1. Introduction

As omni-channel retailing develops, Internet financial technology based on blockchain, big data, artificial intelligence and the Internet of Things has provided an important impetus for the channel marketing of banks, and omni-channel has found wide range of applications [

1]. With the help of Internet fintech, banks can use different channels to communicate simultaneously with customers, providing them with high-quality products and services [

2]. Banks achieve this through an “online + offline” cross-channel marketing framework, which allows for more accurate customer acquisition, improved operation and management efficiency [

3], and the greatest information availability, visibility and consistency for customers [

4,

5]. Omni-channel marketing, on the other hand, is the integration and upgrading of banks’ cross-channel marketing [

6]. It is customer-oriented, centers on customer experience and integrates all bank channels for better marketing management.

The emergence of the omni-channel retailing model, due to the development of mobile internet, has brought about distinctive characteristics compared to traditional marketing channels. This has stimulated customers’ acceptance of all channels, bringing changes to the influencing factors on customers’ channel selection decisions [

7]. Omni-channel retailing breaks down the barriers of customer brand contact points, and the channel decision-making process is more complicated. “Customer perception channel integration—customer empowerment—trust and satisfaction—customer patronage willingness” was proposed as a channel decision-making process [

8]. The influence of competing channels’ strategies, promotion, product, price, transaction information, information acquisition, order execution, and customer service should be included in the channel-selecting process [

9,

10,

11]. There are external and internal drivers of customer behavior in the omni-channel environment [

12]. The external drivers include channel availability, security, and time pressure; internal ones include ease-of-use, enjoyment of the network, and hedonic orientation [

13]. Investigation found the differences in customer purchase intentions under omni-channel and pure online retailing, and found that product type (functional and expressive), product life cycle (durable and non-durable) and the type of retailer all affect the customer’s channel choice [

14]. In addition, factors such as customer preferences, consumer experience technology, and channel characteristics affect the customer’s channel choice. If an enterprise wishes to succeed in omni-channel retailing, it must match the advantages of the selected channel with the characteristics of the products it sells and the needs of the customers it serves [

15]. There are some studies which focus on enterprises which adopt digitization initiatives aims in the increasingly omni-channel environment. These approaches enable advanced analysis of customers and their behavior, and greatly improve the relationship with the client [

16].

New technologies in marketing can have positive effects on the competitive advantage of a company. Mobile marketing is able to provide consumers with unique brand experience, greater real-time interaction and greater brand recognition, which will result in higher customer loyalty [

17]. The application of mobile technology in home shopping has forced retailers to coordinate various online channels to serve the omni-channel environment. To gain a comprehensive understanding of the influencing factors of customers’ channel selections, retailers need to consider how to pass product information via various channels. This requires the formulation of tailored marketing strategies according to the heterogeneity of customer preferences and the correlation between channels. The application of mobile devices and the mobile Internet has brought new opportunities to the retail industry, providing ubiquitous shopping channels but also making retail strategies more complex than ever before [

18].

In normal business patterns, through investing in the operating facility, customers are offered valuable services and revenue can be generated. This creates a win-win scenario for all players [

19]. Identifying consumers with a higher response probability can reduce marketing costs and increase the campaign’s profitability. Marketing resources can be specifically allocated to active customers with a high potential value to the company [

20]. Behaviors are similar in the banking sector. With increasingly fierce competition, banks need to optimize their relationship with customers to maximize benefits. System management involves analyzing customer behavior and attributes, discovering the most profitable customers, and adapting tailored marketing strategies and making distinctions [

21]. Most of the current studies analyze only the customer-to-bank information flow to improve customer profitability for the bank. Changes and adjustments in the two-way decision-making process of information exchanges between the bank and customers are often overlooked. In fact, the activity between the bank and the customer is a dynamic game process with incomplete information, and there will be a series of connections and signal transmissions between the two [

22]. This paper uses the signaling game theory to study the game process between the bank and the customer in the omni-channel environment, demonstrates the aspects that each side is concerned with clearly, and resolves them into the sending and receiving of signals. The index system is perfected through the use of two-way game and multi-stage connection game models. Additionally, a genetic algorithm of the bank–customer signaling game is constructed to serve as a quantitative tool for solving the optimal total utility of banks and customers. This represents a breakthrough in the application of dynamic non-cooperative game theory and GA optimization methods in the field of banking services. Such an application is academically valuable. Finally, this paper takes the Agricultural Bank of China in a case study to analyze its omni-channel transformation practice. The conclusion of the case study is highly consistent with the game relationship between banks and customers and behavior optimization. Therefore, this study is able to provide a scientific reference for the behavioral decision-making of banks and customers in an omni-channel environment, and has strong practical significance.

2. Theoretical Analysis and Hypotheses

2.1. Theoretical Basis

Signaling game theory was first proposed by Spence [

23]. It is the study of a dynamic game of incomplete information with information transmission characteristics. It has been widely used in customer relationships, supply chain management, product pricing and other issues [

24,

25]. The basic feature of the signaling game is to divide the game participants into senders and receivers of signals, with senders acting first and receivers acting later. Senders first send out a signal matching their type, and receivers choose actions based on the observed signals. The receiver has incomplete information, but can obtain part of the information from the sender’s action, which serves as a signal reflecting the receiver’s payoff. Such a game is called a signaling game, which is a general term for a class of dynamic Bayesian games with an information transmission mechanism. Using signaling game theory, this paper examines the interaction between banks and customers in the omni-channel environment. It focuses on the characteristics of the two-way signal transmission between banks and customers, establishing an information game model to explain the process of information transfer and strategy adjustment between banks and customers aiming at maximizing payoff. During the signaling game, the bank and customer follow a sequence of actions. After observing the other party’s action, they infer information and choose their optimal behavior accordingly. The sender’s signal is dependent on the type chosen by nature, and the receiver’s action depends on the signal sent. The sender first sends a signal about its type, and the receiver chooses its own action strategy based on the observed signal. There is a cost to each information transmission, which varies based on the signal quality. Incomplete and asymmetric information may lead to one party misleading the other to maximize their own interests, potentially destroying the information transmission mechanism.

