Prices of Organic Food—The Gap between Willingness to Pay and Price Premiums in the Organic Food Market in Poland

Abstract

:1. Introduction

- To identify the perception of organic food prices by the purchasers and their WTP;

- To determine the average price premiums for organic food products available on the market;

- To compare the WTP and the perception of organic food price level with the obtained price premiums.

2. Materials and Methods

- Fifteen specialist stores with organic food;

- Fifteen general grocery stores offering conventional food;

- Fifteen outlets of retail chains with an assortment of both types of food.

3. Results

3.1. Consumers of Organic Food and Their WTP

3.2. Price Premiums for Organic Food Products

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- International Federation of Organic Agriculture Movements. Sustainable Organic Agriculture Action Network (SOAAN); IFOAM: Bonn, Germany, 2012. [Google Scholar]

- Willer, H.; Schlatter, B.; Trávníček, J. (Eds.) The World of Organic Agriculture. Statistics and Emerging Trends 2023; Research Institute of Organic Agriculture FiBL, Frick, and IFOAM–Organics International: Bonn, Germany, 2023; Available online: https://www.fibl.org/fileadmin/documents/shop/1254-organic-world-2023.pdf (accessed on 14 September 2023).

- Kwasek, M. (Ed.) Z badań nad rolnictwem społecznie zrównoważonym (21). Żywność ekologiczna-regulacje prawne, system kontroli i certyfikacji; Instytut Ekonomiki Rolnictwa i Gospodarki Żywnościowej Państwowy Instytut Badawczy: Warszawa, Poland, 2013; Available online: https://www.statista.com/statistics/632792/per-capita-consumption-of-organic-food-european-union-eu/ (accessed on 28 September 2023).

- Kowalska, A. Jakość i Konkurencyjność w Rolnictwie Ekologicznym; Difin: Warszawa, Poland, 2010. [Google Scholar]

- Żywność Ekologiczna w Polsce 2021. Available online: https://jemyeko.com/wpcontent/uploads/2021/07/raport_05-07-2021.pdf (accessed on 25 September 2023).

- Statistical Yearbook of Agriculture. GUS. Warsaw 2022. Available online: https://stat.gov.pl/en/topics/statistical-yearbooks/statistical-yearbooks/statistical-yearbook-of-agriculture-2022,6,17.html (accessed on 12 September 2023).

- Statista. Available online: https://www.statista.com/statistics/263077/per-capita-revenue-of-organic-foods-worldwide-since-2007/ (accessed on 25 September 2023).

- Homburg, C.; Koschate, N.; Hoyer, W.D. Do satisfied customers really pay more? A study of the relationship between customer satisfaction and willingness to pay. J. Mark. 2005, 69, 84–96. [Google Scholar] [CrossRef]

- Łuczka-Bakuła, W.; Smoluk-Sikorska, J. Porównanie poziomu cen warzyw ekologicznych i konwencjonalnych. J. Res. Appl. Agric. Eng. 2008, 53, 6–8. [Google Scholar]

- Park, C.H.; Kim, Y.G. Identifying key factors affecting consumer purchase behavior in an online shopping context. Int. J. Retail Distrib. Manag. 2003, 31, 16–29. [Google Scholar] [CrossRef]

- Albari, A.; Safitri, I. The Influence of Product Price on Consumers’Purchasing Decisions. Rev. Integr. Bus. Econ. Res. 2018, 7, 328–337. [Google Scholar]

- Wojciechowska-Solis, J.; Śmiglak-Krajewska, M. Being a product consumer during the COVID-19 pandemic: Profile of the Polish consumer in the organic dairy market. Br. Food J. 2023, 125, 2350–2367. [Google Scholar] [CrossRef]

- Rajasa, E.Z.; Manap, A.; Ardana, P.D.H.; Yusuf, M.; Harizahayu, H. Literature Review: Analysis of Factors Influencing Purchasing Decisions Product Quality and Competitive Pricing. J. Ekon. 2003, 12, 451–455. [Google Scholar]

- Devi, N.; Nana, S.; Canggih, G.F. The Influence of Price and Quality of Products on the Purchase Decision of Bread Products. eCo-Fin 2020, 2, 147–151. [Google Scholar]

- Kotler, P.; Keller, K.L. Marketing Management, 15th ed.; Pearson Prentice Hall: Hoboken, NJ, USA, 2016. [Google Scholar]

- Faith, D.O.; Agwu, M.E. A Review of the Effect of Pricing Strategies on the Purchase of Consumer Goods. Int. J. Res. Manag. Sci. Technol. 2014, 2, 88–102. [Google Scholar]

- Al-Mamun, A.; Rahman, M.K. A Critical Review of Consumers’ Sensitivity to Price: Managerial and Theoretical Issues. J. Int. Bus. Econ. 2014, 2, 01–09. [Google Scholar]

- Kotler, P.; Armstrong, G. Principles of Marketing, 15th ed.; Pearson Prentice Hall: Hoboken, NJ, USA, 2014. [Google Scholar]

