Are Small Agricultural Markets Recipients of World Prices? The Case of Poland

Abstract

:1. Introduction

- Q1. Is the Polish agricultural market a recipient of prices from the world market?

- Q2. Is the price volatility of the domestic market of agricultural raw materials higher or lower than the price volatility of world markets?

2. Materials and Methods

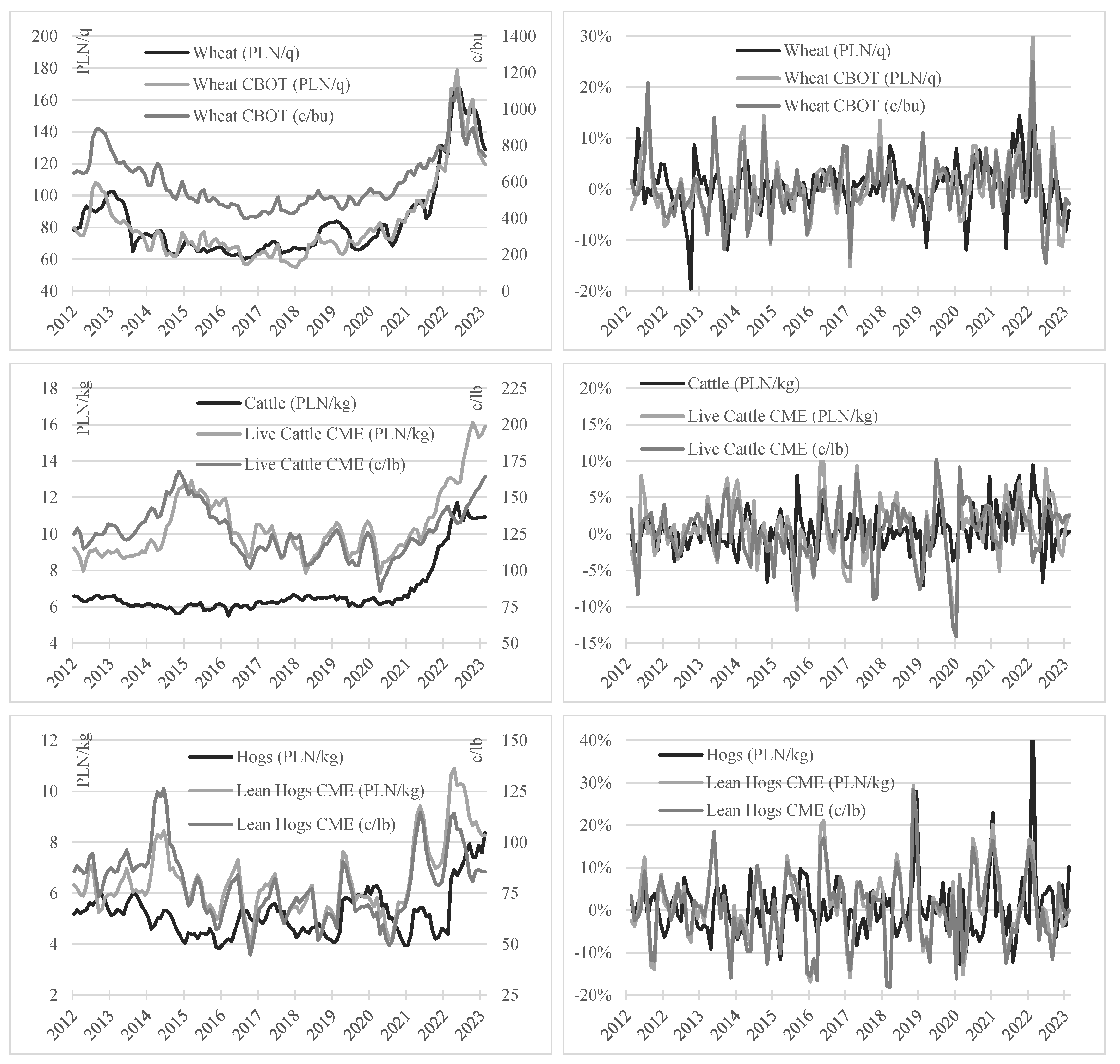

- Wheat (in PLN/q); (q = 0.1 kg).

- Cattle (in PLN/kg).

- Hogs (in PLN/kg).

