1. Introduction

With the rapid growth of the global economy, sustainable economics has gradually emerged as a significant driving force propelling continuous development in our era [

1]. In recent years, the rising awareness of the importance of environmental protection and social responsibility has placed higher demands on corporate sustainability. Carbon peaking, carbon neutrality, and ecological civilization-building have become global consensuses, and all stakeholders expect companies to balance environmental and social impacts with economic growth. As early as 1992, the United Nations Environment Programme Finance Initiative (UNEPFI) stated that financial institutions were expected to integrate environmental, social, and corporate governance (ESG) considerations into their decision-making processes. As times have changed, stakeholder needs have shifted significantly in the investment arena. Investors are increasingly focused on labor rights, business ethics, and environmental protection. This shift has driven an important transformation in corporate sustainability. ESG as a system of indicators to assess the comprehensive sustainability of companies [

2,

3,

4], is receiving widespread attention for its focus on environmental, social, and corporate governance aspects. The factors influencing ESG performance have been well explored in existing studies. Starting from the external environment, scholars have studied the influencing factors of ESG performance from social institutions [

5], carbon regulatory policy risks [

6], environmental policy uncertainty [

7], digital finance [

2], and multiculturalism [

8]. Internally, research has examined the impact of several aspects on the performance of ESG, such as supervisory or collusive behaviors of major shareholders [

9], heterogeneity of ownership structure [

10], and digitalization of companies [

11]. Despite the considerable amount of research focusing on ESG performance and its influencing factors, urban digital infrastructure, which serves as a “central node” and “transmission link” in modern economic systems, has yet to be included in the scope of consideration.

The digital era refers to the current period in our society and economic environment in which digital technology is highly prevalent and widely utilized [

12]. In this era, the volume of information and data continues to expand, necessitating the use of digital technology for efficient processing and management of this extensive information and data. As the underlying logic supporting digital technology, urban digital infrastructure provides efficient information exchange and data storage capabilities. It offers the essential conditions required for businesses to engage in digital operations and address market challenges. At the same time, urban digital infrastructure is also an essential part of sustainable development. Through digital transformation, companies can better fulfill their social responsibilities and contribute to environmental protection and social welfare. At the moment, academics are studying the macro- and micro-level evolution of urban digital infrastructure. On a micro level, urban digital infrastructure empowers enterprises to leverage digital technologies like the Internet, big data, and blockchain [

13]. This enables them to decrease transaction costs and enhance productivity, ultimately impacting corporate governance [

14]. At the macro level, urban digital infrastructure impacts low-carbon development [

15]. This means that while benefiting from the “low-carbon dividend” brought by urban digital infrastructure, governments and enterprises in developing countries have also achieved significant results in environmental sustainability. Furthermore, urban digital infrastructure contributes to reducing carbon emissions in Chinese cities [

16]. These studies all suggest that urban digital infrastructure has some positive impact on sustainability [

17]. ESG performance is a crucial metric for assessing a company’s sustainability [

2]. Nevertheless, the current body of literature lacks concrete evidence regarding the direct impact of urban digital infrastructure on corporate ESG performance.

