The Impact of Global Digital Trade Development on China’s Grain Import Trade Potential: An Empirical Analysis Based on a Time-Varying Stochastic Frontier Gravity Model

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Materials

3.1.1. Explained Variable

3.1.2. Explanatory Variables

- (1)

- Normalization of the data for each indicator is required to eliminate the scale problem caused by the different ranges of values for the secondary indicators:

- (2)

- All indicators are normalized, and the proportion of country i in index j in year t is calculated.

- (3)

- The information entropy of the indicator ej is calculated as follows:

- (4)

- Information entropy redundancy is calculated as follows:

- (5)

- The weight of indicator j is defined as follows:

- (6)

- The main weighted arithmetic average model is used to synthesize the digital trade development index.

3.1.3. Control Variables

3.2. Methods

3.2.1. Stochastic Frontier Gravity Model

3.2.2. Inefficiency Model

3.2.3. Model Construction

4. Results

4.1. The Results of the Measurement of the Digital Trade Development Level

4.2. Model Applicability Evaluation

4.3. Analysis of the Estimation Results of the Stochastic Frontier Gravity Model

4.4. Analysis of the Regression Results from the Import Trade Inefficiency Model

- (1)

- The key explanatory variable (lnDELjt), the level of digital trade development, passes the significance test at the 1% level, with a negative coefficient, indicating that the digital trade development level of major grain-exporting countries can suppress the decline in China’s grain trade efficiency. Digital trade, through advanced digital tools, such as electronic information systems and the Internet, breaks traditional geographical constraints, enabling more efficient dissemination of global grain trade information, thereby reducing trade costs. Additionally, digital trade can facilitate the establishment of high-speed and efficient cross-border electronic payment platforms, accelerating the exchange of grain and financial transactions between exporting countries and promoting fintech and trade cooperation among major exporters. Digital platforms established at both demand and supply sides enable producers to more rapidly perceive market demand changes, allowing targeted product design, which further enhances the grain export quality and trade efficiency of the main exporting nations.

- (2)

- The virtual variable representing whether the grain trade parties have signed free trade agreements (FTAijt) does not show significant effects, contrary to expectations. This may be due to the insufficient number of free trade agreements signed between China and the sample countries, leading to an underestimation of their roles in removing trade barriers and facilitating trade facilitation.

- (3)

- The tariff level of the importing country (TAFijt) is significantly positive at the 1% level, which is consistent with the expected outcome, implying that higher tariffs in import countries are associated with greater restrictive effects on China’s grain imports. Nonetheless, the coefficient is relatively small, indicating a limited impact.

- (4)

- The linear shipping connectivity index (LSCIjt) is significant and passes the significance test at the 1% level, suggesting that the development level of transportation infrastructure in grain-exporting countries significantly influences their export efficiency. Higher levels of trade facilities and freight infrastructure in export nations lead to lower inefficiency in China’s grain imports from these countries, thereby contributing to an improvement in trade efficiency. Consequently, China should strengthen cooperation with major grain-exporting countries, enhance the transportation environment for trade, reduce trade costs, and promote the efficiency of its grain import trade.

- (5)

- The three indices of economic freedom—namely monetary freedom, trade freedom, and financial freedom—reflect the overall business environment of a country. Among these control variables, only financial freedom passes the significance test at the 1% level and bears a negative sign, indicating that higher levels of financial freedom in grain-exporting countries facilitate the reduction in trade costs and enhance the efficiency of grain exports to China. Conversely, monetary freedom does not show a significant effect, and trade freedom exhibits a significant positive correlation at the 10% level, which somewhat inhibits China’s import efficiency from these countries. This may be attributable to the prevalence of trade barriers, as countries prioritize grain security and impose various restrictions on grain exports, thereby hindering China’s grain imports. The non-significance of financial freedom could be explained by the fact that the majority of the sampled countries are developing nations with limited financial liberalization and outreach, reducing the potential impact of financial freedom on import trade efficiency.

