1. Introduction

Controlled environment agriculture (CEA)—an overarching category that includes vertical farms, greenhouses, aquaponics, and other configurations and technologies—pivots food production from an outdoor field setting to the indoors where growing conditions can be calibrated to fit crop needs. When controlled-environment agriculture startups began entering the food production space in earnest, optimism about their business case of continually producing high-value crops on a large scale helped with raising significant capital. Agri-preneurs and investors felt bullish because CEA facilities had several attractive points from an operational, environmental sustainability, and social perspective. They include the following: less use of land and water [

1], year-round production and high yields [

2], and proximity to consumers without long transportation distances and lead times [

3].

Scale and location advantages, however, largely could not protect a young CEA industry from headwinds. CEA operations face challenges including large initial investment, high energy costs, and over-engineering. According to a 2016 survey of more than 150 indoor farm growers from around the world [

1], reducing operating costs to achieve economic viability was the most prominent of all CEA challenges.

The subject of this research is vertical farms, which have taken various forms ranging from a shipping container outfitted with multilevel growing spaces to large-scale facilities built or retrofitted to accommodate stacks of growing plants [

4]. The industry has recognized that ensuring vertical farming’s viability will require honing the business model and carefully managing the economics. Such financial considerations may not have been the highest priorities when capital flowed easily [

5]. A Crunchbase project found 22 indoor and vertical farming businesses—most of which had U.S. headquarters but some that had more global footprints—raised more than

$5.6 billion in roughly the four years preceding July 2024. The bulk of these operations secured their capital investments early during this period, and investments slowed in 2023 and 2024 [

6]. Readily available funding allowed vertical farms to differentiate their businesses by spending heavily on proprietary technology for maintaining temperature, controlling humidity, lighting facilities, planting seeds, and harvesting crops. Although the motivation has often been to lower costs, the research and development expense can be difficult to recoup, particularly if selling a lower value food product [

7]. Consumers already feel sensitive to price. The 2023 Power of Produce study from FMI-The Food Industry Association found consumers identified price as the top-ranked factor influencing produce purchase decisions [

8].

The industry needs a shift toward constructing and operating scale-appropriate vertical farms with efficient supply chains built to maximize total net profit. Therefore, more insights are needed to optimize operations and distribution of CEA crops produced in not only complex designs but also simple designs. The current research explores whether vertical farming business models with simple designs can be financially viable. It proposes an optimization model for designing a CEA supply chain network—with costs in mind as key considerations—and choosing the CEA crops to produce based on their yield potential, buyer demand, and consumer willingness to pay. Using the St. Louis area as a case study, we show how our model and method will provide data-driven decision-support for entrepreneurs to successfully operate and scale.

A model equipped to offer insights about scale-appropriate sizing and cost control is important because farming vertically does increase costs, including those for energy and labor [

9]. Energy powers processes include lighting growing spaces, cooling rooms, and filtering or purifying water [

10]. Barclay’s estimates an average vertical farm would have energy costs representing 50% to 70% of the cost of goods sold. Compared with quick-to-turn crops such as greens and herbs, those with longer production cycles such as fruits would accrue energy costs throughout their extended growing periods [

11]. From a labor perspective, tasks such as moving, sorting, and harvesting plants take more time and human effort in a vertical farm than they would in a greenhouse. To save on labor inputs, automation would need to accommodate tasks in a multitier growing configuration—a tall order for technology developers [

12].

High capital expenditures, energy costs, and labor requirements may complicate the economic feasibility for vertical farms, but they also contribute to environmental control. This enables operators to create desirable, consistent growing conditions, which lead to several product and food production process benefits [

13]. One example is water use efficiency. Hydroponic systems with water recirculation may only use 10% of the water consumed by conventionally irrigated fields [

14]. Aeroponics producer AeroFarms says it saves as much as 95% of the water typically applied to a field farm [

15]. Just as it can reduce water use, vertical farming can also reduce the space needed to produce crops. A United States Department of Agriculture (USDA) Agricultural Research Service researcher estimates that vertical farms can record yields per acre that are 10 to 20 times better than yields in open fields [

16]. Growing in an indoor setting also offers protection from potential contaminants that may circulate in an external growing environment. That said, an indoor growing environment does not completely solve food safety concerns. CEA operations tend to have moist, warm conditions, which can trigger bacterial growth [

17].

Despite the costs, the ability for vertical farms to convert any location anywhere into growing space also supports food production near consumers [

18]. In some cities, vertical farms have been sought as tenants for commercial buildings that may be costly to redesign for other uses, such as housing [

19]. Consumers say they desire food grown close to home. Roughly two-thirds of those participating in the FMI Power of Produce 2024 survey said they wanted more locally grown produce options available [

8]. For vertical farms to sustain their local offerings, they must have a workable business case.

The industry’s evolution has reinforced that achieving CEA economic viability calls for properly managed business decisions. The current research adds to a growing body of literature exploring this topic and others relevant to improving CEA production and decision-making. Baumont De Oliveira et al. [

20] introduced a conceptual decision-support framework to manage a CEA system involving information about locations, resources (e.g., space, energy), crops, and operations to achieve profitability. Similar conceptual frameworks were proposed by other authors without a concrete analytical model or data-driven approach [

21,

22].