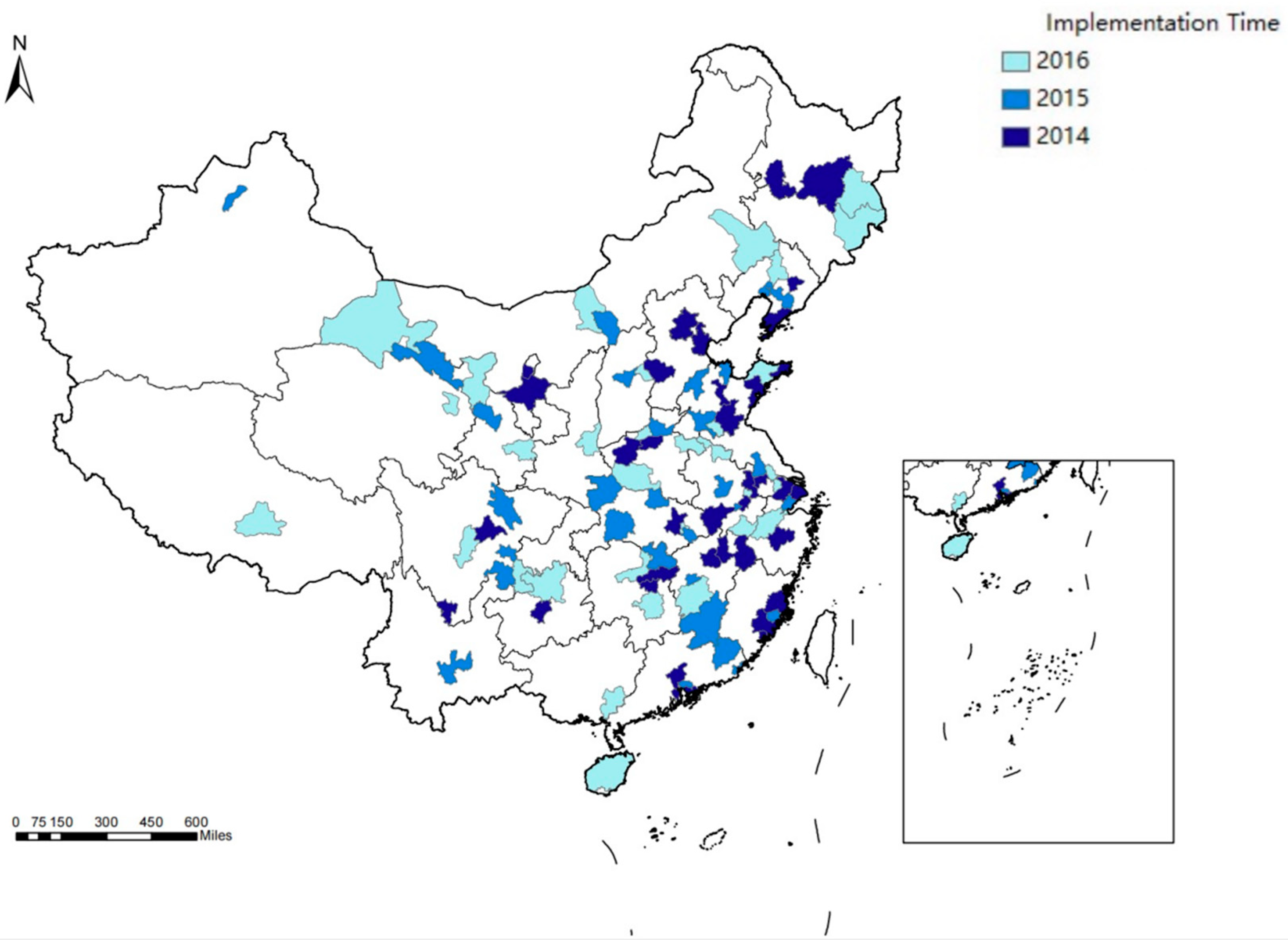

For this paper, the research sample comprises panel data from Chinese A-share listed companies spanning the period from 2011 to 2021. It employs the “Broadband China” strategy as a quasi-natural experiment to empirically examine the impact of urban digital infrastructure on corporate ESG performance. The “Broadband China” strategy selected 120 cities (grouped into three batches) in 2014, 2015, and 2016 as demonstration cities for the purpose of developing broadband infrastructure.

