Mapping the Intellectual Structure of Computational Risk Analytics in Banking and Finance: A Bibliometric and Thematic Evolution Study

Abstract

1. Introduction

- RQ1: What are the publication trends in CRA research?

- RQ2: Where are the most influential publications (outlets and articles) on CRA?

- RQ3: Who are the most prolific contributors to CRA research (authors, countries, and institutions)?

- RQ4: What insights do existing research themes and topics provide about CRA?

- RQ5: Has CRA evolved into a multidisciplinary research field bridging computer science, finance, and decision sciences?

- RQ6: What future research avenues can be explored to enrich our understanding of CRA?

2. Materials and Methods

2.1. Data Collection

2.1.1. The Source of Data Collection

2.1.2. Keyword Selection Strategy and Refinement Process

2.2. Study Approach and Tools

3. Results

3.1. Dataset General Information

3.2. Publication Trend: A Temporal Analysis (RQ1)

3.3. Publication Outlets (RQ2)

3.4. Globally Cited Articles (RQ2)

3.5. Prolific Contributors, Authors (RQ3)

3.6. Prolific Contributors, Countries, and Institutions (RQ3)

3.6.1. Countries’ Scientific Production and Most-Cited Countries

3.6.2. Affiliations’ Scientific Output

3.7. Intellectual Structures of CRA Research RQ4

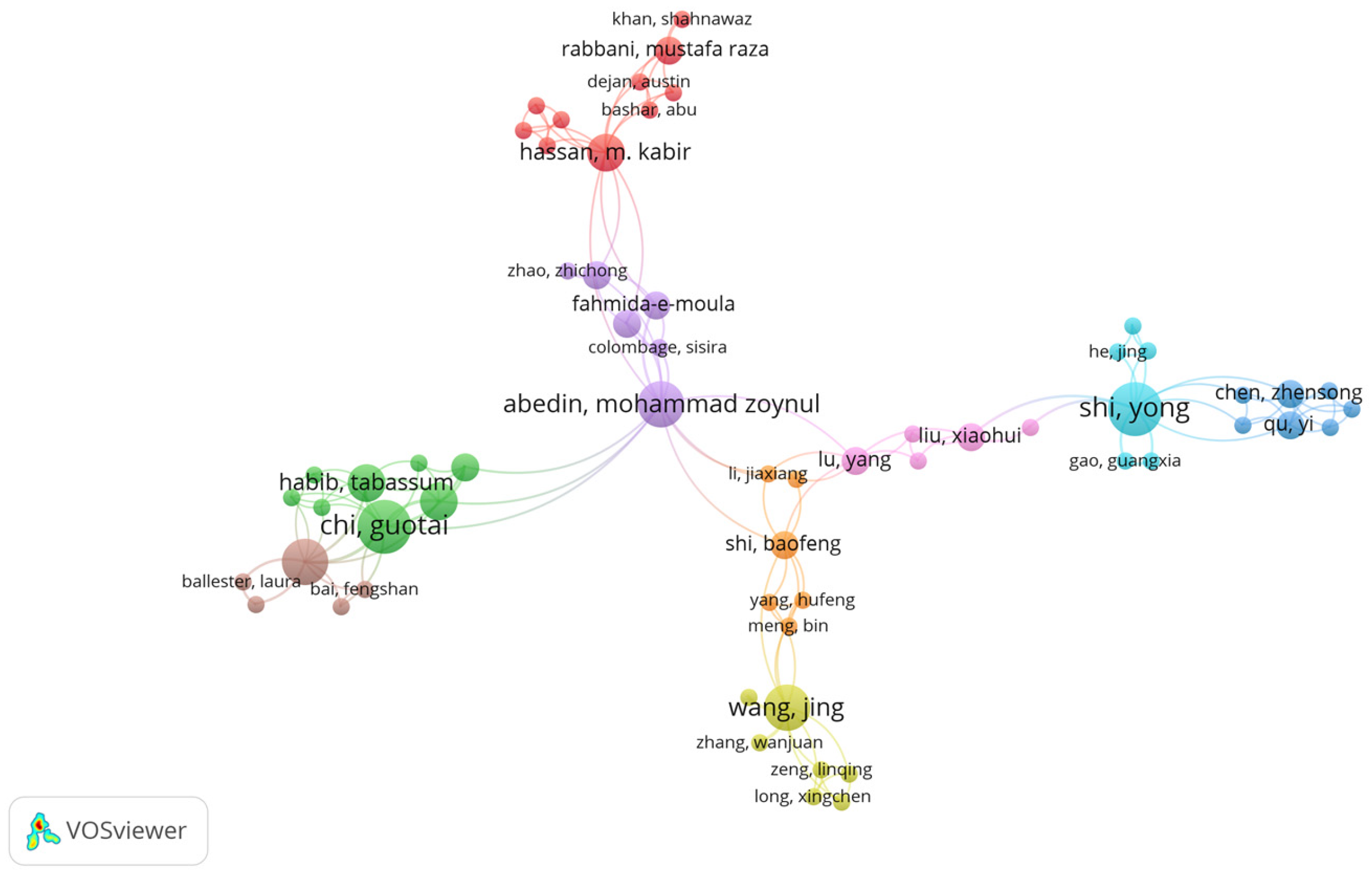

3.7.1. Co-Authorship (Author Collaboration Networks)

3.7.2. Keyword Co-Occurrence (DE—Author Keywords and ID—Keywords Plus)

- Keyword Co-occurrence (DE—Author Keywords)

- Cluster 1 (red) focuses on ML and hybrid models in bankruptcy and credit default prediction, including significant words like ensemble, DT, and Support Vector Machine (SVM);

- Cluster 2 (green) concentrates on AI integration in financial services, featuring keywords like FinTech, digital banking, financial inclusion, and blockchain;

- Cluster 3 (blue) represents advanced deep learning applications in textual data, ESG, and credit analytics;

- Cluster 4 (yellow) captures traditional econometric and scoring methods, including Altman Z-score, logit model, and financial ratios.

- Keyword Co-occurrence (ID—Keywords Plus)

- Cluster 1 (bankruptcy, models, classification) maps the computational core of CRA methods, such as default prediction, ensemble models, and ANNs;

- Cluster 2 (banking, impact, management) focuses on financial services and adoption frameworks, including FinTech, information systems, and technology acceptance models;

- Cluster 3 contains structural topics like corporate governance, performance, and corporate social responsibility (CSR), indicating interest in firm-level risk and disclosure;

- Other clusters cover the rest of the areas, such as macroeconomic instability (crisis, monetary policy); sustainability and ESG terms; and computational enhancements like optimization, feature selection, and survival analysis.

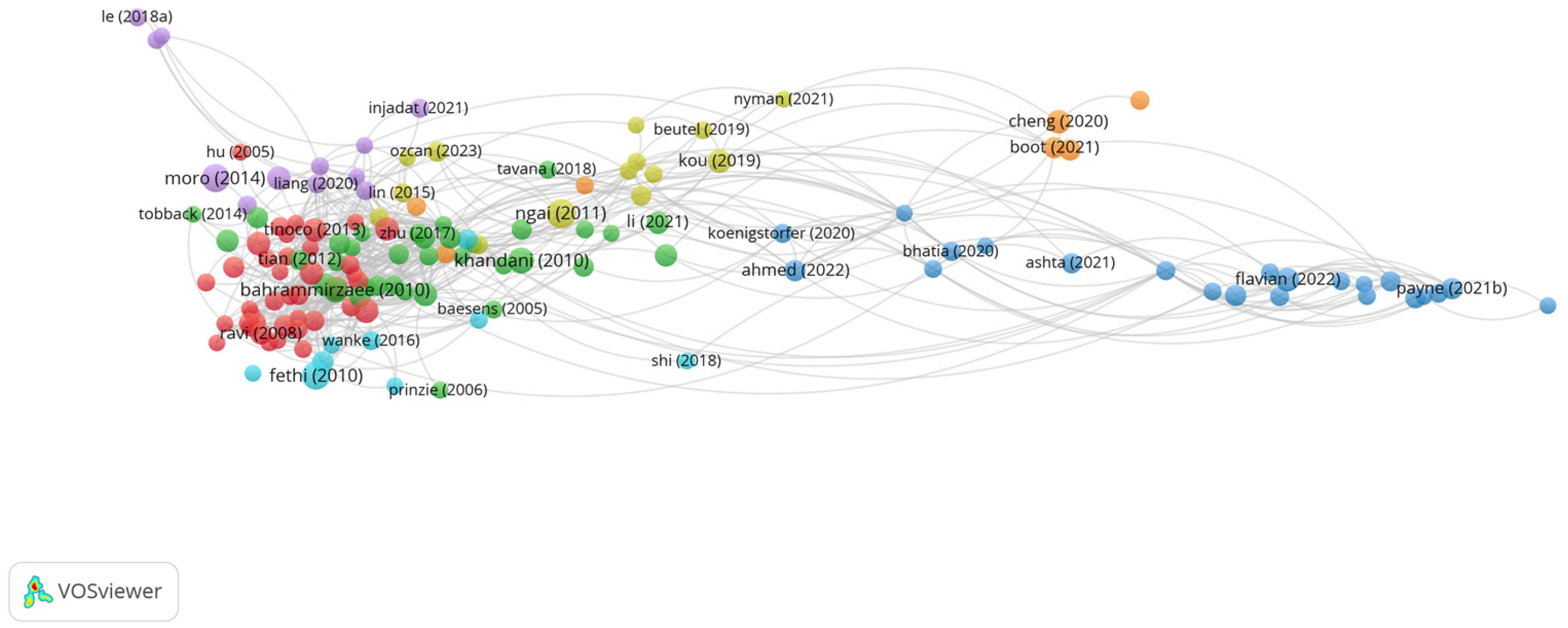

3.7.3. Bibliographic Coupling (Documents)

- Cluster 1 (Red): Bankruptcy Prediction and Hybrid Methodologies

- Cluster 2 (Green): Advanced ML for Credit Scoring and Financial Distress

- Cluster 3 (Blue): AI and FinTech in Finance

- Cluster 4 (Yellow): DM and ML in Financial Fraud and Risk

- Cluster 5 (Purple): Feature Engineering and Model Enhancement for Bankruptcy Prediction

