1. Introduction

In recent years, the global economy is experiencing a downturn due to a complex mix of factors. On the contrary, the online second-hand market is bucking the trend and showing a thriving situation. GlobalData’s report on U.S.-based second-hand e-commerce giant ThredUp shows that total global second-hand clothing sales will increase by 18% in 2023 compared to 2022 to reach USD 197 billion, and the global second-hand clothing market is projected to reach USD 350 billion by 2028 (see globaldata.com). According to the “Used Recycling Insight Report (Q2 2024)” by Zhuanzhuan, a leading platform for second-hand consumer electronics in China, the market for second-hand electronics in China continues to heat up, with the platform’s Q2 sales orders up 35% year-on-year, and recycling orders up 42% year-on-year (see zhuanzhuan.com). eBay noted in its “E-Commerce Report 2024” that young people across the globe are particularly enthusiastic about the circular economy, with over 90% of millennials being particularly interested in recycling enthusiastically, with over 90% of millennial and gen Z sellers saying they value eBay’s ability to keep items out of landfills (see ebayinc.com). There is no doubt that the topic of online second-hand marketplaces will be a constant focus of attention, both now and in the future.

As an important channel for individuals to redeploy their assets, the online second-hand market facilitates sellers to transfer unused products to other people in need, and also enables buyers to save money compared to purchasing new products. However, in the traditional online second-hand market, the non-standardization of used products and information asymmetry often cause buyers to experience a poor purchasing experience when the expected quality of used products deviates from the real quality [

1]. In recent years, in order to alleviate buyers’ quality concerns, some second-hand e-commerce platforms have begun to provide customers with inspection services for used products, including setting quality standards for used products as well as testing the authenticity of products [

2]. The introduction of inspection services has bolstered buyer confidence in used products and has contributed to significant commercial success for these platforms.

In practice, the operation modes adopted by mainstream SIPs vary significantly, e.g., StockX and RealReal utilize the consignment mode, while ATRnew and PaiPai employ the resale mode, and Zhuanzhuan and Xianyu implement the hybrid mode. We summarize the differences among the three modes as follows: First, the ownership and pricing authority of used products are different. Under the consignment mode, the seller owns the used product and can therefore set its own price. Under the resale mode, the platform makes an offer to the seller to take ownership of the used product, and then sells it to the buyer at the resale price. Under the hybrid mode, the platform operates both the consignment channel and the resale channel, and the ownership and pricing of used products under both channels are similar to those in the consignment and resale modes, respectively. Second, the platform provides different protection services. For used products owned by platforms, platforms often provide guarantees for them, which are not available for products from individual sellers. Therefore, buyers have a higher expected value for the platform’s products. Finally, the degree of competition is different. Under the consignment mode, all individual sellers compete with each other. Under the resale mode, the platform mitigates competition among sellers by setting a recycling price [

3]. Under the hybrid mode, sellers in the consignment channel compete with each other while facing competition with products from the platform [

4]. Interestingly, we observe that, in addition to different platforms adopting different operation modes, the same platform may also experience shifts in its operation mode over time. For example, Poizon and eBay initially adopted the consignment mode and are now shifting to the hybrid mode. Thus, the motivations behind the platform’s choice among these alternative modes naturally emerge as a significant issue worth exploring.

Platforms need to make trade-offs when it comes to the choice of operation modes. Under the consignment mode, buyers are mainly influenced by the inspection service level when making purchase decisions. On the one hand, the higher inspection service level correlates with increased customer perceived value. On the other hand, the higher inspection service level may lead to supply-side contraction, as low-quality sellers are excluded from the market when they fail to pass the inspection. In the resale mode, platforms provide guarantees for used products, giving buyers a higher perceived value for their products compared to the consignment mode. Additionally, acquiring ownership of the products allows the platform greater flexibility in increasing the unit price of used products. However, the platform must bear the cost of the guarantee, while also potentially facing a decline in buyer demand. Under the hybrid mode, platforms need to consider not only the trade-offs inherent in each individual channel but must also account for competition between channels. Consequently, in order to achieve higher profitability, the platform must exercise greater caution in setting transaction fees within the consignment channel, as well as in determining the recycling price, resale price, and penalty within the resale channel.

The issue of operation mode selection for e-commerce platforms has been widely explored by academics. Scholars have conducted a series of discussions on the impact of different factors (e.g., consumer valuation uncertainty, downstream competition intensity, order fulfillment costs, quality uncertainty, additional services, differentiated products, carbon emissions, and customer returns) on the selection of the optimal operation mode for e-commerce platforms in a variety of business contexts [

3,

5,

6,

7,

8,

9,

10,

11]. However, these studies mainly focus on manufacturers or new product e-tailers, and relatively few studies have been conducted on second-hand platforms. In addition, the issue of applying emerging technologies (e.g., blockchain and AI technologies) to alleviate consumer quality concerns in online second-hand marketplaces is also addressed by existing studies [

2,

12,

13,

14,

15,

16], which focus on the impact of supply chain structure on the adoption of emerging technologies and the associated pricing issues. However, the inspection service, which has emerged in the online second-hand market in recent years, has received limited attention despite some studies having demonstrated that it can significantly benefit the second-hand marketplace. In order to fill the gap of the existing research, this paper will study the role of inspection services on the decision-making of second-hand platforms’ operation modes from the perspective of SIPs, and explore how the inspection services affect second-hand transactions as well as consumer surplus and social welfare under different operation modes. Specifically, we will try to answer the following questions:

(1) What are the differences between SIPs’ equilibrium results under different operation modes?

(2) What is the optimal operation mode strategy for SIPs?

(3) How do inspection services affect SIPs’ equilibrium strategies and used products sales under different operation modes?

(4) How do SIPs’ operation mode strategy and inspection service level affect consumer surplus and social welfare?

To answer the above questions, we consider a supply chain including an SIP, an individual buyer, and a seller. The goal of the SIP is to maximize its profit, while the buyer and seller decide their buying or selling decisions, respectively, based on the net utilities. We first derive the optimal decisions and maximum profits for the platform under various operation modes through backward induction. Subsequently, we compare the equilibrium results under different modes and explore the platform’s optimal operation mode choices. In addition, we examine the effect of inspection service level on the platform’s optimal decisions and maximum profit. Finally, we investigate the specific impact of inspection service level on consumer surplus and social welfare under different operation modes.

