Updating Financial Contingency in Execution of Typologically Diverse Construction Projects

Abstract

1. Introduction

2. Methods

2.1. Research Sample

2.2. Survey Tool

3. Results

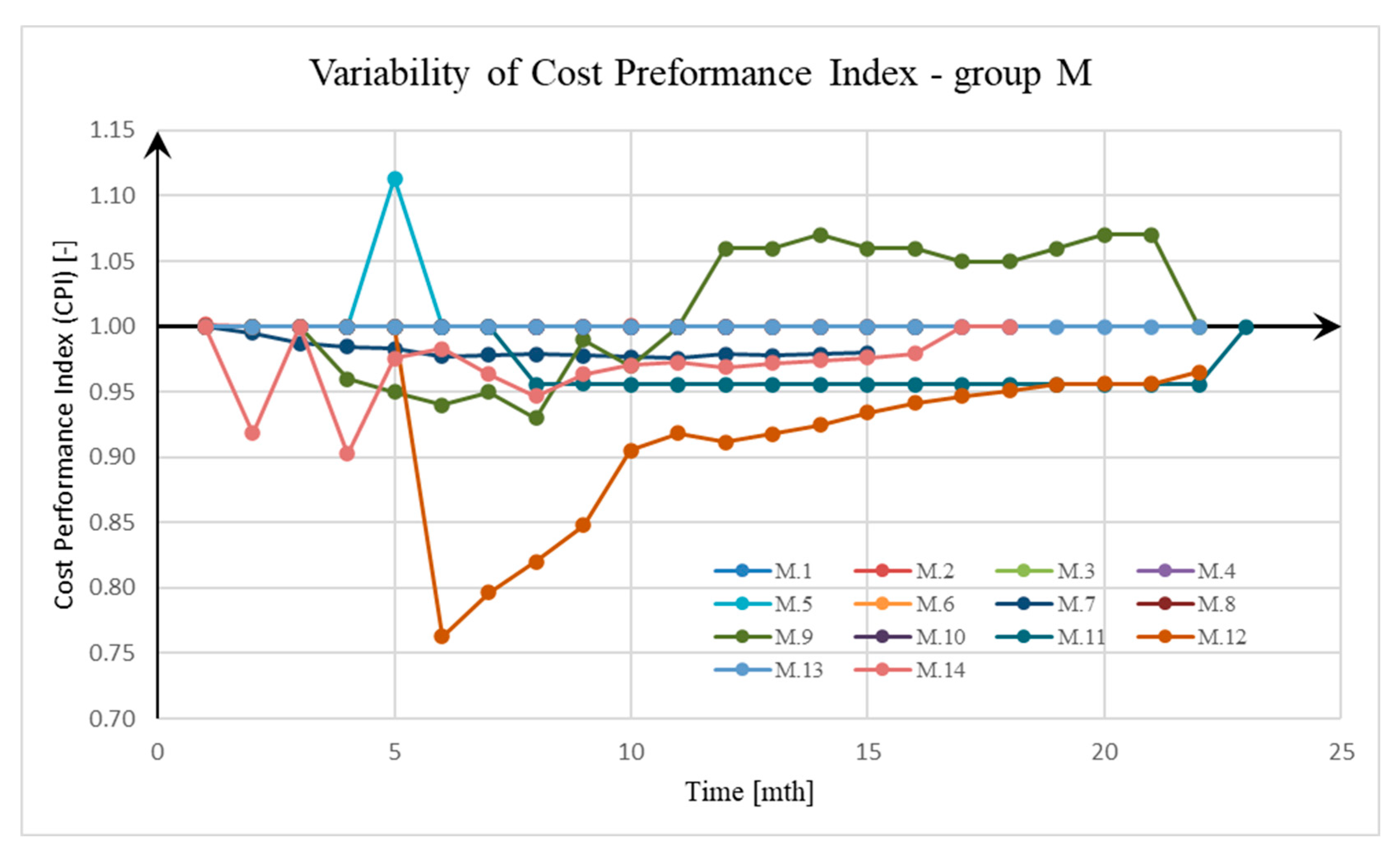

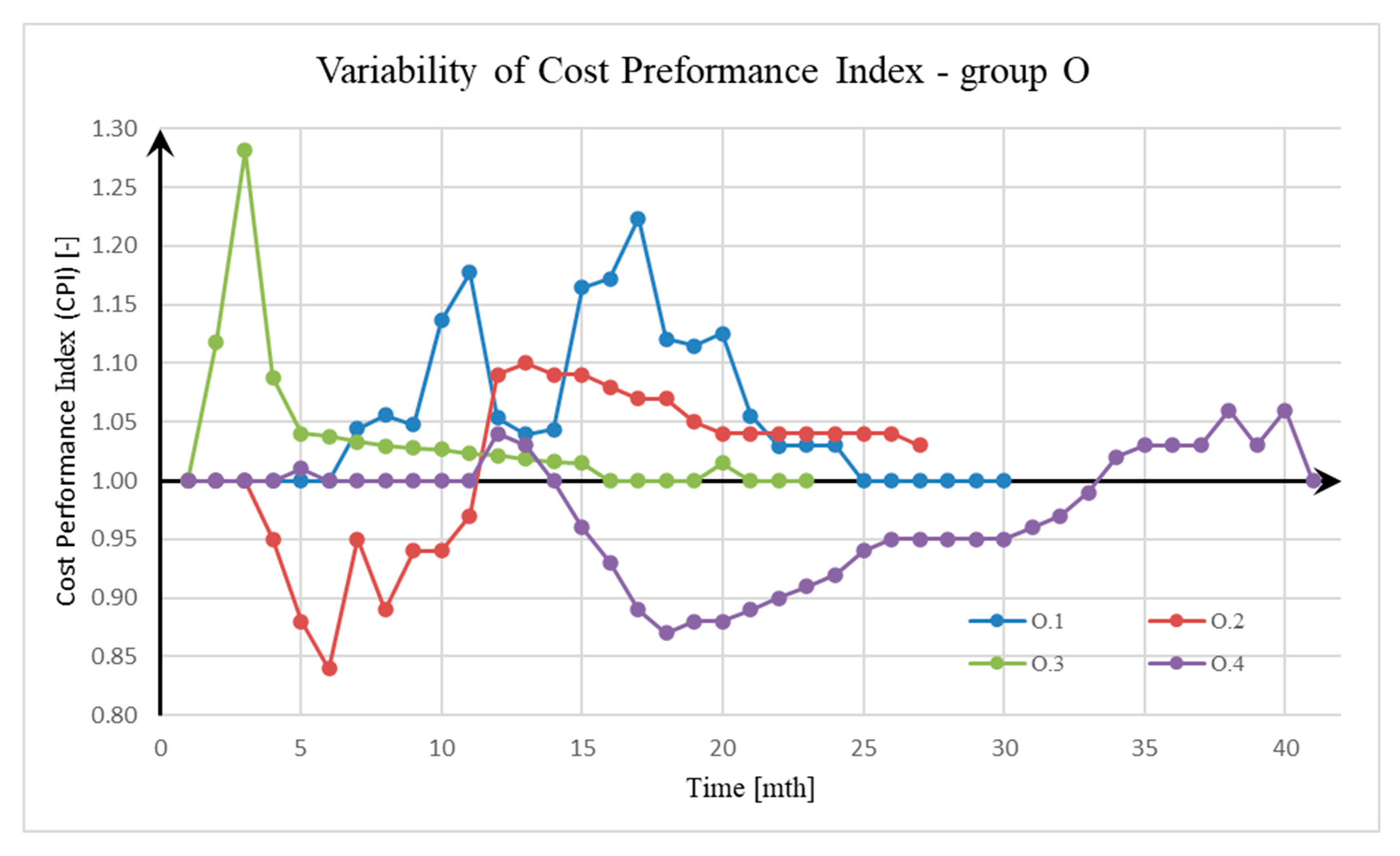

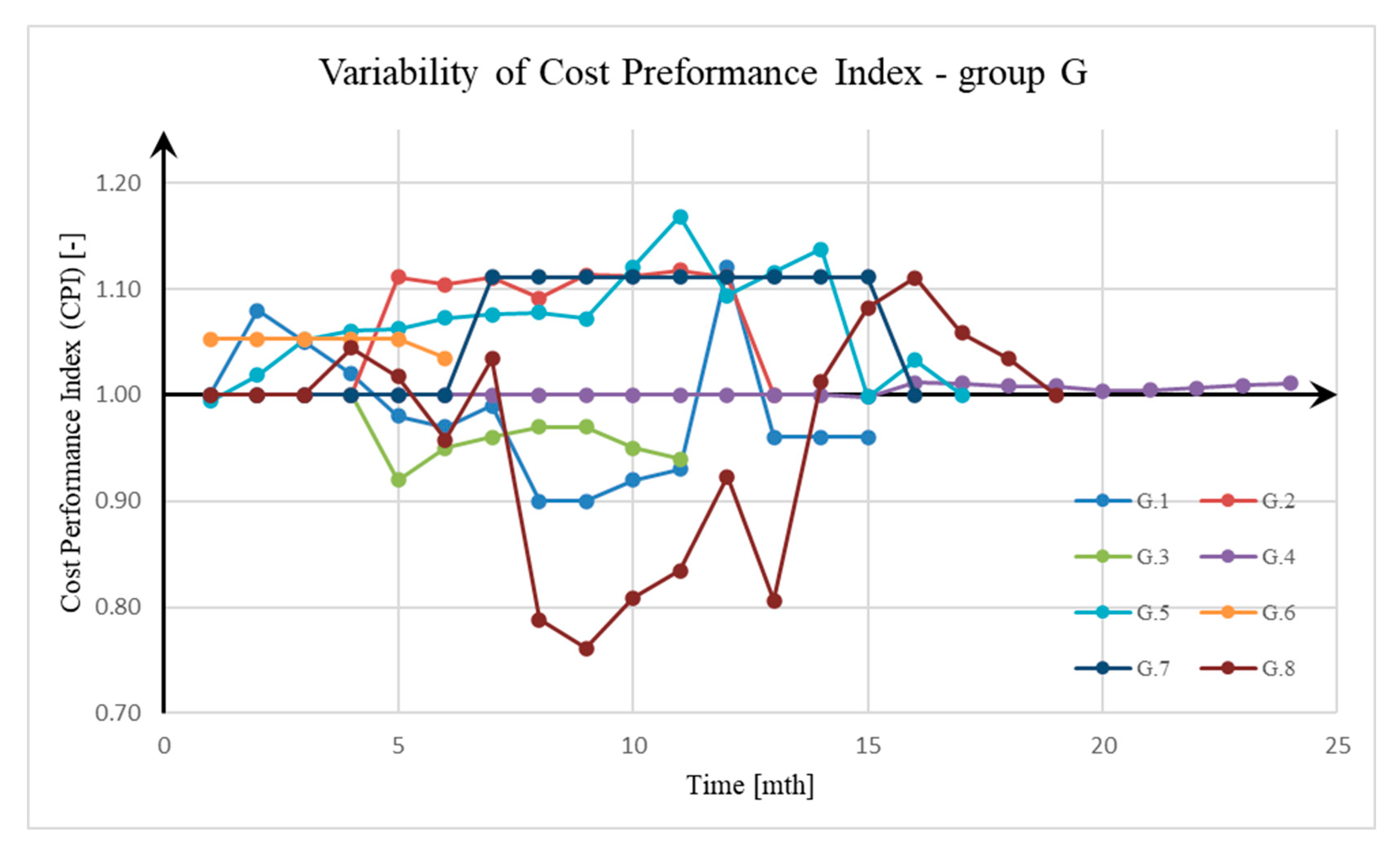

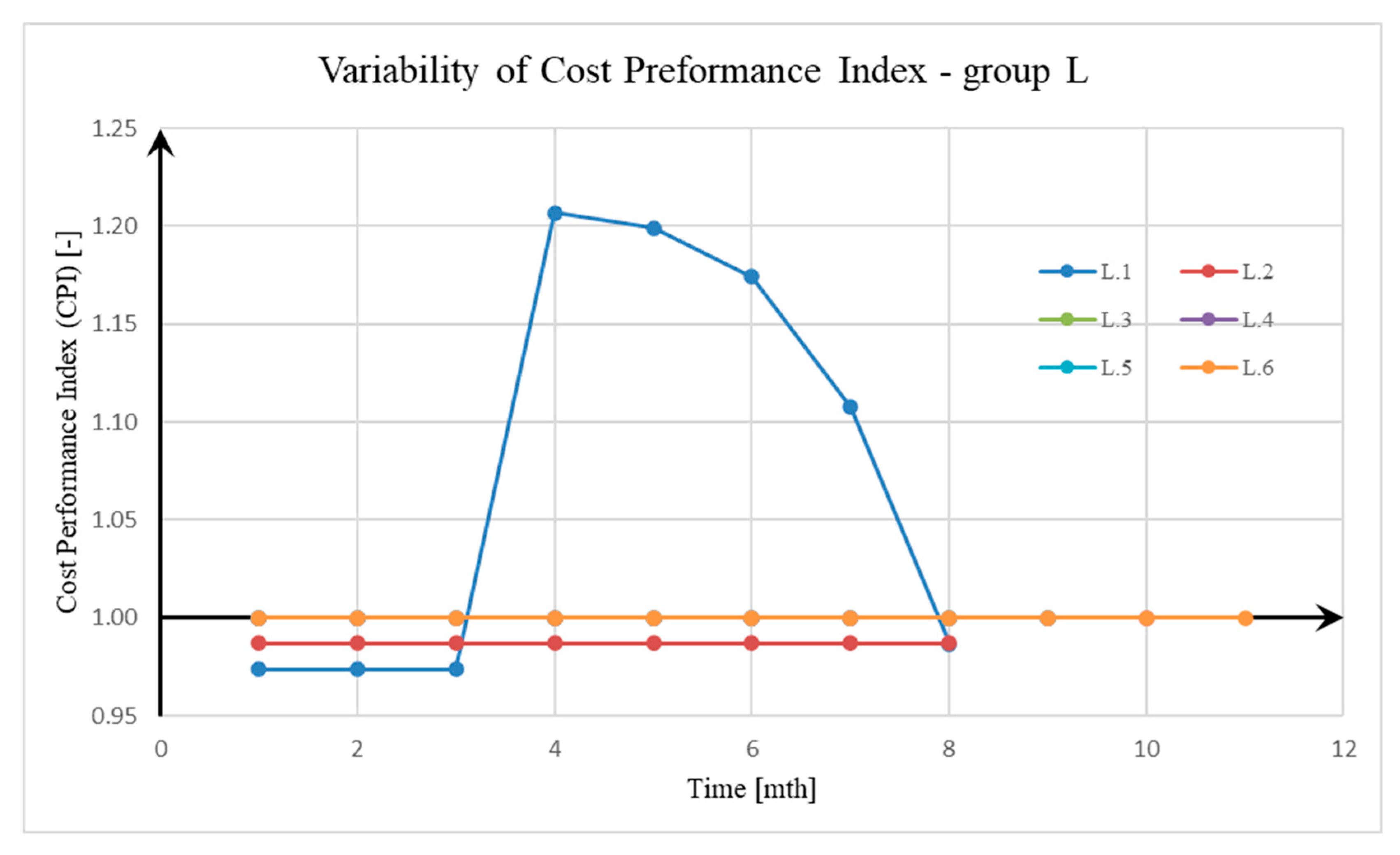

3.1. Cost Performance Index (CPI) in Diversified Construction Projects

- The cost performance indexes in the various groups of facilities show great variation both in terms of the values obtained and the observed course;

- The values of the cost performance index are characterized by greater and more chaotic dynamics of variation than the corresponding values of the schedule performance index. This shows the absence of a direct relationship between cost and schedule overruns;

- The course of the values of the individual indicators shown in the charts indicates the values of the CPI at a given, well-defined moment in the life of the investment and does not directly indicate the ultimate cost and schedule overruns of the investment;

- The course of CPI volatility is complex in nature and shows great variation even within groups of facilities. This does not allow any trend to be determined.

