Abstract

This paper constructs a digital technology multilayer convergence network model to explore the mechanisms of digital technology convergence. The analysis is based on patent data from China’s A-share listed companies from 2012 to 2021. The results show a continuous increase in network scale and structural complexity, with intensified cross-domain interactions. The company collaboration subnetwork evolved from decentralization to a more centralized structure, while the technology convergence subnetwork expanded and became increasingly complex. Core technologies maintained dominant positions, and the co-evolution between companies and technologies showed sustained development. This study reveals intricate interdependencies between technological convergence and company collaboration, providing theoretical insights and practical implications for digital technology innovation and strategic decision-making.

1. Introduction

With the rapid development of new-generation information technologies such as big data, cloud computing, the Internet of Things, blockchain, 5G, and artificial intelligence, the roles of traditional production factors like land, capital, and labor have been constrained to varying degrees. Additionally, the goals of carbon peaking and carbon neutrality have further driven transformations in production methods. As data increasingly become critical production factors, the vigorous development of the digital economy has become an inevitable choice across industries. Meanwhile, technological convergence has emerged as a key marker of the new wave of scientific and technological revolutions, characterized by the nonlinear fusion of diverse knowledge and multidisciplinary intersections [1]. Companies, as primary innovators, achieve cross-domain convergence of digital-related technologies through cross-domain collaboration, accelerating the connection of different types of factors [2], thereby forming complex relationships within the cross-domain convergence network of digital technology. Therefore, an in-depth analysis of the characteristics and evolution of these digital technology convergence networks is crucial for understanding the cross-domain innovation of emerging technologies.

Technological development relies on innovation entities, and technological convergence not only transcends cross-domain technological boundaries but also organizational boundaries. During this process, the collaboration among innovation entities and the convergence of technology form a bidirectional interactive relationship [3]: on the one hand, collaboration promotes technological convergence, facilitating the convergence of knowledge and resources across different fields; on the other hand, technological convergence further stimulates cooperation among innovation entities. This interactive influence constructs a complex network of technological convergence, which cannot be fully captured by a single-layer network. For instance, many companies that independently complete technological convergence appear as isolated nodes in a single-layer collaboration network. Similarly, certain companies that file patents based on a single technology are represented as isolated IPC codes in a single-layer technological knowledge network. These isolated phenomena fail to reveal real-world connections. The advantage of multilayer network analysis lies in its ability to simultaneously integrate different types of nodes and the complex relationships between them [4], a feature that is particularly important when analyzing patent data. Patent data contain multidimensional information such as knowledge, technological innovation, and collaboration between patent holders [5]. By using multilayer network analysis methods, it is possible to study the overall structure and key nodes of networks with multiple attributes more systematically. This approach not only provides richer information compared to single-layer network analysis but also offers a deeper understanding of the dynamic evolution of networks and the relationships between innovation entities.

The innovation of digital technology, as a core driver of China’s digital economy development, directly influences the digital transformation process of traditional companies and plays a critical role in enabling high-quality growth. In this study, we focus on digital technology to explore, first, how the overall cross-domain convergence network of digital technology evolves during the process of cross-domain convergence, and second, how innovation entities and technological elements change throughout the evolution of the digital technology convergence network.

To address these questions, we constructed a digital technology multilayer convergence network based on digital technology patent data. This network is a complex system structure model developed using multilayer network theory, designed to reveal the dynamic interactions that occur across technological domains and organizational boundaries during the digital technology innovation process. By integrating different types of nodes (e.g., company nodes and technology nodes) and various relationships (e.g., company collaborations, technological co-occurrence, and company–technology affiliations), the digital technology multilayer convergence network captures the multidimensional characteristics of digital technology’s convergence and expansion. The digital technology multilayer convergence network reveals the complex co-evolutionary relationships between innovation entities and technologies, allowing for a more precise evaluation of the role of technological innovation in cross-domain collaboration and corporate development.

The main contributions of this paper are as follows:

(1) We integrate multilayer network analysis with patent data to construct a model of digital technology’s cross-domain convergence. This study explores co-evolutionary mechanisms in multilayer networks, analyzing changes in collaboration and technology convergence at different stages—early, mid, and late—and their effects on network evolution. This offers a deeper understanding of the complex dynamics between patent collaboration and technology convergence, bridging theory and practice.

(2) This study empirically validates the interconnections and dependencies among key elements in digital technology innovation. It captures diverse information on both technological domains and innovation entities, providing a theoretical and methodological foundation for future research and practice in multilayer networks.

(3) Unlike many studies that focus on multiple entities, this paper emphasizes the role of companies as primary drivers of digital innovation. Companies, with their market orientation and flexibility in resource allocation, can swiftly respond to market needs, integrate R&D resources, and commercialize innovations more efficiently than other entities like universities or research institutions. This study highlights the unique role of companies in advancing digital technology and offers practical guidance for enhancing innovation capacity and market competitiveness during digital transformation.

2. Literature Review

2.1. Related Research on Multilayer Network Theory

Multilayer network theory is an effective tool for studying complex systems. Its theoretical foundation was first proposed by Mesarovic et al. [6] in their “Theory of Hierarchical, Multi-Level Systems”, which systematically discussed the interactions and coupling relationships between different layers within multi-level systems. With advancements in technology and network science, multilayer network theory has been gradually applied to various fields, such as transportation, social networks, finance, and biological networks [7,8,9]. One notable contribution is the “Holonic Network Theory” proposed by Mella [10], which describes the dual roles of each component within a system—functioning both as an independent entity and as part of the overall system. This theory provides a theoretical framework for understanding multi-level interactions in companies, with particular relevance to resource allocation and risk management.

In recent years, researchers have further expanded the application of multilayer networks, especially in synchronization and systemic risk management. Boccaletti et al. [8] explored chaotic behaviors in complex networks, revealing the role of multilayer networks in information transmission and risk propagation within financial systems. Through analyzing interactions between nodes and information flows, they demonstrated the advantages of multilayer networks in addressing complexity and uncertainty. Dai et al. [11] constructed a multilayer network model based on returns, volatility, and extreme risk, which uncovered the interconnectedness of energy companies under different market conditions and examined the risk transmission mechanisms of multilayer networks during market crises.

Current research has applied various methodologies, such as game theory [12], data-driven logic [13], and information diffusion and behavior-driven logic [14], to preliminarily reveal the evolution patterns and pathways of multilayer networks. These studies systematically analyze node utility, information flow, and the prevalence of different strategies across network layers, thereby elucidating key relationships and structural changes. This has promoted a transition from single-layer to multilayer network research. Such comprehensive analysis of multiple relationships not only deepens our understanding of network structures and their evolutionary characteristics but also provides new insights and approaches for future research.

However, existing studies often rely on single-layer network analysis methods, simplifying multilayer networks into single-layer networks for measurement. This approach fails to fully capture the complexity of multilayer networks and the dynamic evolution of their internal relationships. Although some studies have attempted to apply true multilayer network analysis methods, such as measuring node connectivity and inter-layer coupling degree [15], there is still a lack of research cases closely aligned with practical issues. Therefore, future research could further explore multilayer-specific indicators and methodologies to reveal the multidimensional interactions within complex systems and their applications to real-world problems.

2.2. Related Research on Innovation Network Evolution

Network evolution refers to the dynamic process of changes in nodes and edges within a system over time. Early-stage innovation network research primarily focused on single-layer networks, emphasizing direct relationships and structural characteristics between innovation participants. Chen et al. [15] studied the evolution of single-layer knowledge innovation networks, demonstrating how companies evolve from a single knowledge base to a diversified network structure. Kivelä et al. [16] discussed the addition and removal of nodes and edges in single-layer networks and proposed an evolution model based on weighted graphs to simulate cooperation relationships among different organizations. However, single-layer networks are limited in their ability to capture the complexity of real-world systems, particularly when multiple layers of interactions are present.

