Enabling Technologies for Circular Economy Transition: Cases in the Manufacturing Industry

Abstract

1. Introduction

2. Research Methods

2.1. Literature Review and Research Protocol

2.2. Case Selection and Data Gathering

2.3. Data Analysis

3. Literature Review

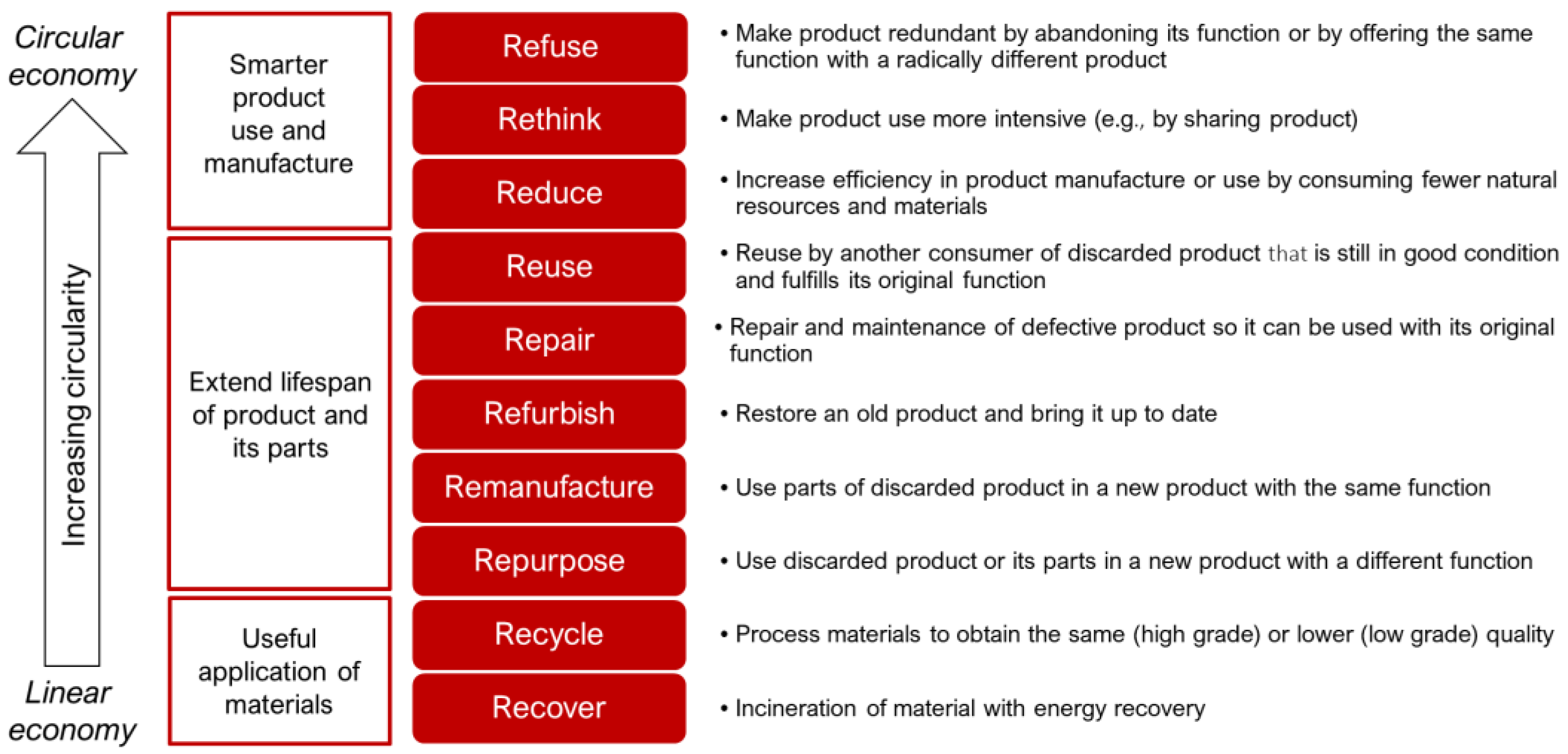

3.1. Circular Economy

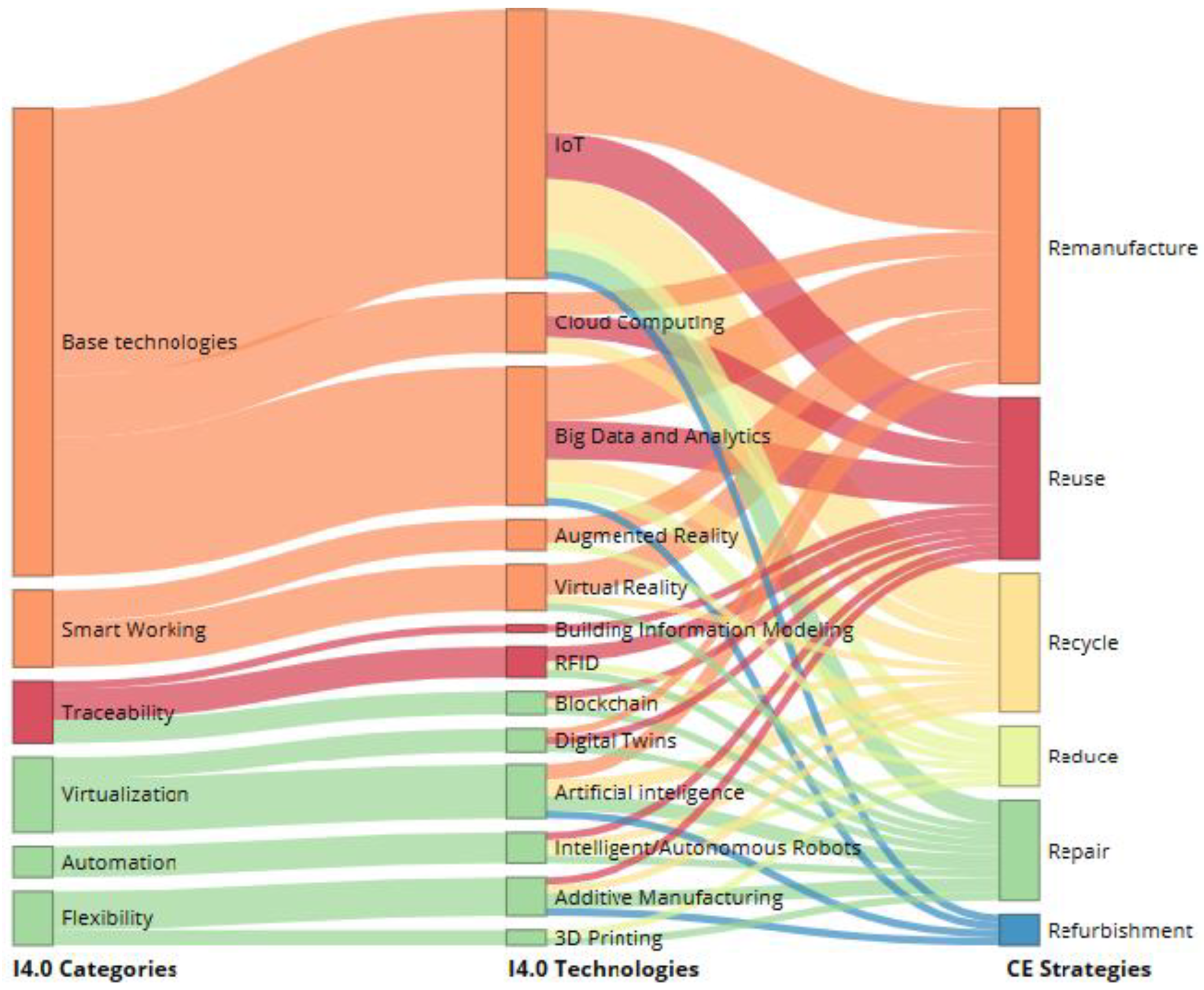

3.2. Enabling CE Through I4.0 Technologies

3.2.1. Reuse Strategy

3.2.2. Repair Strategy

3.2.3. Refurbishment Strategy

3.2.4. Remanufacture Strategy

4. Case Studies

4.1. Circular Strategies Adoption

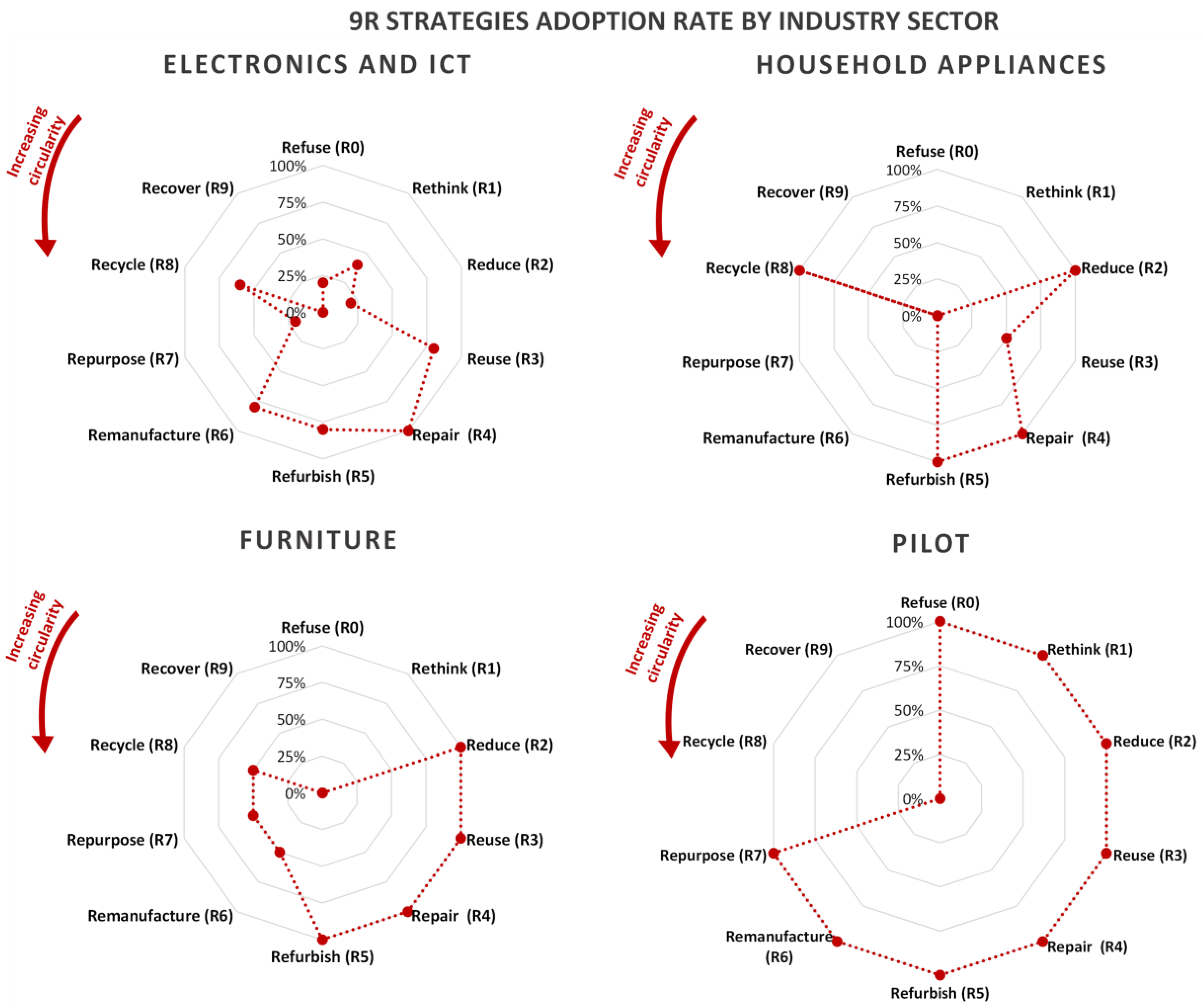

4.1.1. 9R Strategies Adoption

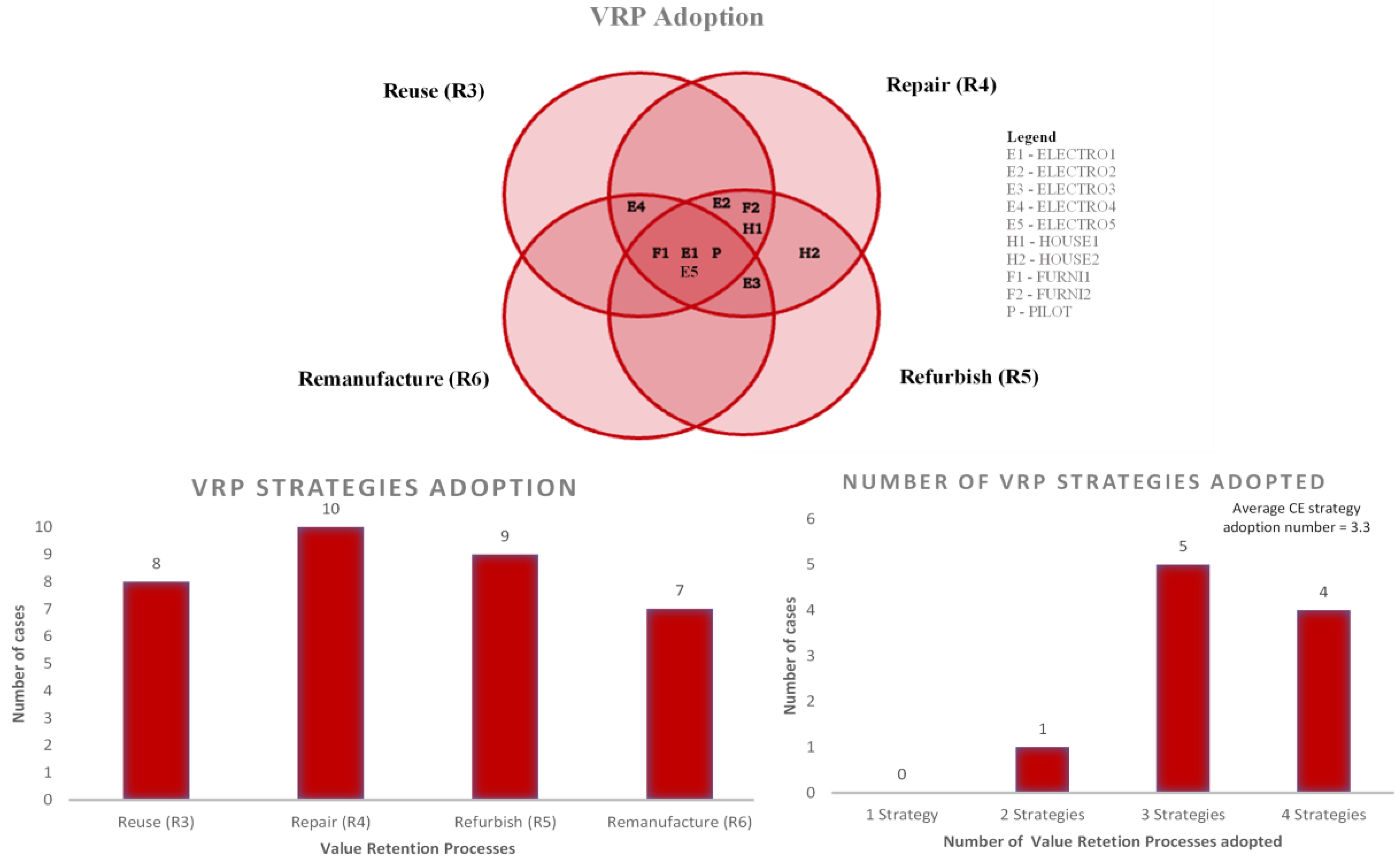

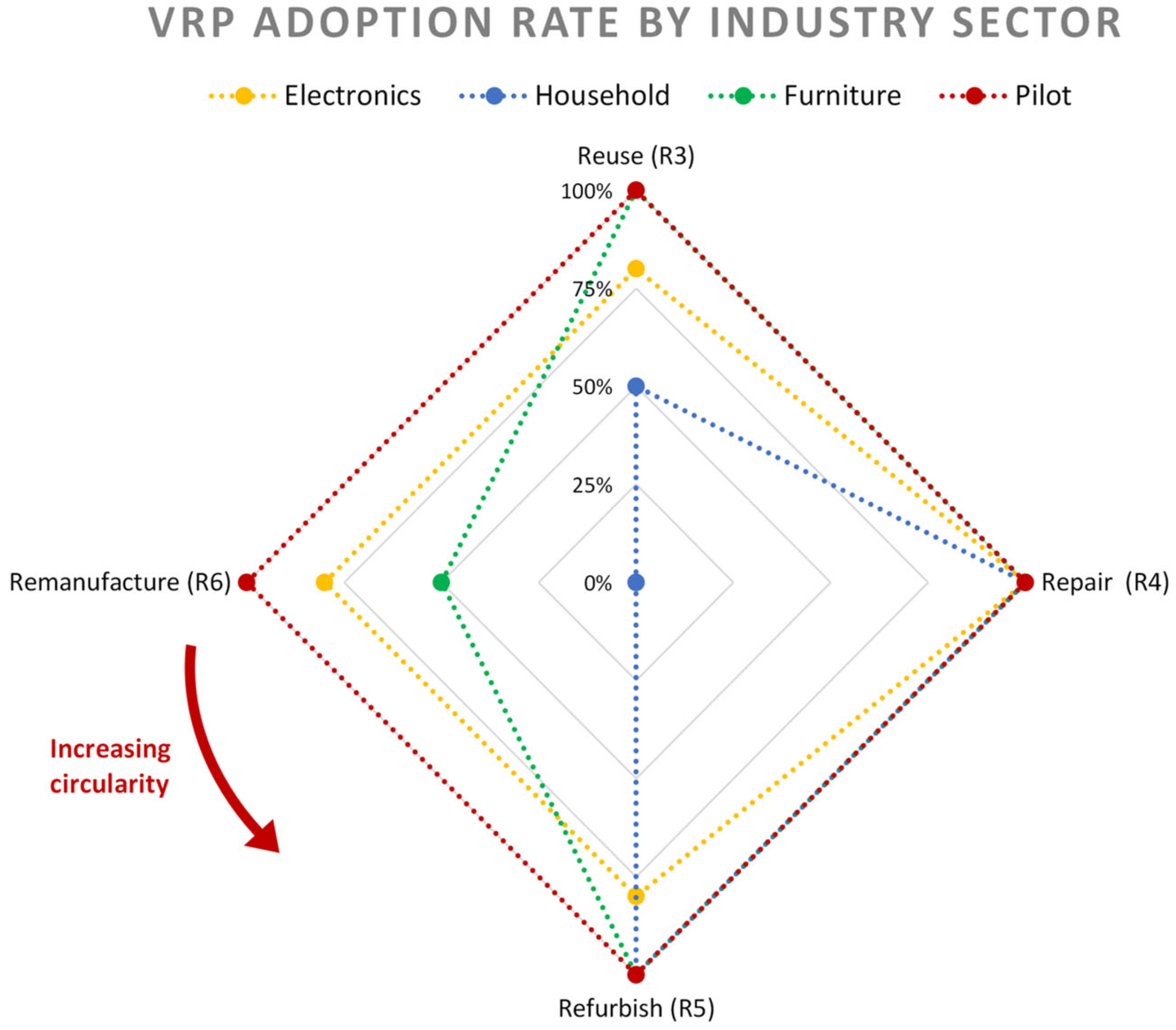

4.1.2. VRP Adoption

4.1.3. Challenges in Circular Economy Implementation

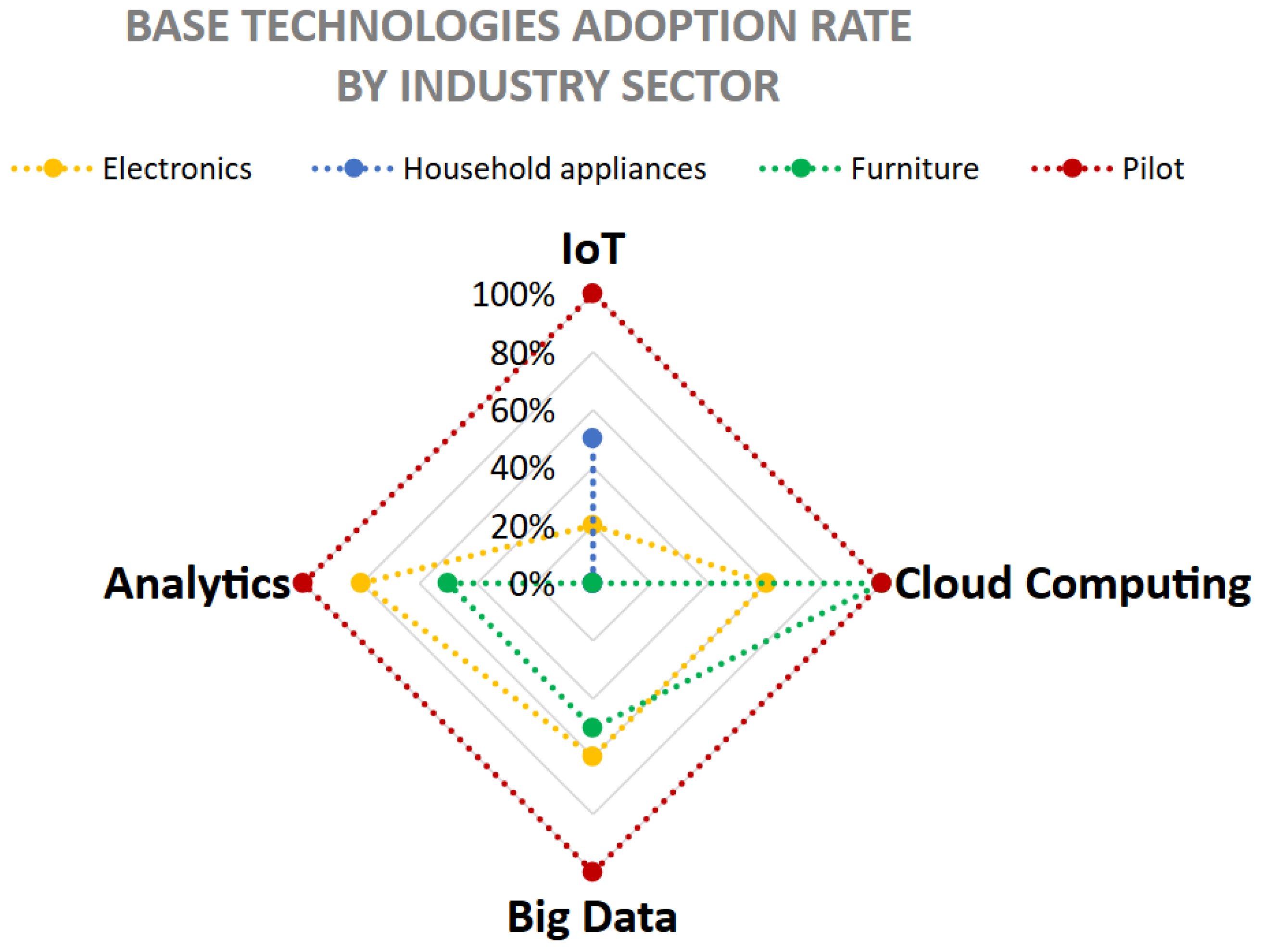

4.2. Enabling Technologies to CE Adoption

4.3. Barriers to I4.0 Adoption in Circular Business Models

5. Discussion

5.1. Implications for Theory

5.2. Implications for Practice

5.3. Limitations and Future Research Agenda

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AI | Artificial Intelligence |

| AGV | Automated Guided Vehicle |

| BIM | Building Information Modelling |

| CAD | Computer-Aided Design |

| CE | Circular Economy |

| CRM | Customer Relationship Management |

| ERP | Enterprise Resource Planning |

| I4.0 | Industry 4.0 |

| IoT | Internet of Things |

| MRP | Materials Requirements Planning |

| RFID | Radio Frequency Identification |

| VR | Virtual Reality |

| VRP | Value-Retention Process |

Appendix A

| Phase | Content/Goal |

|---|---|

