Abstract

This study aims to examine the effect of FinTech adoption on the sustainability performance of banking institutions in an emerging economy such as Bangladesh. Besides, this study also investigates the mediating role of green finance and green innovation in the relationship between FinTech adoption and sustainability performance. To examine the relationship among the study variables, this study used data from 351 employees of banking institutions operating in Bangladesh during the period January to March 2021 using a convenience sampling method. Furthermore, the study utilized a two-staged structural equation modeling and an artificial neural network (SEM-ANN) approach to analyze the data. The findings show that FinTech adoption significantly influences green finance, green innovation, and sustainability performance. Similarly, the results indicate that green finance and green innovation have a significant positive influence on sustainability performance. Furthermore, the results reveal that green finance and green innovation fully mediate the relationship between FinTech adoption and the sustainability performance of banking institutions. Moreover, the present study contributes to the existing literature on technological innovation, green finance, and sustainability performance greatly as it is the first study to examine both linear and non-linear relationships among these variables using the SEM-ANN approach. As a result, the study highlights the importance of FinTech adoption, green finance, and innovation in the attainment of sustainability performance, as well as the urgent need to incorporate new technologies, green initiatives, and financing into banking strategies to help achieve the country’s sustainable economic development.

1. Introduction

Financial technology (FinTech) and environmental sustainability have recently become hot topics among researchers, academics, and practitioners, as well as in the banking, securities, and asset management businesses. Simultaneously, governments around the world have initiated a variety of measures in favor of green finance and sustainable banking in order to improve environmental sustainability [1,2]. In this context, digitalization aids in the transformation of sustainable economies by promoting inclusive growth and increasing overall productivity, with online banking and trade playing a significant role. Activities on sustainable digital finance and fintech have recently been at the center of a new line of research on the relationship between digital finance and environmental sustainability. Furthermore, the adoption of a reliable and effective digital payment system, both at the national and cross-border levels, is an important strategy for reducing inequality and enhancing environmental sustainability. According to Nassiry [3], FinTech and green finance are crucial to regulators, particularly in developing nations, in order to meet the Paris Agreement and the Sustainable Development Goals (SDGs). Banking institutions are playing a critical role in achieving the country’s sustainable development through the adoption of innovative technologies including blockchain, green banking, and online banking [3,4], as well as the financing of various eco-friendly initiatives such as clean energy, energy efficiency, clean technology, and green industry development [1,5,6]. As a result, this study concentrates on the variables that influence the sustainability performance (SP) of banking institutions in an emerging country like Bangladesh.

Issues associated with environmental sustainability, economic growth, and technical innovation are not new, but incorporating these issues in a single study is becoming more significant [7,8]. FinTech is described as “organizations or businesses that connect financial services with new, creative technologies such as blockchain” [9]. FinTech is the use of technological innovation to provide people with financial services and products [10]. Green finance (GF), on the other hand, is defined as financial investments in a variety of environmentally friendly initiatives and activities that assist a business in achieving environmental sustainability and stimulating the growth of a more sustainable economy [4,11]. Moreover, the research has shown that technological progress like blockchain has the potential to accelerate the flow of capital toward a more sustainable economic technology [3], and financial instruments like GF are regarded as important indicators of improving organizations’ environmental sustainability. Green innovation (GI) can be defined as technological advances that reduce waste, environmental degradation, air pollution, energy consumption, and the use of coal, oil, and power while also conserving energy [8]. Likewise, GI is important in today’s corporate sector for mitigating the harmful effects of climate change as well [11,12]. As a result, FinTech and GF can be concluded to contribute to the promotion of environmental sustainability of banking institutions by incorporating eco-friendly advanced technologies into their operations (e.g., digital lending, digital banking, mobile banking, and online customer care services) and financing various environmentally friendly initiatives (e.g., renewable energy, green industry development, alternative energy and waste management).

To date, various studies have recently been conducted to evaluate the relationship between GF and business environmental SP [5,7,13,14]. The literature has demonstrated that GF significantly enhances corporate green performance [15], SP [1,14], and environmental performance [2,5]. Besides, Awawdeh et al. [7] observed that technological innovation significantly determines the environmental performance. Furthermore, research has shown that FinTech adoption (FA) has a significant impact on the competitiveness and performance of the banking industry [10]. Wang et al. [16] found that there is a positive link between GI and organizational performance, including environmental performance. Despite various studies showing that GF and GI have a positive influence on a firm’s environmental and sustainability performance, little attention has been given to the relationship between FA, GF, GI, and SP in the context of banking institutions of an emerging economy like Bangladesh. Nevertheless, scholars continue to focus on this link because of mixed findings reported in past studies [5]. Therefore, the current study established a comprehensive research model to investigate the impact of FA on SP of banking institutions through the mediating effect of GF and GI.

The primary goal of the study is to investigate the effect of FA on SP through the mediating role of GF and GI in the setting of banking institutions in order to address the aforementioned research gaps. To achieve the stated goals, the following two research questions are further addressed: What is the relationship between FA, GF, GI, and SP of banking institutions? Do GF and GI partially or fully mediate the association between FA and SP? The current study will not only bridge a gap in the existing body of literature regarding how FA, GF, GI, and SP connect to each other, but it will also offer banking executives insightful information regarding how to improve organizational sustainability performance using FA and GF.

The current study enhances the existing literature in several theoretical and practical aspects. First, it elaborates on the link between FA and the SP of banks, as well as the mediating function of GF and GI. Second, methodologically, this is one of the earliest studies that used a two-staged SEM-ANN approach using a nonlinear non-compensatory neural network model to find the correlations between the study variables. Third, this is the first study to incorporate FA, GF, GI, and SP in a single research model in the context of an emerging economy’s banking institutions. Finally, this study indicates how developing market banking institutions may use FinTech, GF, and innovation to improve overall organizational environmental sustainability. Moreover, managers in emerging nations such as Bangladesh can utilize this research paradigm to enhance banking institutions’ overall environmental sustainability.

