2.1. The Impact of Digital Technology Innovation on Companies’ Position in the Supply Chain

Scholars have broadly discussed digital innovation as an essential factor in influencing the position of a company’s supply chain [

1,

19,

20]. Digital technological innovations such as big data platforms and remote control can efficiently integrate various resources, such as optimizing the combination of labor, raw materials, production tools, and other resources based on their complementarity. This will increase the value of resource utilization and lead to a competitive advantage in the industry, thus consolidating the company’s position in the supply chain [

21]. Mohammadi and Rashidzadeh [

22] suggested that Internet of Things (IoT) technology can help organizations interconnect their equipment to reduce failures and downtime, increase productivity, and improve product quality and safety. Companies utilize IoT digital technology innovations to achieve real-time massive big data comparisons and analyses [

23]. Automation, robotics, and other AI digital technology innovations in new energy vehicle companies have improved the flexibility of production lines and shortened the time to market [

6]. Companies can predict market demand more timely and accurately, thus optimizing their inventory management, reducing costs, and improving response time [

24]. These effectively support companies’ production decision making, forming their dynamic capabilities and enhancing their competitive advantages.

In addition, digital technology promotes company innovation and strengthens technological research and development in the core technology area of new energy vehicles. Tang et al. [

25] found that companies strengthened their technological leadership by enhancing power battery innovation through digital technologies. Personalized digital technology products and services, such as assisted driving and VR experiences, can help companies better understand customer needs [

26], as well as provide repair services such as rapid fault detection and intelligent maintenance in the after-sales period, which in turn improves customer satisfaction and loyalty. Digital technology improves the efficiency of companies in a way that is more in line with the concept of green and sustainable development and enhances their ESG [

27]. In summary, digital technology innovation realizes the fine control of the production process, the full use of resources, and the efficient access to information, all of which can effectively improve the quality of company products and services. It helps companies gain a greater competitive advantage in the market, thus enhancing their position in the supply chain network. Given the above literature, this study proposes the following hypothesis:

Hypothesis 1 (H1). Digital technology innovation drives the position of a company’s supply chain.

2.2. The Mechanisms of Digital Technology Innovation Affecting Companies’ Supply Chain Position

On the one hand, digital technology innovations help allocate quality resources to high-value-added production segments, thus enhancing the productivity of the entire industry. Digital technology reduces the cost of communication between companies and between internal and external parties, effectively solving the problem of information asymmetry [

28]. Helping to reduce the flow of information and transaction costs ensures that the supply of production resources is accurately matched to the needs of each production segment. For example, applying digital technologies such as digital production lines, robotic automation, and IoT optimizes production and improves product quality. The Choudhury et al. [

29] study found that companies and supply chain partners share data through digital technologies to accurately match R&D, design, manufacturing, and user needs. Online platforms and mobile applications provide a personalized car-buying experience and convenient after-sales service, enhancing customer stickiness [

30]. Digital technology helps companies continuously collect and analyze customer feedback to improve product and service quality continually [

31]. This close collaboration improves managerial efficiency and helps to enhance the company’s position as the center of the supply chain.

On the other hand, digital technology innovations reduce the dependence of traditional manufacturing on labor but increase the demand for talent. This type of talent requires the ability to adapt to the new production model of digital technology and use and maintain advanced production equipment. For example, digital technologies such as VR and AI enable companies to conduct efficient simulation tests and data analyses when developing new technologies and products, shortening the development cycle. Digital technologies allow the interconnection of people, machinery, and organizations to improve managerial efficiency, further enhancing companies’ centrality in the supply chain network. Based on these discussions, the following hypothesis is proposed:

Hypothesis 1a (H1a). Digital technology innovation promotes the position of the company supply chain by improving managerial efficiency.

According to the theory of technological innovation, if a company can occupy an advantageous position in technological innovation, it can obtain a monopoly within a certain range. Then, it can achieve a high profit return [

32]. First, digital technological innovation helps automate and intellectualize the production process and promotes improving company production quality and cost reduction [

5]. Chan et al. [

33] found that through real-time monitoring of production parameters and logistics flow, companies can quickly respond to market changes, shorten product delivery time, and thus enhance corporate profit returns.

