Risk Perception and Management Strategies Among Ecuadorian Cocoa Farmers: A Comprehensive Analysis of Attitudes and Decisions

Abstract

1. Introduction

2. Building a Theoretical Model

2.1. Risk Management Strategies

2.2. Risk Perception and Risk Attitude

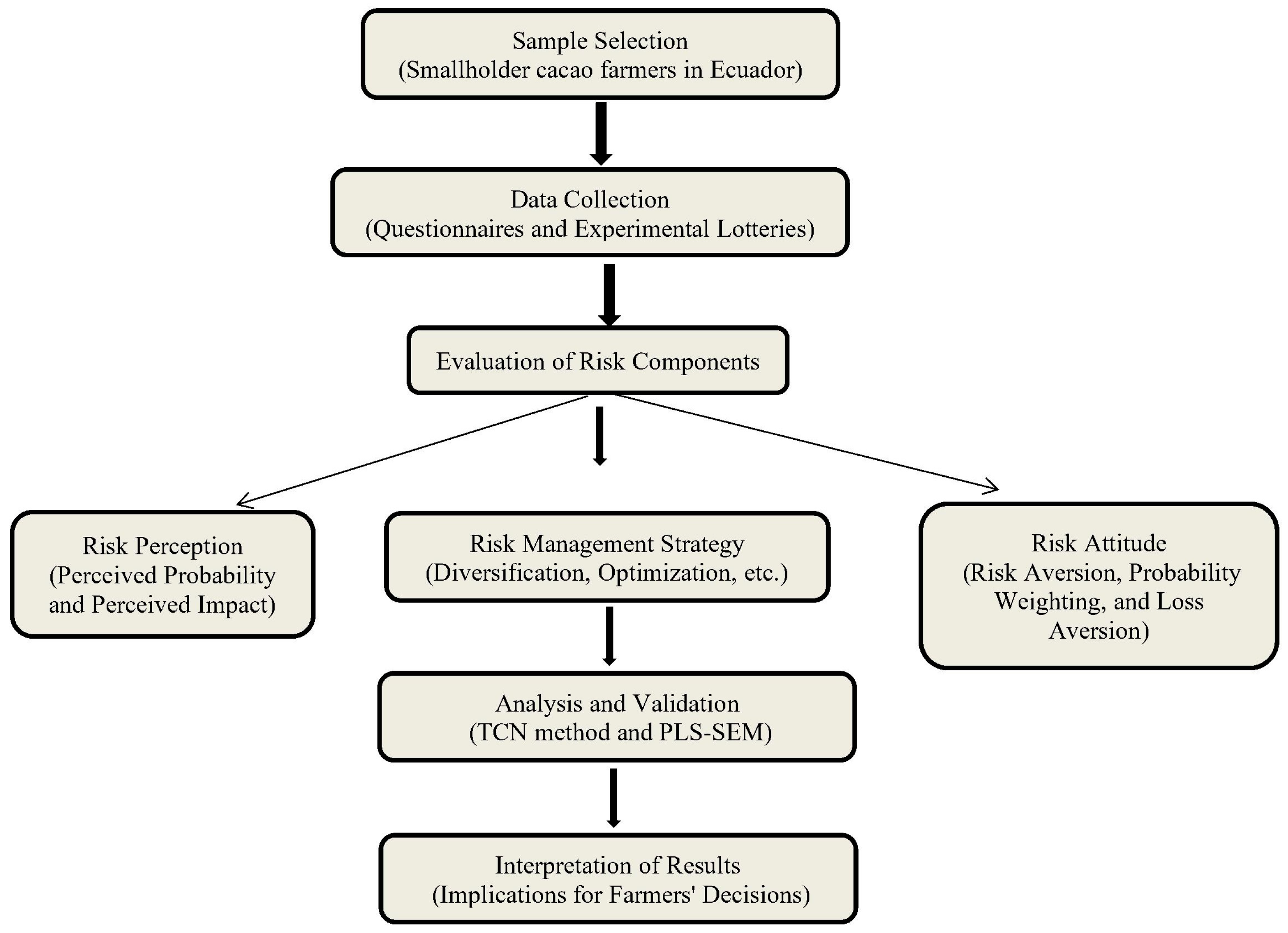

3. Methodology

3.1. Target Sample

3.2. Data Collection and Variables

3.3. Analytical Procedures

4. Results

4.1. Estimation of Risk Attitude Parameters

