This section presents the empirical findings regarding the adoption of artificial intelligence (AI) in micro and small enterprises (MSEs) in Ecuador. The analysis focuses on three key contextual dimensions: firm size, geographic region, and economic sector. By examining variations in adoption levels—categorized as non-adoption, partial adoption, and intensive adoption—this section aims to identify distinct behavioral patterns and characterize the degree of technological integration across different business profiles. The results offer insight into both the extent and distribution of AI implementation, providing a foundation for understanding the strategic positioning of MSEs in the digital transformation process.

4.6. Analysis of Diversity in AI Adoption Across the Value Chain

The researchers calculated Shannon’s entropy for each of the nine value chain activities to assess the variability of AI adoption across business functions. This metric captures the degree of dispersion across three adoption levels (non, partial, intensive), with higher values indicating greater diversity and lower predictability in usage patterns (

Table 12).

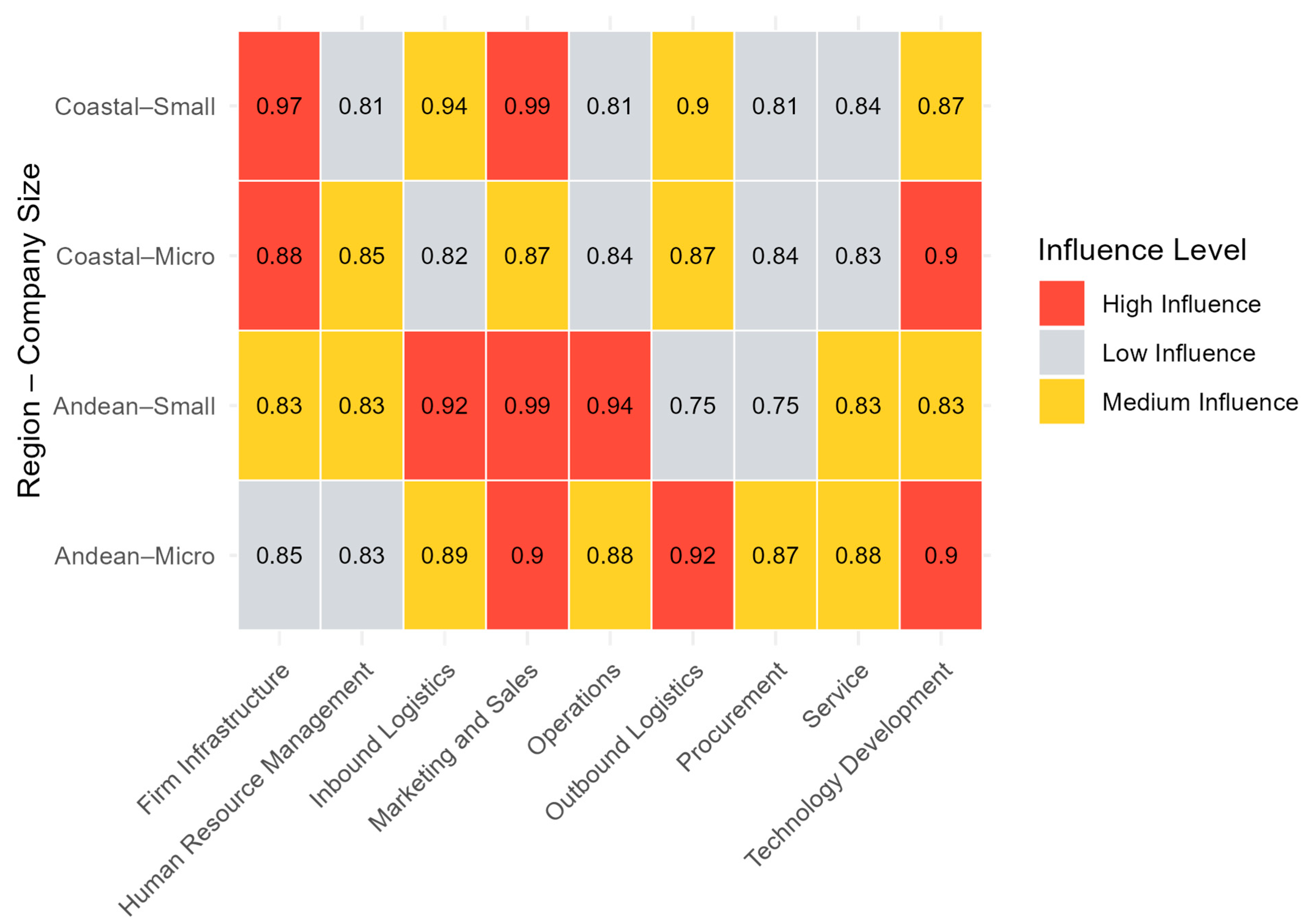

The classifications presented in

Table 13,

Table 14 and

Table 15 derive directly from the thresholds established in

Section 3.7. Using the Jenks natural breaks optimization, three interpretive ranges were defined: H > 0.85 = high functional diversity (“Technological Explorer”/“Innovative” profile), 0.80 ≤ H ≤ 0.85 = moderate diversity (“Incipient Adopter”), and H < 0.80 = low diversity (“Functionally Concentrated”). These thresholds were then applied to classify firms, regions, and sectors based on their average entropy values.

The highest entropy values correspond to Marketing, HR, and Outbound Logistics, reflecting a more exploratory or trial-and-error stage of adoption, often associated with innovations such as chatbots, analytics for segmentation, or personnel selection algorithms. In contrast, Technology Development, Firm Infrastructure, and Service show more homogeneous behaviors, possibly due to financial and technical constraints or limited awareness of strategic value in these areas.

Qualitatively, entropy values above 0.85—such as those observed in Marketing (H = 0.907) and Human Resources (H = 0.896)—can be interpreted as indicating high diversity, reflecting dispersed or exploratory adoption, where firms are experimenting with various AI tools. Values in the 0.80–0.85 range, such as Firm Infrastructure (H = 0.851), indicate moderate diversity, suggesting a mix of adoption but with somewhat more concentration. In contrast, values below 0.80 would signal low diversity, where adoption is relatively uniform—either because most firms are not adopting at all, or because adoption is consolidated in intensive use. This reinforces the need to interpret entropy in conjunction with mean adoption scores to distinguish between incipient non-use and strategic consolidation.

