4.1. Word Cloud

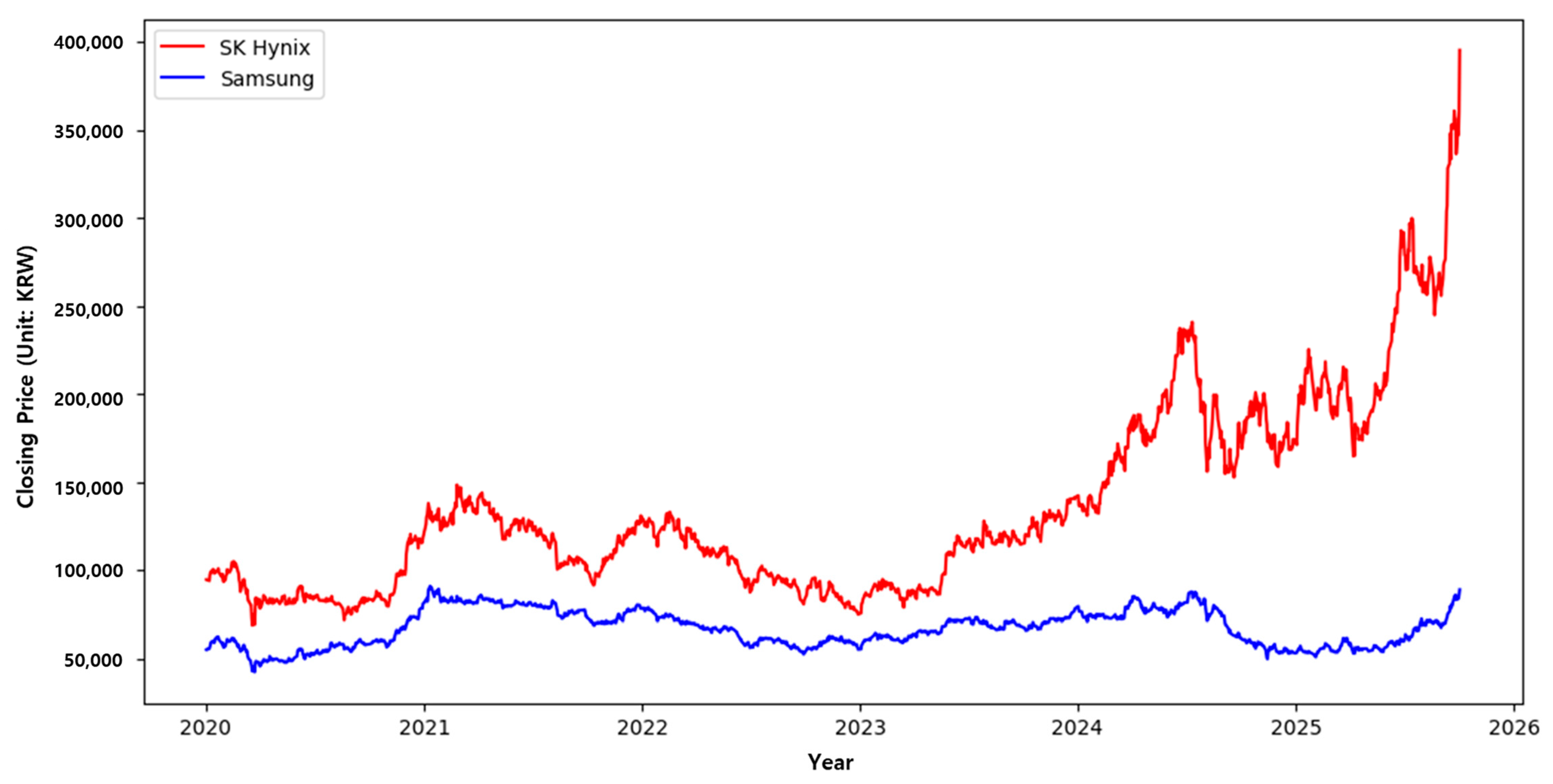

Word clouds provide an illustrative first-pass analysis of how each company is represented in HBM news. We utilize the cleaned Korean corpus from January 2023 to September 2025, and perform the following preprocessing steps: converting text to lowercase, removing stopwords and boilerplate, lemmatizing verbs and nouns to handle inflectional variations, and finally merging significant bi-grams to keep domain-specific phrases like “joint venture,” “in-house development,” and “technology acquisition” rather than splitting them. We also remove firm names and generic market terms to prevent unnecessary clues. The clouds for Samsung Electronics and SK hynix are separately generated to have frequency—and therefore font size—directly reflect the persistence with which related concepts appear in their vicinity.

In

Figure 4. A word cloud for Samsung highlights vertical integration, with key terms denoting internalization and control over interfaces, including self-developed, in-house development, technology acquisition, localization, proprietary, integrated device manufacturer, turnkey, internal embedding, and vertical integration. Self-reliance, in-house, line expansion, independence, and direct management all point to a closed-loop learning approach, accompanied by tighter integration across memory-packaging-fabs and an emphasis on owning process expertise and scheduling. The inclusion of localization terms along with self-developed and proprietary elements suggests a narrative linking internal capability development to supply reliability and accelerated iteration, characteristics typically related to a vertical business approach.

