Sugar Prices vs. Financial Market Uncertainty in the Time of Crisis: Does COVID-19 Induce Structural Changes in the Relationship?

Abstract

1. Introduction

2. Methodology and Data

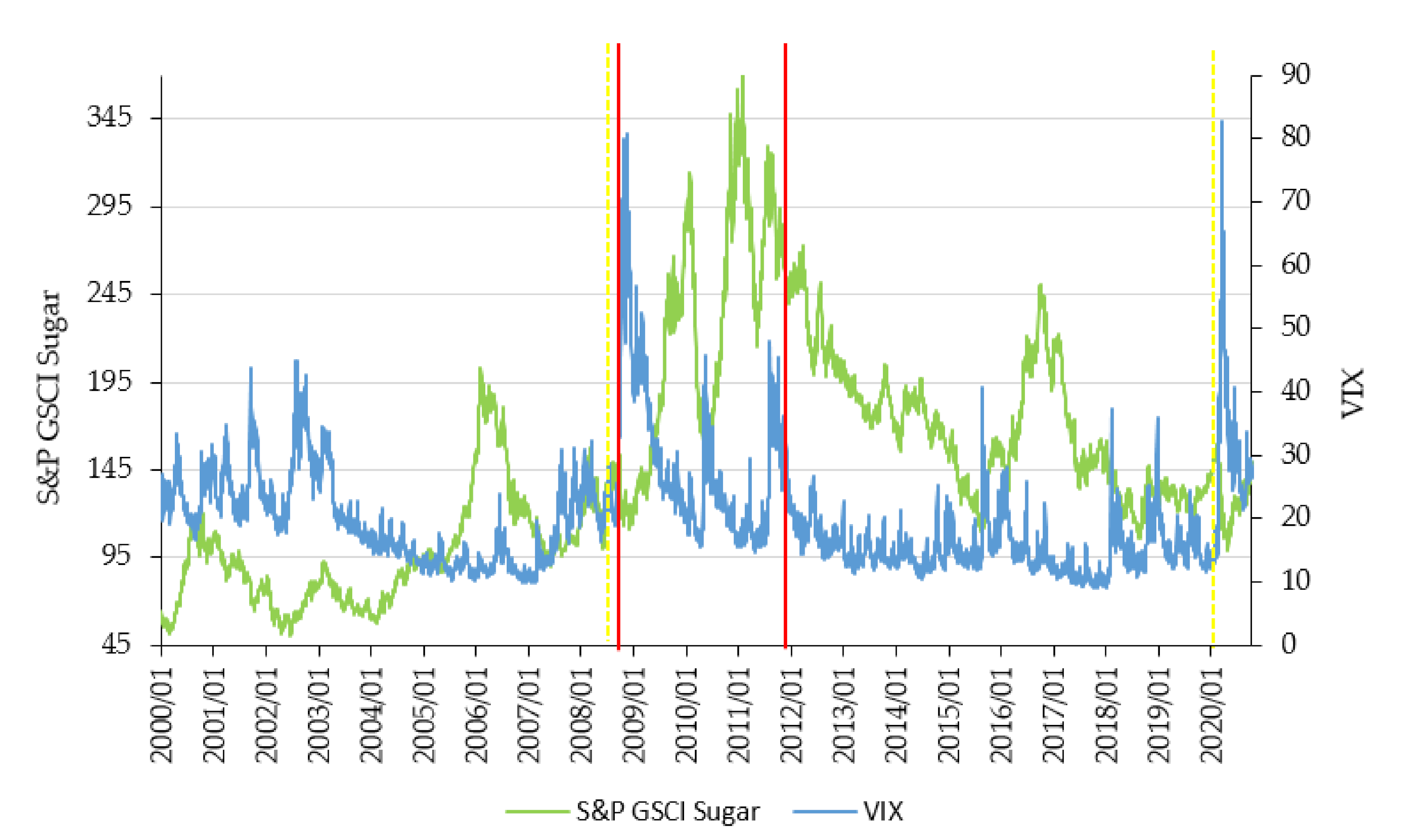

- The global financial crisis has induced structural changes in the relationship between sugar prices and the financial market uncertainty;

- The COVID-19 pandemic has caused structural changes in the relationship between sugar prices and the financial market uncertainty.

