How to Reshape the Selection Boundaries between Traditional and Digital Supply Chain Finance Based on the Pledge Rate and Default Loss: Two Tripartite Game Models

Abstract

1. Introduction

2. Literature Review

2.1. Research on Traditional Supply Chain Finance

2.2. Research on Digital Supply Chain Finance

2.3. Exploring Supply Chain Finance through a Game-Theoretic Lens

3. Model Formulation

3.1. Traditional Supply Chain Finance Model

3.1.1. Problem Description

3.1.2. Assumptions of the Model

3.1.3. Construction of the Model

| Earnings | SME | ||

|---|---|---|---|

| CE | Repayment | ||

| Default | |||

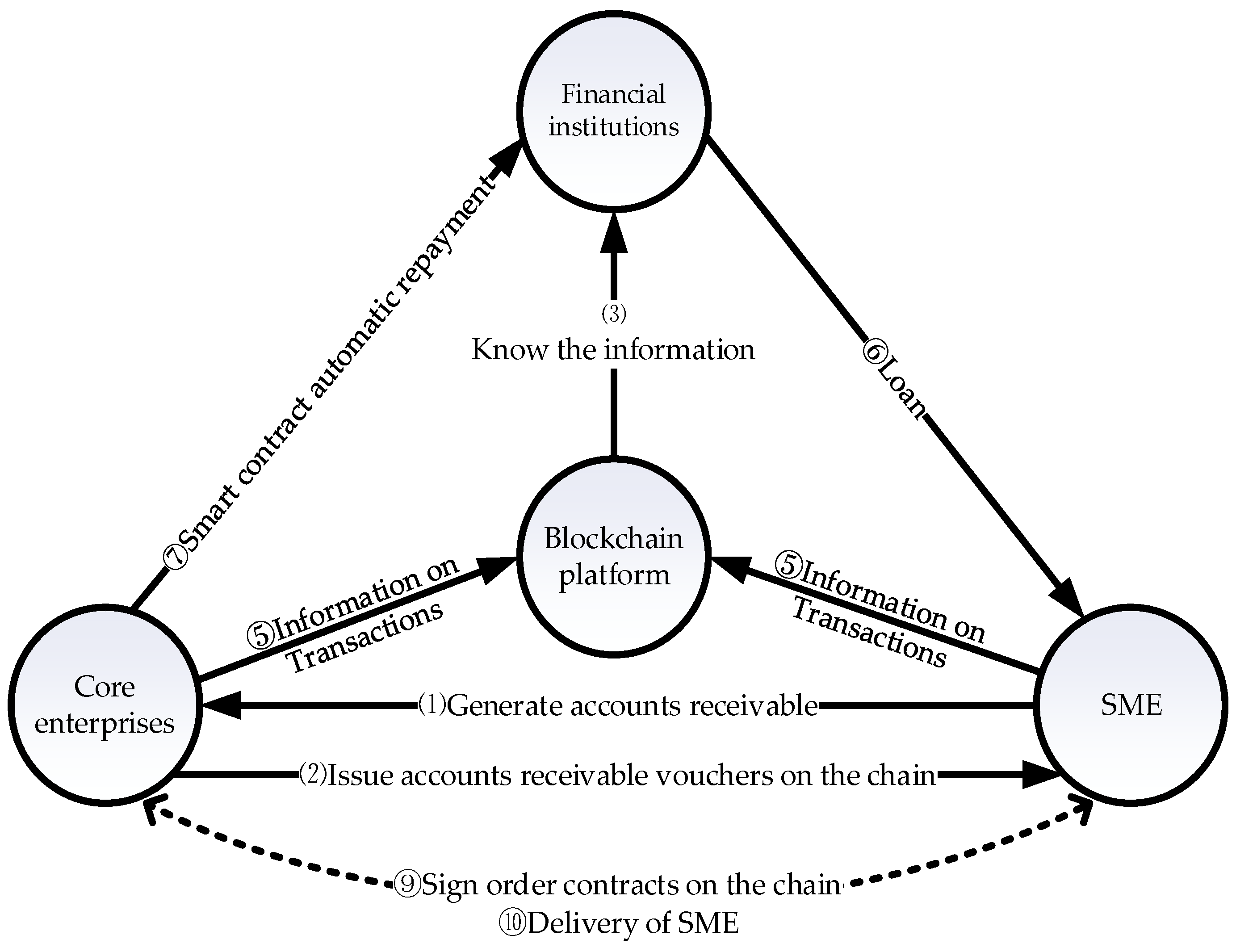

3.2. Digital Supply Chain Finance Model

3.2.1. Problem Description

3.2.2. Assumptions of the Model

| Items | Symbol |

|---|---|

| Default loss of SME (Digital) | |

| Default loss of CE (Digital) | |

| All business additional income (Digital) | |

| CE additional income (Digital) | |

| Cost associated with introducing blockchain and fee for platform maintenance | |

