Regional Differences and Dynamic Evolution of Agricultural Product Market Integration in China

Abstract

1. Introduction

2. Materials and Methods

2.1. Materials

2.2. Methods

2.2.1. Relative Price Method

2.2.2. Dagum–Gini Coefficient and Decomposition

2.2.3. σ Converge Model

2.2.4. β Convergence Model

3. Results

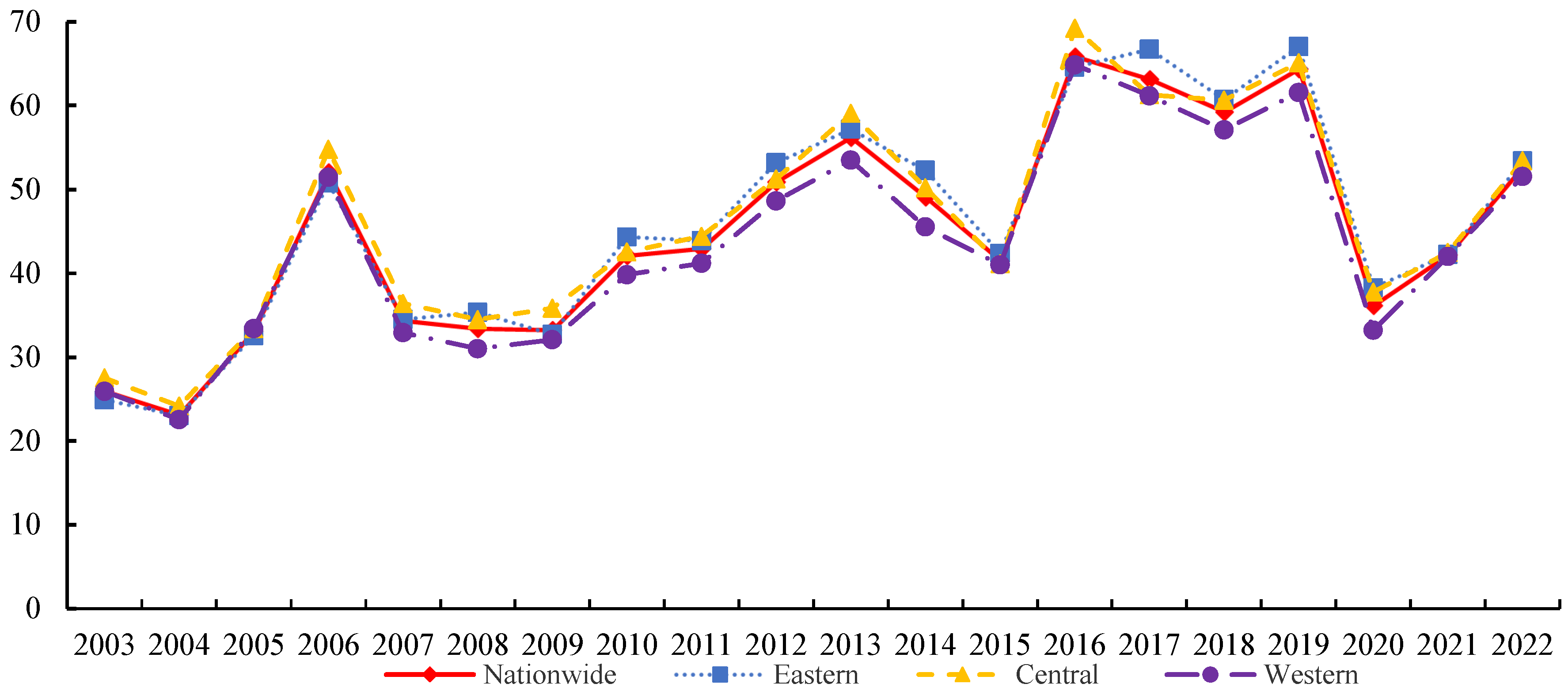

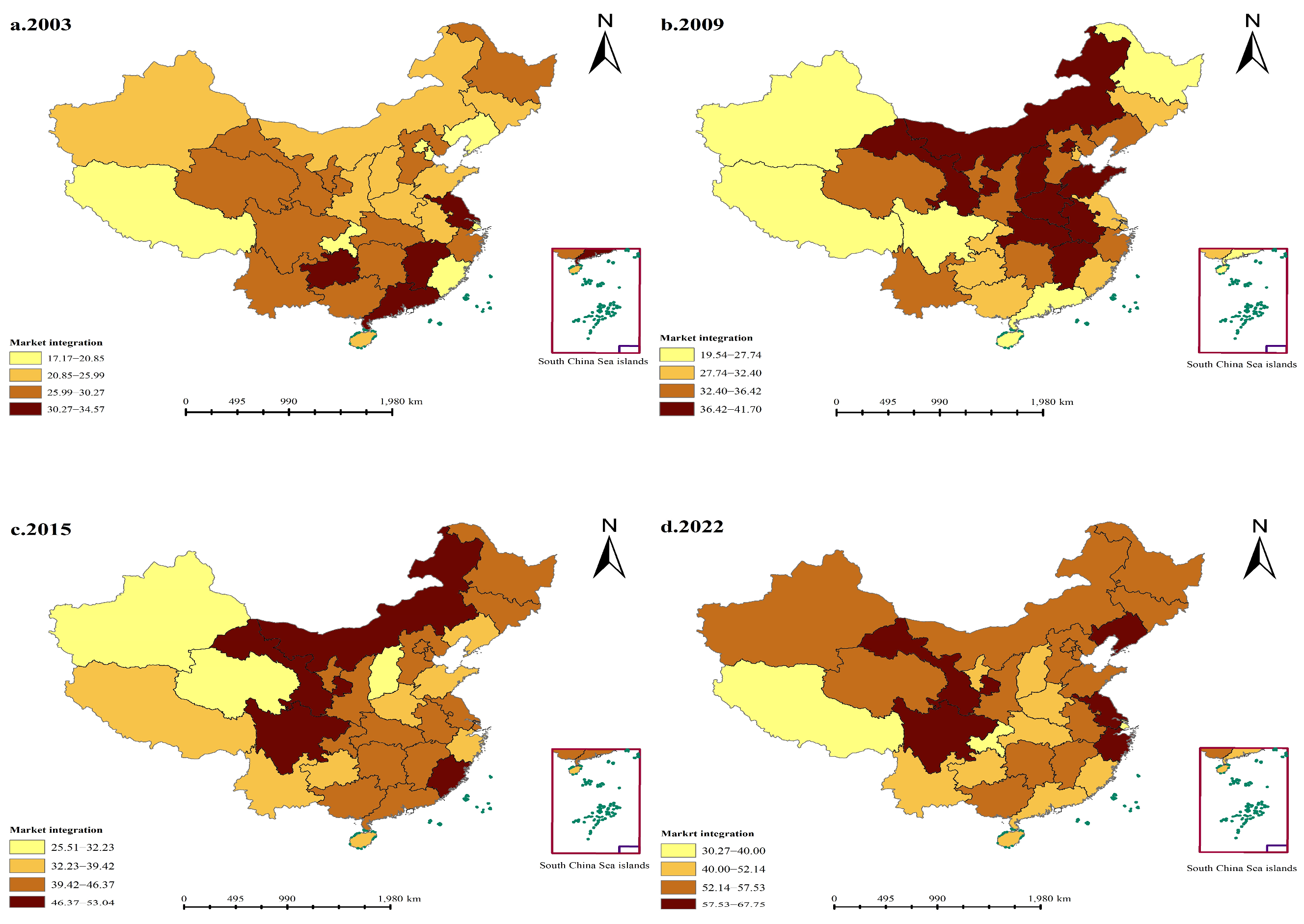

3.1. Status of the Integration of the Agricultural Product Market in China

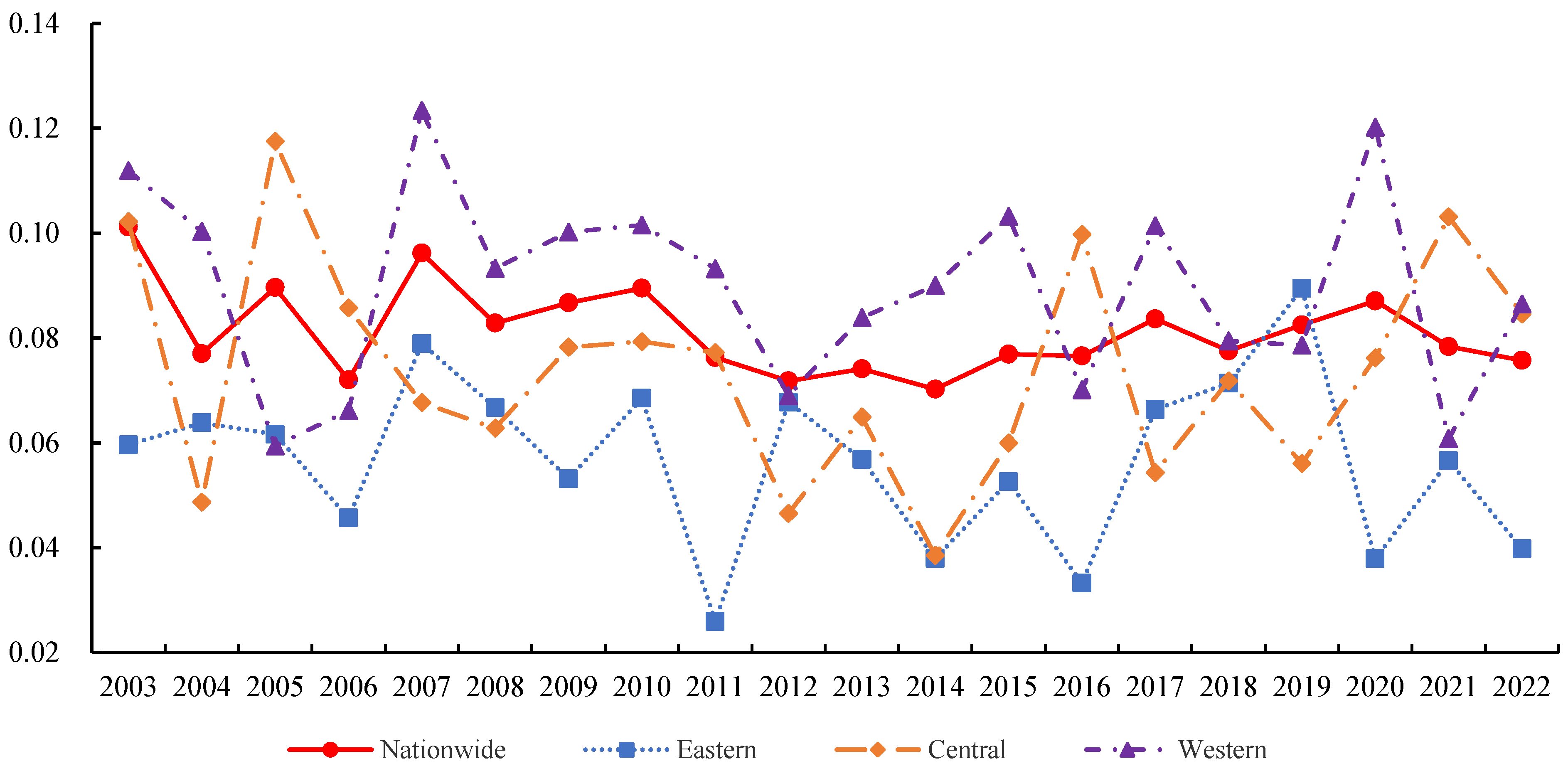

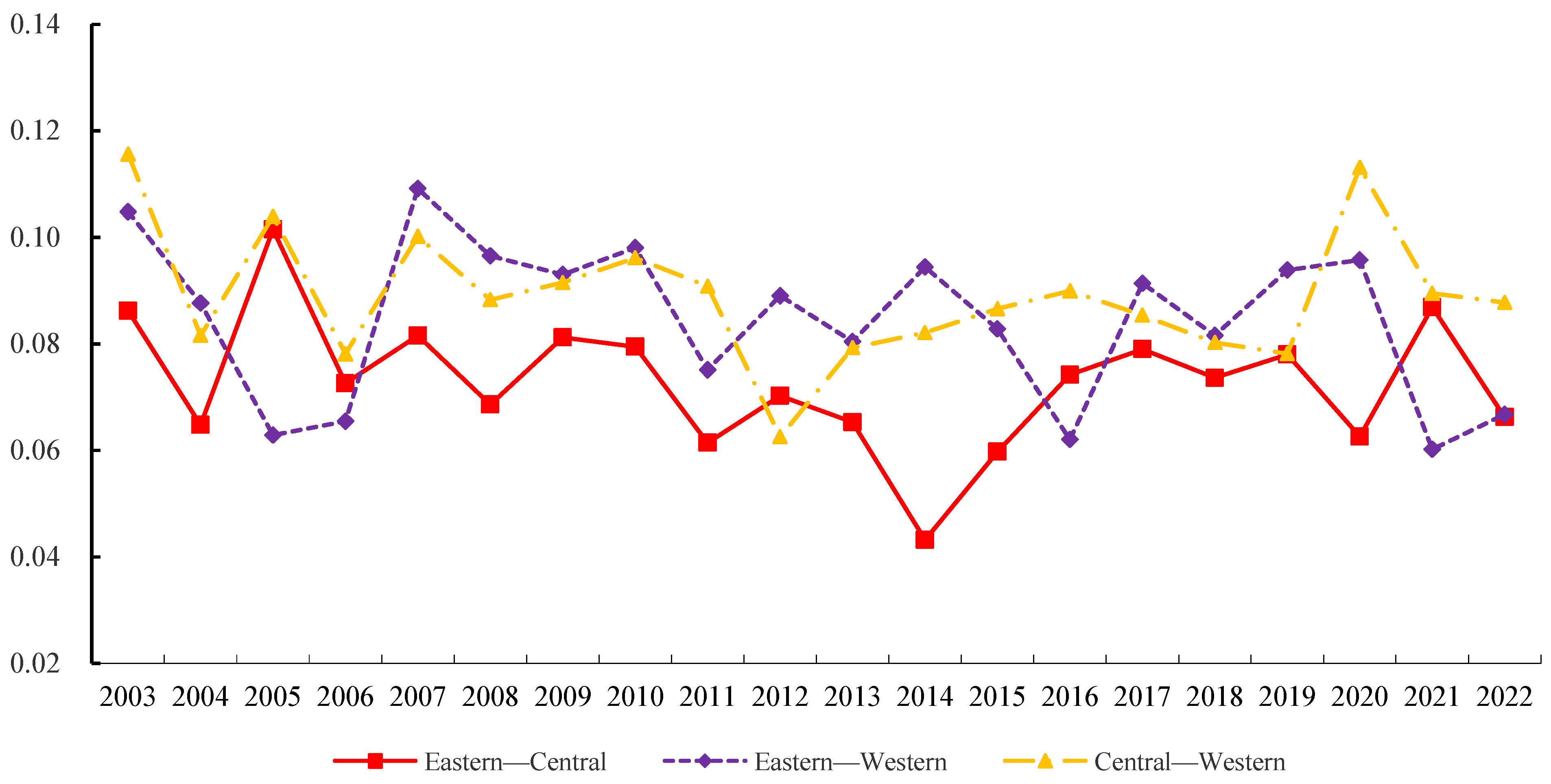

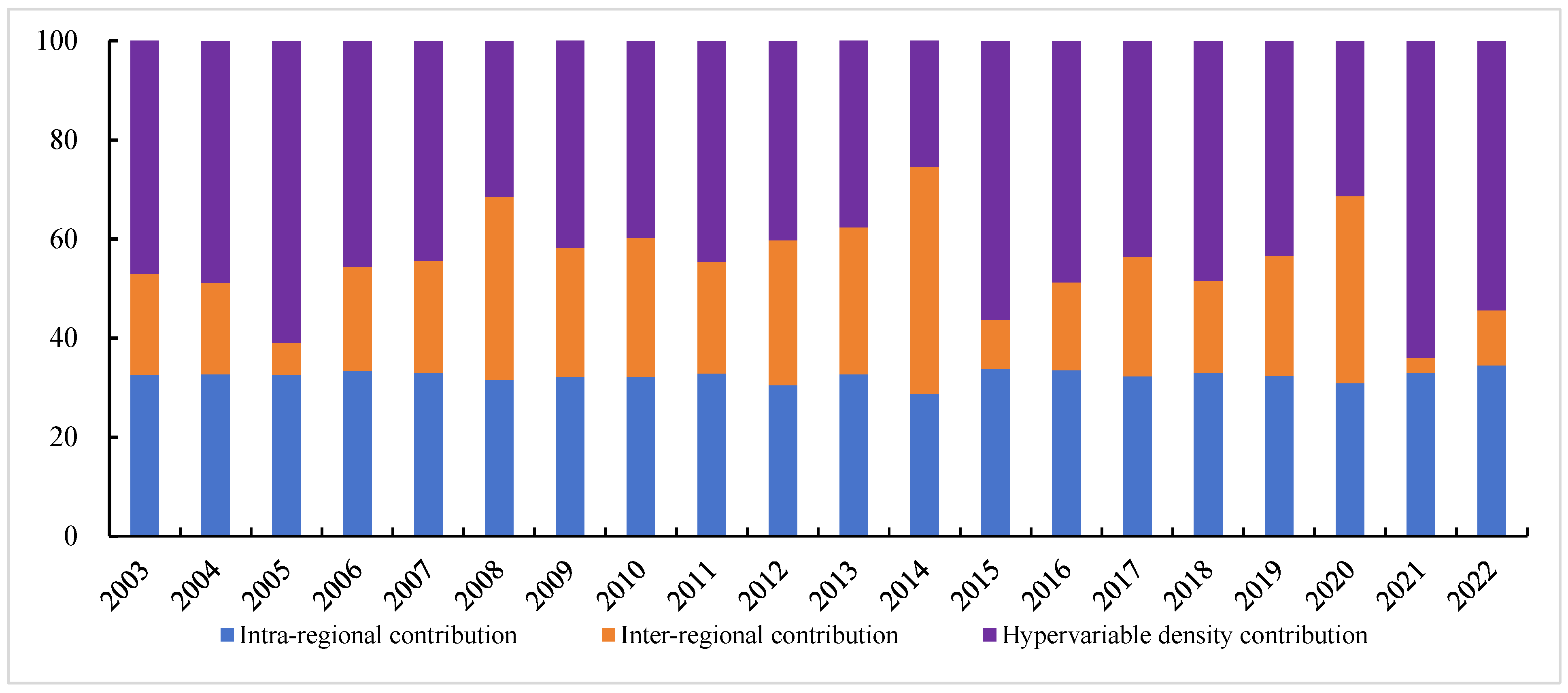

3.2. Characteristics and Sources of Spatial Differentiation