4.5. The Regression Results of the Stochastic Frontier Gravity Model Across Multiple Dimensions of the Digital Economy

4.6. Regression Results of Hierarchical Indicators

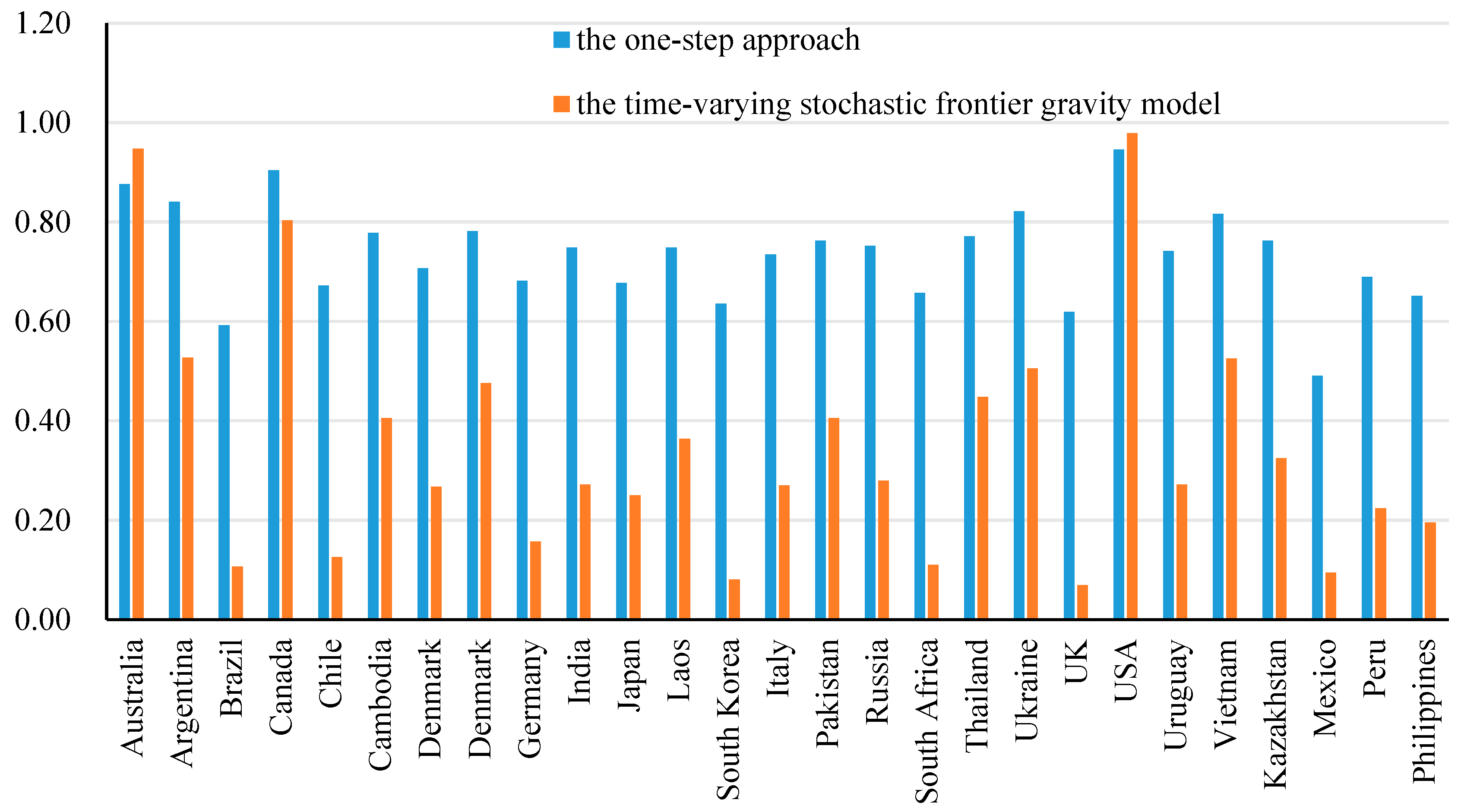

4.7. Measurement of Import Trade Potential and Expansion Space

5. Conclusions and Policy Implications

5.1. Conclusions

5.2. Limitations and Future Development Direction

5.3. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Pawlak, K.; Kołodziejczak, M. The Role of Agriculture in Ensuring Food Security in Developing Countries: Considerations in the Context of the Problem of Sustainable Food Production. Sustainability 2020, 12, 5488. [Google Scholar] [CrossRef]

- Zhu, J.; Li, T. Food Security under Chinese-style Modernization: Goals, Challenges and Paths. J. Acad. Bimest. 2024, 2, 85–97. (In Chinese) [Google Scholar]

- Yan, T.; Zhang, Z. Construction of the Resilient Grain Industry Chain: A Study Based on the Risk Identification Perspective of the Entire Industry Chain. J. Yunnan Univ. Soc. Sci. Ed. 2025, 24, 99–112. (In Chinese) [Google Scholar]

- Wei, Y.; Fang, D.; Wei, X.; Ye, Z. Assessing the equilibrium of food supply and demand in China’s food security framework: A comprehensive evaluation, 1980–2017. Front. Sustain. Food Syst. 2024, 8, 1326839. [Google Scholar] [CrossRef]

- Kummu, M.; Kinnunen, P.; Lehikoinen, E.; Porkka, M.; Queiroz, C.; Röös, E.; Troell, M.; Weil, C. Interplay of trade and food system resilience: Gains on supply diversity over time at the cost of trade independency. Glob. Food Secur. 2020, 24, 100360. [Google Scholar] [CrossRef]

- Li, T.; Zang, X.; Zhu, J. Improving the Quality of Grain Farmers’ Income: Ideas, Mechanisms and Suggestions. J. Macro-Qual. Res. 2025, 13, 15–26. [Google Scholar]

- Ma, S.; Fang, C.; Guo, J. The 2018 World and China Digital Trade Development Blue Paper; Center for Research in Regional Economic Opening and Development, Zhejiang University: Hangzhou, China, 2018. [Google Scholar]

- Borrero, J.D.; Mariscal, J. A Case Study of a Digital Data Platform for the Agricultural Sector: A Valuable Decision Support System for Small Farmers. Agriculture 2022, 12, 767. [Google Scholar] [CrossRef]

- China Food Safety E-Commerce Research Institute; Institute of Business Economics; Beijing Technology and Business University. China Agricultural Products e-Business Development Report. [EB/OL]. 2023. Available online: https://mp.weixin.qq.com/s/RAPYn2ad8Y_fIUA8QHijMw (accessed on 17 June 2025).

