Estimation of LNG Dolphin Capacity: Dolphins of Different Size in Republic of Korea

Abstract

1. Introduction

2. Precedent Studies

3. Material and Methods

3.1. Formula

3.2. Simulation Process

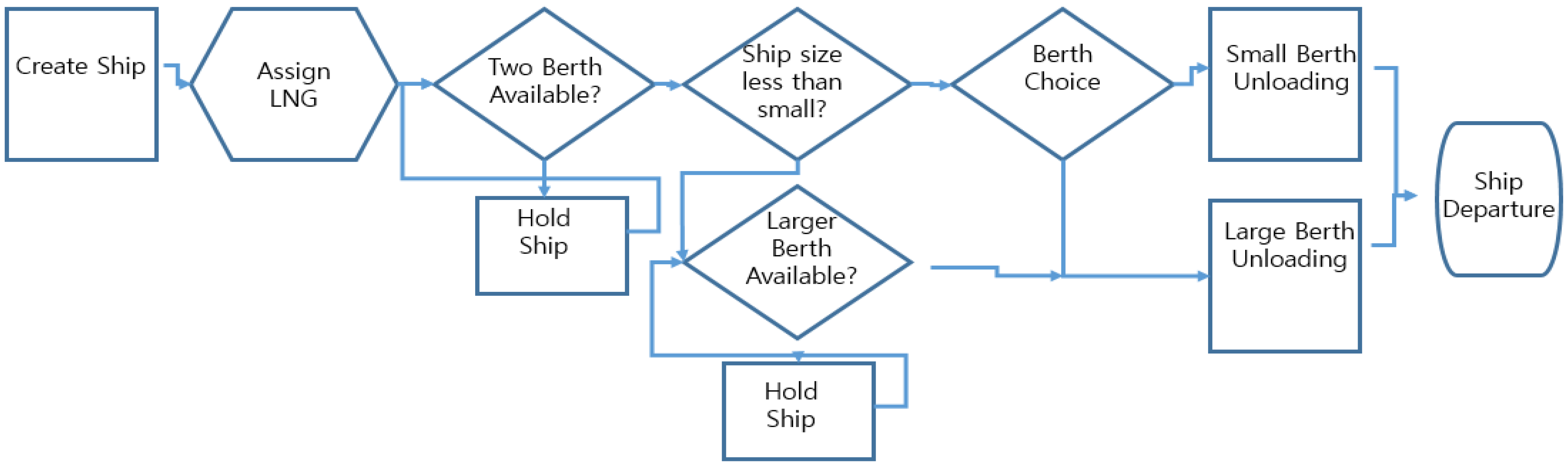

3.3. LNG Terminal Simulation Model

3.4. Input and Output Variables for Simulation

4. Simulation Modeling and Results

4.1. Distribution of Ship Arrival Time Interval

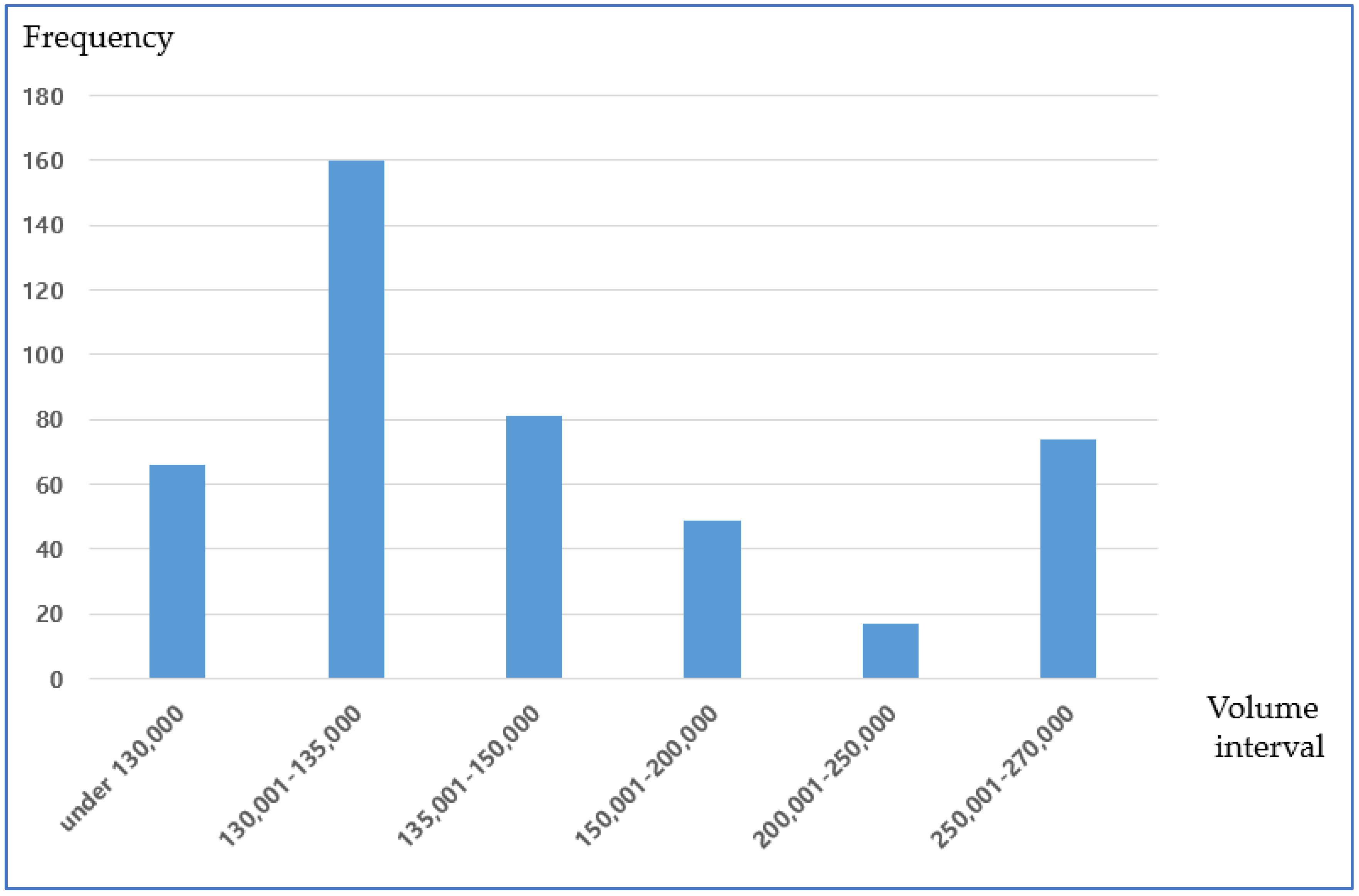

4.2. Distribution of LNG Volume of Calling Ship

4.3. Distribution of Service Time of LNG Ship

- Preparation time for unloading is calculated by subtracting start time of unloading from notice of readiness.

- Unloading work time (full rate time) is calculated by subtracting end time of unloading from start time of unloading

- Preparation time of ship departure is calculated by subtracting departure time of ship from end time of unloading