- Cluster 6 (Turquoise): Credit Risk Management and Loan Defaults

- Cluster 7 (Orange): Predicting Bank Insolvencies and FinTech’s Impact on Stability

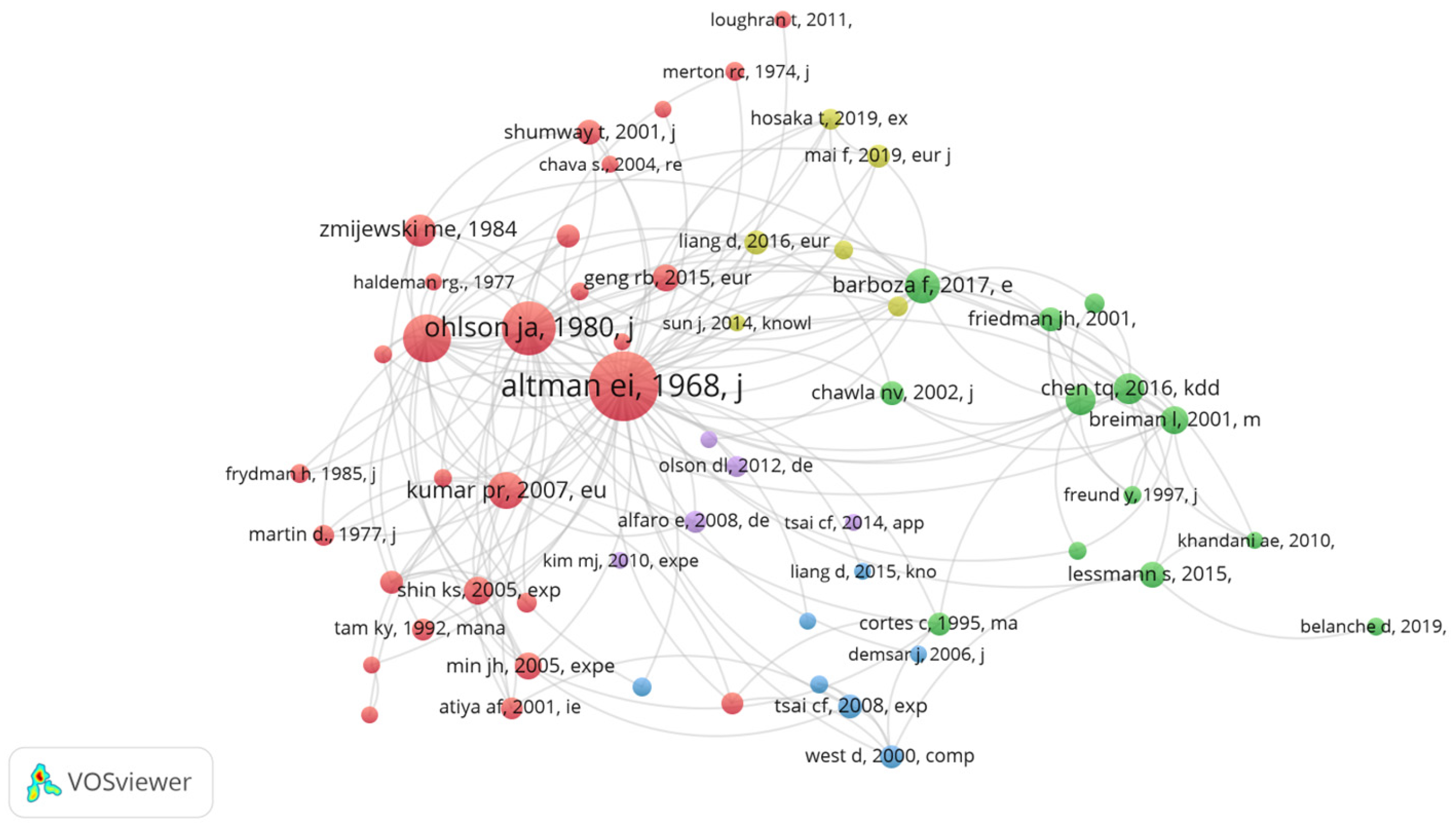

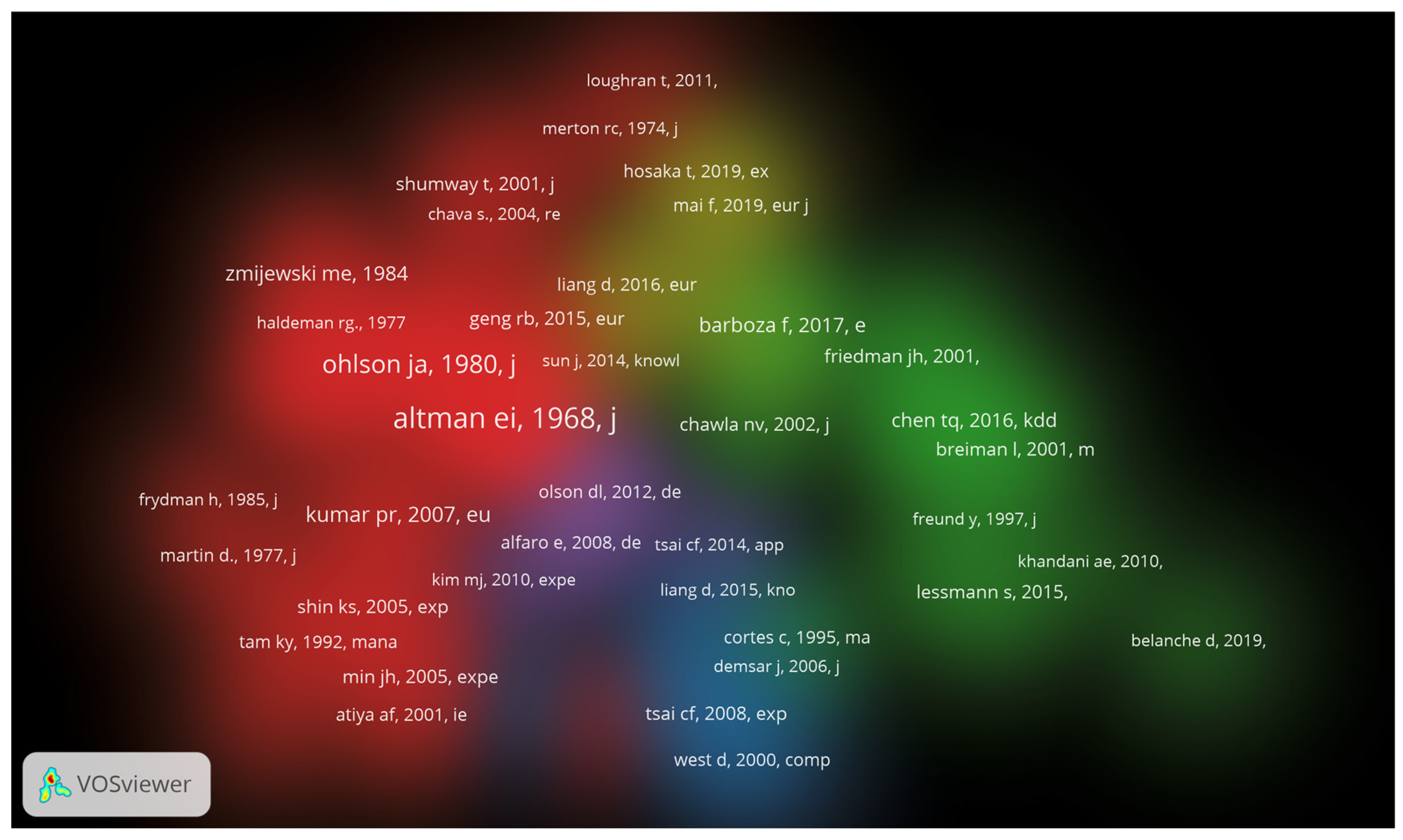

3.7.4. Co-Citation (Cited References)

- Cluster 1 (red): Foundational Financial Distress Prediction Models. In this cluster, prominently featuring references such as [45,46], Refs. [47,48] epresent the foundational theories and models in financial distress prediction, notably including the Z-score and O-score models. These works are central to the field, evidenced by their high citation counts and substantial inter-cluster links, indicating their pervasive influence across various research streams. References like [49,50] also reinforce this cluster’s focus on early quantitative approaches to corporate solvency assessment. Its high density and central positioning in the network images of Figure 10 underscore its role as a core theoretical pillar;

- Cluster 2 (green): Machine Learning and AI in Financial Prediction. Dominated by works from [11,51,52,53], this cluster signifies the integration of advanced ML and AI techniques into financial prediction. The presence of core ML algorithms like RF and GB highlights a methodological shift towards more sophisticated, data-driven approaches for forecasting financial outcomes. This cluster’s growth, particularly with more recent publications, suggests an increasing emphasis on algorithmic performance and predictive accuracy in CRA;

- Cluster 3 (blue): Knowledge-Based Systems and Expert Applications. Key references within this cluster include [54,55,56]. This cluster reflects research leveraging knowledge-based systems and expert systems for decision support in financial contexts. It often involves the application of AI techniques to structured financial data, aiming to provide actionable insights for risk assessment and corporate analysis. The overlap with machine learning aspects of the second cluster suggests a pragmatic application of predictive models within decision support frameworks;

- Cluster 4 (yellow): Contemporary Expert Systems and Financial Applications. This cluster, featuring [8,9,36,57], signifies more recent developments in the application of expert systems to financial problems. While still focused on expert systems, these references often incorporate newer methodologies or address contemporary financial challenges. Their connections to other clusters suggest a continued evolution and diversification of expert system applications, often integrating with statistical or machine learning paradigms;

- Cluster 5 (purple): Hybrid Models and Decision Support Systems. Including works from [25,58,59,60], this cluster likely represents research focused on hybrid modeling approaches and comprehensive decision support systems. These often combine elements from traditional statistical methods, machine learning, and expert systems to create robust predictive and analytical tools. The interdisciplinary nature of this cluster highlights a trend towards multi-methodological integration to tackle the complexities of corporate financial analysis effectively.