| Bank’s pledged interest rate |

3.2.3. Construction of the Model

3.3. Comparison of the Returns with and without Blockchain

3.3.1. Taking SME as Object

- Income expectation of SME in traditional model

- Income expectation of SME in digital model

- The essential prerequisites for the SME to engage in digital supply chain finance

3.3.2. Taking CE as Object

- Income expectation of CE in traditional model

- Income expectation of CE in digital model

- Essential prerequisites for CE to engage in digital supply chain finance

3.3.3. Taking FI as Object

- Income expectation of FI in traditional model

- Income expectation of FI in digital model

- Essential prerequisites for FI to engage in digital supply chain finance

4. Simulation Analysis

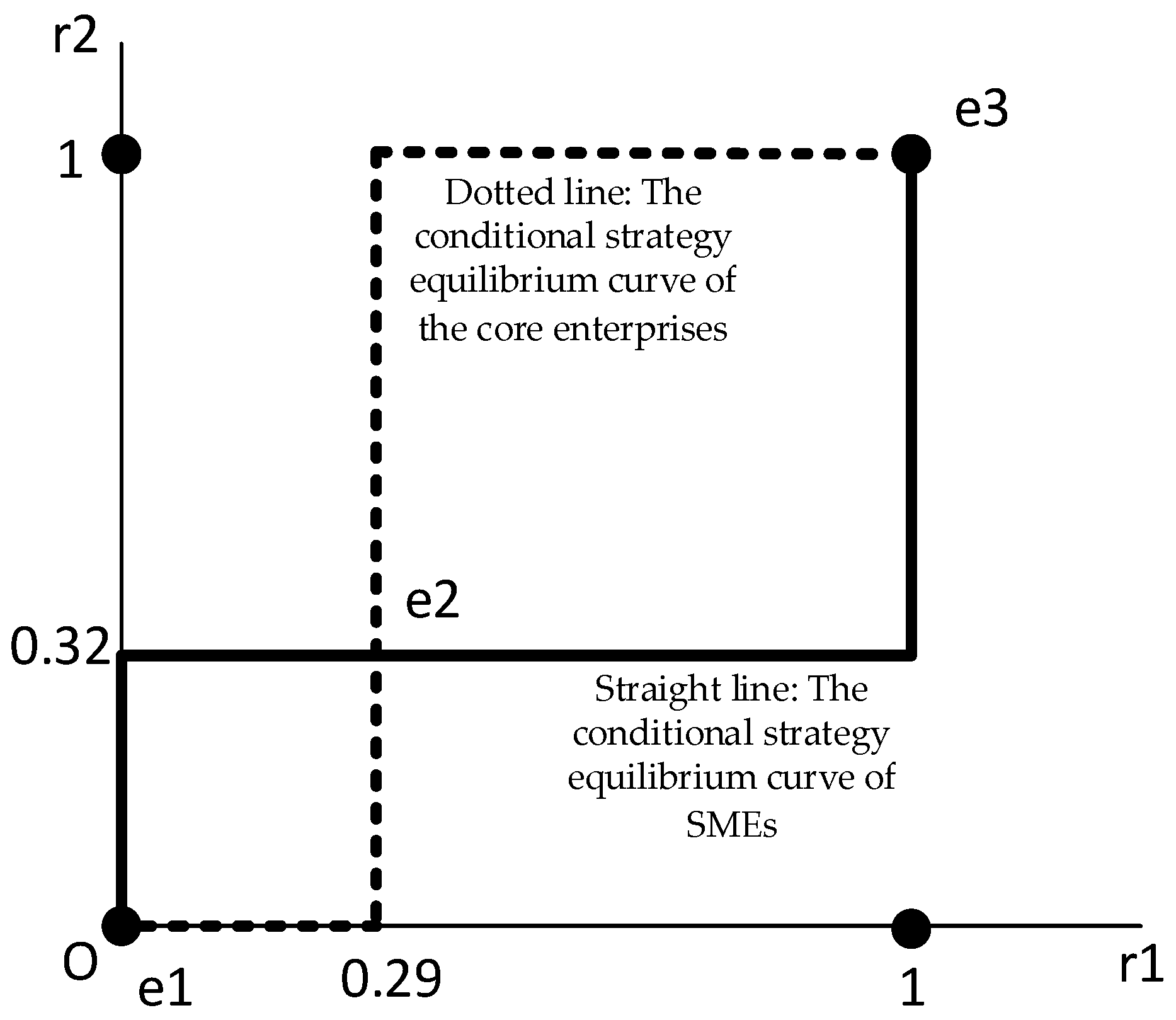

4.1. Static Game Analysis of Complete Information between SME and CE

4.1.1. Traditional Supply Chain Finance Mode

- Conditional mixed strategy

- Mixed strategies and Nash equilibrium

4.1.2. Digital Supply Chain Finance Mode

- Conditional mixed strategy

- Mixed strategies and Nash equilibrium

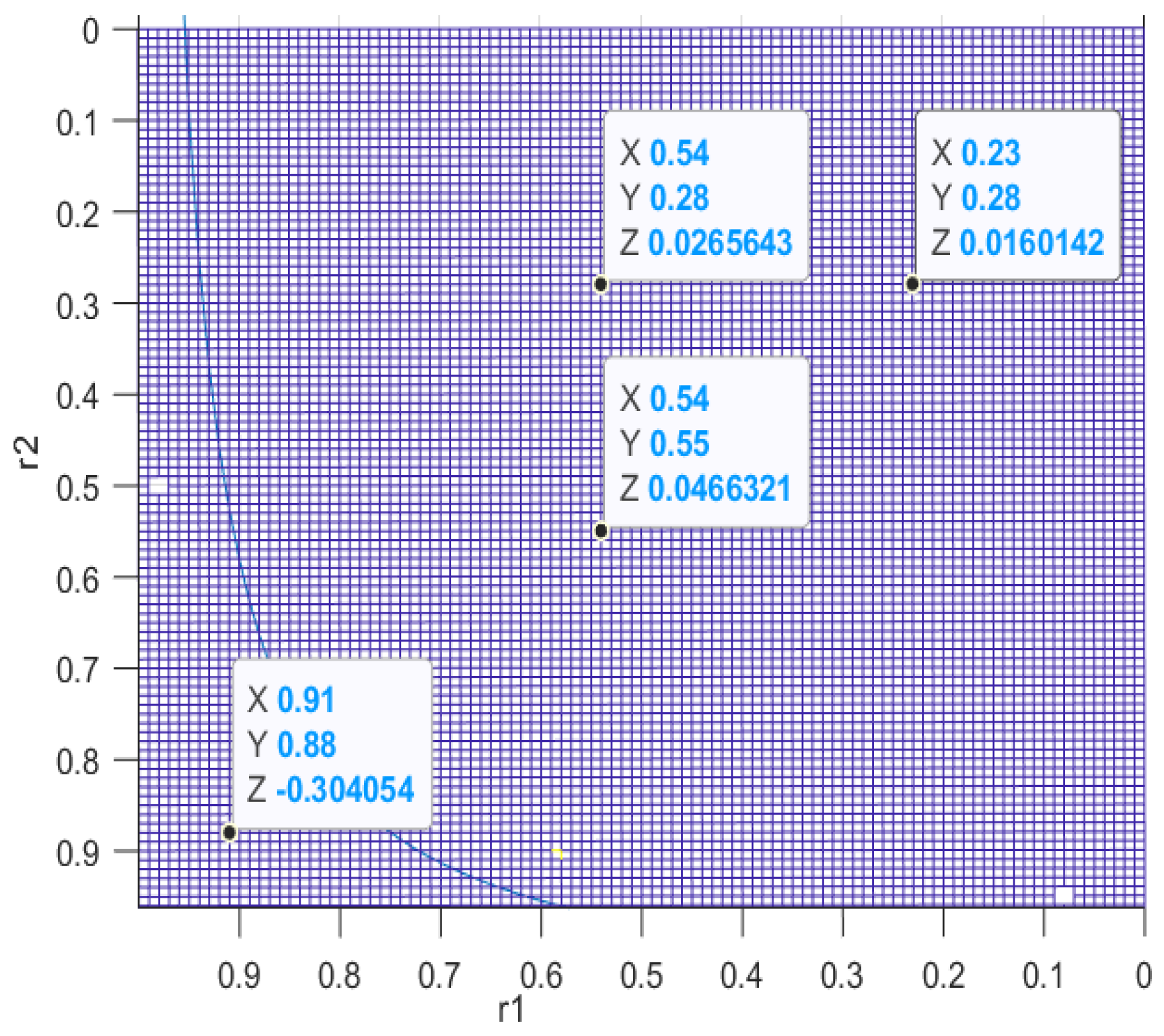

4.2. Impact of the Pledge Rate

