Enhancing Farmer Resilience Through Agricultural Insurance: Evidence from Jiangsu, China

Abstract

1. Introduction

2. Literature Review

3. Theoretical Analysis

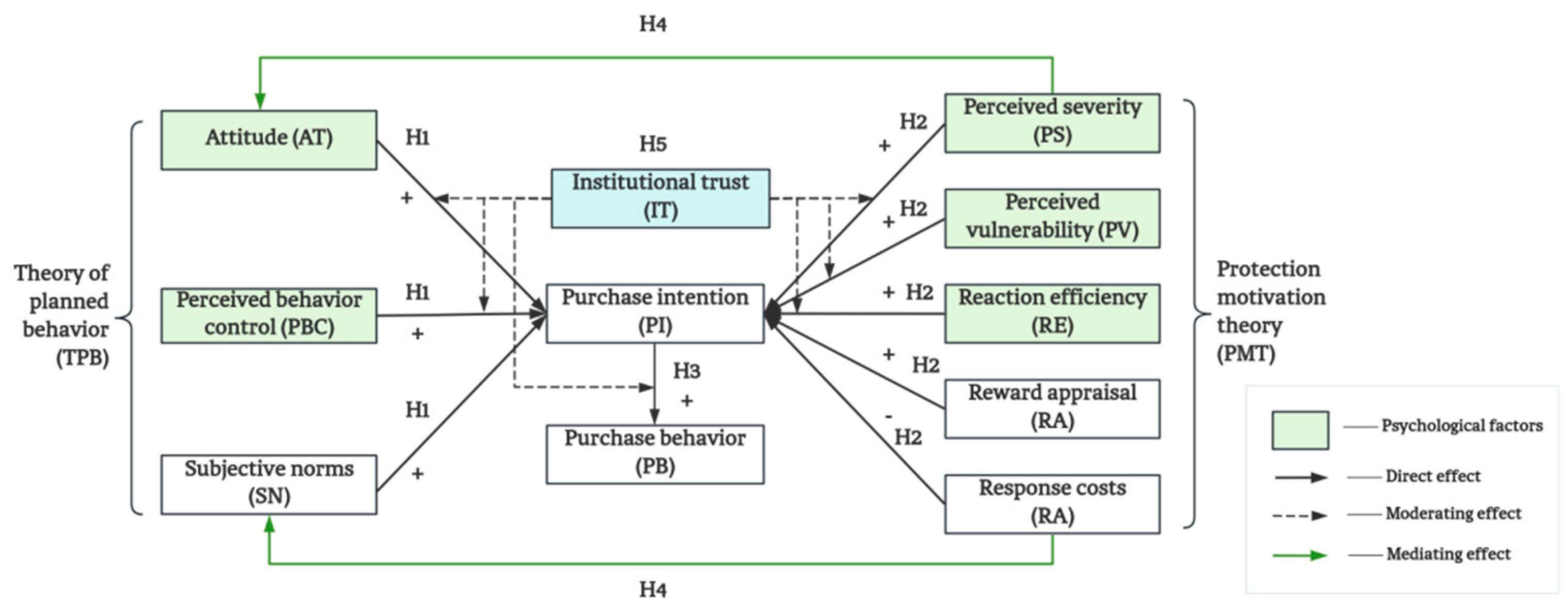

3.1. Theoretical Foundation

3.2. Research Hypotheses Based on TPB-PMT

3.2.1. TPB and Agricultural Insurance Purchase Intention

3.2.2. PMT and Agricultural Insurance Purchase Intention

3.2.3. Farmers’ Agricultural Insurance Purchase Intention and Purchase Behavior

3.2.4. Mediating Role of Attitude and Perceived Behavioral Control

3.2.5. The Moderating Role of Institutional Trust in Public Intervention Situations

4. Research Design

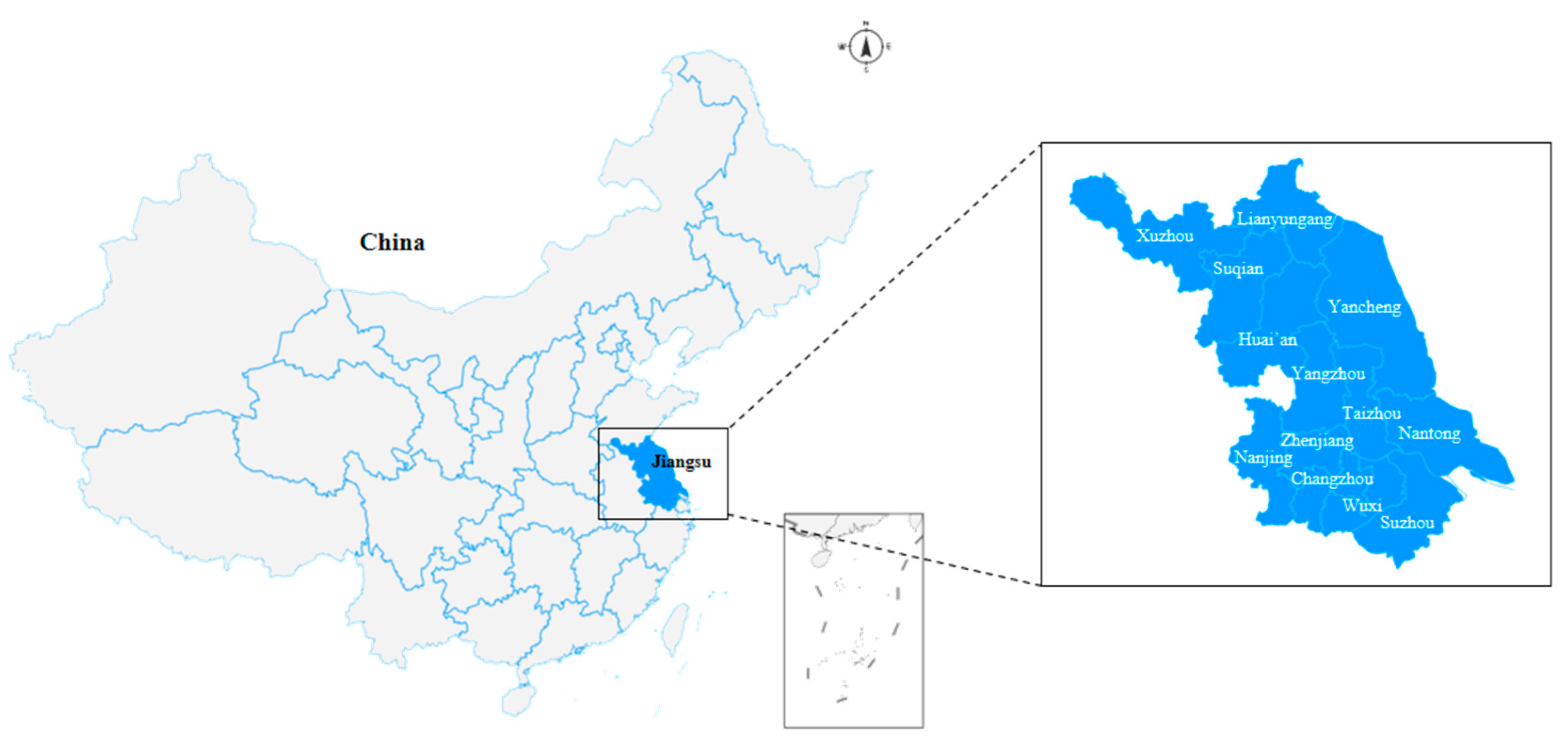

4.1. Research Area

4.2. Questionnaire Design

4.3. Research Implementation and Sample Characterization

4.3.1. Sampling Method

4.3.2. Ethics Statement

4.3.3. Sample Analysis

4.4. Model Construction

5. Empirical Results Analysis

5.1. Reliability and Validity Tests

5.2. Overall Model Fit Test

5.3. Model Results Analysis

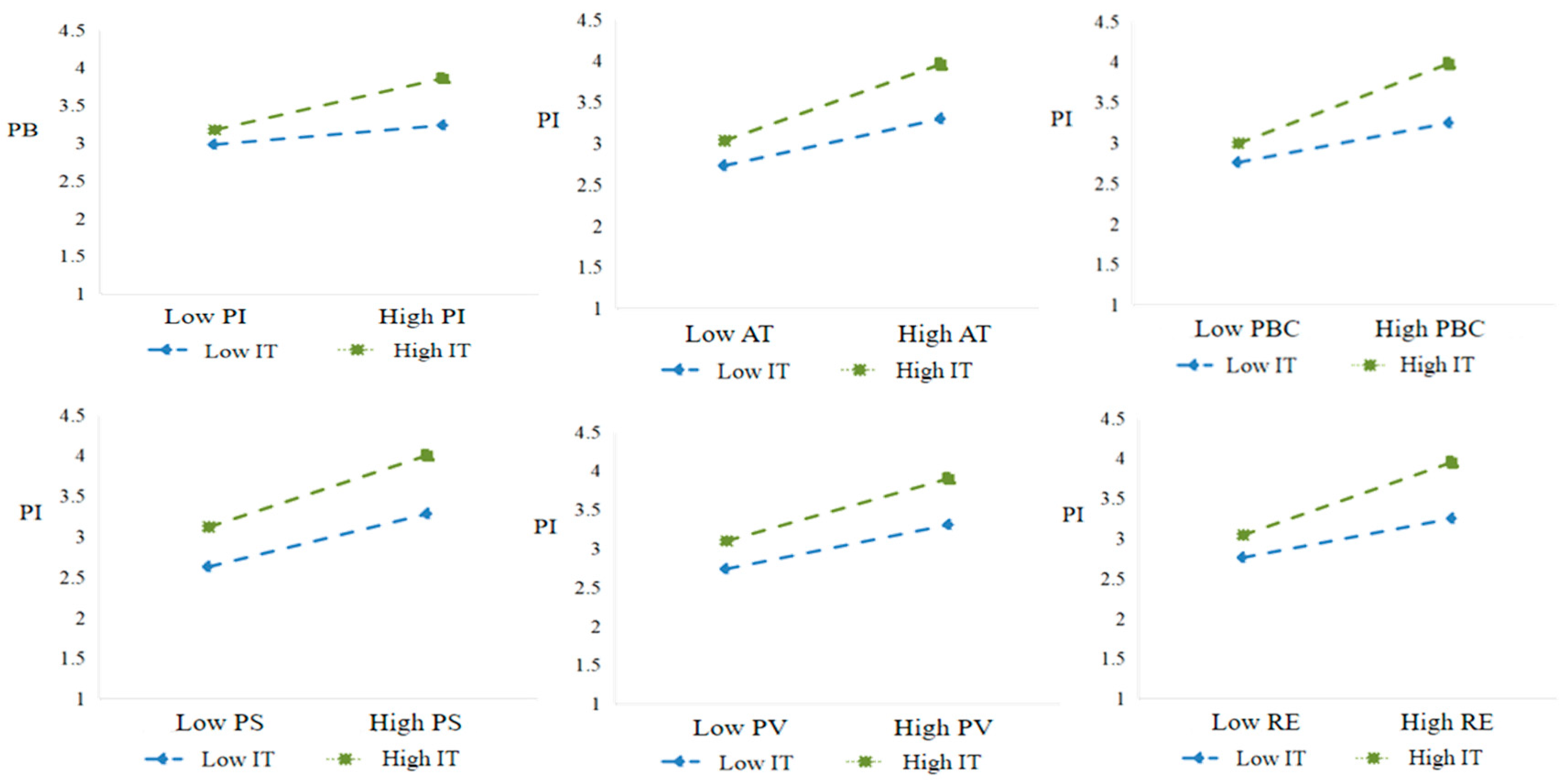

5.4. Analysis of the Moderating Effect of Institutional Trust

6. Discussion

6.1. Multiple-Dimensional Factors Drive Farmers’ Intention to Purchase Agricultural Insurance

6.2. The Driving Role of Subjective Norms from the Perspective of the TPB

6.3. The Driving Role of Risk Perception from the Perspective of PMT

6.4. The Mediating Role of Variables Under the TPB-PMT Integrated Framework

6.5. The Dual Moderating Effects of Institutional Trust in the Context of Public Intervention

7. Conclusions and Policy Recommendations

7.1. Conclusions

7.2. Policy Recommendations

7.3. Limitations and Future Research

7.3.1. Limitations

7.3.2. Future Research