The main findings are as follows:

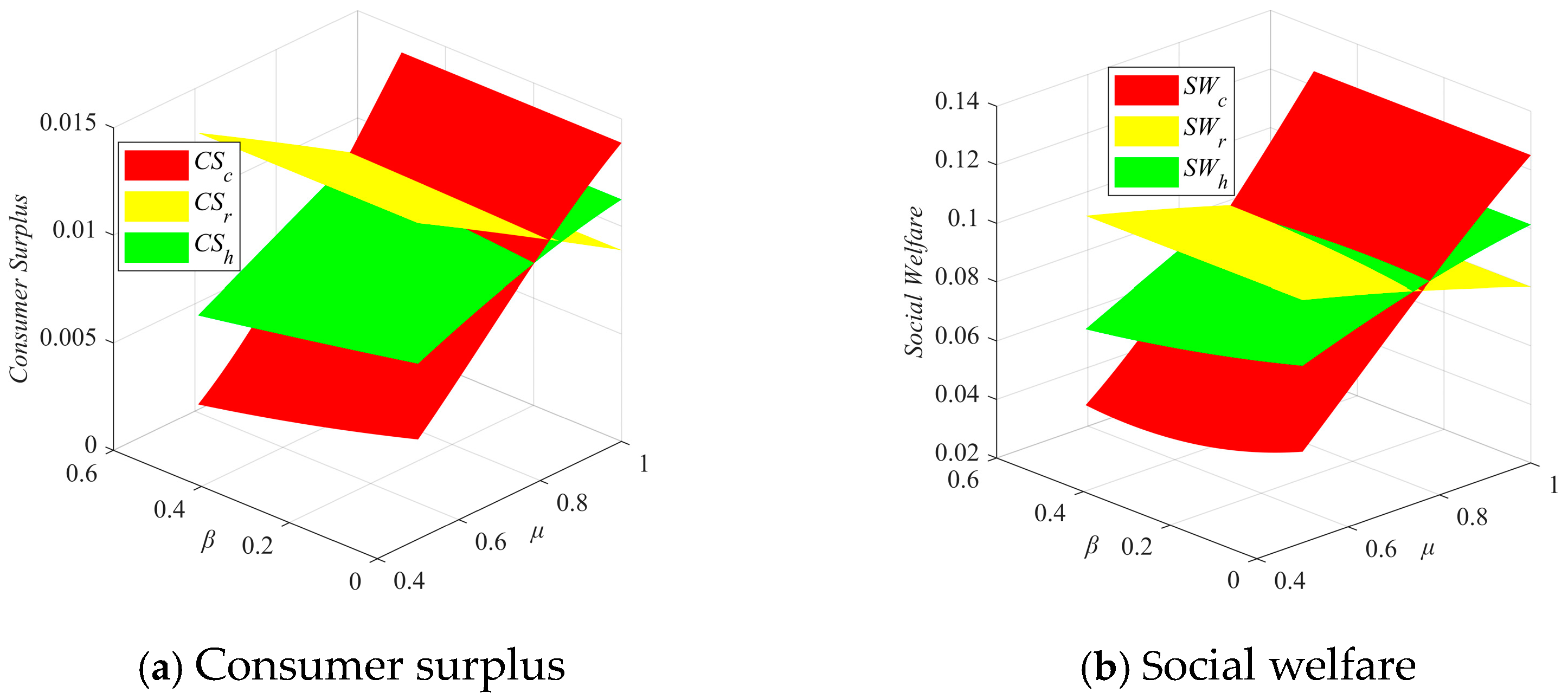

(1) Despite the inter-channel competition in the hybrid mode, the price of used products may be higher than in the other two modes, depending on the cost of guarantee, which also influences the transaction fee, recycle price, and optimal sales. In addition, penalties charged by platforms vary under different modes. (2) The platform’s choice of optimal operation mode depends on the cost of the guarantee. (3) A higher inspection service level may lead to lower profit, sales, transaction fees, and penalties but increase the recycling price. (4) An increase in the inspection service level may reduce consumer surplus and social welfare.

The rest of this paper is organized as follows.

Section 2 briefly reviews the relevant literature.

Section 3 develops the analytical model and

Section 4 analyzes the equilibrium results.

Section 6 examines and analyzes the impact of inspection service level on consumer surplus and social welfare under different operation modes.

Section 6 summarizes conclusions and points to future research directions. All proofs are presented in

Appendix A.

3. Model

We consider a Stackelberg game, in which an SIP links the buyer (she) and seller (he) by providing inspection services for each second-hand product transaction, and only those used products that pass the inspection can be delivered to buyers, while those that do not pass the inspection are returned to sellers (e.g., StockX, Poizon, RealReal, Zhuanzhuan, Paipai). The platform first chooses the optimal operation mode and makes optimal decisions to maximize its profit, which may include the resale price of used products, the recycling price, transaction fees, and penalty. After observing the inspection service level, prices, and penalty, the seller will decide whether to sell or not based on the net utility. If the utility is non-negative, the seller will decide to sell. Similarly, the buyer then observes the price and determines the buying decision based on the net utility. In the following of this section, we first elucidate the inspection process and the different operation modes of the platform, followed by a detailed description of the models for the seller, buyer, and platform.

3.1. Inspection Processes

Assume that there are two types of used products in the market, i.e., high-quality products and low-quality products. Before the used products are delivered to the buyers, the sellers mail the products to the platform for inspection. Referring to the literature [

2,

32,

33], we assume that high-quality products will definitely pass the inspection, while low-quality products will pass the inspection with a probability

, where

represents the inspection services level that reflects the probability of identifying low-quality products.

reflects the reality that the probability that a set of insubstantial inspection processes can identify a low-quality product is

, because a used product is either high-quality or low-quality. In addition, the inspection is not perfect, and therefore the probability of identifying a low-quality product is only infinitely close to

. This is common in practice, e.g., despite the fact that many SIPs demonstrate the sophistication and rigor of their inspection processes on their homepages, consumers often complain that their purchases of checked products have been found to have quality problems. After inspection processes, if the product passes the inspection, the platform will ship the product to the buyer and remit the portion of the payment to the seller after deducting the transaction fees (in the case of resale, the platform pays the recycling price). If the product fails the inspection, the platform returns the product to the seller and charges a penalty.