- Liu, C.; Fu, G. Dynamic Impact of Digital Economy on Heterogeneity of Agricultural Trade Volumes—Empirical Evidence Based on Import and Export Volumes of Major Agricultural Products in China. J. Agric. Econ. Manag. 2022, 5, 1–11. (In Chinese) [Google Scholar]

- Ministry of Agriculture of the PRC. Import and Export of Agricultural Products in China from January to December 2023. [EB/OL]. Available online: https://www.moa.gov.cn/ztzl/nybrl/rlxx/202401/t20240123_6446367.htm (accessed on 17 June 2025).

- Liu, K.; Fu, Q. Does Geopolitical Risk Affect Agricultural Exports? Chinese Evidence from the Perspective of Agricultural Land. Land 2024, 13, 371. [Google Scholar] [CrossRef]

- Feng, H.; Chen, Y. Characteristics of China’s Major Agricultural Import Risks and Response Strategies. World Agric. 2023, 8, 51–62. [Google Scholar]

- Liu, Y.; Dong, Y. The impact of agricultural digital economy on the sustainable development of China’s agricultural exports. J. Prices Mon. 2024, 11, 67–80. (In Chinese) [Google Scholar]

- Li, L.; Zhang, L.; Li, X. Analysis on the Trade Structure of Agricultural Products Between China and the Regions Along the “21st Century Maritime Silk Road”. J. Inq. Econ. Issues 2022, 12, 169–180. (In Chinese) [Google Scholar]

- Abudukeremu, A.; Youliwasi, A.; Abula, B. Study on the pattern and efficiency of agricultural trade between China and Central Asian countries. Chin. J. Agric. Resour. Reg. Plan. 2025, 46, 126–139. (In Chinese) [Google Scholar]

- Abdullahi, N.M.; Aluko, O.A.; Huo, X. Determinants, efficiency and potential of agri-food exports from Nigeria to the EU: Evidence from the stochastic frontier gravity model. J. Agric. Econ. 2021, 67, 337–349. [Google Scholar] [CrossRef]

- Romyen, A.; Nunti, C.; Neranon, P. Trade efficiency under FTA for Thailand’s agricultural exports: Copula-based gravity stochastic frontier model. J. Econ. Struct. 2023, 12, 9. [Google Scholar] [CrossRef]

- Li, M.; Yu, Y.; Xu, Y. The efficiency and potential of China’s agricultural products exports to RCEP member countries-Analysis based on stochastic frontier gravity model. World Agric. 2021, 8, 33–43. (In Chinese) [Google Scholar]

- Gao, X.; Humayun, K.; Xin, L. The impact of BRICS trade facilitation on China’s import and export trade in agricultural products. Front. Sustain. Food Syst. 2024, 8, 1397350. [Google Scholar]

- Chen, Y. Research on the export effects and trade prospects of China’s agricultural products market in the RCEP free trade zone—Based on the stochastic model and empirical analysis of market segments. China Bus. Mark. 2022, 36, 56–66. (In Chinese) [Google Scholar]

- Li, Y.; Zhang, J. Study on the Efficiency and Potential of China’s Agricultural Trade. J. Stat. Decis. 2021, 37, 112–116. (In Chinese) [Google Scholar]

- Fang, G.; Lei, Q.; Qi, C. Does institutional quality promote high value-added agricultural product exports?—Evidence from global citrus trade. J. Huazhong Agric. Univ. 2023, 5, 77–89. (In Chinese) [Google Scholar]

- Cao, F.; Zhang, J.; Li, X. Research on the Impact of Trade Regime Arrangements on the Trade Efficiency of China’s Agricultural Products Export to Countries along the Belt and Road—An Empirical Analysis based on the Time-varying Stochastic Frontier Gravity Model. China Bus. Mark. 2022, 36, 67–78. (In Chinese) [Google Scholar]

- Ding, C.; Xia, Y.; Su, Y.; Li, F.; Xiong, C.; Xu, J. Study on the Impact of Climate Change on China’s Import Trade of Major Agricultural Products and Adaptation Strategies. J. Environ. Res. Public Health 2022, 19, 14374. [Google Scholar] [CrossRef] [PubMed]

- Qi, X.; Wu, S.; Liu, H. Influencing factors of China’s grain import and measurement of trade efficiency. J. Prices Mon. 2023, 12, 29–36. (In Chinese) [Google Scholar]

- Cheng, Y.; Wu, S.; Liu, X. Research on the Efficiency and Potential of Agricultural of Agricultural Products Import Trade between China and RCEP Countries. Chin. J. Agric. Resour. Reg. Plan. 2022, 43, 252–262. [Google Scholar]

- Cui, H.; Wu, T.; Huo, Q. Potential of China’s Import Trade of Agricultural Products from ASEAN With Focus on Food Security: Measurement Based on Stochastic Frontier Gravity Model. J. Int. Econ. Coop. 2024, 40, 13–24. (In Chinese) [Google Scholar]

- Xiao, Y.; Abula, B. Examining the impact of digital economy on agricultural trade efficiency in RCEP region: A perspective based on spatial spillover effects. J. Knowl. Econ. 2024, 15, 9907–9934. [Google Scholar] [CrossRef]

- Soylu, Ö.; Adeleye, B.; Ergül, M.; Okur, F.; Balsalobre Lorente, D. Investigating the impact of ICT-trade nexus on competitiveness in Eastern and Western European countries. J. Econ. Stud. 2023, 50, 773–789. [Google Scholar] [CrossRef]