- Wheat CBOT (c/bu); (c = 0.01 USD; bu = 27.216 kg for wheat).

- Live cattle CME (c/lb); (1 lb = 0.454 kg).

- Lean hogs CME (c/lb).

- Wheat CBOT (in PLN/q).

- Live cattle CME (in PLN/kg).

- Lean hogs CME (in PLN/kg).

- Graphical presentation of time series of agricultural commodity prices and their rates of return along with descriptive statistics:

- Time series of prices—mean, standard deviation, coefficient of variation;

- Time series of returns—standard deviation, minimum, maximum.

- A simple correlation study:

- Analysis of Pearson’s linear correlation coefficient rXY between domestic and world agricultural commodity prices;

- Spearman RXY rank coefficient analysis between domestic and world agricultural commodity prices;

- Determining the degree of curvilinearity of domestic and world prices of agricultural raw materials:

- Granger causality study between domestic and world prices of agricultural commodities. The idea of Granger causality is based on Equation [50]:

3. Results

3.1. Shaping Prices and Rates of Return of Agricultural Commodities

3.2. Correlations of Prices and Rates of Return of Agricultural Raw Materials

3.3. Causality in the Market of Agricultural Commodities

- Poland’s current wheat returns are strongly influenced by the 1-month lagged global wheat returns (t-Stat = 2.9043) and by their own lags (t-Stat = 3.5442).

- No significant impact of the rates of return for wheat in Poland on the rates of return for wheat in the world is clearly visible (t-Stat = −1.6529); global wheat returns are significantly influenced by their own lags (t-Stat = 4.5517).

- Comparing the values of the regression coefficients, the following can be seen:

- -

- For the wheat model in Poland, the regression coefficients of lagged 1-month returns are 0.3345 for Poland, and 0.2182 for the world; so, the coefficient for the world is slightly weaker than for Poland, and the same direction of influence is revealed;

- -

- For the wheat model in the world, the regression coefficients of the rates of return lagged by 1 month are −0.1887 for Poland, and 0.4137 for the world; so, the rates of return in the world do not clearly depend on Poland, but are subject to autocorrelation;

- -

- The significance of the returns lagged by 2 months is clearly weaker than for the returns lagged by 1 month, and their regression coefficients are mostly closer to 0.

- The current rates of return for live cattle in Poland are independent of their lags (t-Stat = −0.0118) and of the lags of rates of return for live cattle worldwide (t-Stat = 1.0419);

- The current rates of return for live cattle in the world depend only on their lags (t-Stat = 6.4481); the lagged rates of return in Poland are not affected here (t-Stat = 0.1966);

- Comparing the values of the regression coefficients, the following can be seen:

- -

- For the cattle model in Poland, the regression coefficients for all of the delays are very close to 0; so, the influence of the world on the rates of return in Poland is not revealed;

- -

- For the global cattle model, the regression coefficients of return rates delayed by 1 month are 0.0213 for Poland and 0.5519 for the world; so, the rates of return in the world do not depend on Poland, but are subject to autocorrelation.

- The current pig livestock returns in Poland are independent of their lags (t-Stat = 1.3232), but dependent on the lags of global returns (a t-Stat of 3.0280 was obtained); so, this is an unprecedented situation even for the wheat market, where the influence of both its lags and the world was revealed;

- The current global pig livestock returns are only dependent on their lags (t-Stat = 6.4894); there is no effect of lagged returns in Poland here (t-Stat = −0.1102);

- Comparing the values of the regression coefficients, the following can be seen:

- -

- For the pig livestock model in Poland, the regression coefficients of 1-month lagged returns in the world are about two times larger than for 1-month lagged returns in Poland, at 0.2391 and 0.1191, respectively; so, it is an unexpected situation that the world market returns dominate so strongly over domestic returns;

- -

- For the pig livestock model in the world, the regression coefficients of the rates of return lagged by 1 month are −0.0107 for Poland, and 0.5553 for the world; so, the rates of return in the world do not depend on Poland, but are subject to autocorrelation.

- Wheat, which showed strong correlations, is subject to one-sided causal dependence from the world market to the Polish market;

- Live cattle, which showed average correlation relationships, did not show significant causal relationships;

- Pig livestock, which did not show very strong correlations, is subject, like wheat, to a one-way causal relationship from the world market to the Polish market.