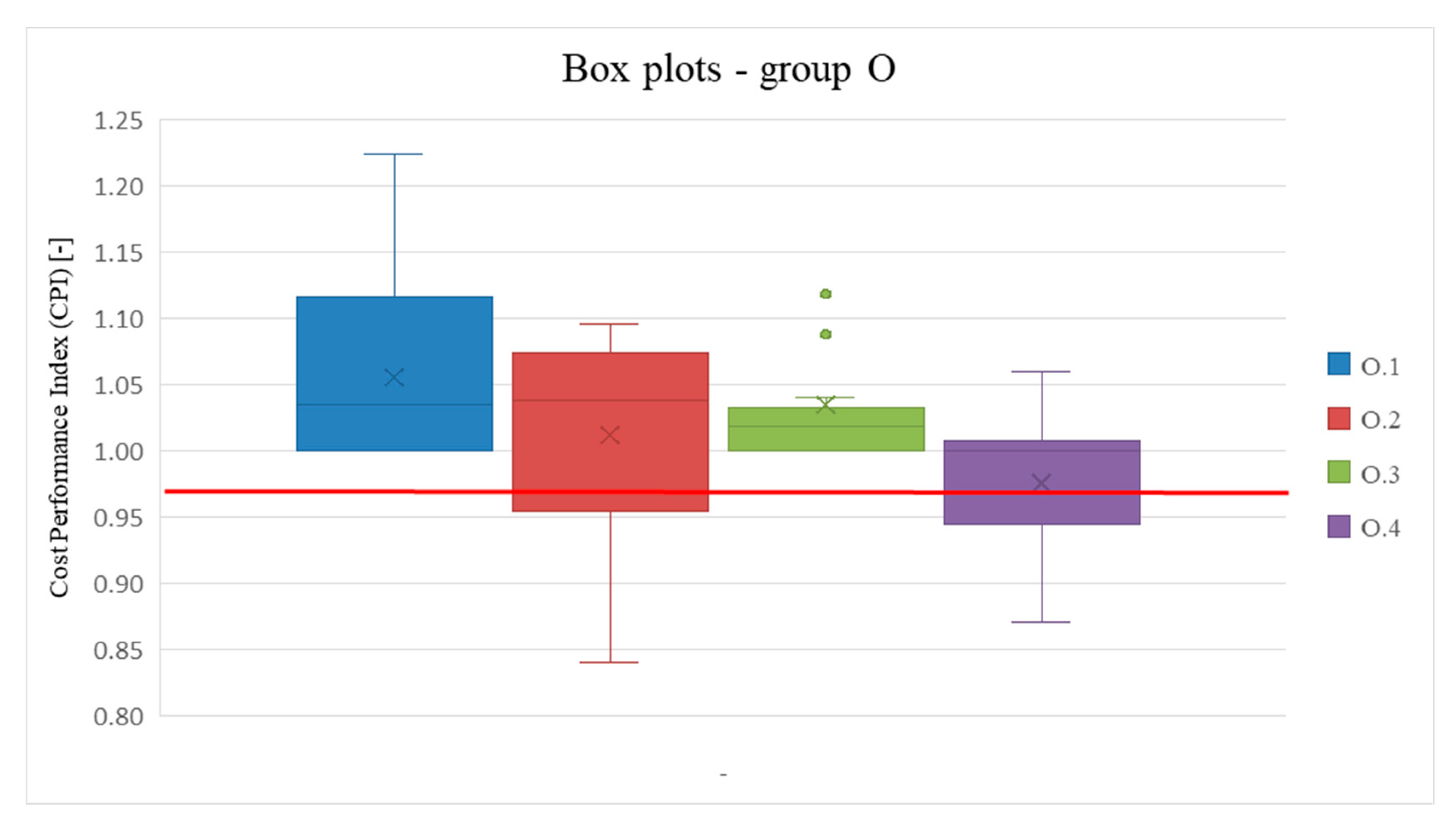

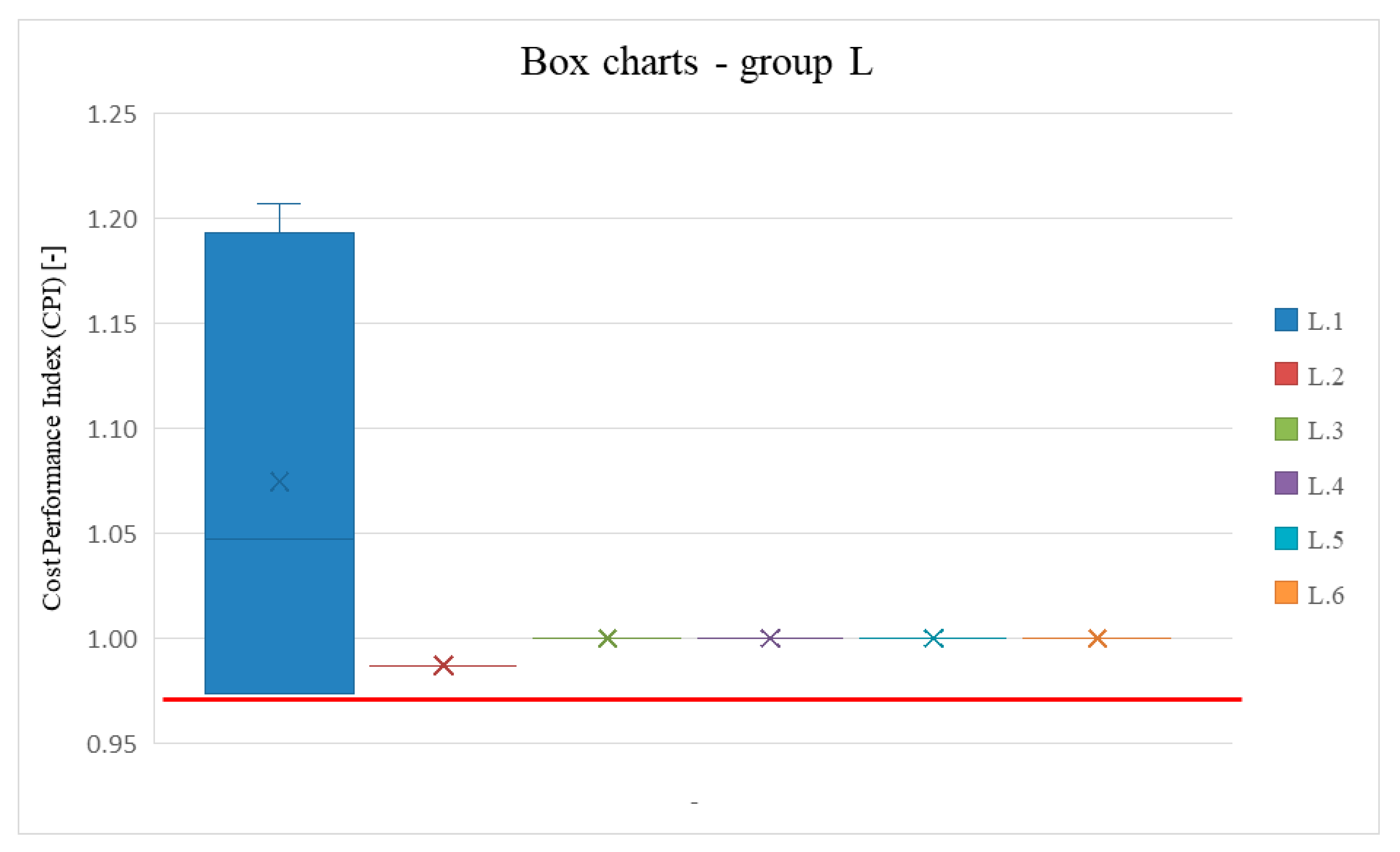

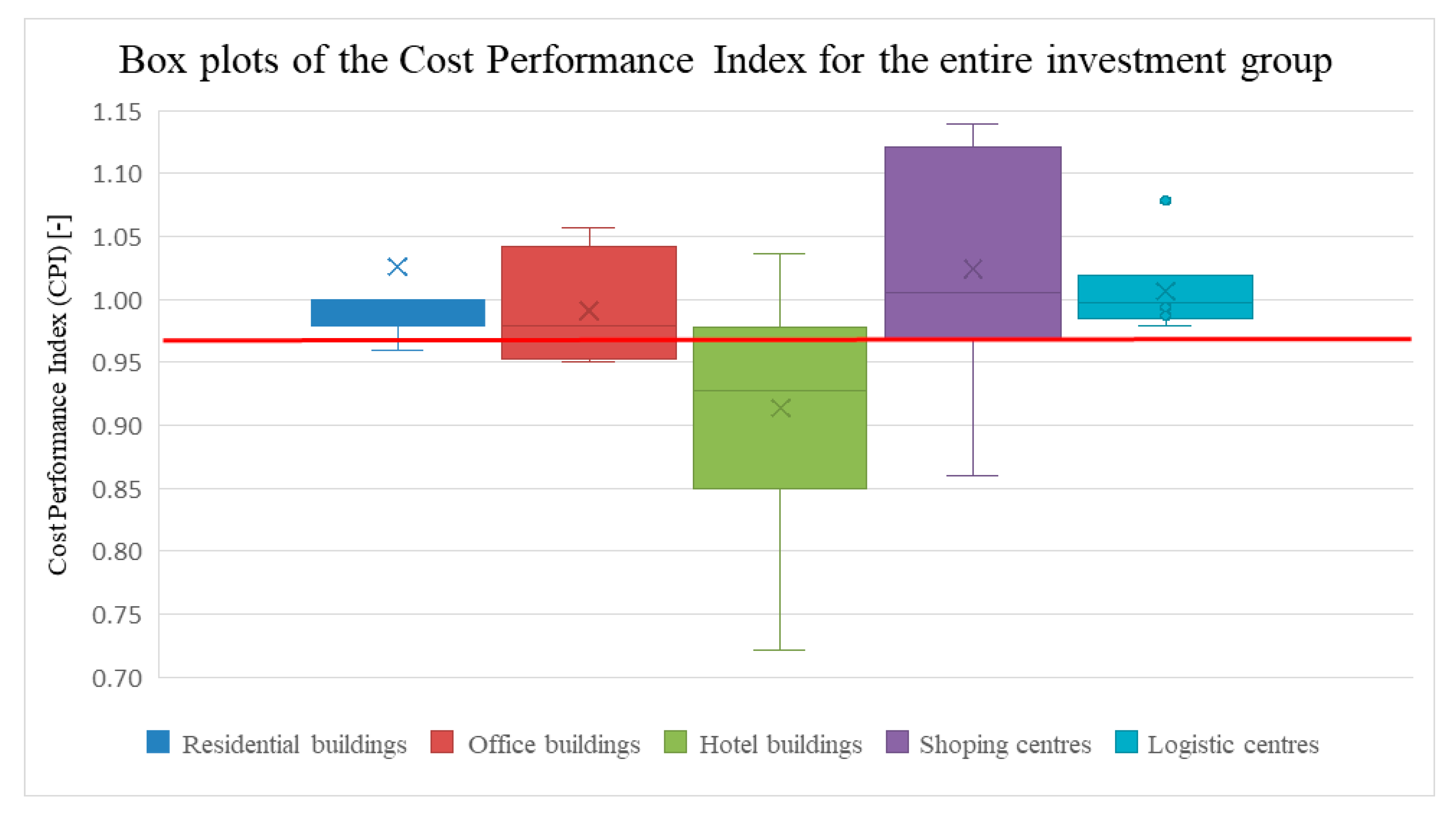

3.2. Analysis of Cost Overruns by Investment Group

- The ranges of CPI values observed in the identified investment groups are characterized by wide variation between individual projects;

