1. Introduction

Economic development has entered a new era, technological change has accelerated, and market competition has become increasingly fierce. As a single entity, it is increasingly difficult for firms to obtain sufficient resources for their new product development [

1]. Firms must continually enhance their knowledge and innovation abilities in order to foster competitive advantage [

2]. Against the background of innovation-driven development, there are some limitations in the firm’s resources and innovation cognition, rendering it difficult for firms to obtain considerable economic benefit by relying on independent innovation alone [

3]. To cope with complex and fierce market competition, firms must create strong advantages in innovation and market competitiveness. This requires firms to actively seek external cooperation, increase knowledge source channels, and enrich their knowledge [

4]. Due to increasingly complex innovation activities, firms have begun to turn their attention to open innovation, which indirectly promotes the construction and development of collaboration networks. Innovation is no longer the independent behaviour of a single firm, but a group behaviour based on a collaboration network [

5]. At present, many firms have broken the knowledge shackles through forming innovation alliances and achieved knowledge and technological advances with the help of partner firms.

An innovation alliance is an effective way for firms to share knowledge resources and achieve innovation performance and economic benefit [

6]. Against the background of open innovation, firms actively cooperate with external entities and embed themselves in innovation alliance networks. This enables them to obtain more innovation resources and reconstruct the knowledge system, leading to enhanced innovation performance [

7]. If firms want to continue innovating, they must continue to absorb, transform, update, and apply knowledge. Knowledge sharing is an effective way for firms to supplement these knowledge resources and enhance innovation capabilities [

8]. Firms with embedded innovation alliances and participating in knowledge sharing from these alliances can acquire heterogeneous innovation knowledge. The innovation alliance reduces the cost of transposition for firms and improves the efficiency of resource utilization [

9]. These measures will help firms create advantages in innovation, enhance strategic flexibility, increase innovation potential, and improve market competitiveness [

10,

11]. Although innovation alliances are beneficial for firms to obtain complementary knowledge and strategic resources, there is also the risk of private knowledge leakage in the process of knowledge transfer [

12]. When the leaked knowledge is imitated by partners, the innovation ability of the firm will be reduced. The process of firms participating in knowledge sharing in innovation alliances will incur some costs with regard to analysis and application of knowledge and prevention of private knowledge leakage. Firms must consider these costs when seeking to derive benefit from knowledge sharing in innovation alliances [

13]. On the other hand, knowledge sharing between innovation alliance firms will improve the knowledge levels of firms [

14]. This helps them dispose of the path dependence on inherent knowledge and single skills and achieve benefit improvement with efficient knowledge integration [

15].

The impact of knowledge sharing on the development of innovation alliances has been confirmed, but the sustainability of alliance cooperation has not been fully considered. The cooperative game is an effective method to analyze the relationship between firms. Mahjoub and Hennet [

16] used the cooperative game to analyze the supply network design problem based on the market’s expected demand and used the Shapley value to design the profit-sharing policy. Zhang and Liu [

17] used the cooperative game to analyze the decision-making of firms in the supply chain and used the Shapley value to develop a coordination mechanism. Zheng et al. [

18] investigated a three-echelon closed-loop supply chain, composed of a manufacturer, a distributor, and a retailer, using the cooperative game and used the Shapley value to develop a coordination mechanism to distribute the benefit. To this end, we use a two-stage game to analyze the knowledge sharing problem between innovation alliance firms and use the Shapley value to construct a coordination mechanism with knowledge sharing for benefit allocation. We construct game models of innovation alliance firms with and without knowledge sharing to comprehensively examine the changes in benefit brought about by knowledge sharing between innovation alliance firms and to explore the decision boundary of knowledge sharing between innovation alliance firms. We identify the conditions under which firms share knowledge and provide the theoretical basis and management support for knowledge sharing between innovation alliance firms. We also consider the stability and continuity of knowledge sharing between innovation alliance firms in the process of cooperation. We use the Shapley value to reasonably distribute the cooperation benefit to sustain the stability and continuity of alliance cooperation.

2. Model Setup and Assumptions

In the context of alliance cooperation, firms participating in the collaboration network can obtain the required knowledge resources from partners. Knowledge sharing is the basic support for maximizing the cooperation benefit between innovation alliance firms [

19]. Each firm participating in knowledge sharing not only absorbs the heterogeneous knowledge of the partner firms, but also contributes its unique knowledge resources to the other innovation alliance firms [

20]. In other words, the innovation alliance firms participating in knowledge sharing have both knowledge outflow and knowledge inflow. There are close interest relations or interdependent industrial relations between the innovation alliance firms, making it easier for them to achieve binding interest goals [

21]. Participating in knowledge sharing brings benefit and cost at the same time, so firms will not actively open their knowledge boundaries. Firms will choose to sign contracts in the forms of project contracts, R&D cooperation, etc., to participate in the knowledge sharing of innovation alliances [

22].

