1. Introduction

ESG integration has moved from the financial sector’s perimeter to its centre in recent years, especially in risk management and investment decision-making. ESG aspects are unquestionably important, as seen by the rapidity of environmental changes, the escalation of social issues, and the recurrence of governance failures [

1].

Concurrently, increased investor and consumer awareness of corporate social responsibility has led financial product and service providers and designers to include ESG factors as critical evaluation criteria for businesses and investments.

The adoption of ESG integration into financial operations is also being accelerated by regulatory authorities’ constant reinforcement of rules regarding ESG reporting and disclosure.

Despite the multitude of challenges, incorporating ESG not only encourages the development of financially sound goods and services but also offers investors and financial institutions new opportunities for expansion and innovation. Moreover, a paradigm change towards more sustainable and fair financial practices is represented by the growing incorporation of Artificial Intelligence (AI) into Environmental, Social, and Governance (ESG) activities within the financial industry [

2].

Lyu et al. [

3] conducted another study investigating the positive effects of digital innovations on the economic resilience of cities in China. The study’s main findings suggest that digital finance is an essential element in formulating policies and measures to ensure economic resilience. This is usually associated with increased innovation capacities, access to technology, and demographic factors, such as population and population density. Methodologically, the authors developed a composite index to measure economic resilience and used panel data regression methods to evaluate the impact of financial innovations from 2010 to 2020.

Meanwhile, other studies have demonstrated that digital finance, and implicitly, the integration of automation into finance, provides a higher level of financial efficiency and performance. This is achieved through concrete solutions that improve the financing process, enhance financial risk management, and align with ESG objectives [

4,

5,

6,

7].

Specifically, study [

8] investigated how digital finance influences Environmental, Social, and Governance (ESG) criteria among Chinese A-share listed firms from 2011 to 2023 using a dual quantitative transmission approach. The main findings indicated a direct, positive relationship between digital finance and ESG objectives. In other words, improving ESG performance depends on transformations, innovations, and technologies specific to modern finance.

On the other hand, some studies analyse the new scientific field of sustainable finance from a bibliometric perspective. Through bibliometric analysis in Web of Science and Scopus, the authors of the study [

9] highlight the potential for the theoretical development of sustainable finance. They also draw attention to the growing number of subfields and related areas of this new field of interest, with the most common ones referring to the analysis of sustainable development and environmental, social, and governance (ESG) indicators.

Using a specific approach to conduct a sociometric analysis of the links between ESG objectives and their integration into the financial and banking industries, the authors of study [

10] identified the main trends, positive aspects, and opportunities for adopting and ensuring ESG practices in the complex banking sector. Lastly, the study presents new, specific research directions regarding the positive correlation between ESG objectives and the legislative and regulatory challenges identified in the banking sector.

The present study explored the intersection of finance, automation, and Environmental, Social, and Governance (ESG) principles through a bibliometric and systematic analysis of publications indexed in Web of Science (WOS) and Scopus. By examining publication trends, thematic structures, citation networks, and methodological patterns, the research identified the intellectual foundations and emerging directions that characterise the future of finance in an era of digital and sustainable transformation.

The growing concern over how to best understand and accurately interpret ESG criteria is generating new avenues of research that will have multiple effects on the financial sector. The accelerated integration and use of advanced IT processes, such as artificial intelligence, digitization, robotics, and automation, contribute to better economic and financial results. However, they also generate potential challenges and issues regarding compliance with ESG objectives [

5,

10].

The main objective of this study is to provide a bibliometric analysis demonstrating possible theoretical associations between financial and technical fields and sustainability research in terms of adopting and applying ESG criteria. At the same time, the field of ESG has numerous effects on a company’s long-term growth, including identifying opportunities for sustainable growth, improving business strategies and financial results, enhancing the company’s reputation, and promoting economic development.

This research is motivated by the rapid pace of change in the financial sector brought about by automation, technological advances, and digitization, where these processes must often be correlated and used appropriately in response to ESG objectives.

While numerous studies in this framework analyse the implications of automation and ESG practices on financial performance [

7,

9,

10], these analyses are often singular, fragmented, or based solely on empirical evidence. The study is designed from a theoretical point of view. It involves investigating the relationship between automation and the financial sector by integrating Environmental, Social, and Governance (ESG) criteria.

The goal is to discover and highlight the current framework, trends, sub-areas, and specific themes in the scientific literature. The main method used in this study is bibliometric analysis, and the approach is comparative based on theoretical evidence found in the Web of Science and Scopus databases. Lastly, this study aims to provide an adequate and coherent analysis that contributes to clarifying the associations between finance, automation, and ESG principles from a theoretical perspective.

The methodological contribution of the study does not lie in the introduction of new bibliometric tools, but in their integrative use to simultaneously analyse the intersection between digital finance, automation, and ESG, an approach that is lacking in the existing literature.

Specific bibliometric analysis methods are used to highlight the integrative nature of the three key concepts analysed: finance, automation, and ESG. Although these methods are widely used in the literature and are largely standardised, the contribution of this study lies not in methodological innovation per se, but in their integrated application to investigate the conceptual relationships between these fields.

The analysis of keyword prevalence, the visualisation of global collaboration networks between authors and academic institutions, and the use of graphical tools to identify contributions and trends in the literature allow us to highlight emerging thematic structures, under-explored areas, and directions with high research potential, thus contributing to the development of a conceptual theoretical framework of the interconnections between finance, automation, and ESG.

This approach considers the growing intersection of finance, automation, and research, as well as the importance of environmental, governance, and social objectives for a functioning financial system. The proposed scientific framework offers a thorough outlook on the future of modern finance, which could be subject to automation processes and effective ESG management.

On the other hand, the research gap is based on the development of a multidisciplinary bibliometric analysis that proposes a new approach to modern finance.

Although there are numerous research on each of the fields of digital finance, automation, and ESG criteria, they have developed in independent directions, with points of intersection still insufficiently explored. Management studies related to ESG emphasise governance, ethics, and financial performance, while the literature on automation focuses on efficiency and optimisation of financial decisions. Exploring the intersection of how automation specifically acts as a catalyst for ESG integration, the impact on improving transparency and resource optimisation, remains underexplored.

Digital finance addresses the transformation of financial systems but does not integrate automation mechanisms into the analysis of ESG objectives. There are few analyses addressing how AI, automated processes, and advanced data analysis contribute to sustainability objectives, which is reflected in the lack of interdisciplinary bibliometric analyses mapped on the convergence of these fields [

4,

7,

8].

The present study proposes a new approach to address this research gap, examining the interconnections between digital finance, automation, and ESG and offering a perspective on how they evolve together to build the future of sustainable finance.

This study’s main research questions are designed and developed according to performance analysis, keyword mapping, and clustering. These questions refer to:

RQ1: Which studies are the most relevant for analysing and investigating the connections between finance, automation, and ESG principles?

RQ2: What are the main themes, issues, and trends identified in the specialised literature on this topic?

RQ3: How can the main gaps and research opportunities in the literature on the connections between finance, automation, and ESG principles be identified?

RQ4: What information and practical implications can be obtained from analysing clusters based on the most frequently used keywords and collaborations between authors, institutions, and regions?

This study is organised into several sections.

Section 2 reviews the literature on the theoretical and empirical foundations of digital finance, automation, and Environmental, Social, and Governance (ESG) principles.

Section 3 addresses the methodological aspects of the bibliometric analysis performed.

Section 4 provides a comparative presentation and interpretation of the main results.

Section 5 presents the discussion and the practical implications after the conducted bibliometric analysis, while

Section 6 formulates conclusions.

3. Research Methodology

This section outlines the methodological framework adopted for the bibliometric and systematic analysis of the scientific literature on Finance, Automation, and ESG (Environmental, Social, and Governance) principles. The approach combines bibliometric techniques with a systematic review to identify the intellectual structure, research trends, and thematic evolution of the field.

3.1. Databases

This research used two significant academic databases, Web of Science (WOS) and Scopus, to provide bibliometric data because of their extensive multidisciplinary coverage, high standards of quality, and powerful citation tracking features.

Web of Science (WOS), developed by the Thomson Reuters Institute for Scientific Information (ISI), originated from the Science Citation Index created by Eugene Garfield in the 1960s [

33].

It encompasses more than 10,000 high-impact journals and integrates seven core citation databases: Social Sciences Citation Index (SSCI), Science Citation Index Expanded (SCI-Expanded), Conference Proceedings Citation Index-Science (CPCI-S), Arts and Humanities Citation Index (A and HCI), and Conference Proceedings Citation Index-Social Sciences and Humanities (CPCI-SSH). Two specialised chemistry databases, Index Chemicus (IC) and Current Chemical Reactions (CCR-Expanded), are also included. WOS offers extensive citation and bibliographic coverage dating back to 1900 [

34].

Scopus, officially SciVerse Scopus, was introduced by Elsevier in 2004 and has since become the largest multidisciplinary database for the scientific literature. Scopus covers over 49 million records across peer-reviewed journals, trade publications, and book series.

