Abstract

In regions where transportation and the economy are closely integrated, optimizing network structure and enhancing synergy are vital for regional integration. This paper constructs a dual-factor linkage network using enterprise investment and liner shipping data to analyze linkage strength and synergy effects among cities in the Greater Bay Area. The findings reveal that (1) a core-periphery structure exists, with core cities dominating resource flows while secondary cities remain weak. The logistics network is led by Hong Kong and Shenzhen, while the capital flow network showcases the dominance of Hong Kong, Shenzhen, and Guangzhou. (2) From 2016 to 2021, interactions between transportation and the economy deepened, showing strong correlations in logistics and capital flows among core cities and between core and edge cities, but weaker correlations with sub-core and edge cities. Core cities stabilize regional transportation and economy, fostering agglomeration, while sub-core cities are more reliant on them, indicating a need for better resource balance. (3) The spatio-temporal coupling analysis reveals significant heterogeneity in flows among cities, with many exhibiting antagonistic couplings outside core areas. This study enhances understanding of synergy mechanisms in transportation and economic networks, offering insights for optimizing layouts and improving capital flow efficiency.

1. Introduction

World Bank statistics indicate that 75% of the world’s economic activity originates from port and bay areas and their surrounding hinterlands. The Global Cities Index Report 2023 highlights that most of the top thirty cities globally are situated in bay areas, signaling the onset of a Bay Area era. Globalization is driving regional economic integration, which is becoming a vital strategy for countries and regions to foster economic growth. The Guangdong-Hong Kong-Macao Greater Bay Area (referred to as the “Greater Bay Area”) is one of China’s fastest-growing and most dynamic regions, serving as a strategic tool for promoting reform, opening up, and deepening regional cooperation. The release of the Outline of the Greater Bay Area Development Plan signifies rapid progress and the elevation of its development to a national strategy. The economic interdependence within the Greater Bay Area extends beyond city interactions to global economic connectivity. The development and modernization of the transportation system are critical for regional economic growth, directly influencing resource flow, production factor allocation, and market exchanges. Improved transportation significantly reduces physical distances between cities, enhancing the frequency and efficiency of economic activities. Successful examples demonstrate that integrating infrastructure and liberalizing factor flows are essential prerequisites for Bay Area economic development. These elements provide the foundation for deep integration and the creation of a synergistic economic system in the Greater Bay Area [1].

In the context of globalization and localization, regional development has become a central focus in modern economic research. The intersection of geography and economics highlights that transportation development is a crucial link between regions, directly influencing interregional economic interactions and overall growth. The importance of transportation and economic linkages is particularly evident in city clusters and bay regions. Interregional transportation infrastructure significantly affects the emergence and growth of cities, while urban transportation systems impact their size and scope [2]. City clusters are concentrated organizational units within specific geographic areas, primarily influenced by one or more prominent cities. These clusters are interconnected with surrounding regional economies through compact spatial patterns, strong economic ties, and well-developed infrastructure [3,4]. The development of city clusters relies on efficient transportation networks. Notably, the level of economic integration and the fulfillment of regional functions are closely linked to the connectivity and operational efficiency of transportation systems within specific clusters, such as those in the Bay Area.

Cross-border flows of capital, information, cargo, and labor are accelerating, marking a transition in the global economy from the physical concentration of the industrial age to the networked distribution of the information age [5,6]. Traditional geographic space is being compressed by virtual environments and mobile time. The global economic system now embodies a “mobile economy”, where conventional urban patterns converge with flow space, creating a distributed functional space centered around networks. This evolution poses challenges for traditional spatial studies in geography and sociology, which struggle to account for the social impacts of virtual space and network flows. Flow-space theory is crucial for understanding economic activities and network dynamics in this globalized context [7]. Consequently, the research paradigm for regional spatial structure shifts from static to dynamic perspectives, emphasizing the multidimensionality of structures, including information, transportation, capital, technology flows, and functional linkages. Previous research on spatial structures relied heavily on traditional data collection methods and analytical tools, utilizing statistical techniques to study spatial differentiation in population and industry, qualitative methods for describing functional zoning and socio-economic relations, and government statistical data based on administrative divisions, which often inadequately measured interregional interactions. The emergence of geographic information systems enhances the analysis of regional spatial structures, facilitating a shift from static to dynamic research and from local to holistic perspectives. Furthermore, the rapid development of geospatial big data allows for a deeper understanding of the dynamics within regional spatial structures.

The integration of flow space theory and geospatial big data offers a novel methodology for studying regional spatial structures. Flow space theory highlights the dynamic nature of linkages and factor flows, while geospatial big data provides robust, multidimensional data support. However, this approach faces limitations, such as fragmented research and inadequate exploration of the interconnected characteristics of regional spatial structures. There is a particular need for a deeper focus on transportation patterns and the interactions between economic linkages and the coordinated development of regions.

Amid global economic integration and regionally coordinated development strategies, the Greater Bay Area has evolved into a world-class urban agglomeration characterized by increasingly integrated inter-city transportation systems and economic linkages, exhibiting prominent network attributes. Yet, critical questions remain: Are the region’s transportation and economic networks both stable and complementary? Do logistics and capital flows exhibit a synergistic evolutionary dynamic? How are these flows spatially distributed, and how intense are they? This study seeks to address these issues through a systematic examination of the structural and synergistic characteristics of the Greater Bay Area’s transportation-economic network within the framework of flow space, applying complex network analysis methodologies. The study proposes the following research hypotheses:

Hypothesis 1 (H1).

The logistics and capital flow networks within the Greater Bay Area exhibit a polycentric hierarchical configuration, anchored by Hong Kong, Shenzhen, and Guangzhou. However, notable disparities exist in the centrality levels and spheres of influence between the two networks.

Hypothesis 2 (H2).

There is a significant positive correlation between urban transportation accessibility and capital connectivity within the capital flow network. Higher accessibility correlates with enhanced capital absorption capacity.

Hypothesis 3 (H3).

With the progression of regional integration, spatial coupling between the logistics and capital flow networks in the Greater Bay Area intensifies. This is reflected in increasing synergy across node distribution, connection strength, and evolutionary trajectories.

The study employs flow space theory to construct a city economic linkage network based on multidimensional economic indicators, emphasizing transportation and economic connections. It further develops a city logistics and capital flow linkage network utilizing liner schedules and enterprise investment data. Through complex network analysis methods, the research examines the network structure of cities in the Greater Bay Area and their synergy mechanisms. This research aims to elucidate the spatial positioning, dynamic interactions, and economic flow patterns among Bay Area cities, thereby promoting regional economic integration and optimizing the cooperative development model. Investigating the relationship between transportation and the economy in the Greater Bay Area underscores the vital role of transportation networks in facilitating cooperation and resource integration. Additionally, it offers theoretical support and practical insights for development management and policy formulation for individual cities, as well as for the planning and construction of the Greater Bay Area.

The study is organized as follows: Section 2 reviews relevant literature, while Section 3 presents the research data and methodology. Section 4 analyzes the results, quantifying the Greater Bay Area’s structure, city node characteristics, and overall city cluster dynamics based on logistics and capital flow networks. This section reveals the structural traits and synergistic development trends within these networks. Section 5 concludes the study, summarizing key findings and offering recommendations for optimizing transportation infrastructure, constructing efficient logistics networks, and enhancing capital flow within the Greater Bay Area city cluster.

2. Literature Review

With globalization, city clusters are transforming from mere geographic agglomerations into complex functional systems that encompass economic, cultural, and social resources. Through the cross-regional flows of information [8], transportation, capital [9], technology [10], and other factors [11], these clusters create highly interconnected regional networks that enhance their positions in the global value chain. The cooperation and competition among cities accelerate resource flows, serving as a key driver of regional and national economic development. The theory of flow space posits that cities no longer function as isolated units; instead, they are intricately linked to the external environment through multidimensional factor flow [7], particularly within global supply chains, international trade, and multinational enterprises. Consequently, the study of city development must transition from traditional static spatial analysis to a dynamic network perspective, emphasizing how cities integrate into broader regional and global systems through mobility. This approach aims to deepen the understanding of city clusters’ functions and identify strategies to enhance overall competitiveness through regional synergy. Research on regional spatial structures and synergies, driven by the combination of flow space and big data, has become increasingly intensive. This research focuses on the following areas:

(1) Interregional transportation flow refers to the movement of key mobility elements—such as vehicles, goods, people, and information—across geographic regions [12]. As the most visible expression of spatial mobility, transportation flows constitute a fundamental driver of urban development and regional connectivity. From the perspective of research progress and the research paradigm of transportation flow elements, the topological characteristics of transportation networks form the basis for understanding transportation flows. Researchers have used complex network theory to analyze transportation network structure [13]. Barabási and Albert [14] demonstrated that transportation networks exhibit scale-free network characteristics, meaning the degree distribution of nodes in the network follows a power law. This characteristic makes transportation networks highly connected [15], which significantly affects their efficiency and reliability [16]. In terms of urban evolution, transportation networks and spatial development are tightly interlinked: denser inter-city transport links lead to more accelerated urban expansion and greater spatial reach [17]. The degree of regional connectivity both within and beyond the urban system shapes regional spatial structures and inter-city relationships [18]. Additionally, transportation flows induce a spatial-temporal compression effect, catalyzing transformations in urban morphology, functional configurations, developmental trajectories, and the spatial dynamics of regional tourism.

