Abstract

This paper explores the logistics strategy selection of a manufacturer that uses two sales channels (resale and agency channels) to sell the same product through an E-commerce platform. The agency channel offers two logistic strategies, low-quality logistics services provided by third-party enterprises (Strategy N) and high-quality logistics services provided by the platform (Strategy S). When the manufacturer opts for Strategy S, a portion of the market share of the resale channel shifts to the agency channel, which results in the platform logistics effect. We developed a game-theoretic model to investigate the equilibrium results of a manufacturer under different logistics strategies. The results show that there exists a threshold for the platform logistics effect. When the platform logistics effect is lower than this threshold, the manufacturer prefers Strategy N. Otherwise, the manufacturer prefers Strategy S. However, when the platform logistics price reaches a certain level, the manufacturer will always prefer Strategy N. Our study provides valuable insights for manufacturers and e-commerce platforms to optimize their operational decisions based on different logistics strategies. It also helps manufacturers make rational choices about logistics strategies.

1. Introduction

1.1. Background and Motivation

With the rapid development of e-commerce, more consumers choose online shopping channels [1,2,3,4]. According to the latest report released by Digital Commerce 360, US consumer spending on online shopping reached 982.19 billion dollars in 2022, an increase of 13% from the previous year’s 871.03 billion dollars. According to data from the National Bureau of Statistics of China, in 2022, the total online retail sales in the country reached 13.79 trillion yuan, registering a year-on-year growth of 4%. Among this, the online retail sales of physical goods amounted to 11.96 trillion yuan, exhibiting a year-on-year growth of 6.2%. This accounted for a proportion of 27.2% in the total retail sales of consumer goods in society.

Logistics services are an extremely important core element in the transaction mode of e-commerce platforms and retail enterprises. To a certain extent, the quality of logistics services can determine the success or failure of e-commerce platforms and retail enterprises [5,6,7,8]. According to reports, about 93% of shoppers believe that delivery methods are an important factor in their overall shopping experience. As an important component of logistics services, delivery time largely affects consumer demand [8,9,10]. E-commerce consumers prefer fast and reliable delivery [11,12,13]. Many large e-commerce platforms recognize the importance of logistics services to their business and have established their own logistics systems to provide consumers with high-quality logistics services characterized by extremely short delivery times. Amazon and JD are typical representatives of such e-commerce platforms. In recent years, Amazon has invested heavily in its logistics system, from air cargo hubs to last-mile transport [14]. JD is famous for its fast and reliable delivery service [15].

Large e-commerce platforms, such as JD and Amazon, provide two types of selling modes; namely, the reselling mode and the agency mode [16,17,18]. Specifically, in the reselling mode, the e-commerce platform acts as a reseller by reselling products purchased from upstream suppliers. That is, the platform owns all the rights to the products and chooses how to sell them in its stores. In contrast, in the agency mode, the e-commerce platform acts like a marketplace, allowing upstream suppliers to open their own stores on the platform and sell products directly to consumers. In practice, the success of e-commerce platforms is well documented. For example, one of the world’s most successful e-commerce platforms, Amazon, announced that in 2018, its direct revenue from reselling reached $117 billion, while its revenue from agency mode grew to $160 billion, accounting for 58% of its total revenue.

Currently, more brand manufacturers are adopting both reselling and agency modes on an e-commerce platform [19,20] in order to expand the market demand for their products. Specifically, on the one hand, the platform opens its own stores (reselling channels) through the reselling mode; on the other hand, the manufacturers open official stores (agency channels) through the agency mode. For example, Xiaomi has both Mi JD’s self-operated flagship store and Xiaomi’s official flagship store on the JD platform. Other manufacturers adopting this strategy include Dell, Midea, and Gree. There are two delivery strategies for products sold through agency channels: one is to use third-party enterprise logistics and the other is to use platform logistics. Usually, the service level of platform logistics is higher than that of third-party enterprise logistics. By using platform logistics, the manufacturer can enhance the competitiveness of agency channels and increase the market size of agency-channel products. However, not all manufacturers use platform logistics. Among the above companies, Xiaomi and Dell’s official flagship stores use third-party enterprise logistics, while Midea and Gree’s official flagship stores use JD logistics. This fact raises the question of what causes this phenomenon. This paper aims to find out the reasons behind this fact. In addition, the use of platform logistics by the manufacturer has changed the original competition structure. It is still not clear how this change affects the operational decisions of the platform and the manufacturer.

Existing studies focus on exploring whether a platform should share its logistics with third-party sellers [21,22,23], or whether enterprises should use platform logistics or third-party enterprise logistics when opening online channels [24,25,26,27]. The research objects are mostly logistics strategies between different platforms, or logistics strategies for selling substitutable products on the same platform. As far as we know, there are seldom kinds of literature exploring the logistics strategy when two stores (platform self-operated stores and manufacturer’s official stores) coexist on the same platform from the perspective of the manufacturer. Therefore, we cannot provide theoretical guidance for the manufacturers’ logistics strategy selection under the background of both cooperation and competition between the manufacturer and the platform.

1.2. Research Questions, Contribution Statements, and Organization

Motivated by the aforementioned discussion, this paper considers a sales system consisting of a manufacturer and an e-commerce platform. The manufacturer produces one product and sells it through both resale and agency channels of the platform. For products sold through agency channels, the manufacturer has two logistics strategies to choose from: one is to use low-quality logistics services provided by third-party enterprises, and the other is to use high-quality logistics services provided by the platform. When the manufacturer uses platform logistics, a portion of the market share of the resale channel will shift to the agency channel, which is referred to as the platform logistics effect. This paper mainly investigates the following questions:

- (1)

- What are the optimal decisions of the manufacturer and the platform under the two logistics strategies? What is the difference between optimal decisions?

- (2)

- Under what conditions should manufacturers use platform logistics? How do platform logistics effects and platform logistics prices affect manufacturers’ logistics strategy choices?

- (3)

- What role do platform commission rates and inter-channel competition play in manufacturers’ logistics strategy choices?

- (4)

- Considering the unified pricing of resale channels and agency channels, and the platform controlling the pricing power, what is the manufacturers’ logistics strategy preference?

To answer the above questions, we first construct and solve the game models under the two logistics strategies. Then, we perform a comparative analysis of wholesale price, retail price, sales quantity, and profit under the two logistics strategies. Subsequently, we investigate the influence of platform commission rate and competitive intensity on manufacturers’ logistics strategy preferences. Finally, we carry out an extended study considering the unified pricing of resale channels and agency channels.

The main contributions of this paper are reflected in the following aspects. First, this paper considers that the manufacturer uses two sales modes on the same platform, and investigates the manufacturers’ logistics strategy selection in a co-opetition environment. To the best of our knowledge, little research has been conducted on this aspect. Second, we provide the conditions for manufacturers to use platform logistics, and reveal the effects of platform logistics effects and logistics prices on manufacturers’ logistics strategy preferences. Additionally, we examine the roles that platform commission rates and competitive intensity play in manufacturers’ logistics strategy choices. Third, we give manufacturers’ logistics strategy preferences under the unified pricing of the resale channel and agency channel. Finally, the results obtained in this paper can guide manufacturers and platforms to optimize operational decisions under different logistics service strategies, and help manufacturers make informed decisions for logistics strategies.

The rest of this paper is organized as follows. Section 2 reviews the relevant literature. Section 3 presents the model setting and equilibrium results. Section 4 provides a related analysis and discussion. Section 5 carries out a sensitivity analysis of the relevant parameters. Section 6 conducts an extension study to explore logistics strategies under unified pricing. Section 7 summarizes the main findings and management implications and suggests future research directions. All proofs are provided in Appendix A.