Research on innovation network evolution has explored various structural configurations, highlighting the role of multilayer networks in promoting technology convergence. Feng et al. [17] analyze China’s interurban technology cooperation–transfer networks, revealing significant spatial heterogeneity and the U-shaped impact of node degree on innovation capability. Similarly, Cai et al. [18] investigate interprovincial innovation multilayer networks and identify a core–periphery structure, where core provinces dominate resource flows. They emphasize path dependence and the influence of economic and infrastructural factors. At the international level, Yang et al. [19] examine transnational patent networks, highlighting small-world characteristics and hierarchical roles of countries. Their findings reveal developed countries’ dominance and strategic use of transnational patents to maintain technological superiority. Collectively, these studies emphasize the dynamic nature of innovation networks across different spatial scales and their implications for regional and global innovation strategies.

The evolution of innovation networks is driven by both internal and external forces. Internal factors include organizational strategies and network advantages, while external factors encompass policies, regulations, and technological advancements. Mudambi et al. [20] analyzed the evolution of industrial clusters in Ohio over three decades, concluding that knowledge coordination within the network is crucial for long-term sustainability. In research on corporate innovation management, Freire and Gonçalves [21] reviewed the systematic literature on innovation cooperation, emphasizing the role of multilayer networks in technological collaborations. They argued that diversified partnerships enhance innovation performance through cross-level knowledge sharing. This finding is supported by Gkypali et al. [22], whose study indicated that through multilayer cooperation, companies can access more external resources and technological support, significantly improving their innovation capacity. Additionally, external forces such as government policies also influence network evolution. Wei et al. [23] examined the collaborative innovation network in the artificial intelligence industry and proposed a heterogeneous collaborative innovation network model driven by incentives and network responses. These studies suggest that a careful balance of internal and external drivers is essential for the sustainable growth of innovation networks.

2.3. Related Research on Multilayer Networks and Corporate Innovation Management

(1) Multilayer Networks and Technological Innovation

The theory of technological innovation examines how companies use technological advancements to develop new products, services, or processes. Within multilayer networks, innovation is seen as a dynamic process spreading across multiple layers. Boccaletti et al. [8] emphasized that synchronization between layers is vital for driving innovation in complex ecosystems. Companies must align their strategies with changes in digital platforms, manufacturing technologies, and consumer preferences to respond to evolving environments. Dai et al. [11] used multilayer network analysis to study how innovation spreads among interconnected energy companies. Li et al. [24] demonstrated that external factors (political, economic, social, and technological) play a key role in clean energy technology diffusion. Their research suggests that multilayer networks effectively model these interactions, helping companies navigate the market environment and seize opportunities.

(2) Multilayer Networks and Technology Convergence

The theory of technology convergence highlights the integration of diverse technologies and knowledge bases as key drivers of innovation. Traditional research often focuses on single-layer networks within a single domain, which limits understanding of complex cross-domain interactions. In contrast, multilayer networks provide a comprehensive framework to analyze these interactions. Antonelli, Orsatti, and Pialli [25] noted that multilayer networks simulate knowledge flow and convergence across technological domains, helping identify structural bottlenecks that hinder technology convergence. Freire and Gonçalves [21] emphasized that multilayer networks facilitate interdisciplinary collaboration by revealing how companies integrate innovations across various fields, such as pharmaceuticals and information technology. They argued that visualizing these connections helps companies strategically manage technology convergence. Furthermore, Boccaletti et al. [8] found that multilayer networks can detect “isolation effects” where key technologies fail to integrate, thus offering a basis for strategic interventions to improve convergence processes.

(3) Multilayer Networks and Corporate Innovation Cooperation

The relationship between multilayer networks and corporate innovation cooperation is examined from three main perspectives: the promotion of diverse R&D collaborations across multiple layers, the impact of cross-layer interactions on technological innovation and knowledge sharing, and the role of multilayer networks in capturing complex “coopetition” dynamics. These studies collectively demonstrate how multilayer networks facilitate the integration of diverse resources and enhance companies’ innovation capabilities in a highly interconnected environment. Mary B. Rose [26] emphasized that business networks are crucial for company development, industrial innovation, and technological progress by promoting knowledge dissemination and technology diffusion. Gkypali et al. [22] found that diverse R&D collaborations across multiple layers, such as competitors, suppliers, and research institutions, significantly boost innovation performance. Similarly, Dong and Bi [27] highlighted the role of cross-layer interactions in driving breakthrough technological innovation in global value chains. Giovannetti and Piga [28] argued that ICT platforms enhance cross-layer collaborations, improving innovation outcomes through knowledge sharing. Park and Lee [29] showed that even in competitive environments, R&D cooperation with competitors can increase innovation investment, demonstrating how multilayer networks capture complex “coopetition” dynamics for strategic decision-making.

2.4. Research Review

Overall, multilayer network theory provides a novel analytical framework for understanding multidimensional interactions in complex systems and has made significant progress in research fields such as corporate innovation, technology convergence, and cross-organizational collaboration. By introducing a perspective that encompasses multi-level and multidimensional interactions, multilayer network theory reveals structural complexities and dynamic evolutionary characteristics that cannot be captured by single-layer networks, enabling scholars to analyze firms’ behavioral patterns within innovation ecosystems and their capacity to respond to external environments more comprehensively. In existing studies, multilayer networks have been widely applied to understand cross-departmental, cross-domain, and cross-regional innovation cooperation, promoting a theoretical shift from single-layer to multilayer networks and providing strong support for optimizing resource allocation and enhancing competitiveness in dynamic market environments.

Despite the significant progress made in multilayer network theory and its applications, several unresolved issues remain. First, many existing studies still rely on single-layer network analysis methods, simplifying multilayer networks into single-layer networks for measurement and ignoring the information flow and resource allocation mechanisms across different layers. This approach fails to capture the real dynamics and complex characteristics within multilayer networks. In technology convergence research, for instance, many studies still adopt a single-layer network perspective and measure cross-layer technology convergence through simple aggregation of nodes and edges, lacking an in-depth exploration of interaction processes between different technological domains. Such simplification cannot uncover the potential “isolation effect” within multilayer networks, where convergence barriers may arise between different technological modules, thereby constraining firms’ collaborative innovation capacity in a multidimensional technological environment.

Second, although some studies have attempted to apply genuine multilayer network analysis methods (e.g., node coupling degree and inter-layer connectivity), there is still a lack of case studies that closely align with real-world problems. The current literature is mostly focused on constructing theoretical models, lacking detailed analyses of the dynamic evolution of multilayer networks in practical scenarios. Particularly in complex networks involving cross-domain and cross-regional collaborations, researchers need to develop new analytical metrics and models to reveal the evolutionary patterns of different types of relationships in these networks and their impact on firms’ innovation performance. Thus, further exploration is needed on how multilayer-specific indicators and methodologies can uncover complex structural features in real-world problems and how theoretical analyses can be integrated with practical cases to provide more practically oriented research outcomes.

Moreover, existing research on multilayer networks in various application fields such as technological innovation, technology convergence, and corporate collaboration remains fragmented. While some studies have highlighted the role of multilayer networks in synchronization mechanisms, technology diffusion, and cross-layer collaboration, findings from different research domains have yet to achieve effective convergence and dialogue. For example, in technological innovation research, multilayer networks are primarily used to analyze how companies achieve synchronization and coordination across different technological layers. In technology convergence research, multilayer networks depict the process of cross-domain knowledge flow and convergence.

In summary, the multilayer network theory provides a new perspective for understanding company innovation and its dynamic evolution. However, there remains a considerable gap between theoretical approaches and practical applications. Therefore, this study adopts an analytical perspective based on multilayer networks and constructs a digital technology multilayer convergence network using patent data. The objective is to reveal the dynamic interactions across technological domains and organizational boundaries in the process of digital technology innovation.