- Zhang, Y. The Impact of Brand Image on Consumer Behavior: A Literature Review. Open J. Bus. Manag. 2015, 3, 58–62. [Google Scholar] [CrossRef]

- Temsnguanwong, S. OTOP Product Champion Marketing Strategy Model Which are Selected the Best OPC 5-Star Product Approach of Chiang Mai Province: The Fabric and Apparel Community, Thailand. Rev. Integr. Bus. Econ. Res. 2015, 4, 259–276. [Google Scholar]

- Komaladewi, R.; Indika, D. A Review of Consumer Purchase Decision on Low Cost Green Car in West Java, Indonesia. Rev. Integr. Bus. Econ. Res. 2017, 6, 172–184. [Google Scholar]

- Kotler, P.; Armstrong, G.; Ang, S.H.; Leong, S.M.; Tan, C.T.; HoMing, O. Principles of Marketing: An Asian Perspective; Pearson/Prentice-Hall: London, UK, 2012. [Google Scholar]

- Aschemann-Witzel, J.; Niebuhr Aagaard, E.M. Elaborating on the attitude–behaviour gap regarding organic products: Young Danish consumers and in-store food choice. Int. J. Consum. Stud. 2014, 38, 550–558. [Google Scholar] [CrossRef]

- ElHaffar, G.; Durif, F.; Dubé, L. Towards closing the attitude-intention-behavior gap in green consumption: A narrative review of the literature and an overview of future research directions. J. Clean. Prod. 2020, 275, 122556. [Google Scholar] [CrossRef]

- Carrigan, M.; Attalla, A. The Myth of the Ethical Consumer–Do Ethics Matter in Purchase Behaviour? J. Consum. Mark. 2001, 18, 560–577. [Google Scholar] [CrossRef]

- Carrington, M.; Neville, B.; Whitwell, G. Why Ethical Consumers Don’t Walk Their Talk: Towards a Framework for Understanding the GAP between the Ethical Purchase Intentions and Actual Buying Behaviour of Ethical Minded Consumer. J. Bus. Ethics 2010, 97, 139–158. [Google Scholar] [CrossRef]

- Terlau, W.; Hirsch, D. Sustainable consumption and the attitude-behaviour-gap phenomenon-causes and measurements towards a sustainable development. Proc. Food Syst. Dyn. 2015, 6, 199–214. [Google Scholar]

- Kennedy, P.W.; Laplante, B.; Maxwell, J. Pollution Policy: The Role for Publicly Provided Information. J. Environ. Econ. Manag. 1994, 26, 31–43. [Google Scholar] [CrossRef]

- Sammer, K.; Wüstenhagen, R. The influence of eco-labelling on consumer behavior—Results of a discrete choice analysis for washing machines. Bus. Strat. Environ. 2006, 15, 185–199. [Google Scholar] [CrossRef]

- Kucher, A.; Hełdak, M.; Kucher, L.; Raszka, B. Factors forming the consumers’ willingness to pay a price premium for ecological goods in Ukraine. Int. J. Environ. Res. Public Health 2019, 16, 859. [Google Scholar] [CrossRef]

- Pilarczyk, B.; Nestorowicz, R. Marketing Ekologicznych Produktów Żywnościowych; Oficyna Wolters Kluwer Polska: Warszawa, Poland, 2010. [Google Scholar]

- Zeithaml, V. Consumer Perceptions of Price, Quality, and Value: A Means-End Model and Synthesis of Evidence. J. Mark. 1988, 52, 2–22. [Google Scholar] [CrossRef]

- Łuczka, W.; Kalinowski, S. Barriers to the development of organic farming: A Polish case study. Agriculture 2020, 10, 536. [Google Scholar] [CrossRef]

- Śmiglak-Krajewska, M.; Wojciechowska-Solis, J. Consumer versus Organic Products in the COVID-19 Pandemic: Opportunities and Barriers to Market Development. Energies 2021, 14, 5566. [Google Scholar] [CrossRef]

- Padel, S.; Foster, C. Exploring the gap between attitudes and behaviour: Understanding why consumers buy or do not buy organic food. Br. Food J. 2005, 107, 606–625. [Google Scholar] [CrossRef]

- Waniowski, P. Znaczenie badań cen w procesie podejmowania decyzji marketingowych. Pr. Nauk. Akad. Ekon. We Wrocławiu 2003, 1004, 331–337. [Google Scholar]

- Moser, A.K. Thinking green, buying green? Drivers of pro-environmental purchasing behavior. J. Consum. Mark. 2015, 32, 167–175. [Google Scholar] [CrossRef]

- Grunert, K.G.; Juhl, H.J.; Esbjerg, L.; Jensen, B.B.; Bech-Larsen, T.; Brunso, K.; Madsen, C.O. Comparing Methods for Measuring Consumer Willingness to Pay for a Basic and an Improved Ready Made Soup Product. Food Qual. Prefer. 2009, 20, 607–619. [Google Scholar] [CrossRef]

- Witek, L. Ceny produktów ekologicznych a zachowania konsumentów. Handel Wewnętrzny 2018, 3, 406–414. [Google Scholar]