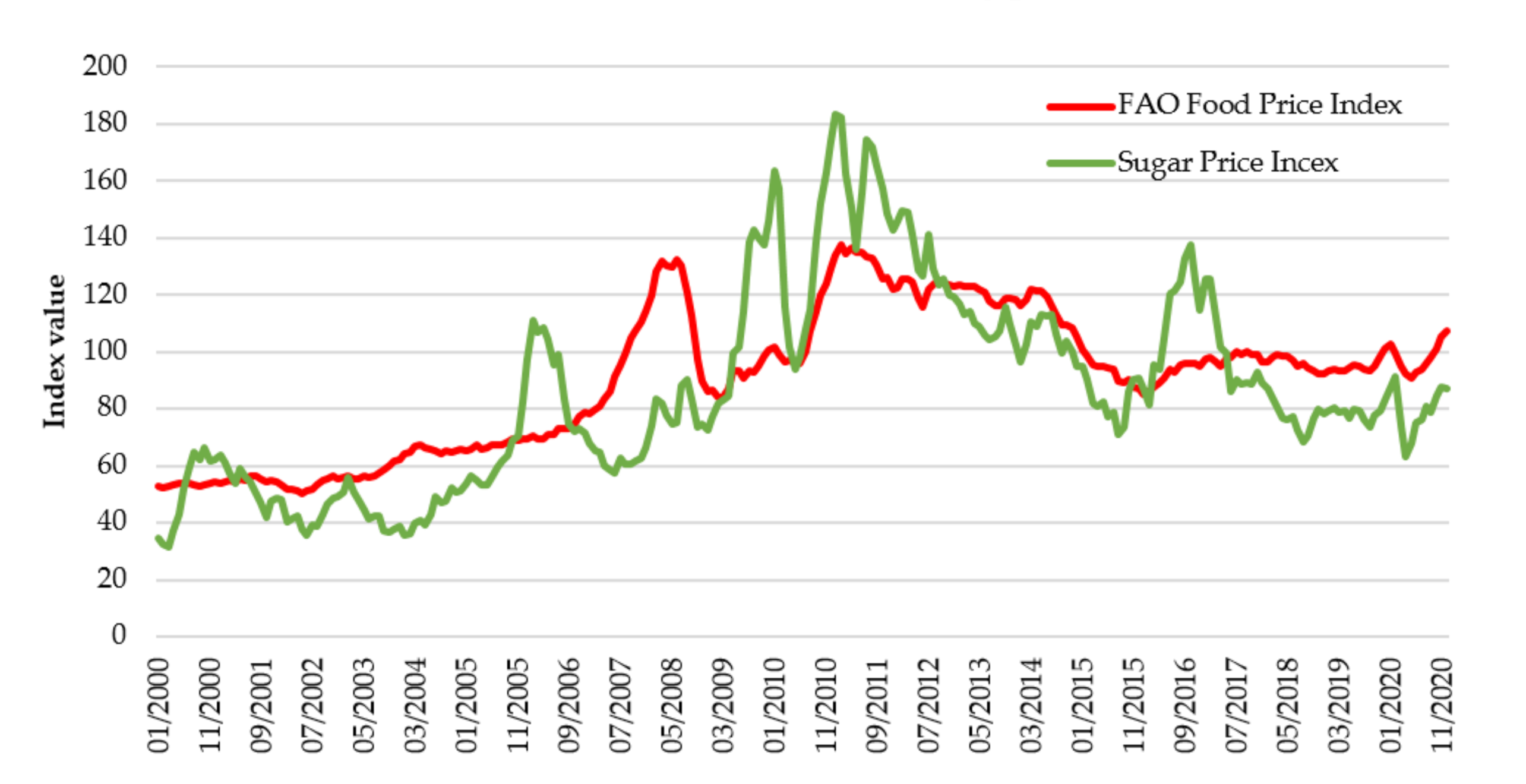

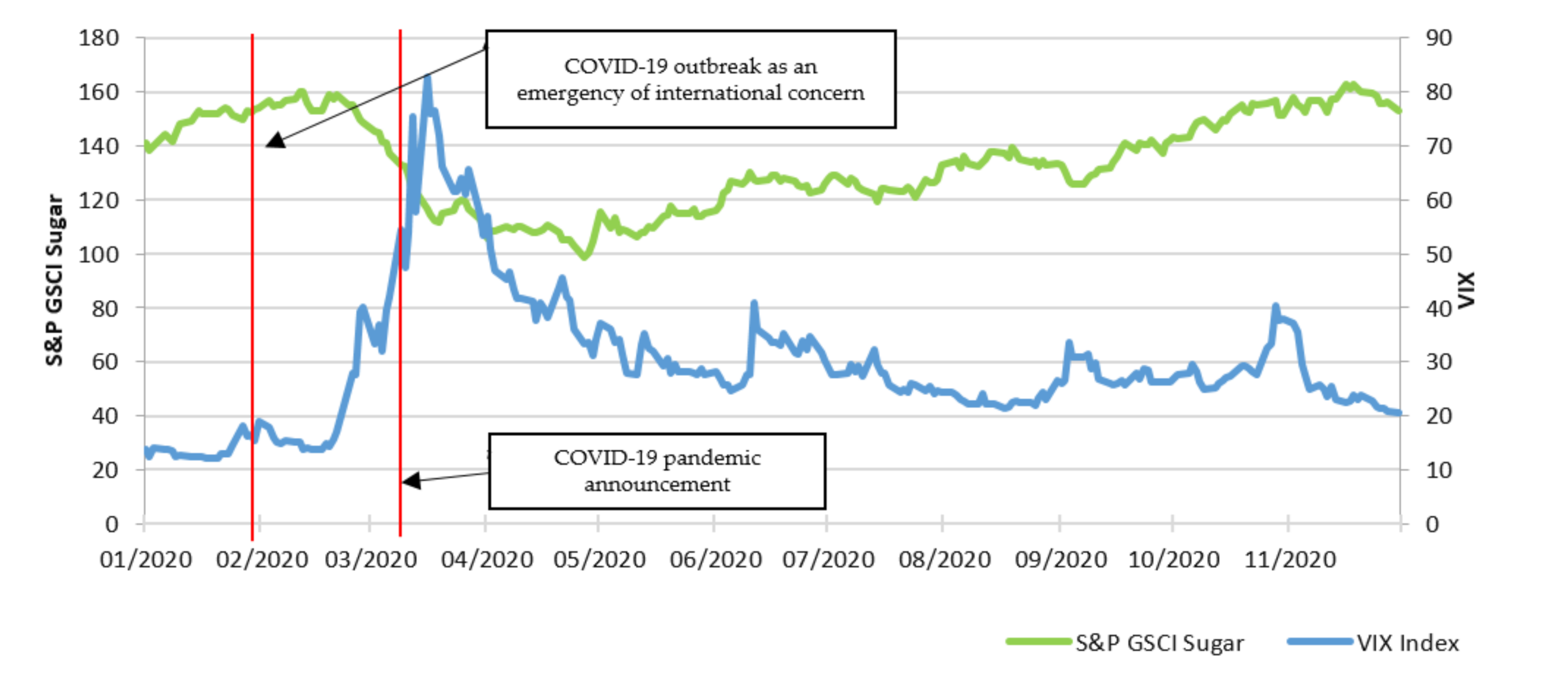

3. Sugar Market Review

4. Research Results and Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zhang, Y.-J.; Chevallier, J.; Guesmi, K. “De-Financialization” of Commodities? Evidence from Stock, Crude Oil and Natural Gas Markets. Energy Econ. 2017, 68, 228–239. [Google Scholar] [CrossRef]

- Vivian, A.; Wohar, M.E. Commodity Volatility Breaks. J. Int. Financ. Mark. Inst. Money 2012, 22, 395–422. [Google Scholar] [CrossRef]

- Mi, Z.; Wei, Y.; Tang, B.; Cong, R.; Yu, H.; Cao, H.; Guan, D. Risk Assessment of Oil Price from Static and Dynamic Modelling Approaches. Appl. Econ. 2017, 49, 929–939. [Google Scholar] [CrossRef]

- Basak, S.; Pavlova, A. A Model of Financialization of Commodities. J. Financ. 2016, 71, 1511–1556. [Google Scholar] [CrossRef]

- Silvennoinen, A.; Thorp, S. Financialization, Crisis and Commodity Correlation Dynamics. J. Int. Financ. Mark. Inst. Money 2013, 24, 42–65. [Google Scholar] [CrossRef]

- Cheng, I.-H.; Xiong, W. Financialization of Commodity Markets. Annu. Rev. Financ. Econ. 2014, 6, 419–441. [Google Scholar] [CrossRef]

- Clapp, J.; Isakson, S.R. Speculative Harvests: Financialization, Food, and Agriculture; Fernwood Publishing: Halifax, NS, Canada, 2018; ISBN 978-1-77363-023-6. [Google Scholar]

- Maizels, A. The Continuing Commodity Crisis of Developing Countries. World Dev. 1994, 22, 1685–1695. [Google Scholar] [CrossRef]