An early review by Benke and Tomkin [

23] discussed CEA’s economic, environmental, social, and political advantages and its challenges including startup costs, crop portfolio, energy consumption, and scale of production. The recent review by Dohlman et al. [

24] recognized the advantage of CEA in logistics and transportation and its potential to enhance food supply chain resilience. They also comment on the relevance of consumer perception on the quality of CEA produce in freshness, flavor, and nutrition.

Several papers surveyed recent CEA-related technological advances including lightweight transparent polymer composites for vertical structure, growing shelves, engineered LED lighting, 3D-printed growing and harvesting materials, sensors, and other materials enabled by the Internet of Things [

25,

26]. Siregar et al. [

27] reviewed applications of various AI techniques and precision agriculture in CEA, including machine learning, neural networks, and optimization. Dsouza et al. [

28] analyzed 610 studies linked to CEA. Lubna et al. [

29] addressed the challenges of CEA from the operational side and highlighted the need for data-driven decision-support in farm planning [

29].

More than half of the reviewed studies focused on biological considerations. Few examined socio-economic forces of CEA operations. Motivating the current research, the authors confirmed the need for more CEA socio-economic research through multidisciplinary involvement by economists and sociologists. Therefore, the main gap addressed by the current research pertains to using an analytical and data-based approach to evaluate vertical farming’s economic viability in an urban setting. It contributes to this topic area by using a mixed-integer linear programming (MILP) formulation to solve a simulated CEA supply chain optimization problem (CEA-SCOP) for vertical farms in the St. Louis region.

2. Materials and Methods

Solving the CEA-SCOP determines how many vertical farms to build, where to locate them, which growing systems with the corresponding capacity level to choose, which crops to produce, and how much to produce and distribute to meet demand. The objective is to maximize total profit (i.e., total revenue minus total operating costs, including the fixed setup cost; operating costs including energy, labor, and water; and transportation cost). The CEA-SCOP takes the following data inputs: market demand, selling price, types of CEA facilities and configuration options, operating costs, and crop yields. A formal description of the CEA-SCOP is provided below, followed by its MILP formulation. First, however, this section summarizes previously published work that examines vertical farming’s feasibility and offers ideas into optimizing decisions for vertical farming businesses.

2.1. Vertical Farming Feasibility Studies

In the existing literature, Perez [

30] investigated vertical farming’s viability with a case study of lettuce production in Indiana. The work found that vertical farming is technically viable and environmentally sustainable for producing leafy greens, even in regions with no land constraint such as Indiana. This study did point out future needs to study the economic feasibility and perform a cost–benefit analysis.

A study conducted at the Concurrent Engineering workshop by the Association of Vertical Farming in Bremen, Germany, proposed a vertical farm design with a baseline scenario of leafy greens or a vine crop. The economic feasibility study showed the break-even point for selling produce [

31]. Banerjee and Adenaeuer [

32] studied vertical farming’s feasibility by focusing on its economic and market potential. Through market analysis and strengths–weaknesses–opportunities–threats analysis, they concluded that vertical farming is economically and technically feasible in resource-constrained regions or urban areas with high local foods demand.

Avgoustaki and Xydis [

33] employed cash flow analysis to compute and compare the internal rate of return and net present value (NPV) of vertical farming and traditional greenhouse facilities using a Denmark case study. They concluded that vertical farming is more profitable and saves significant resources compared with greenhouses. Through an economic and environmental comparison of CEA and conventional supply chains for U.S.-produced leafy lettuce, Nicholson et al. [

34] found CEA supply chains have tradeoffs with lower transport and spoilage costs but higher production costs. A technical–economic–environmental analysis was conducted by Teo and Go [

35] to examine the use of solar photovoltaic (PV) systems in vertical farming. They found integrating PV into vertical farming facilities is technically, economically, and environmentally viable, especially in tropical areas such as Selangor and Sarawak, Malaysia. Recently, Burritt et al. [

36] used qualitative methods to assess vertical farming’s sustainability using Elkington’s profit, plant, and people framework. They found that vertical farms can achieve financial viability through a systems approach to simultaneously address crop portfolio and production, resource utilization, and consumers/markets to serve. Al-Farouni et al. [

37] proposed a vertical farm setup that combines aquaponics and hydroponics. They showed that such an integrated system can reduce water and land use with year-round crop production.

Although the feasibility studies attempt to evaluate economic performance metrics in certain geographical and technical scenarios, they have a clear drawback. They all assume the related operational and supply chain decisions (e.g., facility location, crop portfolio, and market/consumer fulfillment) are given as is. The industry has a significant need for a feasibility study that endogenously considers operating and planning decisions.