It includes approximately 20,500 journals from 5000 publishers, along with 1200 open-access journals, 600 trade publications, 500 conference proceedings, and 360 book series. Nearly 80% of its records contain abstracts, and its citation coverage extends to the 1960s. Scopus is widely recognised for its accessibility, quality outcomes, and analytical depth, with strong representation from Europe, the Middle East, and Africa [

34].

Both databases support Basic and Advanced Search functionalities, enabling researchers to refine research by author, year, country, subject area, document type, institution, funding agency, and language [

35]. Retrieved documents include bibliographic information, abstracts, and citation data, which can be exported in standardised formats for bibliometric processing.

Thus, the two databases, Web of Science and Scopus, were carefully chosen for their ability to provide relevant, theoretically justified information on finance and automation through scientific publications. These articles frequently use terms such as innovation, artificial intelligence, robotics, and digitization. The databases also provide links to ESG objectives and criteria.

3.2. The Proposed Keyword Strategy

The strategy applied in searching for scientific publications to achieve the central objective of the study was based on the selection of three terms that belong to and are specific to the economic and financial field (“finance”), the technical field (“automation”), and the interdisciplinary field (“ESG”), respectively. Another important aspect of this strategy was the use of Boolean operators, and this relationship was applied in the following form: (“finance” AND “automation”) OR “ESG”.

The AND operator was chosen between the first two keywords to include scientific publications focusing on analysing financial aspects and the role of digitization and automation processes in financial results and performance.

The OR operator was used for the third keyword to demonstrate links and associations between finance and automation and ESG objectives, in terms of trends and theoretical approaches, in the analysed articles.

Lastly, the present study aims to demonstrate the connections and synergies between the complex scientific fields of finance and computer science, automated IT processes, and the rapidly developing field of theoretical and empirical practices and mechanisms in investigating ESG criteria.

It should be noted that the search query was applied successively and individually within the Web of Science and Scopus databases so that connections could be identified from a comparative perspective. Another specific aspect of the scientific article search strategy was obtaining the set of records from the two databases.

Each file contained 1000 manually verified records from the Web of Science platform. This process was repeated 16 times to create the final dataset. As for Scopus, the file was agreed upon in Excel format.

Space issues, missing records, and other inconsistencies were manually verified and corrected to generate the file with the data used in the bibliometric analysis. Thus, the final Web of Science data set consisted of 15,035 articles. The same process was applied to the Scopus platform, generating 1414 articles.

The entire process took place on 21 September 2025. Prior to the actual bibliometric analysis, inclusion and exclusion criteria were applied.

To be included, publications had to meet the following criteria: the publication type had to be peer-reviewed research articles, proceedings papers, or book chapters; all publications had to be written and edited in English; the time period had to be that of indexing in these databases (in this case, 1974–2026); and all publications had to comply with the relevant themes and concepts regarding the keywords used for the issue discussed.

The exclusion criteria used also targeted editorial publications, reviews, or publications that had been withdrawn, and those that had not been peer-reviewed.

Based on the final data set, the bibliometric analysis was performed in the Bibliometrix package in R-Studio using the Biblioshiny interface. The cluster analyses performed in Biblioshiny were set up appropriately to avoid label overlap and ensure clarity of cluster visualisation.

Considering the Boolean operator-based relationship used to search for the three keywords, the Web of Science results have a much broader scope and coverage than the Scopus results. This can be explained by the desire to demonstrate theoretical differences and distinctions regarding trends, authors, academic sources, article indexing distribution during the analysed period, citation dynamics and evolution during this period, cluster formation, and thematic analysis of the search terms.

The broad keyword strategy (“finance AND automation”) OR “ESG,” was used to cover a wide thematic spectrum and enable a comparative assessment of database coverage and conceptual structures between Web of Science and Scopus.

This design allowed us to compare how Web of Science and Scopus index technology-based financial research and the ESG-related literature. Differences in the number of retrieved records are not considered methodological inconsistencies but rather empirical evidence of database-specific indexing practices.

The large number of articles indexed by Web of Science can be explained by the fact that these studies only briefly analyse the relationships between finance, automation, and ESG without providing specific analyses of the intersection of these three fields.

Another possible explanation is the synonym relationships between the search terms, particularly for the term “automation,” which can be associated with “digitization,” “digital,” “innovation,” “advanced data technology,” “artificial intelligence,” and so on, and for the term “ESG,” which can be associated with “environment,” “social,” “society,” “social footprint,” “sustainability,” “governance,” “environmental regulation,” “social regulation,” “environmental responsibility,” and “social responsibility.” We acknowledge this as a methodological limitation and will consider more elements and criteria for inclusion and exclusion in the final dataset for bibliometric analysis in future research directions.

4. Results

The findings of the bibliometric analysis looking at the relationships between automation, finance, and Environmental, Social, and Governance (ESG) principles are presented in

Section 4.

This section offers a comparative and methodical interpretation of the key findings using data taken from the Web of Science and Scopus databases and processed using the Bibliometrix R package. Publication trends, citation dynamics, top journals and authors, institutional and geographic contributions, and thematic structures derived from keyword co-occurrence and clustering techniques are all highlighted in the analysis.

By combining these findings, this section provides a thorough summary of the field’s intellectual landscape and highlights the key research areas influencing automated and sustainable finance in the future.

4.1. Publication Activity Results for the Finance-Automation-ESG Topic

The findings of the bibliometric and systematic study of articles related to automation, finance, and ESG principles are presented in this chapter. As mentioned in

Section 3, the outcomes are based on information that was taken from the Scopus and Web of Science (WOS) databases and examined with the Bibliometrix tool from R Studio. An explanation of methodological patterns and types of findings follows the study, which includes publication trends, thematic structures, leading authors, country-level contributions, and citation dynamics.

The bibliometric analysis investigated the connections between finance, automation, and Environmental, Social, and Governance (ESG) principles. The analysis was based on information from two specialised literature databases: Web of Science Core Collection and Scopus. The results reveal an important positive finding: the addressed subject has gained significant interest in recent years [

49,

50].

In this regard, researchers are increasingly concerned with understanding the relevance of automation for economic and social development and progress at the micro and macro levels. It can also be said that automation can have positive effects on financial and economic analyses at the company level. However, this level of performance must be correlated with compliance with environmental, governance, and social principles, often referred to as ESG standards.

Results from Web of Science showed over 15,000 publications on this topic published between 1976 and 2026. For 2026, these publications are in press and early access. Additionally, over 73% of these publications are original research articles, while approximately 10% are articles and papers published in national and international conference proceedings. It is also notable that the analysis of the intersection of finance, automation, and ESG principles is a topical and academically interesting one.

This is evident from the topic’s annual growth of approximately 4%, an average publication age of 4.80 years, and an average of 19 citations per year. These elements are positive indicators of the increased relevance of this topic in the literature.

Another aspect shows that the authors are productive and efficient. Most publications are written by teams of four authors, on average, and through the expansion of international collaborations, which account for a significant 29% of publications.

The analysis carried out within Scopus, on the other hand, highlighted 1414 publications indexed between 1974 and 2026. Similarly, the topic of the connections between finance, automation, and Environmental, Social, and Governance (ESG) principles is relevant and prolific, with data showing a 2.70% increase per year and an average of approximately 15 citations.

Notably, the total number of indexed publications and their distribution differ between Scopus and other sources. In Scopus, more than 29% of academic publications are conference proceedings. The key bibliometric indicators of the conducted bibliometric research are provided in

Table 1.

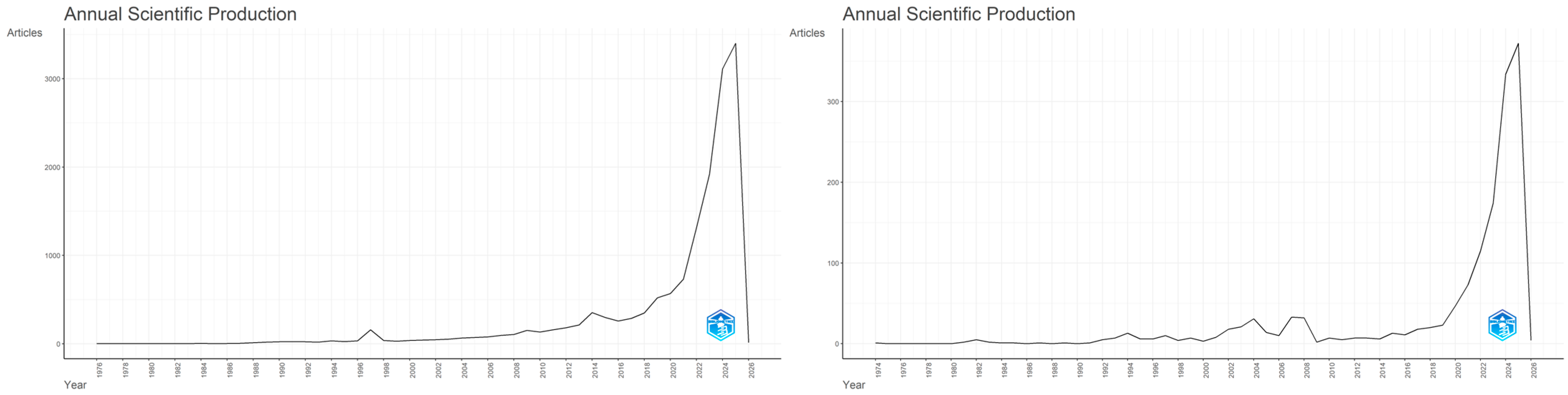

Moving forward, the analysis pursued the evolution and dynamics of the number of indexed publications in the two databases analysed from 1974 to 2026. The results, illustrated in

Figure 2, clearly confirm an upward trend in research on the theoretical connections between automation and finance and ESG principles, highlighting the relevance of this topic and researchers’ efforts to expand the specialised literature.