In the bank’s omni-channel environment, the main action is the targeted promotion of omni-channels based on the understanding of customer-related information and an analysis of customer preferences. This process aims to maximize bank interests and customer satisfaction. The interaction between the banks’ promotion of channels and customers’ selection of channels can be repeated infinitely, representing a repeated optimization process. Given the complexity of the market environment and decision-making problems, and the limitations to the rationality of decision-making, this paper analyzes the learning and strategy adjustment mechanisms of banks and customers in the game process using a genetic algorithm. The algorithm is based on the limited rational behavior of game players in the game process. Through mathematical formulas and computer simulation operations, the genetic algorithm converts problem-solving into the crossover and mutation of genes on chromosomes, using a fitness function to perform an optimization search. In the bank–customer signaling game model, the utility function can be converted into the fitness function of the genetic algorithm, allowing for optimal solutions. The implementation of the genetic algorithm based on the bank–customer signal involves determining the coding scheme, establishing the fitness function, designing the genetic operator and selecting control parameters.

2.2. Model Assumptions

The signaling game involves two players, the bank and the customer, who act as both the sender and the receiver of signals. The signaling process between the bank and the customer is divided into three stages, during which time the bank sends three signals and the customer sends three signals. The signals sent by the bank to the customer include omni-channel construction level , brand image and risk control ability ; whereas the signals sent by the customer to the bank include searching degree , credit status and and risk tolerance . The subscript represents the stage of the game. To maximize their own utility, the bank and the customer must consider the other party’s reaction before sending signals. Both parties hope that the signals they send will prompt the other party to act in a way that benefits their own utility.

According to the omni-channel performance (, ), banks can be divided into two types: high capability and low capability. A bank’s omni-channel performance is the concept that comprehensively reflects the omni-channel’s convenience, risk and cost-of-use. Therefore, a high-capability bank has well-performing omni-channel and high service quality, while a low-capability bank has poor-performing omni-channel and low service quality. According to the level of customer net worth (, ), customers can be divided into two types: valuable and low value. Both sides of the game are boundedly rational, and select strategies based on their own perception of the strategy benefits, which conforms to the value function of the prospect theory, assuming that the original reference point is 0.

The bank’s omni-channel construction cost is , with representing the effort cost coefficient ( > 0), representing the perceivable coefficient of omni-channel construction, and the effort level () being proportional to the bank’s general ability. The range of all signal values in this paper is [0,1].

2.3. Bank–Customer Signaling Game Process

In the first stage of the game process, in addition to the respective types of banks and customers, the main factors that affect the utility of the bank and customer are the level of omni-channel construction of the bank and the searching degree of the customer. The omni-channel promotion level refers to the intensity of promotional activities perceived by the customer, while the customer’s searching degree of the omni-channel is the cost that the customer pays for consulting channel performance in the early stage of choosing omni-channel. Investment in channel promotion by the bank reduces its utility in the short term, but serves as a signal and a basis for customers to judge the type of the bank.

In the second stage of the game process, the factors that affect the utility of the bank and the customer are mainly the types of banks and customers, the brand image of the bank and the credit status of the customer. At this stage, the customer sends signals to the bank about their credit status, which the bank uses to check the customers’ integrity. The bank sends signals about its brand image to the customer, with which the customer judges the bank’s reputation.

The third stage of the game process involves the types of banks and customers, the bank’s risk control ability, and the risk tolerance of the customer. During this process the customer sends a signal to the bank about risk tolerance, which the bank uses to examines the customer’s risk tolerance. The bank sends a signal to the customer about its own risk control ability, and the customer determines the possible loss associated with choosing the bank’s omni-channel service before deciding to choose it.