In addition, through digital technology innovation, companies can more accurately grasp consumer demand and market trends, optimize inventory management, and reduce inventory costs [

6]. In turn, they can gain a greater competitive advantage in the market and achieve a more central position in the supply chain network. Trinugroho et al. [

34] took SMEs (small and medium-sized enterprises) in Indonesia as the research object and found that digital technological innovation improved profitability. Bui and Do [

35] found that digital technology reduces the financial constraints of Vietnamese SMEs, and rising profits help them gain a dominant position in the supply chain. Based on these considerations, the following hypothesis is proposed:

Hypothesis 1b (H1b). Digital technology innovation promotes the position of the company supply chain by improving profitability.

2.3. The Impact of Digital Technology Innovation Heterogeneity on Companies’ Position in the Supply Chain

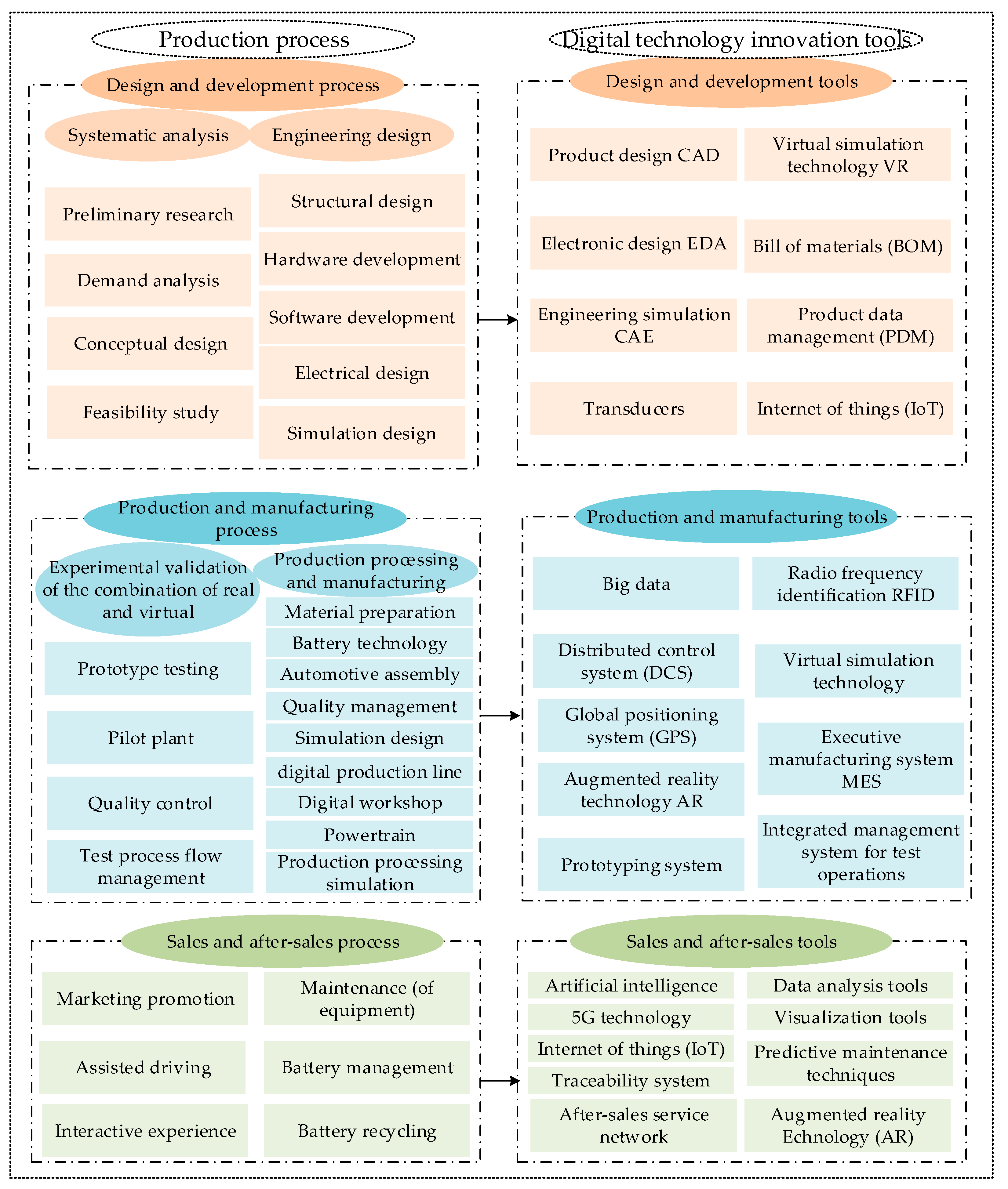

To study the heterogeneous impact of digital technological innovation on the position of the company supply chain, this paper took the patents applied by new energy vehicle companies as the object. It divided them into three types of digital technological innovation: the design and development process, the production and manufacturing process, and the sales and after-sales process. The digital technology innovation contents corresponding to the three processes were collated, as shown in

Figure 1.

