Assessing the Effect of the Economy for the Common Good System on Business Performance

Abstract

:1. Introduction

2. Conceptual Framework and Hypothesis Development

2.1. The ECG as a Holistic Organizational System to Integrate CS into Business Strategy

2.2. Sustainable-Driven Hybrid Organizations and SDGs Integration

2.3. Hypothesis Development

3. Methodology

3.1. Data Collection and Sample Profile

3.2. Endogenous Construct

3.3. Exogenous Constructs

3.4. Analysis Technique

4. Results and Discussion

5. Conclusions

5.1. Contributions

5.2. Limitations and Future Research

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- World Commission on Environment and Development. Our Common Future; United Nations: New York, NY, USA, 1987. [Google Scholar]

- Van Zanten, J.; Van Tulder, R. Multinational enterprises and the Sustainable Development Goals: An institutional approach to Corporate engagement. J. Int. Bus. Policy 2018, 1, 208–233. [Google Scholar] [CrossRef]

- Howard-Grenvile, J.; Davis, G.; Dyllick, T.; Miller, C.; Thau, S.; Tsui, A. Sustainable development for a better world: Contributions of leadership, management and organizations. Acad. Manag. Discov. 2019, 5, 335–366. [Google Scholar] [CrossRef]

- Sachs, J.; Schmidt-Traub, G.; Mazzucato, M.; Messner, D.; Nakicenovic, N.; Rockström, J. Six transformations to achieve the Sustainable Development Goals. Nat. Sustain. 2019, 2, 805–814. [Google Scholar] [CrossRef]

- Ejarque, A.T.; Campos, V. Assessing the Economy for the Common Good measurement theory ability to integrate the SDGs into MSMEs. Sustainability 2020, 12, 10305. [Google Scholar] [CrossRef]

- Johson, M.; Schaltegger, S. Two decades of sustainability management tools for SMEs: How far have we come? J. Small Bus. Manag. 2016, 54, 481–505. [Google Scholar] [CrossRef]

- Dyllick, T.; Hockerts, K. Beyond the business case for Corporate Sustainability. Bus. Strategy Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Engert, S.; Rauter, R.; Baumgartner, R. Exploring the integration of Corporate Sustainability into Strategic Management: A literature review. J. Clean. Prod. 2016, 112, 2833–2850. [Google Scholar] [CrossRef]

- Galbreath, J. Building Corporate Social Responsibility into strategy. Eur. Bus. Rev. 2009, 21, 109–127. [Google Scholar] [CrossRef]

- Silvestre, W.; Fonseca, A. Integrative sustainable intelligence: A holistic model to integrate Corporate Sustainability strategies. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1578–1590. [Google Scholar] [CrossRef]

- Haigh, N.; Walker, J.; Bacq, S.; Kickul, J. Hybrid Organizations: Origins, strategies, impacts, and implications. Calif. Manag. Rev. 2015, 57, 5–12. [Google Scholar] [CrossRef]

- Candi, M.; Melia, M.; Colurcio, M. Two birds with one stone: The quest for addressing both business goals and social needs with innovation. J. Bus. Ethics 2019, 160, 1019–1033. [Google Scholar] [CrossRef]

- Alexius, S.; Furusten, S. Enabling sustainable transformation: Hybrid organizations in early phases of path generation. J. Bus. Ethics 2020, 165, 547–563. [Google Scholar] [CrossRef] [Green Version]

- Dyllick, T.; Muff, K. Clarifying the meaning of Sustainable Business: Introducing a typology from business-as-usual to true business sustainability. Organ. Environ. 2016, 29, 156–174. [Google Scholar] [CrossRef] [Green Version]

- Geisenbauer, B.; (University of Bremen, Bremen, Germany); Müller-Christ, G.; (University of Bremen, Bremen, Germany). Die Sustainable Development Goals für und durch KMU: Ein leitfaden für kleine und mittlere unthernehmen. Personal communication, 2018. [Google Scholar]

- Müller-Christ, G.; Geisenbauer, B.; Tegeler, M. Die Umsetzung der SDGs im deutschen Bildungssystem: Studie im aufrag des rats für nachhaltige entwicklung der bundesregierung. Z. Für Int. Bild. Und Enwicklungspädagogik 2018, 41, 19–26. [Google Scholar] [CrossRef]