The analysis similarly highlights this upward trend, showing that the number of publications in Web of Science grew exponentially between 2014 and 2024, reaching over 3000 articles published this year. Scopus also notes this aspect, with a visible increase in the number of publications occurring between 2018 and 2024. For example, more than 300 academic publications were indexed in 2025 [

40,

44].

Furthermore, these results suggest an accelerating pace in researchers’ theoretical and empirical contributions to associations between finance, automation, and environmental, social, and governance (ESG) factors. These results can also be correlated with the integration of sustainability measurement criteria into financial strategies and decisions at the business level. Lastly, emphasising the use of automated processes in financial reporting has a positive effect on contributions to the specialist literature.

There are notable differences in the average number of citations per year. In Web of Science, the average number of citations was 8 during the analysed period, with some fluctuations in the average number of accumulated citations per year.

For instance, citations increased from an average of 2 to 6 between 2014 and 2018. Then, there was a decrease to an average of 4 citations between 2019 and 2020. Finally, citations increased again between 2021 and 2024.

The situation is different when it comes to the average number of citations per year in Scopus. For instance, citations ranged from 0 to 2 per year for a long period of time (1974–2003).

A first wave of increases was observed between 2005 and 2007, when the average number of citations was approximately 4 per year. Between 2015 and 2022, there was a considerable increase in citations, with an average of about 9 per year.

Figure 3 illustrates these findings.

These findings regarding the increase in the number of citations in recent years reflect the current research trend in these scientific fields, with more researchers focusing on interdisciplinary analyses aimed at explaining the future of modern finance, which is susceptible to ESG criteria regulation issues and opportunities generated by automation processes [

41,

43,

50].

Specifically, analysing scientific contributions and citation impact in Web of Science and Scopus from 1974 to 2026 can provide insight into the following research question: RQ1: Which studies are the most relevant for analysing the connections between finance, automation, and ESG principles?

4.2. Three-Field Plot Results

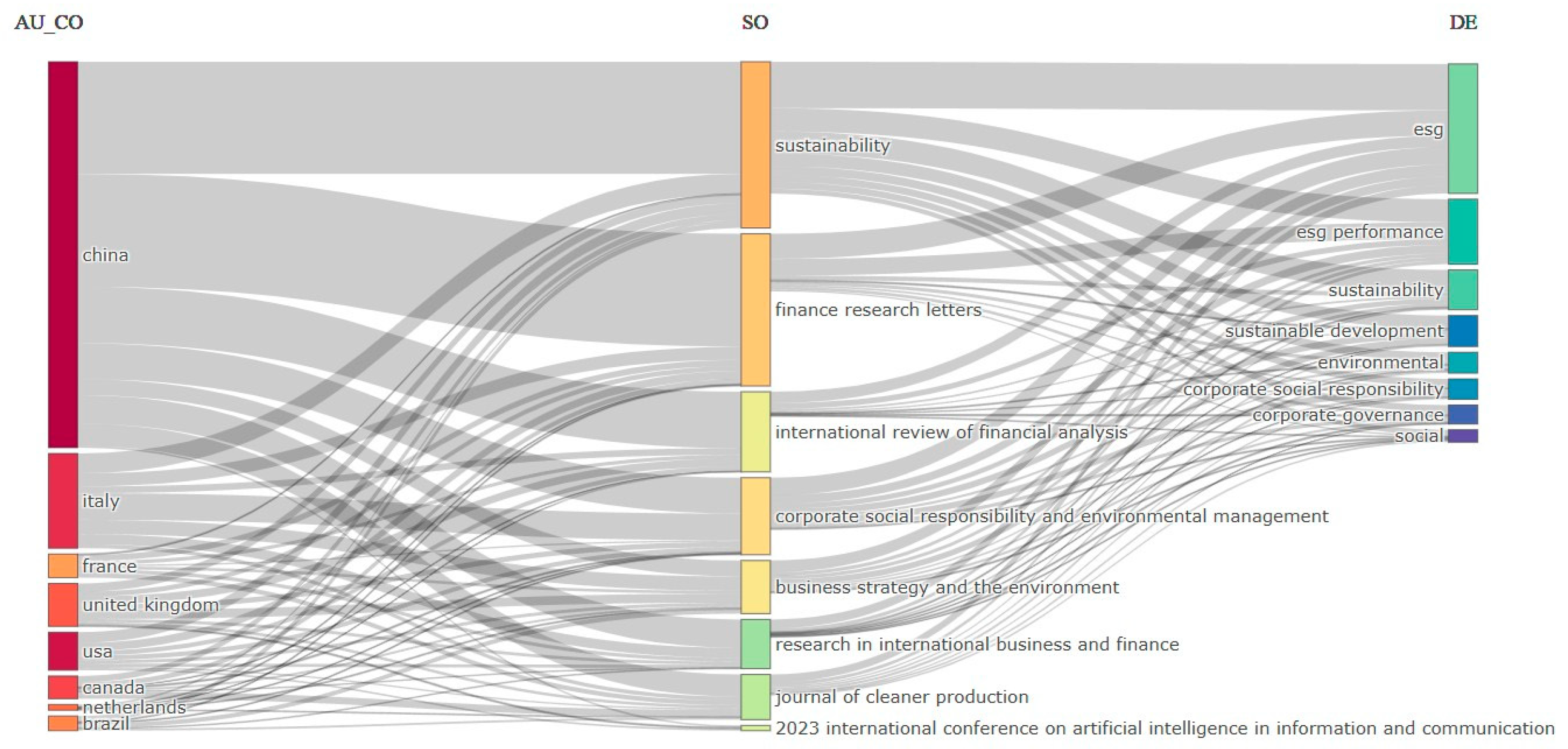

Another relevant finding of the bibliometric analysis was the clear visualisation of the degree to which researchers understand the connections between the financial system, automation, and the formulation of ESG principles, as well as their main areas of interest and study.

Considering the theoretical and empirical evidence from Web of Science and Scopus, we were able to create a diagram showing the contributions of academic publications by country, journal, and topic in finance, automation processes, governance, and social and environmental objectives.

In this regard, the first column (on the left) of the diagram refers to the countries of origin of the authors, the second column highlights the sources of publication, and the third column represents the most frequently used keywords by the authors on the subject under investigation. There are certain connections and associations between the three columns [

51,

52].

Figure 4 and

Figure 5 show both the Web of Science and Scopus visualisation of the diagram.

Theoretical findings reveal specific aspects of digital finance, which is an area of growing interest due to the integration of automated processes and criteria for measuring social, environmental, and corporate governance performance.

These three-field plots support the convergence relationships between the three analysed areas, as well as the current state of digital finance’s transition (much research is based on current theoretical aspects related to environmental, social, and governance (ESG) performance, green finance, environmental aspects, and sustainable development).

Similar results show that the largest flow of articles comes from China, with the preferred topic being the analysis of ESG principles and the most frequent publication outlet being Sustainability, a prestigious multidisciplinary journal owned by MDPI.

Other topics of interest include sustainable finance, the performance analysis of ESG principles, green finance, artificial intelligence and automation in finance, and topics related to sustainable development and social governance.

These research topics originate in the US and most European countries, including France, Great Britain, Italy, Spain, and the Netherlands. These authors also publish in other prestigious journals, such as the Journal of Risk and Financial Management (an academic journal published by MDPI), Finance Research Letters, International Review of Financial Analysis, and the Journal of Environmental Management (journals published by Elsevier).

