The Impact of Supply Chain Finance on the Total Factor Productivity of Agricultural Enterprises: Evidence from China

Abstract

1. Introduction

2. Literature Review

3. Mechanism Analysis and Research Hypotheses

3.1. Supply Chain Finance and Total Factor Productivity of Agricultural Enterprises

3.2. Moderating Effects of Enterprise Digital Transformation

3.3. Moderating Effects of Enterprise Innovativeness

4. Empirical Design

4.1. Sample Selection and Data Sources

4.2. Variable Selection and Descriptive Statistics

- (1)

- Explained Variable

- (2)

- Explanatory Variables

- (3)

- Moderating Variables

- (4)

- Control Variables

4.3. Model Setting

- (1)

- Benchmark Regression Model

- (2)

- Moderating Effect Model

5. Empirical Analysis

5.1. Benchmark Regression

5.2. Robustness Test

- (1)

- Replacement of explanatory variables

- (2)

- Extending the observation window

- (3)

- Regression excluding samples from municipalities and random subsamples

5.3. Endogeneity Test

- (1)

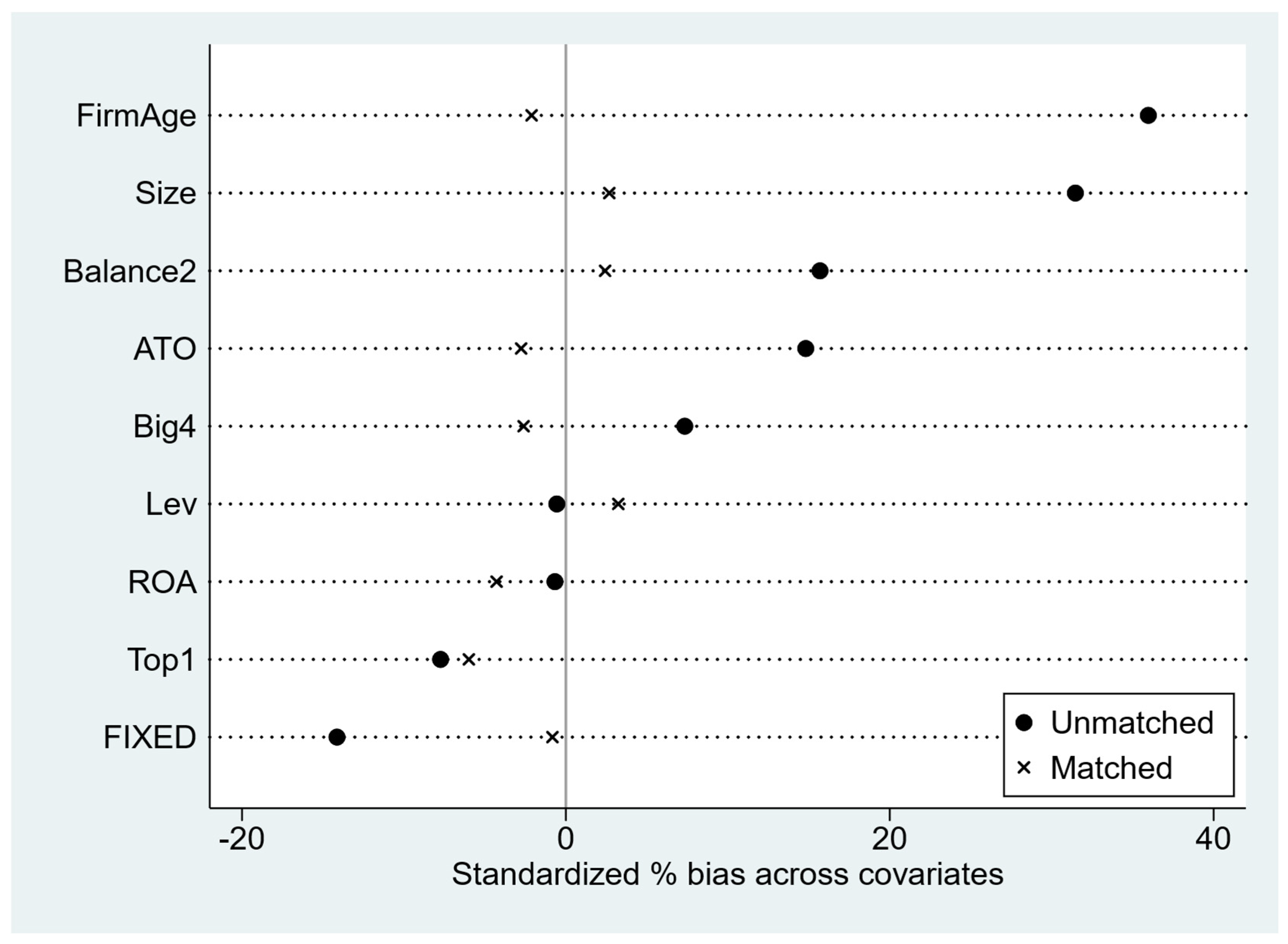

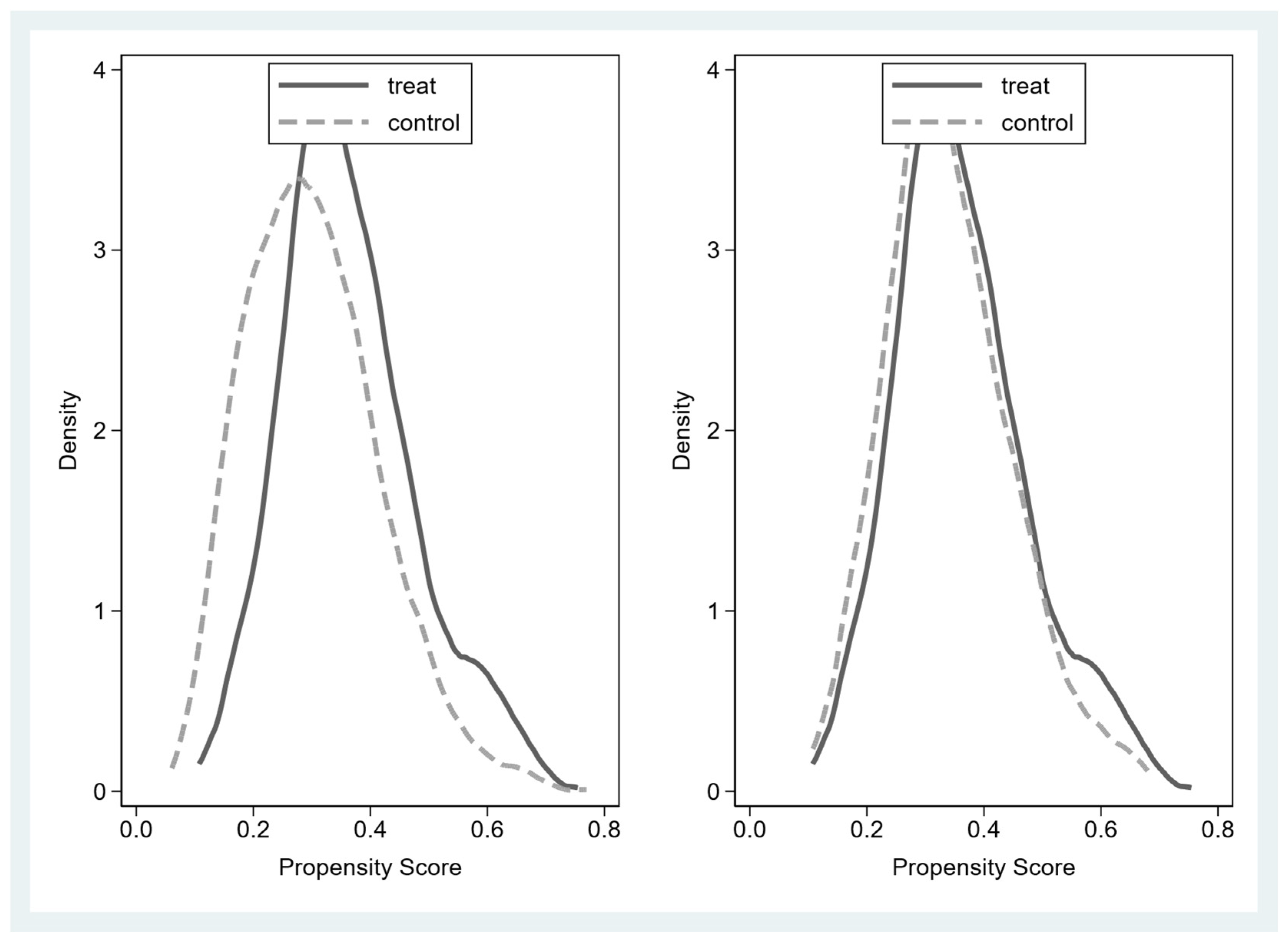

- Propensity Score Matching (PSM) Test

- (2)

- Instrumental Variable (IV) Test

6. Further Analysis

6.1. Mechanism Test: Moderation Effect Analysis

- (1)