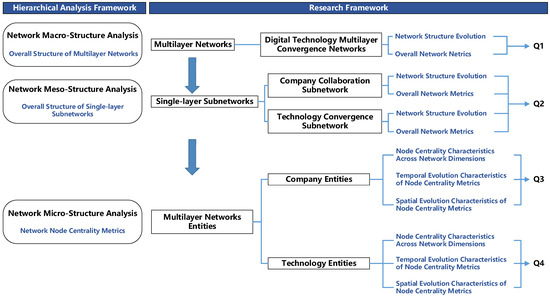

Based on this, we constructed the research framework diagram as shown in Figure 1 to clarify the research logic and research questions of this study. This study follows a macro–meso–micro perspective to analyze the overall structural evolution characteristics of the digital technology multilayer convergence networks, the evolution characteristics of subnetwork structures, and the evolution of individual nodes within the multilayer network. Accordingly, the research questions are formulated as follows:

Figure 1.

Research framework diagram.

Q1. How does digital technology evolve dynamically across different technological domains and organizational boundaries, and what are the key patterns of growth, convergence, and efficiency improvement in digital technology multilayer convergence networks?

Q2. How do company collaboration and technological convergence evolve within the context of digital technology innovation, and what mechanisms drive the formation of centralized collaboration patterns and highly integrated systems?

Q3. How do company influence and connectivity evolve within complex digital technology networks, and what factors drive the spatial and temporal disparities in collaboration and innovation capabilities across different regions?

Q4. How does technological convergence reshape the roles and influence of core and emerging technologies in complex digital technology networks, and what are the advantages of using multilayer network metrics to capture these dynamics?

3. Construction and Evolution Mechanism of Multilayer Networks

3.1. Construction of Multilayer Networks

The annual cross-domain convergence network of digital technology was constructed using R 4.3.2, and the muxViz package was employed to calculate the centrality metrics for both the multilayer networks and their individual subnetwork. Additionally, Gephi 0.10.1 was used to visualize the network graphs. The construction process is as follows:

We first extracted multidimensional arrays for the co-occurrence relationships of IPC codes, the co-authorship of patents by companies, and the affiliations between companies, patents, and IPC codes from digital technology patent data. These arrays were then used to construct the digital technology convergence subnetwork, the company collaboration subnetwork, and the affiliation network between the two types of entities. Together, these three networks form a complete digital technology multilayer convergence network. The specific steps for constructing the network are as follows:

Step 1: We obtained and organized patent application information from the listed companies. Following the methodology of Wang et al. [30] and Schillebeeckx et al. [31], we constructed the digital technology network based on the digital technology-related invention patents applied for by companies in each year. This approach is grounded in the following considerations: first, patent activities reflect the technological development direction of companies, and a large number of digital technology-related patent applications indicate significant technological progress in the digital field. Second, only invention patents were considered, as they require rigorous substantive examination, offering a higher degree of innovation compared to utility models or design patents, and better reflecting companies’ digital technology achievements. Finally, the number of patent applications more accurately reflects a company’s level of digital technology innovation in a given year compared to granted patents. We followed the method of Huang [32] to identify digital technology patents. Using the “Strategic Emerging Industries Classification and International Patent Classification Reference Table (2021)” issued by the State Intellectual Property Office (SIPO), we identified patents corresponding to cloud computing, big data, IoT, industrial internet, blockchain, AI, virtual reality, augmented reality, and other digital technology sectors based on their IPC codes.

We matched the SIPO patent data with China’s listed companies and their subsidiaries, following the method of He et al. [33]. Using the Patsnap global patent database, we retrieved and organized patent data for sample companies and their subsidiaries. The detailed steps were as follows: (1) search for name change histories of the sample of listed companies using the CNRDS and CSMAR databases; and (2) query the patent application data for listed companies and their subsidiaries from the Patsnap global patent database to compile a comprehensive dataset of company–year patent records. Ultimately, we obtained 193,625 invention patent applications from 2397 listed companies during the period from 2012 to 2021.

Step 2: Based on the co-occurrence of patent IPC codes, we constructed the digital technology convergence subnetwork. This network is an undirected, unweighted network.

Step 3: Using the co-authorship of patents, we constructed the company collaboration subnetwork, which is also an undirected, unweighted network. In this study, co-authored patents between parent companies and their subsidiaries were not considered as company collaborations. Only co-authorship between different companies was treated as collaboration. To ensure the completeness of the digital technology convergence process, we retained both companies that applied for patents independently and those that co-applied for patents with other patentees. As a result, isolated companies exist in the multilayer network.

Step 4: We linked the digital technology knowledge network with the company collaboration subnetwork based on the ownership relationship between patents and companies, forming a complete multilayer network for the cross-domain convergence of digital technology. This network is undirected and unweighted.

The digital technology multilayer convergence networks represent a systematic structure built on a multilayer network model, designed to capture the complex interactions that occur across technological domains and organizational boundaries during digital technology innovation. By integrating multiple network layers and different types of nodes (such as companies and technology nodes), this network framework reveals the dynamic co-evolutionary patterns among technology convergence, corporate collaboration, and technology layout.

Specifically, the digital technology multilayer convergence networks consist of the following three subnetworks:

(1) Company Collaboration Subnetwork: This subnetwork focuses on companies as the main entities and is constructed based on co-patenting relationships. It reflects the collaborative patterns among innovation entities and their connections in cross-domain technology collaboration.

(2) Technology Convergence Subnetwork: This subnetwork centers on technology nodes, established through co-occurrences of different IPC (International Patent Classification) codes. It represents the cross-domain convergence characteristics, highlighting the pathways of collaborative innovation and knowledge flow among various digital technology fields.

(3) Inter-Layer Network: This network includes both company and technology nodes, built upon the affiliation relationships between companies and their patented technologies. It illustrates how companies are positioned across diverse technological fields and their control over core technologies.

The digital technology multilayer convergence networks can capture cross-layer interactions that cannot be reflected in single-layer networks, thereby uncovering the intricate co-evolutionary relationships between innovation entities and technologies. As a more realistic model of complex systems, multilayer networks capture dynamic associations between heterogeneous nodes and network layers, revealing the crucial role of cross-domain technology collaboration and corporate development. Through a more precise analysis of multilayer structures, this network provides both theoretical and practical insights into the mechanisms of technological evolution in the context of the digital economy.

3.2. Evolution Mechanism of Multilayer Networks

The convergence of digital technology requires technology cross-domain convergence to achieve the fusion of technological knowledge. It also necessitates crossing organizational boundaries to foster collaboration among innovation entities. In the early stages of digital technology convergence, individual innovation entities cannot achieve breakthroughs by relying solely on their own resources [34]. They must establish cross-domain collaborations across organizations and industries, facilitating knowledge exchange and sharing across different fields through technology knowledge search. Technology cross-domain convergence enables the fusion of technological knowledge [35], which further promotes cross-domain cooperation between innovation entities [36]. Due to the uncertainty surrounding emerging technologies and markets, the number of elements and relationships within the digital technology multilayer convergence networks constantly changes. This network is decomposed into the digital technology convergence subnetwork and the company collaboration subnetwork to analyze the relationship between technological convergence and cross-domain collaboration among innovation entities during its evolution.

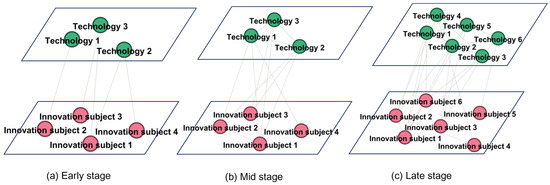

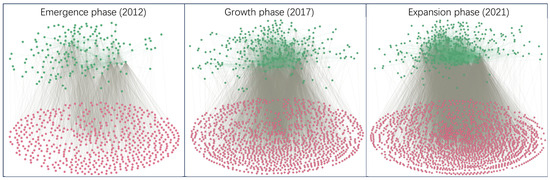

As shown in Figure 2, the green nodes represent technology entities, while the red nodes indicate innovation entities. In the early stages of the digital technology multilayer convergence networks’ evolution, innovation entities and technology entities remain independent, with no established cooperation or convergence relationships. When fusion between innovation entities and technologies begins, and connections form within the company collaboration subnetwork and the digital technology convergence subnetwork, the network enters its mid-evolution phase. As new innovation entities or technological fields join, and the number of connections both within and between layers increases, the network reaches its late-evolution phase.

