Abstract

Sustainability credentialling is the communication of environmental, social, economic, or animal-welfare-related information about a producer or product. Demand for sustainability credentials has been increasing and the aim of this study was to describe the main drivers for this kind of information in Australian red meat value chains that reach consumers across Australia and internationally, mainly in Asia, the USA, and the Middle East. The mixed methods approach included consultation with red meat processors. Desk-based research explored drivers from outside the value chain identified in the consultation. Little evidence was found that consumers are a driver of sustainability credentialling. The main drivers were in the global financial system, expressed in coordinated climate action policies by financial service providers and emerging government climate-related financial legislation. The inclusion of Scope 3 emissions extends coverage to most value chain participants. Net zero transitioning presents many risks to red meat value chains, potentially involving costly interventions and greater difficulty accessing financial services, with direct implications for production costs and asset values. Urgent action is recommended to achieve the formal recognition and use of climate metrics that differentiate the management strategies that are applicable to short-lived biogenic methane compared to CO2 to achieve the Paris Agreement goals.

1. Introduction

Typically, value chain analysis involves the characterization of material, informational, and financial flows along a value chain [1,2,3]. For red meat products from beef cattle, sheep, and lambs, the value chain includes breeding and the primary production of livestock on grassland, possible finishing in a concentrated animal feeding operation, slaughtering, carcass breakdown and potential further processing and packaging, after which products may follow various pathways to retail markets and places of food service to reach final purchasers. As the name implies, the value chain approach is highly consumer-oriented. Value chain analysis seeks first to discern what constitutes value to the consumer and then sets about coordinating the activities of value chain participants to efficiently deliver value-enhanced offerings. As described by Porter [4], it is the value chain, rather than the individual firm, that is the source of sustainable competitive advantage.

Sustainability credentials have the potential to be value-enhancing attributes of red meat products. These sustainability credentials could take the form of an environmental, social, or animal welfare claim or label informing consumers that some level of performance has been achieved or exceeded in the production process [5,6]. That said, examples of red meat products bearing such credentials in the marketplace are relatively few, especially in Australia, even though interest in the sustainability of agricultural and food systems is said to be increasing at an exponential rate [7]. While there is some evidence that consumers are willing to pay more for meat products with sustainability credentials [8,9,10], other evidence points to the contrary [11,12]. Overall, the evidence concerning a willingness to pay for meat products differentiated by sustainability credentialling is limited as it is mainly derived from choice experiments using hypothetical products rather than studies conducted in real consumer settings [13].

Red meat value chains are also dependent on a network of other actors that have the potential to be drivers for the reporting of sustainability credentials. These actors include government regulators. An example is the EU regulation on deforestation-free products that requires red meat producers or traders who place commodities on the EU market to demonstrate that products have not originated from recently deforested land or have contributed to forest degradation [14]. In Australia, as in many other jurisdictions, mandatory GHG emission reporting exists for organizations above a prescribed threshold [15]. Many red meat processors and corporate food retailers exceed these thresholds. Other actors include investment companies, financial service providers, and other service providers, as well as organizations that shape the policy and informational environment [16]. These external demands for sustainability credentialling add compliance costs and may not add value to consumers of red meat products. Indeed, they may erode value by increasing costs and limiting product choice. Nevertheless, they are becoming a part of conducting business, typically motivated by policy decisions external to the value chain, such as sustainable development goals [17] or steps being taken to understand and mitigate risks.

The political–economic–market environment for red meat is complex, with the demand for sustainability credentialling potentially arising from a variety of channels. The aim of this research was to address knowledge gaps by describing the main drivers of sustainability credentialling in Australian red meat value chains. Australian red meat value chains are diverse. Livestock are raised on pastures and rangelands, and some are finished in feedlots. The industry is also highly export-oriented, reaching international consumers mainly in Asia, the USA, and the Middle East. The objective was to support the red meat industry in mitigating risks and taking advantage of beneficial opportunities arising from the changing business landscape. The study was not designed to test a specific a priori research hypothesis. Here, sustainability credentialling refers to information communicated, either business-to-business or business-to-consumer, relating to sustainability, whereby sustainability-related information can address environmental, social, or economic aspects, or animal welfare, or a combination thereof. Due to the broad nature of the topic, a multimethod research approach was deemed appropriate, consisting of a combination of interviews and a literature review.

2. Materials and Methods

In order to achieve a detailed contextual understanding of the drivers of sustainability credentialling in the red meat value chain and to enable an exploration of the risks and opportunities, a multimethod research approach was chosen. Due to the absence of a specific research hypothesis, a formal systemic review was not deemed appropriate, nor a purely quantitative approach. The relevant evidence base was also diverse, including the testimony of participating businesses in the red meat value chain, as well as published government and corporate information. This meant that much of the available evidence was not directly comparable without interpretation. The scope of the study was beyond a theoretical or conceptual discussion of the topic, as it sought to integrate evidence and practice.

