1. Introduction

Since the global momentum towards carbon neutrality has solidified, the international economic landscape and climate governance models have undergone profound changes. Competition between economies is no longer confined to traditional arenas such as ideological conflicts, industrial rivalry, and national security, but has gradually expanded to new domains, including green and low-carbon transitions, climate response, and sustainable development. In this process, some developed countries have expanded carbon emission management beyond domestic boundaries to cover the entire life cycle of cross-border industrial chains, thereby establishing a new form of green trade barriers in international trade [

1,

2]. For instance, in May 2023, the European Union (EU) adopted the Carbon Border Adjustment Mechanism (CBAM); the United States reintroduced the Clean Competition Act in the same year; and the United Kingdom announced plans to launch its own carbon border measures by 2027. While such measures may promote global emissions reduction to some extent, particularly by incentivizing economies that have yet to make climate commitments or lack a robust carbon pricing mechanism to accelerate climate action, they are also viewed by developing countries as unilateral actions that risk creating new forms of discrimination and friction in international trade [

3,

4].

In fact, among pressing global issues, green trade barriers have emerged as a key point of contention between developing and developed countries [

5]. At COP28, China, Brazil, India, South Africa, and other developing countries called for the inclusion of unilateral measures on the climate change agenda, citing Article 3.5 of the United Nations Framework Convention on Climate Change to support their position. Notably, as the EU’s two-year CBAM transition period draws to a close and the onset of its substantive implementation approaches, exporters outside the EU, supply chains built around core firms, and even economy-wide industrial chains all face the risk of potential disruption.

From a theoretical standpoint, the impact of green trade barriers on the industrial chains of developing countries extends beyond cost pressures, potentially altering their operational dynamics and long-term functionality. Drawing on the theory of externalities in environmental economics and the rule-setting perspective in institutional economics, such unilateral measures may exacerbate institutional asymmetries across economies, thereby undermining industrial chain resilience [

5,

6,

7]. But existing literature largely focuses on supply chain-level analyses, while systematic studies at the macro-level industrial chain remain limited.

Meanwhile, green finance is widely recognised as a critical instrument for advancing low-carbon transitions and enhancing system resilience [

8,

9]. Its effectiveness is generally defined as the capacity of green finance, under given policy and market conditions, to foster low-carbon technological innovation, reduce transition costs, and strengthen the long-term adaptive capacity of industries. Nevertheless, academic debate on this issue remains unresolved. On the one hand, green finance can facilitate the implementation of green practises by directing capital flows [

10]. On the other hand, limitations such as weak institutional constraints, inadequate funding delivery, and low efficiency may compromise its practical effectiveness [

11,

12]. In particular, when faced with green trade barriers such as CBAM, questions regarding whether green finance retains its effectiveness and how its mechanisms operate urgently require further investigation.

Building on the context outlined above, this study poses the following exploratory questions:

Question 1: Under scenarios where green trade barriers exert tangible effects, can green finance still enhance the industrial chain resilience of developing countries?

Question 2: How should developing countries optimise their regulatory approaches to enhance the resilience of industrial chains more effectively?

To address these questions, this study develops a system-based analytical framework grounded in the Pressure–State–Response (PSR) approach and applies it to the case of China’s steel industrial chain, simulating the dynamic evolution of resilience under the implementation of EU’s CBAM. It is important to note that the issue of green trade barriers involves a degree of uncertainty; furthermore, in the absence of comprehensive cross-national empirical data, this study does not seek to draw definitive causal conclusions. Instead, it adopts a system dynamics model to conduct scenario simulations of the case industrial chain, with findings interpreted as exploratory insights derived from the simulations. Nevertheless, given that the steel sector is among the first industries covered by EU’s CBAM and also a key priority for the expansion of China’s carbon market, the case exhibits both representativeness and practical relevance, thereby providing a useful reference for developing countries in comparable circumstances.

The remainder of this paper is structured as follows:

Section 2 reviews the relevant literature;

Section 3 outlines the research methods and model specifications;

Section 4 conducts system dynamics simulations using the China–EU steel trade case;

Section 5 analyses and discusses the simulation results; and

Section 6 concludes with the main findings, policy implications, and research limitations.

2. Literature Review

The concept of resilience has been systematically explored across engineering, ecology, and the social sciences [

13]. With the deepening of globalisation and the rising frequency of risk events, a growing number of scholars have adopted systems-based approaches to examine resilience in complex systems [

14,

15]. Compared with earlier studies that focused primarily on resistance and recovery [

16], more recent research has increasingly integrated longer-term dimensions, such as adaptation, into analytical frameworks [

17,

18,

19].

While extensive findings have been amassed on supply chain resilience [

20,

21], research on industrial chain resilience remains relatively limited, with most studies published in Chinese-language literature [

22]. Theoretically, although supply chains and industrial chains are closely intertwined in operational terms, they are not identical. Supply chain resilience tends to focus on inter-firm logistics, inventory management, and collaborative coordination, whereas industrial chain resilience emphasises life-cycle-wide integration, cross-sectoral coordination, and macroeconomic resilience [

23,

24,

25]. This distinction is particularly important in environmental economics and industrial organisation theory, where industrial chain resilience highlights cross-sectoral resource allocation and institutional adaptability—rather than the operational efficiency, cost minimisation, or logistical stability of individual firms.

Given that most resilience studies lack a clear definition [

13], this study defines industrial chain resilience as follows: the capacity of an industry, encompassing its upstream-to-downstream integration as a cohesive whole, to maintain core functionality, restore disrupted operations, and adapt to long-term transformative pressures in the face of external shocks. Its core dimensions include resistance, recovery, and adaptation [

26,

27,

28,

29].

The proliferation of research on resilience coincides with the emergence of green trade barriers. Beyond traditional tariffs and quotas, non-tariff measures, particularly those centred on environmental standards, have exerted a profound influence on international trade structures in recent years [

5]. The implementation of such policies, or so-called green trade barriers, may simultaneously advance global emissions reduction while imposing additional cost pressures on export-oriented economies [

30]. A substantial body of research has demonstrated that carbon border measures affect industrial competitiveness and trade patterns, with distributional effects differing markedly between developed and developing countries [

6,

7,

31].

Taking the EU’s CBAM as an example. As CBAM’s implementation nears, non-EU exporters face cost pressures. Specifically, the EU CBAM tax rate depends on the difference between the EU’s carbon price and the exporting country’s carbon price, along with the product’s carbon emissions. It means that developing countries can only reduce carbon taxes by rapidly reducing emissions or rapidly raising domestic carbon prices. However, achieving either objective is costly and highly challenging [

32]. Developing countries, in particular, may struggle to overcome the green trade barriers imposed by the EU’s CBAM in an equitable manner while maintaining industrial competitiveness [

4]. These findings underscore that discussions of industrial chain resilience must explicitly account for shocks generated by green trade barriers.

In responding to these shocks, green finance is often regarded as a key instrument [

33,

34]. Encompassing green credit, green bonds, and carbon finance, it can theoretically enhance resilience by directing capital flows to support industrial green transitions [

35,

36,

37]. Nevertheless, empirical findings on its effectiveness remain inconclusive. While most studies highlight green finance’s positive role in facilitating green practices and strengthening economic resilience, others suggest its macro-level effects may be heterogeneous [

38,

39]. Contributing factors include policy implementation uncertainties, the short-term orientation of financial markets, and inadequate regulation [

40]. Thus, whether green finance can enhance industrial chain resilience under green trade barriers remains both empirically contested and theoretically underexplored.

Moreover, the literature emphasises identification of challenges in assessing policy effectiveness. For both green finance policies and green trade barriers, channels of influence often involve multi-level, multi-actor interactions [

12,

40]. The absence of clear control groups and quasi-experimental conditions complicates causal inference [

41]. This further underscores the necessity of system-oriented modelling and simulation approaches [

42].

At the methodological level, existing studies have employed qualitative approaches such as case studies and expert interviews [

43,

44,

45], alongside quantitative techniques including structural equation modelling, input–output analysis, and machine learning to examine resilience [

46,

47,

48]. However, when applied to the issue of green trade barriers, these methods face two major challenges: limited data availability and difficulty in capturing complex feedback relationships. The PSR framework provides a structured means of linking environmental pressures, system states, and policy responses [

49,

50,

51]. Meanwhile, System Dynamics (SD) modelling is particularly well-suited to representing nonlinear feedback mechanisms and simulating the evolution of industrial chain resilience under multi-factor interactions [

21,

31]. Together, these two approaches offer fresh methodological insights for studying resilience in the context of green trade barriers.

In summary, while the existing literature illuminates certain connexions between green trade barriers, industrial chain resilience, and green finance, three key gaps remain: (1) a lack of systematic research that links non-tariff environmental standards to industrial chain resilience; (2) insufficient exploration into the effectiveness of green finance under green trade barriers; (3) inadequate attention to the challenges of identifying policy intervention effects in complex systems.

Accordingly, this study aims to integrate the PSR framework with SD modelling in order to systematically analyse the dynamic evolution of industrial chain resilience under the pressure of green trade barriers, and to explore the transmission mechanisms of green finance in this context.