4. Discussion—RQ5 and RQ6

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| AI | Artificial Intelligence |

| ANN | Artificial Neural Network |

| AML | Anti-Money Laundering |

| CI | Collaboration Index/Computational Intelligence (context-dependent) |

| CRA | Computational Risk Analytics |

| CSR | Corporate Social Responsibility |

| DAOs | Decentralized Autonomous Organizations |

| DE | Author Keywords (from bibliometric datasets) |

| DeFi | Decentralized Finance |

| DL | Deep Learning |

| DT | Decision Tree |

| ESG | Environmental, Social, and Governance |

| GB | Gradient Boosting |

| ID | Keywords Plus (from bibliometric datasets) |

| IoT | Internet of Things |

| ML | Machine Learning |

| MCP | Multiple-Country Publications |

| MCP_Ratio | Ratio of Multiple-Country Publications |

| NP | Number of Publications |

| NAY | Number of Active Years |

| PAY | Productivity per Active Year |

| PY | Publication Year/Start Year |

| RF | Random Forest |

| RQ | Research Question |

| SA | Single-authored Publications |

| SCP | Single-Country Publications |

| SVM | Support Vector Machine |

| TC | Total Citations |

| TC/TP | Citations per Publication |

| TLS | Total Link Strength |

| TP | Total Publications |

| VOSviewer | Visualization of Similarities Viewer |

| WoS | Web of Science |

| XAI | Explainable Artificial Intelligence |

| XGBoost | eXtreme Gradient Boosting |

Appendix A

| Journal Title | Number of Articles by Journal |

|---|---|

| APPLIED SOFT COMPUTING | 25 |

| COMPUTATIONAL ECONOMICS | 24 |

| EUROPEAN JOURNAL OF OPERATIONAL RESEARCH | 24 |

| RISKS | 23 |

| ANNALS OF OPERATIONS RESEARCH | 21 |

| INTERNATIONAL JOURNAL OF BANK MARKETING | 21 |

| JOURNAL OF FORECASTING | 21 |

| KNOWLEDGE-BASED SYSTEMS | 19 |

| INTERNATIONAL REVIEW OF FINANCIAL ANALYSIS | 18 |

| COGENT ECONOMICS & FINANCE | 15 |

| DECISION SUPPORT SYSTEMS | 15 |

| INFORMATION SCIENCES | 14 |

| INTERNATIONAL JOURNAL OF FINANCIAL STUDIES | 14 |

| JOURNAL OF RISK AND FINANCIAL MANAGEMENT | 14 |

| MATHEMATICAL PROBLEMS IN ENGINEERING | 14 |

| NEURAL COMPUTING & APPLICATIONS | 13 |

| FINANCE RESEARCH LETTERS | 12 |

| HELIYON | 11 |

| APPLIED ECONOMICS LETTERS | 10 |

| FRONTIERS IN ARTIFICIAL INTELLIGENCE | 10 |

| JOURNAL OF FINANCIAL STABILITY | 10 |

| JOURNAL OF THE OPERATIONAL RESEARCH SOCIETY | 10 |

| RESEARCH IN INTERNATIONAL BUSINESS AND FINANCE | 10 |

| PLOS ONE | 9 |

| ARTIFICIAL INTELLIGENCE REVIEW | 8 |

| BORSA ISTANBUL REVIEW | 8 |

| COGENT BUSINESS & MANAGEMENT | 8 |

| INTELLIGENT SYSTEMS WITH APPLICATIONS | 8 |

| JOURNAL OF RISK MODEL VALIDATION | 8 |

| NEUROCOMPUTING | 8 |

| QUANTITATIVE FINANCE | 8 |

| APPLIED INTELLIGENCE | 7 |

| COMPLEXITY | 7 |

| FINANCIAL AND CREDIT ACTIVITY-PROBLEMS OF THEORY AND PRACTICE | 7 |

| MACHINE LEARNING WITH APPLICATIONS | 7 |

| OECONOMIA COPERNICANA | 7 |

| PACIFIC-BASIN FINANCE JOURNAL | 7 |

| STRATEGIC CHANGE-BRIEFINGS IN ENTREPRENEURIAL FINANCE | 7 |

| TECHNOLOGICAL AND ECONOMIC DEVELOPMENT OF ECONOMY | 7 |

| ECONOMIC MODELLING | 6 |

| INFORMATION | 6 |

| INZINERINE EKONOMIKA-ENGINEERING ECONOMICS | 6 |

| JOURNAL OF BUSINESS RESEARCH | 6 |

| JOURNAL OF CREDIT RISK | 6 |

| JOURNAL OF INTELLIGENT & FUZZY SYSTEMS | 6 |

| JOURNAL OF THE KNOWLEDGE ECONOMY | 6 |

| SOFT COMPUTING | 6 |

| COMPUTATIONAL INTELLIGENCE | 5 |

| ECONOMIC COMPUTATION AND ECONOMIC CYBERNETICS STUDIES AND RESEARCH | 5 |

| FINANCIAL INNOVATION | 5 |

| FUTURE INTERNET | 5 |

| INTERNATIONAL JOURNAL OF FORECASTING | 5 |

| INTERNATIONAL JOURNAL OF INFORMATION TECHNOLOGY & DECISION MAKING | 5 |

| JOURNAL OF MODELLING IN MANAGEMENT | 5 |

| MANAGEMENT DECISION | 5 |

| SCIENTIFIC REPORTS | 5 |

| APPLIED ECONOMICS | 4 |

| COMPUTERS & SECURITY | 4 |

| DISCRETE DYNAMICS IN NATURE AND SOCIETY | 4 |

| ECONOMICS AND BUSINESS REVIEW | 4 |

| GLOBAL BUSINESS REVIEW | 4 |

| INTERNATIONAL JOURNAL OF COMPUTATIONAL INTELLIGENCE SYSTEMS | 4 |

| INTERNATIONAL JOURNAL OF DATA SCIENCE AND ANALYTICS | 4 |

| INTERNATIONAL JOURNAL OF EMERGING MARKETS | 4 |

| INTERNATIONAL JOURNAL OF FINANCE & ECONOMICS | 4 |

| INTERNATIONAL JOURNAL OF FINANCIAL ENGINEERING | 4 |

| INTERNATIONAL JOURNAL OF ISLAMIC AND MIDDLE EASTERN FINANCE AND MANAGEMENT | 4 |

| JOURNAL OF FINANCIAL REPORTING AND ACCOUNTING | 4 |

| JOURNAL OF FINANCIAL SERVICES MARKETING | 4 |

| JOURNAL OF INTERNATIONAL FINANCIAL MARKETS INSTITUTIONS & MONEY | 4 |

| KNOWLEDGE AND INFORMATION SYSTEMS | 4 |

| PACIFIC BUSINESS REVIEW INTERNATIONAL | 4 |

| SYMMETRY-BASEL | 4 |

| SYSTEMS | 4 |

| ACCOUNTING AND FINANCE | 3 |

| DATA | 3 |

| ECONOMIC ANALYSIS AND POLICY | 3 |

| ENGINEERING LETTERS | 3 |

| EUROPEAN JOURNAL OF INNOVATION MANAGEMENT | 3 |

| FUTURE BUSINESS JOURNAL | 3 |

| INTELLIGENT DATA ANALYSIS | 3 |

| INTERNATIONAL JOURNAL OF ACCOUNTING INFORMATION SYSTEMS | 3 |

| INTERNATIONAL JOURNAL OF COMPUTATIONAL SCIENCE AND ENGINEERING | 3 |

| INTERNATIONAL REVIEW OF ECONOMICS & FINANCE | 3 |

| JOURNAL OF ADVANCES IN INFORMATION TECHNOLOGY | 3 |

| JOURNAL OF BANKING & FINANCE | 3 |

| JOURNAL OF BANKING REGULATION | 3 |

| JOURNAL OF BEHAVIORAL AND EXPERIMENTAL FINANCE | 3 |

| JOURNAL OF BUSINESS ECONOMICS AND MANAGEMENT | 3 |

| JOURNAL OF CENTRAL BANKING THEORY AND PRACTICE | 3 |

| JOURNAL OF INTERNATIONAL MONEY AND FINANCE | 3 |

| JOURNAL OF RESEARCH IN INTERACTIVE MARKETING | 3 |

| JOURNAL OF RETAILING AND CONSUMER SERVICES | 3 |

| LATIN AMERICAN JOURNAL OF CENTRAL BANKING | 3 |

| MONTENEGRIN JOURNAL OF ECONOMICS | 3 |

| NEURAL NETWORK WORLD | 3 |

| NORTH AMERICAN JOURNAL OF ECONOMICS AND FINANCE | 3 |

| OXFORD REVIEW OF ECONOMIC POLICY | 3 |

| POLISH JOURNAL OF MANAGEMENT STUDIES | 3 |

| PROGRESS IN ARTIFICIAL INTELLIGENCE | 3 |

| QUANTITATIVE FINANCE AND ECONOMICS | 3 |

| REVIEW OF QUANTITATIVE FINANCE AND ACCOUNTING | 3 |

| SYSTEMS AND SOFT COMPUTING | 3 |

| TEHNICKI VJESNIK-TECHNICAL GAZETTE | 3 |

| TRANSFORMATIONS IN BUSINESS & ECONOMICS | 3 |

| ABACUS-A JOURNAL OF ACCOUNTING FINANCE AND BUSINESS STUDIES | 2 |

| ACM TRANSACTIONS ON MANAGEMENT INFORMATION SYSTEMS | 2 |

| ACTA OECONOMICA | 2 |

| AI | 2 |

| ARABIAN JOURNAL FOR SCIENCE AND ENGINEERING | 2 |

| ARGUMENTA OECONOMICA | 2 |

| ASIA-PACIFIC FINANCIAL MARKETS | 2 |