2. Literature Review

Our work is primarily related to two research streams. The first stream encompasses those studies concerning logistics strategies in e-commerce, and the second stream concentrates on the selling mode decision of an e-commerce platform. This section will review the literature on these two streams and discern the differences between this paper and the existing literature.

2.1. Logistics Strategies in E-Commerce

Logistics plays an important role in e-commerce activities, and many scholars have studied logistics strategies in e-commerce. He et al. [22] and Niu et al. [28] studied the logistics resource sharing problem between two e-commerce platforms, wherein one platform had its own logistics system and was willing to share its logistics resources with another platform that lacked its own system. He et al. [13] studied the logistics resource sharing problem in a dual-channel e-commerce supply chain composed of a manufacturer and an e-commerce platform. The manufacturer sells products through the platform’s reselling mode and also builds its own website to directly sell the same products. Considering an e-commerce platform and a merchant selling substitute products through the platform, Qin et al. [23] studied the impact of platform logistics resource sharing on the platform and merchant and explored under what conditions the two parties would reach a logistics sharing agreement. Qin et al. [16] studied the interaction mechanism between e-commerce platform sales modes and logistics strategies, proposing four modes based on two sales modes (reselling mode and agency mode) and two logistics strategies (supplier providing logistics services and platform providing logistics services). The authors mainly explored which mode was optimal and determined the equilibrium scenario through the strategic game between the supplier and the platform. Cao et al. [26] studied the channel selection and logistics strategies of offline enterprises, mainly exploring whether online enterprises should open an online sales channel through an e-commerce platform; and if opened, whether to use third-party logistics or platform logistics. On the basis of the supplier reselling through the e-commerce platform, Zhang and Ma [27] considered introducing an agency mode and studied the optimization decision under different logistics strategies. The authors mainly explored the reaction of the supplier and e-commerce platform to the introduction of the agency mode and which logistics strategy should be adopted. Considering a manufacturer selling two substitute products through an agency mode or a reselling mode and an e-commerce platform, Li et al. [25] studied different logistics strategies between the manufacturer and the platform. Wang et al. [24] studied the channel selection and logistics strategies of the manufacturer. The manufacturer can choose single-channel (reselling mode) sales or dual-channel (reselling mode and agency mode) sales. When choosing dual channels, the manufacturer needs to decide whether to build its own logistics or use platform logistics. Considering an e-commerce supply chain composed of a manufacturer, an e-commerce platform, and a third-party logistics enterprise, He et al. [21] explored the manufacturer’s channel invasion and the platform’s logistics integration strategy.

Unlike the above literature, this paper focuses on the logistics strategies of manufacturers when selling products through two sales modes on e-commerce platforms. The paper most similar to this paper is Wang et al. [20], which explores whether manufacturers should use the high-quality logistics services provided by platforms. However, there are three differences between our research and theirs. First, Wang et al. [20] mainly studied the impacts of external and internal platform logistics costs on manufacturers’ logistics preferences, while this paper focuses on the effects of platform logistics effects and platform logistics prices on manufacturers’ logistics preferences by modeling the increased market size of the agency channel when using platform logistics (which we refer to as the platform logistics effect). Second, Wang et al. [20] constructed a quantity competition model, while this paper constructed a price competition model. We focused on the impacts of the price competition intensity between channels on manufacturers’ logistics preferences and found that the increase in competition intensity will raise the threshold of manufacturers’ use of platform logistics. Third, we conducted a model extension to explore the logistics strategies when the reselling channel and agency channel have unified prices.

2.2. Selling Mode Decision of an E-Commerce Platform

With the development of e-commerce, many scholars have paid attention to the operation decision-making problems related to e-commerce platform retail. For example, under the premise of reselling model, Mantin et al. [29] explored whether the platform should introduce the agency mode. Considering when sellers and platforms are able to strive to increase demand, Hagiu and Wright [30] explored the strategy selection between the two sales modes. Abhishek et al. [31] studied the optimal sales mode of the platform under the premise of the existence of traditional retail channels. Tian et al. [32] investigated how the sales mode decision depends on the order fulfillment cost and competition intensity. Liu et al. [33] explored the impacts of data-driven marketing and market size on the platform’s sales mode preference. Pu et al. [34] investigated the three possible online sales channels of a manufacturer (direct sales channel, agency channel, and reselling channel), while the manufacturer also distributes its products through independent retailers in traditional channels. In addition, Pu et al. [18] studied the online sales mode selection strategies of manufacturers under different offline channel power structures. Considering three channel configurations, i.e., direct sales, agency sales, and dual-channel sales, Zhang et al. [35] explored which channel configuration should be chosen from the perspectives of manufacturers and the entire supply chain. Considering a manufacturer producing the same product sold through two competitive e-commerce platforms, Wei et al. [36] studied the platform’s sales mode selection problem. Shi et al. [37] studied under what conditions manufacturers and retailers should introduce the agency mode. Huang et al. [38] investigated the interactive mechanism between the introduction of proprietary brands and the selection of sales modes by manufacturers. Luo et al. [39] studied how product quality decisions affect the selection of distribution channels (resale only, agency only, and both) on the platform. Zhen and Xu [40] explored the impact of different pricing strategies on the introduction of third-party platform channels by manufacturers and retailers. Liu et al. [41] studied the motivation of manufacturers and e-commerce platforms to adopt hybrid retail strategies. Wang et al. [42] examined the interaction between suppliers’ online channel selection and green investment in e-commerce platforms. Ha et al. [19] studied the impact of service efforts of e-commerce platforms on channel structure. Under the assumption of the existence of a resale mode, Ha et al. [43] explored the interaction between manufacturers’ introduction of agency mode and information sharing of e-commerce platforms. On the basis of retailers reselling products through the platform, considering the selection of sales modes (resale, agency, and direct sales) by manufacturers to introduce dual channels, Wang et al. [17] explored which sales mode manufacturers should choose. Considering three channel structures, namely direct sales from self-built websites, agency sales through e-commerce platforms, and direct sales + agency sales, Siqin et al. [44] explored the channel selection strategies of electronic retailers.

In addition to Ha et al. [19] and Ha et al. [43], the aforementioned literature does not consider the same manufacturer selling products through the two sales modes of e-commerce platforms simultaneously. However, Ha et al. [19] and Ha et al. [43] did not consider the logistics strategy among channels. This paper aims to explore this issue to fill the gap in the existing research.

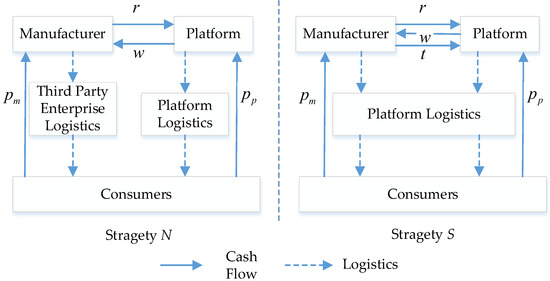

3. Model

We consider a sales system composed of a manufacturer and an e-commerce platform. The e-commerce platform has two sales modes, namely the resale mode and the agency mode. The manufacturer uses both modes to sell the same product. Specifically, through the resale mode, the manufacturer wholesales the product to the platform and then the platform opens a self-operated store (resale channel); through the agency mode, the manufacturer opens an official store (agency channel) through the platform. The platform’s commission rate is . According to the survey of Tmall and JD, the commission rate is within 10%, thus we assume . The platform has an advanced self-operated logistics system, which can quickly deliver products to consumers compared with other third-party enterprise logistics. The products sold through the agency channel have two logistics strategies to choose from: one is to use low-quality logistics services provided by third-party enterprises (Strategy N); the other is to use high-quality logistics services provided by the platform (Strategy S). Here, products sold through the resale channel are always delivered by platform logistics. The model structure is shown in Figure 1.