- Sadefo Kamdem, J.; Bandolo Essomba, R.; Njong Berinyuy, J. Deep Learning Models for Forecasting and Analyzing the Implications of COVID-19 Spread on Some Commodities Markets Volatilities. ChaosSolitons Fractals 2020, 140, 110215. [Google Scholar] [CrossRef]

- Bakas, D.; Triantafyllou, A. Commodity Price Volatility and the Economic Uncertainty of Pandemics. Econ. Lett. 2020, 193, 109283. [Google Scholar] [CrossRef]

- Bakas, D.; Triantafyllou, A. The Impact of Uncertainty Shocks on the Volatility of Commodity Prices. J. Int. Money Financ. 2018, 87, 96–111. [Google Scholar] [CrossRef]

- Prokopczuk, M.; Stancu, A.; Symeonidis, L. The Economic Drivers of Commodity Market Volatility. J. Int. Money Financ. 2019, 98, 102063. [Google Scholar] [CrossRef]

- Karyotis, C.; Alijani, S. Soft Commodities and the Global Financial Crisis: Implications for the Economy, Resources and Institutions. Res. Int. Bus. Financ. 2016, 37, 350–359. [Google Scholar] [CrossRef]

- Nissanke, M. Commodity Market Linkages in the Global Financial Crisis: Excess Volatility and Development Impacts. J. Dev. Stud. 2012, 48, 732–750. [Google Scholar] [CrossRef]

- Zhang, D.; Broadstock, D.C. Global Financial Crisis and Rising Connectedness in the International Commodity Markets. Int. Rev. Financ. Anal. 2020, 68, 101239. [Google Scholar] [CrossRef]

- Masters, M.W. Testimony of Michael W. In Masters before the Committee on Homeland Security and Governmental Affairs United States Senate; Washington, DC, USA, 2008; p. 19. Available online: https://www.hsgac.senate.gov/imo/media/doc/052008Masters.pdf (accessed on 19 January 2021).