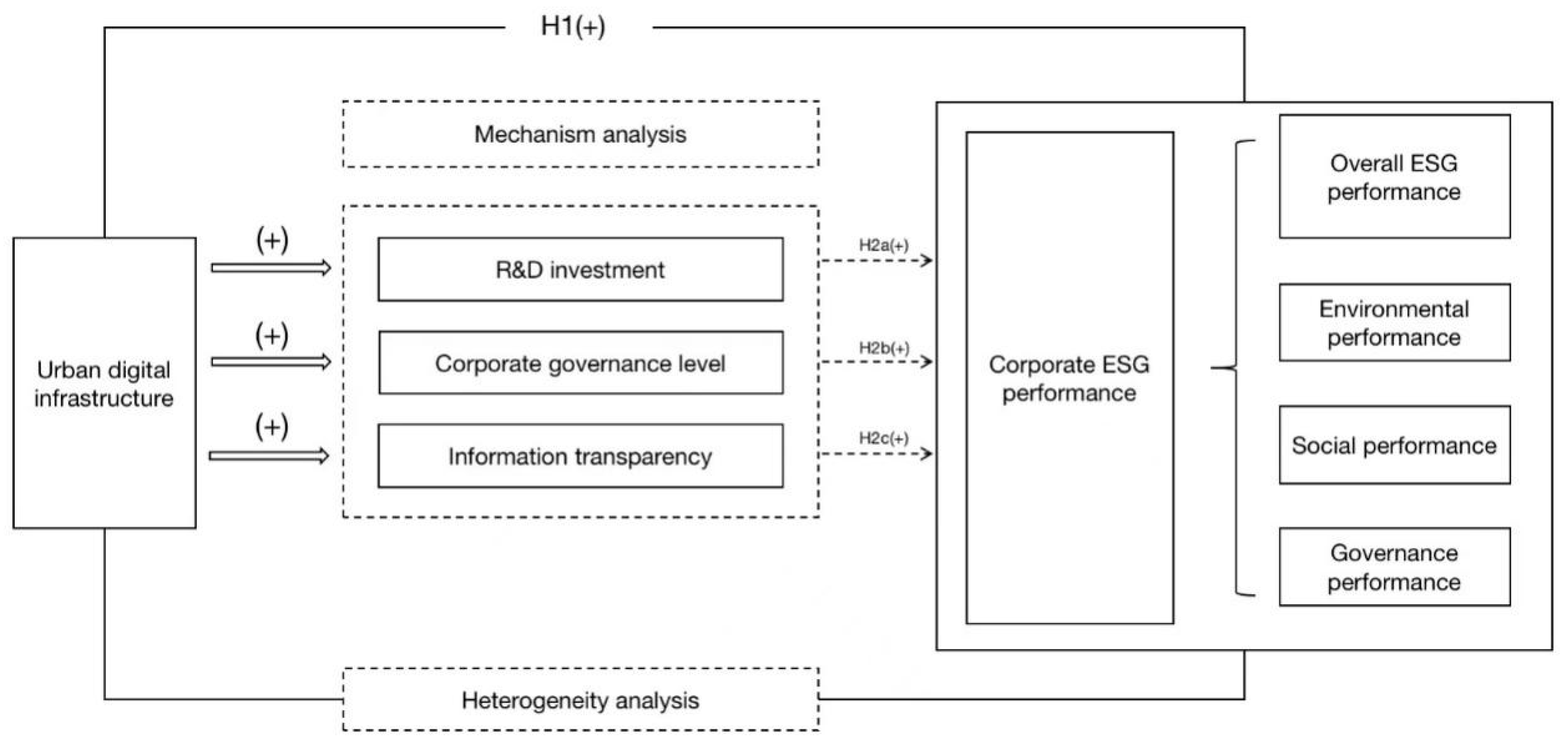

Figure 1 depicts the distribution of cities, with the various shades of blue signifying the various “Broadband China” strategy implementation years. The darker the color, the earlier the implementation year. The selection of these cities for the “Broadband China” strategy was conducted independently of the development status of local enterprises, thus establishing a relatively exogenous factor for companies. To create distinct groups, this paper divides the sample into an experimental group and a control group based on whether the registered location of listed companies falls within the designated “Broadband China” demonstration cities. The paper employs the difference in difference (DID) method to examine the impact of urban digital infrastructure on corporate ESG performance. The important finding from the research is that urban digital infrastructure can greatly improve corporate ESG performance. Additionally, robustness checks were conducted by incorporating macro-level factors, excluding samples from directly administered and provincial capital cities, and utilizing alternative rating agencies for the dependent variable. Secondly, the mechanism analysis indicates that urban digital infrastructure can promote corporate ESG performance by increasing R&D investment, enhancing corporate governance, and improving information transparency (

Figure 2). Moreover, the influence of urban digital infrastructure on ESG performance demonstrates variations and heterogeneity. From a company-level perspective, urban digital infrastructure greatly promotes corporate ESG performance in state-owned enterprises, small-scale businesses, those in the growth phase, and companies with lower profitability. Urban digital infrastructure has a greater influence on promoting ESG performance in non-polluting enterprises and businesses registered in China’s central and western regions.

Compared to previous studies, this paper’s marginal contributions lie in the following three aspects. Firstly, this paper leverages the “Broadband China” strategy to create a quasi-natural experiment and empirically analyze the impact of urban digital infrastructure on corporate ESG performance, which enriches the research on the effects brought about by urban digital infrastructure. The utilization of quasi-natural experiments in this paper enhances the reliability of causal inferences. Quasi-natural experiment methods, which combine causal identification techniques such as randomized controlled trials, matching methods, and instrumental variable approaches, enable more accurate inference of causal effects. Secondly, in terms of paper quality, this paper contributes to the understanding of the variables affecting ESG performance. From existing research, scholars have already conducted extensive discussions on the variables affecting corporate ESG performance. In recent years, with the development of the digital economy, there has been literature focusing on the impact of digitalization on ESG performance, but most studies have been conducted from the perspective of digital finance, and less attention has been paid to the role of urban digital infrastructure. Urban digital infrastructure is the cornerstone of the development of digital economy and has a wider impact on economic and social development, but the existing literature has not paid enough attention to it, especially its role in ESG, and this paper makes up for the gap. Thirdly, the practical implications of this study are of significant importance for both businesses and policymakers. Through an examination of how the development of urban digital infrastructure impacts corporate ESG (environmental, social, and governance) performance, businesses can gain a deeper understanding of the critical role of digital infrastructure in achieving sustainable development goals and enhancing their ESG performance. This understanding can help businesses enhance their social reputation, attract investors and customers, and prepare for future sustainability initiatives. Additionally, policymakers can benefit from the research findings as they provide valuable insights and guidance. Policymakers can use these results to formulate policies that actively encourage businesses to participate in the development of urban digital infrastructure and incorporate ESG considerations into their strategic planning. These policies can contribute to reducing information asymmetry, enhancing information transparency, and increasing external oversight of businesses, thereby motivating companies to fulfill their social responsibilities more effectively. Overall, these measures have the potential to improve corporate ESG performance while also supporting the achievement of sustainable development goals.

The structure of this paper is as follows:

Section 2 presents theoretical analysis and research hypotheses. The model creation process, pertinent variables, and a description of the paper’s data are all included in

Section 3.

Section 4 presents regression results and robustness test regarding the impact of urban digital infrastructure on ESG performance, further examining mechanism analysis and heterogeneity analysis.