New energy vehicle companies mainly carry out systematic analysis and engineering design in the design and development process, including preliminary research and demand analysis, conceptual design, feasibility studies, structural design, hardware and software development, electrical design, and simulation design. The main digital technology innovation is embodied in digital simulation and research and development, including computer-aided design (CAD), computer-aided engineering (CAE), electronic design (EDA), virtual simulation technology (VR), product data management (PDM), and so on.

CAD software helps automotive design engineers to digitally create, modify, and analyze 3D models of their products. CAE software allows engineers to better simulate the performance of their products under different environments and stresses, improving product quality and reliability [

36]. Adjustments and optimizations based on real-time feedback reduce the risk of increased manufacturing costs due to poor design considerations to improve profitability and, in turn, enhance the company network position. EDA technology helps companies build a prototype vehicle trial production system, which realizes the interconnection between people, equipment, and systems. Through the real-time collection of equipment information and production progress data at the production site, production problems can be solved promptly, greatly improving vehicle performance testing and production efficiency [

37]. VR simulations of vehicle collision, driving, and power consumption scenarios, etc., and testing of intelligent driving systems are necessary to promote the mass production of high-level automatic cars, which has formed the industry standard for new energy vehicles [

38]. The PDM digital management platform based on the full life cycle development of the entire vehicle can respond to new market trends such as the diversification of automotive product configurations, the rapid iteration of new cars on the market, and the growing personalized needs of users, thanks to its fast and robust system integration capability, comprehensive and clear process tracking capability, and efficient data management and publishing capability [

39]. These digital technology innovations have improved the efficiency and accuracy of design, provided a more open and expansive design space [

40], and positively impacted the advancement of companies in the supply chain network. We thus posit the following:

Hypothesis 2 (H2). Digital technology innovations in the design and development process have a driving effect on the position of the company’s supply chain.

New energy vehicle manufacturers mainly conduct experimental validation through a combination of the real and virtual, as well as production processing and manufacturing in the production and manufacturing process. This includes small-batch trial productions of prototype vehicles, quality control, material preparation, vehicle assembly, production quality management, and digital production lines. Digital technology innovation is mainly embodied by big data analysis, distributed control systems (DCSs), virtual simulation technology, radio frequency identification (RFID), global positioning systems (GPSs), executive manufacturing systems (MESs), integrated management systems for test operations, and so on.

Big data analysis helps new energy vehicle companies establish intelligent production lines, visualize, monitor, and automate production processes with lower labor inputs, and improve production efficiency [

6]. DCSs helps to detect and quickly solve any quality problems. Gong et al. [

41] found that using automotive virtual simulation technology to operate and manage automotive assemblies and using FlexSim software to build models to solve assembly problems can lead to a significant reduction in assembly time while equipment utilization is significantly improved. Since the production and manufacturing process for new energy vehicles requires a large number of components, such as batteries, motors, control systems, etc., logistics and supply chain management are the key to ensuring production efficiency and product quality. Aggarwal and Das [

42] found that tracking and managing the logistics and supply chain process through digital technological innovations such as RFID and GPSs reduces the production process’s error rate and transport costs. Prabhu et al. [

43] found that MESs and integrated management systems for test operations, by deepening the degree of digital application of each process, can effectively reduce the excess energy consumption and material consumption caused by irrational manual production operations, thus improving the fine degree of manufacturing of new energy vehicles. In summary, digital technology innovation in the new energy vehicle production and manufacturing process helps companies to achieve the automation and intelligence of manufacturing, reducing production costs, improving production efficiency, and ultimately playing a role in promoting the position of companies in the supply chain network. Thus, the above arguments led this study to develop the following hypothesis:

Hypothesis 3 (H3). Digital technology innovations in the production and manufacturing process drive the position of the company’s supply chain.

New energy vehicle companies mainly include marketing promotion, assisted driving, interactive experience, equipment maintenance, battery management, and recycling in the sales and after-sales process. The main digital technology innovations are the Internet of Things (IoT), Augmented Reality (AR), 5G technology, artificial intelligence (AI), visualization tools, traceability systems, predictive maintenance techniques, and so on.