Figure 1.

Model structure.

Generally, the service level of platform logistics is higher than that of third-party enterprises. Without loss of generality, we assume that the logistics price of third-party enterprises is zero, and the logistics price of the platform is . In addition, we normalize the marginal production cost to zero, which does not affect the results obtained in this paper. The mathematical notation of the model is summarized in Table 1.

Table 1.

Summary of notations.

Following He et al. [13], Liu et al. [23], Niu et al. [41], Qin et al. [45], and Zennyo [46], the demand functions of the agency channel and the resale channel under Strategy N are, respectively,

Here, we normalize the market size of the agency channel and the resale channel to and , respectively. Considering that the market size of the agency channel is usually smaller than that of the resale channel, thus we assume . and are retail prices for agency channels and resale channels, respectively. is the cross-price sensitivity, which reflects the competitive intensity of channels. Usually, the cross-price sensitivity is smaller than the price sensitivity, thus we assume .

Under Strategy S, the demand functions of the agency channel and resale channel are, respectively,

The manufacturer using platform logistics increases the market size of the agency channel. Therefore, when the manufacturer uses platform logistics, the market size of the agency channel will increase from to . Wherein represents the increase in market size when the manufacturer uses platform logistics, which we call the platform logistics effect. Since the total market size of the same product is determined, manufacturers using platform logistics will erode the market size of the resale channel, that is, the resale channel market size will decrease from to .

3.1. Strategy N

Under Strategy N, the manufacturer uses third-party enterprise logistics. Consequently, the objective functions of the manufacturer and the platform are, respectively,

The sequence of events is as follows. In the first stage, the manufacturer decides the wholesale price ; in the second stage, the platform and the manufacturer decide on both the retail price and simultaneously. We solve the model by backward induction and find Lemma 1.

Lemma 1.

The equilibrium results under Strategy N are as follows:

3.2. Strategy S

Under Strategy S, the manufacturer uses platform logistics. Typically, the platform charges the same logistics price for all merchants; in addition, the platform logistics price setting must consider the logistics price of other third-party companies. These factors make the platform unable to set the platform logistics price from the perspective of its profit maximization. Therefore, we assume that the platform logistics price is an exogenous variable. The objective functions of the manufacturer and the platform are, respectively,

The sequence of events is as follows. In the first stage, the manufacturer decides the wholesale price ; in the second stage, the platform and the manufacturer decide on both the retail price and simultaneously. We solve the model by backward induction and find Lemma 2.

Lemma 2.

The equilibrium results under Strategy S are as follows:

Corollary 1.

.

Corollary 1 shows that the wholesale price as well as the resale channel price decrease with the platform logistics effect, while the agency channel price increases. This is because the enhancement of the platform logistics effect means that the market size of the resale channel is reduced. Lower market size forces the platform to lower the resale channel price to increase sales. To incentivize the marketing efforts of the resale channel, the manufacturer can lower the wholesale price to maintain the marginal profit of the resale channel. On the other hand, the enhancement of the platform logistics effect means an increase in the market size of the agency channel. Therefore, the manufacturer can set a higher agency channel price to obtain more revenue.

Corollary 2.

.

Corollary 2 shows that with the increase in the platform logistics price, the agency channel price and the resale channel price both increase, while the wholesale price decreases. Clearly, to maintain profits, the manufacturer will increase the agency channel price to offset the rise in logistics costs. When the agency channel price increases, the platform can take the opportunity to increase the resale channel price. On the one hand, this can narrow the price gap between channels and weaken the intensity of competition; on the other hand, it can increase the marginal profit to procure more returns.

4. Analysis and Discussion

This section compares the equilibrium results of the two logistics strategies. The following proposition illustrates the results of the comparison of the wholesale price, retail price, sales quantity, and profit. The values of and are shown in the Appendix A.

4.1. Comparison of Prices

We find Proposition 1 by comparing wholesale prices under the two logistics strategies.

Proposition 1.

The wholesale price under Strategy S is less than Strategy N, i.e., .

Proposition 1 states that Strategy S leads to a reduction in wholesale price compared to Strategy N. Corollary 1 shows that the wholesale price under Strategy S is affected by the platform logistics effect and price. Transfer of market demand between channels or the rise of platform logistics price reduces the wholesale price. The usage of platform logistics by manufacturers intensifies competition with the resale channel, and to reduce conflict between channels, manufacturers can reduce wholesale prices.

Proposition 2.

(i) The agency channel price under Strategy S is greater than Strategy N, i.e., . (ii) If t > t1, the resale channel price under Strategy S is higher than Strategy N, i.e., ; otherwise, .

Proposition 2 (i) states that the price of the reselling channel is higher under Strategy S than under Strategy N due to a larger platform logistics price and improved shopping experience in the agency channel. Proposition 2 (ii) shows that the price of the reselling channel only increases when the platform logistics price exceeds a certain threshold. The use of platform logistics by the manufacturer causes the market size of the reselling channel to shrink, and the platform raises the price of the reselling channel. However, when the agency channel price is high enough, the platform can raise the price of the reselling channel to reduce the price gap between the two channels and increase unit product profit.

Proposition 3.

If , the marginal profit of the resale channel under Strategy S is larger than Strategy N, i.e., .

Proposition 3 suggests that the marginal profit of the reselling channel is higher under Strategy S compared to Strategy N, but only when the platform logistics price exceeds a certain threshold. This is because, according to Proposition 1, the wholesale price is lower under Strategy S. Additionally, Proposition 2 (ii) highlights that the price of the reselling channel is higher under Strategy S when the platform logistics price is above a certain threshold. As a result, in situations where the platform logistics price is higher, the marginal profit of the reselling channel is higher under Strategy S.

4.2. Comparison of Sales Quantities

By comparing sales quantities under the two logistics strategies, we find Proposition 4.

Proposition 4.

(i) If , the sales quantity of the agency channel under Strategy S is less than Strategy N, i.e., .

(ii) The sales quantity of the resale channel under Strategy S is less than Strategy N, i.e., .

(iii) If , the total sales quantity under Strategy S is less than Strategy N, i.e., .

Proposition 4 (i) indicates that compared to Strategy N, if the platform logistics price is greater than a certain threshold, the sales quantity of the agency channel under Strategy S will be smaller. This is because the large market size of the agency channel under Strategy S leads to a higher price, causing a decrease in demand. Proposition 4 (ii) reveals that the sales quantity of the resale channel under Strategy S is always larger than in Strategy N. This is mainly due to the reduction in the market size of the resale channel under Strategy S. Proposition 4 (iii) indicates that when the platform logistics price is greater than a certain threshold, the total sales quantity under Strategy N is greater than that of Strategy S. In conclusion, the platform logistics price is a decisive factor in determining the overall product sales under the two logistics strategies.

4.3. Comparison of Profits

We first compare the manufacturer’s profits under the two logistics strategies and find Proposition 5.

Proposition 5.

(i) If

, the manufacturer’s profit under Strategy S is always lower than Strategy N, i.e.,

.

(ii) when , if , the manufacturer’s profit under Strategy S is lower than Strategy N, i.e., ; If , the manufacturer’s profit under Strategy S is higher than Strategy N, i.e., .

