1. Introduction

The global automotive industry is undergoing a rapid transformation as electric vehicles (EVs) increasingly replace traditional internal combustion engine vehicles. This transition is propelled by a combination of factors, including advancements in EV powertrain technologies, significant reductions in battery manufacturing costs, the accelerated development of charging infrastructure, and robust governmental support through incentives and policy frameworks. These dynamics not only represent an industrial shift but also reflect a broader global commitment to achieving carbon neutrality and fostering sustainable transportation systems in response to climate change challenges and urban air pollution [

1]. The momentum toward electrification has become a central pillar of national mobility strategies in many countries, influencing both the private and public transport sectors.

Reflecting the global trend, Thailand has also experienced a notable surge in EV adoption. According to official registration data, by 2024, the country had registered 70,137 fully electric vehicles, representing approximately 14% of all new vehicle registrations nationwide out of a total of 502,077 vehicles [

2]. This rapid growth highlights the increasing consumer acceptance of EVs, driven by factors such as heightened environmental awareness, improved vehicle availability across price segments, and the Thai government’s commitment to electrification through targeted policy interventions. The expanding EV fleet presents a critical challenge: ensuring that supporting infrastructure, especially charging facilities, is available, reliable, and accessible to meet the evolving demands of this growing user base [

3,

4,

5].

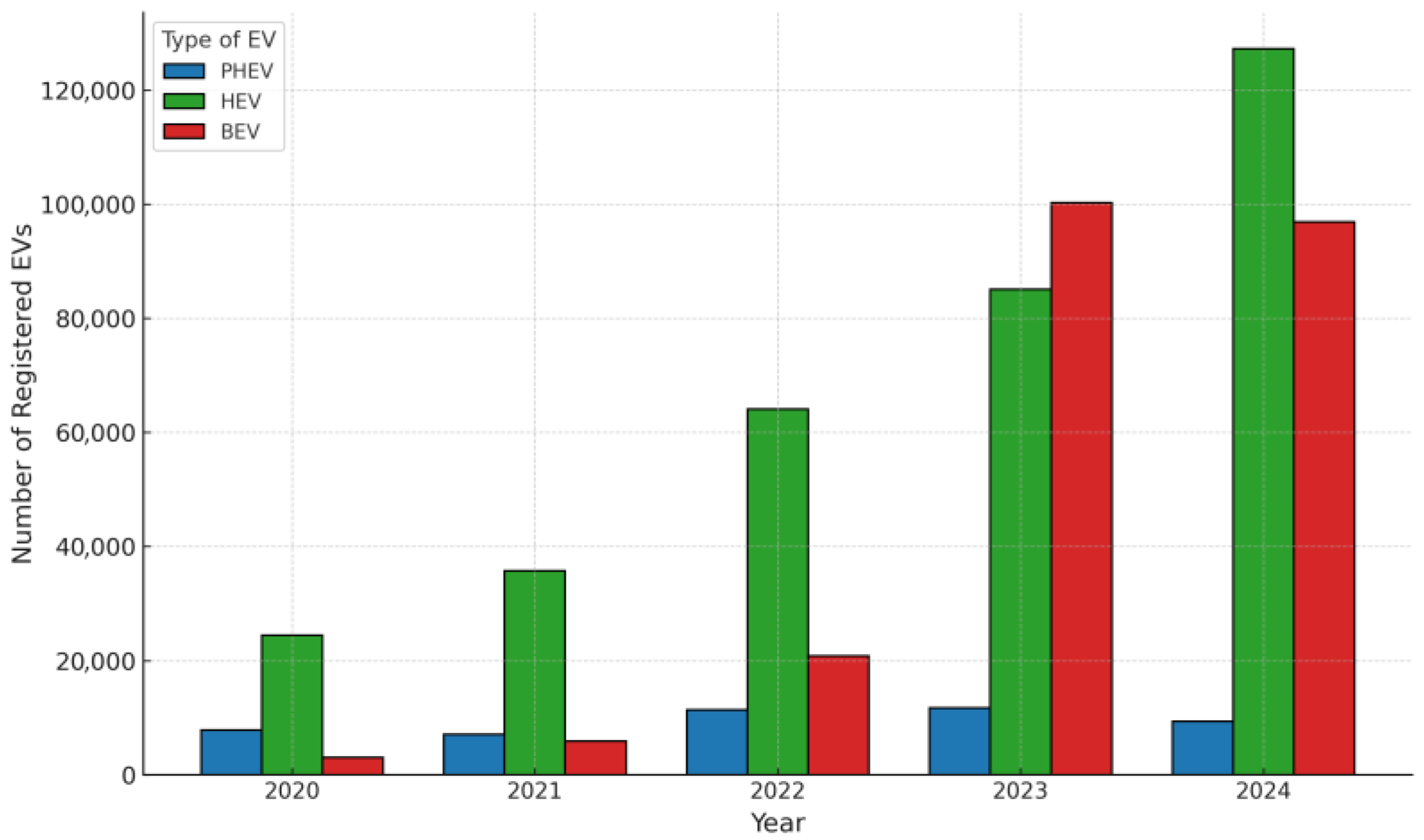

Figure 1 further illustrates the overall growth of EV registrations in Thailand across multiple categories (BEVs, HEVs, and PHEVs) from 2020 to 2024, highlighting the broader nationwide shift toward electrification.

In response to this growth, the Thai government has introduced a series of policies aimed at accelerating EV adoption and expanding the necessary infrastructure. These include investment subsidies, tax incentives for EV manufacturers and buyers, and preferential electricity tariffs specifically for public DC fast-charging stations. While such high-powered stations are essential for long-distance travel and highway use, their deployment is largely limited to specific geographic corridors, and they often require substantial grid upgrades. As a result, these facilities are less accessible for daily users, especially those in urban areas who require more convenient and frequent charging options. Consequently, many EV owners prefer homebased AC charging solutions, which allow them to charge their vehicles overnight using residential electricity rates and without the need for frequent trips to public charging points [

6].

However, the home charging model is not universally feasible, particularly for residents of high-density residential buildings such as condominiums and apartments. In such settings, residents often share ownership of common areas and face limitations related to assigned parking, building codes, and electricity capacity. Moreover, most existing residential buildings were not originally designed to accommodate EV charging systems, especially those requiring significant electrical upgrades or reconfigurations. As a result, private charger installation is often restricted or subject to lengthy approval processes by juristic persons or property management committees [

7]. To fill this service gap, commercial providers have started offering shared EV charging services tailored to these environments. These services typically involve semi-public AC charging stations installed in shared parking zones within private residential complexes, effectively operating at the intersection of public accessibility and private governance [

8,

9,

10].

Despite increasing interest, investing in EV charging infrastructure within residential buildings remains a complex endeavor. Prospective investors face considerable uncertainties in estimating actual user demand, which varies by location, user profile, and vehicle ownership patterns. In addition, they must navigate legal and contractual negotiations with property managers, resolve questions related to cost-sharing among residents, and ensure that the existing building electrical systems can support the additional load. Beyond these practical concerns, the technical selection of appropriate charging equipment also requires understanding of user behaviors such as charging duration, time-of-day preferences, and load profiles, which are rarely studied in detail for residential environments. These interrelated factors present both technical and financial risks that are not yet fully understood or supported by empirical evidence, particularly in the context of emerging EV markets like Thailand [

11,

12].

This study aims to comprehensively assess the investment feasibility and operational viability of deploying EV charging infrastructure in high-density residential buildings. Specifically, it seeks to carry out the following:

Analyze real-world user behavior and charging patterns within residential EV charging environments using empirical data collection.

Evaluate the financial cost structures, investment requirements, and long-term profitability of EV charging stations.

Conduct sensitivity analysis to assess the financial vulnerability of EV charging investments under variations in key economic parameters.

Identify policy and regulatory implications that may facilitate or hinder the development of financially sustainable EV charging infrastructure in residential sectors.