2.2. Vertical Farming Optimization-Based Decision Support

From an optimization perspective, one stream of research addresses the optimal design of CEA systems to minimize energy and water use. Pimentel et al. [

38] developed a math programming model in a

p-graph framework to optimize the capacity of each operation in the vertical farming system over multiple periods while minimizing the total energy cost. Arabzadeh et al. [

39] studied an energy optimization problem for a vertical farm in connection with an external renewable energy system such as wind power. They proposed a MILP model—note, the MILP model’s complete formulation was not provided in the paper—to optimize energy production and energy sold to consumers and maximize the total annual profit (i.e., total revenue less total operating costs including those for fuels, carbon emissions, and operations). A case study for Helsinki, Finland, assessed the effectiveness of the proposed MILP model. Bakirov et al. [

40] studied the optimization of energy and water usage in a hydroponic vertical farm with real-time environmental data (i.e., temperature, humidity, water flow) collected from various sensors and applied a reinforcement learning technique to dynamically adjust irrigation levels and lighting intensity while minimizing total resource usage. Kang and van Hooff [

41] considered the design of air distribution systems in a vertical farm and applied computational fluid dynamics simulations to evaluate the effects of key design parameters on reducing excess heat generated by LED lamps.

The other active stream of work addresses planning and scheduling decisions at the operational level. Notably, Santini et al. [

42] considered a multi-period crop growth planning problem in vertical farming that determines the temperature and humidity needed to meet crop growth requirements. The addressed problem is shown to be NP-hard and modeled as an integer linear program with different objective functions. Bagnerrini et al. [

42] studied a novel problem of scheduling crop seedings in the context of new adaptive vertical farming where the vertical space between crops can adjust to maximize yield. A MILP model was developed to address the scheduling problem, and a numerical study showed the proposed approach’s effectiveness. Daniels et al. [

43] addressed the problem of optimizing water, radiation, and temperature inputs during crop growing cycles, in conjunction with the growing cycle’s duration, and exploited their tradeoffs. An optimal control model and solution was proposed to provide dynamic and adaptive solutions to the addressed problem. Luo and Ball [

44] addressed a planning problem to optimize the planting decision to meet expected demand with limited resources. A digital twin of the vertical farming system provided the data. They showed that the dynamic and adaptive solution provided by reinforcement learning (Q-learning) outperformed the deterministic MILP solution.

Another line of research addresses tactical- or strategic-level planning decisions. Notably, Li et al. [

45] developed a mixed-integer nonlinear programming model to determine how much planting area to allocate for each crop and what growing environment settings, such as temperature, humidity, light intensity, and carbon dioxide concentration, to use. The objective was to maximize total NPV over the planning horizon and include economic and environmental metrics. Schulman et al. [

46] considered the capacity level and investment for different types of lighting systems and their allocation to different crops in multiple years while maximizing total profitability during the planning horizon. Robust optimization was applied given demand and production uncertainties. Aljuhani et al. [

47] studied the location decision of vertical farming facilities with a Saudi Arabian case study.

2.3. Description of CEA-SCOP

For this study, we propose a model for solving a CEA supply chain optimization problem. It is specified as follows. Consider a CEA startup that has a set of candidate locations for building vertical farming facilities to serve a set of retail stores in a region. The startup has a set of candidate crops to produce with the selling price per pound of crop denoted by . Each facility, once built, has a set of options characterized by different growing systems, such as nutrient film technique (NFT) and deep water culture (DWC). CEA options differ in capacity, yield, initial fixed cost, and operating cost. Specifically, for option , the annualized fixed cost is , the annual operating cost is , and the production capacity in square feet is . Fixed facility costs are amortized over the lifespan of facilities. The yield in pounds per square foot of option for produce is . The annual demand of produce at retail store is . The distance in miles between location and retail store is , and the unit transportation cost per pound per mile is . The startup needs to decide (i) how many vertical farms to build and where to locate them, (ii) which vertical growing system to use, (iii) which crops to grow and how much, and (iv) how to allocate and distribute production to meet retail store demand. These decisions must be simultaneously made to maximize the total profit as a function of total revenue subtracting the total costs, which include the fixed setup cost, operating cost, and transportation cost.

2.4. MILP Formulation

We define the following decision variables for the MILP model: A binary decision variable of if candidate location is selected with option or otherwise a 0; a continuous decision variable representing the amount of produce to grow at location with option ; and a continuous decision variable representing the amount of produce shipped from location to serve the demand at retail store .

Objective Function: The objective function of the MILP model maximizes total annual profit, which can be written as follows:

The first term in Equation (1) is the total revenue earned by all vertical farms fulfilling all produce demand at retail stores. The second term is total annual fixed and operating costs. The third term is the total transportation cost incurred to move all produce from vertical farms to retail stores. Constraints in the MILP model are detailed below.

Facility and Option Selection: A candidate location

can be selected to build a vertical farming facility, and if so, then the facility can be built with one option from the available configuration options:

Capacity of Facility: The capacity of facility

configured with option

cannot be exceeded by the amount of all crops produced at the facility:

Note that Equation (3) is the well-known big-M constraint that ensures that no production at facility can take place if the corresponding location is not selected (i.e., ).