- Except for the group of logistics centres (L), it was observed that the number of projects with cost overruns above the financial contingency level was in the range of 30–50%. The exception was the group of hotel buildings (H), where more than 70% of the projects showed significant overruns of this parameter. Such a high number of overruns observed in each audit period had a significant impact on the final cost of implementation and its deviation from the planned cost and the financial contingency;

- The distribution of CPI values against the financial contingency, observed in the box plots, indicates the possibility that the final cost of the project may not be maintained at the planned level.

3.3. Analysis of the Relationship Between Planned Cost and Actual Cost in the Context of Financial Contingency

- Despite the slight variation in CPI, outliers were observed in the groups of residential buildings (M) and logistics centres (L), indicating the possibility of projects in which the actual cost differs significantly from the planned cost. As these values approach the level of the financial contingency, the real possibility of exceeding it emerges;

- The compact range of CPI values with no outliers, as seen in the group of office buildings (O), indicates a stable range of observed deviations of actual cost from planned cost, and a low probability of values significantly deviating from the range contained between quartiles Q1 and Q3;

- The breadth of the range of CPI values observed in the groups of hotel buildings (H) and shopping centres (G) shows high variability, as evidenced by the height of the boxes in the graphs for these groups of facilities. Both groups were also found to have maximum and minimum values that significantly deviate from the box. This allows us to assume that there may be projects in which the actual cost exceeds not only the planned cost, but also the value of the budget provision.

4. Summary and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Tijanić, K.; Car-Pušić, D. Application of S-Curve in EVA Method. In Proceedings of the 13th International Conference “Organization, Technology and Management in Construction”, Poreč, Croatia, 27–30 September 2017; pp. 103–115. [Google Scholar]

- Project Management Institute. A Guide to the Project Management Body of Knowledge (PMBOK Guide), 6th ed.; Project Management Institute (PMI): Newtown Square, PA, USA, 2017; ISBN 9781935589679. [Google Scholar]

- IPMA. IPMA Individual Competence Baseline; IPMA: Lisboa, Portugal, 2015. [Google Scholar]

- Abba, W.F. How Earned Value Got to Primetime: A Short Look Back and Glance Ahead. In Proceedings of the Project Management Institute Annual Seminars & Symposium, Houston, TX, USA, 7–16 September 2000; Project Management Institute (PMI): Houston, TX, USA, 2000. [Google Scholar]

- De Marco, A.; Narbaev, T. Earned Value-Based Performance Monitoring of Facility Construction Projects. J. Facil. Manag. 2013, 11, 69–80. [Google Scholar] [CrossRef]

- Zohoori, B.; Verbraeck, A.; Bagherpour, M.; Khakdaman, M. Monitoring Production Time and Cost Performance by Combining Earned Value Analysis and Adaptive Fuzzy Control. Comput. Ind. Eng. 2019, 127, 805–821. [Google Scholar] [CrossRef]

- Chen, H.L.; Chen, W.T.; Lin, Y.L. Earned Value Project Management: Improving the Predictive Power of Planned Value. Int. J. Proj. Manag. 2016, 34, 22–29. [Google Scholar] [CrossRef]

- Bhosekar, S.K.; Vyas, G. Cost Controlling Using Earned Value Analysis in Construction Industries. Int. J. Eng. Innov. Technol. 2012, 1, 324–332. [Google Scholar]

- Waris, M.; Khamidi, M.F.; Idrus, A. The Cost Monitoring of Construction Projects through Earned Value Analysis. J. Constr. Eng. Proj. Manag. 2012, 2, 42–45. [Google Scholar] [CrossRef]

- Szóstak, M.; Stachoń, T.; Konior, J. Course of Cumulative Cost Curve (CCCC) as a Method of CAPEX Prediction in Selected Construction Projects. Appl. Sci. 2024, 14, 5597. [Google Scholar] [CrossRef]

- Ballesteros-Pérez, P.; Sanz-Ablanedo, E.; Soetanto, R.; González-Cruz, M.C.; Larsen, G.D.; Cerezo-Narváez, A. Duration and Cost Variability of Construction Activities: An Empirical Study. J. Constr. Eng. Manag. 2020, 146, 04019093. [Google Scholar] [CrossRef]

- Przywara, D.; Rak, A. Monitoring of Time and Cost Variances of Schedule Using Simple Earned Value Method Indicators. Appl. Sci. 2021, 11, 1357. [Google Scholar] [CrossRef]

- Plebankiewicz, E. Model of Predicting Cost Overrun in Construction Projects. Sustainability 2018, 10, 4387. [Google Scholar] [CrossRef]

- Konior, J.; Szóstak, M. The S-Curve as a Tool for Planning and Controlling of Construction Process-Case Study. Appl. Sci. 2020, 10, 2071. [Google Scholar] [CrossRef]

- Konior, J. Monitoring of Construction Projects Feasibility by Bank Investment Supervision Approach. Civ. Eng. Archit. 2019, 7, 31–35. [Google Scholar] [CrossRef]