2.1. Consultation with Australian Red Meat Processors

Consultation with the red meat value chain focused on Australian red meat processors, i.e., businesses engaged in the slaughtering of livestock and carcass breakdown into saleable cuts, along with packaging and marketing. These businesses are typically value chain leaders, sensitive to market signals arising from downstream buyers, retailers, and consumers, and acting as a channel of information back to agricultural livestock producers. The consultation was subject to ethics approval 188/23 (5 October 2023) by the CSIRO Social and Interdisciplinary Science Human Research Ethics Committee (https://www.csiro.au/en/about/policies/ethical-human-research, accessed on 5 October 2023). The ethics approval covered interviews conducted virtually or in person with results communicated through public reports without individual attributions. Red meat processors were invited to participate, by email, in the consultation, and provided a participant information sheet describing the project objectives and what the consultation would involve, and explaining that participation was voluntary and that withdrawal could occur at any time. Each interview was conducted separately and involved a loosely structured conversation covering the following topics:

- What sustainability credentials are currently being provided, and to whom?

- What demands for sustainability credentials are likely to emerge in future?

- Perceived opportunities and risks associated with sustainability credentialling.

In addition, data were collected about the types of animals processed, the extent to which the businesses were supplying domestic versus export markets, and the types of ownership structures (private, public, local, international).

In total, 10 processors (out of 19 contacted) were included in the consultation. Of these processors, three processed beef cattle only, three processed small stock only (sheep, lamb, goats, etc.), and four processed a combination of these types. Ninety percent of processors interviewed were exporting and for these businesses, on average, exports amounted to around 80% of production. Australia is a major red meat exporter, currently ranked fifth for export volumes of beef and first for export volumes of sheep and goat meat [18]. All the processors were privately owned, which is the dominant ownership structure for red meat processors in Australia. That said, one processor was in partial international private ownership. Another was under full private international ownership, with one of the owners an international publicly listed company. Overall, the sample was considered broadly representative of the Australian red meat processing sector. The precise representativeness was not able to be characterized because data on sales volume and turnover were not collected. The association for the Australian red meat processing industry currently lists 110 members. The persons involved in the interviews had job titles such as Innovation Manager, Environmental Manager, Production Manager, Manager of Corporate and Industry Affairs, etc.

2.2. Desk-Based Research

As a subsequent step, desk-based research was undertaken to understand drivers stemming from outside the value chain that were identified in the consultation process (Section 2.1). This involved a review of the material published in reports and similar documents that are available online to obtain information about sustainability strategies, policies, and regulations (around 40 documents). Where necessary, the search extended to next level tiers of actors with the intention of identifying primary sources of demand for sustainability credentials. This process was undertaken iteratively.

3. Results

3.1. Consumer Value Drivers of Sustainability Credentialling

The consultation identified few current examples of sustainability credentialling directed toward consumers. The most prominent example was the carbon neutral labelling of selected beef products sold by a major Australian food and grocery retailer [19]. These products are certified under the Australian Government’s Climate Active Program [20] and bear the Program’s ecolabel on the packaging. The recurring message was that processors do not see value in product-level sustainability credentialling for consumers. Comments received included “Sustainability credentials are valued by few end consumers”, “End consumers not paying more”, and “Don’t see any premium for credentials for consumers”. Furthermore, this situation was not anticipated to change greatly in the future. One processor remarked that they did not expect that carbon neutral red meat products would become more commonplace due to the increased costs and limited market opportunities.

That said, several processors highlighted consumer demand for premium 100% grass-fed red meat products and noted that, for these products, sustainability credentials were a supporting attribute. The kinds of sustainability credentials mentioned were free to roam, implying a high standard of animal welfare, hormone and antibiotic free, and raised using regenerative agricultural practices. For these products, sustainability credentials support the primary value proposition, which is the 100% grass-fed production system. This is a less industrialized form of food production, and many consumers are aware of the higher levels of omega-3 fatty acids in grass-fed products compared to animals that have been fed grain. Examples include the Great Southern™ range of grass-fed beef and lamb products produced by JBS Foods Australia [21], and Greenham Natural Beef [22]. Market segments willing to pay a premium for such products are recognized, especially in the US and in Australia. For Australian red meat producers, these products leverage a natural advantage, as most cattle and sheep are raised in pasture and rangeland-based production systems. To support these products, a variety of producer-assurance programs are being operated. Not all the sustainability claims are accurately described. However, they seem to be sufficiently supported to meet the requirements of consumers at this time.

Overwhelmingly, Australian red meat processors identified the main demand for sustainability credentialling as coming from large corporate entities in the value chain, from banks and other financial service providers, and from government. The common view about large corporate entities in the value chain was that sustainability credentialling was less about increasing value to red meat consumers and more about addressing their own requirements to report corporate sustainability information and to address corporate policies. At the moment, sustainability credentialling covers a variety of aspects including GHG emissions, GHG emission reduction targets, deforestation, packaging materials, modern slavery, and workforce composition. Some processors reported that conversations with large corporate entities about sustainability credentialling were just beginning and were mainly focused on qualitative information describing sustainability plans and targets. However, the indication was that quantitative information would be required in the near future. Processors expressed the view that sustainability credentialling for large corporate entities, banks, and other financial service providers, and for government, was expected to increase and expand to include a wider range of environmental, social and governance aspects, and in particular, information about natural capital and biodiversity.