(2) Intercity interactions are fundamentally anchored in economic linkages, with enterprises serving as key agents within these networks [19]. Under the influence of value law and incentive mechanisms, enterprise-driven investment connections give rise to capital and economic flows that reflect the intensity and tightness of interurban relations [20]. As a critical vector of economic activity, capital flow exerts profound effects on regional development, urban morphology, and the functional specialization of firms [21,22]. With the advancement of research on transportation and economic factor flows—particularly within the framework of network analysis—scholars have increasingly examined their synergistic interplay from multidimensional perspectives [23]. Empirical evidence indicates a causal feedback mechanism between transportation circulation and economic mobility, forming a closed-loop dynamic [24,25]. Transportation infrastructure fosters economic vitality, which in turn enhances and sustains transportation systems. This mutual reinforcement catalyzes iterative improvements to both the regional economy and transportation networks, underscoring the inherent interdependence between economic and mobility flows [26].

Current evaluations of synergistic development dynamics among cities in the Greater Bay Area, particularly the interplay between transportation demand and economic flows, remain inadequate. This gap stems from two key limitations: (1) the absence of geospatial big data, with reliance on statistical yearbooks and bulletins introducing inconsistencies; (2) insufficient attention to intra-cluster synergy heterogeneity, where variation in intercity coordination levels is often overlooked. The interaction between transport infrastructure and economic mobility plays a pivotal role in resource reallocation, regional economic agglomeration, and enhanced competitiveness via structural optimization of transportation systems. Empirical studies affirm a strong coupling effect between transportation and capital flows [27], underscoring the necessity of integrated planning to ensure the healthy and sustainable evolution of urban agglomerations [28].

Accordingly, this study adopts a flow space framework and a transportation–economic linkage perspective to construct an intercity economic network using multidimensional indicators. It further develops logistics and capital flow networks based on liner schedules and enterprise investment data, revealing the structural characteristics and synergistic mechanisms among cities in the Greater Bay Area. Employing complex network analysis, the study identifies the spatial positioning, dynamic interactions, and economic flow patterns within the region. This approach facilitates regional economic integration and enhances the synergistic development model among cities. By examining the transportation–economy relationship, the study highlights the pivotal role of the transportation network in fostering collaboration and resource convergence. It also provides theoretical guidance and actionable insights for governance, policy formulation, and regional planning.

3. Research Data and Methods

3.1. Overview of the Research Area

Logistics and capital flows are closely interconnected in modern economies. Efficient logistics accelerates cargo and service turnover, enhances market responsiveness, and reduces transaction costs, thereby attracting capital inflows and fostering regional investment and economic growth [29]. Conversely, robust capital flows support the development and upgrading of logistics infrastructure, providing essential financial backing for the logistics sector. Additionally, the efficiency and security of capital flows are critical for expanding logistics networks and improving accessibility. In the context of deepening globalization and regional integration, the Guangdong-Hong Kong-Macao Greater Bay Area serves as a dynamic economic growth hub, characterized by a complex transportation network and diverse economic connections [30]. Major cities such as Guangzhou, Shenzhen, Hong Kong, and Macau form an integrated system through efficient transport and strong economic ties [31]. The region’s logistics system thrives on a highly liquid and innovative capital market, with Hong Kong acting as an international capital center that enables rapid access to global markets for cargo and services [32]. The synergy between logistics and financial technology innovation in the Greater Bay Area enhances the efficiency of both logistics and capital flows, driving industrial upgrading and economic transformation. This interplay allows the Greater Bay Area to maintain its competitive edge and economic vitality in the global landscape.

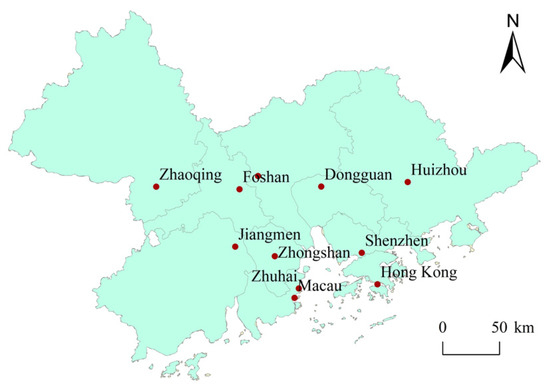

The Greater Bay Area, situated along the southern coast of China, is one of the country’s most economically developed and open regions. It includes the special administrative regions of Hong Kong and Macao, along with nine cities in the Pearl River Delta of Guangdong Province: Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen, and Zhaoqing, covering approximately 56,000 square kilometers (as shown in Figure 1). Geographically positioned near Southeast Asia and supported by the extensive mainland Chinese market, the Greater Bay Area serves as a crucial hub linking the mainland to international markets. It acts as a vital window for China’s global engagement and a frontline for international economic competition. With a diversified industrial structure, well-developed infrastructure, and significant economic influence, the Greater Bay Area holds a prominent position in the global economy [33].

Figure 1.

Geographic location of the Guangdong-Hong Kong-Macao Greater Bay Area.

3.2. Data Source

The underlying logic of transport networks is rooted in interregional trade relations, particularly those driven by factor flows, with a focus on capital. Inter-enterprise investment reflects the movement of resources, capital, technology, and markets, which are central to regional economic linkages [34]. This encompasses not only capital flow paths but also insights into industrial partnerships, technology transfer, and market expansion. Furthermore, inter-enterprise investment relationships elucidate the synergies among industries, revealing the division of labor and cooperative dynamics across various links in the industrial chain. This enhances the comprehension of industrial synergies and resource-sharing mechanisms among the economies within the Greater Bay Area. The study selects 2016, 2019, and 2021 as key temporal nodes based on two principal considerations. First, these years reflect critical shifts in policy and macro-level conditions. Specifically, 2016 marks the prelude to the formal release of the Outline Development Plan for the Greater Bay Area, serving as a baseline for regional economic linkage analysis prior to policy implementation. The year 2019 represents the initial phase of policy execution, enabling observation of the early impact on regional factor flows. In contrast, 2021 coincides with the onset of the 14th Five-Year Plan and is characterized by the dual context of epidemic disruption and deepened policy advancement, providing a robust basis for examining network evolution. Second, data for all three years derive from a consistent platform with standardized collection protocols and indicator definitions. This ensures temporal continuity, enhances data comparability, and strengthens the foundation for longitudinal network analysis.

Therefore, utilizing inter-enterprise investment data to construct a capital flow network effectively captures the complexity and multidimensionality of economic interactions within and beyond the region [35]. This analysis is based on inter-regional investment data from 2016, 2019, and 2021, provided by Qixinbao (Qixinbao is a complete database containing samples from 110 million Chinese enterprises extracted from 100 websites, including the National Enterprise Credit Information Public Disclosure System, the China Court Judgment Network, and the China Enforcement Information Public Network (https://www.qixin.com/group-buy, accessed on 1 June 2025)). The data undergoes manual verification and correction through random sampling and cross-checking to ensure completeness and scientific integrity. Applying principles of representativeness, quantifiability, and comparability, the “enterprise-enterprise” network is transformed into a “city-city” network. This process filters the investment linkage data between enterprises across cities in the Greater Bay Area. Ultimately, a capital flow network is constructed, using city economic data sourced from the China City Yearbook.