- Shah, F.H.; Bhatti, O.S.; Ahmed, S. A Review of the Effects of Project Management Practices on Cost Overrun in Construction Projects †. Eng. Proc. 2023, 44, 1. [Google Scholar] [CrossRef]

- Gunduz, M.; Maki, O.L. Assessing the Risk Perception of Cost Overrun through Importance Rating. Technol. Econ. Dev. Econ. 2018, 24, 1829–1844. [Google Scholar] [CrossRef]

- Daoud, A.O.; El Hefnawy, M.; Wefki, H. Investigation of Critical Factors Affecting Cost Overruns and Delays in Egyptian Megaconstruction Projects. Alex. Eng. J. 2023, 83, 326–334. [Google Scholar] [CrossRef]

- Wang, Y.; Ghazali, F.E.M. Effective Control Measures to Minimize Cost Overrun during Construction Phase of High-Rise Residential Building Projects in Chongqing, China. Arch. Civ. Eng. 2023, 69, 79–94. [Google Scholar] [CrossRef]

- Sheamar, S.; Wedawatta, G.; Tennakoon, M.; Palliyaguru, R.; Antwi-Afari, M.F. The Potential of New Models of Construction Procurement to Counter Cost Overruns in Construction Projects: An Exploratory Study from a Contractors’ Perspective. J. Financ. Manag. Prop. Constr. 2024, 29, 211–228. [Google Scholar] [CrossRef]

- Ammar, T.; Abdel-Monem, M.; El-Dash, K. Risk Factors Causing Cost Overruns in Road Networks. Ain Shams Eng. J. 2022, 13, 101720. [Google Scholar] [CrossRef]

- Sharma, S.; Gupta, A.K. Analysis of Factors Affecting Cost and Time Overruns in Construction Projects. In Advances in Geotechnics and Structural Engineering: Select Proceedings of TRACE 2020; Lecture Notes in Civil Engineering; Springer: Singapore, 2021; Volume 143, ISBN 9789813369689. [Google Scholar]

- Alhammadi, Y.; Al-Mohammad, M.S.; Rahman, R.A. Modeling the Causes and Mitigation Measures for Cost Overruns in Building Construction: The Case of Higher Education Projects. Buildings 2024, 14, 487. [Google Scholar] [CrossRef]

- Memon, A.H.; Rahman, I.A.; Aziz, A.A.A. Study of Causative Factors of Cost Overrun in Large Projects of Southern Part of Peninsular Malaysia. In Proceedings of the 26th International Business Information Management Association Conference—Innovation Management and Sustainable Economic Competitive Advantage: From Regional Development to Global Growth, IBIMA 2015, Madrid, Spain, 11–12 November 2015; pp. 3580–3592. [Google Scholar]

- Ezeldin, A.S.; Ali, G.G. Cash Flow Optimization for Construction Portfolios. In Proceedings of the International Conference on Sustainable Infrastructure 2017: Policy, Finance, and Education, New York, NY, USA, 26–28 October 2017; pp. 26–37. [Google Scholar]

- Konior, J. Mitigation of correlated risk in construction projects. Civ. Eng. Archit. 2019, 7, 17–22. [Google Scholar] [CrossRef]

- Konior, J.; Szóstak, M. Time and Cost Variance of Construction Projects Monitored by Bank Investment Supervision. In International Scientific Conference Environmental Challenges in Civil Engineering; Springer International Publishing: Berlin/Heidelberg, Germany, 2021; Volume 122, ISBN 9783030638788. [Google Scholar]

- PM Group. Polska sp. z o.o. 2006–2015 and 3EPCM sp. z o.o. 2016–2024. “Initial, Monthly, Close-out Reporting of Bank Investment Supervision”.

- Regulation of the Council of Ministers of 30 December 1999 on the Polish Classification of Building Structures (PKOB) (Decree from 1999 r. No 112, Item. 1316). Available online: https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU19991121316 (accessed on 20 February 2025).

- Wickham, H.; Stryjewski, L. 40 Years of Boxplots. Had.Co.Nz 2011. Available online: https://vita.had.co.nz/papers/boxplots.pdf (accessed on 20 February 2025).

- Karunakaran, P.; Abdullah, A.H.; Nagapan, S.; Sohu, S.; Kasvar, K.K. Categorization of Potential Project Cost Overrun Factors in Construction Industry. IOP Conf. Ser. Earth Environ. Sci. 2018, 140, 012098. [Google Scholar] [CrossRef]

- Asiedu, R.O.; Adaku, E. Cost Overruns of Public Sector Construction Projects: A Developing Country Perspective. Int. J. Manag. Proj. Bus. 2020, 13, 66–84. [Google Scholar] [CrossRef]

- Larsen, J.K.; Shen, G.Q.; Lindhard, S.M.; Brunoe, T.D. Factors Affecting Schedule Delay, Cost Overrun, and Quality Level in Public Construction Projects. J. Manag. Eng. 2016, 32, 04015032. [Google Scholar] [CrossRef]

- Han, S.; Love, P.; Peña-Mora, F. A System Dynamics Model for Assessing the Impacts of Design Errors in Construction Projects. Math. Comput. Model. 2013, 57, 2044–2053. [Google Scholar] [CrossRef]

- Love, P.E.D.; Edwards, D.J.; Irani, Z.; Walker, D.H.T. Project Pathogens: The Anatomy of Omission Errors in Construction and Resource Engineering Project. IEEE Trans. Eng. Manag. 2009, 56, 425–435. [Google Scholar] [CrossRef]