| Phase 0: Presentation and general instructions | - introduction of the research topic and objectives, general instructions. - presentation of the confidentiality agreement |

| Phase 1: General questions about the company | - identification of the main activities of the company, size, and role of the interviewee in the company - identification of the scope and motivation of the CE project carried out |

| Phase 2: Questions about the CE project carried out | - assessment of the level of CE adoption in the company and the relative importance of circular manufacturing compared to other manufacturing capabilities - identification of circular economy strategies from the 9R framework adopted by the company |

| Phase 3: Questions on CE challenges | - recognition of the challenges faced by the company - recognition of core skills required to meet the challenges - recognition of key benefits gained from the implementation of the CE project - identification of the role of digitalization in the CE project |

| Phase 4: Questions about enabling technologies adoption | - assessment of the level of I4.0 technologies adoption in the company - identification of base technologies’ adoption - identification of Smart Manufacturing technologies adoption and the purpose of this adoption - recognition of product’s capability improvement - identification of Smart Working technologies adoption - identification of Smart Supply Chain technologies adoption - identification of possible future technologies adoption |

| Phase 5: Final questions and conclusion | - assessment on how technologies can be used to attain CE - identification of partners along the supply chain that help make the business viable - finalization of the interview and elucidation of remaining questions |

References

- Bocken, N.M.P.; De Pauw, I.; Bakker, C.; Van Der Grinten, B. Product design and business model strategies for a circular economy. J. Ind. Prod. Eng. 2016, 33, 308–320. [Google Scholar] [CrossRef]

- Homrich, A.S.; Galvão, G.; Abadia, L.G.; Carvalho, M.M. The Circular Economy Umbrella: Trends and Gaps on Integrating Pathways. J. Clean. Prod. 2018, 175, 525–543. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Morioka, S.N.; de Carvalho, M.M.; Evans, S. Business models and supply chains for the circular economy. J. Clean. Prod. 2018, 190, 712–721. [Google Scholar] [CrossRef]

- Manninen, K.; Koskela, S.; Antikainen, R.; Bocken, N.M.P.; Dahlbo, H.; Aminoff, A. Do circular economy business models capture intended environmental value propositions? J. Clean. Prod. 2018, 171, 413–422. [Google Scholar] [CrossRef]

- Lasi, H.; Fettke, P.; Kemper, H.G.; Feld, T.; Hoffmann, M. Industry 4.0. Bus. Inf. Syst. Eng. 2014, 6, 239–242. [Google Scholar] [CrossRef]

- Rosa, P.; Sassanelli, C.; Urbinati, A.; Chiaroni, D.; Terzi, S. Assessing relations between circular economy and industry 4.0: A systematic literature review. Int. J. Prod. Res. 2020, 58, 1662–1687. [Google Scholar] [CrossRef]

- Sung, T.K. Industry 4.0: A korea perspective. Technol. Forecast. Soc. Change 2018, 132, 40–45. [Google Scholar] [CrossRef]

- Bag, S.; Telukdarie, A.; Pretorius, J.H.C.; Gupta, S. Industry 4.0 and supply chain sustainability: Framework and future research directions. Benchmarking Int. J. 2021, 28, 1410–1450. [Google Scholar] [CrossRef]

- Frank, A.G.; Dalenogare, L.S.; Ayala, N.F. Industry 4.0 technologies: Implementation patterns in manufacturing companies. Int. J. Prod. Econ. 2019, 210, 15–26. [Google Scholar] [CrossRef]