3. Methodology

3.1. System Identification

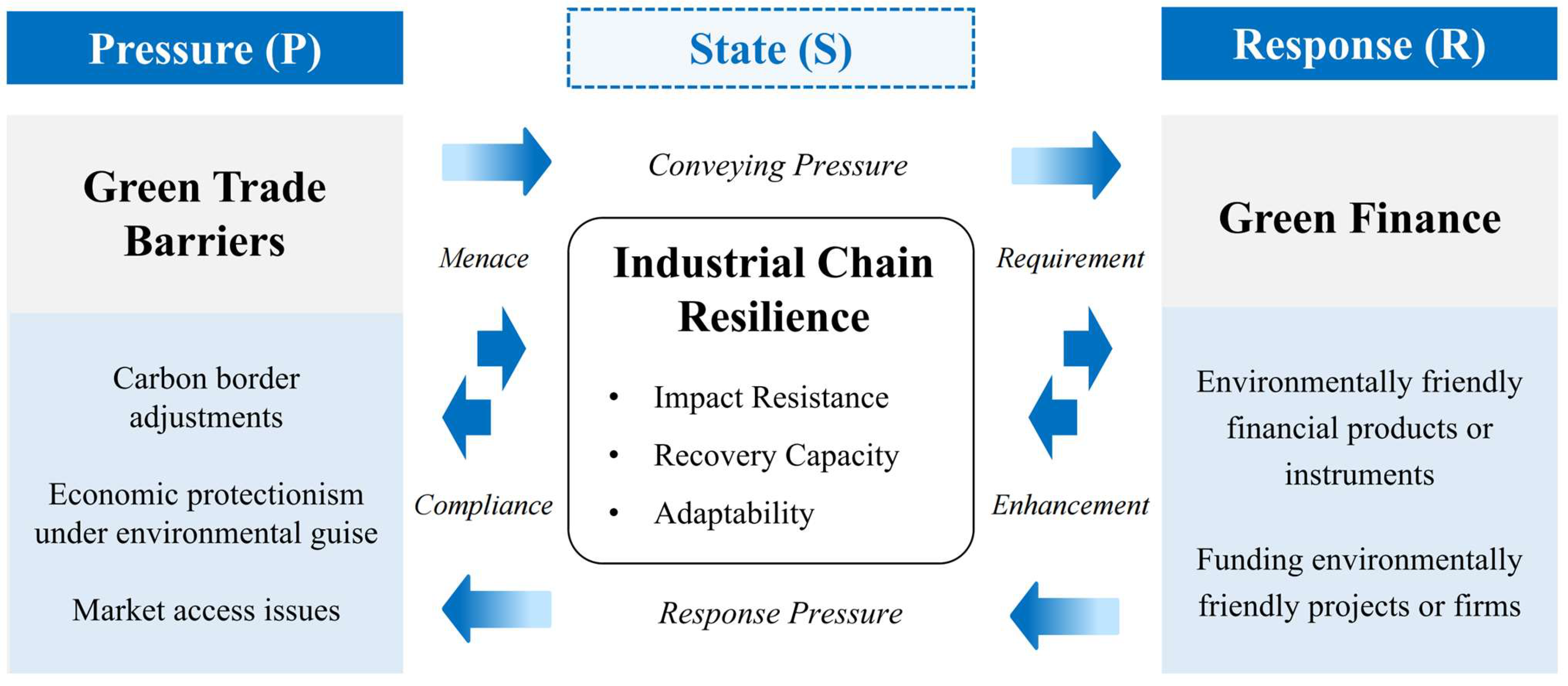

The relationship between green trade barriers, industrial chain resilience, and green finance can be conceptualised as a complex system, which encompasses the dynamic interactions among external pressures, the adaptive state of industries, and response mechanisms. Building on the PSR framework and drawing on the lens of stakeholder theory, institutional theory, and the resource-based view, we develop a structured analytical framework (shown in

Figure 1). This framework aims to elucidate how environmental pressures represented by green trade barriers, may influence the system state that is industrial chain resilience, and how green finance functions as a key response mechanism to mitigate shocks and facilitate adaptation.

Within this system: (1) Green trade barriers constitute external pressures, driving up compliance costs and eroding export competitiveness. From the lens of institutional theory and stakeholder theory, green trade barriers, such as the EU’s CBAM and the US’s CCA, exert external, mandatory institutional pressure to compel exporting firms to meet elevated environmental standards [

5,

52]. Critically, their effects may propagate to other stakeholders across the industrial chain. (2) Green finance represents a key prototypical institutional response mechanism, providing financial support to enable firms across the industrial chain to adopt green technologies [

40,

53]. On the one hand, governments and industry associations’ development of green finance embodies a normative institutional response that encourages firms to adopt green practises not only to comply with trade requirements but also to secure economic gains and manage their reputation. On the other hand, amid an uncertain international trade environment, firms frequently adopt mimetic institutional responses; green finance provides reference pathways and resources to support this process. (3) Industrial chain resilience constitutes the system’s state, with this study focusing on three core capacities: resistance, recovery, and adaptation. From an RBV perspective, green trade barriers reshape the industrial chain’s resource demand structure, while green finance assists firms in accumulating green technologies, knowledge, and organisational capabilities [

54,

55]. Together, these factors shape the industrial chain’s capacity to acquire and allocate resources that ultimately manifest in its resilience.

Furthermore, when exploring industrial chain resilience, while it is important to account for extreme events (such as the pandemic, natural disasters, and conflicts) and various obstacles to the implementation of green finance, these issues fall beyond the scope of the present study. As such, the simplified system structure does not capture these factors or their precise interlinkages. For the purposes of this research, the overall system is therefore divided into three subsystems: the green trade barrier subsystem, the industrial chain resilience subsystem, and the green finance subsystem.

To ensure the reliability of the SD model, five assumptions are proposed based on existing literature and practical industry insights: (1) The intensity of green trade barriers increases, and their coverage expands over time. (2) There are differences between economies in carbon market prices and industry-average carbon emission levels. (3) Owing to the rapid development of information technology and the presence of numerous third-party service providers, the response lags of governments and industries to emerging green trade barriers can be regarded as negligible. (4) In scenarios involving the payment of carbon border taxes, other domestic demand and supply shocks arising from geopolitical issues are simplified for the purposes of this study, with the potential to incorporate them in future research. (5) Given the large number of firms in the industrial chain, the complexity of transport routes, and constraints on data availability, transportation costs are restricted to cross-border shipments from the exporting country to the importing country, while domestic logistics are excluded.

3.2. Key Variables Setting

To ensure the SD model’s accuracy and reliability, this study identified key variables by drawing on a comprehensive review of relevant literature and insights gathered from an expert panel. During the literature review, particular focus was placed on research into industrial chain resilience, green trade barriers, and green finance, domains central to the study’s objectives. Building on this foundation, four experts with interdisciplinary research backgrounds were consulted on the selection of key variables. This consultation ensured that each variable accurately captures the system’s dynamic behaviour and is consistent with real-world contexts. All experts have prior experience of national-level research projects or policy advisory work in domains including green finance, industrial green transition, environmental sustainability, and corporate sustainable development. Their involvement brought substantial research and practical expertise to the study, strengthening the validity of the variable selection process.

The final list of variables and their definitions is provided in

Table 1, forming the foundation for subsequent modelling. These symbols will appear in subsequent formulas, models, and textual explanations. Unless necessary, they will not be re-explained.

First, with respect to industrial chain resilience, in developing countries, industrial chains prioritise resilience as their primary objective; profitability and other considerations are addressed only once security is assured. Within this resilience-focused cycle, this study incorporates three core components: supply, demand, and strategic reserves [

56,

57]. Strategic reserves deserve particular attention. Developing countries frequently face challenges such as economic vulnerability, geopolitical risks, and constrained industrial capacity, and thus often seek to establish government intervention mechanisms to safeguard critical supply chains, prevent disruptions, stabilise markets, and manage resource dependencies [

58,

59]. These mechanisms can take both direct and indirect forms.

Direct interventions typically involve physical stockpiling measures, encompassing the procurement, stockpiling, and release of strategic resources (e.g., food, rare minerals, and fuels). Governments or government-incentivised private sector entities purchase and store such resources when supply outstrips demand or market prices are depressed, releasing them as required. Indirect interventions—more common for non-strategic goods—tackle overcapacity or supply deficits. When supply outstrips demand and market prices fall, governments may commission infrastructure projects, steer consumer behaviour, or coordinate emergency measures to rapidly absorb surplus supply. Conversely, in cases of supply shortfalls, governments can activate standby capacity, implement price interventions, or coordinate emergency responses to restore supply, thereby achieving market balance and stability.

Second, regarding green trade barriers, drawing on the EU’s CBAM, these new barriers are not rigid entry thresholds but function by levying additional carbon tariffs. This increases the costs of exported goods and erodes their competitiveness [

6,

7,

31]. In other words, countries with less ambitious decarbonisation pathways or lower carbon abatement costs face indirect disadvantages. Consequently, this study centres on three key variables: product carbon intensity, carbon market coverage, and carbon prices.