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Fahad, S.; Wang, J.; Hu, G.; Wang, H.; Yang, X.; Shah, A.A.; Huon, N.T.L.; Bilal, A. Empirical analysis of factors influencing farmers crop insurance decisions in Pakistan: Evidence from Khyber Pakhtunkhwa province. Land Use Policy 2018, 75, 459–467. [Google Scholar] [CrossRef]

- Goel, R.K.; Yadav, C.S.; Vishnoi, S.; Rastogi, R. Smart agriculture—Urgent need of the day in developing countries. Sustain. Comput. Inform. Syst. 2021, 30, 100512. [Google Scholar] [CrossRef]

- Birthal, P.S.; Hazrana, J.; Negi, D.S.; Mishra, A.K. Assessing benefits of crop insurance vis-a-vis irrigation in Indian agriculture. Food Policy 2022, 112, 102348. [Google Scholar] [CrossRef]

- He, W.; Liu, Y.; Sun, H.; Taghizadeh-Hesary, F. How Does Climate Change Affect Rice Yield in China? Agriculture 2020, 10, 441. [Google Scholar] [CrossRef]

- Zhang, S.; Xie, X.; Luo, Y.; Liu, X.; Zhao, M. The influence of asset specificity on farmers’ willingness to participate in fallow from the perspective of farmer differentiation. Front. Environ. Sci. 2023, 11, 1107545. [Google Scholar] [CrossRef]

- Lee, C.; Zeng, M.; Luo, K. How does climate change affect food security? Evidence from China. Environ. Impact Assess. Rev. 2024, 104, 107324. [Google Scholar] [CrossRef]

- Wong, H.L.; Wei, X.; Kahsay, H.B.; Gebreegziabher, Z.; Gardebroek, C.; Osgood, D.E.; Diro, R. Effects of input vouchers and rainfall insurance on agricultural production and household welfare: Experimental evidence from northern Ethiopia. World Dev. 2020, 135, 105074. [Google Scholar] [CrossRef]

- Mishra, A.K.; Goodwin, B.K. Revenue insurance purchase decisions of farmers. Appl. Econ. 2006, 38, 149–159. [Google Scholar] [CrossRef]

- Ghosh, R.K.; Gupta, S.; Singh, V.; Ward, P.S. Demand for Crop Insurance in Developing Countries: New Evidence from India. J. Agric. Econ. 2020, 72, 293–320. [Google Scholar] [CrossRef]