These variations highlight that AI integration is uneven across functions. Adoption tends to be broader and more diverse in externally facing or customer-centered activities, while internally focused functions exhibit more cautious or standardized approaches. Although entropy values do not reach the theoretical maximum (~1.585), they offer analytically meaningful insights into the functional heterogeneity of digital transformation.

To complement this analysis,

Table 13 presents the most frequently reported AI applications by activity, evidencing how firms operationalize AI in practice.

These findings underscore AI’s dual role as both an operational enabler and a strategic asset. The functional diversity in adoption not only reflects the state of technological integration but also reveals the sectoral priorities, organizational constraints, and internal capabilities that shape the digital transformation of MSEs.

4.6.4. Shannon Entropy by Region, Firm Size, and Economic Sector

Table 17 shows the average Shannon entropy of AI adoption across nine value chain activities, segmented simultaneously by region, firm size, and economic sector. It also identifies the most influential activity in each subgroup.

The combined segmentation reveals that microenterprises in the Andean region exhibit high entropy in sectors such as agriculture (0.8885), services (0.8787), and trade (0.8711), with outbound logistics as a recurring driver of variability, likely due to geographical and infrastructural challenges. Conversely, small enterprises in the same region show more restricted adoption, especially in agriculture (0.4081), with inbound logistics and operations emerging as key functional areas of variation.

In the Coastal region, microenterprises in agriculture (0.9192), manufacturing (0.8588), and services (0.8489) report high functional dispersion, linked to broader experimentation across both core and support activities. For small enterprises, entropy remains high in manufacturing (0.8269), trade (0.8595), and services (0.8461), with strategic activities such as post-sales service, marketing, and infrastructure being key drivers of adoption.

These findings underscore that AI adoption is function-specific, shaped by the interaction between regional conditions, firm size, and sectoral dynamics. The identification of high-entropy activities signals where experimentation is most active and where support policies could have the most significant impact.

Ultimately, this analysis reveals a modular pattern of digital transformation, with firms integrating AI in a fragmented manner across various business functions. Rather than reflecting linear or uniform progress, AI adoption in MSEs appears as a hybrid ecosystem, where traditional operations coexist with exploratory digital initiatives.

