Configurational Pathways to Breakthrough Innovation in the Digital Age: Evidence from Niche Leaders

Abstract

1. Introduction

2. Theoretical Background and Model Construction

2.1. Breakthrough Innovation in Niche Leaders

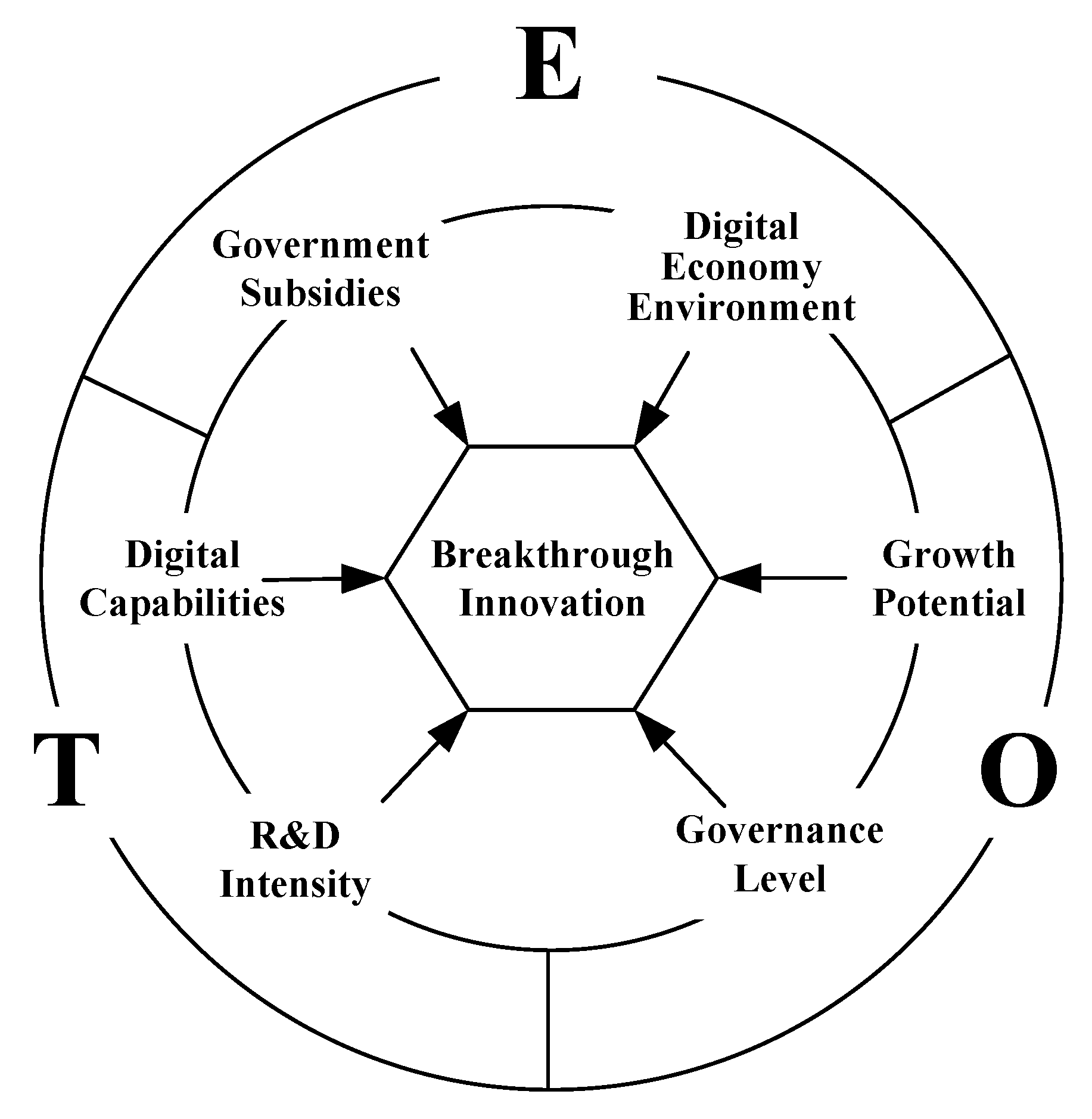

2.2. TOE Theoretical Framework

2.3. Model Construction

2.3.1. Technological Factors

2.3.2. Organizational Factors

2.3.3. Environmental Factors

3. Research Design

3.1. Research Method

3.2. Data Sources

3.3. Variable Measurement

- (1)

- R&D intensity: this is measured as the ratio of R&D expenditures to operating revenue [74].

- (2)

- Digital capability: This is assessed by analyzing annual reports of the sampled enterprises. We used the PyPDF2 tool to extract text and calculate the frequency of keywords related to digital transformation [11].

