1. Introduction

As an essential component of human dietary structure, vegetables provide indispensable nutrients including water, cellulose, and vitamins crucial for maintaining health [

1]. From the consumption perspective, the per capita annual vegetable and edible fungus consumption in China totals 113.6 kg, second only to cereal consumption at 134.4 kg, underscoring their fundamental role in nutritional intake [

2]. From the production perspective, China, as the world’s largest vegetable producer, contributes more than 50% of the world’s total output, making significant contributions to global food security and agricultural economic development [

3,

4].

However, Chinese vegetable markets have experienced increasing price fluctuations despite expansion in production. The national agricultural monitoring data reveal frequent large-scale fluctuations during 2014–2024, with tomato prices surging from 1.86 CNY/kg in August 2014 to 9.03 CNY/kg in January 2022, representing a 385% maximum amplitude. Such volatility generates multidimensional impacts, microeconomically affecting the income stability and production decisions of farmers while macroeconomically exacerbating market imbalances and increasing regulatory pressure [

5]. Studies indicate that price fluctuations result from the synergistic effects of climate anomalies, pest outbreaks, supply–demand mismatches, financial speculation, and public sentiment [

5,

6,

7]. Consequently, developing accurate price prediction models holds significant practical value for revealing market patterns, guiding production decisions, and maintaining supply–demand equilibrium [

4]. The proposed framework further provides decision-making references for governmental departments, producers, and operators aiming to formulate targeted strategies for stabilizing vegetable prices.

Agricultural price forecasting has evolved through two methodological phases: initial statistical approaches like linear regression and Autoregressive Integrated Moving Average (ARIMA) models, which prioritize computational efficiency but inadequately handle non-stationarity and nonlinearity. The linear regression model for egg prices developed by [

8] achieved an R

2 of 0.9592 under stable conditions, yet demonstrated limited robustness during sudden market shifts [

8]. This performance contrast is mirrored in environmental modeling, where the clustered ARIMA approach by [

9] attained 98.3% accuracy in soil respiration prediction while exhibiting deficiencies in decoding multivariate interactions [

9]. Deep learning advancements have introduced Long Short-Term Memory (LSTM) and GRU networks with enhanced feature extraction capabilities. This progress is exemplified by the potato price prediction model developed by [

10], which achieved an R

2 of 98.2% [

10]. However, single models still have limitations in capturing comprehensive features, such as difficulty in effectively extracting multi-scale temporal features, driving research toward hybrid approaches. Recent studies have demonstrated the effectiveness of integrated methodologies across diverse applications. The fusion of convolutional neural network (CNN) and LSTM architectures with sentiment analysis has shown improved exchange rate forecasting accuracy, though challenges remain in parameter optimization [

11]. In energy systems, stacked GRU models enhanced with attention mechanisms achieved a 27.2% accuracy boost for power load predictions [

12]. Further advances in load forecasting have been realized through the synergistic application of VMD and partial autocorrelation function (PACF) analysis [

13]. While these hybrid approaches demonstrate superior performance compared to single-model solutions, they collectively reveal ongoing challenges in optimizing model parameters and extracting discriminative temporal features across different application domains.

To address existing research gaps, this study develops a hybrid framework integrating VMD, FOA, and GRU architectures through three synergistic components. The framework employs adaptive signal decomposition via VMD to extract multi-scale intrinsic mode functions (IMFs), effectively isolating periodic and trend components in time series data [

14]. It incorporates GRU networks with update–reset gate mechanisms that preserve long-term temporal dependencies while mitigating gradient vanishing issues [

15]. Crucially, the system implements FOA-driven autonomous optimization of critical GRU hyperparameters, specifically targeting hidden layer size and learning rate configurations, with experimental validation showing a 2–10% RMSE reduction in green vegetable consumption forecasting [

16,

17]. This multidimensional integration demonstrates enhanced capability in resolving complex temporal patterns compared to single-model approaches.

The proposed framework addresses three critical challenges in agricultural price forecasting:

- (1)

Effective isolation of multi-scale temporal patterns under high-noise conditions.

- (2)

Dynamic adaptation to nonlinear market interactions through gate-controlled memory units.

- (3)

Self-adaptive hyperparameter configuration for minimizing manual intervention.

The paper begins with a comprehensive review of the existing literature in the field, establishing a foundational context for the research. Following this methodological foundation, the subsequent section provides detailed explanations of the VMD-FOA-GRU model. The results analysis section systematically examines three critical aspects: parameter sensitivity patterns, comparative decomposition performance, and predictive accuracy evaluations. After presenting these core experimental findings, the discussion addresses the inherent limitations and implementation challenges. The study concludes with some final conclusions while proposing actionable directions for future research advancement in temporal sequence analysis.

2. Forecasting Model Review

The evolution of agricultural price forecasting has progressed through three methodological stages: traditional statistical methods, intelligent algorithms, and hybrid models [

18]. This section systematically reviews these methodologies, with

Table 1 summarizing key studies that demonstrate the transition from single to hybrid approaches with improved accuracy.

2.1. Traditional Models

Traditional statistical models primarily include linear regression and ARIMA methods. Linear regression is widely adopted due to its simplicity and interpretability. Ref. [

19] developed a linear regression model for tomato price prediction, achieving prediction errors below 5% through parallel computing [

19]. Ref. [

8] integrated multiple variables to predict egg prices, obtaining an R

2 of 0.9592 [

8]. Ref. [

20] applied a quantile regression methodology using 0.05 and 0.95 quantile thresholds to construct confidence intervals, successfully capturing the statistical characteristics of price volatility [

20].

In contrast, ARIMA models demonstrate superior capability in processing time series characteristics compared to linear regression approaches. Ref. [

22] predicted tilapia prices using the ARIMA, forecasting 118% production growth by 2040 [

22]. Enhanced variants include the ARIMAX model by [

21], which maintained a 1% prediction error for US catfish prices, and the clustered ARIMA, which achieved 98.3% accuracy in soil respiration prediction [

9,

21]. Ref. [

23] implemented the Box–Jenkins ARIMA methodology to generate precise predictions of jute cultivation area expansion trends [

23].

Despite their merits, traditional models face limitations in handling nonlinear patterns and non-stationary data, especially during market shocks.

2.2. Intelligent Models

Artificial intelligence technologies provide new pathways to overcome the limitations of traditional methods. Intelligent prediction models demonstrate outstanding performance in complex price forecasting tasks through their advantages in automated feature extraction and nonlinear mapping, primarily including artificial neural networks and deep learning approaches.

Convolutional neural network applications demonstrate versatile implementations across agricultural forecasting domains. Ref. [

24] implemented three-dimensional convolutional neural networks with multidirectional convolution kernels to extract spatiotemporal patterns, achieving a 40% accuracy enhancement [

24]. In neural network architecture comparisons, ref. [

25] established the superior predictive capability of radial basis function neural networks (RBFNN), achieving 0.8555 accuracy compared to backpropagation neural networks’ 0.7742 performance in vegetable price forecasting [

25].

Deep learning models exhibit stronger modeling capabilities. Ref. [

26] constructed an LSTM network for weekly agricultural price forecasting, obtaining an MSE value of 0.304 that outperformed ARIMA and support vector regression (SVR) benchmarks [

26]. Ref. [

27] proposed a Deep Long Short-Term Memory (DLSTM) model that reduced corn price prediction errors by 72% [

27]. In environmental forecasting, ref. [

28] employed multi-head LSTM for soil moisture prediction, achieving an R

2 value of 95.04% [

28]. Ref. [

29] designed an attention-based LSTM model that attained 93.13% accuracy in greenhouse temperature prediction [

29].

Although intelligent models show significant advantages in handling nonlinear features, single architectures struggle to effectively extract multi-scale temporal characteristics, highlighting hybrid models as a new research direction.

2.3. Hybrid Models

Hybrid models achieve significant progress through methodological integration encompassing three principal technical pathways: decomposition–machine learning fusion, optimization–neural network integration, and deep learning architecture combinations.

Ref. [

33] implemented a traditional ARIMA-RF hybrid model, yielding an MAE of 0.6315, demonstrating the effectiveness of combining statistical and machine learning approaches for time series forecasting [

33].

Seasonal-Trend Decomposition using an LOESS–Extreme Learning Machine (STL-ELM) model, proposed by [

30], demonstrated superior performance across multiple forecasting horizons by skillfully handling seasonal price patterns [

30]. Ref. [

31]’s STL-LSTM hybrid model achieved 92.05% accuracy in seasonal vegetable price prediction, demonstrating superior performance in capturing nonlinear and seasonal patterns compared to standalone LSTM or traditional statistical methods [

31]. Ref. [

32] further developed the STL with an Attention–LSTM model, which integrates meteorological data and attention mechanisms to reduce prediction errors by 12% [

32].

Ref. [

34] proposed an MEMD-TCN framework combining multivariate empirical mode decomposition with temporal convolutional networks, achieving 80% directional accuracy in stock predictions through multi-scale analysis of non-stationary financial data [

34]. Ref. [

36] developed a VMD-BiLSTM-GRU architecture, attaining R

2 = 99.5% in traffic flow forecasting, by integrating variational mode decomposition with bidirectional and gated recurrent units [

36]. For renewable energy, ref. [

35]’s COA-VMD hybrid model achieved R

2 = 99.5% in wind power prediction using chaotic optimization for decomposition parameter selection [

35]. In energy markets, ref. [

37] implemented a WOA-VMD-SCINet framework with R

2 = 98% for electricity price forecasting, combining whale optimization with sample convolutional interaction networks [

37].

In crude oil price forecasting, ref. [

43] developed a linear ensemble method, achieving an MAE of 3.80, demonstrating the viability of integrated statistical approaches for baseline price trend modeling [

43]. Ref. [

41] proposed a VMD-LSTM-MW framework that decomposed oil price signals using variational mode decomposition before LSTM processing, attaining RMSE = 1.30 in WTI crude oil predictions [

41]. Ref. [

42] implemented an ICEEMDAN-based model that captured nonlinear price dynamics through improved noise-assisted decomposition, reporting RMSE = 1.24 for WTI benchmarks [

42]. Advancing decomposition–reconstruction architectures, ref. [

44]’s VMD-PSR-CNN-BiLSTM hybrid model achieved RMSE = 0.579 for Brent crude oil prices by integrating phase space reconstruction with deep learning components [

44].

In optimization–neural network integration, ref. [

4] employed the FOA to optimize parameters of a General Regression Neural Network (GRNN) and RBFNN, outperforming nine benchmark models [

4]. The Hidden Markov with Deep Learning hybrid model proposed by [

38] enhanced potato price prediction accuracy by 20–30% [

38].

Regarding deep learning combinations, ref. [

39]’s convolutional–recurrent neural network (CNN-RNN) hybrid reduced corn yield prediction errors to 9%, while [

40]’s variational mode decomposition–Ensemble Empirical Mode Decomposition–LSTM (VMD-EEMD-LSTM) framework improved accuracy through secondary decomposition [

39,

40].

These advancements substantiate the methodological superiority of hybrid models in complex price forecasting tasks.

3. Methods

3.1. Variational Mode Decomposition

Variational mode decomposition (VMD) is an adaptive non-recursive signal-processing method [

45]. Its core idea is to decompose complex time series into intrinsic mode functions (IMFs) with different center frequencies and finite bandwidths. Due to the completeness of VMD, the superposition of these IMF components can completely reconstruct the original signal. VMD demonstrates significant advantages in time series prediction, mainly reflected in its excellent noise-handling capability and effective decomposition of nonlinear, non-stationary signals. This decomposition method enables VMD to accurately capture multi-scale patterns and inherent laws in data, providing clearer feature representations for subsequent prediction tasks. To achieve this decomposition process, the variational problem of VMD can be formally expressed as follows:

- (1)

The VMD algorithm achieves signal decomposition by minimizing the bandwidth of each IMF. In this process, each IMF is modulated around its corresponding center frequency. The algorithm uses Hilbert transform to calculate the time derivative of the analytic signal to estimate bandwidth while ensuring the sum of all IMFs equals the original signal under constraints. The mathematical formulation is as follows:

where

is the input signal,

represents the k-th IMF component,

is the center frequency of the k-th IMF,

is the Dirac function, ∗ denotes the convolution operation,

represents the partial time derivative, and

denotes the

norm.

- (2)

To solve this constrained variational problem, quadratic penalty terms and Lagrange multipliers are introduced to convert it into an unconstrained variational problem, constructing the augmented Lagrangian function as follows:

where

is the penalty factor and

is the Lagrange multiplier.

- (3)

To solve the above optimization problem, the VMD algorithm employs the Alternating Direction Method of Multipliers (ADMM) for iterative optimization. The iterative update process includes three steps: updating each mode component in the frequency domain, updating center frequencies by calculating the power spectrum centroid of current modes, and adjusting Lagrange multipliers to enhance reconstruction constraint satisfaction. The specific iteration formulas are as follows:

where

is the noise tolerance parameter,

,

, and

represent the Fourier transforms of

,

, and

, respectively, and

n is the iteration number.