4. Discussion

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Maslow, A. A Theory of Human Motivation. Psychol. Rev. 1943, 7, 370–396. [Google Scholar] [CrossRef] [Green Version]

- Bachev, H. Needs, Modes and Efficiency of Economic Organizations and Public Interventions in Agriculture; University Library of Munich: Munich, Germany, 2010. [Google Scholar]

- Pierre, G.; Kaminski, J. Cross country maize market linkages in Africa: Integration and price transmission across local and global market. Agric. Econ. 2019, 50, 79–90. [Google Scholar] [CrossRef]

- Wiedenmann, S.; Geldermann, J. Supply planning for processors of agricultural raw materials. Eur. J. Oper. Res. 2015, 242, 606–619. [Google Scholar] [CrossRef]

- Emback, A.; Raquet, V. The Story Behind Commodity Price Changes—Causes and Implications; Copenhagen Business School: Frederiksberg, Denmark, 2011. [Google Scholar]

- Flassbeck, H.; Bichetti, D.; Mayer, J.; Rietzler, K. Price Formation in Financialized Commodity Markets: The Role of Information; United Nations Publications; United Nations Conference on Trade and Development (UNCTAD): Geneva, Switzerland, 2011. [Google Scholar]

- Kaltalioglu, M.; Soytas, M. Volatility spillover from oil to food and agricultural raw material markets. Mod. Econ. 2011, 2, 71–76. [Google Scholar] [CrossRef] [Green Version]

- Nayyar, S.; Dreier, L. Shaping the Future of Global Food Systems: A Scenarios Analysis, A report by the World Economic Forum’s System Initiative on Shaping the Future of Food Security and Agriculture; World Economic Forum: Cologny, Switzerland, 2017. [Google Scholar]

- Petrunina, I.V.; Gorbunowa, N.A.; Zakharov, A.N. Assessment of causes and consequences of food and agricultural raw material loss and opportunities for its reduction. Theory Pract. Meat Process. 2023, 8, 51–61. [Google Scholar] [CrossRef]

- Prakash, A. Safeguarding Food Security in Volatile Global Markets; Food and Agriculture Organization of the United Nations: Rome, Italy, 2011. [Google Scholar]

- Kusz, D.; Kusz, B.; Hydzik, P. Changes in the Price of Food and Agricultural Raw Materials in Poland in the Context of the European Union Accession. Sustainability 2022, 14, 4582. [Google Scholar] [CrossRef]

- Gill, G.J. Seasonality and Agriculture: A Problem for the Poor and Powerless; Cambridge University Press: Cambridge, UK, 1991; p. 343. [Google Scholar]

- Beckert, J. Where do prices come from? Sociological approaches to price formation. Socio-Econ. Rev. 2011, 9, 757–786. [Google Scholar] [CrossRef]

- Baumol, W.J. The Free-Market Innovation Machine: Analyzing the Growth Miracle of Capitalism; Princeton University Press: Princeton, NJ, USA, 2002. [Google Scholar]

- Tarasovych, L. Price policy in the marketing system of agricultural enterprises. Manag. Theory Stud. Rural. Bus. Infrastruct. Dev. 2014, 36, 672–678. [Google Scholar] [CrossRef] [Green Version]

- Gernah, D.I.; Ukeyima, M.T.; Ikya, J.K.; Ode, F.K.; Ogunbande, B.J. Addressing food security challenges through agro raw materials processing. Agric. Sci. Res. J. 2013, 3, 6–13. [Google Scholar]

- Huchet-Bourdon, M. Agricultural Commodity Price Volatility: An Overview; OECD: Paris, France, 2011. [Google Scholar]

- Borychowski, M.; Czyżewski, A. Determinants of prices increase of agricultural commodities in a global context. Management 2015, 19, 152. [Google Scholar] [CrossRef] [Green Version]

- Fukase, E.; Martin, W. Economic growth, convergence, and world food demand and supply. World Dev. 2020, 132, 104954. [Google Scholar] [CrossRef]

- Gao, G. World food demand. Am. J. Agric. Econ. 2012, 94, 25–51. [Google Scholar] [CrossRef]

- Valin, H.; Sands, R.D.; van der Mensbrugghe, D.; Nelson, G.C.; Ahammad, H.; Blanc, E.; Bodirsky, B.; Fujimori, S.; Hasegawa, T.; Havlik, P.; et al. The future of food demand: Understanding differences in global economic models. Agric. Econ. 2014, 45, 51–67. [Google Scholar] [CrossRef]

