Agri-Food Supply and Retail Food Prices during the Russia–Ukraine Conflict’s Early Stage: Implications for Food Security

Abstract

:1. Introduction

- What were the food commodity supply implications of the Russia–Ukraine conflict resulting from blocking Ukrainian seaports and signing the Black Sea Grain Initiative (BSGI)?

- How much have global agricultural commodity prices risen as a result of the conflict?

- Have retail food prices in developing countries, particularly net importers of food and grains, increased more than in other countries?

- What are the key transmission mechanisms of the Russia–Ukraine conflict for food security?

2. Materials and Methods

3. Results

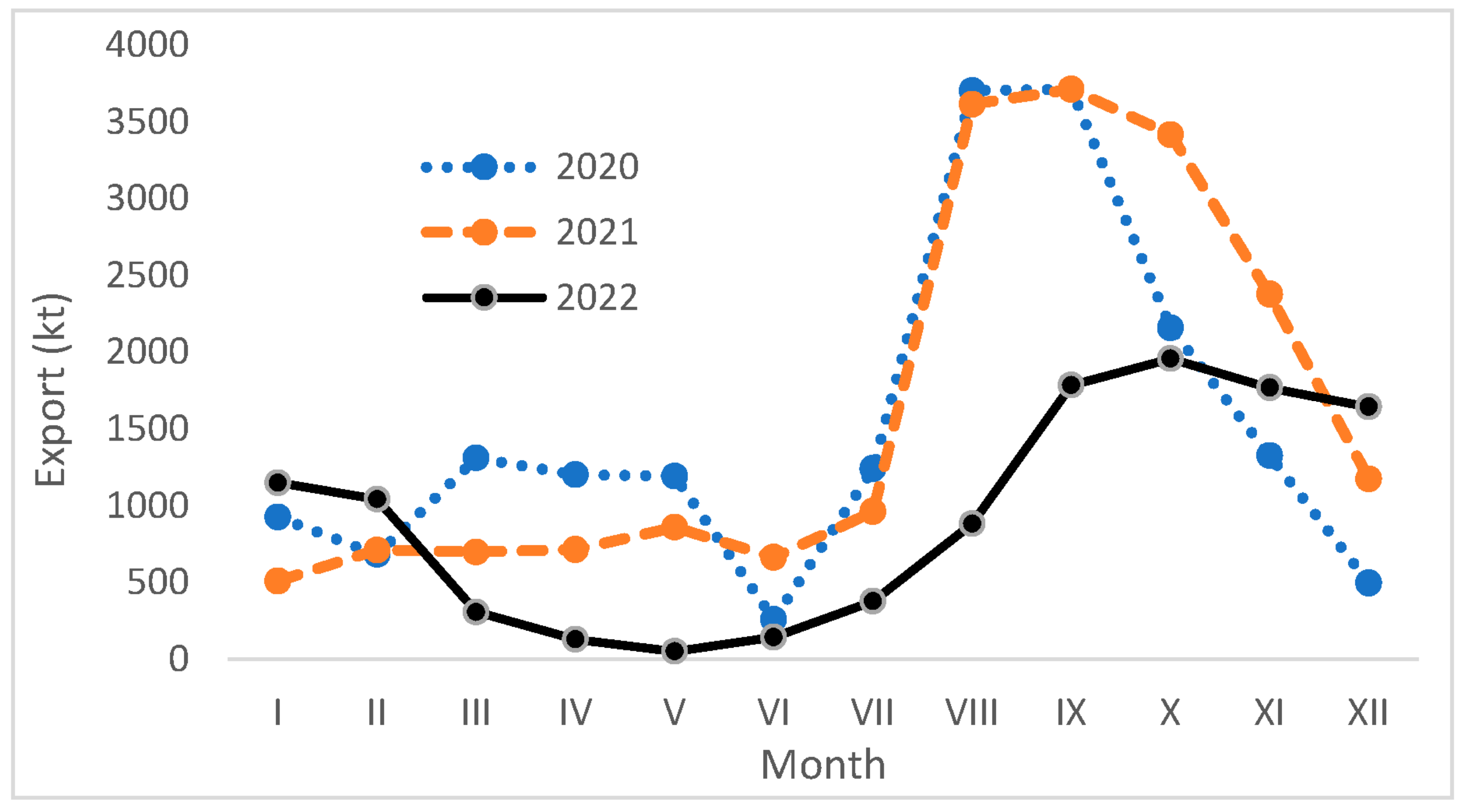

3.1. Agri-Food Supply under the Russia–Ukraine Conflict

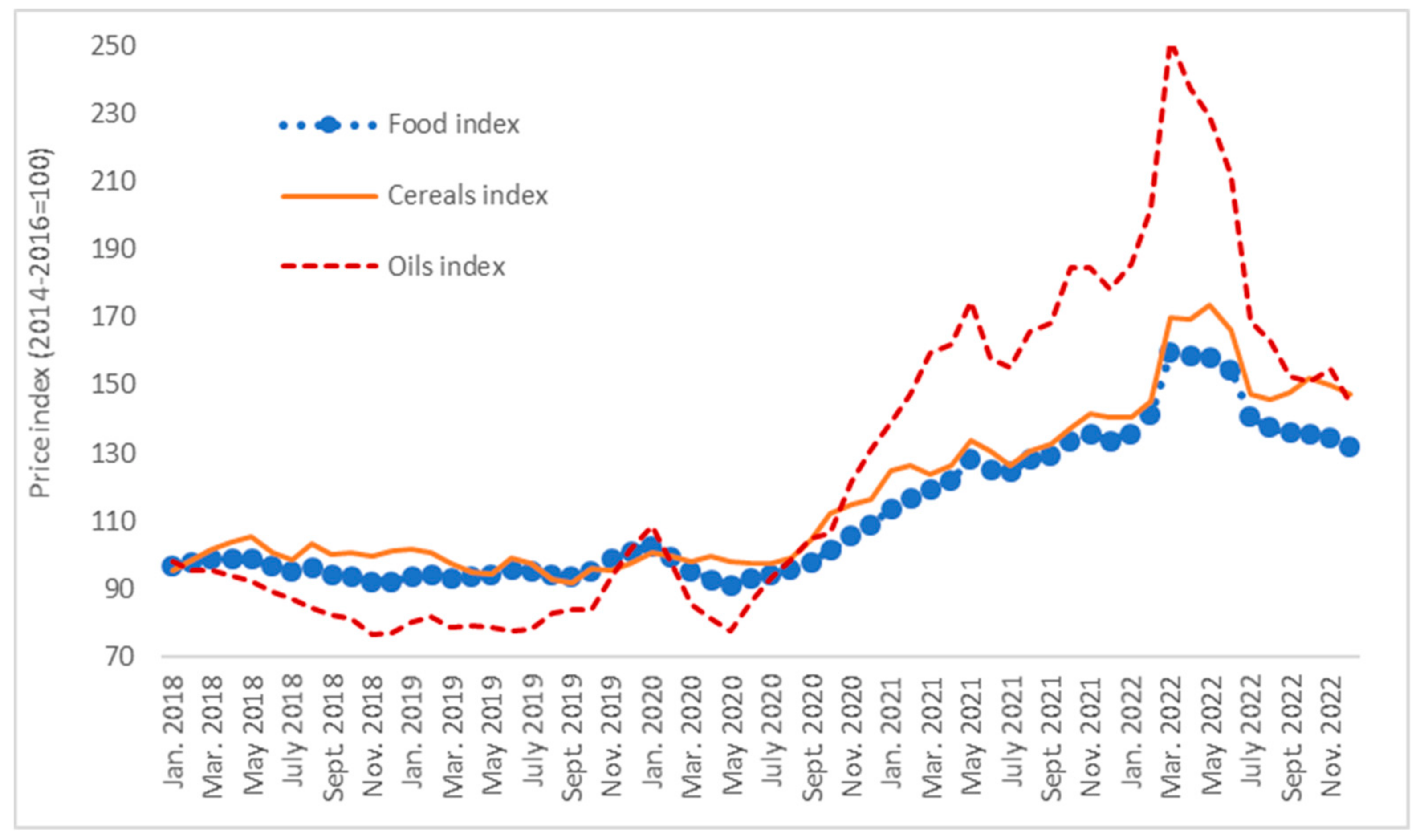

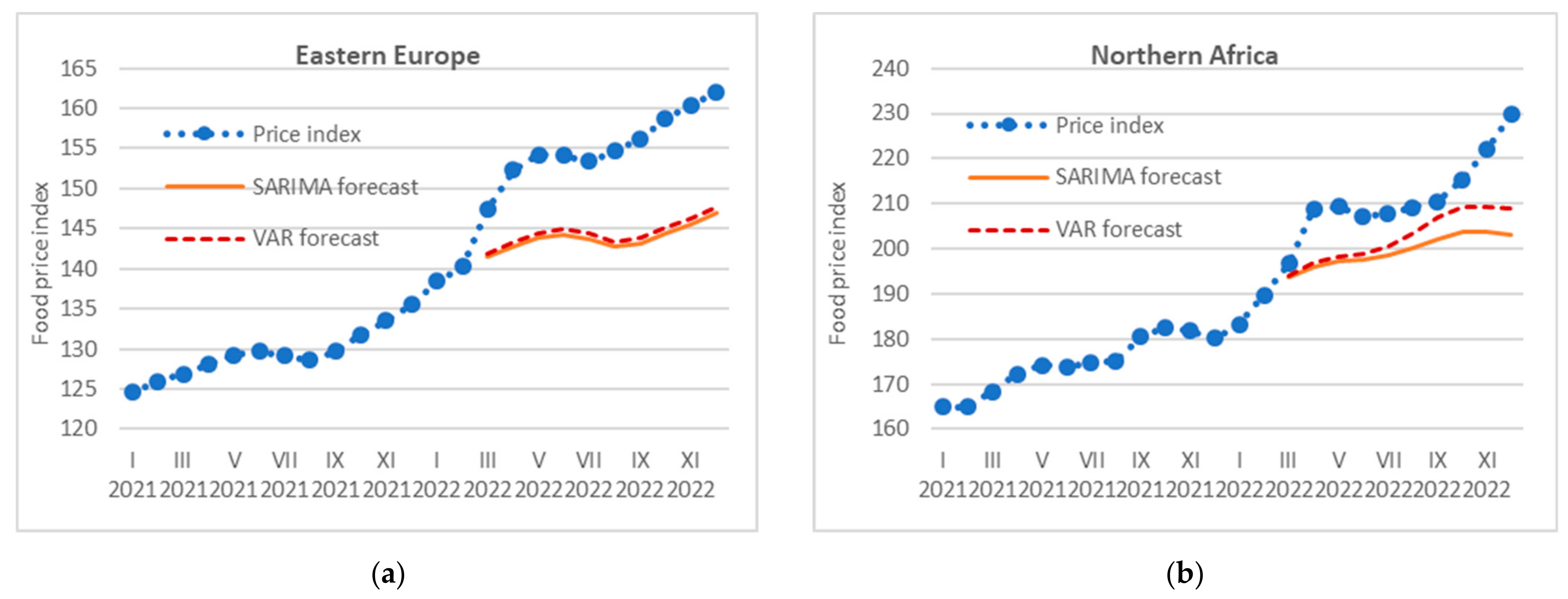

3.2. Price Implications of the Conflict between Russia and Ukraine

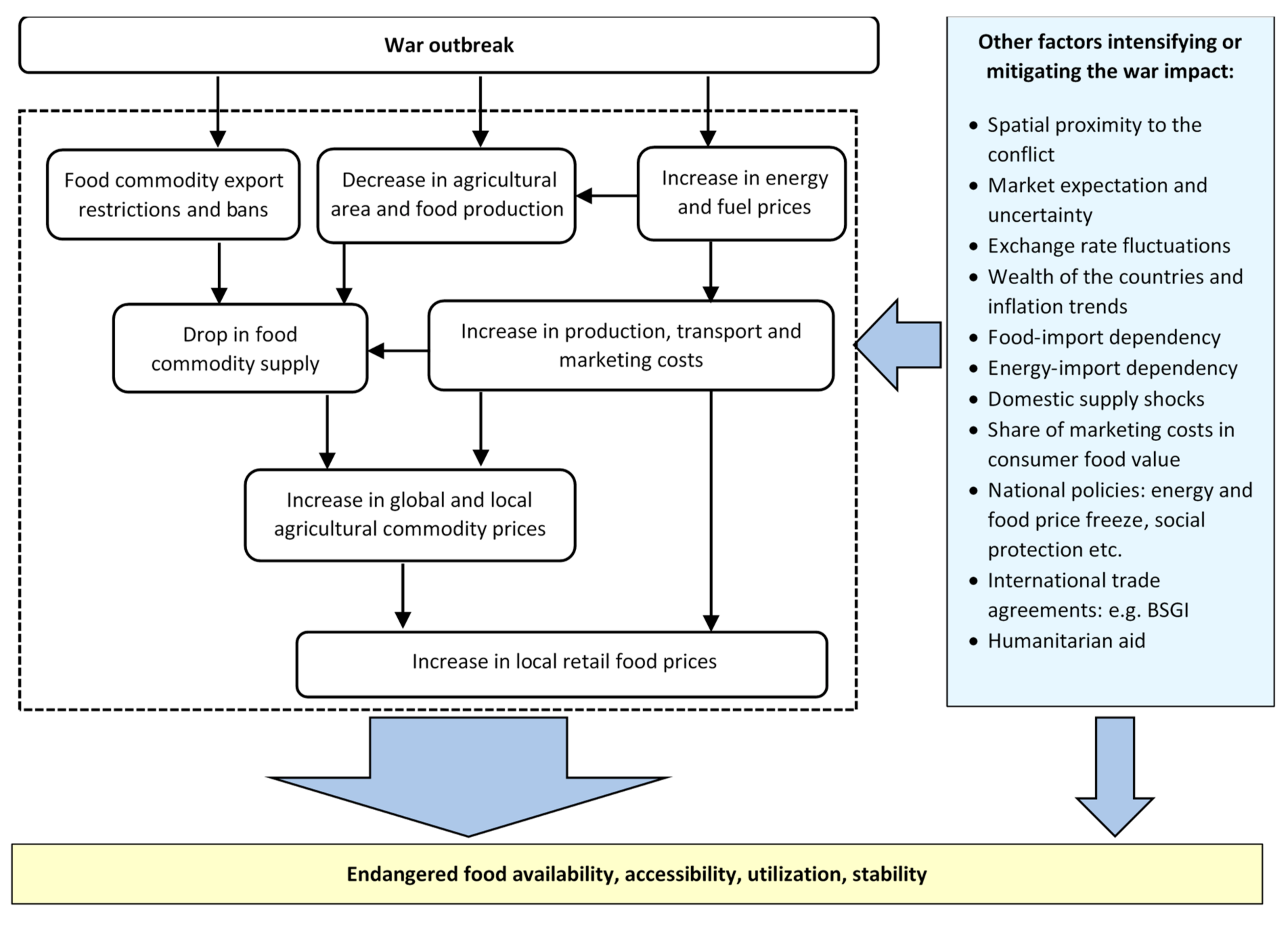

4. Discussion: Linking Food Supply and Retail Price Responses with Food Security

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Region | Cereals and Cereal Preparations | Oil Seeds | Vegetable Oils | |||

|---|---|---|---|---|---|---|

| Ukraine | Russia | Ukraine | Russia | Ukraine | Russia | |

| World | −12,775.0 | −10,232.8 | −2306.6 | 103.8 | −6802.4 | −3015.7 |

| Africa | −3104.2 | −3423.4 | −38.9 | −9.2 | −292.4 | −231.1 |

| Eastern Africa | −343.0 | −441.1 | 0.0 | x | −61.7 | −19.7 |

| Middle Africa | x | x | x | x | x | x |

| Northern Africa | −2472.8 | −1978.2 | −38.3 | −10.8 | −199.5 | −206.9 |

| Southern Africa | −9.3 | x | x | 0.0 | −5.0 | −0.3 |

| Western Africa | −254.8 | −550.7 | −0.4 | 1.6 | −23.9 | −3.9 |

| Americas | −52.7 | −155.8 | 14.0 | 927.3 | −136.5 | −22.7 |

| Northern America | −14.8 | −6.3 | −37.7 | −27.7 | −102.5 | 0.1 |

| Latin America and the Caribbean | −37.9 | −149.6 | 51.7 | 955.0 | −34.0 | −22.8 |