5. Standard Dolphin Occupancy in Incheon Port

5.1. The Relationship between Dolphin Occupancy and Ship Waiting Rate

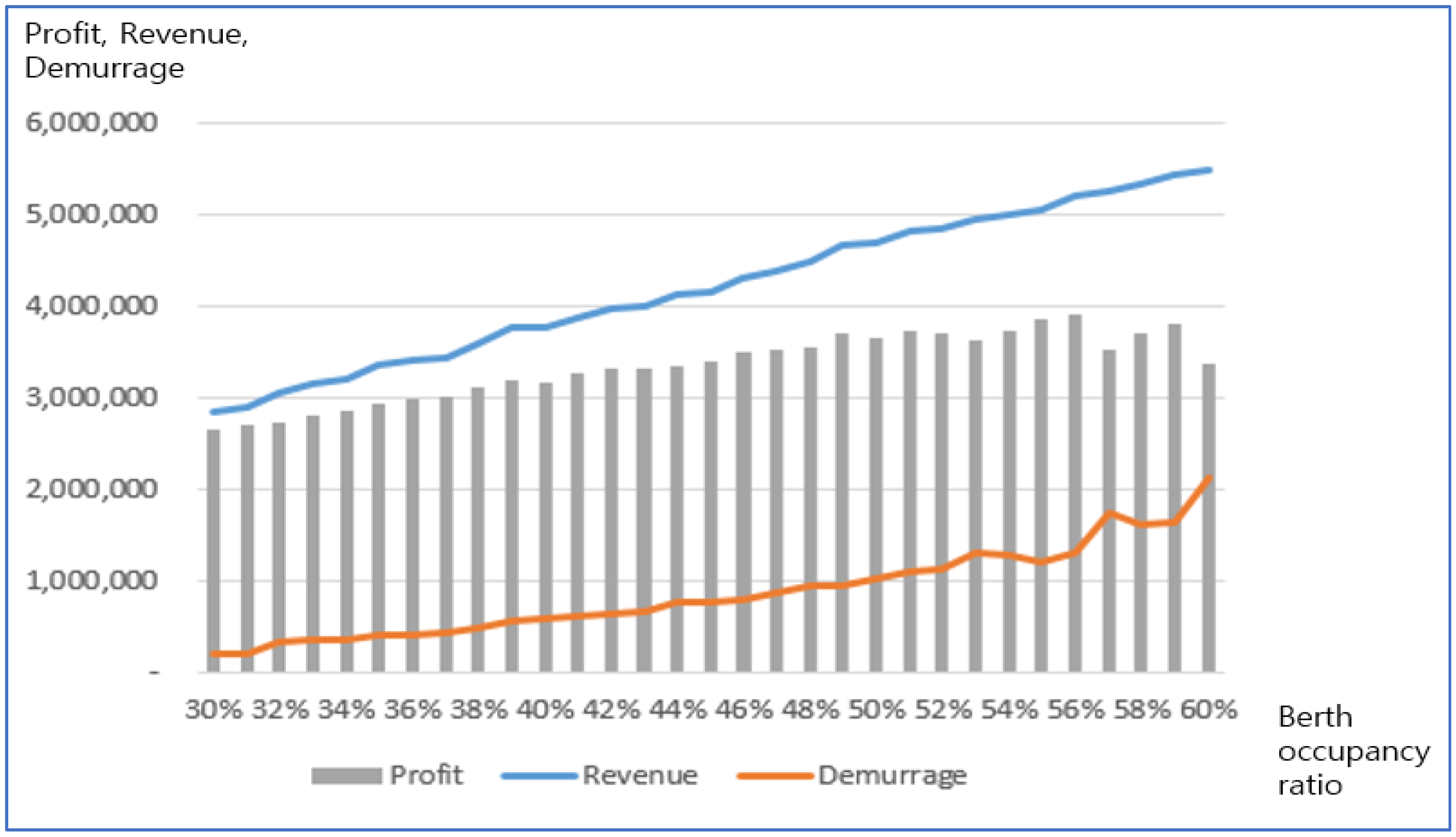

5.2. The Formula for Maximum Profit

5.3. The Sensitivity Analysis for the Maximum Profit Considering Changing Demurrage

5.4. The Dolphin Capacity by the Simulation

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lindstad, E.; Eskeland, G.S.; Rialland, A.; Valland, A. Decarbonizing maritime transport: The importance of engine technology and regulations for LNG to serve as a transition fuel. Sustainability 2020, 12, 8793. [Google Scholar] [CrossRef]

- IMO. Studies on the Feasibility & Use of LNG as a Fuel for Shipping. 2016. Available online: https://greenvoyage2050.imo.org/wp-content/uploads/2021/01/STUDIES-ON-THE-FEASIBILITY-AND-USE-OF-LNG-AS-A-FUEL-FOR-SHIPPING-.pdf (accessed on 11 November 2022).