- (3)

- Corporate governance level: Based on existing research, we constructed a composite index using seven indicators, namely, executive compensation, shareholding ratios, independent director ratios, board size, institutional shareholding, equity balance, and the CEO–chairman duality. Principal component analysis was applied to derive a comprehensive governance quality indicator [64].

- (4)

- Enterprise growth: this is measured by the growth rate in terms of core business revenue [29].

- (5)

- Digital economy environment: this was evaluated by using the “China Urban Digital Economy Index”, developed by the New H3C Group and institutions such as the China Academy of Information and Communications Technology, to capture the digital economic environment in the enterprise’s location.

- (6)

- Government subsidies: this is measured as the ratio of government subsidies to total assets—a key focus of this study [17].

- (7)

- Enterprise breakthrough innovation: This study measures breakthrough innovation through the International Patent Classification (IPC) system, utilizing the first four digits of IPC codes to capture fundamental technological characteristics [75,76]. Following established methodologies, we employ a five-year rolling window approach: a patent is classified as a breakthrough patent if its IPC code differs from all IPC codes present in the firm’s patent portfolio during the previous five years. The annual sum of such patents represents the firm’s breakthrough innovation output [77,78]. This approach effectively captures technological discontinuities, as patents with novel IPC codes indicate that firms are exploring unfamiliar technical domains and creating new knowledge spaces. Such departures from established technological trajectories reflect the breakthrough nature of innovation.

3.4. Data Calibration

4. Data Analysis and Empirical Results

4.1. Necessity Analysis of Individual Conditions

4.2. Sufficiency Analysis of Conditional Configurations

4.2.1. Pooled Results

- Configurational analysis of high-innovation configurations.

- 2.

- Configurational analysis of the absence of high-breakthrough innovation

4.2.2. Inter-Group Results

- Inter-group analysis of high-breakthrough innovation

- 2.

- Inter-group analysis of the absence of high-breakthrough innovation

4.2.3. Intra-Group Results

4.3. Robustness Check

5. Conclusions and Discussion

5.1. Research Conclusions

5.2. Theoretical Contributions

5.3. Practical Implications

5.4. Research Limitations and Future Prospects

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Xiao, Y.; Tylecote, A.; Liu, J. Why not greater catch-up by Chinese firms? The impact of IPR, corporate governance and technology intensity on late-comer strategies. Res. Policy 2013, 42, 749–764. [Google Scholar] [CrossRef]

- Dosi, G. Technological paradigms and technological trajectories: A suggested interpretation of the determinants and directions of technical change. Res. Policy 1982, 11, 147–162. [Google Scholar] [CrossRef]

- Kraft, P.S.; Dickler, T.A.; Withers, M.C. When do firms benefit from overconfident CEOs? The role of board expertise and power for technological breakthrough innovation. Strateg. Manag. J. 2024. [Google Scholar] [CrossRef]

- Capponi, G.; Martinelli, A.; Nuvolari, A. Breakthrough innovations and where to find them. Res. Policy 2022, 51, 104376. [Google Scholar] [CrossRef]

- Qin, L.; Sun, S.L. Knowledge collaboration in global value chains: A comparison of supplier selection between a forerunner and a latecomer. Asia Pac. J. Manag. 2024, 41, 51–79. [Google Scholar] [CrossRef]

- Srivastava, M.K.; Gnyawali, D.R. When do relational resources matter? Leveraging portfolio technological resources for breakthrough innovation. Acad. Manag. J. 2011, 54, 797–810. [Google Scholar] [CrossRef]

- Wu, F.-S.; Tsai, C.-C.; Wu, C.-H.; Lo, T.-H. An exploratory study of breakthrough innovations in digital businesses: The case of the Perfect Corporation. Technol. Forecast. Soc. Chang. 2024, 201, 123233. [Google Scholar] [CrossRef]

- Popa, S.; Soto-Acosta, P.; Palacios-Marqués, D. A discriminant analysis of high and low-innovative firms: The role of IT, human resources, innovation strategy, intellectual capital and environmental dynamism. J. Knowl. Manag. 2022, 26, 1615–1632. [Google Scholar] [CrossRef]

- Skare, M.; de Obesso, M.d.l.M.; Ribeiro-Navarrete, S. Digital transformation and European small and medium enterprises (SMEs): A comparative study using digital economy and society index data. Int. J. Inf. Manag. 2023, 68, 102594. [Google Scholar] [CrossRef]

- Liu, J.; Chen, Y.; Liang, F.H. The effects of digital economy on breakthrough innovations: Evidence from Chinese listed companies. Technol. Forecast. Soc. Chang. 2023, 196, 122866. [Google Scholar] [CrossRef]

- Liu, M.; Li, C.; Wang, S.; Li, Q. Digital transformation, risk-taking, and innovation: Evidence from data on listed enterprises in China. J. Innov. Knowl. 2023, 8, 100332. [Google Scholar] [CrossRef]