| Central America | −33.3 | −38.7 | 0.3 | 8.2 | −11.7 | −2.2 |

| Caribbean | −0.1 | −10.2 | x | x | −0.7 | −20.1 |

| South America | −4.6 | −100.6 | 51.5 | 946.8 | −21.6 | −0.4 |

| Asia | −7493.6 | −6278.2 | −590.7 | −467.0 | −3662.5 | −2632.5 |

| Central Asia | −17.8 | −324.7 | 0.5 | −25.3 | −1.6 | −470.3 |

| Eastern Asia | −3473.7 | −379.7 | −39.2 | −420.6 | −1079.5 | −1005.3 |

| Southern Asia | −747.0 | −756.2 | −250.2 | 7.2 | −2159.4 | −707.0 |

| Southeastern Asia | −1236.8 | −495.9 | −0.7 | −3.1 | 242.1 | 794.4 |

| Western Asia | −2018.3 | −4321.7 | −301.2 | −25.2 | −664.1 | −1244.3 |

| Europe | −2123.5 | −375.3 | −1724.4 | −347.3 | −2670.5 | −129.4 |

| Eastern Europe | 4.6 | −232.3 | −274.0 | −353.6 | −434.3 | 19.4 |

| Northern Europe | −243.2 | −32.6 | −177.9 | −11.9 | −228.2 | −231.6 |

| Southern Europe | −1061.8 | −254.5 | −104.9 | 61.7 | −889.9 | 99.3 |

| Western Europe | −823.2 | 144.2 | −1167.6 | −43.6 | −1118.1 | −16.5 |

| Oceania | −0.9 | 0.0 | 33.4 | x | x | 0.0 |

References

- Lawlis, T.; Islam, W.; Upton, P. Achieving the four dimensions of food security for resettled refugees in Australia: A systematic review. Nutr. Diet. 2018, 75, 182–192. [Google Scholar] [CrossRef]

- Sam, A.S.; Abbas, A.; Padmaja, S.S.; Sathyan, A.R.; Vijayan, D.; Kächele, H.; Kumar, R.; Müller, K. Flood vulnerability and food security in eastern India: A threat to the achievement of the Sustainable Development Goals. Int. J. Disaster Risk Reduct. 2021, 66, 102589. [Google Scholar] [CrossRef]

- Farrukh, M.U.; Bashir, M.K.; Rola-Rubzen, M.F.; Ahmad, A. Dynamic effects of urbanization, governance, and worker’s remittance on multidimensional food security: An application of a broad-spectrum approach. Socio-Econ. Plan. Sci. 2020, 84, 101400. [Google Scholar] [CrossRef]

- Waha, K.; Accatino, F.; Godde, C.; Rigolot, C.; Bogard, J.; Domingues, J.P.; Gotor, E.; Herrero, M.; Martin, G.; Mason-D’Croz, D.; et al. The benefits and trade-offs of agricultural diversity for food security in low- and middle-income countries: A review of existing knowledge and evidence. Glob. Food Secur. 2022, 33, 100645. [Google Scholar] [CrossRef]

- HLPE. Food Security and Nutrition: Building a Global Narrative Towards 2030. A Report by the High Level Panel of Experts on Food Security and Nutrition of the Committee on World Food Security; FAO: Rome, Italy, 2020; Available online: https://www.fao.org/3/ca9731en/ca9731en.pdf (accessed on 20 January 2023).

- Clapp, J.; Moseley, W.G.; Burlingame, B.; Termine, P. Viewpoint: The case for a six-dimensional food security framework. Food Policy 2022, 106, 102164. [Google Scholar] [CrossRef]

- Taylor, S.F.W.; Roberts, M.J.; Milligan, B.; Ncwadi, R. Measurement and implications of marine food security in the Western Indian Ocean: An impending crisis? Food Secur. 2019, 11, 1395–1415. [Google Scholar] [CrossRef]

- Kemoe, L.; Mitra, P.; Okou, C.; Unsal, F. How Africa Can Escape Chronic Food Insecurity Amid Climate Change. IMF Blog. Available online: https://www.imf.org/en/Blogs/Articles/2022/09/14/how-africa-can-escape-chronic-food-insecurity-amid-climate-change (accessed on 10 November 2022).

- Wiebe, K.; Robinson, S.; Cattaneo, A. Climate Change, Agriculture and Food Security: Impacts and the Potential for Adaptation and Mitigation. In Sustainable Food and Agriculture. An Integrated Approach; Campanhola, C., Pandey, S., Eds.; FAO: Rome, Italy, 2022; pp. 55–74. [Google Scholar] [CrossRef]

- Mirón, I.J.; Linares, C.; Díaz, J. The influence of climate change on food production and food safety. Environ. Res. 2023, 216, 114674. [Google Scholar] [CrossRef] [PubMed]

- Lin, F.; Li, X.; Jia, N.; Feng, F.; Huang, H.; Huang, J.; Fan, S.; Ciais, P.; Song, X.P. The impact of Russia-Ukraine conflict on global food security. Glob. Food Secur. 2023, 36, 100661. [Google Scholar] [CrossRef]

- Pereira, P.; Zhao, W.; Symochko, L.; Inacio, M.; Bogunovic, I.; Barcelo, D. The Russian-Ukrainian armed conflict will push back the sustainable development goals. Geogr. Sustain. 2022, 3, 277–287. [Google Scholar] [CrossRef]

- UNCTAD. International Merchandise Trade. Available online: https://unctadstat.unctad.org/wds/ReportFolders/reportFolders.aspx?sCS_referer=&sCS_ChosenLang=en (accessed on 18 February 2023).