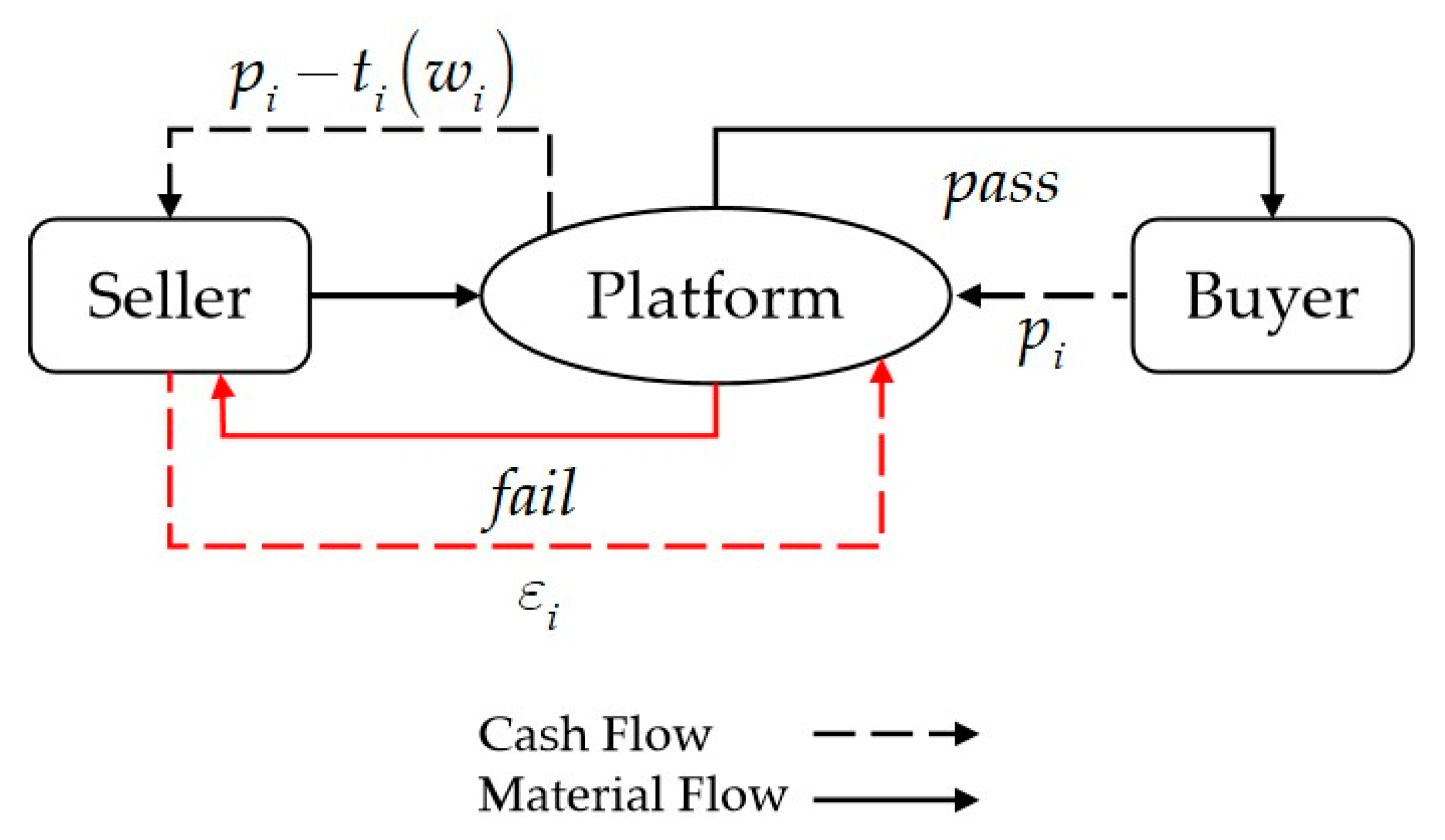

Figure 1 illustrates the inspection service processes, where the black line represents passing the inspection while the red line represents failing the inspection. The footprint

represents consignment mode, resale mode, consignment channel, and resale channel in hybrid mode, respectively.

3.2. Operation Modes

Regarding the platform’s operation mode, we classify the platform’s operation mode into consignment mode (e.g., StockX, Poizon, RealReal) and resale mode (e.g., Paipai, ATRnew) based on whether the platform owns the used products, which are labelled C and R, respectively. Under the consignment mode, the seller owns the used products and sells them at the market-clearing price and the platform collects transaction fees from each transaction [

34]. In the resale mode, the platform decides the recycling price and resale price, acquires ownership of the used product from the seller, and then sells it to the buyer. In addition to this, we also consider the competition among channels and introduce the third mode, the hybrid mode, labelled H, wherein the platform retains both the consignment channel and the resale channel (e.g., Zhuanzhuan).