- The Moderating Effect of Enterprise Digital Transformation

- (2)

- The Moderating Effect of Enterprise Innovation Capability

6.2. Heterogeneity Analysis

- (1)

- Based on the degree of human capital optimization

- (2)

- Based on the degree of financing constraints

- (3)

- Credit resource allocation efficiency

7. Conclusions and Policy Recommendations

7.1. Conclusions

7.2. Policy Recommendations

8. Limitations of the Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Yin, N.; Wang, Y. Impacts of Rural Labor Resource Change on the Technical Efficiency of Crop Production in China. Agriculture 2017, 7, 26. [Google Scholar] [CrossRef]

- Lin, L.; Gu, T.; Shi, Y. The Influence of New Quality Productive Forces on High-Quality Agricultural Development in China: Mechanisms and Empirical Testing. Agriculture 2024, 14, 1022. [Google Scholar] [CrossRef]

- Manioudis, M.; Meramveliotakis, G. Broad strokes towards a grand theory in the analysis of sustainable development: A return to the classical political economy. New Political Econ. 2022, 27, 866–878. [Google Scholar] [CrossRef]

- Dan, L.; Longlong, L. Building a Global Community of Shared Development: Core Connotations and China’s Practice. Int. Stud. 2024, 4, 5–36+138–139. [Google Scholar]