Third, concerning green finance, as highlighted in prior research, green finance provides financing for the development and deployment of energy-saving and emission-reduction technologies [

53]. However, integrating insights from cognitive-behavioural theory and the economic rationality premise reveals that direct financial support is not the sole driver of green technology adoption in developing countries [

53,

60]. Instead, such decisions are largely shaped by cognitive processes, which are concurrently influenced by factors including profit trajectories, stakeholder perspectives, and transition costs. These decisions reflect the interplay of costs, profitability, regulatory pressures, government support, and fiscal resources. For example, industries with low initial profitability or high transition costs may be reluctant to adopt green technologies, given the risk of further eroding their profitability. Green finance instruments can directly reduce these costs, while the institutional and policy environments established by governments can indirectly shape decision-makers’ perceptions, making green technology adoption more attractive [

61,

62]. Accordingly, this study highlights variables including green finance investment, green technology implementation costs, profit levels, environmental regulations, and government promotion measures.

Furthermore, to enhance the reliability of the logical mechanisms across subsystems, several additional variables are incorporated. For instance, demand for exported goods in importing countries fluctuates around the baseline, driven by relative prices and relative technological levels [

63]. Additionally, given that government actions on green finance are responsive to green trade barriers, both government regulation and government-led publicity are shaped by the intensity of these barriers and the pressure perceived by governments [

62]. Specifically, higher carbon intensity of exported goods or higher carbon prices in importing countries amplify perceived pressure, prompting more robust government responses. The model therefore includes additional variables such as product prices, transportation costs, technological levels, and government-perceived pressure.

3.3. Causal Loop Diagram and Model Structure

To elucidate the dynamic interactions within the system and its subsystems, this study develops feedback loops between key variables, as illustrated in

Figure 2.

Specifically, the feedback loops of the industrial chain resilience subsystem are presented in

Figure 3. For the industrial chain, total supply within developing countries is operationalized as the actual supply value derived from the industrial chain’s total domestic output and total imports from overseas, as shown in Equation (1). Both domestic output and imports incorporate the respective values from the previous period, plus the changes observed in the current year, as expressed in Equations (2) and (3).

On the demand side, the total demand faced by the industry chain is similarly represented by the actual total demand value, which is the sum of foreign demand and domestic demand for the year, as shown in Equation (4). Likewise, both domestic total demand and foreign total demand include the corresponding values from the previous period as well as the level of change during the current year, as expressed in Equations (5) and (6).

About strategic reserves, the moment of government intervention is determined by fluctuations in supply and demand, relative to a country’s tolerance thresholds. The calculation method is shown in Equations (7) and (8).

When the extent of supply–demand fluctuations fall below the lower tolerance limit, the actual supply is significantly lower than the actual demand. To uphold industrial chain stability, the government releases strategic reserves to return the system to within the tolerance range. Conversely, when the extent of supply–demand fluctuations exceed the upper tolerance limit, the actual supply significantly exceeds the actual demand. To mitigate severe overcapacity and prolonged price declines and to safeguard industrial chain resilience, the government intervenes through product procurement and stockpiling, restoring balance within the tolerance range.

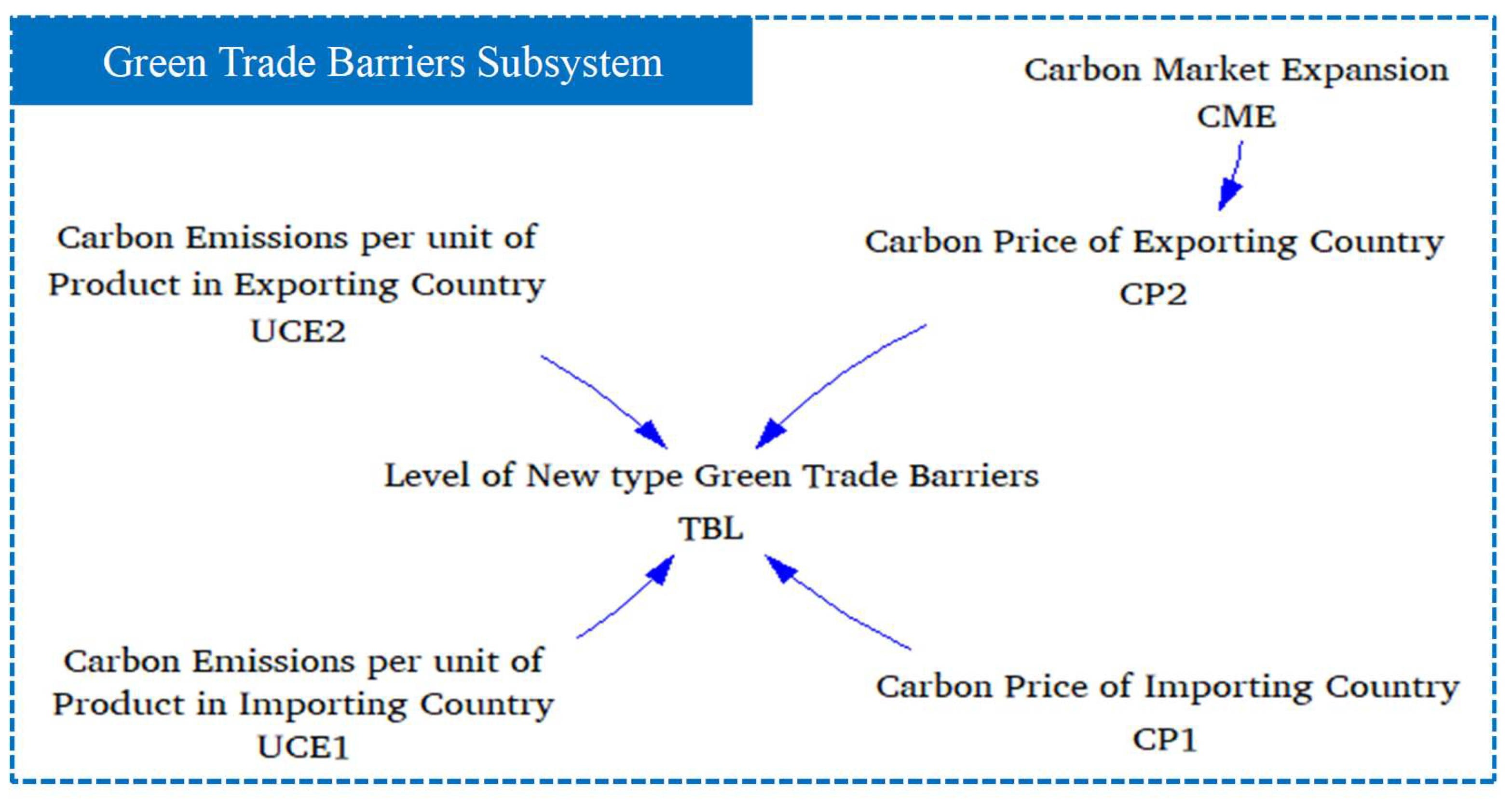

The feedback loops of the green trade barrier subsystem are presented in

Figure 4. In operationalizing the level of green trade barriers, this study draws on the calculation principles of the EU’s CBAM tax, as shown in Equation (9).

Regarding carbon pricing, most economies implementing these green trade barriers are developed countries, which have relatively mature carbon market systems that cover multiple industries. Consequently, this study does not incorporate the potential expansion of carbon markets in these importing countries. In contrast, for exporting countries, differences in decarbonisation strategies and transition speeds require accounting for the impact of carbon market expansion on carbon prices, as highlighted in Equation (10).

The feedback loops of the green finance subsystem are illustrated in

Figure 5. Green finance and its accompanying policy measures influence the adoption of green technologies within the industrial chain, as shown in Equation (11).

These measures may either amplify or attenuate one another’s effects on industrial chain decision-making and are therefore better conceptualised as exerting cumulative effects. It is also important to note that, unlike costs, profits, and financial subsidies that exert direct influence on industrial chain decisions, government regulation and government-led publicity affect firms’ choices indirectly. As such, potential losses incurred during the transmission process of these indirect effects need to be accounted for.

Furthermore, to integrate the three subsystems, this study incorporates several additional variables. The measure of changes in demand for exported products in importing countries is outlined in Equations (12)–(14).

In Equation (13), a key assumption that grounded in practical industry contexts is that the export product price already incorporates applicable tariffs. Consequently, no additional tariff coefficient is included.

Changes in government regulation are represented by Equations (15)–(17), with analogous expressions for government-led publicity. Moreover, the green technologies ultimately implemented by industries will also reduce the carbon emissions per unit of product, as shown in Equation (18), where

is a coefficient that takes values of 0 or 1 to indicate whether decarbonization measures are undertaken to reduce the carbon emissions of each unit product.

For the measurement of industry profit levels, this study focuses on the difference in prices faced by exported products. This differential is calculated by comparing the product’s price in the importing country with the sum of the exporting country’s product price and total costs incurred during the export process, as formalised in Equation (19).

4. SD Model Simulation

4.1. Case Selection and Scenario Discussion

Among formally implemented green trade barriers, the EU’s CBAM is the most representative [

7] and is anticipated to exert profound impacts on a broad range of developing countries, including China [

6]. This study therefore selects the EU’s CBAM as a case study to represent green trade barriers.

For industry selection, this study focuses on China’s steel industry for three key reasons: (1) China is the world’s largest developing country and a major trading partner for products covered by the EU’s CBAM [

6]; (2) China has long utilised green finance to drive industrial green transitions, yet existing research has not fully explored the mechanisms through which green finance operates under the impact of green trade barriers; (3) The steel industry is among the first carbon-intensive sectors included in the EU’s CBAM. As a key foundational and export-oriented industry in developing countries, it also represents a critical domain for safeguarding industrial chain resilience [

31,

64].

