Social Engineering Attacks and Countermeasures in the New Zealand Banking System: Advancing a User-Reflective Mitigation Model

Abstract

:1. Introduction

2. Background

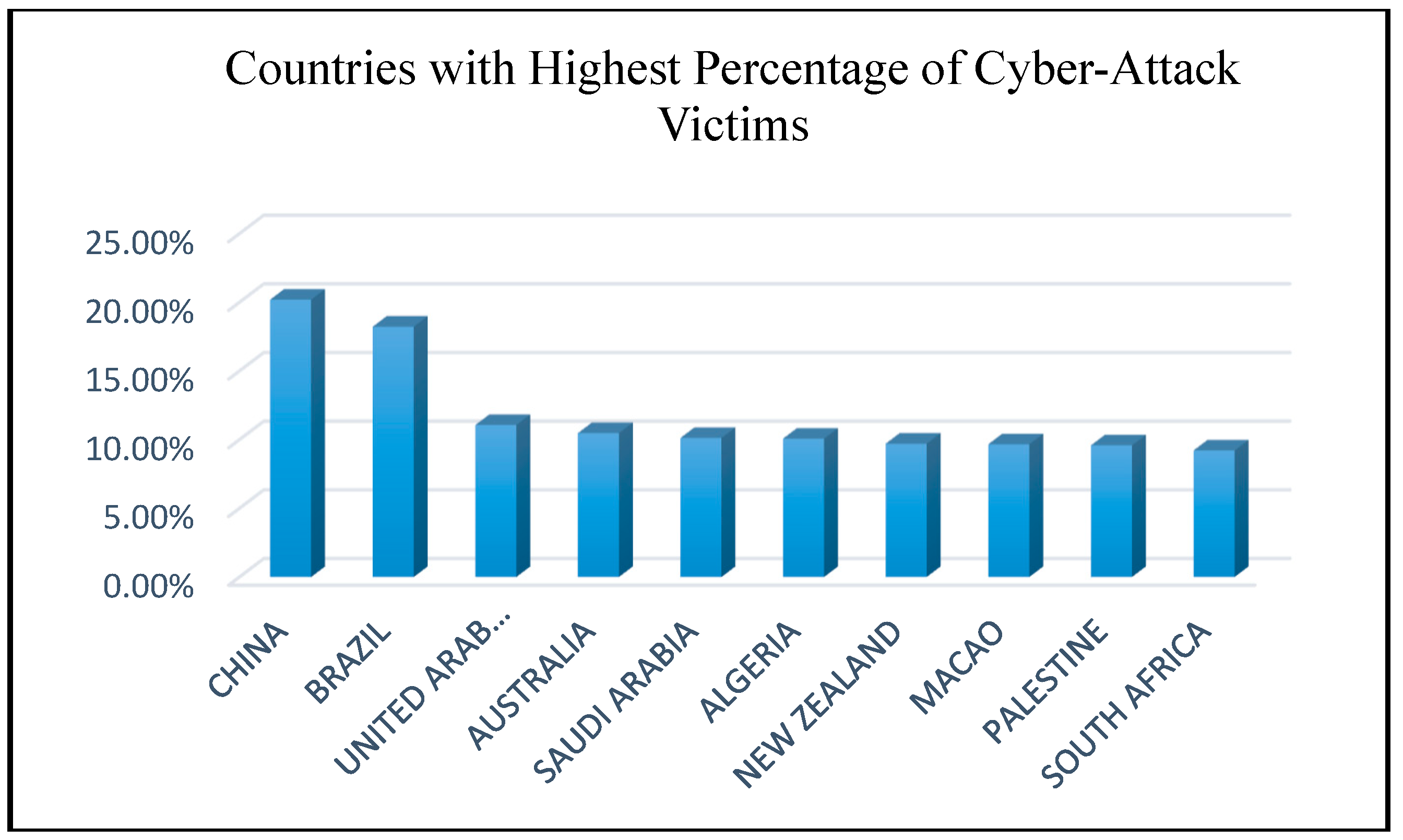

2.1. Banking and Cyber-Attacks

2.2. The New Zealand Banking System

2.3. Social Engineering Attacks

2.3.1. The Attack Cycle

- Research: This involves gathering information about the target. The final result is dependent on the quality of the information collected at this stage. The data collected is utilized in succeeding phases and is of crucial importance in making the attack successful.

- Developing Rapport and Trust: Various types of social engineering techniques are deployed in this phase to ensure the victim trusts the attacker. The data collected in the first phase, such as public name, employer’s details, and company details, are used to make the victim believe they are truly dealing with the organization.

- Exploiting Trust: Attackers manipulate human behavior and exploit trust and stealthily steal the desired information. This can be executed in multiple ways, for example email spoofs, scam phone calls, or malware installation.

- Utilize Information: This final phase is also referred to as “cashing in”, where the information gained from the previous phases is used to perpetrate the attack.

- Single-stage attack: As the name indicates, the attack is performed just once. The information collected is utilized to exploit the users’ financial transactions for fraudulent purposes. The single-stage attack ends after conducting the attack only once [3].

- Multiple-stage attack: A multiple-stage attack occurs when the information collected from a successful attack is used to deploy one or more similar social engineering attacks. The time duration of multiple-stage attack can be minutes, hours or even weeks or months. This depends on the nature of the threatened person and/or the organization involved [3].