- Yun, D.; Jia, Z. An investigation into the connection between green total factor productivity in agriculture and high-quality agricultural progress: Based on the mechanism of regional financial development. Financ. Res. Lett. 2025, 81, 107324. [Google Scholar] [CrossRef]

- Schipmann, C.; Qaim, M. Supply chain differentiation, contract agriculture, and farmers’ marketing preferences: The case of sweet pepper in Thailand. Food Policy 2011, 36, 667–677. [Google Scholar] [CrossRef]

- Hofmann, E.; Zumsteg, S. Win-win and No-win Situations in Supply Chain Finance: The Case of Accounts Receivable Programs. Supply Chain Forum 2015, 16, 30–50. [Google Scholar] [CrossRef]

- Wang, H.; Wang, Q.; Lai, Y.; Liang, C. Drivers and outcomes of supply chain finance adoption: An empirical investigation in China. Int. J. Prod. Econ. 2020, 220, 107453. [Google Scholar] [CrossRef]

- Dong, C.; Feng, X. The Problems and Solutions of Supply Chain Financial Services in Agricultural Modernization. Academics 2020, 12, 130–139. [Google Scholar]

- Xu, Y.; Zhang, L. The Digital Transformation of Agricultural Supply Chain Finance: Theory and Chinese Cases. Issues Agric. Econ. 2020, 41, 72–81. [Google Scholar] [CrossRef]

- Yan, P.; Wang, B. Efficiency, Technical Progress & Productivity Growth: An Empirical Analysis Based on DEA. Econ. Res. J. 2004, 9, 55–65. [Google Scholar]

- Guo, J.; Luo, P. Does the Internet promote China’s total factor productivity? J. Manag. World 2016, 10, 34–49. [Google Scholar] [CrossRef]

- Yang, H.; Jiang, L. Digital economy, spatial effects, and total factor productivity. Stat. Res. 2021, 38, 3–15. [Google Scholar] [CrossRef]

- Li, J.; Liu, H.; Wan, J. Research on the Impact of Industrial Policies on Total Factor Productivity: Based on the Perspectives of Competitiveness and Fairness. Ind. Econ. Res. 2017, 4, 115–126. [Google Scholar] [CrossRef]

- Li, Z.; Yang, S.; Lu, J. The heterogeneous impact of government subsidies on total factor productivity of manufacturing enterprises. Bus. Manag. J. 2019, 41, 5–20. [Google Scholar] [CrossRef]

- Mao, Q.; Sheng, B. Opening up to the outside world, regional market integration, and total factor productivity. China Econ. Q. 2012, 11, 181–210. [Google Scholar] [CrossRef]

- Tang, S.; Lai, X.; Huang, R. How does fintech innovation affect total factor productivity: Promoting or inhibiting? Theor. Anal. Framew. Reg. Pract. China Soft Sci. 2019, 7, 134–144. [Google Scholar]

- Ren, S.; Lv, B.; Zhu, X.; Shi, Q.; Gai, Q. Misallocation and TFP in Rural China. Econ. Res. J. 2011, 46, 86–98. [Google Scholar]

- Yin, L.; Shen, Y. Impact of China’s Rural Financial Development on Agricultural Total Factor Productivity: Technical Progress or Technical Efficiency? Financ. Trade Res. 2014, 25, 32–40. [Google Scholar] [CrossRef]

- Männasoo, K.; Hein, H.; Ruubel, R. The contributions of human capital, R&D spending and convergence to total factor productivity growth. Reg. Stud. 2018, 52, 1598–1611. [Google Scholar] [CrossRef]

- Li, T.; Dong, Y.; Wang, Z. Management Efficiency, Quality Ability and Firms Total Factor Productivity: Empirical Studies Based on the China Employer-Employee Survey. J. Manag. World 2018, 34, 86–99+184. [Google Scholar] [CrossRef]

- Zhao, C.; Wang, W.; Li, X. How Does Digital Transformation Affect the Total Factor Productivity of Enterprises? Financ. Trade Econ. 2021, 42, 114–129. [Google Scholar] [CrossRef]

- Ren, S.; Lv, B. The Financial Constraints, the Government Subsidies and the Factor Productivity: A Case Study on the Equipment—Manufacturing Enterprises in China. J. Manag. World 2014, 11, 10–23+187. [Google Scholar] [CrossRef]

- Xiong, A.; Zhang, Z. State-owned Enterprise Mixed Ownership Reform, Degree of Financialization and Total Factor Productivity South China. J. Econ. 2020, 39, 86–106. [Google Scholar] [CrossRef]

- Qian, X.; Kang, J.; Tang, Y.; Cao, X. Industrial Policy, Efficiency of Capital Allocation and Firm’s Total Factor Productivity—Evidence from a Natural Experiment in China. China Ind. Econ. 2018, 8, 42–59. [Google Scholar] [CrossRef]

- Grosse-Ruyken, P.T.; Wagner, S.M.; Jönke, R. What is the right cash conversion cycle for your supply chain? Int. J. Serv. Oper. Manag. 2011, 10, 13–29. [Google Scholar] [CrossRef]

- Song, H.; Lu, Q. How Does Supply Chain Finance Dominated by Industrial Enterprises Promote SMEs’ Financing Performance—A Multi-Case Comparative Study. Econ. Theory Bus. Manag. 2017, 12, 47–58. [Google Scholar]