3.2. Drivers of Sustainability Credentialling beyond the Value Chain

Red meat processors frequently referred to interest in sustainability credentialling arising from the financial services sector, especially banks, and particularly in relation to GHG emissions, although natural capital and deforestation were also mentioned as additional concerns. This was found to align with data obtained from the sustainability reports of major financial institutions servicing the Australian agribusiness sector. This includes the four major Australian banks, Commonwealth Bank of Australia (CBA) [23], National Australia Bank (NAB) [24], Westpac Banking Corporation [25], and the Australia and New Zealand Banking Group (ANZ) [26], as well as the Dutch multinational financial services company Rabobank, which is also active in rural and agribusiness finance in Australia [27]. All are members of the UN-convened Net-Zero Banking Alliance (Table 1). This involves a commitment to financing ambitious climate action and a commitment to supporting a transitioning of the economy to net-zero GHG emissions by 2050 through the management of their lending and investment portfolios [28].

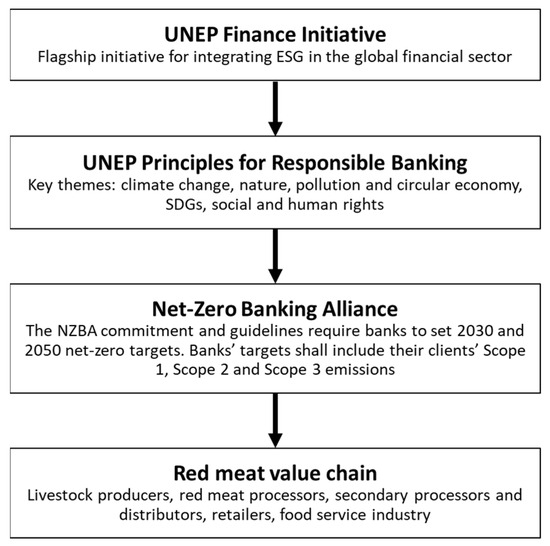

The practical implication is that lending products are now being developed where the interest charges are linked to sustainability performance targets, e.g., [29], and where lending is targeted directly to GHG emission reduction, such as the purchasing of lower-emission vehicles and machinery. Furthermore, in line with their NZBA commitments, banks are reporting annually on their financed emissions, whereby GHG emissions are attributed to the bank in proportion to their involvement in providing capital or financing [30]. For example, in the financial year 2022, CBA reported financed emissions of 22.3 Mt CO2e, of which 3.0 Mt CO2e was related to business lending to Australian agriculture and another 2.6 Mt CO2e was related to New Zealand agriculture [23]. Together, these emissions exceeded CBA’s financed emissions related to housing (4.4 Mt CO2e); commercial property (1.3 Mt CO2e); mining, oil, and gas (2.3 Mt CO2e); and manufacturing (3.0 Mt CO2e) [23]. In addition, under the NZBA, banks are developing sector plans that are designed to transition their financed emissions to net zero by mid-century or sooner. What is interesting is that all major agribusiness banking service providers in Australia joined the NZBA within about 12 months of its foundation, and within 9 months of each other (Table 1), suggesting that membership is beneficial for participation in global financial markets. The NZBA is itself part of a larger initiative, the UNEP Finance Initiative (Figure 1), which can be considered an originating driver. The UNEP Finance Initiative also addresses insurance providers and asset managers; however, these sectors of the finance industry featured less prominently than banks in the consultation with red meat processors.

Figure 1.

Banking sector drivers for sustainability credentialling in the red meat sector.

Table 1.

Australian agribusiness banking industry participation in the Net-Zero Banking Alliance (NZBA) and UNEP Finance Initiative 1.

Table 1.

Australian agribusiness banking industry participation in the Net-Zero Banking Alliance (NZBA) and UNEP Finance Initiative 1.

| Bank | Signed NZBA | Scope |

|---|---|---|

| ANZ Group | October 2021 | NZBA and Principles for Responsible Banking |

| Commonwealth Bank of Australia | January 2022 | NZBA and Principles for Responsible Banking |

| Macquarie Group | October 2021 | Net Zero Banking Alliance |

| National Australia Bank | December 2021 | NZBA and Principles for Responsible Banking |

| Westpac Banking Corporation | July 2022 | NZBA and Principles for Responsible Banking |

| Coöperatieve Rabobank | November 2021 | Blue Finance, NZBA, and Principles for Responsible Banking |

1 Data: [31].

In addition to finance sector drivers of sustainability credentialling, the consultation with red meat processors also identified emerging government regulation. In 2023, the Australian Government Treasury Department released a consultation paper on proposed mandatory climate-related financial disclosure [32]. This was followed by a consultation on draft legislation [33]. A phased implementation has been proposed (Table 2) that in a short number of years will require businesses with an annual revenue of AUD 50 million and as few as 100 employees to report information about climate-related governance processes, transition planning and climate-related targets, and GHG emissions. Many red meat processors in Australia would exceed these reporting thresholds, as would corporate food and grocery retailers.

Table 2.

Phased implementation of mandatory climate-related financial disclosure in Australia.

