Construction of Complex Network with Multiple Time Series Relevance

Abstract

1. Introduction

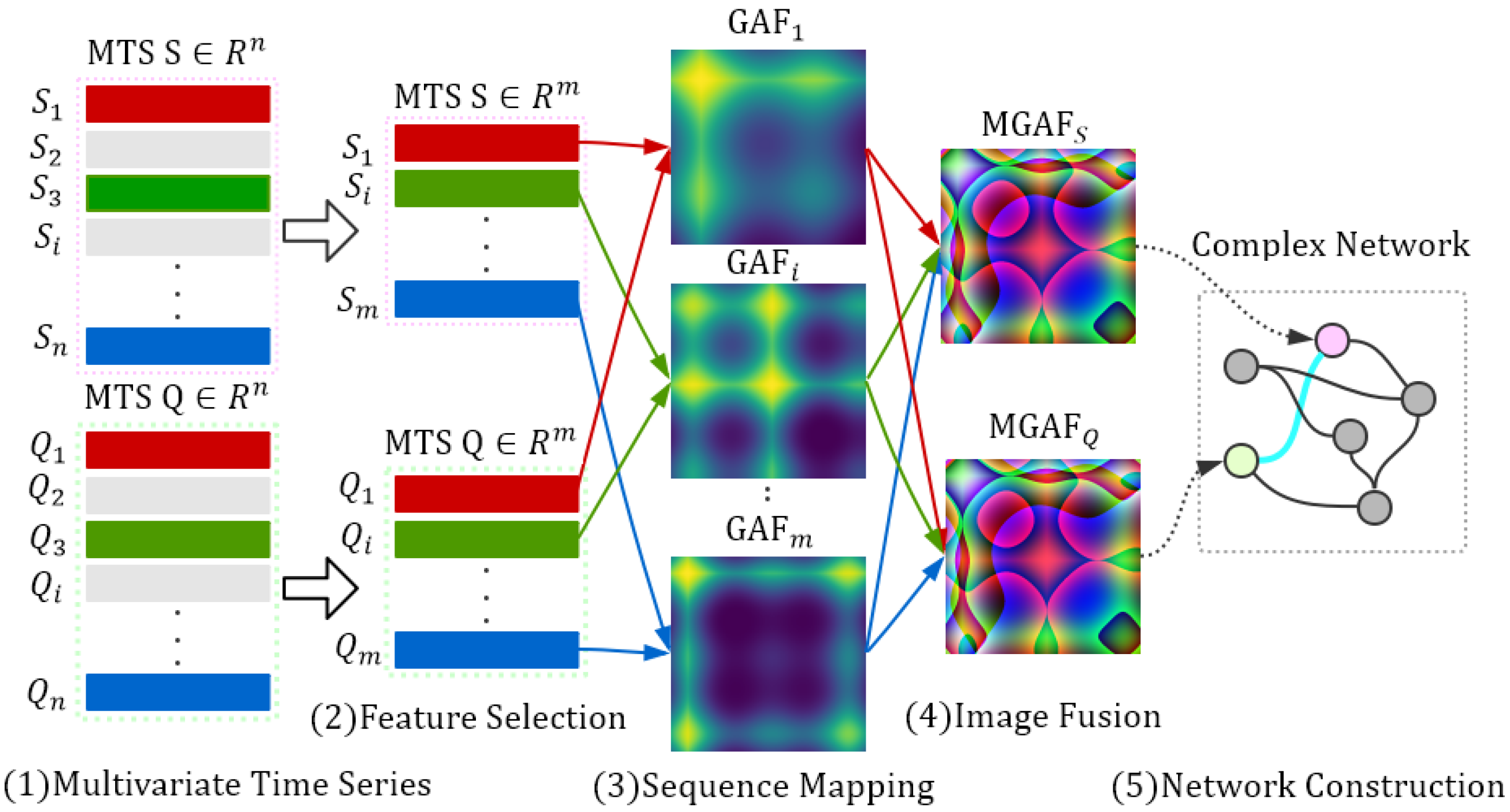

2. Image Fusion Network Construction Method

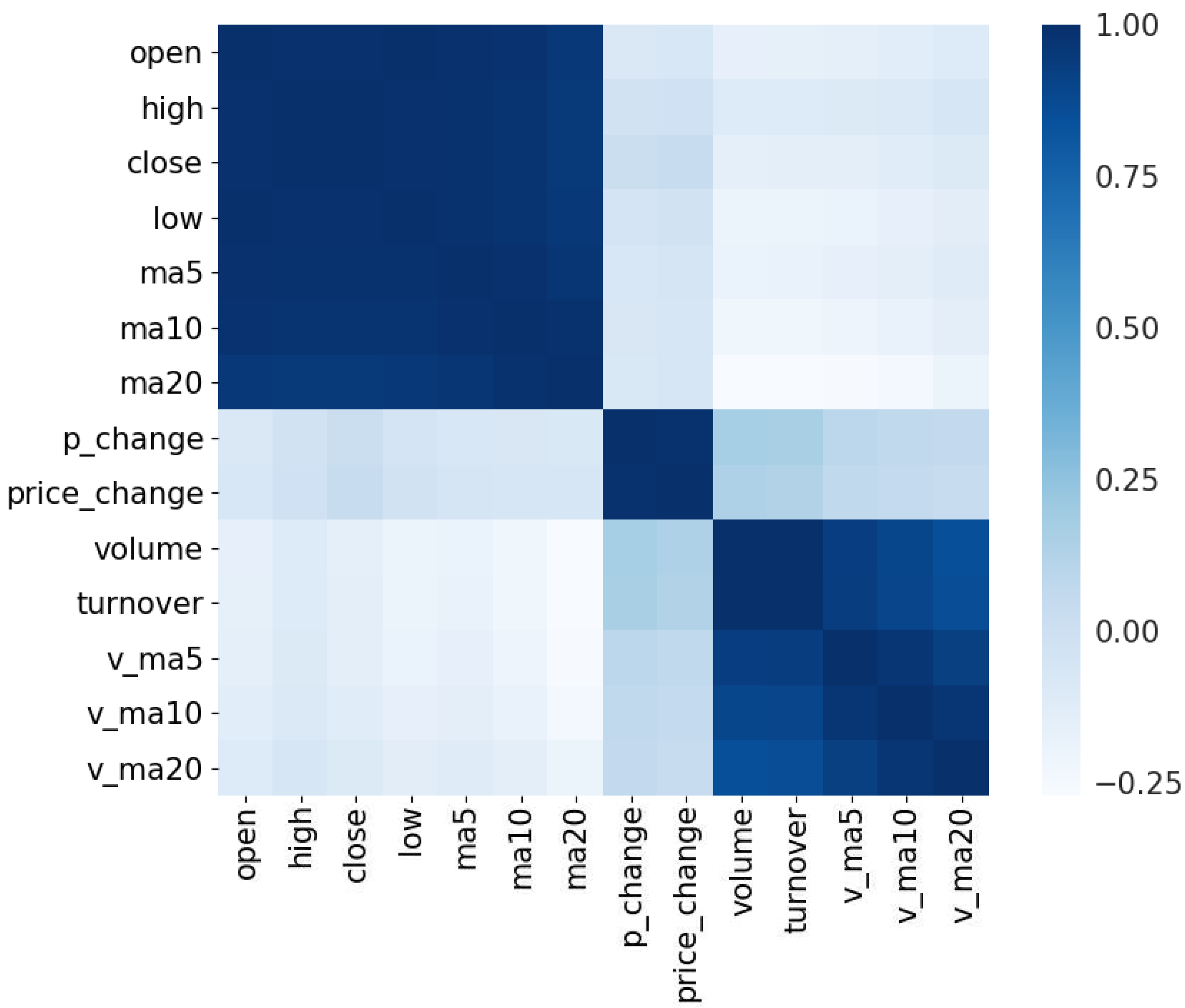

2.1. Feature Selection

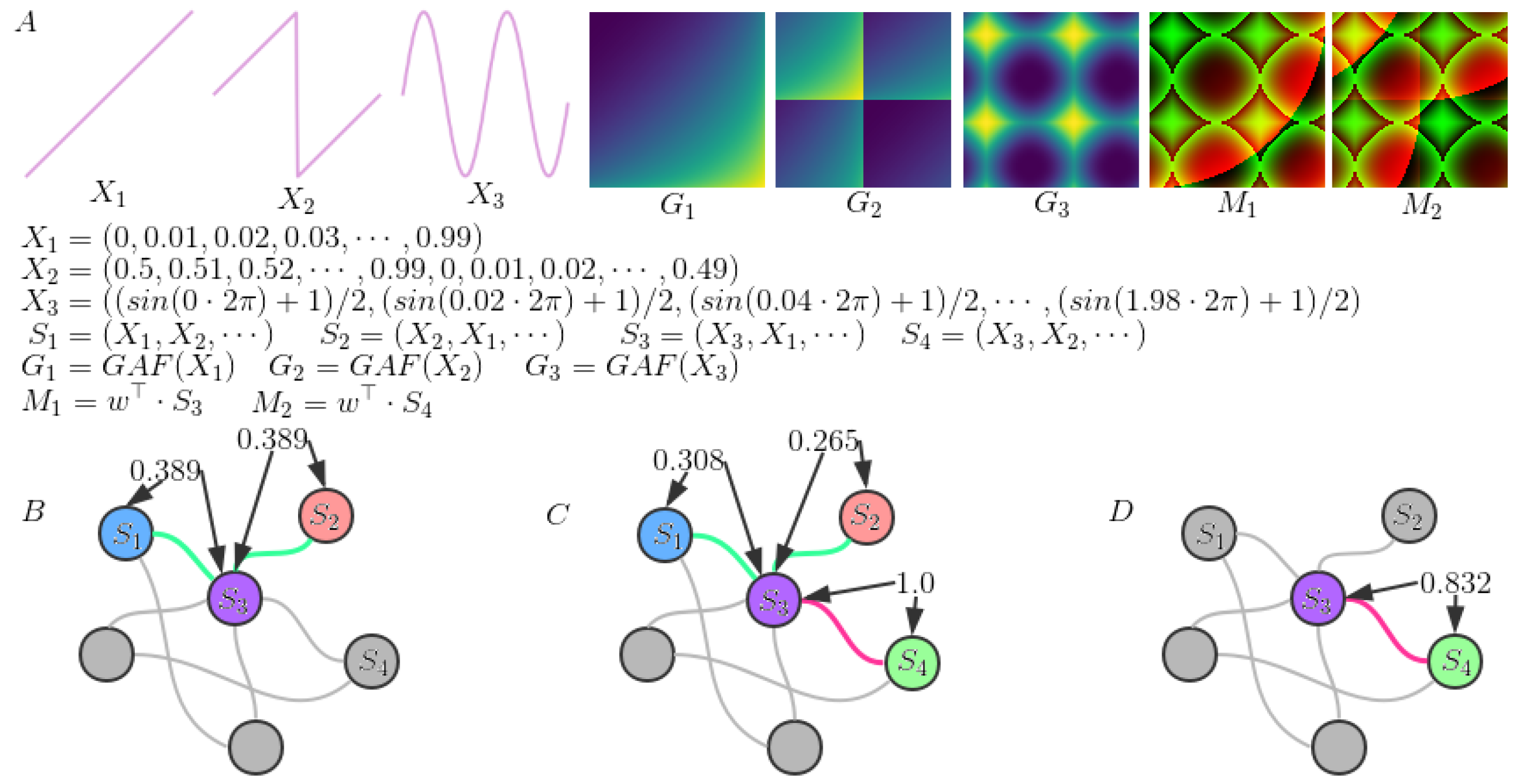

2.2. Imaging Multivariate Time Series and Similarity Calculation

2.3. The Connection Efficiency

3. Results and Discussion

3.1. Data

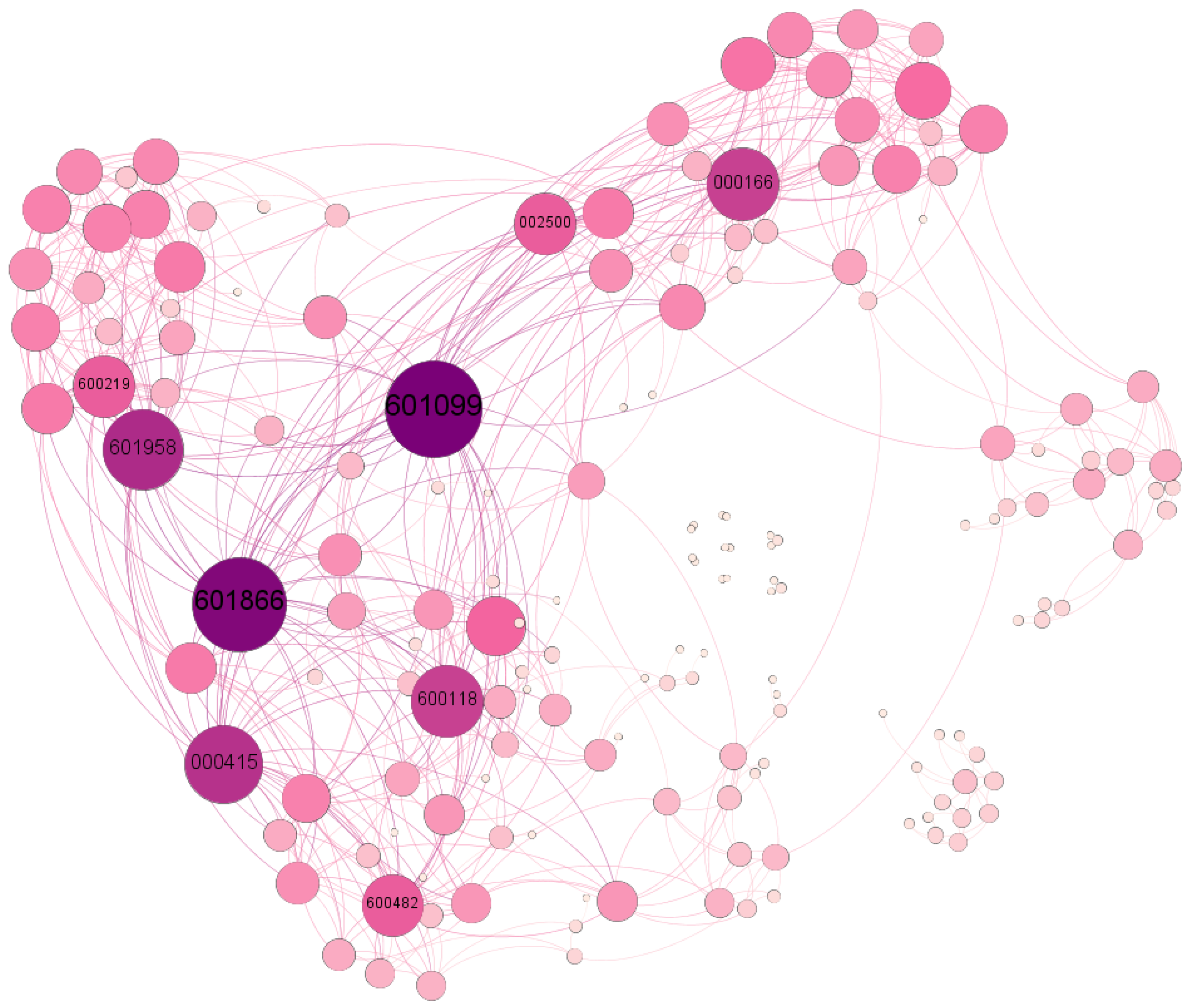

3.2. The Network Overview

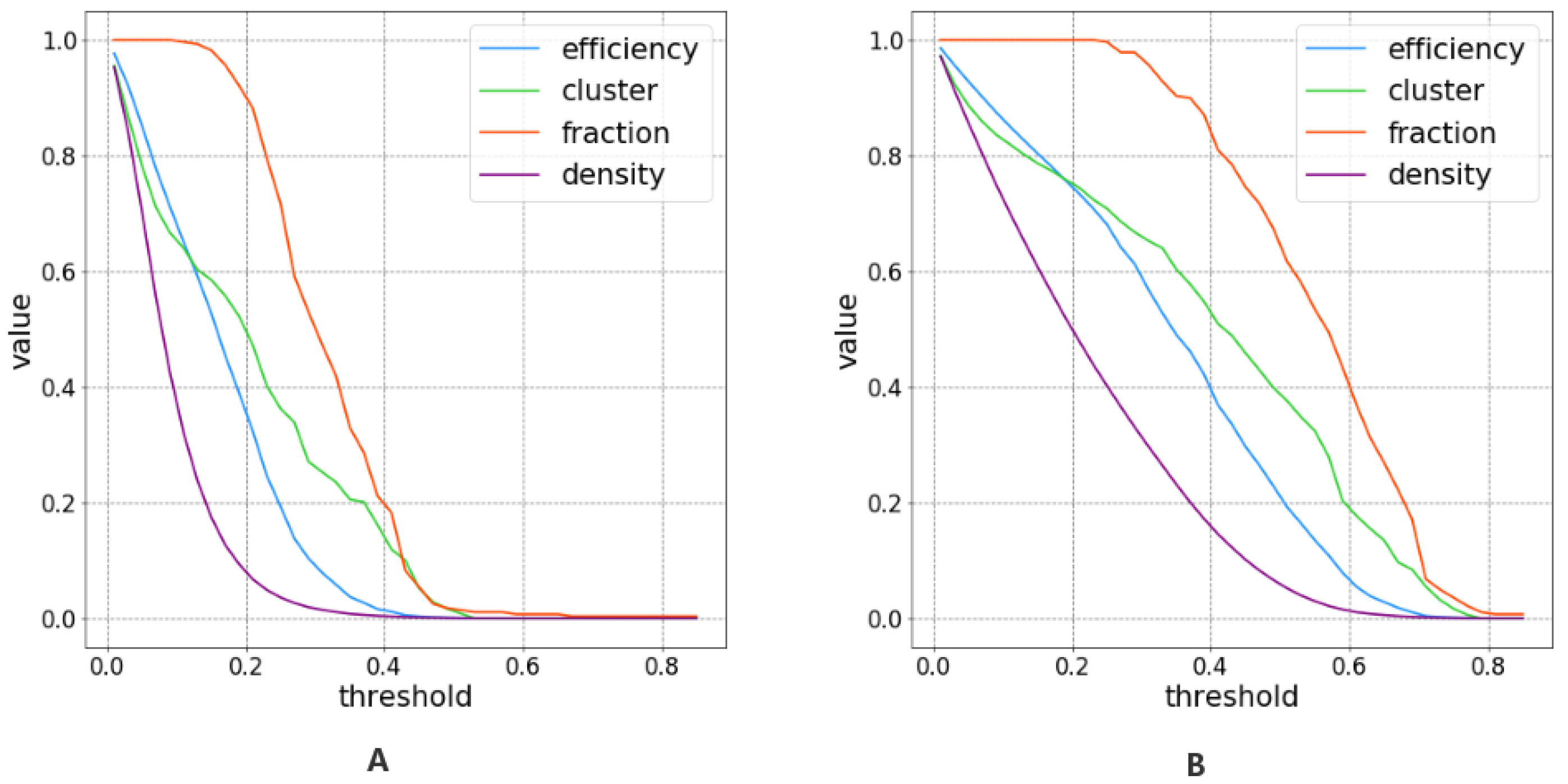