- Ben Hassen, T.; El Bilali, H. Impacts of the Russia-Ukraine War on Global Food Security: Towards More Sustainable and Resilient Food Systems? Foods 2022, 11, 2301. [Google Scholar] [CrossRef]

- Hellegers, P. Food security vulnerability due to trade dependencies on Russia and Ukraine. Food Secur. 2022, 14, 1503–1510. [Google Scholar] [CrossRef]

- Abay, K.A.; Breisinger, C.; Glauber, J.; Kurdi, S.; Laborde, D.; Siddig, K. The Russia-Ukraine war: Implications for global and regional food security and potential policy responses. Glob. Food Secur. 2023, 36, 100675. [Google Scholar] [CrossRef]

- Brooks, J.; Matthews, A. Trade Dimensions of Food Security; OECD Food, Agriculture and Fisheries Papers, no. 77; OECD Publishing: Paris, France, 2015. [Google Scholar] [CrossRef]

- Dithmer, J.; Abdulai, A. Does trade openness contribute to food security? A dynamic panel analysis. Food Policy 2017, 69, 218–230. [Google Scholar] [CrossRef]

- Bonuedi, I.; Kamasa, K.; Opoku, E.E.O. Enabling trade across borders and food security in Africa. Food Secur. 2020, 12, 1121–1140. [Google Scholar] [CrossRef]

- Pawlak, K.; Kołodziejczak, M. The role of agriculture in ensuring food security in developing countries: Considerations in the context of the problem of sustainable food production. Sustainability 2020, 12, 5488. [Google Scholar] [CrossRef]

- Ahn, S.; Kim, D.; Steinbach, S. The impact of the Russian invasion of Ukraine on grain and oilseed trade. Agribusiness 2022, 39, 291–299. [Google Scholar] [CrossRef]

- Grant, J.; Arita, S.; Xie, C.; Sydow, S. Russia’s Invasion of Ukraine: The War’s Initial Impacts on Agricultural Trade. Choices 2023, 38, 52–64. Available online: https://www.choicesmagazine.org/choices-magazine/theme-articles/turmoil-in-global-food-agricultural-and--input-markets-implications-of-russias-invasion-of-ukraine/russias-invasion-of-ukraine-the-wars-initial-impacts-on-agricultural-trade (accessed on 28 March 2023).

- Xu, Y.; Wang, Z.; Dong, W.; Chou, J. Predicting the Potential impact of Emergency on Global Grain Security: A Case of the Russia-Ukraine Conflict. Foods 2023, 12, 2557. [Google Scholar] [CrossRef] [PubMed]

- Mottaleb, K.A.; Govindan, V. How the ongoing armed conflict between Russia and Ukraine can affect the global wheat food security? Front. Food Sci. Technol. 2023, 3, 1072871. [Google Scholar] [CrossRef]

- De S. Nóia, R., Jr.; Ewert, F.; Webber, H.; Martre, P.; Hertel, T.W.; Van Ittersum, M.K.; Asseng, S. Needed global wheat stock and crop management in response to the war in Ukraine. Glob. Food Secur. 2022, 35, 100662. [Google Scholar] [CrossRef]

- Mottaleb, K.A.; Kruseman, G.; Snapp, S. Potential impacts of Ukraine-Russia armed conflict on global wheat food security: A quantitative exploration. Glob. Food Secur. 2022, 35, 100659. [Google Scholar] [CrossRef]

- Zhou, X.Y.; Lu, G.; Xu, Z.; Yan, X.; Khu, S.T.; Yang, J.; Zhao, J. Influence of Russia-Ukraine War on the Global Energy and Food Security. Resour. Conserv. Recycl. 2023, 188, 106657. [Google Scholar] [CrossRef]

- Glauben, T.; Svanidze, M.; Götz, L.; Prehn, S.; Jaghdani, T.J.; Durić, I.; Kuhn, L. The War in Ukraine, Agricultural Trade and Risks to Global Food Security. Intereconomics 2022, 57, 157–163. [Google Scholar] [CrossRef]

- Hatab, A.A. Africa’s Food Security under the Shadow of the Russia-Ukraine Conflict. Strateg. Rev. S. Afr. 2022, 44, 37–46. [Google Scholar] [CrossRef]

- WFP. WFP Annual Review 2022. Available online: https://docs.wfp.org/api/documents/WFP-0000150530/download/?_ga=2.59604139.765583441.1699451624-895967128.1699451624 (accessed on 8 November 2023).

- Rabbi, M.F.; Ben Hassen, T.; El Bilali, H.; Raheem, D.; Raposo, A. Food Security Challenges in Europe in the Context of the Prolonged Russian–Ukrainian Conflict. Sustainability 2023, 15, 4745. [Google Scholar] [CrossRef]

- Alexander, P.; Arneth, A.; Maire, J.; Rabin, S.; Rounsevell, M.D.A. High energy and fertilizer prices are more damaging than food export curtailment from Ukraine and Russia for food process, health and the environment. Nat. Food 2022, 4, 84–95. [Google Scholar] [CrossRef]

- Arndt, C.; Diao, X.; Dorosh, P.; Pauw, K.; Thurlow, J. The Ukraine war and rising commodity process: Implications for developing countries. Glob. Food Secur. 2023, 36, 100680. [Google Scholar] [CrossRef]

- UN Comtrade. UN Comtrade Database. Available online: https://comtrade.un.org/data (accessed on 20 December 2022).

- FAOSTAT. Data. Available online: https://www.fao.org/faostat/en/#data (accessed on 4 December 2022).