3.3. Trend in Development over Time

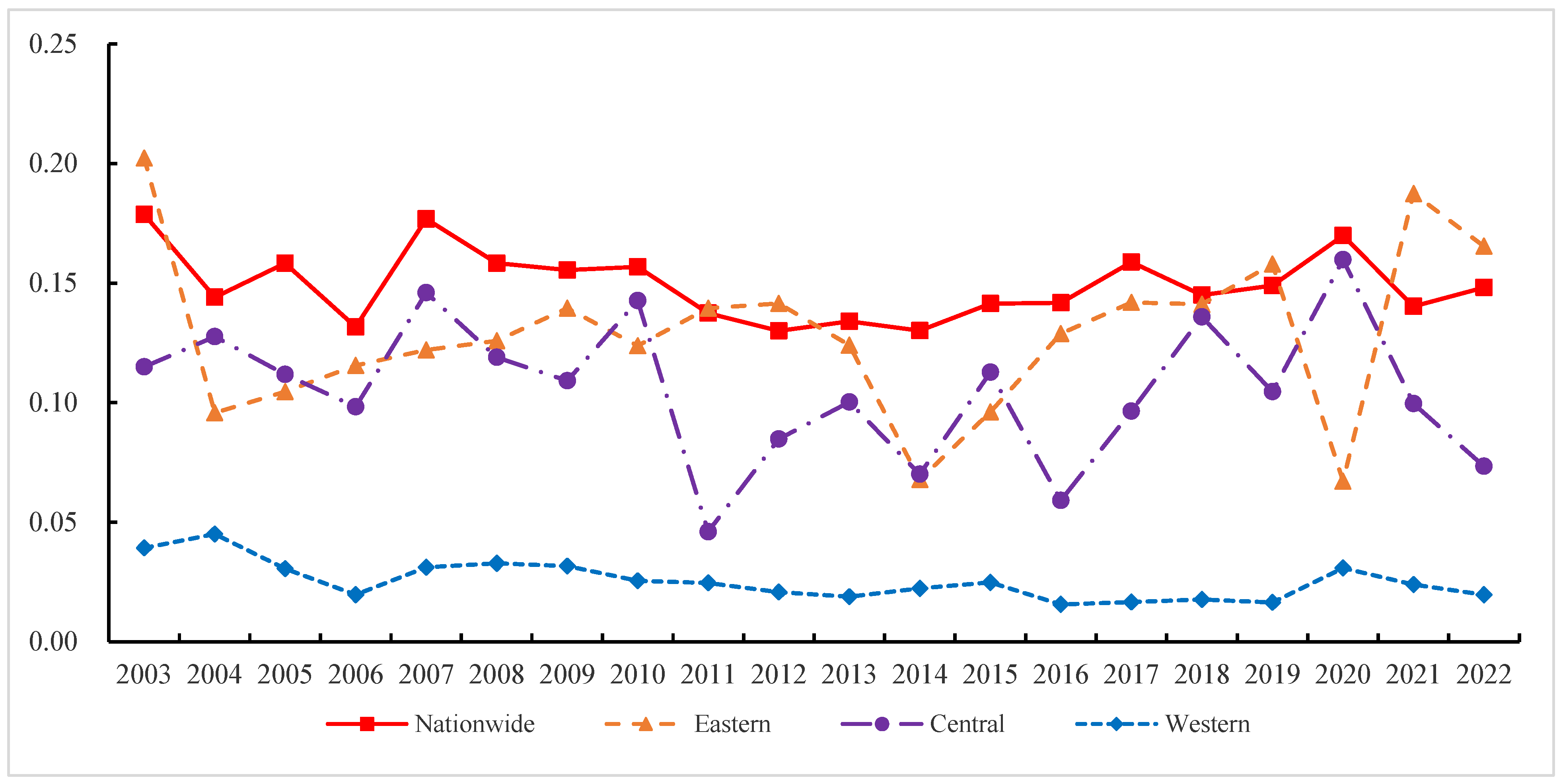

3.3.1. σ Convergence Analysis

3.3.2. Absolute β Convergence Analysis

3.3.3. Conditional β Convergence Analysis

4. Discussion

5. Conclusions and Policy Implications

5.1. Conclusions

5.2. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Bian, Y.; Song, K.; Bai, J. Market segmentation, resource misallocation and environmental pollution. J. Clean. Prod. 2019, 228, 376–387. [Google Scholar] [CrossRef]

- Borsellino, V.; Schimmenti, E.; El Bilali, H. Agri-food markets towards sustainable patterns. Sustainability 2020, 12, 2193. [Google Scholar] [CrossRef]

- Miao, X.; Han, J.; Wang, S.; Li, X. Spatial effects of market integration on the industrial agglomeration of agricultural products: Evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 84949–84971. [Google Scholar] [CrossRef] [PubMed]

- Kabbiri, R.; Dora, M.; Elepu, G.; Gellynck, X. A global perspective of food market integration: A review. Agrekon 2016, 55, 62–80. [Google Scholar] [CrossRef]