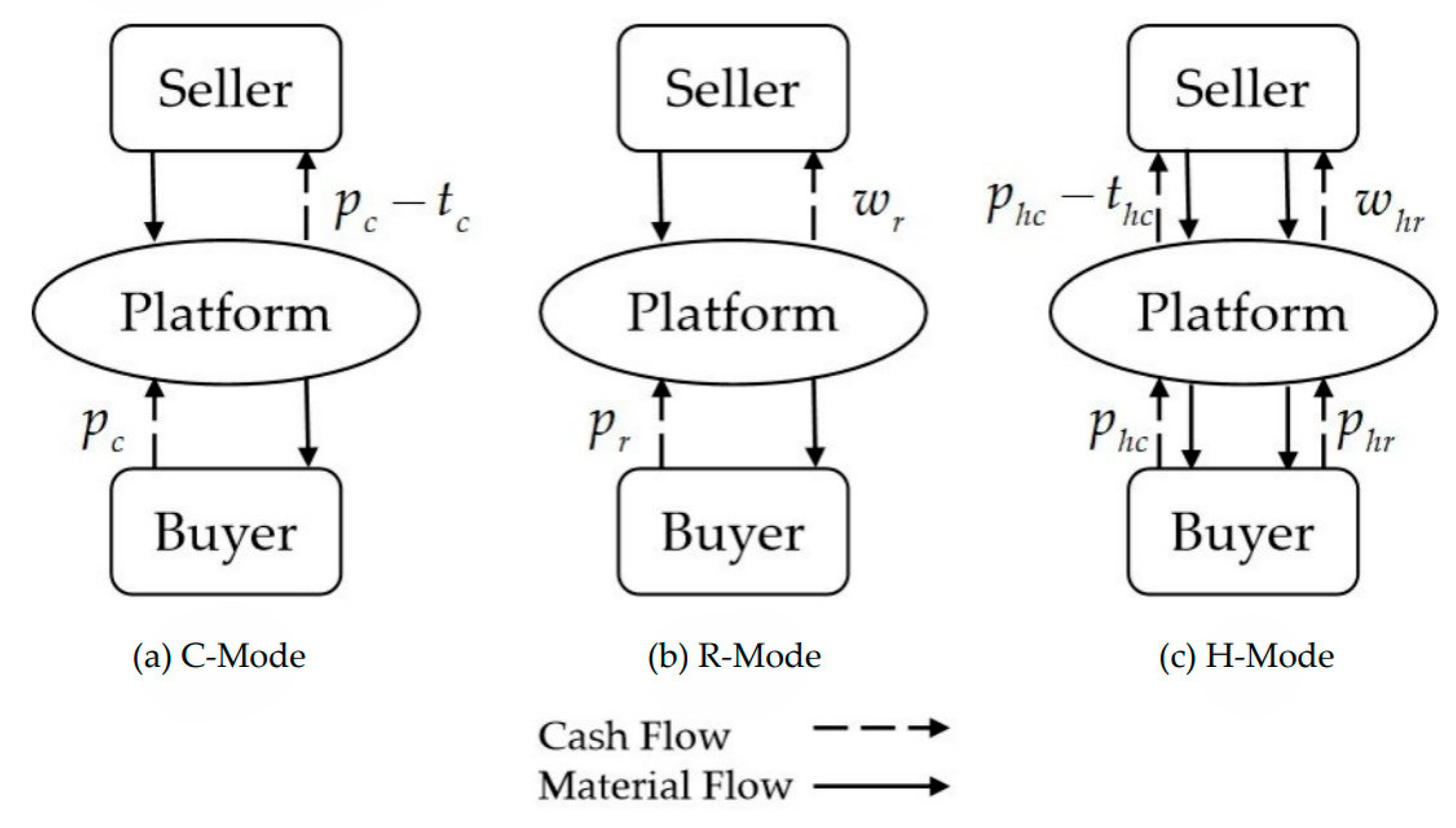

Figure 2 illustrates the model structure under the three operation modes. The sequences of events under different modes are as follows:

Consignment mode: the platform first sets the transaction fee and penalty, and the seller decides whether to sell based on expected utility. When the seller chooses to sell (the selling price is the market-clearing price), he needs to send the product to the platform for inspection. If the product passes inspection, the buyer will place an order and the platform will mail the product to the buyer and pay the seller the remainder of the purchase price after deducting transaction fees. If the product fails to pass, the platform will return the product to the seller and charge a penalty.

Resale Mode: The platform first sets the recycling price and penalty, and the seller decides whether to sell based on his expected utility. If the seller chooses to sell, the seller sends the product to the platform for inspection. If the product passes inspection, the platform will pay the seller the recycling price, and then the platform will set the resale price and sell it to the buyer. If the product fails to pass, the platform returns the product to the seller and charges a penalty.

Hybrid mode: it is worth mentioning that, in order to ensure the simultaneous existence of the consignment channel and the resale channel under the hybrid mode, the expected utility acquired by the seller through any channel must be equal; otherwise, the channel with the lower expected utility of the seller will not be able to exist because the seller will only choose to join the channel with the higher expected utility [

34]. Therefore, the sequence of events under the hybrid mode is that the platform first decides on the transaction fees, recycling prices, and penalty, which will result in sellers acquiring the same expected utility in the consignment channel and the resale channel. Subsequently, sellers decide whether to sell or recycle based on their expected utility (here, we assume that the probability of a seller choosing both channels is equal, i.e., half of the sellers in each channel choose either the consignment channel or the resale channel). When a seller chooses the consignment channel, the subsequent sequence of events is the same as under the consignment mode. When sellers choose the resale channel, the subsequent sequence of events is the same as in the resale mode.

It is worth noting that returns are not permitted under any of the three operation modes, which is a common phenomenon in the second-hand market. There are various reasons for this phenomenon, such as the difficulty for buyers to prove that the quality problems of the used products they purchased were not due to their personal use. Additionally, price volatility of used products has prompted platforms such as StockX and Poizon to ban returns to protect sellers against speculative buyers.

3.3. Seller

Assume that there is a unit number of risk-neutral individual sellers in the market, each holding at most one used product. A proportion

of them own high-quality products, which we call the “H-type”, labelled “H”, and a proportion

of them own low-quality products, which we call the “L-type”, labelled “L”. Considering the asymmetry of information about the quality of used products, we assume that the quality information is private to the sellers. We capture the heterogeneity of sellers’ salvage value

for used products and assuming

follows a uniform distribution on

[

13,

35,

36]. As mentioned in the previous section, the seller is paid when the used product passes the inspection and pays the penalty when it fails. A high-quality product must pass the inspection, and the probability that a low-quality product passes the inspection is

. Therefore, we can obtain the expected utility of the “H-type” seller and the “L-type” seller in the consignment, resale, and hybrid modes:

In Equation (1),

is the portion of the purchase price paid by the buyer after deducting the transaction fee charged by the platform.

is the salvage value of the seller. In Equation (2),

is the expected gain from passing the inspection of low-quality products, and the expected loss from paying the penalty when the product fails to pass the quality inspection is

. Then, we can derive the supply of H-type and L-type sellers respectively:

In Equation (5),

is the recycling price paid by the platform to the seller. In Equation (6),

is the expected gain of the low-quality product passing the inspection, and

is the expected loss of failing the inspection. The supply of the two types of sellers is, respectively:

Hybrid mode:

As mentioned in the previous section, the existence of both the consignment channel and the resale channel under the hybrid mode is conditional on the seller obtaining equal expected utility through both channels, i.e., . Under this condition, we assume that “H-type” sellers and “L-type” sellers have equal probabilities of choosing the two channels, i.e., half of the “H-type” sellers and half of the “L-type” sellers join the consignment channel, while the other half join the resale channel. In addition to this, the platform’s penalty is the same in both channels, denoted by . Therefore, the expected utility of “H-type” sellers and “L-type” sellers under the consignment channel and the resale channel, respectively, is as follows:

The meanings of the components in Equations (9)–(12) are similar to those of Equations (1), (2), (5) and (6) and will not be repeated. The supply of different types of sellers in different channels is as follows:

3.4. Buyer

Assume that there exist potential buyers, labelled B. In practice, buyers are only willing to pay the price for used products of a certain standard of quality, and therefore many platforms set thresholds for the quality of used products, e.g., RealReal only accepts products with minor wear and tear; Poizon only accepts brand new, unused products; Zhuanzhuan does not accept disassembled of electronic products. Therefore, in our model, we assume that buyers’ valuations of low-quality products are , and valuations of high-quality products are , which is heterogeneous and follows a uniform distribution on . In addition, buyers’ valuation of used products is also affected by the different operation modes adopted by the platform, as follows:

Under the consignment mode, the buyer’s valuation of the used product is affected by the platform’s inspection service level

, and the higher

means that the buyer is able to buy a high-quality product with a higher probability. The expected utility of the buyer is as follows:

When the expected utility is non-negative, the buyer will choose to buy and hence the buyer’s demand can be obtained as follows:

Under the resale mode, the ownership of the used product will be transferred from the seller to the platform, and when selling to the buyer, the platform usually provides a quality guarantee for its products to boost buyers’ confidence. Therefore, when a buyer buys a low-quality product through the platform, the platform can make up for it through measures such as guarantee or replacement. We assume that the quality guarantee can fully compensate for the buyer’s valuation loss due to the purchase of a low-quality product. The expected utility of the buyer is as follows:

When the expected utility is non-negative, the buyer will choose to buy and hence the buyer’s demand can be obtained as follows:

Under the hybrid mode, buyers decide their purchasing channel based on the level of their expected utility. Therefore, there exists a threshold

such that the expected utility of a buyer who buys a used product from both channels is equal, i.e.,

. And there exists a threshold

such that the expected utility of buying from the consignment channel is equal to the expected utility of not buying enough, i.e.,

. And the buyer’s demand for each of the two channels is as follows:

3.5. Platforms

The platform provides a trading place for buyers and sellers and exerts influence on both sides through inspection services. We assume that the platform’s cost of providing inspection services is a sunk cost, e.g., the purchase of testing equipment and the training cost of inspection personnel. For simplicity, sunk costs are assumed to be , because positive costs do not essentially change our results except by increasing the complexity of the computation. The profitability of platforms varies depending on their mode of operation. Under the consignment mode, platforms profit by charging transaction fees for each transaction. Under the resale mode, the platform acquires used products from sellers and sells them to buyers to earn the difference in price. Under the hybrid mode, the platform makes profits in both ways, charging transaction fees in the consignment channel and earning the difference in price in the resale channel. We present the profit function of the platform under each of the three operation modes below:

Consignment mode:

Under the consignment mode, the platform generates revenue from transaction fees and penalties charged for products that fail the inspection. Since the buyer’s demand equals the seller’s supply, the platform charges a transaction fee of

. The number of products that do not pass the inspection is

, so the revenue from penalties is

. When a low-quality product passes the inspection, we assume that buyers will eventually find out and become dissatisfied, resulting in a loss

to the platform, e.g., it is common for platforms to issue coupons to buyers in response to consumer dissatisfaction. In practice, we observe that such compensation generally does not exceed the

total price of the products (see Poizon.com), so we assume that

. Therefore, the profit function of the platform is as follows:

Resale mode:

Under the resale mode, the platform’s revenue comes from the price difference between the resale price and the recycling price, and from penalty charged for products that do not pass the inspection. Since the platform can decide the recycling price and resale price, its optimal price decision must make supply and demand equal, because when there is an imbalance between supply and demand, the platform can adjust the recycling price or resale price to bring supply and demand into equilibrium. Therefore, the platform’s resale revenue is

. Similar to the consignment mode, the platform’s penalty revenue is

. In addition, the platform will incur a marginal cost

when providing guarantees. Motived by the practice in the insurance industry, we assume that the cost of the guarantee does not exceed

of the total price of the products, e.g.,

, and the total guarantee cost is

. The profit function of the platform is as follows:

Hybrid mode:

Under the hybrid mode, the platform’s revenues include transaction fees from the consignment channel, sales revenues from the resale channel, and penalty revenues from both channels. The platform’s expenses, on the other hand, include the consignment channel’s expenses in response to buyer dissatisfaction and the resale channel’s guarantee cost. As a result, the platform profit function for each of the two channels is as follows:

Table 1 summarizes the decision variables and parameters.

4. Equilibrium Analysis

Lemma 1. The equilibrium results of the platform under different modes are summarized in Table 2.

According to Lemma 1, we find that optimal prices (including equilibrium market clearing prices, resale prices, and recycling prices), transaction fee, penalty, sales, and profits differ when platforms adopt different operation modes. This is because these outcomes are subject to the combined effects of seller structure (), inspection service level (), guarantee cost (), and inspection failure loss (), which in turn vary depending on the platform’s adoption of different operation modes. Some of these differences are more intuitive; e.g., in terms of penalty decisions, the platform does not charge penalties in the resale mode while it charges higher penalties under the consignment mode than under the hybrid mode. The penalty decreases with the inspection service level but increases with the inspection failure loss. There are also differences that are relatively complex, such as the platform’s profit, which make it necessary for platforms to carefully consider the interplay of relevant factors when making operation mode decisions.

Proposition 1. For the platform under different operation modes, the trends of the equilibrium results change with the cost of guarantee as follows:

(a) Profit: ;

(b) Price: ;

(c) Transaction fee: ;

(d) Sales: ;

(e) Recycling price: ;

(f) Penalty: .