Allocation of Supply: For each crop

produced at each facility

, the total shipment to all retail stores cannot exceed the total amount of crop

produced:

Demand Fulfillment: Annual demand for produce

at retail store

must be satisfied by the total shipment of produce

received from all the vertical farm facilities:

The MILP formulation (1)~(5) is a variant (extension) of the classical capacitated facility location problem [

48], which is known to be NP-hard—meaning that finding an optimal solution for a large-size instance can be computationally challenging.

Data Sources: Data used in the optimization modeling is primarily from U.S. government sources, which represent some of the best secondary data available. Analyzing these combined data sources represents the first step a vertical farming operation would undertake in identifying a site location. A follow-up step would be collecting primary data to validate expected demand. Actual startup and operational fixed costs would need to be adjusted to reflect inflation and changes in operational scale and scope.

2.5. Demand Estimates

The case study estimates the demand for multiple produce types well-suited to vertical production: tomatoes, cucumbers, lima beans, okra, onions, turnip greens, romaine and leaf lettuce, kale, and spinach. Demand represents the total product quantity typically purchased within a given period for a given area. To estimate a product’s demand, multiply population by per capita consumption.

To derive per capita consumption, this analysis used USDA-reported, national average per capita availability from 2020 as the starting value for each product and then adjusted availability for losses in the supply chain. Per capita availability was used because of our interest in levels of product transferred between producers and retail, institutional, or wholesale buyers. Because food product affinity—and therefore, consumption—can vary by area, the starting values had marginal adjustments to ensure per capita consumption reflected typical consumption in a region.

Table 1 shows average per capita consumption values used in the case study’s base scenario. These values reflect the regional average. In reality, per capita consumption varies by individual consumer, but for most foods, the cost–benefit tradeoff is too high to identify consumption behavior, quantity demand, and purchase location preferences for each consumer. Regional averages sufficiently suggest per capita consumption and total estimated demand needed for scenario analysis and business planning purposes.