- Kim, S. Expansion of markets and the geographic distribution of economic activities: The trends in US regional manufacturing structure, 1860–1987. Q. J. Econ. 1995, 110, 881–908. [Google Scholar] [CrossRef]

- Naughton, B. How much can regional integration do to unify China’s markets? In How Far Across the River; Stanford University Press: Redwood City, CA, USA, 2003; pp. 204–232. [Google Scholar]

- Parsley, D.C.; Wei, S.J. Convergence to the law of one price without trade barriers or currency fluctuations. Q. J. Econ. 1996, 111, 1211–1236. [Google Scholar] [CrossRef]

- Xu, X. Have the Chinese provinces become integrated under reform? China Econ. Rev. 2002, 13, 116–133. [Google Scholar] [CrossRef]

- Young, A. The razor’s edge: Distortions and incremental reform in the People’s Republic of China. Q. J. Econ. 2000, 115, 1091–1135. [Google Scholar] [CrossRef]

- Ke, S. Domestic market integration and regional economic growth—China’s recent experience from 1995–2011. World Dev. 2015, 66, 588–597. [Google Scholar] [CrossRef]

- Zhang, Y.; Hao, X.Y.; Han, Y.J. Analysis on vertical price transmission and market integration of wheat industry chain in China. Econ. Probl. 2018, 65–70. [Google Scholar]

- Loy, J.P.; Weiss, C.R.; Glauben, T. Asymmetric cost pass-through? Empirical evidence on the role of market power, search and menu costs. J. Econ. Behav. Organ. 2016, 123, 184–192. [Google Scholar] [CrossRef]

- Abay, K.A.; Abdelfattah, L.; Breisinger, C.; Siddig, K. Evaluating cereal market (dis) integration in less developed and fragile markets: The case of Sudan. Food Policy 2023, 114, 102399. [Google Scholar] [CrossRef]

- Wu, L.P. Study on the relationship between domestic and foreign grain markets. Chin. Rural. Obs. 2001, 01, 24–32. [Google Scholar] [CrossRef]

- Li, Z.; Diao, G.; Zhao, H.F. Dynamic Analysis of Chinese mutton price market integration: Granger Causality Test based on spectrum. Agric. Tech. Econ. 2020, 11, 122–134. [Google Scholar] [CrossRef]

- Nigatu, G.; Adjemian, M. A wavelet analysis of price integration in major agricultural markets. J. Agric. Appl. Econ. 2020, 52, 117–134. [Google Scholar] [CrossRef]

- Zhou, Z.Y.; Wan, G.H.; Chen, L.B. Integration of rice markets: The case of southern China. Contemp. Econ. Policy 2000, 18, 95–106. [Google Scholar] [CrossRef]

- Latham, A.J.H.; Neal, L. The international market in rice and wheat, 1868–1914. Econ. Hist. Rev. 1983, 36, 260–280. [Google Scholar] [CrossRef]

- Awokuse, T.O. Market reforms, spatial price dynamics, and China’s rice market integration: A causal analysis with directed acyclic graphs. J. Agric. Resour. Econ. 2007, 32, 58–76. [Google Scholar]

- Rozelle, S.; Park, A.; Huang, J.; Jin, H. Liberalization and rural market integration in China. Am. J. Agric. Econ. 1997, 79, 635–642. [Google Scholar] [CrossRef]

- Zhou, W. The role of the state in making a national market: The evolution of the grain market in China (1978–2000). China Agric. Econ. Rev. 2010, 2, 276–297. [Google Scholar] [CrossRef]

- Huang, X.; Chen, S.; Li, T. Price differences, market segmentation and border effect: Based on empirical analysis of 15 cities in Yangtze River Delta province. Econ. Res. J. 2014, 49, 18–32. [Google Scholar]

- Ge, Y.; Wang, H.H.; Ahn, S.K. Cotton market integration and the impact of China’s new exchange rate regime. Agric. Econ. 2010, 41, 443–451. [Google Scholar] [CrossRef]

- Liu, R.; Liu, R. SOEs, Invisible Subsidy and Market Segmentation: Mechanism III. In How State-Owned Enterprises Drag on Economic Growth: Theory and Evidence from China; Springer: Berlin/Heidelberg, Germany, 2019; pp. 73–95. [Google Scholar]

- Zheng, S.; Kahn, M.E. China’s bullet trains facilitate market integration and mitigate the cost of megacity growth. Proc. Natl. Acad. Sci. USA 2013, 110, E1248–E1253. [Google Scholar] [CrossRef] [PubMed]

- Yang, Z.; Ye, Z. Domestic market integration in China: The role of the financial sector. Chin. Econ. 2016, 49, 343–358. [Google Scholar] [CrossRef]

- Liu, H.B.; McCarthy, B.; Chen, T.; Guo, S.; Song, X. The Chinese wine market: A market segmentation study. Asia Pac. J. Mark. Logist. 2014, 26, 450–471. [Google Scholar] [CrossRef]