| BALTIC JOURNAL OF ECONOMIC STUDIES | 2 |

| BENCHMARKING-AN INTERNATIONAL JOURNAL | 2 |

| BUSINESS PROCESS MANAGEMENT JOURNAL | 2 |

| COMPETITIVENESS REVIEW | 2 |

| COMPUTACION Y SISTEMAS | 2 |

| COMPUTERS | 2 |

| CORPORATE GOVERNANCE-THE INTERNATIONAL JOURNAL OF BUSINESS IN SOCIETY | 2 |

| DATA SCIENCE IN FINANCE AND ECONOMICS | 2 |

| E & M EKONOMIE A MANAGEMENT | 2 |

| ELECTRONIC COMMERCE RESEARCH | 2 |

| EMPIRICAL ECONOMICS | 2 |

| EQUILIBRIUM-QUARTERLY JOURNAL OF ECONOMICS AND ECONOMIC POLICY | 2 |

| EUROPEAN FINANCIAL MANAGEMENT | 2 |

| EUROPEAN JOURNAL OF FINANCE | 2 |

| FIIB BUSINESS REVIEW | 2 |

| INGENIERIA SOLIDARIA | 2 |

| INTELLIGENT DECISION TECHNOLOGIES-NETHERLANDS | 2 |

| INTELLIGENT SYSTEMS IN ACCOUNTING FINANCE & MANAGEMENT | 2 |

| INTERNATIONAL JOURNAL OF ACCOUNTING AND INFORMATION MANAGEMENT | 2 |

| INTERNATIONAL JOURNAL OF COMPUTATIONAL ECONOMICS AND ECONOMETRICS | 2 |

| INTERNATIONAL JOURNAL OF COMPUTER APPLICATIONS IN TECHNOLOGY | 2 |

| INTERNATIONAL JOURNAL OF INFORMATION TECHNOLOGY PROJECT MANAGEMENT | 2 |

| INTERNATIONAL JOURNAL OF MACHINE LEARNING AND CYBERNETICS | 2 |

| INTERNATIONAL JOURNAL OF NEURAL SYSTEMS | 2 |

| INTERNATIONAL JOURNAL OF SYSTEM ASSURANCE ENGINEERING AND MANAGEMENT | 2 |

| INTERNATIONAL JOURNAL OF TECHNOLOGY | 2 |

| INTERNATIONAL JOURNAL ON ARTIFICIAL INTELLIGENCE TOOLS | 2 |

| INVESTMENT ANALYSTS JOURNAL | 2 |

| JOURNAL OF ACCOUNTING LITERATURE | 2 |

| JOURNAL OF APPLIED ACCOUNTING RESEARCH | 2 |

| JOURNAL OF ASIAN FINANCE ECONOMICS AND BUSINESS | 2 |

| JOURNAL OF BUSINESS FINANCE & ACCOUNTING | 2 |

| JOURNAL OF ECONOMIC SURVEYS | 2 |

| JOURNAL OF FINANCIAL SERVICES RESEARCH | 2 |

| JOURNAL OF INDUSTRIAL AND MANAGEMENT OPTIMIZATION | 2 |

| JOURNAL OF KING SAUD UNIVERSITY-COMPUTER AND INFORMATION SCIENCES | 2 |

| JOURNAL OF MANAGEMENT ANALYTICS | 2 |

| JOURNAL OF MANAGEMENT SCIENCE AND ENGINEERING | 2 |

| JOURNAL OF MONETARY ECONOMICS | 2 |

| JOURNAL OF MONEY CREDIT AND BANKING | 2 |

| JOURNAL OF SMALL BUSINESS MANAGEMENT | 2 |

| MARKETING AND MANAGEMENT OF INNOVATIONS | 2 |

| OMEGA-INTERNATIONAL JOURNAL OF MANAGEMENT SCIENCE | 2 |

| QUARTERLY REVIEW OF ECONOMICS AND FINANCE | 2 |

| REVIEW OF FINANCIAL ECONOMICS | 2 |

| REVISTA INTERNACIONAL DE METODOS NUMERICOS PARA CALCULO Y DISENO EN INGENIERIA | 2 |

| ROMANIAN JOURNAL OF ECONOMIC FORECASTING | 2 |

| SAGE OPEN | 2 |

| SOCIAL NETWORK ANALYSIS AND MINING | 2 |

| SOCIO-ECONOMIC PLANNING SCIENCES | 2 |

| TEM JOURNAL-TECHNOLOGY EDUCATION MANAGEMENT INFORMATICS | 2 |

| ACADEMIA-REVISTA LATINOAMERICANA DE ADMINISTRACION | 1 |

| ACCOUNTING HORIZONS | 1 |

| ACCOUNTING REVIEW | 1 |

| ACM JOURNAL OF DATA AND INFORMATION QUALITY | 1 |

| ACTA INFOLOGICA | 1 |

| ACTA INFORMATICA PRAGENSIA | 1 |

| ADMINISTRATIVE SCIENCES | 1 |

| ADVANCES IN ACCOUNTING | 1 |

| AFRICAN JOURNAL OF BUSINESS MANAGEMENT | 1 |

| AFRICAN JOURNAL OF ECONOMIC AND MANAGEMENT STUDIES | 1 |

| AFRICAN JOURNAL OF SCIENCE TECHNOLOGY INNOVATION & DEVELOPMENT | 1 |

| AIN SHAMS ENGINEERING JOURNAL | 1 |

| ALEXANDRIA ENGINEERING JOURNAL | 1 |

| AMERICAN ECONOMIC REVIEW | 1 |

| ANALES DEL INSTITUTO DE ACTUARIOS ESPANOLES | 1 |

| ANNALS OF FINANCIAL ECONOMICS | 1 |

| APPLIED ECONOMICS JOURNAL | 1 |

| ASIA-PACIFIC JOURNAL OF ACCOUNTING & ECONOMICS | 1 |

| ASIA-PACIFIC JOURNAL OF BUSINESS ADMINISTRATION | 1 |

| ASIA-PACIFIC JOURNAL OF FINANCIAL STUDIES | 1 |

| ASR CHIANG MAI UNIVERSITY JOURNAL OF SOCIAL SCIENCES AND HUMANITIES | 1 |

| AUSTRALASIAN ACCOUNTING BUSINESS AND FINANCE JOURNAL | 1 |

| BANKS AND BANK SYSTEMS | 1 |

| BIG DATA & SOCIETY | 1 |

| BRAZILIAN JOURNAL OF OPERATIONS & PRODUCTION MANAGEMENT | 1 |

| BRITISH ACCOUNTING REVIEW | 1 |

| BRITISH JOURNAL OF MANAGEMENT | 1 |

| BULLETIN OF THE NATIONAL ACADEMY OF SCIENCES OF THE REPUBLIC OF KAZAKHSTAN | 1 |

| CENTRAL BANK REVIEW | 1 |

| CENTRAL EUROPEAN JOURNAL OF OPERATIONS RESEARCH | 1 |

| CENTRAL EUROPEAN MANAGEMENT JOURNAL | 1 |

| CHINA ECONOMIC REVIEW | 1 |

| CIENCIA ERGO-SUM | 1 |

| CMES-COMPUTER MODELING IN ENGINEERING & SCIENCES | 1 |

| COGENT SOCIAL SCIENCES | 1 |

| COMMUNICATIONS OF THE ASSOCIATION FOR INFORMATION SYSTEMS | 1 |

| COMPLEX & INTELLIGENT SYSTEMS | 1 |

| COMPUTATION | 1 |

| COMPUTATIONAL MANAGEMENT SCIENCE | 1 |

| COMPUTING AND INFORMATICS | 1 |

| CONSTRUCTION MANAGEMENT AND ECONOMICS | 1 |

| CROATIAN ECONOMIC SURVEY | 1 |

| DATA & KNOWLEDGE ENGINEERING | 1 |

| DECISION SCIENCE LETTERS | 1 |

| DISCOVER COMPUTING | 1 |

| ECONOMETRICS | 1 |

| ECONOMIC INQUIRY | 1 |

| ECONOMIC SYSTEMS | 1 |

| ECONOMICS & SOCIOLOGY | 1 |

| ECONOMICS AND FINANCE LETTERS | 1 |

| ECONOMICS OF TRANSITION AND INSTITUTIONAL CHANGE | 1 |

| ECONOMICS-THE OPEN ACCESS OPEN-ASSESSMENT E-JOURNAL | 1 |

| EGE ACADEMIC REVIEW | 1 |

| EKONOMI POLITIKA & FINANS ARASTIRMALARI DERGISI | 1 |

| EKONOMIA I PRAWO-ECONOMICS AND LAW | 1 |

| ELECTRONIC COMMERCE RESEARCH AND APPLICATIONS | 1 |

| EMERGING MARKETS REVIEW | 1 |

| ENGINEERING RESEARCH EXPRESS | 1 |

| ENTERPRISE INFORMATION SYSTEMS | 1 |

| ENTREPRENEURSHIP AND SUSTAINABILITY ISSUES | 1 |

| EPJ DATA SCIENCE | 1 |

| EURASIAN BUSINESS REVIEW | 1 |

| EUROMED JOURNAL OF BUSINESS | 1 |

| EUROPEAN ACCOUNTING REVIEW | 1 |

| EUROPEAN BUSINESS REVIEW | 1 |

| EUROPEAN MANAGEMENT STUDIES | 1 |

| EUROPEAN RESEARCH ON MANAGEMENT AND BUSINESS ECONOMICS | 1 |

| EVOLUTIONARY INTELLIGENCE | 1 |

| FINANCE A UVER-CZECH JOURNAL OF ECONOMICS AND FINANCE | 1 |

| FORECASTING | 1 |

| FRONTIERS IN APPLIED MATHEMATICS AND STATISTICS | 1 |

| FRONTIERS OF BUSINESS RESEARCH IN CHINA | 1 |

| FUDAN JOURNAL OF THE HUMANITIES AND SOCIAL SCIENCES | 1 |

| GENEVA PAPERS ON RISK AND INSURANCE-ISSUES AND PRACTICE | 1 |

| GREY SYSTEMS-THEORY AND APPLICATION | 1 |

| HUMAN-CENTRIC COMPUTING AND INFORMATION SCIENCES | 1 |

| IIMB MANAGEMENT REVIEW | 1 |

| IMA JOURNAL OF MANAGEMENT MATHEMATICS | 1 |

| INDUSTRIAL AND CORPORATE CHANGE | 1 |

| INFOR | 1 |

| INFORMATION-AN INTERNATIONAL INTERDISCIPLINARY JOURNAL | 1 |

| INGENIERIA | 1 |

| INGENIERIA E INVESTIGACION | 1 |

| INNOVATIVE MARKETING | 1 |

| INTERNATIONAL JOURNAL OF ADVANCED AND APPLIED SCIENCES | 1 |

| INTERNATIONAL JOURNAL OF ASIAN BUSINESS AND INFORMATION MANAGEMENT | 1 |