The iteration termination condition is defined as the relative change of each mode being less than a preset threshold. When satisfied, it indicates minimal changes in mode functions between consecutive iterations, suggesting that the algorithm has converged to a stable solution:

where

is the convergence threshold. When this condition is met, the algorithm is considered to have converged to a stable solution.

VMD serves as the critical signal preprocessor for the integrated model, adaptively decomposing complex price series into stationary IMFs to reduce modeling complexity. Its inherent noise suppression and perfect reconstruction properties preserve essential data patterns while providing high-quality inputs for subsequent prediction modules.

3.2. Fruit Fly Optimization Algorithm

The Fruit Fly Optimization Algorithm (FOA) is an optimization algorithm that simulates the foraging behavior of fruit fly populations [

46]. Based on the characteristics of fruit flies, who use keen olfaction and vision for foraging, this algorithm implements iterative population searching in a solution space. Compared with conventional optimization approaches like Genetic Algorithms (GA), the FOA exhibits distinctive advantages in algorithmic structure simplicity, powerful global search capability, and low computational complexity [

47].

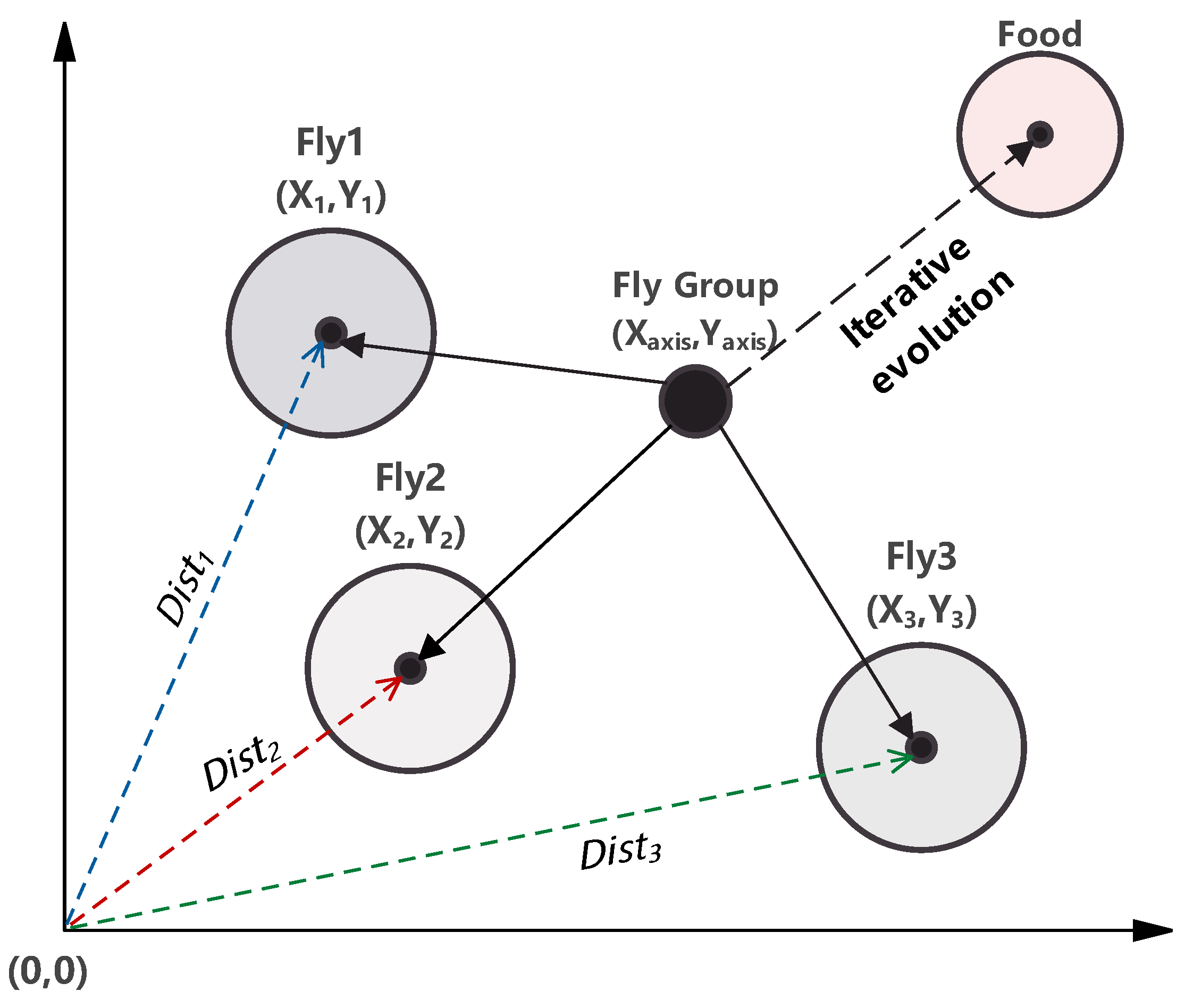

Figure 1 illustrates the iterative search process of fruit flies. The method features simple computation, fast convergence, and stochastic characteristics, making it well suited for model parameter optimization. The implementation steps are as follows:

- (1)

Randomly initialize the position coordinates

and

of the fruit fly population in the search space:

where

represents the reference starting point of the search space.

- (2)

Each fruit fly individual performs a random search through olfactory mechanisms:

where

i denotes the

i-th fruit fly individual.

- (3)

Since fruit flies cannot directly determine food location, the algorithm evaluates position quality by calculating individual distance to the origin and corresponding smell concentration:

where

represents the Euclidean distance of the

i-th fruit fly to the origin, and

is the smell concentration determination value.

- (4)

Substitute the distance judgment value

into the fitness function to obtain the smell concentration value

at each fruit fly’s position:

- (5)

Identify the individual with the best smell concentration in the population:

where

represents the optimal fitness value in the population, and

is the index of the fruit fly individual with the optimal fitness value.

- (6)

After determining the individual with the best smell concentration, preserve its optimal smell concentration value and corresponding coordinates. The fruit fly population then uses visual systems to fly toward this optimal position:

where

is the best smell concentration value found in the current iteration, and

are the corresponding optimal coordinates.

- (7)

Check if the current iteration count reaches the preset maximum. If yes, terminate the algorithm and return the optimal fruit fly individual; otherwise, return to Step 2 to continue iterations.

The integration of the FOA into the hybrid system achieves a balance between model capacity and computational efficiency. The algorithm’s global search capability enables efficient exploration of high-dimensional parameter spaces, overcoming the local optimum trap common in gradient-based optimization methods.

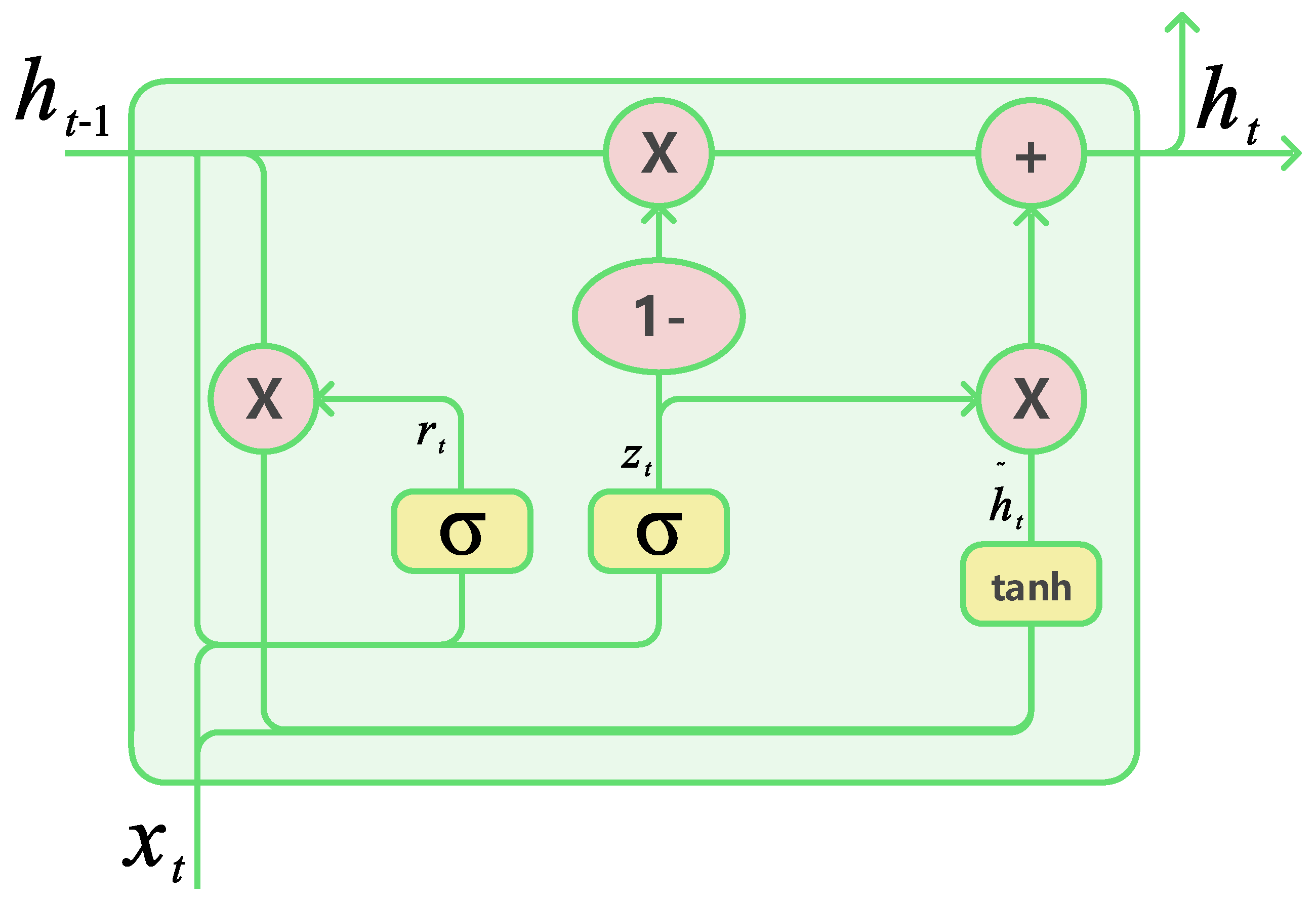

3.3. Gated Recurrent Unit

The gated recurrent unit (GRU), first proposed in [

48], is a variant of recurrent neural networks (RNN). Compared with traditional RNNs, the GRU effectively alleviates gradient vanishing in long sequence training through update and reset gates while maintaining low computational complexity [

48]. The GRU structure is shown in

Figure 2, with its core computational process described by the following mathematical formulas.

- (1)

The update gate

controls the proportion of previous hidden state information transmitted to the current moment:

where

denotes the sigmoid activation function,

and

are weight matrices of the update gate,

is the current input, and

is the previous hidden state.

- (2)

The reset gate

regulates the influence of historical state information on the current candidate hidden state:

where

and

are weight matrices of the reset gate.

- (3)

The candidate hidden state

combines current input and regulated historical information:

where

W and

U are weight matrices for historical information.

- (4)

The final hidden state is obtained by linearly interpolating the candidate hidden state and previous hidden state through the update gate:

Although both LSTM and the GRU are based on RNN architecture, they differ significantly in structural design. The GRU adopts a more streamlined structure with only two gating units (update and reset gates), compared to the three gates (input, forget, and output) in LSTM. Studies show that GRUs not only demonstrate comparable or superior performance to LSTM in multiple sequence modeling tasks but also typically offer advantages in training speed and convergence due to having fewer parameters [

49].

The GRU functions as the core predictor, leveraging gated mechanisms to model multi-scale IMF patterns. It balances long-term trend capture and short-term fluctuation detection while maintaining computational efficiency. Synergizing with VMD and FOA optimization, the GRU achieves precise predictions for complex price dynamics.