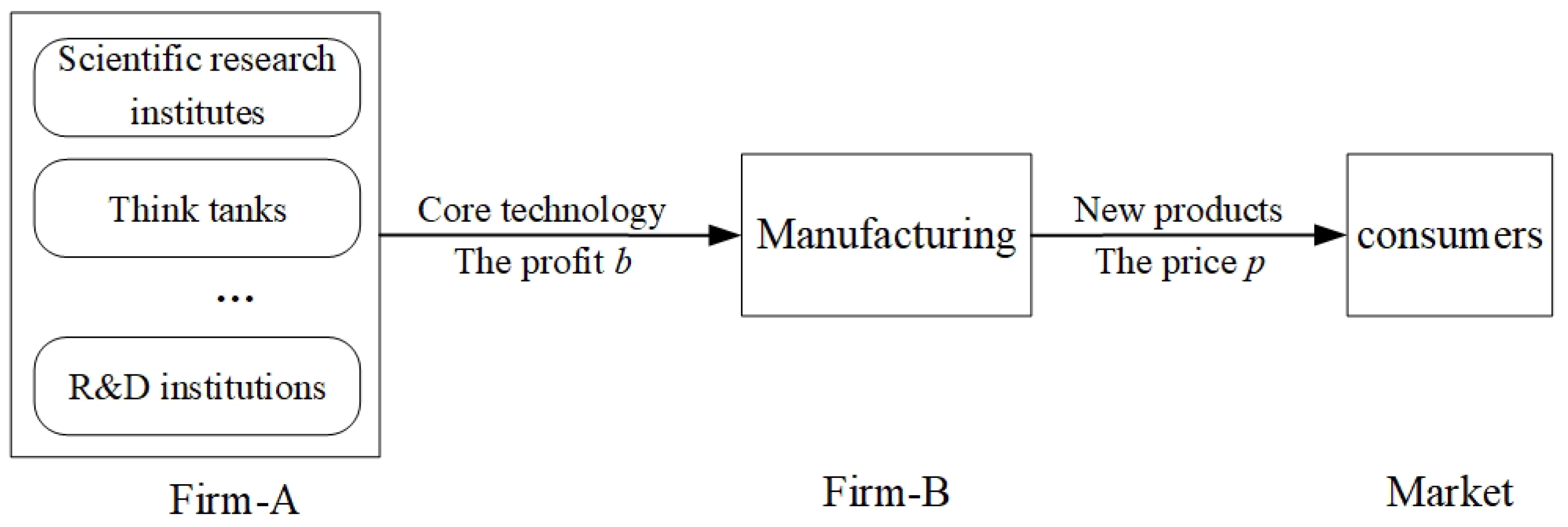

The knowledge subjects in the innovation alliance include not only firms that face the market directly, but also scientific research institutes, think tanks, and R&D institutions that provide knowledge services [

23]. These knowledge service institutions can be regarded as “firms” in the innovation alliance. Knowledge service institutions play an important role in innovation alliances [

24]. We regard the knowledge service institution in the innovation alliance as firm A and the firm that provides products to the market as firm B. Firm B needs to purchase core technologies from firm A to produce new products, such as patent authorization, software copyright authorization etc. We assume that firm B produces and sells a new product, and firm A obtains a profit b from it. Firm A determines the profit b based on factors such as its R&D cost, training cost, and the market price of the new product. Firm B designs and manufactures the new product after obtaining the technical support and knowledge resources of firm A. Firm B determines the price p of the new product according to the market demand, the manufacturing cost, logistics cost, and marketing effect. We show the game model in

Figure 1. We list in

Table 1 all the notation used throughout the paper.

2.1. R&D and Training Costs

Firm A in the innovation alliance has the characteristics of intensive knowledge and technology resources. Technological knowledge updates have higher potential but also higher risks [

25]. To adapt to changing market demands, firm A needs to continuously update its knowledge and technology. Firm A communicates with firm B to enhance the market competitiveness of the new product, which requires investment in R&D to ensure that the innovative talent continue to carry out R&D activities [

26]. Therefore, we assume that the R&D cost of firm A is

.