- Lopes de Sousa Jabbour, A.B.; Jabbour, C.J.C.; Godinho Filho, M.; Roubaud, D. Industry 4.0 and the circular economy: A proposed research agenda and original roadmap for sustainable operations. Ann. Oper. Res. 2018, 270, 273–286. [Google Scholar] [CrossRef]

- Kristoffersen, E.; Blomsma, F.; Mikalef, P.; Li, J. The smart circular economy: A digital-enabled circular strategies framework for manufacturing companies. J. Bus. Res. 2020, 120, 241–261. [Google Scholar] [CrossRef]

- Dubey, R.; Gunasekaran, A.; Childe, S.J.; Papadopoulos, T.; Luo, Z.; Wamba, S.F.; Roubaud, D. Can big data and predictive analytics improve social and environmental sustainability? Technol. Forecast. Soc. Change 2019, 144, 534–545. [Google Scholar] [CrossRef]

- Laskurain-Iturbe, I.; Arana-Landín, G.; Landeta-Manzano, B.; Uriarte-Gallastegi, N. Exploring the influence of industry 4.0 technologieson the circular economy. J. Clean. Prod. 2021, 321, 128944. [Google Scholar] [CrossRef]

- Prause, G.; Atari, S. On sustainable production networks for industry 4.0. Entrep. Sustain. Issues 2017, 4, 421–431. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research and Applications: Design and Methods, 6th ed.; Sage: Thousand Oaks, CA, USA, 2018. [Google Scholar]

- Eisenhardt, K.M.; Graebner, M.E. Theory building from cases: Opportunities and challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Carvalho, M.M.; Fleury, A.; Lopes, A.P. An overview of the literature on technology roadmapping (trm): Contributions and trends. Technol. Forecast. Soc. Change 2013, 80, 1418–1437. [Google Scholar] [CrossRef]