An important feature of the draft legislation is the requirement to disclose material Scope 3 emissions. These Scope 3 emissions refer to emissions that occur in the value chain of the reporting entity. This includes upstream GHG emissions, which for a red meat processor would include the emissions associated with the farming system that produced the livestock. For a retailer of red meat, this would include GHG emissions associated with farming and processing. In addition, Scope 3 emissions can include downstream emissions associated with distribution, storage, use, and end-of-life treatment if they are deemed material. As such, businesses in the red meat value chain will be included in the disclosure requirements, even if they are below the disclosure thresholds (Table 2), if they participate in a value chain where one or more entities are required to disclose. This is likely to include the majority of Australian red meat value chain participants, with the only likely exceptions being small-scale livestock producers supplying local independent meat vendors.

Australian climate-related financial disclosure legislation is being supported by new sustainability reporting standards, in development, by the Australian Accounting Standards Board [34]. These activities are occurring under the coordination of the Australian Council of Financial Regulators (CFR), comprised of four main members: the Australian Prudential Regulation Authority (APRA), the Australian Securities and Investments Commission (ASIC), the Australian Treasury, and the Reserve Bank of Australia (Figure 2) [35]. The CFR is the coordinating body for financial regulation in Australia and coordinates action in relation to international developments in global financial systems. Therefore, the Australian framework of legislation around climate-related disclosure can be seen as a response to emerging international financial reporting developments [36] that have arisen as a result of the work of the Task Force on Climate-Related Financial Disclosure [37] established by the Financial Stability Board of the Bank of International Settlements (BIS) [38], which can be considered an originating driver. An analogous Taskforce on Nature-Related Financial Disclosures (TNFD) [39] has since been formed, with the aim of shifting global financial flows away from activities that negatively impact nature.

Figure 2.

Drivers of mandatory climate-related financial disclosures in Australia.

4. Discussion

4.1. Opportunities and Risks

The consultation with red meat processors revealed scant evidence that sustainability credentials are an opportunity for value creation for consumers. The main exception was in the case of 100% grass-fed red meat products, for which a price premium exists in some markets and where sustainability credentials can enhance the overall value proposition to consumers. This finding is based on evidence from the market itself, based on the assumption that if consumers did value sustainability credentials, reflected in a willingness to pay a price premium, the value chain would accurately discern this. Actual market behavior is considered a more accurate indicator of what drives consumer value than experimental studies that seek to estimate willingness to pay from hypothetical product choices where the participants are not actually committing their own, limited finances. In any case, the findings from such studies are mixed and inconclusive [8,9,10,11,12,13]. That said, the evidence obtained in this study reflects the present situation and does not inform us how consumer value drivers might change in the future.

While opportunities for red meat value chains to benefit from sustainability credentialling may be few, the drivers from beyond the value chain present many risks. All the major banks active in rural and agribusiness finance in Australia have committed to the NZBA. This requires that banks develop sector strategies consistent with their transition plans to net-zero financed emissions. In the first instance, this will mean additional reporting and compliance activities for livestock producers and downstream processors to maintain access to financial services. Banks publicly report their financed emissions, and in the livestock sector, these are estimated using activity-based methods using data such as head of cattle. However, detailed emissions data at the individual customer level that can demonstrate progress toward emission reduction targets will be increasingly in demand. The risk is that increasingly, business-level decision making in the red meat value chain will be directly influenced by financial service providers. It is also not out of the question that banks could rebalance their lending and investment portfolios away from red meat producers, making refinancing or the purchase of sheep- and cattle-producing farms difficult without large-scale interventions to mitigate or offset emissions through the sequestration of carbon in soils and vegetation. This would undoubtedly have implications for productivity, profitability, and the value of assets.

As mentioned already, mandatory climate-related financial disclosure legislation will impact the Australian red meat value chain at all levels through the requirement of larger GHG emitters to report material Scope 3 emissions. Again, this will imply new reporting demands across the value chain that may be easily met in the first instance through simple activity data but will likely become more complex and costly as it becomes necessary to verify the emission reductions associated with the adoption of new technologies and practices. Smaller producers that are unable to comply with new reporting requirements will risk being left out of supply chains. For large retailers, there may also be decisions taken to reduce Scope 3 emissions by downscaling the sale of red meat products in favor of lower-emission plant-based alternatives, thereby limiting channels to market for red meat producers. If emissions disclosures become publicly reported, this will also create an avenue for public activism [40] designed to pressure large corporate retailers away from the red meat industry. Furthermore, government climate-related financial disclosure regulations will potentially underpin other forms of direct government intervention in industry.

An important observation is that the main drivers for sustainability credentialling are not local but originate in global policy making fora (Figure 1 and Figure 2). Arising from outside the value chain, these drivers of sustainability credentialling risk interfering with normal processes of value chain operation that traditionally concern the efficient production of goods and services that are valued by consumers. In this regard, value chains are sensitive to the social and environmental concerns of their current and potential future customers. However, what is emerging is a situation where financial institutions take autonomy away from value chains and consumers and make decisions about the pace and extent of social and environmental change. Moreover, the market for financial services in Australia is limited as all the major rural and agribusiness providers are part of the same global alliance (NZBA and UNEP PRB). As such, banks and other financial institutions become the change-makers [41,42], an outcome deemed desirable by some [43], but which nonetheless represents a risk to red meat producers as decision making about social and environmental matters becomes externalized and centralized.