- Felber, C.; Campos, V.; Sanchis, J.R. The Common Good Balance Sheet, an adequate tool to capture non-financials? Sustainability 2019, 11, 3791. [Google Scholar] [CrossRef] [Green Version]

- Pinelli, M.; Maiolini, R. Strategies for sustainable development: Organizational motivations, stakeholders’ expectations, and sustainability agendas. Sustain. Dev. 2017, 25, 288–298. [Google Scholar] [CrossRef]

- Montiel, I.; Delgado-Ceballos, J. Defining and measuring Corporate Sustainability: Are we there yet? Organ. Environ. 2014, 27, 113–139. [Google Scholar] [CrossRef]

- Kock, C.; Santaló, J.; Diestre, L. Corporate Governance and environment: What type of governance creates greener companies? J. Manag. Stud. 2012, 49, 492–514. [Google Scholar] [CrossRef]

- Freeman, R. Strategic Management: A Stakeholder Perspective; Prentice-Hall: New York, NY, USA, 1984. [Google Scholar]

- Teece, D.; Kay, N. The Evolution of the Theory of the Firm; Eduard Elgar Publishing: Cheltenham, UK, 2019. [Google Scholar]

- Porter, M.; Kramer, M. How to reinvent capitalism and unleash a wave of innovation and growth. Harv. Bus. Rev. 2011, 89, 62–77. [Google Scholar]

- Talavera, C.; Sanchis, J.R. Alliances between for-profit and non-profit organizations as an instrument to implement the Economy for the Common Good. Sustainability 2020, 12, 9511. [Google Scholar] [CrossRef]

- European Commission. Annual Report on European SMEs; European Commission: Brussels, Belgium, 2021. [Google Scholar]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone: Oxford, UK, 1997. [Google Scholar]

- Baumgartner, R.; Rauter, R. Strategic perspectives of Corporate Sustainability management to develop a sustainable organization. J. Clean. Prod. 2017, 140, 81–92. [Google Scholar] [CrossRef]

- Horne, J.; Recker, M.; Michelfelder, I.; Jay, J.; Kratzer, J. Exploring entrepreneurship related to the Sustainable Development Goals: Mapping new venture activities with semi-automated content analysis. J. Clean. Prod. 2020, 242, 118052. [Google Scholar] [CrossRef]

- Bretos, I.; Diaz-Fonceca, M.; Marcuello, C. International expansion of Social Enterprises as a catalyst for scaling up social impact across borders. Sustainability 2020, 12, 3262. [Google Scholar] [CrossRef] [Green Version]

- Mair, J.; Mayer, J.; Lutz, E. Navigating institutional plurality: Organizational governance in hybrid organizations. Organ. Stud. 2015, 36, 713–739. [Google Scholar] [CrossRef] [Green Version]

- Jancsary, D.; Meyer, R.; Hollerer, M.; Barbeiro, V. Toward a structural model of organizational-level institutional pluralism and logic interconnectedness. Organ. Sci. 2017, 28, 1150–1167. [Google Scholar] [CrossRef] [Green Version]

- Campos, V.; Sanchis, J.R.; Ejarque, A.T. Social Entrepreneurship and Economy for the Common Good: Study of their relationship through a bibliometric analysis. J. Entrep. Innov. 2020, 21, 156–167. [Google Scholar] [CrossRef]

- Stubbs, W. Strategies, practices, and tensions in managing business model innovation for sustainability: The case of Australian BCorp. Soc. Responsib. Environ. Manag. 2019, 26, 331–344. [Google Scholar] [CrossRef]

- Tabares, S. Do hybrid organizations contribute to Sustainable Development Goals? Evidence from B Corps in Colombia. J. Clean. Prod. 2021, 280, 124615. [Google Scholar] [CrossRef]

- Ganescu, M. Corporate Social Responsibility, a strategy to create and consolidate sustainable businesses. Theor. Appl. Econ. 2012, 19, 91–106. [Google Scholar]

- Peters, M.; Zelewski, S. Competitive strategies, their relevance for sustainable development in the food industry. J. Mgmt. Sustain. 2013, 3, 148. [Google Scholar] [CrossRef] [Green Version]