The paper is prepared as follows: Section 2 discovers the literature and elaborates on the hypotheses. Section 3 displays the research methodology, and Section 4 covers the main findings of the SEM-ANN analysis; Section 5 advances the discussion, and the study’s conclusion, implications, limitations, and directions for future research in Section 6 follows.

2. Literature Review and Hypotheses Development

2.1. FinTech Adoption and Sustainability Performance

Researchers are now concentrating on FinTech because of the increasing preference of customers for environmentally friendly and simple-to-use goods and services. Financial institutions, according to Al Nawayseh [17], performed a wide range of functions to support financial and economic activity through technological advancements such as FinTech. FinTech is the use of technological innovation to supply financial services and products to customers [10]. The advancement of ICT has altered financial businesses throughout the years, allowing for more efficient and inventive service delivery as well as enhanced environmental sustainability [18]. Previous research has identified technological innovation as a strong predictor of environmental performance [7]. Similarly, Dwivedi et al. [10] discovered that FA had a substantial impact on the banking industry’s competitiveness and performance. Furthermore, environmental sustainability is described as the development of products, methods, and management actions linked with the delivery of a product or service [7]. A recent study found a correlation between technological innovation and environmental sustainability [19]. The study also suggested that firms use environmentally friendly technologies to help them reach overall environmental performance. Numerous studies have been undertaken to date in order to determine the link between technological innovation and environmental performance; however, little attention has been paid to the link between FA and SP in the context of banking institutions such as in Bangladesh. As a result, the purpose of this study is to fill that gap by investigating the influence of FA on the SP of banking institutions. As a result, the following theory is proposed:

Hypothesis 1 (H1).

FA significantly enhances the SP of banking institutions.

2.2. FinTech Adoption, Green Finance, and Green Innovation

The literature on the relationship between innovation and environmental sustainability is extensive [8]. However, there has been little attention given to exploring the link between FA, GF, and GI in a single piece of research, particularly in the context of banking firms in emerging economies. As a result, the present study aims to fill this gap by examining the associations between these variables. Awawdeh et al. [7] have investigated the impact of GF and CSR on technological innovation and company environmental performance. According to the findings of the study, technical innovation and GF have a significant positive impact on company environmental performance. According to Peng and Zheng [20], GF can assist regulators to optimize energy structure and improve sustainability by fostering the development of novel energy technologies and disruptive GI. FinTech has the ability to use GF technologies like blockchain, the Internet of Things, and big data to help achieve the SDGs [3]. Furthermore, the link between GF and GI has yielded conflicting results [21]. On the one hand, GF was found to have a positive impact on GI in emerging economies and countries with low amounts of green finance. However, it has a negative impact on GI in countries with higher levels of technology or EP. Furthermore, Xiong and Sun [22] discovered that green insurance and green structure have positive effects on green investment and GI. As a result, the present literature on the association between FA, GF, and GI is inconclusive and needs to be expanded. Nonetheless, FA, GF, and GI can be argued to be critical in achieving an organization’s SP. The subsequent research hypotheses have been developed in light of the above discussion:

Hypothesis 2 (H2).

FA significantly enhances the GF of banking institutions.

Hypothesis 3 (H3).

FA significantly enhances the GI of banking institutions.

2.3. Green Finance and Sustainability Performance

The relationship between GF and a company’s environmental sustainability has long been studied, with various studies suggesting a strong relationship between the two variables. In other words, the greener a company’s finance, the greater its environmental sustainability. As a result, in accordance with Zhang et al. [5], GF in this study has been defined as the financing of various ecofriendly projects such as renewable energy, clean technology, green industrial growth, and waste management in order to increase banks’ SP. According to the literature, GF and its dimensions have a favorable influence on the SP of banking institutions [1]. Extant literature, on the other hand, has confirmed that GF favorably influences corporate environmental performance [2,7]. Moreover, Xu et al. [23] have shown that GF improves corporate green performance significantly. Green investment has a considerable positive influence on the firm’s financial and SP, according to Indriastuti and Chariri [14]. Although the relationship between GF and firm environmental sustainability is extensively documented in the literature, there has been less emphasis on the interaction of FA, GF, GI, and SP in a single study. GF is predicted to have a significant favorable influence on banking institutions’ SP. As a result, the following study hypothesis is developed:

Hypothesis 4 (H4).

GF significantly enhances the SP of banking institutions.

2.4. Green Innovation and Sustainability Performance

GI is defined as technological developments that strive to reduce waste, environmental degradation, air pollution, energy consumption, and the use of coal, oil, and power while also conserving energy [8]. GIis critical in today’s corporate sector for mitigating the harmful effects of climate change [11,12]. Besides, GI can be defined in this study as technological advancements in the banking sector such as green banking, internet banking, mobile banking, green environmental strategy, and green marketing strategy to reduce both internal and external environmental pollution and help banks achieve environmental sustainability. The literature has demonstrated that green innovation significantly enhances sustainability performance [24]. According to Adegbile et al. [25], GI improves environmental performance and is linked to a firm’s environmental management approach. Furthermore, research has demonstrated that GI significantly reduces a firm’s negative environmental effect while concurrently improving organizational financial performance through cost and waste reduction [26]. Wang et al. [16] observed a positive relationship between GI and organizational performance, including environmental performance. Similarly, Kraus et al. [8] established that GI influences environmental performance. Despite this, Edeh et al. [27] discovered that technological innovation improved export performance significantly. Various studies on GI and EP have been conducted to date, with inconsistent results [8]. As a result, the purpose of this study is to confirm the association between GI and SP in the banking business. Based on the preceding reviewed literature, the following study hypothesis is developed:

Hypothesis 5 (H5).