Furthermore, drivers for sustainability credentialling that originate in global policy making fora may lack sensitivity to local sustainability priorities as well as sectoral nuances. This represents a further risk. In Australia, sheep and cattle production occurs across a wide range of biogeographical contexts using a variety of production systems, spanning open rangeland grazing, to grazing on intensively managed pastures, to intensive production in feedlots. The potential for GHG mitigation therefore varies widely. Feed additives, such as 3-Nitrooxypropanol and those based on seaweed, offer potential for substantial enteric methane inhibition, but they are presently most readily able to be deployed in systems where farmers have regular daily contact with animals and a high level of control over feed intake [44,45,46,47,48]. Likewise, the potential for carbon sequestration in soils and vegetation on farms is highly variable [49]. Also, unlike most sectors of the economy, GHG emissions in the red meat industry are mainly biogenic methane, and questions have been raised as to whether conventional accounting methods for GHG emissions are even fit for purpose [50,51,52,53,54]. In a new era where social and environmental targets are driven by decisions taken in global policy making fora, there is a risk of misalignment with the priorities and values of local industries and communities.

4.2. Implications for the Red Meat Industry

While biodiversity impacts are an important emerging topic for sustainability credentialling in the red meat sector [16], the current focus centers upon GHG emissions reduction [28,32]. However, as mentioned above, red meat industry emissions are unlike most other industries in that the main GHG emission is biogenic methane. How biogenic methane emissions are addressed in GHG accounting schemes is therefore a matter of major consequence. In the case of the NZBA, methane and other non-CO2 emissions are converted to CO2-equivalent emissions using 100-year global warming potentials. Equivalency factors are derived by comparing the integral of radiative forcing over a future 100-year time horizon for the non-CO2 GHG with that of CO2. However, it is critical to note that there is no scientific argument for selecting this basis of equivalency: it is a value choice [55]. There is no absolute equivalence in the climate impact of two different GHGs, as each GHG has its particular radiative forcing characteristics and atmospheric lifetime [56]. Depending on the climate metric chosen, the relative importance of different GHGs varies, so much so that reported results and conclusions can be dramatically changed [54]. While the choice of climate metric may be a small matter for industries where non-CO2 emissions are of minor importance, the issue is of major consequence for the red meat industry.

The Paris Agreement sets the ambitious goal of limiting the global mean temperature rise to 1.5 °C above pre-industrial levels (well below 2 °C) to significantly reduce risks and impacts [57]. The UNEP Principles for Responsible Banking and NZBA state alignment with this goal [58]. However, regarding the Paris Agreement goal of stabilizing the climate, the Intergovernmental Panel on Climate Change (IPCC) has in recent years drawn greater attention to the need for different management strategies for short-lived GHGs, like methane, compared to CO2 and other GHGs with long atmospheric lifetimes. According to the IPCC, “Stabilizing the climate will require strong, rapid, and sustained reductions in greenhouse gas emissions, and reaching net zero CO2 emissions” [59]. However, the IPCC also adds that “Limiting other greenhouse gases and air pollutants, especially methane, could have benefits for both health and climate” [59]. In other words, the same requirement to achieve net zero does not apply to methane. With biogenic methane, the relatively short atmospheric lifetime, of around 12 years [60], means that a more-or-less steady emissions profile over time can be consistent with climate stabilization. There is a natural cycle whereby atmospheric CO2 is assimilated into grasses and other vegetation by photosynthesis. As ruminants digest this vegetation, methane is produced and emitted to the atmosphere, where it breaks back down to CO2.

On this basis, there is a strong case for the use of climate metrics in the red meat industry that better reflect the warming potential of biogenic methane over time [61]. Two such metrics have been proposed: the GWP* [62] and the radiative forcing (RF) footprint [53]. These metrics enable a more transparent reporting of climate impact and alignment with the goal of climate stabilization, reflecting the need to reduce long-lived GHG emissions to net zero and the need to manage the rate of methane emission such that there is no additional contribution to warming. The implications for the industry are enormous, as any requirement to reduce red meat industry biogenic methane emissions to net zero will not only be extraordinarily costly, but unnecessary to achieve alignment with the Paris Agreement. It should be a matter of urgency for the red meat industry to achieve formal recognition of climate metrics that are applicable to the industry’s standing as a predominantly non-CO2 emitter.

5. Conclusions

In summary, this study has identified that the main drivers for sustainability credentialling in Australian red meat value chains are in the global financial system, expressed in coordinated climate action policies by financial service providers as well as emerging government financial regulations in relation to climate-related financial disclosure. The latter includes the mandatory reporting of material Scope 3 emissions, meaning that most value chain participants, small or large, will be included. Requirements to transition to net zero GHG emissions present many risks to red meat value chains, potentially involving costly interventions and more difficult access to financial services, with direct implications for production costs and asset values. What is missing is an approach to climate action in red meat value chains that is commensurate with the GHG emissions profile which is dominated by short-lived biogenic methane. The climate stabilization objectives of the Paris Agreement can be met without reducing these emissions to net zero. Urgent action is recommended by the red meat industry to achieve the formal recognition and use of climate metrics that differentiate the management strategies that are needed for short-lived biogenic methane compared to CO2. This study provides new insight into the influence of global policy making fora upon local value chains. The study was limited by its focus upon red meat processors and not other value chain actors. In addition, drivers from outside the value chain were explored through publicly accessible documents, which may convey selective information. Therefore, future research is recommended to expand the scope of investigations.