- Pan, A.; Wang, H.; Ling, R. Can Supply Chain Finance Promote the Cultivation of Chain Owner Enterprises?—Based on the Empirical Evidence of Enterprise M&A. Account. Res. 2023, 14, 120–134. [Google Scholar]

- Zhang, S. Supply Chain Finance and Enterprise Technological Innovation: Mechanisms and Effects. Stat. Decis. 2024, 40, 184–188. [Google Scholar]

- Lam, K.H.; Zhan, Y.; Zhang, M.; Wang, Y.; Lyons, A. The effect of supply chain finance initiatives on the market value of service providers. Int. J. Prod. Econ. 2019, 216, 227–238. [Google Scholar] [CrossRef]

- Lei, X.; Bin, L.; Chen, M.; Jingyu, L. Supply chain finance and firm diversification: Evidence from China. Aust. J. Manag. 2023, 48, 408–435. [Google Scholar] [CrossRef]

- Jiang, B.; Wen, T. Research Progress on Agricultural Supply Chain Finance (ASCF). Issues Agric. Econ. 2021, 2, 84–97. [Google Scholar] [CrossRef]

- Peng, L. The Main Characteristics of the Financial risk in Agricultural Supply Chain and the Basic Principles of Risk Prevention. Theory Pract. Financ. Econ. 2015, 36, 20–24. [Google Scholar] [CrossRef]

- Wang, T.; Lan, Q.; Chu, Y. Supply Chain Financing Model: Based on China’s Agricultural Products Supply Chain. Appl. Mech. Mater. 2013, 380–384, 4417–4421. [Google Scholar] [CrossRef]

- Chen, X.; Liu, C.; Li, S. The role of supply chain finance in improving the competitive advantage of online retailing enterprises. Electron. Commer. Res. Appl. 2019, 33, 100821. [Google Scholar] [CrossRef]

- Guan, Y.; Sun, N.; Wu, S.J.; Sun, Y. Supply Chain Finance, Fintech Development, and Financing Efficiency of SMEs in China. Adm. Sci. 2025, 15, 86. [Google Scholar] [CrossRef]

- Yang, L.; Yuan, H. Supply Chain Financing and Total Factor Productivity: Evidence From Listed Manufacturing Companies in China. J. Int. Dev. 2025, 37, 334–349. [Google Scholar] [CrossRef]

- Zhou, Y.; Wang, X.; Wu, J. Will Supply Chain Finance Improve Total Factor Productivity of Enterprises? Econ. Probl. 2023, 11, 57–64. [Google Scholar] [CrossRef]

- Gu, H.; Yang, S.; Xu, Z.; Cheng, C. Supply chain finance, green innovation, and productivity: Evidence from China. Pac.-Basin Financ. J. 2023, 78, 101981. [Google Scholar] [CrossRef]

- Zhang, L.; Su, X.; Yuan, L. Supply Chain Finance and Digital Transformation of Enterprises: Heterogeneous Features, Channel Mechanisms, and Effect Differences in an Untrustworthy Environment. Financ. Econ. Res. 2021, 36, 51–67. [Google Scholar]

- Song, M.; Zhou, P.; Si, H. Financial Technology and Enterprise Total Factor Productivity—Perspective of “Enabling” and Credit Rationing. China Ind. Econ. 2021, 4, 138–155. [Google Scholar] [CrossRef]

- Ayyagari, M.; Demirgüç-Kunt, A.; Maksimovic, V. Formal versus Informal Finance: Evidence from China. Rev. Financ. Stud. 2010, 23, 3048–3097. [Google Scholar] [CrossRef]

- Guo, J.; Gu, L. Can Agricultural Supply Chain Finance Alleviate the Financing Constraints of Agricultural Enterprises?—Evidence from the Enterprises’ Participation in Targeted Poverty Alleviation. Oper. Res. Manag. Sci. 2022, 31, 112–118. [Google Scholar]

- Li, W.; Niu, J. Climate Change, Climate Adaptation Measures and Agricultural Total Factor Productivity—From the Perspective of Input Factors. World Agric. 2025, 5, 29–41. [Google Scholar] [CrossRef]

- Zheng, K.; Zheng, L.J.; Gauthier, J.; Zhou, L.; Xu, Y.; Behl, A.; Zhang, J.Z. Blockchain technology for enterprise credit information sharing in supply chain finance. J. Innov. Knowl. 2022, 7, 100256. [Google Scholar] [CrossRef]

- Chakuu, S.; Masi, D.; Godsell, J. Exploring the relationship between mechanisms, actors and instruments in supply chain finance: A systematic literature review. Int. J. Prod. Econ. 2019, 216, 35–53. [Google Scholar] [CrossRef]

- Liu, L.; Zhao, S. Local government debt, financing constraints and firms’ green total factor productivity. Int. Rev. Financ. Anal. 2025, 97, 103874. [Google Scholar] [CrossRef]

- Zhou, K.; Yu, L. How to Empower Common Prosperity with the Advanced Structure of Human Capital. J. Nanjing Audit. Univ. 2025, 22, 100–111. [Google Scholar]

