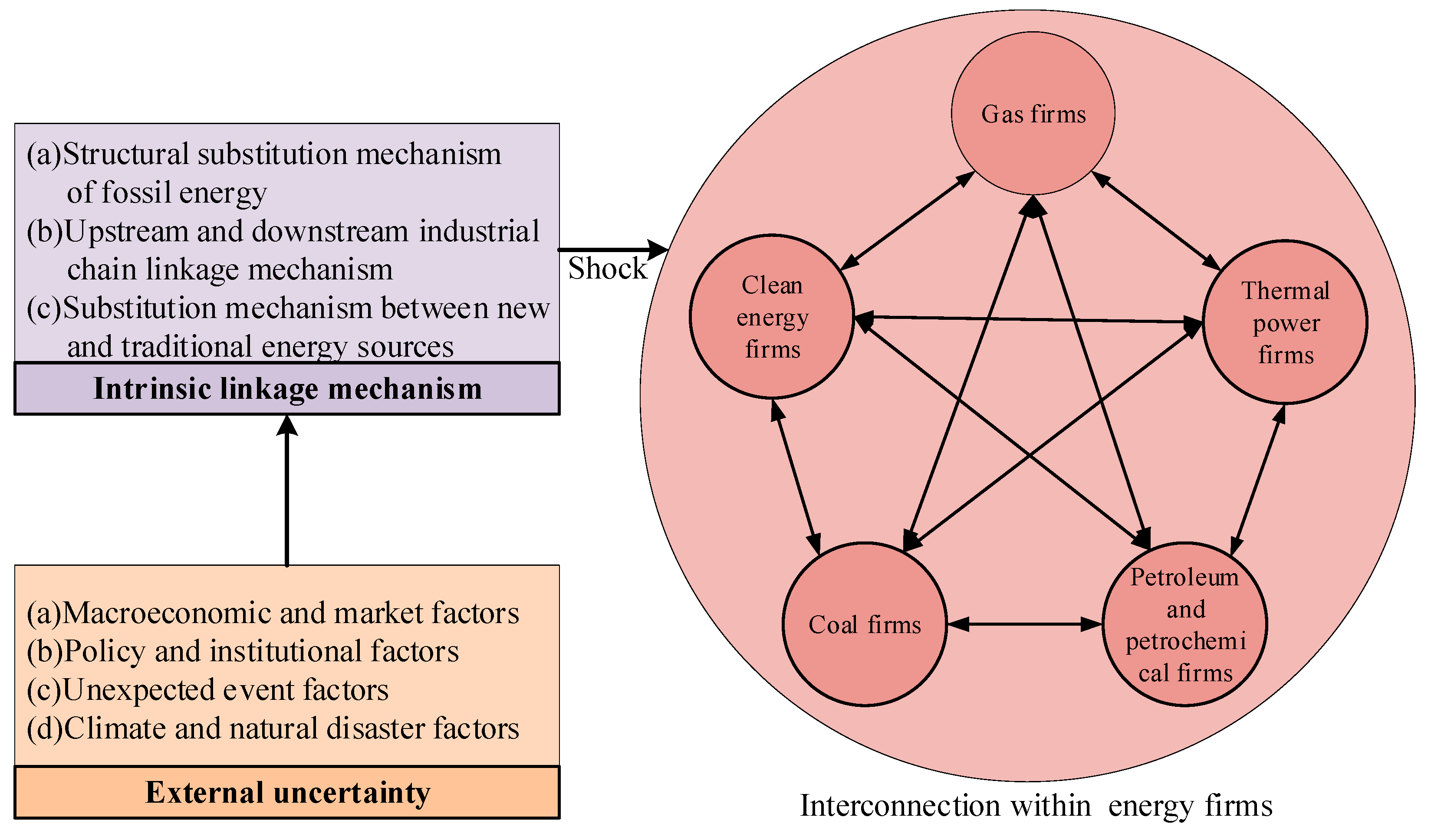

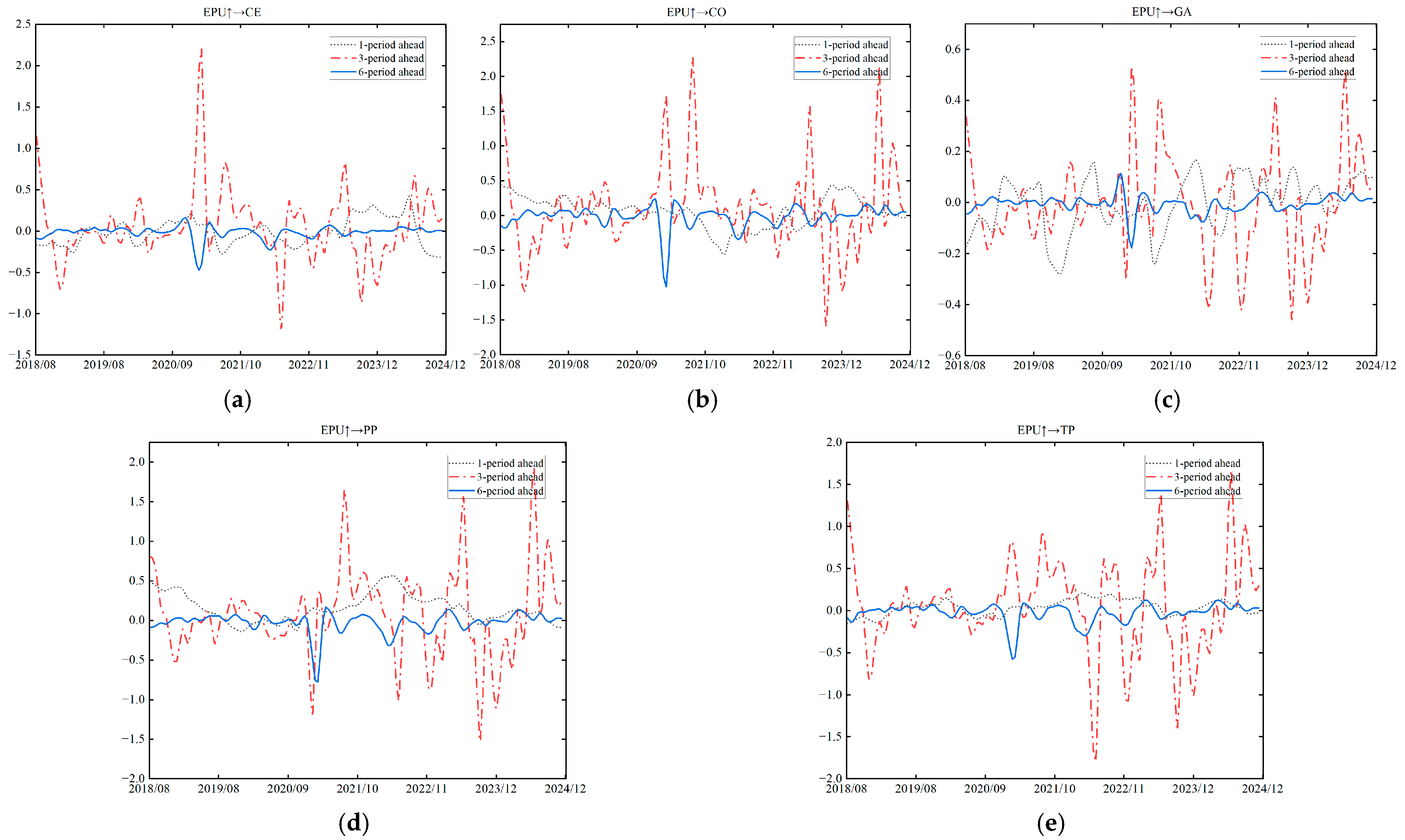

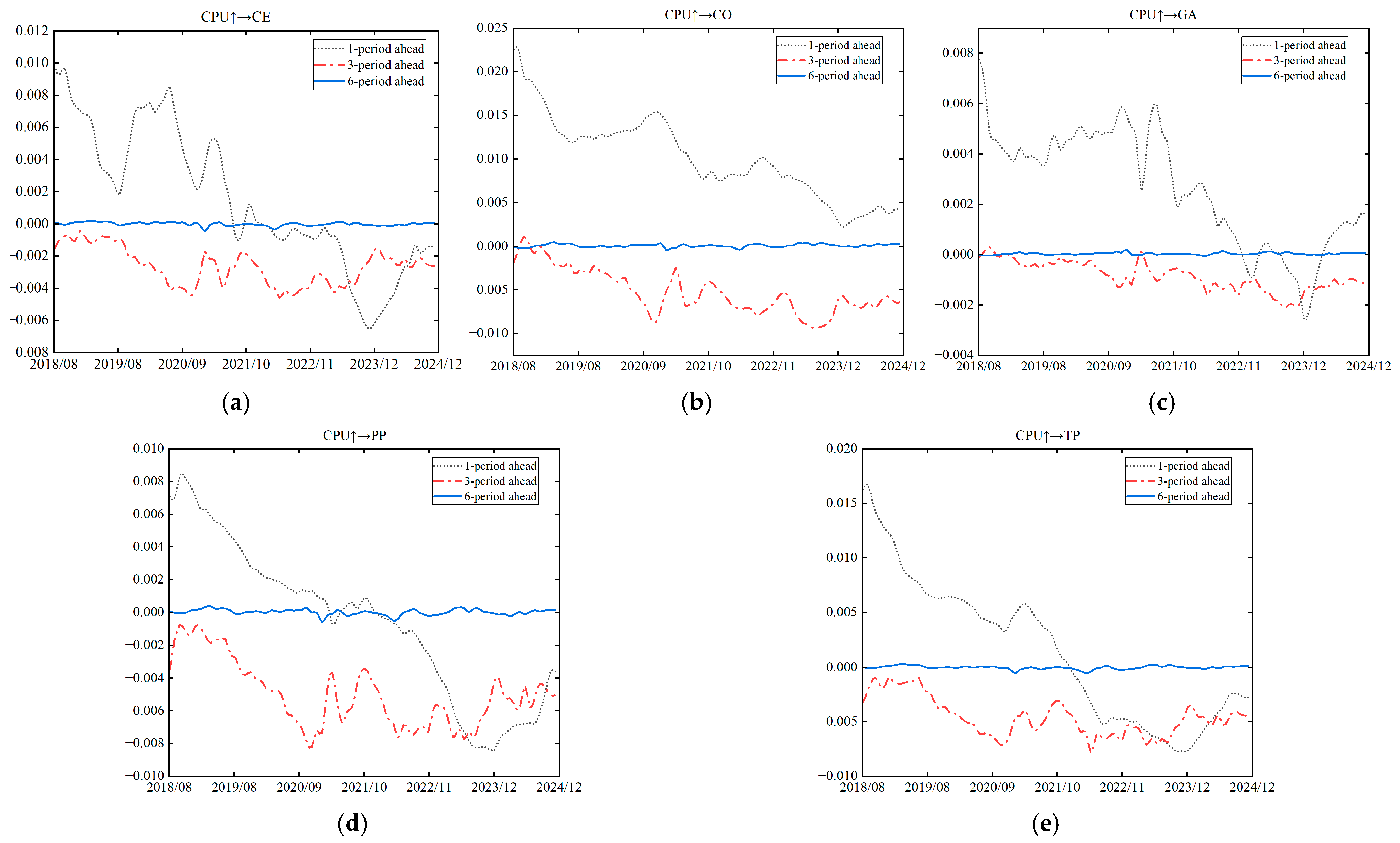

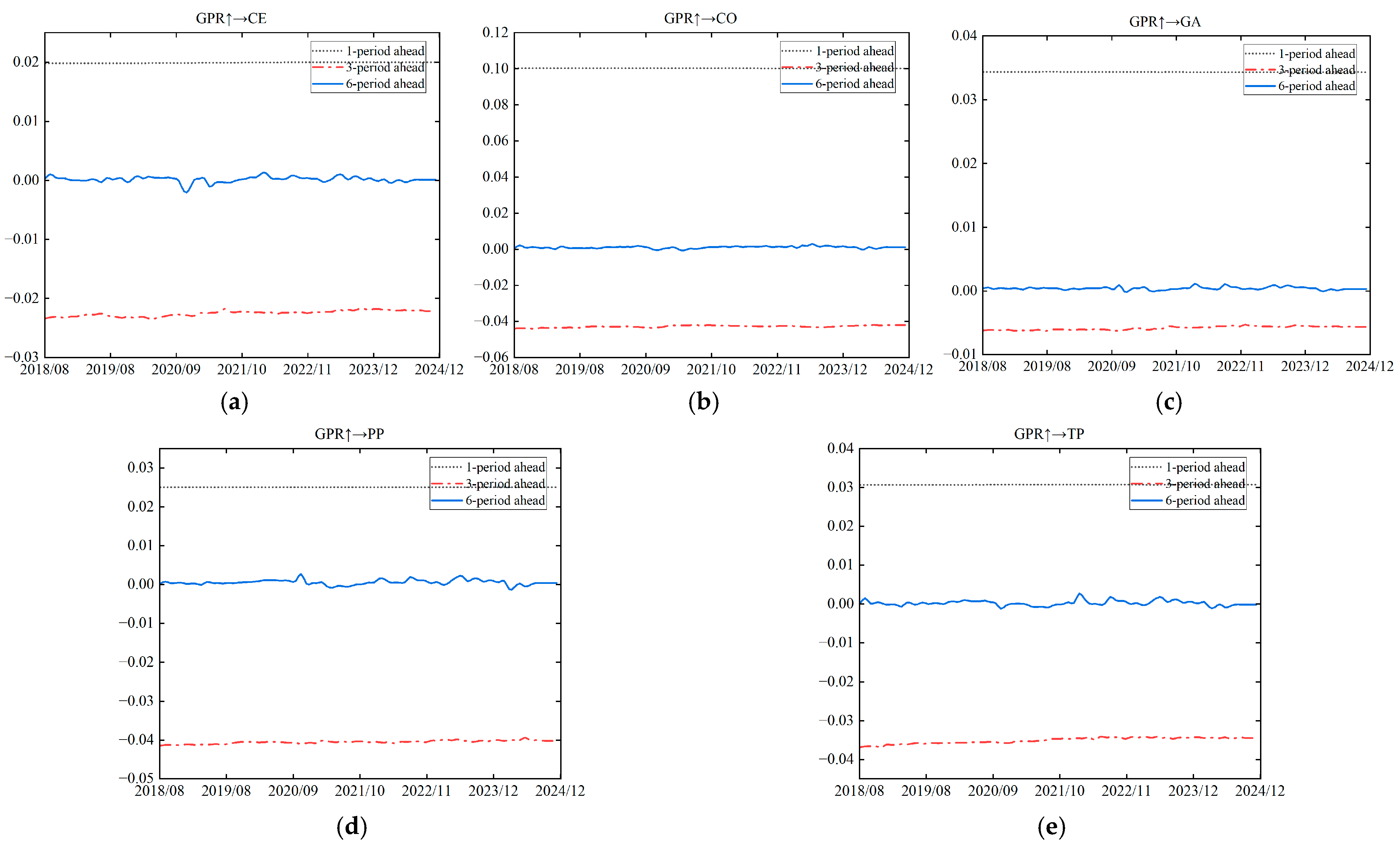

Figure 1). The potential contributions of this paper are threefold: (1) It extends the existing literature, which has primarily analyzed energy risk interconnections from single dimensions such as the market or the firm, leading to a fragmented understanding of the overall energy system. This study advances the analysis from the firm level to the industry level and constructs a multi-level comprehensive analytical framework of “system-industry-firm,” thereby providing a holistic view of energy risk spillover effects across multiple layers. (2) It qualitatively investigates the linkage mechanisms of the energy system under external uncertainty shocks and further conducts quantitative analysis based on major events and uncertainty indices, establishing a dual-track “qualitative-quantitative” research framework. This approach