It is essential to clarify that, although the results presented in

Table 14,

Table 15,

Table 16 and

Table 17 show high entropy values across all groups, the analytical framework is designed to prevent misinterpretation in cases of low entropy. Low entropy values indicate low functional diversity in AI adoption, but they do not indicate whether adoption levels are low or high. A low

H could reflect either widespread non-adoption or widespread intensive adoption. Therefore, in any analysis involving low-entropy groups, interpretation is systematically complemented by the mean adoption level across activities to distinguish between functionally restricted and strategically consolidated adoption patterns. For example, in the Coastal region, microenterprises in the ‘Agriculture, Forestry, Livestock, and Fishing’ sector show the highest entropy (H = 0.9192), indicating a highly dispersed pattern of AI adoption across value chain activities. This suggests a phase of exploratory adoption, where AI is being tested in multiple functions, albeit not necessarily deeply or intensively. In contrast, small enterprises in the ‘Trade’ sector exhibit high entropy (H = 0.8595) and are more likely to report intensive adoption in key areas such as marketing and customer service. This contrast underscores the importance of interpreting entropy in conjunction with adoption intensity metrics to distinguish between broad but shallow experimentation and functionally diverse, advanced integration.

4.10. Integrated Reflection: Strategic Perception and Functional Reality

The contrast between individual perceptions and actual adoption configurations offers a deeper understanding of AI integration processes among micro and small enterprises (MSEs). While most firms perceive their AI use as strategic—particularly in services, trade, and manufacturing—the analysis of functional combinations reveals a significant misalignment. Many organizations that claim to pursue differentiation adopt fragmented or isolated practices, which do not translate into a systemic competitive advantage.

This misalignment is often interpreted as a capability gap—reflecting limited managerial, technical, or organizational resources to implement coherent AI strategies. While such constraints are clearly present, particularly among microenterprises, it is also plausible that some firms exhibit strategic selectivity rather than strategic overestimation. That is, entrepreneurs may deliberately prioritize high-impact, low-complexity functions (e.g., marketing, sales, and service) as part of a rational, resource-aware digitalization strategy. Indeed, these functions are present in all high-scoring configurations (

Table 22), suggesting that they are not only accessible but also perceived as strategically valuable. However, the key insight from the data is that even when selectivity is intentional, it rarely evolves into integrated, cross-functional configurations capable of generating sustained advantage. Thus, while strategic selectivity may explain which functions are adopted, it does not fully account for the persistent gap between perceived strategic impact and the systemic coherence required for actual competitive differentiation. The challenge lies not in the act of selection itself, but in the failure to build dynamic, interconnected capabilities from those challenges.

From a hypothesis-testing perspective, these results indicate that H2a and H2b are not supported: broader functional diversity in AI adoption (entropy) does not correlate significantly with higher perceived strategic value or with stronger dynamic capabilities. Rather than a null finding, this outcome has theoretical relevance. It challenges the widespread assumption—rooted in technology adoption literature—that expanding adoption across multiple functions necessarily translates into strategic differentiation or capability development. Instead, the evidence suggests that strategic value and adaptability emerge from qualitative factors such as the coherence of functional combinations, alignment with business goals, and the firm’s ability to integrate and scale AI-driven practices. This insight refines the Resource-Based View (RBV) and dynamic capabilities perspective by underscoring that what matters is not the breadth of adoption per se, but the extent to which firms can reconfigure and orchestrate resources to build defensible, long-term advantages.

This asymmetry points to a persistent gap between strategic intention and organizational reality, driven by several factors:

- •

Technical limitations in integrating AI across value chain functions.

- •

Limited capabilities to scale beyond pilot implementations.

- •

Overestimation of the strategic value of narrow or symbolic applications.

Microenterprises are particularly susceptible to this misalignment, exhibiting greater disparity between perception and practice. In contrast, small enterprises exhibit higher convergence, suggesting more deliberate implementation. Similarly, sectors with higher adoption volumes—such as services and trade—also show the widest perceptual gaps, signaling the need for targeted support to consolidate their technological trajectories.

These findings highlight that AI adoption in MSEs is not inherently strategic; it only becomes so when configurations are coherent, integrated, and scalable. Thus, public policies should not only promote adoption but also focus on strengthening the technical and organizational conditions that allow AI to function as a trustworthy source of competitive transformation.

This integrated analysis sets the stage for the next section, which examines the specific combinations of AI-enabled functions that firms themselves associate with strategic value. Going beyond the quantity of adopted functions, this approach emphasizes which activities—and in what combinations—generate genuine synergies, contributing to the construction of sustainable advantages.

Table 23 presents the functional combinations of AI adoption that firms rated as having the highest strategic value—defined by perceived uniqueness, inimitability, and alignment—considering only adopted activities (partial or intensive). All combinations reach an average strategic rating of at least 3.0, reflecting a clear recognition of value in specific adoption patterns.

Several conclusions emerge:

- 1.