Proposition 5 depicts the relationship between the profits of manufacturers under the two logistics strategies. It can be seen that the platform logistics effect plays a crucial role. Specifically, when , the profits of the manufacturers under Strategy N are always greater than those under Strategy S. That is to say, even if all the market share of the reselling channel is transferred to the agency channel, Strategy S is still unfavorable to the manufacturers. When and , the manufacturers under Strategy S can recoup more profits.

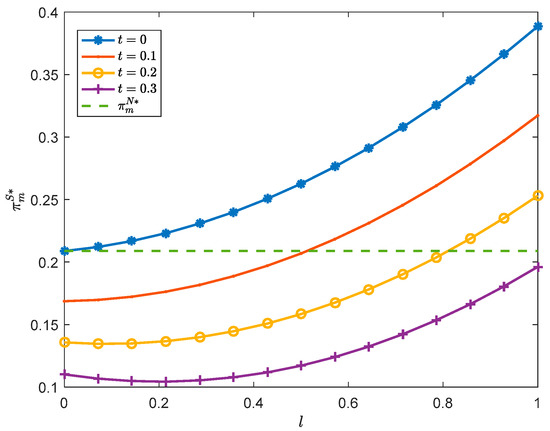

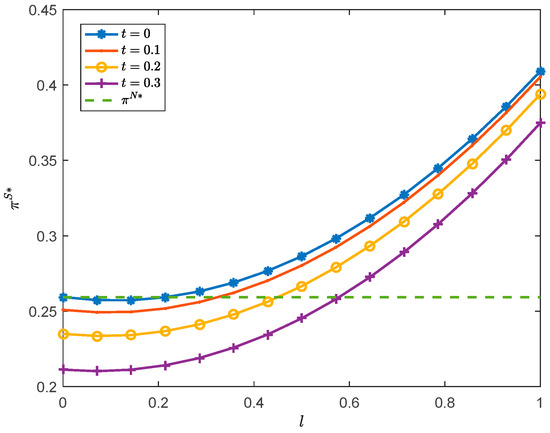

To better illustrate the conclusion of Proposition 5, we use numerical simulations to depict the relationship between the profits of manufacturers under the two logistics strategies and the platform logistics effect. The parameters are set as follows: . We produce Figure 2 and Figure 3.

Figure 2.

The relationship between the manufacturers’ profit and .

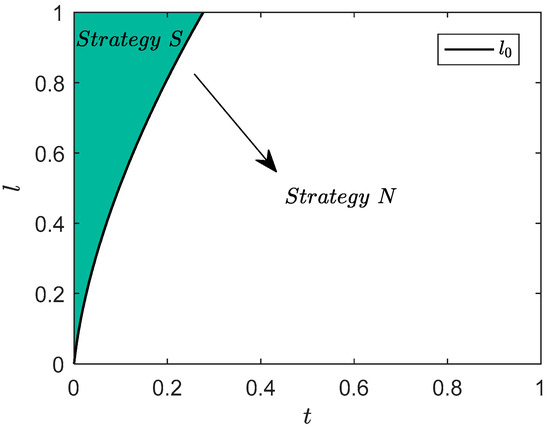

Figure 3.

Manufacturers’ logistics strategy preferences.

As shown in Figure 2, if when the platform logistics price is zero, the manufacturer’s profit under Strategy S gradually increases with the enhancement of the platform logistics effect, and it is always higher than that under Strategy N. This implies that when the cost of using platform logistics is equal to the cost of using third-party enterprise logistics, the manufacturer would prefer to use platform logistics. However, due to the efficiency of platform logistics, the corresponding usage costs are higher. Next, we analyze the situation where the platform logistics price is higher than zero.

If and , the platform logistics price and platform logistics effect are given, the manufacturer’s profit under Strategy S will still increase with the platform logistics effect. However, when the platform logistics price is high (i.e., ), the manufacturer’s profit under Strategy S will only be greater than Strategy N when the platform logistics effect is relatively strong. Intuitively, this implies that larger platform logistics prices will lead to decreased manufacturer profits, but when the platform logistics effect is large enough, manufacturers using platform logistics can still gain improved performance.

If , the analysis of the manufacturer’s profits derived from Strategies S and N reveals that, under an enhanced platform logistics effect, the former initially decreases and then increases, always remaining lower than the latter. This implies that raising the platform logistics price does not yield higher profits for the manufacturer; even if the resale channel’s market share is entirely transferred to the agency channel, the manufacturer cannot gain more profit from the utilization of platform logistics.

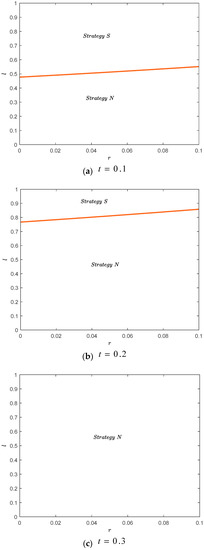

In addition, we find that the manufacturer’s profit under Strategy S is negatively correlated with the platform logistics price; that is, an increase in the platform logistics price will result in a decrease in the manufacturer’s profit. This result is intuitive. Furthermore, as shown in Figure 3, when is within a certain range, the threshold is positively correlated . This suggests that if the platform logistics price is high, the manufacturer will prefer Strategy S only when the platform logistics effect is sufficiently large. Moreover, if the platform logistics price is high enough, the manufacturer will always prefer Strategy N. Additionally, if the platform logistics effect is constant, the manufacturer’s strategic preference will shift from S to N as the platform logistics price increases.

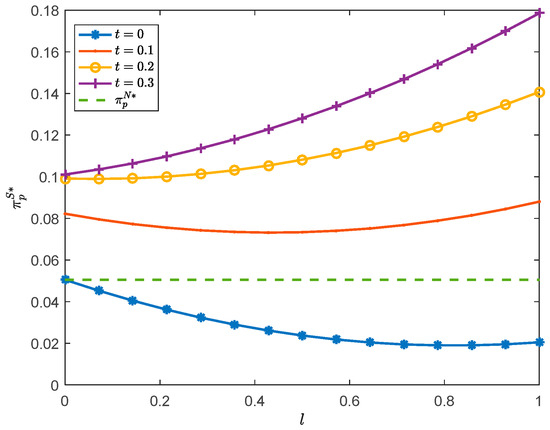

We can further utilize numerical simulations to analyze the platforms and total profits under two different logistics strategies, and use Figure 4 and Figure 5 to demonstrate our findings.

Figure 4.

Relationship between the platform’s profit and .

Figure 5.

Relationship between total profit and .

From Figure 4, when , the platform’s profit under Strategy S decreases with the platform logistics effect, and it is always less than Strategy N. This is intuitively understandable, as without the benefit of logistics services, the market size of the resale channel would be small, thus leading to a decrease in the platform’s revenue. However, when , the platform’s profit under Strategy S decreases initially and then increases with the platform logistics effect, and it is always greater than Strategy N. This is because when the platform logistics effect is strong enough, the platform can garner more commission income. Based on the results from , we can conclude that if the platform logistics price is low, the platform’s profit under Strategy S is higher than that of Strategy N, regardless of the size of the platform logistics effect. Additionally, if and , the platform logistics price is high, the platform profit under Strategy S increases with the platform logistics effect, and is always greater than that of Strategy N. Thus, when the platform logistics price is high, the platform will always prefer Strategy S.

As illustrated in Figure 5, if , the total profit under Strategy S decreases or increases with the platform logistics effect. Moreover, when , if the platform logistics effect is sufficiently high, the total profit under Strategy S is greater than Strategy N, indicating that if the platform logistics price is equal to the logistics price of third-party enterprises and more market share is transferred to the agency channel, then the entire sales system will reap more benefits. Additionally, when or , the total profit under Strategy S is positively correlated with the platform logistics effect and is always greater than Strategy N, implying that when the platform logistics price is within a certain reasonable range, dual cooperation between the manufacturer and the platform will generate more profits.