The research addresses key questions such as how users interact with residential EV charging services, how financial cost structures and revenue models affect long-term investment sustainability, how sensitive financial outcomes are to variations in key economic parameters, and what policy interventions may be required to mitigate financial risks and promote infrastructure deployment. By integrating empirical usage data with comprehensive financial modeling and sensitivity analysis, this study aims to contribute to the development of financially viable and policy-supported EV charging solutions for high-density urban residential environments.

A key contribution of this research lies in its use of empirical field data collected directly from operational charging stations deployed within real residential buildings. This approach allows for more accurate modeling of user behavior, energy consumption, and investment performance than purely theoretical models. Furthermore, the inclusion of sensitivity analysis enables policymakers and investors to better understand how variations in critical financial parameters affect investment outcomes. Unlike many prior studies that focus primarily on public DC charging infrastructure, this study specifically addresses shared AC charging services in high-density residential buildings, a context that remains underexplored but increasingly important as EV adoption continues to expand.

2. Literature Review

The development of EV charging infrastructure has attracted increasing academic attention across multiple disciplines, including engineering, transportation planning, energy policy, and investment finance. Numerous studies have investigated the optimal deployment of charging stations to ensure sufficient service coverage while maintaining grid stability [

13,

14,

15]. Recent work has also incorporated multi-objective methods to determine optimal charging station placement by balancing technical constraints, mobility patterns, and user behavior. For instance, a hierarchical clustering and Pareto-based approach was proposed to identify suitable locations for semi-fast charging stations at the neighborhood level, considering uncertainties in EV load profiles and planning horizons [

16].

Several models have been proposed for optimal siting of public charging infrastructure [

4,

17,

18]. Some researchers introduced spatial coverage models to maximize accessibility while minimizing grid congestion [

19,

20,

21], while others extended these models to incorporate multi-objective optimization that balances user convenience and distribution network constraints [

22,

23,

24]. These approaches are widely applied in urban planning for public DC fast-charging networks but are less applicable to residential environments where installation decisions are often governed by building management and space ownership issues.

Technical standards governing EV charger installations have also evolved considerably. International standards define safety, connector compatibility, and communication protocols for EV charging equipment, while some national regulatory bodies have begun incorporating charger installation requirements into local building codes [

25,

26]. However, specific standards for shared EV chargers in multi-unit residential buildings remain underdeveloped, particularly in emerging EV markets such as Thailand [

27].

From a cost perspective, previous studies have identified key factors influencing the financial viability of EV charging investments [

28,

29]. Some emphasized that both capital expenditure (CAPEX) and long-term operating expenses (OPEX) must be carefully managed to achieve sustainable business models [

30]. Others further highlighted the importance of understanding grid upgrade costs, installation complexity, land use, and equipment life cycles when evaluating financial feasibility [

31].

Grid interaction remains a critical concern when scaling up EV charging deployment. Large-scale EV charging may negatively affect local grid performance through increased peak loads, voltage fluctuations, harmonic distortion, and transformer overloads [

32]. Recent studies have modeled EV-induced demand under future adoption scenarios and found that while voltage impacts may remain modest in primary systems, line loading can increase significantly, especially during synchronized peak charging events [

33]. Complementary field-based findings from residential settings in Bangkok have also demonstrated notable effects on power quality, including voltage unbalance, high neutral currents, and increased harmonic distortion during EV charging, particularly with single-phase equipment [

34]. These studies underscore the importance of load management strategies and infrastructure readiness, especially in retrofitted systems with limited capacity buffers. Several studies provide detailed analyses of these technical challenges and potential mitigation strategies such as load management and controlled charging algorithms [

35,

36,

37]. These issues are particularly relevant in residential buildings where available electrical capacity is often limited, requiring costly infrastructure upgrades to support additional EV loads.

User charging behavior directly influences both the technical design and financial viability of EV charging infrastructure. Behavioral studies consistently report that EV owners primarily charge their vehicles during evening hours at home, aligning with postcommute arrival times. Understanding these daily and weekly load profiles is essential for accurately forecasting charging demand, optimizing station capacity, and managing peak load stress on the electrical system. Recent simulation-based studies further demonstrate that user decisions regarding charging immediacy or delay can significantly alter distribution network performance. For instance, a Monte Carlo simulation of residential neighborhoods in New Zealand revealed that selfish charging behavior may increase transformer loading exceedance by over 250%, compared to less than 20% under altruistic charging patterns, thereby increasing maintenance costs and shortening asset lifespans [

38].

In addition to temporal behavior, user responses to electricity pricing also play a critical role in demand management. A recent large-scale analysis in Shenzhen, China, demonstrated that although public EV charging demand is generally price inelastic, spatial and temporal variations in user responsiveness exist, particularly under positive price impulses. Furthermore, significant spillover effects were observed, where localized price changes influenced demand patterns across a radius of several kilometers [

39]. These findings suggest that while direct pricing mechanisms may not uniformly shift user behavior, tailored pricing strategies could be employed in specific urban contexts to optimize charger utilization and reduce grid strain. Collectively, this body of research underscores the importance of integrating user behavior modeling into EV infrastructure planning to ensure both technical reliability and economic sustainability.

In terms of pricing models, recent research has proposed several strategies to improve charger utilization and balance affordability with profitability. Common approaches include time-of-use (TOU) tariffs, dynamic pricing based on demand fluctuations, and subscription-based models. Dynamic pricing, in particular, has gained attention as a flexible mechanism that responds to real-time grid conditions and user demand. To enhance pricing accuracy and responsiveness, advanced techniques such as artificial intelligence (AI) and reinforcement learning (RL) are increasingly used. These methods allow service providers to adjust pricing dynamically by learning from user behavior, mobility patterns, and power system constraints, which is especially valuable in high-density urban settings [

40,

41]. These flexible pricing strategies can significantly influence user charging patterns while improving overall business performance.

While these studies provide important insights into public charging deployment, user behavior, pricing strategies, and grid interactions, significant research gaps remain. In particular, there is limited empirical research focusing on the financial viability of residential EV charging investments within multi-unit buildings using real-world operational data. Furthermore, very few studies have incorporated detailed financial modeling that includes sensitivity analysis to evaluate how fluctuations in utilization rates, profit margins, energy costs, capital expenses, and operating expenses affect long-term investment sustainability [

42,

43]. These gaps are especially important in emerging EV markets like Thailand where investment uncertainty remains high and policy frameworks continue to evolve.

This study seeks to address these gaps by integrating field-measured charging load profiles with comprehensive financial models and sensitivity analysis to evaluate investment risks. In doing so, it provides new insights for policymakers, investors, and building managers to support the financially sustainable deployment of residential EV charging infrastructure.

3. Methodology

This study aims to investigate the real-world demand for EV charging infrastructure in high-density residential buildings. The objective is to assess charging behavior within an actual residential setting, reflecting the practical limitations and operational challenges associated with shared EV charging stations. By conducting the study within an existing residential environment, the findings provide a more accurate representation of the demand for EV charging services and the feasibility of integrating such infrastructure into similar housing developments.

The research framework focuses on understanding user charging patterns, analyzing energy consumption data, and identifying constraints related to retrofitting EV chargers in buildings not originally designed for EV infrastructure. Given the rapid adoption of electric vehicles in Thailand, existing residential buildings often lack adequate electrical capacity and regulatory provisions to support widespread charger installations. This study highlights these challenges while exploring practical solutions for optimizing EV charging accessibility in urban residential complexes.

This study was conducted in a residential building with 28 floors and 958 units, chosen as a representative sample of high-density housing environments. Unlike large-scale installations, this study focuses on a single EV charging station, which serves as a direct representation of the energy demand within the building. The limited availability of charging infrastructure provides a controlled scenario where power consumption data accurately reflect real-world demand from EV users within the facility.