- Schutter, O.D. Food Commodities Speculation and Food Price Crises—Regulation to Reduce the Risks of Price Volatility; United Nations: NewYork, NY, USA, 2010; p. 14. [Google Scholar]

- Clapp, J. Food Price Volatility and Vulnerability in the Global South: Considering the Global Economic Context. Third World Q. 2009, 30, 1183–1196. [Google Scholar] [CrossRef]

- Irwin, S.H.; Sanders, D.R. Testing the Masters Hypothesis in Commodity Futures Markets. Energy Econ. 2012, 34, 256–269. [Google Scholar] [CrossRef]

- Andreasson, P.; Bekiros, S.; Nguyen, D.K.; Uddin, G.S. Impact of Speculation and Economic Uncertainty on Commodity Markets. Int. Rev. Financ. Anal. 2016, 43, 115–127. [Google Scholar] [CrossRef]

- Irwin, S.H. Commodity Index Investment and Food Prices: Does the “Masters Hypothesis” Explain Recent Price Spikes?: S. H. Irwin. Agric. Econ. 2013, 44, 29–41. [Google Scholar] [CrossRef]

- Haniotis, T.; Baffes, J. Placing The 2006/08 Commodity Price Boom Into Perspective; Policy Research Working Papers; The World Bank: Washington, DC, USA, 2010. [Google Scholar]

- World Health Organization Statement on the Second Meeting of the International Health Regulations (2005) Emergency Committee Regarding the Outbreak of Novel Coronavirus (2019-NCoV). Available online: https://www.who.int/news/item/30-01-2020-statement-on-the-second-meeting-of-the-international-health-regulations-(2005)-emergency-committee-regarding-the-outbreak-of-novel-coronavirus-(2019-ncov) (accessed on 11 January 2021).

- Maier, B.F.; Brockmann, D. Effective Containment Explains Subexponential Growth in Recent Confirmed COVID-19 Cases in China. Science 2020, 368, 742–746. [Google Scholar] [CrossRef]

- Andersen, K.G.; Rambaut, A.; Lipkin, W.I.; Holmes, E.C.; Garry, R.F. The Proximal Origin of SARS-CoV-2. Nat. Med. 2020, 26, 450–452. [Google Scholar] [CrossRef]

- Barro, R.J.; Ursua, J.F.; Weng, J. The Coronavirus and the Great Influenza Epidemic—Lessons from the “Spanish Flu” for the Coronavirus’s Potential Effects on Mortality and Economic Activity. Available online: https://www.cesifo.org/DocDL/cesifo1_wp8166.pdf (accessed on 19 January 2021).

- Nicola, M.; Alsafi, Z.; Sohrabi, C.; Kerwan, A.; Al-Jabir, A.; Iosifidis, C.; Agha, M.; Agha, R. The Socio-Economic Implications of the Coronavirus Pandemic (COVID-19): A Review. Int. J. Surg. 2020, 78, 185–193. [Google Scholar] [CrossRef] [PubMed]

- Goodell, J.W. COVID-19 and Finance: Agendas for Future Research. Financ. Res. Lett. 2020, 35, 101512. [Google Scholar] [CrossRef] [PubMed]

- Czech, K.; Wielechowski, M.; Kotyza, P.; Benešová, I.; Laputková, A. Shaking Stability: COVID-19 Impact on the Visegrad Group Countries’ Financial Markets. Sustainability 2020, 12, 6282. [Google Scholar] [CrossRef]

- Shruthi, M.S.; Ramani, D. Statistical Analysis of Impact of COVID 19 on India Commodity Markets. Mater. Today Proc. 2020. [Google Scholar] [CrossRef] [PubMed]

- Wang, J.; Shao, W.; Kim, J. Analysis of the Impact of COVID-19 on the Correlations between Crude Oil and Agricultural Futures. ChaosSolitons Fractals 2020, 136, 109896. [Google Scholar] [CrossRef]

- Babirath, J.; Malec, K.; Schmitl, R.; Sahatqija, J.; Maitah, M.; Kotásková, S.K.; Maitah, K. Sugar Futures as an Investment Alternative During Market Turmoil: Case Study of 2008 and 2020 Market Drop. Sugar Tech. 2020. [Google Scholar] [CrossRef]