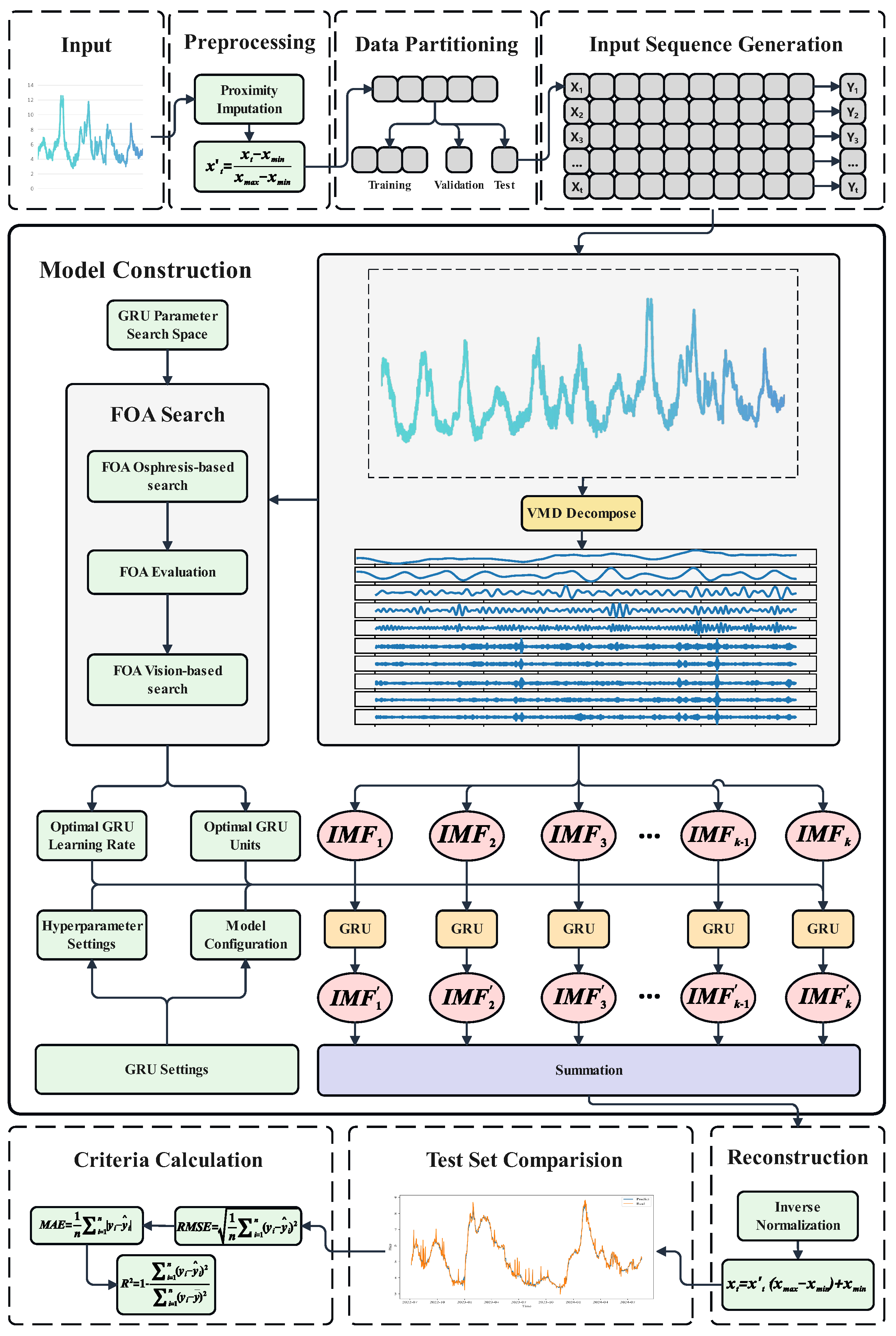

3.4. Proposed Model

This study develops an innovative model that integrates the VMD method proposed in [

45], the FOA introduced in [

46], and the GRU architecture established in [

48], applying this VMD-FOA-GRU combination for the first time to agricultural commodity price prediction, as illustrated in

Figure 3. The model achieves high-precision modeling and prediction of complex non-stationary time series through multi-level signal processing and deep learning methods. Before model training, data preprocessing and partitioning are first conducted, followed by test set prediction and corresponding evaluation metric calculation. The detailed pseudocode is shown as Algorithm 1. The model’s processing flow can be decomposed into the following key stages:

First, the model employs VMD for multi-scale analysis of the input raw time series. Compared with classical empirical mode decomposition (EMD), VMD has stronger theoretical foundations and better noise resistance. The VMD decomposer breaks down complex non-stationary signals into k IMF components, each with specific center frequencies and finite bandwidth characteristics. This adaptive signal decomposition method effectively captures time series features across different frequency domains while significantly reducing mode mixing, laying the foundation for subsequent deep learning modeling.

Second, considering the strong dependence of deep learning model performance on network parameter selection, the model innovatively incorporates FOA-based parameter optimization. The fruit fly algorithm optimizes GRU parameters through simulated foraging behavior, employing swarm intelligence strategies in a high-dimensional parameter space via olfactory and visual search phases. This bio-inspired optimization method not only converges rapidly but also avoids local optima, thereby ensuring optimal parameter configurations for subsequent GRU networks.

After obtaining optimal GRU parameters, the model equips each IMF component with an independent GRU deep learning network for prediction. As an improved RNN variant, the GRU effectively resolves gradient vanishing in long sequence modeling through update and reset gates. Each GRU network specializes in processing its corresponding IMF component, adaptively learning and capturing temporal features, periodic patterns, and long short-term dependencies of frequency-specific signals during IMF mapping. This divide-and-conquer strategy enables precise characterization of different frequency components’ dynamic behaviors.

Finally, the model integrates outputs from all GRU networks through summation to reconstruct the final predictions. The decomposition–individual modeling–integration strategy fully handles original signal nonlinearity and non-stationarity while significantly enhancing overall prediction performance through parameter optimization. Notably, the summation operation preserves contributions from all frequency components, ensuring prediction completeness and interpretability.

The framework fully utilizes VMD’s multi-scale analysis, the FOA’s parameter optimization, and the GRU’s temporal modeling to form an end-to-end intelligent prediction system. VMD-based frequency decomposition reveals signal structures, the FOA ensures optimal parameter selection, and the GRU provides powerful nonlinear mapping. This multi-level synergy makes the model particularly suitable for complex time series prediction tasks with multi-scale features.

| Algorithm 1 VMD-FOA-GRU-based price prediction |

- Input:

Original time series data S, VMD parameters - Output:

Predicted price - 1:

Preprocess data: Normalize and handle missing values in S - 2:

Decompose S using VMD: - 3:

Initialize FOA parameters: population size P, iterations N - 4:

for each do - 5:

Construct feature matrix by combining with original features - 6:

→ - 7:

end for - 8:

Initialize GRU parameters search space: - 9:

Optimize parameters using FOA: - 10:

for iteration to N do - 11:

for each fly do - 12:

Train GRU with current parameters - 13:

Evaluate MSE on validation set - 14:

Update best parameters - 15:

end for - 16:

end for - 17:

for each do - 18:

Train GRU model with on - 19:

Generate predictions - 20:

end for - 21:

Aggregate predictions: - 22:

Calculate metrics: - 23:

return

|

3.5. Evaluation Criteria

This study employs three widely used statistical metrics for quantitative evaluation of time series prediction models: the Mean Absolute Error (MAE), Root Mean Square Error (RMSE), and Coefficient of Determination (R

2). Their calculation formulas are as follows:

where

represents actual values,

denotes predicted values,

is the mean of actual values, and

n is the sample size.

The MAE reflects the average absolute deviation between predictions and actual values, with smaller values indicating better accuracy. The RMSE shows higher sensitivity to outliers through squared error terms, making it particularly suitable for evaluating model performance during large fluctuations. The R2 has a range of [0, 1], measuring the model’s ability to explain data variability, with values closer to 1 indicating a better fit.

These metrics provide a comprehensive evaluation from different perspectives; the MAE and RMSE reflect prediction accuracy and robustness, while R2 assesses trend capture capability. Simultaneous achievement of a low MAE/RMSE and a high R2 indicates accurate prediction while effectively identifying inherent patterns in time series data.

3.6. Dataset and Preprocessing

To evaluate the accuracy of the proposed model, six vegetable species were selected: cabbage, cucumber, beans, tomato, chili, and radish. These selections were based on two primary considerations: First, these vegetables hold significant agricultural and dietary importance in Chinese production systems. Second, they exhibit substantial morphological diversity across categories—leafy vegetables (cabbage), fruit vegetables (cucumber, tomato, chili), legumes (beans), and root vegetables (radish)—providing optimal conditions for validating the model’s classification capability across distinct morphological types.

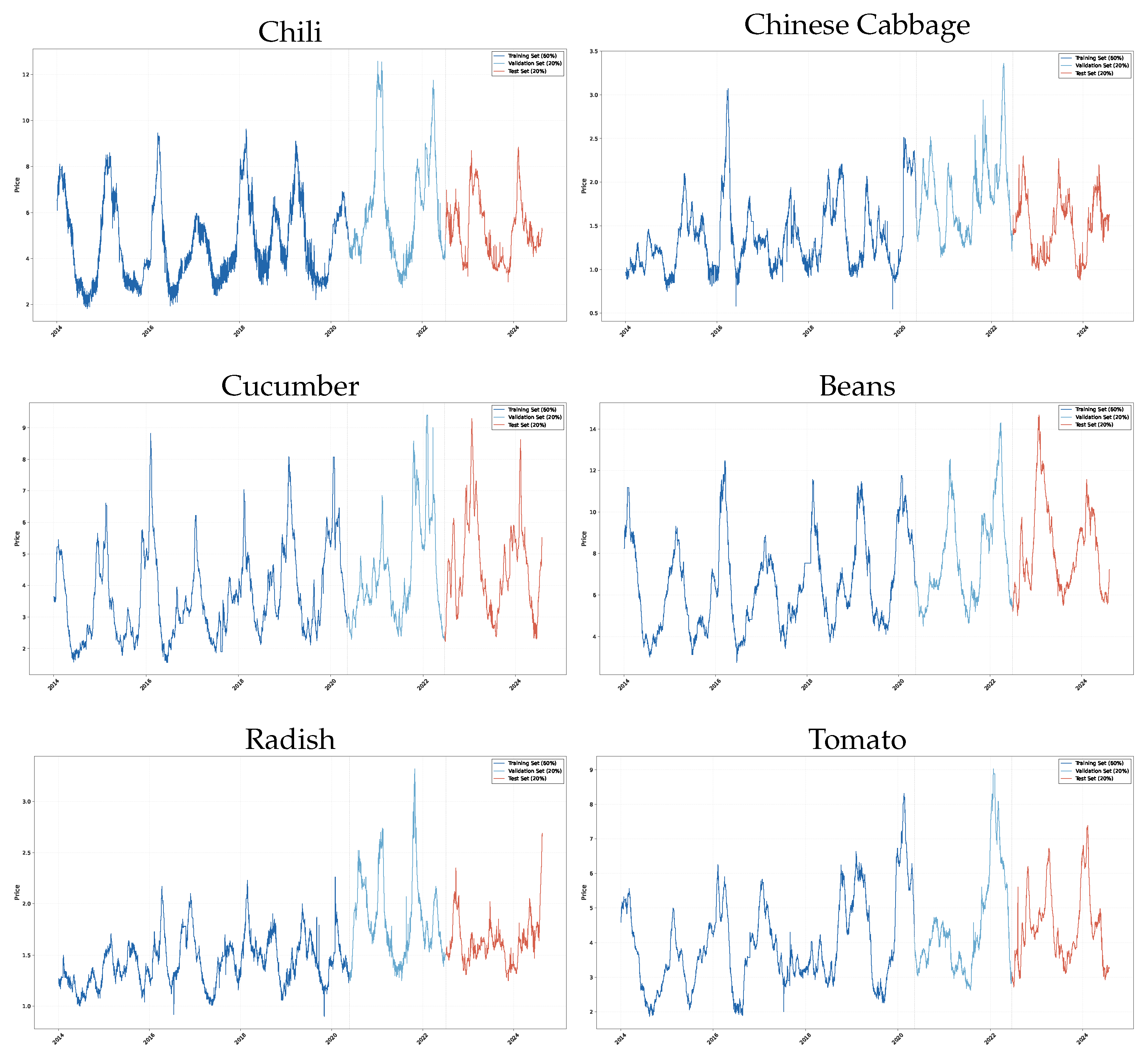

The study employs daily price data as primary indicators, sourced from the National Agricultural Products Business Information Public Service Platform (

https://www.agdata.cn/, accessed on 22 April 2025). As shown in

Figure A1, the price data for six vegetables span from January 2014 to August 2024, comprising approximately 3800 daily price data points. Temporal missing values were addressed through forward-fill and backward-fill imputation methods, particularly suitable for maintaining temporal continuity in time series analysis. Each vegetable dataset was partitioned into three subsets: a training set (first 60% of data points), validation set (subsequent 20%), and testing set (final 20%), designated for model training, parameter selection, and performance verification, respectively.

To optimize training efficiency, price data underwent Min–Max normalization scaled to the [0, 1] range. The normalization formula is expressed as follows:

where

and

represent the maximum and minimum values in the original sequence, respectively.

4. Results

This study conducted five experiments to verify the superiority of the proposed VMD-FOA-GRU model. The experiments included comparisons of VMD quantities, different decomposition methods, FOA optimization methods, ablation experiments, and Cross-Dataset Performance Verification for the VMD-FOA-GRU model. The key parameters related to model training are shown in

Table 2.

The parameter selection criteria for the FOA integrate both theoretical foundations and empirical validation. MaxGen and PopSize were configured to preserve the algorithm’s O(n) time complexity advantage. The parameter ranges for neural network units and learning rates were derived from grid search experiments on validation datasets, ensuring compatibility with deep learning architectures while avoiding overfitting.

All experiments were performed on a Windows 11 64-bit operating system using Python 3.9.20 and TensorFlow 2.17 with GPU support. The CPU has AMD Ryzen 9 7950X3D specifications (Advanced Micro Devices, Inc., Santa Clara, CA, USA), and the GPU is an NVIDIA GeForce RTX 4090 (NVIDIA Corporation, Santa Clara, CA, USA) with 32 GB of RAM.