4.2.1. Impact on SME’s Willingness to Participate in the Digital Supply Chain

4.2.2. Impact on FI’s Willingness to Participate in the Digital Supply Chain

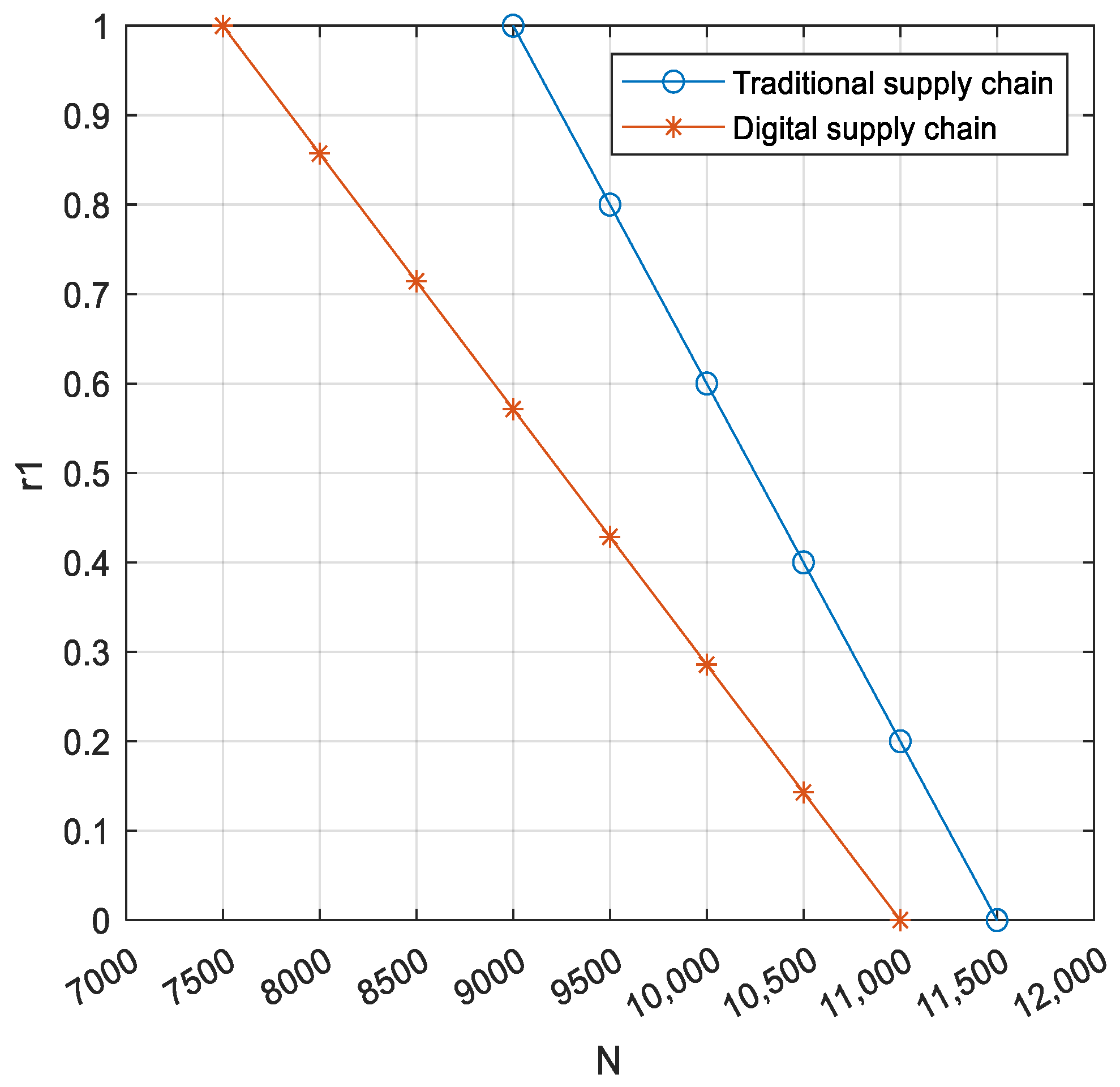

4.2.3. Impact of the Pledge Rate on SME’s Willingness to Keep Loyalty in Traditional and Digital Supply Chains

4.2.4. Impact of the Pledge Rate on FI’s Willingness to Loan in Traditional and Digital Supply Chains

4.3. Impact of the Default Loss

4.3.1. Impact of the Difference in the Default Losses on the Willingness of SME to Engage in the Digital Supply Chain

4.3.2. Impact of the Difference in the Default Losses on the Willingness of CE to Engage in the Digital Supply Chain

4.3.3. Impact of the Default Losses on CE’s Willingness to Keep Repayment in Traditional and Digital Supply Chains

5. Conclusions and Suggestions

5.1. Conclusions

5.2. Suggestions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zhang, L. Research on financial innovation of supply chain driven by blockchain from the perspective of game theory. Econ. Probl. 2019, 4, 48–54. [Google Scholar]