Considering the actual situation, this study enumerates the possible measures that China could take to ensure the industrial chain resilience of the steel, explicitly excluding the assumption of intergovernmental negotiations. Three principal measures are incorporated as policy scenarios:

Measure 1: Extending China’s national carbon emissions trading system (CETS) to cover the steel industry.

The carbon market serves as a pivotal instrument for achieving China’s climate objectives and shaping the low-carbon trajectory of its manufacturing industries [

65,

66,

67]. Considering the China’s national CETS expansion policy announced by the Ministry of Ecology and Environment of PRC, we expect that the regulatory guidelines issued after the steel industry is included in the carbon market and completing a trading cycle will directly affect its development path.

Measure 2: Upgrading the technological pathway of steel production.

This scenario considers promoting a shift from the long process blast furnace-converter method, which is mainly used in the industry, to the short process electric arc furnace method, which will significantly reduce carbon emissions [

68]. Therefore, the process of switching the technological can in a sense also be considered as a process of switching to energy cleanliness.

For measures 1 and 2, we borrowed the design ideas from [

31]. However, we do not discuss the impacts of such technologies as the effectiveness of CCS and CCUS has been in question for a long time, and practice projects have been mostly risky in recent years [

69,

70]. Additionally, we added the exploration of the green finance support to address green trade barriers, i.e., measure 3.

Measure 3: Strengthening green finance for steel decarbonisation.

Green finance allocation in China varies markedly across sectors [

71]. The steel industry’s high-carbon intensity, technical retrofitting difficulties, and extended payback horizons have long constrained access to such finance [

72,

73]. Reflecting recent policy shifts and directives from the Central Committee of the CPC and the State Council, we assume that green finance will increase financial support for the transformation of the iron and steel industry in the future by means of enriching the financial instruments, improving the judging criteria, and controlling the proportion of funding.

To summarise, we set up different scenarios as shown in

Table 2.

BS serves as a baseline for evaluating the incremental effects of other interventions. WIS simulates the impact of a single market-based tool on industrial chain resilience, testing the effectiveness of price mechanisms. MIS examines the combined effects of market-based tools and structural interventions, assessing how the resilience of the industrial chain responds to cost pressures and technological progress. SIS models a comprehensive policy package integrating market-based tools, structural interventions, and green finance support, evaluating trends in industrial chain resilience under multi-dimensional policy coordination.

It is worth noting that for the MIS and SIS, this study assumes that beyond market-based tools, the government implements stronger institutional interventions. This assumption aligns with China’s practical approach to carbon markets and industrial policy, where interventions combine conditionally active government with efficient market [

74]. To reflect this, the MIS and SIS enhance the intensity of Measure 1: for instance, by further removing barriers to third-party participation in carbon markets and increasing the activity level of carbon trading in the steel industry. These adjustments are reflected in carbon market trading volumes, transaction numbers, and carbon prices.

4.2. Scenario Setting

To apply the SD model to scenario-based simulations of the resilience of China’s steel industrial chain, the specification of both general parameters and variable parameters is required.

Table 3 presents the values of general parameters and their respective reference sources.

For general parameters: CIGT is derived from reports by the

First Financial Daily and

People’s Daily, calculated as the ratio of the average cost of decarbonizing the Chinese steel industry to the average cost of long-process steelmaking in China. The unit carbon emissions of products in the importing country are measured based on the emissions level of short-process steelmaking, while the unit carbon emissions for the exporting country are set in reference to the findings of [

75], indicating the impact level of implementing green technologies on unit producing carbon emissions.

Table 3.

General parameter setting.

Table 3.

General parameter setting.

| Parameter | Set Value | Reference |

|---|

| k1 | 0.71 | [62] |

| k2 | 0.76 |

| CIGT | 0.22 | [68,76] |

| X0 | 1.80 | [68] |

| ETC | $100 | [77] |

| UP1 | $680 |

| UP2 | $500 |

| LL | −0.05 | [56] |

| UL | 0.05 |

Drawing on [

78], the average annual growth rate of China’s steel production is projected at –0.67% for 2020–2025 and –2.27% for 2025–2030. According to [

79], domestic demand is expected to grow by 0.70% annually between 2020 and 2025, before declining by –1.55% per annum over 2025–2030. In line with the [

80], the steel industry is to achieve global competitiveness by 2025, with advanced technologies, improved quality, branding, and intelligent manufacturing. Accordingly, the technological sophistication of EU products is set at 1, while Chinese products are assumed at 0.5 until 2025, linearly rising to parity by 2030.

In addition, China’s steel import demand has steadily declined due to overcapacity, technological upgrades, industrial chain modernisation, and a slowdown in domestic construction [

81]. Simultaneously, persistent trade frictions with partners such as the United States have led to retaliatory tariffs, heightening supply chain risks [

82]. Considering that the Chinese government is making efforts to promote the safe development of domestic industries and reduce the import dependence of various industries, we combine the import data in recent years with the domestic and international market situation and assume that the current rate of decline will be maintained until 2025, while a relatively stable state will be maintained after 2025.

While the primary focus is on the EU CBAM, exports to other regions remain significant. As developed economies expand carbon tariffs, demand for Chinese steel is expected to fall further. Following expert consultation, this study assumes that China’s export share to the EU will decline from 4% (2020–2024) to 2% by 2030, decreasing linearly. Additionally, the CBAM is projected to reduce Chinese steel exports to the EU by 32% from 2024 onwards [

31].

To ensure the reasonable specification of each scenario, variable parameters are adjusted under different conditions, as presented in

Table 4.

Measure 1 (Carbon Price of Exporting Country). The primary adjustment relates to the exporting country’s carbon price. Starting with the WIS, this study assumes that by 2025, China’s national carbon emissions trading market will expand to incorporate the steel industry. Drawing on the carbon price in China’s power sector, the initial compliance carbon price for the steel industry upon its inclusion is projected at $15, with a benchmark carbon price of $20 by 2030.

Measure 2 (Government Regulation and Government-led Publicity). Technological upgrading in China’s steel industry is government-driven and tied to the institutional environment shaped by state policy. In line with [

62], the baseline intensities for government regulation and government promotion are set at 0.71 and 0.76, respectively.

Measure 3 (Green Financial Investment). Green finance investment is the core adjustable parameter for this measure. Based on [

83], the baseline value of the green finance investment coefficient is set at 0.12.

Additional settings for MIS and SIS. In light of the development trends of China’s and the EU’s carbon markets, this study assumes that under the MIS and SIS, China’s carbon price could reach 50% of the EU’s current market price by 2030 (i.e., $40). Furthermore, given the strong intervention capacity of the Chinese government, when the state actively drives policy implementation rather than merely issuing policy recommendations, the intensities of both regulation and promotion are significantly enhanced. Consequently, under the MIS and SIS, the relevant coefficients (for regulation and publicity) are assumed to increase to 1, which means the steel industry fully perceives the government’s regulatory pressure and promotional stance. Furthermore, under SIS, this study assumes that green finance can flow substantially into the steel industry, with funding support significantly higher than the baseline (set at 0.30).

4.3. Model Verification

Model validation in system dynamics is crucial to help determine whether the model structure, assumptions and equations accurately represent the real-world processes it is intended to simulate, as well as to detect unreasonable parameter settings or errors in model construction. Among them, structural integrity testing and behavioural reproduction testing are two possible means [

31,

84].

In terms of structural integrity testing. After checking, we ensured that the variable relationships within and between each subsystem were logical, the mathematical equations were reasonably constructed, and the total system description was consistent with reality. In addition, a check of the units of each variable was completed to ensure that the scale was kept at the same level.

In terms of behavioural reproduction testing. Since the purpose of the behavioural reproduction test is to check whether the model can simulate real-world behaviours over time, the focus is on ensuring that the model produces results that are similar to the historical data, trends and patterns observed in the actual system.

In this study, the SD model’s simulation period is set from 2020 to 2030, with its behaviour replication period for validation spanning 2020 to 2023. The rationale for this choice is twofold: (1) Alignment with policy cycles and key targets. This interval corresponds to a critical policy window for carbon reduction and industrial transformation in economies such as China and the EU. It encompasses China’s Nationally Determined Contributions (NDCs) and carbon peaking initiatives, while also coinciding with the gradual formation and substantive impact of various green trade barriers. The simulation thus captures the primary short-term and medium-term pathways of policy implementation and technological evolution. (2) Representative, data-complete validation period. This period includes multiple exogenous shocks, such as the pandemic, geopolitical conflicts, and economic recovery, providing an ideal stress test to assess whether the model can replicate real-world system behaviours under extreme conditions. Notably, extending the validation period prior to 2020 could introduce structural mismatches. The industrial structure, international trade rules, China’s national carbon market, and the maturity of green finance development before 2020 differ significantly from post-2020 conditions. Additionally, backward extension would raise data availability challenges.

We selected China’s total steel imports and exports as validation targets, as these variables are comprehensive and effectively reflect the actual performance of the steel industrial chain amid trade frictions. An evaluation of the model shows that key variables exhibit consistent trends during the replication period: (1) MAPE values are 6.41% and 7.46%, indicating acceptable relative errors. (2) RMSE values are 75.24 and 645.78, both below 10% of the respective variables’ mean actual values, confirming absolute errors are within a reasonable range. The SD model is therefore deemed sufficiently accurate, and its simulation results are suitable for subsequent analysis.