GI significantly influences the SP of banking institutions.

2.5. The Mediating Role of Green Finance and Innovation

The previous discussion of the connection between FA, GF, GI, and SP indicated that GF and GI enhance the organization’s SP significantly. Nevertheless, no prior research has examined the influence of FA on SP in the context of financial institutions via the mediating variables of GF and GI. As a result, the present study fills a gap in the research literature by examining the relationship between these variables in the context of a banking business in an emerging economy. Recently, Zhang et al. [13] have investigated the influence of green banking activities on the environmental performance of banking institutions via the mediating effect of GF. The study discovered that GF strongly mediated the association between green banking operations and the environmental performance of banking organizations. Besides, the literature has confirmed that GF significantly influences SP [1]. Furthermore, studies discovered that GI has a significant impact on environmental performance [8,28,29]. Moreover, Kraus et al. [8] discovered that GI mediates the association between corporate social responsibility and environmental performance significantly. These results suggested that GF and GI may have a major positive impact on the banking industry’s link between FA and SP. There have been no previous investigations to investigate the mediating influence of GF and GI on the link between FA and SP. As a result, the current study fills these gaps. Hence, the subsequent research hypotheses are proposed:

Hypothesis 6 (H6).

GA significantly mediates the association between FA and SP of banking institutions.

Hypothesis 7 (H7).

GI significantly mediates the association between FA and SP of banking institutions.

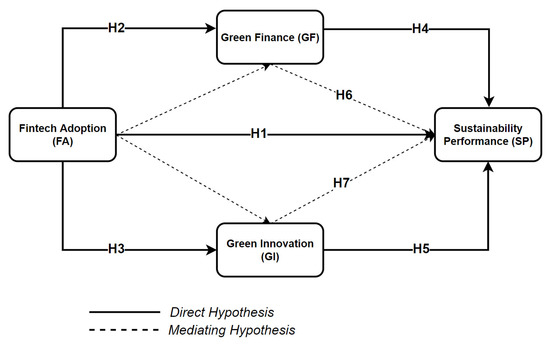

The conceptual framework of the study, is shown in Figure 1.

Figure 1.

Conceptual Framework of the Study.

3. Materials and Methods

3.1. Sampling and Data Collection

The purpose of the current study is to ascertain how FA influences banking institutions’ SP in a developing country like Bangladesh. The study also looks at how GF and GI mediate the relationship between FA and SP. Furthermore, the FinTech business in Bangladesh, such as mobile financial services (MFS), has seen a significant increase in the number of customers recently [18,30]. Banking firms in Bangladesh, led by Bkash, an initiative of Brac Bank Limited, provide the vast majority of MFS services in the country [18]. Banking institutions in Bangladesh have been specially selected for this study due to their significant contribution to FA, particularly mobile banking, which is why the country’s high mobile banking adoption rate during the past few years is beneficial to our research [18,30] and green financing [4,11]. Moreover, existing literature has demonstrated that banking firms play a significant role in the long-term economic growth of a country like Bangladesh by funding a wide range of environmentally responsible projects, including green sources, clean energy, and green industrial growth [1,5].

Furthermore, the study used a structured questionnaire to collect primary data from staff of commercial banks operating in Dhaka. From January to March 2021, the respondents were chosen using convenience sampling methods. We collected 400 questionnaires in total, 49 of which were subsequently deleted from the final analysis because of incorrect or missing values. As a result, the final sample size for the study is 351. A pilot test was done prior to the main survey among 30 randomly selected commercial bank employees to verify the validity and accuracy of the survey questions. The demographic information of the respondents is reported in Table 1.

Table 1.

Respondents Profile.

3.2. Survey Instrument Development

The measurement items for assessing the variables employed in the study, namely FA, GF, GI, and SP, were developed through a review of the literature. The current study gathered primary information by using structured questionnaires modified from prior studies to assess the influence of FA on SP with the mediating effect of GF and GI. The questionnaire method was divided into two segments which were the participant’s personal information and questions concerning the endogenous and exogenous variables used in the study. The questions were scored on a five-point Likert scale ranging from 1 (strongly disagree) to 5 (strongly agree). Six items derived from previous studies were used to measure FA [17,18]. The FA scale assesses a banker’s opinion of the effect of their organization’s FA intentions on GF, GI, and SP (e.g., ‘our bank has already implemented or intends to use mobile banking services in the future’). The alpha value for these items was 0.892. Furthermore, five questions were employed to quantify GF, which were modified from the investigations of [1,5]. The GF scale measured GF using various statements (e.g., our bank invests more in renewable energy, waste management, energy efficiency and green industry development sectors). The GI was evaluated using four items from the studies of [8,31]. Examples of these items include: ‘our bank implements green technology, green banking, and provides online customer service’. Moreover, the SP scale was evaluated with six questions modified from previous investigations of [1]. An example of EP items includes: ‘FA, GF, and GI help to reduce carbon emissions from banking activities’. Finally, the reliability value for these items was 0.872.