Figure 2.

Evolution process of the multilayer networks: early, mid, and late stages.

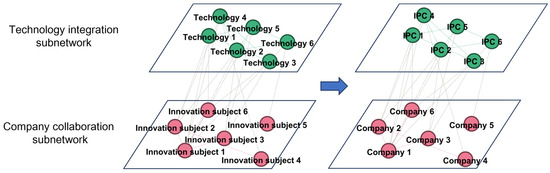

Based on this framework, we constructed a patent assignee collaboration network and a patent technology convergence subnetwork, representing the company collaboration subnetwork and the digital technology convergence subnetwork, respectively. The affiliation network between these two subnetworks was built using the relationships between IPC codes, patents, and companies, as shown in Figure 3. The green nodes represent technology entities (i.e., IPC nodes), while the red nodes indicate innovation entities (i.e., company nodes). The data and relationships in each network layer are presented in Table 1.

Figure 3.

Digital technology cross-domain convergence network model based on patent data.

Table 1.

Data and relationships related to the digital technology cross-domain convergence networks based on patents.

The company collaboration subnetwork is built upon the cross-domain collaboration relationships among innovation entities. Companies, as innovation entities, are the owners of patents. Co-occurrences of companies on the same patent reflect their collaboration. The number of co-occurrences between companies indicates the frequency of collaboration, which in turn reflects the level of cooperation between them. An increase in co-occurrences suggests that innovation entities are strengthening their cooperation, while a decrease implies that entities are developing independently.

The digital technology convergence subnetwork is constructed based on the cross-domain convergence of digital technologies. The co-occurrence of patent IPC codes reveals the technology convergence phenomena behind technologies and sheds light on the development trends in different technological fields. The frequency of patent IPC co-occurrences indicates the extent of technology convergence between technological fields. Cross-domain convergence of technologies is manifested in patents that span multiple technological fields, with multiple classifications across different technological categories.

The affiliation network is constructed based on the relationships between innovation entities and the technologies they own. The co-occurrence network of companies and patent IPC codes reflects the cross-domain technological relationships of innovation entities. The frequency of co-occurrence between companies and IPC codes indicates the extent to which a company has mastered the technology in a particular patent IPC classification. An increase in the number of patent IPC codes owned by an innovation entity indicates its ongoing cross-domain technological convergence.

4. Data Sources and Research Methods

4.1. Data Sources

This study focuses on A-share listed companies in China’s Shanghai and Shenzhen stock exchanges from 2012 to 2021, along with their patent application information. The sample was filtered using the following criteria: (1) exclusion of companies marked as ST or *ST; (2) exclusion of samples with missing relevant data; and (3) merging the patent application data of parent companies and their subsidiaries. As a result, we obtained a dataset consisting of 193,625 invention patent applications from 2397 listed companies.

We present the changes in basic information for a portion of the sample companies in 2012, 2017, and 2021, as shown in Table 2. Our selection logic was based on identifying the top 10 companies by patent applications in 2012. In some cases, company names have changed due to renaming during the sample period; therefore, company identification should be based on the company code. For more detailed company information, please refer to Table A1 in Appendix A.

Table 2.

Basic information of sample companies (10 in total).

The data sources for this study are as follows: companies’ invention patent application information was retrieved from the Patsnap Global Patent Database, while company data were sourced from the CSMAR database.

The tools used for network construction and the calculation of network metrics were Gephi and R, with Gephi also used for visualization. Data cleaning and statistical analysis were performed using Python 3.11 and STATA 16.0.

4.2. Structural Characteristics and Measurement Methods of Multilayer Networks

Isolating each layer of a coupled system or aggregating them into a traditional network may lead to a network model with weaker explanatory power. In a multilayer network, there are cross-layer paths, meaning that a company node’s neighboring nodes may not only be other company nodes but also technology nodes (IPC codes). Furthermore, a node’s neighbors and the neighbors of its neighbors may be of heterogeneous types. For example, a company node might be connected to a technology node via other company or technology nodes. These unique cross-layer connections provide company nodes with enhanced network penetration capabilities, allowing their influence to spread through multiple pathways. In this study, we identify key nodes in the multilayer network system through measures of multilayer degree centrality, multilayer eigenvector centrality, and multilayer PageRank centrality. The muxViz package in R was used to calculate these multilayer network metrics.

(1) Multilayer Degree Centrality

Multilayer degree centrality measures the number of edges connected to a given node [18]. In the context of multilayer network analysis, this metric extends the scope of calculation to consider correlations across layers and between layers, expressed through a tensor equation. The specific calculation formula is as follows [37]:

The term represents the multilayer adjacency tensor, which captures all interactions between nodes both within and across layers, effectively forming a tensorized representation of the complete multilayer network structure. A tensor is a generalization of scalars and vectors and is used to represent higher-dimensional data. In its simplest form, a tensor can be viewed as a multidimensional array composed of elements of the same type (typically numbers). Scalars, vectors, and matrices can be considered as the simplest 0th-, 1st-, and 2nd-order tensors, respectively. The symbols and represent network layers, where and , with representing the number of layers. The indices and denote nodes, where .

The function operates on each entry of the tensor, returning 1 if the entry is greater than zero, and 0 otherwise. Essentially, this function binarizes the tensor. The term denotes the reduction in the multilayer adjacency tensor into a 2nd order 1-tensor (where all components are set to 1). refers to the aggregate network that accounts for inter-layer connections. Lastly, represents the sum of all edges connected to node in the multilayer network system, excluding the edges connected to .

(2) Multilayer Eigenvector Centrality

Eigenvector centrality is a metric used to measure the importance of a node within a network. It not only takes into account the number of connections a node has but also considers the significance of the nodes it is connected to [38]. A node that is connected to other important nodes will have a higher eigenvector centrality. Specifically, it is calculated through the principal eigenvector of the adjacency matrix, where a node’s centrality is proportional to the centrality of its neighboring nodes. In a single-layer network, eigenvector centrality is computed by identifying a dominant eigenvector from a 2nd-order adjacency tensor. In a multilayer network, this computation extends to a 4th-order tensor, which requires considering the overall interconnection structure across layers. The specific formula is as follows [37]:

Here, represents the largest eigenvalue, while is the eigenvector that encodes the centrality of each node in each layer, considering the overall interconnected structure.

(3) Multilayer PageRank Centrality

PageRank centrality was originally developed for ranking web pages and is used to measure the relative importance of nodes within a network. The core concept is that the importance of a node depends not only on how many other nodes point to it but also on the importance of those pointing nodes. Through iterative calculations, the PageRank score is continuously updated based on the PageRank values of connected nodes, similar to eigenvector centrality, but with the introduction of a damping factor to prevent the concentration of influence [39]. When extended from single-layer to multilayer networks, the approach is essentially based on a multilayer random walk [40]. It accounts for both a node’s jumps to neighboring nodes within the same layer and its transitions to nodes in other layers via inter-layer connections. The specific calculation formula is as follows [37]:

Here, is a constant, typically set to the default value of 0.85, as in Google’s original algorithm [39]. is the number of nodes in each layer, and is the number of layers (dimensions). is a 4th-order tensor where all components are equal to 1. The steady-state solution to the principal equation corresponding to this transition tensor provides the PageRank centrality for interconnected multilayer networks.