offers deeper insights into the dynamic evolution of energy system risk connectivity under external uncertainty shocks. (3) It yields several novel and policy-relevant findings: different major events affect inter-firm risk connectedness through heterogeneous mechanisms—the global COVID-19 pandemic and official launch of the national carbon market primarily intensify node-to-node connectedness, whereas the Russia-Ukraine conflict mainly amplifies spillover intensity between nodes. In addition, the effects of uncertainty index shocks differ markedly: economic policy uncertainty (EPU) has the most substantial impact, followed by climate policy uncertainty (CPU), while geopolitical risk (GPR) is the weakest.

This paper has six sections. After the introduction,

Section 2 discusses the mechanisms and theoretical analysis;

Section 3 presents the methodology;

Section 4 analyzes the risk connectedness under major-event shocks;

Section 5 examines impulse responses under uncertainty shocks;

Section 6 concludes.

6. Conclusions

Using multiple major events as the analytical frame, this paper applies LASSO-VAR-DY to study the risk spillover network of China’s listed energy firms from 2018 to 2024. Further, it extends firm-level connectedness to the industry level to identify system-level connectedness under major-event shocks. Based on recursively constructed industry-level series, a TVP-SV-VAR model is then used to evaluate the impulse responses of China’s energy industries to shocks in economic policy uncertainty (EPU), climate policy uncertainty (CPU), and China’s geopolitical risk (GPR). The main findings are:

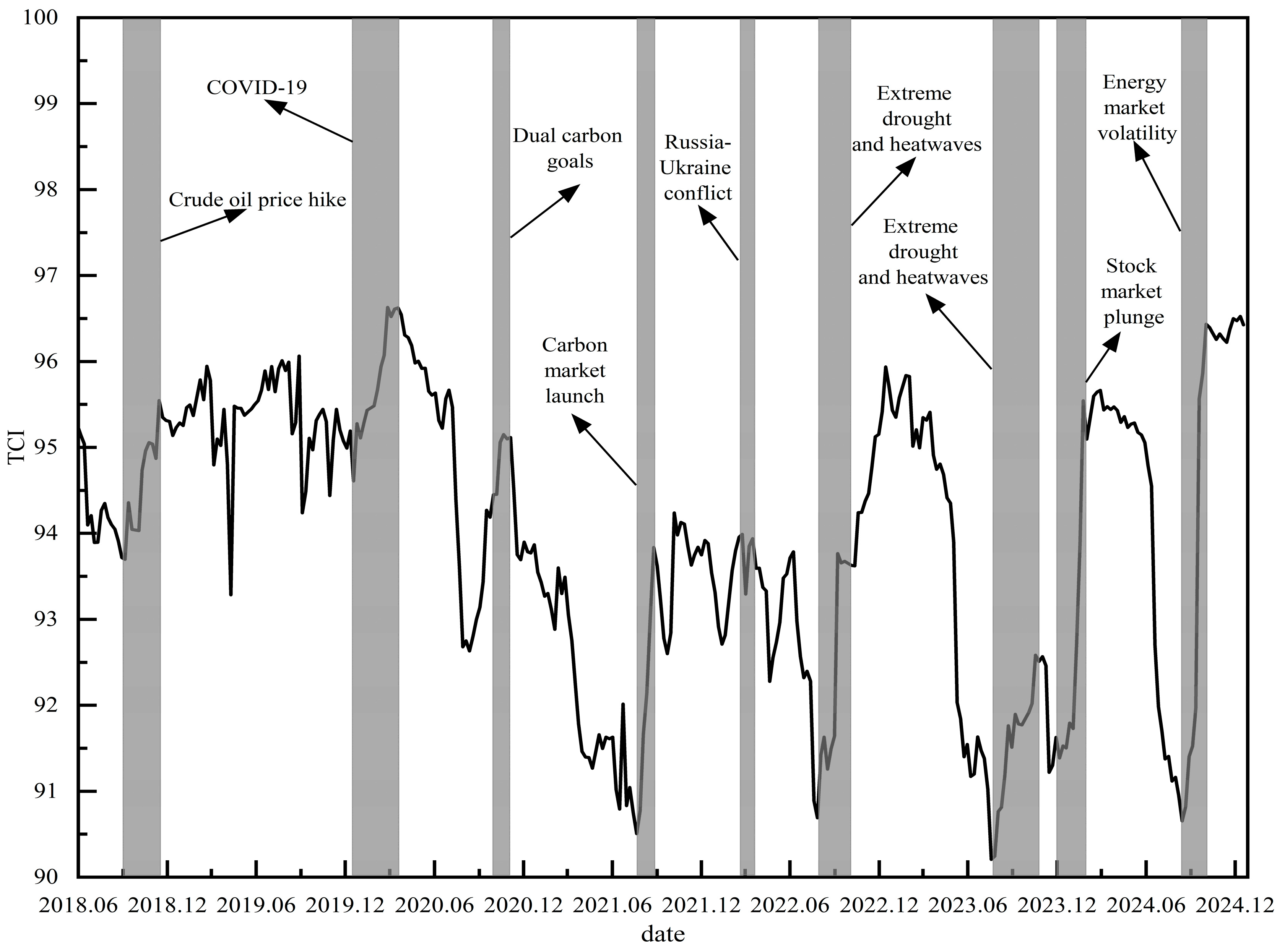

(1) The energy system’s overall risk connectedness remains high, with regime-like shifts and persistent fluctuations. The system is vulnerable, and macroeconomic and market factors, policy and institutional factors, major unexpected events, climate and natural-disaster factors all exert significant effects on overall risk.