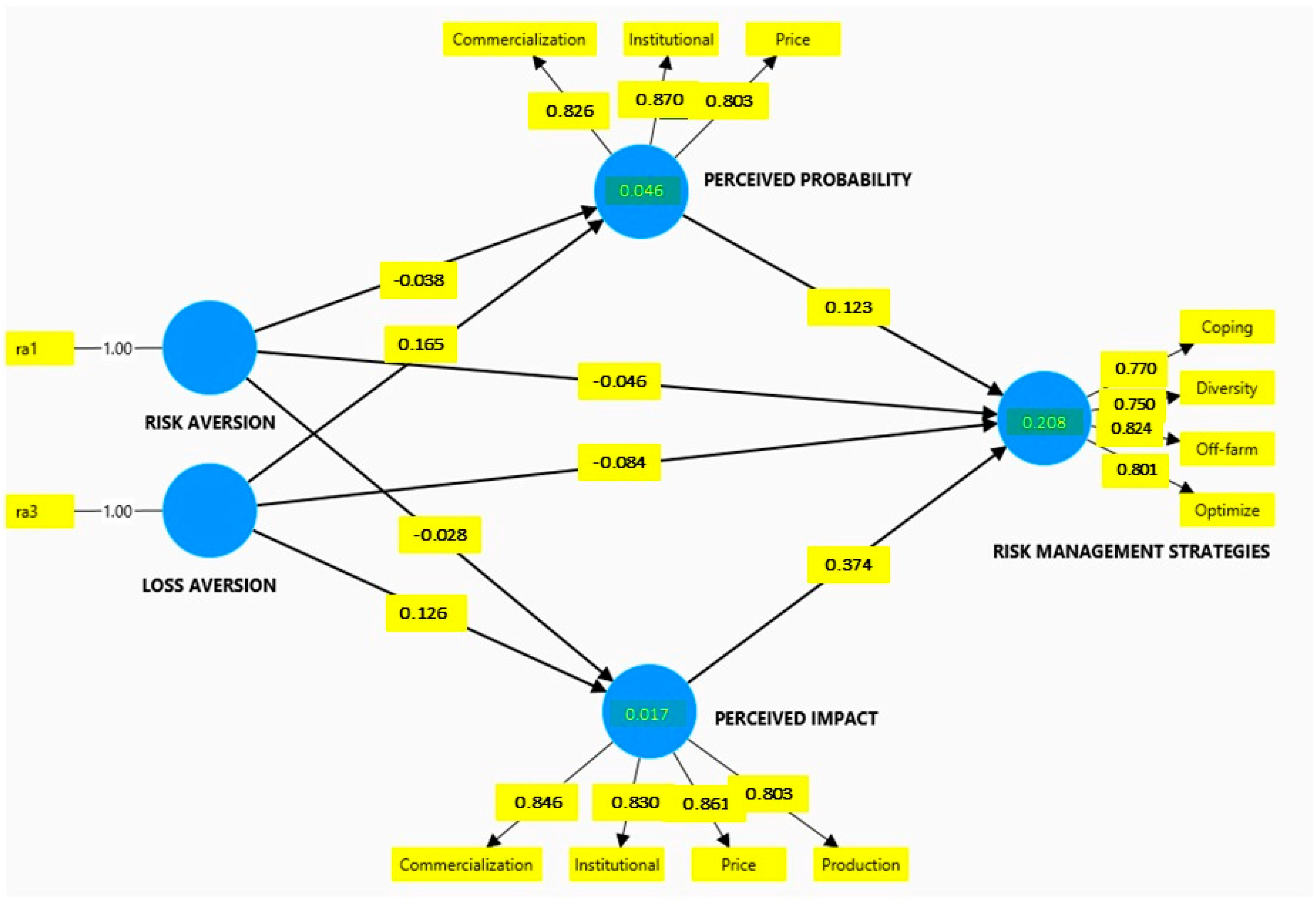

4.2. The Structural Equation Model

4.3. Measurement Model Assessment

4.4. Structural Model Assessment

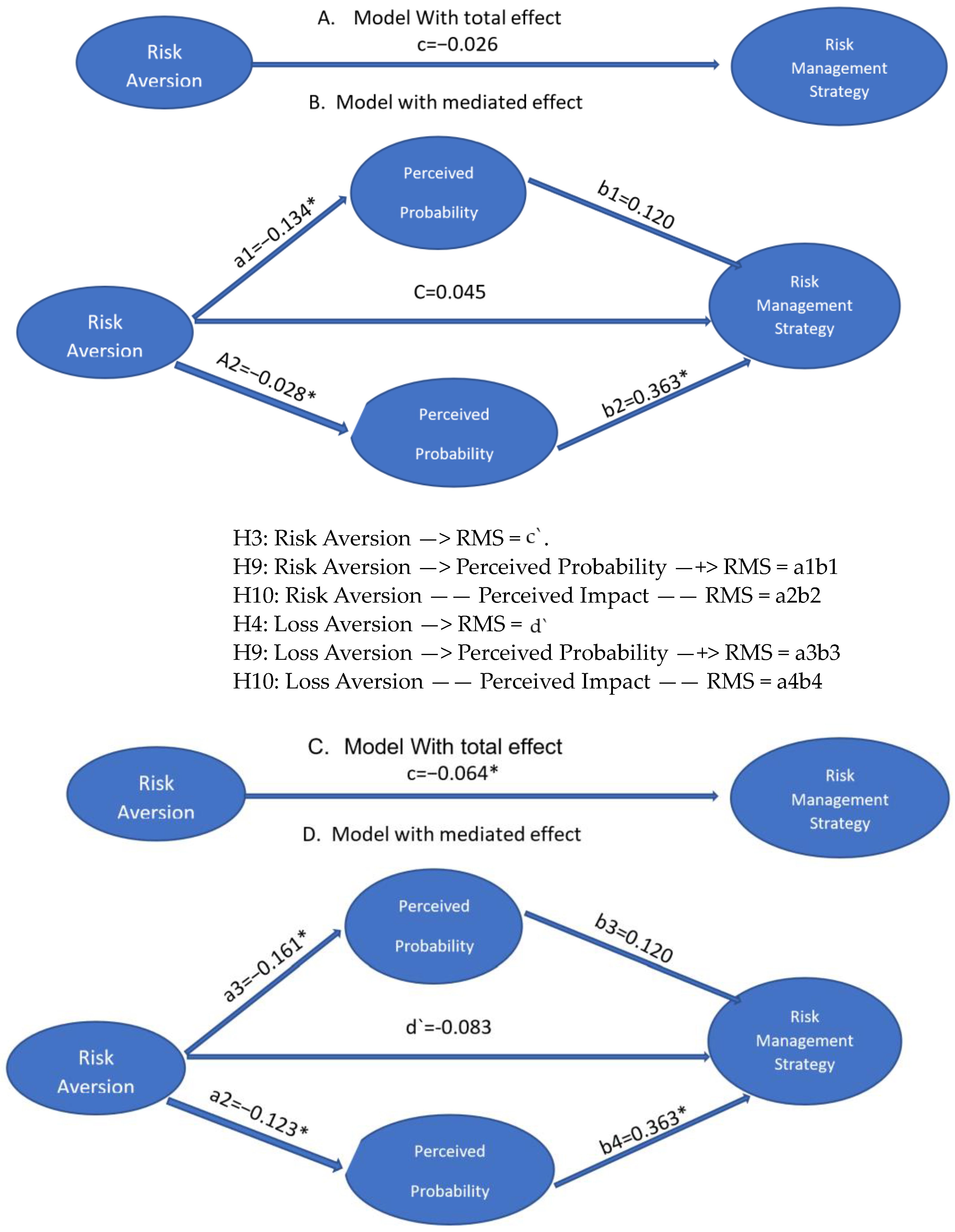

4.5. Mediation Analysis

5. Discussion

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ullah, R.; Shivakoti, G.P. Adoption of On-Farm and Off-Farm Diversification to Manage Agricultural Risks: Are These Decisions Correlated? Outlook Agric. 2014, 43, 265–271. [Google Scholar] [CrossRef]