- Cho, G.; Sheldon, I.M.; McCorriston, S. Exchange rate uncertainty and agricultural trade. Am. J. Agric. Econ. 2002, 84, 931–942. [Google Scholar] [CrossRef]

- Kandilov, I.T. The effects of exchange rate volatility on agricultural trade. Am. J. Agric. Econ. 2008, 90, 1028–1043. [Google Scholar] [CrossRef]

- Chavas, J.P.; Nauges, C. Uncertainty, learning, and technology adoption in agriculture. Appl. Econ. Perspect. Policy 2020, 42, 42–53. [Google Scholar] [CrossRef] [Green Version]

- Sun, T.-T.; Su, C.-W.; Mirza, N.; Umar, M. How does trade policy uncertainty affect agriculture commodity prices? Pac.-Basin Financ. J. 2021, 66, 101514. [Google Scholar] [CrossRef]

- Algieri, B. Conditional price volatility, speculation, and excessive speculation in commodity markets: Sheep or shepherd behaviour? Int. Rev. Appl. Econ. 2016, 30, 210–237. [Google Scholar] [CrossRef]

- Algieri, B.; Kalkuhl, M.; Koch, N. A tale of two tails: Explaining extreme events in financialized agricultural markets. Food Policy 2017, 69, 256–269. [Google Scholar] [CrossRef]

- Gilbert, C.L.; Pfuderer, S. The role of index trading in price formation in the grains and oilseeds markets. J. Agric. Econ. 2014, 65, 303–322. [Google Scholar] [CrossRef] [Green Version]

- Mayer, D. The Growing Interdependence between Financial and Commodity Markets; United Nations Conference on Trade and Development (UNCTAD): Geneva, Switzerland, 2009. [Google Scholar]

- Sierra, L.P.; Girón, L.E.; Girón, V.; Girón, A. What is the spillover effect of the US equity and money market on the key Latin American agricultural exports? Glob. Econ. J. 2018, 18, 20180060. [Google Scholar] [CrossRef]

- Brzozowska, A.; Bubel, D.; Kalinichenko, A.; Nekrasenko, L. Transformation of the agricultural financial system in the age of globalisation. Agric. Econ. 2017, 63, 548–558. [Google Scholar] [CrossRef] [Green Version]

- Adeleke, M.A.; Awodumi, O.B. Modelling time and frequency connectedness among energy, agricultural raw materials and food markets. J. Appl. Econ. 2022, 25, 644–662. [Google Scholar] [CrossRef]

- Basu, P.; Gavin, W.T. What Explains the Growth in Commodity Derivatives? Federal Reserve Bank of St. Louis: St. Louis, MO, USA, 2011. [Google Scholar]

- Schmitt Olabisi, L.; Ugochukwu Onyeneke, R.; Prince Choko, O.; Nwawulu Chiemela, S.; Liverpool-Tasie, L.S.O.; Ifeyinwa Achike, A.; Ayo Aiyeloja, A. Scenario Planning for Climate Adaptation in Agricultural Systems. Agriculture 2020, 10, 274. [Google Scholar] [CrossRef]

- Broll, U.; Welzei, P.; Wong, K.P. Price risk and risk management in agriculture. Contemp. Econ. 2013, 7, 17–20. [Google Scholar] [CrossRef] [Green Version]

- Abuselidze, G.; Alekseieva, K.; Kovtun, O.; Kostiuk, O.; Karpenko, L. Application of Hedge Technologies to Minimize Price Risks by Agricultural Producers. In XIV International Scientific Conference INTERAGROMASH 2021 Precision Agriculture and Agricultural Machinery Industry; Springer International Publishing: Cham, Switzerland, 2021; Volume 1, pp. 906–915. [Google Scholar]

- Staritz, C. Financial Markets and the Commodity Price Boom: Causes and Implications for Developing Countries; Austrian Research Foundation for International Development: Vienna, Austria, 2012; Working Paper 30. [Google Scholar]

- Girardi, D. A Brief Essay on the Financialization of Agricultural Commodity Markets; Munich Personal RePEC Archive, Paper No. 44771; University of Siena: Siena, Italy, 2012. [Google Scholar]

