Numeric Evaluation of Game-Theoretic Collaboration Modes in Supplier Development

Abstract

Featured Application

Abstract

1. Introduction

2. Related Literature

2.1. Supplier Development

2.2. Types of Games in Game Theory

2.2.1. Cooperative and Non-Cooperative Games

2.2.2. Symmetric and Asymmetric Games

2.2.3. Zero-Sum and Non Zero-Sum Games

2.2.4. Simultaneous and Sequential Games

2.2.5. Perfect Information and Imperfect Information Games

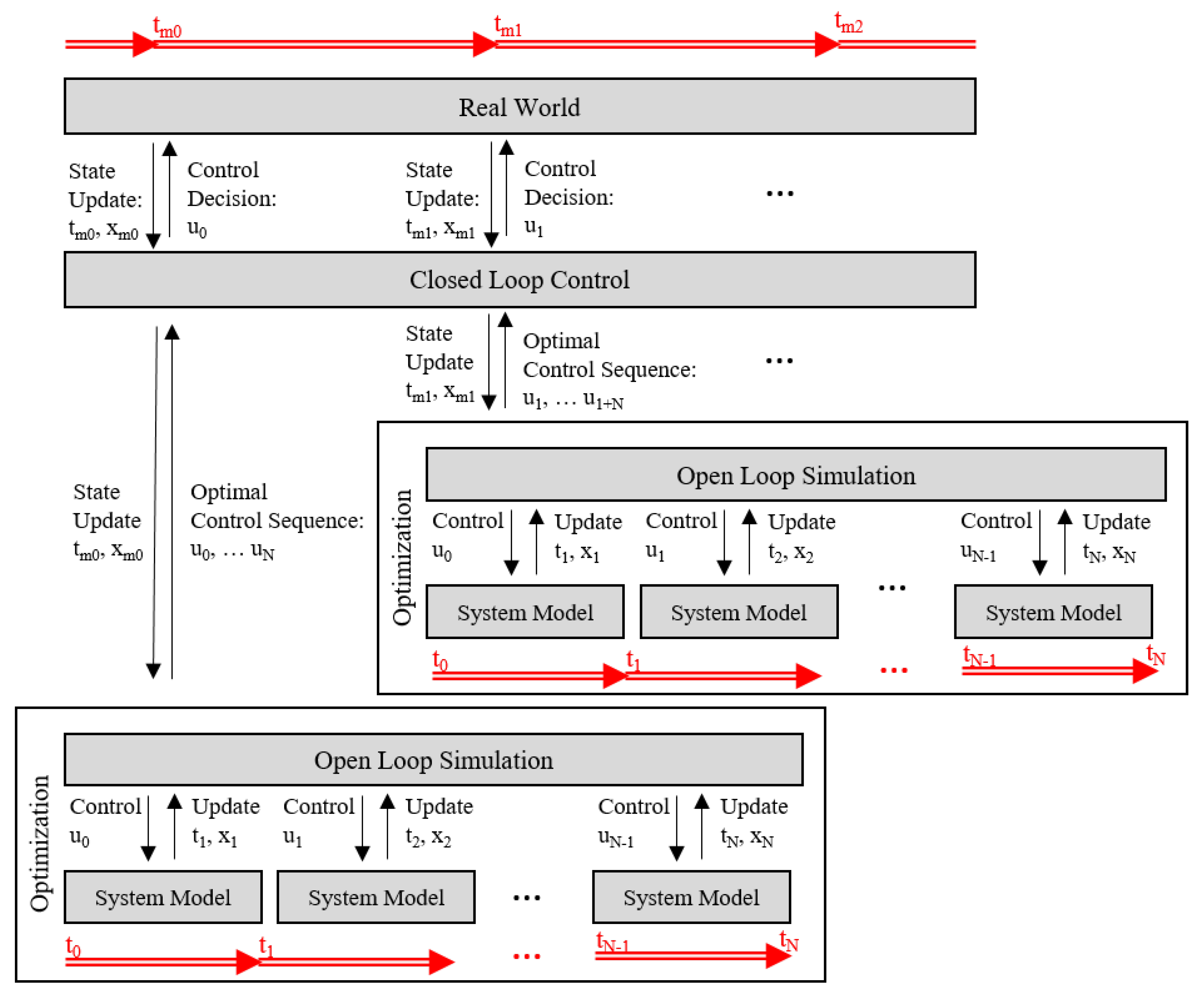

3. MPC Control Scheme

- Cost function: The cost function of each scenario differs in whether the manufacturers pursue a common goal or try to obtain their respective profit.

- System model: Depending on the scenario, the system model can differ strongly. For example, in the full cooperation setting, a common system model can be used, which includes all information about both manufacturers. In contrast, the non-cooperation setting uses two fully separate system models as neither manufacturer has any information about the other.

- Order and sequence of decision-making: In particular the sequential and simultaneous settings rely on different orders of decision making steps within each time step. For instance, multiple decision-making iterations can be used to represent the sharing of information. Thereby, each manufacturer makes a decision and conveys this decision to the other one. The latter uses the mentioned information to render its own decision and replies back to the first manufacturer. Now, the first manufacturer can again use the newly acquired information to update its decision and so on. As a result, several cycles of decision making can be part of a single time step.