- Li, S.; Kallas, Z. Meta-analysis of consumers’ willingness to pay for sustainable food products. Appetite 2022, 163, 105239. [Google Scholar] [CrossRef]

- Kovacs, I.; Keresztes, E.R. Perceived Consumer Effectiveness and Willingness to Pay for Credence Product Attributes of Sustainable Foods. Sustainability 2022, 14, 4338. [Google Scholar] [CrossRef]

- Henson, S. Consumer willingness to pay for reductions in the risk of food poisoning in the UK. J. Agric. Econ. 1996, 47, 403–420. [Google Scholar] [CrossRef]

- Fillion, L.; Arazi, S. Does organic food taste better? A claim substantiation approach. Nutr. Food Sci. 2002, 32, 153–157. [Google Scholar] [CrossRef]

- Hamm, U.; Gronefeld, F.; Halpin, D. Analysis of the European Market for Organic Food: Organic Marketing Initiatives and Rural Development; School of Management and Business, University of Wales: Aberystwyth, UK, 2002. [Google Scholar]

- Loureiro, M.L.; McCluskey, J.J.; Mittelhammer, R.C. Assessing consumer preferences for organic, eco-labeled, and regular apples. J. Agric. Resour. Econ. 2001, 26, 404–416. [Google Scholar] [CrossRef]

- Cohen, S.F. Utility model of preventive behaviour. J. Epidemiol. Community Health 1984, 38, 61–65. [Google Scholar] [CrossRef]

- Pawlewicz, A. Change of Price Premiums Trend for Organic Food Products: The Example of the Polish Egg Market. Agriculture 2020, 10, 35. [Google Scholar] [CrossRef]

- Łuczka, W. The Changes on the Organic Food Market. J. Agribus. Rural Dev. 2016, 42, 597–605. [Google Scholar] [CrossRef]

- Łuczka, W. Changes in the behavior of organic food consumer. Ekon. I Sr. 2019, 3, 140–153. [Google Scholar]

- Rao, A.R.; Bergen, M.E. Price premium variations as a consequence of buyers’ lack of information. J. Consum. Res. 1992, 19, 412–423. [Google Scholar] [CrossRef]

- Poulston, J.; Yiu, A.Y.K. Profit or principles: Why do restaurants serve organic food? Int. J. Hosp. Manag. 2011, 30, 184–191. [Google Scholar] [CrossRef]

- Van der Veen, M. When is food a luxury? World Archaeol. 2003, 34, 405–427. [Google Scholar] [CrossRef]

- Halberg, N.; Peramaiyan, P.; Walaga, C. Is organic farming an unjustified luxury in a world with too many hungry people? In The World of Organic Agriculture. Statistics & Emerging Trends 2009; FiBL and IFOAM: Frick, Switzerland, 2009; pp. 95–100. [Google Scholar]

- Zhang, B.; Kim, J.-H. Luxury fashion consumption in China: Factors affecting attitude and purchase intent. J. Retail. Consum. Serv. 2013, 20, 68–79. [Google Scholar] [CrossRef]

- Salem, S.F.; Chaichi, K. Investigating causes and consequences of purchase intention of luxury fashion. Manag. Sci. Lett. 2018, 8, 1259–1272. [Google Scholar] [CrossRef]

- Brzeziński, J.; Stachowski, R. Zastosowanie Analizy Wariancji w Eksperymentalnych Badaniach Psychologicznych; Państwowe Wydawnictwo Naukowe: Warszawa, Poland, 1981. [Google Scholar]

- Sobczyk, M. Statystyka; Wydawnictwo Naukowe PWN: Warszawa, Poland, 2007. [Google Scholar]

- Żakowska-Biemans, S.; Górska-Warsewicz, H.; Świątkowska, M.; Krajewski, K.; Stangierska, D.; Szlachciuk, J.; Bobola, A.; Świstak, E.; Pieniak, Z.; Czmoch, M.; et al. Marketing, Promocja Oraz Analiza Rynku, Analiza Rynku Produkcji Ekologicznej w Polsce, w Tym Określenie Szans i Barier Dla Rozwoju Tego Sektora. 2017. Available online: http://wnzck.sggw.pl/wp-content/uploads/2015/08/Raport_MINROL_15_11_2017_upowsz.pdf (accessed on 14 September 2023).