- Abeliansky, A.; Hilbert, M. Digital technology and international trade: Is it the quantity of subscriptions or the quality of data speed that matters? Telecommun. Policy 2017, 41, 35–48. [Google Scholar] [CrossRef]

- Pan, Z. Research on the Export Efficiency and Potential of China’s Digital Service Trade to RCEP Member Countries—Based on Stochastic Frontier Gravity Model. China Bus. Mark. 2024, 38, 105–116. (In Chinese) [Google Scholar]

- Fan, X. The Development of Digital Economy and the Efficiency and Uncertainty of International Trade. Financ. Trade Econ. 2020, 41, 145–160. (In Chinese) [Google Scholar] [CrossRef]

- Zhu, Z.; Ming, H. Can the Development of Digital Trade Improve the Efficiency of China’s Agricultural Exports: Empirical Evidence Based on Agricultural Importing Countries. J. Sichuan Agric. Univ. 2023, 41, 945–951. (In Chinese) [Google Scholar]

- Hu, Y.; Guo, C.; Chen, J. The Impact of Digital Economy Development on China’s Export Trade Efficiency in RCEP Member Countries. Jianghan Trib. 2024, 5, 28–37. (In Chinese) [Google Scholar]

- Wang, S.; Xu, J.; Si, Z. Research on the Impact of Digital Trade Development on China’s Regional Export Efficiency. China Bus. Mark. 2024, 38, 100–114. (In Chinese) [Google Scholar]

- Chen, Y.; Li, E. Spatial pattern and evolution of cereal trade networks among the Belt and Road countries. Prog. Geogr. 2019, 38, 1643–1654. (In Chinese) [Google Scholar] [CrossRef]

- Zhu, J.; Wang, R.; Xu, L. Agricultural Trade and China’s Food Security under the Greater Food Approach. Issues Agric. Econ. 2023, 5, 36–48. (In Chinese) [Google Scholar]

- Wei, Y.; Yu, H.; Zhu, J. Economic Policy Uncertainty, Regional Economic Cooperation and Global Food Trade Increase. World Agric. 2024, 10, 43–55. (In Chinese) [Google Scholar]

- Moroz, M. The level of development of the digital economy in Poland and selected European countries: A comparative analysis. Found. Manag. 2017, 9, 175. [Google Scholar] [CrossRef]

- Zhang, B.; Shen, K. Quantitative Evaluation and Characteristics of the Development Readiness in Digital Economy for “the Belt and Road” Countries. Shanghai J. Econ. 2018, 1, 94–103. (In Chinese) [Google Scholar]

- Jia, H.; Gao, X.; Xu, X.; Fang, Y. Initial Study of the Concept Framework, Indicator System and Measurement Method of Digital Trade. J. Stat. Res. 2021, 38, 30–41. (In Chinese) [Google Scholar]

- Yao, Z. The Relationship between Digital Trade, Upgrading of Industrial Structure and Export Technical Complexity: Based on Multiple Mediating Effects of Structural Equation Model. J. Reform 2021, 1, 50–64. (In Chinese) [Google Scholar]

- Kong, X.; Lang, L.; Wang, Y. The Impact of Digital Trade on China’s Economic Resilience: Empirical Evidence from China’s Cities. J. Int. Econ. Trade Res. 2024, 40, 20–39. (In Chinese) [Google Scholar]

- Battese, G.E.; Coelli, T.J. A model for technical inefficiency effects in a stochastic frontier production function for panel data. J. Empir. Econ. 1995, 20, 325–332. [Google Scholar] [CrossRef]

- Yang, J.; Qi, C. An Empirical Analysis on the Trade Potential of Export to China from Countries Along the Silk Road Economic Belt—Based on TPI and an Expanded Framework of Stochastic Frontier Gravity Model. J. Int. Trade 2020, 6, 127–142. (In Chinese) [Google Scholar]

- Gu, X.; Ren, S. Research on China’s Import Potential from Emerging Market Countries from the Perspective of Trade Efficiency—Measure Based on Time-varying SFA Model. J. Intertrade 2023, 10, 3–15. (In Chinese) [Google Scholar]

- Yang, Y.; Cao, J. The Impact of Digital Trade Competitiveness Enhancement on Cost Reduction and Efficiency Promotion in Cross-border Trade: A Study Based on China and the Countries Along the Belt and Road. J. Commer. Econ. 2023, 6, 127–131. (In Chinese) [Google Scholar]

- Zhao, J.; Tian, Z. Agricultural Export Efficiency of China to Belt and Road Countries. J. Northwest AF Univ. 2019, 19, 111–117. (In Chinese) [Google Scholar]

- Zhu, J.; Zhang, R.; Xie, C. Global Agricultural Governance and China’s Food Security. Issues Agric. Econ. 2022, 11, 4–17. (In Chinese) [Google Scholar]

- Wang, C.; Meng, F.; Liu, T. The impact of digital trade development on China’s export of technology-intensive products: Evidence from importing countries. PLoS ONE 2025, 20, e0321285. [Google Scholar] [CrossRef] [PubMed]