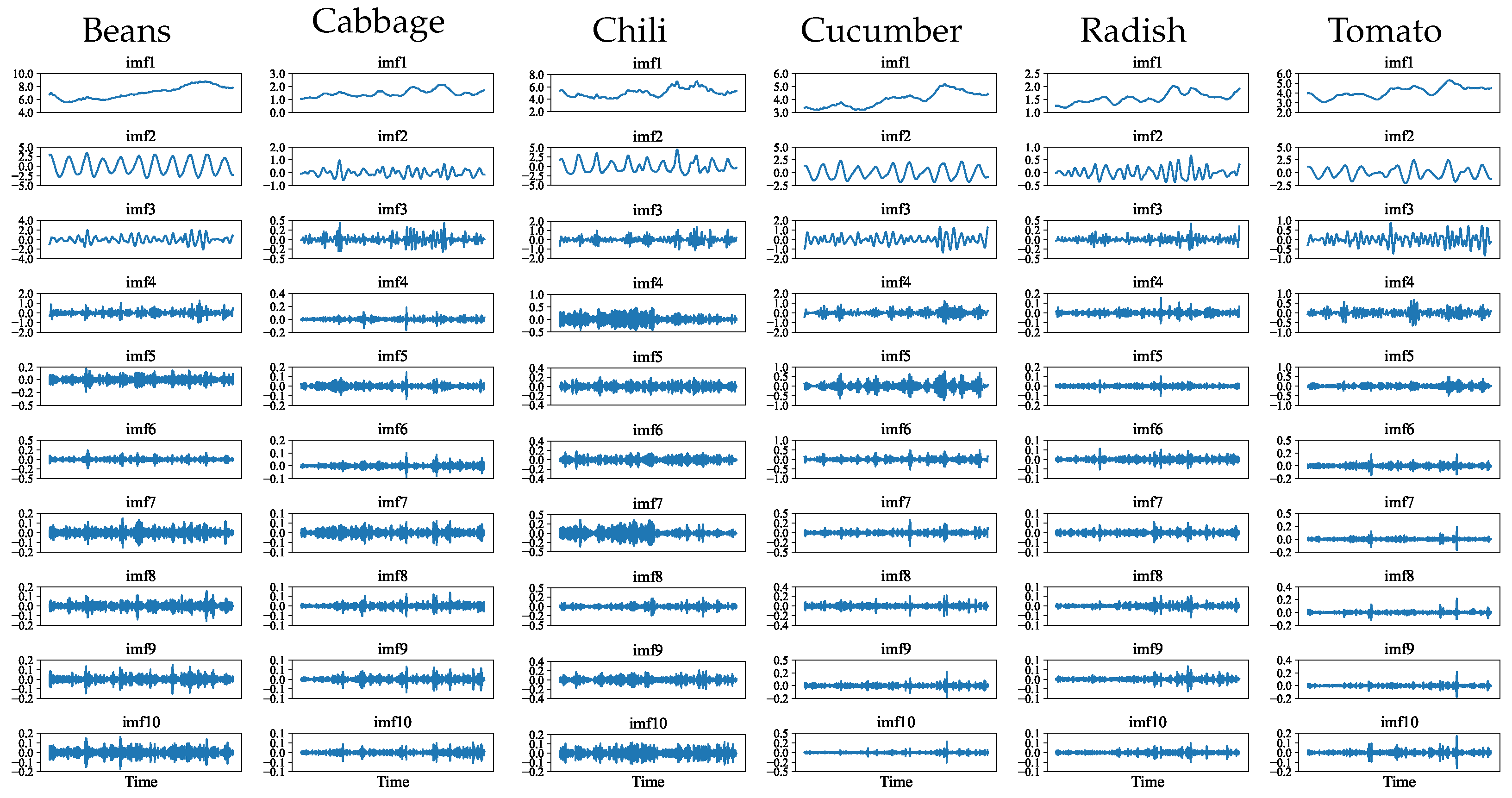

4.1. VMD Number IMF Comparison

VMD decomposes the original signal into multiple IMFs, with their quantity determined by the parameter K. The selection of K significantly impacts model prediction performance; an undersized K leads to insufficient signal decomposition, reducing prediction accuracy, while an oversized K increases computational complexity and may degrade prediction performance beyond specific thresholds. Therefore, selecting an appropriate K value is crucial for balancing prediction accuracy and computational efficiency.

To determine the optimal K, systematic experiments were conducted on the VMD-GRU model with K ranging from 5 to 10. Using vegetable price datasets from six categories under consistent GRU architecture and training parameters (with only the IMF quantity adjusted), model performance was evaluated through the RMSE, MAE, and R

2 metrics. As shown in

Table 3 and

Table 4 and

Figure 4, the prediction accuracy demonstrated an ascending trend with increasing K values. When K = 10, all vegetable categories achieved minimum prediction errors. For instance, in radish price prediction, the RMSE decreased significantly from 0.0313 at K = 5 to 0.0161 at K = 10, representing a 48.6% reduction.

Based on these experimental results, this study adopted K = 10 for VMD of vegetable price time series, as illustrated in

Figure A3. The decomposition exhibits distinct frequency stratification characteristics, with IMF1 capturing the highest-frequency price fluctuations and IMF2 to IMF10 progressively revealing more stable low-frequency features.

Figure A4 presents the training and validation loss curves for each IMF component, demonstrating effective convergence across all components and verifying the decomposition scheme’s validity.

4.2. Comparison of Decomposition Methods

This study conducted systematic comparative experiments to evaluate the performance of different decomposition methods combined with deep learning models for agricultural product price prediction. Four mainstream signal decomposition methods were employed: variational mode decomposition (VMD), empirical mode decomposition (EMD), Complete Ensemble Empirical Mode Decomposition with Adaptive Noise (CEEMDAN), and Ensemble Empirical Mode Decomposition (EEMD).

As a novel adaptive signal-processing method, VMD demonstrates superior capability in addressing mode mixing compared to traditional EMD [

45]. EMD, as a classical empirical decomposition approach, has been extensively applied in time series analysis [

50]. CEEMDAN and EEMD, as improved versions of EMD, effectively mitigate mode aliasing and noise sensitivity [

51,

52].

For deep learning architectures, four models were selected: GRU, LSTM, MLP, and Transformer models. LSTM and GRU models, as mainstream recurrent neural network variants, have demonstrated exceptional performance in time series forecasting tasks [

53]. The MLP, despite its simple structure, exhibits strong nonlinear fitting capabilities [

54]. The Transformer has shown significant potential in temporal prediction through its parallel computation architecture and long-term dependency modeling [

55].

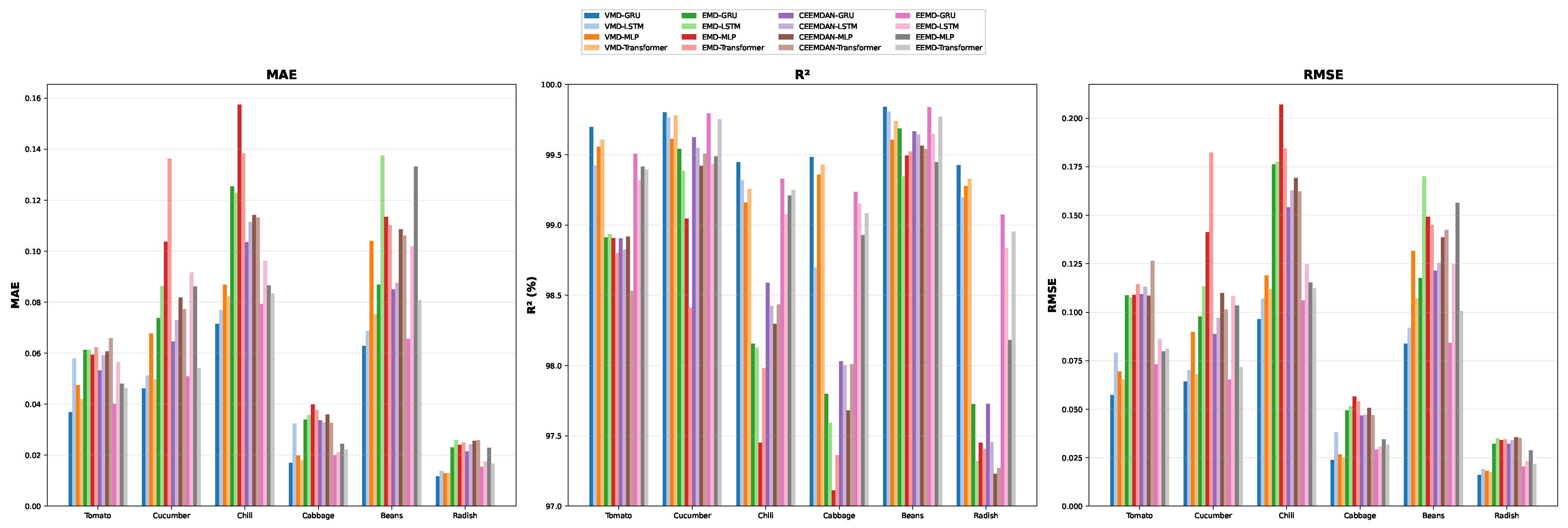

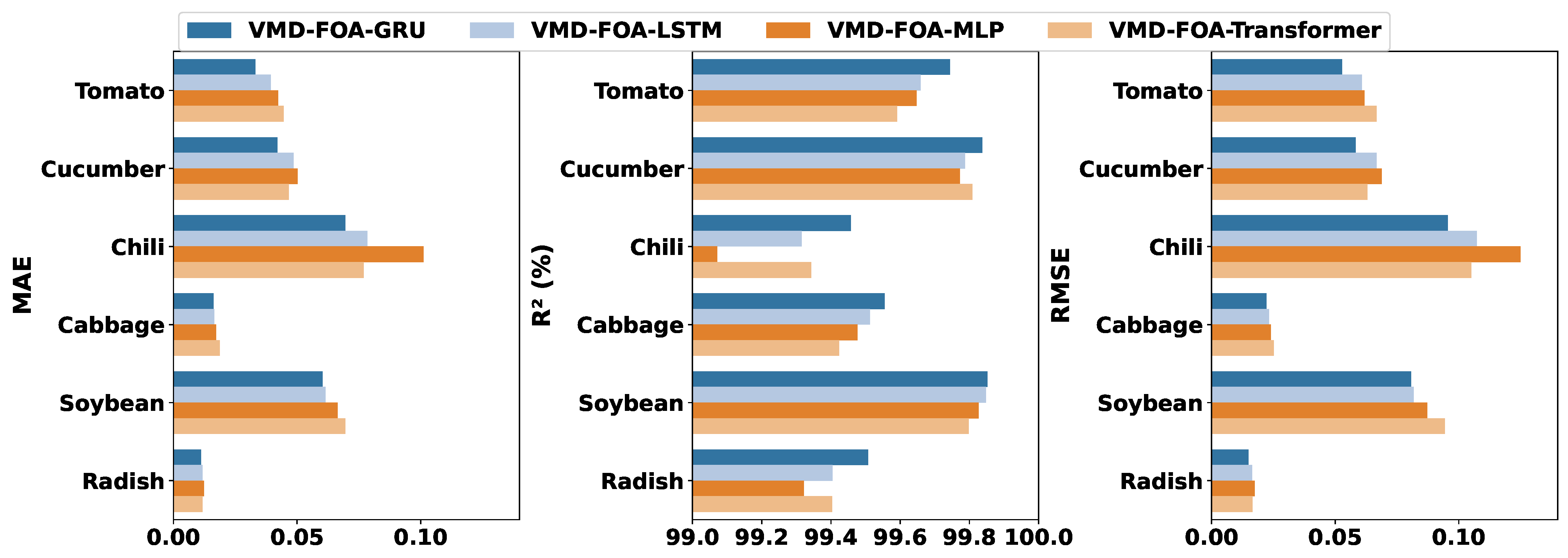

Under unified parameter configurations, this study constructed 16 hybrid models through method combinations. The GRU method experimental results are presented in

Table 5 and

Table 6, and the full results are presented in

Table A1 and

Table A2. The results reveal that the VMD-GRU model achieved optimal performance across all agricultural price prediction scenarios, while EMD- and CEEMDAN-based methods exhibited relatively inferior results. For tomato price prediction, the VMD-GRU model demonstrated remarkable advantages with RMSE = 0.0573, MAE = 0.0368, and R

2 = 99.698%. In contrast, models based on EMD and CEEMDAN generally showed RMSE values exceeding 0.10, indicating substantial performance gaps. As illustrated in

Figure 5 and

Figure A2, this performance superiority was consistently validated across all evaluation metrics and agricultural product categories.

The experimental results confirm VMD’s significant advantages in processing nonlinear and non-stationary time series data, providing superior feature representations for subsequent deep learning models. Based on these findings, VMD was adopted as the primary signal decomposition method for subsequent experiments.