- Guo, X.; Zhao, Y.; Arshad, M.U.; Gong, Y. Farmers’ Willingness to Pay a High Premium for Different Types of Agricultural Insurance: Evidence from Inner Mongolia, China. Discret. Dyn. Nat. Soc. 2022, 2022, 8476087. [Google Scholar] [CrossRef]

- Falco, S.D.; Adinolfi, F.; Bozzola, M.; Capitanio, F. Crop Insurance as a Strategy for Adapting to Climate Change. J. Agric. Econ. 2014, 65, 485–504. [Google Scholar] [CrossRef]

- Chen, X.; Zhao, Y. Study on the impact of climate risk on the agricultural insurance purchasing behavior of herding households—An empirical analysis based on Inner Mongolia. Front. Sustain. Food Syst. 2024, 8, 1365536. [Google Scholar] [CrossRef]

- Lan, D.H.; Truong, D.D.; Hoang, T.; Hang, N.D.; Huan, L.H. Determinants of Crop Insurance Participation of Farming Households in Mekong River Delta, Vietnam in Climate Change Context. Environ. Res. Commun. 2024, 6, 105014. [Google Scholar] [CrossRef]

- Mishra, P.K. Agricultural Risk, Insurance and Income. Economic and Political Weekly, 1996. [Google Scholar]

- Tuo, G.; Wang, G. Agricultural Insurance and the System of Social Security in Chinese Countryside; Capital University of Economics & Business Publishing House: Beijing, China, 2002. [Google Scholar]

- Chambers, R.G. Insurability and Moral Hazard in Agricultural Insurance Markets. Am. J. Agric. Econ. 1989, 71, 604–616. [Google Scholar] [CrossRef]

- Miranda, M.J. Area-Yield Crop Insurance Reconsidered. Am. J. Agric. Econ. 1991, 73, 233–242. [Google Scholar] [CrossRef]

- Netusil, N.R.; Kousky, C.; Neupane, S.; Daniel, W.; Kunreuther, H. The Willingness to Pay for Flood Insurance. Land Econ. 2021, 97, 17–38. [Google Scholar] [CrossRef]

- Reynaud, A.; Nguyen, M.-H.; Aubert, C. Is there a demand for flood insurance in Vietnam? Results from a choice experiment. Environ. Econ. Policy Stud. 2017, 20, 593–617. [Google Scholar] [CrossRef]

