Decision-Making and Contract Coordination of Closed-Loop Supply Chain with Dual-Competitive Retail and Recycling Markets

Abstract

1. Introduction

- (1)

- What is the effect of changing the number of retailers and collectors on the decisions and profits of supply chain members and the system as a whole?

- (2)

- How can a contract be designed to achieve perfect coordination in a closed-loop supply chain with dual-competitive retail and recycling markets?

- (1)

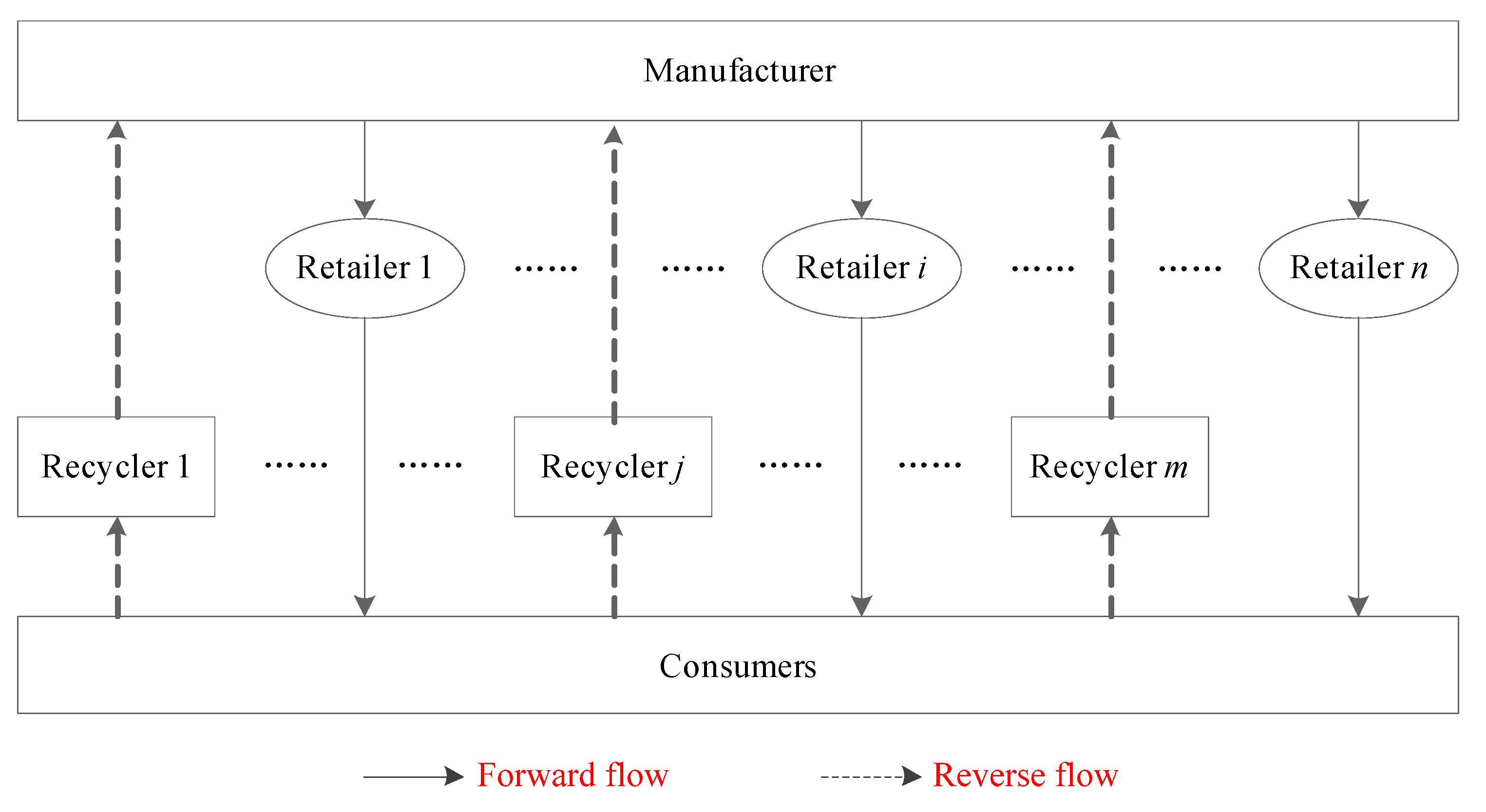

- To our knowledge, this study represents the first attempt to investigate management decisions in a closed-loop supply chain system comprising one manufacturer, retailers, and recyclers.