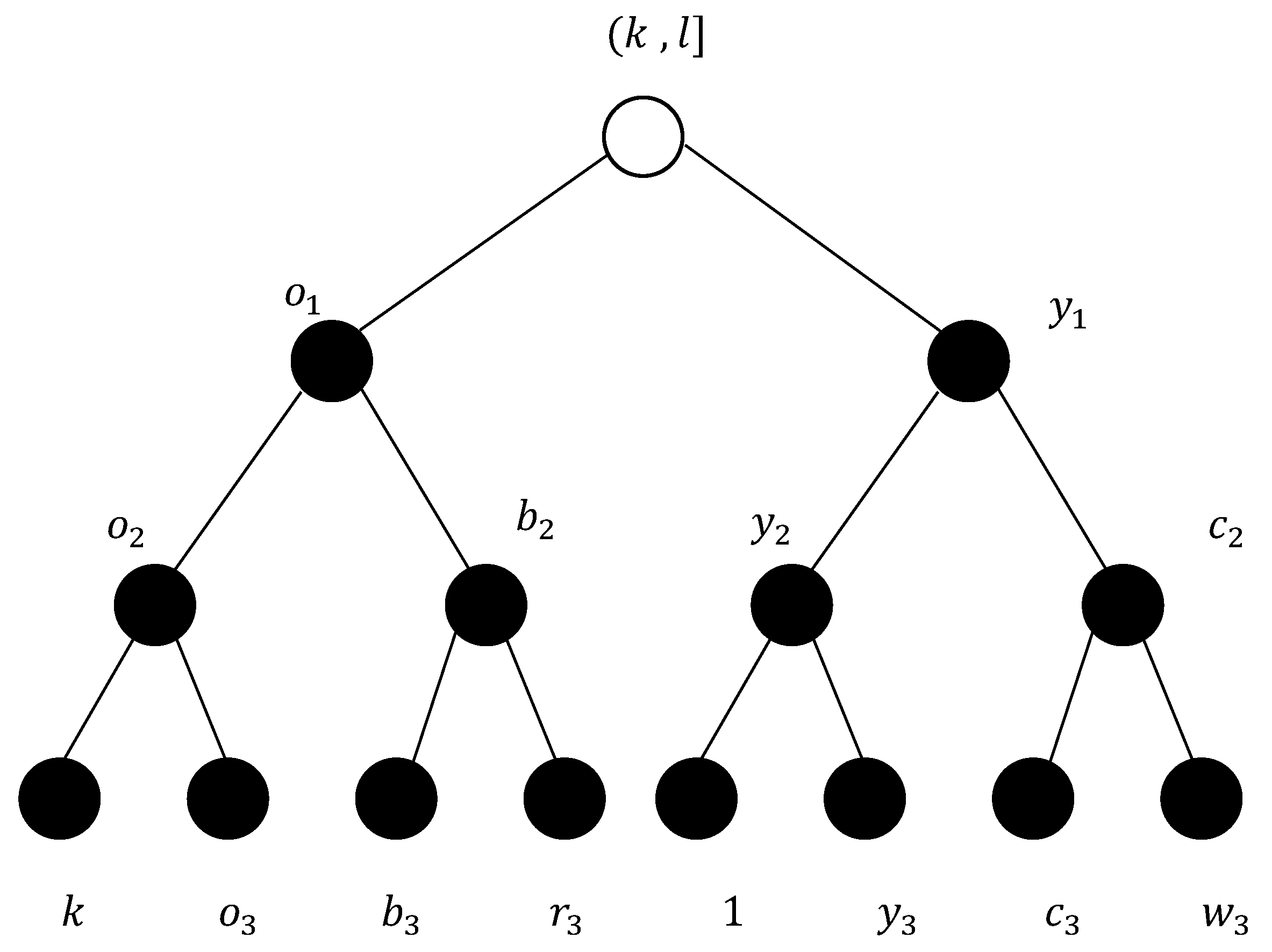

To sum up, the bank–customer signaling game model is shown in

Figure 1.

3. Model Construction

Signaling games are dynamic games with incomplete information that focus on signaling mechanisms with information transmission characteristics [

26]. In the omni-channel environment of the bank, the interactions between the bank and the customer are a dynamic game with incomplete information. By taking the bank and the customer as the two players in the game, the bank–customer signaling game model is established to analyze their interactions.

3.1. Basis for Model Construction

Since signaling games are, at the same time, dynamic Bayesian games, they can be directly transformed into dynamic games of complete yet imperfect information. First, based on a chosen possibility , choose the sender type from the set of available types , and the sender then chooses a message from the set of available messages (i.e., the message space). The receiver cannot observe , but they can choose an action from its set of available actions based on . Using to represent the Sender and the Receiver, the message space of , the action space of , with and standing for the utility of and and standing for the possibility distribution of ’s choice of types, the signaling game can be demonstrated as:

- (1)

is the possibility of , while ;

- (2)

sends out message ;

- (3)

chooses action after observing ;

- (4)

The utility and of and are dependent on , and .

In this model, the sender’s message is dependent on nature’s endowment, and the action of the sender serves as information transmission for the receiver. Therefore, even though does not know the type of is , it does know , which means that the action of is dependent on the message chosen by the Sender; the that chooses is the function of as well as and ; t, m and can be from a discrete space or a continuous space.

After expressing signaling games as dynamic games with complete but imperfect information, they can be analyzed by using a perfect Bayesian equilibrium, including pure strategy and mixed strategy perfect Bayesian equilibriums, pooled equilibrium and split equilibriums, etc. According to the characteristics of the signaling game, its perfect Bayesian equilibrium condition is as follows:

- (1)

After observing from , will decide on ’s type, which means that when chooses , stands for the possibility of being each type of . and .

- (2)

For each pair of and , ’s action must result in the maximum expected payoff for , which means that is the solution to the maximization problem .

- (3)

For each specific , ’s choice must result in the maximum payoff for , which means that is the solution to the maximization problem .

- (4)

For each , if there is a making , then ’s decision on ’s place in the message set must match ’s strategy and Bayesian rule, even if there is no that makes .

The two-party strategy and the receiver’s judgment that meet the above conditions constitute a perfect Bayesian equilibrium. Since the above-mentioned two-party strategies are all pure strategies, it is a pure-strategy perfect Bayesian equilibrium. In addition, if in a pure-strategy perfect Bayesian equilibrium of a signaling game the of different types are sending out the same signal , then it is called a merged equilibrium, and if the signals are different it is a separate equilibrium.