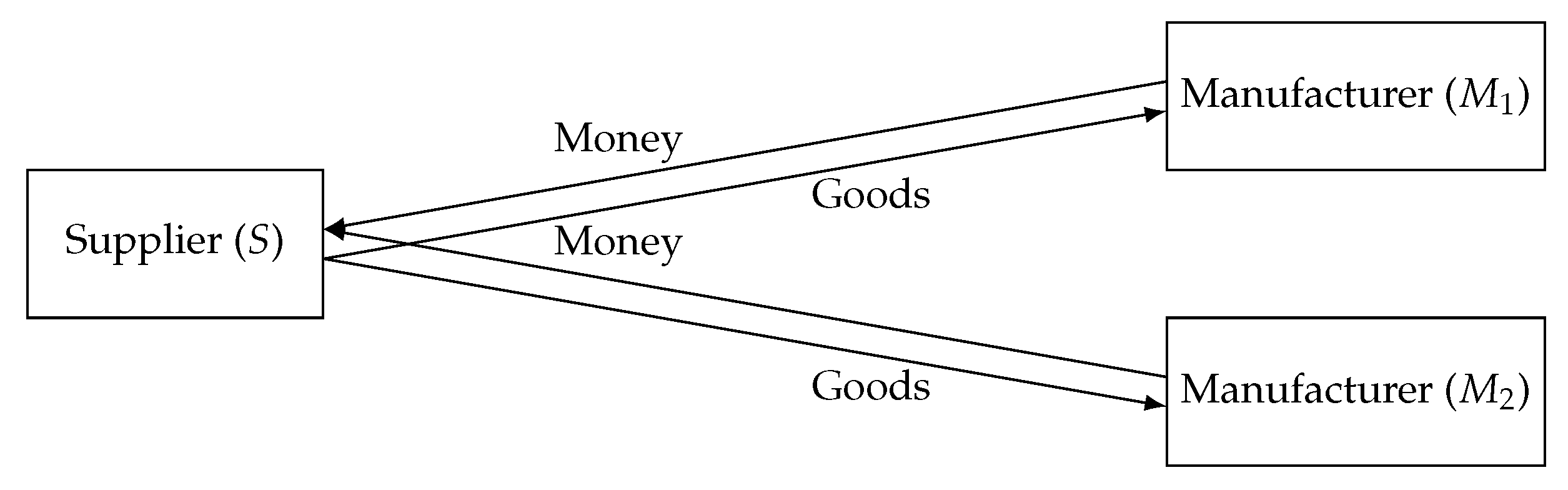

4. Model Description

4.1. Derivation of the Optimizer’s Cost Function

4.2. Settings

4.2.1. Cooperative Supplier Development

4.2.2. Collaborative Supplier Development

4.2.3. Non-Cooperative Supplier Development

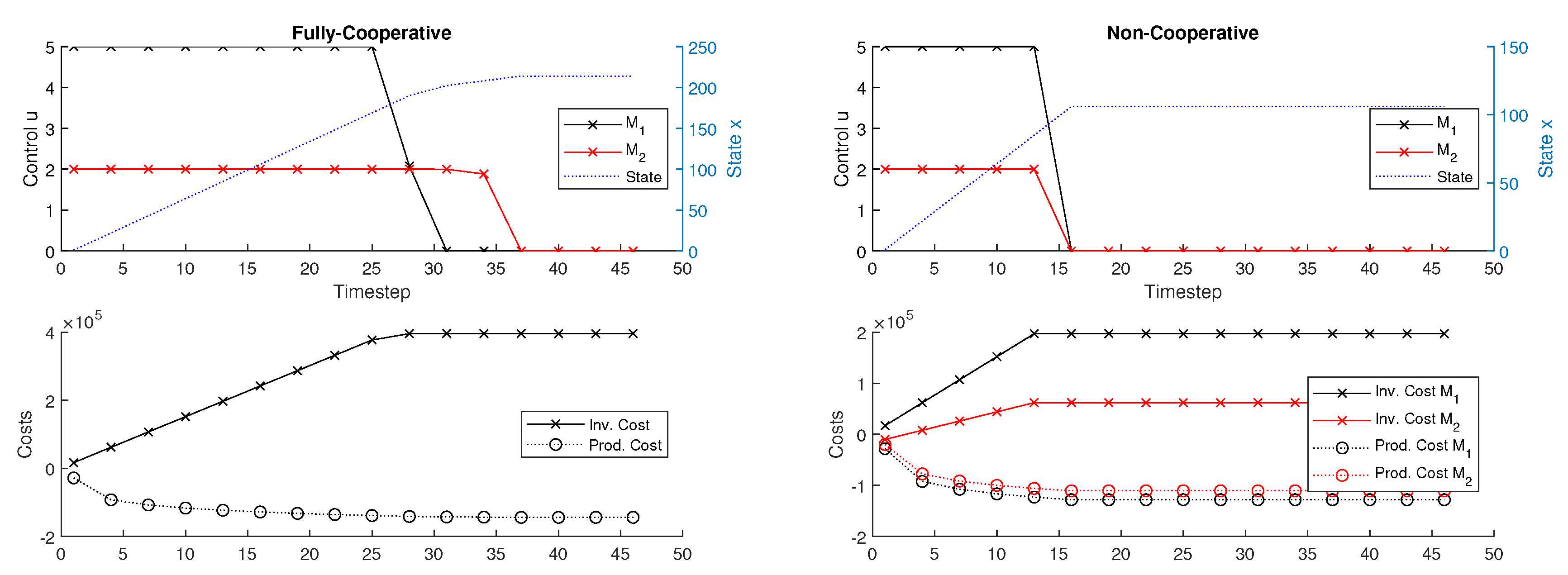

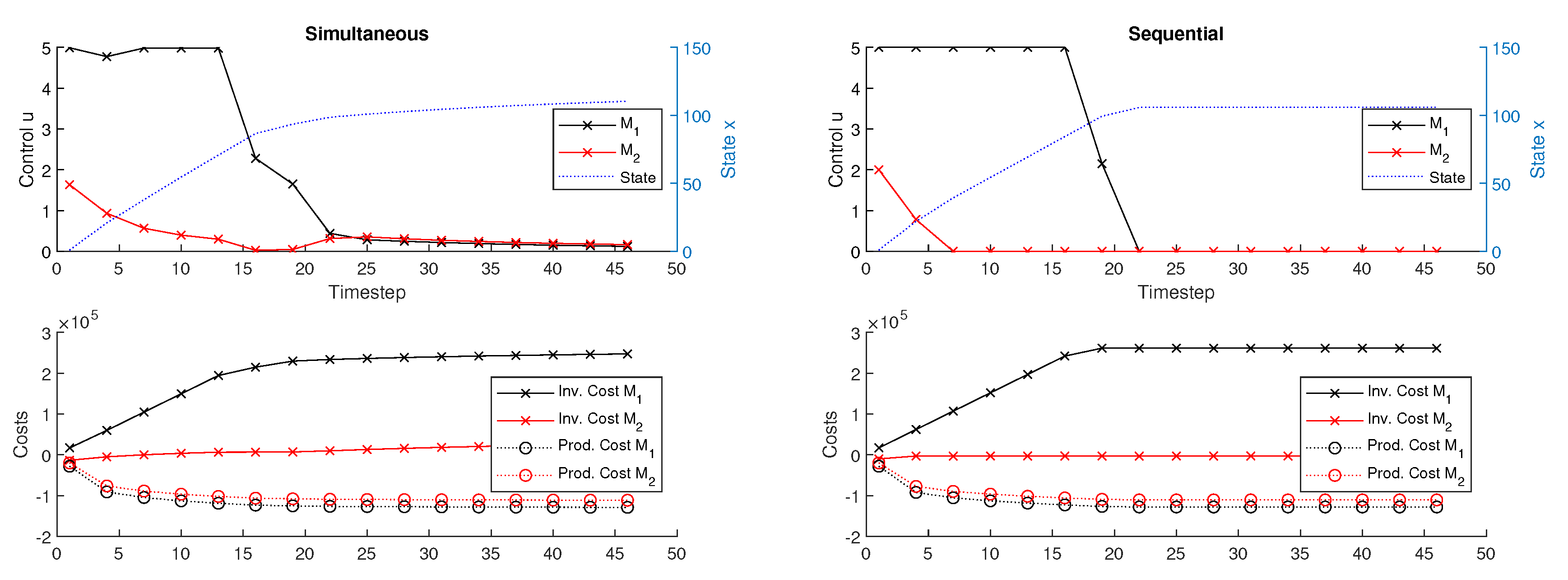

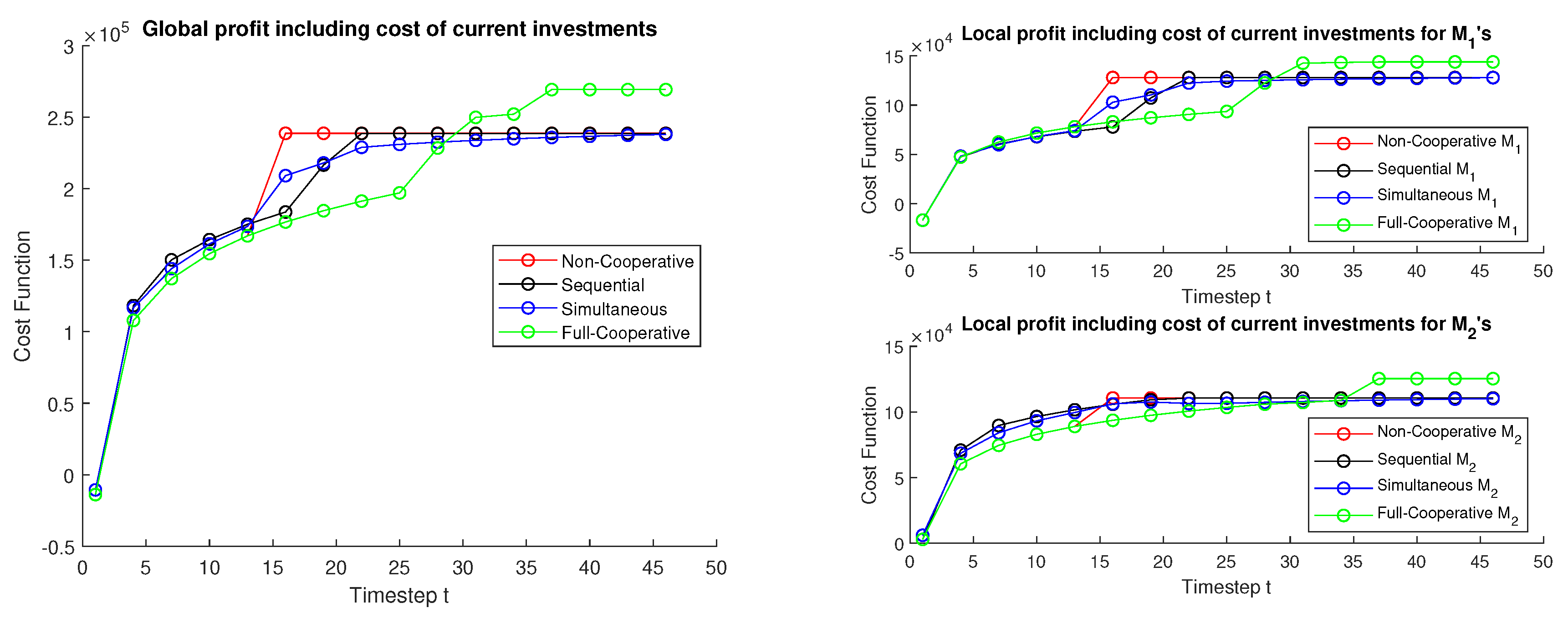

5. Results

6. Discussion

Author Contributions

Funding

Conflicts of Interest

References

- Reed, F.; Walsh, K. Enhancing technological capacity through supplier development: A study of the UK aerospace industry. Trans. Eng. Manag. 2002, 49, 231–242. [Google Scholar] [CrossRef]