- Zheng, Z.; Gao, M. Rural Human Capital Promotes New Quality Productive Forces:Key Problem and Policy Optimization. J. Huazhong Agric. Univ. (Soc. Sci. Ed.) 2024, 5, 10–21. [Google Scholar] [CrossRef]

- Cheng, M.; Gai, Q.; Jin, Y.; Shi, Q. Accumulation of Human Capital and Growth of Farmers’ Income. Econ. Res. J. 2016, 51, 168–181+192. [Google Scholar]

- Yue, S.; Liu, C. Analysis of Human Capital and Regional Total Factor Productivity. Econ. Res. J. 2006, 4, 90–96+127. [Google Scholar]

- Solaimani, S.; van der Veen, J. Open supply chain innovation: An extended view on supply chain collaboration. Supply Chain Manag. Int. J. 2022, 27, 597–610. [Google Scholar] [CrossRef]

- Hu, H.; Dou, B.; Wang, A. Corporate Financialization and Productivity. J. World Econ. 2021, 43, 70–96. [Google Scholar] [CrossRef]

- Murinde, V.; Rizopoulos, E.; Zachariadis, M. The Impact of the FinTech Revolution on the Future of Banking: Opportunities and Risks. Int. Rev. Financ. Anal. 2022, 81, 102103. [Google Scholar] [CrossRef]

- Maryna, D.; Viktor, K.; Volodymyr, H.; Valentyna, K.; Dzintra, A. Ensuring sustainable development of enterprises in the conditions of digital transformations. E3S Web Conf. 2021, 280, 02002. [Google Scholar] [CrossRef]

- Kaminsky, O.; Koval, V.; Yereshko, J.; Vdovenko, N.; Bocharov, M.; Kazancoglu, Y. Evaluating the Effectiveness of Enterprises’ Digital Transformation by Fuzzy Logic. Adv. Soft Comput. Appl. 2023, 1, 15. [Google Scholar] [CrossRef]

- Guo, J.; Huo, J.; Zhang, J. How Does Digital Finance Affect the Cost of Different Financing Modes?—Based on the Dual Perspective of Internal and External Information Asymmetry. J. Guizhou Univ. Financ. Econ. 2024, 5, 38–47. [Google Scholar]

- Qiu, H.; Xu, H. The impact of digital transformation on the performance of agricultural enterprises. Stat. Decis. 2022, 38, 90–95. [Google Scholar]

- Hua, J.; Liu, C.; Zhu, D. Digital Transformation, Financing Constraints and Enterprise Total Factor Productivity. South China Financ. 2022, 7, 54–65. Available online: https://link.cnki.net/urlid/44.1479.F.20220701.1759.004 (accessed on 16 June 2025).

- Yang, Z.; Wang, X. Digital transformation and high-quality development of agricultural enterprises. J. Huazhong Agric. Univ. (Soc. Sci. Ed.) 2025, 1, 108–120. [Google Scholar]

- Li, L.; Zhao, J. Digital Economy Policies and Enterprise Total Factor Productivity: Effect and Mechanism. J. Lanzhou Univ. (Soc. Sci.) 2023, 51, 29–41. [Google Scholar] [CrossRef]

- Klarin, T. The Concept of Sustainable Development: From its Beginning to the Contemporary Issues. Zagreb Int. Rev. Econ. Business 2018, 21, 67–94. [Google Scholar] [CrossRef]

- Chenxin, M.; Ji, X. R&D Globalization and Enterprise innovation capability. Financ. Res. Lett. 2024, 65, 105613. [Google Scholar] [CrossRef]

- Yao, D.; Yan, K. Can factoring business alleviate the seasonal impact on agricultural supply chain enterprises? Int. Rev. Financ. Anal. 2025, 98, 103891. [Google Scholar] [CrossRef]

- Guo, X.; Chmutova, I.; Sochynska-Sybirtseva, I.; Karpunina, M. Assessment of China’s Macro-Readiness for Integrated Innovative Management Technologies Employment. Econ. Ecol. Socium 2023, 7, 40–53. [Google Scholar] [CrossRef]

- Chen, Y.; Bu, D. Agricultural Information Infrastructure Construction and Agricultural Enterprises’ Values: A Quasi-natural Experiment Based on the “Broadband China” Strategy. J. Agrotech. Econ. 2024, 5, 126–144. Available online: https://link.cnki.net/doi/10.13246/j.cnki.jae.20240312.001 (accessed on 16 June 2025).

- Solow, R.M. Technical change and the aggregate production function. Rev. Econ. Stat. 1957, 39, 312–320. [Google Scholar] [CrossRef]

- Olley, J.M.; Murray, A.; Roberts, R.G. The effects of disequilibria in the uranium and thorium decay chains on burial dose rates in fluvial sediments. Quat. Sci. Rev. 1996, 15, 751–760. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 70, 317–341. Available online: https://www.jstor.org/stable/3648636 (accessed on 16 June 2025). [CrossRef]

- Ackerberg, D.A.; Caves, K.; Frazer, G. Identification Properties of Recent Production Function Estimators. Econometrica 2015, 83, 2411–2451. [Google Scholar] [CrossRef]

- Jin, S.; Tang, P.; Ren, Z. Can Digital Transformation Improve the Total Factor Productivity of Agribusiness? Reform 2024, 2, 131–148. [Google Scholar]