- Aruga, K.; Li, R. Testing market integration for Japanese retail seafood markets. Aust. J. Agric. Resour. Econ. 2016, 60, 212–226. [Google Scholar] [CrossRef]

- Lv, B.; He, Y. Decentralization, tax division and market segmentation. J. Peking Univ. Philos. Soc. Sci. 2019, 56, 54–66. [Google Scholar]

- Ma, Z.; Li, W.; Wang, Q. Does financial development promote regional economic integration?—Empirical evidence from Yangtze River Delta region. J. Harbin Univ. Commer. Soc. Sci. Ed. 2022, 2, 43–57. [Google Scholar]

- Wang, W.; Kong, F. Study on the impact of transportation infrastructure construction and Internet Development on regional market segmentation. J. Yunnan Univ. Financ. Econ. 2019, 36, 3–16. [Google Scholar]

- Zhou, L.; Feng, D. Structural decomposition and integration of market size: A Study based on China’s inter-regional Input-output table. J. Xiangtan Univ. Philos. Soc. Sci. Ed. 2016, 40, 80–84. [Google Scholar]

- Tuo, Y.; Kong, L. Will target constraints on economic growth exacerbate beggar-thy-neighbor policies? Mod. Econ. Res. 2022, 8, 25–39. [Google Scholar]

- Xie, F.; Yuan, L.; Fu, W. How can the Yangtze River Delta achieve high-quality market integration?—Based on the perspective of opening up, upgrading of industrial structure and financial development. Reform 2021, 6, 112–124. [Google Scholar]

- Samuelson, P.A. Theoretical notes on trade problems. Rev. Econ. Stat. 1964, 46, 145–154. [Google Scholar] [CrossRef]

- Parsley, D.C.; Wei, S.J. Explaining the border effect: The role of exchange rate variability, shipping costs, and geography. J. Int. Econ. 2001, 55, 87–105. [Google Scholar] [CrossRef]

- Dagum, C. A new approach to the decomposition of the Gini income inequality ratio. Empir. Econ. 1997, 22, 515–531. [Google Scholar] [CrossRef]

- Shahzad, M.A.; Razzaq, A.; Qing, P.; Rizwan, M.; Faisal, M. Food availability and shopping channels during the disasters: Has the COVID-19 pandemic changed peoples’ online food purchasing behavior? Int. J. Disaster Risk Reduct. 2022, 83, 103443. [Google Scholar] [CrossRef]

- Shahzad, M.A.; Qing, P.; Rizwan, M.; Razzaq, A.; Faisal, M. COVID-19 Pandemic, Determinants of Food Insecurity, and Household Mitigation Measures: A Case Study of Punjab, Pakistan. Healthcare 2021, 9, 621. [Google Scholar] [CrossRef]

- Bagnied, M.A.; Speece, M. Marketing and regional integration for food security in the Arab world. J. Macromarket. 2019, 39, 115–135. [Google Scholar] [CrossRef]

- Simola, A.; Boysen, O.; Ferrari, E.; Nechifor, V.; Boulanger, P. Economic integration and food security—The case of the AfCFTA. Glob. Food Secur. 2022, 35, 100651. [Google Scholar] [CrossRef]

- Sanogo, I.; Amadou, M.M. Rice market integration and food security in Nepal: The role of cross-border trade with India. Food Policy 2010, 35, 312–322. [Google Scholar] [CrossRef]

- Caliendo, L.; Opromolla, L.D.; Parro, F.; Sforza, A. Goods and factor market integration: A quantitative assessment of the EU enlargement. J. Political Econ. 2021, 129, 3491–3545. [Google Scholar] [CrossRef]

- Antwiago Amarchey, C.; Adjei Kwakwa, P. Spatial market integration analysis of plantain markets in mid Ghana. Cogent Bus. Manag. 2024, 11, 2311222. [Google Scholar] [CrossRef]

- Ahmed, M.; Singla, N.; Singh, K. Market integration and price transmission in wheat markets of India: A transaction cost approach. J. Agribus. Dev. Emerg. Econ. 2024, 14, 552–569. [Google Scholar] [CrossRef]

- Heerman, K.E.R.; Arita, S.; Gopinath, M. Asia-Pacific Integration with China versus the United States: Examining Trade Patterns under Heterogeneous Agricultural Sectors. Am. J. Agric. Econ. 2015, 97, 1324–1344. [Google Scholar] [CrossRef]

- Lai, J.T.; McNelis, P.D.; Yan, I.K.M. Regional capital mobility in China: Economic reform with limited financial integration. J. Int. Money Financ. 2013, 37, 493–503. [Google Scholar] [CrossRef]

- Sekhar, C. Agricultural market integration in India: An analysis of select commodities. Food Policy 2012, 37, 309–322. [Google Scholar] [CrossRef]