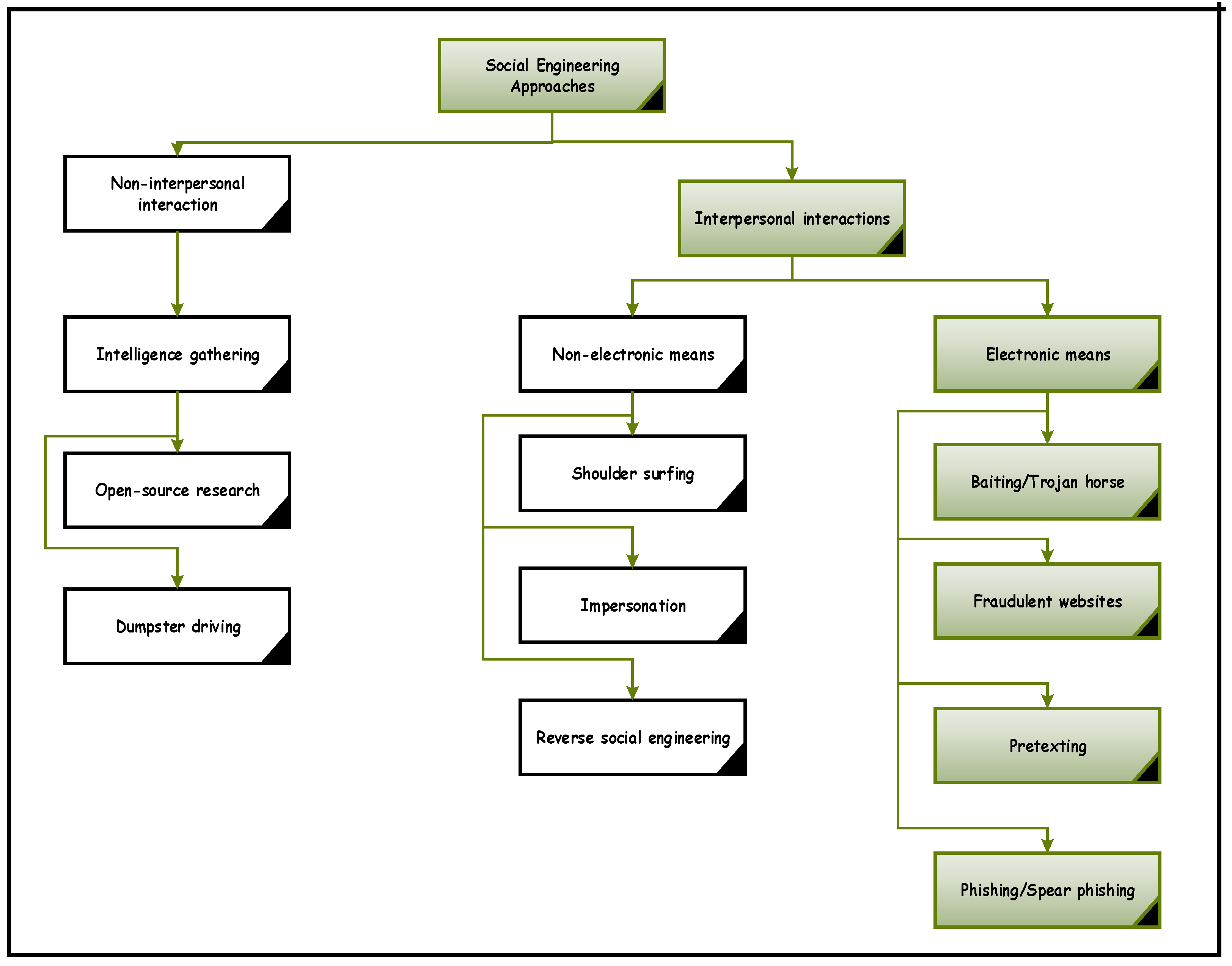

2.3.2. Social Engineering Taxonomy

- Vishing: Vishing is a form of social engineering attack in which an attacker uses a phone call to trick a victim to reveal sensitive information such as credit card number, pin code or detailed home address. The attack exploits voice over IP (VoIP) technology since it is cheap, and the attacker could be calling from anywhere around the world, with their identity concealed [18,19].

- Baiting/Trojan Horse: Baiting uses digital devices such as USB drive or RAM to gain a victim’s attention and perpetrate an attack. This technique relies on human curiosity to deploy the attack, which in turn spreads the malware installed on their device [3]. As a result, the organization’s internal network will fall under the control of the hacker.

- Fraudulent Websites: With this attack type, the hacker exploits a victim’s trust, leading them to access their fake website, which automatically downloads malicious files onto the victim’s computer [16]. As with the Trojan Horse attack, the downloaded file gives the attacker access to sensitive information from the local browser of the victim.

- Pretexting: This is an exploit that uses a scripted scenario to trick the victim to reveal sensitive information or accomplish other malicious activities unknowingly. Reverse social engineering is the best example for pretexting, in which an attacker creates a scene or situation and an innocent victim believes that the hacker can provide a solution [3].

- Phishing/Spear Phishing: Phishing is the most popular social engineering attack in the online banking system. Typically, a hacker sends an email using the legitimate organization’s trademark to get the attention of their target. The fake email appears to be from a trusted bank requesting that the customer updates their account information using the provided link (which is a bogus link). The attached fraudulent website leads the victim to divulge sensitive financial credentials [3]. Phishing is considered one of the most effective attacks and the technique has become more sophisticated over the years. Spear Phishing uses the personal details of a potential victim to tailor the email content, with a higher probability of success [16].

2.3.3. Causative Factors

- Demographic Factors: Gender, age, personality characters and cultural factors are the main demographic aspects which influence social engineering attacks. These susceptibilities, however, may vary between male and female, young and old, literate and illiterate and so on. A survey conducted by Carnegie Mellon University revealed that women were more susceptible than men. The reason advanced for this was that women feel more comfortable using digital media and are more likely to reply to junk advertisements or commercial offers [3]. Factors such as normative commitment, affective commitment, trust and fear are related to personality traits and contribute to susceptibility to attacks [20].

- Organizational Factors: Insufficient management and security policies can make an organization vulnerable to cyber-attacks. Strong cyber security strategies and network protections must be ensured to reduce any kind of exploits. The lack of proper resource management and job pressure may poorly influence human performance [3]. Organizational components can create susceptibilities that attackers may abuse, directly or indirectly, for financial benefit. Failure of management systems can also negatively impact employee fulfilment, causing discontentment that could potentially result in the employee sabotaging the organization.