- Stiglitz, J.E.; Weiss, A. Credit rationing in markets with imperfect information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Wang, X.; Zhang, J. On the bank credit rationing and loan of small and medium-sized Enterprises (SMEs). Econ. Res. J. 2003, 7, 68–75+92. [Google Scholar]

- Lin, Y.F.; Sun, X.F. Information, informal finance and SME financing. Econ. Res. J. 2005, 7, 35–44. [Google Scholar] [CrossRef]

- Liu, C.; Liu, C.; Ma, G.R. Small-and-medium banks and small-and-medium enterprise loans. Econ. Res. J. 2017, 8, 65–77. [Google Scholar]

- Lin, Y.F.; Li, Y.J. Promoting the growth of medium and small-sized enterprises through the development of medium and small-sized financial institutions. Econ. Res. J. 2001, 1, 10–18+53. [Google Scholar]

- Zhang, Y.L.; Lin, Y.F.; Gong, Q. Firm size, bank size and optimal banking structure: From the perspective of new structural economics. J. Manag. World 2019, 35, 31–47+206. [Google Scholar]

- Song, H. Pattern Innovation of the Supply Chain Finance Enabled by the Digital Platform. China Bus. Mark. 2020, 34, 17–24. [Google Scholar]

- Liu, Y.M.; Cao, T.Q.; Liu, J.H. Research on Supply Chain Finance and Chinese Listed Companies’ Risk-taking Level. Syst. Eng.-Theory Pract. 2024, 1–20. Available online: https://link.cnki.net/urlid/11.2267.N.20240515.1602.029 (accessed on 8 July 2024).

- Berger, A.N.; Udell, G.F. A more complete conceptual framework for SME finance. J. Bank. Financ. 2006, 30, 2945–2966. [Google Scholar] [CrossRef]

- Yu, H.; Wang, S. Core Enterprises’ Willingness to Participate in Supply Chain Finance and Their Orientation of Financing Pattern. China Bus. Mark. 2022, 36, 22–34. [Google Scholar]

- Yang, B.; Zhu, W.M.; Zhao, H.Y. Theoretical study on upstream party initiated finance. J. Financ. Res. 2016, 12, 175–190. [Google Scholar]

- Song, H.; Lu, Q.; Yu, K. Comparative study of the impact supply chain finance and bank lending on financing performance of SMEs. Chin. J. Manag. 2017, 14, 897–907. [Google Scholar]

- Gomm, M.L. Supply chain finance: Applying finance theory to supply chain management to enhance finance in supply chains. Int. J. Logist. Res. Appl. 2010, 13, 133–142. [Google Scholar] [CrossRef]

- Lekkakos, S.D.; Serrano, A. Supply chain finance for small and medium sized enterprises: The case of reverse factoring. Int. J. Phys. Distrib. Logist. Manag. 2016, 46, 367–392. [Google Scholar] [CrossRef]