4.3. FOA Model Performance Comparison

To validate the performance improvement of the FOA method, comparative experiments were conducted on baseline models and FOA-enhanced counterparts. The results presented in

Table 7 and

Table 8, along with the visualizations in

Figure 6, demonstrate that the VMD-FOA-GRU model achieved optimal performance across all six crop prediction tasks.

For tomato price prediction, the model obtained superior metrics with RMSE = 0.0528, MAE = 0.0332, and R2 = 99.744%, significantly outperforming other comparative models. The model showed an equally impressive performance for cucumber prediction, achieving RMSE = 0.0583, MAE = 0.0421, and R2 = 99.837%. Notably, in the challenging bell pepper price prediction task, VMD-FOA-GRU maintained leadership with RMSE = 0.0955 and R2 = 99.457%. For cabbage prediction, the model achieved RMSE = 0.0222, outperforming both VMD-FOA-LSTM (0.0232) and VMD-FOA-Transformer (0.0252). The consistent superiority across all three evaluation metrics confirms the FOA mechanism’s effectiveness in enhancing prediction accuracy.

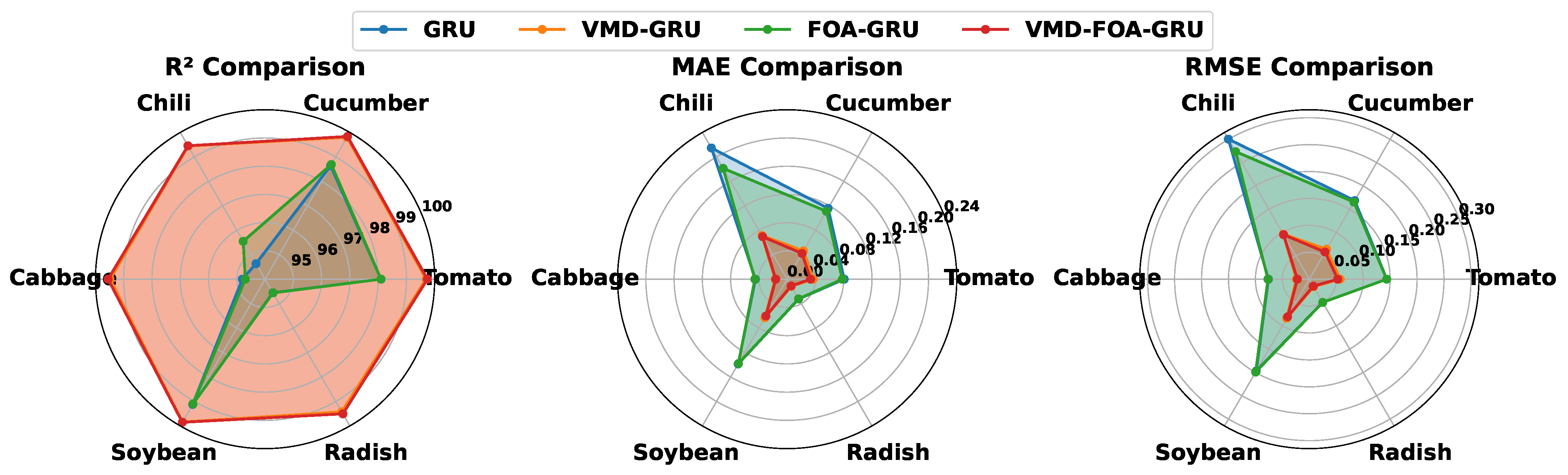

4.4. VMD-FOA-GRU Ablation Experiments

To validate the predictive performance of the VMD-FOA-GRU model across six vegetable price datasets, ablation experiments were conducted. The results shown in

Table 9 and

Table 10, along with the visualizations in

Figure 7, demonstrate significant improvements compared to the baseline GRU. For tomato price prediction, the RMSE decreased from 0.1437 to 0.0573, with R

2 increasing to 99.698%.

Notably, the standalone FOA-GRU model exhibited unstable performance, underperforming compared to the baseline GRU in some datasets. For cabbage prediction, FOA-GRU achieved RMSE = 0.0767 compared to GRU’s 0.0759. However, the integrated VMD-FOA-GRU configuration demonstrated substantial performance gains, achieving optimal results across all six crops. Particularly for the tomato and cucumber datasets, the RMSE decreased to 0.0528 and 0.0583, respectively, with R2 values reaching 99.744% and 99.837%. This synergy enhances the model’s capability to capture multi-scale price variation patterns, substantially improving overall predictive performance.

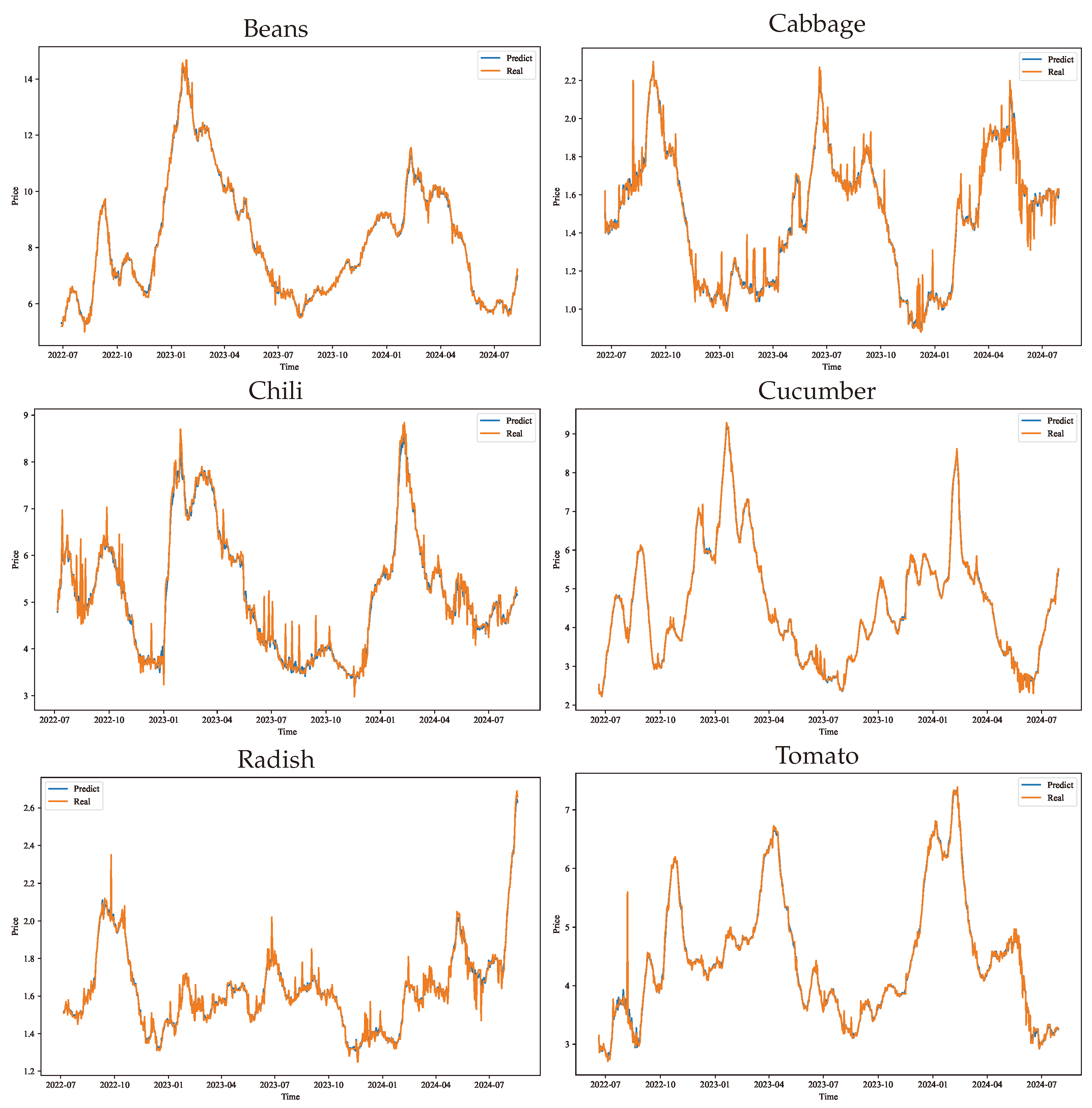

Figure A6 illustrates the alignment between predicted and actual values in the test sets. The model maintained excellent tracking capability even during periods of high volatility, demonstrating superior accuracy and stability in capturing seasonal fluctuations across annual price peaks.

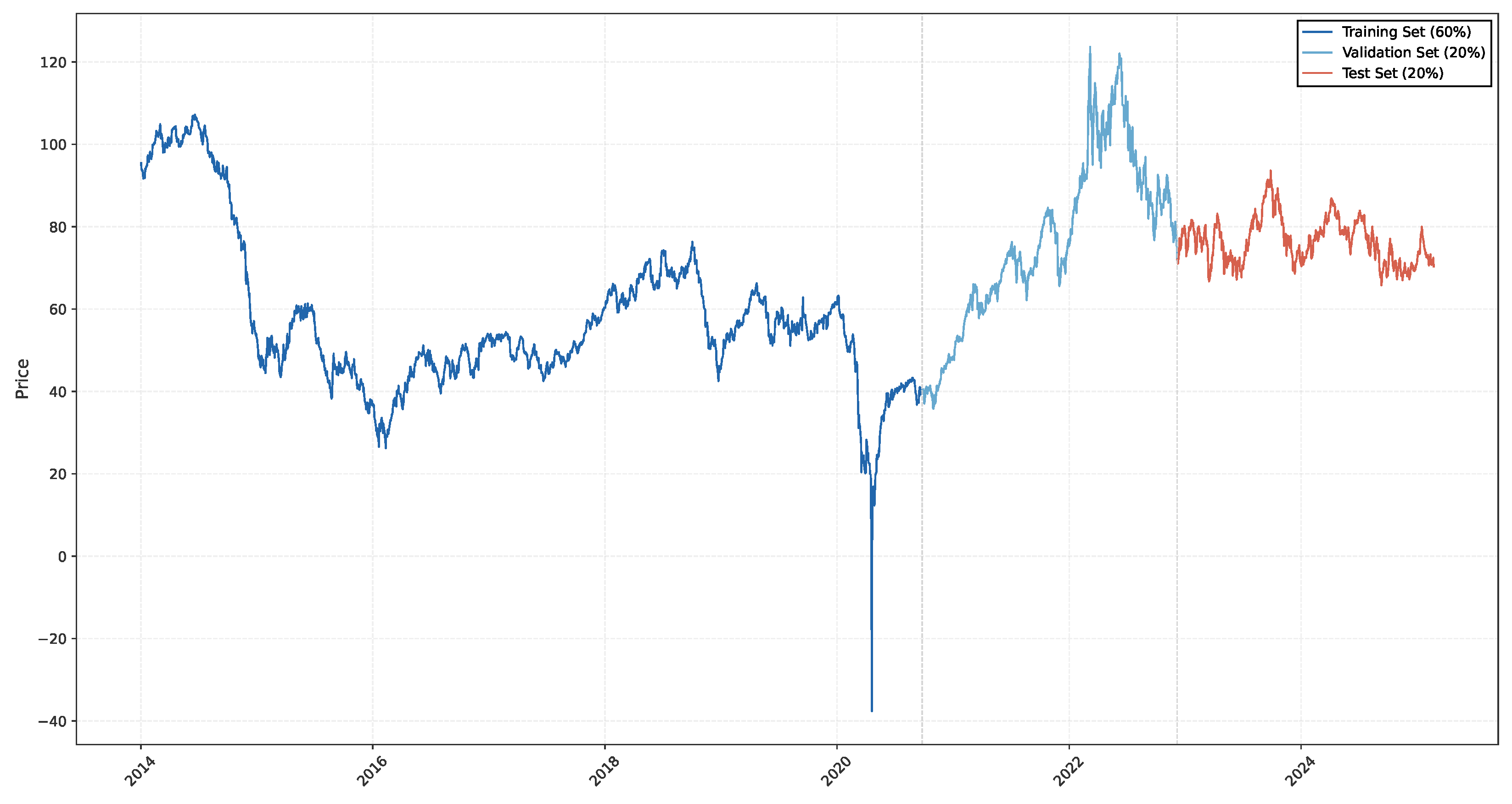

4.5. Cross-Dataset Performance Verification

To systematically evaluate the generalization capability of the VMD-FOA-GRU model, this study conducted cross-domain empirical analysis using WTI market crude oil futures price data from 2014 to 2025, data sourced from the Wind Financial Platform (

https://www.wind.com.cn, accessed on 22 April 2025). The experiment strictly adhered to the preprocessing procedures and model configurations previously established for vegetable price prediction, with the data distribution illustrated in

Figure A5.

The experimental results are shown in

Table 11 and data visualization is shown in

Figure 8, which reveal that, while the baseline GRU model achieved an R

2 value of 88.773%, its predictive performance demonstrates potential for enhancement. The implementation of VMD signal decomposition and FOA parameter optimization strategies induced progressive improvements in model accuracy. Notably, the VMD-enhanced model exhibited a significant R

2 increase to 98.373%, representing an improvement of nearly 10 percentage points over the baseline. The integrated VMD-FOA-GRU architecture ultimately demonstrated optimal forecasting performance, attaining an R

2 value of 98.765% with corresponding RMSE and MAE metrics optimized to 0.6087 and 0.4897, respectively.