- Human Factors: An individual may exhibit many emotions depending on their character, surroundings, habits, or physical impairments. These emotions and circumstances may well be utilized by an attacker to make an attack successful. Lack of attention, memory failure, faulty judgment, poor risk perception, casual values about compliance, stress, anxiety and physical impairments are some of the human behaviors that create vulnerabilities. Social engineering scams, particularly phishing attacks, exploit human emotional flaws to gain unauthorized access to information. Ignorance and lack of awareness towards cyber-attacks leads to the rapid growth of social engineering attacks. Studies [21] have shown that the majority of online users have difficulty distinguishing the difference between real and fake websites.

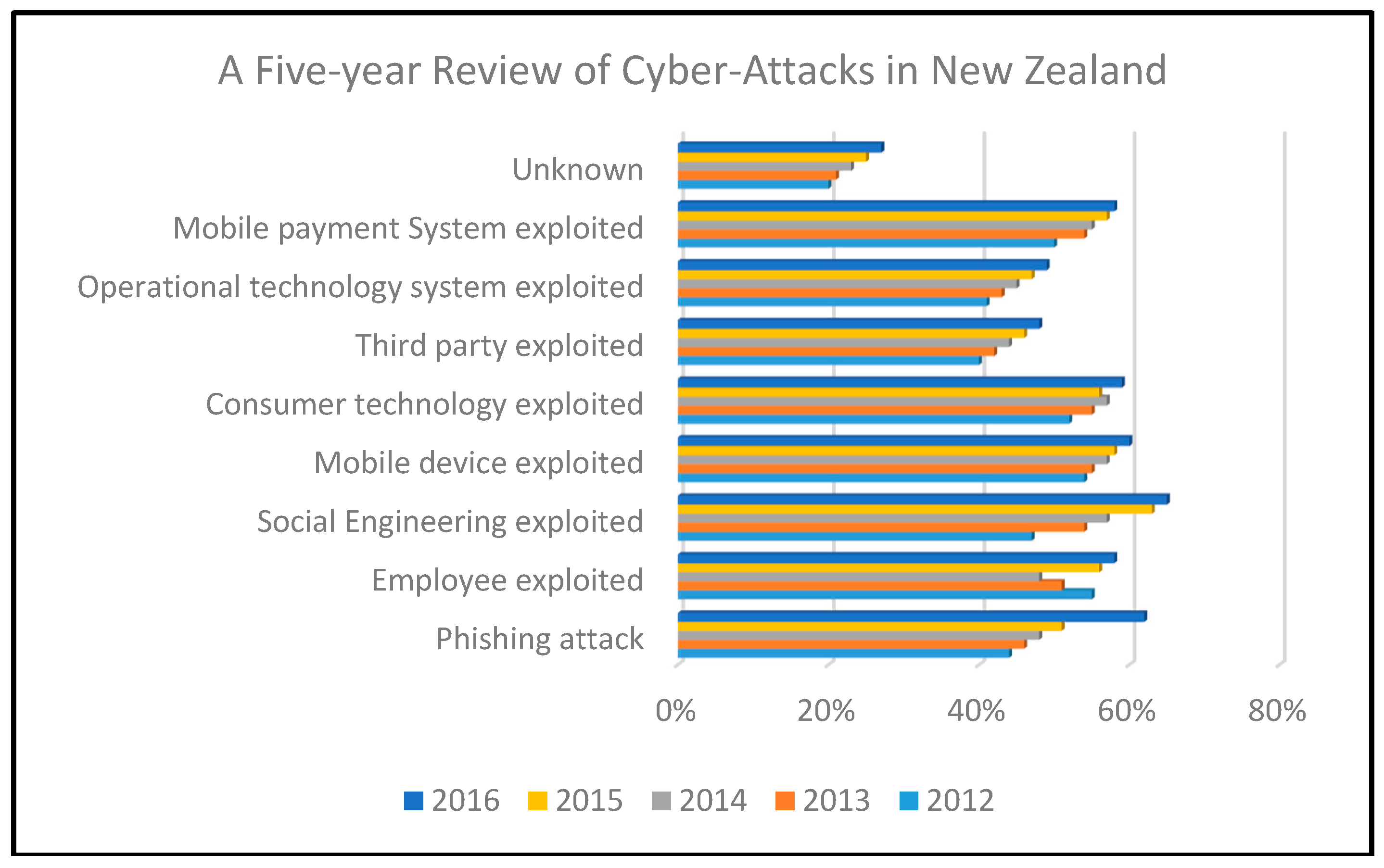

2.3.4. New Zealand Banks and Cyber-Attacks: A Five-Year Review

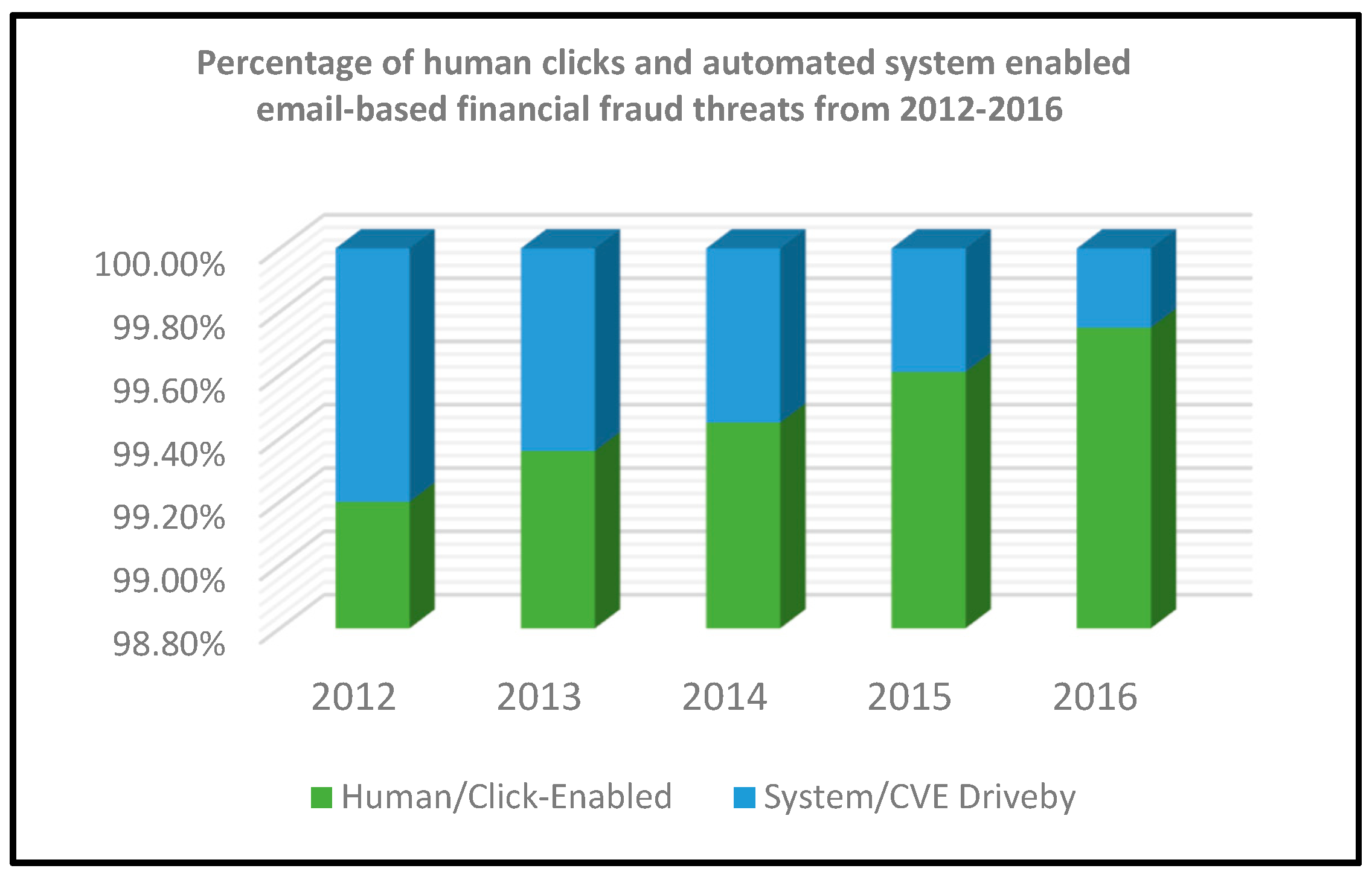

2.4. Analysis of Customer Behaviour to Social Engineering Attacks

2.4.1. Online Customer Behavior

2.4.2. Customers’ Perception of Online Threats

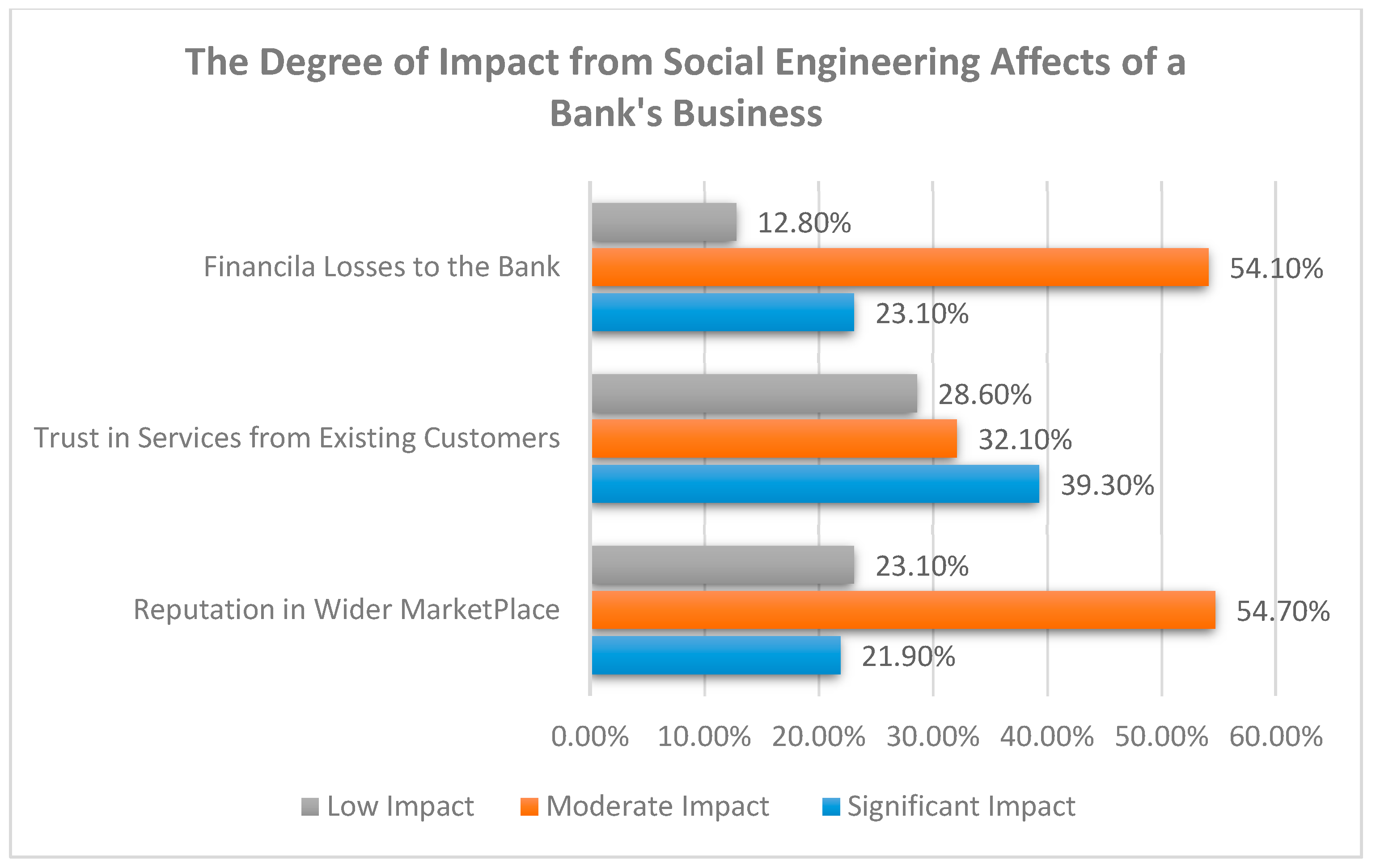

2.5. Impact of Social Engineering Attacks in the Banking Sector

3. Addressing Social Engineering Attacks in New Zealand Bank

3.1. Fraud Detection System