- (2)

- The study uncovers the dynamics of how competition influences supply chain management decision-making.

- (3)

- The research involves a linear transfer-payment contract designed to achieve perfect coordination within the supply chain.

2. Literature Review

2.1. Competition in Sales Channels

2.2. Competition in Recycling Channels

2.3. Dual Competition in Sales Channels and Recycling Channels

3. Problem Description and Notations

4. The Model

4.1. Centralized Decision-Making

4.2. Decentralized Decision-Making

4.3. Coordinated Decision-Making

5. Numerical Analysis

5.1. Changing Trends

- (1)

- Regardless of whether decision-making is decentralized or centralized, the optimal order quantities decrease as the number of retailers increases.

- (2)

- Under decentralized decision-making, the optimal order quantities are consistently lower than those under the centralized scenario.

- (3)

- The gap between and gradually decreases as increases.

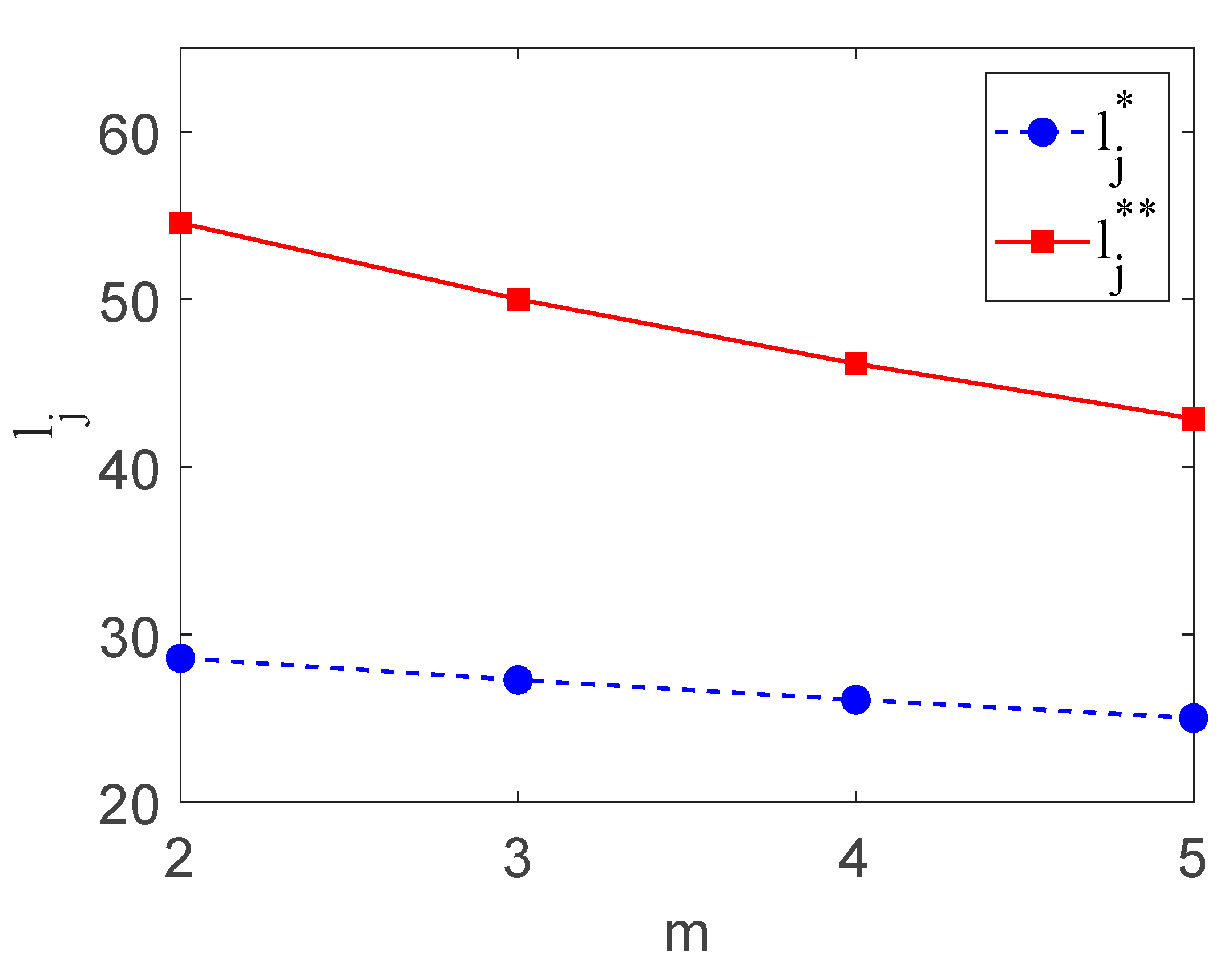

- (1)

- Under both decentralized and centralized decision-making, the optimal recycling quantities decline as increases.

- (2)

- The optimal recycling quantities under decentralized decision-making are consistently lower than those under the centralized scenario.

- (3)

- As increases, the difference between and gradually decreases.

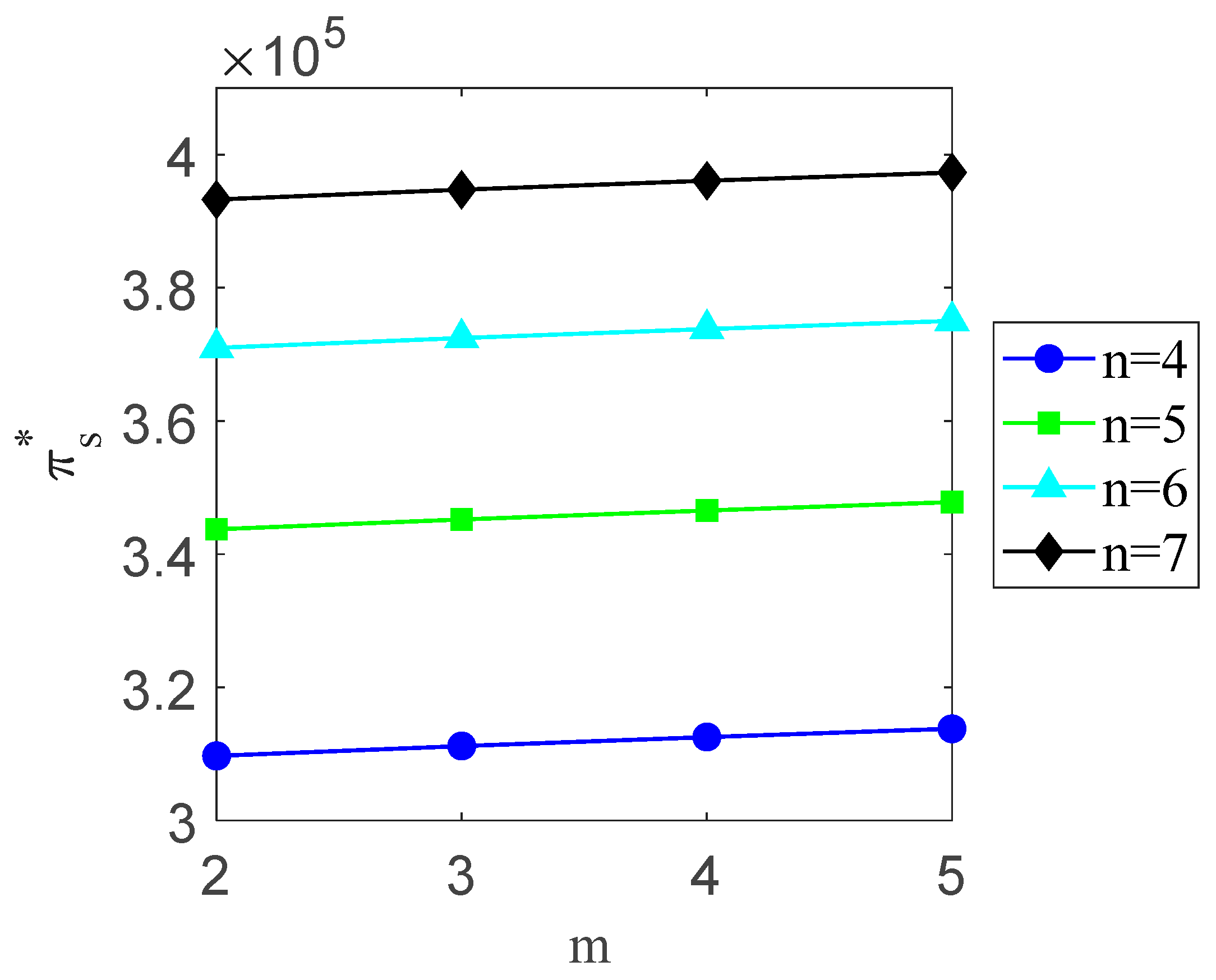

- (1)