The empirical findings substantiate that the VMD-FOA-GRU hybrid model demonstrates consistent superiority in agricultural commodity price forecasting while exhibiting robust cross-domain generalization capabilities. This domain adaptation capacity extends to diverse time series prediction tasks, particularly those involving energy futures pricing and other commodities characterized by high volatility, strong trend persistence, and both short- and long-term dependencies. The framework’s applicability is primarily constrained by limited data availability resulting from lower-frequency data granularity, where optimal performance currently relies on daily-frequency datasets and demonstrates reduced efficacy when historical observations become insufficient for robust pattern recognition. Higher-frequency applications necessitate architectural adaptations to maintain prediction reliability.

5. Conclusions

This study proposes and validates a hybrid VMD-FOA-GRU model for vegetable price prediction. The model enhances prediction accuracy and generalization capability through three cohesive components: multi-scale decomposition, adaptive parameter optimization, and robust nonlinear feature extraction. First, VMD processes raw price series into IMFs, generating noise-resistant inputs that preserve multi-scale temporal patterns. Second, the FOA autonomously adjusts GRU hyperparameters by balancing global search efficiency with local convergence precision. Finally, component-specific GRU predictors extract nonlinear features from decomposed IMFs, with systematic aggregation of sub-predictions effectively mitigating error propagation. This integrated approach demonstrates superior handling of non-stationary agricultural price dynamics through coordinated signal decomposition, intelligent parameter navigation, and ensemble forecasting.

To validate the hybrid model’s predictive performance, experimental analysis was conducted using daily price datasets from six vegetable categories. Through systematic comparison of FOA-optimized VMD integration with multiple deep learning architectures, experimental results demonstrate that the VMD-FOA-GRU model achieves optimal performance across all test datasets. Compared to the baseline GRU, the final hybrid model shows significant improvements, particularly demonstrating 5% accuracy enhancement in chili and radish price predictions. Notably, this methodological innovation was further validated through cross-domain verification using WTI crude oil futures data, demonstrating a 10% accuracy enhancement that notably exceeds the performance baseline of the original GRU architecture.

The price forecasting model offers multi-tiered benefits across agricultural value chains. For policymakers, the model provides actionable insights for designing dynamic price stabilization mechanisms and early-warning systems for supply chain disruptions. Farmers could access daily price predictions through alert systems, mobile applications, and social media platforms, enabling informed decisions on harvest timing and crop rotation planning based on real-time market intelligence. Consumers would benefit from enhanced price transparency via public dashboard interfaces, news aggregation platforms, and community-driven social media channels, which collectively mitigate abrupt market shocks by democratizing access to predictive analytics.

Despite demonstrating significant advantages in price prediction for six major vegetable crops, the proposed model retains important limitations. First, although the VMD-FOA-GRU model excels in capturing established price patterns and seasonal fluctuations, its responsiveness to unexpected events (e.g., pandemics, natural disasters) or non-marketized data remains insufficiently validated. Such anomalous events may substantially alter price fluctuation patterns, potentially reducing prediction accuracy. Second, model performance significantly depends on manually configured hyperparameters, including the number of VMD components and FOA population size. While optimal parameter configurations were experimentally determined for the current dataset, their generalizability across different agricultural products and market environments requires further investigation.

The proposed model not only outperforms state-of-the-art forecasting models in agricultural price prediction, but also exhibits comparable or superior performance when compared against hybrid models from other domains. Future research will focus on integrating multidimensional external factors including meteorological data and market sentiment indicators to further improve prediction accuracy and reliability.

Author Contributions

Conceptualization, G.W. and S.X.; methodology, G.W. and S.X.; software, G.W.; validation, Z.C., S.X., and Y.L.; formal analysis, G.W.; investigation, G.W. and S.X.; resources, S.X.; data curation, G.W.; writing—original draft preparation, G.W.; writing—review and editing, G.W., S.X., and Z.C.; visualization, G.W.; supervision, Y.L.; project administration, Y.L.; funding acquisition, Y.L. All authors have read and agreed to the published version of the manuscript.

Funding

The work is supported by the National Social Science Foundation of China (No. 21BGL168).

Institutional Review Board Statement

Not applicable.

Data Availability Statement

Data will be made available on request.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Figure A1.

Time series of vegetable prices with training, validation, and test sets.

Figure A1.

Time series of vegetable prices with training, validation, and test sets.

Table A1.

Performance comparison of different decomposition methods coupled with various models for forecasting tomato, cucumber, and chili prices.

Table A1.

Performance comparison of different decomposition methods coupled with various models for forecasting tomato, cucumber, and chili prices.

| Model | Tomato | Cucumber | Chili |

|---|

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

|---|

| VMD-GRU | 0.0573 | 0.0368 | 99.698 | 0.0642 | 0.0462 | 99.802 | 0.0965 | 0.0714 | 99.446 |

| VMD-LSTM | 0.0792 | 0.0580 | 99.423 | 0.0701 | 0.0512 | 99.764 | 0.1070 | 0.0769 | 99.318 |

| VMD-MLP | 0.0694 | 0.0475 | 99.557 | 0.0899 | 0.0677 | 99.612 | 0.1189 | 0.0869 | 99.159 |

| VMD-Transformer | 0.0655 | 0.0420 | 99.605 | 0.0681 | 0.0498 | 99.778 | 0.1119 | 0.0822 | 99.256 |

| EMD-GRU | 0.1088 | 0.0613 | 98.913 | 0.0977 | 0.0738 | 99.542 | 0.1762 | 0.1254 | 98.155 |

| EMD-LSTM | 0.1076 | 0.0613 | 98.936 | 0.1132 | 0.0863 | 99.386 | 0.1776 | 0.1230 | 98.126 |

| EMD-MLP | 0.1090 | 0.0594 | 98.907 | 0.1413 | 0.1037 | 99.044 | 0.2071 | 0.1575 | 97.452 |

| EMD-Transformer | 0.1143 | 0.0622 | 98.799 | 0.1823 | 0.1363 | 98.410 | 0.1843 | 0.1383 | 97.982 |

| CEEMDAN-GRU | 0.1092 | 0.0532 | 98.903 | 0.0886 | 0.0645 | 99.624 | 0.1541 | 0.1035 | 98.588 |

| CEEMDAN-LSTM | 0.1130 | 0.0591 | 98.827 | 0.0970 | 0.0729 | 99.549 | 0.1628 | 0.1115 | 98.425 |

| CEEMDAN-MLP | 0.1085 | 0.0607 | 98.917 | 0.1098 | 0.0818 | 99.422 | 0.1693 | 0.1142 | 98.297 |

| CEEMDAN-Transformer | 0.1264 | 0.0659 | 98.531 | 0.1014 | 0.0772 | 99.508 | 0.1623 | 0.1131 | 98.435 |

| EEMD-GRU | 0.0731 | 0.0401 | 99.508 | 0.0653 | 0.0509 | 99.795 | 0.1061 | 0.0792 | 99.330 |

| EEMD-LSTM | 0.0860 | 0.0564 | 99.320 | 0.1084 | 0.0916 | 99.437 | 0.1246 | 0.0962 | 99.077 |

| EEMD-MLP | 0.0797 | 0.0480 | 99.416 | 0.1034 | 0.0861 | 99.488 | 0.1153 | 0.0866 | 99.210 |

| EEMD-Transformer | 0.0812 | 0.0463 | 99.394 | 0.0717 | 0.0540 | 99.753 | 0.1124 | 0.0834 | 99.249 |

Table A2.

Performance comparison of different decomposition methods coupled with various models for forecasting cabbage, beans, and radish prices.

Table A2.

Performance comparison of different decomposition methods coupled with various models for forecasting cabbage, beans, and radish prices.

| Model | Cabbage | Beans | Radish |

|---|

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

|---|

| VMD-GRU | 0.0239 | 0.0170 | 99.484 | 0.0837 | 0.0629 | 99.841 | 0.0161 | 0.0117 | 99.425 |

| VMD-LSTM | 0.0380 | 0.0323 | 98.698 | 0.0919 | 0.0688 | 99.808 | 0.0191 | 0.0138 | 99.197 |

| VMD-MLP | 0.0266 | 0.0198 | 99.358 | 0.1316 | 0.1039 | 99.607 | 0.0181 | 0.0130 | 99.278 |

| VMD-Transformer | 0.0251 | 0.0180 | 99.430 | 0.1072 | 0.0752 | 99.739 | 0.0174 | 0.0129 | 99.329 |

| EMD-GRU | 0.0494 | 0.0339 | 97.798 | 0.1177 | 0.0869 | 99.686 | 0.0322 | 0.0230 | 97.726 |

| EMD-LSTM | 0.0517 | 0.0356 | 97.591 | 0.1700 | 0.1374 | 99.346 | 0.0349 | 0.0259 | 97.322 |

| EMD-MLP | 0.0566 | 0.0398 | 97.113 | 0.1492 | 0.1134 | 99.495 | 0.0341 | 0.0240 | 97.451 |

| EMD-Transformer | 0.0540 | 0.0377 | 97.363 | 0.1451 | 0.1101 | 99.523 | 0.0344 | 0.0249 | 97.408 |

| CEEMDAN-GRU | 0.0467 | 0.0336 | 98.030 | 0.1213 | 0.0850 | 99.666 | 0.0322 | 0.0214 | 97.727 |

| CEEMDAN-LSTM | 0.0470 | 0.0328 | 98.001 | 0.1254 | 0.0876 | 99.643 | 0.0340 | 0.0242 | 97.454 |

| CEEMDAN-MLP | 0.0507 | 0.0360 | 97.680 | 0.1386 | 0.1086 | 99.565 | 0.0355 | 0.0256 | 97.229 |

| CEEMDAN-Transformer | 0.0469 | 0.0326 | 98.010 | 0.1423 | 0.1061 | 99.541 | 0.0352 | 0.0259 | 97.272 |

| EEMD-GRU | 0.0291 | 0.0200 | 99.235 | 0.0842 | 0.0655 | 99.839 | 0.0205 | 0.0154 | 99.073 |

| EEMD-LSTM | 0.0306 | 0.0212 | 99.151 | 0.1249 | 0.1020 | 99.647 | 0.0230 | 0.0176 | 98.833 |

| EEMD-MLP | 0.0344 | 0.0244 | 98.929 | 0.1563 | 0.1331 | 99.447 | 0.0288 | 0.0228 | 98.182 |

| EEMD-Transformer | 0.0318 | 0.0223 | 99.083 | 0.1005 | 0.0807 | 99.771 | 0.0218 | 0.0167 | 98.954 |

Figure A2.

Performance metrics comparison of different decomposition methods across different vegetables.

Figure A2.

Performance metrics comparison of different decomposition methods across different vegetables.

Figure A3.

VMD extracted IMFs for different vegetable price datasets.

Figure A3.

VMD extracted IMFs for different vegetable price datasets.

Figure A4.

Training loss curves for VMD-decomposed IMFs of vegetable prices.

Figure A4.

Training loss curves for VMD-decomposed IMFs of vegetable prices.

Figure A5.

Time series of WTI crude oil with training, validation, and test sets.

Figure A5.

Time series of WTI crude oil with training, validation, and test sets.

Figure A6.

Performance evaluation of the VMD-FOA-GRU model across six vegetables.

Figure A6.

Performance evaluation of the VMD-FOA-GRU model across six vegetables.

References

- Guo, Z.; Wu, X.; Jayan, H.; Yin, L.; Xue, S.; El-Seedi, H.R.; Zou, X. Recent developments and applications of surface enhanced Raman scattering spectroscopy in safety detection of fruits and vegetables. Food Chem. 2024, 434, 137469. [Google Scholar] [CrossRef] [PubMed]

- National Bureau of Statistics of China. China Statistical Yearbook; National Bureau of Statistics of China: Beijing, China, 2024.