- Mubarak, M.F.; Petraite, M. Industry 4.0 technologies, digital trust and technological orientation: What matters in open innovation? Technol. Forecast. Soc. Chang. 2020, 161, 120332. [Google Scholar] [CrossRef]

- Wimelius, H.; Mathiassen, L.; Holmström, J.; Keil, M. A paradoxical perspective on technology renewal in digital transformation. Inf. Syst. J. 2021, 31, 198–225. [Google Scholar] [CrossRef]

- Shao, K.; Wang, X. Do government subsidies promote enterprise innovation?—Evidence from Chinese listed companies. J. Innov. Knowl. 2023, 8, 100436. [Google Scholar] [CrossRef]

- Koh, Y.; Lee, G.M. R&D subsidies in permissive and restrictive environment: Evidence from Korea. Res. Policy 2023, 52, 104620. [Google Scholar]

- Andrade-Rojas, M.G.; Saldanha, T.J.; Kathuria, A.; Khuntia, J.; Boh, W. How Information Technology Overcomes Deficiencies for Innovation in Small and Medium-Sized Enterprises: Closed Innovation vs. Open Innovation. Inf. Syst. Res. 2024; ahead-of-print. [Google Scholar] [CrossRef]

- Pan, X.; Chen, X.; Qiu, S. Pushing boundaries or overstepping? Exploring the paradoxical impact of radical innovation on government subsidies in Chinese SMEs. Technovation 2024, 132, 102988. [Google Scholar] [CrossRef]

- Chen, J.; Lu, Q.; Heng, C.S.; Tan, B.C. The signaling effect of entrepreneurship subsidies on initial public offering investor valuation: An anticorruption campaign as a quasi-natural experiment. Strateg. Entrep. J. 2023, 17, 633–670. [Google Scholar] [CrossRef]

- Zhong, C.; Huang, R.; Duan, Y.; Sunguo, T.; Dello Strologo, A. Exploring the impacts of knowledge recombination on firms’ breakthrough innovation: The moderating effect of environmental dynamism. J. Knowl. Manag. 2024, 28, 698–723. [Google Scholar] [CrossRef]

- Ettlie, J.E.; Bridges, W.P.; O’keefe, R.D. Organization strategy and structural differences for radical versus incremental innovation. Manag. Sci. 1984, 30, 682–695. [Google Scholar] [CrossRef]

- Khalid, K.; Ahmad, S.Z.; Behery, M. The impact of social ties on balanced vs combined innovation: The role of dynamic capabilities and innovation climate in knowledge-intensive business services firms. Int. J. Innov. Sci. 2024; ahead-of-print. [Google Scholar] [CrossRef]

- Ritala, P.; Kianto, A.; Vanhala, M.; Hussinki, H. To protect or not to protect? Renewal capital, knowledge protection and innovation performance. J. Knowl. Manag. 2023, 27, 1–24. [Google Scholar] [CrossRef]

- Byun, S.K.; Oh, J.-M.; Xia, H. Incremental vs. breakthrough innovation: The role of technology spillovers. Manag. Sci. 2021, 67, 1779–1802. [Google Scholar] [CrossRef]

- Qu, G.; Chen, J.; Zhang, R.; Wang, L.; Yang, Y. Technological search strategy and breakthrough innovation: An integrated approach based on main-path analysis. Technol. Forecast. Soc. Chang. 2023, 196, 122879. [Google Scholar] [CrossRef]

- Yang, M.; Wang, J. Boundary-spanning search and breakthrough innovation: The moderating role of big data analytics capability. J. Enterp. Inf. Manag. 2024, 37, 1301–1321. [Google Scholar] [CrossRef]

- Singh, S.K.; Gupta, S.; Busso, D.; Kamboj, S. Top management knowledge value, knowledge sharing practices, open innovation and organizational performance. J. Bus. Res. 2021, 128, 788–798. [Google Scholar] [CrossRef]

- Lin, R.; Li, B.; Lu, Y.; Li, Y. Degree assortativity in collaboration networks and breakthrough innovation: The moderating role of knowledge networks. Scientometrics 2024, 129, 3809–3839. [Google Scholar] [CrossRef]

- Zhou, L.; Qu, C.; Zhi, L. Research on the Impact of Digital Infrastructure on Urban Breakthrough Green Innovation: A Case Study of the Yangtze River Economic Belt in China. Sustainability 2024, 16, 9650. [Google Scholar] [CrossRef]

- Xia, Q.; Zhu, Q.; Tan, M.; Xie, Y. A configurational analysis of innovation ambidexterity: Evidence from Chinese niche leaders. Chin. Manag. Stud. 2024, 18, 954–977. [Google Scholar] [CrossRef]