There is a technical gap between firm A and firm B in the innovation alliance, and the knowledge resources and knowledge structure mastered by both firms are quite different. This may lead to the situation where firm A provides a core technology to firm B but firm B cannot fully absorb and integrate it into its knowledge base [

27]. In that case, firm A needs to provide technical training and knowledge teaching. Firm A should not only train its knowledge team to fully master the core technology and knowledge base but also dispatch this knowledge team to firm B to conduct the corresponding training on the technical knowledge purchased by firm B. Therefore, we assume that the training cost of firm A is

.

The R&D and training costs of firm A are related to the product production planning of firm B. Firm B adopts different production plans such as customer customization, personalized production, on-demand production, and mass production, which have different requirements for technical resources. The R&D and training costs that firm A needs to incur are also different. Therefore, we assume that the R&D and training costs of firm A are both unit costs.

2.2. Logistics and Manufacturing Costs

In the context of innovation alliance cooperation, on the one hand, firm B acquires the core technology and innovation knowledge from firm A; on the other hand, firm B receives market signals in real-time and dynamically tracks changes in market demand. Under the two-way guidance of innovation knowledge and market demand, firm B receives technical knowledge from firm A to carry out manufacturing of the new product [

28]. Firm B needs not only to mobilize resources within the innovation alliance but also to seek resources outside the innovation alliance [

29]. In the process of resource transport and product circulation, firm B incurs the logistics cost. Therefore, we assume that the logistics cost of firm B is

.

After receiving the core technology and knowledge resources of firm A, firm B designs, manufactures, and sells the new product in view of the feedback of market demand. To manufacture the new product, firm B incurs some costs, such as the rental for the production workshop, wages of workforce, depreciation of the production equipment and machines, and other manufacturing-related costs [

30]. Therefore, we assume that the manufacturing cost of firm B is

.

The logistics and manufacturing costs of firm B are related to the product output. The more of the product is manufactured, the larger are logistics and manufacturing costs are for firm B. Therefore, we assume that the logistics and manufacturing costs of firm B are unit costs.

2.3. Marketing Effect

Firm B will take the initiative to carry out marketing activities to increase the sales of the new product and expand the scale of market demand. Firm B advertises in the market, spreads it in new and traditional media, and conducts promotional activities to improve the market awareness of the new product. This will make the potential consumers in the market have a favourable impression of the new product and stimulate their desire to buy [

31]. This can boost sales of the new product. We assume that the marketing effect function of firm B is

, where t is the effective exposure time, which is the time when the advertisement is shown to the potential consumers to watch. The longer the effective exposure time of the advertisement is, the more potential consumers see the advertisement. Specifically, when

, it means that marketing has no effect; when

, it means that marketing is fully effective.

2.4. Knowledge Sharing Cost

Knowledge sharing is a two-way behaviour in which multiple subjects actively open their boundaries for cross-organizational cooperation. The innovation alliance achieves greater benefit by uniting various subjects to build an innovative knowledge chain and coordinating the direction of knowledge transfer and the depth of knowledge sharing [

32]. As an intangible resource, knowledge often does not realize its value in the short term but has a long-term value. In the process of knowledge sharing, firms may put the knowledge contributor at a disadvantage in market competition. This leads to the possibility of “adverse selection” or “prisoner’s dilemma” in knowledge sharing [

33]. To achieve a tangible benefit when participating in knowledge sharing, innovation alliance firms incur some costs to ensure the smooth development of knowledge sharing. We assume that the knowledge sharing cost is

. Firm A and firm B in the innovation alliance share the knowledge sharing cost. With knowledge sharing, firm A no longer asks firm B for the profit

b but jointly pursues the optimal total benefit and shares the total benefit.

2.5. Demand Function

The demand of the potential consumers for the new product in the market is affected by the market price of the new product and the marketing effect [

34]. The greater the marketing effect of the new product is, the more likely are the potential consumers to buy it, given the market price. Therefore, we assume that the demand function is

, where

.

2.6. Benefit Functions

We use

to denote the benefit function of the innovation alliance firms,

. The benefit functions of firm A and firm B are as follows:

4. Equilibrium Result

In this section we identify the conditions under which firms should choose knowledge sharing and analyse the impacts of knowledge sharing on firms and consumers based on the equilibrium benefits of the firms under the two models without and with knowledge sharing.

Theorem 1. Definewhen

,

. Innovation alliance firms will choose knowledge sharing, and the innovation alliance cooperation benefit will increase.