- Guo, N. The government? The market? Who is more effective-a study on the effectiveness of financing mechanism for small and medium-sized enterprises. J. Financ. Res. 2013, 03, 194–206. [Google Scholar]

- Gong, Q.; Ban, M.Y.; Zhang, Y.L. Blockchain, enterprise digitalization and supply chain finance innovation. J. Manag. World 2021, 37, 22–34. [Google Scholar]

- Song, X.C.; Mao, J.Y. Research on the process of blockchain-based interorganizational trust building—Take the digital supply chain finance model for example. Chin. Ind. Econ. 2022, 11, 174–192. [Google Scholar]

- Tang, S.; Xie, X.Y. How Do Firms Holding Financial Institutions Serve the Real Economy—From the Perspective of Supply Chain Spillover Effect. China Ind. Econ. 2021, 11, 116–134. [Google Scholar]

- Zhang, C.; Dhaliwal, J. An investigation of resource-based and institutional theoretic factors in technology adoption for operations and supply chain management. Int. J. Prod. Econ. 2009, 120, 252–269. [Google Scholar] [CrossRef]

- Chen, J.; Huang, S.; Liu, Y.H. Operations Management in the Digitization Era: From Empowering to Enabling. J. Manag. World 2020, 36, 117–128+222. [Google Scholar]

- Song, H.; Yang, Y.D.; Tao, Z. The Application of Blockchain in Enterprise Financing: A Literature Review and Knowledge Framework. Nankai Bus. Rev. 2022, 25, 34–48. [Google Scholar] [CrossRef]

- Jon, F.; Leonardo, G.; Yi, H. BigTech and the changing structure of financial intermediation. Econ. Policy 2019, 34, 761–799. [Google Scholar]

- Fuster, A.; Plosser, M.; Schnabl, P. The Role of Technology in Mortgage Lending. Rev. Financ. Stud. 2019, 32, 1854–1899. [Google Scholar] [CrossRef]

- Sheng, T.X.; Fan, C.L. Fintech, Optimal Banking Market Structure, and Credit Supply for SMEs. J. Financ. Res. 2020, 6, 114–132. [Google Scholar]

- Zhu, Y.; Jia, R.; Wang, G.J. A review of supply chain finance risk assessment research: Based on knowledge graph technology. Syst. Eng.-Theory Pract. 2023, 43, 795–812. [Google Scholar]

- Chod, J.; Trichakis, N.; Tsoukalas, G.; Aspegren, H.; Weber, M. On the Financing Benefits of Supply Chain Transparency and Blockchain Adoption. Manag. Sci. 2020, 66, 4378–4396. [Google Scholar] [CrossRef]

- Ali, O.; Ally, M.; Clutterbuck, D.Y. The state of play of blockchain technology in the financial services sector: A systematic literature review. Int. J. Inf. Manag. 2020, 54, 102199. [Google Scholar] [CrossRef]

- Iansiti, M.; Lakhani, K.R. The truth about blockchain (Note). Harv. Bus. Rev. 2017, 95, 118–127. [Google Scholar]

- Choi, T.M. Supply chain financing using blockchain: Impacts on supply chains selling fashionable products. Ann. Oper. Res. 2020, 331, 393–415. [Google Scholar] [CrossRef]

- Catalini, C.; Gans, J.S. Some simple economics of the blockchain. Commun. ACM 2020, 63, 80–90. [Google Scholar] [CrossRef]

- Easley, D.; O’Hara, M.; Basu, S. From mining to markets: The evolution of bitcoin transaction fees. J. Financ. Econ. 2019, 134, 91–109. [Google Scholar] [CrossRef]

- Biais, B.; Bisière, C.; Bouvard, M.; Casamatta, C. The Blockchain Folk Theorem. Rev. Financ. Stud. 2019, 32, 1662–1715. [Google Scholar] [CrossRef]

- Makarov, I.; Schoar, A. Trading and Arbitrage in Cryptocurrency Markets. J. Financ. Econ. 2020, 135, 293–319. [Google Scholar] [CrossRef]

- Cong, L.W.; Li, Y.; Wang, N. Tokenomics: Dynamic Adoption and Valuation. Rev. Financ. Stud. 2021, 34, 1105–1155. [Google Scholar] [CrossRef]

- Howell, S.T.; Niessner, M.; Yermack, D. Initial Coin Offerings: Financing Growth with Cryptocurrency Token Sales. Rev. Financ. Stud. 2020, 33, 3925–3974. [Google Scholar] [CrossRef]