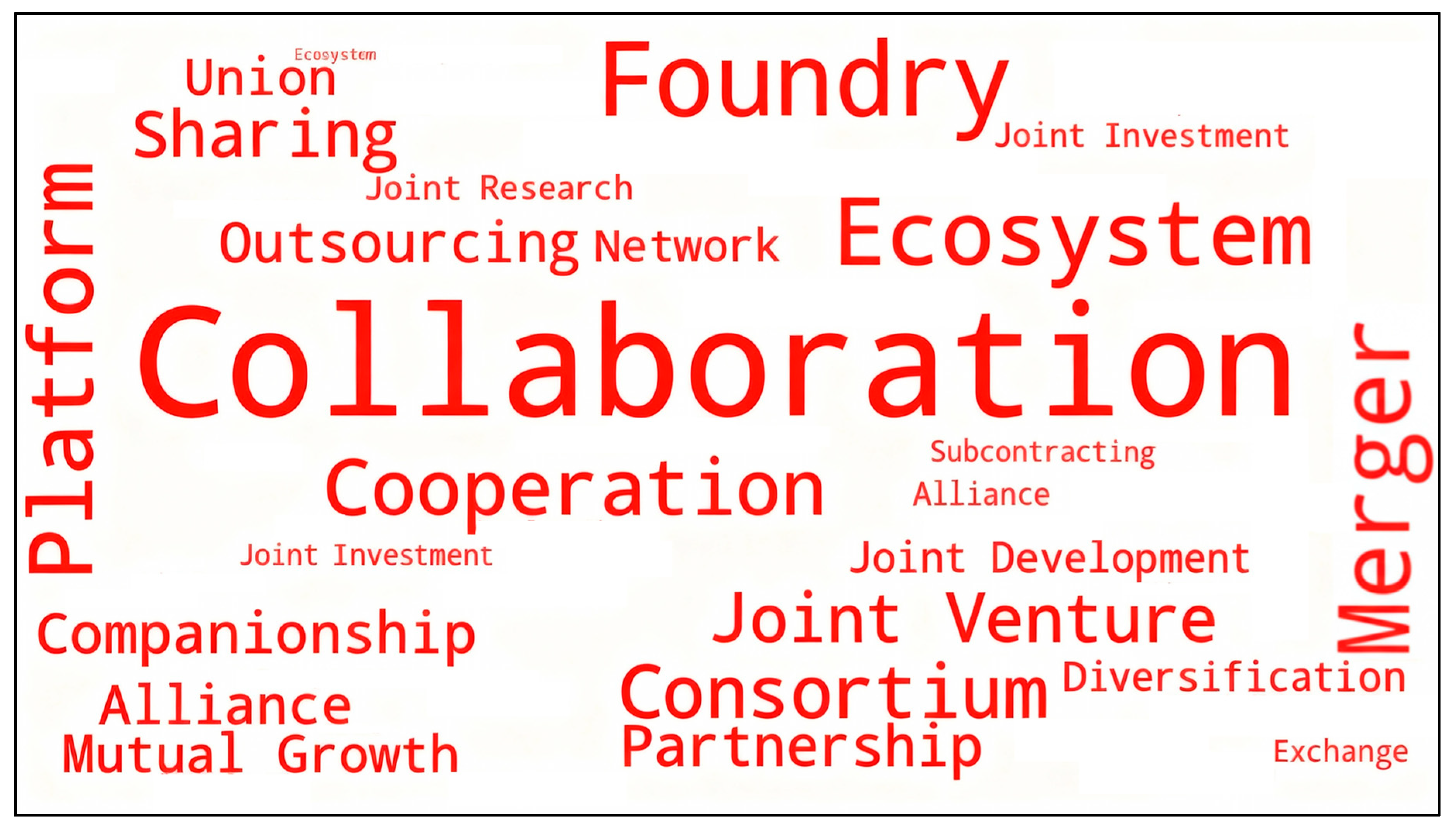

In contrast,

Figure 5 Depicts a word cloud highlighting SK Hynix’s focus on horizontal integration, which includes terms like partner-facing and ecosystem language: collaboration, ecosystem, cooperation, foundry, consortium, partnership, joint venture, joint development, platform, outsourcing, mutual growth, and network sharing. The presence of foundry, joint development, and platform, in addition to consortium and partnership, indicates a pattern of collaborative design with external experts, verification using shared equipment and protocols, and diversity across the supply chain. Terms like mergers and diversification emerge, supporting a portfolio strategy in which complementary assets are obtained using partnerships instead of internal integration.

In conjunction, the two clouds act as a visual point of reference, implying that public discourse about Samsung tends to internalize, whereas public discussion of SK Hynix tends to focus on strategic partnerships. We view these clouds as exploratory diagnostics rather than as inferential evidence. The seed lexicons used in our topic model are informed by them; they help to prevent label drift and prompt the creation of monthly topic-intensity series, which are then tested against market-implied valuation in the empirical analysis that follows. By design, Samsung loads only on the vertical signal, and SK Hynix loads only on the horizontal signal. The estimation of standard errors is implemented using robustness to heteroskedasticity, without additional controls, leaving identification dependent on the observed variation in the importance of strategic integration.