5. Analysis of Evolutionary Characteristics of Multilayer Networks

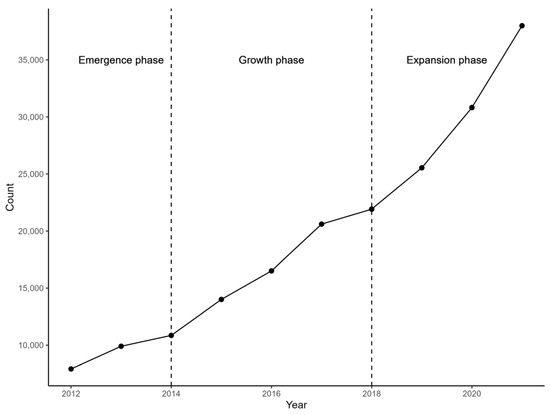

In this study, we used the date of the first patent application as the filing date and plotted the trend in patent application volumes, as shown in Figure 4. Between 2012 and 2014, the number of digital technology-related patent applications showed a slow growth trend, with only modest increases, indicating that digital technology was still in its early stages. Technological innovation and patent activity within the industry were gradually accumulating during this period. From 2015 to 2018, the growth rate accelerated significantly, signaling that digital technology was entering a rapid development phase. Although there were occasional slowdowns, the overall trend continued to rise. From 2019 to 2021, patent applications experienced explosive growth, reflecting the widespread adoption and attention given to digital technology across the country, with innovation activities reaching their peak. Based on the changes in patent application volumes, we divided the evolution of the digital technology multilayer convergence networks into three phases: the emergence phase (2012–2014), the growth phase (2015–2018), and the expansion phase (2019–2021) [41,42].

Figure 4.

Trend in digital technology-related patent applications.

5.1. Evolution Characteristics of the Overall Structure of Multilayer Networks

Based on the logic for constructing the digital technology multilayer convergence networks outlined earlier, we used Gephi software and the Yifan Hu algorithm to draw the annual multilayer network diagrams. The Yifan Hu algorithm is an efficient force-directed layout algorithm specifically designed to handle large graphs. Force-directed layout algorithms simulate physical forces within a system, where nodes in the graph are treated as repelling charges, and edges act like springs applying attractive forces between the nodes. The system eventually reaches a dynamic equilibrium, determining the final spatial positions of the nodes. At this point, the network structure represents the aggregated state, showing relationships between multilayer network nodes in a two-dimensional plane. Additionally, we used the Network Splitter 3D algorithm to visualize the structural evolution of the digital technology knowledge network. The Network Splitter 3D algorithm allows users to split the network into different layers or regions based on specific node attributes and display this layered structure in three-dimensional space.

Figure 5 presents the overall structural evolution of the digital technology multilayer convergence networks from 2012 to 2021. Due to space limitations, only the overall network diagrams for 2012, 2017, and 2021 are shown. The upper green nodes represent the digital technology convergence subnetwork, with green edges indicating co-occurrence relationships between knowledge elements. The lower pink nodes represent the company collaboration subnetwork, with pink edges representing co-authored patent relationships between companies. The green nodes represent technology entities, while the red nodes indicate innovation entities. Gray lines show the connections between knowledge elements and companies based on patent ownership. The key observations from the figure are as follows: (1) The network scale increased year by year, the network structure became increasingly complex, and network density rose steadily. This indicates a growing variety of technologies and an increase in collaboration between companies. The possible reasons for this include the fact that (a) companies are combining more fields of technology with digital technology, and (b) more companies are entering the digital technology sector. (2) Compared to the internal connectivity of single-layer networks, the increase in the connectivity density of cross-layer affiliations is more pronounced. This suggests that companies have been increasingly engaging in digital technology R&D activities in recent years. (3) In the early stages of network development, most nodes operated in a decentralized collaboration pattern. Over time, the network evolved from scattered, independent collaborations to a more centralized cooperation model, where one or a few key nodes serve as the hubs. As a result, new central nodes formed in the network, and overall cohesion strengthened.

Figure 5.

Structural evolution of the digital technology multilayer convergence networks.

To further analyze the characteristics of the overall network, we calculated the network metrics for each year, as shown in Table 3. The key findings are as follows: (1) The size of the network (number of nodes) and the number of edges (connections) showed a continuous growth trend from 2012 to 2021. This indicates that during the observed period, both the number of entities in the network (technological elements and companies) and the relationships between them (co-occurrence, collaboration, etc.) increased steadily, reflecting the growing frequency and complexity of activities and interactions in the digital technology field. (2) The network diameter, which refers to the length of the shortest path between the two most distant nodes in the network, remained mostly stable between 6 and 7, with a decrease to 5 in 2020. The network diameter represents the maximum shortest path length between two nodes in the network. This relative stability, along with the reduction in 2020, suggests that despite the expanding network size, the maximum distance between nodes has not significantly increased and even decreased in some cases, possibly indicating more efficient dissemination of technological knowledge and innovation within the field. (3) Network density, defined as the ratio of the actual number of edges to the possible number of edges, showed a slight decline over time but remained relatively stable overall. Network density measures the closeness of the network by comparing the actual number of edges to the maximum possible number of edges. The slight decrease may suggest that although the actual number of connections increased with network growth, the rate of increase was slower compared to the possible connections. (4) The modularity index decreased year by year, indicating a shift in the internal structure of the network from a more segmented grouping (high modularity) to a more integrated structure (low modularity). This likely signifies that cross-domain collaboration and technology convergence within the digital technology domain became more common over time. (5) The average clustering coefficient showed an upward trend, indicating an increasing tendency for nodes in the network to form tightly connected groups, also known as triangles or triadic closures. This trend suggests that collaboration and interactions within the network are becoming more cohesive. (6) The average path length, which represents the average shortest path between any two nodes in the network, decreased over time, indicating that the “distance” between any two nodes in the network has shortened. This implies that the efficiency of information or knowledge diffusion within the network has improved.

Table 3.

Overall network metrics.

5.2. Evolution Characteristics of Overall Structure of Single-Layer Subnetwork

5.2.1. Evolution Characteristics of the Company Collaboration Subnetwork

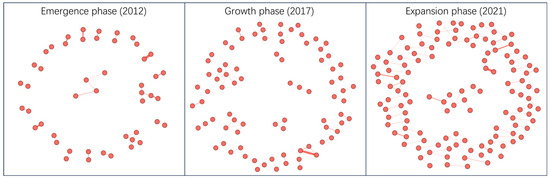

In this study, companies are represented as nodes, and co-authored patent relationships between companies are depicted as edges, forming the company collaboration subnetwork evolution map. To better illustrate the relationships between entities, this section uses an undirected weighted network, where thicker lines indicate higher collaboration frequency between companies, as shown in Figure 6.

Figure 6.

Evolution of the company collaboration subnetwork.

During the emergence phase, the network structure is relatively fragmented, with lower collaboration frequency between companies, resulting in many small-scale collaboration groups. This reflects that digital technology cooperation among companies was still in its infancy, with a limited scope of collaboration, and interactions between innovation entities had not yet formed a widespread network.

During the growth phase, the structure of the company collaboration subnetwork gradually evolved, with a significant increase in both the number of nodes and edges. Multiple collaboration groups centered around key nodes began to emerge. Some companies (acting as central nodes) occupied prominent positions in the collaboration network, with significantly increased collaboration frequency with other companies The thickness of the weighted edges indicates that the collaboration frequency between core companies increased substantially, while peripheral nodes maintained relatively lower collaboration intensity. This phase demonstrates that cooperation between companies intensified, and the collaboration network gradually expanded from local groups to a broader scale, with some companies taking on a leading role in technological collaboration.

During the expansion phase, while the main network structure still consisted of small-scale groups, these collaboration groups expanded significantly. Some smaller groups exhibited high-frequency collaboration, indicating that certain companies had established fixed partnerships. At this stage, collaboration was no longer confined to localized “core–periphery” structures, but instead, multiple groups became highly interconnected, marking the onset of a boom in company technological collaboration. The connectivity of the collaboration network increased significantly, and interactions among collaboration entities became more frequent, resulting in highly coordinated technological innovation activities. Across the three phases shown in the network evolution map, it is clear that the company collaboration subnetwork evolved from a decentralized to a more centralized structure, with collaboration relationships gradually transitioning from scattered to more cohesive.