- Stead, J.; Stead, W. Sustainable Strategic Management; Routledge: London, UK, 2014. [Google Scholar]

- Engert, S.; Baumgartner, R. Corporate Sustainability strategy: Bridging the gap between formulation and implementation. J. Clean. Prod. 2016, 113, 822–834. [Google Scholar] [CrossRef]

- Ortiz-Avram, D.; Dommanovich, J.; Kronenberg, C.; Scholz, M. Exploring the integration of Corporate Social Responsibility into the strategies of small and medium-sized enterprises: A systematic literature review. J. Clean. Prod. 2018, 201, 254–271. [Google Scholar] [CrossRef]

- Linnenluecke, M.; Griffits, A. Corporate Sustainability and organizational culture. J. World Bus. 2010, 45, 357–366. [Google Scholar] [CrossRef]

- Patel, V.; Manley, S.; Hair, J., Jr.; Ferrell, O.; Pieper, T. Is stakeholder orientation relevant for European firms? Eur. Manag. J. 2016, 34, 650–660. [Google Scholar] [CrossRef]

- Barnett, M.; Salomon, R. Beyond dichotomy: The curvilinear relationship between social responsibility and financial performance. Strateg. Manag. J. 2006, 27, 1101–1122. [Google Scholar] [CrossRef]

- Podsakoff, N.; MacKenzie, S.B.; Lee, J.Y.; Podsakoff, N.P. Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef]

- Johnson, M.P. Sustainability management and Small and Medium-sized Enterprises: Managers’ awareness and implementation of innovative tools. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 271–285. [Google Scholar] [CrossRef]

- Hair, J.; Black, W.; Babin, B.; Anderson, R. Multivariate Data Analysis, 7th ed.; Pearson: Harlow, UK, 2013. [Google Scholar]

- Cleff, T. Applied Statistics and Multivariate Data Analysis for Business and Economics: A Modern Approach Using SPSS, Stata, and Excel; Springer: Berlin, Germany, 2019. [Google Scholar] [CrossRef]

- Aiken, L.; West, S.; Reno, R. Multiple Regression: Testing and Interpreting Interactions; Sage: Thousand Oaks, CA, USA, 1991. [Google Scholar]

- Mc Clelland, G.; Irwing, J.; Disatnik, D.; Sivan, L. Multicollinearity is a red herring in the search for moderator variables: A guide to interpreting moderated multiple regression models. Behav. Res. Methods 2017, 49, 394–402. [Google Scholar] [CrossRef] [Green Version]

- Janssen, O. Fairness perceptions as a moderator in the curvilinear relationships between job demands, and job performance and job satisfaction. Acad. Manag. J. 2001, 44, 1039–1050. [Google Scholar] [CrossRef]

- Le, H.; Oh, I.S.; Robbins, S.B.; Lies, R.; Holland, E.; Westrick, P. Too much of a good thing: Curvilinear relationships between personality traits and job performance. J. Appl. Psychol. 2011, 96, 113–133. [Google Scholar] [CrossRef] [Green Version]

- Pierce, J.R.; Aguinis, H. The Too-Much-of-a-Good-Thing Effect in Management. J. Manag. 2013, 39, 313–338. [Google Scholar] [CrossRef]

- Shields, J.; Shelleman, J. Integrating sustainability into SME strategy. J. Small Bus. Strategy 2015, 25, 59–78. [Google Scholar]

- Kyaw, K.; Olugbode, M.; Petracci, B. The role of the institutional framework in the relationship between earnings management and corporate social performance. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 543–554. [Google Scholar] [CrossRef]

- Manning, B.; Braam, G.; Reimsbach, D. Corporate governance and sustainable business conduct effects of board monitoring effectiveness and stakeholder engagements on corporate sustainability performance and disclosure choices. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 351–366. [Google Scholar] [CrossRef]

- Rosati, F.; Faria, L. Addressing the SDGs in sustainability reports: The relationship with institutional factors. J. Clean. Prod. 2019, 215, 1312–1326. [Google Scholar] [CrossRef]

- Rosati, F.; Faria, L. Business contribution to the Sustainable Development agenda: Organizational factors related to early adoption of SDG reporting. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 588–597. [Google Scholar] [CrossRef]