- Under both decentralized and centralized decision-making, the optimal profits of the supply chain increase with the number of retailers or recyclers.

- (2)

- The optimal profits of the supply chain under decentralized decision-making are always lower than those under a centralized scenario. These lower profits indicate that the supply chains are in a state of discoordination.

5.2. Contract Coordination Effect

5.3. Sensitivity Analyses

- (1)

- The manufacturer’s profit is sensitive to the penalty–reward factors, but this sensitivity gradually decreases as the number of retailers and recyclers increases.

- (2)

- Every retailer’s (recycler’s) profit is sensitive to the penalty–reward factor for product-ordering (recycling of used products), but this sensitivity gradually decreases as the number of recyclers (recyclers) increases.

- (3)

- Within a defined supply chain system, the manufacturers are consistently more sensitive to the penalty–reward factor for product-ordering (recycling of used products) compared to retailers (recyclers).

6. Conclusions, Managerial Implications, and Limitations

6.1. Conclusions

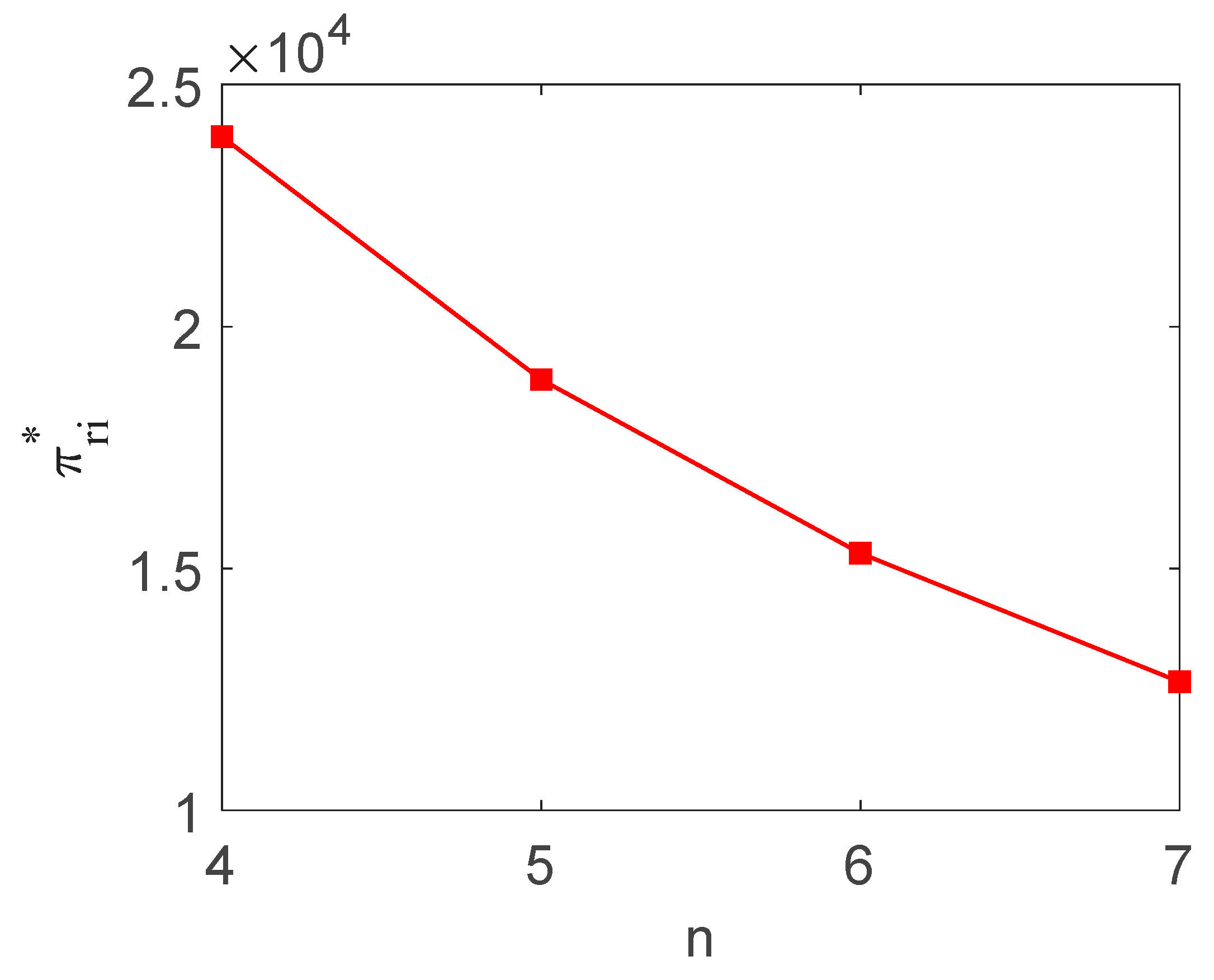

- (1)

- Under decentralized decision-making, an increase in the number of retailers reduces their optimal order quantities and retail prices. In contrast, under centralized decision-making, more retailers lower optimal order quantities but leave the optimal retail price unaffected. For recyclers, decentralized decision-making results in decreased recycling volumes yet higher optimal recycling prices as their numbers grow. Under centralized decision-making, however, more recyclers reduce recycling volumes, while the optimal recycling price remains stable.

- (2)

- Competition among retailers or recyclers enhances profits for the supply chain and the manufacturer, whereas retailer competition erodes retailers’ profits, and recycler competition similarly diminishes recyclers’ profits.

- (3)

- When the order quantity reward–penalty factor and the recycling volume reward–penalty factor fall within specified ranges, the linear transfer-payment contract achieves coordination in a competitive CLSC comprising one manufacturer, retailers, and recyclers.

- (4)

- Every enterprise’s profit is sensitive to the penalty–reward factor, but this sensitivity also gradually decreases as the number of retailers and (or) recyclers increases.