Funding

This research received no external funding.

Institutional Review Board Statement

This study was approved by the CSIRO Social and Interdisciplinary Science Human Research Ethics Committee (https://www.csiro.au/en/about/policies/ethical-human-research). Ethics approval 188/23 dated 5 October 2023.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

This study was supported by CSIRO’s Trusted Agrifood Exports Mission, which is a partnership with the Australian Government Department of Agriculture, Fisheries and Forestry. The author has previously undertaken food systems research addressing environmental issues for a variety of private sector organizations and Australian government agencies. This includes Dairy Australia, Meat and Livestock Australia, and the Australian Meat Processor Corporation.

References

- Fearne, A.; Martinez, M.G.; Dent, B. Dimensions of sustainable value chains: Implications for value chain analysis. Supply Chain Manag. Int. J. 2012, 17, 575–581. [Google Scholar] [CrossRef]

- Akyüz, Y.; Salali, H.E.; Atakan, P.; Günden, C.; Yercan, M.; Lamprinakis, L.; Kårstad, S.; Solovieva, I.; Kasperczyk, N.; Mattas, K.; et al. Case study analysis on agri-food value chain: A guideline-based approach. Sustainability 2023, 15, 6209. [Google Scholar] [CrossRef]

- Ridoutt, B.; Sanguansri, P.; Bonney, L.; Crimp, S.; Lewis, G.; Lim-Camacho, L. Climate change adaptation strategy in the food industry—Insights from product carbon and water footprints. Climate 2016, 4, 26. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Advantage: Creating and Sustaining Superior Performance; Free Press: New York, NY, USA, 1985. [Google Scholar]

- ISO 14020:2020; International Organization for Standardization. Environmental Statements and Programmes for Products—Principles and General Requirements. ISO: Geneva, Switzerland, 2020.

- ISO 17033:2019; International Organization for Standardization. Ethical Claims and Supporting Information—Principles and Requirements. ISO: Geneva, Switzerland, 2019.

- McRobert, K.; Gregg, D.; Fox, T.; Heath, R. Development of the Australian Agricultural Sustainability Framework 2021–22; Australian Farm Institute: Eveleigh, NSW, Australia, 2022. [Google Scholar]

- Tait, P.; Saunders, C.; Guenther, M.; Rutherford, P. Emerging versus developed economy consumer willingness to pay for environmentally sustainable food production: A choice experiment approach comparing Indian, Chinese and United Kingdom lamb consumers. J. Clean. Prod. 2016, 124, 65–72. [Google Scholar] [CrossRef]

- Bastounis, A.; Buckell, J.; Hartmann-Boyce, J.; Cook, B.; King, S.; Potter, C.; Bianchi, F.; Rayner, M.; Jebb, S.A. The impact of environmental sustainability labels on willingness-to-pay for foods: A systematic review and meta-analysis of discrete choice experiments. Nutrients 2021, 13, 2677. [Google Scholar] [CrossRef] [PubMed]

- Li, S.; Kallas, Z. Meta-analysis of consumers’ willingness to pay for sustainable food products. Appetite 2021, 163, 105239. [Google Scholar] [CrossRef] [PubMed]

- Katare, B.; Yim, H.; Byrne, A.; Wang, H.H.; Wetzstein, M. Consumer willingness to pay for environmentally sustainable meat and a plant-based meat substitute. App. Econ. Perspect. Policy 2023, 45, 145–163. [Google Scholar] [CrossRef]

- Schrobback, P.; Zhang, A.; Ha, T.M. Demand for Agri-Food Attributes and Attribute Claim Assurance in China and Vietnam from Importers’ Perspective; CSIRO: Canberra, Australia, 2022.

- Cook, B.; Costa Leite, J.; Rayner, M.; Stoffel, S.; van Rijn, E.; Wollgast, J. Consumer interaction with sustainability labelling on food products: A narrative literature review. Nutrients 2023, 15, 3837. [Google Scholar] [CrossRef] [PubMed]

- Regulation on Deforestation-Free Products. Available online: https://environment.ec.europa.eu/topics/forests/deforestation/regulation-deforestation-free-products_en (accessed on 1 February 2024).

- About the National Greenhouse and Energy Reporting Scheme. Available online: https://www.cleanenergyregulator.gov.au/NGER/About-the-National-Greenhouse-and-Energy-Reporting-scheme (accessed on 1 February 2024).

- Thomas, D.T.; Mata, G.; Toovey, A.F.; Hunt, P.W.; Wijffels, G.; Pirzl, R.; Strachan, M.; Ridoutt, B.G. Climate and biodiversity credentials for Australian grass-fed beef: A review of standards, certification and assurance schemes. Sustainability 2023, 15, 13935. [Google Scholar] [CrossRef]

- The 17 Goals. Available online: https://sdgs.un.org/goals (accessed on 1 February 2024).

- MLA. The Australian Red Meat and Livestock Industry—State of the Industry Report 2023; Meat & Livestock Australia: North Sydney, NSW, Australia, 2023. [Google Scholar]

- Coles Finest Certified Carbon Neutral Range. Available online: https://www.coles.com.au/about/our-partners/farming/carbon-neutral (accessed on 7 February 2024).