Considering the geographical specificity of the city cluster in the Greater Bay, transport flow data is sourced from container liner AIS data provided by global port, shipping, and logistics companies, particularly Alphaliner. This data includes detailed information such as shipping companies, origin ports, destination ports, call ports, route operation ship sizes (measured by container capacity), and schedules (frequency of calls at each port per week). A global shipping database is constructed for the years 2016, 2019, and 2021. From this database, ship schedule information between ports in the Greater Bay Area, including transshipment ports, is screened and analyzed. Based on these insights, a comprehensive transportation and logistics network is developed. Additionally, port cargo throughput and port container throughput data are obtained from the China Port Yearbook.

3.3. Research Methods

3.3.1. Network Construction

Cross-regional investment flows between enterprises and cargo flows between ports within the Greater Bay Area are abstracted as network expressions, with cities as nodes and intercity capital and shipping links as edges. Taking into account the directionality and inequality of capital and transportation flows between cities, weighted directed capital flow networks and logistics networks are constructed and represented by adjacency matrices and , respectively:

3.3.2. Empirical Quantitative Metrics

(1) Degree (): The most intuitive indicator characterizing the importance of cities, measured from three perspectives: inflow, outflow, and aggregation [36]. Among them, for outflow direction, outgoing degree indicates a city’s ability to disseminate or export resources and flows to the external entities. For inflow direction, the incoming degree indicates a city’s ability to receive resources and flows. For aggregation, the total degree combines both inflow and outflow metrics, reflecting the overall influence and activity of the city within the network. Specifically, it is as follows:

where , , and are the outgoing, incoming, and total degrees of the cities, respectively.

(2) Clustering coefficient (): the average of the clustering coefficients of all cities in the network [37].

where is the actual number of edges among the cities connected by the city .

(3) Efficiency (E): The distribution efficiency of the capital and transportation flow elements is represented by the average of the shortest path lengths between any two cities in the network [38].

where is the shortest path length between city and city . is the number of nodes in the network, .

(4) Density (): the ratio of the number of edges actually present in the network to the maximum number of possible edges, which is used to measure the connectivity of the network [38].

where is the number of edges actually present in the network.

(5) Centrality: quantifies the heterogeneity and hierarchy of the roles, positions, and functions of cities in networks of capital flows and networks of transport flows by the extent to which they are central to the network. Based on the network perspective, centrality is known as central potential and characterizes the degree of closeness of the entire network [36]. Degree characterizes the nature of individual nodes, and potential characterizes the nature of the entire graph.

where , , and are the degree, proximity, and mediating centrality of the network. , , and are the degree, proximity, and mediating centrality of the cities. is the number of shortest paths between city and city , and is the number of cities that pass through city in the shortest path between city and city . The above indicators make it possible to quantify the directionality of capital and transport flows while measuring the overall degree of interaction between cities.

(6) Degree of coupling and coordination: describes the degree to which two or more systems interact and influence each other [39]. The degree of coupling and coordination determines the evolution of the system. Logistics and capital flow networks are independent and interacting systems. The coupling degree coordination model is used to quantify the degree of development coordination of logistics and capital flow networks in the Greater Bay Area metropolitan cluster. At the same time, the relative development coordination degree is introduced to measure the relative development level of logistics and capital flow in each city (as shown in Table 1).

where and denote the degree of centrality of cities in logistics and capital flow linkage, respectively. is the development coefficient of logistics and capital flow linkage coordination of cities in the Bay Area, is the comprehensive logistics and capital flow coordination index, and is the degree of linkage coordination. is the relative development coefficient.

Table 1.

Status of coupled and coordinated development between logistics and capital flow.

4. Results Analysis

To uncover the flow patterns and synergistic dynamics among cities in the Greater Bay Area, this study constructs a dual-factor linkage network integrating enterprise investment and liner transportation data. This framework facilitates a comprehensive analysis of the interactive structure between logistics and capital flows. During data processing, topological characteristics of the network—including node centrality, network density, and clustering coefficients—were quantitatively evaluated using the NetworkX 3.2.1 library in Python 3.12.6 and Gephi 0.9.2 software. For enhanced spatial visualization and interpretability, ArcGIS 10.8 was employed to spatially map the intercity linkages, while Origin 2024 was used to illustrate indicator trends and comparative analyses.

4.1. The Potential of Logistics and Capital Flow Networks in the Greater Bay Area

Table 2 illustrates the evolution of the logistics and capital flow networks in the Greater Bay Area from 2016 to 2021. The logistics network emphasizes balanced development, while the capital flow network increasingly centralizes, indicating differentiated resource flow and allocation patterns. First, regarding collaboration intensity among local cities, the agglomeration coefficient of the logistics network shows fluctuation; it is 0.869 in 2016, 0.819 in 2019, and 0.853 in 2021, which indicates that the regional collaboration capacity of the logistics network tends to stabilize after experiencing a certain decline in the short term. In contrast, the agglomeration coefficient of the capital flow network rises consistently, from 0.785 in 2016 to 0.819 in 2021, reflecting enhanced cooperation among cities. Second, concerning the transmission speed and cost of information and resources, the efficiency of the logistics network peaks at 0.918 in 2019 before declining, likely due to diminishing marginal efficiency from expanded logistics resource distribution. Conversely, the capital flow network’s efficiency shows continuous improvement, indicating ongoing optimization and increasing mobility in resource allocation. Third, in terms of physical connectivity, the logistics network’s density decreases annually, correlating with broader distribution and diversification within the Greater Bay Area. The capital flow network, however, becomes more cohesive, signifying heightened economic activity. This is evidenced by an increase in the logistics network’s diameter and a stable diameter in the capital flow network, indicating structural complexity in logistics and compact connectivity in capital flows. Finally, examining network centrality potential, the degree centrality of the logistics network declines from 1.5 in 2016 to 1.291 in 2021, reflecting a balance in the importance of regional cities. The capital flow network improves from 1.109 to 1.364, highlighting increased control by core cities. Regarding intermediary centrality, the logistics network remains lower than the capital flow network, which plays a more significant role for key cities, suggesting that certain cities serve as crucial intermediaries in capital flows. In terms of tight centrality, the logistics network declines annually, while the capital flow network increases to 0.770 in 2021, indicating greater efficiency in resource flow and diffusion. Overall, the logistics network exhibits a downward trend, while the capital flow network remains relatively balanced, with core cities maintaining a stable position.

Table 2.

Network topology statistics.

The comparative analysis of logistics and capital flow networks in the Greater Bay Area reveals that cities are extensively connected within the logistics network. This network exhibits an increasing diameter and decreasing degree centrality. Although overall efficiency declines, high agglomeration persists, indicating that regional logistics depend on robust cooperation. However, the decrease in marginal returns highlights the heterogeneity and expanding distribution of the logistics network, resulting in diversification and increased complexity. This shift narrows the importance gap among cities in the network. The optimization of the network structure facilitates mutual enhancement of circulation and cooperation among elements. The synergy between logistics and capital flow networks underscores the interconnection between transportation and economic activities in the Greater Bay Area. The logistics network underpins the flow of goods, establishing conditions conducive to interregional capital movement. Consequently, the influx of capital from regional cities fosters infrastructure development and enhances logistics capacity.

4.2. The City Nodes Variability in Logistics and Capital Flow Linkages

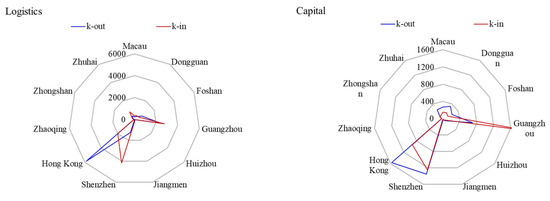

The logistics and capital flow networks in the Greater Bay Area exhibit distinct characteristics in spatial distribution and functional roles. The logistics network emphasizes extensive intercity coverage, while the capital flow network demonstrates centralized development around core cities. As shown in Figure 2, the logistics network reveals that Shenzhen and Hong Kong possess higher weighted degrees, underscoring their dominant roles in logistics output. Hong Kong, in particular, functions as an international logistics center, characterized by a significant outflow of logistics resources. Conversely, Guangdong, Foshan, and Dongguan exhibit higher weighted inwardness, indicating strong demand for logistics inputs. These regions, as manufacturing hubs, are increasingly reliant on efficient logistics systems. In the capital flow network, Hong Kong and Shenzhen are prominent in capital exports, with Hong Kong’s capital outflow reflecting its status as an international financial center. Guangzhou’s exceptionally high weighted inwardness highlights its central role in absorbing capital within the region, closely linked to the degree of industrial agglomeration and the vibrancy of business activities in the city.

Figure 2.