3.2. Construction of Bank–Customer Signaling Game Model

3.2.1. Game Analysis of Bank and Customer Signaling Based on Prospect Theory

The bank-customer signaling game problem model is the utility function of both parties under certain constraints. The construction of the bank–customer signaling game model involves determining the bank’s profit function and the customer’s utility function in the process of customer choice in the omni-channel environment. Bank profits and customer utility are interrelated and checked. The construction process of the bank’s total profit function and the customer’s total utility function must consider the influence of bank type and customer type and six signals at different stages, since bank profit and customer utility are the sums obtained in the above three stages.

Prospect theory believes that most decision makers are risk-averse and tend to underestimate high-probability events while overestimating small-probability events when faced with uncertain returns [

27]. When customers’ preferences are unknown to the bank, it invests prudently in improving omni-channel performance, which makes customers less sensitive to the bank’s omni-channel environment. However, to meet customers’ omni-channel usage needs and realize omni-channel distribution, customer choice is the premise and bank promotion is a necessary means. This paper adopts prospect theory to establish the objective function for better dealing with the strategy selection of different decision-making bodies in the bank’s omni-channel environment. Under the assumption that banks and customers are “bounded rational people”, the game player’s perception of the loss/gain of a certain action is not equal to its absolute value but a relative value compared with a certain reference point. In order to better deal with the strategy selection of different decision-making bodies in the bank’s omni-channel environment, the article adopts the prospect theory to establish the objective function:

among which

,

,

,

, ,

In the formula, is the prospect value; and are the probability weight functions of gain and loss; represents the decision-making perception of the bank and customers when making choices; is its value function, and and , respectively, represent the concavity and convexity of the value function of the gain and loss intervals (i.e., the marginal sensitivity and ), and , represents the reference point set by the game parties. For the convenience of analysis, we assume that the original reference point is 0, x represents the actual profit or loss, controls the loss aversion degree of the bank and the customer () and is the possibility of the bank possessing each type of omni-channel; and , respectively, represent the possibility weight functions of different types of bank omni-channels when gain and loss are present.

When there are two possible types of bank omni-channel,

At the same time, or .

3.2.2. The Utility Function of Players in the Preparation Stage

- (1)

The utility function for the bank in stage one (

):

- (2)

The utility function for the customer in stage one (

):

In the first stage, the customer sends to the bank the message of their searching degree of the bank’s omni-channel, which is the cost paid by the customer for searching relevant information in the early stage of selecting the bank’s omni-channel. The investment on channel construction by the bank reduces the utility of the bank in the short term, but it can serve as a signal by which customers can judge the type of the bank. Banks focus on maximizing economic benefits when they decide to promote omni-channels, whereas customers focus on maximizing their own utility when making choices about bank omni-channels. The value function and decision weight of each decision of the game parties vary dynamically in different stages, dependent on the different signals received. The adjustments in decision-making of the two parties will result in a strategic equilibrium.

3.2.3. The Utility Function of Players in the Second Stage

- (1)

The utility function for the bank in stage two (

):

- (2)

The utility function for the customer in stage two (

):

In the second stage, the factors that affect the utility of banks and customers are mainly the types of banks and customers, the brand image of banks, and the credit status of customers. The model is the discount coefficient. Banks determine their omni-channel advantages based on the information received from customers on their omni-channel searching level. Customers’ decisions to choose bank omni-channel services are influenced by their net worth and the bank’s reputation.

3.2.4. The Utility Function of Players in the Third Stage

- (1)

The utility function for the bank in stage three (

):

- (2)

The utility function for the customer in stage two (

):

In the third stage, the factors that affect the utility of banks and customers are mainly the respective types of banks and customers, the risk control ability of banks and the risk tolerance of customers. Banks pay risk control costs to reduce the risk of providing omni-channel services. The higher the risk control costs, the stronger the control ability, and the higher the quality of omni-channel services, which informs the customers about the bank’s omni-channel type through its risk control ability. At this stage, the customer feeds back their risk tolerance to the bank, which can be judged by the customer’s own net worth (customer type). Here, it is assumed that the value range of the signal is [0,1].

To fully explain the impact of the above six signal factors, the effects of other factors in the market on the utility functions of the bank and the customer are ignored, such as the increase in the value of banking channels brought by the increase in market share, the possible increase in future income brought by the value of customer recommendation, as well as the opportunity cost paid by customers in the planning stage (first stage) before choosing the bank channel and during searching for the bank channel, etc.

4. Genetic Algorithm Based on the Bank–Customer Signaling Game Model

4.1. Determination of Coding Scheme

In the bank–customer signaling game model, the equilibrium optimization of their respective utility functions is realized mainly through the selection of signaling actions of the two gaming parties, which serve as the parameters of the problem space. Therefore, it is a multi-parameter optimization problem.

To optimize the bank–customer signaling game model, the phenotype-to-Adelaide type mapping, or coding process, must be performed. This study uses a multi-parameter mapping coding structure for the genetic algorithm based on bank and signal. The coding scheme encodes the six signals sent by the bank and customer as parameters, normalizes the signal data, obtains substrings, and concatenates them into a chromosome. Each signal’s value range is an abstraction of the actual problem and depends on its magnitude.

The six signals sent in this optimization process are inter-related and affect each other in a specific order. Therefore, the genetic algorithm coding scheme based on the signaling game between the bank and the customer uses 42-bit coding, seven bits for each signal, and then connects them into a chromosome according to the order of signal transmission.