- Ding, M.; Gao, Q. The impact of artificial intelligence technology application on total factor productivity in agricultural enterprises: Evidence from China. Econ. Anal. Policy 2025, 86, 399–415. [Google Scholar] [CrossRef]

- Zhou, L.; Wu, H. Supply Chain Finance and Product Market Performance. Financ. Econ. Res. 2022, 37, 99–112. [Google Scholar]

- Zhang, Y.; Li, X.; Xing, M. Enterprise Digital Transformation and Audit Pricing. Audit. Res. 2021, 3, 62–71. [Google Scholar]

- Zhang, Y.; Zhuo, C.F.; Deng, F. Policy Uncertainty, Financialization and Enterprise Technological Innovation: A Way Forward Towards Economic Development. Front. Environ. Sci. 2022, 5, 905505. [Google Scholar] [CrossRef]

- Wei, S.; Du, J. How Does Supply Chain Finance Affect Enterprise Innovation? Comp. Econ. Soc. Syst. 2023, 2, 62–74. [Google Scholar]

- Qiu, J.; Cui, M.; Pan, A. Supply Chain Finance and Corporate Sustainable Development: Empirical Evidence from ESG Performance. Nankai Bus. Rev. 2025, 6, 1–32. Available online: https://link.cnki.net/urlid/12.1288.f.20250321.1116.003 (accessed on 16 June 2025).

- Cheng, C.; Tian, X.; Xu, Z. Supply Chain Finance and Corporate Efficiency Upgrading: Dual Evidence from Listed Company Announcements and Local Policy Documents. J. Financ. Res. 2023, 516, 132–149. [Google Scholar]

- Bartik, T.J. Who Benefits from State and Local Economic Development Policies; W.E. Upjohn Institute for Employment Research: Kalamazoo, MI, USA, 1991. [Google Scholar]

- Goldsmith-Pinkham, P.; Sorkin, I.; Swift, H. Bartik Instruments: What, When, Why, and How. Am. Econ. Rev. 2020, 110, 2589–2624. [Google Scholar] [CrossRef]

- Li, R.; Lai, Z. The Impact of Supply Chain Finance on Corporate Resilience: A Resource Acquisition Perspective. Commer. Res. 2025, 2, 41–50. [Google Scholar] [CrossRef]

- Huang, Y. Can Talent Policies Drive Enterprise Digital Technology Innovation: Evidence from Enterprise Digital Patents China. J. Econ. 2025, 12, 247–264. [Google Scholar]

- Guo, W.; Guo, T.; Geng, Y. Digital Economy, Upgrading of Human Capital Structure and Total Factor Productivity of Enterprises. Econ. Probl. 2023, 11, 73–79+129. [Google Scholar] [CrossRef]

- Kaplan, S.; Zingales, L. Do Financing Constraints Explain Why Investment Is Correlated with Cash Flow? Q. J. Econ. 1997, 112, 168–216. [Google Scholar] [CrossRef]

- Bu, J.; Zhu, Y. Can Supply Chain Finance Improve the Total Factor Productivity of Enterprises? Res. Financ. Econ. Issues 2024, 5, 89–104. [Google Scholar] [CrossRef]

- Liu, H.; Qi, J. Is the “competition friendly” industrial policy more conducive to improving the efficiency of enterprise investment? A quasi natural experiment based on the fair competition review system. Financ. Trade Econ. 2022, 43, 101–116. [Google Scholar] [CrossRef]

| Type | Keywords |

|---|---|

| Accounts receivable-related | Accounts receivable financing, factoring, reverse factoring, dynamic discounting, accounts receivable securitization |

| Prepayment-related | Prepayment financing, future claim financing, pledge of goods financing, guarantee–warehouse financing |

| Inventory-related | Movable property pledge financing, inventory pledge financing, inventory financing, stock financing, spot goods pledge financing, warehouse receipt financing, purchase order financing, raw material financing |

| Comprehensive | Supply chain finance, supply chain financing, supply chain fund, supply chain investment, supply chain loan, supply chain management, trade credit, financial supply chain, supplier financing, buyer financing, supplier–managed inventory, buyer investment, distributor financing, working capital management, logistics financing, unified credit financing, financial value chain, working capital optimization |