3.3. Data Analysis Techniques

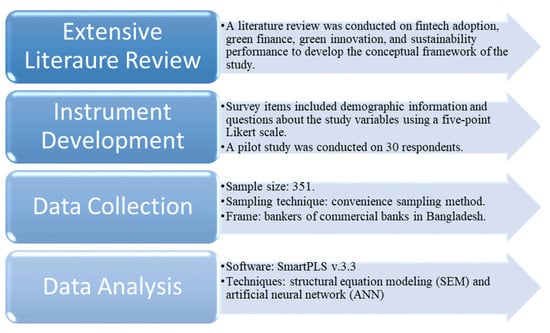

The study utilized a two-staged structural equation modeling and an artificial neural network (SEM-ANN) approach to analyze the data. In the first stage, the study used the SEM approach to examine the impact of FA on SP of banking institutions in Bangladesh through the mediating effect of GF and GI. In order to test the proposed research hypotheses, the study employed an SEM technique via SmartPLS 3, as suggested by Ringle et al., [32]. In the second stage, the study conducted an ANN analysis to rank the normalized importance of the relevant predictors based on the PLS analysis due to the presence of nonlinear interactions between the independent and dependent variables [33]. The neural network module for IBM’s SPSS was used to perform the ANN analysis. Finally, the graphical presentation of the research methodology is shown in Figure 2.

Figure 2.

Flowchart of Research Methods.

4. Data Analysis and Results

4.1. Descriptive Statistics and Common Method Bias (CMB)

According to the descriptive analysis of the study constructs shown in Table 2, the mean scores of all items ranged between 3.88 and 4.17, showing that the majority of the respondents agreed with the survey questions. The standard deviation values are pretty near to one another, suggesting that the components are uniformly dispersed. Furthermore, the empirical data revealed that the values of skewness and kurtosis were lower than 3 and 10, respectively. The findings for data normality are validated and adequate since the variance produced by the normality tests revealed no issues. [32]. Moreover, since predictor and outcome data were gathered using a single instrument, the study evaluated the presence of CMB. Initially, Harman’s single component was tested, and statistical analysis revealed that a single factor explains just 32.318 percent of the total variation. Because it is less than 50%, the problem of CMB does not exist. As a result, it can establish that CMB is not a problem.

Table 2.

Descriptive Statistics.

4.2. Multivariate Statistical Assumptions

Several criteria must be fulfilled in order to perform multivariate analysis [33]. Table 3 validates the linear and nonlinear connections between the dependent and independent variables in terms of linearity. Furthermore, the study investigated the VIFs to determine the multicollinearity problem as can be shown in Table 2. The findings revealed that the VIFs range from 1.228 to 2.255, which is less than the standard threshold of 10, suggesting the absence of multicollinearity. Moreover, the study used the one-sample Kolmogorov-Smirnov test to determine whether the distribution was normal. All p-values are less than 0.05, demonstrating the non-normality of the data distribution. The variance-based structural equation modeling of partial least squares was chosen due to the distribution’s non-normality as it is more robust to non-normal distributions than the covariance-based SEM [34]. According to Ringle et al. [35], the SmartPls 3.3 was used to validate the research hypotheses. We undertook additional assessment utilizing artificial neural networks (ANN) to rank the normalized importance of the relevant predictors based on the PLS analysis due to the presence of nonlinear interactions between the independent and dependent variables.

Table 3.

ANOVA test for Linearity.

4.3. Assessment of the Measurement Model

The measuring model contains two kinds of tests to validate the variables used in this study: reliability (item and internal consistency) and validity (convergent and discriminant). The construct’s reliability and validity are shown in Table 4. The findings (see Table 2) show that the minimum individual factor loading is 0.651 and the maximum value is 0.847, both of which are greater than the recommended value of 0.50, confirming the reliability of the individual items utilized in this study [36]. Additionally, CA and CR values were determined to validate the structures’ internal reliability, and the result has to be greater than 0.60 to be regarded as acceptable [36]. The findings indicate that the CA and CR values for all factors were more than the suggested value of 0.60, suggesting that the study met the internal consistency reliability standards [37].

Table 4.

Construct Reliability and Validity.

Furthermore, the AVE value was used to examine the convergent validity of the research variables, and the findings showed that the AVE values ranged from 0.501 to 0.640, which is greater than the suggested value of 0.50 [36]. As a result, it is reasonable to infer that the research variables fulfill convergent validity [38]. Moreover, the Fornell-Larcker criteria and the heterotrait-monotrait correlation ratio (HTMT) were used to assess the validity (discriminant) of the research variables. Table 5 shows the results of the discriminant validity. According to the findings, the correlations between each set of variables were not more than the square root of their AVE. Secondly, the HTMT values for all components are less than 0.85, demonstrating that discriminant validity is not an issue [39]. According to the findings, the studied variables achieved good discriminant validity [39,40,41].

Table 5.

Discriminant Validity.

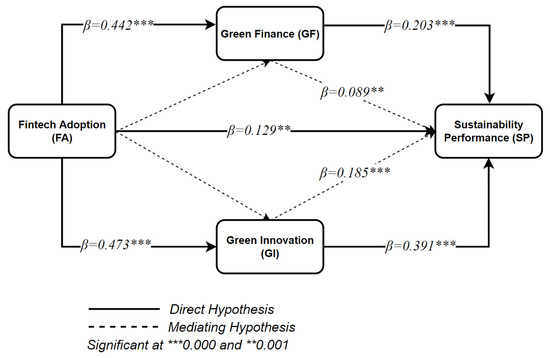

4.4. Structural Equation Modeling and Hypotheses Testing

Following the development of the measurement model, the structural model is evaluated and the hypothesis is tested. PLS-SEM was used in the study, which used a bootstrapping resampling process with 1000 subsamples. The results of the hypothesis testing are shown in Figure 3 and Table 6. Furthermore, the results demonstrate that all of the hypothesized associations are significant. The results indicate that Hypotheses 1, 2, and 3 are supported, meaning that the FA has a substantial positive impact on SP (=0.129, p-value = 0.014), GF (= 0.442, p-value = 0.000), and GI (= 0.473, p-value = 0.000). In addition, the results show that GF has a positive impact on SP (= 0.203, p-value = 0.000), thus supporting Hypothesis 4. As expected, hypothesis 5 is also supported, meaning that the GI has a significant positive influence on SP (= 0.391, p-value = 0.000). Finally, the results from the mediation analysis show that Hypotheses 6 and 7 are accepted, meaning that GF and GI fully mediate the relationship between FA and SP.