It should be particularly noted that this study conducted a systematic sensitivity analysis across parameter ranges by establishing reasonable intervals for key parameters and defining extreme scenarios. Results indicate that model output exhibit consistent trends across different parameter ranges, which will be analysed and discussed in detail in

Section 5.

5. Analysis and Discussion

5.1. Changes in Industrial Chain Resilience in the Baseline Scenario

In alignment with this study’s definition of industrial chain resilience, our simulation process focuses on the impact resistance, recovery capacity, and adaptability of China’s steel industry chain. These dimensions are measured using Fluctuation Range of Supply and Demand (FR), Stock in Amount (SA), and Implementation of Green Technologies (IGT). Specifically:

(1) Impact resistance denotes the capacity of the steel industry chain to withstand sudden disruptions or external shocks, represented by the FR indicator. A positive FR implies that supply can meet demand, evidencing resilience, the larger its absolute value, the stronger the resistance. By contrast, a negative FR indicates supply shortfalls, signalling limited capacity to absorb shocks.

(2) Recovery capacity refers to the industry’s ability to restore operations swiftly following a disruption. Here, government intervention is treated as a proxy, inversely reflecting self-recovery capability. In practice, the Chinese government often deploys measures, such as fiscal stimulus, infrastructure investment, financial support, and trade adjustments, to stabilise demand and production and to expedite recovery.

In this study, this inverse relationship is operationalised as shown in Equation (20). A negative recovery capacity implies reliance on government intervention, the greater its magnitude, the higher the dependency and the weaker the sector’s autonomous recovery. A zero value denotes full self-adjustment, indicating robust recovery capacity.

(3) Adaptability denotes the industry’s ability to adjust to long-term changes and transformations, with the level of green practices implemented in the steel sector reflecting its capacity to adapt to evolving global conditions. A higher level of IGT, stronger adaptability within the industry chain.

Figure 6 and

Table 5 present the projected effects of green trade barriers on the resilience of China’s steel industry under the BS, absent additional government intervention.

First, impact resistance is projected to show a gradual declining trend, falling from 0.30 in 2020 to −0.01 in 2030, as illustrated in

Figure 6a. This indicates that the industrial chain is already exposed to certain risks. One plausible explanation is the sustained decline in the total supply of China’s steel industrial chain, which encompasses a significant reduction in imports and limited fluctuations in total domestic output. The latter aligns broadly with real-world developments and is therefore not discussed further. The former may be linked to reduced import dependency: higher import dependency is often associated with weaker industrial chain security and stability [

85], whereas China has recently strengthened resource security and reduced reliance on imports—thereby partially altering the total supply structure [

86]. Another potential danger is the steady growth in total demand, particularly demand from emerging markets under the Belt and Road Initiative and domestic demand, which may have contributed to this trend. By contrast, demand fluctuations from the EU are relatively modest. This aligns with the views of [

31,

87], who argue that while the EU’s CBAM increases the costs of Chinese steel exports, its impact is likely secondary compared with demand from other regions and domestic markets.

Second, recovery capacity exhibits a gradual upward trend. It remains negative between 2020 and 2028 but improves, turning positive after 2029, as illustrated in

Figure 6b. This implies a strong reliance on government intervention during this period; without such support, the industry might struggle to recover effectively. A potential reason is that China’s carbon peaking and carbon neutrality strategies, its NDCs and growing societal and market attention to decarbonisation all intensify transformation pressures on the steel industry [

88]. To adapt, steel enterprises must invest heavily in green technologies and low-carbon retrofitting. While this may underpin the long-term improvement of recovery capacity, short-term financial constraints and production adjustments could hinder recovery speed [

53,

67]. On the other hand, the year-on-year improvement may also reflect how government interventions provide critical transformation windows, and alongside market-oriented reforms, enable enterprises to gradually develop self-adjustment mechanisms. By 2029, the industry under these mechanisms may no longer depend heavily on government support. This finding differs somewhat from studies suggesting that China’s steel industry is highly economically vulnerable [

64,

85], but this discrepancy may stem from our focus on industrial chain resilience rather than purely supply chain resilience. In the context of developing countries, government actions often serve not only economic objectives but also autonomy and security priorities, which may not be fully captured in some existing research.

Third, adaptability shows a stepwise upward trend. It remains stable between 2020 and 2025, then rises to 1.35 after 2026 and stabilises, representing a cumulative increase of approximately 30.59%, as illustrated in

Figure 6c. This indicates that the industrial chain gradually adopted more green practises to enhance adaptability amid changing environmental conditions and policy adjustments. The increase aligns with potential incentives provided by green finance and related measures [

71,

83]. Notably, after the EU’s CBAM formally entered its taxation phase, the level of green practice implementation rose markedly. This shift can be interpreted as the policy event altering the external environment, which through stakeholder pressures influenced firms’ perceptions and behaviours [

89,

90]. However, this does not confirm that green trade barriers directly force carbon-intensive industries in developing countries to achieve large-scale decarbonisation via carbon pricing. A more credible explanation lies in the complex interplay of institutional pressure and stakeholder influence, rather than a single causal relationship.

5.2. Trends in Industrial Chain Resilience Under Different Scenarios

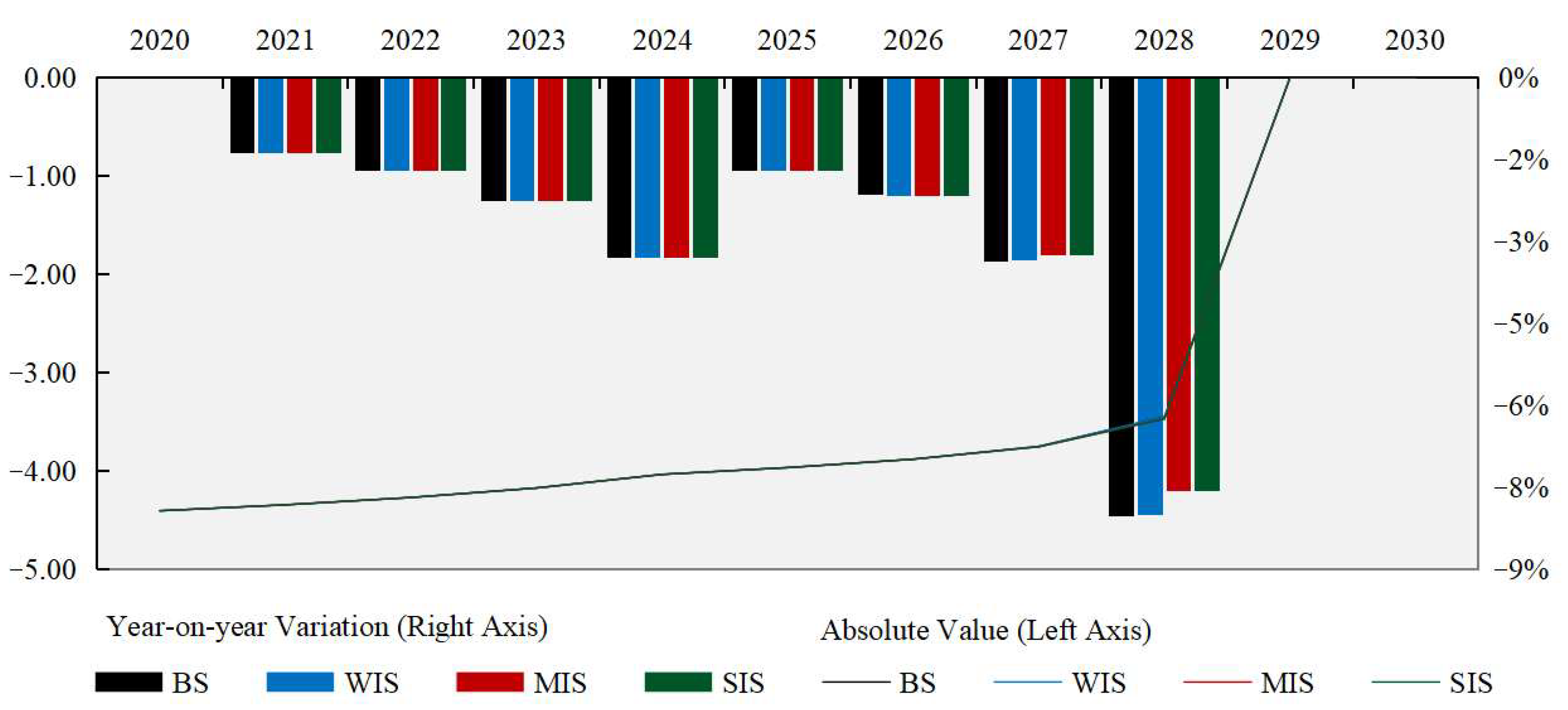

5.2.1. Changes in Impact Resistance

The absolute and relative changes in impact resistance are illustrated in

Figure 7. Over the decade, the impact resistance of China’s steel industrial chain is projected to decline gradually overall. While differences across intervention scenarios are relatively modest, they still yield valuable insights. In absolute terms, impact resistance decreases year-on-year under all scenarios, falling from 0.30 in 2020 to negative values by 2030. However, by 2030, MIS and SIS exhibit relatively higher impact resistance compared with BS and WIS, with year-on-year change rates following comparable trends.