- De Castro, A.B.R.; Kornher, L. The effect of trade and customs digitalization on agrifood trade: A gravity approach. Q Open 2023, 3, qoac037. [Google Scholar] [CrossRef]

| Variable | Obs. | Mean | Std. Dev. | Minimum | Maximum |

|---|---|---|---|---|---|

| Ln (IMPijt) | 459 | 27.05 | 1.66 | 22.71 | 30.67 |

| Ln (GDPit) | 459 | 22.89 | 0.55 | 21.72 | 23.61 |

| Ln (GDPjt) | 459 | 20.14 | 1.72 | 15.06 | 23.97 |

| Ln (POPit) | 459 | 14.13 | 0.03 | 14.09 | 14.16 |

| Ln (POPjt) | 459 | 10.87 | 1.25 | 8.11 | 14.16 |

| BORDij | 459 | 0.22 | 0.42 | 0 | 1 |

| Ln (DISTij) | 459 | 8.75 | 0.81 | 6.91 | 9.56 |

| DELjt | 459 | 0.17 | 0.12 | 0.01 | 0.63 |

| FTAijt | 459 | 0.37 | 0.48 | 0 | 1 |

| TARIit | 459 | 3.96 | 1.32 | 1.24 | 5.99 |

| LSCIjt | 459 | 43.30 | 25.71 | 1 | 115.68 |

| MFjt | 459 | 76.05 | 7.88 | 37.90 | 94.30 |

| TFjt | 459 | 77.61 | 9.13 | 24 | 90 |

| FFjt | 459 | 56.10 | 18.50 | 20 | 90 |

| Primary Indicators | Sub-Indicators | Data Sources | Indicator Attribute |

|---|---|---|---|

| Digital Infrastructure Construction (A) | Fixed broadband subscriptions | International Telecommunication Union | + |

| Fixed telephone subscriptions | + | ||

| Mobile cellular subscriptions | + | ||

| Internet penetration rate | + | ||

| Digital Trade Competition Intensity (B) | Percentage of ICT goods exports | World Bank database | + |

| Percentage of ICT service exports | + | ||

| Percentage of high-technology exports | + | ||

| E-Government Development Index | United Nations E-Government | + | |

| Digital Technology Innovation Ability (C) | Research and development expenditure | World Bank database | + |

| Patent applications, nonresidents | + | ||

| Patent applications, residents | + | ||

| Scientific and technical journal articles | + | ||

| School enrollment, tertiary | + |

| Variable | Description | Expected Sign | Economic Interpretation |

|---|---|---|---|

| IMPijt | Import trade value of grain. | (+) | China’s grain import value from sampled countries. |

| GDPit | GDP of importing country i in period t. | (+) | It reflects the economic development scale of the importing country; generally, the larger the economic scale, the greater the import demand tends to be. |

| GDPjt | GDP of exporting country j in period t. | (+) | It reflects the economic development scale of the exporting country, and generally, the larger the economic development scale of the exporting country, the greater the scale of its export trade tends to be. |

| POPit | Population of the importing country i in period t. | (±) | It reflects the market size of the importing country; generally, the larger the population, the greater the import demand. Meanwhile, some research posits that the larger the market size of the importing country, the lesser its reliance on the international market. |

| POPjt | Population of the exporting country j in period t. | (±) | It reflects the market size of the exporting country; typically, the greater the population, the stronger its export capacity. Additionally, some research argues that the larger the market size of the exporting country, the less imperative it becomes to explore international markets to boost exports. |

| BORDij | Whether importing country i shares a common border with exporting country j. | (+) | It reflects whether the two countries are contiguous; the existence of a common border facilitates the reduction in transportation costs, thereby promoting trade development. |

| DISTij | The geographical distance between importing country i and exporting country j. | (−) | It reflects the geographic distance between countries, with longer distances leading to increased transportation costs, which in turn hinder the development of grain trade. |

| FTAijt | Whether the trading parties have signed a free trade agreement. | (±) | The signing of a free trade agreement is conducive to reducing trade costs, thereby fostering the development of trade. |

| TARIit | The tariff level of the importing country i in period t. | (−) | It reflects the tariff barriers of the importing country; the higher the tariff barriers, the more detrimental they are to trade between two countries. |

| LSCIjt | Linear shipping connectivity index. | (−) | The higher the index in the exporting country, the better its maritime infrastructure, which is more conducive to the development of trade between two countries. |

| MFjt | The currency freedom index of country j in period t. | (+) | The higher the level of currency freedom in the exporting country, the smaller the trade barriers, which in turn is more conducive to the development of grain trade between two countries. |

| TFjt | The trade freedom level/index of country j in period t. | (+) | The higher the level of trade freedom in the exporting country, the smaller the trade impediments, thereby fostering the development of grain trade between two countries. |

| FFjt | The financial freedom index/level of country j in period t. | (+) | The higher the level of financial freedom in the exporting country, the smaller the trade impediments, which is more conducive to the development of grain trade between two countries. |

| Country | Digital Infrastructure Construction | Digital Trade Competition Intensity | Digital Technology Innovation Ability | 2006–2022 Mean | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2006 | 2012 | 2022 | 2006 | 2012 | 2022 | 2006 | 2012 | 2022 | ||

| Australia | 0.554 | 0.621 | 0.645 | 0.318 | 0.310 | 0.379 | 0.308 | 0.300 | 0.309 | 0.314 |

| Argentina | 0.264 | 0.489 | 0.578 | 0.212 | 0.232 | 0.324 | 0.129 | 0.154 | 0.201 | 0.209 |