- Serra, T.; Zilberman, D. Price volatility in ethanol markets. Eur. Rev. Agric. Econ. 2011, 38, 259–280. [Google Scholar] [CrossRef] [Green Version]

- Tyner, W.E.; Taheripour, F. Policy Options for Integrated Energy and Agricultural Markets. Rev. Agric. Econ. 2008, 30, 387–396. [Google Scholar] [CrossRef]

- Tyner, W.E. The Integration of Energy and Agricultural Markets. Agric. Econ. 2010, 41, 193–201. [Google Scholar] [CrossRef]

- Manandhar, A.; Milindi, P.; Shah, A. An overview of the post-harvest grain storage practices of smallholder farmers in developing countries. Agriculture 2018, 8, 57. [Google Scholar] [CrossRef] [Green Version]

- Wright, B.D. The economics of grain price volatility. Appl. Econ. Perspect. Policy 2011, 33, 32–58. [Google Scholar] [CrossRef] [Green Version]

- Kenkel, P. Economics of grain storage. In Storage of Cereal Grains and Their Products; Woodhead Publishing: Sawston, UK, 2022; pp. 687–696. [Google Scholar]

- Protopapadakis, A.; Stoll, H.R. Spot and futures prices and the law of one price. J. Financ. 1983, 38, 1431–1455. [Google Scholar] [CrossRef]

- Jerzak, M. Towarowe instrumenty pochodne w zarządzaniu ryzykiem cenowym w rolnictwie. Rocz. Nauk. Ekon. Rol. I Rozw. Obsz. Wiej. 2014, 101, 78–84. [Google Scholar]

- Barrett, C.B. Measuring integration and efficiency in international agricultural markets. Appl. Econ. Perspect. Policy 2001, 23, 19–32. [Google Scholar] [CrossRef]

- Fox, S. Open prosperity: How latent realities arising from virtual-social-physical convergence (VSP) increase opportunities for global prosperity. Technol. Soc. 2016, 44, 92–103. [Google Scholar] [CrossRef]

- Pigman, G.A. Trade Diplomacy Transformed: Why Trade Matters for Global Prosperity; Lulu.com: Morrisville, NC, USA, 2016. [Google Scholar]

- Granger, C.W.J. Investigating causal relations by econometric models and cross-spectral methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Lopez, L.; Weber, S. Testing for Granger causality in panel data. Stata J. 2017, 17, 972–984. [Google Scholar] [CrossRef] [Green Version]

- Labys, W.C. Modeling and Forecasting Primary Commodity Prices; Ashgate Publishing, Ltd.: Farnham, UK, 2006. [Google Scholar]

- Kurpayanidi, K.I. On the problem of macroeconomic analysis and forecasting of the economy. Theor. Appl. Sci. 2020, 3, 1–6. [Google Scholar] [CrossRef]

- Kiryluk-Dryjska, E.; Baer-Nawrocka, A. Reforms of the Common Agricultural Policy of the EU: Expected results and their social acceptance. J. Policy Model. 2019, 41, 607–622. [Google Scholar] [CrossRef]

- Garrone, M.; Emmers, D.; Olper, A.; Swinnen, J. Jobs and agricultural policy: Impact of the common agricultural policy on EU agricultural employment. Food Policy 2019, 87, 101744. [Google Scholar] [CrossRef] [Green Version]

- Moreira, F.; Peter, G. Agricultural policy can reduce wildfires. Science 2018, 359, 1001. [Google Scholar] [CrossRef] [PubMed]

- Moschini, G.; Hennessy, D.A. Uncertainty, risk aversion, and risk management for agricultural producers. Handb. Agric. Econ. 2001, 1, 87–153. [Google Scholar]

- Aimin, H. Uncertainty, risk aversion and risk management in agriculture. Agric. Agric. Sci. Procedia 2010, 1, 152–156. [Google Scholar] [CrossRef] [Green Version]

- Janowski, A. CSR in Management Sciences: Is It “a Road to Nowhere”? Economies 2021, 9, 198. [Google Scholar] [CrossRef]

- Bureau, J.C.; Swinnen, J. EU policies and global food security. Glob. Food Secur. 2018, 16, 106–115. [Google Scholar] [CrossRef]