Under WIS, the impact resistance curve of the steel industrial chain closely mirrors that of BS. Between 2020 and 2026, discrepancies are minimal; however, in 2029 and 2030, the rate of decline is slightly less pronounced under WIS. One plausible explanation is that integrating the steel industry into the China’s national CETS theoretically exposes enterprises to carbon price signals and fosters a decarbonization-oriented environment [

65,

66]. Nevertheless, given the low carbon price levels, incentives for emission reduction remain limited. Additionally, the substantial price gap between China’s and the EU’s CETS means CBAM-related tariffs stay high—suggesting a single market-based instrument may be insufficient to meaningfully enhance impact resistance.

Under MIS, the impact resistance curve shows modest improvement relative to BS and WIS. After 2027, the rate of decline narrows; by 2030, the year-on-year decline in impact resistance under MIS is 115%, compared with 126% for WIS and 127% for BS, indicating a slight advantage. This improvement may stem from the combined effects of higher carbon prices and low-carbon technological upgrades: these measures increase both pressure and motivation for emission reduction, while narrowing gaps with the EU’s carbon prices and product emission levels, thereby partially alleviating the CBAM tariff burden. That said, these interventions appear insufficient to fully reverse the downward trend, suggesting limited carbon price adjustments and incremental technological upgrades alone may not entirely offset external shocks.

Under SIS, the impact resistance curve is broadly analogous to that of MIS. The addition of green finance support provides the sector with supplementary funding, which may help mitigate external market pressures and enhance the industrial chain’s recovery potential to some degree. However, the improvement in impact resistance relative to MIS is not substantial. This outcome may be linked to implementation barriers in green finance [

12,

40]. For instance, if green finance is poorly coordinated with technological upgrades and decarbonization policies, its supportive effects may not be fully realised [

91]. Another plausible explanation is the steel industry’s large scale: the financial requirements for its transformation are substantial, which may create threshold effects in green finance investment [

92]. Under conditions of limited support, the impact of green finance is diluted, resulting in overall performance similar to that of MIS.

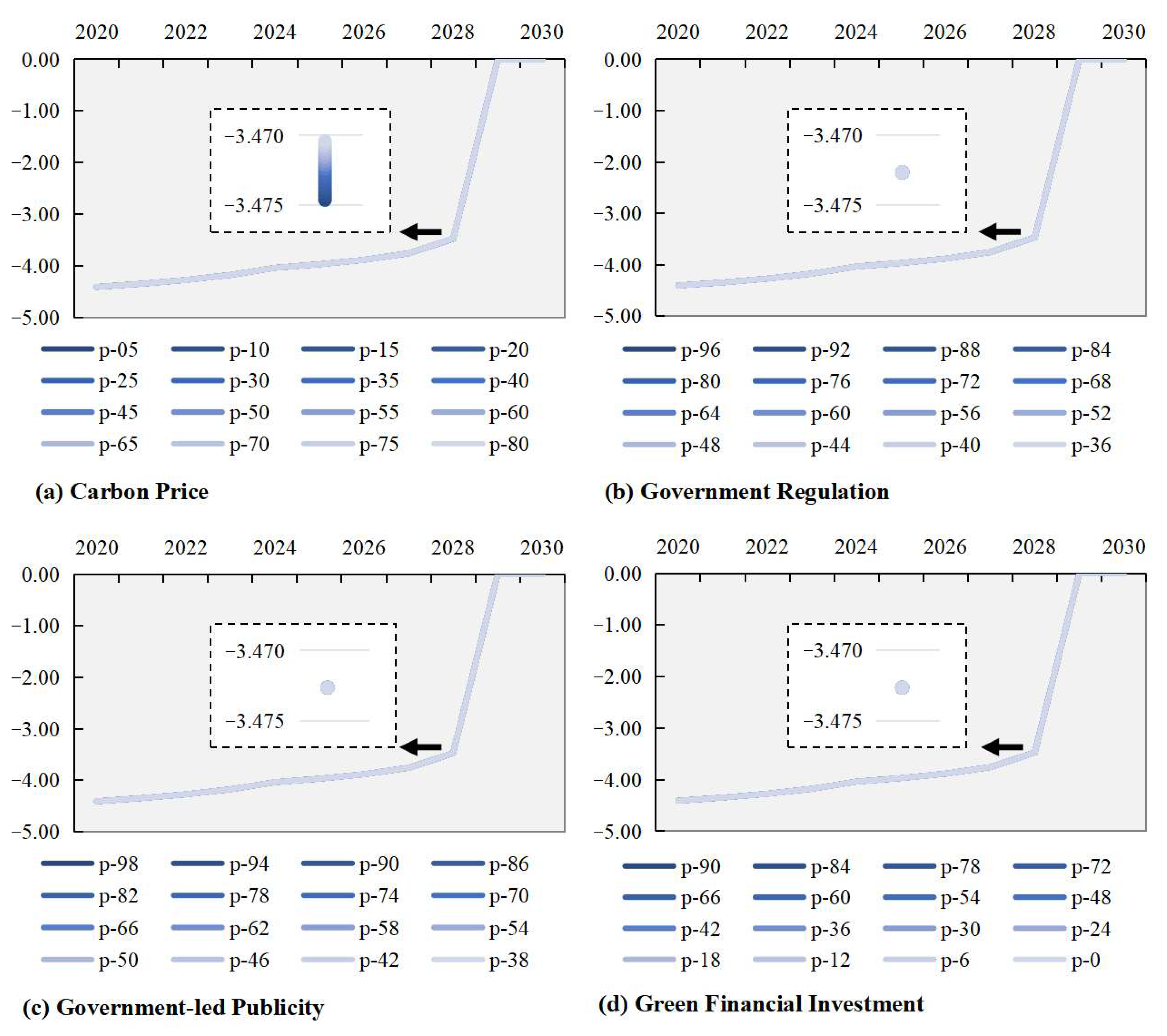

5.2.2. Changes in Recovery Capacity

The absolute and relative changes in recovery capacity are illustrated in

Figure 8. Overall, recovery capacity improves steadily from 2020 to 2028, reaching zero by 2029–2030, implying that the industry can then self-adjust without external intervention. The trends across scenarios are magnitudes vary, though broadly consistent. Compared to BS, WIS demonstrates marginally lower recovery capacity by 2028, yet the difference remains negligible. MIS and SIS show slight divergence around 2027, with recovery gains in 2026–2028 trailing those of BS and WIS.

Specifically, compared with BS, recovery capacity under WIS is slightly lower by 2028. The curves under MIS and SIS begin to diverge around 2027, and their improvements between 2026 and 2028 are somewhat slower than those observed under WIS and BS. This finding appears somewhat counterintuitive: despite the expansion of intervention measures and increases in their intensity, the improvement in recovery capacity falls short of expectations.

One plausible explanation lies in the short-term cost effects of policy interventions [

93,

94]. For instance, once the steel industry is incorporated into the national CETS, firms may need to purchase additional allowances or invest in emission reductions, both of which could drive up short-term operating costs, squeeze profit margins, and constrain investment capacity, thereby slowing the recovery process. Another potential factor is the low-carbon technology upgrading pathway. This process typically requires substantial financial input and may initially reduce production efficiency or create adaptation challenges for firms, which could limit short-term recovery. Regarding green finance support, while it can alleviate financial pressures in the long term, delays in the allocation, disbursement, and utilisation of funds may weaken its immediate impact.

Furthermore, structural adjustments triggered by policy implementation and interaction effects between multiple intervention measures may also constrain short-term improvements in recovery capacity. These phenomena can be conceptualised as a policy friction period [

95,

96], which is a phase during which firms require time to adapt to the new policy environment. As a result, the effects of interventions are not realised immediately; in some cases, the adaptation process itself may temporarily reduce recovery capacity.