- Talluri, S.; Narasimhan, R.; Chung, W. Manufacturer cooperation in supplier development under risk. Eur. J. Oper. Res. 2010, 207, 165–173. [Google Scholar] [CrossRef]

- Govindan, K.; Kannan, D.; Haq, A.N. Analyzing supplier development criteria for an automobile industry. Ind. Manag. Data Syst. 2010, 110, 43–62. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J. Green supplier development: Analytical evaluation using rough set theory. J. Clean. Prod. 2010, 18, 1200–1210. [Google Scholar] [CrossRef]

- Zajac, E.J.; Olsen, C.P. From transaction cost to transactional value anlysis: Implications for the study of interorganizational strategies. J. Manag. Stud. 1993, 30, 131–214. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J. Supplier development investment strategies: A game theoretic evaluation. Ann. Oper. Res. 2016, 240, 583–615. [Google Scholar] [CrossRef]

- Worthmann, K.; Proch, M.; Braun, P.; Schlüchtermann, J.; Pannek, J. Towards dynamic contract extension in supplier development. Logist. Res. 2016, 9, 1–12. [Google Scholar] [CrossRef]

- Proch, M.; Worthmann, K.; Schlüchtermann, J. A negotiation-based algorithm to coordinate supplier development in decentralized supply chains. Eur. J. Oper. Res. 2017, 256, 412–429. [Google Scholar] [CrossRef]

- Grüne, L.; Pannek, J. Nonlinear Model Predictive Control: Theory and Algorithms; Springer: Cham, Switzerland, 2017. [Google Scholar] [CrossRef]

- Ivanov, D.; Sokolov, B. Control and system-theoretic identification of the supply chain dynamics domain for planning, analysis and adaptation of performance under uncertainty. Eur. J. Oper. Res. 2013, 224, 313–323. [Google Scholar] [CrossRef]

- Krause, D.R.; Scannell, T. Supplier development practices: Product- and service-based industry comparisons. J. Supply Chain Manag. 2002, 38, 13–21. [Google Scholar] [CrossRef]

- Wagner, S. A firm’s responses to dficient suppliers and competitive advantage. J. Bus. Res. 2006, 59, 686–695. [Google Scholar] [CrossRef]