3.2. Authentication Methods

3.3. Customer Practices

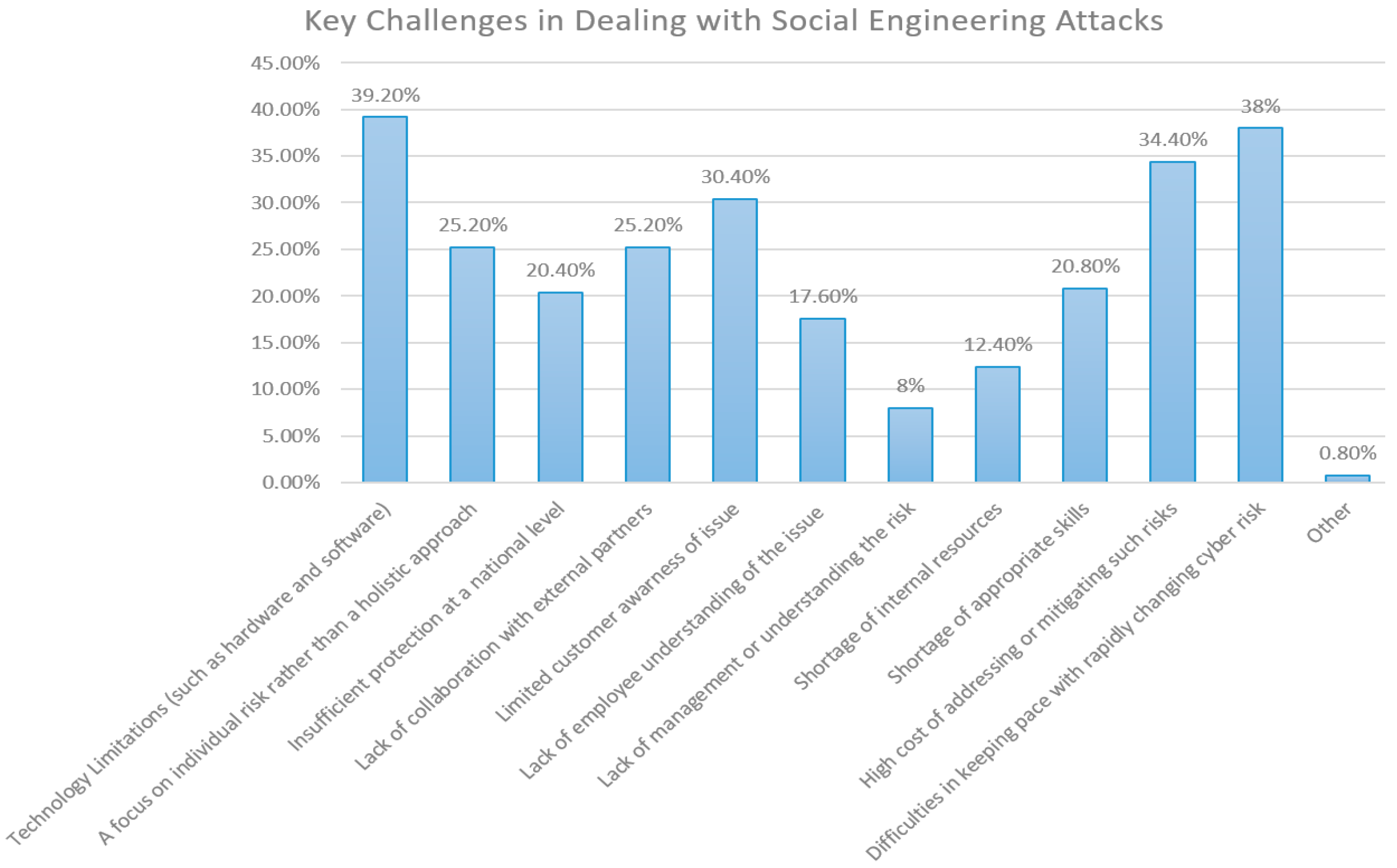

3.4. Challenges of Secure Practices used by New Zealand Banks

3.5. Mitigating Social Engineering Attacks

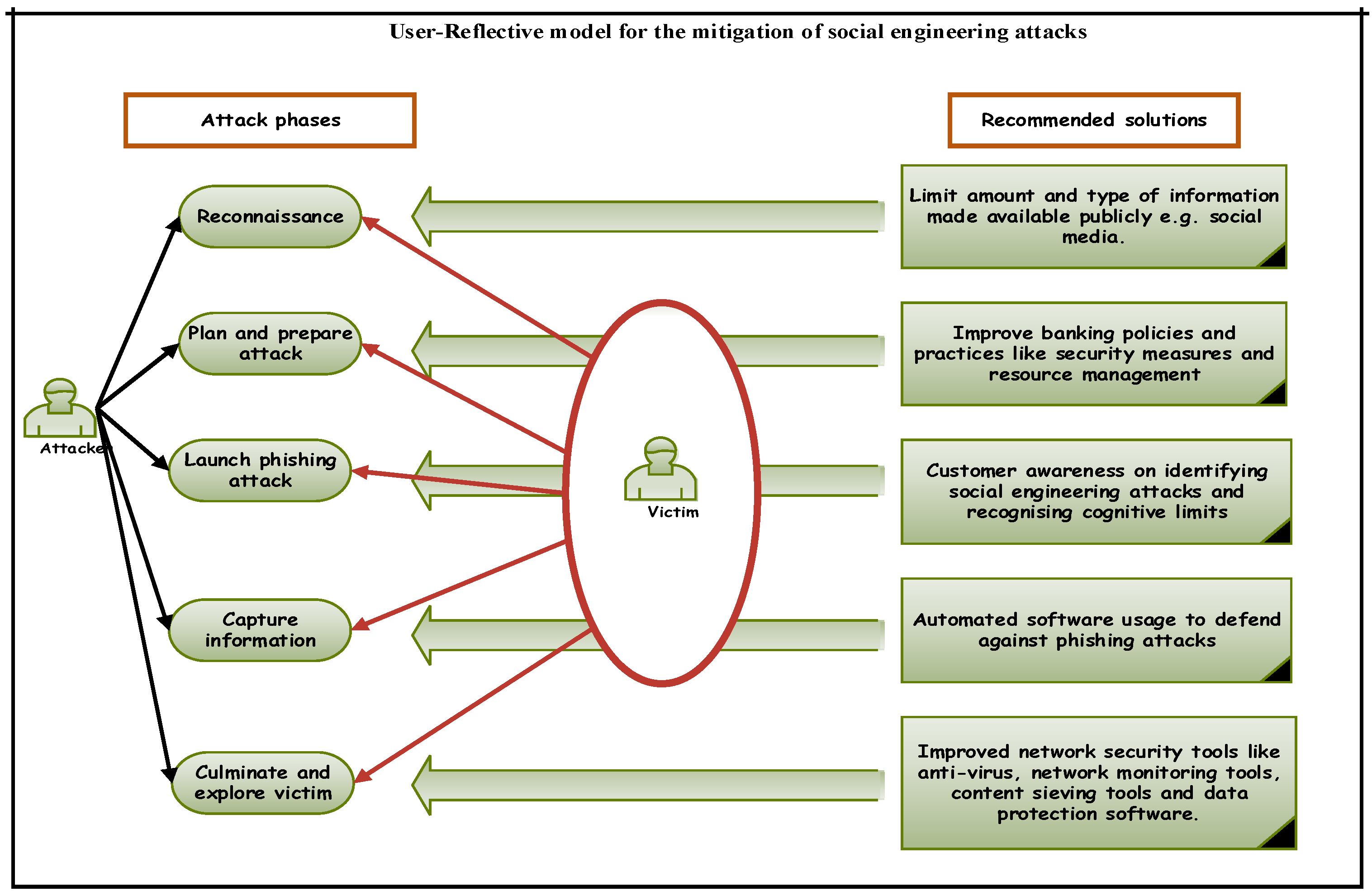

4. The User-Reflective Mitigation Model

- Sensitizing customers/users with awareness materials on social engineering attacks and the techniques used by attackers.

- Provision of supporting materials like news reports to buttress the seriousness of social engineering attacks and their trends.

- For fake phone calls from attackers, users need to be adequately sensitized by their organizations to recognize