- Zou, Z.; Zou, X. Geographical and ecological differences in pepper cultivation and consumption in China. Front. Nutr. 2021, 8, 718517. [Google Scholar] [CrossRef] [PubMed]

- Li, B.; Ding, J.; Yin, Z.; Li, K.; Zhao, X.; Zhang, L. Optimized neural network combined model based on the induced ordered weighted averaging operator for vegetable price forecasting. Expert Syst. Appl. 2021, 168, 114232. [Google Scholar] [CrossRef]

- Li, Y.; Yao, J.; Song, J.; Feng, Y.; Dong, H.; Zhao, J.; Lian, Y.; Shi, F.; Xia, J. Investigation of causal public opinion indexes for price fluctuation in vegetable marketing. Comput. Electr. Eng. 2024, 116, 109227. [Google Scholar] [CrossRef]

- Yang, H.; Cao, Y.; Shi, Y.; Wu, Y.; Guo, W.; Fu, H.; Li, Y. The dynamic impacts of weather changes on vegetable price fluctuations in Shandong Province, China: An analysis based on VAR and TVP-VAR models. Agronomy 2022, 12, 2680. [Google Scholar] [CrossRef]

- Qiao, Y.; Kang, M.; Ahn, B.i. Analysis of factors affecting vegetable price fluctuation: A case study of South Korea. Agriculture 2023, 13, 577. [Google Scholar] [CrossRef]

- Li, Z.; Li, G.; Wang, Y. Construction of short-term forecast model of eggs market price. Agric. Agric. Sci. Procedia 2010, 1, 396–401. [Google Scholar] [CrossRef][Green Version]

- Wang, G.; Su, H.; Mo, L.; Yi, X.; Wu, P. Forecasting of soil respiration time series via clustered ARIMA. Comput. Electron. Agric. 2024, 225, 109315. [Google Scholar] [CrossRef]

- Zhang, Q.; Yang, W.; Zhao, A.; Wang, X.; Wang, Z.; Zhang, L. Short-term forecasting of vegetable prices based on lstm model-Evidence from Beijing’s vegetable data. PLoS ONE 2024, 19, e0304881. [Google Scholar] [CrossRef]

- Xueling, L.; Xiong, X.; Yucong, S. Exchange rate market trend prediction based on sentiment analysis. Comput. Electr. Eng. 2023, 111, 108901. [Google Scholar] [CrossRef]

- Zheng, J.; Zhu, J.; Xi, H. Short-term energy consumption prediction of electric vehicle charging station using attentional feature engineering and multi-sequence stacked Gated Recurrent Unit. Comput. Electr. Eng. 2023, 108, 108694. [Google Scholar] [CrossRef]

- Guan, S.; Xu, C.; Guan, T. Multistep power load forecasting using iterative neural network-based prediction intervals. Comput. Electr. Eng. 2024, 119, 109518. [Google Scholar] [CrossRef]

- Xue, H.; Wang, G.; Li, X.; Du, F. Predictive combination model for CH4 separation and CO2 sequestration with CO2 injection into coal seams: VMD-STA-BiLSTM-ELM hybrid neural network modeling. Energy 2024, 313, 133744. [Google Scholar] [CrossRef]

- Liu, Y.; Ning, C.; Zhang, Q.; Yuan, G.; Li, C. Utilizing VMD and BiGRU to predict the short-term motion of buoys. Ocean Eng. 2024, 313, 119237. [Google Scholar] [CrossRef]

- Li, B.; Liao, M.; Yuan, J.; Zhang, J. Green consumption behavior prediction based on fan-shaped search mechanism fruit fly algorithm optimized neural network. J. Retail. Consum. Serv. 2023, 75, 103471. [Google Scholar] [CrossRef]

- Ibrahim, I.A.; Hossain, M.; Duck, B.C. A hybrid wind driven-based fruit fly optimization algorithm for identifying the parameters of a double-diode photovoltaic cell model considering degradation effects. Sustain. Energy Technol. Assessments 2022, 50, 101685. [Google Scholar] [CrossRef]

- Wang, L.; Feng, J.; Sui, X.; Chu, X.; Mu, W. Agricultural product price forecasting methods: Research advances and trend. Br. Food J. 2020, 122, 2121–2138. [Google Scholar] [CrossRef]

- BV, B.P.; Dakshayini, M. Performance analysis of the regression and time series predictive models using parallel implementation for agricultural data. Procedia Comput. Sci. 2018, 132, 198–207. [Google Scholar]

- Li, G.Q.; Xu, S.W.; Li, Z.M.; Sun, Y.G.; Dong, X.X. Using quantile regression approach to analyze price movements of agricultural products in china. J. Integr. Agric. 2012, 11, 674–683. [Google Scholar] [CrossRef]

- Hasan, M.R.; Dey, M.M.; Engle, C.R. Forecasting monthly catfish (Ictalurus punctatus.) pond bank and feed prices. Aquac. Econ. Manag. 2019, 23, 86–110. [Google Scholar] [CrossRef]

- Siddique, M.A.B.; Mahalder, B.; Haque, M.M.; Shohan, M.H.; Biswas, J.C.; Akhtar, S.; Ahammad, A.S. Forecasting of tilapia (Oreochromis niloticus) production in Bangladesh using ARIMA model. Heliyon 2024, 10, e27111. [Google Scholar] [CrossRef] [PubMed]

- Yasmin, S.; Moniruzzaman, M. Forecasting of area, production, and yield of jute in Bangladesh using Box-Jenkins ARIMA model. J. Agric. Food Res. 2024, 16, 101203. [Google Scholar] [CrossRef]

- Cheung, L.; Wang, Y.; Lau, A.S.; Chan, R.M. Using a novel clustered 3D-CNN model for improving crop future price prediction. Knowl.-Based Syst. 2023, 260, 110133. [Google Scholar] [CrossRef]

- Hemageetha, N.; Nasira, G. Radial basis function model for vegetable price prediction. In Proceedings of the 2013 International Conference on Pattern Recognition, Informatics and Mobile Engineering, Salem, India, 21–22 February 2013; IEEE: Piscataway, NJ, USA, 2013; pp. 424–428. [Google Scholar]

- Yuan, C.Z.; Ling, S.K. Long short-term memory model based agriculture commodity price prediction application. In Proceedings of the 2020 2nd International Conference on Information Technology and Computer Communications, Kuala, Malaysia, 12–14 August 2020; pp. 43–49. [Google Scholar]

- Jaiswal, R.; Jha, G.K.; Kumar, R.R.; Choudhary, K. Deep long short-term memory based model for agricultural price forecasting. Neural Comput. Appl. 2022, 34, 4661–4676. [Google Scholar] [CrossRef]

- Datta, P.; Faroughi, S.A. A multihead LSTM technique for prognostic prediction of soil moisture. Geoderma 2023, 433, 116452. [Google Scholar] [CrossRef]

- Li, X.; Zhang, L.; Wang, X.; Liang, B. Forecasting greenhouse air and soil temperatures: A multi-step time series approach employing attention-based LSTM network. Comput. Electron. Agric. 2024, 217, 108602. [Google Scholar] [CrossRef]

- Xiong, T.; Li, C.; Bao, Y. Seasonal forecasting of agricultural commodity price using a hybrid STL and ELM method: Evidence from the vegetable market in China. Neurocomputing 2018, 275, 2831–2844. [Google Scholar] [CrossRef]

- Jin, D.; Yin, H.; Gu, Y.; Yoo, S.J. Forecasting of vegetable prices using STL-LSTM method. In Proceedings of the 2019 6th International Conference on Systems and Informatics (ICSAI), Shanghai, China, 2–4 November 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 866–871. [Google Scholar]

- Yin, H.; Jin, D.; Gu, Y.H.; Park, C.J.; Han, S.K.; Yoo, S.J. STL-ATTLSTM: Vegetable price forecasting using STL and attention mechanism-based LSTM. Agriculture 2020, 10, 612. [Google Scholar] [CrossRef]

- Zhang, H.; Yan, Z. Vegetable Price Forecasting Based on ARIMA Model and Random Forest Prediction. J. Educ. Humanit. Soc. Sci. 2024, 25, 74–82. [Google Scholar] [CrossRef]

- Yao, Y.; Zhang, Z.y.; Zhao, Y. Stock index forecasting based on multivariate empirical mode decomposition and temporal convolutional networks. Appl. Soft Comput. 2023, 142, 110356. [Google Scholar] [CrossRef]

- Wang, C.; Lin, H.; Hu, H.; Yang, M.; Ma, L. A hybrid model with combined feature selection based on optimized VMD and improved multi-objective coati optimization algorithm for short-term wind power prediction. Energy 2024, 293, 130684. [Google Scholar] [CrossRef]

- Ma, C.; Hu, Y.; Xu, X. Hybrid deep learning model with VMD-BiLSTM-GRU networks for short-term traffic flow prediction. Data Sci. Manag. 2024; in press. [Google Scholar] [CrossRef]

- Zhao, Y.; Peng, X.; Tu, T.; Li, Z.; Yan, P.; Li, C. WOA-VMD-SCINet: Hybrid model for accurate prediction of ultra-short-term Photovoltaic generation power considering seasonal variations. Energy Rep. 2024, 12, 3470–3487. [Google Scholar] [CrossRef]

- Avinash, G.; Ramasubramanian, V.; Ray, M.; Paul, R.K.; Godara, S.; Nayak, G.H.; Kumar, R.R.; Manjunatha, B.; Dahiya, S.; Iquebal, M.A. Hidden Markov guided Deep Learning models for forecasting highly volatile agricultural commodity prices. Appl. Soft Comput. 2024, 158, 111557. [Google Scholar] [CrossRef]

- Khaki, S.; Wang, L.; Archontoulis, S.V. A CNN-RNN framework for crop yield prediction. Front. Plant Sci. 2020, 10, 1750. [Google Scholar] [CrossRef]

- Sun, C.; Pei, M.; Cao, B.; Chang, S.; Si, H. A Study on Agricultural Commodity Price Prediction Model Based on Secondary Decomposition and Long Short-Term Memory Network. Agriculture 2023, 14, 60. [Google Scholar] [CrossRef]

- Huang, Y.; Deng, Y. A new crude oil price forecasting model based on variational mode decomposition. Knowl.-Based Syst. 2021, 213, 106669. [Google Scholar] [CrossRef]

- Sun, J.; Zhao, P.; Sun, S. A new secondary decomposition-reconstruction-ensemble approach for crude oil price forecasting. Resour. Policy 2022, 77, 102762. [Google Scholar] [CrossRef]

- Santos, J.L.F.d.; Vaz, A.J.C.; Kachba, Y.R.; Stevan, S.L., Jr.; Antonini Alves, T.; Siqueira, H.V. Linear Ensembles for WTI Oil Price Forecasting. Energies 2024, 17, 4058. [Google Scholar] [CrossRef]

- Dong, Y.; Jiang, H.; Guo, Y.; Wang, J. A novel crude oil price forecasting model using decomposition and deep learning networks. Eng. Appl. Artif. Intell. 2024, 133, 108111. [Google Scholar] [CrossRef]

- Dragomiretskiy, K.; Zosso, D. Variational mode decomposition. IEEE Trans. Signal Process. 2013, 62, 531–544. [Google Scholar] [CrossRef]

- Pan, W.T. A new fruit fly optimization algorithm: Taking the financial distress model as an example. Knowl.-Based Syst. 2012, 26, 69–74. [Google Scholar] [CrossRef]

- Zhang, Q.; Li, C.; Yin, C.; Zhang, H.; Su, F. A hybrid framework model based on wavelet neural network with improved fruit fly optimization algorithm for traffic flow predictio. Symmetry 2022, 14, 1333. [Google Scholar] [CrossRef]

- Cho, K.; van Merrienboer, B.; Gulcehre, C.; Bahdanau, D.; Bougares, F.; Schwenk, H.; Bengio, Y. Learning Phrase Representations using RNN Encoder-Decoder for Statistical Machine Translation. arXiv 2014, arXiv:1406.1078. [Google Scholar] [CrossRef]

- Chung, J.; Gulcehre, C.; Cho, K.; Bengio, Y. Empirical Evaluation of Gated Recurrent Neural Networks on Sequence Modeling. arXiv 2014, arXiv:1412.3555. [Google Scholar] [CrossRef]

- Huang, N.E.; Shen, Z.; Long, S.R.; Wu, M.C.; Shih, H.H.; Zheng, Q.; Yen, N.C.; Tung, C.C.; Liu, H.H. The empirical mode decomposition and the Hilbert spectrum for nonlinear and non-stationary time series analysis. Proc. R. Soc. London. Ser. A: Math. Phys. Eng. Sci. 1998, 454, 903–995. [Google Scholar] [CrossRef]

- Torres, M.E.; Colominas, M.A.; Schlotthauer, G.; Flandrin, P. A complete ensemble empirical mode decomposition with adaptive noise. In Proceedings of the 2011 IEEE International Conference on Acoustics, Speech and Signal Processing (ICASSP), Prague, Czech, 22–27 May 2011; IEEE: Piscataway, NJ, USA, 2011; pp. 4144–4147. [Google Scholar]

- Wu, Z.; Huang, N.E. Ensemble empirical mode decomposition: A noise-assisted data analysis method. Adv. Adapt. Data Anal. 2009, 1, 1–41. [Google Scholar] [CrossRef]

- Yamak, P.T.; Yujian, L.; Gadosey, P.K. A comparison between arima, lstm, and gru for time series forecasting. In Proceedings of the 2019 2nd International Conference on Algorithms, Computing and Artificial Intelligence, Sanya, China, 20–22 December 2019; pp. 49–55. [Google Scholar]

- Hornik, K. Approximation capabilities of multilayer feedforward networks. Neural Netw. 1991, 4, 251–257. [Google Scholar] [CrossRef]

- Zhou, H.; Zhang, S.; Peng, J.; Zhang, S.; Li, J.; Xiong, H.; Zhang, W. Informer: Beyond efficient transformer for long sequence time-series forecasting. In Proceedings of the AAAI Conference on Artificial Intelligence, Virtual, 2–9 February 2021; Volume 35, pp. 11106–11115. [Google Scholar]

Figure 1.