- Chang, Y.-Y.; Hughes, M. Drivers of innovation ambidexterity in small-to medium-sized firms. Eur. Manag. J. 2012, 30, 1–17. [Google Scholar] [CrossRef]

- Bao, Y.; Chen, X.; Zhou, K.Z. External learning, market dynamics, and radical innovation: Evidence from China’s high-tech firms. J. Bus. Res. 2012, 65, 1226–1233. [Google Scholar] [CrossRef]

- Li, P.P.; Prashantham, S.; Zhou, A.J.; Zhou, S.S. Compositional springboarding and EMNE evolution. J. Int. Bus. Stud. 2022, 53, 754–766. [Google Scholar] [CrossRef]

- Drucker, P.F. Innovation and Entrepreneurship: Practice and Principles; Harper & Row: New York, NY, USA, 1986. [Google Scholar]

- Chesbrough, H. Open Business Models: How to Thrive in the New Innovation Landscape; Harvard Business Press: Boston, MA, USA, 2006. [Google Scholar]

- Ed-Dafali, S.; Al-Azad, M.S.; Mohiuddin, M.; Reza, M.N.H. Strategic orientations, organizational ambidexterity, and sustainable competitive advantage: Mediating role of industry 4.0 readiness in emerging markets. J. Clean. Prod. 2023, 401, 136765. [Google Scholar] [CrossRef]

- Hu, S.; Gong, H.; Li, S. Fail forward: The relationship between innovation failure and breakthrough innovation in the context of knowledge-based capabilities. Eur. J. Innov. Manag. 2024; ahead-of-print. [Google Scholar] [CrossRef]

- Yu, J.; Wen, Q.; Xu, Q. The configurational effects of centrifugal and centripetal forces on firms’ breakthrough innovation and strategic performance in the artificial intelligence context. Eur. J. Innov. Manag. 2024, 27, 1743–1766. [Google Scholar] [CrossRef]

- Bendig, D.; Göttel, V.; Eckardt, D.; Schulz, C. Human capital in corporate venture capital units and its relation to parent firms’ innovative performance. Res. Policy 2024, 53, 105003. [Google Scholar] [CrossRef]

- Zhang, W.; Zeng, X.; Liang, H.; Xue, Y.; Cao, X. Understanding how organizational culture affects innovation performance: A management context perspective. Sustainability 2023, 15, 6644. [Google Scholar] [CrossRef]

- Raffaelli, R.; Glynn, M.A.; Tushman, M. Frame flexibility: The role of cognitive and emotional framing in innovation adoption by incumbent firms. Strateg. Manag. J. 2019, 40, 1013–1039. [Google Scholar] [CrossRef]

- Davis, C.; Tomoda, Y. Competing incremental and breakthrough innovation in a model of product evolution. J. Econ. 2018, 123, 225–247. [Google Scholar] [CrossRef]

- Kveton, V.; Shkolnykova, M. Technological Novelty, Knowledge Bases, and Regional Differentiation: Towards a Regional Typology of Radical, Breakthrough, and Discontinuous Innovations. Eurasian Geogr. Econ. 2023. [Google Scholar] [CrossRef]

- Zimmermann, A.; Hill, S.A.; Birkinshaw, J.; Jaeckel, M. Complements or substitutes? A microfoundations perspective on the interplay between drivers of ambidexterity in SMEs. Long Range Plan. 2020, 53, 101927. [Google Scholar] [CrossRef]

- Burgelman, R.A. A process model of internal corporate venturing in the diversified major firm. Adm. Sci. Q. 1983, 28, 223–244. [Google Scholar] [CrossRef]

- Luo, Y.; Wu, A.; Liu, Y.; Song, D. The impact of long-term orientation on the resilience of niche leaders. Asia Pac. J. Manag. 2024. [Google Scholar] [CrossRef]

- Schenkenhofer, J. Hidden champions: A review of the literature & future research avenues. Manag. Rev. Q. 2022, 72, 417–482. [Google Scholar]

- Johann, M.S.; Block, J.H.; Benz, L. Financial performance of hidden champions: Evidence from German manufacturing firms. Small Bus. Econ. 2022, 59, 873–892. [Google Scholar] [CrossRef]

- Garaus, M.; Wagner, U.; Kummer, C. Cognitive fit, retail shopper confusion, and shopping value: Empirical investigation. J. Bus. Res. 2015, 68, 1003–1011. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Lehmann, E.E.; Schenkenhofer, J. Internationalization strategies of hidden champions: Lessons from Germany. Multinatl. Bus. Rev. 2018, 26, 2–24. [Google Scholar] [CrossRef]

- Pustovrh, A.; Rangus, K.; Drnovsek, M. The role of open innovation in developing an entrepreneurial support ecosystem. Technol. Forecast. Soc. Chang. 2020, 152, 119892. [Google Scholar] [CrossRef]