- Chen, J.N.; Chen, S.Y.; Luo, S.Y.; Wang, Q.; Cao, B.; Li, X.Q. An intelligent task offloading algorithm (iTOA) for UAV edge computing network. Digit. Commun. Netw. 2020, 6, 433–443. [Google Scholar] [CrossRef]

- Wang, S.P.; Li, H.; Chen, J.J.; Wang, J.F.; Deng, Y.J. DAG blockchain-based lightweight authentication and authorization scheme for IoT devices. J. Inf. Secur. Appl. 2022, 66, 103134. [Google Scholar] [CrossRef]

- Yang, Z.X.; Yang, R.Z.; Yu, F.R.; Li, M.; Zhang, Y.H.; Teng, Y.L. Sharded Blockchain for Collaborative Computing in the Internet of Things: Combined of Dynamic Clustering and Deep Reinforcement Learning Approach. IEEE Internet Things J. 2022, 9, 16494–16509. [Google Scholar] [CrossRef]

- Liu, C.; Cao, G.Y.; Ma, G.R. Does the Local Government Financing Platform Crowd Out Small and Medium-sized Enterprise Loans? Econ. Res. J. 2020, 55, 50–64. [Google Scholar]

- Lou, Y.; Chang, Y.X.; Hao, F.X. The influence of blockchain on supply chain finance—Based on tripartite game theory and dynamic evolutionary game theory. Chin. J. Manag. 2022, 30, 352–360. [Google Scholar]

- Sun, R.; He, D.Y.; Su, H.L. Application of blockchain technology to preventing supply chain finance based on evolutionary game. Chin. J. Manag. 2024, 32, 125–134. [Google Scholar]

- Ling, R.Z.; Li, B.; Pan, A.L. Supply Chain Finance and Corporate Debt Maturity Selection. Econ. Res. J. 2023, 58, 93–113. [Google Scholar]

- Song, H.; Yang, X. How does supply chain finance help SMEs financing—Perspective of supply chain network embeddedness. R&D. Manag. 2018, 30, 22–33. [Google Scholar]

- Duan, W.C. Blockchain Supply Chain Finance, 1st ed.; Publishing House of Electronics Industry: Beijing, China, 2018; pp. 31–94. [Google Scholar]

- Wuttke, A.D.; Blome, C.; Foerstl, K. Managing the innovation adoption of supply chain finance—Empirical evidence from six europeancase studies. J. Bus. Logist. 2013, 34, 148–166. [Google Scholar] [CrossRef]

- Zhang, W.B.; Liu, K. The implementation of supply chain finance, can it alleviate the financing constraints faced by SMEs?—Drawing on empirical analysis of small and medium-sized listed companies. Econ. Sci. 2012, 3, 22–33. [Google Scholar]

- Bai, Y.F.; Zhai, D.X.; Wu, D.L.; Lin, X. Blockchain—Based optimization strategies for supply chain finance platforms. Financ. Econ. Res. 2020, 35, 119–132. [Google Scholar]

- Song, H.; Han, S.Q.; Liu, W.Y. Digital Financial Technology Platform Enabled Supply Chain Finance Pattern: A Comparative Case Study from Information Processing Perspective. Manag. Rev. 2024, 36, 264–275. [Google Scholar]

- Roberts, R.M. The role of dynamic renegotiation and asymmetric information in financial contracting. J. Financ. Econ. 2015, 116, 61–81. [Google Scholar] [CrossRef]

- Priyanka, C.B.; Vimal, K.; Tzu-Chuen, L.; Tugrul, D. Technology convergence assessment: Case of blockchain within the IR 4.0 platform. Technol. Soc. 2021, 67, 101709. [Google Scholar]

- Yuan, Y.; Wang, Y.F. Blockchain: The state of the art and future trends. Acta. Autom. Sin. 2016, 42, 481–494. [Google Scholar]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L.J. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2019, 57, 2117–2135. [Google Scholar] [CrossRef]

- Sun, G.Q.; Xie, Y.F. Blockchain Technology, Supply Chain Networks and Data Sharing: Based on the Perspective of Evolutionary Game.Chin. J. Manag. Sci. 2023, 31, 149–162. [Google Scholar]