- Amar, A.B.; Belaid, F.; Youssef, A.B.; Chiao, B.; Guesmi, K. The Unprecedented Reaction of Equity and Commodity Markets to COVID-19. Financ. Res. Lett. 2020, 101853. [Google Scholar] [CrossRef]

- Delatte, A.-L.; Lopez, C. Commodity and Equity Markets: Some Stylized Facts from a Copula Approach. J. Bank. Financ. 2013, 37, 5346–5356. [Google Scholar] [CrossRef]

- Poncela, P.; Senra, E.; Sierra, L.P. Common Dynamics of Nonenergy Commodity Prices and Their Relation to Uncertainty. Appl. Econ. 2014, 46, 3724–3735. [Google Scholar] [CrossRef]

- Gozgor, G.; Lau, C.K.M.; Bilgin, M.H. Commodity Markets Volatility Transmission: Roles of Risk Perceptions and Uncertainty in Financial Markets. J. Int. Financ. Mark. Inst. Money 2016, 44, 35–45. [Google Scholar] [CrossRef]

- Huchet, N.; Fam, P.G. The Role of Speculation in International Futures Markets on Commodity Prices. Res. Int. Bus. Financ. 2016, 37, 49–65. [Google Scholar] [CrossRef]

- Kuzmenko, E.; Smutka, L.; Strielkowski, W.; Štreimikis, J.; Štreimikienė, D. Cointegration Analysis of the World’s Sugar Market: The Existence of the Long-Term Equilibrium. E+M 2020, 23, 23–38. [Google Scholar] [CrossRef]

- Smutka, Ľ.; Rovný, P.; Palkovič, J. Sugar Prices Development: The Relation among Selected Commodity Stocks Exchange. J. Int. Stud. 2020, 13, 310–328. [Google Scholar] [CrossRef]

- Food and Agricultural Organization. Medium-Term Prospects for RAMHOT Products; Food and Agricultural Organization: Rome, Italy, 2016; ISBN 978-92-5-109202-6. [Google Scholar]

- Amrouk, E.M.; Heckelei, T. Forecasting International Sugar Prices: A Bayesian Model Average Analysis. Sugar Tech. 2020, 22, 552–562. [Google Scholar] [CrossRef]

- Elobeid, A.; Beghin, J. Multilateral Trade and Agricultural Policy Reforms in Sugar Markets. J. Agric. Econ. 2006, 57, 23–48. [Google Scholar] [CrossRef]

- van der Mensbrugghe, D.; Beghin, J.; Mitchell, D. Modeling Tariff Rate Quotas in a Global Context: The Case of Sugar Markets in OECD Countries; Center for Agricultural and Rural Development (CARD) at Iowa State University: Ames, IA, USA, 2003. [Google Scholar]

- Brown, O.; Gibson, J.; Crawford, A. International Institute for Sustainable Development Boom or Bust: How Commodity Price Volatility Impedes Poverty Reduction and What to Do about It; Interntional Institute for Sustainable Development: Winnipeg, MB, Canada, 2008; ISBN 978-1-894784-04-7. [Google Scholar]

- Dartanto, T. Usman Volatility of World Soybean Prices, Import Tariffs and Poverty in Indonesia: A CGE-Microsimulation Analysis. Margin 2011, 5, 139–181. [Google Scholar] [CrossRef]

- S&P Dow Jones Indices S&P GSCI Sugar Capped Component. Available online: https://www.spglobal.com/spdji/en/indices/commodities/sp-gsci-sugar-capped-component/#overview (accessed on 21 October 2020).

- Whaley, R.E. Derivatives on Market Volatility: Hedging Tools Long Overdue. JOD 1993, 1, 71–84. [Google Scholar] [CrossRef]

- Whaley, R.E. Understanding the VIX. JPM 2009, 35, 98–105. [Google Scholar] [CrossRef]

- Caggiano, G.; Castelnuovo, E.; Kima, R. The Global Effects of Covid-19-Induced Uncertainty. Econ. Lett. 2020, 194, 109392. [Google Scholar] [CrossRef]

- Heber, G.; Lunde, A.; Shephard, N.; Sheppard, K.K. Oxford-Man Institute’s Realized Library; Oxford-Man Institute, University of Oxford: Oxford, UK, 2009. [Google Scholar]

- Song, H.; Shin, D.W.; Yoo, J.K. Do We Need the Constant Term in the Heterogenous Autoregressive Model for Forecasting Realized Volatilities? Commun. Stat. Simul. Comput. 2018, 47, 63–73. [Google Scholar] [CrossRef]

- Christensen, B.J.; Prabhala, N.R. The Relation between Implied and Realized Volatility. J. Financ. Econ. 1998, 50, 125–150. [Google Scholar] [CrossRef]

- Grinold, R.C. Are Benchmark Portfolios Efficient? JPM 1992, 19, 34–40. [Google Scholar] [CrossRef]