Strategic value derives from cross-functional integration.

The most highly rated combinations include three or more value chain activities, especially core functions like operations, marketing, sales, and services, often complemented by infrastructure or HR. This suggests that strategic differentiation emerges not from isolated implementations but from synergies across interconnected functions.

- 2.

Marketing, sales, and services are central to strategic configurations.

Marketing and sales are present in every top-rated combination, often with intensive adoption, highlighting their role in generating competitive advantage. Service also appears in all cases, underscoring the strategic importance of customer experience and post-sale engagement.

- 3.

Partial adoption can still generate strategic impact.

Many combinations involve mixed levels of adoption, showing that strategic configurations do not require complete digitalization. For MSEs, this is encouraging: coherent integration across select functions can yield meaningful value, even under resource constraints.

- 4.

High-impact configurations are rare but replicable.

Although only a small number of firms currently adopt these configurations, the recurrence of specific structures indicates the potential for replication. These patterns can serve as references for firms aiming to align digital adoption with strategic outcomes.

In short, strategic value in AI adoption does not stem solely from intensity, but from the functional articulation of its benefits. The most effective configurations combine customer-facing innovation with operational optimization and organizational support. This insight reinforces that the shift from perception to actual competitive advantage depends less on the number of digitalized functions and more on their interconnection, coherence, and alignment with business goals.

To assess whether greater functional diversity in AI adoption is associated with higher perceived strategic value, Spearman correlation coefficients were calculated by region and firm size. The results, summarized in

Table 24 and

Table 25, indicate that the correlation values are close to zero and statistically non-significant in all cases (

p > 0.05).

At the regional level, the Coast and Highlands exhibit similar levels of functional diversity (mean entropy 0.8553 and 0.8422, respectively) and comparable strategic scores. However, the Spearman coefficients (ρ = 0.0194 and –0.0326) indicate no systematic relationship between the extent of AI integration across functions and the enterprises’ perceived strategic value.

Similarly, no significant correlation emerges when the data are disaggregated by firm size. Although small enterprises report a higher average strategic score (3.13 vs. 2.97), the correlation with entropy remains negligible (ρ = –0.0189). Among microenterprises, the association is virtually null (ρ = –0.0010).

These findings suggest that greater diversity in AI adoption across the value chain does not, by itself, guarantee a higher strategic impact, at least from the perspective of the firms surveyed. Strategic value appears to depend less on the breadth of functional coverage and more on which specific combinations are adopted and how coherently they are aligned with business goals.

This finding directly challenges a prevalent assumption in digital transformation literature—that wider technological adoption across functions is a proxy for organizational maturity and strategic advantage. While intuitive, our results show that functional diversity, as measured by entropy, does not correlate significantly with perceived strategic value (ρ ≈ 0,

p > 0.05 across all segments) or with the development of dynamic capabilities. This suggests that broader adoption is not synonymous with more profound transformation. Instead, the data indicate that strategic impact emerges from qualitative factors, including the coherence of functional combinations, alignment with business objectives, and the firm’s ability to integrate and scale AI-driven practices. For instance,

Table 23 reveals that high-impact configurations are not the most diverse, but rather those that link customer-facing innovation (e.g., marketing, sales, service) with operational optimization (e.g., operations, infrastructure). These synergistic patterns, even when limited in scope, generate perceived strategic value because they are functionally articulated and operationally viable. In contrast, dispersed adoption across many functions, potentially reflecting experimentation or uncoordinated initiatives, does not automatically translate into competitive differentiation. This distinction is critical: digital maturity may be less about how many functions use AI, and more about how well they work together. The lack of significant correlation, therefore, is not a null result, but a substantive insight, one that redirects attention from adoption breadth to organizational integration as the actual driver of strategic advantage.

Similarly to the regional and firm-size analyses, the sector-level results do not show statistically significant correlations between functional diversity in AI adoption, measured via Shannon entropy, and enterprises’ perceived strategic value. As detailed in

Table 26, all Spearman coefficients are low and non-significant (

p > 0.05). Even in the case of the Mining and Quarrying sector (ρ = –0.3145), where the correlation is moderately negative, the small sample size (n = 17) and high

p-value (

p = 0.219) preclude drawing firm conclusions.

Taken together, these results do not support the hypothesis that broader or more functionally diverse AI adoption is associated with higher strategic value. Across all segmentation levels—region, firm size, and economic sector—correlation values are low and statistically insignificant.