- Morioka, S.N.; Carvalho, M.M. A systematic literature review towards a conceptual framework for integrating sustainability performance into business. J. Clean. Prod. 2016, 136, 134–146. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Building theories from case study research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Voss, C.; Tsikriktsis, N.; Frohlich, M. Case research in operations management. Int. J. Oper. Prod. Manag. 2002, 22, 195–219. [Google Scholar] [CrossRef]

- Kirchherr, J.; Reike, D.; Hekkert, M. Conceptualizing the circular economy: An analysis of 114 definitions. Resour. Conserv. Recycl. 2017, 127, 221–232. [Google Scholar] [CrossRef]

- Bressanelli, G.; Adrodegari, F.; Perona, M.; Saccani, N. Exploring how usage-focused business models enable circular economy through digital technologies. Sustainability 2018, 10, 639. [Google Scholar] [CrossRef]

- Bressanelli, G.; Saccani, N.; Perona, M.; Baccanelli, I. Towards circular economy in the household appliance industry: An overview of cases. Resources 2020, 9, 128. [Google Scholar] [CrossRef]

- Bressanelli, G.; Perona, M.; Saccani, N. Challenges in supply chain redesign for the circular economy: A literature review and a multiple case study. Int. J. Prod. Res. 2019, 57, 7395–7422. [Google Scholar] [CrossRef]

- Nascimento, D.L.M.; Alencastro, V.; Quelhas, O.L.G.; Caiado, R.G.G.; Garza-Reyes, J.A.; Rocha-Lona, L.; Tortorella, G. Exploring industry 4.0 technologies to enable circular economy practices in a manufacturing context. J. Manuf. Technol. Manag. 2019, 30, 607–627. [Google Scholar] [CrossRef]

- Russell, J.D.; Nasr, N.Z. Value-retained vs. impacts avoided: The differentiated contributions of remanufacturing, refurbishment, repair, and reuse within a circular economy. J. Remanuf. 2023, 13, 25–51. [Google Scholar] [CrossRef]

- Lei, Z.; Cai, S.; Cui, L.; Wu, L.; Liu, Y. How do different industry 4.0 technologies support certain circular economy practices? Ind. Manag. Data Syst. 2023, 123, 1220–1251. [Google Scholar] [CrossRef]

- Xing, K.; Kim, K.P.; Ness, D. Cloud-bim enabled cyber-physical data and service platforms for building component reuse. Sustainability 2020, 12, 10329. [Google Scholar] [CrossRef]

- Rizvi, S.W.H.; Agrawal, S.; Murtaza, Q. Circular economy under the impact of it tools: A content-based review. Int. J. Sustain. Eng. 2021, 14, 87–97. [Google Scholar] [CrossRef]

- Chen, M.; Ogunseitan, O.A. Zero e-waste: Regulatory impediments and blockchain imperatives. Front. Environ. Sci. Eng. 2021, 15, 114. [Google Scholar] [CrossRef]

- Preut, A.; Kopka, J.-P.; Clausen, U. Digital twins for the circular economy. Sustainability 2021, 13, 10467. [Google Scholar] [CrossRef]

- Yusoh, S.S.M.; Abd Wahab, D.; Habeeb, H.A.; Azman, A.H. Intelligent systems for additive manufacturing-based repair in remanufacturing: A systematic review of its potential. PeerJ Comput. Sci. 2021, 7, e808. [Google Scholar] [CrossRef]

- Daneshmand, M.; Noroozi, F.; Corneanu, C.; Mafakheri, F.; Fiorini, P. Industry 4.0 and prospects of circular economy: A survey of robotic assembly and disassembly. Int. J. Adv. Manuf. Technol. 2023, 124, 2973–3000. [Google Scholar] [CrossRef]

- Liu, L.; Song, W.; Liu, Y. Leveraging digital capabilities toward a circular economy: Reinforcing sustainable supply chain management with industry 4.0 technologies. Comput. Ind. Eng. 2023, 178, 109113. [Google Scholar] [CrossRef]

- Caterino, M.; Fera, M.; Macchiaroli, R.; Pham, D.T. Cloud remanufacturing: Remanufacturing enhanced through cloud technologies. J. Manuf. Syst. 2022, 64, 133–148. [Google Scholar] [CrossRef]

- Ghiaci, A.M.; Ghoushchi, S.J. Assessment of barriers to IoT-enabled circular economy using an extended deci-sion-making-based FMEA model under uncertain environment. Internet Things 2023, 22, 100719. [Google Scholar] [CrossRef]

- Awan, U.; Sroufe, R.; Shahbaz, M. Industry 4.0 and the circular economy: A literature review and recommendations for future research. Bus. Strat. Environ. 2021, 30, 2038–2060. [Google Scholar] [CrossRef]

- Massaro, M.; Secinaro, S.; Dal Mas, F.; Brescia, V.; Calandra, D. Industry 4.0 and circular economy: An exploratory analysis of academic and practitioners’ perspectives. Bus. Strat. Environ. 2021, 30, 1213–1231. [Google Scholar] [CrossRef]

- Ingemarsdotter, E.; Jamsin, E.; Kortuem, G.; Balkenende, R. Circular strategies enabled by the internet of things—Aframework and analysis of current practice. Sustainability 2019, 11, 5689. [Google Scholar] [CrossRef]

- Delpla, V.; Kenné, J.P.; Hof, L.A. Circular manufacturing 4.0: Towards internet of things embedded closed-loop supply chains. Int. J. Adv. Manuf. Technol. 2022, 118, 3241–3264. [Google Scholar] [CrossRef]

- Taddei, E.; Sassanelli, C.; Rosa, P.; Terzi, S. Circular supply chains in the era of industry 4.0: A systematic literature review. Comput. Ind. Eng. 2022, 170, 108268. [Google Scholar] [CrossRef]

- Fofou, R.F.; Jiang, Z.; Wang, Y. A review on the lifecycle strategies enhancing remanufacturing. Appl. Sci. 2021, 11, 5937. [Google Scholar] [CrossRef]

- Tiwari, D.; Miscandlon, J.; Tiwari, A.; Jewell, G.W. A review of circular economy research for electric motors and the role of industry 4.0 technologies. Sustainability 2021, 13, 9668. [Google Scholar] [CrossRef]

- Kerin, M.; Pham, D.T. A review of emerging industry 4.0 technologies in remanufacturing. J. Clean. Prod. 2019, 237, 117805. [Google Scholar] [CrossRef]

- Subramoniam, R.; Sundin, E.; Subramoniam, S.; Huisingh, D. Riding the digital product life cycle waves towards a circular economy. Sustainability 2021, 13, 8960. [Google Scholar] [CrossRef]

- Chau, M.Q.; Nguyen, X.P.; Huynh, T.T.; Chu, V.D.; Le, T.H.; Nguyen, T.P.; Nguyen, D.T. Prospects of application of iot-based advanced technologies in remanufacturing process towards sustainable development and energy-efficient use. Energy Sources Part A Recovery Util. Environ. Eff. 2021, 47, 1994057. [Google Scholar] [CrossRef]

- Sun, X.; Wang, X. Modeling and Analyzing the Impact of the Internet of Things-Based Industry 4.0 on Circular Economy Practices for Sustainable Development: Evidence From the Food Processing Industry of China. Front. Psychol. 2022, 13, 866361. [Google Scholar] [CrossRef]