This value is the decision boundary of whether knowledge sharing between firms in the innovation alliance can improve the benefit, and it is also the condition under which firm A and firm B share knowledge. When this condition is met, firm A will share knowledge with firm B. We also find that the marketing effect directly affects the decision boundary of knowledge sharing between innovation alliance firms. The greater the impact of knowledge sharing on the marketing effect is, the higher is the knowledge sharing cost that can be accepted by innovation alliance firms.

Theorem 2. Definewhen

,

. Consumers benefit from a lower market price of the new products.

This value is the decision boundary of whether firm B in the innovation alliance can reduce the market price of the new product with knowledge sharing. When this condition is met, the new product price with knowledge sharing is more favourable to the consumers. We find that the greater impact of knowledge sharing on the marketing effect is, the lower is the knowledge sharing cost required for innovation alliance firms and the smaller is the reduction in the market price of the new product. According to signal theory [

43], the good marketing effect of the product will convey to consumers the signal that the product is trustworthy. Good market feedback from consumers on the product will further reinforce this signal. Therefore, when the marketing effect is good, the firm needs not reduce the price to expand the market channel.

Theorem 3. Definewhen

,

. At this juncture, both consumers and firms benefit from knowledge sharing.

At this time, the knowledge sharing cost between firm A and firm B must meet the conditions of Theorem 2, so that the market price of the new product can be reduced without harming the benefit. That is to say, with knowledge sharing, there is an upper limit on the marketing effect, which can increase the innovation alliance cooperation benefit and also achieve the goal of a lower market price of the new product. This can achieve the win–win outcome for the firms and consumers. On the contrary, if the marketing effect brought by knowledge sharing is above the upper limit, the firm will not lower the price of the new product, and consumers will no longer benefit from it.

Finally, we introduce a convex cooperation game and make an inference of Theorem 1. The convex cooperation game allows firms to gain in innovation alliances no less than when they operate independently. The convexity of the cooperative game is similar to the Nash equilibrium for the noncooperative game, which makes the core of the game nonempty. The Shapley value distribution result must be in the core, which is a stable distribution. The concept of the convex cooperation game is as follows:

For any two sub-alliances S and T, if , then the game is a convex cooperation game.

Inference 1. When , . This game is a convex cooperation game and the Shapley value is in the core, which is a stable distribution.

Inference 1 shows that with knowledge sharing between innovation alliance firms, the distribution value of the cooperation benefit between firm A and firm B is greater than the benefit value of each firm without knowledge sharing. Knowledge sharing between innovation alliance firms is stable. With knowledge sharing, the increase in the benefit of each firm is conducive to the continuity and stability of innovation alliance cooperation, and the effect of knowledge sharing is consolidated.

5. Numerical Example

Consider an innovation alliance consisting of a knowledge service provider A and a product manufacturer and seller B. We assume that in this innovation alliance, firm A needs to bear the R&D and training costs, and firm B needs to bear the logistics and manufacturing costs. With knowledge sharing, the two firms jointly undertake innovation risks, share information, data, technology, and other resources in real time, and collaborate on a series of innovation activities to reap the innovation alliance cooperation benefit. We show the game process between the two firms in

Figure 2.

We solve the problem to verify the findings derived in the above model analysis. Innovative products require more investment in knowledge resources. In the case of fierce market competition, once the price of an innovative product rises, consumers may choose other alternative products resulting in changes in the demand for the new product. Therefore, we assume that the price elasticity is

. Firm A’s R&D cost is

(unit: Ұ, omitted later) and training cost is

. Firm B’s logistics cost is

and manufacturing cost is

. The knowledge sharing cost is

. The above costs are unit costs. The market volume for the new product is

and the marketing effects are

and

. Substituting the above parameters into the model, we find

. We show in

Table 2 the other parameter relationships.