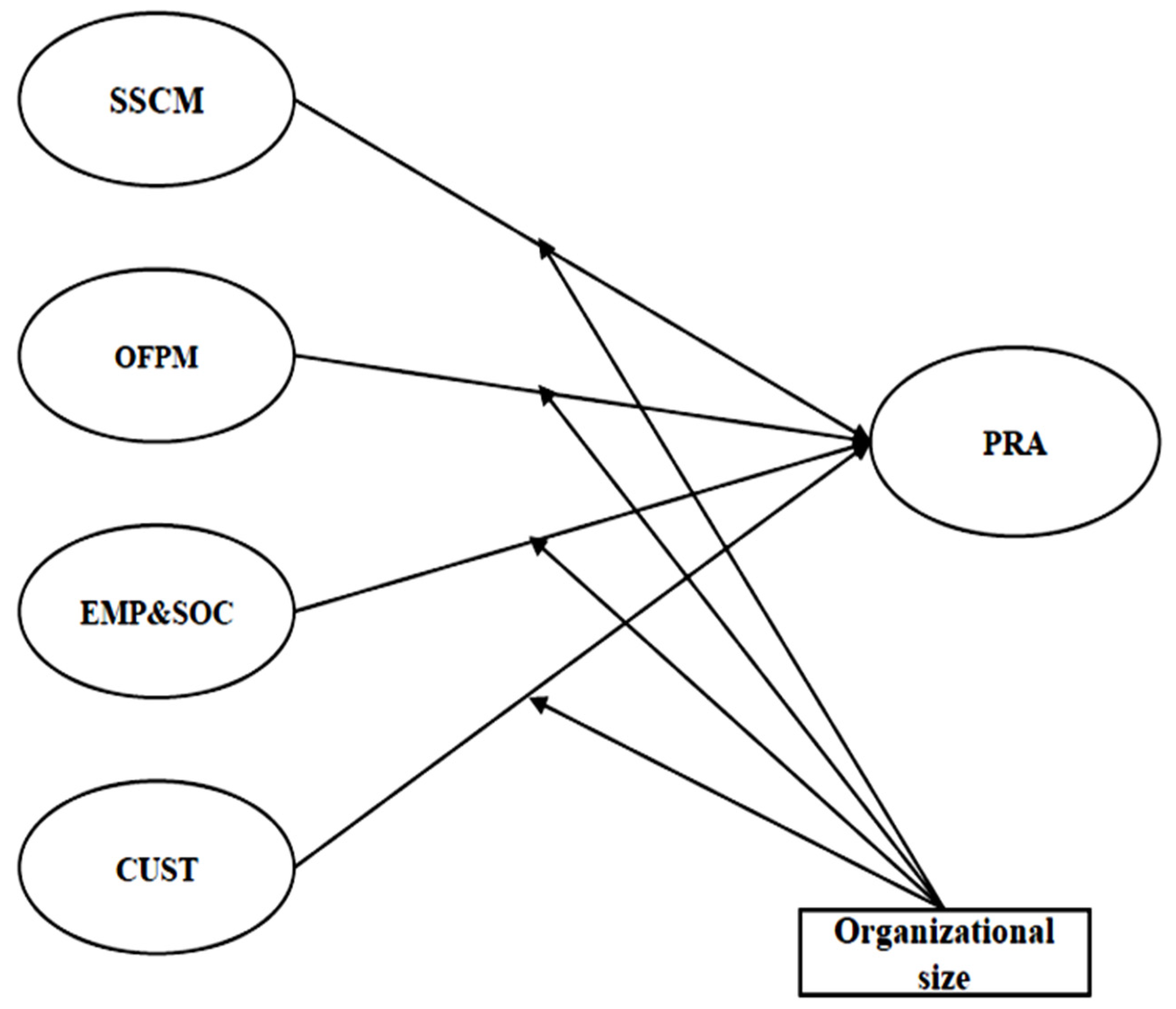

| Dimension | Items | Scale Type | Source |

|---|---|---|---|

| Sustainable supply chain management orientation (SSCM) | A1. Human dignity in the supply chain A2. Solidarity and social justice in the supply chain A3. Environmental sustainability in the supply chain A4. Transparency and co-determination in the supply chain | Absolute scores from the firms’ Common Good balance sheet | Ejarque and Campos (2020) [5]; Felber et al. (2019) [17] |