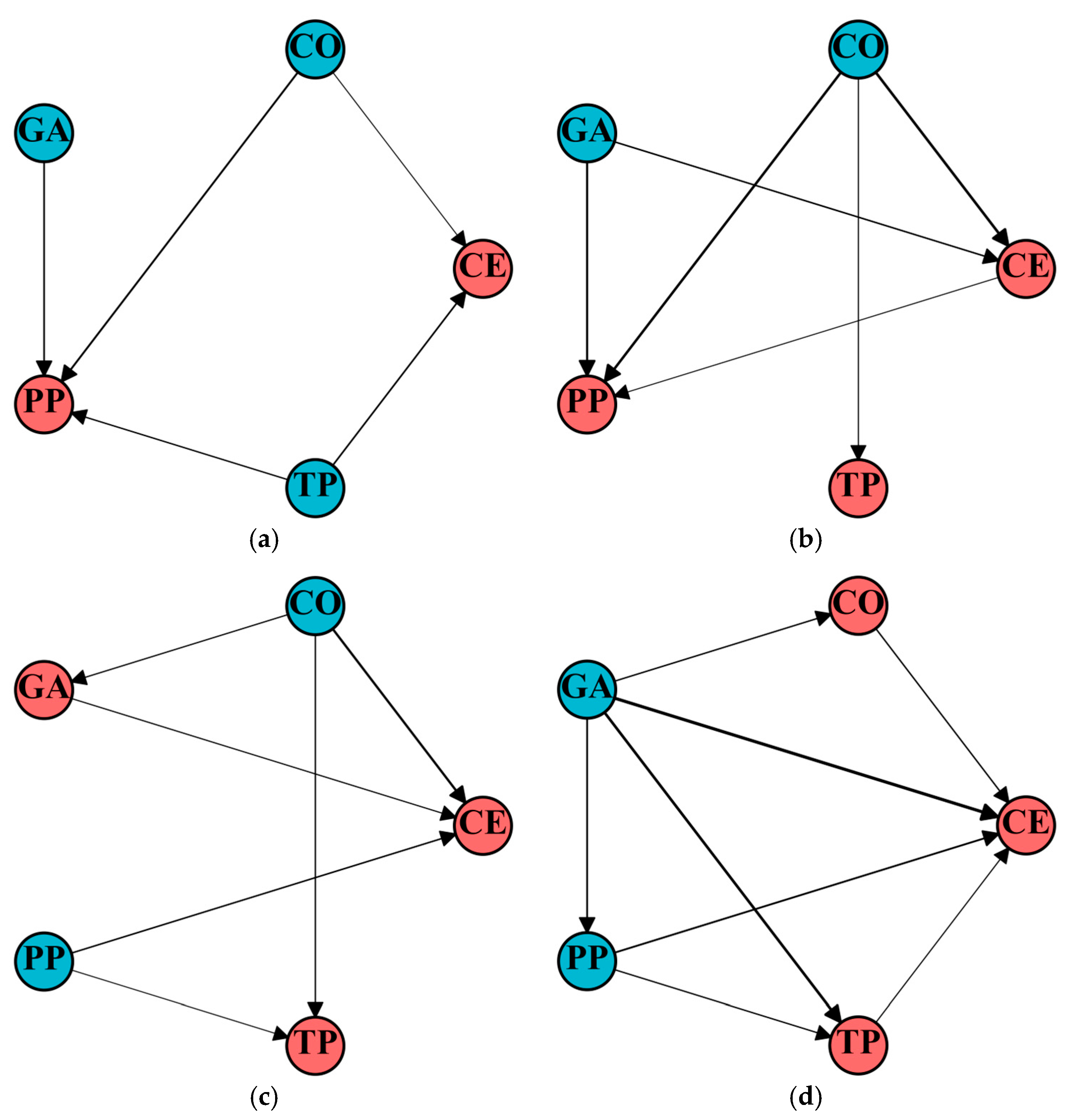

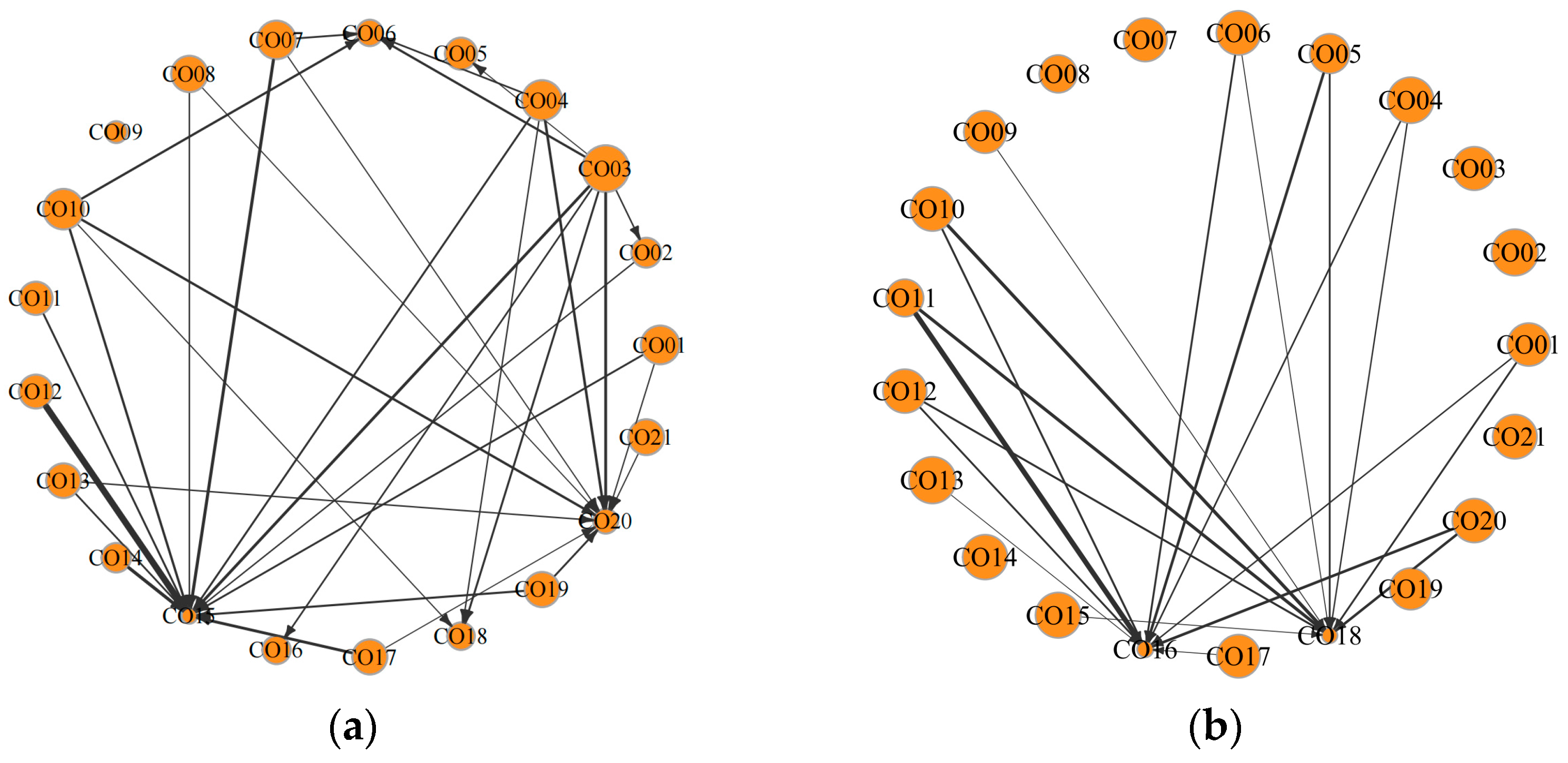

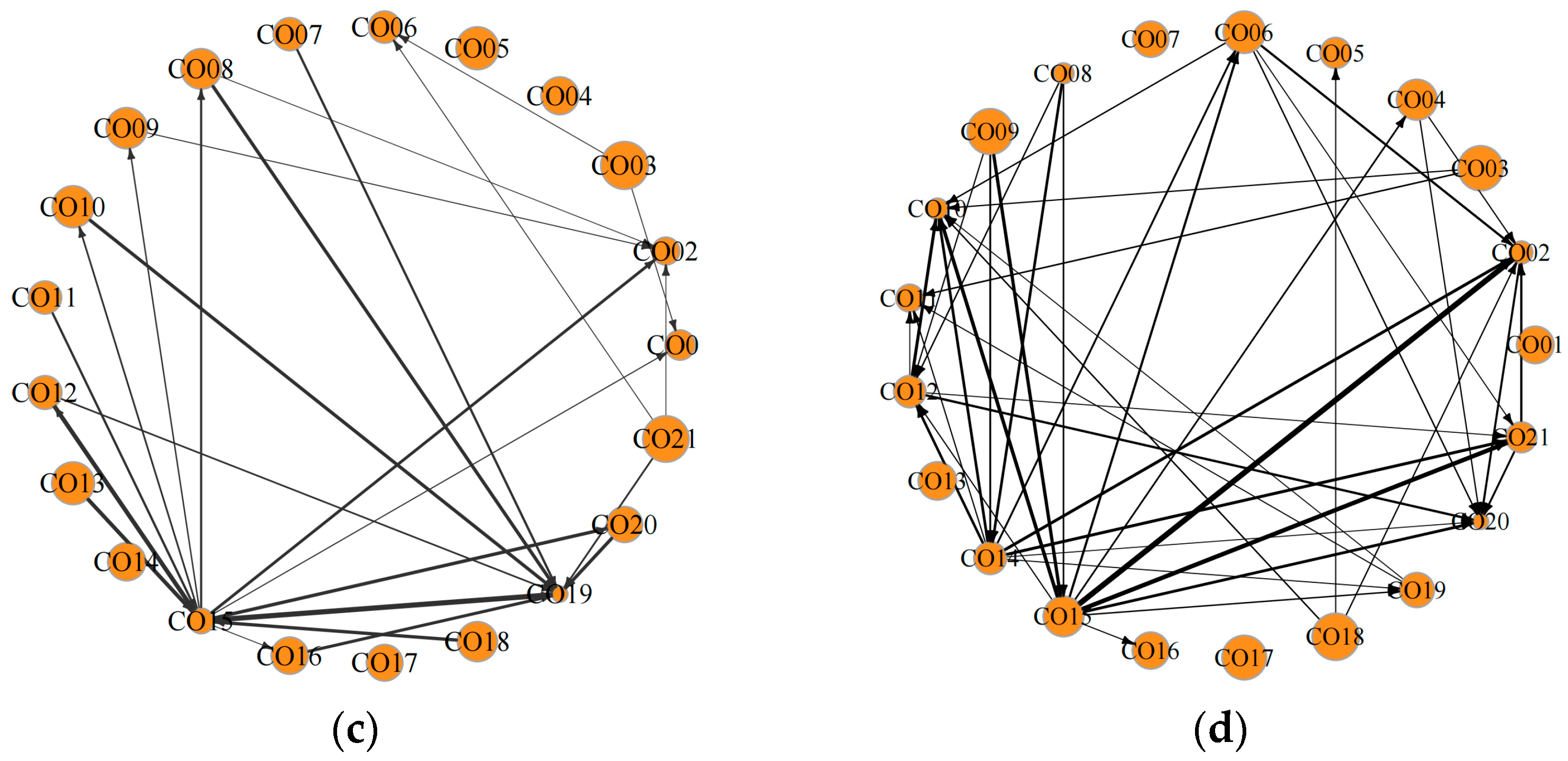

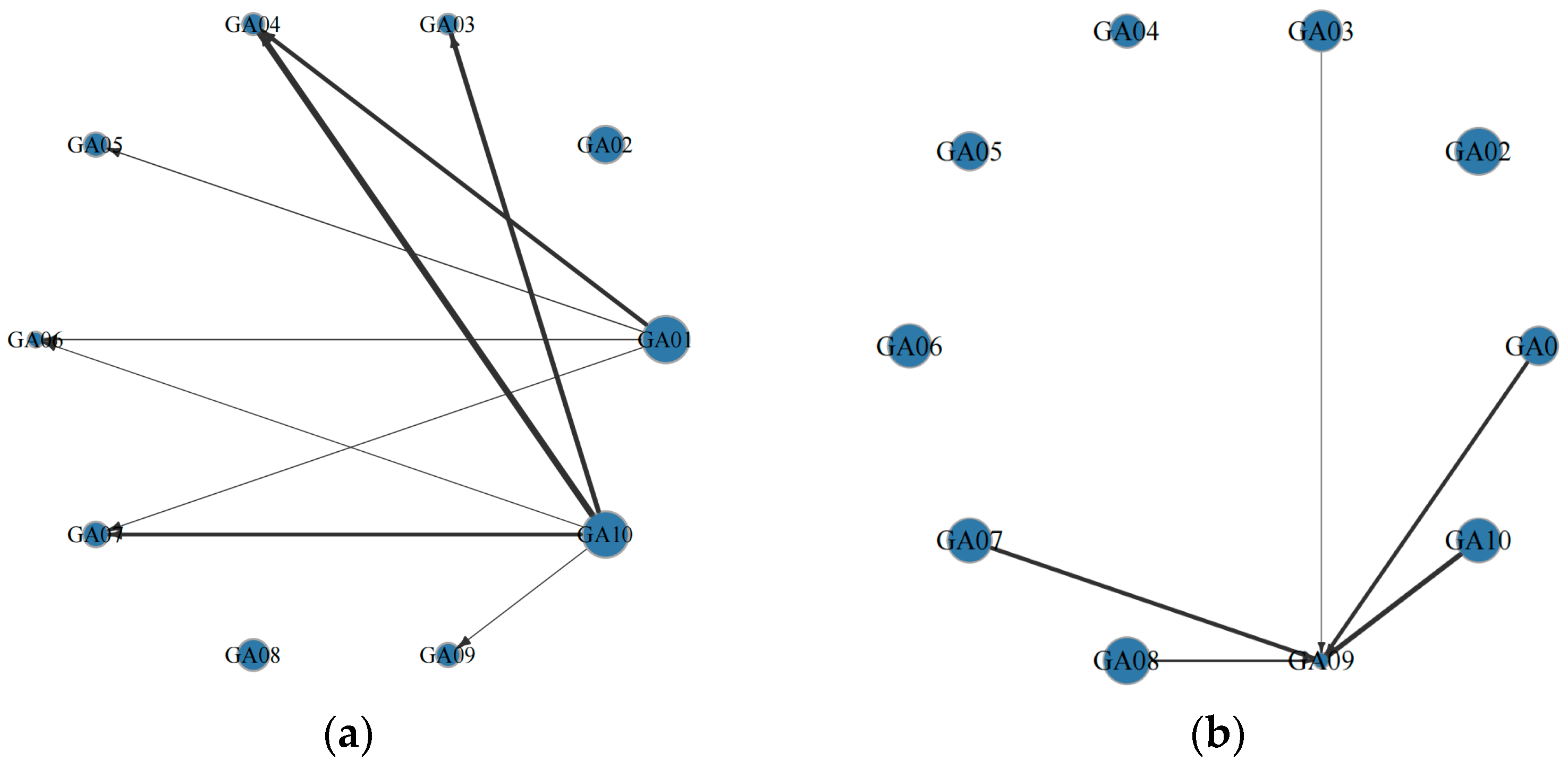

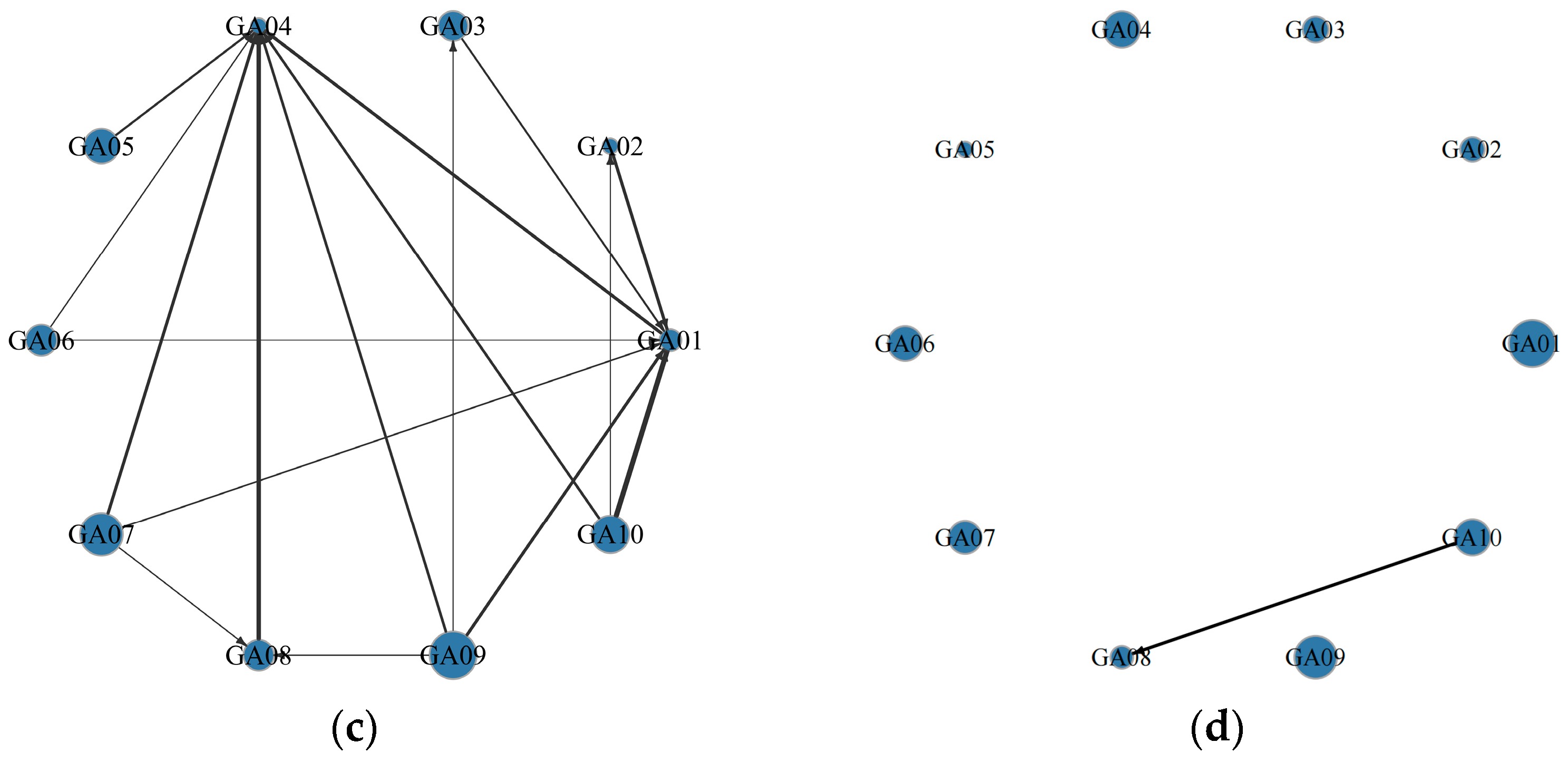

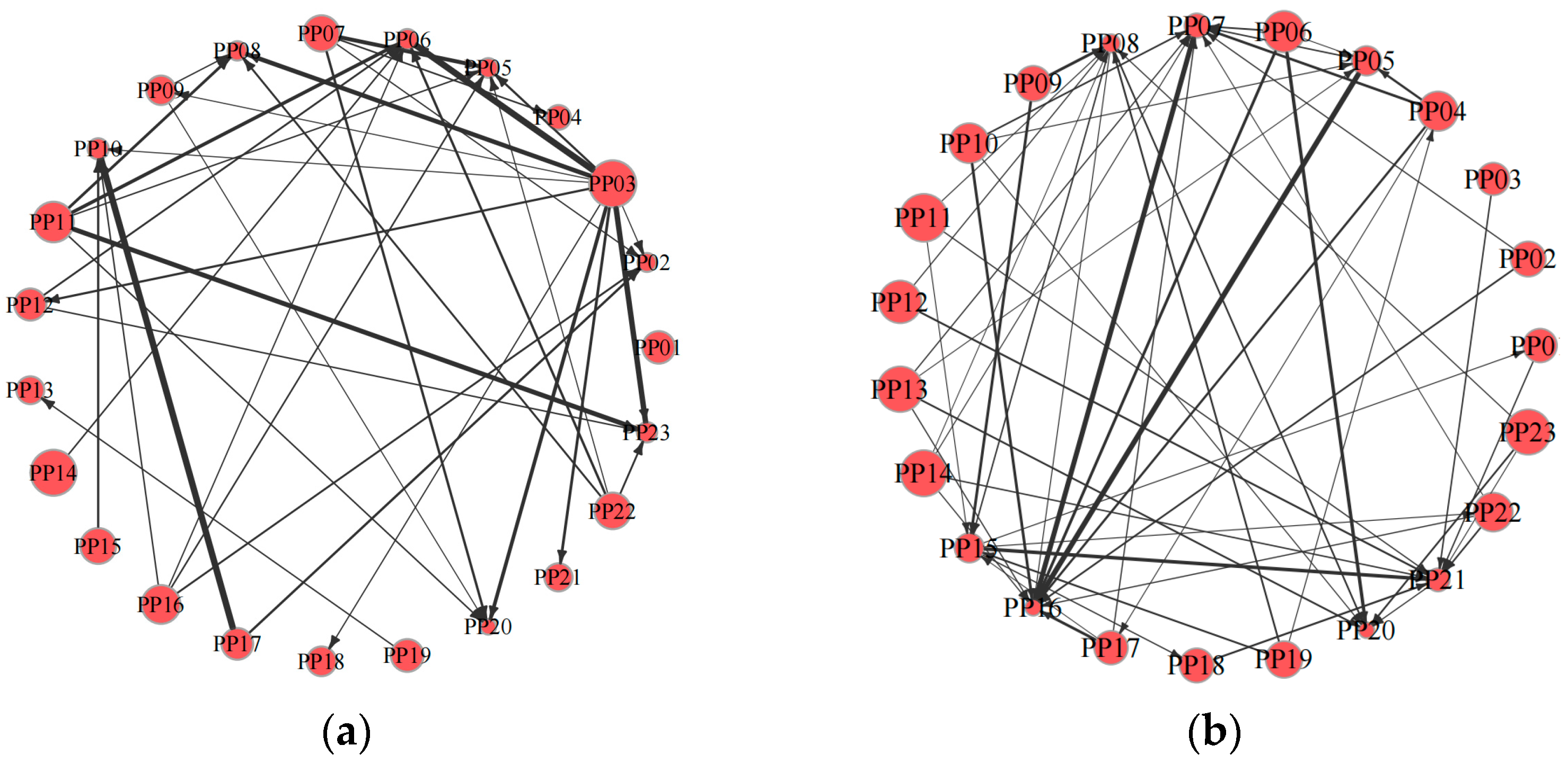

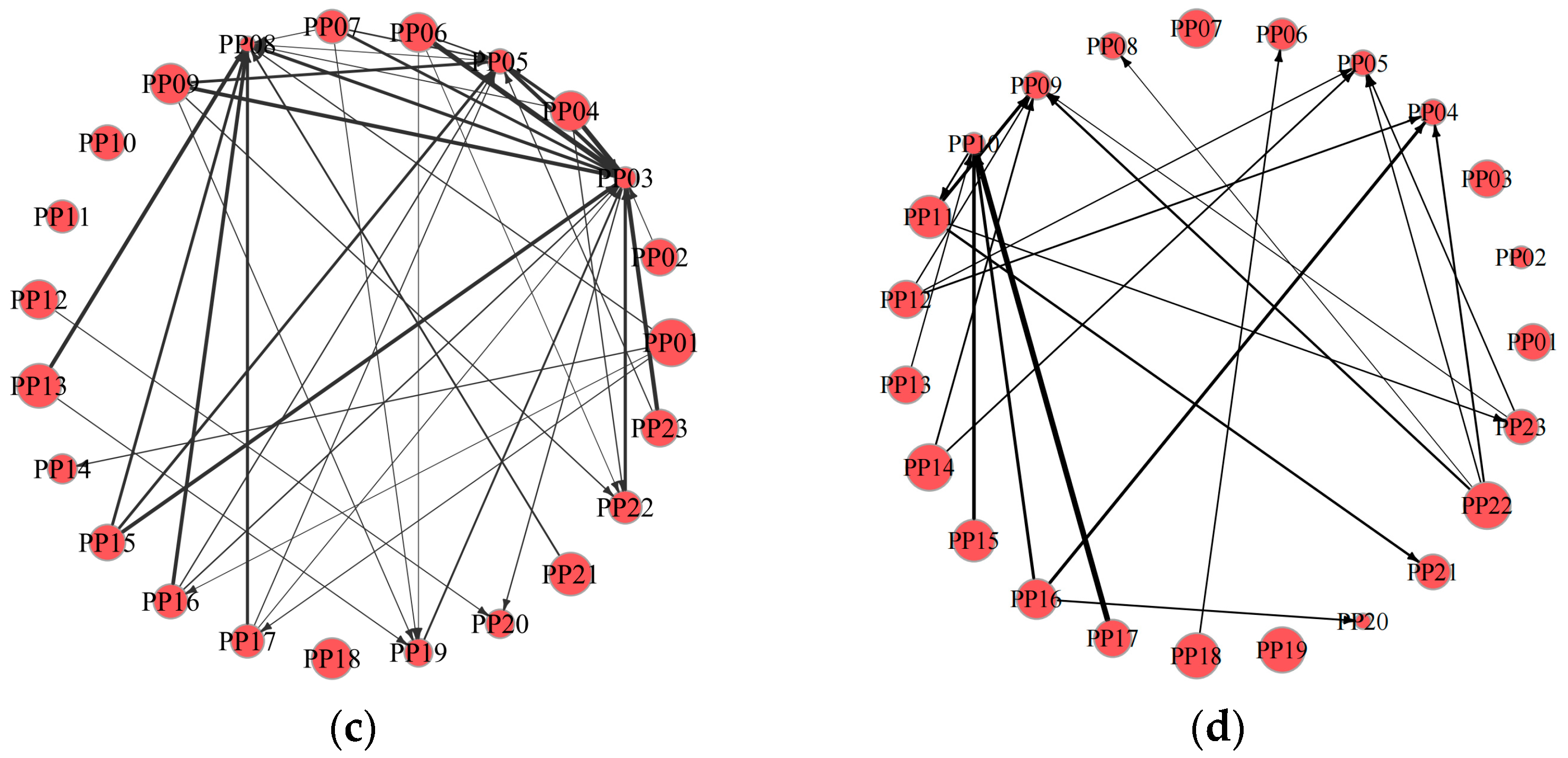

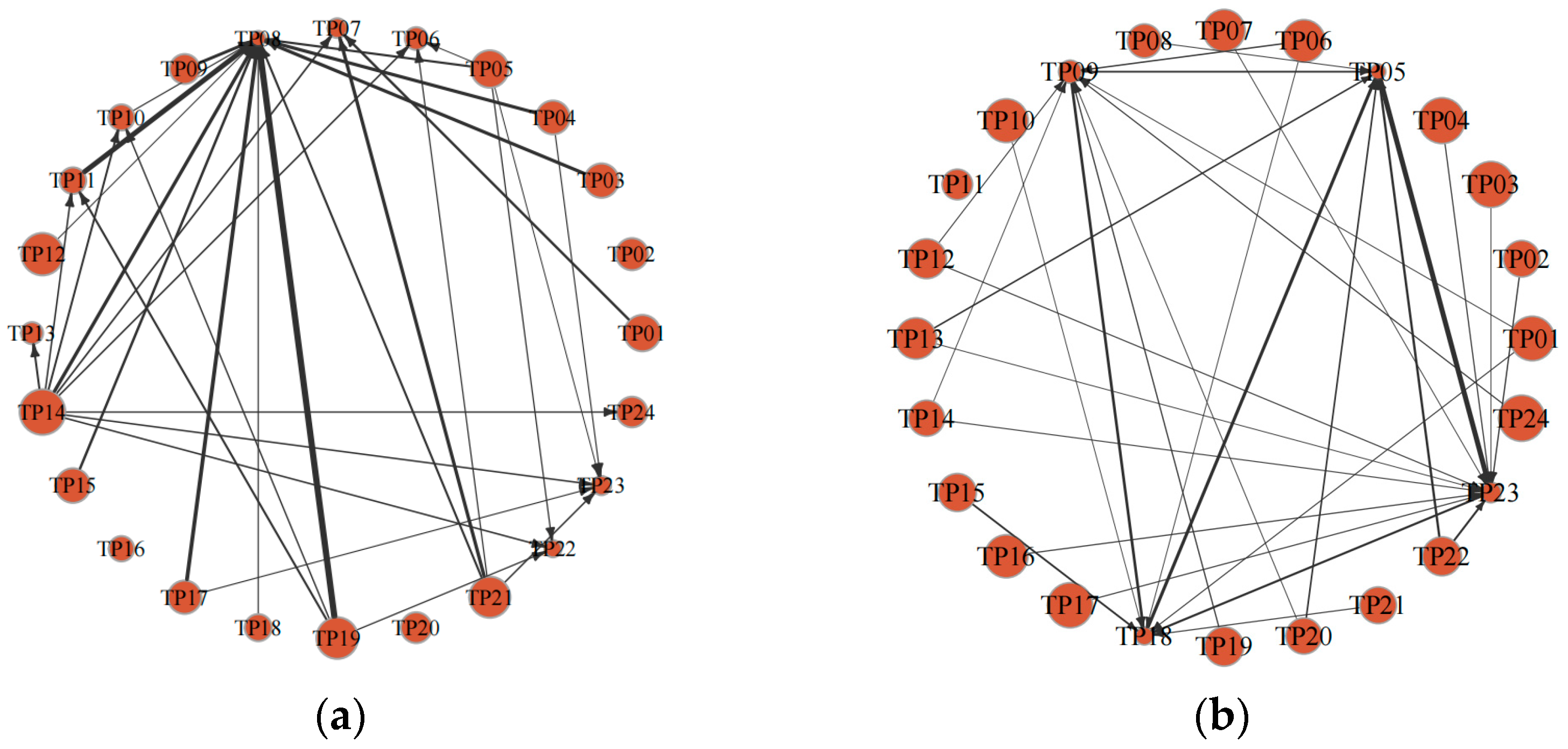

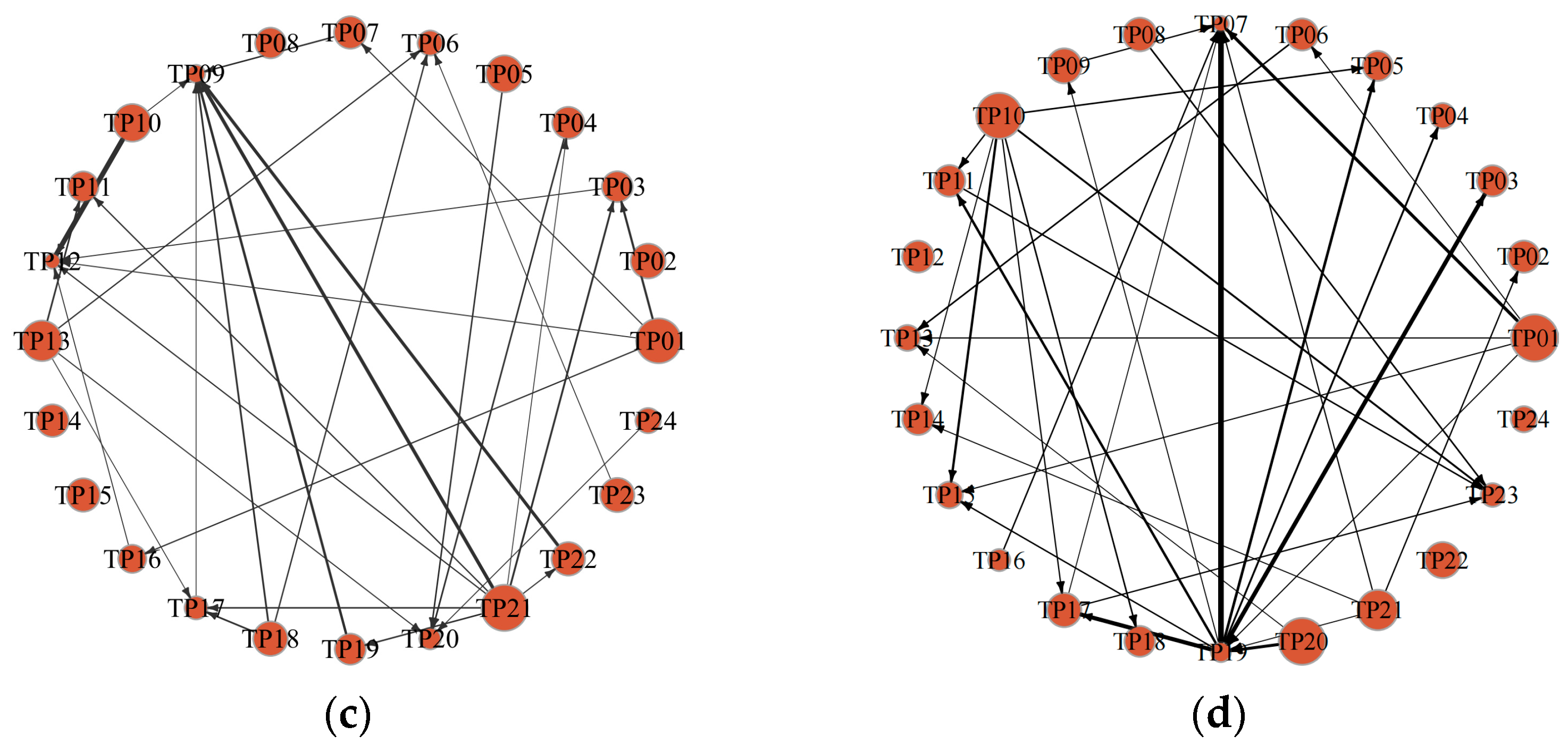

(2) Major event shocks amplify the spillover effects among energy industries and firms. At the industry level, the clean energy sector consistently acts as a net risk receiver across all four periods, while the other sectors alternate between risk transmitters and receivers under different shocks. At the firm level, the global COVID-19 pandemic outbreak and the official launch of the national carbon market primarily strengthen node-to-node connectedness, whereas the Russia-Ukraine conflict mainly intensifies the spillover strength between nodes. The Russia-Ukraine conflict significantly increases both the risk