City characterization under logistics and capital flows.

There exists a spatial overlap between core cities in the logistics network and the capital flow network, indicating a differentiated division of roles among these cities. In the logistics network, core cities are geographically and logistically concentrated in hub locations. In contrast, core cities within the capital flow network are closely linked to regional economic centers and capital hubs. Regarding the division of roles, Hong Kong and Shenzhen serve as output nodes for logistics resources, while Zhuhai and Zhongshan function as input nodes, effectively complementing regional cargo flow. Conversely, capital primarily flows from Hong Kong and Shenzhen to Guangzhou, subsequently radiating to other cities. This pattern reflects a cascading distribution of capital flows, highlighting the interconnectedness of logistics and capital networks in the region.

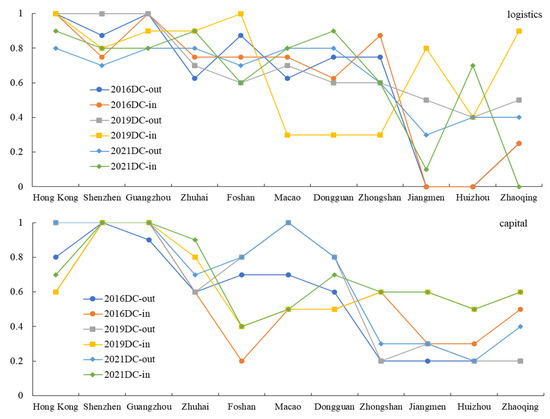

Outgoing centrality indicates the influence a city exerts on others within the network. Cities with high outgoing centrality in logistics or capital flow networks are more likely to function as output and distribution centers. Conversely, incoming centrality measures a node’s capacity to receive information and capital, with cities exhibiting high incoming centrality serving as primary recipients. As illustrated in Figure 3, the outgoing and incoming centrality of Greater Bay Area cities in the logistics and capital flow networks reveals characteristics such as spatial imbalance, the dual role of core nodes, and strong synergy of factor flows. Specifically, the incoming centrality of each city indicates a clear core-edge structure. Cities with both high out-degree and high in-degree centrality not only generate significant resources and funds but also act as major recipients, embodying the dual function of core nodes within the network. The synergy between logistics and capital flow elements is significant. Cities that demonstrate high outgoing centrality in logistics also tend to exhibit high outgoing centrality in capital flows.

Figure 3.

Distribution of logistics and capital flow centrality within the Greater Bay Area, 2016–2021.

During the logistics element process, Hong Kong, Shenzhen, and Guangzhou consistently exhibit high outgoing and incoming centrality throughout the study period. In contrast, cities like Macao, Dongguan, and Foshan recorded an incoming centrality of only 0.3 in 2016, indicating limited integration into the logistics backbone network during the early stages of the study. Jiangmen and Zhaoqing were even less integrated, with incoming centrality values close to 0 in 2016. The evolution of centrality within the capital flow network shows some synchronization with the logistics network, albeit with notable differences. Hong Kong, Shenzhen, and Guangzhou maintain high outgoing capital flow centrality. However, sub-cities such as Foshan and Dongguan still have lower centrality scores compared to the main cities, though they demonstrate a growth trend in outgoing centrality by 2019. Unlike the logistics network, the incoming centrality within the capital flow network appears relatively more balanced, suggesting a more equitable distribution of capital absorption among various cities. This indicates that while core cities dominate both networks, there is a gradual improvement in the performance of secondary cities in capital flow dynamics.

For the overall development trend, the logistics network is characterized by core cities leading and secondary cities supporting. From 2016 to 2021, the centrality of Hong Kong, Shenzhen, and Guangzhou maintained a high level, especially the out-degree centrality, which is increasingly prominent in the distribution of logistics within the Greater Bay Area. The second is the increase in regional integration. With the progress of infrastructure development within the Greater Bay Area, cities such as Zhuhai, Foshan, Dongguan, and Zhongshan are gradually establishing themselves as important sub-logistics hubs. The centrality of Hong Kong and Shenzhen, especially the out-degree centrality, is always at a high level, demonstrating their unwavering output position in capital flows. Despite the dominance of the core cities, the incoming centrality of the secondary cities of Foshan, Dongguan, and Zhuhai is gradually increasing, and their ability to attract capital is growing.

For the spatial dimension, the high centrality of logistics and capital flows in Hong Kong and Shenzhen, both recognized as international cities, indicates their strong regional control. The significant correlation between logistics centrality and capital centrality suggests that logistics may drive capital flows in this context. Domestic cities such as Jiangmen and Zhaoqing exhibit markedly weaker logistics network centrality, reflecting a status quo characterized by insufficient infrastructure and low economic activity. Regarding the temporal evolution, the centrality of major cities such as Shenzhen is gradually increasing, which is closely related to the optimization of economic structure, the improvement of transportation facilities, and the promotion of the Greater Bay Area integration policy. The centrality of some cities, such as Huizhou and Jiangmen, has not increased significantly, mainly due to the constraints of unbalanced industrial layout and the limited role of the economic hinterland.

4.3. The Macro State of City Clusters in the Greater Bay Area

4.3.1. Regional Logistics Advantage Linkages

The flow backbone structure of the logistics and capital flow networks emerges from the initial connections between cities, illustrating the dynamics and spatial patterns of factor flows within the Greater Bay Area. Both networks display a core-edge structure, primarily dominated by Hong Kong, Shenzhen, and Guangzhou. These core cities exert substantial influence over the flow of resources and capital. As integration policies within the Greater Bay Area advance, the inter-city linkages in both logistics and capital flow networks are significantly strengthened. This enhancement of intra-regional connections facilitates more efficient movement of cargo and capital, reinforcing the dominance of core cities while promoting collaboration among secondary cities. This evolving structure reflects the ongoing efforts to optimize regional integration and economic cooperation.

In the logistics network, the link between Hong Kong and Shenzhen consistently occupies a prominent dominant position, leading other cities by a significant margin and maintaining a stable core flow direction. This central connection underscores the importance of these cities in regional logistics dynamics. Non-core cities, such as Zhaoqing, Jiangmen, and Zhuhai, exhibit weaker logistics flow direction and intensity, highlighting their limited role in the overall logistics framework. The distribution of logistics flow intensity reveals distinct characteristics of central city dominance: Hong Kong, Shenzhen, and Guangzhou form a core hub with strong interconnections. In contrast, secondary cities like Dongguan demonstrate limited connections, primarily oriented towards local directions (e.g., Dongguan → Guangzhou, Dongguan → Zhuhai). This pattern indicates that while core cities drive the logistics network, secondary cities are still developing their connectivity and influence within the regional logistics landscape, as illustrated in Table 3.

Table 3.

City dominance flows in the logistics network.

4.3.2. Regional Capital Flow Advantage Linkages

In the capital flow network, the link from Shenzhen to Guangzhou consistently exhibits the highest flow intensity, recorded at 15.794% in 2019 and 15.657% in 2021. This underscores Shenzhen’s prominent position as a key output center for capital resources. Additionally, the flow intensities from Hong Kong to Guangzhou and Shenzhen to Hong Kong are also noteworthy, highlighting Hong Kong’s central role in attracting capital flows and its significance within the regional financial system. The increasing intensity of the Shenzhen → Guangzhou flow (13.947%, 15.794%, and 15.657%) reflects Shenzhen’s emergence as a regional economic engine, characterized by its status as a hub for innovation and industrial development. This growth is accompanied by capital spillover effects, contributing to the phenomenon of regional capital return. From 2016 to 2021, capital flows have gradually concentrated in the two core cities of Shenzhen and Hong Kong. Shenzhen, in particular, has demonstrated a significantly stronger role in capital export, maintaining a consistently high share in the direction of Shenzhen → Guangzhou and Shenzhen → Hong Kong. This indicates a clear pattern of dual-core driving within the network. Secondary cities are becoming more connected, such as Dongguan → Guangzhou, where the intensity of financial flows is gradually decreasing, but still maintains an important position in the regional financial flow system. Overall, the capital flow network exhibits a pronounced dual-core trend centered on Shenzhen and Hong Kong. Compared to the logistics network, the coverage of capital flows is broader. Smaller cities, like Foshan and Dongguan, are showing some growth in capital absorption capacity, indicating a spatial dynamic characterized by both centralization and multipolarization, as illustrated in Table 4.

Table 4.

City dominance flows in the capital flows network.