- Polat, G.; Okay, F.; Eray, E. Factors Affecting Cost Overruns in Micro-Scaled Construction Companies. Procedia Eng. 2014, 85, 428–435. [Google Scholar] [CrossRef]

- Aslam, M.; Baffoe-Twum, E.; Saleem, F. Design Changes in Construction Projects—Causes and Impact on the Cost. Civ. Eng. J. 2019, 5, 1647–1655. [Google Scholar] [CrossRef]

- Derakhshanalavijeh, R.; Teixeira, J.M.C. Cost Overrun in Construction Projects in Developing Countries, Gas-Oil Industry of Iran as a Case Study. J. Civ. Eng. Manag. 2017, 23, 125–136. [Google Scholar] [CrossRef]

- Alhammadi, A.S.A.M.; Memon, A.H. Ranking of the Factors Causing Cost Overrun in Infrastructural Projects of Uae. Int. J. Sustain. Constr. Eng. Technol. 2020, 11, 204–211. [Google Scholar] [CrossRef]

- Yap, J.B.H.; Skitmore, M. Ameliorating Time and Cost Control with Project Learning and Communication Management: Leveraging on Reusable Knowledge Assets. Int. J. Manag. Proj. Bus. 2020, 13, 767–792. [Google Scholar] [CrossRef]

- Amusan, L.M.; Afolabi, A.; Ojelabi, R.; Omuh, I.; Okagbue, H.I. Data Exploration on Factors That Influences Construction Cost and Time Performance on Construction Project Sites. Data Brief 2018, 17, 1320–1325. [Google Scholar] [CrossRef]

- Senouci, A.B.; Mubarak, S.A. Multiobjective Optimization Model for Scheduling of Construction Projects under Extreme Weather. J. Civ. Eng. Manag. 2016, 22, 373–381. [Google Scholar] [CrossRef]

- Przywara, D.; Rak, A. Analysis Construction Industry on the Basis of Price Trends of Labor Cost. In Proceedings of the MATEC Web of Conferences, Bandung, Indonesia, 18 April 2018; Volume 174. [Google Scholar]

- Przywara, D.; Rak, A. Economic Conditions of Leaving the Construction Site by the Contractor at Different Stages of Its Implementation. In Environmental Challenges in Civil Engineering II; Lecture Notes in Civil Engineering; Springer: Cham, Switzerland, 2023; Volume 322. [Google Scholar]

| Category | Typological Group | Symbol According to PKOB | Measurement Period | Number of Construction Projects | Number of Measurements |

|---|---|---|---|---|---|

| M | Residential buildings | 1130 | 2006–2021 | 14 | 218 |

| O | Office buildings | 1220 | 2008–2021 | 4 | 69 |

| H | Hotels | 1211 | 2013–2020 | 9 | 110 |

| G | Shopping centres | 1230 | 2008–2018 | 8 | 113 |

| L | Logistics centres | 1252 | 2017–2024 | 6 | 37 |

| Sum | 41 | 547 |

| Category | Typological Group | Bottom Whisker Value | Quartile Q1 Median | Quartile Q3 Median | Top Whisker Value |

|---|---|---|---|---|---|

| M | Residential buildings | 0.96 | 0.98 | 1.00 | 1.03 |

| O | Office buildings | 0.95 | 0.95 | 1.04 | 1.06 |

| H | Hotels | 0.72 | 0.85 | 0.98 | 1.04 |

| G | Shopping centres | 0.86 | 0.97 | 1.12 | 1.14 |

| L | Logistics centres | 0.98 | 0.99 | 1.02 | 1.08 |

| Category | Typological Group | Bottom Whisker Value | Quartile Q1 Median | Quartile Q3 Median | Top Whisker Value |

|---|---|---|---|---|---|

| M | Residential buildings | 0.96 | 0.98 | 1.00 | 1.03 |

| O | Office buildings | 0.95 | 0.95 | 1.04 | 1.06 |

| H | Hotels | 0.72 | 0.85 | 0.98 | 1.04 |

| G | Shopping centres | 0.86 | 0.97 | 1.12 | 1.14 |

| L | Logistics centres | 0.98 | 0.99 | 1.02 | 1.08 |

| Category | Typological Group | Existing Level of Financial Contingency | Recommended Level of Financial Contingency |

|---|---|---|---|

| M | Residential buildings | 3% | 5% |

| O | Office buildings | 3% | 5% |

| H | Hotels | 3% | 30% |

| G | Shopping centres | 3% | 25% |

| L | Logistics centres | 3% | 3% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stachoń, T.; Szóstak, M.; Konior, J. Updating Financial Contingency in Execution of Typologically Diverse Construction Projects. Appl. Sci. 2025, 15, 4445. https://doi.org/10.3390/app15084445

Stachoń T, Szóstak M, Konior J. Updating Financial Contingency in Execution of Typologically Diverse Construction Projects. Applied Sciences. 2025; 15(8):4445. https://doi.org/10.3390/app15084445

Chicago/Turabian StyleStachoń, Tomasz, Mariusz Szóstak, and Jarosław Konior. 2025. "Updating Financial Contingency in Execution of Typologically Diverse Construction Projects" Applied Sciences 15, no. 8: 4445. https://doi.org/10.3390/app15084445

APA StyleStachoń, T., Szóstak, M., & Konior, J. (2025). Updating Financial Contingency in Execution of Typologically Diverse Construction Projects. Applied Sciences, 15(8), 4445. https://doi.org/10.3390/app15084445