- van Asseldonk, M.; Tzouramani, I.; Ge, L.; Vrolijk, H. Adoption of Risk Management Strategies in European Agriculture. Stud. Agric. Econ. 2016, 118, 154–162. [Google Scholar] [CrossRef]

- Akhtar, S.; Li, G.; Nazir, A.; Razzaq, A.; Ullah, R.; Faisal, M.; Naseer, M.A.U.R.; Raza, M.H. Maize Production under Risk: The Simultaneous Adoption of off-Farm Income Diversification and Agricultural Credit to Manage Risk. J. Integr. Agric. 2019, 18, 460–470. [Google Scholar] [CrossRef]

- Knapp, L.; Wuepper, D.; Dalhaus, T.; Finger, R. Revisiting the Diversification and Insurance Relationship: Differences between on–and off-Farm Strategies. Clim. Risk Manag. 2021, 32, 100315. [Google Scholar] [CrossRef]

- Ali, J. Adoption of Diversification for Risk Management in Vegetable Cultivation. Int. J. Veg. Sci. 2015, 21, 9–20. [Google Scholar] [CrossRef]

- Falco, S.D.; Adinolfi, F.; Bozzola, M.; Capitanio, F. Crop Insurance as a Strategy for Adapting to Climate Change. J. Agric. Econ. 2014, 65, 485–504. [Google Scholar] [CrossRef]

- Bezabih, M.; Sarr, M. Risk Preferences and Environmental Uncertainty: Implications for Crop Diversification Decisions in Ethiopia. Environ. Resour. Econ. 2012, 53, 483–505. [Google Scholar] [CrossRef]

- van Winsen, F.; de Mey, Y.; Lauwers, L.; Van Passel, S.; Vancauteren, M.; Wauters, E. Determinants of Risk Behaviour: Effects of Perceived Risks and Risk Attitude on Farmer’s Adoption of Risk Management Strategies. J. Risk Res. 2016, 19, 56–78. [Google Scholar] [CrossRef]

- Thompson, N.M.; Bir, C.; Widmar, N.J.O. Farmer Perceptions of Risk in 2017. Agribusiness 2019, 35, 182–199. [Google Scholar] [CrossRef]

- Meraner, M.; Finger, R. Risk Perceptions, Preferences and Management Strategies: Evidence from a Case Study Using German Livestock Farmers. J. Risk Res. 2017, 22, 110–135. [Google Scholar] [CrossRef]

- McRoberts, N.; Hall, C.; Madden, L.V.; Hughes, G. Perceptions of Disease Risk: From Social Construction of Subjective Judgments to Rational Decision Making. Phytopathology 2011, 101, 654–665. [Google Scholar] [CrossRef] [PubMed]

- JianJun, J.J.; YiWei, G.; XiaoMin, W.X.; Nam, P.K. Farmers’ Risk Preferences and Their Climate Change Adaptation Strategies in the Yongqiao District, China. Land Use Policy 2015, 47, 365–372. [Google Scholar] [CrossRef]

- Avadí, A. Environmental Assessment of the Ecuadorian Cocoa Value Chain with Statistics-Based LCA. Int. J. Life Cycle Assess. 2023, 28, 1495–1515. [Google Scholar] [CrossRef]

- Caicedo-Vargas, C.; Pérez-Neira, D.; Abad-González, J.; Gallar, D. Agroecology as a Means to Improve Energy Metabolism and Economic Management in Smallholder Cocoa Farmers in the Ecuadorian Amazon. Sustain. Prod. Consum. 2023, 41, 201–212. [Google Scholar] [CrossRef]

- Mihai, R.A.; Landazuri Abarca, P.A.; Tinizaray Romero, B.A.; Florescu, L.I.; Catană, R.; Kosakyan, A. Abiotic Factors from Different Ecuadorian Regions and Their Contribution to Antioxidant, Metabolomic and Organoleptic Quality of Theobroma Cacao L. Beans, Variety “Arriba Nacional”. Plants 2022, 11, 976. [Google Scholar] [CrossRef]

- Villacis, A.H.; Alwang, J.R.; Barrera, V.; Dominguez, J. Prices, Specialty Varieties, and Postharvest Practices: Insights from Cacao Value Chains in Ecuador. Agribusiness 2022, 38, 426–458. [Google Scholar] [CrossRef]

- Ahmad, D.; Afzal, M.; Rauf, A. Analysis of Wheat Farmers’ Risk Perceptions and Attitudes: Evidence from Punjab, Pakistan. Nat. Hazards 2019, 95, 845–861. [Google Scholar] [CrossRef]

- Pham, T.T.; Dang, H.L.; Pham, N.T.A.; Dang, H.D. Adoption of Contract Farming for Managing Agricultural Risks: A Case Study in Rice Production in the Mekong Delta, Vietnam. J. Agribus. Dev. Emerg. Econ. 2021. ahead-of-print. [Google Scholar] [CrossRef]

- Zelingher, R.; Makowski, D. Investigating and Forecasting the Impact of Crop Production Shocks on Global Commodity Prices. Environ. Res. Lett. 2023, 19, 014026. [Google Scholar] [CrossRef]

- Salazar, O.V.; Latorre, S.; Godoy, M.Z.; Quelal-Vásconez, M.A. The Challenges of a Sustainable Cocoa Value Chain: A Study of Traditional and “Fine or Flavour” Cocoa Produced by the Kichwas in the Ecuadorian Amazon Region. J. Rural Stud. 2023, 98, 92–100. [Google Scholar] [CrossRef]

- Hansson, H.; Lagerkvist, C.J. Decision Making for Animal Health and Welfare: Integrating Risk-Benefit Analysis with Prospect Theory. Risk Anal. 2014, 34, 1149–1159. [Google Scholar] [CrossRef] [PubMed]