Figure 3.

Structural Model.

Table 6.

Hypotheses Relationships.

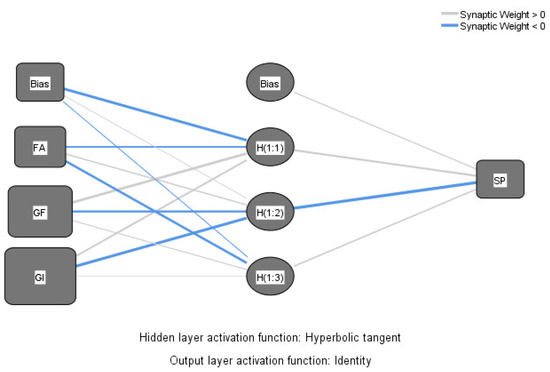

4.5. ANN Analysis

Subsequently, the study used the SEM-PLS path analysis’ important variables as the input neurons for the artificial neural network (ANN) model according to the study of [42]. Non-normal data distribution and the presence of non-linear correlations between the dependent and independent variables are key reasons for implementing the ANN. Besides, the artificial neural network analysis is robust to noise, outliers, and smaller sample sizes. The neural network module for IBM’s SPSS was used to perform the ANN analysis. The ANN method does not necessitate a normal distribution and may capture both linear and nonlinear interactions [43]. A typical ANN is made up of several hierarchical levels, including one input, one or more hidden layers, and one output level [44]. Nevertheless, this study’s input layer included three independent important factors such as the adoption of FinTech, green finance, and green innovation, but the output layer only included one outcome variable (e.g., sustainability performance). Therefore, the ANN model is shown in Figure 4.

Figure 4.

ANN Model. Note: FA, FinTech adoption; GF, green finance; GI, green innovation; SP, sustainability performance.

Moreover, to prevent the potential over-fitting problem in the ANN model, a tenfold cross-validation procedure was used. In this regard, 90% of the data was chosen for training (learning), while the remaining 10% was chosen for testing (predicting) [34,45]. Table 7 shows the root mean square error (RMSE) results for both training and testing. Hyndman and Koehler [46] proposed that reliability can be assessed utilizing RMSE since it is a scale-dependent measure of prediction accuracy based on evaluating particular datasets to estimate mistakes. The lower limit of RMSE is zero (0), whereas the higher limit is unlimited. The results indicate that the mean RMSE values for training and testing in the model are 0.586 and 0.602, showing that the ANN model detects linear-nonlinear correlations rather accurately [34,45]. This is assuming that the ANN models should be considered as having a higher level of precision when recognizing the correlations because the mean RMSE values are relatively modest with minimal standard deviations in both the testing and training phases [42].

Table 7.

Values of RMSE for Model A.

Table 8 presents the sensitivity analysis performance. The sensitivity analysis was used to rank the variables based on their normalized relative importance to the dependent variable. The sensitivity analysis revealed the importance of each predictor, whilst the significance of each independent variable indicated how much the value projected by the network structure differs with different independent variable values [47]. The results of the sensitivity analysis indicate that green innovation was the most significant predictor of SP, followed by GF and FA.

Table 8.

Sensitivity Analysis.

5. Findings and Discussion

The purpose of this research is to empirically investigate the impact of FA on SP via the mediating effect of GF and GI in the setting of banking institutions in an emerging economy such as Bangladesh. To find the correlations between the study variables, the researchers employed a multi-analytic SEM-ANN technique. According to the data, FA has a significant positive effect on GF, GI, and SP. Further, the findings revealed that GF and GI have a significant impact on SP. Moreover, the empirical data revealed that in the context of banking institutions, GF and GI significantly mediated the link between FA and SP.

The empirical results demonstrated that FA has a significant effect on the SP of banking institutions, indicating that FA is critical in assisting businesses to achieve SP by adopting new eco-friendly techniques into their operations, such as digital lending, electronic payments, mobile banking, internet customer support services, so on. This is one of the first studies to look at this relationship, thus there is no supporting literature. However, scan evidence can be found by the study of [7], who found that technological innovation enhances environmental performance significantly. Furthermore, the literature has indicated that FA enhances the competitiveness and performance of the banking industry [10]. In order to attain organizational overall sustainability, banks are advised to include eco-friendly practices in their everyday operations.

As expected, the findings revealed that FA significantly improves bank GF. This means that FA may mobilize green funding by creating new financial and investment channels, such as digital financing. This result is supported by the study of [48]. The study indicated that FinTech helps to ensure GF. According to existing research, FinTech plays a critical role in providing GF by merging big data and artificial intelligence to accelerate the transition to a green economy [49]. Furthermore, the researcher concluded that in the future, FinTech can mobilize GF by easing access to new sources of money and investment [50]. Likewise, the findings revealed that FA has a favorable impact on GI, implying that FA helps substantially to the increased acceptance of green initiatives by banking institutions, thereby assisting them in achieving sustainability [25]. Even though this study is one of the first to examine the link between FA and GI in the context of financial organizations, however, scant evidence on the link between these two variables can be found by the earlier studies of [22,51].

The empirical findings demonstrated that GF and GI have a significant influence on the SP of banking firms, demonstrating that banks may improve their environmental sustainability by investing in green projects and executing green initiatives. These findings are consistent with those of earlier studies [5,7,13], which found that GF significantly enhances SP. Likewise, green investment has a significant beneficial influence on an organization’s SP [14]. Furthermore, the literature has confirmed that GI significantly enhances the environmental performance of an organization [8,25]. Therefore, it may be said that GF and GI are necessary for achieving corporate environmental sustainability.