6.2. Managerial Implications

- (1)

- Initially, the dominant manufacturer should collaborate with as many retailers and recyclers as possible, provided they are willing, as this benefits the manufacturer, the supply chain, and consumers.

- (2)

- After a period of collaboration with all retailers and recyclers, the dominant manufacturer should conduct a systematic evaluation of their commercial credibility and default risks, and subsequently establish long-term partnerships with as many retailers and recyclers as possible who demonstrate high commercial credibility and low default risks.

- (3)

- The dominant manufacturer introduces the linear transfer-payment contract to all long-term partners (retailers and recyclers), elaborating on its benefits for all supply chain members.

- (4)

- Based on historical commercial collaboration data and participation constraints, the manufacturer preliminarily determines the value of the reward–penalty factor in the cooperation contract, and finalizes its value through negotiations with retailers and recyclers.

- (5)

- All supply chain members engage in a new round of commercial cooperation based on a linear transfer-payment contract.

- (6)

- At the end of a collaboration cycle, the manufacturer evaluates the collaborative performance, identifies issues, analyzes their causes, and implements solutions to ensure the continuity of the cooperation.

6.3. Limitations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Brief Worked Example

References

- Zhang, Y.; Chen, W.; Mi, Y. Third-party remanufacturing mode selection for competitive closed-loop supply chain based on evolutionary game theory. J. Clean. Prod. 2020, 263, 121305. [Google Scholar] [CrossRef]

- Ranjbar, Y.; Sahebi, H.; Ashayeri, J.; Teymouri, A. A competitive dual recycling channel in a three-level closed loop supply chain under different power structures: Pricing and collecting decisions. J. Clean. Prod. 2020, 272, 122623. [Google Scholar] [CrossRef]

- Calanter, P.; Drăgoi, A.E.; Gramaticu, M.; Dumitrescu, A.; Taranu, M.; Gudanescu, N.; Alina-Cerasela, A. Circular Economy and Job Creation: A Comparative Approach in an Emerging European Context. Sustainability 2025, 17, 2614. [Google Scholar] [CrossRef]