4.2. Establishment of Fitness Function

Fitness refers to the adaptability of an individual to the environment. In the genetic algorithm, the fitness function evaluates individuals based on target functions and is used as a basis for subsequent genetic operations. The design of the fitness function must meet the following criteria: (1) single value, continuous, non-negative, and maximization; (2) consistency; (3) small amount of calculation; (4) strong versatility. In the bank–customer signaling game model, the design of the fitness function is mainly determined by combining the bank’s total utility function and the customer’s total utility function model.

In the total utility function model of the bank and the customer, assuming the discount coefficient

, the effort cost coefficient of the bank’s omni-channel construction

and the perceived coefficient of the omni-channel construction

, the simplified utility function of both sides of the bank–customer signaling game problem can be obtained:

The genetic algorithm is a process of optimizing a single-objective single-parameter (or multi-parameter) function. By combining the bank profit function (9) with the customer utility function (10), the algorithm studies actions that bring the greatest overall utility to both parties. The utility functions of the bank and customer are combined with equal weight coefficients of 0.5, and jointly construct the fitness function in the genetic algorithm, namely:

In addition, in order to ensure the non-negativity of the fitness function value, the following conversion is performed:

4.3. Design of the Genetic Operator and Selection of Control Parameter

- (1)

Design of the genetic operator

The genetic operator design aims to optimize the environmental adaptability of encoded individuals. A genetic algorithm includes three types of genetic operators: selection, crossover and mutation. The selection and crossover operators provide search ability, while the mutation operator ensures global optimization. For the bank–customer signal transmission problem, the fitness ratio method is used for the selection operator, single-point crossover for the crossover operator and basic bit mutation for the mutation operator.

- (2)

Selection of control parameters

When establishing the genetic algorithm structure, it is necessary to determine the parameters to select. The main parameters are population size , crossover probability , mutation probability , etc. In order to reflect the diversity of samples and ensure optimization in a wide search space, the group size is usually slightly larger. According to the characteristics of the bank–customer signaling game problem in this study, the fitness function established is a simplified model with strong convergence, combined with the selected six signal behaviors to reflect the evolution process of the genetic algorithm. The control parameters are selected as follows: the population capacity is selected to be small , the other evolutionary parameters are set as crossover probability and mutation probability , and the number of genetic evolution generations is set to 100.

5. Genetic Algorithm Optimization Based on Bank–Customer Signaling Game

5.1. Algorithm Process Description

The signals sent by the two sides of the game are the parameters of the fitness function. For the convenience of practical control, these parameters are set to be discrete, so this algorithm is essentially a combinatorial optimization problem. The process of the combinatorial optimization method based on the genetic algorithm of the bank–customer signaling game is described as follows:

- (1)

Set the population size at , randomly generate 40 possible solutions () and set a starting point for iteration. The string structure data of each individual have only two values: “1” and “0”.

- (2)

For each individual , calculate its fitness according to function (5).

- (3)

Using the simulated roulette operation, for each individual calculate its survival probability, i.e., select the operator , and then design a random selector and generate breeding individuals via certain random method.

- (4)

Randomly pair the individuals in the population ( and ). The initial population size in this paper is 40; therefore, there are 20 paired individual groups. For each pair of individuals, they have the possibility (possibility of single-point crossover , possibility of mutation of basic bit ) of choosing a position after a gene locus as a cross point, and two individuals ( and ) exchange part of their chromosomes to generate two new individuals ( and ) until a new generation of N individuals is formed.

- (5)

Repeat steps ② to ④ until the conditions of ending the process are met (reaching termination mark K).

5.2. Experimentation Scenarios

To run the genetic algorithm program for the bank–customer signals, the bank and customer types must be input as a number between 0 and 1 (the input of these two types makes the algorithm applicable to the signaling game optimization process between different bank channels and different customers). This signaling game assumes 0.8 and 0.4 to explain high and low levels of capability, respectively. The combinations of different types of bank and customers form four scenarios (

Table 1).