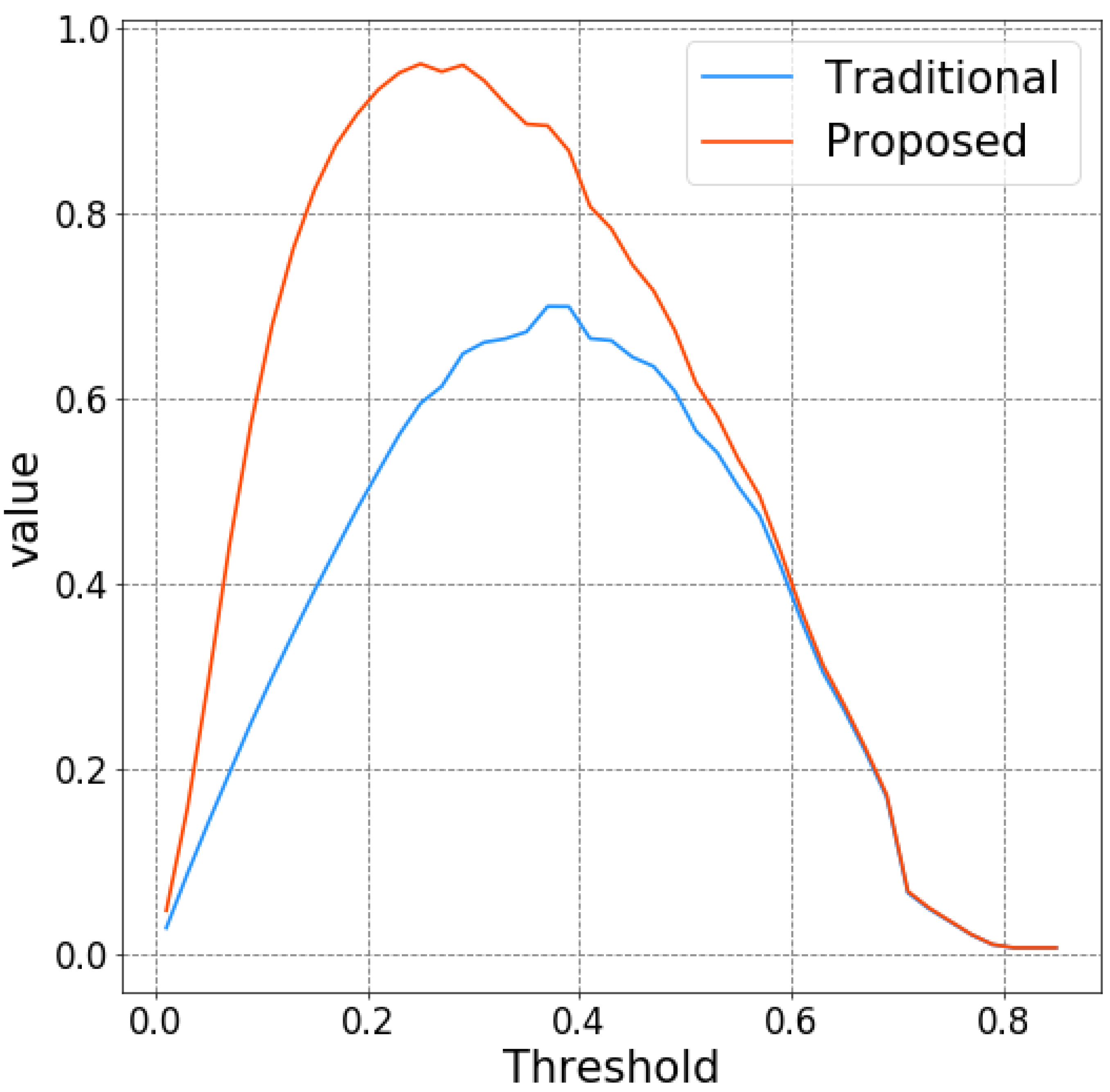

3.3. Threshold Selection

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Newman, M.E.J. The Structure and Function of Complex Networks. SIAM Rev. 2003, 45, 167–256. [Google Scholar] [CrossRef]

- Albert, R.; Barabási, A. Statistical mechanics of complex networks. Rev. Mod. Phys. 2002, 74, 47. [Google Scholar] [CrossRef]

- Guimera, R.; Amaral, L.A.N. Functional cartography of complex metabolic networks. Nature 2005, 433, 895–900. [Google Scholar] [CrossRef] [PubMed]