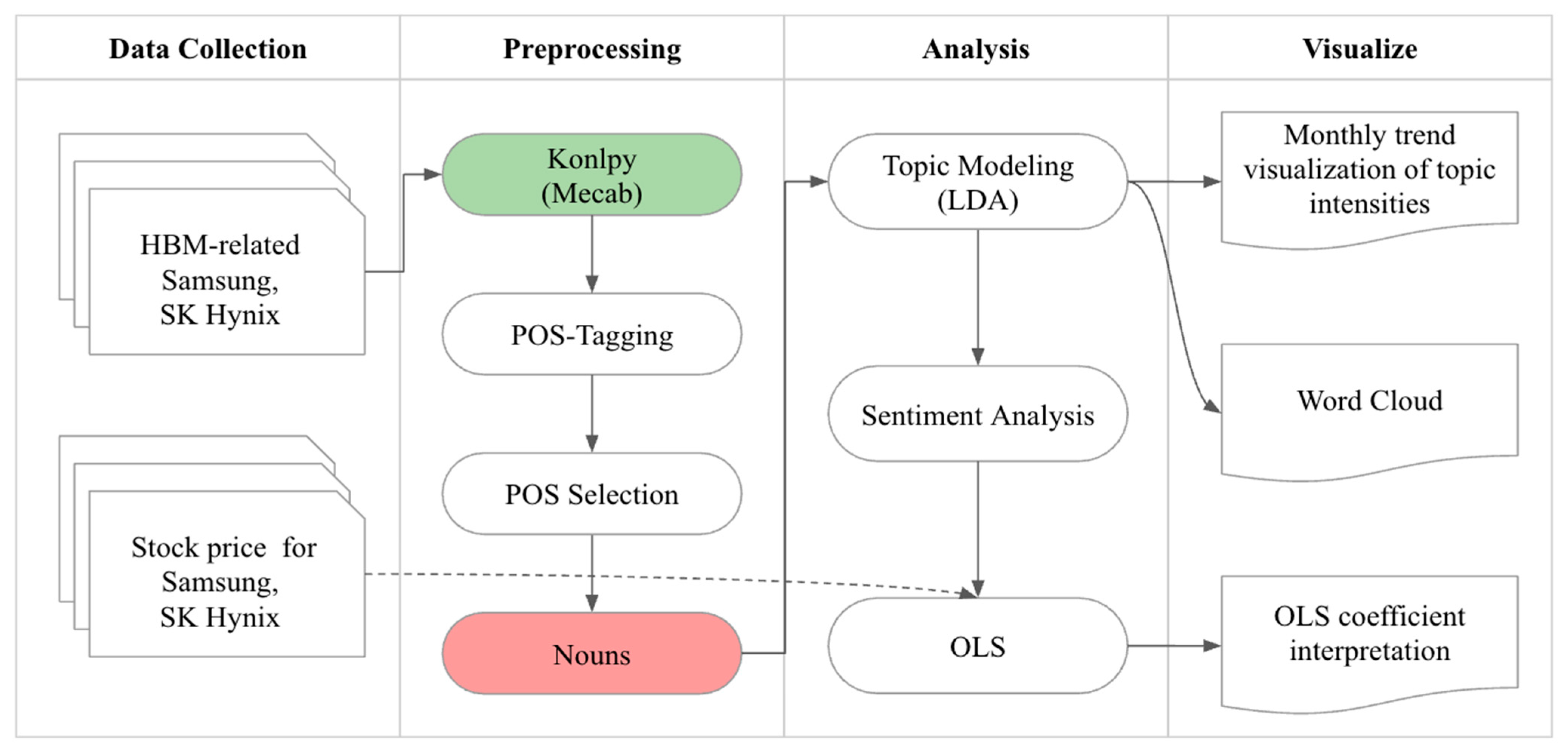

4.2. Topic Modeling Results

Table 4 shows that the topic model generates a consistent vertical-integration footprint for Samsung, consisting of ten distinct but complementary thematic clusters. At the higher level of governance, autonomy and localization (Topic 1) emphasizes self-sufficiency and internal supply (autonomy, management, operations), while foundry-centric architecture (Topic 2) and integrated foundry and supply chain (Topic 3) concentrate the organizational core around the foundry-memory interface (foundry, semiconductor, network, supply). These topics work together to support make-vs-buy decisions that eventually prefer internalization and system ownership, positioning Samsung as a coordinator of design, process, and capacity similar to an integrated device manufacturer.

Moving from planning to practice, Topic 7, process control, is the most operationally complex theme. It focuses on stability and ramp across facility, packaging, process, and mass production (production, process, quality, fab/plant, packaging, facilities). The vocabulary used is in line with closed-loop learning and schedule management, as opposed to relying on external sources. In-house design enablement (Topic 10) extends this concept into the design toolchain and platform infrastructure, implying that upstream design enablement is viewed as an internal capability that influences decisions on manufacturing and packaging. These two topics represent the “through-line” of a vertically governed process from stack design to process, process to yield, and yield to volume that is managed within firm boundaries. The supplier and ecosystem references are visible, but the layout orientation is still vertical. Vertical supplier enablement (Topic 4) emphasizes co-growth, industry-academia connections, and terms related to equipment and ecosystems (equipment, test, ecosystem), but the key collocations indicate supplier qualification and enablement based on Samsung’s criteria rather than traditional arm’s-length partnerships.