- Ranga, M.; Mroczkowski, T.; Araiso, T. University–industry cooperation and the transition to innovation ecosystems in Japan. Ind. High. Educ. 2017, 31, 373–387. [Google Scholar] [CrossRef]

- Zhao, T.; Ma, R.; Chen, S. The International Operations of China’s Hidden Champions—Based on Fuzzy-Set Qualitative Comparative Analysis. SAGE Open 2024, 14, 21582440241271071. [Google Scholar] [CrossRef]

- Hanelt, A.; Bohnsack, R.; Marz, D.; Antunes Marante, C. A systematic review of the literature on digital transformation: Insights and implications for strategy and organizational change. J. Manag. Stud. 2021, 58, 1159–1197. [Google Scholar] [CrossRef]

- Gao, J.; Zhang, W.; Guan, T.; Feng, Q.; Mardani, A. The effect of manufacturing agent heterogeneity on enterprise innovation performance and competitive advantage in the era of digital transformation. J. Bus. Res. 2023, 155, 113387. [Google Scholar] [CrossRef]

- Hassan, S.S.; Meisner, K.; Krause, K.; Bzhalava, L.; Moog, P. Is digitalization a source of innovation? Exploring the role of digital diffusion in SME innovation performance. Small Bus. Econ. 2024, 62, 1469–1491. [Google Scholar] [CrossRef]

- Tornatzky, L.G. The Processes of Technological Innovation; Lexington/DC Heath & Company: Lexington, MA, USA, 1990. [Google Scholar]

- Gama, F.; Magistretti, S. Artificial intelligence in innovation management: A review of innovation capabilities and a taxonomy of AI applications. J. Prod. Innov. Manag. 2023. [Google Scholar] [CrossRef]

- Shang, M.; Jia, C.; Zhong, L.; Cao, J. What determines the performance of digital transformation in manufacturing enterprises? A study on the linkage effects based on fs/QCA method. J. Clean. Prod. 2024, 450, 141856. [Google Scholar] [CrossRef]

- Chen, L.; Tu, R.; Huang, B.; Zhou, H.; Wu, Y. Digital transformation’s impact on innovation in private enterprises: Evidence from China. J. Innov. Knowl. 2024, 9, 100491. [Google Scholar] [CrossRef]

- Zahoor, N.; Khan, H.; Shamim, S.; Puthusserry, P. Examining the microfoundations for digital business model innovation of developing markets international new ventures (2023). IEEE Trans. Eng. Manag. 2023, 71, 12854–12867. [Google Scholar] [CrossRef]

- Adomako, S.; Amankwah-Amoah, J.; Danso, A.; Danquah, J.K.; Hussain, Z.; Khan, Z. R&D intensity, knowledge creation process and new product performance: The mediating role of international R&D teams. J. Bus. Res. 2021, 128, 719–727. [Google Scholar]

- Omari, D.; Scott, S.A.; Toth, Z.; Tsinopoulos, C. The SME R&D intensity and product innovation relationship: The mediating role of quality management in the context of a developing country. R&D Manag. 2024. [Google Scholar] [CrossRef]

- Gomes, L.A.d.V.; Flechas, A.; Facin, A.L.F.; Borini, F.M.; Stefani, B.; Leal, L.F. Entrepreneurial judgment governance adaptation for digital transformation in established firms. Strateg. Entrep. J. 2024, 18, 200–225. [Google Scholar] [CrossRef]

- He, Y.; Chiu, Y.-h.; Zhang, B. The impact of corporate governance on state-owned and non-state-owned firms efficiency in China. N. Am. J. Econ. Financ. 2015, 33, 252–277. [Google Scholar] [CrossRef]

- Huang, H.; Wang, C.; Wang, L.; Yarovaya, L. Corporate digital transformation and idiosyncratic risk: Based on corporate governance perspective. Emerg. Mark. Rev. 2023, 56, 101045. [Google Scholar] [CrossRef]

- Joseph, J.; Wilson, A.J. The growth of the firm: An attention-based view. Strateg. Manag. J. 2018, 39, 1779–1800. [Google Scholar] [CrossRef]

- Wang, B.Y.; Khan, I.; Ge, C.L.; Naz, H. Digital transformation of enterprises promotes green technology innovation—The regulated mediation model. Technol. Forecast. Soc. Chang. 2024, 209, 123812. [Google Scholar] [CrossRef]

- Piccoli, G.; Rodriguez, J.; Grover, V. Digital strategic initiatives and digital resources: Construct definition and future research directions. MIS Q. 2022, 46, 2289–2316. [Google Scholar] [CrossRef]