This outcome suggests that the perceived strategic value of AI is not determined solely by the number of functions digitized or the breadth of technology deployment. Instead, other qualitative and organizational dimensions may play a more decisive role. These may include:

- •

The degree of alignment between AI use and business objectives;

- •

The firm’s capability to integrate and scale AI solutions across the organization;

- •

The depth of internal adoption and knowledge absorption;

- •

Firms’ interpretive frameworks, which may not associate multi-function digitization with strategic differentiation.

From a theoretical standpoint, these findings align with the concept of dynamic capabilities, which is defined as an organization’s ability to integrate, build, and reconfigure internal and external competencies in response to rapidly changing environments. In the context of AI adoption, these capabilities are not limited to deploying digital tools across more activities but require organizational learning, structural adaptation, and knowledge orchestration.

The evidence gathered in this study suggests that such dynamic capabilities are still in their early stages among Ecuadorian MSEs. While many firms demonstrate an aspirational orientation toward AI as a strategic lever, the actual configuration of adoption remains fragmented, and the capacity to extract cumulative strategic value from functionally diverse AI use is still developing.

In summary, functional diversity alone is not a sufficient condition for achieving differentiation. What matters more is how firms combine, align, and integrate AI adoption within coherent strategic and organizational architectures. This insight will inform the following section on capability development and policy implications.

Table 27 synthesizes the main findings on the development of dynamic capabilities among micro and small enterprises (MSEs) in the context of AI adoption. The results reflect a mixed scenario, marked by operational transformations on the one hand and persistent organizational rigidities on the other.

A first relevant signal is that AI is producing tangible operational change: 58.5% of firms report a “moderate” to “very high” transformation in their operations. This suggests that technological adoption is not merely symbolic but is altering production and service dynamics—a prerequisite for building adaptive capabilities.

However, these changes do not yet translate into systemic flexibility. Only one-third of firms consider AI expansion or cross-functional integration to be “simple” or “easy.” This indicates that while transformations are occurring, they are often isolated or hard to scale, typical of organizations still developing the internal coordination mechanisms that underpin dynamic capabilities.

The speed of organizational response to AI adoption also reflects an intermediate stage. Just 25.2% of firms report rapid adjustment, while most describe a “normal” pace (43.5%) or even a “slow” pace (31.3%). A similar pattern emerges in future preparedness: although 56.5% feel “moderately prepared,” only 18.4% express high confidence in their adaptive capacity. This suggests that firms are aware of the need for transformation but remain cautious about their ability to execute it effectively.

More critical, however, are the deficits in organizational learning and knowledge management. Only 21.5% of MSEs consistently document learning from AI use, while nearly 80% admit to doing so only occasionally or not at all. Furthermore, just 25.4% affirm that knowledge flows adequately within the organization, suggesting that expertise remains compartmentalized and under-leveraged. The picture is similar regarding tolerance for error—a key ingredient for innovation and experimentation, with only 21.1% affirming that their firm accepts mistakes as part of the learning process.

Taken together, these findings suggest that AI adoption is triggering change, but not yet driving deep, sustained organizational renewal. The current trajectory suggests the incipient development of dynamic capabilities, which is constrained by the limited institutionalization of knowledge, low integration across functions, and cultures that still prioritize control over experimentation.

In short, MSEs are beginning to transform operationally but lack the structural conditions to consolidate adaptive, learning-oriented organizations. Closing this gap will require not only further technological adoption but also the development of management systems, knowledge architectures, and cultural norms that enable continuous innovation and strategic agility.

To examine whether greater functional diversity in AI use (measured by Shannon entropy) is linked to the development of dynamic capabilities, Spearman correlation coefficients were calculated by region and firm size.

At the regional level (

Table 28), correlations were low and not statistically significant (ρ = 0.0370 for Coast, ρ = 0.0791 for Highlands;

p > 0.05). Similarly, by firm size (

Table 29), no significant associations were found, though a slightly higher coefficient was observed for small enterprises (ρ = 0.1116).

Table 30 presents the correlation between AI adoption entropy and the development of dynamic capabilities across economic sectors. In all cases, the Spearman coefficients are low and statistically non-significant (

p > 0.05), with one industry—construction—showing a slightly negative, yet inconclusive, correlation.

These results confirm that there is no significant association between the diversity of functional AI adoption and the development of dynamic capabilities, at least in the short term. While broader AI use may support transformation, capability development likely depends more on qualitative organizational factors—such as internal coordination, leadership, or learning culture—than on the breadth of adoption alone. Additionally, dynamic capabilities may require more time to mature following initial implementation efforts.