- Bai, J.; Perron, P. Estimating and Testing Linear Models with Multiple Structural Changes. Econometrica 1998, 66, 47. [Google Scholar] [CrossRef]

- Bai, J.; Perron, P. Computation and Analysis of Multiple Structural Change Models. J. Appl. Econ. 2003, 18, 1–22. [Google Scholar] [CrossRef]

- Chow, G.C. Tests of Equality Between Sets of Coefficients in Two Linear Regressions. Econometrica 1960, 28, 591. [Google Scholar] [CrossRef]

- Hansen, B.E. The New Econometrics of Structural Change: Dating Breaks in U.S. Labor Productivity. J. Econ. Perspect. 2001, 15, 117–128. [Google Scholar] [CrossRef]

- Quandt, R.E. Tests of the Hypothesis That a Linear Regression System Obeys Two Separate Regimes. J. Am. Stat. Assoc. 1960, 55, 324–330. [Google Scholar] [CrossRef]

- Andrews, D.W.K. Tests for Parameter Instability and Structural Change With Unknown Change Point. Econometrica 1993, 61, 821. [Google Scholar] [CrossRef]

- Dufour, J.-M. Generalized Chow Tests for Structural Change: A Coordinate-Free Approach. Int. Econ. Rev. 1982, 23, 565. [Google Scholar] [CrossRef]

- Bai, J.; Perron, P. Critical Values for Multiple Structural Change Tests. Econom. J. 2003, 6, 72–78. [Google Scholar] [CrossRef]

- Bai, J.; Perron, P. Multiple Structural Change Models: A Simulation Analysis. In Econometric Theory and Practice; Corbae, D., Durlauf, S.N., Hansen, B.E., Eds.; Cambridge University Press: Cambridge, UK, 2006; ISBN 978-1-139-16486-3. pp. 212–238. [Google Scholar]

- Liu, J.; Wu, S.; Zidek, J.V. On Segmented Multivariate Regression. Stat. Sin. 1997, 7, 497–525. [Google Scholar]

- Yao, Y.-C. Estimating the Number of Change-Points via Schwarz’ Criterion. Stat. Probab. Lett. 1988, 6, 181–189. [Google Scholar] [CrossRef]

- Voora, V.; Bermúdez, S.; Larrea, C. Global Market Report: Sugar; International Institute for Sustainable Development: Winnipeg, MB, Canada, 2020. [Google Scholar]

- OECD Sugar. OECD-FAO Agricultural Outlook 2018–2027; OECD-FAO Agricultural Outlook; OECD: Paris, France, 2018; pp. 139–148. ISBN 978-92-64-29721-0. [Google Scholar]

- Martiniello, G.; Azambuja, R. Contracting Sugarcane Farming in Global Agricultural Value Chains in Eastern Africa: Debates, Dynamics, and Struggles. Agrar. South: J. Political Econ. 2019, 8, 208–231. [Google Scholar] [CrossRef]

- Taylor, R.D. 2017 Outlook of the U.S. and World Sugar Markets, 2016–2026; Agribusiness & Applied Economics Report; Center for Agricultural Policy and Trade Studies: Fargo, ND, USA, 2017; p. 26. [Google Scholar]

- Ministry of Agriculture of the Czech Republic. Situační a Výhledová Zpráva Cukr—Cukrová Řepa; Ministry of Agriculture of the Czech Republic: Prague, Czech Republic, 2017. [Google Scholar]

- Maitah, M.; Smutka, L. The Development of World Sugar Prices. Sugar Tech. 2019, 21, 1–8. [Google Scholar] [CrossRef]

- Rumánková, L.; Smutka, L. Global Sugar Market—The Analysis of Factors Influencing Supply and Demand. Acta Univ. Agric. Silv. Mendel. Brun. 2013, 61, 463–471. [Google Scholar] [CrossRef]

- McConnell, M.; Dohlman, E.; Haley, S.L. World Sugar Price Volatility Intensified by Market and Policy Factors. Available online: https://ageconsearch.umn.edu/record/121895 (accessed on 11 January 2021).

- Foreign Agricultural Service. Global Production Rebounds but Record Consumption And Tight Stocks Undergird Strong Prices; Sugar: World Markets and Trade; United States Department of Agriculture: Washington, DC, USA, 2016. [Google Scholar]

- Food and Agricultural Organization FAO Food Price Index. Available online: http://www.fao.org/worldfoodsituation/foodpricesindex/en/ (accessed on 7 January 2021).

- Foreign Agricultural Service Record Global Production Spurs Record Consumption; Sugar: World Markets and Trade; United States Department of Agriculture: Washington, DC, USA, 2017.