- Boccaletti, S.; Latora, V.; Moreno, Y.; Chavez, M.; Hwang, D.U. Complex networks: Structure and dynamics. Phys. Rep. 2006, 424, 175–308. [Google Scholar] [CrossRef]

- Stanley, H.E.; Amaral, L.A.N.; Buldyrev, S.V.; Gopikrishnan, P.; Plerou, V.; Salinger, M.A. Self-Organized Complexity in Economics and Finance. Proc. Natl. Acad. Sci. USA 2002, 99, 2561–2565. [Google Scholar] [CrossRef] [PubMed]

- Caldarelli, G.; Battiston, S.; Garlaschelli, D.; Catanzaro, M. Emergence of Complexity in Financial Networks. Lect. Notes Phys. 2004, 650, 399–423. [Google Scholar]

- Onnela, J.P.; Kaski, K.; Kertész, J. Clustering and information in correlation based financial networks. Eur. Phys. J. B 2004, 38, 353–362. [Google Scholar] [CrossRef]

- Tumminello, M.; Aste, T.; Di Matteo, T.; Mantegna, R.N. A tool for filtering information in complex systems. Proc. Natl. Acad. Sci. USA 2005, 102, 10421–10426. [Google Scholar] [CrossRef] [PubMed]

- Boginski, V.; Butenko, S.; Pardalos, P.M. Statistical analysis of financial networks. Comput. Stat. Data Anal. 2005, 48, 431–443. [Google Scholar] [CrossRef]