Topics 8 and 9, internal partner onboarding and internal ecosystem, emphasize collaboration and openness, but only in the context of integrating partners into Samsung’s internal framework (build-out, provision, participation), which aligns with a vertically structured ecosystem instead of a horizontally connected alliance network. Contracts for control (Topic 5) and M&A and risk consolidation (Topic 6) contain numerous governance mechanisms that are consistent with vertical control. The former focuses on formalizing control over key assets and interfaces through contracting, entity setup, and joint-venture structures (contract, establishment, corporation/legal entity), whereas the latter focuses on consolidation and risk management via mergers and joint venture structures (merger, risk, strategy, strengthening). These themes, when read in conjunction with Topics 2–3 and 7, imply that legal and organizational tools are used to strengthen interface control and shorten cycle times.

The ten topics together compose a cohesive narrative structure, encompassing Samsung’s HBM stance that is characterized by internal capability development and localized control (Topic 1), a foundry-based architecture and integrated supply chain (Topics 2–3), operational ownership spanning design enablement to ramp-up and packaging (Topics 10 and 7), and governance mechanisms that synchronize suppliers and partners with internal standards (Topics 4–5, 8–9), as well as consolidating control where necessary (Topic 6). This configuration matches the “vertical empire” construct and provides the textual basis for the firm-month integration signals used in subsequent valuation assessments.