Lastly, the mediation results proved that GI fully mediates the relationship between banking institutions’ FA and SP. This implies that FA has an influence on the banking industry’s SP both directly and indirectly through GI. Additionally, the empirical data revealed that GF serves as a significant mediator between FA and SP, meaning that green activities such as green technology, online banking, green banking, and online customer service are crucial in enhancing the link between FA and SP. To restate, FA enhances GI and GF, which leads to an improvement in the organization’s SP. Because no earlier research has been undertaken on the relationship between FA, GF, and SP, as well as the mediating function of GI and GF in the setting of financial institutions in a developing country like Bangladesh, the current study adds significantly to the existing literature. Furthermore, according to Kraus et al. [8], GI strongly mediates the relationship between CSR and EP. In general, FA, GF, and GI significantly improve SP by reducing carbon emissions, power use, and paper usage, as well as by offering staff members green training. In order to boost their overall SP and contribute to the long-term growth of the nation, bank managers should concentrate on technological developments, green technology, and the support of environmentally friendly initiatives.

6. Conclusions, Implications, and Directions for Future Research

Using a two-staged SEM-ANN technique with a nonlinear non-compensatory neural network model, this study successfully validated the impacts of FA on the SP of banks. Besides, the study highlighted the importance of GF and GI as mediators in the link between FA and SP. The empirical findings showed that FA, GF, and GI have a substantial positive effect on the SP of Bangladeshi banking institutions. On the other hand, GI is the most significant in terms of normalized importance, followed by GF and FA.

Furthermore, the findings of the study provide substantial theoretical and practical contributions to the literature on technological innovation, GF, and sustainability. First, it elaborates on the link between FA and the SP of banks, as well as the mediating function of GF and GI. Second, methodologically, this is one of the earliest pieces of research that used a two-staged SEM-ANN approach using a nonlinear non-compensatory neural network model to find the correlations between the study variables. Third, this is the first study to incorporate FA, GF, GI, and SP in a single research model in the context of an emerging economy’s banking institutions. Finally, this study indicates how developing market banking institutions may use FinTech, green finance, and innovation to improve overall organizational environmental sustainability.

In reality, the findings suggest that incorporating FinTech, green finance, and green innovations into banking institutions’ daily operations is critical to achieving SP. Furthermore, the study’s findings give numerous practical managerial advice for bank managers as well as lawmakers. These include the use of new technology and the funding of environmentally friendly programs to improve overall environmental sustainability performance, the improvement of managerial attitudes toward the natural environment, and the establishment of appropriate green innovative cultures within banks. Moreover, the Bangladesh Bank (the country’s central bank) and the government may encourage GF and innovation by compensating or rewarding banking institutions that prudently implement new technologies such as blockchain, online banking, mobile banking, and digital lending, as well as finance a variety of eco-friendly projects such as renewable energy, energy efficiency, green industry development, and waste management, as these activities support organizational achievement. To boost sustainable performance, managers and policymakers must focus on adopting new technologies, GF, and innovation.

Despite making an important contribution to the literature on technological innovation, GF, GI, and environmental sustainability management, this study contains some flaws that should be addressed in future research. Firstly, the study’s sample size was limited to 351 employees, including 74% males and 26% females, from Bangladeshi banking firms; thus, the results might not be applicable to other emerging nations or business sectors. The samples indicate that data collection is unbalanced due to the narrower cultural context that male workers are higher than females. As a result, the findings of the study can only be applicable to the banking sectors of an emerging economy such as Bangladesh or similar cultural contexts. Future studies may use larger samples, balance the gender gaps, and include people from different countries and industries. Secondly, the study looked at the influence of FA on SP, with GF and GI acting as a mediator. Nevertheless, by analyzing multiple mediators such as environmental strategy, employee green behavior, and technological capabilities, the current research model’s explanatory power might be enhanced. Finally, the SP assessment measures did not take into account whether the studied firms have sustainability policies and procedures in place to demonstrate legislative compliance or their commitment to environmental SP. Therefore, a future study may concentrate on alternate environmental facilitators, accelerators, and stimuli.

Author Contributions

Conceptualization, C.Y., A.B.S. and M.N.R.; Data curation, C.Y.; Formal analysis, A.B.S.; Funding acquisition, Q.D.; Investigation, M.N.R.; Methodology, C.Y. and A.B.S.; Project administration, G.-W.Z.; Resources, R.M N.; Software, M.N.R.; Supervision, L.Y. and Q.D.; Visualization, Q.D. and G.-W.Z.; Writing—Original draft, C.Y. and A.B.S.; Writing—Review and editing, L.Y., Q.D. and G.-W.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This study was funded by the Key Project of the National Social Science Foundation of China (grant no.20AJY015), The Fundamental Research Funds for the Central Universities (grant No.300102341667).

Institutional Review Board Statement

Ethical review and approval were waived for this study due to the fact that there is no institutional review board or committee in Bangladesh. Besides, the study was conducted as per the guidelines of the Declaration of Helsinki. The research questionnaire was anonymous, and no personal information was gathered.

Informed Consent Statement

Oral consent was obtained from all individuals involved in this study.

Data Availability Statement

The data that support the findings of this study are available from the corresponding authors upon reasonable request.