potential attackers. A general rule of thumb is for them to never give out personal and sensitive details like pin code and credit card number under any circumstances.

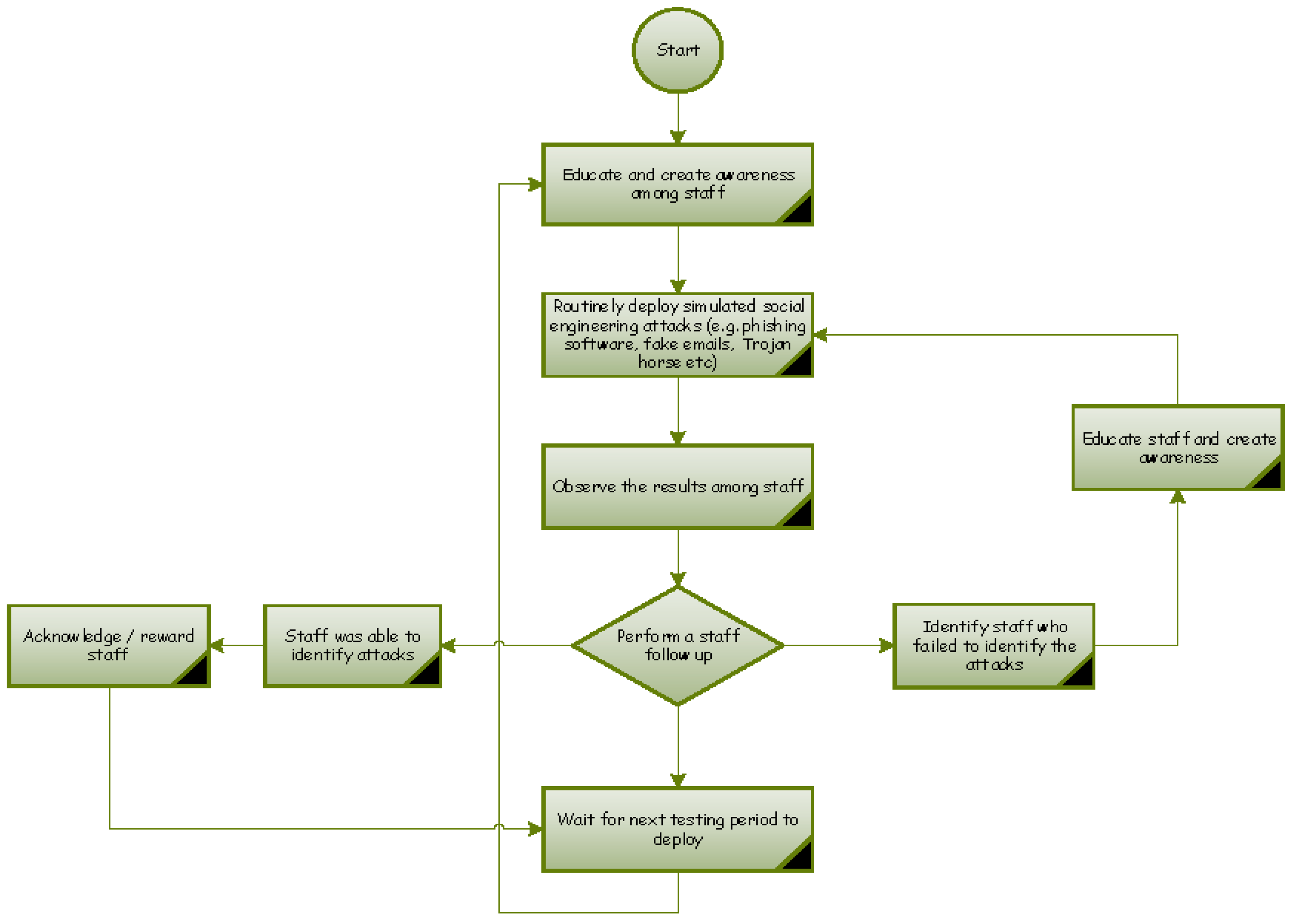

4.1. Ensuring the Success of the User-Reflective Model

4.1.1. Education and Awareness

4.1.2. Monitoring

5. Conclusions

Author Contributions

Conflicts of Interest

References

- PriceWaterhouseCoopers. Adjusting the Lens on Economic Crime; PriceWaterhouseCoopers (PWC): Auckland, New Zealand, 2016. [Google Scholar]

- US Department of the Treasury. Financial Services Sector-Specific Plan; US Department of the Treasury: New York, NY, USA, 2015.