- Climate Active Certification. Available online: https://www.climateactive.org.au/be-climate-active/certification (accessed on 7 February 2024).

- Great Southern Farms 100% Grass Fed Australian Beef and Lamb. Available online: https://greatsouthernfarms.com.au/ (accessed on 7 February 2024).

- Greenham Natural Beef. Available online: https://www.greenham.com.au/greenham-natural-beef/ (accessed on 7 February 2024).

- Commonwealth Bank of Australia. 2023 Climate Report; CBA: Sydney, NSW, Australia, 2023. [Google Scholar]

- National Australia Bank. Climate Report 2023. Available online: https://www.nab.com.au/content/dam/nab/documents/reports/corporate/2023-climate-report.pdf (accessed on 2 January 2024).

- Westpac Group. Westpac 2023 Climate Report. Available online: https://www.westpac.com.au/content/dam/public/wbc/documents/pdf/aw/ic/Westpac-2023-Climate-Report.pdf (accessed on 2 January 2024).

- Australia and New Zealand Banking Group. 2023 Climate-Related Financial Disclosures. Available online: https://www.anz.com.au/content/dam/anzcomau/about-us/anz-2023-climate-related-financial-disclosures.pdf (accessed on 2 January 2024).

- The Cooperative Rabobank. Global Standard on Sustainable Development. Available online: https://media.rabobank.com/m/3197e93d12fa9d9/original/Sustainability-Policy-Framework.pdf (accessed on 12 February 2024).

- Net-Zero Banking Alliance. Available online: https://www.unepfi.org/net-zero-banking/ (accessed on 12 February 2024).

- Australia’s First Sustainability-Linked Loan for Agriculture. Available online: https://www.commbank.com.au/articles/newsroom/2021/07/sustainability-linked-loan-for-agriculture.html (accessed on 2 January 2024).

- Partnership for Carbon Accounting Financials (PCAF). The Global GHG Accounting and Reporting Standard Part A: Financed Emissions, 2nd ed.; Partnership for Carbon Accounting Financials: Parkes, ACT, Australia; Available online: https://carbonaccountingfinancials.com/en/ (accessed on 12 February 2024).

- Net-Zero Banking Alliance—Our Members. Our Members—United Nations Environment—Finance Initiative. Available online: http://unepfi.org (accessed on 12 February 2024).

- Australian Government, Treasury. Climate-Related Financial Disclosures; Consultation Paper, June 2023; Commonwealth of Australia: Parkes, ACT, Australia, 2023.

- Climate-Related Financial Disclosure: Exposure Draft Legislation. Available online: https://treasury.gov.au/consultation/c2024-466491#:~:text=The%20Exposure%20Draft%20legislation%20seeks,climate%2Drelated%20risks%20and%20opportunities (accessed on 13 February 2024).

- Exposure Draft ED SR1 Australian Sustainability Reporting Standards—Disclosure of Climate-related Financial Information. Available online: https://aasb.gov.au/news/exposure-draft-ed-sr1-australian-sustainability-reporting-standards-disclosure-of-climate-related-financial-information/ (accessed on 13 February 2024).

- Council of Financial Regulators—Climate Change. Available online: https://www.cfr.gov.au/financial-stability/climate-change.html (accessed on 13 February 2024).

- International Financial Reporting Standards Foundation—General Sustainability-related Disclosures. Available online: https://www.ifrs.org/projects/completed-projects/2023/general-sustainability-related-disclosures/ (accessed on 13 February 2024).

- Task Force on Climate-Related Financial Disclosures. Available online: https://www.fsb-tcfd.org/ (accessed on 13 February 2024).

- Financial Stability Board. Available online: https://www.fsb.org/ (accessed on 13 February 2024).

- Taskforce on Nature-Related Financial Disclosures. Available online: https://tnfd.global/ (accessed on 13 February 2024).

- Edmans, A. The end of ESG. Financ. Manag. 2023, 52, 3–17. [Google Scholar] [CrossRef]

- Elsner, C.; Neumann, M. Caught between path-dependence and green opportunities—Assessing the impetus for green banking in South Africa. Earth Syst. Gov. 2023, 18, 100194. [Google Scholar] [CrossRef]

- Etty, T.; van Zeben, J.; Carlarne, C.; Duvic-Paoli, L.-A.; Huber, B.; Huggins, A. The possibility of radical change in transnational environmental law. Transnat. Environ. Law 2022, 11, 447–461. [Google Scholar] [CrossRef]

- Parker, C.; Sheedy-Reinhard, L. Are banks responsible for animal welfare and climate disruption? A critical review of Australian banks’ due diligence policies for agribusiness lending. Transnat. Environ. Law 2022, 11, 603–628. [Google Scholar] [CrossRef]

- Ridoutt, B.; Lehnert, S.A.; Denman, S.; Charmley, E.; Kinley, R.; Dominik, S. Potential GHG emission benefits of Asparagopsis taxiformis feed supplement in Australian beef cattle feedlots. J. Clean. Prod. 2022, 337, 130499. [Google Scholar] [CrossRef]

- Black, J.L.; Davison, T.M.; Box, I. Methane emissions from ruminants in Australia: Mitigation potential and applicability of mitigation strategies. Animals 2021, 11, 951. [Google Scholar] [CrossRef] [PubMed]