- Pawlak, K. Competitiveness of the EU Agri-Food Sector on the US Market: Worth Reviving Transatlantic Trade? Agriculture 2022, 12, 23. [Google Scholar] [CrossRef]

- Przekota, G. Do High Fuel Prices Pose an Obstacle to Economic Growth? A Study for Poland. Energies 2022, 15, 6606. [Google Scholar] [CrossRef]

- Broz, J.L.; Werfel, S.H. Exchange rates and industry demands for trade protection. Int. Organ. 2014, 68, 393–416. [Google Scholar] [CrossRef] [Green Version]

- Bilewicz, A.; Mamonova, N.; Burdyka, K. “Paradoxical” Dissatisfaction among Post-Socialist Farmers with the EU’s Common Agricultural Policy: A Study of Farmers’ Subjectivities in Rural Poland. East Eur. Politics Soc. 2022, 36, 892–912. [Google Scholar] [CrossRef]

- Farmer, A.D. “Somebody Has to Pay”: Audley Moore and the Modern Reparations Movement. Palimpsest 2018, 7, 108–134. [Google Scholar] [CrossRef]

- Von Cramon-Taubadel, S.; Goodwin, B.K. Price transmission in agricultural markets. Annu. Rev. Resour. Econ. 2021, 13, 65–84. [Google Scholar] [CrossRef]

- Olipra, J. Price transmission in (de) regulated agricultural markets. Agrekon 2020, 59, 412–425. [Google Scholar] [CrossRef]

- Svanidze, M.; Durić, I. Global wheat market dynamics: What is the role of the EU and the Black Sea wheat exporters? Agriculture 2021, 11, 799. [Google Scholar] [CrossRef]

| Raw Agricultural Products | Price Level | Rates of Return | ||||

|---|---|---|---|---|---|---|

| Mean | St.dev. | Vol.coef. | St.dev. | Min | Max | |

| Wheat (PLN/q) | 84.01 | 25.71 | 30.6% | 4.99 | −19.5% | 19.9% |

| Wheat CBOT (c/bu) | 601.86 | 152.58 | 25.4% | 5.89 | −14.4% | 25.0% |

| Wheat CBOT (PLN/q) | 82.44 | 25.60 | 31.0% | 6.31 | −15.2% | 30.6% |

| Cattle (PLN/kg) | 6.85 | 1.47 | 21.5% | 2.83 | −7.7% | 9.4% |

| Live Cattle CME (c/lb) | 126.27 | 16.50 | 13.1% | 3.98 | −14.1% | 10.1% |

| Live Cattle CME (PLN/kg) | 10.34 | 1.83 | 17.7% | 4.28 | −11.3% | 9.9% |

| Hogs (PLN/kg) | 5.20 | 0.91 | 17.5% | 7.07 | −12.7% | 49.1% |

| Lean Hogs CME (c/lb) | 79.48 | 16.74 | 21.1% | 8.50 | −18.2% | 28.3% |

| Lean Hogs CME (PLN/kg) | 6.47 | 1.41 | 21.9% | 8.73 | −18.2% | 29.4% |

| Raw Agricultural Products | Price Level (Non-Stationary Variables) | Rates of Return (Stationary Variables) | ||||

|---|---|---|---|---|---|---|

| r Pear. | R Spear. | m | r Pear. | R Spear. | m | |

| Wheat (PLN/q) ↔ Wheat CBOT (c/bu) | 0.8525 | 0.8220 | 0.0511 | 0.3397 | 0.3126 | 0.0177 |

| Wheat (PLN/q) ↔ Wheat CBOT (PLN/q) | 0.9519 | 0.8472 | 0.1882 | 0.3862 | 0.3321 | 0.0388 |

| Cattle (PLN/kg) ↔ Live Cattle CME (c/lb) | 0.3318 | 0.0180 | 0.1098 | 0.1073 | 0.0912 | 0.0032 |

| Cattle (PLN/kg) ↔ Live Cattle CME (PLN/kg) | 0.7055 | 0.1680 | 0.4695 | 0.1516 | 0.1305 | 0.0060 |

| Hogs (PLN/kg) ↔ Lean Hogs CME (c/lb) | 0.2955 | 0.3306 | −0.0219 | 0.1957 | 0.0463 | 0.0361 |

| Hogs (PLN/kg) ↔ Lean Hogs CME (PLN/kg) | 0.5085 | 0.3107 | 0.1621 | 0.2323 | 0.0750 | 0.0484 |