- Smoluk-Sikorska, J. Szanse i Ograniczenia Rozwoju Rynku Żywności Ekologicznej w Polsce; Wydawnictwo Difin: Warszawa, Poland, 2021. [Google Scholar]

- Bryła, P. Organic food consumption in Poland: Motives and barriers. Appetite 2016, 105, 737–746. [Google Scholar] [CrossRef]

- Aschemann-Witzel, J.; Zielke, S. Can’t buy me green? A review of consumer perceptions of and behavior toward the price of organic food. J. Consum. Aff. 2007, 51, 211–251. [Google Scholar] [CrossRef]

- Roman, T.; Bostan, I.; Manolică, A.; Mitrica, I. Profile of green consumers in Romania in light of sustainability challenges and opportunities. Sustainability 2015, 7, 6394–6411. [Google Scholar] [CrossRef]

- Gotkiewicz, W.; Szafranek, R.C. Ecological farms as an element of the agricultural production market. Econ. Sci. 2000, 2, 29–39. [Google Scholar]

- Staniszewska, M. Rolnictwo ekologiczne w Polsce na początku XXI wieku. In Materiały I Ogólnopolskiej Młodzieżowej Konferencji Naukowej: Integracja z UE a Rolnictwo Ekologiczne i Ekoturystyka w Polsce na Początku XXI Wieku; Wyd. AR we Wrocławiu: Wrocław, Poland, 2001. [Google Scholar]

- Hermaniuk, T. Postawy i zachowania konsumentów na rynku ekologicznych produktów żywnościowych. Handel Wewnętrzny 2016, 2, 189–199. [Google Scholar]

- Götze, F.; Mann, S.; Ferjani, A.; Kohler, A.; Heckelei, T. Explaining market shares of organic food: Evidence from Swiss household data. Br. Food J. 2016, 118, 931–945. [Google Scholar] [CrossRef]

- Cichocka, I.; Grabiński, T. Psychograficzno-motywacyjna charakterystyka polskiego konsumenta żywności ekologicznej. Żywność. Nauka. Technologia. Jakość 2009, 5, 107–118. [Google Scholar]

- Łuczka-Bakuła, W. Przeobrażenia na rynku żywności ekologicznej. Przemysł Spożywczy 2004, 1, 11–14. [Google Scholar]

- Ahmed, N.; Thompson, S.; Turchini, G.M. Organic aquaculture productivity, environmental sustainability, and food security: Insights from organic agriculture. Food Secur. 2020, 12, 1253–1267. [Google Scholar] [CrossRef]

- Kihlberg, I.; Risvik, E. Consumers of organic foods—Value segments and liking of bread. Food Qual. Prefer. 2007, 18, 471–481. [Google Scholar] [CrossRef]

- De Boni, A.; Pasqualone, A.; Roma, R.; Acciani, C. Traditions, health and environment as bread purchase drivers: A choice experiment on high-quality artisanal Italian bread. J. Clean. Prod. 2019, 221, 249–260. [Google Scholar] [CrossRef]

- Hempel, C.; Hamm, U. Local and/or organic: A study on consumer preferences for organic food and food from different origins. Int. J. Consum. Stud. 2016, 40, 732–741. [Google Scholar] [CrossRef]

- Gil, J.M.; Gracia, A.; Sanchez, M. Market segmentation and willingness to pay for organic products in Spain. Int. Food Agribus. Manag. Rev. 2000, 3, 207–226. [Google Scholar] [CrossRef]

- Sellers, R. Would you pay a price premium for a sustainable wine? The voice of the Spanish consumer. Agric. Agric. Sci. Procedia 2016, 8, 10–16. [Google Scholar] [CrossRef]

- Yiridoe, E.K.; Bonti-Ankomah, S.; Martin, R.C. Comparison of consumer perceptions and preferences toward organic versus conventionally produced foods: A review and update of the literature. Renew. Agric. Food Syst. 2005, 20, 195–205. [Google Scholar] [CrossRef]

- Roitner-Schobesberger, B.; Darnhofer, I.; Somsook, S.; Vogl, C.R. Consumer perceptions of organic foods in Bangkok, Thailand. Food Policy 2008, 33, 112–121. [Google Scholar] [CrossRef]

- Shafie, F.A.; Rennie, D. Consumer perceptions towards organic food. Procedia-Soc. Behav. Sci. 2012, 49, 360–367. [Google Scholar] [CrossRef]

- Lindström, H. The Swedish consumer market for organic and conventional milk: A demand system analysis. Agribusiness 2022, 38, 505–532. [Google Scholar] [CrossRef]

- Bissinger, K.; Herrmann, R. Regional Origin Outperforms All Other Sustainability Characteristics in Consumer Price Premiums for Honey: Empirical Evidence for Germany. J. Econ. Integr. 2021, 36, 162–184. [Google Scholar] [CrossRef]

- Gayle, P.; Wang, J.; Fang, S. The Organic food price premium and its susceptibility to news media coverage: Evidence from the US milk industry. Appl. Econ. 2022, 55, 3296–3315. [Google Scholar] [CrossRef]

- Lee, M.; Von der Heidt, T.; Bradbury, J.; Gracea, S. How Much More to Pay? A Study of Retail Prices of Organic Versus Conventional Vegetarian Foods in an Australian Regional Area. J. Food Distrib. Res. 2021, 52, 46–62. [Google Scholar]

- Łuczka-Bakuła, W.; Smoluk-Sikorska, J. Poziom cen ekologicznych owoców i warzyw a rozwój rynku żywności ekologicznej (The organic fruit and vegetables price level and the development of organic food market). J. Res. Appl. Agric. Eng. 2010, 55, 12–14. [Google Scholar]