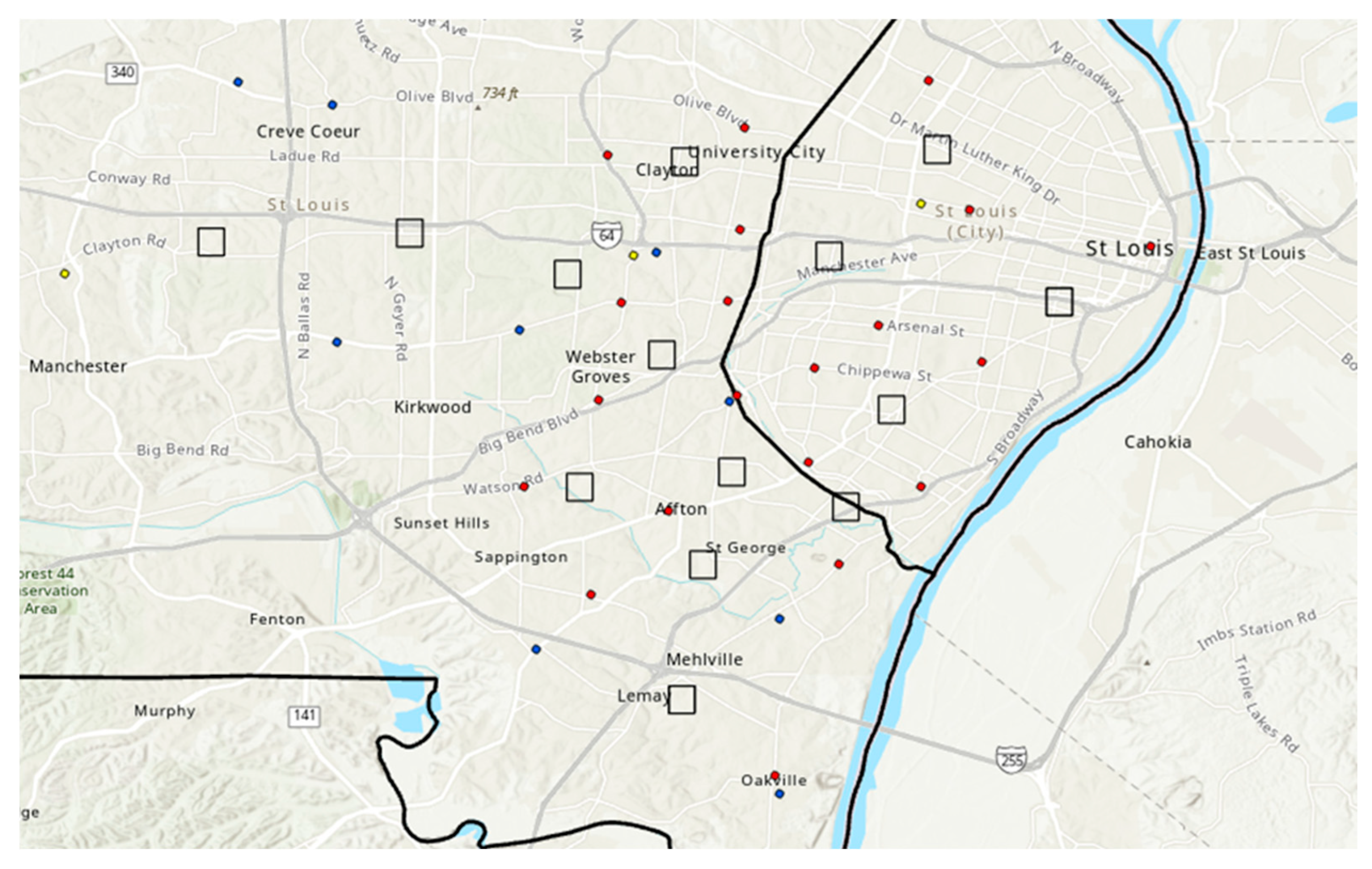

To approximate a food product’s demand potential, this study assumes ABC Produce Farms would capture a 1% share of the St. Louis market. Therefore, a product’s demand at a single retail store can be estimated as follows: average per capita consumption 300,000 residents in the St. Louis area 0.01 market share/32 retail stores.

Successfully capturing a 1% market share requires setting prices consumers would be willing to pay. Based on 2018 data from the USDA Economic Research Service,

Table 2 provides produce market prices considered in this case study.

Analyzing the market price’s effect on profitability requires estimating the price elasticity of demand.

Table 3 shares the extent to which demand would change in percentage terms if the product price changed by 1%. Price elasticities are from: tomatoes, Caputo and Lusk [

49]; cucumbers, Naanwaab and Yeboah [

50]; lima beans (authors estimation); Okra, Khaliukova [

51]; onions [

51]; turnip greens, mustard green, kale, and spinach were each extrapolated from adjusting per capita consumption of lettuce elasticity estimated in [

49].

2.6. Facility Specifications

The case study considered that farming facilities would adopt a Dutch bucket kit, NFT, or DWC technology [

24]. Based on information collected from subject matter expert interviews, we assume the following costs for these growing technologies:

When configuring a particular growing facility, ABC Produce Farms not only must choose the growing technology to use but also the type of growing environment (i.e., greenhouse, container, vertical farming facility) and the facility’s size.

Table 5 summarizes the options considered in this case study.

For vertical farms, water and energy are the two main variable costs. With respect to water, the case study assumes a water cost of

$0.0087 per gallon, and

Table 6 shares estimated water usage by technology option as reported by Nederfhoff and Stanghellini [

52], Raid and Mishara [

53], and Stein [

54].

Energy cost is estimated to be

$0.12 per kWH.

Table 7 reports estimated energy consumption per year using information from Barbosa et al. [

52,

53,

54,

55]. The following assumptions were used to approximate energy usage. The NFT and DWC scenarios assume that energy use totals 11,000 kJ per kilogram per year, based on lettuce as the model crop. Yields are estimated at 41 kg per square meter per year. The Dutch bucket models assume energy is needed for fluorescent lighting, heating, and cooling. The greenhouse model also requires energy for air fans, and the indoor plant factory or container operations use additional energy for ventilation. Note, water pumps are not required in Dutch bucket configurations. The Dutch bucket indoor plant factory or container farm model would encompass vertical production.

The study also assumes labor expense is $12.09 per square foot per year.

2.7. Crop Yield Estimates

This case study’s expected yields are based on subject matter expert input and other sources [

56]. Yields in NFT systems are assumed to be four times greater than yields in DWC systems because NFT configurations usually have four vertical racks.

Table 8 shows estimated yields for crops considered in this case study. N/A indicates a crop is usually not grown in a configuration.

2.8. Distribution

Distributing produce from farms to markets is considered at the strategic level, assuming all produce ships using refrigerated trucks—known as reefers—with no more than 40,000 lb. per truckload. In the Midwest, reefer costs are about

$4.03 per mile [

57]. Because operational-level route planning and fleet scheduling decisions are not considered, the supply chain optimization model conservatively estimates transportation costs.

4. Discussion

Motivated by the opportunity to produce more food near where it will be consumed, the CEA community has invested significantly in designing technology and production systems tailored to indoor production agriculture—in some cases, without a tight focus on whether the costs could be recouped. The literature demonstrates that fine-tuning CEA economics has had less attention. A strong business case, however, is essential for CEA to pivot from being a passion project for its innovators to operating as an economically feasible, self-sustaining venture positioned with the right location, supply chain configuration (e.g., facility size, technology type), and product to suit local demand, cover costs, and leave room for profit.