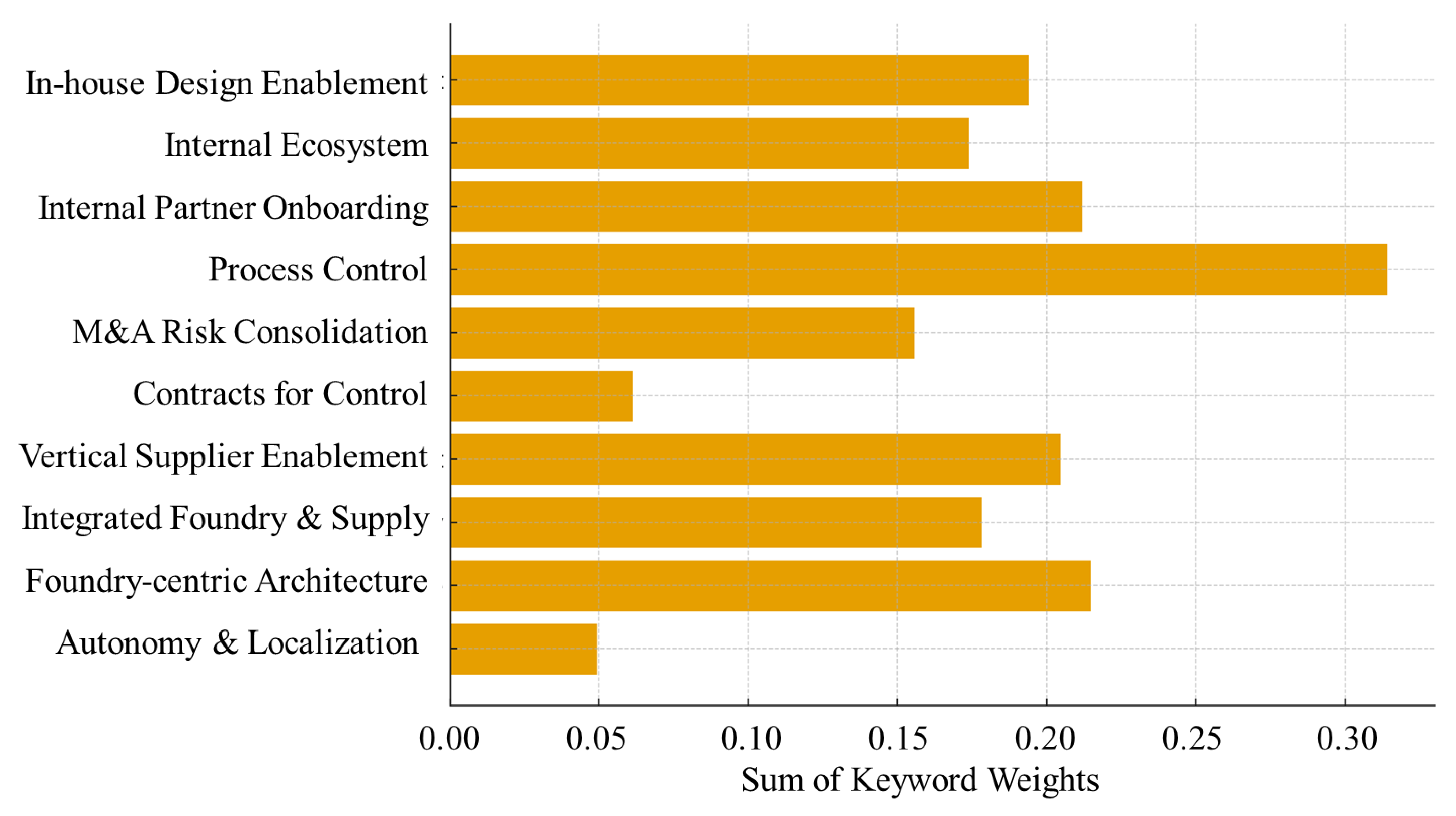

Figure 6 represents the combined weights of Samsung’s topic groups related to vertical integration. The distribution is heavily weighted towards process control, with internal partner onboarding, foundry-centric architecture, and integrated foundry and supply ranking. The public narrative focuses primarily on the operational aspects of ownership, like the ramp and stability of fab/process/packaging, as well as the integration of suppliers and partners into Samsung’s internal stack. In short, managing the memory–advanced-packaging–foundry interface in-house is more important than outside sourcing. Vertical supplier enablement and M&A and risk consolidation are important but secondary elements that align with a governance toolset designed to verify suppliers and equipment according to Samsung’s standards, as well as to standardize control mechanisms (e.g., consolidation or joint venture structures) during times with substantial obstacles or asset specificity. The internal and in-house design enablement gives significant weight to ownership upstream of the platform/design and feeds into the process loop. In contrast, contracts for control and autonomy and localization are less significant; they serve as enabling layers (legal/organizational instruments and localization rhetoric) rather than being the primary focus of news coverage. In general, the profile confirms the “vertical empire” interpretation displayed in

Table 2, with narrative significance focused on the operational core (design → process → yield → volume) and the regulated integration of partners into a vertically structured framework. This footprint acts as the basis for Samsung’s firm-month vertical signal, which is used in subsequent valuation assessments.

The topic model for SK Hynix envisions a horizontally orchestrated architecture, in which capability access and scale are achieved through platforms, partnerships, and networked production instead of internalization alone (see

Table 5). At its core, the partnered tech platform (Topics 1 and 10) combines technological and operational language with terms such as “platform,” “ecosystem,” and “partner,” indicating that enabling tools, layers, operating interfaces, and joint workflows are intended to integrate external specialists and support core customers. These surrounding clusters contract, expand, and productively leverage partnerships. Topic 2, joint contracts and expansion, focuses on agreements, the expansion, and participation of alliance scope, while Topic 9, solution contracting, connects solution language to integration and signing terms, demonstrating a process for transforming collaborative design to formalized delivery.

Consortium co-design (Topic 3) represents innovation and design co-specialization, with terms like “foundry,” “consortium,” and “joint venture” appearing alongside process and manufacturing terminology. This pattern is consistent with risk sharing during the early stages of development and qualification, as well as the use of multi-party vehicles to combine complementary assets. The global open network (Topic 4) builds on the existing framework by incorporating a large network of collaborating entities, as defined by terms like “ecosystem,” “open,” “partner,” “alliance,” and “sharing,” implying the presence of deliberate governance structures that promote information exchange across companies and geographic regions. Joint development (Topic 7) reinforces the horizontal posture concept by using terms as “solution,” “cooperation,” and “platform” alongside “adoption” and “expansion,” implying that co-development programs are intended to produce repeatable products. The executional scale manifests as scale-up with vendors (Topic 6), which is distinguished by a high concentration in areas such as production, equipment, foundry, packaging, outsourcing, and supply chain. The language indicates that distributed capabilities and vendor-aided throughput, encompassing tooling and materials suppliers, instead of a unified internal basis. Two governance clusters support risk management and capacity assurance. Topic 8, joint entities and risk sharing, emphasizes “legal entity,” “joint venture,” and “risk management” importance, while utilizing corporate structures to manage secure access and exposure. In the meantime, co-growth programs (Topic 5) present an ecosystem development framework that incorporates the terms “platform,” “co-growth,” and “design,” allowing suppliers and customers to collaborate on shared objectives and qualification cycles.

The ten topics, when combined, form a cohesive “horizontal alliance” framework, with contracts and platforms serving as the consortium, interface, and joint development driving innovation, open networks, global dissemination of knowledge, and vendor-based scale and joint venture structures transforming collaborations into substantial volumes with controlled risk. This configuration meets the study’s expectations, reflecting SK Hynix’s emphasis on partner specialization and co-design via its HBM approach, with the monthly horizontal signal extracted from the text used in the subsequent valuation analysis.