| INTERNATIONAL JOURNAL OF COMPUTER SCIENCE AND NETWORK SECURITY | 1 |

| INTERNATIONAL JOURNAL OF COOPERATIVE INFORMATION SYSTEMS | 1 |

| INTERNATIONAL JOURNAL OF DIGITAL CRIME AND FORENSICS | 1 |

| INTERNATIONAL JOURNAL OF DISCLOSURE AND GOVERNANCE | 1 |

| INTERNATIONAL JOURNAL OF E-COLLABORATION | 1 |

| INTERNATIONAL JOURNAL OF ELECTRONIC SECURITY AND DIGITAL FORENSICS | 1 |

| INTERNATIONAL JOURNAL OF ENGINEERING BUSINESS MANAGEMENT | 1 |

| INTERNATIONAL JOURNAL OF ENTERPRISE INFORMATION SYSTEMS | 1 |

| INTERNATIONAL JOURNAL OF ENTREPRENEURSHIP & SMALL BUSINESS | 1 |

| INTERNATIONAL JOURNAL OF ETHICS AND SYSTEMS | 1 |

| INTERNATIONAL JOURNAL OF INFORMATION RETRIEVAL RESEARCH | 1 |

| INTERNATIONAL JOURNAL OF INFORMATION SYSTEMS AND SUPPLY CHAIN MANAGEMENT | 1 |

| INTERNATIONAL JOURNAL OF INFORMATION TECHNOLOGY AND WEB ENGINEERING | 1 |

| INTERNATIONAL JOURNAL OF INNOVATIVE COMPUTING INFORMATION AND CONTROL | 1 |

| INTERNATIONAL JOURNAL OF INTERACTIVE MULTIMEDIA AND ARTIFICIAL INTELLIGENCE | 1 |

| INTERNATIONAL JOURNAL OF ORGANIZATIONAL ANALYSIS | 1 |

| INTERNATIONAL JOURNAL OF PHYSICAL DISTRIBUTION & LOGISTICS MANAGEMENT | 1 |

| INTERNATIONAL JOURNAL OF PRODUCTIVITY AND PERFORMANCE MANAGEMENT | 1 |

| INTERNATIONAL JOURNAL OF SOCIAL ECONOMICS | 1 |

| INTERNATIONAL JOURNAL OF TECHNOLOGY MANAGEMENT | 1 |

| INTERNATIONAL JOURNAL OF UNCERTAINTY FUZZINESS AND KNOWLEDGE-BASED SYSTEMS | 1 |

| IRANIAN JOURNAL OF MANAGEMENT STUDIES | 1 |

| ISTANBUL BUSINESS RESEARCH | 1 |

| JOURNAL OF ADVANCED COMPUTATIONAL INTELLIGENCE AND INTELLIGENT INFORMATICS | 1 |

| JOURNAL OF APPLIED ECONOMICS | 1 |

| JOURNAL OF ASIA BUSINESS STUDIES | 1 |

| JOURNAL OF ASIAN BUSINESS AND ECONOMIC STUDIES | 1 |

| JOURNAL OF BEHAVIORAL FINANCE | 1 |

| JOURNAL OF BUSINESS & INDUSTRIAL MARKETING | 1 |

| JOURNAL OF CASES ON INFORMATION TECHNOLOGY | 1 |

| JOURNAL OF CLOUD COMPUTING-ADVANCES SYSTEMS AND APPLICATIONS | 1 |

| JOURNAL OF COMPUTER INFORMATION SYSTEMS | 1 |

| JOURNAL OF COMPUTER VIROLOGY AND HACKING TECHNIQUES | 1 |

| JOURNAL OF CONSUMER BEHAVIOUR | 1 |

| JOURNAL OF CONTEMPORARY ACCOUNTING & ECONOMICS | 1 |

| JOURNAL OF CORPORATE ACCOUNTING AND FINANCE | 1 |

| JOURNAL OF CORPORATE FINANCE | 1 |

| JOURNAL OF DEVELOPMENT ECONOMICS | 1 |

| JOURNAL OF ECONOMETRICS | 1 |

| JOURNAL OF ECONOMIC BEHAVIOR & ORGANIZATION | 1 |

| JOURNAL OF ECONOMIC DYNAMICS & CONTROL | 1 |

| JOURNAL OF ECONOMIC POLICY RESEARCHES-IKTISAT POLITIKASI ARASTIRMALARI DERGISI | 1 |

| JOURNAL OF ECONOMICS AND FINANCE | 1 |

| JOURNAL OF ECONOMICS, FINANCE AND ADMINISTRATIVE SCIENCE | 1 |

| JOURNAL OF EMERGING MARKET FINANCE | 1 |

| JOURNAL OF ENGINEERING SCIENCE AND TECHNOLOGY | 1 |

| JOURNAL OF FINANCE AND DATA SCIENCE | 1 |

| JOURNAL OF FINANCIAL ECONOMIC POLICY | 1 |

| JOURNAL OF FINANCIAL ECONOMICS | 1 |

| JOURNAL OF FINANCIAL INTERMEDIATION | 1 |

| JOURNAL OF FINANCIAL REPORTING | 1 |

| JOURNAL OF GLOBAL RESPONSIBILITY | 1 |

| JOURNAL OF INDUSTRIAL AND BUSINESS ECONOMICS | 1 |

| JOURNAL OF INFORMATION AND COMMUNICATION TECHNOLOGY-MALAYSIA | 1 |

| JOURNAL OF INFORMATION TECHNOLOGY RESEARCH | 1 |

| JOURNAL OF INNOVATION & KNOWLEDGE | 1 |

| JOURNAL OF INTELLIGENT INFORMATION SYSTEMS | 1 |

| JOURNAL OF INTERNATIONAL COMMERCE ECONOMICS AND POLICY | 1 |

| JOURNAL OF INTERNATIONAL ECONOMICS | 1 |

| JOURNAL OF INTERNATIONAL FINANCIAL MANAGEMENT & ACCOUNTING | 1 |

| JOURNAL OF ISLAMIC ACCOUNTING AND BUSINESS RESEARCH | 1 |

| JOURNAL OF MANAGEMENT & ORGANIZATION | 1 |

| JOURNAL OF MANAGEMENT AND GOVERNANCE | 1 |

| JOURNAL OF MARKETING ANALYTICS | 1 |

| JOURNAL OF MATHEMATICS IN INDUSTRY | 1 |

| JOURNAL OF OPERATIONAL RISK | 1 |

| JOURNAL OF ORGANIZATIONAL COMPUTING AND ELECTRONIC COMMERCE | 1 |

| JOURNAL OF QUANTITATIVE ECONOMICS | 1 |

| JOURNAL OF SCIENTIFIC & INDUSTRIAL RESEARCH | 1 |

| JOURNAL OF SERVICE MANAGEMENT | 1 |

| JOURNAL OF STRATEGIC MARKETING | 1 |

| JOURNAL OF THE FACULTY OF ENGINEERING AND ARCHITECTURE OF GAZI UNIVERSITY | 1 |

| JOURNAL OF THE OPERATIONS RESEARCH SOCIETY OF JAPAN | 1 |

| JOURNAL OF THEORETICAL AND APPLIED ELECTRONIC COMMERCE RESEARCH | 1 |

| KNOWLEDGE ENGINEERING REVIEW | 1 |

| KUWAIT JOURNAL OF SCIENCE | 1 |

| MACHINE LEARNING | 1 |

| MACROECONOMICS AND FINANCE IN EMERGING MARKET ECONOMIES | 1 |

| MANAGEMENT RESEARCH AND PRACTICE | 1 |

| MANAGEMENT REVIEW QUARTERLY | 1 |

| MANAGEMENT SCIENCE | 1 |

| MANAGEMENT-POLAND | 1 |

| MANAGERIAL FINANCE | 1 |

| MARKET-TRZISTE | 1 |

| MEASUREMENT-INTERDISCIPLINARY RESEARCH AND PERSPECTIVES | 1 |

| METHODSX | 1 |

| NANKAI BUSINESS REVIEW INTERNATIONAL | 1 |

| NATIONAL ACCOUNTING REVIEW | 1 |

| NATURE COMMUNICATIONS | 1 |

| NATURE MACHINE INTELLIGENCE | 1 |

| NAVAL RESEARCH LOGISTICS | 1 |

| NETWORKS AND HETEROGENEOUS MEDIA | 1 |

| NEW MATHEMATICS AND NATURAL COMPUTATION | 1 |

| OPEN ECONOMIES REVIEW | 1 |

| OPERATIONS RESEARCH AND DECISIONS | 1 |

| OR SPECTRUM | 1 |

| PANOECONOMICUS | 1 |

| PATTERN RECOGNITION AND IMAGE ANALYSIS | 1 |

| PATTERN RECOGNITION LETTERS | 1 |

| PROCEEDINGS OF THE NATIONAL ACADEMY OF SCIENCES INDIA SECTION A-PHYSICAL SCIENCES | 1 |

| PUBLIC FINANCE QUARTERLY-HUNGARY | 1 |

| QUALITATIVE RESEARCH IN FINANCIAL MARKETS | 1 |

| RAE-REVISTA DE ADMINISTRACAO DE EMPRESAS | 1 |

| REAL ESTATE MANAGEMENT AND VALUATION | 1 |

| RETOS-REVISTA DE CIENCIAS DE LA ADMINISTRACION Y ECONOMIA | 1 |

| REVIEW OF ACCOUNTING AND FINANCE | 1 |

| REVIEW OF ACCOUNTING STUDIES | 1 |

| REVIEW OF DEVELOPMENT FINANCE | 1 |

| REVIEW OF FINANCE | 1 |

| REVISTA GESTAO & TECNOLOGIA-JOURNAL OF MANAGEMENT AND TECHNOLOGY | 1 |

| REVISTA INNOVACIENCIA | 1 |

| REVISTA UNIVERSIDAD EMPRESA | 1 |

| RISK MANAGEMENT-AN INTERNATIONAL JOURNAL | 1 |

| RISUS-JOURNAL ON INNOVATION AND SUSTAINABILITY | 1 |

| SADHANA-ACADEMY PROCEEDINGS IN ENGINEERING SCIENCES | 1 |

| SCANDINAVIAN JOURNAL OF ECONOMICS | 1 |

| SCIENCE TECHNOLOGY AND SOCIETY | 1 |

| SCIENTIFIC BULLETIN OF MUKACHEVO STATE UNIVERSITY-SERIES ECONOMICS | 1 |

| SCIENTIFIC DATA | 1 |

| SERBIAN JOURNAL OF MANAGEMENT | 1 |

| SERVICE BUSINESS | 1 |

| SERVICE INDUSTRIES JOURNAL | 1 |

| SOUTH AFRICAN JOURNAL OF BUSINESS MANAGEMENT | 1 |

| SOUTH AFRICAN JOURNAL OF ECONOMIC AND MANAGEMENT SCIENCES | 1 |