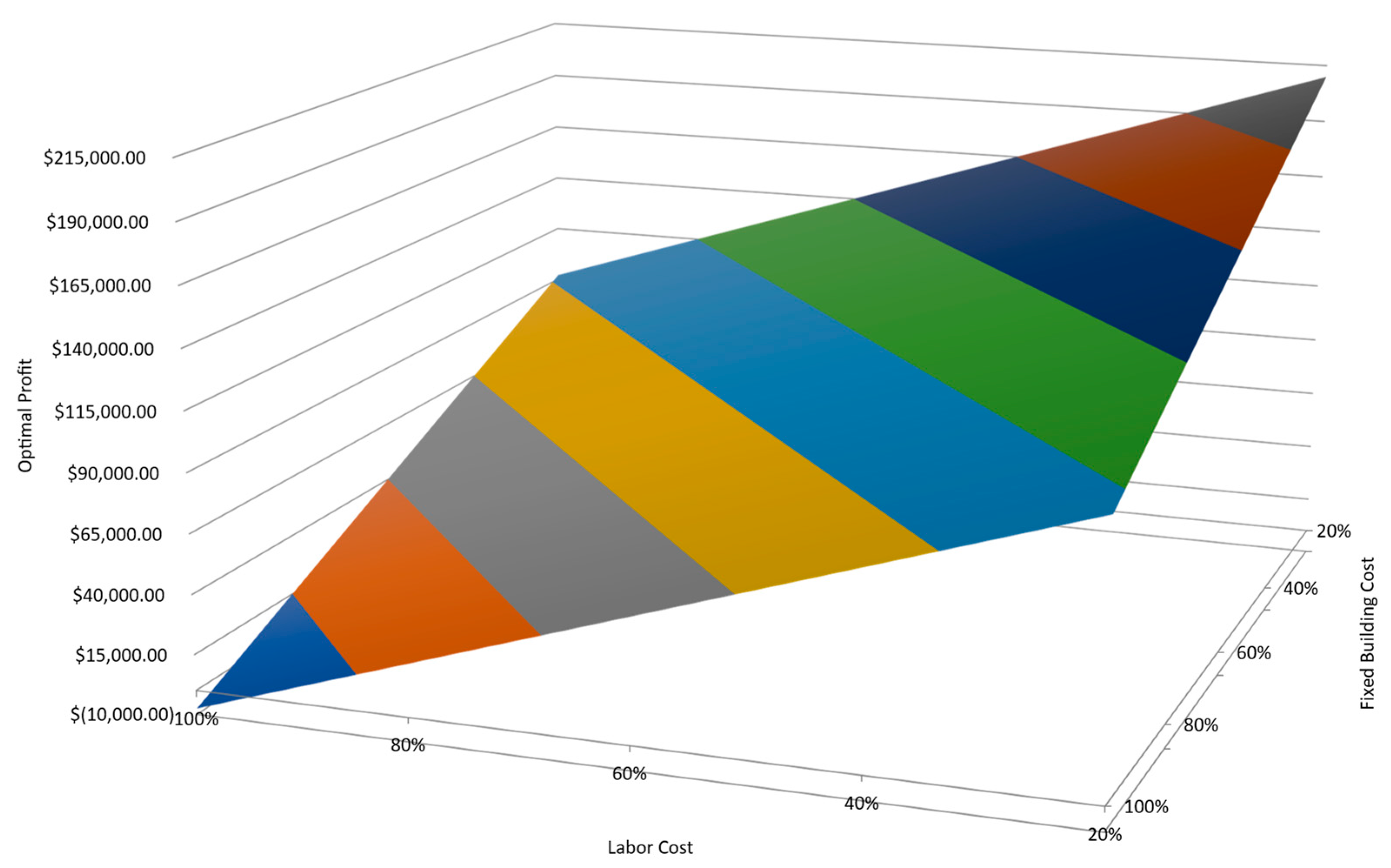

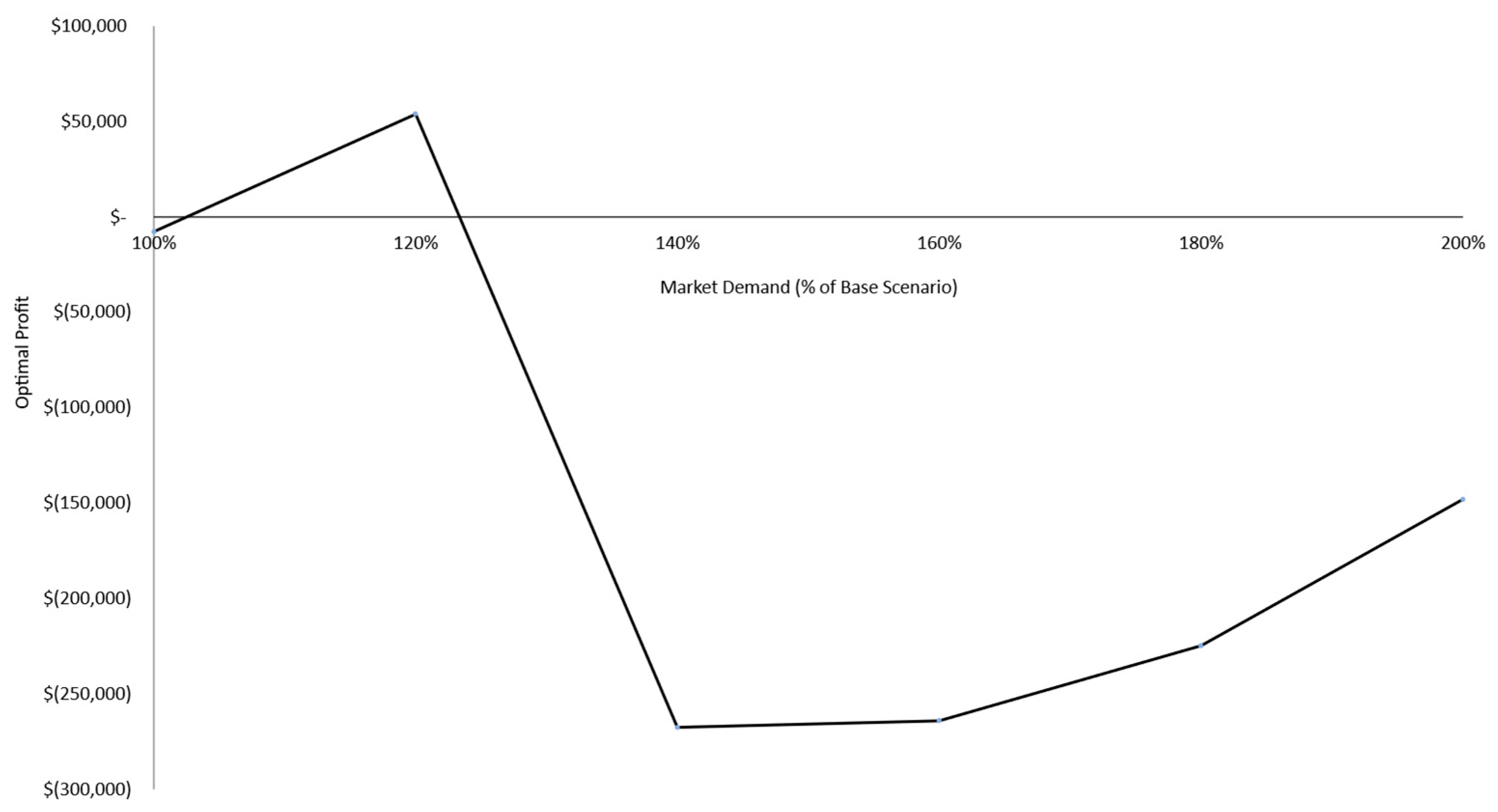

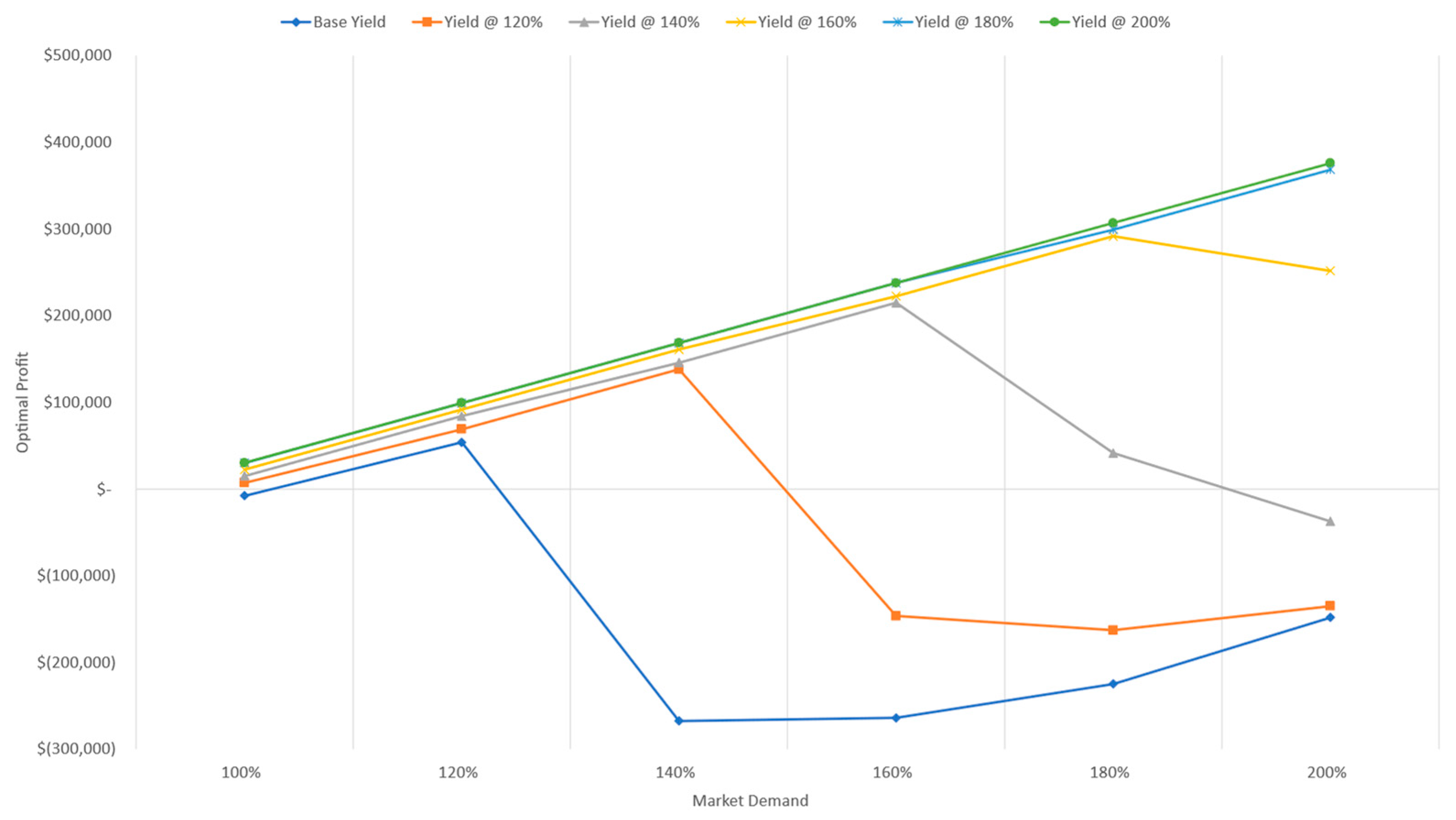

Our CEA-SCOP model presented in this paper provides data-driven decision support for indoor farming startups to plan their supply chain networks and product portfolios while maximizing net profit. It considers crop yields; farm-level costs, including fixed facility cost and variable operating costs such as labor and energy; distribution cost; and market factors, including demand and price. These factors are used as input data to the model. The model is applicable for any startup in any region or any operating and market scenario with customized input data. The suite of sensitivity analysis (i.e., what-if analysis) provides a playbook for startups to obtain analytical solutions to optimize supply chain and production decisions and understand the impacts of varied input data on the optimal solution. Our case study and sensitivity analysis yield three main findings. First, reducing the fixed facility cost and variable operating cost (e.g., labor, energy) is an effective means to improve profitability. This can be achieved by proper facility-level production and resource planning. Second, increasing market prices may benefit profitability but with diminishing returns. This motivates a CEA firm to improve reputation and competitiveness in the market, though the benefits of these marketing activities will decline when the price reaches a high level. Third, growing demand or market share does not necessarily improve profitability, which may feel counterintuitive. Without improving other operational aspects such as reducing costs, increasing prices, or boosting yield, attempting to meet more demand might significantly reduce profit or even trigger a loss because satisfying more demand increases facility and operating costs. This partially explains why most indoor farming startups face challenges as they scale. Further analysis shows that if crop yields improve simultaneously with demand, then profitability can increase as demand and market share strengthen.