Acknowledgments

The researchers would like to express their gratitude to the anonymous re-viewers for their efforts to improve the quality of this paper.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Zheng, G.; Siddik, A.B.; Masukujjaman, M.; Fatema, N. Factors Affecting the Sustainability Performance of Financial Institutions in Bangladesh: The Role of Green Finance. Sustainability 2021, 13, 165. [Google Scholar] [CrossRef]

- Guang-Wen, Z.; Siddik, A.B. Do Corporate Social Responsibility Practices and Green Finance Dimensions Determine Environmental Performance? An Empirical Study on Bangladeshi Banking Institutions. Front. Environ. Sci. 2022, 10, 890096. [Google Scholar] [CrossRef]

- Nassiry, D. The Role of Fintech in Unlocking Green Finance—Policy Insights for Developing Countries; ADBI Working Paper 883; Asian Development Bank Institute: Tokyo, Japan, 2019; pp. 315–336. [Google Scholar]

- Siddik, A.B.; Zheng, G. Green Finance during the COVID-19 Pandemic and Beyond: Implications for Green Economic Recovery. Preprints 2021. [Google Scholar] [CrossRef]

- Chen, J.; Siddik, A.B.; Zheng, G.-W.; Masukujjaman, M.; Bekhzod, S. The Effect of Green Banking Practices on Banks’ Environmental Performance and Green Financing: An Empirical Study. Energies 2022, 15, 1292. [Google Scholar] [CrossRef]

- Akter, N.; Siddik, A.B.; Al Mondal, M.S. Sustainability Reporting on Green Financing: A Study of Listed Private Sustainability Reporting on Green Financing: A Study of Listed Private Commercial Banks in Bangladesh. J. Bus. Technol. 2018, XII, 14–27. [Google Scholar]

- Awawdeh, A.E.; Ananzeh, M.; El-khateeb, A.I.; Aljumah, A. Role of green financing and corporate social responsibility (CSR) in technological innovation and corporate environmental performance: A COVID-19 perspective. China Finance Rev. Int. 2022, 12, 297–316. [Google Scholar] [CrossRef]

- Kraus, S.; Rehman, S.U.; García, F.J.S. Corporate social responsibility and environmental performance: The mediating role of environmental strategy and green innovation. Technol. Forecast. Soc. Change 2020, 160, 120262. [Google Scholar] [CrossRef]

- Dorfleitner, G.; Hornuf, L.; Schmitt, M.; Weber, M. Definition of FinTech and description of the FinTech industry. In FinTech in Germany; Springer: Cham, Switzerland, 2017; pp. 5–10. [Google Scholar]

- Dwivedi, P.; Alabdooli, J.I.; Dwivedi, R. Role of FinTech Adoption for Competitiveness and Performance of the Bank: A Study of Banking Industry in UAE. Int. J. Glob. Bus. Compet. 2021, 16, 130–138. [Google Scholar] [CrossRef]

- Zheng, G.W.; Siddik, A.B.; Masukujjaman, M.; Fatema, N.; Alam, S.S. Green finance development in Bangladesh: The role of private commercial banks (PCBs). Sustainability 2021, 13, 795. [Google Scholar] [CrossRef]

- Li, Z.; Deng, X.; Peng, L. Uncovering trajectories and impact factors of CO2 emissions: A sectoral and spatially disaggregated revisit in Beijing. Technol. Forecast. Soc. Change 2020, 158, 120124. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, Z.; Zhong, X.; Yang, S.; Siddik, A.B. Do Green Banking Activities Improve the Banks’ Environmental Performance? The Mediating Effect of Green Financing. Sustainability 2022, 14, 989. [Google Scholar] [CrossRef]

- Indriastuti, M.; Chariri, A. Social responsibility investment on sustainable The role of green investment and corporate social responsibility investment on sustainable performance. Cogent Bus. Manag. 2021, 8, 1960120. [Google Scholar] [CrossRef]

- Xu, X.; Li, J. Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J. Clean. Prod. 2020, 264, 121574. [Google Scholar] [CrossRef]

- Wang, X.; Zhao, H.; Bi, K. The measurement of green finance index and the development forecast of green finance in China. Environ. Ecol. Stat. 2021, 28, 263–285. [Google Scholar] [CrossRef]

- Al Nawayseh, M.K. Fintech in COVID-19 and beyond: What factors are affecting customers’ choice of fintech applications? J. Open Innov. Technol. Mark. Complex. 2020, 6, 153. [Google Scholar] [CrossRef]

- Yan, C.; Siddik, A.B.; Akter, N.; Dong, Q. Factors influencing the adoption intention of using mobile financial service during the COVID-19 pandemic: The role of FinTech. Environ. Sci. Pollut. Res. 2021. [Google Scholar] [CrossRef]

- Severo, E.A.; Becker, A.; De Guimarães, J.C.F.; Rotta, C. The teaching of innovation and environmental sustainability and its relationship with entrepreneurship in Southern Brazil. Int. J. Innov. Learn. 2019, 25, 78–105. [Google Scholar] [CrossRef]

- Peng, J.; Zheng, Y. Does Environmental Policy Promote Energy Efficiency? Evidence from China in the Context of Developing Green Finance. Front. Environ. Sci. 2021, 9, 733349. [Google Scholar] [CrossRef]

- Wang, Q.-J.; Wang, H.-J.; Chang, C.-P. Environmental performance, green finance and green innovation: What’s the long-run relationships among variables? Energy Econ. 2022, 110, 106004. [Google Scholar] [CrossRef]

- Xiong, Q.; Sun, D. Influence analysis of green finance development impact on carbon emissions: An exploratory study based on fsQCA. Environ. Sci. Pollut. Res. 2022. [Google Scholar] [CrossRef]

- Xu, H.; Mei, Q.; Shahzad, F.; Liu, S.; Long, X.; Zhang, J. Untangling the Impact of Green Finance on the Enterprise Green Performance: A Meta-Analytic Approach. Sustainability 2020, 12, 9085. [Google Scholar] [CrossRef]