5. Sensitivity Analysis

In this section, we investigate how commission rate and competitive intensity influence manufacturers’ choices in terms of logistics strategies. We aim to assess how these two factors affect the selection of logistics strategies by manufacturers.

5.1. Effect of Commission Rate on Manufacturers’ Strategic Preferences

The parameters are set as follows: . We explore the effect of commission rate on manufacturers’ logistics strategy preferences under different values of platform logistics prices and analyze the results in Figure 6.

Figure 6.

The impact of commission rate on manufacturers’ logistics strategy preferences.

Figure 6 shows the relationship between and under different levels of . The results demonstrate a positive correlation between and , the two variables, indicating that as the commission rate increases, the manufacturer is more likely to select Strategy S when the platform logistics cost is high. However, as the platform logistics cost increases, the probability of the manufacturer preferring Strategy S decreases, indicating that the platform logistics cost must be sufficiently small for the manufacturer to find the agency channel profitable. When the cost of platform logistics is sufficiently high, manufacturers may switch from Strategy S to Strategy N. This suggests that an increase in the commission rate can alter the manufacturers’ preference for Strategy S, as a higher cost of platform logistics will make it more favorable.

5.2. The Impact of Competitive Intensity on Manufacturers’ Strategic Preferences

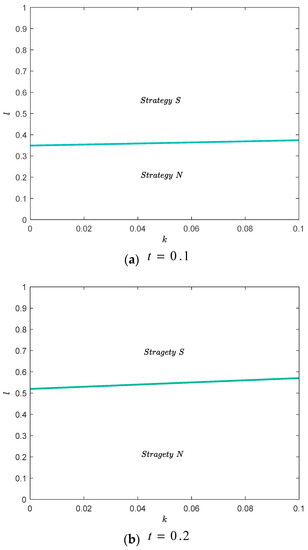

The parameters are set as follows: . We examine how varying levels of competitive intensity and platform logistics prices influence manufacturers’ logistics strategy preferences, as illustrated in Figure 7.

Figure 7.

Effect of competitive intensity on manufacturers’ logistics strategy preferences.

Figure 7 depicts the relationship between and under different values of . We observe a positive relationship between and . That is, when the competitive intensity increases, the manufacturer will be more likely to prefer Strategy S due to the greater platform logistics effect. However, as the price of platform logistics increases, the probability of the manufacturer preferring Strategy S decreases, which is consistent with the findings presented in Figure 6. In conclusion, we can see that an increase in competitive intensity, as well as a higher commission rate, will make it more advantageous for manufacturers to prefer Strategy S.

6. Unified Pricing Decision

In this section, we consider the case where both the resale and agency channels are uniformly priced. As platforms generally maintain a dominant position in channel pricing, dual-channel pricing is likely to be determined by the platform, denoted as . For the manufacturer, we use the superscript EN to indicate the use of third-party enterprise logistics, and the superscript ES to indicate the use of platform logistics.

Under Strategy EN, the demand functions of the agency channel and the resale channel are, respectively,

Furthermore, the objective function of the manufacturer and platform are, respectively,

Under Strategy ES, the demand functions of the agency channel and the resale channel are, respectively,

Furthermore, the objective function of the manufacturer and platform are, respectively,

The sequence of events can be outlined as follows: initially, the manufacturer sets a wholesale price ; then, the platform determines a retail price based on Lemmas 3 and 4, which is obtained by solving the model.

Lemma 3.

The equilibrium results under Strategy EN are as follows:

Lemma 4.

The equilibrium results under Strategy ES are as follows:

By comparing the optimal decisions under the two logistics strategies, we find Proposition 6.

Proposition 6.

The optimal decisions under Strategy ES and Strategy EN satisfy the following relationship:

Under Strategy ES, the manufacturer has to pay the corresponding logistics costs, which can be recouped by increasing the wholesale price. This means that the wholesale price under Strategy ES will be greater than the wholesale price under Strategy EN, i.e., . At the same time, in order to maintain sales, the platform will lower the retail price, resulting in a lower retail price under Strategy ES than under Strategy EN, i.e., .

By comparing the sales quantities under the two logistics strategies, we find Proposition 7.

Proposition 7.

The sales quantities under Strategy ES and Strategy EN satisfy the following relationship:

,

,

.

From Proposition 6, it can be seen that the retail price under Strategy ES is lower than that of Strategy EN, and the market size of the agency channel under Strategy ES is large. Therefore, the sales quantity of the agency channel under Strategy ES is greater than that of Strategy EN, i.e., . For the resale channel, the retail price decreases under the ES Strategy, resulting in an increase in sales quantity. However, due to the reduced market size of the resale channel, the sales quantity of the resale channel under the ES Strategy is lower than that of Strategy EN, i.e., . The total sales quantity under Strategy ES is higher than that under Strategy EN, due to its smaller retail price, i.e., .

By comparing the profits under the two logistics strategies, we find Proposition 8. The values of and are shown in Appendix A.

Proposition 8.

The firms’ profits under Strategy ES and Strategy EN satisfy the following relationship:

(i) If

, the manufacturer’s profit under Strategy ES is higher than Strategy EN, i.e.,

; otherwise, we have

.

(ii) If

, the platform’s profit under Strategy ES is lower than Strategy EN, i.e.,

; otherwise, we have

.

(iii) The total profit under Strategy ES is always higher than Strategy EN, i.e., .

From Proposition 8 (i), when the platform logistics effect is below a certain threshold, the manufacturer can gain more benefits via Strategy ES. This is due to the fact that when a higher market share is shifted to the agency channel, the manufacturer’s revenue from wholesale products decreases. Moreover, the retail price, being determined by the platform, may decrease even if the agency channel’s market share grows, which does not necessarily result in an increase in agency channel revenue. Therefore, if and only if the platform logistics effect is low, the manufacturer will opt for Strategy ES.

Proposition 8 (ii) shows that when the platform logistics effect is greater than a certain threshold, the platform can obtain more benefits under Strategy ES. Specifically, the platform can obtain higher profits from three sources: sales revenue from the resale channel, commission revenue, and logistics service revenue. The increased market size of the agency channel reduces the sales in the resale channel, thus resulting in reduced product profit margins. Nonetheless, the platform can still benefit from the increased commission income and the additional income from logistics services.

Proposition 8 (iii) states that the sales system under Strategy ES can generate more profit. This is attributed to the stronger cooperation between the manufacturer and the platform due to the use of platform logistics, which in turn eliminates the double marginal effect and, consequently, leads to enhanced performance.