| VarName | N | Mean | p50 | SD | Min | Max |

|---|---|---|---|---|---|---|

| TFP_LP | 2139 | 8.3144 | 8.2363 | 0.9130 | 5.6408 | 11.4030 |

| lnSCF | 2139 | 0.4017 | 0 | 0.7105 | 0 | 4.5430 |

| Size | 2139 | 22.0880 | 21.9633 | 1.0771 | 19.0456 | 26.3316 |

| Lev | 2139 | 0.3682 | 0.3588 | 0.1717 | 0.0198 | 1.0369 |

| ROA | 2139 | 0.0552 | 0.0456 | 0.0763 | −0.4309 | 0.6754 |

| Age | 2139 | 2.9084 | 2.9444 | 0.3411 | 1.0986 | 3.6889 |

| Big4 | 2139 | 0.0645 | 0 | 0.2457 | 0 | 1 |

| ATO | 2139 | 0.8020 | 0.6716 | 0.5704 | 0.0744 | 6.1342 |

| FIXED | 2139 | 0.2695 | 0.2515 | 0.1362 | 0.0087 | 0.7364 |

| Top1 | 2139 | 0.3665 | 0.3542 | 0.1476 | 0.0391 | 0.8999 |

| Balance | 2139 | 0.6699 | 0.4651 | 0.6225 | 0.0108 | 3.7306 |

| (1) | (2) | |

|---|---|---|

| Variables | TFP_LP | TFP_LP |

| lnSCF | 0.0777 *** (4.0573) | 0.0311 *** (3.0319) |

| Size | 0.6407 *** (41.1273) | |

| Lev | 0.1106 ** (2.1928) | |

| ROA | 0.6872 *** (6.4271) | |

| FirmAge | −0.0439 (−0.4953) | |

| Big4 | 0.1925 *** (3.9978) | |

| ATO | 0.6636 *** (13.9041) | |

| FIXED | −0.5710 *** (−9.1880) | |

| Top1 | 0.4110 *** (2.8528) | |

| Balance | −0.0013 (−0.0595) | |

| Constant | 8.2857 *** (735.0122) | −6.3429 *** (−14.3708) |

| Individual fixed effects | Yes | Yes |

| Year fixed effects | Yes | Yes |

| N | 2118 | 2118 |

| R2 | 0.8840 | 0.9712 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | TFP_OP | TFP_OLS | TFP_FE | TFP_GMM | TFP_ACF |

| lnSCF | 0.0333 *** (2.6950) | 0.0281 *** (3.0042) | 0.0272 *** (2.9777) | 0.0347 *** (2.7693) | 0.0188 *** (2.7075) |

| Controls | Yes | Yes | Yes | Yes | Yes |

| Constant | −4.5080 *** (−9.4579) | −8.5669 *** (−19.6772) | −9.2642 *** (−21.0192) | −3.4756 *** (−7.3275) | 0.7465 *** (2.6853) |

| Individual fixed effects | Yes | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes |

| N | 2118 | 2118 | 2118 | 2118 | 2118 |

| R2 | 0.9444 | 0.9815 | 0.9835 | 0.9366 | 0.9540 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| VARIABLES | TFP_LP | TFP_LP | TFP_LP | F.TFP_LP |

| L.lnSCF | 0.0352 *** (3.1507) | |||

| L2.lnSCF | 0.0315 *** (2.6932) | |||

| L3.lnSCF | 0.0305 ** (2.4113) | |||

| lnSCF | 0.0243 * (1.6643) | |||

| Controls | Yes | Yes | Yes | Yes |

| Constant | −6.5273 *** (−11.7812) | −6.2706 *** (−10.4392) | −5.7345 *** (−9.1626) | −2.9572 *** (−2.9434) |

| Individual fixed effects | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes |

| N | 1844 | 1634 | 1457 | 1844 |

| R2 | 0.9720 | 0.9741 | 0.9763 | 0.9449 |

| Excluding Samples from Municipalities | 80% Random Subsamples | 60% Random Subsamples | 40% Random Subsamples | |

|---|---|---|---|---|

| TFP_LP | TFP_LP | TFP_LP | TFP_LP | |

| lnSCF | 0.0315 *** (2.8418) | 0.0280 ** (2.4081) | 0.0231 * (1.7077) | 0.0495 *** (2.9974) |

| Controls | Yes | Yes | Yes | Yes |

| Constant | −5.8072 *** (−13.1194) | −6.2199 *** (−12.4628) | −5.9522 *** (−10.0541) | −6.8076 *** (−8.0159) |

| Individual fixed effects | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes |

| N | 1865 | 1723 | 1295 | 826 |

| R2 | 0.9705 | 0.9703 | 0.9750 | 0.9812 |

| Covariate | Sample Category | Mean | Deviation Change Rate (%) | t Test | ||

|---|---|---|---|---|---|---|

| Treatment Group | Control Group | t | p > |t| | |||

| Size | Prematching | 22.323 | 21.977 | 31.5 | 7.02 | 0.000 |

| Postmatching | 22.314 | 22.284 | 2.7 | 0.48 | 0.628 | |

| Lev | Prematching | 0.3676 | 0.3686 | −0.6 | −0.12 | 0.904 |

| Postmatching | 0.3669 | 0.3613 | 3.2 | 0.61 | 0.540 | |

| ROA | Prematching | 0.0549 | 0.0554 | −0.7 | −0.15 | 0.882 |

| Postmatching | 0.0553 | 0.0586 | −4.3 | −0.79 | 0.432 | |

| FirmAge | Prematching | 2.9883 | 2.8705 | 36.0 | 7.56 | 0.000 |

| Postmatching | 2.9874 | 2.9944 | −2.1 | −0.43 | 0.666 | |

| Big4 | Prematching | 0.0770 | 0.0586 | 7.3 | 1.62 | 0.105 |

| Postmatching | 0.0773 | 0.0838 | −2.6 | −0.45 | 0.656 | |

| ATO | Prematching | 0.8588 | 0.7751 | 14.8 | 3.18 | 0.002 |

| Postmatching | 0.8584 | 0.8740 | −2.8 | −0.45 | 0.654 | |

| FIXED | Prematching | 0.2565 | 0.2757 | −14.1 | −3.05 | 0.002 |

| Postmatching | 0.2564 | 0.2575 | −0.8 | −0.16 | 0.874 | |

| Top1 | Prematching | 0.3588 | 0.3701 | −7.7 | −1.67 | 0.096 |

| Postmatching | 0.3593 | 0.3681 | −6.0 | −1.09 | 0.275 | |

| Balance2 | Prematching | 0.7368 | 0.6382 | 15.7 | 3.43 | 0.001 |

| Postmatching | 0.7336 | 0.7183 | 2.4 | 0.43 | 0.666 | |

| Variables | TFP_LP |

|---|---|

| lnSCF | 0.0232 * (1.7105) |

| Size | 0.6420 *** (21.1058) |

| Lev | 0.0966 (0.9547) |

| ROA | 0.6662 *** (3.4403) |

| FirmAge | 0.3269 * (1.7900) |

| Big4 | 0.1989 ** (2.3461) |

| ATO | 0.6317 *** (7.5105) |

| FIXED | −0.5824 *** (−4.1883) |

| Top1 | 0.5628 * (1.8312) |

| Balance2 | 0.0086 (0.2221) |

| Constant | −7.4797 *** (−8.3249) |

| Individual fixed effects | Yes |

| Year fixed effects | Yes |

| N | 1397 |

| R2 | 0.9746 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | lnSCF | TFP_LP | lnSCF | TFP_LP |

| lnSCF | 0.0942 * (1.7472) | 0.0659 * (1.9171) | ||

| bartik_iv | 3.4390 *** (5.0651) | |||

| L.provscf_iv | 0.5265 *** (8.7275) | |||

| Controls | Yes | Yes | Yes | Yes |

| Constant | −3.4352 *** (−2.9413) | −6.1102 *** (−11.3168) | −1.7817 * (−1.7538) | −5.5761 *** (−12.5396) |

| Individual fixed effects | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes |

| Kleibergen–Paap rk LM | 24.56 [0.0000] | 74.73 (0.0000) | ||

| Kleibergen–Paap rk Wald F | 25.65 [16.38] | 76.17 [16.38] | ||

| N | 1873 | 1873 | 1873 | 1873 |

| R2 | 0.9715 | 0.9775 | ||

| (1) | (2) | |

|---|---|---|

| Variables | TFP_LP | TFP_LP |

| lnSCF | 0.0303 *** (2.9670) | 0.0249 ** (2.3533) |

| scf_Digitaleco | 0.1630 ** (2.0203) | |

| Digitaleco | −0.1075 ** (−2.2402) | |

| scf_Inno | 0.0164 *** (3.3094) | |

| Inno | 0.0009 (0.1842) | |

| Controls | Yes | Yes |

| Constant | −6.3077 *** (−14.2818) | −6.2900 *** (−13.9705) |

| Individual fixed effects | Yes | Yes |

| Year fixed effects | Yes | Yes |

| N | 2118 | 2118 |

| R2 | 0.9714 | 0.9715 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| High-Quality Human Capital | Low-Quality Human Capital | High Financing Constraints | Low Financing Constraints | High Efficiency of Credit Resource Allocation | Low Efficiency of Credit Resource Allocation | |

| Variables | TFP_LP | TFP_LP | TFP_LP | TFP_LP | TFP_LP | TFP_LP |

| Supply chain finance level index | 0.0372 ** (2.0853) | 0.0101 (0.9636) | 0.0428 *** (2.6740) | 0.0121 (0.9484) | 0.0252 ** (2.3414) | 0.0371 (1.1287) |

| Controls | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −7.6474 *** (−8.8161) | −6.3400 *** (−10.9969) | −5.4217 *** (−8.3510) | −6.9266 *** (−9.9621) | −6.2369 *** (−13.9408) | −5.5013 *** (−4.1936) |

| Individual fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed effects | Yes | Yes | Yes | Yes | Yes | Yes |

| p value | 0.080 ** | 0.060 * | 0.030 ** | |||

| N | 962 | 1137 | 1049 | 1032 | 1643 | 444 |

| R2 | 0.9680 | 0.9797 | 0.9698 | 0.9815 | 0.9761 | 0.9729 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, H.; Yu, Y.; Wang, L.; Wu, Y.; Liu, Y. The Impact of Supply Chain Finance on the Total Factor Productivity of Agricultural Enterprises: Evidence from China. Agriculture 2025, 15, 1325. https://doi.org/10.3390/agriculture15121325

Luo H, Yu Y, Wang L, Wu Y, Liu Y. The Impact of Supply Chain Finance on the Total Factor Productivity of Agricultural Enterprises: Evidence from China. Agriculture. 2025; 15(12):1325. https://doi.org/10.3390/agriculture15121325

Chicago/Turabian StyleLuo, Haoyang, Yue Yu, Lan Wang, Yanru Wu, and Yan Liu. 2025. "The Impact of Supply Chain Finance on the Total Factor Productivity of Agricultural Enterprises: Evidence from China" Agriculture 15, no. 12: 1325. https://doi.org/10.3390/agriculture15121325

APA StyleLuo, H., Yu, Y., Wang, L., Wu, Y., & Liu, Y. (2025). The Impact of Supply Chain Finance on the Total Factor Productivity of Agricultural Enterprises: Evidence from China. Agriculture, 15(12), 1325. https://doi.org/10.3390/agriculture15121325