| Raw Agricultural Products | Rates of Return (Stationary Variables) | |

|---|---|---|

| F Stat | p-Value | |

| Wheat (PLN/q) → Wheat CBOT (c/bu) | 2.2094 | 0.1140 |

| Wheat CBOT (c/bu) → Wheat (PLN/q) | 4.2181 | 0.0169 |

| Cattle (PLN/kg) → Live Cattle CME (c/lb) | 0.0832 | 0.9202 |

| Live Cattle CME (c/lb) → Cattle (PLN/kg) | 0.7285 | 0.4846 |

| Hogs (PLN/kg) → Lean Hogs CME (c/lb) | 0.9813 | 0.3777 |

| Lean Hogs CME (c/lb) → Hogs (PLN/kg) | 5.0710 | 0.0076 |

| Explanatory Variables | Rates of Return (Stationary Variables, Dependent Variables) | |

|---|---|---|

| Wheat (PLN/q) | Wheat CBOT (c/bu) | |

| Wheat (PLN/q) (−1) | 0.3345 | −0.1887 |

| [3.5442] | [−1.6529] | |

| Wheat (PLN/q) (−2) | −0.0507 | 0.2019 |

| [−0.5475] | [1.8008] | |

| Wheat CBOT (c/bu) (−1) | 0.2182 | 0.4137 |

| [2.9043] | [4.5517] | |

| Wheat CBOT (c/bu) (−2) | −0.0487 | −0.2973 |

| [−0.6423] | [−3.2377] | |

| C | 0.0029 | 0.0022 |

| [0.7386] | [0.4562] | |

| R-squared | 0.2109 | 0.1729 |

| Explanatory Variables | Rates of Return (Stationary Variables, Dependent Variables) | |

|---|---|---|

| Cattle (PLN/kg) | Live Cattle CME (c/lb) | |

| Cattle (PLN/kg) (−1) | −0.0010 | 0.0213 |

| [−0.0118] | [0.1966] | |

| Cattle (PLN/kg) (−2) | 0.0513 | 0.0387 |

| [0.5796] | [0.3569] | |

| Live Cattle CME (c/lb) (−1) | 0.0728 | 0.5519 |

| [1.0419] | [6.4481] | |

| Live Cattle CME (c/lb) (−2) | 0.0078 | −0.2669 |

| [0.1112] | [−3.1102] | |

| C | 0.0040 | 0.0019 |

| [1.5867] | [0.6157] | |

| R-squared | 0.0148 | 0.25117 |

| Explanatory Variables | Rates of Return (Stationary Variables, Dependent Variables) | |

|---|---|---|

| Hogs (PLN/kg) | Lean Hogs CME (c/lb) | |

| Hogs (PLN/kg) (−1) | 0.1191 | −0.0107 |

| [1.3232] | [−0.1102] | |

| Hogs (PLN/kg) (−2) | −0.0267 | −0.1306 |

| [−0.3044] | [−1.3726] | |

| Lean Hogs CME (c/lb) (−1) | 0.2391 | 0.5553 |

| [3.0280] | [6.4894] | |

| Lean Hogs CME (c/lb) (−2) | −0.0307 | −0.2462 |

| [−0.3752] | [−2.7695] | |

| C | 0.0047 | 0.0033 |

| [0.7871] | [0.5135] | |

| R-squared | 0.0994 | 0.2690 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Szczepańska-Przekota, A. Are Small Agricultural Markets Recipients of World Prices? The Case of Poland. Agriculture 2023, 13, 1214. https://doi.org/10.3390/agriculture13061214

Szczepańska-Przekota A. Are Small Agricultural Markets Recipients of World Prices? The Case of Poland. Agriculture. 2023; 13(6):1214. https://doi.org/10.3390/agriculture13061214

Chicago/Turabian StyleSzczepańska-Przekota, Anna. 2023. "Are Small Agricultural Markets Recipients of World Prices? The Case of Poland" Agriculture 13, no. 6: 1214. https://doi.org/10.3390/agriculture13061214

APA StyleSzczepańska-Przekota, A. (2023). Are Small Agricultural Markets Recipients of World Prices? The Case of Poland. Agriculture, 13(6), 1214. https://doi.org/10.3390/agriculture13061214