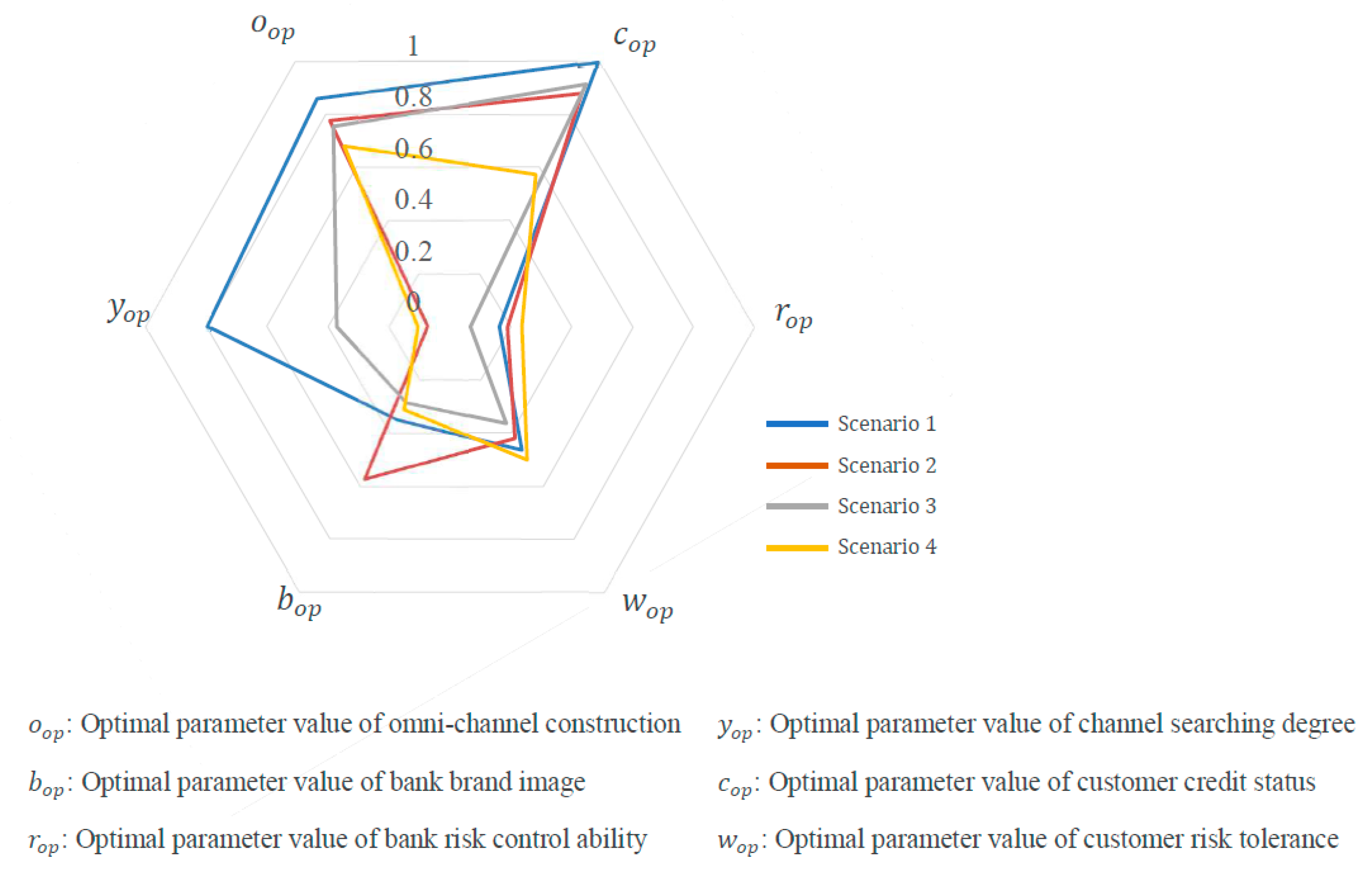

Initial population will be generated, which consists of 40 individuals, each containing six signal values. The evolution of the genetic algorithm is random, producing different optimization results each time. After running the algorithm several times, several sets of optimization results are obtained. This paper uses the evolution process with the maximum fitness value to demonstrate the optimization process for different bank and customer types in conducting business. The results of the optimal parameter values of six signals in four scenarios are shown in

Table 2 and

Figure 2.

Scenario 1: The bank type is 0.80, and the customer type is 0.80. This means that the bank has high capability and the customer value is high. The optimal individual obtained after 100 generations of genetic evolution is

Additionally, the optimal fitness value is

Scenario 2: The bank type is 0.80, and the customer type is 0.40. This means that the bank has high capability and the customer value is low. The optimal individual obtained after 100 generations of genetic evolution is

Additionally, the optimal fitness value is

Scenario 3: The bank type is 0.40, and the customer type is 0.80. This means that the bank has low capability and the customer value is high. The optimal individual obtained after 100 generations of genetic evolution is

Additionally, the optimal fitness value is

Scenario 4: The bank type is 0.40, and the customer type is 0.40. This means that the bank has low capability and the customer value is low. The optimal individual obtained after 100 generations of genetic evolution is

Additionally, the optimal fitness value is

From the above results, we can draw two conclusions.

- (1)

The optimal signaling behaviors of banks and customers change according to the types of banks and customers (

Figure 2). A conclusion could be drawn from the genetic algorithm optimization results, as shown in the following

Table 3.