Compared to Figure 5, the number of nodes in the company collaboration subnetwork in Figure 5 is significantly smaller than the number of company nodes in the multilayer network. This is because many companies in the multilayer network independently achieve technological convergence, which appears as isolated nodes in the company collaboration subnetwork. These companies, which are not involved in co-authored patents, are removed from the subnetwork, greatly reducing the number of nodes in the company collaboration subnetwork. This reduction reflects the focus of the company collaboration subnetwork on cooperation and interactions between companies, rather than on individual companies’ independent innovation activities. As a result, the nodes in the subnetwork only represent companies that have established collaborative relationships, while the multilayer network captures a broader range of independent innovators who are not involved in such collaborations. The multilayer network can reveal complex interactions across different layers, providing a more comprehensive and accurate representation of the network structure. This multidimensional analysis helps to understand the role and influence of isolated companies—those that do not directly collaborate with others but still contribute through technological innovation—within the innovation ecosystem.

The changing trends in network structure metrics are shown in Table 4. First, the breadth of company collaboration expanded as the network evolved through different stages. The number of nodes and edges gradually increased over time, with a notable rise from 2019 to 2021, indicating that more companies joined the collaboration network, and cooperative relationships grew. The number of nodes increased from 48 in 2012 to 125 in 2021, and the number of edges rose from 34 to 79. This growth trend suggests that the scale and scope of the company collaboration subnetwork continued to expand, with more companies progressively entering the collaborative system. The network diameter showed a fluctuating upward trend, indicating that the maximum span of the company collaboration subnetwork increased over these years. Overall, the diameter of the network fluctuated only slightly, suggesting that the distances between companies in different years remained relatively stable. Network density gradually declined over the analysis period, possibly due to the expansion of the network as more new companies joined.

Table 4.

Structural characteristics of the company collaboration subnetwork.

Second, the depth of company collaboration increased as the network evolved, reflected by the growing frequency and intensity of collaboration. The total collaboration weight increased steadily from 831 in 2012 to 8010 in 2021, with a significant rise between 2019 and 2021. This indicates that, as the network expanded, collaboration frequency between companies increased markedly, and relationships became more tightly knit. The clustering coefficient exhibited more fluctuation, showing a decline followed by a recovery between 2012 and 2016, peaking at 0.7500 in 2018. This indicates that local collaboration networks were highly cohesive during this period but then declined to 0.1034 by 2021. This decline could be attributed to the addition of new companies to the network, leading to more dispersed collaboration relationships and a weakening of local clustering effects. The average path length generally trended downward, from 1.3950 in 2012 to 1.0580 in 2018, indicating shorter collaboration distances between companies and improved collaboration efficiency. Although there was a slight increase during the expansion phase, overall collaboration efficiency remained high. In summary, both the breadth and depth of company collaboration increased as the network expanded, and despite some fluctuations in local cohesion, collaboration frequency and efficiency continued to grow.

5.2.2. Evolution Characteristics of the Technology Convergence Subnetwork

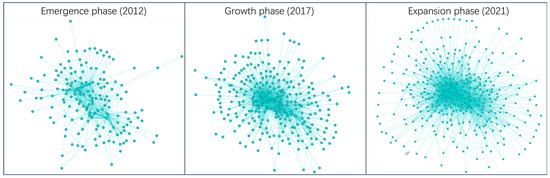

In this study, technologies (represented by IPC codes) are depicted as nodes, and the co-occurrence relationships between IPC codes as edges, forming the technology convergence subnetwork evolution map. To better illustrate the relationships between entities, this section uses an undirected weighted network, where thicker lines indicate higher co-occurrence frequencies between IPC codes, as shown in Figure 7.

Figure 7.

Evolution of the technology convergence subnetwork.

During the emergence phase, the technology convergence subnetwork had already formed a relatively complete structure, unlike the company collaboration subnetwork, which featured many small, fragmented groups. However, most of the edges in the network were thin, indicating weak associations between technologies, with cross-domain convergence still in its early stages. At this point, technological convergence was often based on innovations within single domains, primarily concentrated within their respective fields, lacking cross-domain convergence. The application of digital technologies was relatively limited, and most companies or research institutions had not yet fully realized the potential for technological convergence, resulting in a relatively small and simple network structure.

In the growth phase, the technology convergence subnetwork began to expand significantly, with multiple central groups emerging within the network. These nodes, representing specific technological fields, developed more frequent co-occurrence relationships with other technologies, indicating that the subnetwork was expanding beyond individual fields to encompass multiple technological domains.

During the expansion phase, the complexity and connectivity of the technology convergence subnetwork increased dramatically, and the convergence of technologies across fields entered a highly concentrated stage. The frequency of co-occurrences between technologies rose sharply, as reflected in the diagram by denser nodes and thicker edges, indicating high-frequency interactions between technologies. This dynamic led the technology convergence subnetwork to evolve into a highly interconnected and complex system. Unlike the company collaboration subnetwork, the technology convergence subnetwork not only reflected an increase in collaboration frequency but also demonstrated greater diversity and complexity in cross-domain innovations. At this stage, technological convergence depended not only on company collaboration but also on the deep combination of patent technologies and cross-domain innovations, which represents a key distinction between the technology convergence subnetwork and the company collaboration subnetwork.

The changing trends in network structure metrics are shown in Table 5. First, the breadth of technological convergence expanded progressively with the evolution of the network. Both the number of nodes and edges showed significant growth over the entire period, with a sharp increase from 2019 to 2021. This indicates that more technological elements (IPC codes) were involved in the technology convergence subnetwork, and co-occurrence relationships between technological elements continued to grow. The number of nodes increased from 167 in 2012 to 359 in 2021, while the number of edges rose from 5525 to 33,355. This growth trend demonstrates the continuous expansion of the technology convergence subnetwork, with more technological fields gradually entering the convergence system. The rapid development of the digital technology sector, in particular, has driven cross-domain technological convergence. Between 2012 and 2014, the network diameter fluctuated, reaching 16 in 2013, but the overall trend has been downward in the following years, reducing to 9 by 2021. This suggests that, over time, connections between technological fields became increasingly tighter, and cross-domain technological collaboration became more direct. Especially after 2019, as digital technology emerged as a core integrating force, it significantly shortened the distance between technologies. Network density initially declined and then increased during the analysis period. Between 2012 and 2015, network density dropped from 0.3986 to 0.2218, possibly due to the addition of new technological fields that decreased network connectivity. However, starting in 2016, the density began to recover, reaching 0.4275 in 2020 and 0.5191 in 2021. This indicates that connections between technological fields became increasingly close, particularly with the influence of digital technology, which significantly strengthened convergence relationships across different fields and greatly enhanced the overall connectivity of the technology convergence subnetwork.

Table 5.

Structural characteristics of the technology convergence subnetwork.

Second, as the technology convergence subnetwork expanded, the depth of convergence between technologies also increased significantly, with co-occurrence frequencies and local clustering structures becoming more cohesive. The total weight, reflecting the co-occurrence frequency between technological fields, experienced a sharp rise—from 653,917 in 2012 to 20,531,777 in 2021, with particularly accelerated growth after 2019. This trend indicates that co-occurrence relationships between technological fields have become increasingly frequent, greatly enhancing the synergy of innovation. The clustering coefficient fluctuated during the analysis period. In 2012, it was 0.2838 and remained relatively high, reaching 0.3090 in 2021. This reflects strong local clustering within the technology convergence subnetwork, indicating that technological convergence occurred not only at the overall network level but also within smaller subgroups that exhibited tight interactions. As digital technology penetrated multiple fields, several technological domains formed clustered collaborations. The tightness of these local networks underscores the increasing depth of technological convergence. The average path length shortened each year, indicating that the average distance between technological fields decreased, leading to more efficient interactions within the technology convergence subnetwork.