- Zientek-Varga, J. Ekorynek w Polsce–w stronę rozwoju. Fresk Cool. Marke. Branżowy Miesięcznik O Żywności 2009, 2, 18–25. [Google Scholar]

- Żakowska-Biemans, S. Polish consumer food choices and beliefs about organic food. Br. Food J. 2011, 113, 122–137. [Google Scholar] [CrossRef]

- Goryńska-Goldmann, E.; Gazdecki, M. Searching for and perception of information by consumers in the light of the sustainable consumption idea—On the example of food markets. Mark. Sci. Res. Organ. 2020, 36, 1–18. [Google Scholar] [CrossRef]

| Specification | Share |

|---|---|

| Gender | |

| Men | 27.71% |

| Women | 72.29% |

| Education level | |

| Basic | 0.78% |

| Vocational | 1.36% |

| Secondary | 61.82% |

| Higher | 36.05% |

| Place of residence | |

| Rural area | 40.50% |

| Town with less than 20.000 inhabitants | 14.34% |

| Town between 20,000 and 39,999 inhabitants | 7.95% |

| Town between 40,000 and 99,999 inhabitants | 6.40% |

| Town between 100,000 and 199,999 inhabitants | 2.71% |

| City over 200,000 inhabitants | 28.10% |

| Number of people in a household | |

| One | 8.53% |

| Two | 21.12% |

| Three | 19.38% |

| Four | 26.94% |

| Five | 14.15% |

| Six | 5.04% |

| Seven | 3.10% |

| Eight and more | 1.74% |

| Number of working people in a household | |

| Nobody works | 0.97% |

| One person works | 14.53% |

| Two people work | 50.19% |

| Three people work | 22.48% |

| Four people work | 8.91% |

| Five and more people work | 2.91% |

| Specification | Total | Women | Men | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1-Not Important at All, …, 5-Very Important [%] | Mean | Median | Mode | Mean | Median | Mode | Mean | Median | Mode | |||||

| 1 | 2 | 3 | 4 | 5 | ||||||||||

| High price | 6.17 | 10.49 | 20.99 | 16.67 | 45.68 | 3.85 | 4.00 | 5.00 | 3.74 | 4.00 | 5.00 | 4.08 | 5.00 | 5.00 |

| Bad taste | 29.63 | 23.46 | 22.84 | 9.26 | 14.81 | 2.56 | 2.00 | 1.00 | 2.65 | 3.00 | 1.00 | 2.38 | 2.00 | 1.00 |

| Short expiry date | 20.37 | 23.46 | 30.86 | 14.81 | 10.49 | 2.72 | 3.00 | 3.00 | 2.69 | 3.00 | 3.00 | 2.77 | 3.00 | 3.00 |

| Narrow offer | 20.37 | 18.52 | 30.25 | 21.60 | 9.26 | 2.81 | 3.00 | 3.00 | 2.65 | 3.00 | 3.00 | 3.13 | 3.00 | 3.00 |

| Low availability | 13.58 | 22.22 | 31.48 | 15.43 | 17.28 | 3.01 | 3.00 | 3.00 | 2.94 | 3.00 | 3.00 | 3.15 | 3.00 | 3.00 |

| Little information on organic food | 17.90 | 19.14 | 32.10 | 17.28 | 13.58 | 2.90 | 3.00 | 3.00 | 2.67 | 3.00 | 3.00 | 3.36 | 3.00 | 3.00 |

| Low credibility | 19.75 | 22.22 | 34.57 | 14.20 | 9.26 | 2.71 | 3.00 | 3.00 | 2.61 | 3.00 | 3.00 | 2.91 | 3.00 | 3.00 |

| Unattractive appearance | 33.95 | 22.84 | 24.69 | 9.88 | 8.64 | 2.36 | 2.00 | 1.00 | 2.28 | 2.00 | 1.00 | 2.55 | 3.00 | 1.00 |

| I cannot recognize it | 32.72 | 20.37 | 29.63 | 9.26 | 8.02 | 2.40 | 2.00 | 1.00 | 2.17 | 2.00 | 1.00 | 2.87 | 3.00 | 3.00 |

| Poor promotion | 26.54 | 17.90 | 31.48 | 12.35 | 11.73 | 2.65 | 3.00 | 3.00 | 2.33 | 2.00 | 1.00 | 3.30 | 3.00 | 3.00 |

| Specification | Total | Women | Men | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in %) | Mean | Median | Mode | Mean | Median | Mode | Mean | Median | Mode | |||||

| 1 | 2 | 3 | 4 | 5 | ||||||||||

| Greater availability | 6.79 | 9.88 | 24.69 | 22.22 | 36.42 | 3.72 | 4.00 | 5.00 | 3.70 | 4.00 | 5.00 | 3.75 | 4.00 | 5.00 |

| Lower price | 3.70 | 9.26 | 13.58 | 22.22 | 51.23 | 4.08 | 5.00 | 5.00 | 4.07 | 4.00 | 5.00 | 4.09 | 5.00 | 5.00 |