Of note, though production and resource planning can help firms to manage their fixed and variable expenses, external forces do affect some costs (e.g., energy, labor). One advantage of our model and solution approach is its data-driven feature. Parameters used in the modeling (i.e., input data) can be updated to reflect a variety of situations. Then, the model will generate optimal solutions based on the input values.

Regardless of whether a vertical farm business is just starting up or it is expanding, the sensitivity analysis results have value. They suggest it is better for a CEA startup to enter the industry when capital costs, interest rates, construction material and equipment costs, and labor costs are low. As for expansion, results show that a CEA business can scale smoothly under the following conditions: produce raised in a CEA system has a sufficient price advantage in the market or better and affordable CEA growing technologies are available.

Findings about profitability have implications for groups beyond farm operators. Investors can take away that the focus should not solely be growing market share and expanding production capacity. Monitoring other important factors such as market conditions (i.e., demand, retail price), growing technologies, and their tradeoffs is critical. Our findings suggest motivation for local or state policymakers to consider providing support for CEA startups, especially during early stages of growth, or local food initiatives more generally. Urban planners may use the findings to consider how to create an environment where CEA has long-term sustainability in urban areas (e.g., siting decisions on grocery stores and commercial complexes with demands for year-round fresh produce; connections with food processors and restaurants for value-added activities centered on CEA).

5. Conclusions