- Adnan, K.M.M.; Ying, L.; Ayoub, Z.; Sarker, S.A.; Menhas, R.; Chen, F.; Yu, M. Risk Management Strategies to Cope Catastrophic Risks in Agriculture: The Case of Contract Farming, Diversification and Precautionary Savings. Agriculture 2020, 10, 351. [Google Scholar] [CrossRef]

- Komarek, A.M.; De Pinto, A.; Smith, V.H. A Review of Types of Risks in Agriculture: What We Know and What We Need to Know. Agric. Syst. 2020, 178, 102738. [Google Scholar] [CrossRef]

- Mase, A.S.; Gramig, B.M.; Prokopy, L.S. Climate Change Beliefs, Risk Perceptions, and Adaptation Behavior among Midwestern U.S. Crop Farmers. Clim. Risk Manag. 2017, 15, 8–17. [Google Scholar] [CrossRef]

- Antón, J. Managing Risk in Agriculture: A Holistic Approach; OECD: Paris, France, 2009. [Google Scholar]

- Shah, J.; Alharthi, M. The Association between Farmers’ Psychological Factors and Their Choice to Adopt Risk Management Strategies: The Case of Pakistan. Agriculture 2022, 12, 412. [Google Scholar] [CrossRef]

- Wauters, E.; van Winsen, F.; de Mey, Y.; Lauwers, L. Risk Perception, Attitudes towards Risk and Risk Management: Evidence and Implications. Agric. Econ. (Zemědělská Ekon.) 2014, 60, 389–405. [Google Scholar] [CrossRef]

- Iqbal, M.A.; Ping, Q.; Abid, M.; Kazmi, S.M.M.; Rizwan, M. Assessing Risk Perceptions and Attitude among Cotton Farmers: A Case of Punjab Province, Pakistan. Int. J. Disaster Risk Reduct. 2016, 16, 68–74. [Google Scholar] [CrossRef]

- Lucas, M.P.; Pabuayon, I.M. Risk Perceptions, Attitudes, and Influential Factors of Rainfed Lowland Rice Farmers in Ilocos Norte, Philippines. Asian J. Agric. Dev. 2011, 8, 61–77. [Google Scholar] [CrossRef]

- Duong, T.T.; Brewer, T.; Luck, J.; Zander, K. A Global Review of Farmers’ Perceptions of Agricultural Risks and Risk Management Strategies. Agriculture 2019, 9, 10. [Google Scholar] [CrossRef]

- Tedesco, I. A Holistic Approach to Agricultural Risk Management for Improving Resilience. Platf. Agric. Risk Manag. Work. Pap. 2018, 5. [Google Scholar]

- Novickytė, L. Income Risk Management in Agriculture Using Financial Support. Eur. J. Sustain. Dev. 2018, 7, 191. [Google Scholar] [CrossRef]

- Śmiglak-Krajewska, M. Agricultural Risk and Its Perception among Protein Plant Farmers. Roczniki 2019, 2019, 191. [Google Scholar] [CrossRef]

- Iqbal, M.A.; Abbas, A.; Naqvi, S.A.A.; Rizwan, M.; Samie, A.; Ahmed, U.I. Drivers of Farm Households’ Perceived Risk Sources and Factors Affecting Uptake of Mitigation Strategies in Punjab Pakistan: Implications for Sustainable Agriculture. Sustainability 2020, 12, 9895. [Google Scholar] [CrossRef]

- Finger, R.; Garcia, V.; McCallum, C.; Rommel, J. A Note on European Farmers’ Preferences under Cumulative Prospect Theory. J. Agric. Econ. 2023, 75, 465–472. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef]

- Spiegel, A.; Britz, W.; Finger, R. Risk, Risk Aversion, and Agricultural Technology Adoption—A Novel Valuation Method Based on Real Options and Inverse Stochastic Dominance. Q Open 2021, 1, qoab016. [Google Scholar] [CrossRef]

- Girma, Y.; Kuma, B.; Bedemo, A. Risk Aversion and Perception of Farmers about Endogenous Risks: An Empirical Study for Maize Producers in Awi Zone, Amhara Region of Ethiopia. J. Risk Financ. Manag. 2023, 16, 87. [Google Scholar] [CrossRef]

- Sulewski, P.; Wąs, A.; Kobus, P.; Pogodzińska, K.; Szymańska, M.; Sosulski, T. Farmers’ Attitudes towards Risk—An Empirical Study from Poland. Agronomy 2020, 10, 1555. [Google Scholar] [CrossRef]

- Lee, C.K.; Foo, M.Y. Risk Attitudes and the Big Five Personality Traits: A Study on Construction Project Practitioners in Malaysia. Int. J. Constr. Manag. 2022, 22, 2435–2445. [Google Scholar] [CrossRef]

- Coll, E.P.C.; Dilas-Jiménez, J.O. Producción y Exportación Del Cacao Ecuatoriano y El Potencial Del Cacao Fino de Aroma. Qantu Yachay 2022, 2, 08–15. [Google Scholar] [CrossRef]

- Barragán-Landy, M.; Sousa, S.; Romero, F.; Leão, C. A Proposed Representative Sampling Methodology. In Proceedings of the 20th European Conference on Research Methodology for Business and Management Studies: ECRM, Aveiro, Portugal, 17–18 June 2021; p. 8. [Google Scholar]

- Tanaka, T.; Camerer, C.F.; Nguyen, Q. Risk and Time Preferences: Linking Experimental and Household Survey Data from Vietnam. Am. Econ. Rev. 2010, 100, 557–571. [Google Scholar] [CrossRef]

- Rommel, J.; Hermann, D.; Müller, M.; Mußhoff, O. Contextual Framing and Monetary Incentives in Field Experiments on Risk Preferences: Evidence from German Farmers. J. Agric. Econ. 2019, 70, 408–425. [Google Scholar] [CrossRef]

- Praveen, K.V.; Suresh, A.; Reddy, A.A.; Singh, D.R. Risks and Adaptation Strategies in Rainfed Agriculture in India: An Analysis. Indian J. Agric. Sci. 2018, 88, 958–963. [Google Scholar] [CrossRef]