- Wagner, S. Supplier development and the relationship life-cycle. Int. J. Prod. Econ. 2011, 129, 277–283. [Google Scholar] [CrossRef]

- Routroy, S.; Pradhan, S. Evaluating the critical success factors of supplier development: A case study. Benchmarking Int. J. 2013, 20, 322–341. [Google Scholar] [CrossRef]

- Dale, B.G.; Burnes, B.; Reid, I.; Bamford, D. Supplier Development. In Managing Quality 6e; John Wiley & Sons, Ltd.: Cornwall, UK, 2016; pp. 141–157. [Google Scholar] [CrossRef]

- Kumar, C.V.; Routroy, S. Modeling Supplier Development barriers in Indian manufacturing industry. Asia Pac. Manag. Rev. 2018, 23, 235–250. [Google Scholar] [CrossRef]

- Glavee-Geo, R. Does supplier development lead to supplier satisfaction and relationship continuation? J. Purch. Supply Manag. 2019, 25, 100537. [Google Scholar] [CrossRef]

- Krause, D.R.; Handüeld, R.; Tyler, B.B. The relationships between supplier development, commitment, social capital accumulation and performance improvement. J. Oper. Manag. 2007, 2, 528–545. [Google Scholar] [CrossRef]

- Qu, Z.; Qin, Z.; Wang, J.; Luo, L.; Wei, Z. A cooperative game theory approach to resource allocation in cognitive radio networks. In Proceedings of the 2010 2nd IEEE International Conference on Information Management and Engineering (ICIME), Chengdu, China, 16–18 April 2010; pp. 90–93. [Google Scholar] [CrossRef]

- Bilbao, J. Cooperative Games on Combinatorial Structures; Kluwer Academic Publishers: New York, NY, USA, 2000; Volume 26. [Google Scholar]

- Kim, S. Game Theory Applications in Network Design; Information Science Reference - Imprint; IGI Publishing: Hershey, NY, USA, 2014. [Google Scholar] [CrossRef]

- Lazaridou, A.; Peysakhovich, A.; Baroni, M. Multi-Agent Cooperation and the Emergence of (Natural) Language. In Proceedings of the International Conference on Learning Representations (ICLR), Toulon, France, 24–26 April 2017. [Google Scholar]

- Bonau, S. A Case for Behavioural Game Theory. J. Game Theory 2017, 6, 7–14. [Google Scholar]

- Ferguson, T.S. Game Theory; UCLA: Los Angeles, CA, USA, 2014. [Google Scholar]

- Gaunersdorfer, A.; Hofbauer, J.; Sigmund, K. On the dynamics of asymmetric games. Theor. Popul. Biol. 1991, 39, 345–357. [Google Scholar] [CrossRef]

- Tuyls, K.; Pérolat, J.; Lanctot, M.; Ostrovski, G.; Savani, R.; Leibo, J.Z.; Ord, T.; Graepel, T.; Legg, S. Symmetric Decomposition of Asymmetric Games. Sci. Rep. 2018, 8, 1–20. [Google Scholar] [CrossRef]

- Lescanne, P.; Perrinel, M. “Backward” coinduction, Nash equilibrium and the rationality of escalation. Acta Inform. 2012, 49, 117–137. [Google Scholar] [CrossRef]

- Spangler, B. Positive-Sum, Zero-Sum, and Negative-Sum Situations; University of Colorado: Boulder, CO, USA, 2003. [Google Scholar]

- Shoam, Y.; Leyton-Brown, K. MULTIAGENT SYSTEMS Algorithmic, Game-Theoretic, and Logical Foundations; Cambridge University Press: Cambridge, UK, 2008. [Google Scholar]

- Jalali, O.; Nasrollahi, Z.; Hatefi Madjumerd, M. An Experimental Study of Incentive Reversal in Sequential and Simultaneous Games. Iran. Econ. Rev. 2018, 23, 639–658. [Google Scholar]