- Shahzad, M.; Qu, Y.; Rehman, S.U.; Zafar, A.U. Adoption of green innovation technology to accelerate sustainable development among manufacturing industry. J. Innov. Knowl. 2022, 7, 100231. [Google Scholar] [CrossRef]

- Adegbile, A.; Sarpong, D.; Meissner, D. Strategic Foresight for Innovation Management: A Review and Research Agenda. Int. J. Innov. Technol. Manag. 2017, 14, 1750019–1750034. [Google Scholar] [CrossRef]

- Weng, H.-H.; Chen, J.-S.; Chen, P.-C. Effects of Green Innovation on Environmental and Corporate Performance: A Stakeholder Perspective. Sustainability 2015, 7, 4997–5026. [Google Scholar] [CrossRef]

- Edeh, J.N.; Obodoechi, D.N.; Ramos-Hidalgo, E. Effects of innovation strategies on export performance: New empirical evidence from developing market firms. Technol. Forecast. Soc. Change 2020, 158, 120167. [Google Scholar] [CrossRef]

- Wang, H.; Khan, M.A.S.; Anwar, F.; Shahzad, F.; Adu, D.; Murad, M. Green Innovation Practices and Its Impacts on Environmental and Organizational Performance. Front. Psychol. 2021, 11, 3316. [Google Scholar] [CrossRef]

- Ahmad, N.; Scholz, M.; Al Dhaen, E.; Ullah, Z.; Scholz, P. Improving Firm’s Economic and Environmental Performance through the Sustainable and Innovative Environment: Evidence from an Emerging Economy. Front. Psychol. 2021, 12, 5105. [Google Scholar] [CrossRef]

- Khatun, M.N.; Mitra, S.; Sarker, M.N.I. Mobile banking during COVID-19 pandemic in Bangladesh: A novel mechanism to change and accelerate people’s financial access. Green Finance 2021, 3, 253–267. [Google Scholar] [CrossRef]

- Tang, G.; Chen, Y.; Jiang, Y.; Paillé, P.; Jia, J. Green human resource management practices: Scale development and validity. Asia Pac. J. Hum. Resour. 2018, 56, 31–55. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Becker, J.-M. SmartPLS 3 2015; SmartPLS GmbH: Boenningstedt, Germany, 2015. [Google Scholar]

- Teo, A.-C.; Tan, G.W.-H.; Ooi, K.-B.; Hew, T.-S.; Yew, K.-T. The effects of convenience and speed in m-payment. Ind. Manag. Data Syst. 2015, 115, 311–331. [Google Scholar] [CrossRef]

- Kline, R.B. Principles and Practice of Structural Equation Modeling; Guilford Publications: New York, NY, USA, 2015; ISBN 1462523358. [Google Scholar]

- Ooi, K.-B.; Lee, V.-H.; Tan, G.W.-H.; Hew, T.-S.; Hew, J.-J. Cloud computing in manufacturing: The next industrial revolution in Malaysia? Expert Syst. Appl. 2018, 93, 376–394. [Google Scholar] [CrossRef]

- Leong, L.-Y.; Hew, T.-S.; Ooi, K.-B.; Lin, B. Do Electronic Word-of-Mouth and Elaboration Likelihood Model Influence Hotel Booking? J. Comput. Inf. Syst. 2019, 59, 146–160. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. Partial least squares: The better approach to structural equation modeling? Long Range Plan. 2012, 45, 312–319. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Premier on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 4th ed.; Prentice Hall: Hoboken, NJ, USA, 2010. [Google Scholar]

- Liébana-Cabanillas, F.; Marinković, V.; Kalinić, Z. A SEM-neural network approach for predicting antecedents of m-commerce acceptance. Int. J. Inf. Manag. 2017, 37, 14–24. [Google Scholar] [CrossRef]

- Chong, A.Y.-L.; Chan, F.T.S.; Ooi, K.-B. Predicting consumer decisions to adopt mobile commerce: Cross country empirical examination between China and Malaysia. Decis. Support Syst. 2012, 53, 34–43. [Google Scholar] [CrossRef]

- Alam, M.M.D.; Alam, M.Z.; Rahman, S.A.; Taghizadeh, S.K. Factors influencing mHealth adoption and its impact on mental well-being during COVID-19 pandemic: A SEM-ANN approach. J. Biomed. Inform. 2021, 116, 103722. [Google Scholar] [CrossRef]

- Hyndman, R.J.; Koehler, A.B. Another look at measures of forecast accuracy. Int. J. Forecast. 2006, 22, 679–688. [Google Scholar] [CrossRef]

- Garson, G.D. Neural Networks: An Introductory Guide for Social Scientists; Sage: Thousand Oaks, CA, USA, 1998. [Google Scholar]

- Cen, T.; He, R. Fintech, green finance and sustainable development. Adv. Soc. Sci. Educ. Hum. Res. 2018, 291, 222–225. [Google Scholar]

- Wang, L.; Wang, Y.; Sun, Y.; Han, K.; Chen, Y. Financial inclusion and green economic efficiency: Evidence from China. J. Environ. Plan. Manag. 2022, 65, 240–271. [Google Scholar] [CrossRef]

- Dorfleitner, G.; Braun, D. Fintech, digitalization and blockchain: Possible applications for green finance. In The Rise of Green Finance in Europe; Springer: Cham, Switzerland, 2019; pp. 207–237. [Google Scholar]

- Salampasis, D.; Mention, A.-L. Chapter 18—FinTech: Harnessing Innovation for Financial Inclusion. In Handbook of Blockchain, Digital Finance, and Inclusion; Lee Kuo Chuen, D., Deng, R., Eds.; Academic Press: Cambridge, MA, USA, 2018; Volume 2, pp. 451–461. ISBN 978-0-12-812282-2. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).