| A wider offer | 7.41 | 8.02 | 22.84 | 25.93 | 35.80 | 3.75 | 4.00 | 5.00 | 3.72 | 4.00 | 5.00 | 3.79 | 4.00 | 5.00 |

| More accessible information about these foods | 8.02 | 14.20 | 29.01 | 19.75 | 29.01 | 3.48 | 3.00 | 3.00 | 3.39 | 3.00 | 3.00 | 3.66 | 4.00 | 5.00 |

| More ecological packaging | 18.52 | 13.58 | 32.10 | 18.52 | 17.28 | 3.02 | 3.00 | 3.00 | 3.11 | 3.00 | 3.00 | 2.85 | 3.00 | 3.00 |

| A wider range of convenience foods | 11.73 | 13.58 | 22.22 | 27.16 | 25.31 | 3.41 | 4.00 | 4.00 | 3.39 | 4.00 | 5.00 | 3.45 | 4.00 | 4.00 |

| Higher income | 6.79 | 9.88 | 17.28 | 17.28 | 48.77 | 3.91 | 4.00 | 5.00 | 3.83 | 4.00 | 5.00 | 4.08 | 5.00 | 5.00 |

| Market information regarding, e.g., sales places | 11.11 | 15.43 | 28.40 | 19.75 | 25.31 | 3.33 | 3.00 | 3.00 | 3.32 | 3.00 | 3.00 | 3.34 | 3.00 | 3.00 |

| Wider promotion | 9.26 | 19.75 | 25.31 | 21.60 | 24.07 | 3.31 | 3.00 | 3.00 | 3.30 | 3.00 | 5.00 | 3.34 | 3.00 | 3.00 |

| Specification | Total | Women | Men |

|---|---|---|---|

| Organic food is expensive | 88.27% | 83.49% | 98.11% |

| Organic food is not expensive | 11.73% | 16.51% | 1.89% |

| Specification | Total | Women | Men | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 1 | 2 | 3 | 4 | 5 | 6 | 1 | 2 | 3 | 4 | 5 | 6 | |

| Fruits | 2.21 | 13.97 | 33.82 | 28.68 | 15.44 | 5.88 | 2.30 | 13.79 | 40.23 | 24.14 | 12.64 | 6.90 | 2.08 | 14.58 | 20.83 | 37.50 | 20.83 | 4.17 |

| Vegetables | 2.21 | 11.76 | 37.50 | 28.68 | 16.91 | 4.41 | 2.30 | 12.64 | 41.38 | 25.29 | 14.94 | 4.60 | 2.08 | 10.42 | 29.17 | 35.42 | 22.92 | 4.17 |

| Fruit products | 1.47 | 6.62 | 30.15 | 33.09 | 19.12 | 9.56 | 1.15 | 8.05 | 31.03 | 33.33 | 17.24 | 10.34 | 2.08 | 4.17 | 29.17 | 33.33 | 22.92 | 8.33 |

| Vegetable products | 1.47 | 6.62 | 34.56 | 30.15 | 16.91 | 10.29 | 1.15 | 6.90 | 36.78 | 33.33 | 13.79 | 10.34 | 2.08 | 6.25 | 31.25 | 25.00 | 22.92 | 10.42 |

| Meat | 2.94 | 5.15 | 19.12 | 28.68 | 33.82 | 11.03 | 2.30 | 8.05 | 20.69 | 26.44 | 31.03 | 12.64 | 4.17 | 0.00 | 16.67 | 31.25 | 39.58 | 8.33 |

| Cold cuts | 2.94 | 6.62 | 17.65 | 31.62 | 29.41 | 12.50 | 2.30 | 9.20 | 20.69 | 28.74 | 27.59 | 13.79 | 4.17 | 2.08 | 12.50 | 35.42 | 33.33 | 10.42 |

| Dairy products | 2.21 | 9.56 | 30.88 | 28.68 | 18.38 | 8.82 | 1.15 | 14.94 | 32.18 | 28.74 | 13.79 | 9.20 | 4.17 | 0.00 | 27.08 | 29.17 | 27.08 | 8.33 |

| Eggs | 3.68 | 12.50 | 36.76 | 18.38 | 20.59 | 8.82 | 3.45 | 16.09 | 39.08 | 17.24 | 14.94 | 10.34 | 4.17 | 6.25 | 35.42 | 20.83 | 29.17 | 6.25 |

| Fish, seafood | 3.68 | 2.94 | 19.12 | 22.79 | 36.03 | 16.91 | 3.45 | 4.60 | 21.84 | 21.84 | 34.48 | 18.39 | 4.17 | 0.00 | 16.67 | 25.00 | 37.50 | 14.58 |

| Cereal products | 5.88 | 12.50 | 33.82 | 27.94 | 12.50 | 8.82 | 4.60 | 18.39 | 36.78 | 26.44 | 9.20 | 8.05 | 8.33 | 2.08 | 29.17 | 35.42 | 18.75 | 10.42 |

| Bread | 2.21 | 13.24 | 27.21 | 22.79 | 23.53 | 11.03 | 1.15 | 19.54 | 31.03 | 19.54 | 19.54 | 11.49 | 4.17 | 2.08 | 18.75 | 29.17 | 31.25 | 10.42 |