- Software Engineering Institute. Unintentional Insider Threats: Social Engineering; IEEE Security and Privacy Workshops: San Jose, CA, USA, 2014. [Google Scholar]

- Krombholz, K.; Hobel, H.; Huber, M.; Weippl, E. Advanced Social Engineering attacks. J. Inf. Secur. Appl. 2015, 22, 113–122. [Google Scholar] [CrossRef]

- Janczewski, L.J.; Fu, L.R. Social Engineering Attacks: Model and New Zealand Perspective. In Proceedings of the 2010 International Multiconference on Computer Science and Information Technology (IMCSIT), Wisla, Poland, 18–20 October 2010. [Google Scholar]

- World Economic Forum. Understanding Systemic Cyber Risk; World Economic Forum: Cologny, Switzerland, 2016. [Google Scholar]

- Vrancianu, M.; Popa, L.A. Considerations Regarding the Security and Protection of E-Banking Services Consumers’ Interests. Amfiteatru Econ. J. 2010, 12, 388–403. [Google Scholar]

- The Hong Kong Economic Journal. Cryptocurrency Exchange: Coincheck loses US$530 Mlllion in Hack; The Hong Kong Economic Journal: Hon Kong, China, 2018. [Google Scholar]

- Reserve Bank New Zealand, Register of Registered Banks in New Zealand. 8 June 2017. Available online: http://www.rbnz.govt.nz/regulation-and-supervision/banks/register (accessed on 2 March 2018).

- Du, J. An Empirical Analysis of Internet Banking Adoption in New Zealand; Lincoln University: Canterbury, UK, 2011. [Google Scholar]

- Taylor, K. Bank Customers Logging on; The New Zealand Herald: Auckland, New Zealand, 2002. [Google Scholar]

- Canstar. Online Banking. Canstar: Auckland, New Zealand, May 2013. Available online: https://cdn.canstar.co.nz/wp-content/uploads/2014/03/nz-online-banking-apr-2013.pdf (accessed on 3 May 2018).

- Hadnagy, C. Social Engineering: The Art of Human Hackin, 1st ed.; Wiley: Indianapolis, Indiana, 2010. [Google Scholar]

- SANS Institute. Glossary of Security Terms; SANS: Boston, MA, USA, 2016. [Google Scholar]

- Mitnick, D.S.W. The Art of Deception: Controlling the Human Element of Security; Wiley: Hoboken, NJ, USA, 2003. [Google Scholar]

- Papazov, Y. Social Engineering, North Atlantic Treaty Organization; Science and Technology Organization: New York, NY, USA, 2016. [Google Scholar]

- Molia, H.K.; Gohel, H.A. Protection of Computer Networks from the Social Engineering Attacks. Int. J. Adv. Eng. Technol. 2015, 1, 1. [Google Scholar]

- Abu-Shanab, E.; Matalqa, S. Security and Fraud Issues of E-banking. Int. J. Comput. Netw. Appl. 2015, 2, 179–187. [Google Scholar]

- Brar, T.P.S.; Sharma, D.; Khurmi, S.S. Vulnerabilities in e-Banking: A Study of Various Security Aspects. Int. J. Comput. Bus. Res. 2012, 6, 127–132. [Google Scholar]

- Workman, M. Wisecrackers: A Theory-Grounded Investigation of Phishing and Pretext Social Engineering Threats to Information Security. J. Am. Soc. Inf. Sci. Technol. 2008, 59, 662–674. [Google Scholar] [CrossRef]

- Symantec. Internet Security Threat Report; Symantec: Sydney, Australia, 2016. [Google Scholar]

- Radio New Zealand. 108 Cyber-Crime Attacks per Day in NZ; RadioNZ: Wellington, New Zealand, 2016. [Google Scholar]

- Pallavi, P.P.R.; Dudhe, D. Detection of Websites Based on Phishing Websites Characteristics. Int. J. Innov. Res. Comput. Commun. Eng. 2015, 3. [Google Scholar] [CrossRef]

- VASCO. Social Engineering: Mitigating Human Risk in Banking Transactions; Vasco Data Security: Chicago, IL, USA, 2015. [Google Scholar]

- Security Scorecard. 2016 Financial Industry Cybersecurity Report; Security Scorecard: New York, NY, USA, 2016. [Google Scholar]

- Proofpoint. Human Factor; Proofpoint: Chicago, IL, USA, 2017. [Google Scholar]

- Australian Cyber Security Centre. Australian Cyber Security Centre: 2017 Threat Report; Australian Cyber Security Centre: Canberra, Australia, 2017.

- Conference of State Bank Supervisors. Cybersecurity 101: A Resource Guide for Bank Executives; Conference of State Bank Supervisors: Washington, DC, USA, 2016. [Google Scholar]

- Aburrous, M.; Dahal, H.M.A.K.; Thabatah, F. Experimental Case Studies for Investigating E-Banking Phishing. J. Cogn, Comput. 2010, 2, 242–253. [Google Scholar] [CrossRef]

- E-Security Planet. Social Engineering Attack Nets $2.1 Million from Wells Fargo Bank; e-Security Planet: Foster City, CA, USA, 2012. [Google Scholar]

- VASCO Data Security. Social Engineering: Mitigating Human Risk in Banking Transactions; VASCO Data Security: Oakbrook Terrace, IL, USA, 2015. [Google Scholar]

- Longitude Research. Cyberrisk in Banking: A Review of the Key Industry Threats and Responses Ahead; SAS: Chicago, IL, USA, 2015; Available online: https://www.kroll.com/media/pdf/white-papers/cyberrisk-in-banking-106605.pdf (accessed on 3 May 2018).