Section 5 offers a thorough summary of the report and emphasizes the conclusions drawn from the research.

2. Theoretical Analysis and Research Hypotheses

2.1. The Impact of Urban Digital Infrastructure on Corporate ESG Performance

Whether a company can improve its ESG performance depends not only on its internal knowledge base but also on its ability to integrate and utilize external information effectively [

18]. Specifically, companies need to understand external information to establish ESG strategies aligned with their values and business focus. A company’s understanding of market and customer demands, regulatory and government dynamics, and industry and competitive landscape can guide them in formulating and optimizing its ESG strategies, ultimately improving its corporate ESG performance. At the same time, companies need to collect, clean, and analyze a vast amount of ESG information to measure their ESG performance. This includes property and capacity data, supply chain and partner information, as well as social and human-resources related external information. Urban digital infrastructure can establish ESG information exchange platforms, reducing the cost of ESG information dissemination and thereby facilitating corporate ESG performance. Specifically, urban digital infrastructure can build bridges for the free flow of ESG information. Geographical distances can hinder the free flow of information. However, urban digital infrastructure can to some extent break spatial constraints [

19], establishing channels for the free circulation of information, and promoting resource sharing. This, in turn, stimulates the innovation capacity and sustainability awareness of enterprises, ultimately enhancing their ESG performance. Moreover, robust urban digital infrastructure reduces the search and transmission costs of ESG information. It lowers the cost of searching for the latest R&D outcomes and facilitates the transmission of vast amounts of information. This accelerates the dissemination and exchange of ESG information, providing companies with abundant resources to enhance their ESG performance. Lastly, the diverse and convenient methods facilitated by urban digital infrastructure, such as video calls and online meetings, greatly facilitate the collision and integration of information. This accelerates cooperation efficiency among various nodes in the value chain [

20], which is beneficial for enhancing corporate ESG performance.

This paper suggests hypothesis 1 in light of the analyses previously mentioned.

H1. Urban digital infrastructure has a positive impact on corporate ESG performance.

2.2. The Mediating Role of R&D Investment, Corporate Governance Level, and Information Transparency

Drawing upon existing research, urban digital infrastructure provides a material foundation for improving corporate ESG performance. This paper elucidates the pathways through which urban digital infrastructure promotes corporate ESG performance from two perspectives: internal management and external relationships. Corporate governance and R&D investments place a strong emphasis on organizational design, decision-making processes, management, and resource allocation inside the business to ensure its long-term sustainable growth. When viewed in terms of external relations, the level of information transparency focuses on the transparency of financial, operational, and governance information that the company publicly provides. It aims to enhance trust and cooperation between the company and shareholders, investors, media, and government, thereby influencing the company’s healthy development.

2.2.1. Digital Infrastructure Enhances Corporate ESG Performance through R&D Investment

The construction of digital infrastructure has, to some extent, increased corporate R&D investment, subsequently enhancing corporate ESG performance. Firstly, the integration of digital applications, such as artificial intelligence, big data, and blockchain, with R&D enables real-time information dissemination [

21]. Electronic commerce platforms and other digital channels facilitate efficient communication between buyers and sellers, effectively reducing information exchange costs for businesses, as well as internal operational expenses and other economic activity costs. The reduction in various costs improves the profitability of enterprises, thereby incentivizing increased R&D investments [

22]. Furthermore, increased R&D investment can encourage companies to engage in autonomous innovation and product upgrades, which contributes to the renewal of product manufacturing processes and the enhancement of technological innovation capabilities. Through these means, enterprises can enhance production efficiency across various departments, optimizing corporate ESG performance. In addition, R&D investment can also improve a company’s environmental performance by influencing the intensity of energy and carbon emissions, aligning with the perspectives of natural resource-based theories [

23].

We recommend hypothesis H2a based on the analysis provided above.

H2a. Urban digital infrastructure promotes corporate ESG performance by increasing R&D investment.

2.2.2. Digital Infrastructure Enhances Corporate ESG Performance by Improving Corporate Governance

Urban digital infrastructure contributes to the enhancement of corporate governance within organizations [

24]. The application of large-scale urban digital infrastructure enables organizations to adopt a more networked and flattened organizational structure. Various internal components of the organization are standardized and digitized through the integration of various digital technologies into their production, operations, and management processes, facilitating the rapid and accurate transmission of information [

25]. Consequently, the internal governance level of enterprises is elevated. The improvement in internal governance level aids enterprises in accurately addressing various environmental, social, and governance risks. By establishing flexible risk management mechanisms and crisis response plans, enterprises can effectively respond to risk events, reduce adverse impacts on business operations and stakeholders, and thereby safeguard long-term interests and sustainable development. Furthermore, high-level governance is often associated with a long-term value perspective [

26], prioritizing not just short-term profits but also long-term sustainability. This encourages enterprises to focus on long-term viability, including the achievement of ESG objectives.

Based on the paper above, we put forward hypothesis H2b:

H2b. Urban digital infrastructure promotes corporate ESG performance by improving corporate governance.