- Du, Y.; Wang, Q.; Zhou, J. How does digital inclusive finance affect economic resilience: Evidence from 285 cities in China. Int. Rev. Financ. Anal. 2023, 88, 102709. [Google Scholar] [CrossRef]

- Farinloye, T.; Omotoye, O.; Oginni, A.; Moharrak, M.; Mogaji, E. Bridging the digital divide: Consumer engagement with transportation payment apps in emerging economies. J. Consum. Behav. 2024, 23, 3011–3029. [Google Scholar] [CrossRef]

- Cheng, C.; Zhang, M.X.; Dai, J.; Yang, Z. When Does Digital Technology Adoption Enhance Firms’ Sustainable Innovation Performance? A Configurational Analysis in China. IEEE Trans. Eng. Manag. 2024, 71, 1555–1568. [Google Scholar] [CrossRef]

- Beynon, M.J.; Jones, P.; Pickernell, D. Country-level entrepreneurial attitudes and activity through the years: A panel data analysis using fsQCA. J. Bus. Res. 2020, 115, 443–455. [Google Scholar] [CrossRef]

- Castro, R.G.; Ariño, M.A. A general approach to panel data set-theoretic research. J. Adv. Manag. Sci. Inf. Syst. 2016, 2, 63–76. [Google Scholar] [CrossRef]

- Alam, M.S.; Atif, M.; Chien-Chi, C.; Soytaş, U. Does corporate R&D investment affect firm environmental performance? Evidence from G-6 countries. Energy Econ. 2019, 78, 401–411. [Google Scholar]

- Zhang, F.; Liu, Z.; Feng, F.; Li, J. Can FinTech promote enterprises’ ambidextrous innovation capability? Organizational resilience perspective. Financ. Res. Lett. 2024, 68, 105994. [Google Scholar] [CrossRef]

- Guan, J.; Liu, N. Exploitative and exploratory innovations in knowledge network and collaboration network: A patent analysis in the technological field of nano-energy. Res. Policy 2016, 45, 97–112. [Google Scholar] [CrossRef]

- Zhang, N.; You, D.; Tang, L.; Wen, K. Knowledge path dependence, external connection, and radical inventions: Evidence from Chinese Academy of Sciences. Res. Policy 2023, 52, 104738. [Google Scholar] [CrossRef]

- Liang, R.; Wen, X.; Zhu, S. The impact of emission charges on the quality of corporate innovation: Based on the perspective of breakthrough technological innovation. J. Clean. Prod. 2023, 404, 136830. [Google Scholar] [CrossRef]

- Liu, Q.; Kim, Y.G. Exploring the Path of Green Innovation and High-Quality Development of Influential Regional Enterprises Based on the Analysis of the Dynamic QCA Method and MATLAB Sustainability Prediction. Systems 2024, 12, 232. [Google Scholar] [CrossRef]

- Kou, Y.; Chen, H.; Liu, K.; Zhou, Y.; Xu, H. Path Optimization of Technological Innovation Efficiency Improvement in China’s High-Tech Industries Based on QCA and GA-PSO-BP Neural Network. Systems 2023, 11, 233. [Google Scholar] [CrossRef]

- Du, X.; Wang, N.; Lu, S.; Zhang, A.; Tsai, S.-B. Sustainable competitive advantage under digital transformation: An eco-strategy perspective. Chin. Manag. Stud. 2024; ahead-of-print. [Google Scholar] [CrossRef]

- Ribeiro-Navarrete, S.; Botella-Carrubi, D.; Palacios-Marqués, D.; Orero-Blat, M. The effect of digitalization on business performance: An applied study of KIBS. J. Bus. Res. 2021, 126, 319–326. [Google Scholar] [CrossRef]

- Jacqueminet, A.; Durand, R. Ups and downs: The role of legitimacy judgment cues in practice implementation. Acad. Manag. J. 2020, 63, 1485–1507. [Google Scholar] [CrossRef]

- Browder, R.E.; Dwyer, S.M.; Koch, H. Upgrading adaptation: How digital transformation promotes organizational resilience. Strateg. Entrep. J. 2024, 18, 128–164. [Google Scholar] [CrossRef]

- Yoon, S.; Ho, J.Y. Delivering sustainable development via social innovation: Cases of social entrepreneurship in South Korea and Singapore. Sustain. Dev. 2024. [Google Scholar] [CrossRef]

- Smolka, M.; Boeschen, S. Responsible innovation ecosystem governance: Socio-technical integration research for systems-level capacity building. J. Responsible Innov. 2023, 10, 2207937. [Google Scholar] [CrossRef]

- Nast, C.; Broekel, T.; Entner, D. Fueling the fire? How government support drives technological progress and complexity. Res. Policy 2024, 53, 105005. [Google Scholar] [CrossRef]