- Glauber, J.W. Crop Insurance Reconsidered. Am. J. Agric. Econ. 2004, 86, 1179–1195. [Google Scholar] [CrossRef]

- Madaki, M.Y.; Kaechele, H.; Bavorová, M. Agricultural insurance as a climate risk adaptation strategy in developing countries: A case of Nigeria. Clim. Policy 2023, 23, 747–762. [Google Scholar] [CrossRef]

- Wu, G.; Cheng, J.; Yang, F. The Influence of the Peer Effect on Farmers’ Agricultural Insurance Decision: Evidence from the Survey Data of the Karst Region in China. Sustainability 2022, 14, 11922. [Google Scholar] [CrossRef]

- Fahad, S.; Wang, J.; Khan, A.A.; Ullah, A.; Ali, U.; Hossain, M.S.; Khan, S.U.; Huon, N.T.L.; Yang, X.; Hu, G.; et al. Evaluation of farmers’ attitude and perception toward production risk: Lessons from Khyber Pakhtunkhwa Province, Pakistan. Hum. Ecol. Risk Assess. Int. J. 2018, 24, 1710–1722. [Google Scholar] [CrossRef]

- Fu, H.; Zhang, Y.; An, Y.; Zhou, L.; Peng, Y.; Kong, R.; Turvey, C.G. Subjective and objective risk perceptions and the willingness to pay for agricultural insurance: Evidence from an in-the-field choice experiment in rural China. Geneva Risk Insur. Rev. 2021, 47, 98–121. [Google Scholar] [CrossRef]

- Peng, R.; Zhao, Y.; Elahi, E.; Peng, B. Does disaster shocks affect farmers’ willingness for insurance? Mediating effect of risk perception and survey data from risk-prone areas in East China. Nat. Hazards 2021, 106, 2883–2899. [Google Scholar] [CrossRef]

- Petrolia, D.R.; Landry, C.E.; Coble, K.H. Risk Preferences, Risk Perceptions, and Flood Insurance. Land Econ. 2013, 89, 227–245. [Google Scholar] [CrossRef]

- Dragos, C.M.; Dragos, S.L.; Mare, C.; Muresan, G.M.; Purcel, A.-A. Does risk assessment and specific knowledge impact crop insurance underwriting? Evidence from Romanian farmers. Econ. Anal. Policy 2023, 79, 343–358. [Google Scholar] [CrossRef]

- Liu, W.; Wang, B.; Wang, C.; Han, K. The effect of financial literacy on rural households insurance participation: Evidence from farmers in southwest China. Asia-Pac. J. Account. Econ. 2021, 30, 139–155. [Google Scholar] [CrossRef]

- Oppong Mensah, N.; Owusu-Sekyere, E.; Adjei, C. Revisiting preferences for agricultural insurance policies: Insights from cashew crop insurance development in Ghana. Food Policy 2023, 118, 102496. [Google Scholar] [CrossRef]

- Liu, F.; Corcoran, C.P.; Tao, J.; Cheng, J. Risk perception, insurance recognition and agricultural insurance behavior–An empirical based on dynamic panel data in 31 provinces of China. Int. J. Disaster Risk Reduct. 2016, 20, 19–25. [Google Scholar] [CrossRef]

- Sarkar, A.; Wang, H.; Rahman, A.; Abdul Azim, J.; Hussain Memon, W.; Qian, L. Structural equation model of young farmers’ intention to adopt sustainable agriculture: A case study in Bangladesh. Renew. Agric. Food Syst. 2022, 37, 142–154. [Google Scholar] [CrossRef]

- Hu, S.; Yu, M.; Que, T.; Fan, G.; Xing, H. Individual willingness to prepare for disasters in a geological hazard risk area: An empirical study based on the protection motivation theory. Nat. Hazards 2021, 110, 2087–2111. [Google Scholar] [CrossRef]

- Keshavarz, M.; Karami, E. Farmers’ pro-environmental behavior under drought: Application of protection motivation theory. J. Arid Environ. 2016, 127, 128–136. [Google Scholar] [CrossRef]

- Savari, M.; Gharechaee, H. Application of the extended theory of planned behavior to predict Iranian farmers’ intention for safe use of chemical fertilizers. J. Clean. Prod. 2020, 263, 121512. [Google Scholar] [CrossRef]

- Badsar, M.; Moghim, M.; Ghasemi, M. Analysis of factors influencing farmers’ sustainable environmental behavior in agriculture activities: Integration of the planned behavior and the protection motivation theories. Environ. Dev. Sustain. 2022, 25, 9903–9934. [Google Scholar] [CrossRef]

- Wang, Y.; Liang, J.; Yang, J.; Ma, X.; Li, X.; Wu, J.; Yang, G.; Ren, G.; Feng, Y. Analysis of the environmental behavior of farmers for non-point source pollution control and management: An integration of the theory of planned behavior and the protection motivation theory. J. Environ. Manag. 2019, 237, 15–23. [Google Scholar] [CrossRef]

- Adjabui, J.A.; Tozer, P.R.; Gray, D.I. Willingness to participate and pay for index-based crop insurance in Ghana. Agric. Financ. Rev. 2019, 79, 491–507. [Google Scholar] [CrossRef]

- Cialdini, R.B.; Kallgren, C.A.; Reno, R.R. A Focus Theory of Normative Conduct: A Theoretical Refinement and Reevaluation of the Role of Norms in Human Behavior. Adv. Exp. Soc. Psychol. 1991, 24, 201–234. [Google Scholar] [CrossRef]

- Bao, X.; Zhang, F.; Guo, S.; Deng, X.; Song, J.; Xu, D. Peer Effects on Farmers’ Purchases of Policy-Based Planting Farming Agricultural Insurance: Evidence from Sichuan Province, China. Int. J. Environ. Res. Public Health 2022, 19, 7411. [Google Scholar] [CrossRef]