- Burch, N.; Schmid, M.; Moravčík, M.; Bowling, M. AIVAT: A New Variance Reduction Technique for Agent Evaluation in Imperfect Information Games. arXiv 2016, arXiv:1612.06915. [Google Scholar]

- Gutierrez, J.; Giuseppe, P.; Wooldridge, M. Imperfect information in Reactive Modules games. Inf. Comput. 2018, 261, 650–675. [Google Scholar] [CrossRef]

- Bernstein, F.; Kök, G. Dynamic cost reduction through process improvement in assembly networks. Manag. Sci. 2009, 55, 552–567. [Google Scholar] [CrossRef]

- Kim, B. Coordinating an innovation in supply chain management. Eur. J. Oper. Res. 2000, 123, 568–584. [Google Scholar] [CrossRef]

- Li, H.; Wang, Y.; Yin, R.; Kull, T.; Choi, T. Target pricing: Demand-side versus supply-side approaches. Int. J. Prod. Econ. 2012, 136, 172–184. [Google Scholar] [CrossRef]

- Yelle, L. The learning curve: Historical review and comprehensive survey. Decis. Sci. 1979, 10, 302–328. [Google Scholar] [CrossRef]

- Lummus, R.R.; Vokurka, R.J. Defining Supply Chian Management: A Historical Perspective and Practical Guidlines. Ind. Manag. Data Syst. J. 1999, 99, 11–17. [Google Scholar] [CrossRef]

- Park, M.; Park, S.; Mele, F. Modeling of Purchase and Sales Contracts in Supply Chain Optimization. Ind. Eng. Chem. Res. 2006, 45, 5013–5026. [Google Scholar] [CrossRef][Green Version]

- Mentzer, J.; DeWitt, W.; Keebler, J.; Min, S.; Nix, N.; Smith, C.; Zachsria, Z. Defining Supply Chain Managemnet. J. Bus. Logist. 2001, 22, 1–25. [Google Scholar] [CrossRef]

- Mann, H.; Cao, Y.; Mann, I.J. Strategy Implementation Tools in Supply Chain Contracts. IUP J. Bus. Strategy 2011, 23, 34–48. [Google Scholar]

- Deitz, G.D.; Tokman, M.; Glenn Richey, R.; Morgan, R.M. Joint venture stability and cooperation: Direct, indirect and contingent effects of resource complementarity and trust. Ind. Mark. Manag. 2010, 39, 862–873. [Google Scholar] [CrossRef]

| Symbol | Description | Value |

|---|---|---|

| T | Contract period | 60 |

| m | Learning rate | |

| a | Prohabitive price | 200 |

| b | Price elasticity | 0.01 |

| Variable cost per unit () | 65 | |

| Variable cost per unit () | 70 | |

| Variable cost per unit (S) | 100 | |

| Supplier development cost per unit () | 9000 | |

| Supplier development cost per unit () | 8500 | |

| Number of supplier development projects () | [0, 5] | |

| Number of supplier development projects () | [0, 2] |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dastyar, H.; Pannek, J. Numeric Evaluation of Game-Theoretic Collaboration Modes in Supplier Development. Appl. Sci. 2019, 9, 4331. https://doi.org/10.3390/app9204331

Dastyar H, Pannek J. Numeric Evaluation of Game-Theoretic Collaboration Modes in Supplier Development. Applied Sciences. 2019; 9(20):4331. https://doi.org/10.3390/app9204331

Chicago/Turabian StyleDastyar, Haniyeh, and Jürgen Pannek. 2019. "Numeric Evaluation of Game-Theoretic Collaboration Modes in Supplier Development" Applied Sciences 9, no. 20: 4331. https://doi.org/10.3390/app9204331

APA StyleDastyar, H., & Pannek, J. (2019). Numeric Evaluation of Game-Theoretic Collaboration Modes in Supplier Development. Applied Sciences, 9(20), 4331. https://doi.org/10.3390/app9204331