- Kang, K.; Zhao, Y.; Zhang, J.; Qiang, C. Evolutionary game theoretic analysis on low-carbon strategy for supply chain enterprises. J. Clean. Prod. 2019, 230, 981–994. [Google Scholar] [CrossRef]

- Mehrjerdi, Y.Z.; Shafiee, M. A resilient and sustainable closed-loop supply chain using multiple sourcing and information sharing strategies. J. Clean. Prod. 2021, 289, 125141. [Google Scholar] [CrossRef]

- Huang, Y.; Wang, Z. Information sharing in a closed-loop supply chain with technology licensing. Int. J. Prod. Econ. 2017, 191, 113–127. [Google Scholar] [CrossRef]

- Xing, P.; Zhao, X.; Wang, M. The optimal combination between recycling channel and logistics service outsourcing in a closed-loop supply chain considering consumers’ environmental awareness. Sustainability 2022, 14, 16385. [Google Scholar] [CrossRef]

- Wang, J.; Li, W.; Mishima, N. Optimal Decisions of Electric Vehicle Closed-Loop Supply Chain under Government Subsidy and Varied Consumers’ Green Awareness. Sustainability 2023, 15, 11897. [Google Scholar] [CrossRef]

- Zhao, J.; Sun, N. Government subsidies-based profits distribution pattern analysis in closed-loop supply chain using game theory. Neural Comput. Appl. 2020, 32, 1715–1724. [Google Scholar] [CrossRef]

- Wan, P.; Xie, Z. Decision making and benefit analysis of closed-loop remanufacturing supply chain considering government subsidies. Heliyon 2024, 10, e38487. [Google Scholar] [CrossRef]

- Dong, J.; Sun, S.; Gao, G.; Yang, R. Pricing and strategy selection in a closed-loop supply chain under demand and return rate uncertainty. 4OR-Q. J. Oper. Res. 2021, 19, 501–530. [Google Scholar] [CrossRef]

- Huang, Y.; Peng, N. Manufacturer’s cooperation strategies of closed-loop supply chain considering recycling advertising. Rairo-Oper. Res. 2024, 58, 1555–1576. [Google Scholar] [CrossRef]

- Zhao, C.; Wang, D.; Younas, A.; Zhang, B. Coordination of closed-loop supply chain considering loss-aversion and remanufactured products quality control. Ann. Oper. Res. 2025, 349, 1225–1248. [Google Scholar] [CrossRef]

- Pongen, I.; Ray, P.; Govindan, K. Creating a Sustainable Closed-Loop Supply Chain: An Incentive-Based Contract with Third-Party E-Waste Collector. J. Clean. Prod. 2024, 462, 142351. [Google Scholar] [CrossRef]

- Tanak, K.S. Game Theory Applications in Cybersecurity: An Operations Research Approach. J. Al-Qadisiyah Comput. Sci. Math. 2025, 17, 96–109. [Google Scholar] [CrossRef]

- Zheng, B.; Yang, C.; Yang, J.; Zhang, M. Dual-channel closed loop supply chains: Forward channel competition, power structures and coordination. Int. J. Prod. Res. 2017, 55, 3510–3527. [Google Scholar] [CrossRef]

- Pal, B.; Sana, S.S. Game-theoretic analysis in an environment-friendly competitive closed-loop dual-channel supply chain with recycling. Oper. Manag. Res. 2022, 15, 627–646. [Google Scholar] [CrossRef]

- Xie, J.; Zhang, W.; Liang, L.; Xia, Y.; Yin, J.; Yang, G. The revenue and cost sharing contract of pricing and servicing policies in a dual-channel closed-loop supply chain. J. Clean. Prod. 2018, 191, 361–383. [Google Scholar] [CrossRef]

- Zheng, B.; Chu, J.; Jin, L. Recycling channel selection and coordination in dual sales channel closed-loop supply chains. Appl. Math. Model. 2021, 95, 484–502. [Google Scholar] [CrossRef]

- Wei, J.; Zhao, J. Pricing decisions with retail competition in a fuzzy closed-loop supply chain. Expert. Syst. App. 2011, 38, 11209–11216. [Google Scholar] [CrossRef]