- Wang, S.W.; Li, X.; Li, Z.B.; Ye, Y.W. The effects of government support on enterprises’ digital transformation: Evidence from China. Manag. Decis. Econ. 2023, 44, 2520–2539. [Google Scholar] [CrossRef]

- Chen, C.; Zhang, T.; Chen, H.; Qi, X. Regional financial reform and corporate green innovation–Evidence based on the establishment of China National Financial Comprehensive Reform Pilot Zones. Financ. Res. Lett. 2024, 60, 104849. [Google Scholar] [CrossRef]

- Etzkowitz, H.; Leydesdorff, L. The dynamics of innovation: From National Systems and “Mode 2” to a Triple Helix of university–industry–government relations. Res. Policy 2000, 29, 109–123. [Google Scholar] [CrossRef]

- Lai, W.-H.; Chang, P.-L. Corporate motivation and performance in R&D alliances. J. Bus. Res. 2010, 63, 490–496. [Google Scholar]

- Chen, J.; Heng, C.S.; Tan, B.C.; Lin, Z. The distinct signaling effects of R&D subsidy and non-R&D subsidy on IPO performance of IT entrepreneurial firms in China. Res. Policy 2018, 47, 108–120. [Google Scholar]

- Peng, Z.H.; Huang, Y.Q.; Liu, L.H.; Xu, W.L.; Qian, X.H. How government digital attention alleviates enterprise financing constraints: An enterprise digitalization perspective. Financ. Res. Lett. 2024, 67, 105883. [Google Scholar] [CrossRef]

- Gomes, L.A.D.; Chaparro, X.A.F.; Maniçoba, R.F.; Borini, F.M.; Silva, L.E. Transformation of the governance of failure for radical innovation: The role of strategic leaders. Res. Policy 2025, 54, 105108. [Google Scholar] [CrossRef]

- Oludapo, S.; Carroll, N.; Helfert, M. Why do so many digital transformations fail? A bibliometric analysis and future research agenda. J. Bus. Res. 2024, 174, 114528. [Google Scholar] [CrossRef]

- Xie, Y.; Wu, D.S. How does competition policy affect enterprise digitization? Dual perspectives of digital commitment and digital innovation. J. Bus. Res. 2024, 178, 114651. [Google Scholar] [CrossRef]

- Tammi, T.; Saastamoinen, J.; Reijonen, H. Public procurement as a vehicle of innovation–What does the inverted-U relationship between competition and innovativeness tell us? Technol. Forecast. Soc. Chang. 2020, 153, 119922. [Google Scholar] [CrossRef]

- Xie, X.; Wang, H. How can open innovation ecosystem modes push product innovation forward? An fsQCA analysis. J. Bus. Res. 2020, 108, 29–41. [Google Scholar] [CrossRef]

- Gao, Y.; Hu, Y.; Liu, X.; Zhang, H. Can public R&D subsidy facilitate firms’ exploratory innovation? The heterogeneous effects between central and local subsidy programs. Res. Policy 2021, 50, 104221. [Google Scholar]

- Fang, L.; Lerner, J.; Wu, C.; Zhang, Q. Anticorruption, government subsidies, and innovation: Evidence from China. Manag. Sci. 2023, 69, 4363–4388. [Google Scholar] [CrossRef]

- Estévez-Mendoza, C.; Montoro-Sánchez, A. Exploring the relationship between innovation and corporate governance. Technol. Forecast. Soc. Chang. 2024, 209, 123784. [Google Scholar] [CrossRef]

| Variable Name | Calibration | ||||

|---|---|---|---|---|---|

| Fully In | Crossover | Fully Out | |||

| Result variables | Breakthrough innovation (Y) | 22.000 | 4.000 | 0.000 | |

| Conditional variables | T | R&D intensity (A) | 17.722 | 5.875 | 2.084 |

| Digital capabilities (B) | 266.300 | 32.000 | 6.000 | ||

| O | Governance level (C) | 47.553 | 18.846 | 8.949 | |

| Growth potential (D) | 62.443 | 8.247 | −29.208 | ||

| E | Digital economy environment (E) | 93.700 | 82.300 | 60.500 | |

| Government subsidies (F) | 1.426 | 0.419 | 0.108 | ||

| Variant | High-Breakthrough Innovation | Non-High-Breakthrough Innovation | ||||||

|---|---|---|---|---|---|---|---|---|

| Consistency | Coverage | Inter-Group Consistency | Intra-Group Consistency | Consistency | Coverage | Inter-Group Consistency | Intra-Group Consistency | |