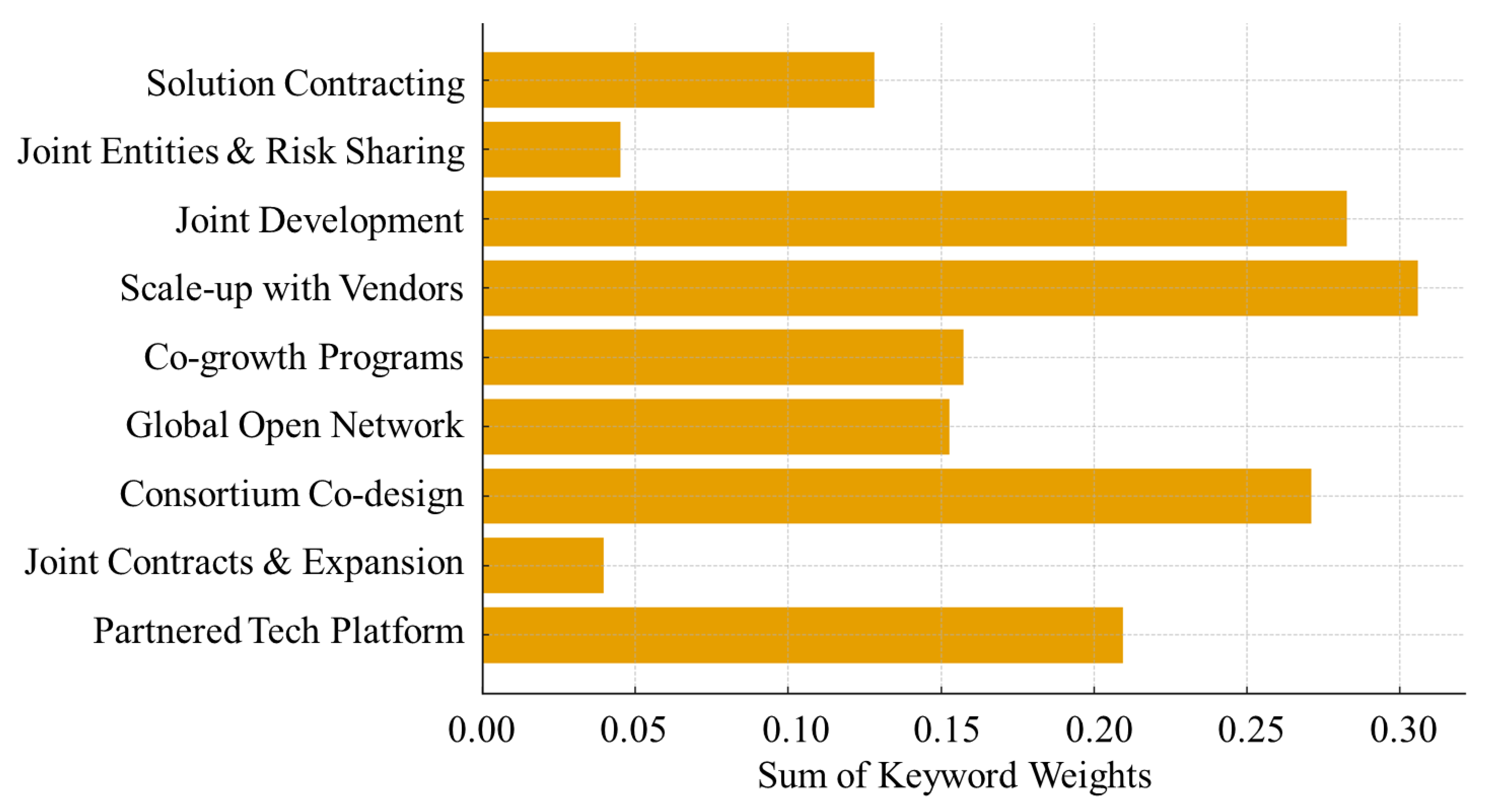

Figure 7 displays SK Hynix’s alliance-oriented topics’ aggregate weights. The majority focuses on scale-up with vendors and joint development, followed by consortium co-design and a partnered tech platform. This overview shows that the public narrative surrounding SK Hynix focuses on execution via a distributed vendor network (packaging, equipment, supply chain capacity) and structured co-development programs that convert partner know-how into producible HBM solutions. The consortium co-design—with “foundry,” “consortium,” and “joint venture” prominence, integrated with process/manufacturing terms—indicates multi-party vehicles for qualification and risk pooling, which is consistent with a horizontal orchestration logic. The mid-tier weight on global open network and co-growth programs indicates intentional information governance of flows and supplier/customer development (partner sharing, open platforms, ecosystem language). Solution contracting is just below this category, recording the deal flow that transforms collaborative solutions into delivery commitments. Joint contracts and expansion and joint entities, and risk sharing, on the contrary, are relatively light in volume, implying that while formal agreements and joint venture structures exist, they serve primarily as enabling mechanisms around the higher-salience pillars of vendor scaling and joint development.

Overall, SK Hynix’s topic-weight profile fits neatly into the study’s “horizontal alliance” framework: platform and consortium activity at the innovation front end; vendor-assisted scaling at the executional front end; and selective contracting and joint venture instruments to manage exposure. This text footprint underpins the firm-month horizontal signal used in the valuation tests and contrasts with Samsung’s vertical emphasis reported in the previous figure.

4.3. T-SNE Results

The t-SNE projection, as shown in

Figure 8, provides a qualitative check on the separability of Samsung’s topic assignments in the HBM news archives, for the period January 2023–September 2025. Individual documents are displayed as points that are colored with reference to their dominant topic (see

Table 2) and positioned in a two-dimensional space using a 2-D embedding of sentence/document vectors before inferring the topic. It is possible to distinctly distinguish several clusters. Documents tagged as process control are the largest and most contiguous, indicating their highly specific terminology concerning process, fabrication, packaging, and ramping. Foundry-centric architecture and integrated foundry and supply are located in nearby districts that partially surround the process cluster, indicating a gradual shift away from structural narratives (foundry/supply/organization) toward executional narratives (process/volume/yield). In-house design enablement appears as a semi-autonomous entity linked to process through a narrow line of interconnected points, consistent with design-manufacturing feedback narratives. Governance and ecosystems-related topics are on the periphery of these operational areas. Vertical supplier enablement and internal partner onboarding belong to the process/foundry area and clearly overlap with it, which is consistent with their role as interface-management stories that frequently involve production and tooling processes like onboarding, qualification, and standardization. Internal ecosystem lies between onboarding and design, reflecting the platform’s use of “open” terminology in discussions of internal platform integration. In contrast, M&A and risk consolidation and contracts for control are evenly dispersed with smaller clusters, indicating corporate actions and legal/organizational announcements that reuse terms of general governance and thus embed themselves closer with several nearby entities instead of forming a cohesive group.