- Box, G.E.P.; Jenkins, G.M. Time Series Analysis: Forecasting and Control; Holden-Day: San Francisco, CA, USA, 1970. [Google Scholar]

- Lütkepohl, H.; Krättzig, M. (Eds.) Applied Time Series Econometrics; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Jagtap, S.; Trollman, H.; Trollman, F.; Garcia-Garcia, G.; Parra-López, C.; Duong, L.; Martindale, W.; Munekata, P.E.S.; Lorenzo, J.M.; Hdaifeh, A.; et al. The Russia-Ukraine Conflict: Its Implications for the Global Food Supply Chains. Foods 2022, 11, 2098. [Google Scholar] [CrossRef] [PubMed]

- Grote, U.; Fasse, A.; Nguyen, T.T.; Erenstein, O. Food Security and the Dynamics of Wheat and Maize Value Chains in Africa and Asia. Front. Sustain. Food Syst. 2021, 4, 617009. [Google Scholar] [CrossRef]

- Parker, C. Calls Grow for Russia to Free Up Ukrainian Ports for Grain Exports. The Washington Post. Available online: https://www.washingtonpost.com/world/2022/05/14/ukraine-ports-grain-global-hunger/ (accessed on 20 January 2023).

- Yarmak, A. Global Food Security Destroyed by Russian Invasion in Ukraine Could Kill Hundreds of Millions Globally. Available online: https://www.linkedin.com/pulse/global-food-security-destroyed-russian-invasion-ukraine-andriy-yarmak?trk=portfolio_article-card_title (accessed on 20 January 2023).

- UNCTAD. Maritime Trade Disrupted. The War in Ukraine and Its Effects on Maritime Trade Logistics. Available online: https://unctad.org/system/files/official-document/osginf2022d2_en.pdf (accessed on 11 September 2022).

- United Nations. Beacon on the Black Sea. Available online: https://www.un.org/en/black-sea-grain-initiative (accessed on 9 January 2023).

- Donaldson, D. The gains from market integration. Annu. Rev. Econ. 2015, 7, 617–647. [Google Scholar] [CrossRef]

- Soffiantini, G. Food insecurity and political instability during the Arab Spring. Glob. Food Secur. 2020, 26, 100400. [Google Scholar] [CrossRef]

- Nasir, M.A.; Nugroho, A.D.; Lakner, Z. Impact of the Russian–Ukrainian Conflict on Global Food Crops. Foods 2022, 11, 2979. [Google Scholar] [CrossRef] [PubMed]

- Leibtag, E. How Much and How Quick? Pass through of Commodity and Input Cost Changes to Retail Food Prices. Am. J. Agric. Econ. 2009, 91, 1462–1467. [Google Scholar] [CrossRef]

- Schnepf, R. Farm-to-Food Price Dynamics; Congressional Research Service Report; Congressional Research Service: Washington, DC, USA, 2015; Available online: https://sgp.fas.org/crs/misc/R40621.pdf (accessed on 20 January 2023).

- Gijs, C. Russia threatens to limit agri-food supplies only to ‘friendly’ countries. Politico, 1 April 2022. Available online: https://www.politico.eu/article/russias-former-president-medvedev-warns-agricultural-supplies-restricted-to-friendly-countries/ (accessed on 20 January 2023).

- Legrand, N. War in Ukraine: The rational “wait-and-see” mode of global food markets. Appl. Econ. Perspect. Policy 2022, 45, 626–644. [Google Scholar] [CrossRef]

- Glauber, J.; Laborde, D. How will Russia’s Invasion of Ukraine Affect Global Food Security? IFPRI Blog: Issue Post. 2022. Available online: https://www.ifpri.org/blog/how-will-russias-invasion-ukraine-affect-global-food-security (accessed on 20 January 2023).

- FAO. Responding to the Ukraine Crisis: Leveraging Social Protection for Food Security and Nutrition. 2022. Available online: https://www.fao.org/3/cc3321en/cc3321en.pdf (accessed on 22 March 2023).

- Gentilini, U.; Almenfi, M.; Iyengar, H.T.; Okamura, Y.; Urteaga, E.R.; Valleriani, G.; Muhindo, J.V.; Aziz, S. Tracking Social Protection Responses in Ukraine and Neighboring Countries; Living Paper 3; World Bank Group: Washington, DC, USA, 2022; Volume 3, Available online: http://documents.worldbank.org/curated/en/451971649433673308/Living-Paper-3 (accessed on 22 March 2022).

- FAO. Eastern Africa Drought: FAO Welcomes a €25 Million Contribution from Germany to Improve Access to Food and Boost Rural Livelihoods in Ethiopia, Kenya, Somalia and the Sudan. 2022. Available online: https://www.fao.org/newsroom/detail/eastern-africa-drought-fao-welcomes-a-25-million-contribution-from-germany-to-improve-access-to-food-and-boost-rural-livelihoods-in-ethiopia-kenya-somalia-and-the-sudan/en (accessed on 22 March 2023).

- Destatis. Destatis Statistisches Bundesamt, Household Consumption Expenditure on Food. 2022. Available online: https://www.destatis.de/EN/Themes/Countries-Regions/International-Statistics/Data-Topic/Tables/BasicData_HouseholdExpFood.html?nn=412386 (accessed on 18 January 2023).