2.2.3. Digital Infrastructure Enhances Corporate ESG Performance by Increasing Information Transparency

The growth of urban digital infrastructure improves information openness within businesses [

27,

28], helping them to fulfill their corporate social obligations. When there is information asymmetry between company management and external stakeholders, the management may selectively disclose social responsibility information to maximize their benefits. This selective disclosure can harm the interests of external stakeholders and significantly hinder the company’s sustainable development. In an era where urban digital infrastructure is being developed quickly, technologies like blockchain and artificial intelligence make it possible to track and record business actions, increasing the extent of information disclosure [

29]. Simultaneously, with the rise of information technology and the advent of the internet, communication methods have undergone enhancements, giving rise to novel communication channels, alleviating communication costs [

30,

31], and achieving greater information transparency [

32,

33]. On the one hand, increased information transparency helps investors to assess specific fixed characteristics of a company more accurately [

34], leading to a gradual reduction in the information gap between the company and external stakeholders. At the same time, stakeholders can utilize urban digital infrastructure to participate in the company’s decision-making processes. Various convenient methods, such as video calls and online meetings, enable them to communicate their value propositions and enhance the awareness of corporate social responsibility. Corporate social responsibility contributes to enhancing a company’s image [

35], thereby achieving higher ESG ratings. On the other hand, increased information transparency expands the governance boundaries of the capital market, allowing companies to easily attract investors, analysts, market intermediaries, and other stakeholders. This helps reduce information asymmetry [

36], enhance information transparency, and increase external monitoring pressure on the company [

37], thereby driving the company to fulfill its social responsibilities.

We suggest hypothesis H2c based on the analysis presented above:

H2c. Urban digital infrastructure positively influences corporate ESG performance by enhancing information transparency.

2.3. The Heterogeneous Impact of Urban Digital Infrastructure on Corporate ESG Performance

Companies come in a variety of shapes and sizes, as well as in different regions, stages of development, and industries. As a result, there are variations in how the expansion of urban digital infrastructure affects corporate ESG performance. The heterogeneity of this impact is examined in this article at the regional, industry, and firm levels.

At the business level, four parameters can be used to assess the heterogeneity of the influence of urban digital infrastructure on corporate ESG performance: ownership nature; company size; corporate life cycle; and profitability status. In terms of the nature of ownership, the coexistence of state-owned listed companies and non-state-owned listed companies, including privately-owned listed companies, is a critical institutional background in China’s capital market [

38]. State-owned businesses often experience greater pressure than non-state-owned businesses to strike a balance between the interests of stakeholders and social obligations, and they are also expected to take on more duties related to public benefit and social welfare. In this context, urban digital infrastructure can serve as a crucial means for providing public services and promoting social welfare, helping state-owned enterprises fulfill their social responsibility requirements. In terms of company size, small-scale enterprises often face limited resources and capabilities, including financial, human, and technological aspects. Urban digital infrastructure may give small-scale enterprises more excellent opportunities and means to improve their ESG performance. It can provide more effective, innovative, and sustainable solutions, assisting small businesses in developing corporate governance, social responsibility, and environmental management practices. In contrast, large-scale enterprises may already possess more resources and capabilities to address ESG challenges. Therefore, the impact of urban digital infrastructure on ESG performance may be less significant. In terms of the company lifecycle, enterprises in the growth stage are typically experiencing rapid development and expansion. Their business models, processes, and technologies require continuous investment and improvement. Urban digital infrastructure provides a robust technological foundation and digital solutions that help enterprises in the growth stage improve efficiency, innovate products and services, and better address ESG challenges. In contrast, mature and declining-stage enterprises may have already established relatively stable business models, so the impact of urban digital infrastructure on their ESG performance is relatively small. Furthermore, growth-stage enterprises often face limited resources and capabilities, including finance, human resources, and technology. Urban digital infrastructure can provide additional resources and support to help improve the ESG performance of growth-stage enterprises. In contrast, mature and declining-stage enterprises may already possess a certain level of resources and capabilities and may prioritize maintaining and managing existing ESG standards. As a result, the impact of urban digital infrastructure on their ESG performance may be relatively smaller. In terms of profitability, low-profit enterprises often face more significant risks and challenges, including financial stability, market share competition, and reputation risks. Therefore, they have more motivation to improve their ESG performance to mitigate these risks and enhance the sustainability and competitiveness of the business. Urban digital infrastructure can assist low-profit enterprises in enhancing environmental management, social responsibility, and corporate governance, achieving significant progress in ESG performance. In contrast, high-profit enterprises may already have favorable financial conditions and market positions, resulting in lower demand for ESG improvements. As a result, their ESG performance may be less significantly affected by the expansion of urban digital infrastructure.

The proposed hypothesis H3a is based on the analysis presented above:

H3a. State-owned, small and medium-sized, mature, and high-profit enterprises all significantly promote the impact of urban digital infrastructure on corporate ESG performance.