The selected building was equipped with a single EV charger installed in a shared parking area, allowing for the collection of precise usage data. Data collection involved recording historical usage logs and real-time power consumption measurements over a specified period of 14 days. By analyzing actual charging behavior, this study aims to provide an accurate depiction of how EV users interact with a limited charging resource in residential settings.

The chargers used in this study adhere to standard specifications, as detailed in

Table 1, which includes information on input voltage, frequency, rated power, output current, and connector type. These chargers were selected to represent commonly available models used in urban residential areas. Power consumption data were logged continuously to capture variations in demand throughout the day and across different days of the week.

Despite selecting a charger that aligns with standard specifications, retrofitting EV chargers in residential buildings presents several challenges. In Thailand, the rapid growth in EV adoption has outpaced the development of infrastructure and regulatory standards, leading to significant constraints in deploying EV charging systems within existing buildings. Most high-rise residential buildings were not originally designed with EV charging capabilities in mind, resulting in technical limitations such as electrical capacity constraints, outdated power distribution systems, and restrictive building management policies.

In this study, the installation of the EV charger was constrained by the existing electrical system’s capacity. Retrofitting the charger required an assessment of the building’s electrical infrastructure to determine the maximum charging capacity that could be supported without extensive modifications. Given that the selected residential complex is relatively new, it was possible to integrate a charging station without major infrastructure upgrades. However, additional considerations, such as approval from the building management committee and compliance with electrical safety regulations, influenced the selection of the charger model.

These constraints highlight the broader challenges associated with deploying EV charging infrastructure in older residential buildings, where limited electrical capacity and regulatory barriers may hinder large-scale implementation. The findings from this study emphasize the importance of assessing electrical system capacity, regulatory requirements, and practical limitations before integrating EV charging stations into high-density residential environments.

To ensure data reliability, power consumption was recorded using calibrated measuring devices installed at key distribution points. The measurement system was designed to capture both real-time and cumulative energy usage patterns, ensuring an accurate assessment of EV charging demand within the study period. Additional verification procedures were implemented, including cross referencing recorded charging sessions with measured energy consumption to validate data accuracy.

Figure 2 illustrates the installation layout and measurement setup, providing a clear representation of the data collection process.

Despite the rigorous data collection approach, certain limitations were acknowledged. This study was designed as a pilot investigation, with data collected over a 14-day observation period due to constraints in access permission and building ownership. While this timeframe is sufficient to establish general usage trends, it cannot fully capture seasonal variations, long-term behavioral changes, or the potential impact of future policy shifts on EV adoption rates. Nevertheless, the data remain valuable as they represent real-world measured behavior in an actual residential environment, where such empirical evidence is currently scarce in Thailand. Additionally, individual factors such as user preferences, variations in vehicle battery capacities, and differences in daily commuting patterns introduce variability in charging habits. These factors were carefully considered during data interpretation to ensure a comprehensive analysis of the study’s findings.

4. Load Profile Analysis and Energy Consumption Efficiency

After collecting data over a 14-day monitoring period, raw data on electrical parameters, charger status, and power quality were obtained. These parameters were analyzed to predict EV charging behavior within residential buildings, aiming to forecast service demand and provide insights for financial and infrastructure planning. The collected data include detailed information about the usage intensity and charging patterns, which were subsequently processed to generate heatmaps and usage graphs for further analysis.

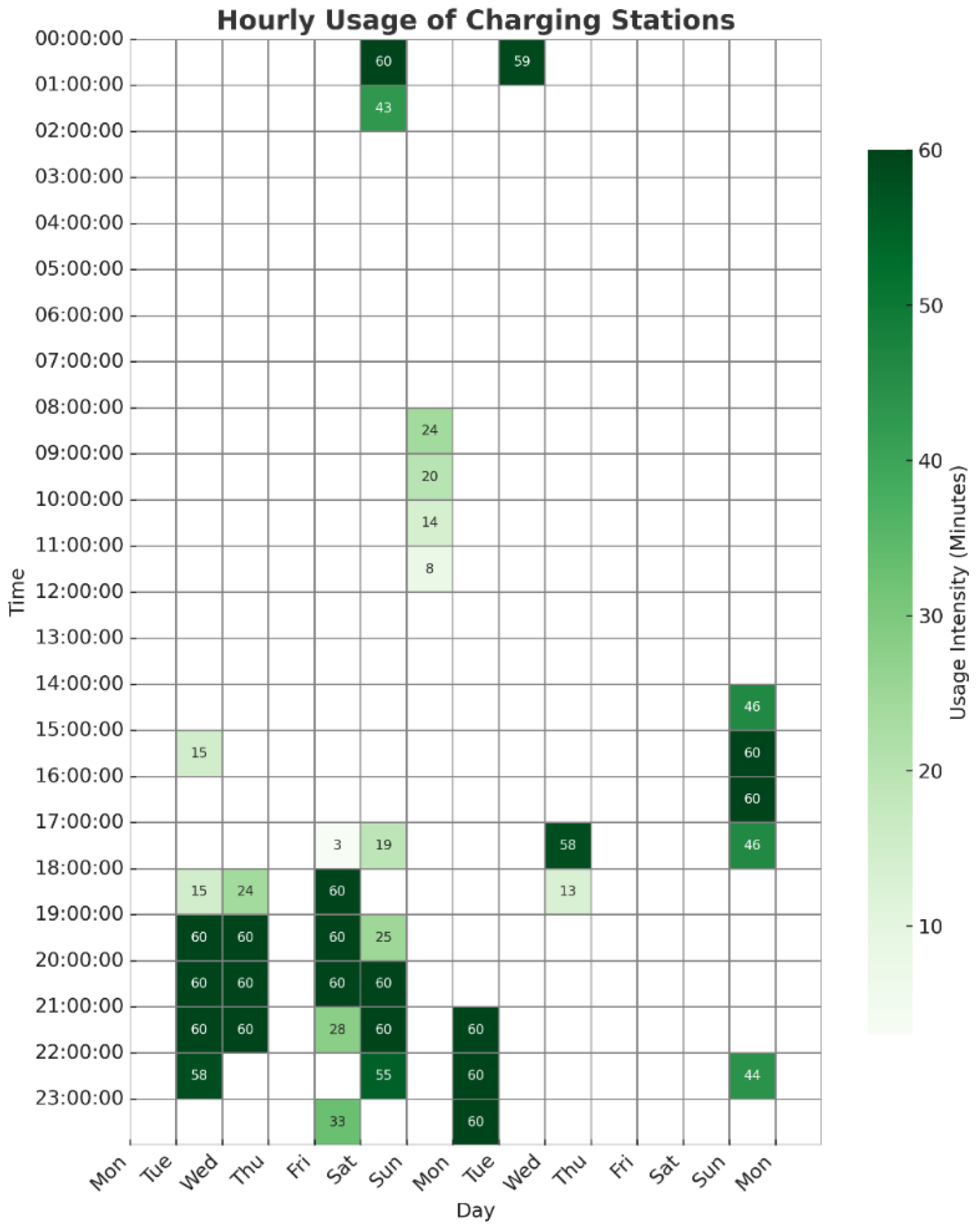

Figure 3 shows the hourly usage intensity of the charging station across different days, highlighting specific periods with concentrated demand. While there is no overnight charging recorded, the results indicate that charging sessions are relatively short but occur with high intensity during peak hours.

The results suggest that the peak charging hours occur between 19:00 and 22:00, consistent with typical residential activity patterns. Residents are more likely to return home during these hours and plug in their vehicles for charging, prioritizing convenience and avoiding the need for public charging stations during the day. Additionally, there is a notable lack of charging activity during late night and early morning hours, which reflects the reliance on scheduled residential usage rather than extended charging durations.

On weekends, the charging patterns differ significantly, displaying a more dispersed usage pattern with a broader distribution of charging activity throughout the day. This variation aligns with changes in mobility patterns, as residents have more flexible schedules during weekends. While charging sessions are more spread out compared to weekdays, the overall energy demand is lower due to reduced commuting needs.