- Chen, X.; Despeisse, M.; Johansson, B. Environmental Sustainability of Digitalization in Manufacturing: A Review. Sustainability 2020, 12, 10298. [Google Scholar] [CrossRef]

- Kerdlap, P.; Low, J.S.C.; Ramakrishna, S. Zero waste manufacturing: A framework and review of technology, research, and implementation barriers for enabling a circular economy transition in Singapore. Resour. Conserv. Recycl. 2019, 151, 104438. [Google Scholar] [CrossRef]

- Okorie, O.; Salonitis, K.; Charnley, F. Remanufacturing and refurbishment in the age of industry 4.0: An integrated research agenda. In Sustainable Manufacturing; Elsevier: Amsterdam, The Netherlands, 2021; pp. 87–107. [Google Scholar]

- Potting, J.; Hekkert, M.P.; Worrell, E.; Hanemaaijer, A. Circular Economy: Measuring Innovation in the Product Chain; PBL Netherlands Environmental Assessment Agency: The Hague, The Netherlands, 2017; Available online: https://research-portal.uu.nl/en/publications/circular-economy-measuring-innovation-in-the-product-chain (accessed on 13 September 2025).

- Kandasamy, J.; Venkat, V.; Mani, R.S. Barriers to the adoption of digital technologies in a functional circular economy network. Oper. Manag. Res. 2023, 16, 1541–1561. [Google Scholar] [CrossRef]

- Swan, M. Blockchain for business: Next-generation enterprise artificial intelligence systems. In Blockchain Technology: Platforms, Tools and Use Cases; Raj, P., Deka, G.C., Eds.; Advances in Computers; Elsevier: Amsterdam, The Netherlands, 2018; Volume 111, pp. 121–162. ISBN 9780128138526. [Google Scholar]

- Tönnissen, S.; Teuteberg, F. Analysing the impact of blockchain-technology for operations and supply chain management: An explanatory model drawn from multiple case studies. Int. J. Inf. Manag. 2020, 52, 101953. [Google Scholar] [CrossRef]

- Manavalan, E.; Jayakrishna, K. An analysis on sustainable supply chain for circular economy. Procedia Manuf. 2019, 33, 477–484. [Google Scholar] [CrossRef]

- Kouhizadeh, M.; Saberi, S.; Sarkis, J. Blockchain technology and the sustainable supply chain: Theoretically exploring adoption barriers. Int. J. Prod. Econ. 2021, 231, 107831. [Google Scholar] [CrossRef]

- Jaeger, B.; Upadhyay, A. Understanding barriers to circular economy: Cases from the manufacturing industry. J. Enterp. Inf. Manag. 2020, 33, 729–745. [Google Scholar] [CrossRef]

- Yadav, G.; Luthra, S.; Jakhar, S.K.; Mangla, S.K.; Rai, D.P. A framework to overcome sustainable supply chain challenges through solution measures of industry 4.0 and circular economy: An automotive case. J. Clean. Prod. 2020, 254, 120112. [Google Scholar] [CrossRef]

- Luthra, S.; Mangla, S.K.; Yadav, G. An analysis of causal relationships among challenges impeding redistributed manufacturing in emerging economies. J. Clean. Prod. 2019, 225, 949–962. [Google Scholar] [CrossRef]

- Suarez-Eiroa, B.; Fernández, E.; Méndez, G. Integration of the circular economy paradigm under the just and safe operating space narrative: Twelve operational principles based on circularity, sustainability and resilience. J. Clean. Prod. 2021, 322, 129071. [Google Scholar] [CrossRef]

- Morseletto, P. Targets for a circular economy. Resour. Conserv. Recycl. 2020, 153, 104553. [Google Scholar] [CrossRef]

- Mendoza, J.M.F.; Sharmina, M.; Gallego-Schmid, A.; Heyes, G.; Azapagic, A. Integrating backcasting and eco–design for the circular economy: The bece framework. J. Ind. Ecol. 2017, 21, 526–544. [Google Scholar] [CrossRef]

- den Hollander, M.C.; Bakker, C.A.; Hultink, E.J. Product design in a circular economy: Development of a typology of key concepts and terms. J. Ind. Ecol. 2017, 21, 517–525. [Google Scholar] [CrossRef]

- Huang, L.; Zhen, L.; Wang, J.; Zhang, X. Blockchain implementation for circular supply chain management: Evaluating critical success factors. Ind. Mark. Manag. 2022, 102, 451–464. [Google Scholar] [CrossRef]

- Huang, Y.; Chen, H.; Liu, B.; Huang, K.; Wu, Z.; Yan, K. Radar technology for river flow monitoring: Assessment of the current status and future challenges. Water 2023, 15, 1904. [Google Scholar] [CrossRef]

- Cwiklicki, M.; Wojnarowska, M. Circular economy and Industry 4.0: One-way or two-way relationships? Eng. Econ. 2020, 31, 387–397. [Google Scholar] [CrossRef]

| ID | Sector | Core Product | Organization Size | Country | Interviewee Role | Language |

|---|---|---|---|---|---|---|

| ELECTRO1 | Electronics and ICT | Laptops | Large company (over 250 employees) | United Kingdom | Sustainability leadership | English |

| ELECTRO2 | Electronics and ICT | Laptops | Large company (over 250 employees) | Germany | Corporate responsibility role | English |

| ELECTRO3 | Electronics and ICT | Laptops | Small company (10 to 49 employees) | Brazil | Corporate responsibility role | Portuguese |

| ELECTRO4 | Electronics and ICT | Drivetrain and battery systems | Large company (over 250 employees) | Germany | Specialized role in Circular Economy | English |

| ELECTRO5 | Electronics and ICT | Laptops, printers, cartridges and toners | Large company (over 250 employees) | Brazil | Director research institute | Portuguese |

| HOUSE1 | Household appliances | Fridges, microwaves and dishwashers | Large company (over 250 employees) | Sweden | Corporate responsibility role | English |

| HOUSE2 | Household appliances | Washing machines, dishwashers and dryers | Large company (over 250 employees) | Germany | Project management role | English |

| FURNI1 | Furniture | Office chairs, tables, sofas | Large company (over 250 employees) | United Kingdom | Sustainability leadership | English |

| FURNI2 | Furniture | Mattress | Large company (over 250 employees) | Germany | Specialized role in Circular Economy | Portuguese |

| PILOT | University | Scooter and mobile working hub | Small organization (10 to 49 employees) | Germany | Academic researcher | English |

| I4.0 Category | I4.0 Technology | Reduce | Reuse | Repair | Refurbishment | Remanufacture | Recycle |

|---|---|---|---|---|---|---|---|

| Base technologies | Cloud Computing | [22,28,34] | [22,34,35] | [34,36] | |||

| Internet of Things | [37,38] | [22,28,37,39,40,41] | [37,42,43] | [42] | [13,22,35,37,39,40,41,42,43,44,45,46,47] | [36,37,38,39,40,42,47] | |

| Big Data and Analytics | [13,38] | [13,22,25,40,42] | [42] | [13,22,36,42,43,44,46] | [13,40,42] | ||

| Smart Manufacturing Traceability | Building Information Modeling | [28] | |||||

| Blockchain | [48] | [48] | [48] | [45,48] | |||

| RFID | [38] | [28,29] | [29] | [29,44] | [38] | ||

| Smart Manufacturing Automation | Intelligent/Autonomous Robots | [13] | [33] | [43] | [33,43,44,45] | [33] | |