- Asravor, R.K. Farmers’ Risk Preference and the Adoption of Risk Management Strategies in Northern Ghana. J. Environ. Plan. Manag. 2019, 62, 881–900. [Google Scholar] [CrossRef]

- Damalas, C.A. Farmers’ Intention to Reduce Pesticide Use: The Role of Perceived Risk of Loss in the Model of the Planned Behavior Theory. Environ. Sci. Pollut. Res. 2021, 28, 35278–35285. [Google Scholar] [CrossRef]

- Antonelli, C.; Coromaldi, M.; Pallante, G. Crop and Income Diversification for Rural Adaptation: Insights from Ugandan Panel Data. Ecol. Econ. 2022, 195, 107390. [Google Scholar] [CrossRef]

- Jarvis, C.B.; MacKenzie, S.B.; Podsakoff, P.M. A Critical Review of Construct Indicators and Measurement Model Misspecification in Marketing and Consumer Research. J. Consum. Res. 2003, 30, 199–218. [Google Scholar] [CrossRef]

- Kipato, N.; Dorward, P.; Clarkson, G. A lower threat than I thought: How the analysis of the interdependence between risks influences smallholder farmers’ perceptions. Sustainability 2023, 15, 14467. [Google Scholar] [CrossRef]

- Mohsin, M.; Yin, H.; Mehak, A. Sustainable solutions: Exploring risks and strategies in Pakistan’s seafood trade for marine conservation. Front. Mar. Sci. 2024, 11, 1420755. [Google Scholar] [CrossRef]

- García-Machado, J.J.; Sroka, W.; Nowak, M. PLS-SEM Model on Business Demand for Technological Services and R&D and Innovation Activities. Technol. Econ. Dev. Econ. 2023, 29, 1–22. [Google Scholar]

- Alexis, H. Villacis Inconsistent Choices over Prospect Theory Lottery Games: Evidence from Field Experiments. J. Behav. Exp. Econ. 2023, 103, 101989. [Google Scholar] [CrossRef]

- Feyisa, A.D.; Maertens, M.; de Mey, Y. Relating Risk Preferences and Risk Perceptions over Different Agricultural Risk Domains: Insights from Ethiopia. World Dev. 2023, 162, 106137. [Google Scholar] [CrossRef]

- Cerroni, S.; Bozzola, M.; Rippo, R. Eliciting Farmers? Risk and Uncertainty Preferences Using Contextualized Field Experiments in Developing Countries: A Pilot Study. In Managing Risk in Agriculture: A Development Perspective; CABI: Wallingford, UK, 2023; pp. 85–100. [Google Scholar] [CrossRef]

- Ihli, H.J.; Chiputwa, B.; Winter, E.; Gassner, A. Risk and Time Preferences for Participating in Forest Landscape Restoration: The Case of Coffee Farmers in Uganda. World Dev. 2022, 150, 105713. [Google Scholar] [CrossRef]

- Edeh, E.; Lo, W.-J.; Khojasteh, J. Review of Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R: A Workbook: By Joseph F. Hair Jr., G. Tomas M. Hult, Christian M. Ringle, Marko Sarstedt, Nicholas P. Danks, Soumya Ray. Cham, Switzerland: Springer, (2021). 197 Pp. $0, Open Access; $59.99, Hardcover Book. Struct. Equ. Model. A Multidiscip. J. 2023, 30, 165–167. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Cheah, J.-H.; Ting, H.; Moisescu, O.I.; Radomir, L. Structural Model Robustness Checks in PLS-SEM. Tour. Econ. 2020, 26, 531–554. [Google Scholar] [CrossRef]

- Wang, S.; Cheah, J.-H.; Wong, C.Y.; Ramayah, T. Progress in Partial Least Squares Structural Equation Modeling Use in Logistics and Supply Chain Management in the Last Decade: A Structured Literature Review. Int. J. Phys. Distrib. Logist. Manag. 2023, 54, 673–704. [Google Scholar] [CrossRef]

- Ringle, C.M.; Sarstedt, M.; Sinkovics, N.; Sinkovics, R.R. A Perspective on Using Partial Least Squares Structural Equation Modelling in Data Articles. Data Brief 2023, 48, 109074. [Google Scholar] [CrossRef] [PubMed]

- Hair, J.F.; Sarstedt, M.; Ringle, C.M.; Sharma, P.N.; Liengaard, B.D. Going beyond the Untold Facts in PLS–SEM and Moving Forward. Eur. J. Mark. 2024, 58, 81–106. [Google Scholar] [CrossRef]

- Sarstedt, M.; Adler, S.J.; Ringle, C.M.; Cho, G.; Diamantopoulos, A.; Hwang, H.; Liengaard, B.D. Same Model, Same Data, but Different Outcomes: Evaluating the Impact of Method Choices in Structural Equation Modeling. J. Prod. Innov. Manag. 2024, 41, 1100–1117. [Google Scholar] [CrossRef]

- Cepeda, G.; Roldán, J.L.; Sabol, M.; Hair, J.; Chong, A.Y.L. Emerging Opportunities for Information Systems Researchers to Expand Their PLS-SEM Analytical Toolbox. Ind. Manag. Data Syst. 2024, 124, 2230–2250. [Google Scholar] [CrossRef]

- Wentzel, L.; Fapohunda, J.; Haldenwang, R. Challenges in Implementing Corporate Social Responsibility: A Study of SMEs in South Africa’s Construction Industry. Acta Structilia 2024, 31, 159–193. [Google Scholar]

- Chitakasempornkul, K.; Rosa, G.J.M.; Jager, A.; Bello, N.M. Hierarchical Modeling of Structural Coefficients for Heterogeneous Networks with an Application to Animal Production Systems. J. Agric. Biol. Environ. Stat. 2020, 25, 1–22. [Google Scholar] [CrossRef]

- Waldman, K.B.; Todd, P.M.; Omar, S.; Blekking, J.P.; Giroux, S.A.; Attari, S.Z.; Baylis, K.; Evans, T.P. Agricultural Decision Making and Climate Uncertainty in Developing Countries. Environ. Res. Lett. 2020, 15, 113004. [Google Scholar] [CrossRef]