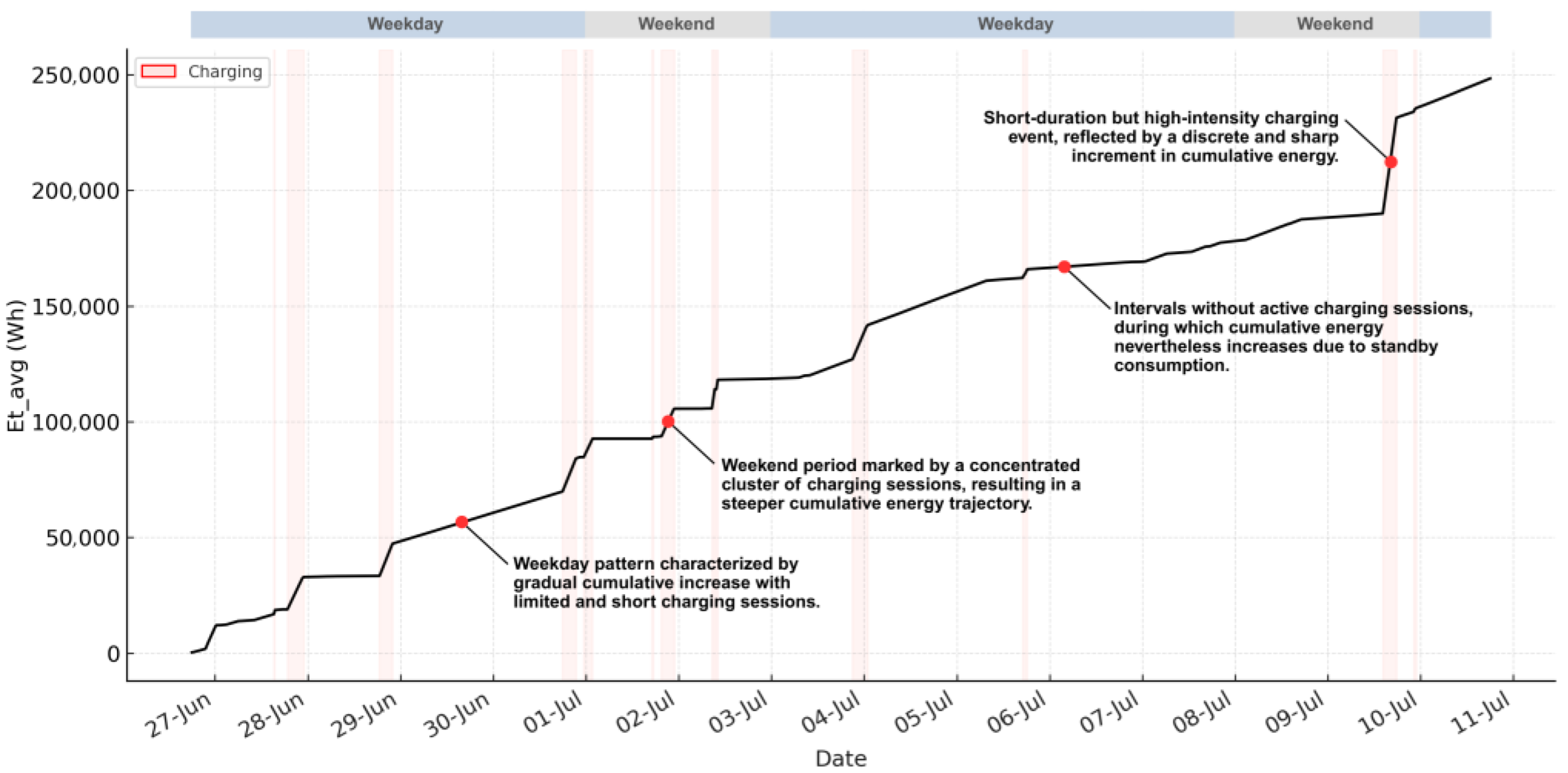

Further analysis reveals a notable discrepancy between total energy consumption and actual energy delivered to users. Over the 14-day period, the total electricity consumption was measured at 248.342 kW, while only 138.24 kW of energy was sold to users. This difference underscores the issue of standby power consumption, where chargers consume energy to remain operational even in the absence of active charging sessions.

This inefficiency contributes to increased operational costs, particularly in cases where the number of chargers installed exceeds the proportionate demand.

Figure 4 emphasizes the relationship between energy usage and charging intensity, illustrating the importance of aligning infrastructure capacity with actual demand. The energy loss observed here highlights the need for energy-efficient equipment and smart charging systems to mitigate unnecessary power consumption. Additionally, the study identifies standby energy consumption as a factor contributing to operational costs. Even when chargers are not actively in use, they continue to draw small amounts of power, adding to overall electricity expenses. This highlights the importance of selecting energy-efficient charging equipment and implementing power management strategies to minimize unnecessary energy waste.

This structured analysis provides a foundation for understanding EV charging behavior in residential buildings, enabling better decision making for infrastructure planning and pricing strategies. By addressing inefficiencies and optimizing charger deployment, this study highlights practical approaches for developing sustainable and financially viable EV charging infrastructure.

5. Financial Feasibility and Pricing Strategy Analysis

The financial feasibility of EV charging infrastructure was assessed based on three key components: investment costs, maintenance expenses, and other operating expenses, as summarized in

Table 2. Investment costs comprised the procurement of EV chargers, installation works, and electrical system upgrades such as panel modifications and cabling. These costs were derived from actual installation data, thereby reflecting real-world procurement and implementation expenses. Land acquisition costs were not included in this analysis because the case study utilized an existing condominium parking facility. In addition, insurance charges were considered, estimated at approximately one percent of the total investment value, to account for project risk coverage.

Maintenance expenses were defined as the regular activities necessary to sustain operational reliability. This included preventive measures such as quarterly inspections, firmware updates, and protective device checks, as well as corrective measures involving replacement or repair of failed components. These recurring costs are critical to ensuring that the charging infrastructure maintains long-term usability and safety.

Other operating expenses referred to the administrative and management costs of operating the service. This category encompassed routine tasks such as meter reading, billing and invoicing, and coordination with the condominium juristic person. For this study, these expenses were conservatively estimated at 0.3% of the total costs per year, consistent with comparable projects in the Thai context.

To evaluate financial outcomes, the model further incorporated an assumed annual interest rate of 5%, representing a typical financing condition for infrastructure investments in Thailand. While inflation, long-term electricity price adjustments, and technological advancements were not explicitly included in the baseline calculation, these factors were recognized as potential sources of variability and were subsequently addressed in the sensitivity analysis and limitation discussions. By defining the cost composition in this structured manner, the model enhances transparency and reproducibility, enabling stakeholders to better understand the financial parameters that govern project feasibility.

5.1. Cash Flow Analysis

The financial viability of deploying EV charging infrastructure in high-density residential buildings was evaluated through detailed cash flow analysis over a 20-year investment horizon. The model incorporates capital investment, operational expenses, and projected revenue streams, providing a comprehensive framework to assess long-term financial sustainability under varying pricing conditions. This approach reflects actual operating characteristics observed from field measurements and aligns with typical constraints encountered in retrofitting EV chargers in existing residential buildings in Thailand.

To establish an appropriate pricing framework, profit margins were examined across a range from 0.114 USD (4 THB) to 0.229 USD (8 THB) per kilowatt-hour (kWh). These boundaries were selected based on the current electricity procurement cost in Thailand, which averages approximately 0.126 USD (4.4 THB) per kWh. This pricing range reflects realistic margins that EV charging service providers in Thailand might expect to apply, considering local market conditions, regulatory structures, and prevailing consumer expectations. The analysis aims to capture both conservative and optimistic scenarios that are practical for residential building environments, where demand patterns and operational costs differ substantially from public or commercial charging stations.

