What Determines the Uptake of Multiple Tools to Mitigate Agricultural Risks among Hybrid Maize Growers in Pakistan? Findings from Field-Level Data

Abstract

:1. Introduction

2. Materials and Methods

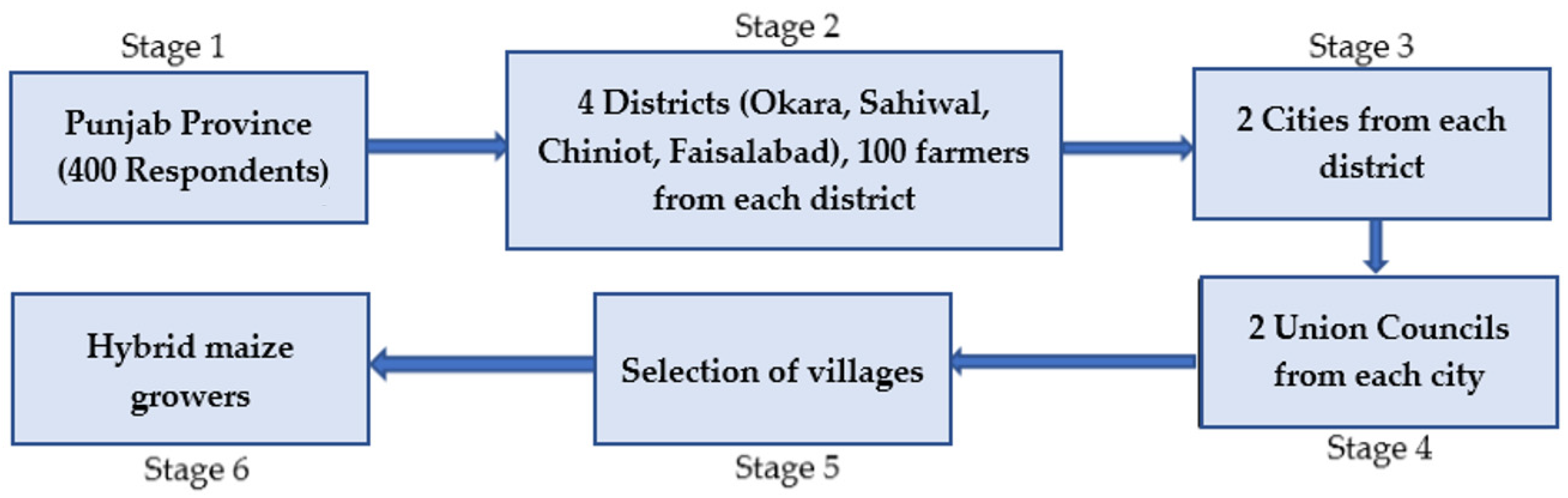

2.1. Sampling Procedure and Study Area

2.2. Multivariate Probit Model

2.3. Farmers’ Risk Perceptions

2.4. Risk Attitude

3. Results and Discussions

3.1. Socioeconomic Profile of the Respondents

3.2. Correlation among Risk Management Strategies

3.3. Parameter Estimates of the Multivariate Probit

3.4. Factors Effecting the Adoption of Contract Farming, Off-Farm Income, and Credit

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Hardaker, J.B.; Lien, G.; Anderson, J.R.; Huirne, R. Coping with Risk in Agriculture: Applied Decision Analysis. Available online: https://library.wur.nl/WebQuery/wurpubs/494080 (accessed on 21 May 2021).

- Aditto, S.; Gan, C.; Nartea, G.V. Sources of Risk and Risk Management Strategies: The Case of Smallholder Farmers in a Developing Economy. In Risk Management—Current Issues and Challenges; InTech: London, UK, 2012. [Google Scholar]

- Jankelova, N.; Masar, D.; Moricova, S. Risk factors in the agriculture sector. Agric. Econ. 2017, 63, 247–258. [Google Scholar] [CrossRef] [Green Version]

- Malcolm, B.; Sinnet, A. Are We Risking Too Much? Australian Agribusiness Perspective; Wiley: New York, NY, USA, 2015; Volume 18, pp. 1–10. [Google Scholar]

- Malcolm, B.; Sinnett, A. Risk Management among Agricultural Households and the Role of Off-Farm Investments in Uasin Gishu County, Kenya. Available online: https://www.researchgate.net/publication/241750695_RISK_MANAGEMENT_AMONG_AGRICULTURAL_HOUSEHOLDS_AND_THE_ROLE_OF_OFF-FARM_INVESTMENTS_IN_UASIN_GISHU_COUNTY_KENYA (accessed on 21 May 2021).