- Barabási, A.L.; Albert, R. Emergence of scaling in random networks. Science 1999, 286, 509–512. [Google Scholar] [PubMed]

- Vandewalle, N.; Brisbois, F.; Tordoir, X. Non-random topology of stock markets. Quant. Financ. 2001, 1, 372–374. [Google Scholar] [CrossRef]

- Keskin, M.; Deviren, B.; Kocakaplan, Y. Topology of the correlation networks among major currencies using hierarchical structure methods. Phys. A Stat. Mech. Appl. 2011, 390, 719–730. [Google Scholar] [CrossRef]

- Naylor, M.J.; Rose, L.C.; Moyle, B.J. Topology of foreign exchange markets using hierarchical structure methods. Phys. A Stat. Mech. Appl. 2007, 382, 199–208. [Google Scholar] [CrossRef]

- Sensoy, A.; Yuksel, S.; Erturk, M. Analysis of cross-correlations between financial markets after the 2008 crisis. Phys. A Stat. Mech. Appl. 2013, 392, 5027–5045. [Google Scholar] [CrossRef]

- Kwapień, J.; Oświęcimka, P.; Forczek, M.; Drożdż, S. Minimum spanning tree filtering of correlations for varying time scales and size of fluctuations. Phys. Rev. E 2017, 95, 052313. [Google Scholar] [CrossRef] [PubMed]