spillover capacity and the cross-sector spillover capacity of gas firms. In other periods, coal firms exhibit stronger risk spillover capacity, while thermal power firms demonstrate higher cross-sector spillover capacity.

(3) The effects of uncertainty index shocks differ markedly: economic policy uncertainty has the most substantial impact, followed by climate policy uncertainty, while geopolitical risk is the weakest. At the industry level, under shocks to economic policy uncertainty, the coal and oil-petrochemical sectors exhibit the most significant short-term responses, while the gas sector shows the smallest. Under shocks to climate policy uncertainty, the short-term impulse responses of the coal and thermal power sectors are significantly higher than those of other industries.

Based on the above findings, the following policy implications can be drawn:

(1) Strengthening risk monitoring and early warning mechanisms in the energy system. Given the high level of interconnectedness and volatility in the energy system, a multidimensional, dynamic risk-monitoring framework should be established. Real-time tracking and identification of macroeconomic, market price, policy, and climate-related indicators are essential. A coordinated monitoring and joint early-warning mechanism should be promoted across energy, financial, and climate risks to prevent the accumulation and contagion of systemic risk.

(2) Enhancing resilience and risk diversification capacity of the energy sector. To mitigate spillover effects triggered by major event shocks, the industrial structure and supply chain layout should be optimized. At the industry level, coordinated development between traditional and renewable energy should be promoted, while mechanisms such as carbon markets, green insurance, and strategic energy reserves can help share and absorb shocks. At the firm level, key energy enterprises should strengthen their risk resistance by pursuing asset diversification, sound financial