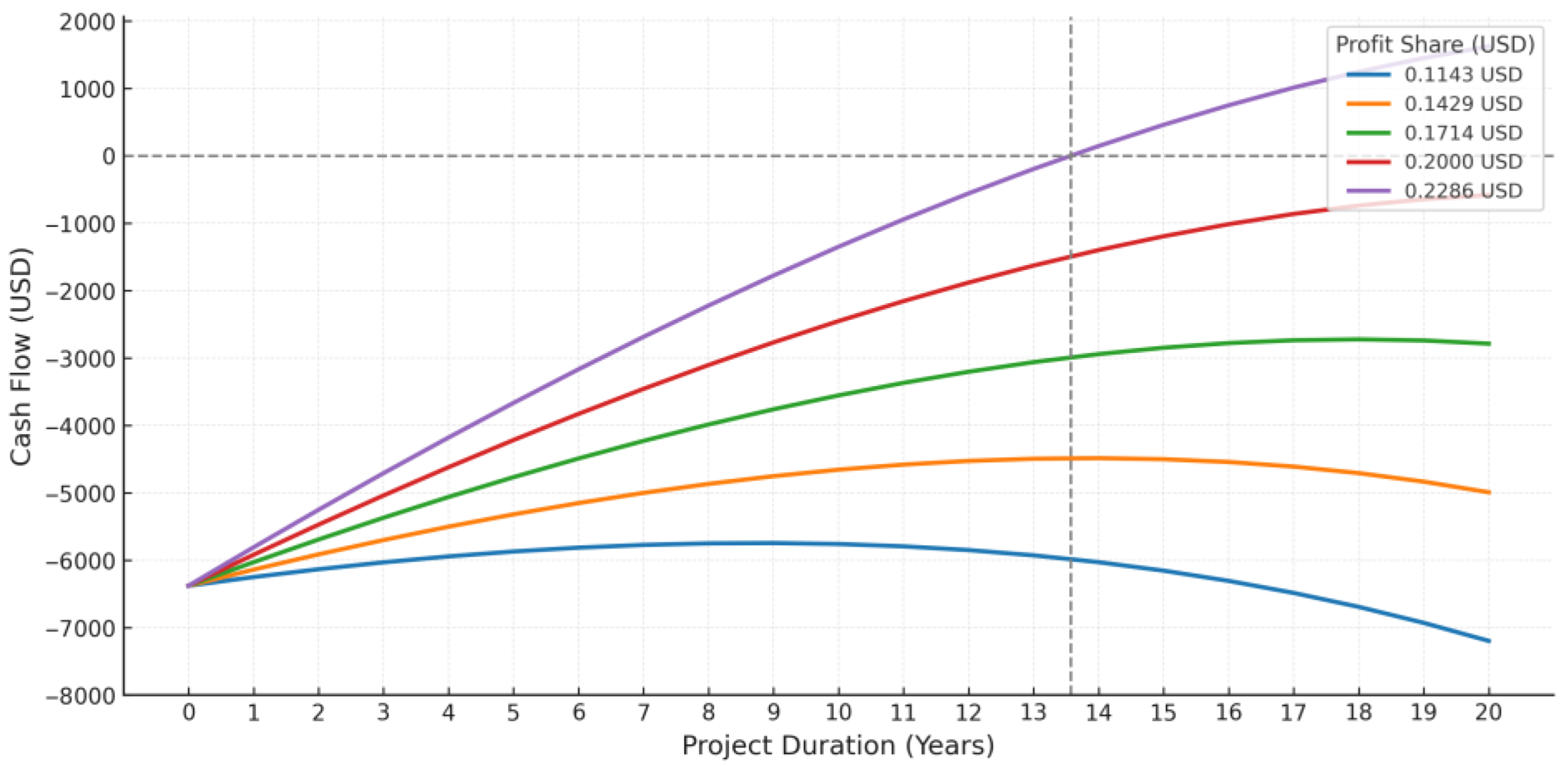

The projected cash flow behavior for each pricing scenario is presented in

Figure 5. The results clearly demonstrate that pricing level exerts a significant influence on financial outcomes. In the early years of operation, nearly all pricing scenarios generate positive cash flow. This is primarily due to the fact that revenue from charging services initially exceeds operating costs during the early project phase, especially when major maintenance and replacement costs have yet to materialize. However, as the project progresses, recurrent operating costs such as maintenance, insurance premiums, administrative overheads, equipment aging, and energy losses accumulate year after year. These gradually erode the initial financial surplus, leading to a divergence in financial viability between different pricing structures.

Among the pricing scenarios evaluated, only the highest margin scenario, where the profit share reaches 0.229 USD (8 THB) per kWh, enables the project to achieve long-term financial sustainability. Under this condition, the project crosses the break-even point within the investment horizon and continues to generate positive cash flow throughout the remaining operational years. In contrast, lower-margin scenarios within the range of 0.114 USD (4 THB) to 0.200 USD (7 THB) per kWh exhibit a common pattern: initial positive cash flow is generated during the first few years, but this gradually becomes insufficient to offset the compounding operational costs, resulting in cumulative financial deficits before the project reaches full maturity.

This finding underscores a critical risk for EV charging investments in residential environments. While many pricing models may appear feasible during early deployment stages, they may fail to sustain profitability over the full investment period due to the escalating nature of fixed and variable costs. The application of fixed pricing models may therefore present inherent vulnerabilities, particularly in residential buildings where charger utilization fluctuates significantly with daily living patterns and occupancy behavior.

The vulnerability of cash flows is further exacerbated when integrated with the actual energy consumption data obtained from field measurements. As previously analyzed, standby energy consumption constitutes a considerable share of operational costs. The charging station continues to consume electricity even when not actively used, contributing to non-revenue-generating energy losses that steadily accumulate. In high-density residential buildings such as condominiums, where peak charging demand is often concentrated during evening hours and significantly drops during daytime or weekdays, idle capacity leads to persistent energy losses that directly impair financial performance. These findings emphasize the structural challenges of operating EV charging stations in environments characterized by sporadic and concentrated user demand.

Moreover, the results suggest that reliance on pricing mechanisms alone may not sufficiently address long-term financial challenges. Static pricing models are unlikely to accommodate fluctuations in user demand, energy market dynamics, or varying levels of infrastructure utilization. As such, dynamic pricing models warrant consideration as a more adaptive strategy. For example, time-of-use pricing structures could incentivize users to shift charging activities toward off-peak hours, improving utilization during otherwise idle periods. Similarly, demand-response pricing or real-time tariff adjustments based on electricity costs may help stabilize revenue streams and mitigate the financial risks posed by fluctuating demand.

The interaction between pricing strategies, demand patterns, and operational efficiency reveals that EV charging projects in residential buildings require a multi-dimensional financial management approach. Operators, investors, and policymakers must incorporate demand forecasting, energy management, and pricing flexibility into project planning to ensure sustained financial viability. Without such integrated financial modeling, EV charging infrastructure projects face substantial risks of long-term underperformance despite initial short-term profitability.

5.2. Financial Profitability Evaluation

To further evaluate the long-term financial performance of the project, comprehensive profitability analysis was conducted using standard investment evaluation indicators: net present value (NPV), internal rate of return (IRR), and payback period. These indicators offer deeper insight into the project’s financial resilience beyond the simple cash flow projections presented in the previous section.

The results of the profitability assessment are summarized in

Table 3. The NPV values, calculated over a 20-year project horizon with appropriate discounting of future cash flows, consistently remain low across all profit share scenarios. Even under the most optimistic pricing condition of 0.229 USD (8 THB) per kWh, where the project achieves positive long-term cash flow, the NPV reaches only 3932 USD. This indicates that while the project may technically generate net profit under this pricing structure, the overall financial surplus remains marginal relative to the scale of the investment.