Focusing on the direction and intensity of factor flows, the commonality of the logistics and capital flow networks is reflected in the stability of their core linkage directions. Hong Kong → Shenzhen and Shenzhen → Guangzhou are the most dominant logistics linkage directions, forming the core axes of the logistics network in the Greater Bay Area. Similarly, Shenzhen → Guangzhou and Hong Kong → Guangzhou represent the strongest capital flow directions, establishing the core driving pattern of the capital flow network. Both network structures are characterized by a “core-core” type of flow, with the linkage strength between core cities exceeding one-third. Additionally, the weaker linkages of sub-nodes in the region indicate that cities such as Zhaoqing and Jiangmen exhibit lower linkage direction and strength in both logistics and capital flow networks. This suggests that, at the current stage, the regional development of the Greater Bay Area is still predominantly influenced by the core cities.

4.4. Synergistic Development Characteristics of Logistics and Capital Flows

4.4.1. Spatial Fluidity of Logistics and Capital Flows

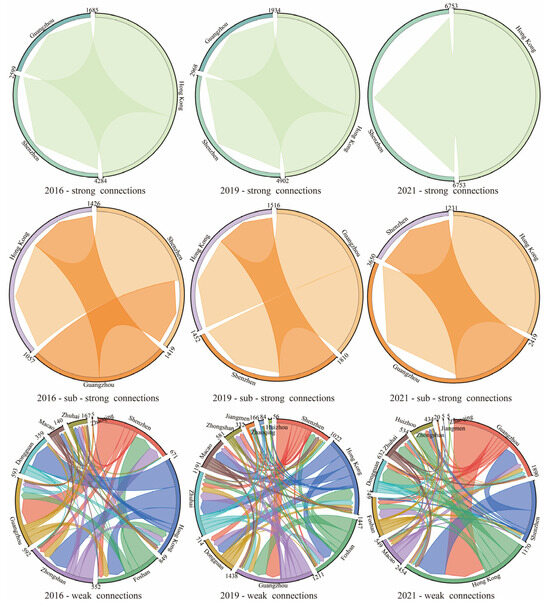

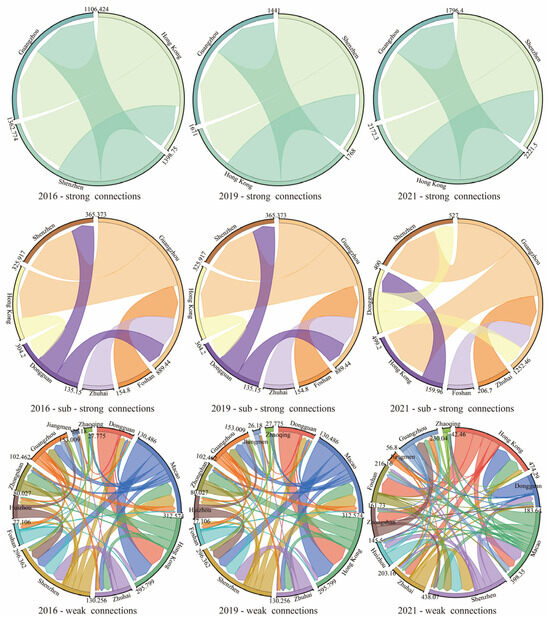

The intercity linkages within the Greater Bay Area are categorized into three tiers—strong, sub-strong, and weak—based on the directionality and intensity of liner shipping and enterprise investment flows. A detailed analysis of the logistics and capital flow networks (see Figure 4 and Figure 5) reveals their structural attributes and spatial distribution patterns, thereby enabling the identification of interaction dynamics among cities across different network levels.

Figure 4.

Spatial pattern of logistics network.

Figure 5.

Spatial patterns of capital network.

The strong linkage network denotes the most intensive core-node relationships, forming the backbone of economic, trade, and logistics activities within the region. Sub-strong linkages represent substantial intercity connections—rooted in strong relational pathways—but with relatively lower proximity and interaction strength. By contrast, weak linkages reflect sparse, low-frequency logistics flows, indicative of marginal investment and transportation activity within the Greater Bay Area. The logistics and capital flow networks across the region reveal a multi-layered hierarchical structure, exposing disparities in cities’ functional roles, resource concentration, and industrial synergy. This stratification further illustrates the organizational mechanisms and polycentric nature of the Greater Bay Area’s flow networks.

The strong linkage network constitutes the structural backbone of the Greater Bay Area’s regional economy. Within the logistics network, Guangzhou, Shenzhen, and Hong Kong form a core contact cluster characterized by high-frequency, high-density, and high-intensity interactions. These intercity connections underpin the region’s logistical framework. Specifically, the connection intensity from Hong Kong to Shenzhen reached 31.7%, 26.01%, and 46.2% across the selected years, indicating a consistent upward trend and highlighting Hong Kong’s expanding hub role in cross-border logistics. In the capital flow network, the linkage weights between Hong Kong and Shenzhen were 12.6%, 11.6%, and 12.5%, while those between Shenzhen and Guangzhou registered 9%, 8.9%, and 9.5%, respectively. These stable increases illustrate Shenzhen’s bridging function, acting as an intermediary in capital transmission from Hong Kong to Guangzhou. These robust linkages signify not only the concentrated flow of logistics and capital but also a high degree of complementarity and interaction frequency among the economic core cities, reinforcing the polycentric dynamics of the Greater Bay Area.

The sub-strong linkage network functions as an industrial synergy support layer within the Greater Bay Area. In the logistics network, the Guangzhou → Shenzhen and Guangzhou → Hong Kong corridors form the second-tier backbone, facilitating coordinated transport and industrial integration. The Guangzhou → Shenzhen connection maintains a stable interaction intensity of 6.7%, while Guangzhou → Hong Kong exhibits a slightly lower but consistent strength of 6.1%. At the periphery of this tier, the Hong Kong → Dongguan link registers approximately 2.2%, indicating marginal interconnection. In the capital flow network, Guangzhou → Shenzhen and Zhuhai → Guangzhou linkages—showing weights of 6.7%, 6.8%, 6.7% and 3.5%, 3.3%, 3.5%, respectively—constitute the region’s economic interaction layer. Meanwhile, Dongguan → Guangzhou connections (2.8%, 2.4%, 2.2%) form the basis of industrial chain collaboration. Although Guangzhou’s presence within the strong linkage network has experienced a modest decline, its sustained engagement across both logistics and capital networks underscores its enduring role as a pivotal regional hub.

The weak linkage network serves as an edge-extension and mutual-support layer within the Greater Bay Area. In the logistics network, the Dongguan → Hong Kong connection, though relatively loose, constitutes a sub-marginal pathway with interaction strengths of 2.1%, 1.8%, and 1.7% across the three time nodes. Despite its low density, this linkage remains a critical component of regional logistics, highlighting Dongguan’s role within the industrial supply chain. Other city pairs in this tier represent the external perimeter of the logistics network, characterized by sparse connections, low interaction intensity, and minimal share. These cities are primarily integrated into the overall system via indirect associations with sub-strong core cities. In the capital flow network, Macau → Hong Kong interactions maintain a low yet stable intensity of 2%, 1.8%, and 1.4%, indicative of a unique capital exchange mechanism between the two SARs. The Huizhou → Shenzhen capital link remains consistently around 1%, while linkages involving cities like Zhongshan and Zhaoqing—though weak individually—collectively form a “subregional mutual-aid layer.” This layer reflects collaborative inter-city relationships maintained through low-frequency financial exchanges among peripheral urban nodes.

The three core cities—Hong Kong, Guangzhou, and Shenzhen—form the foundational backbone of the regional network through strong intercity linkages that catalyze economic activity both within and beyond the Greater Bay Area. Their substantial and frequent logistics and capital flows serve as key drivers of the region’s rapid economic development. The sub-strong linkage network concentrates around these core cities and their adjacent urban areas, functioning as intermediary corridors that connect central hubs with peripheral cities. This configuration strengthens the hierarchical structure of the network and enhances its redundancy and resilience. Despite lower intensity and sparse connectivity, weak linkage networks remain integral to overall regional cohesion. These marginal ties contribute to resource distribution, foster cross-city collaboration, and support the synergistic evolution of the urban agglomeration.