- Ajzen, I. The theory of planned behavior. Organ. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Takahashi, K.; Muraoka, R.; Otsuka, K. Technology adoption, impact, and extension in developing countries’ agriculture: A review of the recent literature. Agric. Econ. 2019, 51, 31–45. [Google Scholar] [CrossRef]

- Platteau, J.-P.; Ugarte Ontiveros, D. Cognitive bias in insurance: Evidence from a health scheme in India. World Dev. 2021, 144, 105498. [Google Scholar] [CrossRef]

- Jessoe, K.; Rapson, D. Knowledge is (Less) Power: Experimental Evidence from Residential Energy Use. Am. Econ. Rev. 2014, 104, 1417–1438. [Google Scholar] [CrossRef]

- Tadesse, M.; Alfnes, F.; Erenstein, O.; Holden, S.T. Demand for a labor-based drought insurance scheme in Ethiopia: A stated choice experiment approach. Agric. Econ. 2016, 48, 501–511. [Google Scholar] [CrossRef]

- Binswanger-Mkhize, H.P. Is There Too Much Hype about Index-based Agricultural Insurance? J. Dev. Stud. 2012, 48, 187–200. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, F.; Liu, S.; Xu, D. Consistency between the subjective and objective flood risk and willingness to purchase natural disaster insurance among farmers: Evidence from rural areas in Southwest China. Environ. Impact Assess. Rev. 2023, 102, 107201. [Google Scholar] [CrossRef]

- Enjolras, G.; Sentis, P. Crop insurance policies and purchases in France. Agric. Econ. 2011, 42, 475–486. [Google Scholar] [CrossRef]

- Nordlander, L.; Pill, M.; Romera, B.M. Insurance schemes for loss and damage: Fools’ gold? Clim. Policy 2019, 20, 704–714. [Google Scholar] [CrossRef]

- Carter, M.R.; Cheng, L.; Sarris, A. Where and how index insurance can boost the adoption of improved agricultural technologies. J. Dev. Econ. 2016, 118, 59–71. [Google Scholar] [CrossRef]

- Wodaju, A.; Nigussie, Z.; Yitayew, A.; Tegegne, B.; Wubalem, A.; Abele, S. Factors influencing farmers’ willingness to pay for weather-indexed crop insurance policies in rural Ethiopia. Environ. Dev. Sustain. 2025, 27, 8951–8976. [Google Scholar] [CrossRef]

- Botzen, W.J.W.; Thepaut, L.D.; Banerjee, S. Kahneman’s Insights for Climate Risks: Lessons from Bounded Rationality, Heuristics and Biases. Environ. Resour. Econ. 2025. [Google Scholar] [CrossRef]

- Marr, A.; Winkel, A.; van Asseldonk, M.; Lensink, R.; Bulte, E. Adoption and impact of index-insurance and credit for smallholder farmers in developing countries. Agric. Financ. Rev. 2016, 76, 94–118. [Google Scholar] [CrossRef]

- Sherrick, B.J.; Barry, P.J.; Ellinger, P.N.; Schnitkey, G.D. Factors Influencing Farmers’ Crop Insurance Decisions. Am. J. Agric. Econ. 2004, 86, 103–114. [Google Scholar] [CrossRef]

- Wang, M.; Ye, T.; Shi, P. Factors Affecting Farmers’ Crop Insurance Participation in China. Can. J. Agric. Econ./Rev. Can. D’agroeconomie 2015, 64, 479–492. [Google Scholar] [CrossRef]

- Cole, S.A.; Giné, X.; Tobacman, J.B.; Townsend, R.M.; Topalova, P.B.; Vickery, J.I. Barriers to Household Risk Management: Evidence from India. SSRN Electron. J. 2012, 5, 104–135. [Google Scholar] [CrossRef]

- Rogers, R.W. A Protection Motivation Theory of fear appeals and attitude change. J. Psychol. 1975, 91, 93–114. [Google Scholar] [CrossRef]

- Karlan, D.; Osei, R.; Osei-Akoto, I.; Udry, C. Agricultural Decisions after Relaxing Credit and Risk Constraints. Q. J. Econ. 2014, 129, 597–652. [Google Scholar] [CrossRef]

- Nunnally, J.C. Psychometric Theory, 3rd ed.; McGraw-Hill: New York, NY, USA, 1994; ISBN 9780071070881. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Bhandari, G.; Pandey, A.; Sapkota, U.; Singh, S.P.; Murano, H. Pesticide use and safety behavior among rice farmers in Nepal: The assessment of theory of planned behavior and potential health risk. Environ. Dev. Sustain. 2025. [Google Scholar] [CrossRef]

- Pennings, J.M.E.; Wansink, B.; Meulenberg, M.T.G. A note on modeling consumer reactions to a crisis: The case of the mad cow disease. Int. J. Res. Mark. 2002, 19, 91–100. [Google Scholar] [CrossRef]

- Menapace, L.; Colson, G.; Raffaelli, R. A comparison of hypothetical risk attitude elicitation instruments for explaining farmer crop insurance purchases. Eur. Rev. Agric. Econ. 2015, 43, 113–135. [Google Scholar] [CrossRef]

- Xu, Z.; Rojniruttikul, N. Determinants of tea planters’ purchasing behavior of planting insurance: SEM analysis. PLoS ONE 2025, 20, e0322798. [Google Scholar] [CrossRef]

- Santana, A.P.; Korn, L.; Betsch, C.; Böhm, R. Lessons learned about willingness to adopt various protective measures during the early COVID-19 pandemic in three countries. PLoS ONE 2022, 17, e0265892. [Google Scholar] [CrossRef]