Industry-level heterogeneity is examined in terms of whether the company is a heavy polluter to investigate the heterogeneous impact of urban digital infrastructure on corporate ESG performance. Non-heavy polluting businesses typically place a higher priority on sustainability and environmental responsibility. They are more willing to invest in urban digital infrastructure to improve environmental impact and meet societal expectations. In contrast, heavy-polluting companies may face more significant challenges in terms of environmental responsibility and may have fewer investments in urban digital infrastructure. Regarding business model differences, non-polluting companies may be more inclined to adopt clean and sustainable business models. Urban digital infrastructure can give them more opportunities for efficient resource utilization, reduce environmental impact, and drive green innovation. The business models of polluting companies may conflict with environmental concerns, which can result in a relatively smaller impact of urban digital infrastructure on their ESG performance. Regarding risk management needs, non-polluting companies may face relatively lower environmental and social risks. Urban digital infrastructure can help them better manage and mitigate these risks. However, polluting companies face a greater variety and complexity of risks, making it challenging for urban digital infrastructure to address these issues comprehensively.

The proposed hypothesis H3b is based on the analysis presented above:

H3b. The promoting effect of urban digital infrastructure on corporate ESG performance is more significant in non-polluting industries.

We examine the spatial heterogeneity of the impact of urban digital infrastructure on corporate ESG performance by taking into account enterprises in the central-western and eastern regions. In terms of infrastructure needs, companies in the central-western region may need more developed infrastructure. Urban digital infrastructure can help bridge this gap by providing more efficient and reliable information and communication networks, thus improving production efficiency and business management for these companies. In contrast, companies in the eastern region have already benefited from better infrastructure conditions. Therefore, the impact of urban digital infrastructure on ESG performance may be more minor. The comparatively underdeveloped condition of the central and western regions makes urban digital infrastructure a more important driving force for their advancement in terms of regional development inequalities. By leveraging urban digital infrastructure, companies in the central and western regions can better integrate into a global competition, enhance their innovation capabilities, and gain market access and sustainable development opportunities. Companies in the eastern region are already relatively mature and developed, so the impact of urban digital infrastructure on their ESG performance may be relatively limited.

The proposed hypothesis H3c is based on the analysis presented above:

H3c. For businesses in the central and western areas, the enhancing impact of urban digital infrastructure on ESG performance is particularly pronounced.

5. Discussion and Conclusions

5.1. Discussion

In recent years, with the increasing global pursuit of sustainable development, companies’ environmental, social, and corporate governance (ESG) performance has become a focal point of attention. ESG performance serves as both a critical foundation for investors, customers, and other stakeholders to assess a company’s worth and reputation as well as a key indicator of corporate sustainable development. In this context, urban digital infrastructure, as a significant component of modern business development, has garnered significant attention from researchers and practitioners due to its relationship with corporate ESG performance.