- Liu, L.; Wang, W.; Yan, X.; Shen, M.; Chen, H. The cascade influence of grain trade shocks on countries in the context of the Russia-Ukraine conflict. Humanit. Soc. Sci. Commun. 2023, 10, 449. [Google Scholar] [CrossRef]

- Neik, T.X.; Siddique, K.H.; Mayes, S.; Edwards, D.; Batley, J.; Mabhaudhi, T.; Song, B.K.; Massawe, F. Diversifying agrifood systems to ensure global food security following the Russia–Ukraine crisis. Front. Sustain. Food Syst. 2023, 7, 1124640. [Google Scholar] [CrossRef]

- Brander, M.; Bernauer, T.; Huss, M. Trade policy announcements can increase price volatility in global food commodity markets. Nat. Food 2023, 4, 331–340. [Google Scholar] [CrossRef] [PubMed]

| Subregion | Ukraine | Russia | Ukraine + Russia | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cereals | Oil Crops | Vegetable Oils | Cereals | Oil Crops | Vegetable Oils | Cereals | Oil Crops | Vegetable Oils | ||||||||||

| A | B | A | B | A | B | A | B | A | B | A | B | A | B | A | B | A | B | |

| Eastern Africa | 5.1 | 0.9 | 7.4 | 0.3 | 1.3 | 1.1 | 10.3 | 1.9 | x | x | 0.0 | 0.0 | 15.5 | 2.9 | x | x | 1.3 | 1.1 |

| Middle Africa | 0.3 | 0.1 | x | x | 0.3 | 0.1 | 13.6 | 4.1 | x | x | 0.0 | 0.0 | 13.9 | 4.2 | x | x | 0.3 | 0.1 |

| Northern Africa | 18.6 | 10.0 | 6.5 | 2.5 | 2.0 | 1.5 | 13.7 | 7.4 | 0.0 | 0.0 | 8.9 | 6.9 | 32.3 | 17.3 | 6.5 | 2.6 | 10.9 | 8.5 |

| Southern Africa | 1.3 | 0.4 | 0.1 | 0.0 | 1.1 | 0.7 | 10.6 | 3.3 | x | x | 0.0 | 0.0 | 11.9 | 3.7 | x | x | 1.1 | 0.8 |

| Western Africa | 1.3 | 0.3 | 0.1 | 0.0 | 0.7 | 0.3 | 8.7 | 2.3 | 1.6 | 0.0 | 0.1 | 0.0 | 9.9 | 2.6 | 1.6 | 0.0 | 0.7 | 0.3 |

| Northern America | 0.1 | 0.0 | 1.9 | 0.1 | 1.0 | 0.3 | 0.0 | 0.0 | 1.6 | 0.1 | 0.0 | 0.0 | 0.1 | 0.0 | 3.5 | 0.1 | 1.0 | 0.3 |

| Central America | 0.4 | 0.2 | 0.0 | 0.0 | 0.6 | 0.2 | 0.6 | 0.3 | x | x | 0.0 | 0.0 | 1.0 | 0.4 | x | x | 0.6 | 0.2 |

| Caribbean | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | 0.1 | x | x | x | x | 10.0 | 8.6 | x | x | x | x | 10.1 | 8.6 |

| South America | 0.1 | 0.0 | 0.0 | 0.0 | 0.4 | 0.1 | 0.5 | 0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.6 | 0.1 | 0.0 | 0.0 | 0.4 | 0.1 |

| Central Asia | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 9.7 | 2.3 | 31.3 | 3.4 | 19.3 | 10.6 | 9.7 | 2.3 | 31.3 | 3.4 | 19.3 | 10.6 |

| Eastern Asia | 10.8 | 1.2 | 0.0 | 0.0 | 7.3 | 2.9 | 0.7 | 0.1 | 0.9 | 0.6 | 5.6 | 2.2 | 11.5 | 1.3 | 1.0 | 0.6 | 12.9 | 5.1 |

| Southern Asia | 14.4 | 0.9 | 1.0 | 0.1 | 9.4 | 6.5 | 17.0 | 1.0 | 0.3 | 0.0 | 3.4 | 2.4 | 31.4 | 1.9 | 1.3 | 0.2 | 12.8 | 8.9 |

| Southeastern Asia | 8.9 | 1.9 | 0.0 | 0.0 | 1.9 | 0.3 | 3.7 | 0.8 | 0.0 | 0.0 | 0.6 | 0.1 | 12.6 | 2.7 | 0.1 | 0.0 | 2.5 | 0.4 |

| Western Asia | 10.7 | 6.3 | 13.5 | 7.2 | 6.3 | 5.3 | 24.0 | 14.1 | 7.6 | 4.1 | 14.8 | 12.3 | 34.6 | 20.4 | 21.1 | 11.3 | 21.1 | 17.5 |

| Eastern Europe | 3.2 | 0.2 | 10.9 | 1.6 | 9.6 | 4.3 | 3.6 | 0.2 | 9.3 | 1.3 | 2.3 | 1.0 | 6.8 | 0.5 | 20.2 | 2.9 | 12.0 | 5.4 |

| Northern Europe | 12.4 | 3.6 | 6.3 | 3.3 | 3.2 | 2.9 | 2.7 | 0.8 | 0.7 | 0.4 | 9.8 | 9.0 | 15.1 | 4.4 | 6.9 | 3.7 | 13.0 | 11.9 |

| Southern Europe | 14.9 | 7.3 | 4.1 | 1.5 | 9.6 | 8.2 | 1.0 | 0.5 | 0.5 | 0.2 | 0.1 | 0.1 | 15.9 | 7.8 | 4.6 | 1.7 | 9.8 | 8.3 |

| Western Europe | 10.4 | 4.8 | 9.9 | 9.2 | 5.3 | 5.5 | 0.1 | 0.1 | 0.2 | 0.2 | 0.1 | 0.1 | 10.5 | 4.8 | 10.1 | 9.4 | 5.4 | 5.6 |

| Oceania | 0.1 | 0.0 | 0.0 | 0.0 | 4.8 | 2.8 | 0.0 | 0.0 | 0.0 | 0.0 | 0.3 | 0.2 | 0.2 | 0.0 | 0.0 | 0.0 | 5.2 | 3.0 |