| Owners and financial partners management orientation (OFPM) | B1. Ethical position concerning the financial resources B2. Social position concerning social resources B3. Use of funds concerning social and environmental impacts B4. Ownership and co-determination | ||

| Employees and society management orientation (EMP&SOC) | C2. Self-determined working arrangements C4. Co-determination and transparency within the organization E2. Contribution to society | ||

| Customer management orientation (CUST) | D1. Ethical customer relations D2. Cooperation and solidarity with other companies D4. Customer participation and product transparency | ||

| Performance in terms of perceived relative advantage (PRA) | Company reputation Competitiveness Costs Customer acquisition and retention Employee motivation Employee productivity Internal Operations Product and service innovation Sales | Likert scale (perceived effects from tool implementation): ranging from 1 “very negative effect” to 5 “very positive effect” | Patel et al. (2016) [41]; Johnson (2015) [44] |

| Organizational size | Number of Employees | European Commission recommendations https://ec.europa.eu/docsroom/documents/42921 (accessed on 12 March 2021) | |

| Annual Revenue | |||

| M | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Ind. | 2.859 | 0.468 | - | |||||||||

| 2. Age | 5.539 | 1.855 | −0.053 | - | ||||||||

| 3. Count. | 2.995 | 1.183 | 0.078 | 0.039 | - | |||||||

| 4. NE | 1.636 | 0.860 | −0.043 | −0.338 ** | −0.078 | - | ||||||

| 5. Rev. | 1.684 | 1.092 | −0.040 | −0.347 ** | −0.024 | 0.781 ** | - | |||||

| 6. SSCM | 10.930 | 7.672 | −0.117 | 0.156 * | −0.121 | −0.151 * | −0.065 | 0.993 | ||||

| 7. OFPM | 3.103 | 1.044 | −0.023 | 0.190 ** | 0.129 | −0.098 | −0.080 | 0.415 ** | 0.976 | |||

| 8. EMP &SOC | 51.387 | 19.001 | −0.094 | −0.112 | −0.163 * | 0.186 ** | 0.164 * | 0.181 ** | 0.181 * | 0.793 | ||

| 9. CUST | 30.398 | 16.507 | −0.017 | 0.011 | −0.058 | 0.049 | 0.085 | 0.342 ** | 0.387 ** | 0.363 ** | 0.704 | |

| 10. PRA | 3.672 | 0.336 | −0.081 | 0.094 | −0.143 * | 0.058 | 0.042 | 0.490 ** | 0.436 ** | 0.621 ** | 0.588 ** | 0.901 |

| Step 1 | Step 2 | Step 3 | Step 4 | Step 5 | Step 6 | Step 7 | Step 8 | Step 9 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B | β | B | β | B | β | B | β | B | β | B | β | B | β | B | β | B | β | |

| Intercept | 3.644 ** | - | 3.644 ** | - | 3.645 ** | - | 3.629 ** | - | 3.634 ** | - | 3.734 ** | - | 3.739 ** | - | 3.725 ** | - | 3.741 ** | - |

| Industry | −0.036 | 0.065 | 0.003 | 0.005 | 0.001 | 0.003 | 0.001 | 0.003 | 0.003 | 0.005 | −0.002 | −0.004 | −0.002 | −0.004 | −0.001 | −0.003 | 0.000 | 0.000 |

| Age | 0.053 | 0.096 | 0.045 | 0.081 | 0.049 | 0.089 | 0.052 | 0.095 * | 0.050 | 0.091 * | 0.029 | 0.052 | 0.029 | 0.052 | 0.033 | 0.059 | 0.019 | 0.035 |

| Country | −0.078 | −0.142 * | −0.025 | −0.045 | −0.031 | −0.055 | −0.026 | −0.046 | −0.025 | −0.046 | −0.015 | −0.026 | −0.014 | −0.025 | −0.014 | −0.026 | −0.007 | −0.012 |

| SSCM | 0.130 | 0.236 ** | 0.137 | 0.248 ** | 0.138 | 0.249 ** | 0.141 | 0.256 ** | 0.158 | 0.287 ** | 0.157 | 0.285 ** | 0.165 | 0.299 ** | 0.156 | 0.283 ** | ||