From a temporal perspective, the logistics network of the Greater Bay Area evolved from a single-core concentration to a polycentric structure between 2016 and 2021. This shift is particularly evident in the rising significance of cities such as Zhuhai and Dongguan, reflecting the diversification of logistics organizational models and functional differentiation within the region. In terms of capital flow, Shenzhen’s ascendancy in the technology and financial sectors has transformed its role from a capital recipient to a regional capital exporter and allocator. Its strengthening financial ties with Guangzhou signal the emergence of a new capital flow hub. Despite year-to-year fluctuations in Hong Kong’s linkages with Guangzhou and Shenzhen, its position within the regional financial network remains firmly established. Peripheral cities, including Huizhou and Zhongshan, are increasingly participating in the regional network, notably through industrial reception and capital absorption functions. These trends collectively illustrate the dynamic evolution and spatial reconfiguration of urban economic roles across the Greater Bay Area.

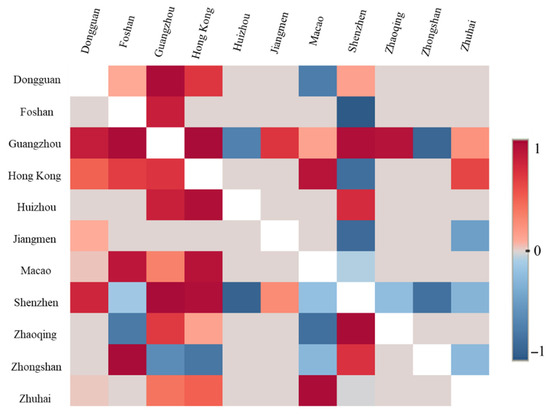

4.4.2. Synergistic Characteristics of Logistics and Capital Flows

The Greater Bay Area serves as a crucial engine for China’s economic development and international trade. Intercity logistics and capital flows not only reflect the intensity of economic activity but also indicate the degree of regional integration. Analyzing these inter-city correlations reveals the division of roles and linkages among the region’s cities in supply chain management, capital flows, and industrial synergies. Figure 6 highlights significant correlations, particularly between Hong Kong-Guangzhou (0.997) and Guangzhou-Shenzhen (0.994). The correlation coefficients for these pairs of cities are close to 1, indicating a high level of synergy in logistics and capital flows among these transportation and economic centers. This strong positive correlation underscores the close cooperation between Hong Kong, Guangzhou, and Shenzhen in their economic activities, resulting in a robust industrial chain and supply chain network. Guangzhou and Shenzhen hold dominant positions in manufacturing, international trade, and high-tech industries, characterized by significant logistics and capital flow intensity. This indicates tightly linked supply chains and a high degree of capital synergy. As an international financial center, Hong Kong maintains strong links with both Guangzhou and Shenzhen, likely driven by the demand for cross-border financial services and international trade settlement.

Figure 6.

Heat map of correlation between logistics and financial flow networks.

The correlation between logistics and capital flows among the four cities of Foshan, Dongguan, Guangzhou, and Zhongshan is more than 0.9, and this strong linkage shows deep cooperation in manufacturing and trade with each other. Foshan and Zhongshan demonstrate profound interdependence in their manufacturing and industrial bases, showcasing highly consistent logistics and capital flows. This alignment may stem from similarities in industrial structures and market demand. The close link between Guangzhou and Dongguan highlights the depth of their cooperation in manufacturing and trade. Their logistics network is tightly integrated, with frequent capital flows that promote regional economic integration. Both Foshan and Dongguan, as prominent manufacturing and industrial bases, exhibit a high degree of correlation with Guangzhou in the logistics network. This relationship results from the vertical integration of the industrial division of labor, where manufactured cargo from Foshan and Dongguan is distributed to various domestic and international markets through Guangzhou, serving as a central node.

The negative correlation coefficients between the city pairs of Shenzhen-Zhuhai, Shenzhen-Macao, and Shenzhen-Foshan indicate an inverse relationship in logistics and capital flows. This may stem from differences in market competition or resource allocation, resulting in a diversion of economic activities among these cities. The moderate correlation between Guangzhou and Macao suggests some economic linkage, while the high positive correlation with Shenzhen reflects a competitive or substitutive relationship between the two cities regarding industry and capital flows.

The correlation between Macao and other cities in the Greater Bay Area is low, especially in the logistics sector. This may be related to the fact that Macao’s economy is dominated by tourism and gaming, with less demand for logistics. However, Macao shows some correlation with Hong Kong and Zhuhai in the area of financial flows, reflecting the relatively active financial flows between Macao and neighboring cities.

The overall correlation of logistics and capital flows indicates that Guangzhou, Shenzhen, and Hong Kong serve as core cities in the Greater Bay Area, exerting a leading and agglomerative effect on the shipping industry. This results in a dense shipping network and capital flow system that fosters economic growth across the region. Highly positively correlated city pairs, such as Foshan-Guangzhou and Shenzhen-Dongguan, demonstrate close cooperation within the industrial chain, optimizing supply chain management and enhancing logistics efficiency. This synergy promotes efficient capital flow throughout the industry chain, bolstering the region’s shipping competitiveness. Conversely, low or negatively correlated city pairs, like Huizhou, Jiangmen, Zhaoqing, Zhongshan, and Zhuhai, reflect the division of labor and complementary relationships among cities. In this context, cities such as Dongguan, Foshan, Zhongshan, Zhaoqing, and Zhuhai emphasize manufacturing and exports, while Hong Kong, Shenzhen, and Guangzhou focus on financial services and capital flows, enhancing overall economic efficiency. Finally, the strong correlation between logistics and capital flows illustrates their mutual reinforcement within the regional economy. An efficient logistics network facilitates rapid capital movement, while robust capital flows support the development and optimization of logistics infrastructure, crucial for strengthening the Greater Bay Area’s shipping economy.

4.4.3. Coupled Coordination of Logistics and Capital Flows

City logistics and capital flow elements interact and attract each other, creating a complex multidimensional phenomenon in space. The results from Table 5 on the spatial and temporal coupling and coordinated development of logistics and capital flows reveal significant heterogeneity among city clusters. Based on the relative development status, coupled coordinated development is categorized into lagging, synchronized, and leading development statuses. Only Guangzhou, Shenzhen, and Hong Kong have achieved a high level of coordination, demonstrating balanced and cohesive development of logistics and capital flows. In contrast, cities such as Macao, Zhaoqing, Huizhou, Zhongshan, and Zhuhai are in the antagonistic stage, often characterized by Type I antagonism, indicating logistics backwardness and dysfunction. While Zhongshan, Zhuhai, Zhaoqing, and Jiangmen exhibit traits of lagging or relatively synchronized financial flows, their coupling coordination remains low. Notably, no city in the Greater Bay Area is classified in the friction stage.

Table 5.

Evaluation of coordinative and harmonious development in space and time between logistics and capital flow in the Great Bay area.

Based on the dynamic process of development stages, from 2016 to 2021, the coupling coordination level of some cities has increased, but the overall progress is slower. The main manifestation is that the coordination level of core cities basically stabilizes at a high level, showing a strong regional economic driving force. The coordination level of non-core cities fluctuates widely and even declines, reflecting the uneven and unsustainable coordinated development of the region. Within the Greater Bay Area, logistics lag is prevalent, reflecting the cities’ shortcomings in transportation infrastructure development and logistics efficiency. Capital lag, on the other hand, is mostly found in cities with lower levels of economic development, indicating shortcomings in their capital attractiveness and financial services capacity.

Hong Kong, as an international financial center, holds a significant advantage in capital flows, benefiting from its connectivity to global capital markets and occupying a central position within the Greater Bay Area. While it depends on imports and re-exports for logistics, its efficient shipping services and free port policy enhance logistics effectiveness. Shenzhen, a hub for high-tech industries and modern services, excels in coordinating logistics and capital flows, supported by a robust supply chain system and innovation capital. Its strong technological and financial capabilities provide an edge in capital flow, while an internationalized port logistics network boosts logistics efficiency. Shenzhen serves as the leader of the logistics and capital flow network in the Greater Bay Area, offering a development model for other cities. Guangzhou possesses notable logistics advantages, thanks to its well-developed transportation infrastructure and established manufacturing supply chain. As a traditional business and financial center, it lags slightly behind Hong Kong and Shenzhen in capital allocation efficiency and financing capacity; yet, it remains an important hub for logistics and capital flows, playing a bridging role in regional resource deployment. Other cities are situated in the antagonistic stage of stability and volatility. As sub-nodes and auxiliary nodes within the Bay Area, their development relies on the support of core nodes.