- Cooper, P.J.M.; Dimes, J.; Rao, K.P.C.; Shapiro, B.; Shiferaw, B.; Twomlow, S. Coping better with current climatic variability in the rain-fed farming systems of sub-Saharan Africa: An essential first step in adapting to future climate change? Agric. Ecosyst. Environ. 2008, 126, 24–35. [Google Scholar] [CrossRef] [Green Version]

- GOP. Economic Survey of Pakistan. Economic Advisor’s Wing, Finance Division, Islamabad, Pakistan. 2021. Available online: http://www.finance.gov.pk/survey_1617.html (accessed on 22 May 2021).

- GOP. Punjab Development Statisitics. Bureau of Statistics. Government of Punjab, Lahore. 2016. Available online: http://www.bos.gop.pk/developmentstat (accessed on 22 May 2021).

- Ullah, R.; Jourdain, D.; Shivakoti, G.P.; Dhakal, S. Managing catastrophic risks in agriculture: Simultaneous adoption of diversification and precautionary savings. Int. J. Disaster Risk Reduct. 2015, 12, 268–277. [Google Scholar] [CrossRef]

- Iqbal, M.A.; Ping, Q.; Abid, M.; Muhammad Muslim Kazmi, S.; Rizwan, M. Assessing risk perceptions and attitude among cotton farmers: A case of Punjab province, Pakistan. Int. J. Disaster Risk Reduct. 2016, 16, 68–74. [Google Scholar] [CrossRef]

- Drollette, S.A. Managing Production Risk in Agriculture; Utah State University Extension: Logan, UT, USA, 2009. [Google Scholar]

- Velandia, M.; Rejesus, R.M.; Knight, T.O.; Sherrick, B.J. Factors Affecting Farmers’ Utilization of Agricultural Risk Management Tools: The Case of Crop Insurance, Forward Contracting, and Spreading Sales. J. Agric. Appl. Econ. 2015, 41, 107–123. [Google Scholar] [CrossRef] [Green Version]

- Shapiro, B.I.; Brorsen, B.W. Factors Affecting Farmers’ Hedging Decisions. Appl. Econ. Perspect. Policy 1988, 10, 145–153. [Google Scholar] [CrossRef]

- Goodwin, B.K.; Mishra, A.K. Farming efficiency and the determinants of multiple job holding by farm operators. Am. J. Agric. Econ. 2004, 86, 722–729. [Google Scholar] [CrossRef]

- Makki, S.S.; Somwaru, A. Farmers’ participation in crop insurance markets: Creating the right incentives. Am. J. Agric. Econ. 2001, 83, 662–667. [Google Scholar] [CrossRef]

- Sherrick, B.J.; Barry, P.J.; Ellinger, P.N.; Schnitkey, G.D. Factors influencing farmers crop insurance decisions. Am. J. Agric. Econ. 2004, 86, 103–114. [Google Scholar] [CrossRef]

- Krejcie, R.V.; Morgan, D.W. Determining sample size for research activities. Educ. Psychol. Meas. 1970, 30, 607–610. [Google Scholar] [CrossRef]

- Abid, M.; Scheffran, J.; Schneider, U.A.; Ashfaq, M. Farmers’ perceptions of and adaptation strategies to climate change and their determinants: The case of Punjab province, Pakistan. Earth Syst. Dyn. 2015, 6, 225–243. [Google Scholar] [CrossRef] [Green Version]

- Badar, H.; Ghafoor, A.; Adil, S.A. Factor Affecting Agricultural Production of Punjab, Pakistan. Available online: https://www.researchgate.net/publication/251879960_Factors_affecting_agricultural_production_of_Punjab_Pakistan (accessed on 22 May 2021).

- Romney, D.L.; Thorne, P.; Lukuyu, B.; Thornton, P.K. Maize as food and feed in intensive smallholder systems: Management options for improved integration in mixed farming systems of east and southern Africa. Field Crops Res. 2003, 84, 159–168. [Google Scholar] [CrossRef]

- Geweke, J. Efficient Simulation from the Multivariate Normal Distribution Subject to Linear Inequality Constraints and the Evolution of Constraint Probabilities. Ph.D. Thesis, Duke University, Durham, NC, USA, 1989. [Google Scholar]

- Hajivassiliou, V.A. The Method for Simulated Scores for the Estimation of LDV Models with an Application to External Debt Crises. Ph.D. Thesis, Yale University, New Haven, CT, USA, 1990. [Google Scholar]

- Keane, M. Simulation estimation for panel data models with limited dependent variable models. In Handbook of Statistics, II; Maddala, G.S., Rao, C.R., Vinod, H., Eds.; Elsevier: North-Holland/Amsterdam, The Netherland, 1993; pp. 545–570. [Google Scholar]

- Lee, D.; Song, K. Simulated maximum likelihood estimation for discrete choices using transformed simulated frequencies. J. Econom. 2015, 187, 131–153. [Google Scholar] [CrossRef]

- Wang, J.X.; Roush, M.L. What Every Engineer Should Know about Risk Engineering and Management. Available online: https://www.goodreads.com/book/show/40731856-what-every-engineer-should-know-about-risk-engineering-and-management (accessed on 22 May 2021).