IoT technology innovation enables the remote monitoring of vehicle performance and status, enabling real-time diagnostics to help customers identify problems and perform maintenance promptly, improving customer satisfaction and loyalty [

44]. Cachada et al. [

45] found that AR technology innovation helps and guides workers in maintenance operations, which greatly improves the after-sales efficiency of companies. AI technology helps companies better analyze large amounts of user data. By integrating internal user data on car purchases, car use, and automotive Internet connectivity with external market data and other third-party data, it is possible to understand further user needs to scientifically, quickly, and accurately formulate marketing strategies for specific users [

30]. In addition, Gong [

46] found that AI smart driving technology helps drivers control their vehicles better, improve car driving safety, reduce traffic accidents, and reduce energy consumption through visualization tools. In terms of enhancing the sense of user experience and driving safety, the high speed, low latency, and wide range embodied in 5G technological innovations can be applied to various scenarios, such as intelligent driving, connected cars, and battery maintenance [

47]. Karpenko et al. [

44] verified the effect of cost optimization and efficiency gains from data sharing provided by traceability system innovations through electric vehicle charging in the EU project bIoTope. Many high-tech components of new energy vehicles, such as batteries and electric motors, require predictive maintenance techniques for regular maintenance and servicing [

48], thus improving maintenance efficiency and reducing maintenance costs. In summary, the digital technology innovation mentioned above, on the one hand, plays a role in reducing the management and maintenance costs within the company; on the other hand, it improves user satisfaction [

31], helps to increase the company’s revenue and competitiveness, and ultimately promotes the enhancement of the company’s supply chain position, which all provide groundings for the postulation of the following hypothesis:

Hypothesis 4 (H4). Digital technology innovations in the sales and after-sales process have a driving effect on the position of the company’s supply chain.