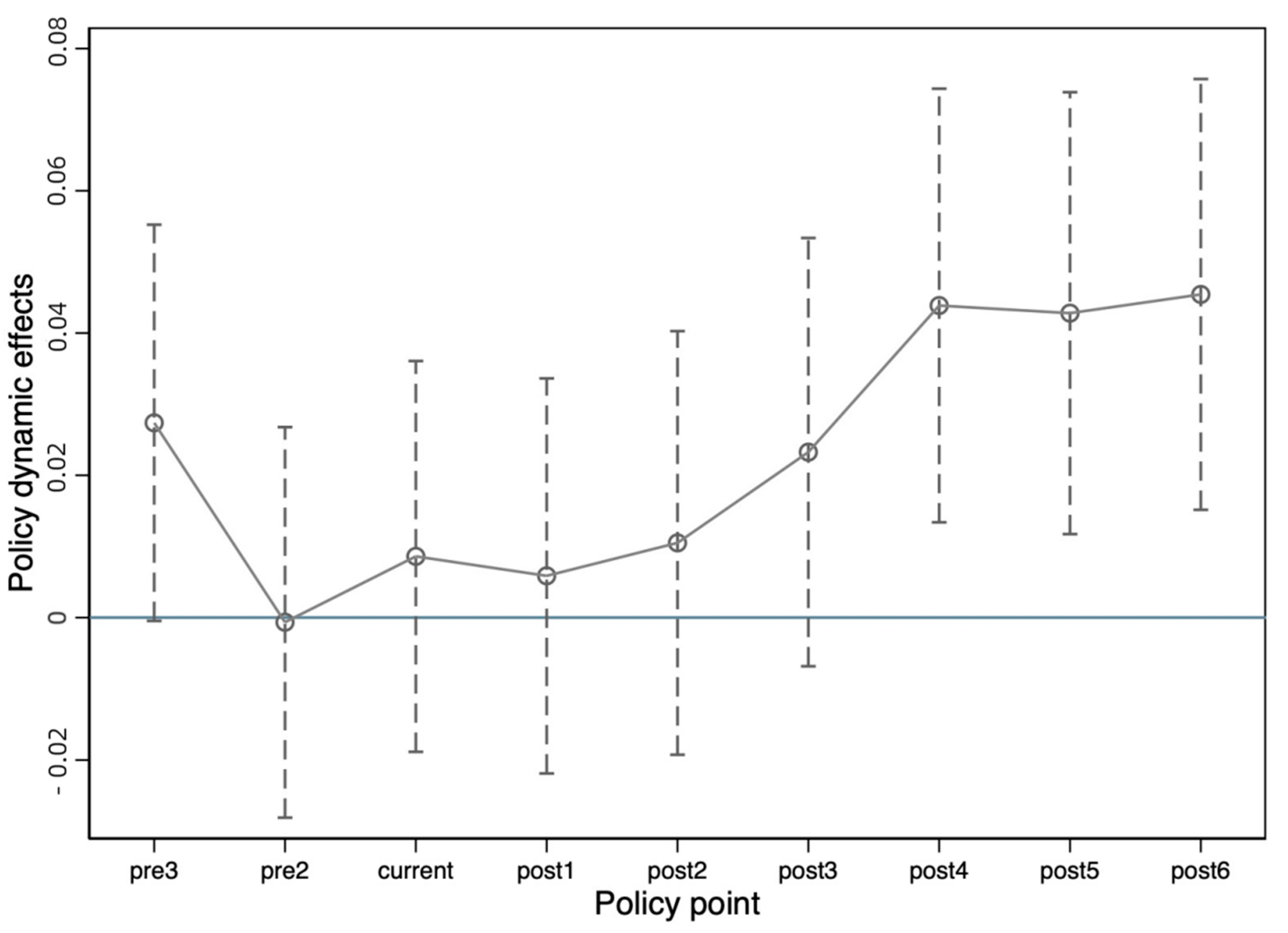

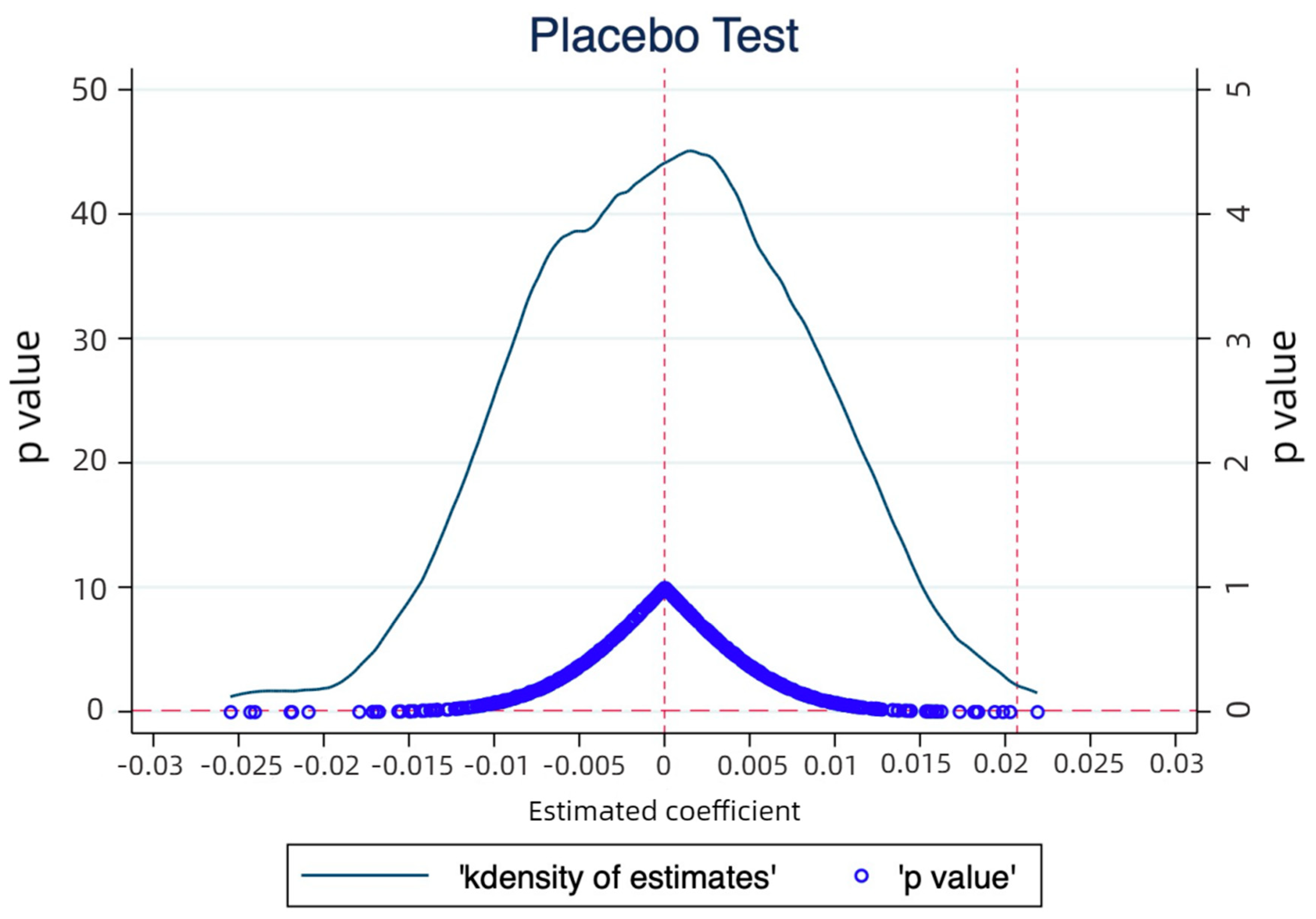

This paper places cities and enterprises within the green and high-quality development framework. It uses a variety of econometric techniques to conduct empirical testing based on theoretical analysis and the “Broadband China” quasi-natural experiment. Data from Chinese A-share listed firms from 2011 to 2021 are used in the paper. The conclusions are as follows. Firstly, urban digital infrastructure significantly positively affects corporate ESG performance. This paper addresses endogeneity concerns by employing propensity score matching and placebo tests. Robustness checks are conducted by incorporating macroeconomic factors, excluding samples from direct-controlled and provincial capital cities, and using alternative ESG rating agencies as explanatory variables. Secondly, urban digital infrastructure can promote corporate ESG performance through various channels, such as increasing R&D investments, enhancing corporate governance, and improving information transparency. Thirdly, state-owned enterprises, small businesses, growing companies, and companies with lower profitability all perform better in ESG metrics at the corporate level, where urban digital infrastructure is more relevant. Urban digital infrastructure has a greater influence on ESG performance at the industry and regional levels for non-polluting businesses and businesses in the central and western regions.

However, this paper has several limitations. Firstly, the indicators for urban digital infrastructure and corporate ESG performance may need improvement due to data constraints. Future research should adapt to new characteristics and refine these indicators accordingly. Secondly, studying the impact of digital infrastructure on corporate ESG performance is a complex and multifaceted issue that requires consideration of various factors and possibilities. For instance, a more in-depth examination of the individual sub-indicators of ESG performance can provide a more comprehensive understanding of the effects of digitization on environmental, social, and governance aspects. Additionally, investments and efforts by companies in digitization may be influenced by competitive pressures and market dynamics, making the competitive environment another crucial factor to consider. Furthermore, digital infrastructure encompasses a wide range of different digital technologies, such as big data analytics, artificial intelligence, and the Internet of Things, among others. These technologies may have distinct and specific impacts on ESG performance. Through a deeper exploration of these unaddressed areas, we can gain a more comprehensive understanding of the relationship between digitization and ESG. This comprehensive research approach can offer valuable insights and opportunities for future studies, ultimately contributing to sustainable development and enhanced corporate ESG performance. Finally, as the global digital economy enters a new