- Olper, A.; Raimondi, V. Agricultural market integration in the OECD: A gravity-border effect approach. Food Policy 2008, 33, 165–175. [Google Scholar] [CrossRef]

- d’Amato, M.; Cucuzza, G. Cyclical capitalization: Basic models. Aestimum 2022, 80, 45–54. [Google Scholar] [CrossRef]

- Deaconu, A.; Oprean, V.B.; Buiga, A. Trends in real estate appraisal: An emerging context. Afr. J. Bus. Manag. 2015, 9, 478–489. [Google Scholar]

| Variable | Observations | Mean | Standard Deviation |

|---|---|---|---|

| Market integration | 620 | 45.1109 | 14.2471 |

| Openness to outside world | 620 | 0.3022 | 0.3549 |

| Fiscal decentralization | 620 | 2.6472 | 2.0733 |

| Level of financial development | 620 | 0.0601 | 0.0321 |

| Traffic conditions | 620 | 13.0894 | 7.9663 |

| Market size | 620 | 0.2996 | 0.7859 |

| Gross domestic product | 620 | 1.8594 | 1.3063 |

| Industrial structure | 620 | 0.1105 | 0.0595 |

| Level of information development | 620 | 0.3881 | 0.2211 |

| Variable | Nationwide | Eastern | Central | Western |

|---|---|---|---|---|

| β | −0.5496 *** | −0.4863 *** | −0.5407 *** | −0.6107 *** |

| (0.0348) | (0.0544) | (0.0687) | (0.0590) | |

| constant | 2.0958 *** | 1.8267 *** | 2.0732 *** | 2.2359 *** |

| (0.1309) | (0.2098) | (0.2653) | (0.2240) | |

| v | 0.0399 | 0.0333 | 0.0389 | 0.0472 |

| N | 589 | 209 | 152 | 228 |

| R2 | 0.309 | 0.290 | 0.303 | 0.333 |

| Variable | Nationwide | Eastern | Central | Western |

|---|---|---|---|---|

| β | −0.8567 *** | −0.7808 *** | −0.9328 *** | −0.9653 *** |

| (0.0428) | (0.0726) | (0.0853) | (0.0685) | |

| Openness to outside world | −0.1618 | −0.0413 | −0.7104 | −0.2534 |

| (0.1187) | (0.1558) | (0.7903) | (0.4876) | |

| Fiscal decentralization | −0.0403 * | −0.3311 ** | −0.1835 ** | −0.0120 |

| (0.0212) | (0.1543) | (0.0765) | (0.0247) | |

| Level of financial development | 2.2757 * | 0.5190 | 4.3289 | 2.0206 |

| (1.3213) | (2.3657) | (3.5086) | (2.1179) | |

| Traffic conditions | 0.0119 ** | 0.0175 * | 0.0318 *** | −0.0044 |

| (0.0049) | (0.0096) | (0.0086) | (0.0091) | |

| Market size | 0.0197 | −0.0313 | −2.1376 | 0.4790 |

| (0.0465) | (0.0611) | (0.9099) | (0.8900) | |

| Gross domestic product | −0.0362 | 0.0447 | 0.0105 | −0.1141 |

| (0.0274) | (0.0373) | (0.1672) | (0.0705) | |

| Industrial structure | −1.5055 ** | −0.0283 | −1.1071 | −5.1934 *** |

| (0.6775) | (1.6648) | (0.9744) | (1.6677) | |

| Level of information | 0.3637 ** | 0.3248 | 0.4055 | 0.7656 ** |

| (0.1439) | (0.2024) | (0.5800) | (0.3509) | |

| constant | 3.1809 *** | 2.9868 *** | 3.7382 *** | 4.2686 *** |

| (0.1976) | (0.4564) | (0.4030) | (0.4927) | |

| v | 0.0971 | 0.0759 | 0.1350 | 0.1681 |

| N | 589 | 209 | 152 | 228 |

| R2 | 0.434 | 0.410 | 0.486 | 0.497 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, F.; Gu, Y.; Liu, Q. Regional Differences and Dynamic Evolution of Agricultural Product Market Integration in China. Agriculture 2025, 15, 861. https://doi.org/10.3390/agriculture15080861

Liu F, Gu Y, Liu Q. Regional Differences and Dynamic Evolution of Agricultural Product Market Integration in China. Agriculture. 2025; 15(8):861. https://doi.org/10.3390/agriculture15080861

Chicago/Turabian StyleLiu, Fuxing, Yumeng Gu, and Qin Liu. 2025. "Regional Differences and Dynamic Evolution of Agricultural Product Market Integration in China" Agriculture 15, no. 8: 861. https://doi.org/10.3390/agriculture15080861

APA StyleLiu, F., Gu, Y., & Liu, Q. (2025). Regional Differences and Dynamic Evolution of Agricultural Product Market Integration in China. Agriculture, 15(8), 861. https://doi.org/10.3390/agriculture15080861