The initial illustration indicates that the vertical spine exhibits cohesive semantic properties derived from design enablement via process control and a foundry-centric structure within public text. Ecosystem and governance topics serve to supplement rather than replace the main framework: their overlap with operational clusters indicates that cooperation and contracting are mainly used to strengthen internal control, instead of standalone partner-driven initiatives. Visual patterns that are consistent with the vertical-integration interpretation obtained from the topic model support vertically oriented topic-intensity series use by Samsung in subsequent OLS valuation tests.

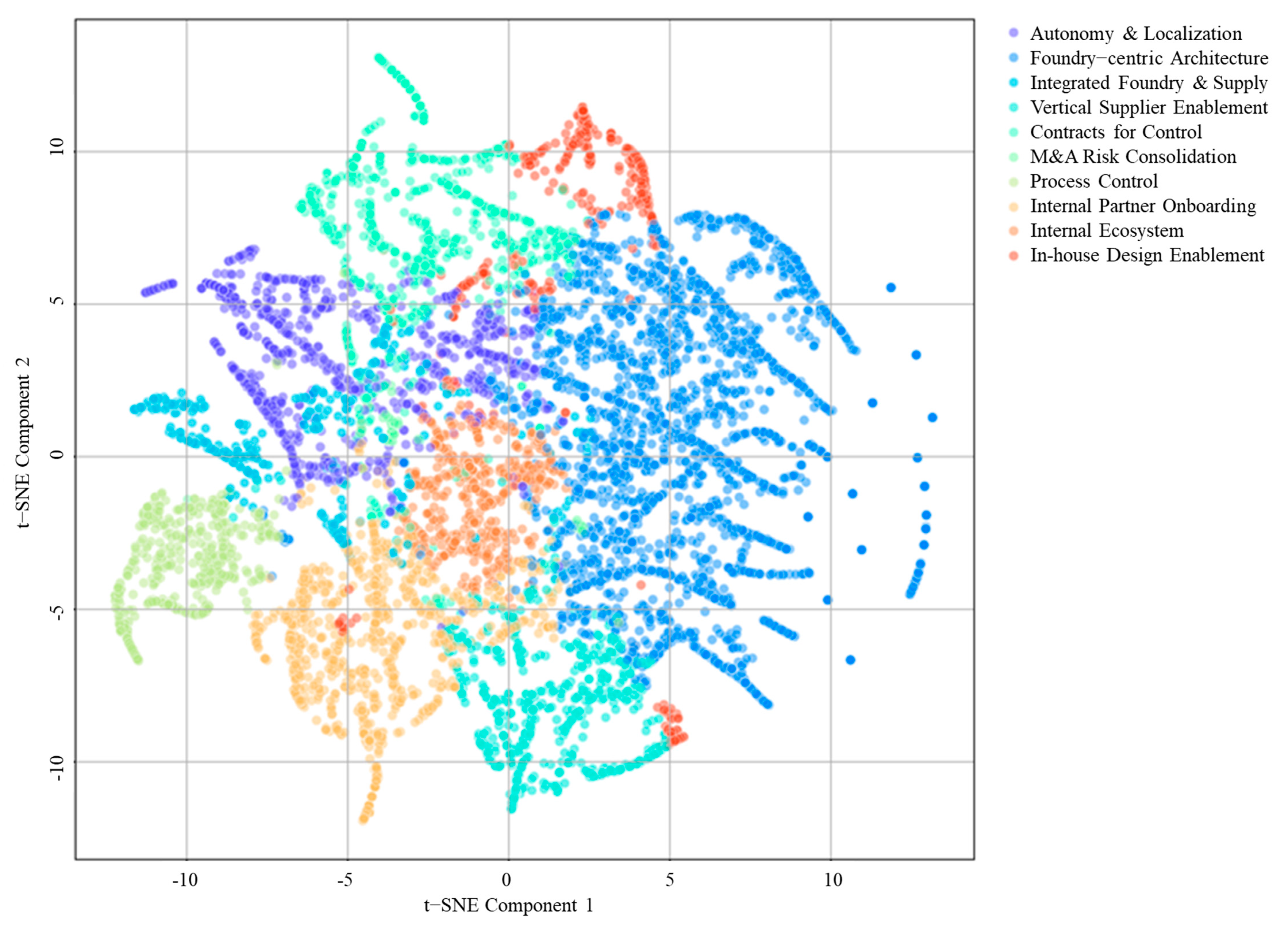

The t-SNE projection (see

Figure 9) depicts SK Hynix news documents from January 2023 to September 2025 in two dimensions, with each point colored according to the dominant topic listed in

Table 5. Clusters here are more intertwined and ribbon-like, aligning with stories connecting different external locations and partners rather than a centralized, self-contained system, unlike Samsung’s approach. Scale-up with vendors creates a single, unbroken band that spans the right side of the map. Its documents frequently include packaging, equipment, supply chain, and outsourcing terminology, and they often intersect with joint development initiatives, echoing stories about tooling qualification, vendor capacity, and co-development programs in the same publications. Consortium co-design is located throughout this band and intersects with the partnered tech platform, a scenario in which platforms (that include the interface, ecosystem, and partner enablement) and multi-party vehicles (such as consortia and JVs) are used to manage early-stage process and packaging work with founders and anchor customers. Global open network and co-growth programs are located near the center and share a neighborhood with joint development that is connected with short bridges. Local mixing indicates that open-network governance (which includes standards, sharing, and partner roles) is not a standalone narrative; rather, it is embedded in articles detailing specific co-development activities and customer initiatives. On the contrary, joint contracts and expansion and joint entities, and risk sharing look like smaller, dispersed pockets at the border. The dispersion corresponds to the standard organizational and legal terminology used in different collaborations, where t-SNE spots near multiple neighbors rather than forming distinct clusters.