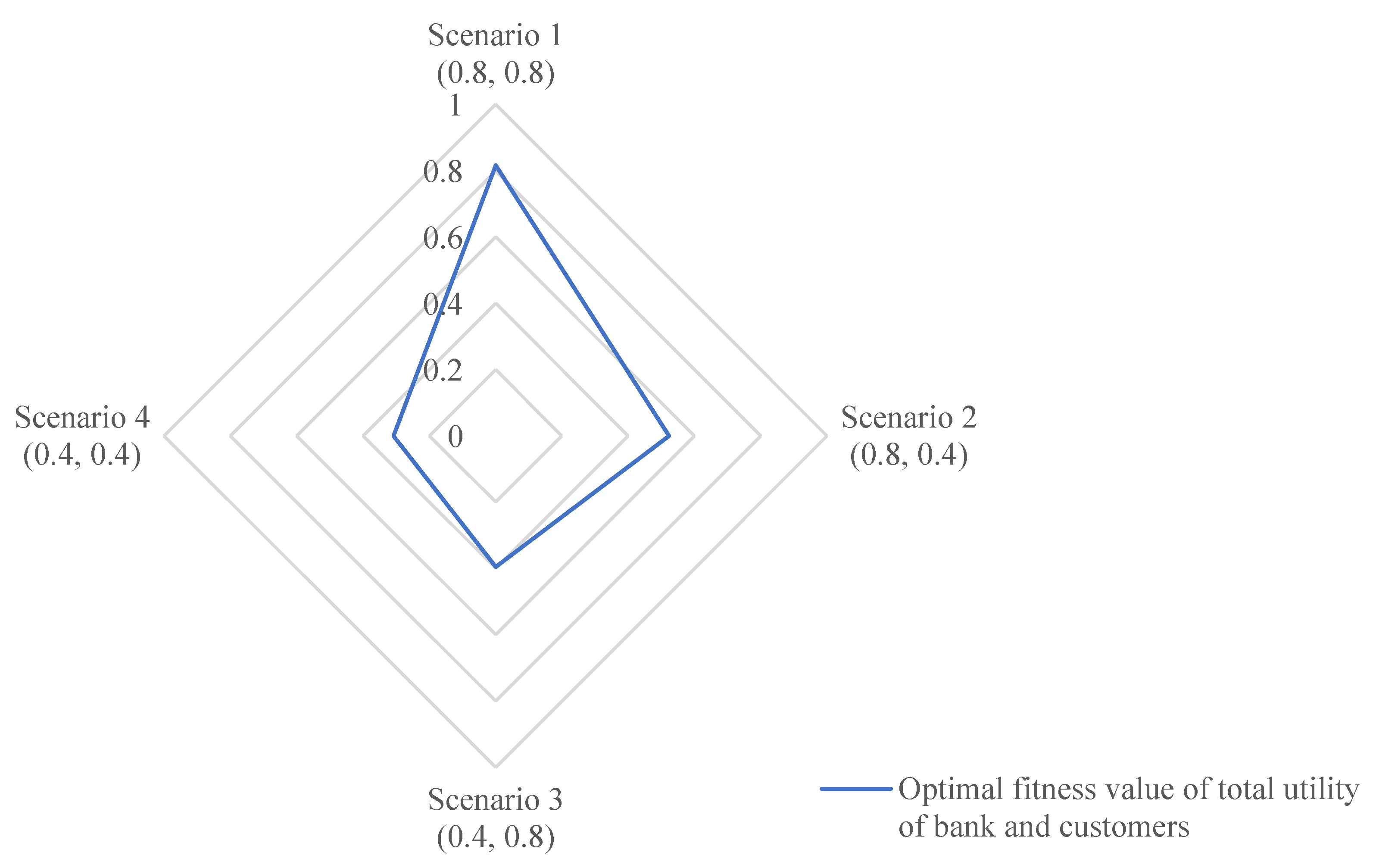

- (2)

For different types of banks and customers, the optimal fitness values are different, as shown in

Figure 3, indicating that total utility value was mainly decided by the level of omni-channel construction and customer credit status.

In the four scenarios, the level of omni-channel construction, channel searching degree, bank brand image, customer credit status, risk control ability and customer risk tolerance have great differences across different types of banks and customers, even though the level of omni-channel construction of the bank and the customer’s credit status are always relatively high. To optimize total utility, banks should focus on improving omni-channel construction and providing targeted services based on customer credit status.

6. Case Illustration: The Agricultural Bank of China as a Case Study

The Agricultural Bank of China (ABC) is one of the major comprehensive financial service providers in China, which with market value exceeds USD 294 billion, with a total number of employees exceeding 450,000 and over 22,000 branch offices, making it the most extensive physical distribution network in China.

In recent years, ABC has continuously innovated its service products through omni-channel networks such as offline, online, and remote ones. Throughout the construction of the omni-channel, the bank pays great attention to two aspects. First, the bank continuously improves the synergy efficiency of omni-channel, providing customers with extensive and accessible financial services. Second, the bank precisely analyzes customer credit status. As a result, customer stickiness and satisfaction have significantly improved.

ABC has comprehensively improved the level of omni-channel construction.

Firstly, in terms of offline channel construction, ABC has continuously expanded its existing channel supply by increasing branch offices in less developed areas, high-altitude areas and border areas. The bank has established service stations in rural areas and promoted car banks and backpack banks, and has deployed self-service machines in remote areas to fill the gaps in financial services. These efforts have served over 110,000 visits by customers from more than 543 towns and townships, offering door-to-door services such as small cash withdrawals, self-service payments, cash remittances and agency collections and payments, thereby increasing the accessibility of financial channels for customers in remote areas.

Secondly, in terms of online and remote channel construction, ABC has focused on building an omni-channel, full-scenario and full-chain online business system, comprehensively improving the value creation and market competitiveness of its online channels. ABC has seamlessly integrated bank products in smart financial scenarios for campuses, canteens, and government services. The bank has also enriched remote online channel service scenarios, reaching an accumulated annual average of over 300 million customers through multi-media customer service (including voice, online, video, and new media). Currently, ABC’s mobile banking and online banking customers are in excess of 410 million, with transaction amounts reaching USD 12.75 trillion and USD 3.77 trillion, respectively, with an average annual growth rate of nearly 20%.

Thirdly, in terms of channel integration and development, ABC has leveraged its physical offices as a “service pivot point” to establish a service channel system of “manned branches + self-service banking + service stations+ internet online channels + remote banks + mobile services”. The bank has strengthened channel integration and development to provide customers with comprehensive and three-dimensional financial services.