| Drones | [45] | ||||||

| Smart Manufacturing Virtualization | Artificial Intelligence | [32,42] | [42] | [42,45] | [36,42] | ||

| Cyber Physical Systems | [28] | [35,36] | |||||

| Digital Twins | [43] | [43] | [43] | [43] | |||

| Smart Manufacturing Flexibility | Additive Manufacturing | [13,25] | [13] | [42,44] | [42] | [13,42,44,45] | [13] |

| 3D Printing | [49] | [35,44,45,46] | [22] | ||||

| Smart Working | Virtual Reality | [13] | [43] | [35,44,45,46] | [13] | ||

| Augmented Reality | [13] | [44,45,46] | [13] |

| CE Strategy | ELECTRO1 | ELECTRO2 | ELECTRO3 | ELECTRO4 | ELECTRO5 | HOUSE1 | HOUSE2 | FURNI1 | FURNI2 | PILOT | n | % * |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Refuse (R0) | X | X | 2 | 20% | ||||||||

| Rethink (R1) | X | X | X | 3 | 30% | |||||||

| Reduce (R2) | X | X | X | X | X | X | 6 | 60% | ||||

| Reuse (R3) | X | X | X | X | X | X | X | X | 8 | 80% | ||

| Repair (R4) | X | X | X | X | X | X | X | X | X | X | 10 | 100% |

| Refurbish (R5) | X | X | X | X | X | X | X | X | X | 9 | 90% | |

| Remanufacture (R6) | X | X | X | X | X | X | X | 7 | 70% | |||

| Repurpose (R7) | X | X | X | 3 | 30% | |||||||

| Recycle (R8) | X | X | X | X | X | X | 6 | 60% | ||||

| Recover (R9) | 0 | 0% | ||||||||||

| Sharing systems (PSS) | X | 1 | 10% | |||||||||

| Number of VRPs (R3–R6) | 4 | 3 | 3 | 3 | 4 | 3 | 2 | 4 | 4 | 4 | ||

| % of VRPs (R3–R6) ** | 100% | 75% | 75% | 75% | 100% | 75% | 50% | 100% | 100% | 100% | ||

| Total Rs CE strategies | 6 | 4 | 4 | 5 | 6 | 5 | 4 | 5 | 7 | 8 | ||

| % Rs CE strategies *** | 60% | 40% | 40% | 50% | 60% | 50% | 40% | 50% | 70% | 80% |

| Category | Challenge | Description | ELECTRO1 | ELECTRO2 | ELECTRO3 | ELECTRO4 | ELECTRO5 | HOUSE1 | HOUSE2 | FURNI1 | FURNI2 | n | % * |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Product characteristics and processes challenges | Lack of knowledge expertise | Companies implementing circular economy approaches may encounter challenges related to a lack of expertise, as current professionals may not yet possess the necessary knowledge of circular practices. | X | X | X | X | X | X | X | X | X | 9 | 100% |

| Product complexity | Companies adopting CE approaches may face challenges due to novelty of materials that are used in circular designs, because they will require new procedures and tools. The abundance of different devices may present challenges for remanufacturers and refurbishers alike, as each device has its own unique set of specifications. | X | X | X | X | X | X | 6 | 67% | ||||

| OEM product design | Companies adopting CE approaches may encounter challenges in disassembling their products. These difficulties arise from the original equipment manufacturer’s failure to consider repair and reuse during the design phase, as well as the use of non-replaceable parts in the product. | X | X | 2 | 22% | ||||||||

| Standards and regulations | Lack of standards | Companies adopting CE approaches may face problems related to lack of standards in processes, materials and activities. | X | X | X | X | X | X | X | X | X | 9 | 100% |

| Measures, metrics, indicators | Companies adopting CE approaches may encounter challenges with regard to indicators. This is because existing indicators were developed around the concept of a linear economy, with the aim of maximising throughput. CE requires a shift away from purely volume-driven economic perspective to a more comprehensive one, encompassing economic, environmental and social dimensions. | X | X | X | 3 | 33% | |||||||

| OEM control | Companies adopting CE approaches can face challenges because original equipment manufacturers have a strong influence on policy and legislation, which can make CE adoption difficult. | X | X | X | 3 | 33% | |||||||

| Taxation and incentives | Companies adopting CE approaches may face difficulties in taxation systems, since the existing taxation policies, incentives, and systems are aligned with traditional or linear models and do not take into account CE adoption. | X | 1 | 11% | |||||||||

| Supply chain management standards | Return flows uncertainty | Companies adopting CE approaches may encounter challenges regarding the uncertainty of the quantity, mix, quality, timing, and location of returns for end-of-use products. This uncertainty can decrease the likelihood of achieving economic scale and result in complications with capacity planning. | X | X | X | X | 4 | 44% | |||||

| Transportation and Infrastructure | Companies adopting CE approaches may face higher transportation activities and costs if they need to send all of their products back to producers or to firms that perform refurbishing and remanufacturing. | X | X | X | 3 | 33% | |||||||

| Availability of suitable supply chain partners | Companies adopting CE approaches usually experience difficulty in finding appropriate supply chain partners with appropriate skills. | X | X | X | 3 | 33% | |||||||

| Technology | Product technology improvement | Companies adopting CE approaches may face challenges because products designed for long life would not be able to participate in continuous technology improvement processes. | X | X | 2 | 22% | |||||||

| Data privacy and security | Companies adopting CE approaches may have heightened concerns about data security and privacy issues when a device has previously been used by someone else. To address this, appropriate data-clear activities should be developed. | X | X | X | 3 | 33% | |||||||

| Economic viability | Financial risk | Companies adopting CE approaches may face challenges in demonstrating to top management that CE adoption can be economically viable and lead to a competitive advantage in the future, as the degree of novelty can be seen as a high financial risk for top management teams. | X | X | X | X | 4 | 44% | |||||

| User behaviour challenges | Customer behaviour change | Companies adopting CE approaches may encounter challenges due to current customer behaviour patterns that heavily rely on a linear perspective. It is necessary to address this issue by implementing strategies that promote a circular approach to consumption. Promoting sustainable consumption patterns and CE-centered consumer behaviour is crucial for implementing the concept of CE in practice. | X | X | X | 3 | 33% | ||||||

| User’s willingness to buy | Companies adopting CE approaches may face challenges because some customers may decline to purchase second-hand products due to status or fashion design reasons, or because they perceive them as less reliable or second-rate. This decreases the market size for refurbished and remanufactured products in comparison to brand new ones. | X | X | 2 | 22% | ||||||||

| Organisation resistance | Cultural issues (linear mindset) | Companies adopting CE approaches may face challenges because of internal resistance to change, particularly as prevailing linear mindsets and structures in industries persist, which creates limited awareness and commitment from both top management and employees. | X | X | X | 3 | 33% | ||||||

| Market and competition | Unauthorized distribution channels | Companies that adopt Circular Economy (CE) approaches may encounter obstacles due to unauthorised distribution channels. This may occur because such markets offer significantly lower prices, which presents a substantial challenge to the implementation of CE approaches by companies that are unable to compete with lower grey market prices. | X | 1 | 11% |

| I4.0 Category | ID | Technology | ELECTRO1 | ELECTRO2 | ELECTRO3 | ELECTRO4 | ELECTRO5 | HOUSE1 | HOUSE2 | FURN1 | FURN2 | PILOT | n | % * | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B1 | Cloud Computing | X | X | X | X | X | X | 6 | 60% | ||||||