5.3. Evolution Characteristics of Network Entities in Multilayer Networks

In this section, we focus on analyzing the dynamic changes in the evolution characteristics of individual entities within the multilayer network, with two primary areas of work: First, we compare the structural metric evolution trends in network entities in both single-layer and multilayer networks, exploring the advantages of multilayer networks in capturing complex network relationships and dynamic evolution. Second, we present the spatiotemporal evolution characteristics of individual network entities, revealing the co-evolution processes of companies and technology entities in different spatiotemporal contexts.

5.3.1. Evolution Characteristics of Company Entities

(1) Node Centrality Characteristics Across Network Dimensions

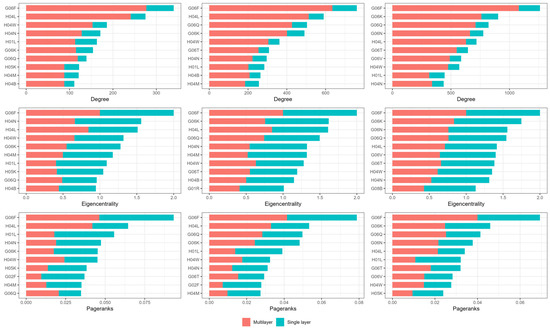

We compared different types of multilayer network metrics with their traditional single-layer counterparts. To maintain consistent measurement standards, both the multilayer network and the single-layer subnetwork are modeled as undirected, unweighted networks in this section.

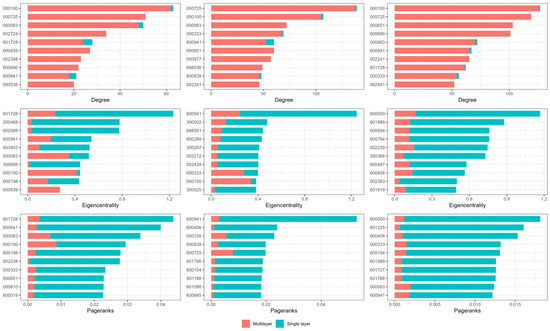

Figure 8 illustrates the ranking differences between companies based on various centrality metrics (degree centrality, eigenvector centrality, and PageRank centrality) across different years (2012, 2017, and 2021). The vertical axis of each subplot represents the stock codes of listed companies. The red bars represent the multilayer network metric values, while the blue bars show the single-layer network metric values. The final ranking is determined by the sum of the two types of metrics.

Figure 8.

Stacked visualization of multilayer network metrics for company entities.

Several key insights emerge from the figure. First, there are noticeable differences between the rankings in single-layer and multilayer networks. For example, in terms of degree centrality, the metric for TCL Technology Group Corporation (000100) in the multilayer network is significantly higher than in the single-layer network. This indicates that within the multilayer network structure, TCL Technology has established a broader range of connections, engaging in various digital technologies and creating extensive links across different fields through technological collaboration. The single-layer network fails to fully capture this cross-domain collaboration advantage. Additionally, some companies that rank highly in the single-layer network, such as China Mobile Communications Group Guangdong Co., Ltd. (600941), rank lower in the multilayer network, indicating that their role within the more complex structure of the multilayer network is relatively weaker, as they have not formed widespread cross-layer collaborations. On the other hand, BOE Technology Group Co., Ltd. (000725), exhibits significantly higher degree centrality in the multilayer network compared to the single-layer network. This may be due to BOE’s increasing importance in the digital technology sector, where cross-domain collaborations have significantly boosted the number of nodes it connects with.

Second, differences in rankings emerge based on various metrics. ① Some nodes rank highly in only one or a few metrics. For example, BOE Technology Group (000725) ranks high in degree centrality but struggles to enter the top ranks for eigenvector centrality and PageRank centrality. Based on BOE’s single-layer degree centrality and PageRank centrality data, the company engages in fewer collaborations with other companies and holds a large number of technological elements. However, the importance or authority of these elements in the digital technology field is relatively low, which does not significantly enhance its global influence. ② Eigenvector centrality rankings tend to fluctuate more compared to the other two metrics, which are relatively stable. In Figure 7, only TCL Technology Group (000100) and China Mobile Communications Group Guangdong Co., Ltd. (600941), consistently rank in the top 10 for eigenvector centrality, while rankings fluctuate for other companies. Throughout network evolution, new companies frequently enter the rankings. Eigenvector centrality takes into account not only the number of direct connections a node has but also the importance of those connected nodes. The feedback loop effect of eigenvector centrality causes a node’s centrality to increase when connected to other high-centrality nodes, further enhancing the centrality of its connected nodes. As a result, any change in the network, especially involving high-impact nodes, rapidly affects the entire network due to this feedback mechanism. This effect is particularly evident during network evolution, as the addition of new nodes and the formation of new connections between important nodes quickly shift the distribution of centrality, leading to frequent adjustments in the eigenvector centrality rankings. In contrast, degree centrality is based solely on the number of direct connections, making it more stable. If a company maintains a high number of collaborations with other nodes, even if those nodes have lower influence, its degree centrality remains high. Degree centrality rankings do not fluctuate significantly due to changes in the overall network structure, as they focus only on the number of collaborations, not the influence of the collaborating nodes. While PageRank centrality is similar to eigenvector centrality in that it depends on the quality and authority of connections, its calculation emphasizes the stable “authority” transmission. Since PageRank is computed through multiple iterations to establish a node’s authority, new nodes take time to establish sufficient transmission effects through high-authority nodes. As a result, PageRank is slower to change and does not respond as immediately to global network changes as eigenvector centrality does.

Through graphical comparison, we can observe that the values of eigenvector centrality and PageRank in the single-layer network are significantly higher than those for degree centrality in the same network. The possible reasons for this are as follows: In our analysis, the number of nodes in the company collaboration subnetwork is much smaller than the number of company nodes in the multilayer network. According to the concepts and definitions of these metrics, the number of nodes and network connectivity significantly impact the results of eigenvector centrality and PageRank calculations. In the company collaboration subnetwork, due to the smaller number of nodes, the network is denser, meaning that the remaining companies form more high-impact connections with each other. Additionally, the removal of isolated nodes increases the density of the company collaboration subnetwork in the single-layer network. As a result, in the single-layer network, companies with higher eigenvector centrality and PageRank values are often those that maintain collaborations with other high-impact nodes in the remaining dense network.

In contrast, in the multilayer network, due to the larger number of nodes and the more dispersed nature of the network, companies’ eigenvector centrality and PageRank values tend to be lower. This is because their connected counterparts may not occupy equally central positions within the larger, more complex network.

(2) Temporal Evolution Characteristics of Node Centrality Metrics

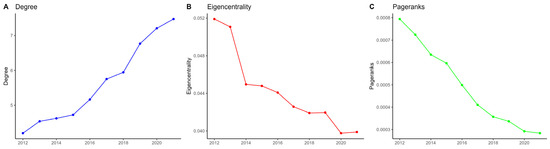

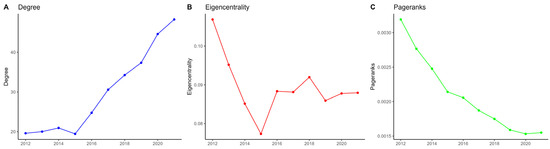

Figure 9 illustrates the evolution of the annual average network metrics for all companies within the multilayer network, aiming to analyze the trends in centrality metrics of companies over time.

Figure 9.

Evolution process of multilayer network metrics for company entities: multilayer degree centrality, multilayer eigenvector centrality, and multilayer PageRank centrality.

As shown in the figure, degree centrality steadily increased from 2012 to 2021, with a notable rise after 2018. This indicates that, over time, companies’ connections within the multilayer network expanded, and company collaborations and technological convergence became more widespread. An increasing number of companies actively engaged in collaborations within the multilayer network, particularly in patent cooperation and cross-domain technology convergence, leading to more direct collaboration relationships and patent ownership ties. Since the multilayer network integrates both company collaborations and technological convergence layers, companies could participate in a broader range of collaborations across different layers, enhancing their multilayer degree centrality. This trend aligns with the increasing number of digital technology-related patent applications shown in Figure 3.