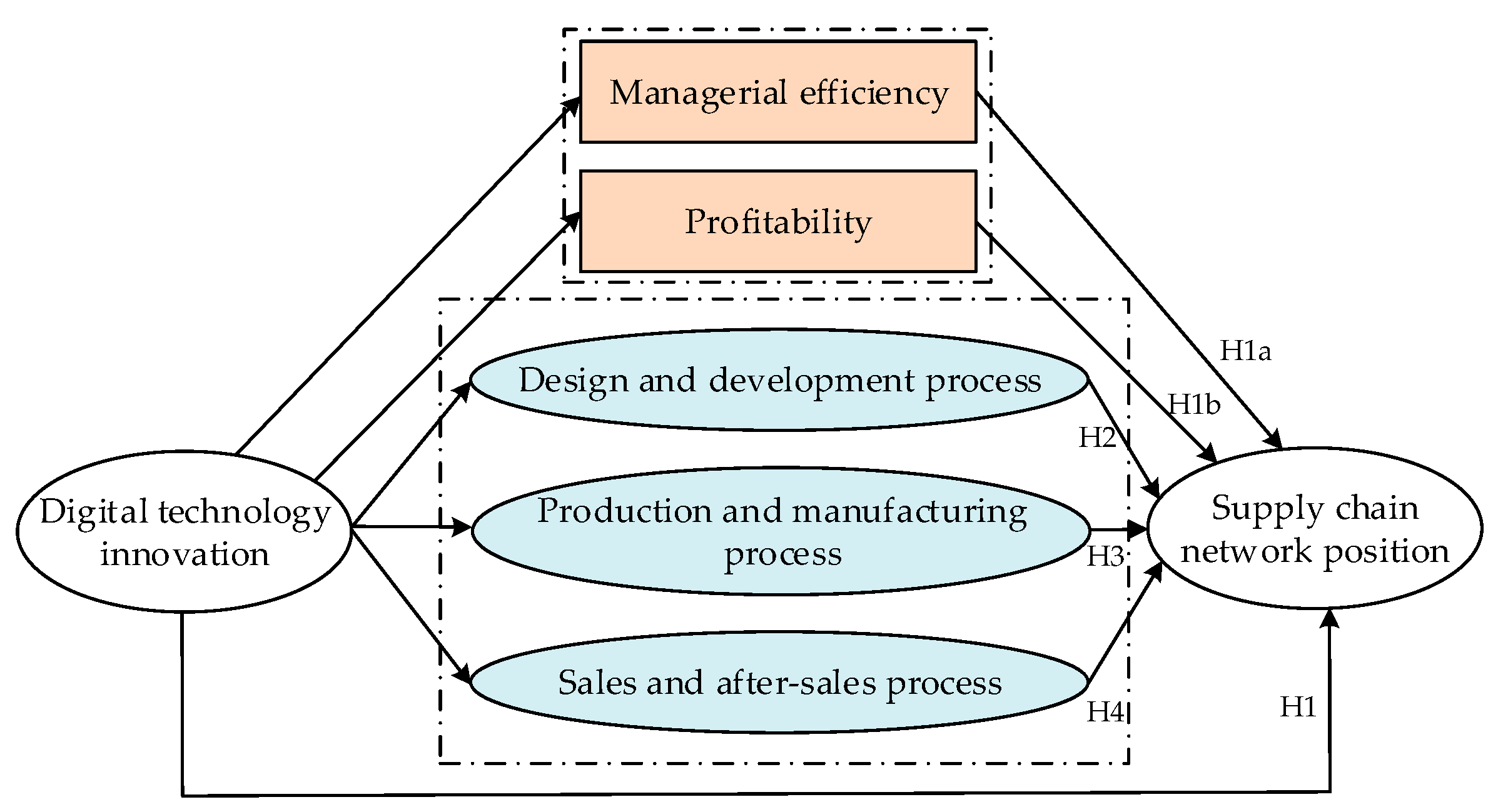

The framework of digital technological innovations affecting supply chain position is visually represented by two colors: blue indicates a direct relationship, while orange indicates an indirect relationship. H1 and H4 represent six hypotheses, respectively, and the relationships among the hypotheses in this paper are shown in

Figure 2 below.

The main themes relevant to this study relate to two types of research: the positions of companies in supply chain networks and digital technological innovation.

Table 1 presents a comparison between this study and the relevant literature. Firstly, numerous studies have utilized the method of social network analysis to measure the positions of companies within supply chain networks [

49,

50]. This includes metrics such as structural holes [

19], PageRank centrality [

10], and harmonic centrality [

51]. This paper employs eigenvector centrality to gauge the position of enterprises within the supply chain network. Unlike other centrality measures, eigenvector centrality can reflect the importance of both upstream suppliers and downstream customers with whom the company has trade relationships. This provides a more comprehensive depiction of a company’s network position.

Secondly, existing studies identify regional or corporate capabilities for digital technology innovation using methods such as literature induction [

52,

53,

54], qualitative analysis [

55,

56], text analysis [

57,

58], case study methodology [

59], and so on. However, there is a lack of detailed discussion on how digital technology innovations are applied to specific production process. This study references existing research that categorizes patents by industry, identifying corporate digital technology innovation capabilities. Furthermore, through the text analysis and co-word analysis, it is determined whether digital technology patents pertain to the design and development process, the production and manufacturing process, or the sales and after-sales process.

Table 1.

A comparison of this study with relevant studies.

Table 1.

A comparison of this study with relevant studies.

| Research Object | Methodologies and Models | Indicators and Data | Authors (Year) |

|---|

| Supply Chain Position | Social network analysis methodology (network centrality and structural holes) | Data on the top five suppliers and customers of the company | Shi et al. (2020) [49]; Du and Zhang (2022) [19] |

| Social network analysis methodology (pagerank centrality) | Data on the top five suppliers and customers of the company | Jing et al. (2023) [10] |

| Social network analysis methodology (network centrality) | Questionnaire methodology to obtain company transaction data | Seiler et al. (2020) [50] |

| Meta analyses | Questionnaire data | Chang et al. (2016) [60] |

| Social network analysis methodology (harmonic centrality) | Global companies’ equity ownership structure | Riccaboni et al. (2021) [51] |

| Social network analysis methodology (eigenvector centrality) | Global supply chain data on the company’s suppliers and customers | This paper |

| Digital technological innovation | Literature induction method | - | Holmström (2018) [52]; Purnomo et al. (2021) [53]; Kohli and Melville (2019) [54] |

| Qualitative analysis methods | Questionnaire methodology | Nambisan et al. (2017) [55]; Wanof (2023) [56] |

| Text analysis method | Patent text | Rodriguez and Piccoli (2018) [57]; Goyal (2024) [58] |

| Principal component analysis (PCA) method | Evaluation indicator system | Zhai et al. (2020) [61]; Jing et al. (2023) [10] |

| Case study methodology | Questionnaire data | Blichfeldt and Faullant (2021) [59] |

| IPC and industry classification | Patent data | Nagaoka et al. (2010) [62]; Ponta et al. (2021) [16] |

| IPC and industry classification, text and co-word analysis method | Patent data and patent text | This paper |