- Cooper, D.F.; Grey, S.R.; Walker, P. Project Risk Management Guidelines: Managing Risk in Large Projects and Complex Procurements; John Wiley & Sons: Hoboken, NJ, USA, 2005; Available online: https://www.worldcat.org/title/project-risk-management-guidelines-managing-risk-in-large-projects-and-complex-procurements/oclc/928875917 (accessed on 22 May 2021).

- Ullah, R.; Shivakoti, G.P. Adoption of On-Farm and Off-Farm Diversification to Manage Agricultural Risks. Outlook Agric. 2014, 43, 265–271. [Google Scholar] [CrossRef]

- Binici, T.; Koç, A.A.; Zulauf, C.R.; Bayaner, A. Risk Attitudes of Farmers in Terms of Risk Aversion: A Case Study of Lower Seyhan Plain Farmers in Adana Province, Turkey; The Scientific and Technological Research Council of Turkey: Ankara, Turkey, 2003; Volume 27.

- Arrow, K.J. The role of securities in the optimal allocation of risk-bearing. Rev. Econ. Stud. 1964, 31, 91–96. [Google Scholar] [CrossRef]

- Olarinde, L.O.; Manyong, V.M.; Akintola, J.O. Attitudes Towards Risk among Maize Farmers in the Dry Savanna Zone of Nigeria: Some Prospective Policies for Improving Food Production. Afr. J. Agric. Res. 2007, 2, 399–408. [Google Scholar]

- Cahyadi, E.R.; Waibel, H. Is Contract Farming in the Indonesian Oil Palm Industry Pro-Poor? Available online: https://ideas.repec.org/p/ags/iaae12/126327.html (accessed on 22 May 2021).

- Deressa, T.T.; Ringler, C.; Hassan, R.M. Factors Affecting the Choices of Coping Strategies for Climate Extremes: The Case of Farmers in the Nile Basin of Ethiopia. Ph.D. Thesis, Unversity of Pretoria, Pretoria, South Africa, 2010. [Google Scholar]

- Ashfaq, M.; Hassan, S.; Zeeshan Naseer, M.; Ahmad Baig, I.; Asma, J. Factors Affecting Farm Diversification in Rice-Wheat. Pak. J. Agric. Sci. 2008, 45, 91–94. [Google Scholar]

- Mesfin, W.; Fufa, B.; Haji, J. Pattern, Trend and Determinants of Crop Diversification: Empirical Evidence from Smallholders in Eastern Ethiopia. J. Econ. Sust. Dev. 2011, 2, 78–89. [Google Scholar]

- Kouamé, E.B.E. Risk, Risk Aversion and Choice of Risk Management Strategies by Cocoa Farmers in Western Cote d’ Ivoire. Ph.D. Thesis, University of Cocody-AERC Collaborative, Abidjan, Cote d’Ivoire, 2010. Available online: http://www.csae.ox.ac.uk/conferences/2010-edia/papers/267-Kouame.pdf (accessed on 9 May 2021).

- Ullah, A.; Arshad, M.; Kaechele, H.; Zeb, A.; Mahmood, N.; Mueller, K. Socio-economic analysis of farmers facing asymmetric information in inputs markets: Evidence from the rainfed zone of Pakistan. Technol. Soc. 2020, 63, 101405. [Google Scholar] [CrossRef]

| Variables | Mean | SD |

|---|---|---|

| Dependent Variables Risk Management Tools | ||

| Contract Farming | 0.61 | 0.49 |

| Off-farm Income Diversification | 0.49 | 0.50 |

| Availing Agriculture Credit | 0.42 | 0.49 |

| Explanatory Variables Socioeconomic Characteristics | ||

| Farmer’s Age (years) | 44.77 | 9.93 |

| Household head’s Education (schooling years) | 6.89 | 4.02 |

| Household head’s Farming Experience (years) | 22.58 | 9.09 |

| Farm Size (acres) | 43.04 | 41.21 |

| Proportion of Maize Area (area under maize/total farm area in acres) | 0.75 | 0.16 |