- Ajzen, I. Perceived behavioral control, self-efficacy, locus of control, and the theory of planned behavior. J. Appl. Soc. Psychol. 2002, 32, 665–683. [Google Scholar] [CrossRef]

- Weedige, S.S.; Ouyang, H.; Gao, Y.; Liu, Y. Decision Making in Personal Insurance: Impact of Insurance Literacy. Sustainability 2019, 11, 6795. [Google Scholar] [CrossRef]

- Luo, T.; Yang, H.; Zhao, J.; Sun, J. Farmers’ Social Networks and the Fluctuation in Their Participation in Crop Insurance: The Perspective of Information Diffusion. Emerg. Mark. Financ. Trade 2019, 56, 1–19. [Google Scholar] [CrossRef]

- Wu, S.; Goodwin, B.K.; Coble, K. Moral hazard and subsidized crop insurance. Agric. Econ. 2019, 51, 131–142. [Google Scholar] [CrossRef]

- Wang, Z. Using the Performance Evaluation System to Combat Corruption: Promises and Challenges. Chin. Political Sci. Rev. 2018, 3, 389–410. [Google Scholar] [CrossRef]

- Boyd, M.; Pai, J.; Zhang, Q.; Holly Wang, H.; Wang, K. Factors affecting crop insurance purchases in China: The Inner Mongolia region. China Agric. Econ. Rev. 2011, 3, 441–450. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263–292. [Google Scholar] [CrossRef]

- Wheeler, R.; Lobley, M. Managing Extreme Weather and Climate Change in UK agriculture: Impacts, Attitudes and Action among Farmers and Stakeholders. Clim. Risk Manag. 2021, 32, 100313. [Google Scholar]

- Jin, J.; Wang, W.; Wang, X. Farmers’ Risk Preferences and Agricultural Weather Index Insurance Uptake in Rural China. Int. J. Disaster Risk Sci. 2016, 7, 366–373. [Google Scholar] [CrossRef]

- Osberghaus, D. The determinants of private flood mitigation measures in Germany—Evidence from a nationwide survey. Ecol. Econ. 2015, 110, 36–50. [Google Scholar] [CrossRef]

- Mare, C.; Manaţe, D.; Mureșan, G.M.; Dragoş, S.L.; Dragoș, C.M.; Purcel, A.-A. Machine Learning Models for Predicting Romanian Farmers’ Purchase of Crop Insurance. Mathematics 2022, 10, 3625. [Google Scholar] [CrossRef]

- Hossain, M.S.; Alam, G.M.M.; Fahad, S.; Sarker, T.; Moniruzzaman, M.; Rabbany, M.G. Smallholder farmers’ willingness to pay for flood insurance as climate change adaptation strategy in northern Bangladesh. J. Clean. Prod. 2022, 338, 130584. [Google Scholar] [CrossRef]

- Lay, B.; Bunyasiri, I.; Suchato, R. Farmers’ Willingness to Purchase Weather Index Crop Insurance: Evidence from Battambang, Cambodia. J. Risk Financ. Manag. 2023, 16, 498. [Google Scholar] [CrossRef]

- Armitage, C.J.; Conner, M. Social cognition models and health behaviour: A structured review. Psychol. Health 2000, 15, 173–189. [Google Scholar] [CrossRef]

- Mayer, R.C.; Davis, J.H.; Schoorman, F.D. An Integrative Model of Organizational Trust. Acad. Manag. Rev. 1995, 20, 709–734. [Google Scholar] [CrossRef]

- Sheeran, P.; Webb, T.L. The Intention-Behavior Gap. Soc. Personal. Psychol. Compass 2016, 10, 503–518. [Google Scholar] [CrossRef]

- Kramer, B.; Hazell, P.; Alderman, H.; Ceballos, F.; Kumar, N.; Timu, A.G. Is Agricultural Insurance Fulfilling its Promise for the Developing World? A Review of Recent Evidence. Annu. Rev. Resour. Econ. 2022, 14, 291–311. [Google Scholar] [CrossRef]

- Van Boom, W.H.; Desmet, P.; Van Dam, M. “If It’s Easy to Read, It’s Easy to Claim”—The Effect of the Readability of Insurance Contracts on Consumer Expectations and Conflict Behaviour. J. Consum. Policy 2016, 39, 187–197. [Google Scholar] [CrossRef]

- Hazell, P.; Varangis, P. Best practices for subsidizing agricultural insurance. Glob. Food Secur. 2019, 25, 100326. [Google Scholar] [CrossRef]

- Nshakira-Rukundo, E.; Kamau, J.W.; Baumüller, H. Determinants of uptake and strategies to improve agricultural insurance in Africa: A review. Environ. Dev. Econ. 2021, 26, 605–631. [Google Scholar] [CrossRef]

| Dimension | Variable Settings | Subjects | Literature Sources | |

|---|---|---|---|---|

| TPB | Attitude | AT01-AT03 | Ajzen [40]; Mishra & Goodwin [8] | |

| Subjective norms | SN01-SN04 | Wu et al. [22] | ||

| Perceived behavior control | PBC01-PBC06 | Enjolras & Sentis [47] | ||

| P M T | Threat assessment | Perceived vulnerability | PV01-PV03 | Peng et al. [25] |

| Perceived severity | PS01-PS03 | Rogers [56]; Wang et al. [46] | ||

| Coping assessment | Reaction efficiency | RE01-RE03 | Karlan et al. [57] | |

| Response cots | RC01-RC03 | Binswanger-Mkhize [45]; Dragos et al. [27] | ||

| Reward Appraisal | RA01-RA03 | Carter et al. [49] | ||

| Institutional context | Institutional trust | IT01-IT03 | Wang et al. [36] | |

| Options | Response | Case Percentage | |

|---|---|---|---|

| Frequency | Percent | ||

| Planting industry (e.g., grain, vegetables, fruits, etc.) | 247 | 20.3% | 40.6% |