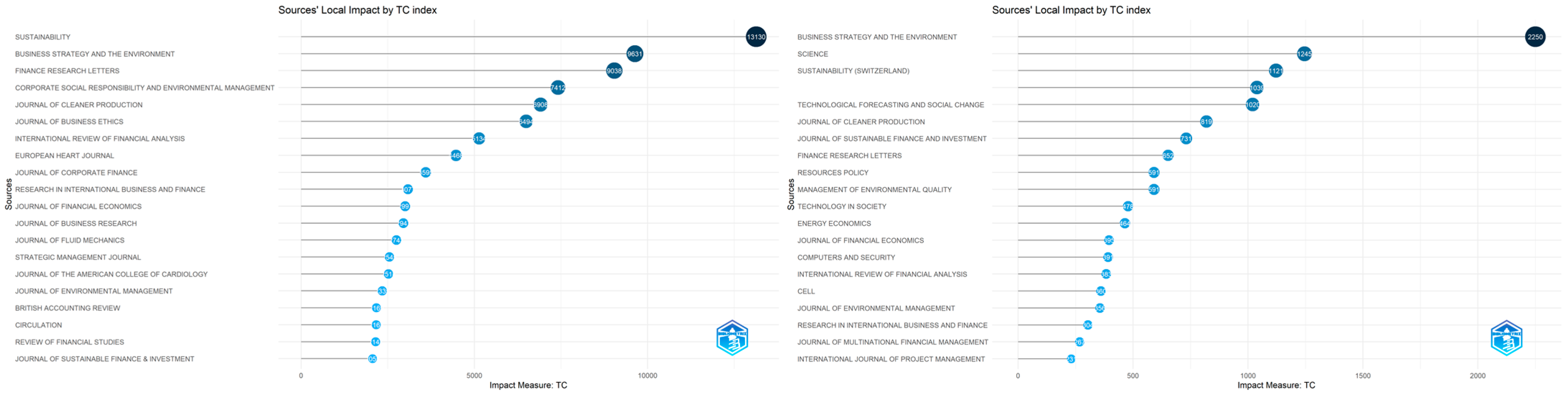

4.3. Bibliometric Analysis of Leading Journals and Most Productive Authors

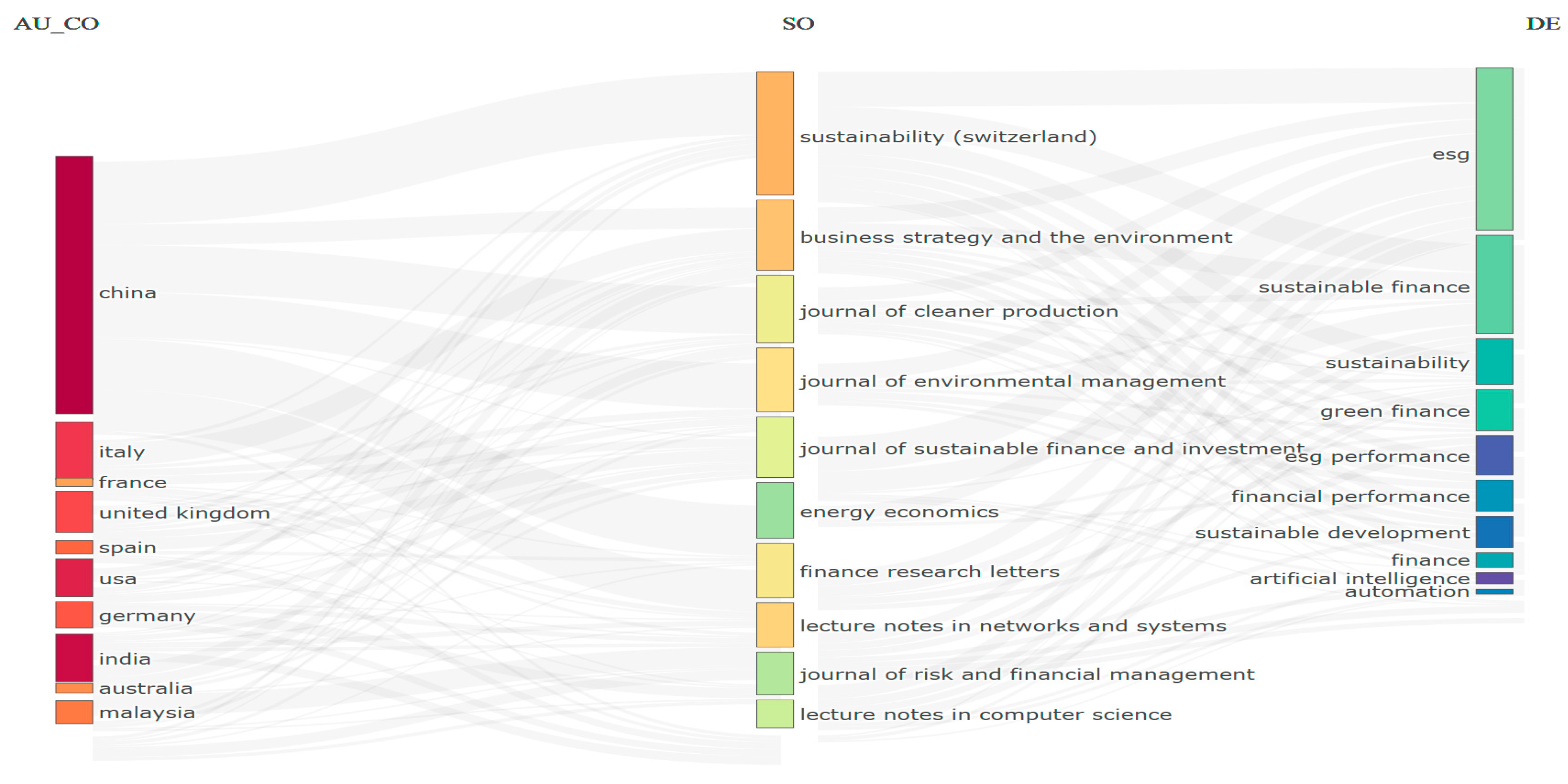

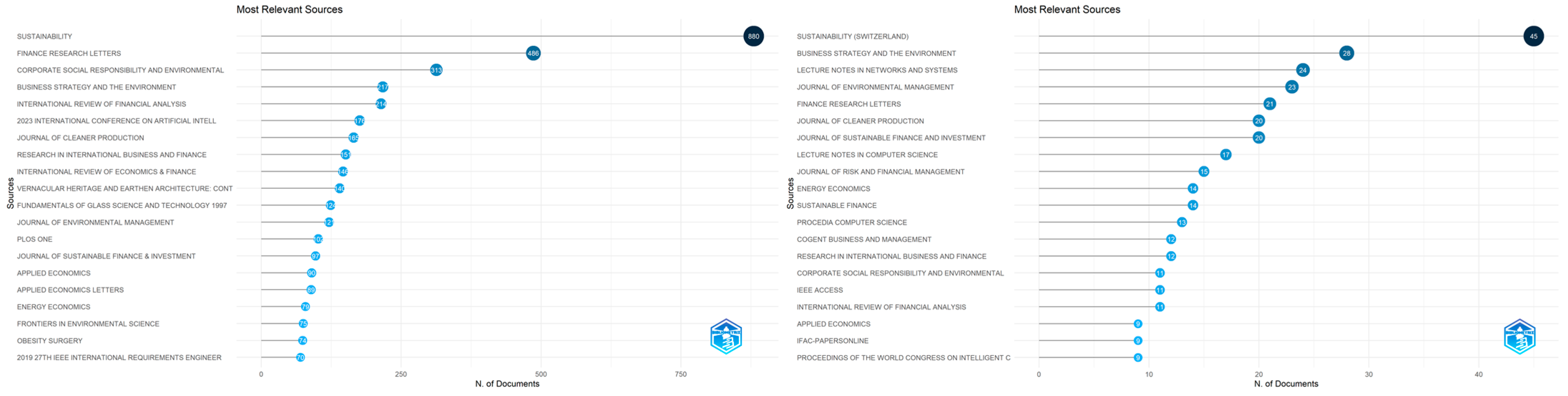

At the same time, through bibliometric analysis, the 20 most prolific academic sources (journals and conference proceedings) were evaluated based on their scientific contributions regarding the associations between finance, automation, and ESG principles.

Among these sources, the academic journal Sustainability was found to be the most relevant and popular, with a total of 880 published articles and over 13,000 citations during the analysed period.

Finance Research Letters ranked second with 486 articles published and over 9000 citations accumulated between 1974 and 2026. This significant academic source publishes articles on complex financial issues, including corporate governance, green finance, innovation, and automation in financial markets.

This ranking also mentions other relevant academic sources addressing issues related to sustainable development, financial system performance, and sustainable finance. These sources include: The Journal of Environmental Management (121 articles published and 33 citations), the Journal of Sustainable Finance and Investment (97 articles published and five citations), and the Business Strategy and the Environment journal (217 indexed articles and over 9600 citations).

Similar aspects could be identified when analysing the most relevant and influential academic publications indexed in Scopus, confirming that this subject is one of these journals’ central themes and that authors tend to publish analyses and research on the connections between automation, ESG principles, and the financial system in such prestigious journals.

The results showed that Sustainability ranked first, with 45 indexed articles and over 1100 citations from 1974 to 2026. The ranking also includes the journals Journal of Cleaner Production and Journal of Risk and Financial Management, which cover research topics in corporate finance, financial risk management, sustainable and environmental finance, corporate sustainability, corporate social responsibility, governance, legislation, and sustainability-related policies.