From

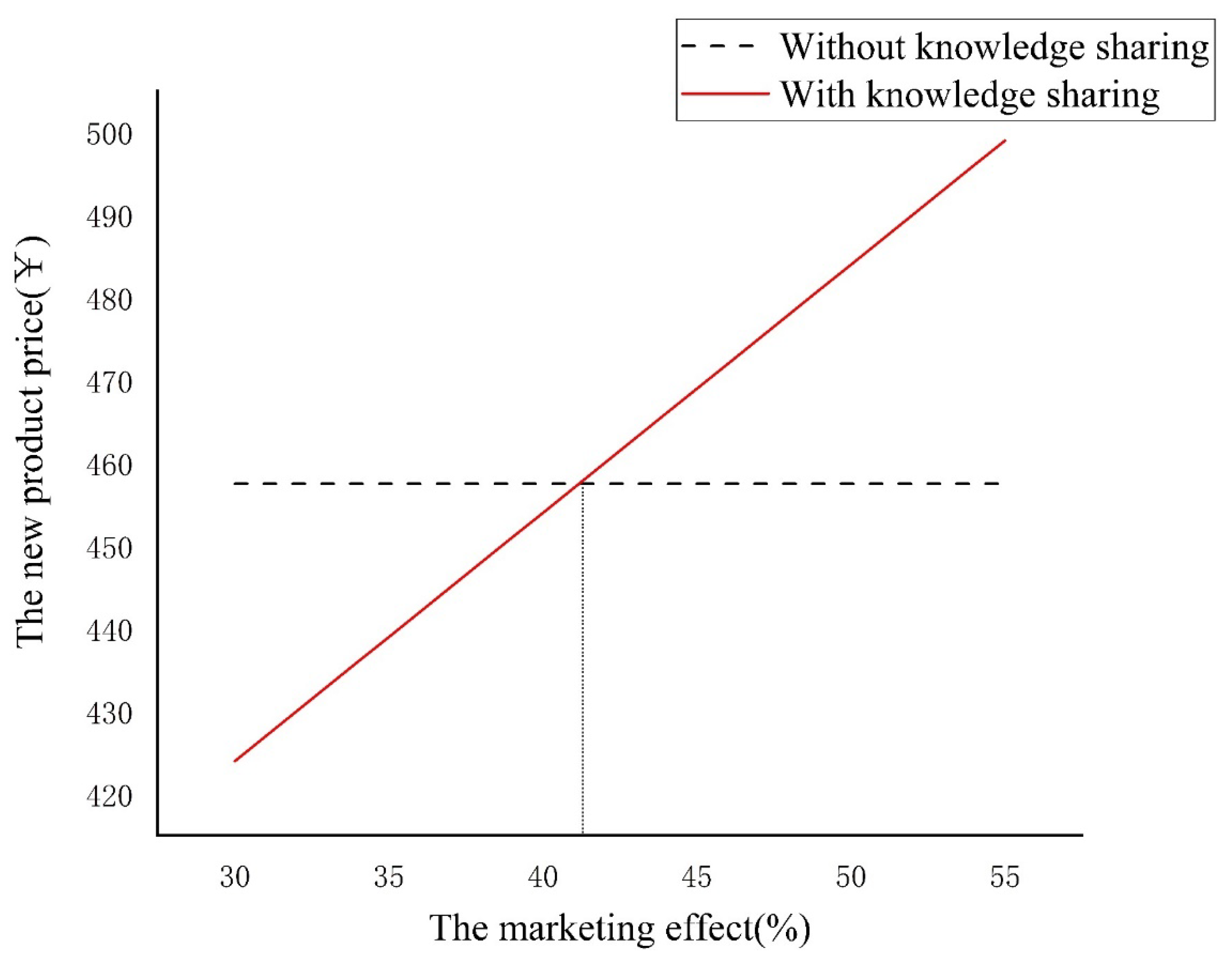

Table 2, we see that with knowledge sharing the benefit of firm A increases by 9.6%, the benefit of firm B increases by 19.3%, and the innovation alliance cooperation benefit increases by 12.9%, which verifies Theorem 1. Consumers benefit from a 2.7% drop in the price of the new product, which verifies Theorem 2. In

Table 2, the benefits of firm A and firm B with knowledge sharing are given by the Shapley value. The game is a convex cooperation game, and the Shapley value is in the core, which is a stable distribution method. This verifies Inference 1. In addition, both the firms and consumers benefit from knowledge sharing, which also means that the marketing effect with knowledge sharing

does not exceed the upper limit in Theorem 3. At this point, the upper limit of the marketing effect is

. Specifically, in this example, the changing trend of the new product price with the marketing effect with knowledge sharing is shown in

Figure 3. It is seen that with knowledge sharing, the price of the new product is proportional to the marketing effect. The better the marketing effect is, the higher is the price of the new product. Moreover, when the marketing effect does not reach the upper limit

, the new product price with knowledge sharing is lower than the new product price without knowledge sharing. At this point, the firm’s benefit increases, and consumers can buy the new product at a lower price. Both the firms and consumers benefit from knowledge sharing. After the marketing effect exceeds the upper limit

, the new product price with knowledge sharing will be higher than the new product price without knowledge sharing. At this point, the firms will gain higher benefits, while the consumers will not, which verifies Theorem 3.