- Hüffmeier, J.; Johanson, M. State-of-the-Art Methods to Improve Energy Efficiency of Ships. J. Mar. Sci. Eng. 2021, 9, 447. [Google Scholar] [CrossRef]

- Ahad, A.-E.; Eric, C.O.; Yusuf, B.; Tareq, A.-A. A review of cleaner alternative fuels for maritime transportation. Energy Rep. 2021, 7, 1962. [Google Scholar]

- Wan, C.P.; Yan, X.P.; Zhang, D.; Yang, Z.L. A novel policy making aid model for the development of LNG fueled ships. Transp. Res. A Policy Pract. 2019, 119, 29. [Google Scholar] [CrossRef]

- UNCTAD. Port Development: A Handbook for Planners in Developing Countries; UN (United Nations): New York, NY, USA, 1985. [Google Scholar]

- KOGAS. The 13th Long-Term Natural Gas Supply and Demand Plan and the Review of LNG Handling Capacity; KOGAS (Korea Gas Coroporation): Daegu, Republic of Korea, 2018. [Google Scholar]

- Park, S.K.; Park, N.K. A study on the estimation model of the proper cargo handling capacity based on simulation in port-port cargo exclusive pier example. J. Korea Inst. Inf. Commun. Eng. 2013, 17, 2454. [Google Scholar]

- Dundović, Č.; Basch, D.; Dobrota, Đ. Simulation method for evaluation of LNG receiving terminal capacity. Promet-Traffic Transp. 2009, 21, 103. [Google Scholar] [CrossRef]

- Arango, C.; Cortés, P.; Muñuzuri, J.; Onieva, L. Berth allocation planning in Seville inland port by simulation and optimisation. Adv. Eng. Inform. 2011, 25, 452. [Google Scholar] [CrossRef]

- Cimpeanu, R.; Devine, M.T.; O’Brien, C. A simulation model for the management and expansion of extended port terminal operations. Trans. Res. Part E Log. Trans. Rev. 2017, 98, 105. [Google Scholar] [CrossRef]

- Zeng, Q.C.; Yang, Z.Z. Integrating simulation and optimization to schedule loading operations in container terminals. Comp. Oper. Res. 2009, 36, 1935. [Google Scholar] [CrossRef]

- Dragović, B.; Tzannatos, E.; Park, N.K. Simulation modelling in ports and container terminals: Literature overview and analysis by research field, application area and tool. Flex. Serv. Manuf. J. 2017, 29, 4. [Google Scholar] [CrossRef]

- Legato, P.; Mazza, R.M. Berth planning and resources optimisation at a container terminal via discrete event simulation. Eurp. J. Oper. Res. 2001, 133, 537. [Google Scholar] [CrossRef]

- Canonaco, P.; Legato, P.; Mazza, R.M.; Musmanno, R. A queuing network model for the management of berth crane operations. Comp. Oper. Res. 2008, 35, 2432. [Google Scholar] [CrossRef]

- Zhou, C.; Qitong, Z.; Haobin, L. Simulation optimization iteration approach on traffic integrated yard allocation problem in transshipment terminals. Flex. Serv. Manuf. J. 2021, 33, 663. [Google Scholar] [CrossRef]

- Sha, M.; Notteboom, T.; Zhang, T.; Zhou, X.; Qin, T. Simulation model to determine ratios between quay, yard and intra-terminal transfer equipment in an integrated container handling system. J. Int. Log. Trade 2021, 19, 1–8. [Google Scholar] [CrossRef]

- Wang, H. Research on LNG Refueling Station Site Selection Direction; Dalian Maritime University: Dalian, China, 2014. [Google Scholar]

- Wang, L. Research on the Development Forecast of Chongqing Marine LNG Bunkering Terminal Layout Planning. China Water Transp. 2014, 14, 279. [Google Scholar]

- Liu, Z. Research on Market Forecast of waterborne LNG Bunkering Station. Gas Heat 2020, 40, 24. [Google Scholar]

- Yang, Y. Planning Site Selection and Evaluation for Coastal Port LNG Fuel Power Ship Filling Station; Harbin Institute of Technology: Harbin, China, 2016. [Google Scholar]

- Yu, Y.-U.; Ahn, Y.-J.; Kim, J.-K. Determination of the LNG Bunkering Optimization Method for Ports Based on Geometric Aggregation Score Calculation. J. Mar. Sci. Eng. 2021, 9, 1116. [Google Scholar] [CrossRef]

- Park, N.K.; Park, S.K. A Study on the Estimation of Facilities in LNG Bunkering Terminal by Simulation—Busan Port Case. J. Mar. Sci. Eng. 2019, 7, 354. [Google Scholar] [CrossRef]