- Almeida, A.K.; Hegarty, R.S.; Cowie, A. Meta-analysis quantifying the potential of dietary additives and rumen modifiers for methane mitigation in ruminant production systems. Anim. Nutr. 2021, 7, 1219–1230. [Google Scholar] [CrossRef]

- Hegarty, R.S.; Passetti, R.A.C.; Dittmer, K.M.; Wang, Y.; Shelton, S.; Emmet-Booth, J.; Wollenberg, E.; McAllister, T.; Beauchemin, K.; Gurwick, N.; et al. An Evaluation of Evidence for Efficacy and Applicability of Methane Inhibiting Feed Additives for Livestock. An Evaluation of Emerging Feed Additives to Reduce Methane Emissions from Livestock. Available online: https://globalresearchalliance.org/wp-content/uploads/2021/12/An-evaluation-of-evidence-for-efficacy-and-applicability-of-methane-inhibiting-feed-additives-for-livestock-FINAL.pdf (accessed on 22 August 2022).

- Fouts, J.Q.; Honan, M.C.; Roque, B.M.; Tricarico, J.M.; Kebreab, E. Enteric methane mitigation interventions. Transl. Anim. Sci. 2022, 6, txac041. [Google Scholar] [CrossRef]

- Mayberry, D.; Bartlett, H.; Moss, J.; Davison, T.; Herrero, M. Pathways to carbon-neutrality for the Australian red meat sector. Agric. Syst. 2019, 175, 13–21. [Google Scholar] [CrossRef]

- Allen, M.R.; Shine, K.P.; Fuglestvedt, J.S.; Millar, R.J.; Cain, M.; Frame, D.J.; Macey, A.H. A solution to the misrepresentations of CO2-equivalent emissions of short-lived climate pollutants under ambitious mitigation. NPJ Clim. Atmos. Sci. 2018, 1, 16. [Google Scholar] [CrossRef]

- Cain, M.; Lynch, J.; Allen, M.R.; Fuglestvedt, J.S.; Frame, D.J.; Macey, A.H. Improved calculation of warming equivalent emissions for short-lived climate pollutants. NPJ Clim. Atmos. Sci. 2019, 2, 29. [Google Scholar] [CrossRef]

- Collins, W.J.; Frame, D.J.; Fuglestvedt, J.S.; Shine, K.P. Stable climate metrics for emissions of short and long-lived species—Combining steps and pulses. Environ. Res. Lett. 2020, 15, 024018. [Google Scholar] [CrossRef]

- Ridoutt, B. Climate neutral livestock production—A radiative forcing-based climate footprint approach. J. Clean Prod. 2021, 291, 125260. [Google Scholar] [CrossRef]

- Ridoutt, B. Climate impact of Australian livestock production assessed using the GWP* climate metric. Liv. Sci. 2021, 246, 104459. [Google Scholar] [CrossRef]

- Myhre, G.; Shindell, D.; Bréon, F.-M.; Collins, W.; Fuglestvedt, J.; Huang, J.; Koch, D.; Lamarque, J.-F.; Lee, D.; Mendoza, B.; et al. Chapter 8 Anthropogenic and natural radiative forcing. In Climate Change 2013: The Physical Science Basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Stocker, T.F., Qin, D., Plattner, G.-K., Tignor, M., Allen, S.K., Boschung, J., Nauels, A., Xia, Y., Bex, V., Midgley, P.M., Eds.; Cambridge University Press: Cambridge, UK, 2013; pp. 659–740. [Google Scholar]

- Ridoutt, B.; Huang, J. When climate metrics and climate stabilization goals do not align. Environ. Sci. Technol. 2019, 53, 14093–14094. [Google Scholar] [CrossRef]

- Paris Agreement. Available online: https://unfccc.int/sites/default/files/english_paris_agreement.pdf (accessed on 4 July 2023).

- The Commitment. Available online: https://www.unepfi.org/net-zero-banking/commitment/ (accessed on 8 December 2023).

- Climate Change Widespread, Rapid, and Intensifying—IPCC. Available online: https://www.ipcc.ch/2021/08/09/ar6-wg1-20210809-pr/ (accessed on 4 July 2023).

- Smith, C.; Nicholls, Z.R.J.; Armour, K.; Collins, W.; Forster, P.; Meinshausen, M.; Palmer, M.D.; Watanabe, M. The earth’s energy budget, climate feedbacks, and climate sensitivity supplementary material. In Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; Masson-Delmotte, V., Zhai, P., Pirani, A., Connors, S.L., Péan, C., Berger, S., Caud, N., Chen, Y., Goldfarb, L., Gomis, M.I., et al., Eds.; Cambridge University Press: Cambridge, UK, 2023; Available online: https://www.ipcc.ch/ (accessed on 22 May 2023).

- FAO. Methane Emissions in Livestock and Rice Systems—Sources, Quantification, Mitigation and Metrics; Livestock Environmental Assessment and Performance (LEAP) Partnership: Rome, Italy, 2023. [Google Scholar]

- del Prado, A.; Lynch, J.; Liu, S.; Ridoutt, B.; Pardo, G.; Mitloehner, F. Opportunities and challenges in using GWP* to report the impact of ruminant livestock on global temperature change. Animal 2023, 17, 100790. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).