- Anonymous. World Sugar Marker: Stock Marker Decline Weights on Sugar Price. Sugar Industry-Zuckerindustrie. 2020, 145, 205–207. [Google Scholar]

- World Trade Organizations. COVID-19 and Agriculture: A Story of Resilience; WTO: Geneva, Switzerland, 2020. [Google Scholar]

- Elleby, C.; Domínguez, I.P.; Adenauer, M.; Genovese, G. Impacts of the COVID-19 Pandemic on the Global Agricultural Markets. Env. Resour. Econ. 2020, 76, 1067–1079. [Google Scholar] [CrossRef]

- Anonymous. RFA: Lockdown Measures Causing Ethanol Sector Collapse. Sugar Industry-Zuckerindustrie. 2020, 145, 345. [Google Scholar]

- Anonymous. World Sugar Market: Brazil’s Performance as Well as Prospects for India and Thailand in the Focus. Sugar Industry-Zuckerindustrie. 2020, 145, 531–533. [Google Scholar]

- Solomon, S.; Rao, G.P.; Swapna, M. Impact of COVID-19 on Indian Sugar Industry. Sugar Tech. 2020, 22, 547–551. [Google Scholar] [CrossRef]

- Anonymous. World Sugar Market: Oil Price Crush and Covid-19 Weigh on World Market Sugar Prices. Sugar Industry-Zuckerindustrie 2020, 145, 267–269. [Google Scholar]

- United States Department of Agriculture. European Union: Sugar Semi-Annual; Brussels, Belgium, 2020. Available online: https://www.fas.usda.gov/data/european-union-sugar-semi-annual (accessed on 22 December 2020).

- United States Department of Agriculture. Sugar Semi-Annual: Brazil; United States Department of Agriculture: Washington, DC, USA, 2020. [Google Scholar]

- Rabobank Sugar Quarterly Q3 2020. Available online: https://research.rabobank.com/far/en/sectors/sugar/sugar-quarterly-q3-2020.html (accessed on 21 October 2020).

- Anonymous. World Sugar Market: Brazil—The Main Short-Term Driver. Sugar Industry-Zuckerindustrie. 2020, 145, 473–475. [Google Scholar]

- European Commission. Sugar Market Situation; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Di Renzo, L.; Gualtieri, P.; Pivari, F.; Soldati, L.; Attinà, A.; Cinelli, G.; Leggeri, C.; Caparello, G.; Barrea, L.; Scerbo, F.; et al. Eating Habits and Lifestyle Changes during COVID-19 Lockdown: An Italian Survey. J. Transl. Med. 2020, 18, 229. [Google Scholar] [CrossRef] [PubMed]

- Altig, D.; Baker, S.; Barrero, J.M.; Bloom, N.; Bunn, P.; Chen, S.; Davis, S.J.; Leather, J.; Meyer, B.; Mihaylov, E.; et al. Economic Uncertainty before and during the COVID-19 Pandemic. J. Public. Econ. 2020, 191, 104274. [Google Scholar] [CrossRef] [PubMed]

- Baker, S.R.; Bloom, N.; Davis, S.J.; Kost, K.J.; Sammon, M.C.; Viratyosin, T. The Unprecedented Stock Market Impact of COVID-19; NBER Working Papers; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 2020. [Google Scholar]

- Ji, Q.; Zhang, D.; Zhao, Y. Searching for Safe-Haven Assets during the COVID-19 Pandemic. Int. Rev. Financ. Anal. 2020, 71, 101526. [Google Scholar] [CrossRef]

- Kalkuhl, M.; von Braun, J.; Torero, M. Volatile and Extreme Food Prices, Food Security, and Policy: An Overview. In Food Price Volatility and Its Implications for Food Security and Policy; Kalkuhl, M., von Braun, J., Torero, M., Eds.; Springer International Publishing: Berlin, Germany, 2016; pp. 3–31. ISBN 978-3-319-28201-5. [Google Scholar]

- Pepitone, J. Runnin’ Scared: VIX Fear Gauge Spikes 35%. Available online: //money.cnn.com/2011/08/18/markets/VIX_fear_index/index.htm (accessed on 11 January 2021).

- Haley, S. World Raw Sugar Prices: The Influence of Brazilian Costs of Production and World Surplus/Deficit Measures. Available online: http://www.ers.usda.gov/publications/pub-details/?pubid=39372 (accessed on 21 October 2020).

- Chang, C.-L.; McAleer, M. A Simple Test for Causality in Volatility. Econometrics 2017, 5, 15. [Google Scholar] [CrossRef]