| A | 0.645 | 0.631 | 0.073 | 0.436 | 0.595 | 0.708 | 0.049 | 0.512 |

| ~A | 0.701 | 0.587 | 0.098 | 0.370 | 0.690 | 0.703 | 0.089 | 0.408 |

| B | 0.612 | 0.643 | 0.113 | 0.493 | 0.550 | 0.703 | 0.092 | 0.531 |

| ~B | 0.718 | 0.568 | 0.107 | 0.380 | 0.721 | 0.693 | 0.095 | 0.389 |

| C | 0.616 | 0.558 | 0.073 | 0.493 | 0.642 | 0.707 | 0.079 | 0.493 |

| ~C | 0.676 | 0.608 | 0.141 | 0.446 | 0.598 | 0.654 | 0.046 | 0.512 |

| D | 0.718 | 0.649 | 0.134 | 0.218 | 0.627 | 0.689 | 0.165 | 0.285 |

| ~D | 0.650 | 0.591 | 0.183 | 0.275 | 0.681 | 0.746 | 0.144 | 0.228 |

| E | 0.672 | 0.568 | 0.070 | 0.455 | 0.654 | 0.671 | 0.037 | 0.493 |

| ~E | 0.610 | 0.592 | 0.107 | 0.588 | 0.579 | 0.682 | 0.055 | 0.636 |

| F | 0.662 | 0.658 | 0.110 | 0.380 | 0.554 | 0.670 | 0.183 | 0.427 |

| ~F | 0.668 | 0.552 | 0.159 | 0.372 | 0.717 | 0.721 | 0.070 | 0.332 |

| Variant | High-Breakthrough Innovation | Non-High-Breakthrough Innovation | ||||

|---|---|---|---|---|---|---|

| a1 | a2 | a3 | a4 | b1 | b2 | |

| R&D intensity (A) | ⬤ | ⬤ | ● | |||

| Digital capabilities (B) | ⬤ | ⬤ | ⬤ | |||

| Governance level (C) | ⨂ | ⨂ | ⬤ | ⬤ | ||

| Growth potential (D) | ● | ⬤ | ⨂ | |||

| Digital economy environment (E) | ⨂ | ⨂ | ⨂ | ● | ⨂ | ● |

| Government subsidies (F) | ⬤ | ⬤ | ⬤ | ⬤ | ⨂ | |

| Consistency | 0.875 | 0.855 | 0.872 | 0.891 | 0.896 | 0.907 |

| PRI | 0.640 | 0.573 | 0.598 | 0.523 | 0.713 | 0.736 |

| Original coverage | 0.273 | 0.276 | 0.285 | 0.240 | 0.240 | 0.284 |

| Unique coverage | 0.021 | 0.012 | 0.073 | 0.046 | 0.104 | 0.147 |

| Inter-group consistency-adjusted distance | 0.092 | 0.113 | 0.076 | 0.089 | 0.064 | 0.073 |

| Intra-group consistency-adjusted distance | 0.152 | 0.171 | 0.161 | 0.133 | 0.142 | 0.123 |

| Overall consistency | 0.833 | 0.888 | ||||

| Overall PRI | 0.576 | 0.732 | ||||

| Overall coverage | 0.433 | 0.388 | ||||

| Region | High-Breakthrough Innovation | Non-High-Breakthrough Innovation | ||||

|---|---|---|---|---|---|---|

| R&D-Driven Innovation Pathway | Digital Transformation-Driven Innovation Pathway | Comprehensive Support Innovation Pathway | Conservative Management Configuration | Digital Island Configuration | ||

| Configuration a1 | Configuration a2 | Configuration a3 | Configuration a4 | Configuration b1 | Configuration b2 | |

| Eastern China | 0.242 | 0.227 | 0.229 | 0.265 | 0.230 | 0.329 |

| Central China | 0.356 | 0.409 | 0.355 | 0.198 | 0.271 | 0.222 |

| Western China | 0.238 | 0.243 | 0.329 | 0.207 | 0.298 | 0.245 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liao, S.; Deng, X.; Lu, H.; Niu, L. Configurational Pathways to Breakthrough Innovation in the Digital Age: Evidence from Niche Leaders. Systems 2024, 12, 542. https://doi.org/10.3390/systems12120542

Liao S, Deng X, Lu H, Niu L. Configurational Pathways to Breakthrough Innovation in the Digital Age: Evidence from Niche Leaders. Systems. 2024; 12(12):542. https://doi.org/10.3390/systems12120542

Chicago/Turabian StyleLiao, Shuai, Xi Deng, Hui Lu, and Luyao Niu. 2024. "Configurational Pathways to Breakthrough Innovation in the Digital Age: Evidence from Niche Leaders" Systems 12, no. 12: 542. https://doi.org/10.3390/systems12120542

APA StyleLiao, S., Deng, X., Lu, H., & Niu, L. (2024). Configurational Pathways to Breakthrough Innovation in the Digital Age: Evidence from Niche Leaders. Systems, 12(12), 542. https://doi.org/10.3390/systems12120542