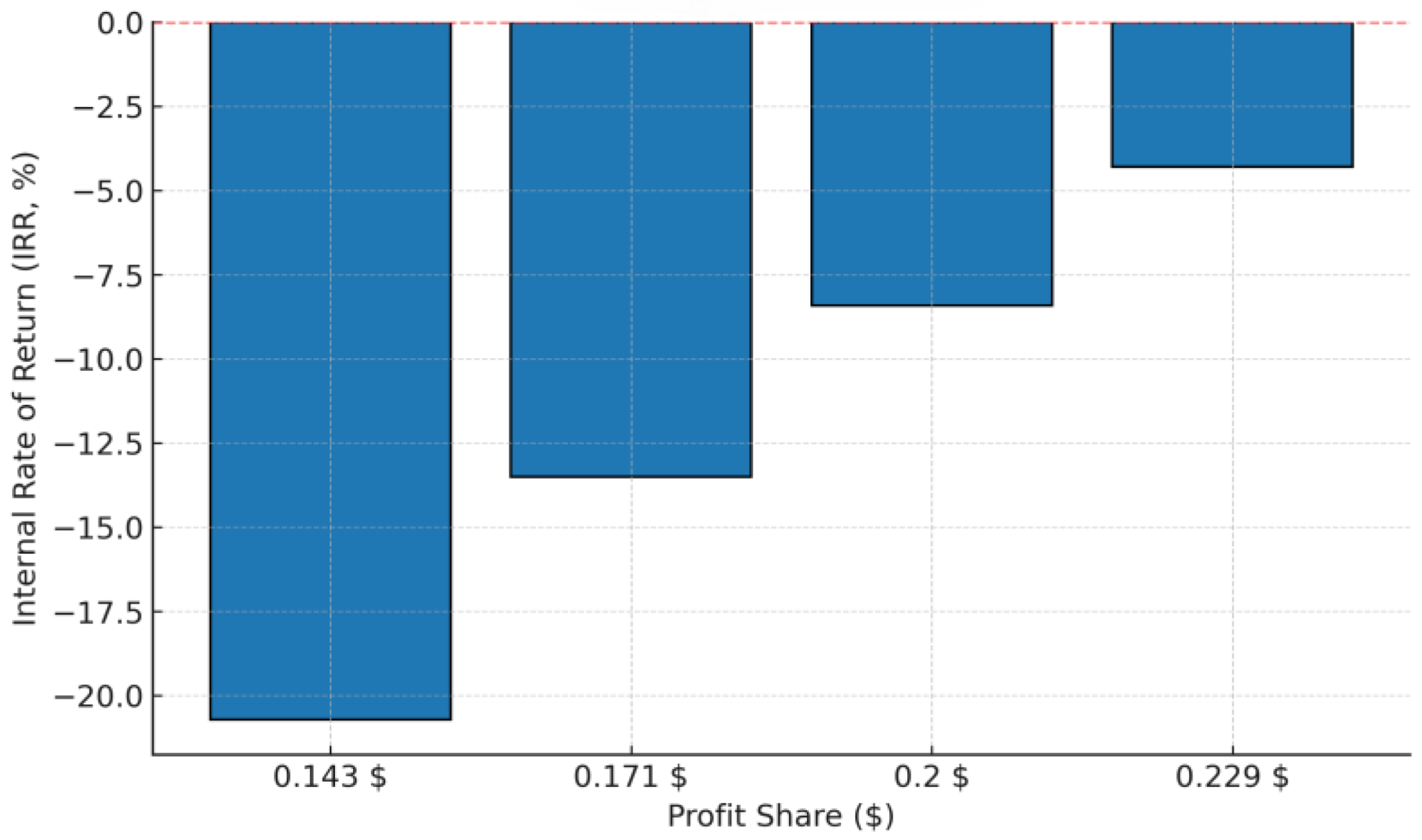

More critically, the IRR results reflect the underlying weakness in the investment’s profitability. Across all pricing scenarios, the IRR values remain negative, except for the highest margin case where the IRR improves to approximately 4.29%. Such negative IRR values demonstrate that the internal returns generated by the project are consistently lower than the cost of capital, suggesting that the project fails to deliver acceptable investment performance under typical financing conditions. To further illustrate these findings,

Figure 6 presents a comparative analysis of IRR outcomes across different profit margin scenarios. The figure clearly highlights that only the scenario with the highest profit share achieves a marginally positive trajectory, while all other cases remain below zero. This visualization underscores the financial fragility of the investment model under current Thai market and policy conditions, emphasizing the need for external policy interventions or supportive incentive mechanisms to improve investment feasibility.

The payback period analysis further reinforces these findings. With the exception of the highest pricing scenario at 0.229 USD (8 THB), all other pricing levels fail to achieve any payback within the 20-year investment horizon. Only at this upper pricing tier does the project manage to recover its initial capital investment, requiring approximately 14 years to break even. This extended payback period reflects both the relatively low revenue generation potential of residential EV charging services and the persistent burden of recurring operating costs.

Taken together, these financial indicators present a consistent picture: under current cost structures, demand patterns, and pricing environments in Thailand, residential EV charging investments face substantial challenges in achieving financial sustainability. The relatively flat utilization rates, combined with significant standby energy losses and escalating operational expenses, constrain the project’s ability to generate sufficient surplus cash flow. While short-term positive cash flows may provide a temporary perception of financial success, as seen in the early years of the cash flow analysis, these gains are quickly eroded over time. The profitability indicators reveal that, in most scenarios, the project operates on narrow margins that leave little room for operational disruptions, price fluctuations, or unforeseen cost escalations.

This analysis underscores the structural difficulties facing private sector investment in EV charging infrastructure within Thailand’s residential market. The limited profitability potential revealed here suggests that without substantial policy intervention, supportive regulatory frameworks, or innovative business models, the private sector may encounter significant financial risks in attempting to scale EV charging networks in residential environments. The relatively high upfront investment costs, coupled with the extended return-on-investment timeline, make such projects challenging to justify under market conditions that lack clear long-term incentives or guaranteed demand stability. These financial constraints contribute directly to the slow expansion of residential EV charging infrastructure in Thailand despite the growing adoption of electric vehicles.

5.3. Sensitivity Analysis

To further strengthen the financial assessment, sensitivity analysis was conducted to evaluate the impact of key financial and operational parameters on the investment performance of the EV charging project. This approach allows for a systematic examination of how variations in critical input variables influence the profitability indicators, thereby identifying the most significant risk drivers and informing investment decisions.

The sensitivity analysis was performed by adopting the most feasible pricing scenario from the previous sections as the base case, where the profit share margin was set at 0.229 USD (8 THB) per kWh. This pricing level was selected because it represented the only scenario in which the project achieved long-term financial viability, as demonstrated by its ability to generate positive net cash flows, achieve a payback period of 14 years, and attain the highest, albeit still negative, internal rate of return. Establishing this base case provided a meaningful foundation for sensitivity testing, as scenarios with lower profit margins consistently failed to reach profitability, leaving insufficient flexibility for meaningful sensitivity comparisons.

The sensitivity analysis employed a one-variable-at-a-time (OVAT) approach, where each parameter was independently varied by ±10% from its base case value while holding other variables constant. The selection of a 10% variation range follows established best practices commonly applied in project finance and infrastructure investment studies. This range strikes a balance between representing plausible real-world fluctuations in market conditions, construction costs, energy prices, and utilization levels, while avoiding excessive deviations that could introduce non-linear or unrealistic effects into the financial model.

Five key parameters were selected for sensitivity testing based on their relevance to the financial performance of EV charging investments in residential contexts. These parameters included profit share, utilization rate, energy purchase cost, CAPEX, and OPEX. Profit share directly affects revenue generation per unit of energy sold, while utilization rate determines the overall volume of energy sold annually. Energy purchase cost represents fluctuations in electricity procurement prices, CAPEX reflects variations in initial equipment and installation costs, and OPEX captures changes in recurring maintenance, insurance, and administrative expenses.