| Brazil | 0.226 | 0.416 | 0.481 | 0.222 | 0.204 | 0.297 | 0.109 | 0.139 | 0.176 | 0.172 |

| Canada | 0.567 | 0.650 | 0.680 | 0.352 | 0.347 | 0.352 | 0.202 | 0.201 | 0.220 | 0.256 |

| China | 0.052 | 0.349 | 0.599 | 0.270 | 0.398 | 0.494 | 0.077 | 0.352 | 0.698 | 0.361 |

| Chile | 0.292 | 0.454 | 0.574 | 0.215 | 0.207 | 0.276 | 0.094 | 0.137 | 0.170 | 0.192 |

| Cambodia | 0.019 | 0.208 | 0.332 | 0.058 | 0.047 | 0.188 | 0.012 | 0.027 | 0.029 | 0.052 |

| Denmark | 0.707 | 0.734 | 0.672 | 0.373 | 0.336 | 0.372 | 0.216 | 0.236 | 0.253 | 0.259 |

| France | 0.523 | 0.733 | 0.808 | 0.341 | 0.383 | 0.369 | 0.183 | 0.198 | 0.220 | 0.252 |

| Germany | 0.641 | 0.733 | 0.771 | 0.350 | 0.345 | 0.366 | 0.213 | 0.249 | 0.294 | 0.279 |

| India | 0.039 | 0.137 | 0.212 | 0.312 | 0.321 | 0.414 | 0.071 | 0.108 | 0.144 | 0.143 |

| Japan | 0.526 | 0.656 | 0.828 | 0.371 | 0.329 | 0.365 | 0.333 | 0.317 | 0.313 | 0.323 |

| Laos | 0.032 | 0.143 | 0.313 | 0.053 | 0.095 | 0.141 | 0.015 | 0.030 | 0.023 | 0.061 |

| South Korea | 0.607 | 0.739 | 0.813 | 0.508 | 0.446 | 0.506 | 0.309 | 0.356 | 0.415 | 0.367 |

| Italian | 0.512 | 0.596 | 0.672 | 0.239 | 0.253 | 0.300 | 0.165 | 0.167 | 0.210 | 0.220 |

| Pakistan | 0.053 | 0.117 | 0.181 | 0.086 | 0.082 | 0.252 | 0.026 | 0.026 | 0.082 | 0.049 |

| Russia | 0.306 | 0.535 | 0.635 | 0.186 | 0.249 | 0.312 | 0.175 | 0.189 | 0.206 | 0.234 |

| South Africa | 0.168 | 0.324 | 0.463 | 0.147 | 0.148 | 0.247 | 0.053 | 0.058 | 0.072 | 0.098 |

| Thailand | 0.170 | 0.301 | 0.575 | 0.355 | 0.275 | 0.360 | 0.093 | 0.102 | 0.140 | 0.162 |

| Ukraine | 0.254 | 0.401 | 0.506 | 0.179 | 0.187 | 0.447 | 0.152 | 0.165 | 0.130 | 0.193 |

| UK | 0.622 | 0.726 | 0.782 | 0.447 | 0.385 | 0.408 | 0.186 | 0.189 | 0.262 | 0.265 |

| America | 0.563 | 0.606 | 0.650 | 0.423 | 0.374 | 0.394 | 0.482 | 0.550 | 0.630 | 0.539 |

| Uruguay | 0.287 | 0.526 | 0.699 | 0.200 | 0.214 | 0.362 | 0.086 | 0.100 | 0.127 | 0.178 |

| Vietnam | 0.112 | 0.361 | 0.502 | 0.108 | 0.301 | 0.493 | 0.034 | 0.053 | 0.090 | 0.130 |

| Kazakhstan | 0.140 | 0.535 | 0.536 | 0.257 | 0.301 | 0.383 | 0.100 | 0.094 | 0.102 | 0.164 |

| Mexico | 0.197 | 0.334 | 0.497 | 0.330 | 0.321 | 0.351 | 0.063 | 0.073 | 0.103 | 0.144 |

| Peru | 0.135 | 0.296 | 0.419 | 0.154 | 0.147 | 0.223 | 0.060 | 0.084 | 0.156 | 0.141 |

| Philippines | 0.098 | 0.245 | 0.386 | 0.562 | 0.520 | 0.715 | 0.051 | 0.056 | 0.088 | 0.157 |

| Null Hypothesis | H0 | H1 | LR Statistic | Degrees of Freedom | 1% Cutoff | Conclusions of Test |

|---|---|---|---|---|---|---|

| There are no trade efficiencies | 453.732 | 535.453 | 163.442 | 1 | 9.500 | refuse |

| Trade efficiencies do not change over time | 453.373 | 481.930 | 57.114 | 2 | 12.810 | refuse |