- Liu, E.M. Time to Change What to Sow: Risk Preferences and Technology Adoption Decisions of Cotton Farmers in China. Rev. Econ. Stat. 2013, 95, 1386–1403. [Google Scholar] [CrossRef]

- Cárcamo, J.; Cramon-Taubadel, S.V. Assessing Small-Scale Raspberry Producers’ Risk and Ambiguity Preferences: Evidence from Field-Experiment Data in Rural Chile; Georg-August-Universität Göttingen, Department für Agrarökonomie und Rurale Entwicklung (DARE): Göttingen, Germany, 2016. [Google Scholar]

- Hasibuan, A.M.; Wulandari, S.; Ardana, I.K.; Wahyudi, A. Understanding Climate Adaptation Practices among Small-Scale Sugarcane Farmers in Indonesia: The Role of Climate Risk Behaviors, Farmers’ Support Systems, and Crop-Cattle Integration. Resour. Environ. Sustain. 2023, 13, 100129. [Google Scholar] [CrossRef]

- Harrison, G.W.; Humphrey, S.J.; Verschoor, A. Choice under Uncertainty: Evidence from Ethiopia, India and Uganda. Econ. J. 2010, 120, 80–104. [Google Scholar] [CrossRef]

- Cheung, G.W.; Cooper-Thomas, H.D.; Lau, R.S.; Wang, L.C. Reporting Reliability, Convergent and Discriminant Validity with Structural Equation Modeling: A Review and Best-Practice Recommendations. Asia Pac. J. Manag. 2024, 41, 745–783. [Google Scholar] [CrossRef]

- Belay, S.; Melese, S.; Seifu, A. Primary School Climate Measurement: Examining Factorial Validity and Reliability from Teachers’ Perspective. Cogent Educ. 2021, 8, 1929039. [Google Scholar] [CrossRef]

- Youssef, N.; Saleeb, M.; Gebreal, A.; Ghazy, R.M. The Internal Reliability and Construct Validity of the Evidence-Based Practice Questionnaire (EBPQ): Evidence from Healthcare Professionals in the Eastern Mediterranean Region. Healthcare 2023, 11, 2168. [Google Scholar] [CrossRef]

- Nabilla, N.F.A.; Afifi, S. Pengaruh Komunikasi Persuasif Dan Personal Branding Celebrity Endorser Terhadap Kesadaran Vaksinasi Covid-19 (Analisis Structural Equation Modeling Partial Least Squares). J. Mhs. Komun. Cantrik 2023, 3. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to Use and How to Report the Results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Abd Wahab, S.R.H.; Sahri, N.N.M.; Muhammad, F.; Ismail, B.; Akbar, A.R.N. The Validity and Reliability of the Theory Behind BIM Adoption in The Facility Management Using PLS-SEM. Online J. TVET Pract. 2023, 8, 51–64. [Google Scholar] [CrossRef]

- Li, W.; Lay, Y.F. Examining the Reliability and Validity of Measuring Scales Related to Informatization and Instructional Leadership Using the PLS-SEM Approach. Humanit. Soc. Sci. Lett. 2024, 12, 461–480. [Google Scholar] [CrossRef]

- Hair, J.F.; Howard, M.C.; Nitzl, C. Assessing Measurement Model Quality in PLS-SEM Using Confirmatory Composite Analysis. J. Bus. Res. 2020, 109, 101–110. [Google Scholar] [CrossRef]

- Tabet, S.M.; Lambie, G.W.; Jahani, S.; Rasoolimanesh, S.M. The Factor Structure of Outcome Questionnaire–45.2 Scores Using Confirmatory Tetrad Analysis–Partial Least Squares. J. Psychoeduc. Assess. 2020, 38, 350–368. [Google Scholar] [CrossRef]

- Mohd Dzin, N.H.; Lay, Y.F. Validity and Reliability of Adapted Self-Efficacy Scales in Malaysian Context Using PLS-SEM Approach. Educ. Sci. 2021, 11, 676. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M. Explanation Plus Prediction—The Logical Focus of Project Management Research. Proj. Manag. J. 2021, 54, 319–322. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences, 2nd ed.; Routledge: New York, NY, USA, 1988; ISBN 978-0-203-77158-7. [Google Scholar]

- Chandra, S.R.; Bhat, A.; Shenoy, S.S.; Shenoy, R.U. Measuring the Effect Size of Coefficient of Determination and Predictive Relevance of External Dormant Variables on Internal Dormant Variables through PLS-SEM at Zuese Gym, Mangalore. Int. J. Econ. Res. 2017, 14, 559–565. [Google Scholar]

- Bonjean, I. Who Are the Loss-Averse Farmers? Experimental Evidence from Structurally Estimated Risk Preferences. Eur. Rev. Agric. Econ. 2023, 50, 421–456. [Google Scholar] [CrossRef]

- Villacis, A.; Alwang, J.; Barrera, V. Cacao Value Chains and Credence Attributes: Lessons from Ecuador. J. Agribus. Dev. Emerg. Econ. 2022, 12, 549–566. [Google Scholar] [CrossRef]

- Rahman, T.; Gasbarro, D.; Alam, K. Financial Risk Protection from Out-of-Pocket Health Spending in Low- and Middle-Income Countries: A Scoping Review of the Literature. Health Res. Policy Sys. 2022, 20, 83. [Google Scholar] [CrossRef] [PubMed]

- Menapace, L.; Colson, G.; Raffaelli, R. Risk Aversion, Subjective Beliefs, and Farmer Risk Management Strategies. Am. J. Agric. Econ. 2013, 95, 384–389. [Google Scholar] [CrossRef]

- Peng, R.; Zhao, Y.; Elahi, E.; Peng, B. Does Disaster Shocks Affect Farmers’ Willingness for Insurance? Mediating Effect of Risk Perception and Survey Data from Risk-Prone Areas in East China. Nat. Hazards 2021, 106, 2883–2899. [Google Scholar] [CrossRef]

- Perlin, L.; Leguizamón, A. Agriculture-Driven Deforestation in Ecuador’s Mache-Chindul Ecological Reserve: The Farmers’ Perspective. J. Rural. Stud. 2024, 107, 103263. [Google Scholar] [CrossRef]