- Chae, G.-Y.; An, S.-H.; Lee, C.-Y. Demand Forecasting for Liquified Natural Gas Bunkering by Country and Region Using Meta-Analysis and Artificial Intelligence. Sustainability 2021, 13, 9058. [Google Scholar] [CrossRef]

- Vidmar, P.; Perkovič, M.; Gucma, L.; Lazuga, K. Risk assessment of moored and passing ships. Appl. Sci. 2020, 10, 6825. [Google Scholar] [CrossRef]

- Lee, H.; Choi, J.; Jung, I.; Lee, S.; Yoon, S.; Ryu, B.; Kang, H. Effect of parameters on vapor generation in ship-to-ship liquefied natural gas bunkering. Appl. Sci. 2020, 10, 6861. [Google Scholar] [CrossRef]

- Wei, G.; Zhang, J. Numerical study of the filling process of a liquid hydrogen storage tank under different sloshing conditions. Processes 2020, 8, 1020. [Google Scholar] [CrossRef]

- Ministry of Transport. Design Code for LNG Terminals; Ministry of Transportation of P.R.C.: Beijing, China, 2016. [Google Scholar]

- Park, N.K. The Establishment of Standards for Calculating the Scale of Cargo Handling Facilities in LNG Terminal; KOGAS (Korea Gas Coroporation): Daegu, Republic of Korea, 2020. [Google Scholar]

- KOGAS. The Port Information and Terminal Regulations of Incheon LNG Terminal; KOGAS (Korea Gas Coroporation): Daegu, Republic of Korea, 2022. [Google Scholar]

- Park, N.K.; Suh, S. The Analysis of Ship Waiting in Oil Terminal by Simulation: The Case of Gwangyang Port. J. Fish. Mar. Sci. Edu. 2018, 30, 1891. [Google Scholar] [CrossRef]

- Park, N.K. Ship-berth link performance evaluation: Simulation and analytical approaches. Marit. Policy Manag. 2006, 33, 281. [Google Scholar]

- Kia, M.; Shayan, E.; Ghotb, F. Investigation of port capacity under a new approach by computer simulation. Comput. Ind. Eng. 2002, 42, 533. [Google Scholar] [CrossRef]

- Ministry of Oceans and Fisheries. A Standard Construction Criteria for Port; MOF (Ministry of Ocean an Fisheries): Seoul, Republic of Korea, 2005. [Google Scholar]

- Ministry of Oceans and Fisheries. A Study on Recalculation of Proper Port Loading Capacity; MOF (Ministry of Ocean an Fisheries): Sejong, Republic of Korea, 2020. [Google Scholar]

- Park, N.K.; An, Y. Financial Analysis of Automated Container Terminal Capacity from the Perspective of Terminal Operating Company. J. Mar. Sci. Eng. 2020, 8, 954. [Google Scholar] [CrossRef]

- An, Y.; Park, N. Economic Analysis for Investment of Public Sector’s Automated Container Terminal: Korean Case Study. J. Mar. Sci. Eng. 2021, 9, 459. [Google Scholar] [CrossRef]

| Notation | Description | Value in the Case |

|---|---|---|

| Number of operating days per year | 365 days | |

| Number of non-working days per month | 53 | |

| Proper dolphin occupancy in consideration of dolphin cost and dolphin revenue | 50% | |

| Number of day and night hours | 24 h | |

| Time required to unload cargo per ship | Small dolphin 14.1 h. Large dolphin 16.6 h | |

| Time (h) for unloading assistance operations | Small dolphin 10.1 h. Large dolphin 9.8 h | |

| Unloading volume per ship (m3) | Small dolphin 132,632 m3, Large dolphin 167,056 m3 | |

| Number of dolphins | One small dolphin and One large dolphin in the case | |

| Peak factor for winter season | 1.13 | |

| Annual proper capacity | Small dolphin 18,174,000 m3, Large dolphin 20,958,000 m3, Total capacity 39.0 million m3 |

| Variable | Description | Unit |

|---|---|---|

| Simulation Period: Working Days | Working days per year (=365 days-non-working days) | days |