| Variable | OLS | Time-Invariant SFA | Time-Variant SAF | |||

|---|---|---|---|---|---|---|

| Coefficient | t-Value | Coefficient | t-Value | Coefficient | t-Value | |

| β0 | −63.889 *** | −4.533 | −56.682 *** | −41.589 | −57.181 *** | −51.255 |

| lnGDPit | 0.962 *** | 147.251 | 0.474 *** | 35.995 | 0.498 *** | 30.230 |

| lnGDPit | −0.371 *** | −7.521 | −0.208 *** | −17.335 | −0.176 *** | −16.413 |

| lnPOPit | 5.656 *** | 5.265 | 5.340 *** | 51.975 | 5.326 *** | 65.234 |

| lnPOPit | 0.014 | 1.591 | 0.290 *** | 17.980 | 0.120 *** | 5.466 |

| lnBORDij | 0.049 ** | 2.309 | −1.102 *** | −19.674 | −0.292 *** | −4.322 |

| lnDISTijt | −0.002 | −0.217 | −0.186 *** | −6.148 | −1.347 *** | −16.844 |

| σ2 | 0.024 | 0.109 *** | 16.861 | 0.143 *** | 19.689 | |

| γ | — | — | 0.965 *** | 199.272 | 0.974 *** | 427.741 |

| μ | — | — | 0.649 *** | 12.986 | 0.747 *** | 12.041 |

| η | — | — | — | — | −0.002 ** | −2.309 |

| log likelihood | 453.732 | 211.655 | 481.930 | |||

| LR | — | 484.154 | 540.549 | |||

| Variable | SAF | Variable | Trade Inefficiency Model | ||

|---|---|---|---|---|---|

| Coefficient | t-Value | Coefficient | t-Value | ||

| β0 | −32.6759 ** | −2.3449 | α0 | 0.5144 *** | 3.1356 |

| lnGDPit | −0.2786 *** | −5.5208 | DELjt | −3.6157 *** | −3.4866 |

| lnGDPjt | 0.9092 *** | 67.7781 | FTAijt | 0.0004 | 0.2614 |

| lnPOPit | 3.3584 *** | 3.1680 | TAFijt | −0.603 *** | −2.7620 |

| lnPOPjt | 0.0291 ** | 2.1387 | LSCIjt | −2.0281 *** | −4.9074 |

| BORDij | 0.1019 *** | 4.4590 | MFjt | 0.0004 | 0.2614 |

| lnDISTijt | 0.0380 *** | 3.9131 | TFjt | 0.0028 * | 1.8612 |

| FFjt | −0.0226 *** | −4.1895 | |||

| σ2 | — | — | σ2 | 0.0229 *** | 11.4768 |

| γ | — | — | γ | 0.9616 *** | 36.3814 |

| LLF | 264.9277 | ||||

| LR | 106.5453 | ||||

| Variable | Model (1) | Model (2) | Model (3) | |||

|---|---|---|---|---|---|---|

| Coefficient | t-Value | Coefficient | t-Value | Coefficient | t-Value | |

| DELAjt | −3.733 ** | −2.2928 | — | — | — | — |

| DELBjt | — | — | −1.813 * | −1.8419 | — | — |

| DELCjt | — | — | — | — | −4.175 *** | −2.9172 |

| FTAijt | −0.0752 ** | −2.2460 | −0.0498 | −1.3128 | −0.0450 * | −1.8238 |

| TAFijt | 0.0368 ** | 2.6702 | 0.0162 | 1.5218 | 0.0179 * | 1.8889 |

| LSCIjt | −0.0057 *** | −6.6560 | −0.0037 *** | −6.5187 | −0.0031 *** | −5.3369 |

| MFjt | 0.0049 ** | 2.7884 | 0.0017 | 1.0232 | 0.0016 | 1.1676 |

| TFjt | 0.0038 ** | 2.3079 | 0.0046 *** | 3.1057 | 0.0040 *** | 3.1896 |

| FFjt | −0.0032 *** | −4.2018 | −0.0027 *** | −3.6549 | −0.0027 *** | −4.1883 |

| Constant | −0.3733 *** | −2.2928 | 0.1124 | 0.5741 | 0.1687 | 1.3142 |

| σ2 | 0.0263 *** | 8.5431 | 0.0240 *** | 9.1810 | 0.0236 *** | 11.3717 |

| γ | 0.7792 *** | 9.9645 | 0.9371 *** | 15.2370 | 0.9627 *** | 40.4533 |

| LLF | 263.0523 | 259.9443 | 262.6948 | |||

| LR | 102.7944 | 96.5785 | 102.0794 | |||

| Market Typology | Grain Importing Countries (Efficiency Score) |

|---|---|

| Saturated markets | USA (0.945), Canada (0.903) |

| Expansion-oriented markets | Australia (0.876), Argentina (0.840), Ukraine (0.821), Vietnam (0.816), France (0.782), Cambodia (0.778), Thailand (0.771), Kazakhstan (0.763), Pakistan (0.763), Russia (0.682), Laos (0.661), India (0.654), Uruguay (0.610) |

| Developing markets | Italy (0.562), Denmark (0.547), Peru (0.532), Germany (0.517), Japan (0.507), Chile (0.471), South Africa (0.462), Philippines (0.434), South Korea (0.426), UK (0.389), Brazil (0.384) |

| Iceberg-type markets | Mexico (0.292) |

| Countries | 2006 | 2012 | 2017 | 2022 | ||||

|---|---|---|---|---|---|---|---|---|

| Import Trade Potential (USD 10 Thousand) | Expansion Space (Times) | Import Trade Potential (USD 10 Thousand) | Expansion Space (Times) | Import Trade Potential (USD 10 Thousand) | Expansion Space (Times) | Import Trade Potential (USD 10 Thousand) | Expansion Space (Times) | |