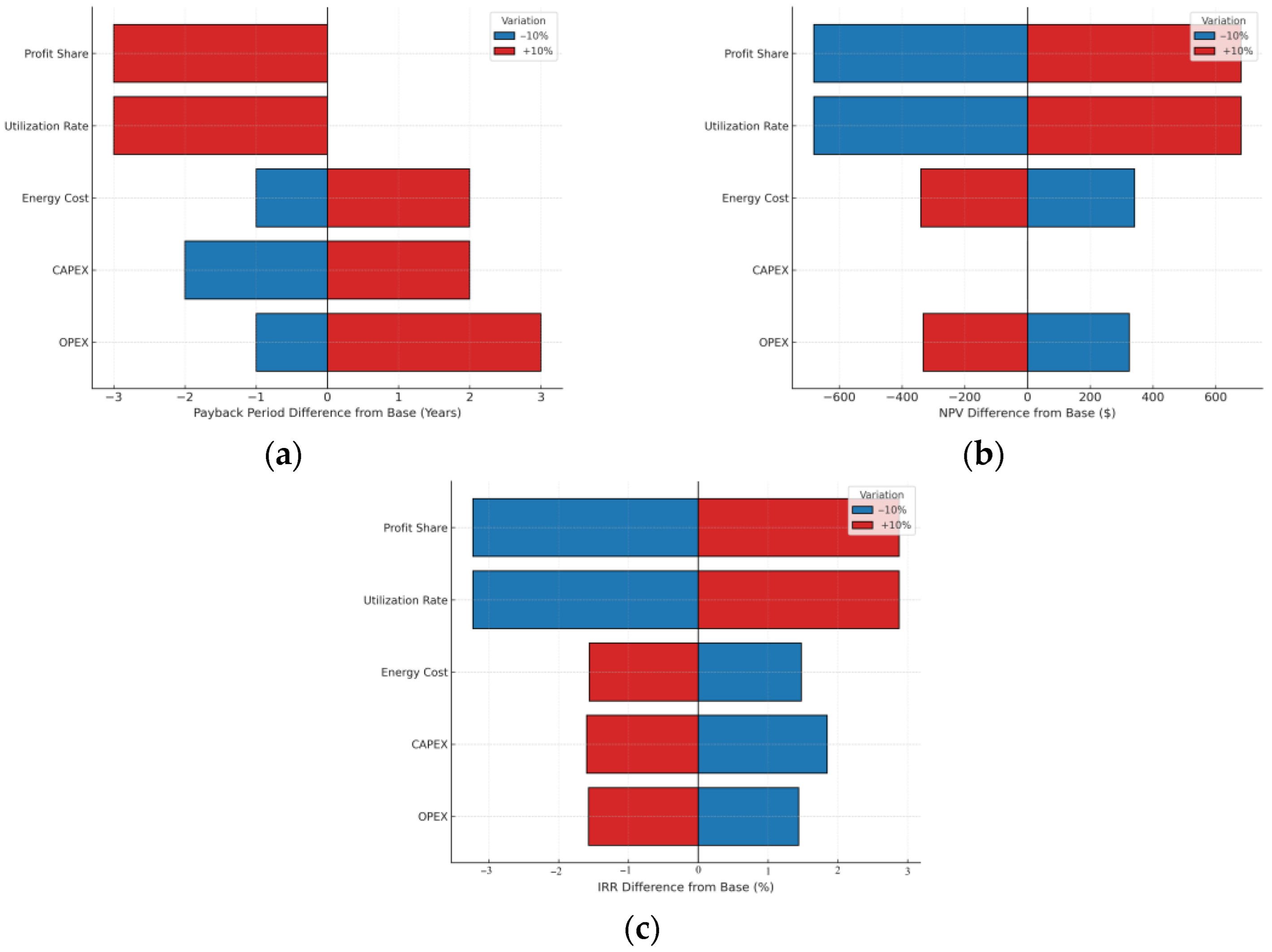

The sensitivity results are summarized in

Table 4. Notably, both profit share and utilization rate exhibited identical effects on financial performance due to their direct proportional relationship within the project’s revenue structure. Specifically, both parameters influence total revenue in a linear manner by either increasing the revenue per kWh sold or expanding the number of kWh sold annually. Consequently, a 10% increase in either parameter reduced the payback period from 14 to 11 years, improved the internal rate of return from −4.29% to −1.41%, and increased the net present value from 3932 USD to 4613 USD. In contrast, a 10% reduction in these parameters resulted in a scenario where the project no longer achieves any payback during the 20-year analysis period. This outcome reflects the highly vulnerable nature of the project’s financial structure when profit share or utilization levels fall below critical thresholds.

The outcomes of the sensitivity analysis are further illustrated in

Figure 7, which presents tornado diagrams summarizing the relative magnitude of each parameter’s impact on financial performance across the three indicators: payback period (

Figure 7a), net present value (

Figure 7b), and internal rate of return (

Figure 7c). These diagrams clearly demonstrate that profit share and utilization rate are the dominant financial drivers across all metrics. Variations of just ±10% in either parameter yield the largest deviations in IRR, NPV, and payback period, visually highlighting their critical roles in determining financial sustainability.

Importantly, for the payback period analysis shown in

Figure 7a, the reduction in profit share and utilization rate by 10% resulted in scenarios where payback becomes infeasible within the project horizon. As these two revenue-dependent variables directly govern the cash inflow magnitude, even minor reductions in revenue generation lead to rapid deterioration of financial feasibility. Conversely, the project’s sensitivity to changes in energy cost, CAPEX, and OPEX remains notably smaller, as demonstrated by narrower variations in IRR, NPV, and payback period. While fluctuations in these cost parameters do affect overall profitability, their impacts are secondary compared to the primary influence of revenue-generating factors.

This analysis strongly emphasizes that the financial success of residential EV charging projects hinges predominantly on achieving sufficient charger utilization and sustaining profit margins that support stable cash inflows. The inability to reach break-even levels under relatively small reductions in utilization or pricing highlights the intrinsic investment risks of deploying EV charging infrastructure within residential contexts under current market conditions in Thailand.

Overall, the sensitivity analysis demonstrates that even under favorable pricing assumptions, the project remains financially vulnerable to modest reductions in either utilization or profit margins. This underscores the importance of accurate demand forecasting, competitive pricing strategies, and operational optimization when planning residential EV charging infrastructure investments. The sensitivity findings also provide essential context for the policy recommendations presented in the subsequent section.

6. Discussion

Following the detailed financial analysis and sensitivity evaluation presented in the previous sections, this discussion section aims to translate these technical findings into practical implications for various stakeholders involved in residential EV charging infrastructure development. Given the significant sensitivity observed in the investment model, particularly in response to variations in revenue and utilization rates, a careful examination of investment risk factors, regulatory challenges, and policy frameworks is warranted. The following subsections address these implications from multiple stakeholder perspectives while outlining the current limitations of the study and directions for future research.

6.1. Policy Implication

The findings of this study provide several critical insights for policymakers, investors, and regulatory agencies concerning the deployment of EV charging infrastructure in high-density residential buildings in Thailand. The empirical results, particularly the load profile analysis, demonstrate that user demand is concentrated during evening hours between 19:00 and 22:00, while long idle periods result in significant standby energy losses. This operational inefficiency, combined with the cash flow analysis, reveals that under current conditions only one pricing scenario, namely achieving a profit margin of 0.229 USD (8 THB) per kWh, enables the project to break even. Lower margins result in sustained financial deficits, which highlights the urgent need for policy interventions to reduce investment risks and operational uncertainties.