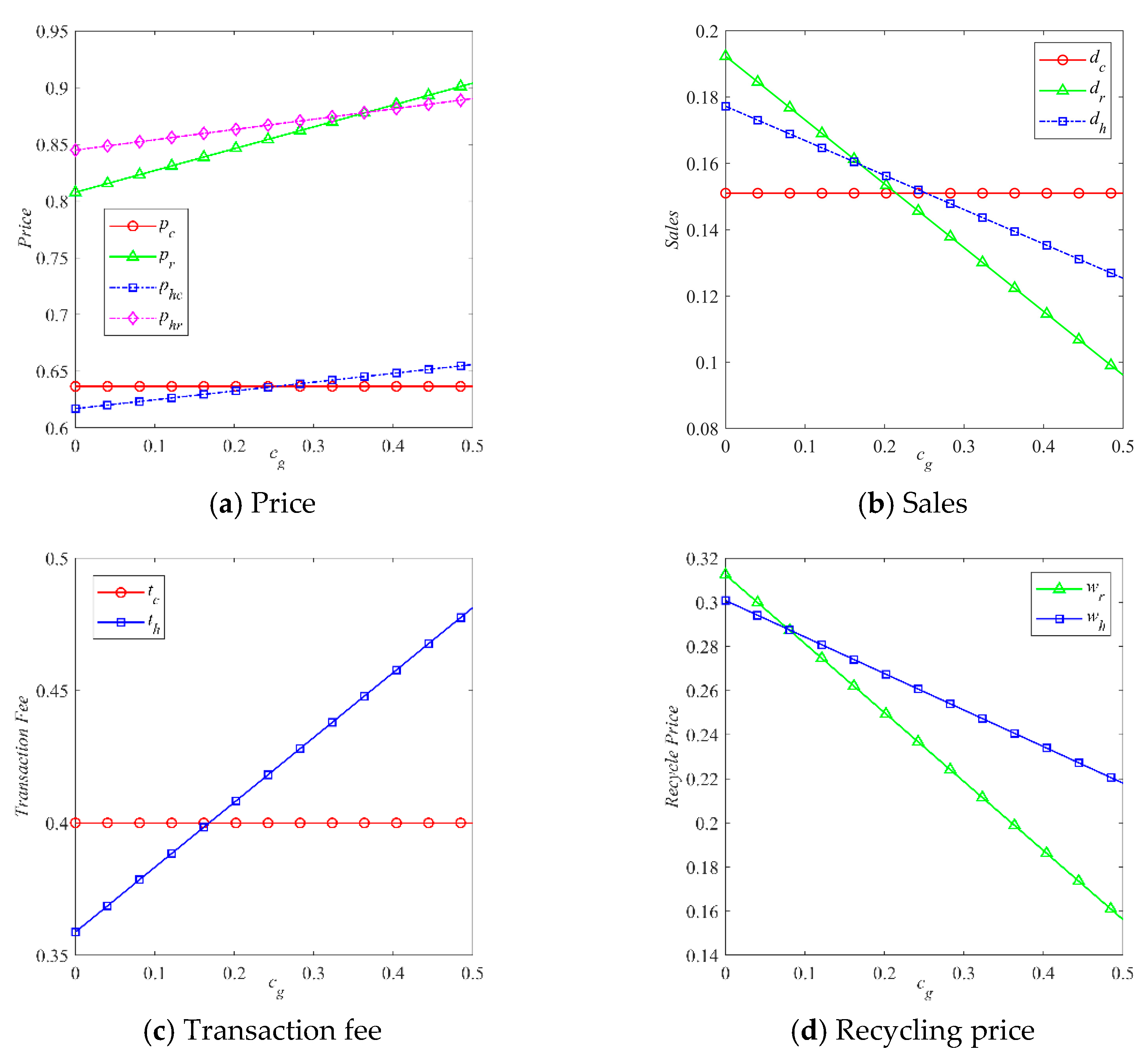

Proposition 1 suggests that the guarantee cost may have different effects on the platform’s optimal profits and decisions under different operation modes. The optimal profit of the consignment mode is independent of the guarantee cost, the optimal profit of the resale mode and the hybrid mode both decrease with the guarantee cost, and the optimal profit of the resale mode decreases faster than that of the hybrid mode (see Proposition 1(a)). With respect to the price, the equilibrium price of the consignment mode is independent of the guarantee cost, the optimal price of the resale mode, the equilibrium price in the consignment channel and the optimal price of the resale channel under the hybrid mode all increase with the guarantee cost, and the rate of the rise is shown to be the fastest in the resale mode, the second fastest in the resale channel, and the slowest in the consignment channel (see Proposition 1(b)). The optimal transaction fee of the consignment mode is independent of the guarantee cost, while the optimal transaction fee of the consignment channel under the hybrid mode increases with the guarantee cost (see Proposition 1(c)). The optimal sales under the consignment mode are independent of the guarantee cost, whereas the optimal sales in both the resale mode and the hybrid mode decrease with the guarantee cost, and the optimal sales in the resale mode decline more rapidly (see Proposition 1(d)). In terms of recycling price, the optimal recycling price decreases with the guarantee cost in both the resale mode and the resale channel under the hybrid mode, and in the resale mode, the optimal recycling price declines faster (see Proposition 1(e)). The optimal penalty in all modes is independent of the guarantee cost (see Proposition 1(f)).

Proposition 2. For the prices of used products and under different operation modes, the following hold (: the cost of guarantee):

(a) , ;

(b) When , ; when , ;

(c) When , ; when , .

Proposition 2 indicates that the prices of used products vary under different operation modes. According to Proposition 2(a), the price under the resale mode is higher than that under the consignment mode, and the price in the resale channel is also higher than that in the consignment channel under the hybrid mode. This is because the platform can maximize buyers’ trust by providing them with quality guarantee, whether in the resale mode or in the resale channel under the hybrid mode, which allows buyers to accept higher selling prices because they perceive a higher value for the platform’s own products compared to those of individual sellers (e.g., used products from the consignment mode or the consignment channel under the hybrid mode). According to Proposition 2(b), when the cost of guarantee is low, the price under the consignment mode is higher than that in the consignment channel under the hybrid mode. When the cost of guarantee is high, the price under the consignment mode is lower than that in the consignment channel under the hybrid mode. This is because the price under the consignment mode is independent of the cost of guarantee, while the price in the consignment channel under the hybrid mode increases with the cost of guarantee (see Proposition 1(b)). The price in the consignment channel under the hybrid mode is lower than that under the consignment mode when the cost of guarantee tends to converge, and as the cost of guarantee increases, the gap between the two prices gradually narrows, and the magnitude relationship is likely to be reversed eventually (see

Figure 3a). According to Proposition 2(c), when the cost of guarantee is high, the price under the resale mode is higher than that in the resale channel under the hybrid mode. When the cost of guarantee is low, the price under the resale mode is lower than that in the resale channel under the hybrid mode. This is because the price in the resale channel under the hybrid mode is higher than that under the resale mode when the cost of guarantee is close to

. While both the price under the resale mode and the price in the resale channel under the hybrid mode tend to increase with the cost of guarantee, the former rises faster with the cost of guarantee than the latter (see Proposition 1(b)), and thus the situation may eventually reverse (see

Figure 3a).

Proposition 3. For the optimal sales under different operation modes, the following hold (: the cost of guarantee):

(a) When , ;

(b) When , ;

(c) When , ;

(d) When , .