- Mithil Vasani, B.P.C.C. Android Based Total Security for System Authentication. J. Eng. Res. Appl. 2015, 5, 115–119. [Google Scholar]

- ANZ New Zealand. ANZ New Zealand Facts, 07 2017. Available online: https://www.anz.co.nz/about-us/our-company/anz-new-zealand/ (accessed on 24 January 2018).

| Salient Features | Information Captured | Potential Consequences |

|---|---|---|

Appeal

Desired response

Suspicious indicators

|

|

|

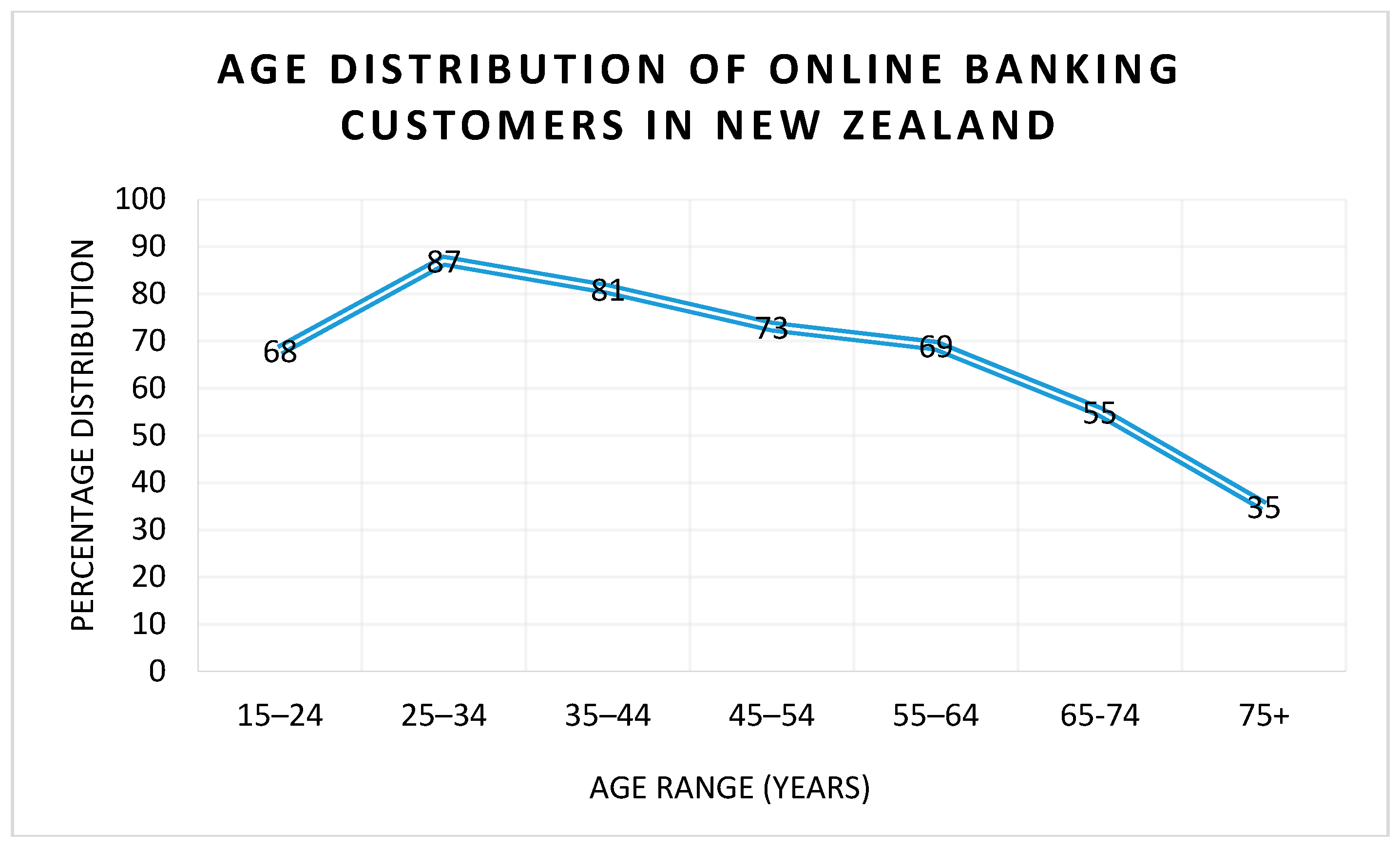

| Age Group (Years) | Percentage of Online Banking Users |

|---|---|

| 15–24 | 68% |

| 25–34 | 87% |

| 35–44 | 81% |

| 45–54 | 73% |

| 55–64 | 69% |

| 65–74 | 55% |

| 75+ | 35% |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Airehrour, D.; Vasudevan Nair, N.; Madanian, S. Social Engineering Attacks and Countermeasures in the New Zealand Banking System: Advancing a User-Reflective Mitigation Model. Information 2018, 9, 110. https://doi.org/10.3390/info9050110

Airehrour D, Vasudevan Nair N, Madanian S. Social Engineering Attacks and Countermeasures in the New Zealand Banking System: Advancing a User-Reflective Mitigation Model. Information. 2018; 9(5):110. https://doi.org/10.3390/info9050110

Chicago/Turabian StyleAirehrour, David, Nisha Vasudevan Nair, and Samaneh Madanian. 2018. "Social Engineering Attacks and Countermeasures in the New Zealand Banking System: Advancing a User-Reflective Mitigation Model" Information 9, no. 5: 110. https://doi.org/10.3390/info9050110

APA StyleAirehrour, D., Vasudevan Nair, N., & Madanian, S. (2018). Social Engineering Attacks and Countermeasures in the New Zealand Banking System: Advancing a User-Reflective Mitigation Model. Information, 9(5), 110. https://doi.org/10.3390/info9050110