| Ship Arrive | Ship arrival time interval | Probability distribution |

| TPC Ratio | Probability of generating cargo volume | Ratio |

| TPC | Unloading volume by ship size (classified into 6 groups from 130 K to 260 K) | Probability distribution |

| Dolphin Service Time | Unloading work time + Unloading auxiliary time | Probability distribution |

| Standard—Dolphin Occupancy | Proper dolphin occupancy for calculating capacity | Ratio |

| Variable | Description | Unit |

|---|---|---|

| Ship Waiting Ratio | Ratio | |

| Dolphin Occupancy | Ratio | |

| Dolphin Throughput | Annual dolphin throughput | m3 |

| Dolphin Calling Ships | Number of calling ship per dolphin | - |

| Dolphin Capacity | Annual unloading capacity per dolphin | m3 |

| LNG Volume (m3) | Ratio | Probability Density Function |

|---|---|---|

| Under 130,000 | 0.17 | NORM (1.25 × 105, 2.48 × 103) |

| ~135,000 | 0.34 | 1.31 × 105 + WEIB (1.12 × 105, 1.71) |

| ~150,000 | 0.18 | 1.35 × 105 + 1.48 × 105 * BETA (1.71, 1.39) |

| ~200,000 | 0.12 | 1.5 × 105 + 1.8 × 104 * BETA (1.12, 1.25) |

| ~250,000 | 0.03 | 2.05 × 105 + 8.08 × 103 * BETA (0.34, 0.37) |

| Over 250,000 | 0.16 | 2.54 × 105 + 7.35 × 103 * BETA (2.06, 0.698) |

| Dolphin Occupancy | Number of Berthed Ships | Ship Waiting Time (Hours) | The Number of Waiting Ships | Ship Waiting Rate |

|---|---|---|---|---|

| 30% | 169 | 9.2 | 25 | 15% |

| 31% | 173 | 9.6 | 26 | 15% |

| 32% | 182 | 11.9 | 33 | 18% |

| 33% | 188 | 12.3 | 34 | 18% |

| 34% | 191 | 12.1 | 36 | 19% |

| 35% | 200 | 13.2 | 38 | 19% |

| 36% | 203 | 13.2 | 38 | 19% |

| 37% | 205 | 12.7 | 34 | 17% |

| 38% | 214 | 14.1 | 41 | 19% |

| 39% | 224 | 13.0 | 51 | 23% |

| 40% | 224 | 13.8 | 45 | 20% |

| 41% | 231 | 14.0 | 45 | 19% |

| 42% | 236 | 14.3 | 47 | 20% |

| 43% | 238 | 14.6 | 47 | 20% |

| 44% | 245 | 14.5 | 50 | 20% |

| 45% | 247 | 14.0 | 55 | 22% |

| 46% | 256 | 14.4 | 67 | 26% |

| 47% | 261 | 15.7 | 66 | 25% |

| 48% | 267 | 15.6 | 72 | 27% |

| 49% | 277 | 15.9 | 76 | 27% |

| 50% | 279 | 16.0 | 83 | 30% |

| 51% | 287 | 15.0 | 87 | 30% |

| 52% | 288 | 15.1 | 90 | 31% |

| 53% | 294 | 17.0 | 93 | 32% |

| 54% | 298 | 16.2 | 95 | 32% |

| 55% | 301 | 14.4 | 100 | 33% |

| 56% | 310 | 15.3 | 103 | 33% |

| 57% | 313 | 17.8 | 117 | 37% |

| 58% | 317 | 17.1 | 114 | 36% |

| 59% | 324 | 16.3 | 120 | 37% |

| 60% | 327 | 18.0 | 142 | 43% |

| Dolphin Occupancy | Demurrage (1) | Dolphin Usage Fee (2) | Wharfage Fee (3) | Dolphin Revenue (4) = (2) + (3) | Dolphin Profit (5) = (4) − (1) |