In the existing literature, CEA optimization research has addressed operational decisions such as CEA system design and resource allocation to determine preferred temperature, humidity, and lighting settings. However, strategic decision-support for CEA is rather limited. And though logistics and transportation greatly affect CEA success, there is a lack of comprehensive and rigorous analytical approaches to optimize facility configuration and crop portfolio decisions from the CEA supply chain perspective. The current work aims to fill this gap. We develop a novel approach to optimize CEA supply chain design, including facility locations, capacity and technological configuration, crop portfolio, and distribution, with the objective of maximizing total profitability.

Our study has several limitations. First, indoor farming technologies are considered at a high level without addressing technology implementation at the operational level (e.g., lighting, layout schemes) and the effects on yield and cost. Second, in the current model, the production side is static in nature, which does not capture the problem’s dynamic features (e.g., growing cycles, demand and price seasonality). Moreover, the current model assumes all input data are deterministic using their point estimates (i.e., means or averages), which does not explicitly account for the impact of uncertainty prior to obtaining solutions.

Our work opens an avenue of opportunities for future research. CEA technologies and options at a more granulate level with their tradeoffs in yield and cost can be considered. Growing and harvest planning decisions, market condition dynamics, and economic performance can be modeled in a multi-period setting. The model and method can also be extended to explicitly deal with uncertainty of yield, demand, and price using various methodologies in stochastic optimization. This would allow for capturing dynamics of varying parameters and decisions over multiple periods. To further extend the model, future research could modify the existing modeling to accommodate stochastic approaches that consider multiple scenarios, cases of multiperiod planning, and opportunities to integrate CEA technologies with renewable energy generation and use.