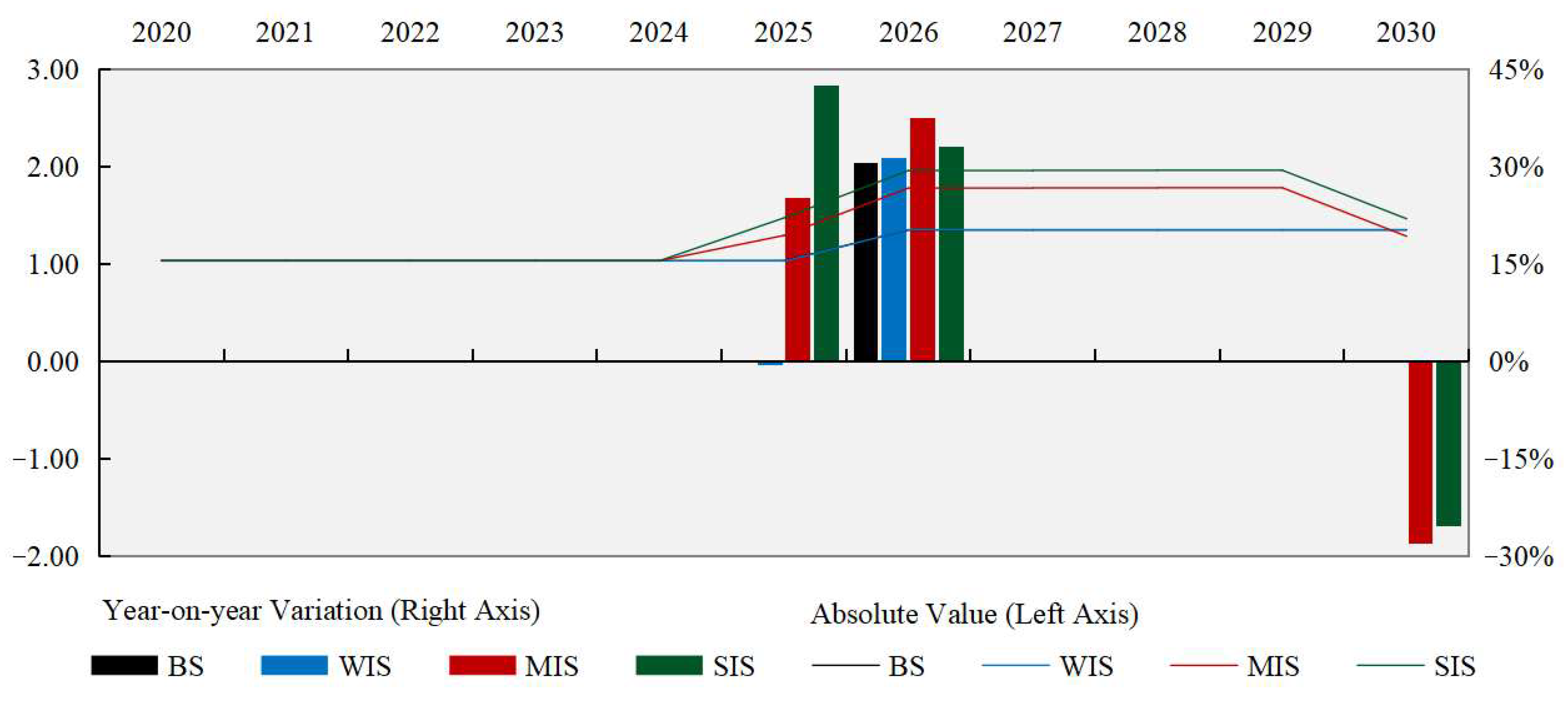

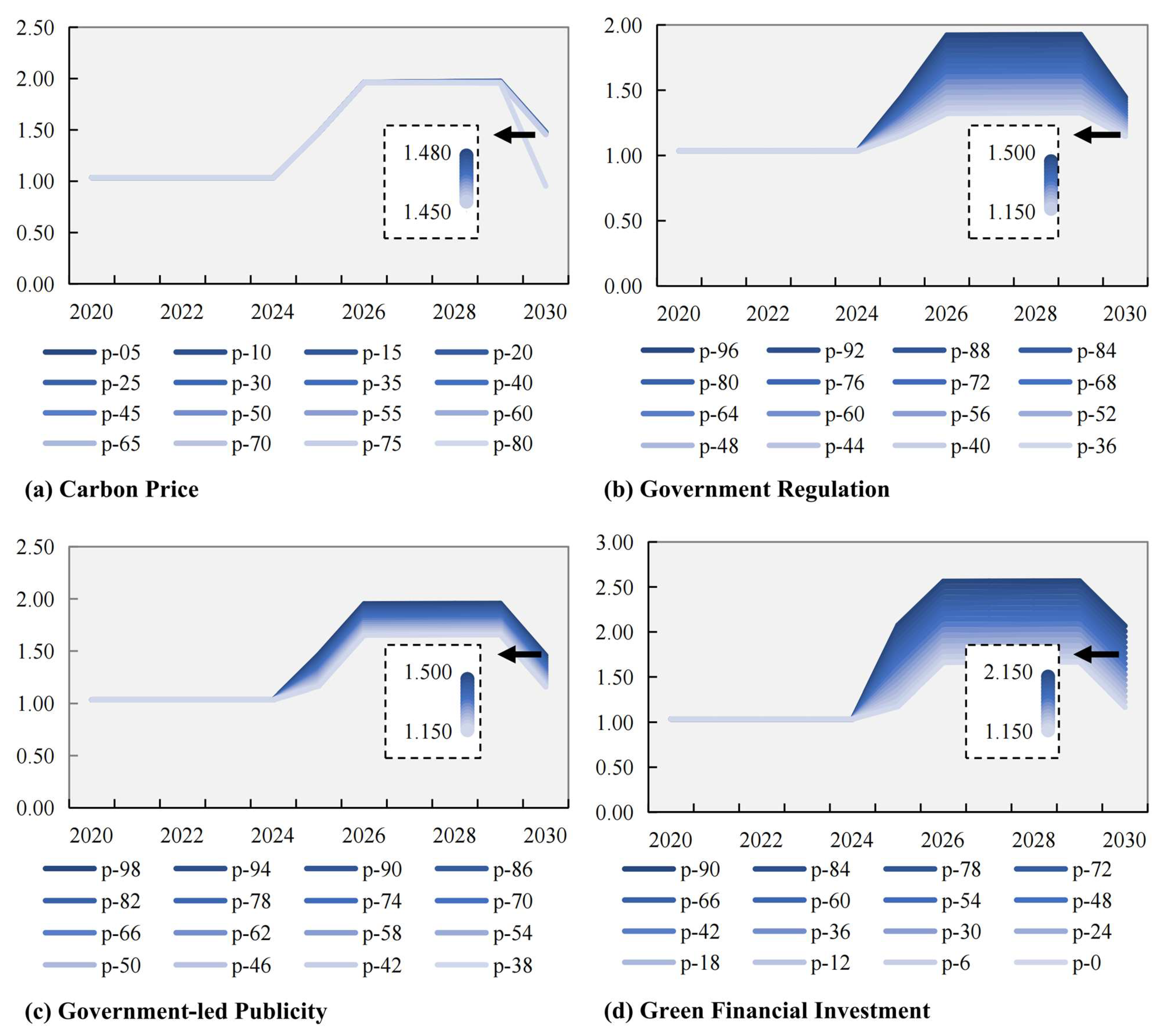

5.2.3. Changes in Adaptability

The absolute and relative changes in adaptability are illustrated in

Figure 9. Overall, the adaptability under different scenarios can be divided into three phases: a rising phase (2024–2026), a plateau phase (2026–2029), and a slight decline (2029–2030).

Specifically, scenario differences begin to emerge in 2025. As intervention measures expand in scope and intensity, the magnitude of improvement in adaptability follows a diverging trend. Under WIS, adaptability falls slightly to 1.03. This may stem from the initial cost burden of the CETS, which temporarily suppresses adaptability. Under MIS, adaptability rises to 1.30, which likely reflects positive adjustments driven by low-carbon technological upgrades. The improvement is more pronounced under SIS, reaching 1.48. This indicates that green finance support, when added alongside technological upgrades, provides effective support.

Between 2026 and 2028, adaptability under all scenarios reaches peak levels. It rises to 1.35 in 2026 under WIS, showing a modest improvement relative to BS. This suggests the CETS’s effects gradually materialise. It rose to 1.78 and 1.96 in 2026 under MIS and SIS, respectively, with slight further growth in 2027 and 2028. One explanation is that technological upgrades and green finance support gradually unleash their medium-term effects, enabling the industrial chain to achieve higher adaptability.

From 2029 to 2030, the trend shifts. Under WIS, adaptability stabilises, but under MIS and SIS, it declines to 1.29 and 1.47, respectively. One plausible reason is that as the carbon intensity of steel products gradually decreases, the production’s emission gap between China and the EU narrows. This reduces the external pressure perceived by the government, which in turn lowers the intensity of environmental regulations [

97]. In this context, firms may curtail environmental protection expenditures due to profit-seeking incentives, indirectly undermining adaptability. Another explanation relates to institutional pressure [

62,

90]. If the intensity of government oversight and social scrutiny decreases, firms may perceive less external normative and mimetic pressure. This reduces their willingness to implement green practices, particularly in highly competitive markets.