Together, the two academic sources total over 900 citations and 30 indexed articles during the analysed period.

Figure 6 and

Figure 7 display the full information on the top 20 leading journals.

The ranking of the most influential and relevant academic sources indicates that the issues examined in this study are theoretical and interdisciplinary. This finding demonstrates researchers’ interest in providing integrated, rather than fragmented, information on the links between finance, automation processes, and ESG objectives [

52].

Additionally, it is important to note that the analysis of these associations is a significant factor in the selection of academic journals, with authors preferring those that focus on sustainability objectives, financial issues, economic aspects, and management from an environmental perspective.

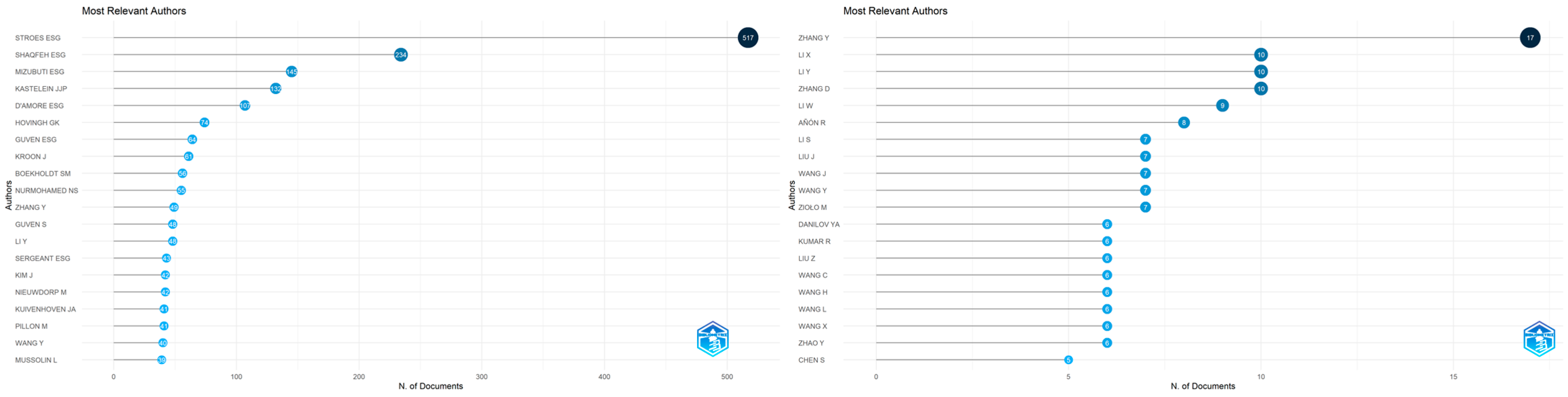

Following the bibliometric analysis, it was noted that the most productive authors were highlighted in terms of studying and analysing the connections between automation, ESG principles, and finance.

Additionally, the most important universities and academic institutions were mentioned. The results showed that approximately 13% of all publications indexed in the Web of Science Core Collection are from the 20 most significant authors and researchers worldwide. These individuals have decisively contributed to accelerating and proliferating the subject of this study.

In comparison, 10% of publications indexed on the Scopus platform represent the scientific contributions of the most influential researchers in this field. Most of these researchers focus on innovation and artificial intelligence, specifically the integration of automation processes in financial, economic, technological, engineering, and medical fields.

The most frequently referenced authors in the WOS network are linked to sustainability and governance, including scholars who have studied the connection between financial performance and ESG factors, such as Friede, Busch, and Bassen. Their research serves as the theoretical cornerstone of the literature on ESG and finance.

On the other hand, the Scopus network includes authors from data science and financial technology, including Arner, Barberis, and Buckley, who have studied blockchain, automation, and artificial intelligence in financial systems.

Figure 8 illustrates this information.

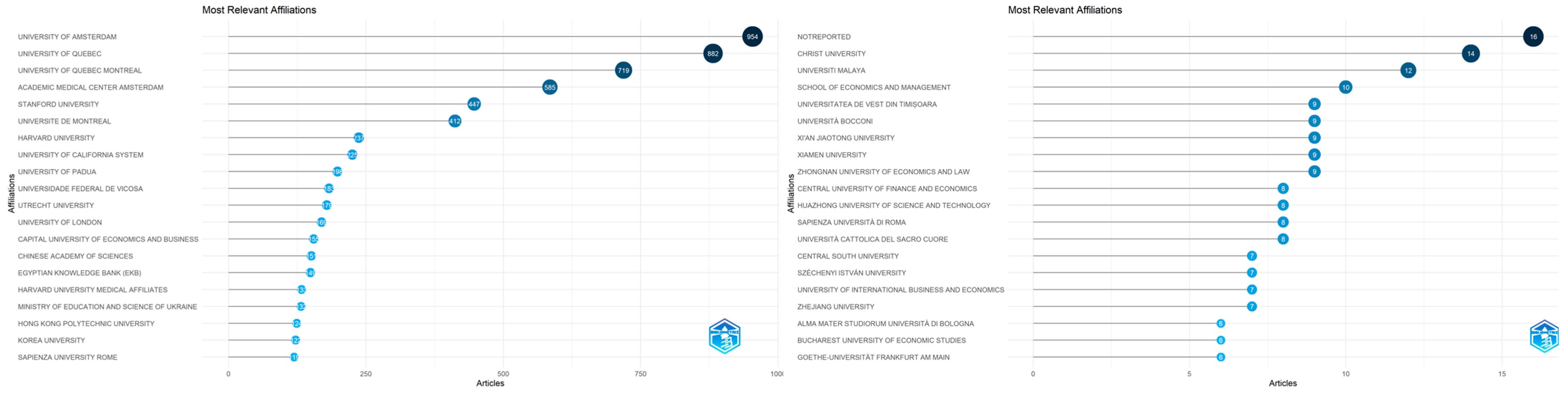

4.4. Bibliometric Analysis of Leading Research Institutions and Countries

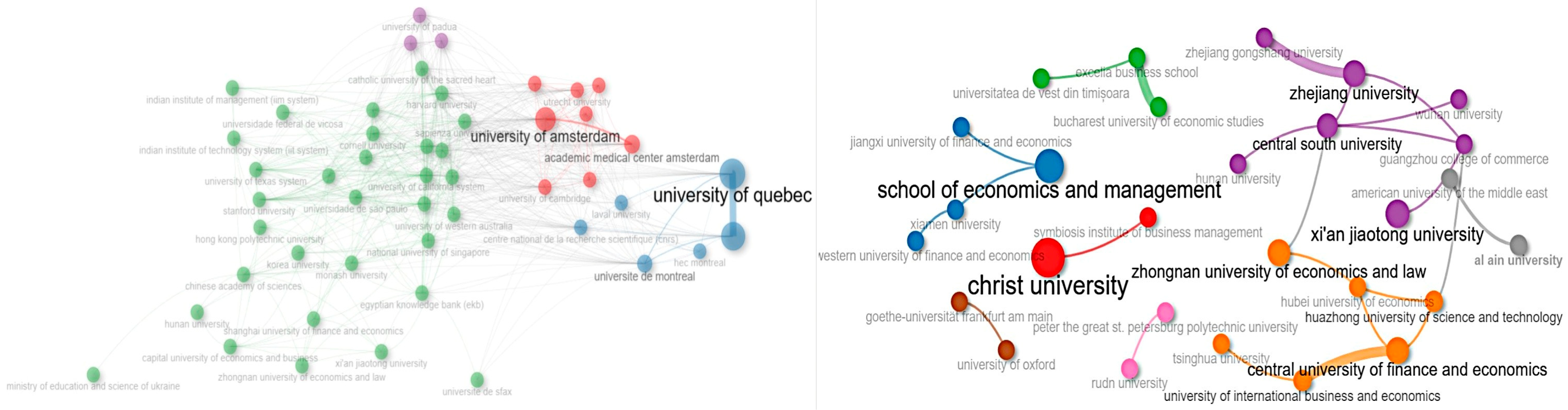

The analysis enabled the creation of a ranking of the 20 most important universities, as well as academic and research institutions, worldwide.

This ranking considers the total number of publications and contributions made by these institutions. The University of Amsterdam had the largest contribution, with a total of over 950 articles. This ranking also highlights the University of Quebec, Stanford University, and Harvard University, which suggests an impressive academic contribution and solid, persistent global presence on the subject under investigation.

Results obtained at the Scopus level highlight other relevant institutions and universities, including Sapienza University of Rome in Italy; Xiamen University in China; and two other Romanian universities: the West University of Timișoara and the Bucharest University of Economic Studies.

These two universities contributed 15 articles. Therefore, it has been found that this topic is discussed and debated globally and is enjoying a growing trend in terms of authors’ interest, concern, and desire for it. The most significant research institutions are illustrated in

Figure 9.

Evidence of scientific contributions at the level of authors and at the level of universities, academic institutions, and research organisations generates a favourable view of the evolution of the literature on the issue in question, namely, increased interest in adopting regional and global collaborations.