Proposition 3 shows that there are various cases of size relationships between optimal sales under different operation modes. Specifically, the resale mode has the highest optimal sales when the cost of guarantee is low (see Proposition 3(a)). The hybrid mode has the highest optimal sales when the cost of guarantee is moderate (see Proposition 3(b)(c)). Optimal sales are highest under the consignment mode when the cost of guarantee is high (see Proposition 3(d)). This is because the optimal sales are highest in the resale mode, second highest in the hybrid mode, and lowest in the consignment mode when the cost of guarantee converges to . In addition, the optimal sales under the resale and hybrid modes decrease with the cost of guarantee, and the optimal sales under the consignment mode decrease faster than that under the hybrid mode, while the optimal sales under the consignment mode are independent of the cost of guarantee (see Proposition 1(d)). As the cost of guarantee increases, the optimal sales under the consignment mode and the hybrid mode decrease, and the optimal sales under the consignment mode are highest before the cost of guarantee reaches the threshold . The hybrid mode has the highest optimal sales when the cost of guarantee crosses the threshold , but before it reaches the threshold . The consignment mode has the highest optimal sales when the cost of guarantee crosses the threshold .

Proposition 4. For the optimal transaction fee , recycling price , and penalty under different operation modes, the following hold (: the cost of guarantee):

(a) When , ; when , ;

(b) When , ; when , ;

(c) .

Proposition 4 suggests that the relative sizes of optimal transaction fee, recycling price, and penalty may be related to the cost of guarantee under different operation modes. In terms of optimal transaction fee, when the cost of guarantee is low, the optimal transaction fee under the consignment mode is higher than that in the consignment channel under the hybrid mode (see Proposition 4(a)). This is because the optimal transaction fee under the consignment mode is higher than that in the consignment channel under the hybrid mode when the cost of guarantee tends to be

, and the optimal transaction fee in the consignment channel under the hybrid mode increases with the increase in the cost of guarantee, whereas the optimal transaction fee under the consignment mode is not affected by the change in the cost of guarantee (see Proposition 1(c)); thus, the optimal transaction fee in the consignment channel under the hybrid mode will be higher than that under the consignment mode when the cost of guarantee is higher than the threshold

(see

Figure 3c). Furthermore, when the cost of guarantee is low, the optimal recycling price under the resale mode is higher than that in the resale channel under the hybrid mode. When the cost of guarantee is high, the optimal recycling price under the resale mode is lower than that in the consignment channel under the hybrid mode (see Proposition 4(b)). This is because the optimal recycling price under the resale mode is higher than that in the consignment channel under the hybrid mode when the cost of guarantee tends to be

; at the same time, the optimal recycling price of the resale mode decreases faster with the cost of guarantee than that in the resale channel under the hybrid mode (see Proposition 1(e)), and the magnitude of the relationship is reversed as the cost of guarantee exceeds the threshold

(see

Figure 3d). In addition, the optimal penalty under the consignment mode is higher than that in the consignment channel under the hybrid mode, and the optimal penalty under the resale mode is

(see Proposition 4(c)).

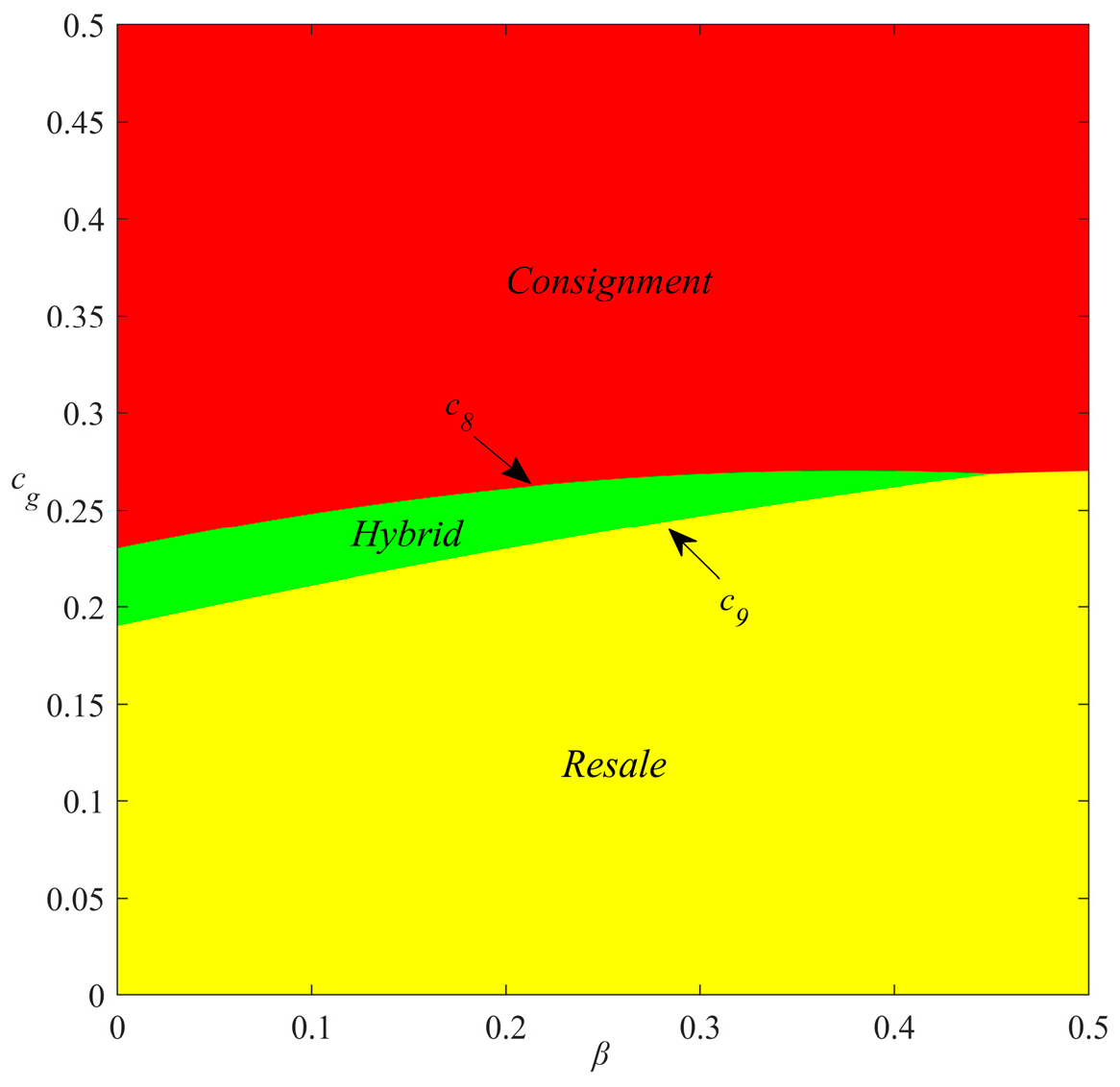

Proposition 5. For the platform’s optimal choice among different operation modes, the following hold (: the cost of guarantee):

(a) When , the preferred mode is consignment mode;

(b) When , the preferred mode is hybrid mode;

(c) When , the preferred mode is resale mode.