|---|---|---|---|---|---|

| 30% | 383,333 | 946,842 | 1,891,444 | 2,838,285 | 2,454,952 |

| 31% | 416,000 | 969,252 | 1,936,211 | 2,905,464 | 2,489,464 |

| 32% | 654,500 | 1,019,676 | 2,036,939 | 3,056,615 | 2,402,115 |

| 33% | 697,000 | 1,053,291 | 2,104,091 | 3,157,383 | 2,460,383 |

| 34% | 726,000 | 1,070,099 | 2,137,667 | 3,207,766 | 2,481,766 |

| 35% | 836,000 | 1,120,523 | 2,238,395 | 3,358,918 | 2,522,918 |

| 36% | 836,000 | 1,137,331 | 2,271,971 | 3,409,301 | 2,573,301 |

| 37% | 846,667 | 1,148,536 | 2,294,355 | 3,442,891 | 2,596,224 |

| 38% | 963,500 | 1,198,959 | 2,395,082 | 3,594,042 | 2,630,542 |

| 39% | 1,147,500 | 1,254,986 | 2,507,002 | 3,761,988 | 2,614,488 |

| 40% | 1,196,000 | 1,254,986 | 2,507,002 | 3,761,988 | 2,565,988 |

| 41% | 1,236,667 | 1,294,204 | 2,585,346 | 3,879,550 | 2,642,883 |

| 42% | 1,287,000 | 1,322,217 | 2,641,306 | 3,963,523 | 2,676,523 |

| 43% | 1,338,333 | 1,333,422 | 2,663,690 | 3,997,112 | 2,658,779 |

| 44% | 1,522,500 | 1,372,641 | 2,742,034 | 4,114,674 | 2,592,174 |

| 45% | 1,516,667 | 1,383,846 | 2,764,417 | 4,148,263 | 2,631,597 |

| 46% | 1,608,000 | 1,434,269 | 2,865,145 | 4,299,415 | 2,691,415 |

| 47% | 1,727,000 | 1,462,282 | 2,921,105 | 4,383,387 | 2,656,387 |

| 48% | 1,872,000 | 1,495,898 | 2,988,257 | 4,484,155 | 2,612,155 |

| 49% | 1,908,000 | 1,551,924 | 3,100,177 | 4,652,101 | 2,744,101 |

| 50% | 2,053,333 | 1,563,129 | 3,122,561 | 4,685,690 | 2,632,357 |

| 51% | 2,175,000 | 1,607,950 | 3,212,096 | 4,820,047 | 2,645,047 |

| 52% | 2,265,000 | 1,613,553 | 3,223,288 | 4,836,841 | 2,571,841 |

| 53% | 2,635,000 | 1,647,169 | 3,290,440 | 4,937,609 | 2,302,609 |

| 54% | 2,565,000 | 1,669,579 | 3,335,208 | 5,004,787 | 2,439,787 |

| 55% | 2,400,000 | 1,686,387 | 3,368,784 | 5,055,171 | 2,655,171 |

| 56% | 2,626,500 | 1,736,810 | 3,469,512 | 5,206,322 | 2,579,822 |

| 57% | 3,471,000 | 1,753,618 | 3,503,088 | 5,256,706 | 1,785,706 |

| 58% | 3,249,000 | 1,776,029 | 3,547,856 | 5,323,884 | 2,074,884 |

| 59% | 3,260,000 | 1,815,247 | 3,626,199 | 5,441,446 | 2,181,446 |

| 60% | 4,260,000 | 1,832,055 | 3,659,775 | 5,491,830 | 1,231,830 |

| Dolphin Occupancy | Demurrage (1) | Dolphin Usage Fee (2) | Wharfage Fee (3) | Dolphin Revenue (4) = (2) + (3) | Dolphin Profit (5) = (4) − (1) |