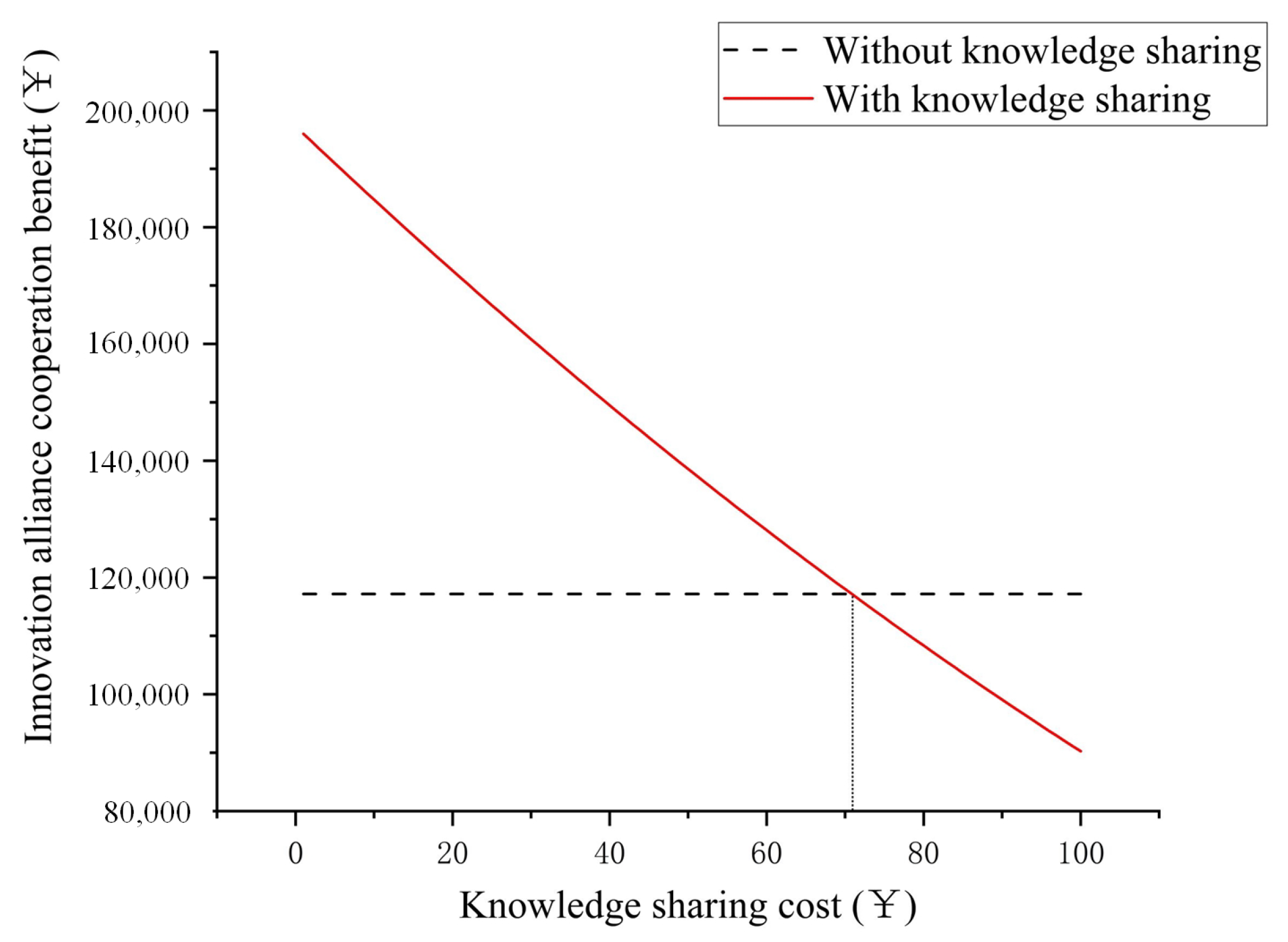

When the other parameters remain unchanged, the trend of the innovation alliance cooperation benefit with changing knowledge sharing cost is shown in

Figure 4. When the knowledge sharing cost is less than

, knowledge sharing between innovation alliance firms makes the knowledge elements circulate efficiently, and the economic benefit is improved. The benefit of the innovation alliance firms with knowledge sharing is significantly higher than that without knowledge sharing. When the knowledge sharing cost is higher than

, the benefit of the innovation alliance firms decreases. At this time, the benefit of the innovation alliance firms with knowledge sharing will be lower than that without knowledge sharing. To prevent the leakage of core knowledge, firms will not share knowledge.