| SPANISH JOURNAL OF FINANCE AND ACCOUNTING-REVISTA ESPANOLA DE FINANCIACION Y CONTABILIDAD | 1 |

| SPATIAL ECONOMIC ANALYSIS | 1 |

| SRI LANKA JOURNAL OF SOCIAL SCIENCES | 1 |

| STATISTIKA-STATISTICS AND ECONOMY JOURNAL | 1 |

| TECHNICS TECHNOLOGIES EDUCATION MANAGEMENT-TTEM | 1 |

| TECHNOLOGIES | 1 |

| TECHNOLOGY ANALYSIS & STRATEGIC MANAGEMENT | 1 |

| TURKISH JOURNAL OF ISLAMIC ECONOMICS-TUJISE | 1 |

| WEB INTELLIGENCE | 1 |

| ZBORNIK RADOVA EKONOMSKOG FAKULTETA U RIJECI-PROCEEDINGS OF RIJEKA FACULTY OF ECONOMICS | 1 |

References

- Fethi, M.D.; Pasiouras, F. Assessing Bank Efficiency and Performance with Operational Research and Artificial Intelligence Techniques: A Survey. Eur. J. Oper. Res. 2010, 204, 189–198. [Google Scholar] [CrossRef]

- Khandani, A.E.; Kim, A.J.; Lo, A.W. Consumer Credit-Risk Models via Machine-Learning Algorithms. J. Bank. Financ. 2010, 34, 2767–2787. [Google Scholar] [CrossRef]

- Bahrammirzaee, A. A Comparative Survey of Artificial Intelligence Applications in Finance: Artificial Neural Networks, Expert System and Hybrid Intelligent Systems. Neural Comput. Appl. 2010, 19, 1165–1195. [Google Scholar] [CrossRef]

- Veganzones, D.; Severin, E. Corporate Failure Prediction Models in the Twenty-First Century: A Review. Eur. Bus. Rev. 2021, 33, 291–316. [Google Scholar] [CrossRef]

- Ngai, E.W.T.; Chau, D.C.K.; Chan, T.L.A. The Application of Data Mining Techniques in Financial Fraud Detection: A Classification Framework and an Academic Review of Literature. Decis. Support Syst. 2011, 50, 775–788. [Google Scholar] [CrossRef]

- Tinoco, M.H.; Wilson, N. Financial Distress and Bankruptcy Prediction among Listed Companies Using Accounting, Market and Macroeconomic Variables. Int. Rev. Financ. Anal. 2013, 30, 394–419. [Google Scholar] [CrossRef]

- Geng, R.; Bose, I.; Chen, X. Prediction of Financial Distress: An Empirical Study of Listed Chinese Companies Using Data Mining. Eur. J. Oper. Res. 2015, 241, 236–247. [Google Scholar] [CrossRef]

- Sun, J.; Luo, Y.; Chen, Y. Predicting Financial Distress and Corporate Failure: A Review from the State-of-the-Art Definitions, Modeling, Sampling, and Featuring Approaches. Knowl. Based Syst. 2014, 57, 41–56. [Google Scholar] [CrossRef]

- Alaka, H.A.; Oyedele, L.O.; Owolabi, H.A.; Kumar, V.; Ajayi, S.O.; Akinade, O.O.; Bilal, M.; Han, S. Systematic Review of Bankruptcy Prediction Models: Towards a Framework for Tool Selection. Expert Syst. Appl. 2018, 94, 164–184. [Google Scholar] [CrossRef]

- Goodell, J.W.; Kumar, S.; Lim, W.M.; Pattnaik, D. Artificial Intelligence and Machine Learning in Finance: Identifying Foundations, Themes, and Research Clusters from Bibliometric Analysis. J. Behav. Exp. Financ. 2021, 32, 100577. [Google Scholar] [CrossRef]

- Barboza, F.; Kimura, H.; Altman, E.I. Machine Learning Models and Bankruptcy Prediction. Expert Syst. Appl. 2017, 83, 405–417. [Google Scholar] [CrossRef]

- Kumar, A.; Sharma, S.; Mahdavi, M. Machine Learning (ML) Technologies for Digital Credit Scoring in Rural Finance: A Literature Review. Risks 2021, 9, 192. [Google Scholar] [CrossRef]

- Andronie, M.; Andronie, I.E.; Dragomir, L.C.; Șerban-Oprescu, G.L. Big Data Management Algorithms in Artificial Internet of Things-Based Fintech. Oeconomia Copernic. 2023, 14, 287–312. [Google Scholar] [CrossRef]

- Lazaroiu, G.; Andronie, M.; Uţă, C.; Hurloiu, I. Artificial Intelligence Algorithms and Cloud Computing Technologies in Blockchain-Based Fintech Management. Oeconomia Copernic. 2023, 14, 89–113. [Google Scholar] [CrossRef]

- Amarnadh, V.; Moparthi, N.R. Comprehensive Review of Different Artificial Intelligence-Based Methods for Credit Risk Assessment in Data Science. Intell. Decis. Technol. 2023, 17, 227–241. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. Software Survey: VOSviewer, a Computer Program for Bibliometric Mapping. Scientometrics 2010, 84, 523–538. [Google Scholar] [CrossRef]

- Aria, M.; Cuccurullo, C. Bibliometrix: An R-Tool for Comprehensive Science Mapping Analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Pranckutė, R. Web of Science (WoS) and Scopus: The Titans of Bibliographic Information in Today’s Academic World. Publications 2021, 9, 12. [Google Scholar] [CrossRef]

- Pritchard, A. Statistical Bibliography or Bibliometrics. J. Doc. 1969, 25, 348–349. [Google Scholar]

- Linnenluecke, M.K.; Marrone, M.; Singh, A.K. Conducting Systematic Literature Reviews and Bibliometric Analyses. Aust. J. Manag. 2020, 45, 175–194. [Google Scholar] [CrossRef]

- Donthu, N.; Kumar, S.; Mukherjee, D.; Pandey, N.; Lim, W.M. How to Conduct a Bibliometric Analysis: An Overview and Guidelines. J. Bus. Res. 2021, 133, 285–296. [Google Scholar] [CrossRef]

- Moro, S.; Cortez, P.; Rita, P. Business Intelligence in Banking: A Literature Analysis from 2002 to 2013 Using Text Mining and Latent Dirichlet Allocation. Expert Syst. Appl. 2015, 42, 1314–1324. [Google Scholar] [CrossRef]

- Cheng, M.; Qu, Y. Does Bank FinTech Reduce Credit Risk? Evidence from China. Pac. Basin Financ. J. 2020, 63, 101398. [Google Scholar] [CrossRef]

- Mai, F.; Tian, S.; Lee, C.; Ma, L. Deep Learning Models for Bankruptcy Prediction Using Textual Disclosures. Eur. J. Oper. Res. 2019, 274, 743–758. [Google Scholar] [CrossRef]

- Alfaro, E.; García, N.; Gámez, M.; Elizondo, D. Bankruptcy Forecasting: An Empirical Comparison of AdaBoost and Neural Networks. Decis. Support Syst. 2008, 45, 110–122. [Google Scholar] [CrossRef]

- Chou, C.; Hsieh, S.; Qiu, C. Hybrid Genetic Algorithm and Fuzzy Clustering for Bankruptcy Prediction. Appl. Soft Comput. 2017, 56, 298–316. [Google Scholar] [CrossRef]

- Tkáč, M.; Verner, R. Artificial Neural Networks in Business: Two Decades of Research. Appl. Soft Comput. 2015, 38, 788–804. [Google Scholar] [CrossRef]

- Akkoç, S. An Empirical Comparison of Conventional Techniques, Neural Networks and the Three Stage Hybrid Adaptive Neuro Fuzzy Inference System (ANFIS) Model for Credit Scoring Analysis: The Case of Turkish Credit Card Data. Eur. J. Oper. Res. 2012, 222, 168–178. [Google Scholar] [CrossRef]

- Chen, N.; Ribeiro, B.; Chen, A. Financial Credit Risk Assessment: A Recent Review. Artif. Intell. Rev. 2016, 45, 1–23. [Google Scholar] [CrossRef]