| Animal husbandry (e.g., cattle, sheep, pigs, chickens, etc.) | 292 | 24.1% | 48.0% |

| Aquaculture (e.g., fish farming, shrimp farming, etc.) | 219 | 18.0% | 36.0% |

| Forestry (e.g., tree planting, bamboo cultivation, etc.) | 251 | 20.7% | 41.3% |

| Leisure agriculture and rural tourism (e.g., farmhouse, picking gardens, etc.) | 205 | 16.9% | 33.7% |

| Total | 1214 | 100.00% | 199.7% |

| Characteristics | Options | Frequency | Percent (%) |

|---|---|---|---|

| Gender | Male | 319 | 52.5 |

| Female | 289 | 47.5 | |

| Age | 20–35 | 42 | 6.9 |

| 36–45 | 101 | 16.6 | |

| 46–55 | 224 | 36.8 | |

| 56–65 | 178 | 29.3 | |

| 66 or above | 63 | 10.4 | |

| Education | Uneducated | 49 | 8.1 |

| Secondary schools | 159 | 26.2 | |

| Junior high schools | 266 | 43.8 | |

| High school or junior college | 108 | 17.8 | |

| College or higher | 24 | 3.9 | |

| Undergraduate or above | 2 | 0.3 | |

| Health status | very poor | 15 | 2.5 |

| rather poor | 43 | 7.1 | |

| general | 261 | 42.9 | |

| better | 172 | 28.3 | |

| rare | 117 | 19.2 | |

| Share of annual income from family agriculture | 20% and below (very low) | 13 | 2.1 |

| 20–40% (less) | 38 | 6.3 | |

| 40–60% (average) | 134 | 22 | |

| 60–80% (more) | 230 | 37.8 | |

| 80% and above (very high) | 193 | 31.7 | |

| Number of persons working in agriculture in households | 2 or less | 15 | 2.5 |

| 3–5 | 425 | 69.9 | |

| 5–10 | 128 | 21.1 | |

| 10 or above | 40 | 6.6 | |

| Length of time in agriculture | Less than 5 years | 22 | 3.6 |

| 5–10 years | 66 | 10.9 | |

| 10–15 years | 55 | 9 | |

| 15–20 years | 176 | 28.9 | |

| 20 years and above | 289 | 47.5 | |

| Agriculture business area | Less than 10 acres | 324 | 53.3 |

| 10–50 acres | 241 | 39.6 | |

| 50–200 acres | 35 | 5.8 | |

| 200–500 acres | 5 | 0.8 | |

| 500 acres and above | 3 | 0.5 |

| Constrcut | Indicator | Number of Items | Cronbach’s Alpha | Standardized Loading | AVE | CR |

|---|---|---|---|---|---|---|

| Attitude | AT01 | 3 | 0.797 | 0.727 | 0.569 | 0.798 |

| AT02 | 0.765 | |||||

| AT03 | 0.770 | |||||

| Subject norms | SN01 | 4 | 0.844 | 0.780 | 0.575 | 0.844 |

| SN02 | 0.722 | |||||

| SN03 | 0.773 | |||||

| SN04 | 0.756 | |||||

| Perceived behavior control | PBC01 | 6 | 0.889 | 0.730 | 0.572 | 0.889 |

| PBC02 | 0.757 | |||||

| PBC03 | 0.789 | |||||

| PBC04 | 0.762 | |||||

| PBC05 | 0.778 | |||||

| PBC06 | 0.720 | |||||

| Perceived vulnerability | PV01 | 3 | 0.826 | 0.787 | 0.614 | 0.826 |

| PV02 | 0.739 | |||||

| PV03 | 0.822 | |||||

| Perceived severity | PS01 | 3 | 0.812 | 0.757 | 0.574 | 0.802 |

| PS02 | 0.744 | |||||

| PS03 | 0.772 | |||||

| Reaction efficiency | RE01 | 3 | 0.816 | 0.785 | 0.597 | 0.816 |

| RE02 | 0.774 | |||||

| RE03 | 0.759 | |||||

| Response costs | RC01 | 3 | 0.825 | 0.791 | 0.600 | 0.818 |

| RC02 | 0.763 | |||||

| RC03 | 0.770 | |||||

| Reward appraisal | RA01 | 3 | 0.802 | 0.756 | 0.575 | 0.802 |

| RA02 | 0.742 | |||||

| RA03 | 0.776 | |||||

| Purchase intention | PI01 | 3 | 0.838 | 0.785 | 0.615 | 0.827 |

| PI02 | 0.780 | |||||

| PI03 | 0.787 | |||||

| Purchase behavior | PB01 | 3 | 0.802 | 0.787 | 0.572 | 0.800 |

| PB02 | 0.757 | |||||

| PB03 | 0.723 |

| RA | RC | RE | PS | PV | SN | PBC | AT | PI | PB | |

|---|---|---|---|---|---|---|---|---|---|---|

| RA | 0.734 | |||||||||

| RC | −0.495 | 0.748 | ||||||||

| RE | 0.453 | −0.503 | 0.732 | |||||||

| PS | 0.533 | −0.587 | 0.515 | 0.748 | ||||||

| PV | 0.460 | −0.457 | 0.422 | 0.488 | 0.733 | |||||

| SN | 0.480 | −0.523 | 0.505 | 0.483 | 0.476 | 0.687 | ||||

| PBC | 0.227 | −0.458 | 0.231 | 0.269 | 0.209 | 0.240 | 0.660 | |||

| AT | 0.291 | −0.320 | 0.281 | 0.545 | 0.266 | 0.263 | 0.147 | 0.718 | ||

| PI | 0.506 | −0.563 | 0.511 | 0.580 | 0.478 | 0.515 | 0.344 | 0.406 | 0.760 | |

| PB | 0.224 | −0.29 | 0.227 | 0.259 | 0.211 | 0.230 | 0.318 | 0.173 | 0.423 | 0.722 |

| CMIN/DF | GFI | AGFI | NFI | IFI | TLI | CFI | RMSEA | |

|---|---|---|---|---|---|---|---|---|

| Model results | 1.867 | 0.916 | 0.900 | 0.908 | 0.955 | 0.949 | 0.955 | 0.038 |