ABC selects customer portraits based on customer credit as the core to achieve precise marketing. Customers will be classified into seven different categories according to their different status. Those who have sound credit status, high value contribution and active financial activities will be categorized as a 7-star-customer, which means enjoying a priority in service level. The bank has implemented a smart marketing project and built a digital marketing tool platform system. It has innovatively launched digital marketing projects such as “Smart Promotion Chain” and “Smart Service Refinement” to accurately portray and screen customers. The system uses sixty-one portrait tags in seven categories to accurately portray customers, and then implements precise marketing. It builds a precise marketing closed-loop operation mechanism and has driven the growth of inclusive loans by nearly USD 44 billion. The “Smart Promotion Chain” project comprehensively uses customer relationship maps such as transaction chains and equity chains to mine potential customers. It meets the comprehensive financial needs of customer groups on the same relationship chain, and the marketing success rate is four times that of the traditional model. “Smart Service Refinement” is a mobile banking customer refinement operation project which focuses on the activity of mobile banking users. It explores new methods of online customer layering, grouping and refinement operation. It has increased the number of loyal mobile banking customers by 15 million.

ABC’s improvement at the level of channel construction and customer screening and marketing based on customer credit status play an important role in optimizing the relationship between the bank and customers. It greatly improves the total utility of the bank and customers. Improving the level of bank channel construction can effectively reduce customers’ search costs, significantly improving the efficiency and economic benefits of bank business processing. Tracking customers’ credit status and selecting high-value customers is helpful for the bank to implement more accurate and targeted marketing and improve operating efficiency. Through the above measures, ABC has expanded its customer base, optimized service quality, and expanded its service scope. It provides customers with more extensive and effective financial services, while significantly improving its own operating capacity and efficiency. It realizes the maximization of the total utility of the bank and customers. These results are consistent with the research results on the game relationship and behavior optimization between banks and customers discussed earlier.

7. Discussion, Implication, and Conclusions

In the omni-channel environment, bank channel promotion and customer choice have a repeated impact on each other during the game and decision-making process. The signals sent in the current round of decision-making affect future rounds. Most of the current studies only analyze the one-way information flow sent from the customers from the perspective of the bank, while failing to discover the change and adjustment of the two-way decision-making process of information exchange between the bank and customers. Therefore, this paper focuses on studying how the two-way signals between banks and customers influence each other in the omni-channel environment. It also investigates which signals have a more prominent impact on improving efficiency. Additionally, it provides a measuring dimension for revealing the optimal solution gap in different scenarios.

This paper uses a bank–customer signaling game model and genetic algorithm (GA) to optimize behavior in an omni-channel environment. Additionally, the optimal solution under different types of subject combinations (the solution with the greatest total utility) is obtained through simulation optimization, as well as the optimization parameters. The results were illustrated through an omni-channel transformation case. The main conclusions are:

- (1)

Regardless of the types of banks and customers, the level of omni-channel construction and customer credit status are the primary factors that contribute the most to the overall utility of banks and customers. These are the primary factors that should be considered in decision-making.

- (2)

Regardless of the types of banks and customers, under the condition that the total utility of banks and customers is optimal, customer risk tolerance has a relatively important impact on the overall utility of banks and customers in an omni-channel environment.

- (3)

Different combinations of bank and customer types result in varying total utilities, with bank type affecting customer search degree and customer type affecting bank brand image the most.

The above conclusion is generally in alignment with the signal factors that existing research in the literature identified as determining total efficiency. Based on this, this paper has clarified the impact and interaction of different signals. In general, in the bank’s omni-channel environment, subject selection decision-making involves judging the other party’s type based on signals sent, if the type is unknown. If the type is known, optimal signaling action selection can optimize the final utility value of both parties. The genetic algorithm based on the bank–customer signaling game provides a quantitative support tool for decision-making and signal selection.

Based on the above conclusions, the following recommendations are made from the perspective of banks:

- (1)

Banks can optimize their relationship with customers and maximize profits by analyzing customer behavior and attributes to find valuable or high-quality customers, and adjusting bank signals accordingly. Banks can objectively examine existing customer products and service systems to make corresponding optimizations that align with their strategic development goals. To create a competitive advantage, the bank needs to improve customer service experience and provide high value-added products, focusing on convenience and supporting services in the customer operating system. This includes product convenience, business procedure complexity, product features, service conditions, bank image, product and service publicity, information transmission marketing methods, etc.

- (2)

Customer information can be organized to distinguish different customer groups and conduct targeted product and channel marketing. Establishing a comprehensive customer consumption tendency archive using the bank’s customer information management system allows account managers to promote financial services to specific customer groups and enhance customer satisfaction. Simplifying banking service operations enhances customer relationships by complementing channels and making the operation process more user-friendly.

- (3)

Optimizing the relationship between the bank and customers is the key to the bank’s sustainable development, based on the bank’s characteristics and customer types. To improve customer service efficiency and reduce operating costs, banks should implement differentiated management based on customer needs, including differentiated service levels, business processes, and resource allocation.

Currently, digital technology develops rapidly, but the new generation of artificial intelligence technologies such as ChatGPT have not yet been widely applied in the construction of bank omni-channels. Therefore, it is difficult to estimate their profound impact on the bank’s construction of omni-channel and operational efficiency. In addition, in the increasingly fierce competition among banks for customer acquisition, the types of signals sent between banks and customers in the game are becoming increasingly diverse. Banks will also receive a large number of customer-specific signals determined by personal factors such as hobbies, age, consumption habits and privacy preferences. Therefore, it is necessary to have them classified and put through big data analysis, and then apply the results to channel construction, marketing information push, customer acquisition interaction, etc., so as to increase bank efficiency and customer satisfaction.