- Sun, Y.; Yu, R.; Cheng, T.C.E. Incentives for Promoting Climate Change Adaptation Technologies in Agriculture: An Evolutionary Game Approach. Environ. Sci. Pollut. Res. 2023, 30, 97025–97039. [Google Scholar] [CrossRef]

| Hypothesis | Description | Type of Relationship |

|---|---|---|

| H1 | The perceived probability of different risk sources significantly influences the intention to implement risk management strategies. | Direct Effect |

| H2 | The perceived impact of different risk sources significantly influences the intention to implement risk management strategies. | Direct Effect |

| H3 | Risk aversion has a significant and negative relationship with the intention to implement risk management strategies. | Direct Effect |

| H4 | Loss aversion has a significant and negative relationship with the intention to implement risk management strategies. | Direct Effect |

| H5 | Individuals with high risk aversion perceive a higher probability of encountering various risk sources. | Direct Effect |

| H6 | Individuals with high risk aversion perceive a greater potential impact of various risk sources. | Direct Effect |

| H7 | Individuals with high loss aversion perceive a higher probability of encountering losses from various risk sources. | Direct Effect |

| H8 | Individuals with high loss aversion perceive a greater potential impact of losses from various risk sources. | Direct Effect |

| H9 | The perceived probability of risk positively mediates the relationship between risk aversion and the intention to implement risk management strategies. | Mediated Effect |

| H10 | The perceived impact of risk positively mediates the relationship between risk aversion and the intention to implement risk management strategies. | Mediated Effect |

| H11 | The perceived probability of risk positively mediates the relationship between loss aversion and the intention to implement risk management strategies. | Mediated Effect |

| H12 | The perceived impact of risk positively mediates the relationship between loss aversion and the intention to implement risk management strategies. | Mediated Effect |

| Latent Variable | Indicators | Code | Description | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|---|---|

| Risk Management Strategies (RMS) | Diversify | RMSDI1 | Plant different products at the same time | 4.5 | 1.2 | 1 | 7 |

| RMSDI2 | Maintain different income sources | 5.0 | 1.5 | 1 | 7 | ||

| Optimize | RMSOP1 | Invest in technical improvements on the farm | 3.8 | 1.3 | 1 | 7 | |

| RMSOP2 | Invest in expanding farmland | 3.9 | 1.4 | 1 | 7 | ||

| Coping | RMSCO1 | Work harder in tough times | 4.2 | 1.4 | 1 | 7 | |

| Off-farm | RMSOF1 | Obtain off-farm income | 4.1 | 1.3 | 1 | 7 | |

| Perceived Probability (PP) Risk Perception (RP) | Perceived Probability (PP) | ||||||

| Commercialization (COMPP) | PPCOM1 | Lack of policies to improve marketing conditions | 4.8 | 4.8 | 4.8 | 4.8 | |

| PPCOM2 | Disrespect for contract conditions | 4.6 | 4.6 | 4.6 | 4.6 | ||

| PPCOM3 | Mixing of National Cacao with CCN-51 at sale. | 4.7 | 4.7 | 4.7 | 4.7 | ||

| Institutional (INSPP) | PPINST1 | Unexpected policy changes negatively affecting farms. | 4.9 | 4.9 | 4.9 | 4.9 | |

| PPINST2 | End of government support program for National Cacao. | 4.6 | 4.6 | 4.6 | 4.6 | ||

| PPINST3 | Discrimination in seed and supply distribution. | 4.5 | 4.5 | 4.5 | 4.5 | ||

| Price (PRIPP) | PPPRIC1 | Excessive drop in product prices | 4.9 | 1.6 | 1 | 7 | |

| PPPRIC2 | Excessive increase in input costs | 4.7 | 1.4 | 1 | 7 | ||

| PPPRIC3 | Low income relative to costs over time | 4.6 | 1.5 | 1 | 7 | ||

| Perceived Impact (PI) | |||||||

| Commercialization (COMPI) | PIMPCOM1 | Increase in intermediaries profiting most | 4.8 | 1.2 | 1 | 7 | |

| PIMPCOM2 | Disrespect for contract conditions by companies | 4.6 | 1.4 | 1 | 7 | ||

| PIMPCOM3 | Mixing National Cacao with CCN-51 at sale | 4.7 | 1.3 | 1 | 7 | ||

| Institutional (INSPI) | PIMPINST1 | Unexpected policy changes harming farms | 4.9 | 1.3 | 1 | 7 | |

| PIMPINST2 | End of government agricultural aid programs | 4.6 | 1.4 | 1 | 7 | ||

| PIMPINST3 | Disappearance of agricultural associations | 4.5 | 1.5 | 1 | 7 | ||

| Price (PRIPI) | PIMPRIC1 | Excessive drop in product prices | 4.9 | 1.6 | 1 | 7 | |

| PIMPRIC2 | Excessive increase in input costs | 4.7 | 1.4 | 1 | 7 | ||

| PIMPRIC3 | Low income relative to costs over time | 4.6 | 1.5 | 1 | 7 | ||

| Production (PROPI) | PIMPRO1 | Production loss due to excess rainfall | 4.7 | 1.4 | 1 | 7 | |

| PIMPRO2 | Production loss due to severe drought | 4.6 | 1.3 | 1 | 7 | ||

| PIMPRO3 | Production loss due to pests and diseases | 4.5 | 1.5 | 1 | 7 | ||

| Farmers’ socio-demographic characteristics | |||||||

| Age (years) | - | 50.2 | 15.0 | 18 | 86 | ||

| Gender (% female) | - | 21.8 | - | - | - | ||

| Education (years) | - | 5.33 | 4.01 | 0 | 15 | ||

| Household size | - | 2.75 | 1.46 | 1 | 7 | ||

| Land size (ha) | - | 5.79 | 3.08 | 0.38 | 47.5 | ||

| Married or live together | - | 71.3 | - | - | - | ||

| Parameter | Description | Mean | Standard Deviation |

|---|---|---|---|

| σ | Coefficient of risk aversion | 0.529 *** | 0.258 |

| α | Probability weighting function parameter | 0.856 *** | 0.420 |

| λ | Coefficient of loss aversion | 3.721 *** | 2.556 |

| Latent Variable | Indicators | Convergent Validity | Internal Consistency Reliability | |||