stage of development, urban digital infrastructure is profoundly transforming the economy and society, continuously impacting the sustainable development of companies, regions, and even individuals. This paper focuses on China and analyzes the impact of urban digital infrastructure on corporate ESG performance. In future research, it would be beneficial to broaden the perspective and analyze this issue from the standpoint of global economic development. Achieving sustainable development through urban digital infrastructure and improving corporate ESG performance requires comprehensive planning and long-term efforts.

5.2. Conclusions

The government and enterprises can consider the following policy implications in light of the paper’s findings.

Accelerating the growth of the digital economy and enhancing urban digital infrastructure should be priorities. Various parts of China have varied levels of development for their urban digital infrastructure, which shows there is space for growth. Companies should seize the opportunities presented by the digital economy era and embark on digital transformation and upgrading. By leveraging digital resources, aligning with policy directions, and promoting sustainable development, companies can assume greater social responsibilities and optimize internal governance efficiency, enhancing their ESG performance.

Enhancing corporate awareness of ESG performance is crucial. Under the supervision and guidance of the government and the market, companies should gradually shift their attitudes towards ESG performance from passive to proactive, increasing their motivation to improve ESG performance and viewing it as an intrinsic requirement. In future developments, companies must consider ESG performance essential to enhance competitiveness, achieve long-term growth, and fulfill social responsibilities. Additionally, public officials should improve their ability to enforce information disclosure, gain an in-depth understanding of companies’ actual situations, establish information exchange platforms, facilitate communication among companies, and positively influence and shape corporate ESG behavior through targeted “dialogue” within urban digital infrastructure.

Based on heterogeneity analysis, it is crucial to strictly control the proportion of heavily polluting industries and actively promote their green transformation for companies with different property rights, varying sizes, geographical locations, profitability levels, industries, and life cycles. Efforts should be made to leverage the leading role of state-owned enterprises and seize the new resources, opportunities, and trends brought by urban digital infrastructure. Local governments should adopt targeted approaches and develop multi-level support programs for different types of enterprises. Limited fiscal resources should be allocated to urban digital infrastructure to lower the barriers for companies to embrace digitization, enhance their digital capabilities, and promote ESG performance.