Iterative food searching of fruit fly.

Figure 1.

Iterative food searching of fruit fly.

Figure 2.

GRU model structure.

Figure 2.

GRU model structure.

Figure 3.

VMD-FOA-GRU model structure.

Figure 3.

VMD-FOA-GRU model structure.

Figure 4.

RMSE, MAE, and R2 (%) with different K values.

Figure 4.

RMSE, MAE, and R2 (%) with different K values.

Figure 5.

GRU performance metrics comparison of different decomposition methods across different vegetables.

Figure 5.

GRU performance metrics comparison of different decomposition methods across different vegetables.

Figure 6.

Performance metrics comparison of FOA-enhanced methods across different vegetables.

Figure 6.

Performance metrics comparison of FOA-enhanced methods across different vegetables.

Figure 7.

Performance metrics comparison of ablation experiments across different vegetables.

Figure 7.

Performance metrics comparison of ablation experiments across different vegetables.

Figure 8.

Performance metrics comparison of WTI markets.

Figure 8.

Performance metrics comparison of WTI markets.

Table 1.

Comparative analysis of agricultural price forecasting studies.

Table 1.

Comparative analysis of agricultural price forecasting studies.

| Type | Model | Researcher | Application | Granularity |

|---|

| Traditional | Regression | [19] | Tomato | Monthly |

| Regression | [8] | Egg | Monthly |

| Quantile Regression | [20] | Livestock products | Monthly |

| ARIMAX | [21] | Catfish | Monthly |

| ARIMA | [22] | Tilapia | Yearly |

| Clustered ARIMA | [9] | Soil respiration | Hourly |

| Box–Jenkins ARIMA | [23] | Jute | Yearly |

| Intelligent | 3DCNN | [24] | Crops | Multi-scale |

| RBFNN/BPNN | [25] | Vegetables | Weekly |

| LSTM | [26] | Agricultural products | Weekly |

| DLSTM | [27] | Commodities | Monthly |

| Multi-Head LSTM | [28] | Soil moisture | 15 min |

| Attention–LSTM | [29] | Temperature | 30 min |

| Hybrid | STL-ELM | [30] | Vegetables | Monthly |

| STL-LSTM | [31] | Vegetables | Monthly |

| STL-ATTLSTM | [32] | Crops | Monthly |

| ARIMA-RF | [33] | Agricultural products | Daily |

| MEMD-TCN | [34] | Stock price forecasting | Daily |

| COA-VMD-Hybrid | [35] | Wind power prediction | 15 min |

| VMD-BiLSTM-GRU | [36] | Traffic flow prediction | Daily |

| WOA-VMD-SCINet | [37] | Energy price forecasting | Hourly |

| Hybrid | FOA-RBFNN | [4] | Vegetable prices | Monthly |

| HMM-DL | [38] | Potato | Weekly |

| CNN-RNN | [39] | Crops | Monthly |

| VMD-EEMD-LSTM | [40] | Agricultural products | Weekly |

| VMD-LSTM-MW | [41] | WTI crude oil prices | Daily |

| ICEEMDAN-PE-EMD-PSR-CSSA-KELM | [42] | WTI crude oil prices | Daily |

| Linear Ensemble | [43] | WTI crude oil prices | Daily |

| VMD-PSR-CNN-BiLSTM | [44] | Brent oil prices | Daily |

Table 2.

Hyperparameter settings.

Table 2.

Hyperparameter settings.

| | Parameter | Value |

|---|

| General training parameters | K | 10 |

| optimizer | Adam |

| epoch | 50 |

| batch size | 64 |

| learning rate | 0.001 |

| loss function | MSE |

| window len | 10d |

| prediction len | 1d |

| GRU | units | 128 |

| activation function | selu |

| VMD | K | 10 |

| alpha | 2000 |

| tau | 0 |

| DC | 0 |

| init | 1 |

| tol | 1 × 106 |

| FOA | MaxGen | 10 |

| PopSize | 5 |

| units range | 32–256 |

| learning rate range | 0.0001–0.01 |

Table 3.

VMD-GRU performance metrics for tomato, cucumber, and chili price prediction with varying K.

Table 3.

VMD-GRU performance metrics for tomato, cucumber, and chili price prediction with varying K.

| K | Tomato | Cucumber | Chili |

|---|

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

|---|

| 10

| 0.0573 | 0.0368 | 99.698 | 0.0642 | 0.0462 | 99.802 | 0.0965 | 0.0714 | 99.446 |

| 9 | 0.0588 | 0.0381 | 99.682 | 0.0730 | 0.0519 | 99.744 | 0.1079 | 0.0773 | 99.307 |

| 8 | 0.0665 | 0.0442 | 99.593 | 0.0894 | 0.0638 | 99.617 | 0.1422 | 0.1026 | 98.798 |

| 7 | 0.0774 | 0.0553 | 99.449 | 0.0999 | 0.0730 | 99.522 | 0.1446 | 0.1050 | 98.758 |

| 6 | 0.0783 | 0.0501 | 99.436 | 0.0999 | 0.0720 | 99.521 | 0.1553 | 0.1107 | 98.567 |

| 5 | 0.0902 | 0.0571 | 99.252 | 0.1055 | 0.0767 | 99.467 | 0.1621 | 0.1132 | 98.438 |

Table 4.

VMD-GRU performance metrics for cabbage, beans, and radish price prediction with varying K.

Table 4.

VMD-GRU performance metrics for cabbage, beans, and radish price prediction with varying K.

| K | Cabbage | Beans | Radish |

|---|

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

|---|

| 10 | 0.0239 | 0.0170 | 99.484 | 0.0837 | 0.0629 | 99.841 | 0.0161 | 0.0117 | 99.425 |

| 9 | 0.0290 | 0.0209 | 99.238 | 0.0854 | 0.0636 | 99.834 | 0.0181 | 0.0131 | 99.278 |

| 8 | 0.0340 | 0.0253 | 98.957 | 0.0973 | 0.0721 | 99.785 | 0.0201 | 0.0146 | 99.109 |

| 7 | 0.0373 | 0.0270 | 98.743 | 0.0993 | 0.0738 | 99.776 | 0.0231 | 0.0166 | 98.829 |

| 6 | 0.0393 | 0.0274 | 98.604 | 0.1045 | 0.0775 | 99.752 | 0.0260 | 0.0184 | 98.512 |

| 5 | 0.0445 | 0.0322 | 98.215 | 0.1689 | 0.1250 | 99.354 | 0.0313 | 0.0226 | 97.848 |

Table 5.

Performance comparison of GRU models with different decomposition methods for forecasting tomato, cucumber, and chili prices.

Table 5.

Performance comparison of GRU models with different decomposition methods for forecasting tomato, cucumber, and chili prices.

| Model | Tomato | Cucumber | Chili |

|---|

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

|---|

| VMD-GRU | 0.0573 | 0.0368 | 99.698 | 0.0642 | 0.0462 | 99.802 | 0.0965 | 0.0714 | 99.446 |

| EMD-GRU | 0.1088 | 0.0613 | 98.913 | 0.0977 | 0.0738 | 99.542 | 0.1762 | 0.1254 | 98.155 |

| CEEMDAN-GRU | 0.1092 | 0.0532 | 98.903 | 0.0886 | 0.0645 | 99.624 | 0.1541 | 0.1035 | 98.588 |

| EEMD-GRU | 0.0731 | 0.0401 | 99.508 | 0.0653 | 0.0509 | 99.795 | 0.1061 | 0.0792 | 99.330 |

Table 6.

Performance comparison of GRU models with different decomposition methods for forecasting cabbage, beans, and radish prices.

Table 6.

Performance comparison of GRU models with different decomposition methods for forecasting cabbage, beans, and radish prices.

| Model | Cabbage | Beans | Radish |

|---|

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

|---|

| VMD-GRU | 0.0239 | 0.0170 | 99.484 | 0.0837 | 0.0629 | 99.841 | 0.0161 | 0.0117 | 99.425 |

| EMD-GRU | 0.0494 | 0.0339 | 97.798 | 0.1177 | 0.0869 | 99.686 | 0.0322 | 0.0230 | 97.726 |

| CEEMDAN-GRU | 0.0467 | 0.0336 | 98.030 | 0.1213 | 0.0850 | 99.666 | 0.0322 | 0.0214 | 97.727 |

| EEMD-GRU | 0.0291 | 0.0200 | 99.235 | 0.0842 | 0.0655 | 99.839 | 0.0205 | 0.0154 | 99.073 |

Table 7.

FOA performance with different VMD models for tomato, cucumber, and chili.

Table 7.

FOA performance with different VMD models for tomato, cucumber, and chili.

| Model | Tomato | Cucumber | Chili |

|---|

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

|---|

| VMD-FOA-GRU | 0.0528 | 0.0332 | 99.744 | 0.0583 | 0.0421 | 99.837 | 0.0955 | 0.0695 | 99.457 |

| VMD-FOA-LSTM | 0.0608 | 0.0394 | 99.659 | 0.0667 | 0.0486 | 99.787 | 0.1073 | 0.0785 | 99.315 |

| VMD-FOA-MLP | 0.0619 | 0.0424 | 99.647 | 0.0688 | 0.0502 | 99.773 | 0.1250 | 0.1012 | 99.071 |

| VMD-FOA-Transformer | 0.0667 | 0.0445 | 99.591 | 0.0630 | 0.0466 | 99.809 | 0.1051 | 0.0770 | 99.343 |

Table 8.

FOA performance with different VMD models for cabbage, beans, and radish.

Table 8.

FOA performance with different VMD models for cabbage, beans, and radish.

| Model | Cabbage | Beans | Radish |

|---|

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

|---|

| VMD-FOA-GRU | 0.0222 | 0.0162 | 99.555 | 0.0807 | 0.0603 | 99.852 | 0.0149 | 0.0111 | 99.507 |

| VMD-FOA-LSTM | 0.0232 | 0.0165 | 99.513 | 0.0817 | 0.0615 | 99.848 | 0.0164 | 0.0118 | 99.404 |

| VMD-FOA-MLP | 0.0240 | 0.0172 | 99.477 | 0.0873 | 0.0664 | 99.827 | 0.0175 | 0.0124 | 99.322 |

| VMD-FOA-Transformer | 0.0252 | 0.0188 | 99.423 | 0.0944 | 0.0695 | 99.798 | 0.0165 | 0.0117 | 99.403 |

Table 9.

Performance of GRU model with successive incorporation of VMD and the FOA for predicting tomato, cucumber, and chili prices.

Table 9.

Performance of GRU model with successive incorporation of VMD and the FOA for predicting tomato, cucumber, and chili prices.

| Model | Tomato | Cucumber | Chili |

|---|

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

|---|

| GRU | 0.1437 | 0.0807 | 98.103 | 0.1686 | 0.1159 | 98.639 | 0.3005 | 0.2147 | 94.636 |

| VMD-GRU | 0.0573 | 0.0368 | 99.698 | 0.0642 | 0.0462 | 99.802 | 0.0965 | 0.0714 | 99.446 |

| FOA-GRU | 0.1437 | 0.0780 | 98.102 | 0.1655 | 0.1111 | 98.689 | 0.2737 | 0.1813 | 95.549 |

| VMD-FOA-GRU | 0.0528 | 0.0332 | 99.744 | 0.0583 | 0.0421 | 99.837 | 0.0955 | 0.0695 | 99.457 |

Table 10.

Performance of GRU model with successive incorporation of VMD and the FOA for predicting cabbage, beans, and radish prices.

Table 10.

Performance of GRU model with successive incorporation of VMD and the FOA for predicting cabbage, beans, and radish prices.

| Model | Cabbage | Beans | Radish |

|---|

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

RMSE

|

MAE

|

R2 (%)

|

|---|

| GRU | 0.0759 | 0.0449 | 94.805 | 0.1969 | 0.1387 | 99.122 | 0.0498 | 0.0324 | 94.553 |

| VMD-GRU | 0.0239 | 0.0170 | 99.484 | 0.0837 | 0.0629 | 99.841 | 0.0161 | 0.0117 | 99.425 |

| FOA-GRU | 0.0767 | 0.0457 | 94.699 | 0.1992 | 0.1380 | 99.101 | 0.0498 | 0.0322 | 94.561 |

| VMD-FOA-GRU | 0.0222 | 0.0162 | 99.555 | 0.0807 | 0.0603 | 99.852 | 0.0149 | 0.0111 | 99.507 |

Table 11.

Performance comparison of GRU models and their variants for WTI crude oil price forecasting.

Table 11.

Performance comparison of GRU models and their variants for WTI crude oil price forecasting.

| Model | RMSE | MAE | R2 (%) |

|---|

| GRU | 1.8360 | 1.4501 | 88.773 |

| VMD-GRU | 0.6988 | 0.5618 | 98.373 |

| FOA-GRU | 1.5291 | 1.2134 | 92.212 |

| VMD-FOA-GRU | 0.6087 | 0.4897 | 98.765 |

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).