- Djauhari, M.A.; Gan, S.L. Optimality problem of network topology in stocks market analysis. Phys. A Stat. Mech. Appl. 2015, 419, 108–114. [Google Scholar] [CrossRef]

- Tumminello, M.; Matteo, T.D.; Aste, T.; Mantegna, R.N. Correlation based networks of equity returns sampled at different time horizons. Eur. Phys. J. B 2007, 55, 209–217. [Google Scholar] [CrossRef]

- Onnela, J.P.; Chakraborti, A.; Kaski, K.; Kertesz, J.; Kanto, A. Dynamics of market correlations: Taxonomy and portfolio analysis. Phys. Rev. E 2003, 68, 056110. [Google Scholar] [CrossRef] [PubMed]

- Namaki, A.; Shirazi, A.; Raei, R.; Jafari, G. Network analysis of a financial market based on genuine correlation and threshold method. Phys. A Stat. Mech. Appl. 2011, 390, 3835–3841. [Google Scholar] [CrossRef]

- Zhao, L.; Li, W.; Cai, X. Structure and dynamics of stock market in times of crisis. Phys. Lett. A 2016, 380, 654–666. [Google Scholar] [CrossRef]

- Huang, W.Q.; Zhuang, X.T.; Yao, S. A network analysis of the Chinese stock market. Phys. A Stat. Mech. Appl. 2009, 388, 2956–2964. [Google Scholar] [CrossRef]

- Yazdanbakhsh, O.; Dick, S. Forecasting of Multivariate Time Series via Complex Fuzzy Logic. IEEE Trans. Syst. Man Cybern. Syst. 2017, 47, 2160–2171. [Google Scholar] [CrossRef]

- Xu, X.; Zhang, J.; Small, M. Superfamily phenomena and motifs of networks induced from time series. Proc. Natl. Acad. Sci. USA 2008, 105, 19601–19605. [Google Scholar] [CrossRef] [PubMed]

- Nakamura, T.; Tanizawa, T.; Small, M. Constructing networks from a dynamical system perspective for multivariate nonlinear time series. Phys. Rev. E 2016, 93, 032323. [Google Scholar] [CrossRef] [PubMed]

- Vazquez, A.; Dobrin, R.; Sergi, D.; Eckmann, J.P.; Oltvai, Z.; Barabási, A.L. The topological relationship between the large-scale attributes and local interaction patterns of complex networks. Proc. Natl. Acad. Sci. USA 2004, 101, 17940–17945. [Google Scholar] [CrossRef] [PubMed]

- Bezsudnov, I.; Snarskii, A. From the time series to the complex networks: The parametric natural visibility graph. Phys. A Stat. Mech. Appl. 2014, 414, 53–60. [Google Scholar] [CrossRef]

- Zhao, Y.; Weng, T.; Ye, S. Geometrical invariability of transformation between a time series and a complex network. Phys. Rev. E 2014, 90, 012804. [Google Scholar] [CrossRef] [PubMed]

- Small, M. Complex networks from time series: Capturing dynamics. In Proceedings of the 2013 IEEE International Symposium on Circuits and Systems (ISCAS), Beijing, China, 19–23 May 2013; pp. 2509–2512. [Google Scholar]

- Shirazi, A.H.; Reza Jafari, G.; Davoudi, J.; Peinke, J.; Rahimi Tabar, M.R.; Sahimi, M. Mapping stochastic processes onto complex networks. J. Stat. Mech. Theory Exp. 2009, 7, P07046. [Google Scholar] [CrossRef]

- Sun, J.; Yang, Y.; Xiong, N.N.; Dai, L.; Peng, X.; Luo, J. Complex Network Construction of Multivariate Time Series Using Information Geometry. IEEE Trans. Syst. Man Cybern. Syst. 2017. [Google Scholar] [CrossRef]

- Mantegna, R. Information and hierarchical structure in financial markets. Comput. Phys. Commun. 1999, 121, 153–156. [Google Scholar] [CrossRef]

- Kazemilari, M.; Djauhari, M.A. Correlation network analysis for multi-dimensional data in stocks market. Phys. A Stat. Mech. Appl. 2015, 429, 62–75. [Google Scholar] [CrossRef]

- Wang, Z.; Oates, T. Imaging time series to improve classification and imputation. arXiv 2015, arXiv:1506.00327. [Google Scholar]

- Wang, Z.; Bovik, A.C.; Sheikh, H.R.; Simoncelli, E.P. Image quality assessment: From error visibility to structural similarity. IEEE Trans. Image Process. 2004, 13, 600–612. [Google Scholar] [CrossRef] [PubMed]