|---|---|---|---|---|---|---|

| Loadings | AVE | Dijkstra– Henseler’s rho (ρA) | Composite Reliability | Cronbach’s Alpha | ||

| >0.70 | >0.50 | >0.70 | 0.70–0.90 | 0.70–0.90 | ||

| Risk Attitude | Risk Aversion | - | - | - | - | - |

| Loss Aversion | - | - | - | - | - | |

| Risk Perception | Perceived Probability | 0.679 | 0.767 | 0.879 | 0.763 | |

| COMPP (Commercialization) | 0.826 *** | |||||

| INSPP (Institutional) | 0.870 *** | |||||

| PRIPP (Price) | 0.803 *** | |||||

| Perceived Impact | 0.677 | 0.851 | 0.911 | 0.851 | ||

| COMPI (Commercialization) | 0.846 *** | |||||

| INSPI (Institutional) | 0.830 *** | |||||

| PRIPI (Price) | 0.861 *** | |||||

| PROPI (Production) | 0.803 *** | |||||

| Risk Management Strategies | Coping | 0.770 *** | 0.602 | 0.803 | 0.875 | 0.788 |

| Diversify | 0.750 *** | |||||

| Off-farm | 0.824 *** | |||||

| Optimize | 0.801 *** | |||||

| Latent Variables | Model-Implied Non-Redundant Vanishing Tetrad | Tetrad Value | Boostrap SD | Boostrap t Value | p Value | CIadj a |

|---|---|---|---|---|---|---|

| Perceived | 1: COMPI, INSPI, PRIPI, PROPI | 0.065 | 0.044 | 1.497 | 0.135 | [−0.018;0.153] |

| impact | 2: COMPI, INSPI, PRIPI, PROPI | 0.016 | 0.049 | 0.331 | 0.741 | [−0.079;0.114] |

| Risk Management Strategy | 1: Coping, Diversify, Off-farm, Optimize | −0.022 | 0.036 | 0.595 | 0.552 | [−0.094;0.048] |

| 2: Coping, Diversify, Optimize, Off-farm | −0.139 | 0.082 | 1.696 | 0.09 | [−0.303;0.019] |

| Latent Variable | Loss Aversion | PI | PB | Risk Aversion | RMS |

|---|---|---|---|---|---|

| Loss Aversion | |||||

| Perceives Impact | 0.136 | ||||

| Perceived Probability | 0.190 | 0.816 | |||

| Risk Aversion | 0.035 | 0.051 | 0.161 | ||

| Risk Management Strategy | 0.028 | 0.523 | 0.450 | 0.089 |

| Loss Aversion | Perceived Impact | Perceived Probability | Risk Aversion | Risk Management Strategy | |

|---|---|---|---|---|---|

| Loss Aversion | 1.001 | 1.001 | 1.029 | ||

| Perceived Impact | 1.677 | ||||

| Perceived Probability | 1.728 | ||||

| Risk Aversion | 1.001 | 1.001 | 1.026 | ||

| Risk Management Strategy |

| Hypotheses | Path | Path Coefficients | 95% Confidence Intervals | Hypothesis Results a |

|---|---|---|---|---|

| H1 | PP à RMS | 0.123 | [0.004, 0.260] | Not supported |

| H2 | PI à RMS | 0.374 | [0.203, 0.561] | Supported |

| H3 | Risk Aversion à RMS | −0.046 | [−0.158, 0.065] | Not supported |

| H4 | Loss Aversion à RMS | −0.084 | [0.190, 0.026] | Not supported |

| H5 | Risk Aversion à PP | −0.138 | [−0.249, −0.027] | Opposite to supported |

| H6 | Risk Aversion à PI | −0.028 | [−0.153, 0.091] | Not supported |

| H7 | Loss Aversion à PP | 0.165 | [0.041, 0.276] | Supported |

| H8 | Loss Aversion à PI | 0.126 | [0.002, 0.239] | Supported |

| R2 | R2 adj | Q2 | |

|---|---|---|---|

| Perceived Impact | 0.017 | 0.005 | 0.003 |

| Perceived Probability | 0.046 | 0.035 | 0.021 |

| Risk Management Strategy | 0.208 | 0.184 | 0.093 |

| Loss Aversion | PI | PP | Risk Aversion | RMS | |

|---|---|---|---|---|---|

| Loss Aversion | 0.015 | 0.027 | 0.008 | ||

| PI | 0.098 | ||||

| PP | 0.010 | ||||

| Risk Aversion | 0.001 | 0.019 | 0.002 | ||

| RMS |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Díaz-Montenegro, J.; Minchala-Santander, R.; Faytong-Haro, M. Risk Perception and Management Strategies Among Ecuadorian Cocoa Farmers: A Comprehensive Analysis of Attitudes and Decisions. Agriculture 2025, 15, 843. https://doi.org/10.3390/agriculture15080843

Díaz-Montenegro J, Minchala-Santander R, Faytong-Haro M. Risk Perception and Management Strategies Among Ecuadorian Cocoa Farmers: A Comprehensive Analysis of Attitudes and Decisions. Agriculture. 2025; 15(8):843. https://doi.org/10.3390/agriculture15080843

Chicago/Turabian StyleDíaz-Montenegro, José, Raúl Minchala-Santander, and Marco Faytong-Haro. 2025. "Risk Perception and Management Strategies Among Ecuadorian Cocoa Farmers: A Comprehensive Analysis of Attitudes and Decisions" Agriculture 15, no. 8: 843. https://doi.org/10.3390/agriculture15080843

APA StyleDíaz-Montenegro, J., Minchala-Santander, R., & Faytong-Haro, M. (2025). Risk Perception and Management Strategies Among Ecuadorian Cocoa Farmers: A Comprehensive Analysis of Attitudes and Decisions. Agriculture, 15(8), 843. https://doi.org/10.3390/agriculture15080843