| OFPM | 0.075 | 0.135 ** | 0.073 | 0.132 ** | 0.072 | 0.131 ** | 0.070 | 0.127 ** | 0.114 | 0.206 ** | 0.112 | 0.202 ** | 0.107 | 0.193 ** | 0.118 | 0.213 ** | ||

| EMP&SOC | 0.249 | 0.451 ** | 0.249 | 0.450 ** | 0.298 | 0.539 ** | 0.274 | 0.497 ** | 0.263 | 0.476 ** | 0.266 | 0.482 ** | 0.269 | 0.487 ** | 0.269 | 0.487 ** | ||

| CUST | 0.159 | 0.287 ** | 0.150 | 0.271 ** | 0.127 | 0.229 ** | 0.136 | 0.246 ** | 0.141 | 0.255 ** | 0.145 | 0.262 ** | 0.145 | 0.262 ** | 0.147 | 0.266 ** | ||

| NE X SSCM | 0.003 | 0.006 | ||||||||||||||||

| NE X OFPM | 0.033 | 0.059 | ||||||||||||||||

| NE X EMP&SOC | 0.012 | 0.019 | ||||||||||||||||

| NE X CUST | 0.015 | 0.035 | ||||||||||||||||

| Rev. X SSCM | −0.031 | −0.065 | ||||||||||||||||

| Rev. X OFPM | 0.023 | 0.044 | ||||||||||||||||

| Rev. X EMP&SOC | 0.118 | 0.187 * | 0.064 | 0.102 * | 0.057 | 0.090 | 0.064 | 0.101 * | 0.059 | 0.094 | 0.063 | 0.100 | ||||||

| Rev. X CUST | −0.054 | −0.128 | ||||||||||||||||

| SSCM2 | −0.057 | −0.122 ** | −0.054 | −0.117 ** | −0.050 | −0.109 * | −0.053 | −0.115 * | ||||||||||

| OFPM2 | −0.053 | −0.120 ** | −0.052 | −0.117 ** | −0.047 | −0.106 * | −0.055 | −0.125 * | ||||||||||

| EMP&SOC2 | 0.002 | 0.005 | ||||||||||||||||

| CUST2 | 0.007 | 0.025 | ||||||||||||||||

| NE X SSCM2 | 0.012 | 0.023 | ||||||||||||||||

| NE X OFPM2 | 0.021 | 0.036 | ||||||||||||||||

| NE X EMP&SOC2 | −0.023 | −0.045 | ||||||||||||||||

| NE X CUST2 | 0.005 | 0.035 | ||||||||||||||||

| Rev. X SSCM2 | −0.030 | −0.065 | ||||||||||||||||

| Rev. X OFPM2 | −0.023 | −0.045 | ||||||||||||||||

| Rev. X EMP&SOC2 | −0.012 | −0.025 | ||||||||||||||||

| Rev. X CUST2 | 0.005 | 0.037 | ||||||||||||||||

| R2 | 0.035 | 0.637 | 0.645 | 0.654 | 0.645 | 0.672 | 0.671 | 0.674 | 0.677 | |||||||||

| Adjusted R2 | 0.020 | 0.625 | 0.625 | 0.634 | 0.631 | 0.651 | 0.654 | 0.650 | 0.653 | |||||||||

| R2 Change | 0.035 | 0.603 ** | 0.008 | 0.016 | 0.008* | 0.027 ** | 0.026 ** | 0.003 | 0.006 | |||||||||

| F2 Change | 2.409 | 82.296 ** | 1.025 | 2.278 | 4.258 * | 3.926 ** | 7.796 ** | 0.372 | 0.855 | |||||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Campos, V.; Sanchis, J.R.; Ejarque, A.T. Assessing the Effect of the Economy for the Common Good System on Business Performance. Systems 2023, 11, 106. https://doi.org/10.3390/systems11020106

Campos V, Sanchis JR, Ejarque AT. Assessing the Effect of the Economy for the Common Good System on Business Performance. Systems. 2023; 11(2):106. https://doi.org/10.3390/systems11020106

Chicago/Turabian StyleCampos, Vanessa, Joan R. Sanchis, and Ana T. Ejarque. 2023. "Assessing the Effect of the Economy for the Common Good System on Business Performance" Systems 11, no. 2: 106. https://doi.org/10.3390/systems11020106