- Ke, H.; Wu, Y.; Huang, H.; Chen, Z. Optimal pricing decisions for a closed-loop supply chain with retail competition under fuzziness. J. Oper. Res. Soc. 2018, 69, 1468–1482. [Google Scholar] [CrossRef]

- Das, M.; Rahaman, M.; Alam, S.; Jana, D.K.; Salameh, A.A.; Al Sulaie, S.; Yin, H.; Ahmadian, A. Pareto improvement in a dual-channel closed-loop supply chain system by integrating product sustainability and consumer focus. Socio-Econ. Plan. Sci. 2025, 99, 102182. [Google Scholar] [CrossRef]

- Shu, Y.; Dai, Y.; Ma, Z. Pricing decisions in closed-loop supply chains with competitive fairness-concerned collectors. Math. Probl. Eng. 2020, 2020, 4370697. [Google Scholar] [CrossRef]

- Suvadarshini, P.; Biswas, I.; Srivastava, S.K. Impact of reverse channel competition, individual rationality, and information asymmetry on multi-channel closed-loop supply chain design. Int. J. Prod. Econ. 2023, 259, 108818. [Google Scholar] [CrossRef]

- Gaula, A.K.; Jha, J.K. Pricing and quality improvement strategies in a closed-loop supply chain with dual collection channel. Int. J. Syst. Sci.-Oper. 2023, 10, 2244416. [Google Scholar] [CrossRef]

- Wang, N.; Song, Y.; He, Q.; Jia, T. Competitive dual-collecting regarding consumer behavior and coordination in closed-loop supply chain. Comput. Ind. Eng. 2020, 144, 106481. [Google Scholar] [CrossRef]

- He, Q.; Wang, N.; Jiang, B. Hybrid closed-loop supply chain with different collection competition in reverse channel. Int. J. Prod. Econ. 2024, 276, 109371. [Google Scholar] [CrossRef]

- Giri, B.C.; Chakraborty, A.; Maiti, T. Pricing and return product collection decisions in a closed-loop supply chain with dual-channel in both forward and reverse logistics. J. Manuf. Syst. 2017, 42, 104–123. [Google Scholar] [CrossRef]

- Zhang, Z.; Liu, S.; Niu, B. Coordination mechanism of dual-channel closed-loop supply chains considering product quality and return. J. Clean. Prod. 2020, 248, 119273. [Google Scholar] [CrossRef]

- Hosseini-Motlagh, S.M.; Johari, M.; Ebrahimi, S.; Rogetzer, P. Competitive channels coordination in a closed-loop supply chain based on energy-saving effort and cost-tariff contract. Comput. Ind. Eng. 2020, 149, 106763. [Google Scholar] [CrossRef]

- Zhang, Z.; Yu, L. Altruistic mode selection and coordination in a low-carbon closed-loop supply chain under the government’s compound subsidy: A differential game analysis. J. Clean. Prod. 2022, 366, 132863. [Google Scholar] [CrossRef]

| Author(s) | Forward Channel | Reverse Channel | Coordination Contract | ||

|---|---|---|---|---|---|

| Selling Entity | Relationship Between Sales Volume and Price | Collection Entity | Relationship Between Collection Amount and Price | ||

| Giri et al. [28] | A manufacturer and a retailer | Competitive selling prices govern sales volume | A manufacturer and a third party | The recycling price is independent of the collection amount | × |

| Zhang et al. [29] | A manufacturer and a retailer | Competitive selling prices govern sales volume | A manufacturer and a retailer | The recycling price is independent of the collection amount | Revenue-sharing contract |

| Hosseini-Motlagh et al. [30] | A manufacturer and two retailers | Competitive selling prices govern sales volume | Two collectors | The recycling price is independent of the collection amount | Cost–tariff contract |

| Our model | retailers | Sales volume governs selling prices | recyclers | Collection amount governs recycling price | Linear transfer-payment contract |

| Notations | Definitions |

|---|---|

| Unit cost of manufacturing new products using new materials (USD/unit) | |

| Unit cost of remanufacturing used products (USD/unit) | |

| Unit remanufacturing cost savings, (USD/unit) | |

| Unit recycling price of used products paid by the manufacturer to the third-party recycler (USD/unit) | |

| Wholesale price per unit set by the manufacturer (USD/unit) | |

| Retailer i’s order quantity from the manufacturer (units) | |

| Collection quantity of used products by the third-party collector from consumers (units) | |