From the investor’s perspective, financial feasibility is constrained not only by high upfront capital expenditures and recurring operational costs but also by regulatory ambiguity. In practice, electricity for residential charging stations is billed through the condominium juristic person, which often leads to inconsistent pricing structures. Some operators impose energy tariffs significantly above the regulated electricity price, creating barriers to adoption and discouraging long-term investment. Policymakers could address this issue by introducing a framework that caps resale tariffs within residential complexes, allowing only a modest margin above the prevailing electricity rate to compensate for administrative management. This would improve price fairness for consumers and reduce the financial uncertainty faced by service providers.

In terms of government incentives, the current Board of Investment (BOI) framework provides tax holidays of up to eight years and import duty reductions, but only for large-scale projects exceeding 5000 million THB. Residential charging infrastructure falls outside this scope, leaving a critical policy gap. Extending targeted incentives to smaller residential projects would create a more level playing field. Rather than direct subsidies tied to a percentage of CAPEX, which may not reflect the diverse scale of projects, a more pragmatic approach would be to reduce import tariffs on charging equipment and provide low-interest financing mechanisms for small- and medium-sized investors. These measures would directly lower entry barriers and encourage broader participation in the market.

Another area of concern is the absence of national technical and safety standards specifically for residential EV charging. Currently, no legal framework governs charger installation, service quality, or maximum capacity guarantees within residential settings. This regulatory vacuum creates risks for both consumers and investors. Establishing standardized safety codes, transparent service quality benchmarks, and enforceable capacity guarantees would strengthen investor confidence and ensure consumer protection. Additionally, extending MEA’s low-priority tariff mechanism, which is currently applied to public fast-charging stations, to residential shared chargers could directly reduce operational costs and improve feasibility, aligning residential charging with Thailand’s national EV adoption goals.

International experience reinforces these recommendations. Singapore’s EV Common Charger Grant subsidizes up to 50% of installation costs in non-landed private residences, directly addressing shared ownership challenges. Similarly, Japan provides targeted subsidies for charger deployment in multi-family dwellings, ensuring equitable access in dense urban areas. Both examples highlight the effectiveness of targeted, context-specific incentives in overcoming infrastructure barriers. For Thailand, adopting similar mechanisms, adapted to local policy frameworks, would enhance project viability, reduce reliance on ad hoc pricing arrangements, and create a more sustainable ecosystem for residential EV adoption.

In conclusion, the policy implications of this study are clear: without targeted interventions, residential EV charging infrastructure in Thailand will struggle to achieve financial feasibility. By integrating lessons from international best practices with domestic policy instruments such as BOI incentives, MEA tariff reforms, and the establishment of national technical standards, Thailand can bridge the current policy gap. These measures would not only improve investor confidence and consumer affordability but also ensure that the national EV adoption agenda is supported by adequate and sustainable infrastructure.

6.2. Limitations and Future Work

While this research provides valuable insights, several limitations should be acknowledged. First, the dataset represents a pilot case study, limited to one residential building with a single installed charger. This design reflects the minimum viable scenario but may not fully capture the diversity of operating conditions, demographic variations, or user behaviors across different residential projects. Broader multi-site investigations would significantly strengthen the generalizability of the findings. Additionally, this study did not explicitly examine heterogeneity across user income groups, since the selected condominium case study represents a relatively homogeneous socio-economic profile. As such, variations in price sensitivity or charging demand across different income levels could not be captured.

Second, the data collection period was limited to 14 consecutive days. Although sufficient for observing short-term charging patterns, this period cannot represent seasonal variability or long-term behavioral adaptations. This limitation arose primarily from access constraints and building management policies; however, the real-world dataset still provides a rare empirical foundation for analyzing residential EV charging demand in Thailand.

Third, the demand model employed in this study assumes a static charging behavior profile throughout the 20-year project horizon. In reality, charging patterns may evolve over time due to factors such as EV penetration rates, battery technology advancements, dynamic electricity tariffs, or changes in user convenience preferences.

Fourth, the model assumes constant technology costs throughout the project lifetime. However, given the rapid pace of development in EV charging equipment, battery storage, smart grid integration, and vehicle-to-grid (V2G) technology, future cost structures may differ substantially from the present assumptions.

Future research should address these limitations by expanding the analysis to include multiple residential case studies across different geographical locations and time periods (multi-site, multi-seasonal) in order to improve generalizability. In addition, developing dynamic demand models that capture time-dependent behavioral changes and applying machine learning techniques for demand forecasting could significantly enhance predictive accuracy. Further studies should also simulate diverse market conditions under fluctuating energy prices, evolving policy frameworks, and emerging technologies such as bidirectional charging. Moreover, incorporating socio-economic factors and analyzing mixed-income residential projects could provide valuable insights into how consumer diversity influences both financial feasibility and infrastructure design. Moreover, incorporating alternative business models, including shared charging networks, subscription-based services, or bundled utility tariffs, may provide deeper insights into financially viable pathways for residential EV infrastructure deployment. Together, these directions will help refine the financial and operational feasibility of EV charging systems and align them more closely with real-world market and policy dynamics.

7. Conclusions

This study comprehensively evaluated the financial and operational feasibility of deploying EV charging infrastructure in high-density residential buildings, focusing on real-world user behavior, energy consumption patterns, cost structures, and investment risks. The research provided empirical data collected from actual charging operations over a 14-day observation period, offering valuable insights into the dynamics of EV charging demand in urban residential contexts.

The load profile analysis revealed that user charging behavior is heavily concentrated during evening hours between 19:00 and 22:00 on weekdays, reflecting typical residential occupancy patterns where users return home and prefer overnight charging. Weekend charging patterns displayed greater dispersion throughout the day but exhibited lower overall demand due to reduced commuting activity. These behavioral insights underscore the importance of designing charging infrastructure and operational models that align with the lifestyle and mobility needs of urban residents to optimize utilization and minimize infrastructure underuse.

The energy consumption analysis further highlighted significant operational inefficiencies related to standby energy losses. While total measured energy consumption over the study period reached 248.342 kW, only 138.24 kW were directly delivered to users, with the remainder were consumed by idle or standby charger operation. This substantial non-utilization energy cost emphasizes the importance of adopting more energy-efficient equipment and intelligent power management systems to reduce unnecessary operational expenses and improve long-term project sustainability.

The financial feasibility assessment identified pricing strategies as the most decisive factor in determining project viability. At the current market conditions, only a profit margin of 0.229 USD (8 THB) per kWh yielded a break-even point within a 20-year project horizon. Lower profit margins, while appearing initially viable, were shown to be insufficient when accounting for cumulative operational and capital costs, ultimately resulting in sustained financial losses. This finding illustrates the fragile financial nature of residential EV charging investments under Thailand’s existing electricity pricing framework.

To further evaluate investment risks, sensitivity analysis was performed on five key financial variables: profit share, utilization rate, energy cost, CAPEX, and OPEX. The results revealed that profit share and utilization rate are the most critical determinants of financial performance, exhibiting nearly linear and proportionate impacts on NPV, IRR, and payback period. Even minor reductions of 10% in these revenue-driven parameters resulted in scenarios where the project entirely failed to achieve break-even status. In contrast, variations in energy cost, capital investment, and operating expenses produced comparatively smaller effects, emphasizing that achieving sufficient charger utilization and revenue margins are the dominant risk factors for this business model.

Beyond financial considerations, this study also highlighted critical policy and regulatory challenges that remain unresolved. These include the lack of comprehensive national safety standards, technical regulations, transparent pricing frameworks, and legal protections for both investors and consumers in Thailand’s residential EV charging sector. Without appropriate policy interventions, market-driven investments may remain financially unattractive, thereby slowing the expansion of necessary charging infrastructure to support Thailand’s national EV adoption targets.

In conclusion, the successful deployment of EV charging infrastructure in high-density residential buildings requires a holistic approach that integrates accurate demand forecasting, dynamic pricing models, energy-efficient technologies, robust policy frameworks, and active government support. By addressing both financial and regulatory barriers, stakeholders can enhance the viability of residential EV charging projects and contribute to a more sustainable, accessible, and resilient urban transportation system.