Two conclusions can be reached: the SK Hynix topic space focuses on partner-driven scalability and co-development—vendor ramp-up, consortium arrangements, and platform support are conceptually similar, yielding a horizontally coordinated production approach. Governance artifacts (joint venture entities, contracts) act as a connecting framework rather than a central narrative, linking vendor-scale experiences to development initiatives. This geometry supports our SK Hynix classification as a horizontal-alliance pillar, and it encourages its horizontally oriented topic-intensity series use in future valuation assessments.

4.4. OLS Analysis

The OLS model is statistically significant at the 5% level using weekly data from 2023 to 2025, with a probability (F-value) of 0.0378, as shown in

Table 6. The model’s fit is poor (R

2 = 0.139), and the Durbin–Watson statistic (2.229) indicates little to no residual autocorrelation. The exchange rate proxy (currency rate) is not significantly different from zero (β = -0.440,

p = 0.120). At the topic level, the M&A and risk consolidation topic has a significant positive correlation with market valuation: β = 0.030, SE = 0.011, t = 2.694,

p = 0.008, 95% CI [0.008, 0.051].

Control-enhancing news, such as mergers, joint venture structures, and risk ring-fencing, is therefore the vertical theme most consistently priced by the market in Samsung’s case. The significance of internal partner onboarding is on the negative side at the conventional threshold (β = −0.030, p = 0.063), indicating that reports presented as partner onboarding/integration—although part of a vertically governed stack—do not immediately yield investor rewards and may be viewed as execution risk or transitional costs. In this specification, the statistical values for the other vertical topics are all essentially equivalent to zero, with the following results: autonomy and localization (β = 0.029, p = 0.295), foundry-centric architecture (β = −0.008, p = 0.790), integrated foundry and supply (β = 0.023, p = 0.262), vertical supplier enablement (β = 0.002, p = 0.901), contracts for control (β = −0.011, p = 0.468), process control (β = 0.012, p = 0.312), internal ecosystem (β = −0.016, p = 0.277), and in-house design enablement (β = −0.018, p = 0.237).

Estimates for these areas are near zero, with large confidence intervals, implying that after controlling for other topics in the same week, the significance of incremental news in these areas is unreliably associated with the level of prices during this period. In conclusion, the market quickly interprets governance actions that strengthen control (joint venture/M&A/risk consolidation) as essential vertical signals within weeks for Samsung’s vertically structured narrative. Operational and architectural vertical indicators, like process, supplier enablement, foundry-centric structure, or design enablement, do not significantly affect this weekly market assessment. These findings necessitate robustness checks (i.e., alternative scaling of topic intensity and return-based specifications), but the main result is that formal consolidation events will dominate Samsung’s vertical pricing over 2023–2025.

Based on weekly data from 2023 to 2025, the SK Hynix model is jointly significant at the 10% level, with a probability of F-statistic of 0.0620 and an R

2 value of 0.129, as presented in

Table 7. The residual dependence is small, according to Durbin–Watson statistic of 1.743. The exchange rate variable is not statistically different from zero (β = −0.759,

p = 0.118). The scale-up and vendors and valuation relationship is significantly positive, with a coefficient of 0.066, a standard error of 0.019, a t-statistic of 3.420, a

p-value of 0.001, and a 95% confidence interval of [0.028, 0.104]. A small positive effect is also supported by joint development at the 5% margin (β = 0.046, SE = 0.023, t = 1.984,

p = 0.049), even though the confidence interval is reversed. All other topics, including the partnered tech platform (β = 0.026,

p = 0.509), joint contracts and expansion (β = 0.028,

p = 0.459), consortium co-design (β = −0.019,

p = 0.441), global open network (β = 0.002,

p = 0.946), co-growth programs (β = 0.016,

p = 0.422), joint entities and risk sharing (β = −0.002,

p = 0.947), and solution contracting (β = −0.004,

p = 0.846), are statistically indistinguishable from zero in this pooled weekly level specification. The market appears to value SK Hynix’s horizontal strategy mainly based on its scale of execution with vendors and joint development, whereas the use of contracting, platform, and governance language does not influence prices, taking other factors into account. This pattern, combined with the Samsung results, reinforces the paper’s central argument: between 2023 and 2025, investors prefer vendor-supported scaling and co-development for SK Hynix, whereas Samsung’s valuation responds more to consolidation-oriented vertical moves.

Interpreting model fit, we view the relatively low R2 as expected for price-based specifications because our topics capture narrow governance constructs rather than the broad set of forces that move equity prices, text-derived measures introduce attenuation, intra-day reactions can be misaligned with weekly outcomes, residual variance is elevated in a two-issuer setting, and nonlinear or threshold effects during the generative AI upcycle are not fully captured by a time-invariant linear model.