|---|---|---|---|---|---|

| 30% | 191,667 | 946,842 | 1,891,444 | 2,838,285 | 2,646,619 |

| 31% | 208,000 | 969,252 | 1,936,211 | 2,905,464 | 2,697,464 |

| 32% | 327,250 | 1,019,676 | 2,036,939 | 3,056,615 | 2,729,365 |

| 33% | 348,500 | 1,053,291 | 2,104,091 | 3,157,383 | 2,808,883 |

| 34% | 363,000 | 1,070,099 | 2,137,667 | 3,207,766 | 2,844,766 |

| 35% | 418,000 | 1,120,523 | 2,238,395 | 3,358,918 | 2,940,918 |

| 36% | 418,000 | 1,137,331 | 2,271,971 | 3,409,301 | 2,991,301 |

| 37% | 423,333 | 1,148,536 | 2,294,355 | 3,442,891 | 3,019,557 |

| 38% | 481,750 | 1,198,959 | 2,395,082 | 3,594,042 | 3,112,292 |

| 39% | 573,750 | 1,254,986 | 2,507,002 | 3,761,988 | 3,188,238 |

| 40% | 598,000 | 1,254,986 | 2,507,002 | 3,761,988 | 3,163,988 |

| 41% | 618,333 | 1,294,204 | 2,585,346 | 3,879,550 | 3,261,216 |

| 42% | 643,500 | 1,322,217 | 2,641,306 | 3,963,523 | 3,320,023 |

| 43% | 669,167 | 1,333,422 | 2,663,690 | 3,997,112 | 3,327,945 |

| 44% | 761,250 | 1,372,641 | 2,742,034 | 4,114,674 | 3,353,424 |

| 45% | 758,333 | 1,383,846 | 2,764,417 | 4,148,263 | 3,389,930 |

| 46% | 804,000 | 1,434,269 | 2,865,145 | 4,299,415 | 3,495,415 |

| 47% | 863,500 | 1,462,282 | 2,921,105 | 4,383,387 | 3,519,887 |

| 48% | 936,000 | 1,495,898 | 2,988,257 | 4,484,155 | 3,548,155 |

| 49% | 954,000 | 1,551,924 | 3,100,177 | 4,652,101 | 3,698,101 |

| 50% | 1,026,667 | 1,563,129 | 3,122,561 | 4,685,690 | 3,659,023 |

| 51% | 1,087,500 | 1,607,950 | 3,212,096 | 4,820,047 | 3,732,547 |

| 52% | 1,132,500 | 1,613,553 | 3,223,288 | 4,836,841 | 3,704,341 |

| 53% | 1,317,500 | 1,647,169 | 3,290,440 | 4,937,609 | 3,620,109 |

| 54% | 1,282,500 | 1,669,579 | 3,335,208 | 5,004,787 | 3,722,287 |

| 55% | 1,200,000 | 1,686,387 | 3,368,784 | 5,055,171 | 3,855,171 |

| 56% | 1,313,250 | 1,736,810 | 3,469,512 | 5,206,322 | 3,893,072 |

| 57% | 1,735,500 | 1,753,618 | 3,503,088 | 5,256,706 | 3,521,206 |

| 58% | 1,624,500 | 1,776,029 | 3,547,856 | 5,323,884 | 3,699,384 |

| 59% | 1,630,000 | 1,815,247 | 3,626,199 | 5,441,446 | 3,811,446 |

| 60% | 2,130,000 | 1,832,055 | 3,659,775 | 5,491,830 | 3,361,830 |

| Item | Current Status | Simulation Result | Accuracy |

|---|---|---|---|

| Number of calling ships per year | 165 | 165 | 100% |

| Throughput per year (m3) | 26,890,000 | 26,503,960 | 99% |

| Average service time (hours) | 25.3 | 25.8 | 98% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Park, N.K.; An, Y. Estimation of LNG Dolphin Capacity: Dolphins of Different Size in Republic of Korea. J. Mar. Sci. Eng. 2022, 10, 2031. https://doi.org/10.3390/jmse10122031

Park NK, An Y. Estimation of LNG Dolphin Capacity: Dolphins of Different Size in Republic of Korea. Journal of Marine Science and Engineering. 2022; 10(12):2031. https://doi.org/10.3390/jmse10122031

Chicago/Turabian StylePark, Nam Kyu, and Yohan An. 2022. "Estimation of LNG Dolphin Capacity: Dolphins of Different Size in Republic of Korea" Journal of Marine Science and Engineering 10, no. 12: 2031. https://doi.org/10.3390/jmse10122031

APA StylePark, N. K., & An, Y. (2022). Estimation of LNG Dolphin Capacity: Dolphins of Different Size in Republic of Korea. Journal of Marine Science and Engineering, 10(12), 2031. https://doi.org/10.3390/jmse10122031