Even though the analysis of the three areas shows a predominantly emerging effect, these interconnections between finance, automation, and ESG principles will take on new theoretical dimensions, and analysis from an integrative perspective will be a central driver in the proliferation of the specialised literature [

27,

38,

44].

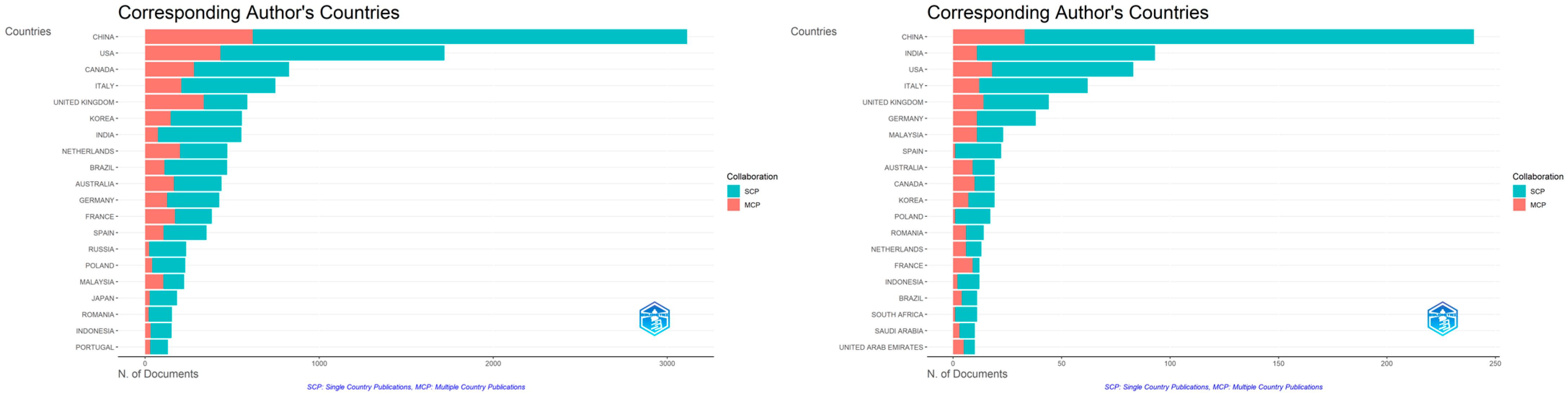

According to

Figure 10, China has the largest number of publications in the field of study discussed in this article.

A total of 3200 of its publications are indexed in Web of Science, and 250 are indexed in Scopus. The United States of America (i.e., USA) ranks second in Web of Science with approximately 2000 publications and third in Scopus with approximately 100 articles.

With an average of about 25 documents, Romania confirms its position and scientific influence by ranking among the top 20 countries. Other countries that contribute to the field include Spain, France, Germany, the Netherlands, and Italy in Europe; India, Korea, Indonesia, and Malaysia in East and Southeast Asia; and Australia, Canada, and Brazil.

In this regard, one practical implication of this study is that the connections between the financial system and the effects of automation and digitization in ensuring ESG objectives are becoming increasingly relevant globally.

Consequently, the flow of scientific contributions comes from many countries and regions. Furthermore, this analysis revealed that these publications consider the research and partnership teams established at the regional and international levels [

53].

From a theoretical point of view, authors from most developed countries and leading prestigious universities predominantly emphasise the accelerating trend toward ESG standards and regulatory aspects specific to governance aimed at sustainable development in the complex economic and financial world. This may also indicate a benchmark in terms of the literature development for other researchers in other geographical areas of the world.

The third research question (RQ3), “How can the main gaps and research opportunities in the literature on the connections between finance, automation, and ESG principles be identified?” was examined through an analysis of publications indexed in Web of Science and Scopus, organised by academic journal, most productive authors, countries, and academic institutions.

Figure 6,

Figure 7,

Figure 8,

Figure 9 and

Figure 10 present this theoretical information on areas and fields of exploitation and possible research opportunities.

4.5. Bibliometric Analysis of Thematic Prevalence and Keyword Occurrences

The analysis proceeded with an evaluation of the associations and relationships formed between the most frequently used keywords and the primary conceptual categories identified in publications indexed in Web of Science and Scopus.

According to

Figure 11, there was a preference for researching the automation process and its role in financial performance and ESG objectives.

This analysis helps identify possible correlations and links between keywords in academic publications within Web of Science, as well as detect/discover trends and preferred topics of study on this subject.

Specifically, the most popular words were: “ESG performance,” “risk,” “management,” “financial performance,” “corporate governance”, and “innovation.” These words are part of well-defined fields and areas of research, such as business finance (3041 keywords), business and economics (over 1850 keywords), and green and sustainable science and technology (over 1550 keywords).

Meanwhile, a scientific field focuses on the processes of automation and digitization and their increasingly accelerated impact on global economic and financial sustainability. In this field, authors frequently use keywords such as “information,” “deep learning,” and “digital transformation.” Within this field of research, 221 academic publications are indexed in the Web of Science.

At the Scopus level (see

Figure 12), the provided context helps highlight and enhance the scientific contributions regarding the relationships between finance, Environmental, Social, and Governance (ESG) principles, and automation.

The most frequently used words in these articles are “sustainable finance,” “green finance,” and “corporate social responsibility.” Meanwhile, “automation,” “artificial intelligence,” and “fintech” are well-integrated terms that clearly explain how a company’s performance level depends on the new digital finance and decentralised financial system approaches.

Therefore, the keyword “automation” appears over 60 times in these publications, ranking 6th.

The difference brings emphasis to the different academic scopes of the databases: Scopus records the computational and technological advancements that support automation and digital transformation, whereas WOS highlights the ethical and managerial ramifications of ESG integration in finance.

The information presented demonstrates that research on the future of finance is conducted using both technology-driven and sustainability-focused methodologies.

Consequently, the increased frequency of terms found in the literature (automation, ESG, performance, digital finance, financial performance) in Web of Science and Scopus indicates relevant information and perspectives on how the literature converges on questioning the way digital technologies support ESG compliance [

7,

10,

18].

On the other hand, there are increasing suggestions that this fusion is affecting financial practices, decisions, and strategies, as well as concerns for sustainability.

Another central point of the bibliometric research was performing a thematic mapping analysis that took word occurrences into account to capture the main themes and directions in the literature on the connection between finance, automation, and ESG principles.

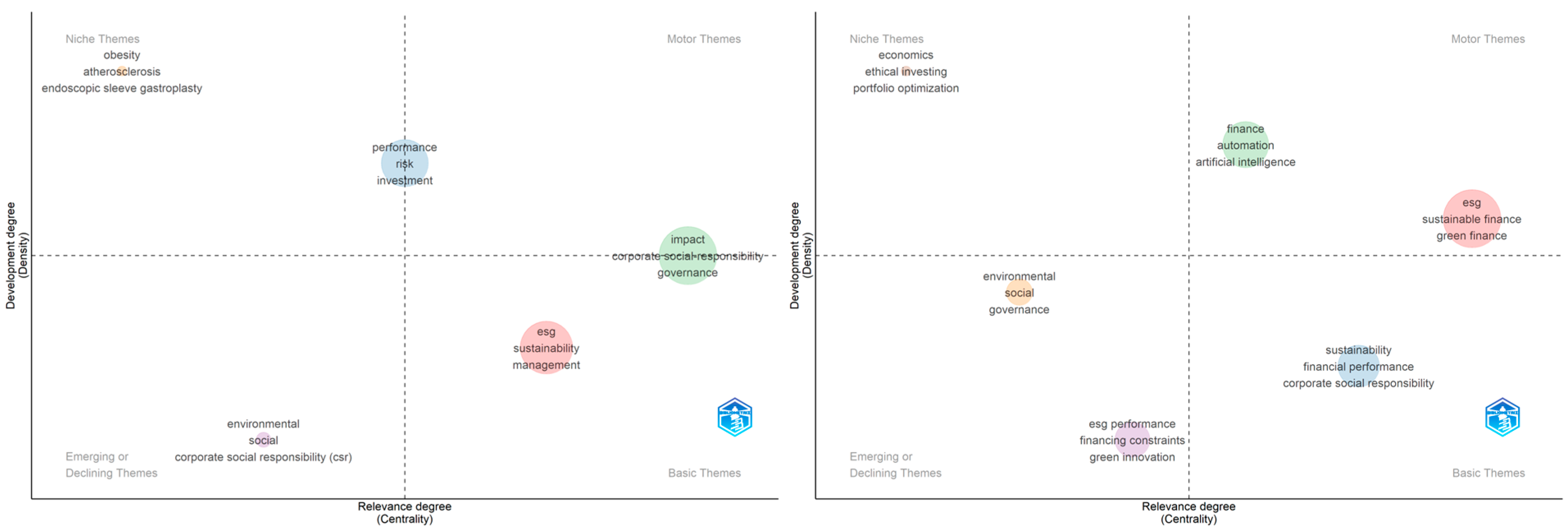

Figure 13 illustrates the results, which allowed the identification of themes classified into four quadrants according to centrality and density.