Overall, the eastern cities in the Greater Bay Area, Guangzhou, Shenzhen, and Hong Kong, are significantly better than the western cities of Zhaoqing and Zhongshan in the coordination level of capital flow and logistics. This situation reveals a distinct gradient distribution, with Shenzhen, Guangzhou, and Hong Kong forming a highland of coupling and coordination. Peripheral cities serve a supporting role, but their synergy effects require enhancement for improved integration and development.

5. Conclusions and Implications

5.1. Discussion

This study employs directional network analysis to systematically investigate the structural attributes of transportation and economic networks across city clusters in the Greater Bay Area. The analysis encompasses spatial configurations, synergistic relationships, evolutionary trajectories, and degrees of coupling and coordination. Through this approach, the study uncovers underlying synergistic mechanisms and regional development dynamics. These findings are validated and further contextualized by existing research across key thematic domains.

First, in relation to the core–periphery structure of urban networks, prior research has argued that global metropolitan systems are inherently stratified and dominated by central nodes. Taylor et al. [40], through the lens of world city network theory, proposed a “super-node versus peripheral-node” hierarchy, emphasizing the pivotal role of financial and professional service sectors in shaping global urban hierarchies. Building on this framework, Du et al. [41], using enterprise connection data, identified Hong Kong, Shenzhen, and Guangzhou as consistent “super nodes” within the Greater Bay Area. Aligned with these findings, this study further delineates a heterogeneous pattern of “logistics dual-core and financial tri-core” dominance, revealing divergent spatial command structures across functional elements of the regional network. This contributes to a deeper understanding of the multicentric division of labor mechanism within urban systems.

Second, with respect to the structural characteristics and synergistic mechanisms of logistics and capital flows, Huang et al. [42] identified morphological distinctions between regional transportation and economic networks: logistics networks emphasize broad coverage and accessibility, whereas capital flows exhibit centralized and selective patterns. This study corroborates that differentiation, revealing a core concentration within the multipolarity pattern in capital flows, is evidenced by the increasing directional dominance of the region’s three core cities. This finding aligns with Pain et al. [43], who described “functional polycentricity with financial dominance” in their analysis of European urban systems. Even within polycentric network structures, capital flows concentrate in a limited number of financially dominant cities, forming a core-radial configuration. The present study reinforces this pattern, illustrating how spatial financial hierarchies persist despite structural polycentricity.

Third, in analyzing the evolution of network dynamics, this study tracks three key time points—2016, 2019, and 2021—to observe longitudinal trends. Findings indicate increasing structural complexity within the logistics network, heightened concentration in capital flows, and progressively strengthened bidirectional synergy between the two systems. These transformations are consistent with Tung’s [44] conceptualization of large urban systems transitioning from “point interconnections” to “network synergies,” marking the Greater Bay Area’s shift from rudimentary connectivity toward integrated, multi-scalar coupling.

Fourth, in examining the degree of coupled coordination, prior studies have frequently employed principal component analysis and coupling models to reveal intra-regional disparities. For instance, Lu et al. [45] identified a core–periphery binary differentiation structure in logistics–capital coordination within the Beijing–Tianjin–Hebei urban agglomeration. Similarly, Ouwehand [46], through empirical analyses of output efficiency, it illustrated the multi-complex regional relationship between centrality and productivity. This study introduces the dual network coupling model of transportation and economic linkages into the Greater Bay Area for the first time. Findings indicate that Hong Kong, Guangzhou, and Shenzhen have reached a stage of high integration. In contrast, most sub-core cities remain in a condition of “dysfunction–antagonism,” constrained by both underdeveloped transportation systems and financial fragility—a phenomenon referred to as “dual constraints.” These results affirm the existence of coordination disparities during regional integration and echo the concept of “coordination asymmetry” identified in global urban systems [47]. They further suggest that institutional, resource, and factor imbalances must be critically addressed to advance effective regional integration strategies.

5.2. Conclusions

As one of China’s most dynamic economic regions, the Greater Bay Area’s complex transportation and economic networks offer a unique perspective for studying the synergistic development of logistics and capital flows. Depicting the network structure of the city cluster in the Greater Bay Area based on the directional flow characteristics of transportation and capital is crucial for analyzing the synergistic development of logistics and capital flows. This study deepens the understanding of regional network economy and synergy mechanisms while providing essential support for optimizing transportation layouts, enhancing capital flow efficiency, and promoting regional integration and cross-border cooperation. After an in-depth analysis, the following conclusions are reached:

(1) The Greater Bay Area city cluster exhibits a clear core-periphery structure, which continues to strengthen, with Hong Kong, Shenzhen, and Guangzhou maintaining dominant positions. Core cities dominate resource flows, while secondary cities occupy a relatively weak position in the network. The logistics network reveals a spatial pattern of dual core cities, primarily driven by Hong Kong and Shenzhen, where core cities lead and secondary cities provide support. In contrast, the capital flow network displays a “triple-core-driven” pattern, centered on Hong Kong, Shenzhen, and Guangzhou, reflecting the continued dominance of core cities alongside a coexistence of centralization and multipolarity.

(2) The logistics and capital flow networks in the Greater Bay Area exhibit notable synergies and differences. The logistics network prioritizes wide regional coverage, focusing on intra-regional resource flows and emphasizing the protective role of inter-city connections, which promotes the equalization of resource distribution. In contrast, the capital flow network demonstrates a pronounced trend of core centralization, with capital predominantly concentrated among the three core cities—Hong Kong, Shenzhen, and Guangzhou—where the dominant role of core cities in resource distribution increasingly intensifies.

(3) From 2016 to 2021, both the complexity of the logistics network and the tightness of the capital flow network have continued to increase, deepening their two-way interaction. There is a strong correlation in logistics and financial flows among core cities, as well as between core and edge cities. However, the correlation is relatively weak between sub-core cities and edge cities. This indicates that core cities play a leading and agglomerative role in transportation and economic activities within the region, maintaining relative stability. Conversely, sub-core cities exhibit greater dependence on core cities, highlighting the need for improved balance in resource flows.

(4) The coupled and coordinated development of logistics and capital flows within the Greater Bay Area highlights the complex interactions among the region’s cities and the level of regional integration. This development reveals significant heterogeneity: Guangzhou, Shenzhen, and Hong Kong have achieved a high level of coordination, while other cities are in an antagonistic phase of coupled coordination, characterized by logistical lag and disorder. There are notable shortcomings in transportation infrastructure and logistics efficiency across the Greater Bay Area, as well as deficiencies in capital attractiveness and financial service capacity among the cities.

5.3. Implications

This study deepens the understanding of factor flow mechanisms within urban agglomerations and offers both theoretical insights and practical guidance for advancing coordinated regional development and optimizing resource allocation. In response to development bottlenecks arising from spatial mismatches between logistics and capital flows, three targeted policy recommendations are proposed to enhance the Greater Bay Area’s overall operational efficiency and level of integrated development.

(1) Strengthen the functional capacity of core cities, boost the competitiveness of secondary cities, and advance synergistic development of the logistics network. At present, the logistics network of the Greater Bay Area is heavily concentrated around Hong Kong, Shenzhen, and Guangzhou, leaving secondary cities relatively marginalized and resulting in low resource flow efficiency. To address this imbalance, the transportation hub capacities of core cities should be further leveraged by developing modern multimodal transit centers, integrating port–rail–road systems, and enhancing cargo circulation efficiency. Simultaneously, policy instruments such as financial subsidies and tax incentives should be utilized to encourage enterprises in lower-efficiency cities, such as Jiangmen and Zhaoqing, to invest in logistics infrastructure. This can improve their integration into the regional logistics network, elevate their operational capacity, and narrow the development gap between core and secondary cities. Ultimately, such measures will foster a more balanced and resilient intra-regional logistics system.

(2) Redirect capital flows from core to secondary cities to facilitate industrial upgrading and balanced financial resource allocation. The study reveals a pronounced siphon effect within the Greater Bay Area’s capital flow network, with financial resources heavily concentrated in core cities such as Hong Kong and Shenzhen. This capital centralization imposes constraints on industrial expansion and development in secondary cities. To mitigate this imbalance, targeted policies should promote the redistribution of financial capital toward manufacturing-oriented cities such as Dongguan and Foshan. Instruments, including dedicated industrial transformation funds and preferential tax schemes, can incentivize capital inflows, catalyze industrial upgrading, and extend regional value chains. Additionally, establishing a regional capital-sharing platform to integrate financial assets across Guangdong, Hong Kong, and Macao would enhance financing accessibility for small and medium-sized enterprises. This platform would reduce transactional costs, improve capital allocation efficiency, and bolster the absorptive capacity of secondary cities. Collectively, these measures would support the optimal deployment of financial resources and foster coordinated economic advancement throughout the region.