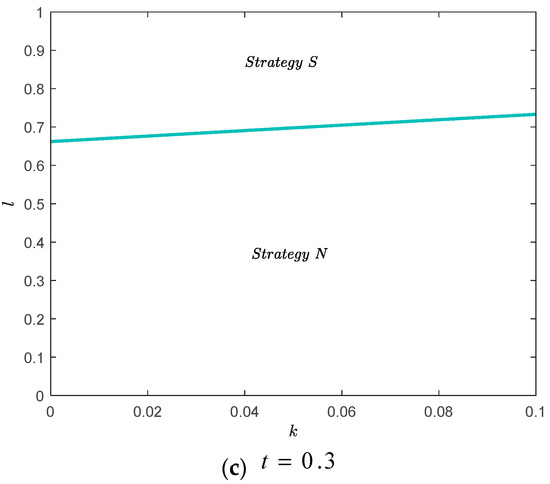

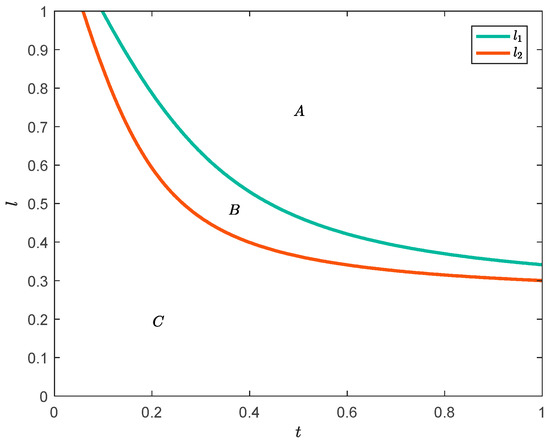

Figure 8 presents the relationship between the logistics strategy preference of the firm and the platform logistics effect across different values of . The results indicate that both and as increases. Proposition 8 reveals that if , the manufacturer prefers Strategy ES, whereas the platform prefers Strategy ES if . Based on these findings, it is evident that in area A, the manufacturer prefers Strategy EN and the platform prefers Strategy ES; in area B, both the manufacturer and the platform prefer Strategy ES; in area C, the manufacturer prefers Strategy ES, while the platform prefers Strategy EN. These results suggest that as the platform logistics price increases, the threshold at which the manufacturer prefers Strategy ES increases, while the threshold at which the platform prefers Strategy ES decreases.

Figure 8.

Logistics strategy preferences of manufacturers and platforms ().

7. Conclusions

This paper discusses a sales system consisting of a manufacturer and an e-commerce platform that offers two sales modes. The platform has its own logistics system that provides quick and efficient delivery services for consumers. The logistics services are also offered to third-party sellers. The manufacturer can choose between two logistics strategies for products sold in the agency channel: third-party enterprise logistics (Strategy N) or platform logistics (Strategy S). This paper first constructs a game model and obtains the equilibrium results under the two logistics strategies. It then compares and analyzes the wholesale price, retail price, sales, and profits under the two logistics strategies. This paper also explores the impact of commission rate and competition intensity on the manufacturer’s logistics strategy preference. Finally, this paper considers the case of unified pricing of the agency channel and the resale channel and conducts extension research.

This paper presents several key findings and managerial implications. First, implementing Strategy S compared to Strategy N results in a lower wholesale price and a higher agency channel price. This suggests that leveraging the platform’s logistics services can lead to cost savings in the wholesale stage, while allowing for a higher retail price to be offered to consumers through the platform. However, the crucial finding is that the resale channel price and marginal profit experience an increase only when the platform logistics price surpasses a specific threshold. This implies that there is a critical point at which the benefits of the platform’s logistics services outweigh the associated costs. For instance, consider a case study involving an e-commerce marketplace. When the platform logistics price is below the threshold, the higher costs associated with utilizing the platform’s logistics network may outweigh any potential benefits. In such cases, Strategy N may be more financially advantageous, resulting in a higher marginal profit. Conversely, once the platform logistics price exceeds the threshold, there are notable advantages to utilizing the platform’s logistics services. These benefits can include improved efficiency, faster delivery times, and enhanced customer satisfaction. As a result, the resale channel price can be increased to justify the added value of the platform’s logistics support. This, in turn, contributes to an increase in the brand’s marginal profit. In summary, while Strategy S yields a lower wholesale price and a higher agency channel price compared to Strategy N, the actual increase in resale channel price and marginal profit is contingent on the platform logistics price surpassing a specific threshold. Thus, businesses must carefully evaluate the economics associated with platform logistics services to determine the optimal strategy.

Second, when the manufacturer adopts Strategy S and leverages the e-commerce platform’s logistics services, it benefits from the platform’s extensive distribution network and streamlined fulfillment processes. Initially, there may be a decrease in resale channel sales due to the manufacturer bypassing agency channels. However, as the platform logistics price remains below a certain threshold, the manufacturer experiences an increase in agency channel sales. This is because the platform’s logistics services enable wider product availability, faster delivery times, and greater visibility on the platform, attracting more consumers to purchase through the agency channel. Additionally, the combination of increased agency channel sales and resale channel sales (albeit lower) contributes to a boost in total sales. The platform’s logistics services help reach new customers and enhance the overall market reach, leading to an overall increase in sales volume and revenue for the manufacturer. It is important to note that the specific threshold for the platform logistics price may vary depending on factors such as product type, market demand, competition, and pricing dynamics. Therefore, it is necessary to analyze the specific industry and market conditions to determine the optimal threshold and assess the impact of Strategy S on resale channel sales, agency channel sales, and total sales.

Third, this paper highlights the importance of the platform logistics effect and identifies a threshold beyond which the manufacturer prefers Strategy S. Furthermore, this paper finds that this preference threshold increases in relation to the commission rate and competition intensity. To illustrate this conclusion, we can consider the example of e-commerce platforms and their relationship with third-party sellers. In a scenario where the commission rate charged by the platform is low and there is minimal competition, manufacturers or sellers may opt for Strategy N. This allows them to retain higher profit margins by avoiding the platform’s commission fees. However, as the commission rate and competition intensity increase, the platform logistics effect becomes more pronounced. The platform’s services, such as order fulfillment, warehousing, and customer reach, have become increasingly valuable for manufacturers. This is particularly evident when competition in the market intensifies, as the platform’s wide customer base and efficient logistics network can help manufacturers gain access to a larger audience and streamline their operations. Once the commission rate and competition intensity surpass a certain threshold, manufacturers may shift their preference toward Strategy S, which involves utilizing the platform’s logistics services. Despite the commission fees, the benefits provided by the platform, such as broader market exposure and streamlined operations, outweigh the costs. Manufacturers can tap into the platform’s existing logistics infrastructure, which is often more efficient and cost-effective than establishing their own. The actual threshold for preferring Strategy S will vary depending on factors such as the specific industry, market dynamics, and individual manufacturer’s circumstances. Therefore, it is crucial for manufacturers to carefully evaluate the platform logistics effect in relation to the commission rate and competition intensity to make informed decisions. Overall, the case of e-commerce platforms and third-party sellers illustrates how the platform logistics effect and its threshold can influence manufacturers’ preferences for Strategy N or Strategy S based on the commission rate and competition intensity.

Finally, this paper finds that adopting Strategy ES, which combines elements of both the resale and agency channels, can result in several outcomes. Specifically, it leads to higher wholesale prices, agency channel sales, total sales, and profits, but with lower resale channel sales. To elaborate on this conclusion, consider a hypothetical example of a consumer electronics manufacturer that sells its products through both resale channels and agency channels. When implementing Strategy ES, the manufacturer sets a unified price for its products across both channels. By doing so, it can achieve higher wholesale prices, as retailers perceive the higher price as a reflection of product quality or exclusivity. This allows the manufacturer to capture a higher profit margin on each unit sold to retailers. Moreover, the adoption of Strategy ES tends to boost agency channel sales. With a unified price, consumers may view the manufacturer’s official store or website as a reliable and trustworthy source. They may be willing to pay the higher price, expecting better service, product support, or an enhanced buying experience. This increased trust and perceived value can drive higher sales through the agency channel. As a result of higher wholesale and agency channel sales, the total sales volume of the manufacturer’s products is likely to increase under Strategy ES. This could be driven by a combination of higher retailer demand (based on the perception of higher product value) and increased consumer confidence in the manufacturer’s direct sales channel. While higher wholesale prices, agency channel sales, and total sales contribute to increased profits, it is important to note that adopting Strategy ES may lead to lower resale channel sales. Resale channels, such as third-party retailers or distributors, might face challenges in competing with the manufacturer’s unified pricing strategy. Consumers who can purchase the product directly from the manufacturer at a consistent price may be less inclined to buy from other retailers offering the same product at potentially higher prices. It is worth noting that the specific outcomes of implementing Strategy ES will depend on various factors, such as market conditions, product attributes, and consumer preferences. Therefore, manufacturers should carefully analyze their industry and customer base to determine the appropriate pricing and channel strategies that align with their goals and market dynamics. In summary, the analysis indicates that implementing Strategy ES with unified pricing can lead to higher wholesale prices, agency channel sales, total sales, and profits. However, it may have the trade-off of lower resale channel sales as consumers are more likely to purchase directly from the manufacturer’s preferred channels.