| Sweets, snacks | 2.94 | 11.76 | 30.88 | 26.47 | 18.38 | 10.29 | 2.30 | 16.09 | 36.78 | 20.69 | 17.24 | 9.20 | 4.17 | 4.17 | 20.83 | 35.42 | 20.83 | 12.50 |

| Spices, herbs | 5.15 | 16.18 | 33.09 | 22.06 | 13.24 | 12.50 | 5.75 | 22.99 | 34.48 | 17.24 | 11.49 | 11.49 | 4.17 | 4.17 | 31.25 | 31.25 | 18.75 | 14.58 |

| Tea, coffee | 5.88 | 12.50 | 26.47 | 22.06 | 21.32 | 11.76 | 5.75 | 16.09 | 27.59 | 21.84 | 20.69 | 11.49 | 6.25 | 6.25 | 27.08 | 22.92 | 25.00 | 12.50 |

| Vegetable fats (oils) | 4.41 | 5.88 | 30.88 | 22.79 | 25.00 | 11.76 | 3.45 | 8.05 | 35.63 | 20.69 | 24.14 | 11.49 | 6.25 | 2.08 | 27.08 | 27.08 | 27.08 | 12.50 |

| Honey | 1.47 | 7.35 | 27.94 | 24.26 | 29.41 | 11.03 | 1.15 | 8.05 | 28.74 | 22.99 | 28.74 | 12.64 | 2.08 | 6.25 | 27.08 | 27.08 | 31.25 | 8.33 |

| Baby food | 5.88 | 8.09 | 23.53 | 18.38 | 22.79 | 21.32 | 6.90 | 10.34 | 26.44 | 17.24 | 22.99 | 18.39 | 4.17 | 4.17 | 18.75 | 20.83 | 22.92 | 27.08 |