- Kumar, A.; Liu, R.; Shan, Z. Is blockchain a silver bullet for supply chain management? Technical challenges and research opportunities. Decis. Sci. 2020, 51, 8–37. [Google Scholar] [CrossRef]

- Shao, Q.F.; Jin, C.Q.; Zhang, Z.; Qian, W.N.; Zhou, A.Y. Blockchain: Architecture and research progress. Chin. J. Comput. 2018, 41, 969–988. [Google Scholar]

- Lu, W.; Robert, L.; Frank, L.; Jose, B. Value creation in blockchain-driven supply chain finance. Inf. Manag. 2022, 59, 103510. [Google Scholar]

- Wang, L.; Duan, T.; Dong, J. Integration of blockchain and enterprise network: Opportunities, challenges and countermeasures. Econ. Prob. 2021, 4, 23–30. [Google Scholar]

- Qian, X.N.; Papadonikolaki, E. Shifting trust in construction supply chains through blockchain technology. Eng. Constr. Archit. Manag. 2021, 28, 584–602. [Google Scholar] [CrossRef]

- Chang, S.E.; Chen, Y. When blockchain meets supply chain: A systematic literature review on current development and potential applications. IEEE Access 2020, 8, 62478–62494. [Google Scholar] [CrossRef]

- Qian, X.D.; Wang, Y.P. Research on evolution of supply chain networks in the blockchain environment. J. Stat. Inf. 2022, 37, 76–89. [Google Scholar]

- Lu, Y. The blockchain: State-of-the-art and research challenges. J. Ind. Inf. Integr. 2019, 15, 80–90. [Google Scholar] [CrossRef]

- Yang, H.Z.; Zhang, W.J.; Xi, X.N. Research on Supply Chain Finance Game Based on Accounts Receivable Model in Blockchain Environment. Math. Pract. Theory 2020, 50, 313–320. [Google Scholar]

- Song, H.; Han, S.Q.; Liu, W.Y. How Does Digital Technology Construct the Trust Relationship of Supply Chain Finance Network? J. Manag. World 2022, 38, 182–200. [Google Scholar]

| Items | Symbol |

|---|---|

| Accounts receivable from SME | |

| Pledge rate for accounts receivable | |

| Loanable amount | |

| CE’s loss rate on the original investment income due to SME’s default | |

| Return on investment of CE | |

| Return on reproduction of SME | |

| Interest rate on FI loan | |

| Interest rate on FI deposit | |

| Loss incurred due to default by SME | |

| Loss incurred due to default by CE | |

| Benefit for SME and CE due to their repayment | |

| FI’s intermediate income | |

| FI’s supervision cost |

| Earnings | SME | ||

|---|---|---|---|

| CE | Repayment | ||

| Default | |||

| Parameter | Values | Parameter | Values |

|---|---|---|---|

| 10,000 | 500 | ||

| 0.6 | 100 | ||

| 0.5 | 8000 | ||

| 0.08 | 10,000 | ||

| 0.3 | 1000 | ||

| 0.1 | 500 | ||

| 0.03 | 30 | ||

| 6000 | 1000 | ||

| 9500 | 0.8 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, X.; Wang, Y.; Huang, Y.; Zhang, Y. How to Reshape the Selection Boundaries between Traditional and Digital Supply Chain Finance Based on the Pledge Rate and Default Loss: Two Tripartite Game Models. Systems 2024, 12, 253. https://doi.org/10.3390/systems12070253

Sun X, Wang Y, Huang Y, Zhang Y. How to Reshape the Selection Boundaries between Traditional and Digital Supply Chain Finance Based on the Pledge Rate and Default Loss: Two Tripartite Game Models. Systems. 2024; 12(7):253. https://doi.org/10.3390/systems12070253

Chicago/Turabian StyleSun, Xiang, Yue Wang, Yinzi Huang, and Yue Zhang. 2024. "How to Reshape the Selection Boundaries between Traditional and Digital Supply Chain Finance Based on the Pledge Rate and Default Loss: Two Tripartite Game Models" Systems 12, no. 7: 253. https://doi.org/10.3390/systems12070253

APA StyleSun, X., Wang, Y., Huang, Y., & Zhang, Y. (2024). How to Reshape the Selection Boundaries between Traditional and Digital Supply Chain Finance Based on the Pledge Rate and Default Loss: Two Tripartite Game Models. Systems, 12(7), 253. https://doi.org/10.3390/systems12070253