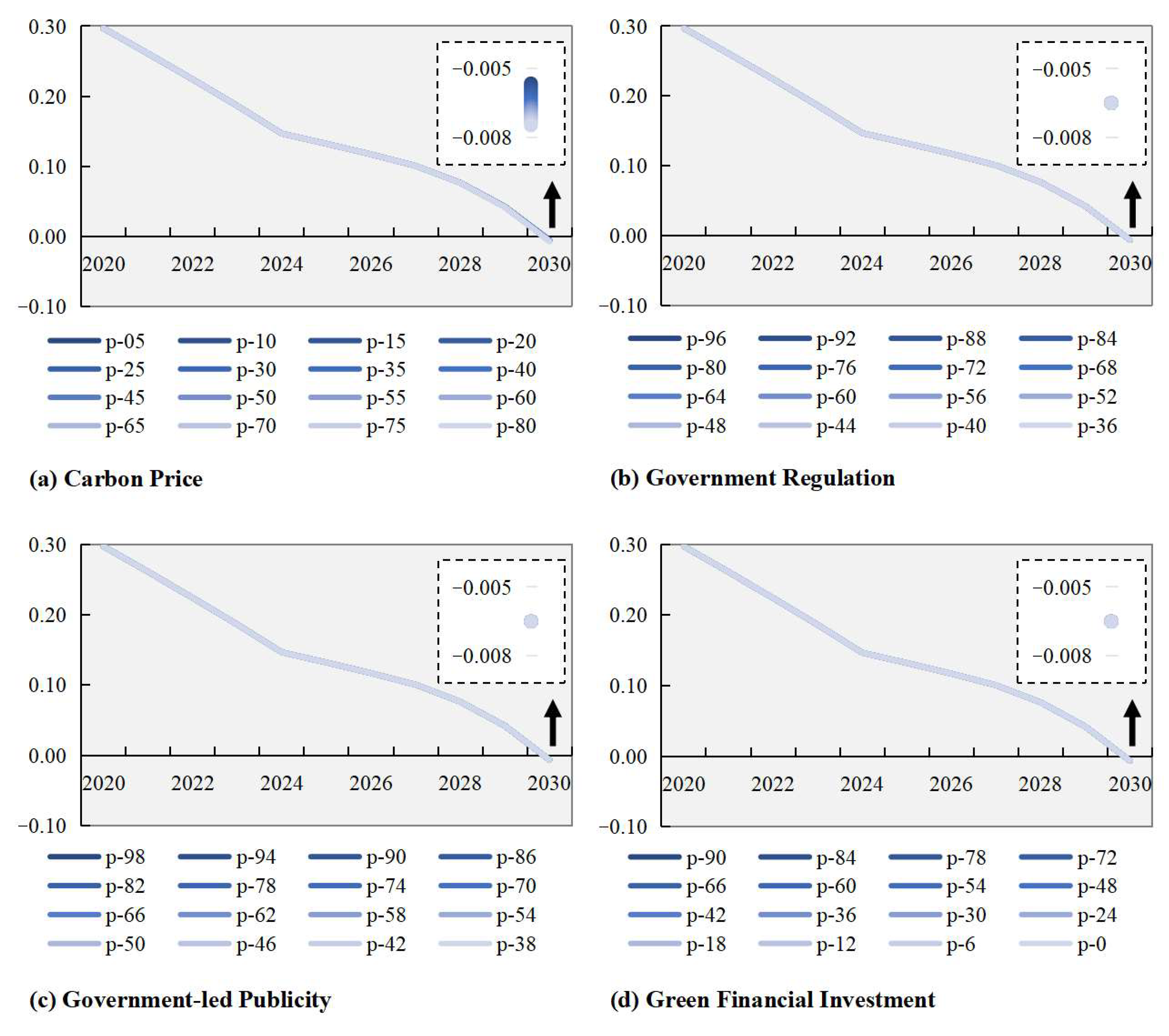

5.3. Effectiveness of Different Control Instruments on Industrial Chain Resilience

Building on the earlier comparison of different intervention scenarios, this study further explores the potential effects of individual policy instruments on industrial chain resilience. To this end, within the framework of SD model under SIS, we conducted a systematic sensitivity analysis across parameter ranges and assessed the model’s robustness under different parameter combinations. Setting is shown in

Table 6.

The carbon price for exporters varied between

$5 (one-third of the China’s national CETS price in 2024) and

$80 (consistent with EU’s level). Conversion coefficients for government regulation and government-led publicity ranged from 0.36, 0.38 (indicating a 50% reduction compared to the BS) to 1.00 (signifying complete conversion), while green financial investment was tested from 0 (no effect) to 0.90 (200% increase relative to SIS).

Table 7 provides a comparative summary of instrument effects on the three resilience dimensions.

Results for impact resistance are presented in

Figure 10. These indicate that carbon price is the most sensitive regulatory instrument. Across the entire test range, no single instrument reverses the overall declining trend of impact resistance; however, adjustments to carbon price exert a relatively greater effect in mitigating this decline. One plausible explanation is that higher carbon prices impose greater costs on all segments of the industrial chain, which may weaken short-term impact resistance. For example, in 2030, impact resistance at a carbon price of

$80 is 32.24% lower than at

$5. This suggests policymakers may need to balance industrial competitiveness with the ability to withstand external shocks when considering carbon price adjustments.

Results for recovery capacity are presented in

Figure 11. Similarly, carbon price emerges as the most sensitive instrument. Within the tested range, none of the instruments alter the overall trend of recovery capacity gradually stabilising around 2029; however, higher carbon price is generally associated with faster recovery. For instance, in 2028, recovery capacity at a carbon price of

$80 is 0.12% higher than at

$5. A plausible explanation is that carbon pricing—acting as a clear economic signal—may accelerate enterprises’ low-carbon transitions, thereby enhancing recovery capacity in the long term. This underscores the importance of carbon pricing in shaping recovery capacity, while also highlighting the need to consider trade-offs between cost burdens and efficiency gains.

Results for adaptability are presented in

Figure 12. Unlike impact resistance and recovery capacity, the effects of different instruments vary significantly. Carbon price exhibits relatively limited sensitivity, but government regulation and government-led publicity both exhibit a more linear upward trend in adaptability, particularly pronounced between 2025 and 2028. Of the two, government-led publicity demonstrates slightly greater marginal improvement. This may be because it reinforces green behaviour not only through institutional pressure but also via cognitive and social pressures. Notably, green finance investment exhibits the highest sensitivity. This likely reflects green finance’s direct influence on the availability of funding, which significantly enhances enterprises’ capacity to implement green transformations. Overall, green finance has the most pronounced marginal effect on adaptability, followed by government regulation and government-led publicity in the medium term. Carbon price, by contrast, primarily affects long-term outcomes, with some certain influence. These results suggest that policy mix design must carefully consider the temporal dynamics and sensitivity of different instruments to achieve more robust improvements in adaptability.

In summary, the cross-parameter sensitivity analysis not only highlights the relative effects of different policy instruments but also confirms that the SD model’s output trends remain broadly consistent across different parameter settings. While numerical values may vary, the underlying trends are robust across a wide range of inputs. Thus, despite inherent uncertainties associated with SD model predictions and parameter assumptions, the results provide a valuable exploratory reference for understanding potential mechanisms and optimising regulatory instruments in policy design.

6. Conclusions

This study uses China’s steel industrial chain as a case study to explore the potential mechanisms linking green trade barriers, green finance, and industrial chain resilience in developing countries. A system dynamics model which informed by scenario and parameter settings, was constructed to conduct simulation-based exploratory analyses on the effectiveness of green finance under green trade barriers.

The key findings and simulation-based insights are as follows:

(1) The Pressure–State–Response framework partially explains the interactions between green trade barriers, industrial chain resilience, and green finance. Green trade barriers like EU’s CBAM constitute external pressure, green finance serves as a response mechanism for developing countries, and these are dynamics reflected in the state of industrial chain resilience. (2) Without extra policy measures, the resilience of China’s steel industrial chain under green trade barriers will exhibits notable fluctuations. Specifically, impact resistance declines gradually year-on-year, recovery capacity improves incrementally, and adaptability follows a stepwise upward trend. (3) Under green trade barriers, green finance and supporting policy measures remain highly impactful. Compared with scenarios relying solely on market-based instruments or excluding green finance, scenarios integrating government-coordinated intervention measures and green finance deliver more pronounced industrial resilience improvements, particularly for adaptability. (4) The sensitivity of industrial chain resilience to policy instruments varies by dimension. Carbon price is the key lever shaping impact resistance and recovery capacity, though it requires balancing short-term negative effects. Government regulation and government-led publicity effectively enhance adaptability, but green finance investment demonstrates the strongest marginal effect in this part.

Based on the SD model’s assumptions and simulation, the following conditional recommendations are proposed for policymakers:

(1) Adjust stakeholder cognitions. Governments and industries should recognise that green finance is a critical tool for enhancing resilience, but not a universal solution or the sole option. In developing countries with less mature green finance systems, improving the precision of government regulation and promotion may be more cost-effective for boosting resilience in carbon-intensive, export-oriented industries (e.g., steel). This recommendation is less applicable, however, in countries with higher carbon prices and more comprehensive green finance and policy frameworks.

(2) Establish dynamic monitoring mechanisms. Government interventions, whether adjusting carbon price or implementing supply-demand measures, must operate within a reasonable range. Developing country governments should prioritise building real-time industrial chain resilience monitoring systems, focusing on key indicators such as supply-demand fluctuations and strategic reserves, as well as integrating digital infrastructure that can enhance policy adjustment efficiency and prevent poorly timed interventions. However, for countries frequently affected by geopolitical conflicts, natural disasters, or with limited capacity to develop digital infrastructure, implementing this recommendation may face significant political and economic constraints.

(3) Provide active government interventions for industrial decarbonization. Green and low-carbon transformation is an inevitable trend, yet industrial chains in developing countries often face financial, technological, and information barriers. Governments should prudently combine market-based instruments with enhanced intervention measures to strengthen industrial chain resilience. For the least developed countries or economies where green trade barriers have a negligible impact, transitional policies that align the interests of domestic and international stakeholders are recommended over aggressive intervention.

It should be noted that the SD model constructed in this study involves multidimensional simplifications. Simulation results are based on a single-country, single-case analysis, specific theoretical assumptions, and particular parameter settings. As such, they reflect scenario-based exploration and mechanism analysis rather than rigorous causal identification, and their generalizability to other contexts is limited. Furthermore, discussions on carbon markets remain preliminary; issues such as auction mechanisms and cross-market coordination warrant further investigation. Future research will aim to integrate alternative methodological approaches, deepen analysis of these mechanisms, and use updated, reliable data to empirically examine key relationships.