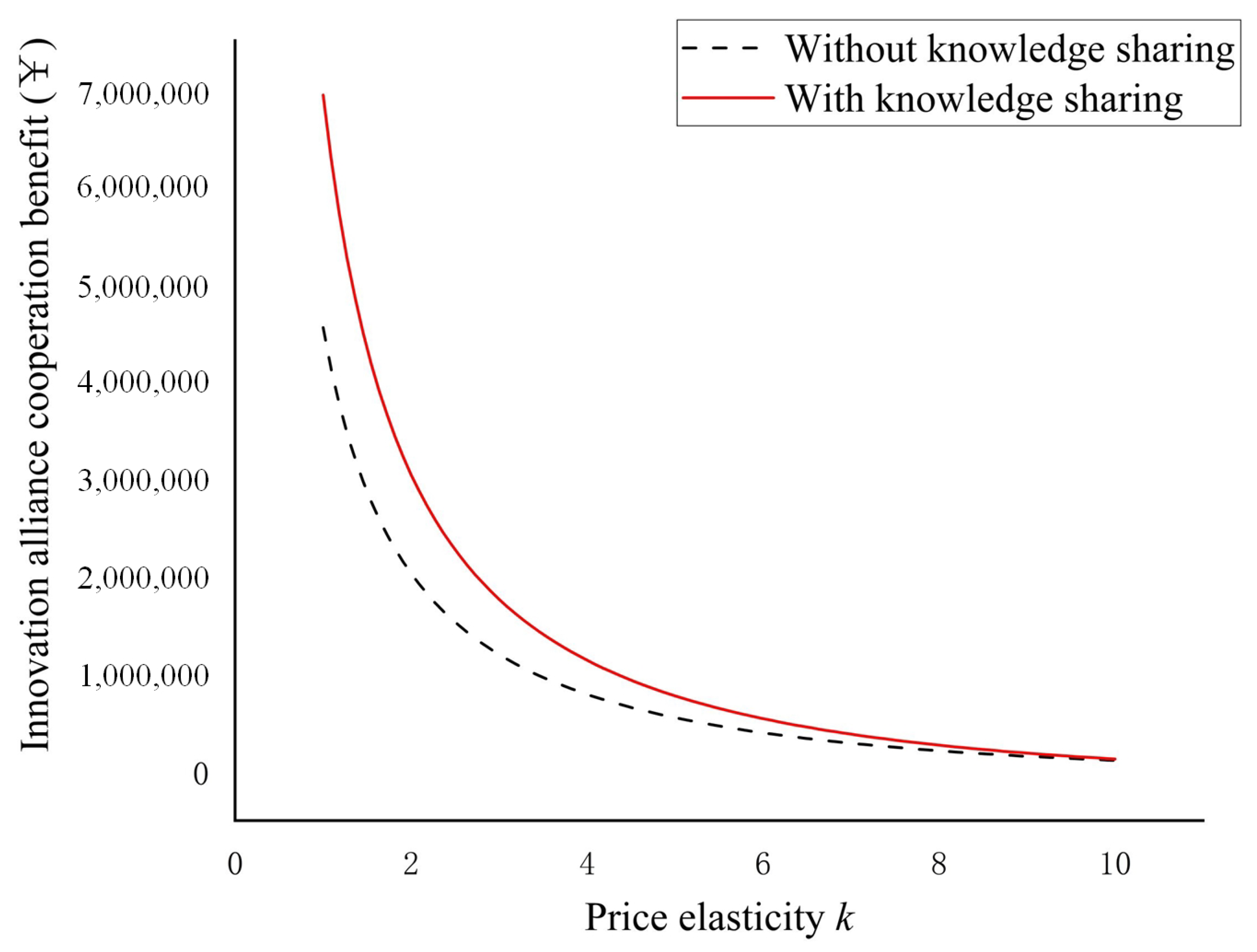

Figure 5 shows the trend of the innovation alliance cooperation benefit changing with price elasticity without and with knowledge sharing. Price elasticity affects the market demand for the new product. When the price elasticity is low, knowledge sharing has a significant impact on the innovation alliance cooperation benefit. At this time, the market demand for the new products is high, and the innovation alliance firms can obtain higher benefits. As price elasticity increases, the innovation alliance cooperation benefit brought about by knowledge sharing becomes less. At this time, the market demand for the new product decreases. Although the innovation alliance firms can still obtain benefit increases compared to those without knowledge sharing, the increases are small.