| Australia | 51,819.06 | 0.40 | 152,304.26 | 0.14 | 192,208.63 | 0.03 | 295,370.26 | 0.03 |

| Argentina | 181,573.68 | 0.12 | 545,571.81 | 0.46 | 299,358.07 | 0.12 | 467,220.47 | 0.18 |

| Brazil | 1,102,450.31 | 2.65 | 3,035,507.38 | 1.13 | 5,623,822.99 | 1.69 | 12,275,389.72 | 2.29 |

| Canada | 15,749.91 | 0.36 | 71,036.39 | 0.06 | 158,223.47 | 0.15 | 195,361.48 | 0.02 |

| Chile | 2.39 | 1.48 | 63.54 | 1.44 | 30.03 | 0.82 | 79.00 | 0.68 |

| Cambodia | 0.01 | 0.04 | 382.65 | 0.27 | 15,501.82 | 0.53 | 27,616.51 | 0.53 |

| Denmark | 0.46 | 0.43 | 121.16 | 0.51 | 656.71 | 1.43 | 566.64 | 1.30 |

| France | 402.59 | 0.43 | 1605.01 | 0.27 | 5947.23 | 0.18 | 113,024.06 | 0.16 |

| Germany | 67.41 | 1.14 | 892.54 | 1.05 | 284.85 | 1.06 | 184.36 | 0.59 |

| India | 120.50 | 0.73 | 87.28 | 0.76 | 2.06 | 0.22 | 118,988.56 | 0.53 |

| Japan | 17.77 | 0.38 | 39.55 | 0.88 | 349.03 | 0.86 | 193.07 | 0.70 |

| Laos | 352.42 | 0.21 | 3292.33 | 0.53 | 12,364.24 | 0.59 | 6649.92 | 0.52 |

| South Korea | 1.50 | 0.74 | 63.30 | 0.78 | 59.47 | 1.85 | 0.44 | 0.85 |

| Italy | 0.25 | 0.72 | 0.12 | 1.30 | 0.36 | 1.06 | 41.89 | 0.28 |

| Pakistan | 10.81 | 0.50 | 36,689.53 | 0.37 | 11,137.87 | 0.19 | 60,732.15 | 0.33 |

| Russia | 55.22 | 0.93 | 5822.51 | 0.57 | 20,897.81 | 0.23 | 56,991.13 | 0.21 |

| South Africa | 0.05 | 0.76 | 0.82 | 1.56 | 10.16 | 1.16 | 23,785.82 | 0.72 |

| Thailand | 33,659.53 | 0.21 | 22,510.62 | 0.40 | 68,850.94 | 0.26 | 51,597.31 | 0.23 |

| Ukraine | 1.04 | 0.04 | 14.30 | 0.43 | 75,290.29 | 0.43 | 227,853.77 | 0.28 |

| UK | 0.05 | 3.62 | 36.33 | 3.54 | 2.13 | 1.66 | 0.79 | 1.19 |

| America | 314,142.52 | 0.14 | 1,776,400.77 | 0.03 | 1,625,446.08 | 0.05 | 3,051,922.81 | 0.13 |

| Uruguay | 23,661.90 | 0.87 | 168,885.50 | 0.39 | 190,079.76 | 0.84 | 177,965.46 | 0.34 |

| Vietnam | 1171.68 | 0.36 | 100,263.20 | 0.47 | 116,593.67 | 0.14 | 44,184.30 | 0.01 |

| Kazakhstan | 0.75 | 0.50 | 5890.89 | 0.34 | 7071.68 | 0.19 | 7568.57 | 0.13 |

| Mexico | 0.01 | 3.91 | 0.91 | 2.64 | 1.00 | 1.70 | 0.39 | 3.17 |

| Peru | 29.86 | 0.88 | 86.33 | 0.97 | 91.63 | 0.63 | 370.52 | 0.60 |

| Philippines | 31.11 | 1.12 | 0.05 | 1.55 | 0.11 | 1.27 | 0.49 | 0.92 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, D.; Qi, C.; Fang, G.; Gu, Y. The Impact of Global Digital Trade Development on China’s Grain Import Trade Potential: An Empirical Analysis Based on a Time-Varying Stochastic Frontier Gravity Model. Agriculture 2025, 15, 1324. https://doi.org/10.3390/agriculture15121324

Xu D, Qi C, Fang G, Gu Y. The Impact of Global Digital Trade Development on China’s Grain Import Trade Potential: An Empirical Analysis Based on a Time-Varying Stochastic Frontier Gravity Model. Agriculture. 2025; 15(12):1324. https://doi.org/10.3390/agriculture15121324

Chicago/Turabian StyleXu, Dongpu, Chunjie Qi, Guozhu Fang, and Yumeng Gu. 2025. "The Impact of Global Digital Trade Development on China’s Grain Import Trade Potential: An Empirical Analysis Based on a Time-Varying Stochastic Frontier Gravity Model" Agriculture 15, no. 12: 1324. https://doi.org/10.3390/agriculture15121324

APA StyleXu, D., Qi, C., Fang, G., & Gu, Y. (2025). The Impact of Global Digital Trade Development on China’s Grain Import Trade Potential: An Empirical Analysis Based on a Time-Varying Stochastic Frontier Gravity Model. Agriculture, 15(12), 1324. https://doi.org/10.3390/agriculture15121324