| Commodity | Export Share | Export Change (1000 t) | ||

|---|---|---|---|---|

| 2022 vs. 2020 | 2022 vs. 2021 | 2022 vs. 2020 | 2022 vs. 2021 | |

| March–July (Before the BSGI signing) | ||||

| Wheat | 0.19 | 0.26 | −4 195 | −2 888 |

| Corn | 0.49 | 0.53 | −5 573 | −4 793 |

| Barley | 0.12 | 0.17 | −1 602 | −1 112 |

| Sunflower oil | 0.30 | 0.49 | −1 985 | −883 |

| Sunflower seeds | 50.58 | 155.98 | 1 382 | 1 401 |

| Rape oil | 0.37 | 0.63 | −5 | −2 |

| Rapeseeds | 0.79 | 2.26 | −40 | 87 |

| August–December (After the BSGI signing) | ||||

| Wheat | 0.71 | 0.56 | −3 356 | −6 255 |

| Corn | 1.95 | 1.16 | 5 591 | 1 551 |

| Barley | 0.56 | 0.39 | −1 150 | −2 346 |

| Sunflower oil | 0.96 | 0.98 | −78 | −32 |

| Sunflower seeds | 3.98 | 15.23 | 492 | 614 |

| Rape oil | 0.61 | 0.45 | −40 | −74 |

| Rapeseeds | 1.27 | 1.22 | 588 | 489 |

| Region | Price Change (%) from II 2022 till: | Forecast Errors (%) for the Period: | ||||||

|---|---|---|---|---|---|---|---|---|

| III 2022 | VI 2022 | IX 2022 | XII 2022 | III 2022 | VI 2022 | IX 2022 | XII 2022 | |

| Eastern Africa | 2.59 | 8.78 | 14.26 | 16.96 | 0.46 | 2.84 | 5.12 | 5.33 |

| Middle Africa | 1.00 | 2.81 | 4.35 | 6.37 | −0.54 | −2.67 | −4.47 | −5.47 |

| Northern Africa | 3.70 | 9.22 | 10.96 | 21.12 | 1.46 | 4.32 | 2.78 | 10.30 |

| Southern Africa | 0.58 | 4.90 | 8.32 | 10.43 | −0.27 | 2.15 | 3.96 | 4.25 |

| Western Africa | 2.02 | 8.62 | 14.40 | 20.12 | 0.74 | 3.12 | 5.38 | 8.04 |

| Northern America | 1.46 | 5.08 | 7.91 | 8.94 | 0.82 | 2.88 | 4.58 | 4.80 |

| Central America | 1.22 | 5.32 | 9.46 | 11.09 | 0.40 | 3.52 | 5.28 | 4.73 |

| Caribbean | 0.91 | 4.58 | 7.74 | 13.51 | 0.08 | 1.29 | 2.05 | 5.30 |

| South America | 5.18 | 16.29 | 32.40 | 46.40 | 0.87 | 1.53 | 5.13 | 5.34 |

| Central Asia | 4.40 | 10.38 | 12.74 | 18.15 | 3.39 | 7.22 | 8.61 | 9.00 |

| Eastern Asia | −0.57 | −1.58 | 1.89 | 2.16 | 0.21 | 0.69 | 2.11 | 2.23 |

| Southern Asia | 1.52 | 18.71 | 26.70 | 28.58 | −0.37 | 9.90 | 10.40 | 7.37 |

| Southeastern Asia | 0.67 | 3.82 | 4.78 | 6.31 | 1.08 | 2.95 | 3.11 | 3.18 |

| Western Asia | 5.33 | 27.78 | 45.07 | 65.27 | 1.30 | 2.60 | −2.38 | −7.50 |

| Eastern Europe | 5.07 | 9.89 | 11.39 | 15.47 | 3.81 | 6.19 | 8.14 | 9.01 |

| Northern Europe | 0.43 | 5.02 | 10.03 | 14.12 | 0.06 | 3.63 | 7.70 | 10.23 |

| Southern Europe | 1.11 | 6.21 | 8.41 | 12.42 | 0.69 | 4.61 | 6.62 | 9.17 |

| Western Europe | 0.92 | 5.91 | 10.18 | 13.66 | 0.58 | 4.59 | 8.67 | 11.00 |

| Oceania | 0.89 | 2.84 | 6.33 | 7.41 | 0.20 | 1.04 | 3.57 | 3.85 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hamulczuk, M.; Pawlak, K.; Stefańczyk, J.; Gołębiewski, J. Agri-Food Supply and Retail Food Prices during the Russia–Ukraine Conflict’s Early Stage: Implications for Food Security. Agriculture 2023, 13, 2154. https://doi.org/10.3390/agriculture13112154

Hamulczuk M, Pawlak K, Stefańczyk J, Gołębiewski J. Agri-Food Supply and Retail Food Prices during the Russia–Ukraine Conflict’s Early Stage: Implications for Food Security. Agriculture. 2023; 13(11):2154. https://doi.org/10.3390/agriculture13112154

Chicago/Turabian StyleHamulczuk, Mariusz, Karolina Pawlak, Joanna Stefańczyk, and Jarosław Gołębiewski. 2023. "Agri-Food Supply and Retail Food Prices during the Russia–Ukraine Conflict’s Early Stage: Implications for Food Security" Agriculture 13, no. 11: 2154. https://doi.org/10.3390/agriculture13112154

APA StyleHamulczuk, M., Pawlak, K., Stefańczyk, J., & Gołębiewski, J. (2023). Agri-Food Supply and Retail Food Prices during the Russia–Ukraine Conflict’s Early Stage: Implications for Food Security. Agriculture, 13(11), 2154. https://doi.org/10.3390/agriculture13112154