| Standard | 1 < CMIN < 5 | >0.9 | >0.9 | >0.9 | >0.9 | >0.9 | >0.9 | <0.08 |

| Hypothesis | Path | Std. Coefficient | UnStd. Coefficient | S.E. | C.R. | p |

|---|---|---|---|---|---|---|

| H1 | AT→PI | 0.128 | 0.137 | 0.054 | 2.541 | 0.011 |

| SN→PI | 0.133 | 0.144 | 0.058 | 2.48 | 0.013 | |

| PBC→PI | 0.109 | 0.127 | 0.051 | 2.51 | 0.012 | |

| H2 | PV→PI | 0.147 | 0.151 | 0.072 | 2.103 | 0.035 |

| PS→PI | 0.11 | 0.116 | 0.053 | 2.186 | 0.029 | |

| RE→PI | 0.137 | 0.137 | 0.053 | 2.571 | 0.01 | |

| RC→PI | −0.138 | −0.133 | 0.061 | −2.177 | 0.03 | |

| RA→PI | 0.122 | 0.134 | 0.059 | 2.25 | 0.024 | |

| H3 | PI→PB | 0.355 | 0.302 | 0.045 | 6.737 | <0.01 |

| H4 | PS→AT | 0.545 | 0.524 | 0.051 | 10.343 | <0.01 |

| RC→PBC | −0.458 | −0.38 | 0.041 | −9.318 | <0.01 |

| Options | Response | Case Percentage | |

|---|---|---|---|

| Frequency | Percent | ||

| Increase claim payment ratio | 30 | 9.20% | 27.80% |

| Expand insurance coverage scope, e.g., disaster types, crops/livestock varieties | 54 | 16.50% | 50.00% |

| Reduce premiums or increase government subsidies | 44 | 13.50% | 40.70% |

| Simplify claims procedures and accelerate settlement speed | 34 | 10.40% | 31.50% |

| Enhance transparency and readability of policy clauses | 55 | 16.80% | 50.90% |

| Expand publicity channels to improve farmers’ insurance literacy | 47 | 14.40% | 43.50% |

| Offer more customized insurance products, e.g., for different operation scales/types | 22 | 6.70% | 20.40% |

| Improve insurers’ service quality, e.g., response speed, communication efficiency | 41 | 12.50% | 38.00% |

| Total | 327 | 100.00% | 302.80% |

| Path | Effect | BootSE | Bias-Corrected 95% CI | ||

|---|---|---|---|---|---|

| Lower | Upper | ||||

| PS→AT→PI | Aggregate effect | 0.463 | 0.037 | 0.39 | 0.536 |

| Direct effect | 0.352 | 0.038 | 0.277 | 0.428 | |

| Intermediary effect | 0.11 | 0.018 | 0.077 | 0.148 | |

| RC→PBC→PI | Aggregate effect | −0.447 | 0.037 | −0.519 | −0.375 |

| Direct effect | −0.349 | 0.037 | −0.421 | −0.276 | |

| Intermediary effect | −0.098 | 0.016 | −0.131 | −0.068 | |

| Model1 | Model2 | Model3 | |||

| Path | Coefficient | Path | Coefficient | Path | Coefficient |

| PI→PB | 0.236 *** | AT→PI | 0.374 *** | PBC→PI | 0.369 *** |

| IT→PB | 0.205 *** | IT→PI | 0.241 *** | IT→PI | 0.242 *** |

| PI × IT→PB | 0.108 *** | AT×IT→PI | 0.090 * | PBC × IT→PI | 0.125 *** |

| Model4 | Model5 | Model6 | |||

| Path | Coefficient | Path | Coefficient | Path | Coefficient |

| PS→PI | 0.385 *** | PV→PI | 0.244 *** | RE→PI | 0.350 *** |

| IT→PI | 0.202 *** | IT→PI | 0.239 *** | IT→PI | 0.246 *** |

| PS × IT→PI | 0.058 | PV × IT→PI | 0.059 | RE × IT→PI | 0.106 *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, X.; Jiang, Y.; Wang, T.; Zhou, K.; Liu, J.; Ben, H.; Wang, W. Enhancing Farmer Resilience Through Agricultural Insurance: Evidence from Jiangsu, China. Agriculture 2025, 15, 1473. https://doi.org/10.3390/agriculture15141473

Chen X, Jiang Y, Wang T, Zhou K, Liu J, Ben H, Wang W. Enhancing Farmer Resilience Through Agricultural Insurance: Evidence from Jiangsu, China. Agriculture. 2025; 15(14):1473. https://doi.org/10.3390/agriculture15141473

Chicago/Turabian StyleChen, Xinru, Yuan Jiang, Tianwei Wang, Kexuan Zhou, Jiayi Liu, Huirong Ben, and Weidong Wang. 2025. "Enhancing Farmer Resilience Through Agricultural Insurance: Evidence from Jiangsu, China" Agriculture 15, no. 14: 1473. https://doi.org/10.3390/agriculture15141473

APA StyleChen, X., Jiang, Y., Wang, T., Zhou, K., Liu, J., Ben, H., & Wang, W. (2025). Enhancing Farmer Resilience Through Agricultural Insurance: Evidence from Jiangsu, China. Agriculture, 15(14), 1473. https://doi.org/10.3390/agriculture15141473