6. Conclusions and Discussion

6.1. Main Findings

This study analyses the impact of knowledge sharing on the firm’s benefit by constructing game models without and with knowledge sharing between innovation alliance firms. According to the upper limit of the knowledge sharing cost, we analyse the benefit changes in the innovation alliance firms. At the same time, we use the Shapley value to consider the stability of cooperation between innovation alliance firms. Based on this, we derive the conditions under which innovation alliance firms should choose knowledge sharing: (1) When the knowledge sharing cost is less than , the innovation alliance cooperation benefit is improved. This boundary value is the judgment basis for innovation alliance firms to decide on knowledge sharing. (2) With knowledge sharing, the benefit of each firm in the innovation alliance is improved. Using the Shapley value to distribute the benefit, we find that the increase in the benefit of firm A is less than that of firm B. The new product price is positively correlated with the marketing effect. The better the marketing effect is, the higher is the price of the new product. Moreover, when the marketing effect does not exceed the upper limit , the price of the new product decreases compared to that without knowledge sharing. At this point, both the firms and consumers benefit from knowledge sharing. The improvement of the benefit of each firm and the good market feedback consolidates the effect of knowledge sharing, making innovation alliance cooperation maintain stability and continuity. (3) The lower the knowledge sharing cost is, the larger is the increase in the innovation alliance cooperation benefit. If the knowledge sharing cost is too high, innovation alliance firms will not choose to share knowledge. In the process of high-quality development of the innovation alliance, firms should reasonably control the knowledge sharing cost and put more new products on the market to obtain more benefits.

6.2. Theoretical Implications

Some studies have explored the direct impact of knowledge sharing on firm performance [

44]. The mechanisms of knowledge sharing on firm performance have been widely discussed by scholars from different perspectives. As in previous studies, we also agree that knowledge sharing promotes firm performance [

14]. Firms absorb external knowledge and combine it with their knowledge through knowledge sharing [

32]. The enrichment of the firm’s knowledge base helps firms generate more benefits [

45]. However, the current literature has not yet focused on the impact of the cost of knowledge sharing on firm benefits and has neglected the distribution of benefits from innovation alliances. Indeed, the costs and benefits of knowledge sharing are critical to firm innovation [

46]. The difference between this paper and previous studies is that we consider the cost of knowledge sharing between firms. Costs and benefits always come together. Firms will only share knowledge with alliance partners if the benefits outweigh the costs. Therefore, this study advances the literature analysing the decision boundary of knowledge sharing between innovation alliance firms by constructing cooperation game models. The game models of innovation alliance firms without and with knowledge sharing are different. This paper uses the changes in the firm’s benefit and innovation alliance cooperation benefit to find out the decision boundary of the firm choosing knowledge sharing. Using the Shapley value, we analyse the distribution of the cooperation benefit of innovation alliance firms with knowledge sharing. The stability and continuity of innovation alliance cooperation can be guaranteed only when the benefit of each firm is improved. In conclusion, by building cooperation game models, we complement the literature on innovation alliance firm cooperation by further linking knowledge sharing to firms’ costs and benefits.

6.3. Practical Implications

Knowledge sharing is an effective way for innovation alliance firms to promote their sustainable development and deal with external risks in the increasingly fierce market competition. After participating in the innovation alliance, firms should choose diversified partners and attach importance to the cooperative relationships with other firms. Firms should control the knowledge sharing cost and continuously improve the level of knowledge sharing to enhance their benefits and the innovation alliance cooperation benefit.

- (1)

Firms should try their best to reduce the knowledge sharing cost. The mutual trust between firms can improve the management efficiency of innovation alliances. This provides a smooth channel for the efficient flow of knowledge elements between innovation alliance firms. Firms can establish trust mechanisms to reduce the knowledge sharing cost.

- (2)

Firms should strive to improve their marketing effects. Firms can make full use of the advantages of innovation alliances and choose partners with complementary knowledge and technical resources. Knowledge sharing between firms can improve the marketing effect and then increase the cooperation benefit of the innovation alliance.

6.4. Limitations and Future Research

Knowledge sharing is an effective way for innovation alliance firms to deal with the fierce competition and the complexity of the market. This paper analyses the basis of knowledge sharing by constructing benefit models of innovation alliance firms without and with knowledge sharing. There are some limitations in our study. Future research should fully consider other factors in the process of firm development and improve the research framework of knowledge sharing between innovation alliance firms. In addition, future research should incorporate knowledge suppliers, knowledge demanders, and consumers in the innovation alliance into the game model. In this way, a more realistic decision-making basis can be inferred.