- Saramäki, J.; Kivelä, M.; Onnela, J.P.; Kaski, K.; Kertesz, J. Generalizations of the clustering coefficient to weighted complex networks. Phys. Rev. E 2007, 75, 027105. [Google Scholar] [CrossRef] [PubMed]

- Latora, V.; Marchiori, M. Efficient behavior of small-world networks. Phys. Rev. Lett. 2001, 87, 198701. [Google Scholar] [CrossRef] [PubMed]

| 0.1 | 0.15 | 0.2 | 0.25 | 0.3 | 0.35 | 0.4 | 0.45 | 0.5 | 0.55 |

|---|---|---|---|---|---|---|---|---|---|

| 000623 | 601099 | 601099 | 601099 | 601099 | 601958 | 601958 | 601958 | 600118 | 601390 |

| 000031 | 000166 | 601866 | 601866 | 601866 | 601866 | 000166 | 000166 | 600030 | 601958 |

| 000166 | 000623 | 000166 | 000415 | 601958 | 600118 | 601555 | 600999 | 601390 | 300027 |

| 601099 | 601881 | 000415 | 601958 | 000415 | 000166 | 600118 | 601688 | 601958 | 600219 |

| 001979 | 000157 | 002500 | 600118 | 600118 | 601099 | 600999 | 600030 | 600340 | 300251 |

| 601881 | 002736 | 600118 | 002500 | 000166 | 601555 | 601788 | 601390 | 600999 | 600999 |

| 600585 | 600221 | 600958 | 000166 | 600219 | 600219 | 600482 | 601788 | 601688 | 601766 |

| 600340 | 000415 | 601881 | 600583 | 002500 | 600482 | 600030 | 600118 | 601818 | 601997 |

| 000008 | 600118 | 600583 | 600038 | 600482 | 600030 | 000060 | 600837 | 300027 | 600919 |

| 000157 | 601866 | 601958 | 600958 | 600038 | 000415 | 601866 | 601555 | 600219 | 601998 |

| 0.1 | 0.2 | 0.3 | 0.35 | 0.4 | 0.45 | 0.5 | 0.6 | 0.7 | 0.8 |

|---|---|---|---|---|---|---|---|---|---|

| 601555 | 000166 | 000686 | 000686 | 000686 | 000686 | 000686 | 601555 | 601555 | 601788 |

| 002736 | 000686 | 000166 | 000166 | 000166 | 601555 | 601555 | 601788 | 601788 | 000686 |

| 000166 | 002736 | 000157 | 601555 | 601555 | 000166 | 000166 | 002736 | 002736 | 601555 |

| 600369 | 000783 | 601555 | 600909 | 002500 | 601163 | 601099 | 000686 | 600030 | 600909 |

| 000686 | 002500 | 600369 | 000157 | 601163 | 002500 | 002736 | 000783 | 600999 | 601375 |

| 600909 | 601555 | 002500 | 002500 | 600369 | 601099 | 600999 | 600030 | 000686 | 601186 |

| 600958 | 000157 | 600909 | 601099 | 002736 | 600369 | 601788 | 000166 | 000166 | 000783 |

| 601099 | 600369 | 601099 | 002736 | 601099 | 600909 | 600369 | 601198 | 000783 | 601881 |

| 002470 | 600498 | 002736 | 600369 | 000157 | 601375 | 002500 | 600999 | 002500 | 000166 |

| 600030 | 002081 | 601881 | 601163 | 603858 | 002736 | 000783 | 601099 | 600369 | 601390 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, Z.; Xu, L.; Wang, L.; Zhang, G.; Liu, Y. Construction of Complex Network with Multiple Time Series Relevance. Information 2018, 9, 202. https://doi.org/10.3390/info9080202

Huang Z, Xu L, Wang L, Zhang G, Liu Y. Construction of Complex Network with Multiple Time Series Relevance. Information. 2018; 9(8):202. https://doi.org/10.3390/info9080202

Chicago/Turabian StyleHuang, Zongwen, Lingyu Xu, Lei Wang, Gaowei Zhang, and Yaya Liu. 2018. "Construction of Complex Network with Multiple Time Series Relevance" Information 9, no. 8: 202. https://doi.org/10.3390/info9080202

APA StyleHuang, Z., Xu, L., Wang, L., Zhang, G., & Liu, Y. (2018). Construction of Complex Network with Multiple Time Series Relevance. Information, 9(8), 202. https://doi.org/10.3390/info9080202