| Distance from Output Market (Km) | 15.83 | 8.78 |

| Extension contact (1 = yes, 0 = otherwise) | 0.73 | 0.45 |

| Regional Dummies | ||

| Okara | 0.25 | 0.43 |

| Sahiwal | 0.25 | 0.43 |

| Chiniot | 0.25 | 0.43 |

| Risk Attitude | ||

| Risk Aversion | 0.78 | 0.42 |

| Perception of Risks (1 = Yes, 0 = Otherwise) | ||

| Price Risk | 0.79 | 0.41 |

| Biological Risk | 0.72 | 0.45 |

| Climate Risk | 0.69 | 0.46 |

| Financial Risk | 0.61 | 0.49 |

| Risk Management Tool | Correlation Coefficient |

|---|---|

| Contract Farming and Agricultural Credit | 0.5103 *** |

| Contract Farming and Off-farm Income | 0.5010 *** |

| Off-farm Income and Agricultural Credit | 0.4056 *** |

| Independent Variables | Contract Farming | Off-Farm Income Diversification | Agricultural Credit |

|---|---|---|---|

| Farmer’s Age | 0.0309 *** (0.0140) | 0.0337 ** (0.0149) | 0.0123 (0.0143) |

| Household Head’s Education | 0.0202 (0.0182) | 0.0505 *** (0.0181) | 0.0140 (0.0181) |

| Farm Experience | 0.0031 (0.0164) | −0.0352 ** (0.0166) | 0.0199 (0.0160) |

| Farm Size | 0.4208 (0.4595) | 0.7324 ** (0.4491) | −0.5186 (0.4444) |

| Proportion of Maize Land | 0.4208 (0.4595) | 0.7324 * (0.4491) | −0.5186 (0.4444) |

| Distance Output Market | 0.0157 ** (0.0082) | 0.0010 (0.0079) | 0.0010 (0.0079) |

| Access to Extension Information | −0.0174 (0.1581) | −0.1642 (0.1565) | 0.3115 ** (0.1588) |

| Okara | 0.5414 *** (0.2015) | −0.1315 (0.1926) | 0.6143 *** (0.1918) |

| Sahiwal | 0.4854 ** (0.2088) | −0.6653 *** (0.2063) | 0.0586 (0.2043) |

| Chiniot | 0.3901 ** (0.1935) | 0.1118 (0.1922) | 0.4669 *** (0.1948) |

| Risk Aversion | 0.4207 *** (0.1709) | 0.3807 ** (0.1643) | 0.0439 (0.1638) |

| Price Risk | 0.4958 *** (0.1623) | 0.1484 (0.1659) | 0.1363 (0.1662) |

| Climate Risk | 0.1488 *** (0.0544) | 0.1613 ** (0.0504) | 0.1016 ** (0.0444) |

| Biological Risk | 0.2982 ** (0.1380) | 0.2678 *** (0.1345) | −0.0208 (0.1324) |

| Financial Risk | 0.1508 (0.1420) | −0.0755 (0.1392) | 0.0883 (0.1380) |

| Log Likelihood Value | −735.079 | ||

| Wald Test Chi2(45) | 137.42 *** | ||

| LR Test of ρkj | 11.44 *** | ||

| Total Observations | 400 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Akhtar, S.; Abbas, A.; Iqbal, M.A.; Rizwan, M.; Samie, A.; Faisal, M.; Sahito, J.G.M. What Determines the Uptake of Multiple Tools to Mitigate Agricultural Risks among Hybrid Maize Growers in Pakistan? Findings from Field-Level Data. Agriculture 2021, 11, 578. https://doi.org/10.3390/agriculture11070578

Akhtar S, Abbas A, Iqbal MA, Rizwan M, Samie A, Faisal M, Sahito JGM. What Determines the Uptake of Multiple Tools to Mitigate Agricultural Risks among Hybrid Maize Growers in Pakistan? Findings from Field-Level Data. Agriculture. 2021; 11(7):578. https://doi.org/10.3390/agriculture11070578

Chicago/Turabian StyleAkhtar, Shoaib, Azhar Abbas, Muhammad Amjed Iqbal, Muhammad Rizwan, Abdus Samie, Muhammad Faisal, and Jam Ghulam Murtaza Sahito. 2021. "What Determines the Uptake of Multiple Tools to Mitigate Agricultural Risks among Hybrid Maize Growers in Pakistan? Findings from Field-Level Data" Agriculture 11, no. 7: 578. https://doi.org/10.3390/agriculture11070578

APA StyleAkhtar, S., Abbas, A., Iqbal, M. A., Rizwan, M., Samie, A., Faisal, M., & Sahito, J. G. M. (2021). What Determines the Uptake of Multiple Tools to Mitigate Agricultural Risks among Hybrid Maize Growers in Pakistan? Findings from Field-Level Data. Agriculture, 11(7), 578. https://doi.org/10.3390/agriculture11070578