Multilayer eigenvector centrality, on the other hand, consistently declined from 2012 to 2021. This suggests that while some companies continued collaborating with others, their partners’ importance or influence might have weakened, leading to a decrease in their overall global influence within the network. The decline in eigenvector centrality could reflect changes in the collaboration and technology structures within the network. Initially, some companies gained high multilayer eigenvector centrality by collaborating with influential companies and holding key digital technology elements. However, as more companies and technological elements entered the network, its complexity increased, and relationships between companies became more dispersed. Some companies that previously collaborated with high-impact firms may have shifted to partnering with lower-impact companies, while many companies focusing on independent digital technology innovation entered the network, contributing to the decline in multilayer eigenvector centrality.

Multilayer PageRank centrality was relatively high in 2012 but showed a continuous decline over the following years, reaching its lowest level by 2021. This suggests that the transmissive influence companies gained through collaborations with high-authority nodes diminished over time. Similar to the decline in multilayer eigenvector centrality, the drop in multilayer PageRank centrality may be attributed to changes in collaboration patterns within the multilayer network. As a large number of companies joined the multilayer network system each year, those that had previously collaborated with influential firms began expanding their partnerships to include lower-impact companies. Additionally, the network absorbed many companies engaging in independent digital technology innovation, which led to a gradual decrease in multilayer PageRank centrality over time.

To comprehensively examine the evolutionary characteristics of multilayer network metrics for corporate entities, this study further investigates the dynamic trends in key network metrics in selected representative companies. The selection criteria for these representative firms are based on their ranking within the top five positions of the annual multilayer network metrics scores. The results are shown in Table 6.

Table 6.

Evolutionary trends in multilayer network metrics for core companies.

The analysis of Table 6 reveals significant evolutionary trends in the multilayer network metrics (multilayer degree centrality, multilayer eigenvector centrality, and multilayer PageRank centrality) for core companies, highlighting their dynamic changes within the digital technology multilayer convergence networks from both temporal and metric perspectives. From the temporal dimension, certain companies maintained a strong centrality position over time. For example, Sinopec Corp. (000100) consistently ranked at the top in terms of multilayer degree centrality in 2012, 2017, and 2021, with its centrality rising from 62 to 126, indicating a continuous expansion of its collaborations and technological footprint, thus consolidating its status as a core company. Similarly, BOE Technology Group Co., Ltd. (000725), peaked at 138 in 2017, slightly declining to 119 in 2021, reflecting its extensive linkages and innovation presence across multiple technological fields. This evolution can be attributed to its deep investments in display technology and semiconductor materials, alongside multidimensional corporate partnerships.

In contrast, ZTE Corporation (000063) experienced fluctuations in its multilayer degree centrality, increasing from 48 in 2012 to 72 in 2017, only to decline to 70 by 2021. This fluctuation may be linked to sanctions in international markets and changes in the policy environment, which likely constrained its global presence and collaboration model, thereby affecting its interactive capabilities within the multilayer network. Similarly, Haier Smart Home Co., Ltd. (600690), demonstrated a notable upward trend post-2017, with its multilayer degree centrality rising from 60 in 2017 to 103 in 2021. This can be attributed to strategic investments and a broad layout in emerging digital technologies like smart home systems and the Internet of Things (IoT), significantly enhancing its interactive capabilities and influence within the multilayer network.

From a metric dimension, the three metrics in Table 6 highlight different facets of influence within the multilayer network. Multilayer degree centrality measures the number of direct connections in the network; thus, companies ranking higher in this metric tend to have numerous direct collaborators across various partnerships and technological linkages. BOE and Sinopec’s top ranks indicate their broad direct partnerships across different subnetworks. In contrast, multilayer eigenvector centrality considers not only the quantity but the quality of connections, meaning companies with higher eigenvector centrality (e.g., ZTE and BOE) may have fewer direct connections but are linked to influential core nodes within the network, granting them substantial influence and authority. Lastly, multilayer PageRank centrality emphasizes the level of “trust” within the overall network, assessing a company’s significance across hierarchical layers. Haier’s rise in this metric post-2017 (from 0.2471 to 0.2638 by 2021) suggests it became a more “trusted” player across the multilayer networks, likely due to its expanding business landscape and widespread application of emerging digital technologies like IoT in its product offerings.

Overall, the evolution in rankings and metric variations of these core companies across different time points reflects a complex interplay of technological layout, collaboration strategies, and external environmental factors.

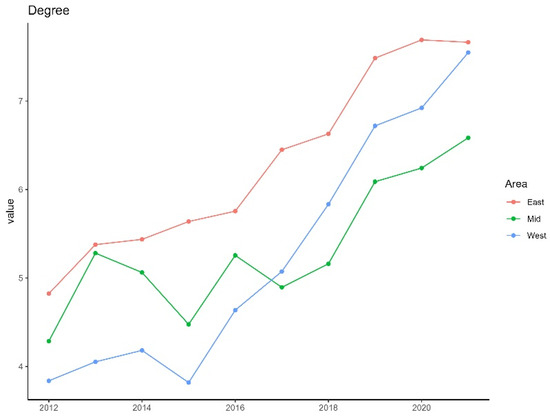

(3) Spatial Evolution Characteristics of Node Centrality Metrics

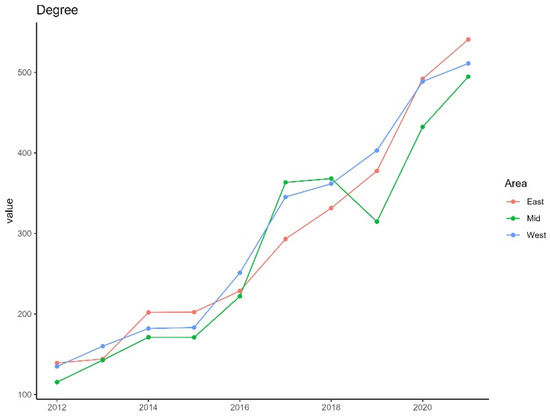

Figure 10 presents the trends in degree centrality of companies across different regions of China (eastern, central, and western regions). China’s eastern, central, and western regions exhibit distinct economic characteristics and variations in terms of company innovation collaboration, digital economy development, and digital technology patent applications. Overall, the eastern region, supported by a strong economic foundation, abundant technological resources, and robust policy backing, leads in digital economy and technological innovation. The central region, while having certain advantages in absorbing industrial transfers and promoting local innovation, still lags behind the eastern region in overall technological capacity and innovation capabilities. In contrast, the western region remains relatively weak in digital technology and company collaboration but has been steadily developing in recent years due to policy guidance and increased infrastructure investments.

Figure 10.

The trend in the multilayer degree centrality metric among companies located in different regions of China.

As shown in the figure, there are noticeable regional differences in the multilayer degree centrality trends. The multilayer degree centrality of companies in the eastern region (red line) steadily increased from 2012 to 2021, with a particularly significant growth rate after 2016. This suggests that companies in the eastern region have established more direct connections in both collaboration networks and technological convergence, reflecting their strong collaboration capabilities and higher levels of technological convergence. The eastern region, which includes economically developed provinces and cities such as Beijing, Shanghai, Jiangsu, Zhejiang, and Guangdong, forms the core area of China’s economic growth. With a high concentration of companies and strong industrial clustering effects, companies in this region hold a leading position in the application and R&D of digital technologies. The regional collaboration networks, exemplified by the Beijing–Tianjin–Hebei region, the Yangtze River Delta, and the Guangdong–Hong Kong–Macau Greater Bay Area, are highly active. Companies in these areas leverage various forms of collaboration, such as upstream and downstream supply chain partnerships and innovation alliances, to drive technological R&D and market expansion.