Consequently, we suggest three possible research directions for further exploration. First, it would be interesting to study how manufacturers’ logistics strategies are affected by a different pricing power between the platform and the manufacturer. Second, it would be valuable to examine logistics strategies under different competitive intensities, as competition may be further intensified when the manufacturer uses platform logistics. Finally, it would be interesting to explore how competition between offline and online channels affects manufacturers’ logistics strategies.

Author Contributions

Conceptualization, H.L. and Y.Z.; software, Y.Z.; validation, H.L.; formal analysis, H.L. and Y.Z.; investigation, H.L. and Y.Z.; writing—original draft preparation, H.L. and Y.Z.; writing—review and editing, H.L. and Y.Z.; visualization, H.L. and Y.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the General Project of Humanities and Social Sciences Research in Henan Province (NO. 2023-ZDJH-028), the Scientific Research Team Plan of Zhengzhou University of Aeronautics (NO. 23ZHTD01013), the National Natural Science Foundation of China (NO. 12171441), the General Project of Humanities and Social Sciences of the Ministry of Education of China (NO. 21YJC630077), the Science and Technology Research Project of Henan Province (NO. 222102210115).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Proof of Lemma 1.

From , , we know is concave and is concave in , respectively. Let , , we obtain

Substituting into , we get

and know is concave in . Let , we obtain the optimal wholesale price . Substituting into , we find the optimal retail price , respectively. □

Proof of Lemma 2.

From , , we know is concave in and is concave in , respectively. Let , , we obtain

Substituting into , we get

and know is concave in . Let , we obtain the optimal wholesale price . Substituting into , we find the optimal retail price , respectively. □

Proof of Corollary 1.

□

Proof of Corollary 2.

We can get

□

Proof of Proposition 1.

□

Proof of Proposition 2.

- (i)

- (ii)

- From , we get

Therefore, we have if and otherwise. □

Proof of Proposition 3.

- From , we get

Therefore, if , then . □

Proof of Proposition 4.

- (i)

- From , we find . Therefore, if , then ; Otherwise, .

- (ii)

- .

- (iii)

- From , we find .

Therefore, if , then ; Otherwise, . □

Proof of Proposition 5.

- (i)

- We can obtainwhere,Let . From , , we know that there exists a unique positive root to , and denote it as . Therefore, if , ; otherwise, . □

Proof of Lemma 3.

From , we know is concave in . Let , we obtain .

Substituting into , we find and know is concave in . Let , we obtain the optimal wholesale price . Substituting into , we obtain the optimal retail price . □

Proof of Lemma 4.

From , we know is concave in . Let , we obtain .

Substituting into , we find and know is concave in . Let , we obtain the optimal wholesale price . Substituting into , we obtain the optimal retail price . □

Proof of Proposition 6.

- (i)

- We can find . Since , we have .

- (ii)

- . □

Proof of Proposition 7.

- (i)

- .

- (ii)

- .

- (iii)

- . □

Proof of Proposition 8.

- (i)

- We can get , where, , , .

Let . From , , we know that there exists a unique positive root to and denote it as . Therefore, if , then ; otherwise, .

- (ii)

- We can find , where, , , .

Let . From , , we know that there exists a unique positive root to and denote it as . Therefore, if , then ; otherwise,.

- (iii)

- We can find , that is . □

References

- Kittaka, Y.; Matsushima, N.; Saruta, F. Negative effect of price-matching policy on traditional retailers in a dual-channel supply chain with different content formats. Transp. Res. Part E Logist. Transp. Rev. 2022, 161, 102682. [Google Scholar] [CrossRef]

- Li, G.; Li, L.; Sun, J. Pricing and service effort strategy in a dual-channel supply chain with showrooming effect. Transp. Res. Part E Logist. Transp. Rev. 2019, 126, 32–48. [Google Scholar] [CrossRef]

- Shao, X. Omnichannel retail move in a dual-channel supply chain. Eur. J. Oper. Res. 2021, 294, 936–950. [Google Scholar] [CrossRef]

- Liu, H.; Kou, X.; Liu, H.; Gao, H.; Zhao, X. Which operating mode is the best? Consider different combinations of sales contracts and service methods. Comput. Ind. Eng. 2022, 168, 108069. [Google Scholar] [CrossRef]

- Li, M.; Shen, L.; Huang, G.Q. Blockchain-enabled workflow operating system for logistics resources sharing in E-commerce logistics real estate service. Comput. Ind. Eng. 2019, 135, 950–969. [Google Scholar] [CrossRef]

- Zheng, K.; Zhang, Z.; Song, B. E-commerce logistics distribution mode in big-data context: A case analysis of JD. COM. Ind. Mark. Manag. 2019, 86, 154–162. [Google Scholar] [CrossRef]

- Xu, G.; Qiu, X.; Fang, M.; Kou, X.; Yu, Y. Data-driven operational risk analysis in E-Commerce Logistics. Adv. Eng. Inform. 2019, 40, 29–35. [Google Scholar] [CrossRef]

- Barenji, A.V.; Wang, W.M.; Li, Z.; Guerra-Zubiaga, D.A. Intelligent E-Commerce Logistics Platform Using Hybrid Agent Based Approach. Transp. Res. Part E Logist. Transp. Rev. 2019, 126, 15–31. [Google Scholar] [CrossRef]

- Xu, X.; Zhang, M.; Chen, L.; Yu, Y. The region-cap allocation and delivery time decision in the marketplace mode under the cap-and-trade regulation. Int. J. Prod. Econ. 2022, 247, 108407. [Google Scholar] [CrossRef]

- Xu, F.; Wang, H. Ordering and transferring model of dual-channel supply chain with delivery time difference. Adv. Eng. Inform. 2021, 49, 101311. [Google Scholar] [CrossRef]

- Noori-Daryan, M.; Taleizadeh, A.A.; Jolai, F. Analyzing pricing, promised delivery lead time, supplier-selection, and ordering decisions of a multi-national supply chain under uncertain environment. Int. J. Prod. Econ. 2019, 209, 236–248. [Google Scholar] [CrossRef]

- Ye, F.; Xie, Z.; Tong, Y.; Li, Y. Promised delivery time: Implications for retailer’s optimal sales channel strategy. Comput. Ind. Eng. 2020, 144, 106474. [Google Scholar] [CrossRef]

- He, P.; Wen, J.; Ye, S.; Li, Z. Logistics service sharing and competition in a dual-channel e-commerce supply chain. Comput. Ind. Eng. 2020, 149, 106849. [Google Scholar] [CrossRef]

- Lai, G.; Liu, H.; Xiao, W.; Zhao, X. “Fulfilled by Amazon”: A Strategic Perspective of Competition at the E-Commerce Platform. Manuf. Serv. Oper. Manag. 2022, 24, 1406–1420. [Google Scholar] [CrossRef]