| The selling price of the product when all retailers’ order sizes are zero (USD/unit) | |

| The competitive intensity in the retail market | |

| The recycling price of used products when the collection quantities of all recyclers are zero (USD/unit) | |

| The competitive intensity in the recycling market | |

| Reward–penalty factor for product-ordering within a linear transfer-payment contract (USD/unit) | |

| Reward–penalty factor for recycling of used products within a linear transfer-payment contract (USD/unit) | |

| Minimum order quantity required by the manufacturer within a linear transfer-payment contract (units) | |

| Minimum recycling quantity required by the manufacturer within a linear transfer-payment contract (units) | |

| Profit of the manufacturer (USD) | |

| Profit of the retailer (USD) | |

| Profit of the recycler (USD) | |

| Profit of the CLSC (USD) | |

| Index of the decentralized decision-making | |

| Index of the centralized decision-making | |

| Index of the coordinated decision-making |

| 100 | 50 | 659.6154 | 69.5455 | |

| 50 | 40 | 635 | 75 | |

| 35 | 30 | 639.4118 | 81.1538 |

| 477,750 | 364,265 | 22,246 | 1125 | |

| 439,900 | 343,740 | 18,906 | 816.3266 | |

| 499,050 | 374,640 | 20,225 | 1020 | |

| 466,570 | 372,450 | 15,314 | 743.8018 | |

| 515,542 | 397,390 | 16,296 | 1020 | |

| 487,380 | 396,070 | 12,656 | 680.5290 |

| Profit | ||||

|---|---|---|---|---|

| 50 | 75 | 370,563.5173 | 20,986.6885 | |

| 80 | 369,303.9023 | 21,238.6115 | ||

| 85 | 368,044.2873 | 21,490.5345 | ||

| 90 | 366,784.6723 | 21,742.4575 | ||

| 40 | 45 | 375,390 | 20,100 | |

| 50 | 374,640 | 20,225 | ||

| 55 | 373,890 | 20,350 | ||

| 60 | 373,140 | 20,475 | ||

| 30 | 35 | 397,387.8641 | 16,295.9415 | |

| 40 | 397,192.2771 | 16,323.8825 | ||

| 45 | 396,996.6901 | 16,351.8235 | ||

| 50 | 396,801.1031 | 16,379.7645 | ||

| Profit | ||||

|---|---|---|---|---|

| 100 | 35 | 364,791.8037 | 862.0264 | |

| 40 | 364,616.3523 | 947.7539 | ||

| 45 | 364,440.8973 | 1037.4814 | ||

| 50 | 364,265.4423 | 1125.2089 | ||

| 50 | 30 | 375,030 | 890 | |

| 35 | 374,835 | 955 | ||

| 40 | 374,640 | 1020 | ||

| 45 | 374,445 | 1080 | ||

| 35 | 23 | 394,644.1705 | 956.0995 | |

| 28 | 397,461.0945 | 1001.8685 | ||

| 33 | 397,278.0185 | 1047.6375 | ||

| 38 | 397,094.9425 | 1093.4065 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gao, W.; Li, M.; Shi, R.; Gao, S. Decision-Making and Contract Coordination of Closed-Loop Supply Chain with Dual-Competitive Retail and Recycling Markets. Systems 2025, 13, 858. https://doi.org/10.3390/systems13100858

Gao W, Li M, Shi R, Gao S. Decision-Making and Contract Coordination of Closed-Loop Supply Chain with Dual-Competitive Retail and Recycling Markets. Systems. 2025; 13(10):858. https://doi.org/10.3390/systems13100858

Chicago/Turabian StyleGao, Wenjun, Muxuan Li, Ruiqing Shi, and Sheng Gao. 2025. "Decision-Making and Contract Coordination of Closed-Loop Supply Chain with Dual-Competitive Retail and Recycling Markets" Systems 13, no. 10: 858. https://doi.org/10.3390/systems13100858

APA StyleGao, W., Li, M., Shi, R., & Gao, S. (2025). Decision-Making and Contract Coordination of Closed-Loop Supply Chain with Dual-Competitive Retail and Recycling Markets. Systems, 13(10), 858. https://doi.org/10.3390/systems13100858