management, and supply chain redundancy design to reduce risk transmission. Financial derivatives can also be effectively utilized to manage price volatility and policy uncertainty.

(3) Optimizing policy tools to address multidimensional uncertainty shocks. In the face of economic policy, climate policy, and geopolitical uncertainties, a response framework emphasizing expectation stability, flexible regulation, and policy coordination should be established. At the economic policy level, maintaining coherence among fiscal, monetary, and energy policies can help mitigate fluctuations in market expectations caused by frequent policy shifts. At the climate policy level, clarifying long-term emission-reduction pathways and technological roadmaps is essential to stabilizing expectations for renewable energy investment and reducing uncertainty. At the geopolitical level, strengthening international energy cooperation and enhancing strategic reserve systems can improve the security of the energy supply chain and overall system resilience.

Anchored in a multi-level “system-industry-firm” framework and combining event shocks with index-based shocks, this study provides a systematic account of risk connectedness in China’s energy system. Nonetheless, limitations remain. Although we consider three core shocks—EPU, CPU, and GPR—the energy system faces multiple sources of disturbance. For example, the direct effects of extreme climate events on generation efficiency and energy demand, and disruptive technological breakthroughs that reshape the energy mix, are not incorporated into the current model. Future research can further refine the scope of analysis by extending the sample period to encompass a broader range of shocks and incorporating firm-level heterogeneity. Moreover, integrating indicators of extreme weather events into the extended model would help capture the multifaceted impacts of climate and environmental uncertainties on the transmission of energy system risk.