Density is represented on the vertical axis, while centrality is represented on the horizontal axis. These properties measure the relevance of topics, distinguishing important from unimportant ones. The more relations a node has with others in the thematic network, the higher its centrality and importance, and the more essential its position in the network becomes.

The first quadrant (top right) contains themes that align with the proposed topic. The second quadrant (top left) contains niche themes that are less relevant to the subject under investigation. The third quadrant (bottom left) contains marginal themes. The fourth quadrant (bottom right) contains common themes that can lead to interdisciplinary research and ongoing development of the subject under analysis.

The answer to the second research question formulated in this study, namely: RQ2: What are the main themes, issues, and trends identified in the specialised literature on this topic? allowed us to identify the main research themes, the relationships between the terms used, and the evolution of these themes over time, from predominant, emerging, or marginal, as illustrated visually in

Figure 4,

Figure 5 and

Figure 13.

The results showed the existence of five thematic clusters in the Web of Science and six thematic clusters in Scopus based on themes classified according to the keywords used by authors. Topics such as ESG, sustainability, and management are basic themes in Web of Science and are very relevant to the development of this field of study [

8,

12]. Topics related to financial performance, investment decisions, risk management, and corporate governance are driving themes.

Thematic analysis of Scopus data revealed that themes with high potential for development in the field are closely related to financial performance, ESG objectives, automation, artificial intelligence, and green finance. Other, more specialised themes relate to ethical issues in investment processes, general economic principles, and portfolio optimisation and diversification.

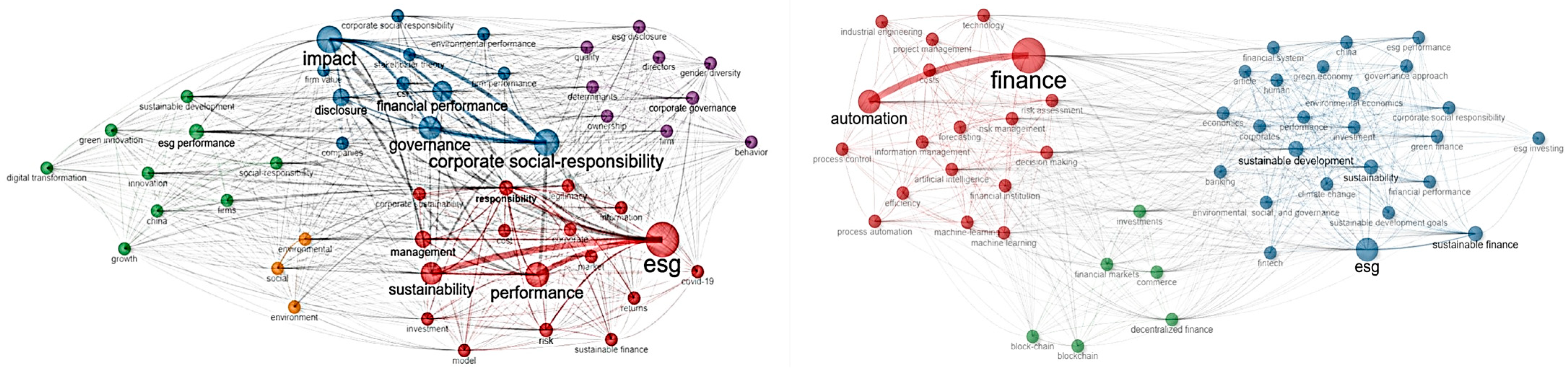

The next part of the bibliometric analysis involved generating a co-occurrence network based on the keywords most frequently used by authors and researchers investigating the associations between automation, financial performance, and ESG objectives.

The analysis was performed in Web of Science and Scopus to illustrate prevalent research themes. The resulting clusters can be viewed in

Figure 14.

The Web of Science Core Collection results showed five clusters. The most visible and relevant cluster deals with topics related to the dependence of financial and economic performance on the achievement of ESG objectives.

The most predominant words and links in this cluster are: “ESG-sustainability,” “ESG-risk,” and “ESG-sustainable finance.”

Within this cluster, we also noted the interaction between ESG objectives and the pandemic, highlighting the implementation of innovative economic and financial measures to ensure business resilience in the face of this crisis.

Furthermore, researchers are increasingly investigating the interactions between “corporate social responsibility” and “performance analysis,” which are included in the blue cluster [

10,

22].

Another identified cluster is the green one, which illustrates the impact of digitization and automation on achieving ESG objectives effectively. The most frequently used keywords are: “sustainable development,” “green innovation,” “digital transformation,” and “growth.”

Lastly, the purple cluster integrates more specific, niche topics on how corporate governance practices influence practitioners’ behaviour in the economic and financial fields. Keywords in this cluster include “ownership,” “quality,” “behaviour,” and “ESG disclosure.”

From a comparative perspective, three clusters were found at the Scopus level based on the frequency of the most frequently used keywords in indexed publications.

The red cluster integrates finance and automation, generating positive effects in terms of performance and development. This cluster highlights the influence of innovation, automation, and technology on financial performance, the most frequently used terms in this spectrum of interest: “artificial intelligence,” “efficiency,” “decision-making,” “machine learning,” and “process control.”

The green cluster examines topics related to decentralised finance, international financial markets, and global supply chains.

The blue cluster identifies research developments concerning ESG objectives, sustainability, climate change, corporate performance, economic systems, investing, and fintech.

This analysis ultimately revealed a significant link between the clusters obtained based on the most frequently used keywords. This finding suggests that automation is a central and fundamental pillar of the modern financial system’s sustainability.

Cluster analysis of the most frequently used keywords in scientific publications reveals specific associations and themes between the field of digital finance, the field of automation processes, and the field of sustainability criteria.

These findings reflect a thematic focus on the transformation of financial and data systems through emerging technologies. It underscores the interaction of advanced technologies with finance and sustainability, demonstrating a push toward building smarter and more resilient economic systems [

3,

5,

11].

4.6. Collaboration Networks of Major Global Countries and Academic Institutions

On another note,

Figure 15 shows a network map highlighting the main research collaborations and partnerships between countries and regions regarding the theoretical interdependence and intersection between “finance,” “automation,” and “ESG.”

The analysis, which covers scientific collaborations from 1974 to 2026, details the most prolific collaborations between countries using a global approach.

According to results from Web of Science, three clusters were identified: the most significant collaborations were between China and the US, China and the UK, and the US and Canada.

Additionally, several regional collaborations regarding the analysis of the automation-ESG-financial system were identified, which is clearly reflected in the collaborations within the three clusters.

For instance, collaborations between European countries are highlighted by the blue cluster (France, Italy, Greece, Austria, and Switzerland), and collaborations between East and West Asian countries (India, Saudi Arabia, Pakistan, and Jordan) are specific to the red cluster.

Another interesting finding is that countries collaborate not only regionally, but also globally within each cluster (e.g., Italy–Japan, Norway–USA, and Spain–Brazil). This results in new directions, issues, and economic and financial aspects of the topic under discussion that are increasingly relevant and appropriate.

Results based on Scopus data are similar and underscore these countries’ intensified efforts to analyse, study, and research the impact of automation on financial efficiency and achieving ESG objectives.

Specifically, China collaborates most frequently with the United States, Australia, Singapore, Turkey, Indonesia, and Romania. Other notable collaborations are between the US and India and between the US and the UK. Based on Scopus data, four clusters emerged.

Collaborations between certain countries are quite specific and concentrated. For example, collaborations are only carried out between Portugal and the Netherlands, and between the countries included in the purple cluster. These countries are in Central and Eastern Europe: the Czech Republic, Hungary, Poland, Slovakia, and Ukraine.

The field is expanding with diverse contributions, but it remains concentrated in a few high-impact regions [

49,

51]. The identification of lasting themes, such as governance models, ESG integration, and inclusivity, provides a theoretical foundation for future research that goes beyond short-term technological or regulatory changes.

These findings are also confirmed by the rapid development of institutions, universities, and research centers at regional and international levels [

54,

55,

56].

The Web of Science analysis yielded four clusters, while the Scopus analysis yielded eight. One difference is that some of these partnerships are formed in isolation and become exclusive. Most of these collaborations are between universities in the same country or region.

For example, there are collaborations between universities in India, China, Japan, Romania, the Netherlands, and Canada. Additionally, there has been a trend toward collaborations with at least regional impact between these research institutions (e.g., Excelia Business School and Bucharest University of Economic Studies; University of Oxford and Goethe University Frankfurt; and University of Padua and National University of Singapore), as revealed by Web of Science and Scopus analyses.

Figure 16 showcases the network map and clusters between the institutions.

Keyword cluster analysis, word cloud formation, and visualisation of collaborations between regions and institutions (

Figure 11,

Figure 12,

Figure 13,

Figure 14,

Figure 15 and

Figure 16) provide a theoretical understanding of the interconnections between digital finance, automation processes, and Environmental, Social, and Governance (ESG) objectives.