(3) Establish cross-regional synergy mechanisms, advance institutional innovation, and facilitate seamless resource flows to promote integrated regional development. The concentration of high-intensity logistics and capital flows among core cities in the Greater Bay Area reflects a relatively barrier-free environment, but also highlights a lack of broader institutional coordination across the region. To address this, cross-regional policy frameworks, resource allocation mechanisms, and technical standards must be unified to create a robust institutional foundation for cooperation. In logistics, efforts should focus on harmonizing regulatory standards and enhancing coordination in cross-border goods transportation. In the financial domain, progressively relaxing constraints on capital movement across jurisdictions will improve flexibility and ease of access for both enterprises and individuals. Through institutional reform and policy integration, cross-regional barriers can be dismantled, governance efficiency elevated, and resource allocation optimized—paving the way for Guangdong, Hong Kong, and Macao to jointly develop a high-functioning, integrated economic system within the Greater Bay Area.

Despite its contributions, this study presents several limitations. First, the analysis relies on static data from discrete time nodes, which constrains the ability to capture long-term dynamic shifts and forecast future development trajectories. Second, while the adopted methodology effectively delineates network structures and synergistic effects, it lacks the capacity to uncover causal linkages and dynamic interactions between the logistics and capital flow networks. In particular, the absence of dynamic modeling and mechanism-based analysis restricts accurate assessment of policy adjustments or external shocks on system performance and evolution. Moreover, the study primarily focuses on macro-level structures—such as regional flow networks and intercity dynamics—without delving into micro-level factors like enterprise behavior and individual resource flows. This analytical gap hampers a holistic understanding of how micro-behaviors interact with and shape macro-network configurations. Future research will incorporate spatio-temporal modeling, micro-level analysis, and interdisciplinary approaches—leveraging innovative data sources and analytical techniques—to deepen insight into the complex interplay of logistics and capital flows within the Greater Bay Area. These enhancements will improve the comprehensiveness, diagnostic precision, and explanatory power of subsequent investigations.

Author Contributions

Conceptualization, S.W. and Y.Q.; Methodology, Y.Q. and X.L.; Software, X.L.; Validation, S.W.; Formal analysis, Y.Q.; Investigation, Z.W.; Data curation, Y.L.; Writing—original draft, S.W. and Y.Q. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the Key Laboratory of Natural Resources Monitoring in Tropical and Subtropical Area of South China, Ministry of Natural Resources (No. 2024NRMK08).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Acknowledgments

We are grateful to Ministry of Natural Resources, Lanzhou University, Lands and Resource Department of Guangdong Province and Dalian University of Technology for the assistance provided.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Shen, M.; Wang, Y. Implications of International Bay Area Practices for Building the Guangdong-Hong Kong-Macau Greater Bay Area. Dev. Reform Theory Pract. 2017, 7, 9–13. (In Chinese) [Google Scholar]

- Pokharel, R.; Bertolini, L.; te Brömmelstroet, M. How does transportation facilitate regional economic development? A heuristic mapping of the literature. Transp. Res. Interdiscip. Perspect. 2023, 19, 100817. [Google Scholar]

- Fang, C. Major Progress and Future Development Direction of China’s Urban Agglomeration Research. J. Geogr. 2014, 69, 1130–1144. (In Chinese) [Google Scholar]

- Gu, Z. Progress and Perspectives of City Cluster Research. Geogr. Stud. 2011, 30, 771–784. (In Chinese) [Google Scholar]

- Llagostera-Brugarola, E.; Corpas-Marco, E.; Victorio-Vergel, C.; Lopez-Aguilera, E.; Vázquez-Gallego, F.; Alonso-Zarate, J. A Digital Twin for Intelligent Transportation Systems in Interurban Scenarios. Appl. Sci. 2025, 15, 7454. [Google Scholar]

- Yan, G.; Zou, L.; Liu, Y. The Spatial Pattern and Influencing Factors of China’s Nighttime Economy Utilizing POI and Remote Sensing Data. Appl. Sci. 2024, 14, 400. [Google Scholar]

- Henri, L.; Donald, N.-S. The Production of Space; Wiley: Blackwell, MA, USA, 1991. [Google Scholar]

- Liang, D.; Ruilin, W.; Zhan, C. The backbone structure and influence mechanism of urban information networks in China. Hum. Geogr. 2024, 39, 113–122. (In Chinese) [Google Scholar]

- Liao, C.; Li, X.; Hong, W. Multidimensional Measurement of the Network Structure of the Guangdong-Hong Kong-Macao Greater Bay Area from the Spatial Perspective of Traffic Flow. Geogr. Res. 2023, 42, 550–562. (In Chinese) [Google Scholar]

- Leng, S.; Xi, G.; Zhen, F. Research on the Evolution and Spatial Expansion Model of the Digital Economy Network in the Yangtze River Delta Based on Enterprise Equity Correlation. Hum. Geogr. 2024, 39, 81–91+182. (In Chinese) [Google Scholar]

- Liu, C.; Yan, S. The Spatial evolution of China’s Transnational Intercity Technology Corridors and its influencing factors. J. Geogr. 2022, 77, 331–352. (In Chinese) [Google Scholar]

- Loder, A.; Ambühl, L.; Menendez, M.; Axhausen, K.W. Understanding traffic capacity of urban networks. Sci. Rep. 2019, 9, 16283. [Google Scholar]

- Barroso, J.M.F.; Albuquerque-Oliveira, J.L.; Oliveira-Neto, F.M. Correlation analysis of day-to-day origin-destination flows and traffic volumes in urban networks. J. Transp. Geogr. 2020, 89, 102899. [Google Scholar]

- Barabási, A.-L.; Albert, R. Emergence of Scaling in Random Networks. Science 1999, 286, 509–512. [Google Scholar] [PubMed]

- Liu, Z.; Wang, W.; Pan, L. Destruction Resistance of Marine Freight Transportation Networks Based on Multilayer Complex Network Theory. Mar. Bull. 2018, 37, 652–658. [Google Scholar]

- Zhang, X.; Miller-Hooks, E.; Denny, K. Assessing the role of network topology in transportation network resilience. J. Transp. Geogr. 2015, 46, 35–45. (In Chinese) [Google Scholar]

- Dong, B.; Zhengchen, R.; Yang, Y. Study on the structural characteristics of transportation network and spatial correlation of cities and towns in Inner Mongolia. Arid. Zone Resour. Environ. 2022, 42, 1729–1742. (In Chinese) [Google Scholar]

- Feng, Z.; You, S.; You, Z. Spatial Identification and Structural Characterization of Chinese City Clusters Based on Transportation Big Data Networks. Geogr. Study 2023, 42, 1729–1742. (In Chinese) [Google Scholar]

- Shi, S.; Wong, S.K.; Zheng, C. Network capital and urban development: An inter-urban capital flow network analysis. Reg. Stud. 2022, 56, 406–419. [Google Scholar]

- Cheng, Z.; Xu, Y. Research on the Impact of New Trade Corridors on the Economic Linkages of Cities Along the Route—A Quasi-Natural Experiment Based on the Opening of the China-Europe Liner Train. Urban Issue 2022, 56, 409–419. (In Chinese) [Google Scholar]

- Xiao, F.; Chen, J.; Xia, L. Technology spillovers accompanying capital flows—The impact of shareholders’ technology level on innovation in high-tech firms. Geogr. Sci. 2020, 40, 1460–1467. (In Chinese) [Google Scholar]

- Guo, J.; Qin, Y.; Guo, S. The Influence of Enterprise Investment Behavior on the Cyberspace Connection of Coastal Cities: Empirical Evidence from China. J. Urban Plan. Dev. 2023, 149, 05022046. [Google Scholar]

- Zhu, J.; Gong, Y.; Yang, X. Spatial Matching of Land Transportation and Tourism Economy in the Central Triangle Region. Geogr. Sci. 2025, 45, 1284–1294. (In Chinese) [Google Scholar]

- Zhang, F.; Graham, D.J. Air transport and economic growth: A review of the impact mechanism and causal relationships. Transp. Rev. 2020, 40, 506–528. [Google Scholar]

- Lao, X.; Zhang, X.; Shen, T.; Skitmore, M. Comparing China’s city transportation and economic networks. Cities 2016, 53, 43–50. [Google Scholar]