| Base technologies | B2 | IoT | X | X | X | 3 | 30% | ||||||||

| B3 | Big Data | X | X | X | X | X | 5 | 50% | |||||||

| B4 | Analytics | X | X | X | X | X | X | 6 | 60% | ||||||

| Total | 3 | 0 | 3 | 1 | 4 | 0 | 1 | 1 | 3 | 4 | |||||

| % ** | 75% | 0% | 75% | 25% | 100% | 0% | 25% | 25% | 75% | 100% | |||||

| M1 | Enterprise Resource Planning (ERP) | X | X | X | 3 | 30% | |||||||||

| Vertical Integration | M2 | Customer Relationship Management (CRM) | X | 1 | 10% | ||||||||||

| M3 | Materials Requirements Planning (MRP) | X | 1 | 10% | |||||||||||

| M4 | Building Information Modeling (BIM) | X | 1 | 10% | |||||||||||

| Traceability | M5 | Blockchain | X | 1 | 10% | ||||||||||

| Smart | M6 | Radio Frequency Identification (RFID) | X | 1 | 10% | ||||||||||

| Manufacturing | M7 | Robots | X | 1 | 10% | ||||||||||

| Automation | M8 | Automated Guided Vehicle (AGV) | X | 1 | 10% | ||||||||||

| M9 | Automated picking systems | X | 1 | 10% | |||||||||||

| M10 | Artificial Intelligence (AI) | X | X | 2 | 20% | ||||||||||

| Virtualization | M11 | Digital worker assistance system | X | 1 | 10% | ||||||||||

| M12 | Virtual simulation of processes | X | X | 2 | 20% | ||||||||||

| Flexibility | M13 | Additive manufacturing—3D Printing | X | X | 2 | 20% | |||||||||

| M14 | Computer-aided design (CAD) | X | X | 2 | 20% | ||||||||||

| Total | 2 | 1 | 1 | 0 | 4 | 0 | 0 | 3 | 1 | 8 | |||||

| % ** | 14% | 7% | 7% | 0% | 29% | 0% | 0% | 21% | 7% | 57% | |||||

| Smart Supply Chain | S1 | Digital platforms with suppliers | X | X | X | 3 | 30% | ||||||||

| S2 | Digital platforms with customers | X | X | 2 | 20% | ||||||||||

| Total | 1 | 1 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 1 | |||||

| % ** | 50% | 25% | 0% | 25% | 0% | 0% | 25% | 0% | 0% | 25% | |||||

| Smart Working | W1 | Collaborative robots | X | 1 | 10% | ||||||||||

| W2 | Virtual Reality (VR) and Augmented reality | X | X | 0 | 0% | ||||||||||

| Total | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 2 | |||||

| % ** | 0% | 0% | 0% | 0% | 25% | 0% | 0% | 0% | 0% | 50% | |||||

| Barrier | Description | ELECTRO1 | ELECTRO2 | ELECTRO3 | ELECTRO4 | ELECTRO5 | HOUSE1 | HOUSE2 | FURNI1 | FURNI2 | n | % * |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Limited scalability | Companies adopting CE approaches may have a barrier against I4.0 adoption due to the limited scalability in their business models, since usually there is an insecurity about technical and financial resources available. Another possible cause for limited scalability may be the insufficient progress in technology towards Industry 4.0 application. | X | X | X | X | X | X | X | X | 8 | 89% | |

| Lack of roadmap for successful implementation of Industry 4.0 | Companies adopting CE approaches may not have a well-defined strategy for I4.0 implementation, which could be an obstacle for its adoption. Organisations require a strategy that comprehends the principles and fundamentals of Industry 4.0, taking into account necessary technological and financial resources. | X | X | X | X | X | X | X | 7 | 78% | ||

| Difficulty and complexity in changing organisational culture | Companies adopting CE approaches may have a barrier against I4.0 implementation due to the difficulty in changing the organisation structure. Organisations often focus on short-term goals that demand quick results, which can limit the implementation of new policies and hinder changes to their workflow. There is a need for organisations to come up with the change in policies or define a new set of guidelines and also would need to develop a better understanding within themselves so that it would create an effective change in Industry 4.0 implementation. | X | X | X | X | X | X | 6 | 67% | |||

| Lack of knowledge expertise and awareness on digital technology implementation | Companies adopting CE approaches need proactive plans to implement digitisation across all organisational hierarchies in the supply chain. There is also a lack of standard tools and business models, which poses a challenge to the adoption of Industry 4.0. Some companies do not have the basic principles of I4.0 and therefore do not realise the benefits of implementing it. | X | X | X | X | X | 5 | 56% | ||||

| Immaturity of technology | Companies adopting CE approaches may have a barrier against I4.0 adoption due to lack of development in technology. It is often challenging to implement Industry 4.0 technology on a large scale, and a significant number of organisations have not yet upgraded to the latest technologies. Additionally, some industries remain unaware of the latest tools, which have indirectly contributed to security challenges and a negative perception of technology. | X | X | X | X | 4 | 44% | |||||

| Lack of infrastructure | Companies adopting CE approaches may not possess an up-to-date system infrastructure necessary to handle and incorporate diverse components or devices. The absence of a well-developed infrastructure plays an important role in enabling the implementation of I4.0, as it would be challenging to interface different components in the system without it, thereby impeding interaction with the physical world. | X | X | 2 | 22% | |||||||

| Dependent on 3rd party technology providers | Companies that adopt CE approaches may encounter obstacles in adopting I4.0 due to the current lack of equipped IT resources and infrastructure with the latest technologies. Consequently, these organisations highly depend on third-party technology firms to implement I4.0. | X | X | 2 | 22% | |||||||

| Disruption to existing jobs | Companies adopting CE approaches may hinder the implementation of Industry 4.0 due to employee fears of losing their jobs. Potential reasons for job insecurity and disruption may include insufficient consideration of sustainability and failure to adapt to the needs of the supply chain. | X | X | 2 | 22% | |||||||

| Total | 3 | 7 | 7 | 1 | 0 | 4 | 4 | 4 | 6 | |||

| % | 38% | 88% | 88% | 13% | 0% | 50% | 50% | 50% | 75% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Makssoudian Ferraz, B.; Moltschanov, A.; Meldt, L.; Monteiro de Carvalho, M. Enabling Technologies for Circular Economy Transition: Cases in the Manufacturing Industry. Systems 2025, 13, 865. https://doi.org/10.3390/systems13100865

Makssoudian Ferraz B, Moltschanov A, Meldt L, Monteiro de Carvalho M. Enabling Technologies for Circular Economy Transition: Cases in the Manufacturing Industry. Systems. 2025; 13(10):865. https://doi.org/10.3390/systems13100865

Chicago/Turabian StyleMakssoudian Ferraz, Beatriz, Alexander Moltschanov, Leonie Meldt, and Marly Monteiro de Carvalho. 2025. "Enabling Technologies for Circular Economy Transition: Cases in the Manufacturing Industry" Systems 13, no. 10: 865. https://doi.org/10.3390/systems13100865

APA StyleMakssoudian Ferraz, B., Moltschanov, A., Meldt, L., & Monteiro de Carvalho, M. (2025). Enabling Technologies for Circular Economy Transition: Cases in the Manufacturing Industry. Systems, 13(10), 865. https://doi.org/10.3390/systems13100865