- Flavián, C.; Ibáñez-Sánchez, S.; Orús, C. The Impact of Virtual, Augmented and Mixed Reality Technologies on the Customer Experience. J. Bus. Res. 2022, 142, 620–632. [Google Scholar] [CrossRef]

- Payne, E.H.M.; Dahl, A.J.; Peltier, J. Digital Servitization Value Co-Creation Framework for AI Services: A Research Agenda for Digital Transformation in Financial Service Ecosystems. J. Res. Interact. Mark. 2021, 15, 200–222. [Google Scholar] [CrossRef]

- Hentzen, J.; Hoffmann, A.; Dolan, R.; Pala, E. Artificial Intelligence in Customer-Facing Financial Services: A Systematic Literature Review and Agenda for Future Research. Int. J. Bank Mark. 2021, 40, 1299–1336. [Google Scholar] [CrossRef]

- Milana, C.; Ashta, A. Artificial Intelligence Techniques in Finance and Financial Markets: A Survey of the Literature. Strateg. Change 2021, 30, 189–209. [Google Scholar] [CrossRef]

- Kou, G.; Chao, X.; Peng, Y.; Alsaadi, F.E.; Herrera-Viedma, E. Machine Learning Methods for Systemic Risk Analysis in Financial Sectors. Technol. Econ. Dev. Econ. 2019, 25, 716–742. [Google Scholar] [CrossRef]

- Amani, F.A.; Fadlalla, A.M. Data Mining Applications in Accounting: A Review of the Literature and Organizing Framework. Int. J. Account. Inf. Syst. 2017, 24, 32–58. [Google Scholar] [CrossRef]

- Liang, D.; Lu, C.; Tsai, C.; Shih, G. Financial Ratios and Corporate Governance Indicators in Bankruptcy Prediction: A Comprehensive Study. Eur. J. Oper. Res. 2016, 252, 561–572. [Google Scholar] [CrossRef]

- Liang, D.; Tsai, C.; Lu, H.; Chang, L. Combining Corporate Governance Indicators with Stacking Ensembles for Financial Distress Prediction. J. Bus. Res. 2020, 120, 137–146. [Google Scholar] [CrossRef]

- Ben Jabeur, S.; Stef, N.; Carmona, P. Bankruptcy Prediction Using the XGBoost Algorithm and Variable Importance Feature Engineering. Comput. Econ. 2023, 61, 715–741. [Google Scholar] [CrossRef]

- Demyanyk, Y.; Hasan, I. Financial Crises and Bank Failures: A Review of Prediction Methods. Omega 2010, 38, 315–324. [Google Scholar] [CrossRef]

- Butaru, F.; Chen, Q.; Clark, B.; Das, S.; Lo, A.W.; Siddique, A. Risk and Risk Management in the Credit Card Industry. J. Bank. Financ. 2016, 72, 218–239. [Google Scholar] [CrossRef]

- Chen, Y.; Cheng, C. Hybrid Models Based on Rough Set Classifiers for Setting Credit Rating Decision Rules in the Global Banking Industry. Knowl. Based Syst. 2013, 39, 224–239. [Google Scholar] [CrossRef]

- Petropoulos, A.; Siakoulis, V.; Stavroulakis, E.; Vlachogiannakis, N.E. Predicting Bank Insolvencies Using Machine Learning Techniques. Int. J. Forecast. 2020, 36, 1092–1113. [Google Scholar] [CrossRef]

- Climent, F.; Momparler, A.; Carmona, P. Anticipating Bank Distress in the Eurozone: An Extreme Gradient Boosting Approach. J. Bus. Res. 2019, 101, 885–896. [Google Scholar] [CrossRef]

- Jakšič, M.; Marinč, M. Relationship Banking and Information Technology: The Role of Artificial Intelligence and FinTech. Risk Manag. 2019, 21, 1–18. [Google Scholar] [CrossRef]

- Altman, E.I. Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bankruptcy. J. Financ. 1968, 23, 589. [Google Scholar] [CrossRef]

- Altman, E.I.; Marco, G.; Varetto, F. Corporate Distress Diagnosis: Comparisons Using Linear Discriminant Analysis and Neural Networks (the Italian Experience). J. Bank. Financ. 1994, 18, 505–529. [Google Scholar] [CrossRef]

- Beaver, W.H. Financial Ratios As Predictors of Failure. J. Account. Res. 1966, 4, 71–111. [Google Scholar] [CrossRef]

- Ohlson, J.A. Financial Ratios and the Probabilistic Prediction of Bankruptcy. J. Account. Res. 1980, 18, 109–131. [Google Scholar] [CrossRef]

- Martin, D. Early Warning of Bank Failure: A Logit Regression Approach. J. Bank. Financ. 1977, 1, 249–276. [Google Scholar] [CrossRef]

- Zmijewski, M.E. Methodological Issues Related to the Estimation of Financial Distress Prediction Models. J. Account. Res. 1984, 22, 59–82. [Google Scholar] [CrossRef]

- Breiman, L. Random Forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Chen, T.; Guestrin, C. XGBoost: A Scalable Tree Boosting System. In Proceedings of the 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, San Francisco, CA, USA, 13–17 August 2016; pp. 785–794. [Google Scholar]

- Lessmann, S.; Baesens, B.; Seow, H.; Thomas, L.C. Benchmarking State-of-the-Art Classification Algorithms for Credit Scoring: An Update of Research. Eur. J. Oper. Res. 2015, 247, 124–136. [Google Scholar] [CrossRef]

- Tsai, C.; Wu, J. Using Neural Network Ensembles for Bankruptcy Prediction and Credit Scoring. Expert Syst. Appl. 2008, 34, 2639–2649. [Google Scholar] [CrossRef]

- Tsai, C. Feature Selection in Bankruptcy Prediction. Knowl. Based Syst. 2009, 22, 120–127. [Google Scholar] [CrossRef]

- Liang, D.; Tsai, C.; Wu, H. The Effect of Feature Selection on Financial Distress Prediction. Knowl. Based Syst. 2015, 73, 289–297. [Google Scholar] [CrossRef]

- Zięba, M.; Tomczak, S.; Tomczak, J. Ensemble Boosted Trees with Synthetic Features Generation in Application to Bankruptcy Prediction. Expert Syst. Appl. 2016, 58, 93–101. [Google Scholar] [CrossRef]

- Kim, M.; Kang, D. Ensemble with Neural Networks for Bankruptcy Prediction. Expert Syst. Appl. 2010, 37, 3373–3379. [Google Scholar] [CrossRef]

- Olson, D.L.; Delen, D.; Meng, Y. Comparative Analysis of Data Mining Methods for Bankruptcy Prediction. Decis. Support Syst. 2011, 52, 464–473. [Google Scholar] [CrossRef]

- Wang, G.; Ma, J.; Yang, S. An Improved Boosting Based on Feature Selection for Corporate Bankruptcy Prediction. Expert Syst. Appl. 2014, 41, 2353–2361. [Google Scholar] [CrossRef]

| Author Name (Year) | Time Period | Focus of the Study | Database Used | Number of Documents | Methodology | Contribution | Keywords Used |

|---|---|---|---|---|---|---|---|

| Ngai et al. (2011) [5] | 1997–2010 | Financial fraud detection via DM | WoS, Scopus | 49 articles | Systematic literature review | Classification framework for fraud detection | DM, fraud detection, classification |

| Amarnadh & Moparthi (2023) [15] | 2000–2023 | AI-based credit risk assessment methods | WoS | 85 articles | Comprehensive review | Overview of AI techniques in credit risk assessment | Credit risk, AI, data science |

| Fethi & Pasiouras (2010) [1] | 1998–2008 | Bank efficiency assessment using AI/OR | WoS | 196 articles | Bibliometric review | Survey of AI and OR methods in banking | AI, OR, banking efficiency |

| Veganzones & Severin (2021) [4] | 2000–2020 | Corporate failure prediction models | WoS | 95 articles | Systematic literature review | Updated synthesis of corporate failure models | Bankruptcy, failure prediction, financial distress |

| Bahrammirzaee (2010) [3] | 1994–2009 | AI applications in finance | WoS, Scopus | 125 articles | Comparative review | Review of ANNs, expert systems, and hybrid models | AI, expert systems, ANN |

| Barboza et al. (2017) [11] | 1995–2014 | Bankruptcy prediction with ML | WoS | 130 articles | Meta-review | Comparative performance of ML bankruptcy models | Bankruptcy, ML, prediction |

| Andronie et al. (2023) [13] | 2010–2023 | BDA management algorithms in FinTech | WoS, Scopus | 75 articles | Systematic review | Applications of BDA and IoT in FinTech | BDA, FinTech, AI, IoT |

| Alaka et al. (2018) [9] | 2000–2017 | Corporate default prediction via ML | WoS | 95 articles | Systematic review | Evaluation of ML vs. classical corporate default models | Corporate default, ML, bankruptcy |

| Kumar et al. (2021) [12] | 2000–2020 | Digital credit scoring for rural finance | WoS | 63 articles | Literature review | ML applications in rural microcredit | Credit scoring, rural finance, ML |

| Lazaroiu et al. (2023) [14] | 2010–2023 | Blockchain-based FinTech management | WoS | 45 articles | Systematic review | AI, cloud computing, and blockchain integration | Blockchain, FinTech, AI |

| No. | Search Query | Results |

|---|---|---|

| #1 | Final query: TS = ((“computational intelligence” OR “machine learning” OR “artificial intelligence” OR “data mining” OR “deep learning” OR “neural network”) AND (“bank*” OR “financial institution*” OR “credit risk” OR “risk management” OR “systemic risk”) AND financ* AND bank*). | 2692 |

| #2 | Limiting the study to studies published from 2000 to 2025. | 2655 |

| #3 | Included only fields of economics, finance, business, operations, computer science, engineering, and multidisciplinary journals. | 1120 |

| #4 | Limited online to English journals, research articles, and reviews, | 1083 |