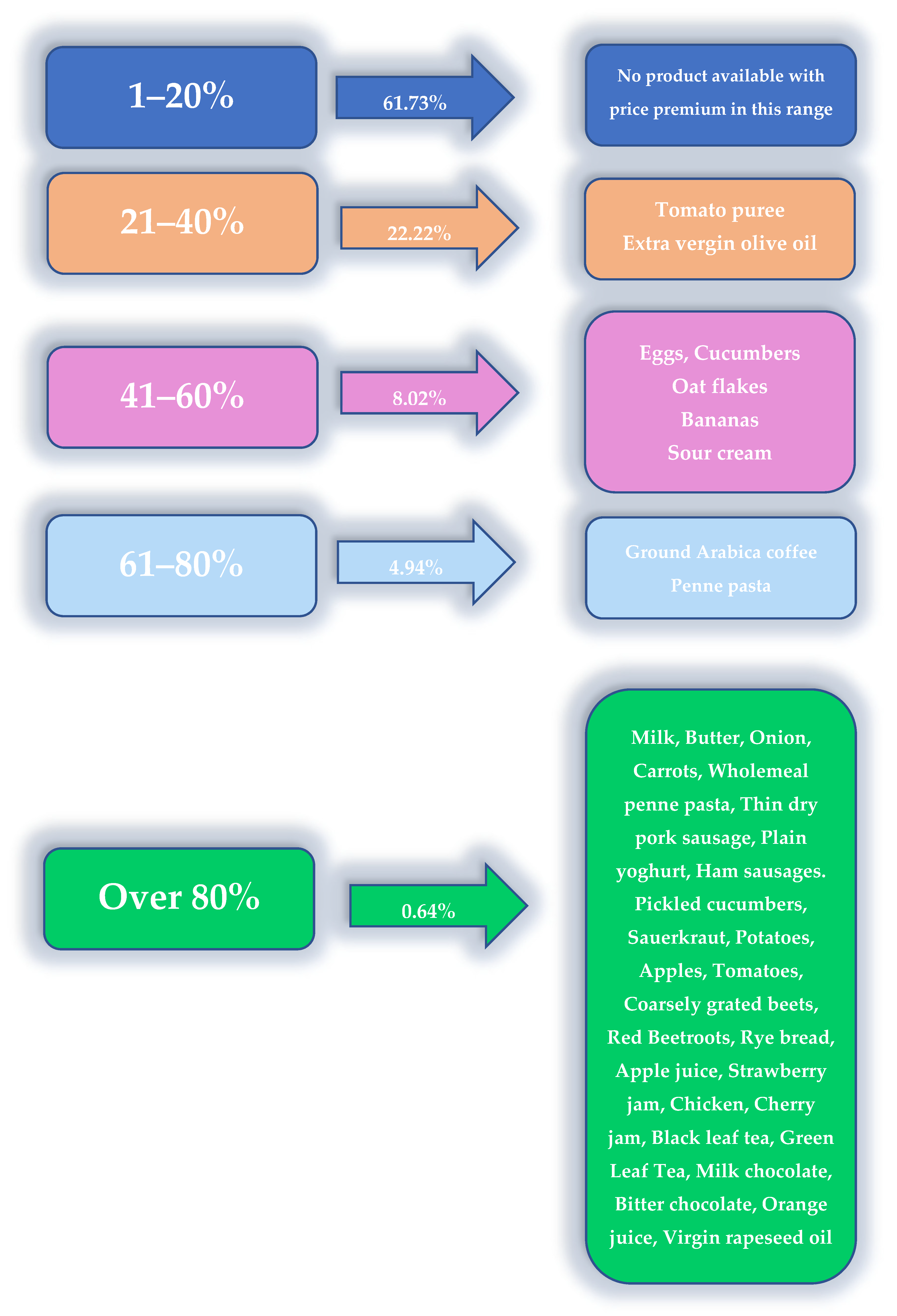

| Premium Range | Total | Women | Men |

|---|---|---|---|

| 1–10% | 24.69% | 22.02% | 30.19% |

| 11–20% | 37.04% | 35.78% | 39.62% |

| 21–40% | 22.22% | 23.85% | 18.87% |

| 41–60% | 8.02% | 9.17% | 5.66% |

| 61–80% | 4.94% | 7.34% | 0.00% |

| Over 80% | 0.62% | 0.92% | 0.00% |

| I am not willing to pay more for this food | 2.47% | 0.92% | 5.66% |

| Product Group | Share of the Respondents who Evaluated the Given Organic Product Group as High or Very High (%) | Specific Product in a Given Product Group | Price Premium (%) |

|---|---|---|---|

| Eggs | 38.97 | Eggs 10 pcs. | 40.04 |

| Cereal products | 40.44 | Oat flakes 500 g | 56.87 |

| Penne pasta 500 g | 70.90 | ||

| Whole meal penne pasta 500 g | 87.89 | ||

| Tea, coffee | 43.38 | Ground arabica coffee 100% 250 g | 66.58 |

| Green leaf tea 100 g | 273.62 | ||

| Black leaf tea 100 g | 198.04 | ||

| Fruit | 44.12 | Apples 1 kg | 118.58 |

| Bananas 1 kg | 58.88 | ||

| Candies | 44.85 | Bitter chocolate 100 g | 222.01 |

| Milk chocolate 100 g | 208.62 | ||

| Vegetables | 45.59 | Potatoes 1 kg | 115.92 |

| Onions 1 kg | 85.49 | ||

| Tomatoes 1 kg | 122.17 | ||

| Cucumbers 1 kg | 47.21 | ||

| Red beetroots 1 kg | 145.88 | ||

| Carrots 1 kg | 85.79 | ||

| Bread | 46.32 | Rye bread 1 kg | 151.22 |

| Vegetable products | 47.06 | Tomato puree 500 g | 35.25 |

| Coarsely grated beets 480 g | 141.18 | ||

| Sour cucumbers 900 g | 109.52 | ||

| Sauerkraut 1 kg | 112.92 | ||

| Dairy products | 47.06 | Milk 1 L | 82.43 |

| Butter 200 g | 85.09 | ||

| Plain yogurt 180 g | 95.41 | ||

| Sour cream 18% 200 g | 59.21 | ||

| Plant oils | 47.79 | Extra virgin rapeseed oil 500 mL | 248.34 |

| Extra virgin olive oil 500 mL | 39.67 | ||

| Fruit products | 52.21 | Strawberry jam 250 g | 161.45 |

| Cherry jam 250 g | 193.13 | ||

| Apple juice 1 L | 158.37 | ||

| Orange juice 1 L | 212.23 | ||

| Meat, cold cuts | 62.50 | Chicken 1 kg | 164.67 |

| Ham sausages 200 g | 106.08 | ||

| Thin dry pork sausages 20 g | 93.64 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Smoluk-Sikorska, J.; Śmiglak-Krajewska, M.; Rojík, S.; Fulnečková, P.R. Prices of Organic Food—The Gap between Willingness to Pay and Price Premiums in the Organic Food Market in Poland. Agriculture 2024, 14, 17. https://doi.org/10.3390/agriculture14010017

Smoluk-Sikorska J, Śmiglak-Krajewska M, Rojík S, Fulnečková PR. Prices of Organic Food—The Gap between Willingness to Pay and Price Premiums in the Organic Food Market in Poland. Agriculture. 2024; 14(1):17. https://doi.org/10.3390/agriculture14010017

Chicago/Turabian StyleSmoluk-Sikorska, Joanna, Magdalena Śmiglak-Krajewska, Stanislav Rojík, and Pavlína Rojík Fulnečková. 2024. "Prices of Organic Food—The Gap between Willingness to Pay and Price Premiums in the Organic Food Market in Poland" Agriculture 14, no. 1: 17. https://doi.org/10.3390/agriculture14010017

APA StyleSmoluk-Sikorska, J., Śmiglak-Krajewska, M., Rojík, S., & Fulnečková, P. R. (2024). Prices of Organic Food—The Gap between Willingness to Pay and Price Premiums in the Organic Food Market in Poland. Agriculture, 14(1), 17. https://doi.org/10.3390/agriculture14010017