For SIPs, the optimal operation mode means that they can maximize their profits when they adopt this mode strategy. According to Proposition 5, the cost of guarantee has a significant impact on the platform in making operation mode decisions. Specifically, when the cost of guarantee is high, the consignment mode is preferred (see Proposition 5(a)). When the cost of guarantee is moderate, the hybrid mode is preferred (see Proposition 5(b)). When the cost of guarantee is low, the resale mode is preferred (see Proposition 5(c)). This is because the optimal profit of the resale mode is the largest, the optimal profit of the hybrid model is the second largest, and the optimal profit of the consignment mode is the smallest when the cost of guarantee tends to be

. According to Proposition 1(a), when the cost of guarantee increases, the optimal profits of both the resale and hybrid modes decrease, and the optimal profit of the resale mode decreases faster than that of the hybrid mode, while the optimal profit of the consignment mode does not change. Specifically, the optimal profit of the resale mode is largest when the cost of guarantee is below the threshold

. The optimal profit of the hybrid mode is greatest when the cost of guarantee exceeds the threshold

, but does not reach

. The optimal profit for the consignment mode is greatest when the cost of guarantee exceeds the threshold

.

Figure 4 illustrates the impact of the cost of guarantee and the inspection failure loss on the SIP’s optimal mode choices.

Proposition 6. Under different operation modes, the trends of equilibrium results change with the inspection service level are as follows (: inspection failure loss):

(a) Profits: Under the C-mode, when , , and when , ; Under the R-mode, ; Under the H-mode, when , and when , ;

(b) Price: Under the C-mode, ; Under the R-mode, ; Under the H-mode, in the consignment channel, ; in the resale channel, when , and when , ;

(c) Transaction fee: Under the C-mode, ; Under the H-mode, ;

(d) Sales: Under the C-mode, when , and when , ; Under the R-mode, ; Under the H-mode, when , and when , , and:

(1) Supply of high-quality sellers: Under the C-mode, ; Under the R-mode, ; Under the H-mode, ;

(2) Supply of low-quality sellers: Under the C-mode, when , and when , ; Under the R-mode, ; Under the H-mode, when , and when , .

(e) Recycling price: Under the R-mode, ; Under the H-mode, ;

(f) Penalty: Under the C-mode, ; Under the H-mode, .

According to Proposition 6, we find that the platform’s profit, price, sales, recycling price, and penalty may show different trends as the inspection service level changes under different operation modes. We elucidate the underlying mechanism of such changes below.

Under the consignment mode, when the inspection failure loss is large, the platform’s profit increases with the inspection service level. When the inspection failure loss is small, the platform’s profit decreases with the inspection service level (see Proposition 6(a)). This result is somewhat counter-intuitive, i.e., an increase in the inspection service level favors the platform because it implies greater competitiveness, enabling the platform to attract more buyers and thus allowing the platform to capture more profits. However, the situation is further complicated by the fact that the platform’s profit under the consignment mode is mainly composed of transaction fees, penalty, and the inspection failure loss (see Equation (23)). The equilibrium price is allowed to rise as the inspection service level increases (see Proposition 6(b)). Higher equilibrium price provides space for the platform to charge higher transaction fees (see Proposition 6(c)). At the same time, a rise in the equilibrium price raises the expected utility of high-quality sellers and increases their supply. In contrast, the expected utility of low-quality sellers decreases with the inspection service level and increases with the equilibrium price, leading to an uncertain change in their supply, which ultimately leads to a different trend in sales with the inspection service level (see Proposition 6(d)). Therefore, an increase in the inspection service level does not necessarily increase the platform’s transaction fee revenue. In addition to this, the platform’s penalty decreases with the inspection service level (see Proposition 6(f)), which, combined with the uncertainty of how the supply of low-quality sellers varies with the inspection service level, makes it likely that the platform’s penalty revenues decrease with the inspection service level. Finally, an increase in the inspection service level does not necessarily reduce the losses suffered by the platform due to inspection failures. This is because, while an increase in the inspection service level reduces the probability of inspection failures, it may also lead to an influx of more low-quality sellers into the marketplace, increasing rather than decreasing the number of low-quality products that pass the inspection, and ultimately resulting in the platform facing more losses.

Under the resale mode, the platform’s profit decreases with the inspection service level (see Proposition 6(a)). This is because, on the demand side, the guarantee offered by the platform is able to completely dispel the buyer’s quality concerns, although the platform pays an additional cost as a result. On the supply side, while the resale price rises with the inspection service level (see Proposition 6(b)), this does not lead to a rise in their unit profit because the price of recycling rises with the inspection service level (see Proposition 6(e)), which offsets the effect of the rise in resale price on the marginal profit (), and with the inspection service level increases, more low-quality sellers are excluded from the market, which makes the supply of sellers lower (see Proposition 6(d)), which ultimately leads to the platform’s profit shrinking with the inspection service level.

Under the hybrid mode, the trend of the platform’s profit with inspection service level is similar to that in the consignment mode (see Proposition 6(a)). In addition, the equilibrium results of the consignment channel under the hybrid mode change with the inspection service level in a similar way as those under the consignment mode (see Proposition 6(b–d,f)). Furthermore, the trend of the recycling price of the resale channel under the hybrid mode changes with the inspection service level is similar to that under the resale mode (see Proposition 6(e)), whereas the trend of the resale price changes with the inspection service level is different from that under the resale mode. Specifically, the resale price of the resale channel under the hybrid mode decreases with the inspection service level when the inspection failure loss is large and increases with the inspection service level when the inspection failure loss is small (see Proposition 6(b)). This is because the resale channel faces competition from the consignment channel under the hybrid mode, and competition for customers between channels becomes fierce as the inspection service level increases.