| Statistic | Value |

|---|---|

| Panel A. Publication Metrics | |

| Total publications (TP) | 1083 |

| Article | 1021 |

| Review | 62 |

| Number of active years (NAY) | 26 |

| Productivity per active year (PAY) | 43.32 |

| Panel B. Citation Metrics | |

| Total citations (TC) | 21,556 |

| Average citations per publication (TC/TP) | 19.9 |

| h-index | 72 |

| g-index | 114 |

| Panel C. Co-authorship Metrics | |

| Number of contributing authors (NCA) | 3387 |

| Number of unique authors (NUA) | 2952 |

| Authors of single-authored publications (ASA) | 103 |

| Single-authored publications (SA) | 110 |

| Co-authored publications (CA) | 973 |

| Collaboration index (CI) | 3.13 |

| International co-authorships (%) (ICA) | 30.38% |

| Source Journal Titles | TC | NP | TC/NP | h- Index | PY_ Start | Scopus SJR Quartile | WoS JCR Quartile |

|---|---|---|---|---|---|---|---|

| Decision Support Systems | 2009 | 15 | 133.93 | 11 | 2008 | Q1 | Q1 |

| European Journal of Operational Research | 1925 | 24 | 80.21 | 18 | 2006 | Q1 | Q1 |

| Applied Soft Computing | 1603 | 25 | 64.12 | 18 | 2008 | Q1 | |

| Knowledge-Based Systems | 1524 | 19 | 80.21 | 18 | 2006 | Q1 | Q1 |

| Neural Computing and Applications | 937 | 13 | 72.08 | 10 | 2010 | Q1 | Q1 |

| International Journal of Bank Marketing | 513 | 21 | 24.43 | 10 | 2015 | Q2 | |

| Information Sciences | 508 | 14 | 36.29 | 10 | 2007 | Q1 | Q1 |

| Journal of Banking and Finance | 476 | 3 | 158.67 | 3 | 2010 | Q1 | Q1 |

| International Review of Financial Analysis | 460 | 18 | 25.56 | 11 | 2013 | Q1 | Q1 |

| Technological & Economic Development of Economy | 450 | 7 | 64.29 | 5 | 2012 | Q2 | Q3 |

| Research in International Business and Finance | 369 | 10 | 36.90 | 7 | 2018 | Q2 | Q3 |

| Journal of Forecasting | 342 | 21 | 16.29 | 11 | 2000 | Q2 | Q2 |

| Journal of Business Research | 325 | 6 | 54.17 | 6 | 2018 | Q1 | Q1 |

| Journal of Research in Interactive Marketing | 321 | 3 | 107.00 | 3 | 2018 | Q2 | Q3 |

| Neurocomputing | 318 | 8 | 39.75 | 7 | 2010 | Q1 | Q1 |

| Sr. No. | Article Title | 1st Author (Year) | Source Title | Cited by |

|---|---|---|---|---|

| 1 | The application of data mining techniques in financial fraud detection: A classification framework and an academic review of literature | Ngai EWT (2011) [5] | Decision Support Systems | 595 |

| 2 | A data-driven approach to predict the success of bank telemarketing | Moro S (2015) [22] | Decision Support Systems | 492 |

| 3 | Assessing bank efficiency and performance with operational research and artificial intelligence techniques: A survey | Fethi MD (2010) [1] | European Journal of Operational Research | 452 |

| 4 | Consumer credit-risk models via machine-learning algorithms | Khandani AE (2010) [2] | Journal of Banking & Finance | 357 |

| 5 | A comparative survey of artificial intelligence applications in finance: artificial neural networks, expert system and hybrid intelligent systems | Bahrammirzaee A (2010) [3] | Neural Computing & Applications | 301 |

| 6 | Prediction of financial distress: An empirical study of listed Chinese companies using data mining | Geng R (2015) [7] | European Journal of Operational Research | 294 |

| 7 | Financial distress and bankruptcy prediction among listed companies using accounting, market and macroeconomic variables | Tinoco MH (2013) [6] | International Review of Financial Analysis | 238 |

| 8 | Predicting financial distress and corporate failure: A review from the state-of-the-art definitions, modeling, sampling, and featuring approaches | Sun J. (2014) [8] | Knowledge-Based Systems | 230 |

| 9 | Does bank FinTech reduce credit risk? Evidence from China | Cheng MY (2020) [23] | Pacific-Basin Finance Journal | 224 |

| 10 | Deep learning models for bankruptcy prediction using textual disclosures | Mai F (2019) [24] | European Journal of Operational Research | 212 |

| Author | Affiliation | Country | TP | TC | PY_ Start |

|---|---|---|---|---|---|

| Sun Jie | School of Management, Harbin Institute of Technology | China | 9 | 646 | 2008 |

| Tsai CF | Department of Information Management, National Central University | Taiwan | 8 | 843 | 2009 |

| Li Hui | Nankai University | China | 8 | 646 | 2008 |

| Shi Yong | University of Chinese Academy of Sciences | China | 5 | 228 | 2010 |

| Du Jardin Philippe | Edhec Business School | France | 5 | 216 | 2010 |

| Virag Miklos | Corvinus University of Budapest | Hungary | 5 | 121 | 2012 |

| Liang Deron | National Central University | Taiwan | 4 | 477 | 2015 |

| Mues Christophe | University of Southampton | UK | 4 | 215 | 2012 |

| Ribeiro Bernardete | University of Coimbra | Portugal | 4 | 194 | 2016 |

| Petropoulos Anastasios | Bank of Greece | Greece | 4 | 102 | 2020 |

| Sr. No. | Country | TP | SCP | MCP | MCP_Ratio |

|---|---|---|---|---|---|

| 1 | China | 212 | 159 | 53 | 25.00% |

| 2 | India | 109 | 94 | 15 | 13.76% |

| 3 | USA | 77 | 48 | 29 | 37.66% |

| 4 | United Kingdom | 51 | 20 | 31 | 60.78% |

| 5 | Spain | 46 | 34 | 12 | 26.09% |

| 6 | Italy | 37 | 20 | 17 | 45.95% |

| 7 | France | 27 | 18 | 9 | 33.33% |

| 8 | Australia | 25 | 18 | 7 | 28.00% |

| 9 | Poland | 25 | 20 | 5 | 20.00% |

| 10 | Iran | 24 | 21 | 3 | 12.50% |

| Rank | Affiliation | Country | 2025 Articles | Total Articles | per Year Article | PY_ Start |

|---|---|---|---|---|---|---|

| 1 | Islamic Azad University | Iran | 25 | 108 | 8.3 | 2013 |

| 2 | Egyptian Knowledge Bank | Egypt | 21 | 54 | 5.4 | 2016 |

| 3 | Min. of Education and Science | Ukraine | 21 | 59 | 9.8 | 2020 |

| 4 | University of London | United Kingdom | 17 | 53 | 8.8 | 2020 |

| 5 | Chinese Academy of Sciences | China | 15 | 97 | 6.1 | 2010 |

| 6 | Bucharest Uni. of Econ. Studies | Romania | 14 | 79 | 6.1 | 2013 |

| 7 | National Central University | Taiwan | 14 | 141 | 8.3 | 2009 |

| 8 | National Institute of Technology | India | 14 | 55 | 7.9 | 2019 |

| 9 | European Central Bank | Eurozone | 12 | 46 | 7.7 | 2020 |

| 10 | University of Granada | Spain | 12 | 50 | 7.1 | 2019 |

| Cluster/Color | Author | Key Metrics (Links/Docs/Cit.) | Indicative Subfield |

|---|---|---|---|

| 1/Red | Hassan, M. Kabir/Rabbani, Mustafa Raza | 12/3/45, 5/2/21 | Recent Trends and Applications in Financial AI |

| 2/Green | Chi, Guotai/Habib, Tabassum | 11/5/35, 8/3/13 | Credit Risk Modeling and Financial Inclusion |

| 3/Blue | Chen, Zhensong/Qu, Yi | 7/2/12, 7/2/12 | DL and Advanced Predictive Analytics |

| 4/Yellow | Wang, Jing/Long, Xingchen | 10/4/51, 4/1/4 | Financial Analysis and Decision Making with Advanced Models |

| 5/Purple | Abedin, Mohammad Zoynul/Fahmida-emoula | 12/4/84, 5/2/30 | ML and Data-Driven Insights |

| 6/Turquoise | Shi, Yong/He, Jing | 11/4/228, 3/1/9 | Computational Finance and Optimization |

| 7/Orange | Shi, Baofeng/Meng, Bin | 8/2/79, 4/1/47 | Interdisciplinary Applications of AI and Data Science |

| 8/Brown | Zhou, Ying/Bai, Fengshan | 10/4/17, 3/1/0 | Emerging Trends and Methodological Innovations |

| 9/Pink | Lu, Yang/Liu, Xiaohui | 7/2/40, 5/2/129 | Quantitative Methods and Algorithmic Trading |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Trigkas, S.J.; Toudas, K.; Chasiotis, I. Mapping the Intellectual Structure of Computational Risk Analytics in Banking and Finance: A Bibliometric and Thematic Evolution Study. Computation 2025, 13, 172. https://doi.org/10.3390/computation13070172

Trigkas SJ, Toudas K, Chasiotis I. Mapping the Intellectual Structure of Computational Risk Analytics in Banking and Finance: A Bibliometric and Thematic Evolution Study. Computation. 2025; 13(7):172. https://doi.org/10.3390/computation13070172

Chicago/Turabian StyleTrigkas, Sotirios J., Kanellos Toudas, and Ioannis Chasiotis. 2025. "Mapping the Intellectual Structure of Computational Risk Analytics in Banking and Finance: A Bibliometric and Thematic Evolution Study" Computation 13, no. 7: 172. https://doi.org/10.3390/computation13070172

APA StyleTrigkas, S. J., Toudas, K., & Chasiotis, I. (2025). Mapping the Intellectual Structure of Computational Risk Analytics in Banking and Finance: A Bibliometric and Thematic Evolution Study. Computation, 13(7), 172. https://doi.org/10.3390/computation13070172