This understanding informs the formulation of implications in line with research question RQ4: What information and practical implications can be obtained from analysing clusters based on the most frequently used keywords and collaborations between authors, institutions, and regions?

5. Discussion

5.1. Synthesis of Bibliometric Findings

The main purpose of the bibliometric analysis in this study was to investigate the theoretical connections between the financial system, the automation process, and Environmental, Social, and Governance (ESG) objectives in studies published and indexed in Web of Science and Scopus.

The study aimed to provide a systematic and adequate analysis of this topic, which is currently of great interest to researchers and authors. Thus, the bibliometric analysis focused on interpreting and discussing the results in a comparative manner.

It considered specific analyses of publication volume, main authors, preferred academic sources, and the most important countries. It also performed analyses on central and emerging themes and conducted word cloud and cluster mapping according to collaboration between countries, academic institutions, and keyword occurrences.

Over the past 20 years, research relating finance, automation, and ESG has clearly increased, according to the temporal history of publications.

Prior to 2010, early works on corporate social responsibility (CSR) and the moral implications of finance were scattered and mostly conceptual. The number of studies increased between 2010 and 2015, in line with international debates about financial technology (FinTech) and sustainable investing. There was a notable increase after 2016 with the emergence of automation technologies (AI, blockchain, and machine learning) in financial services and the concurrent growth of ESG reporting frameworks.

The study revealed that research on this topic has grown rapidly since 2019. This growth can be attributed to the need to use modern technologies to improve financial results, representing an immediate response from the entire academic community.

The high number of publications—over 15,000 in Web of Science and 1414 in Scopus—is extremely favourable, indicating that authors are becoming increasingly concerned with and productive in analysing this topic.

Another finding of the bibliometric analysis is the significant global collaboration between authors, institutions, and countries. After that, the period 2020–2025 marks the most intense growth, driven by post-pandemic digitization, regulatory pressures for ESG disclosure, and the global focus on sustainable development.

Though Scopus shows a wider and faster increase since it includes transdisciplinary and technology publications, both databases show comparable trends. On the other hand, WOS shows consistent growth, mostly in the domains of business, management, and economics.

The analysis of the intersection of automation on achieving ESG objectives and improving companies’ financial performance suggests the effort of researchers to contribute to the development of this part of the literature [

57,

58,

59].

This result is supported by the positive effects of globalisation and economic interdependence. Conversely, the findings obtained using clustering and keyword mapping techniques are supported by a study conducted by [

60].

Specifically, the most frequently used keywords were related to the broad field of sustainable finance. Innovations based on AI and machine learning are essential for achieving economic and financial performance and implicitly improving ESG. While both databases converge on core topics such as sustainability, ESG performance, corporate social responsibility, and innovation, they diverge in their disciplinary emphasis.

Table 2 provides a comparative overview of key findings derived from Web of Science and Scopus.

The WOS dataset highlights the ethical and governance foundations of sustainable finance, underscoring issues of accountability, diversity, and performance measurement.

In contrast, the Scopus dataset reflects the technological and operational transformation of financial systems, integrating automation, artificial intelligence, and data analytics with ESG frameworks.

Despite these differences, both analyses converge on the idea that the future of finance is characterised by the integration of sustainability principles and digital automation. ESG criteria are no longer peripheral but are becoming embedded in automated financial decision-making systems, thereby reshaping investment behaviour, corporate governance, and regulatory expectations.

Lastly, the bibliometric analysis revealed a theoretical connection between automation and ESG, highlighting opportunities for social performance, improved corporate governance transparency, and resource optimisation.

Organisations must use artificial intelligence-based IT support systems to achieve innovation, efficiency, and effectiveness goals, rather than viewing them as an option for their operations. Ensuring sustainability, security, compatibility, compliance, and adherence to legal regulations is contingent on implementing a consistent automation framework for infrastructure, data, IT assets, and life cycle management [

61,

62,

63].

These key findings focus on the growing use of automation processes and machine learning technologies. These technologies are necessary tools that enhance efficiency through process automation and predictive maintenance [

64,

65,

66,

67].

Conversely, companies and firms must increasingly introduce automation processes, as they have the potential to improve economic and environmental performance—a critical synergy for ESG integration [

65,

66].

Automating financial processes leads to better company results and aims to optimise company-wide decisions regarding financing, investments, and risk management, thus achieving a higher ESG score.

The sustainable development of the company is currently based on three fundamental aspects: making the most efficient financial decisions, integrating automation and intelligent financial processes, and being highly involved in environmental and social issues while being transparent about the application and use of corporate governance principles.

5.2. Interprepation of Results

Following the bibliometric analysis, this study provides an interdisciplinary approach to the scientific fields found in the literature and their trends.

Thus, from a comparative point of view, it was possible to identify the theoretical interface between the economic-financial field, the field of computer science, and this new and rapidly expanding field of analysis and investigation of ESG criteria performance.

Specifically, the results based on bibliometric analysis may suggest to researchers the need to evaluate ESG performance in improving financial results through the mediating role of automation.

In this regard, a recent study by Zhou and Kong [

68] demonstrates the considerable role of ESG objectives in accelerating processes based on automation, innovation, and artificial intelligence. This was demonstrated by a quantitative analysis using panel data for A-type companies listed on the Chinese stock exchange between 2013 and 2022.

In addition, the same study [

68] positively validates how the adoption of appropriate automation mechanisms and the application of ESG efficiency measurement strategies rapidly lead to a reduction in financing constraints.

The bibliometric analysis in this study not only exposes theoretical trends regarding the connections between finance, automation, and ESG principles but also identifies specific issues to investigate in this new area of finance. Here, the integration of automation can generate positive aspects from the financial and economic ecosystem’s point of view, as well as challenges regarding compliance with ESG objectives. This information is presented in study [

69].

Using advanced techniques such as quantile regressions, the study shows that operational disruptions and investment risks will occur if there is uncertainty about compliance with ESG objectives. Additionally, the automation process will be susceptible to ethical issues despite considerable improvements in economic and financial results. These empirical findings were observed in US industries between 2018 and 2024.

Companies are also increasingly eager to comply with ESG requirements as they inevitably transition to sustainable development. Consequently, more strategic business decisions involve the appropriate incorporation of ESG principles.

Consequently, companies that integrate ESG objectives and adopt advanced IT processes, including automation, will be more resilient in the face of uncertainties and vulnerabilities in financial markets [

70,

71].

Another aspect highlighted by the bibliometric analysis is the role of automation as the main technology that will support the future of digital finance. This theoretical finding is also supported by the results of the study by [

72].

After conducting a systematic review of the literature on the topic, the authors confirmed the growing importance of incorporating advanced IT processes based on automation and artificial intelligence in sustainable finance. This approach also sends positive signals regarding investment decisions and measuring ESG non-financial performance.

Another relevant finding focuses on the ethical issues raised by using these technologies for financing and investment strategies in a business environment.

Research conducted by [

73] comparatively identified the most important areas in the literature evaluating the intersection between environmental, social, and governance (ESG) criteria and the application of digital processes involving artificial intelligence in the financial sphere.

Artificial intelligence is commonly employed in financial risk management strategies, investment portfolio optimisation, trading activities, and capital market forecasting.

This research [

73] shows that this holistic approach can positively impact the development and launch of new profitable financial products that ensure the achievement of sustainability objectives.

5.3. Implications

The following paragraphs in the discussion section describe the implications of the bibliometric analysis of the theoretical connections between digital finance, automation, and ESG objectives. The first implication is theoretical in nature.

Specifically, this study can generate a better understanding of how digital finance interacts with sustainability measurement through ESG criteria and accelerated automation processes.

Another implication, also from the theoretical perspective, is that this study permitted an integrated, comparative approach to the three theoretical dimensions of digital finance, automation, and ESG criteria. These dimensions were not treated in isolation or in a fragmented manner.

Theoretical evidence was gathered from two databases: Web of Science and Scopus. These databases revealed differences and distinctions in thematic coverage, scientific productivity over time, and resulting cluster analyses.

Topics of accelerated interest to researchers, identified as driving themes, include green finance, sustainable finance, governance, and ESG performance and integration. Additionally, the theoretical foundations extracted from the bibliometric analysis have significant practical implications.

Thus, companies can consolidate their financial strategies by integrating ESG criteria or digital finance technologies into their sustainability plans. Companies that use these technologies can gain a competitive advantage by attracting new investors, improving transparency regarding compliance with ESG objectives, and increasing their value in the medium and long term.

Lastly, the bibliometric analysis highlights the need for uniform ESG regulatory standards and supervision of the use of automation and other technologies in finance.

The results of the bibliometric analysis therefore support the need for continuous digitization of financial systems, periodic evaluation of ESG criteria through automated data analytics, and strengthening of the theoretical framework explaining the interdependencies between automation, finance, and sustainability.