- Yu, Y.; Wang, X.; Zhong, R.Y.; Huang, G.Q. E-commerce Logistics in Supply Chain Management: Practice Perspective. Procedia CIRP 2016, 52, 179–185. [Google Scholar] [CrossRef]

- Qin, X.; Liu, Z.; Tian, L. The optimal combination between selling mode and logistics service strategy in an e-commerce market. Eur. J. Oper. Res. 2020, 289, 639–651. [Google Scholar] [CrossRef]

- Wang, T.-Y.; Chen, Z.-S.; Govindan, K.; Chin, K.-S. Manufacturer’s selling mode choice in a platform-oriented dual channel supply chain. Expert Syst. Appl. 2022, 198, 116842. [Google Scholar] [CrossRef]

- Pu, X.; Zhang, S.; Ji, B.; Han, G. Online channel strategies under different offline channel power structures. J. Retail. Consum. Serv. 2021, 60, 102479. [Google Scholar] [CrossRef]

- Ha, A.Y.; Tong, S.; Wang, Y. Channel Structures of Online Retail Platforms. Manuf. Serv. Oper. Manag. 2021, 24, 1547–1561. [Google Scholar] [CrossRef]

- Wang, P.; Du, S.; Hu, L.; Tang, W. Logistics choices in a platform supply chain: A co-opetitive perspective. J. Oper. Res. Soc. 2022, 74, 93–111. [Google Scholar] [CrossRef]

- He, P.; He, Y.; Tang, X.; Ma, S.; Xu, H. Channel encroachment and logistics integration strategies in an e-commerce platform service supply chain. Int. J. Prod. Econ. 2021, 244, 108368. [Google Scholar] [CrossRef]

- He, P.; Zhang, S.; He, C. Impacts of logistics resource sharing on B2C E-commerce companies and customers. Electron. Commer. Res. Appl. 2019, 34, 100820. [Google Scholar] [CrossRef]

- Qin, X.; Liu, Z.; Tian, L. The strategic analysis of logistics service sharing in an e-commerce platform. Omega 2019, 92, 102153. [Google Scholar] [CrossRef]

- Wang, L.; Chen, J.; Lu, Y. Manufacturer’s Channel and Logistics Strategy in a Supply Chain. Int. J. Prod. Econ. 2022, 246, 108415. [Google Scholar]

- Li, D.; Liu, Y.; Fan, C.; Hu, J.; Chen, X. Logistics service strategies under different selling modes. Comput. Ind. Eng. 2021, 162, 107684. [Google Scholar] [CrossRef]

- Cao, K.; Xu, Y.; Wu, Q.; Wang, J.; Liu, C. Optimal channel and logistics service selection strategies in the e-commerce context. Electron. Commer. Res. Appl. 2021, 48, 101070. [Google Scholar] [CrossRef]

- Zhang, C.; Ma, H.-M. Introduction of the marketplace channel under logistics service sharing in an e-commerce platform. Comput. Ind. Eng. 2021, 163, 107724. [Google Scholar] [CrossRef]

- Niu, B.; Xie, F.; Chen, L.; Xu, X. Join logistics sharing alliance or not? Incentive analysis of competing E-commerce firms with promised-delivery-time. Int. J. Prod. Econ. 2019, 224, 107553. [Google Scholar] [CrossRef]

- Mantin, B.; Krishnan, H.; Dhar, T. The Strategic Role of Third-Party Marketplaces in Retailing. Prod. Oper. Manag. 2014, 23, 1937–1949. [Google Scholar] [CrossRef]

- Hagiu, A.; Wright, J. Marketplace or Reseller? Manag. Sci. 2015, 61, 184–203. [Google Scholar] [CrossRef]

- Abhishek, V.; Jerath, K.; Zhang, Z.J. Agency Selling or Reselling? Channel Structures in Electronic Retailing. Manag. Sci. 2016, 62, 2259–2280. [Google Scholar] [CrossRef]

- Tian, L.; Vakharia, A.J.; Tan, Y.; Xu, Y. Marketplace, Reseller, or Hybrid: Strategic Analysis of an Emerging E-Commerce Model. Prod. Oper. Manag. 2018, 27, 1595–1610. [Google Scholar] [CrossRef]

- Liu, W.; Yan, X.; Li, X.; Wei, W. The impacts of market size and data-driven marketing on the sales mode selection in an Internet platform based supply chain. Transp. Res. Part E Logist. Transp. Rev. 2020, 136, 101914. [Google Scholar] [CrossRef]

- Pu, X.; Sun, S.; Shao, J. Direct Selling, Reselling, or Agency Selling? Manufacturer’s Online Distribution Strategies and Their Impact. Int. J. Electron. Commer. 2020, 24, 232–254. [Google Scholar]

- Zhang, C.; Li, Y.; Ma, Y. Direct selling, agent selling, or dual-format selling: Electronic channel configuration considering channel competition and platform service. Comput. Ind. Eng. 2021, 157, 107368. [Google Scholar] [CrossRef]

- Wei, J.; Lu, J.; Wang, Y. How to choose online sales formats for competitive e-tailers. Int. Trans. Oper. Res. 2020, 28, 2055–2080. [Google Scholar] [CrossRef]

- Shi, D.; Wang, M.; Li, X. Strategic introduction of marketplace platform and its impacts on supply chain. Int. J. Prod. Econ. 2021, 242, 108300. [Google Scholar] [CrossRef]

- Huang, L.; Huang, Z.; Liu, B. Interacting with strategic waiting for store brand: Online selling format selection. J. Retail. Consum. Serv. 2022, 67, 102987. [Google Scholar] [CrossRef]

- Luo, H.; Zhong, L.; Nie, J. Quality and Distribution Channel Selection on a Hybrid Platform. Transp. Res. Part E Logist. Transp. Rev. 2022, 163, 102750. [Google Scholar] [CrossRef]

- Zhen, X.; Xu, S. Who Should Introduce the Third-Party Platform Channel under Different Pricing Strategies? Eur. J. Oper. Res. 2022, 299, 168–182. [Google Scholar] [CrossRef]

- Liu, W.; Liang, Y.; Tang, O.; Ma, X. Channel Competition and Collaboration in the Presence of Hybrid Retailing. Transp. Res. Part E: Logist. Transp. Rev. 2022, 160, 102658. [Google Scholar] [CrossRef]

- Wang, J.; Yan, Y.; Du, H.; Zhao, R. The optimal sales format for green products considering downstream investment. Int. J. Prod. Res. 2019, 58, 1107–1126. [Google Scholar] [CrossRef]

- Ha, A.Y.; Luo, H.; Shang, W. Supplier Encroachment, Information Sharing, and Channel Structure in Online Retail Platforms. Prod. Oper. Manag. 2021, 31, 1235–1251. [Google Scholar] [CrossRef]

- Siqin, T.; Choi, T.M.; Chung, S.H. Optimal E-Tailing Channel Structure and Service Contracting in the Platform Era. Transp. Res. Part E Logist. Transp. Rev. 2022, 160, 102614. [Google Scholar] [CrossRef]

- Niu, B.; Li, Q.; Mu, Z.; Chen, L.; Ji, P. Platform logistics or self-logistics? Restaurants’ cooperation with online food-delivery platform considering profitability and sustainability. Int. J. Prod. Econ. 2021, 234, 108064. [Google Scholar] [CrossRef]

- Zennyo, Y. Strategic contracting and hybrid use of agency and wholesale contracts in e-commerce platforms. Eur. J. Oper. Res. 2020, 281, 231–239. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).