- Candila, V.; Farace, S. On the Volatility Spillover between Agricultural Commodities and Latin American Stock Markets. Risks 2018, 6, 116. [Google Scholar] [CrossRef]

| Index | Period | Mean | Median | Min | Max | Standard Deviation | Coefficient of Variation (%) |

|---|---|---|---|---|---|---|---|

| S&P GSCI Sugar | Full period (3 January 2000–30 December 2020) | 146.204 | 134.630 | 50.840 | 371.680 | 61.520 | 42.08 |

| Pre-global financial crisis announcement period (15 March 2008–14 September 2008) | 130.524 | 132.265 | 100.210 | 149.370 | 12.599 | 9.65 | |

| Post-global financial crisis announcement period (15 September 2008–14 March 2009) | 129.214 | 126.530 | 111.260 | 153.160 | 9.927 | 7.68 | |

| Pre-COVID-19 announcement period (31 July 2019–29 January 2020 | 133.337 | 132.635 | 115.470 | 154.320 | 9.904 | 7.43 | |

| Post-COVID-19 announcement period (30 January 2020–30 July 2020 | 124.767 | 123.265 | 98.740 | 160.040 | 16.216 | 13.00 | |

| VIX | Full period (3 January 2000–30 November 2020) | 19.922 | 17.595 | 9.140 | 82.690 | 8.924 | 44.80 |

| Pre-global financial crisis announcement period (15 March 2008–14 September 2008) | 22.052 | 21.565 | 16.300 | 32.240 | 2.838 | 12.87 | |

| Post-global financial crisis announcement period (15 September 2008–14 March 2009) | 50.956 | 47.560 | 30.300 | 80.860 | 11.048 | 21.68 | |

| Pre-COVID-19 announcement period (31 July 2019–29 January 2020 | 15.024 | 14.135 | 11.540 | 24.590 | 2.708 | 18.03 | |

| Post-COVID-19 announcement period (30 January 2020–30 July 2020 | 34.710 | 31.775 | 13.680 | 82.690 | 14.396 | 41.48 |

| Break Test | F-Statistic | Critical Value * | Break Date |

|---|---|---|---|

| S&P GSCI Sugar Index vs. VIX Index | |||

| 0 vs. 1 | 14.8911 | 8.58 | 23 September 2008 |

| 1 vs. 2 | 38.6522 | 10.13 | 8 December 2011 |

| 2 vs. 3 | 7.3529 | 11.14 | - |

| Parameter | Estimated Coefficient | Std. Error | T-Test Statistics | p-Value |

|---|---|---|---|---|

| 3 January 2000–22 September 2008 | ||||

| 0.0011 | 0.0072 | −0.1561 | 0.8760 | |

| 23 September 2008–7 December 2011 | ||||

| −0.0883 | 0.0091 | −9.1344 | 0.0000 | |

| 8 December 2011–30 November 2020 | ||||

| −0.0179 | 0.0052 | −3.4210 | 0.0006 | |

| non-breaking variable | ||||

| 0.0002 | 0.0003 | 0.5839 | 0.5593 | |

| Break Test | F-Statistic | Critical Value * | Break Date |

|---|---|---|---|

| S&P GSCI Sugar Index vs. S&P 500 Realized Volatility Index | |||

| 0 vs. 1 | 8.8874 | 8.58 | 29 August 2008 |

| 1 vs. 2 | 31.3864 | 10.13 | 10 November 2011 |

| 2 vs. 3 | 1.5929 | 11.14 | - |

| Parameter | Estimated Coefficient | Std. Error | T-Test Statistics | p-Value |

|---|---|---|---|---|

| 4 January 2000–28 August 2008 | ||||

| −0.0002 | 0.0005 | −0.2993 | 0.7647 | |

| 29 August 2008–9 November 2011 | ||||

| −0.0054 | 0.0007 | −7.6306 | 0.0000 | |

| 10 November 2011–30 November 2020 | ||||

| −0.0008 | 0.0004 | −1.9018 | 0.0573 | |

| Non-Breaking Variable | ||||

| 0.0002 | 0.0003 | 0.6096 | 0.5421 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kotyza, P.; Czech, K.; Wielechowski, M.; Smutka, L.; Procházka, P. Sugar Prices vs. Financial Market Uncertainty in the Time of Crisis: Does COVID-19 Induce Structural Changes in the Relationship? Agriculture 2021, 11, 93. https://doi.org/10.3390/agriculture11020093

Kotyza P, Czech K, Wielechowski M, Smutka L, Procházka P. Sugar Prices vs. Financial Market Uncertainty in the Time of Crisis: Does COVID-19 Induce Structural Changes in the Relationship? Agriculture. 2021; 11(2):93. https://doi.org/10.3390/agriculture11020093

Chicago/Turabian StyleKotyza, Pavel, Katarzyna Czech, Michał Wielechowski, Luboš Smutka, and Petr Procházka. 2021. "Sugar Prices vs. Financial Market Uncertainty in the Time of Crisis: Does COVID-19 Induce Structural Changes in the Relationship?" Agriculture 11, no. 2: 93. https://doi.org/10.3390/agriculture11020093

APA StyleKotyza, P., Czech, K., Wielechowski, M., Smutka, L., & Procházka, P. (2021). Sugar Prices vs. Financial Market Uncertainty in the Time of Crisis: Does COVID-19 Induce Structural Changes in the Relationship? Agriculture, 11(2), 93. https://doi.org/10.3390/agriculture11020093