Abstract

This paper analyzes the connection between supply chain management maturity (SCMM) and business performance in light of the balanced scorecard (BSC) framework. The goal is to explore the relationship between SCMM and business performance from the financial and customer, innovation and learning, and internal processes perspectives. Industry characteristics (technological dynamism and the level of state support) are examined to determine their moderating effects. The survey was carried out on a sample of organizations from Bosnia and Herzegovina to test if the BSC approach can be a relevant framework for assessing the effects of SCMM on performance, and whether, as in many countries’ political legacies, the role of the government is significant in this relation. PLS-SEM was used to test the proposed hypotheses. The obtained research results confirm a positive relationship between SCMM and business performance from the BSC perspective. This relation is strengthened when an organization operates in an industry with higher technological dynamism. Interestingly, the results confirm that the level of state support does not influence the contribution of SCMM to business performance. This paper provides a more comprehensive view of the role of SCMM and an additional understanding of its contribution to multiple perspectives of business performance. Furthermore, the relevance of industry characteristics for SCMM and business performance has been illustrated by testing the moderation effect of technological dynamism and the level of state support.

1. Introduction

Supply chain management (SCM) and its development as a bundle of highly integrated processes [1], which can be clearly defined, managed, measured, and controlled over time [2], have become a managerial strategy that many companies are implementing to enhance their competitiveness [3]. It represents a new way of operating that includes integration between internal operations and external suppliers such that organizations can improve cost management, product development, cycle times, and total quality control [4]. It has an important role in the contemporary economy, especially considering Industry 4.0 practices [5], sustainability [6,7], and the establishment of a green supply chain [8].

A maturity approach to SCM provides managers with a map and provides guidance on which path to follow [9]. Understanding maturity and its role in SCM can help organizations achieve higher levels of performance, but also generate additional value along the value chain (both upstream and downstream), consecutively boosting service levels [10]. Still, too often, managers do not always comprehend all the potential benefits an SCM and its development can have for overall organizational performance or neglect all relevant aspects of business performance [11].

The relationship between supply chain management maturity (SCMM) and firm performance is still not fully explored. Many authors provide a systemic overview of the existing theoretical models [12], indicating that higher maturity leads to higher performance, or, in their empirical analysis on the influence of SCMM on performance, focus on one aspect of performance, and mostly financial performance at that [11].

This paper aims to provide a more comprehensive view of SCMM’s effects on business performance by applying a balanced scorecard (BSC) perspective to performance analysis. This hierarchical, balanced set of performance metrics allows us to assess performance from multiple perspectives, namely, from the financial, customer, innovation and learning, and internal processes perspectives [13]. To the best of our knowledge, the existing research on the relationship between SCM and business performance has only been conducted on samples of companies in developed economies; thus, performing an analysis of Bosnia and Herzegovinian (BIH) companies at the national level can help further develop this area of study, especially as similar research was not found in the region and other less developed countries. In addition, one of the conclusions of a bibliometric analysis of papers carried out in this field suggests that the development of the subject in less-developed countries may constitute a useful tool that can be used to increase the competitiveness of organizations in these countries [14].

Therefore, this paper explores the relationship between the SCMM of organizations in BIH and their business performance measured by the BSC framework. Using the BSC framework allows for the evaluation of various perspectives of organizational activities within the supply chain and their integral contribution to business performance [15]. We presume that SCMM positively relates to business performance from the financial, customer, innovation, learning, and internal processes perspectives. The business environment and dynamics of change cannot be neglected; therefore, industry characteristics are also considered. It is presumed that the industry characteristics (technological dynamism and the level of state support) have a moderating effect on the strength of the relationship between SCMM and business performance assessed through the BSC perspective.

2. Models of Supply Chain Management Maturity

In recent decades, numerous studies have been conducted to define, determine, and describe SCMM.

The SCMM approach is based on business process orientation (BPO) and business process management maturity (BPMM). BPO assumes a horizontal view of business activities and emphasizes the coordination and integration of business activities within the management of business processes [16]. A business process refers to the structured cross-functional set of activities that shows the transformation of resources through business functions and requires continuous improvement. It is assumed that business processes have life cycle levels through which they can be transformed and that a higher maturity level results in better process performance [1]. Process maturity represents the extent to which the processes are defined, managed, measured, and controlled [1]. Progress in process maturity (the quality of process implementation and produced output) contributes to process management maturity [17]. Models of process management maturity are composed of a certain number of dimensions in which there are a certain number of factors (activities), and a description of these factors determines maturity levels (often three to six levels) [18]. The factors included in the main dimensions are those assumed to be critical for the success of business processes. Therefore, the quality and presence of these factors (activities) determine the maturity of process management [17]. The highest maturity level corresponds to the world’s best practices [19].

Models of SCMM expand the maturity issue to whole supply chains. These models include various factors (activities) grouped into the main SCM dimensions to determine the SCMM level [9]. SCMM models often offer certain quantification (metrics and scales) and technology to determine performance and maturity in each dimension (process area). Through assessments undertaken according to SCM best practices within SCMM models, companies can determine the areas of SCM in which they are progressing and those in which they lag. SCMM models can assess and improve SCM activities at the operative and strategic levels [18]. The literature offers various approaches toward modelling SCMM, such as the SCOR model [20], the SCM model [21], the SCM model [12], the SCMAT model [9], the SCPM3 model [22], etc.

The first version of the SCMM model was the SCOR (Supply-Chain Operation Reference) that Supply-Chain Council introduced in 1996. According to the SCOR model, the main dimensions (elements of process orientation) are measurement and process management systems; the documentation of the process, process structure, process values, and attitudes; the ownership of processes; and information technology [2]. Drawing on the SCOR model and BPO approach, one of the most popular models was created, namely, the SCM (Supply Chain Management) process maturity model, which explains the progression of SCM practices in four main dimensions (Plan, Source, Make, and Deliver) through the following five stages: Ad hoc, Defined, Linked, Integrated, and Extended [1].

The SCMAT (Supply Chain Maturity Assessment Test) model is based on an extensive literature review [9] and can be used for the assessment of the maturity of supply chain activities from levels one to five in seven main dimensions: Strategy, Control, Process, Resources, Materials, Information, and Organization.

Starting from the SMC model developed by [1,12] created an SCM maturity model based on an extensive systematic literature review and qualitative case-study approach. This broad theoretical model summarizes previously used SCMM dimensions from the literature and integrates them into 11 dimensions: costs, customers, processes, technologies, tools, collaboration, management, performance measurement, strategic focus, responsiveness, resources, and environment. The model sets three maturity levels: initial, intermediate, and advanced. It is stated that different dimensions can be at different maturity levels, and overall maturity is determined based on the level at which most dimensions are placed [12].

The empirical research conducted in this paper is based on the SCPM3 model. The SCPM3 model was developed on and is grounded in the global data of hundreds of companies across many industries [22]. The SCPM3 model presents the evolution of SCM maturity through five levels: Foundation, Structure, Vision, Integration, and Dynamics. These levels are described in the following paragraphs.

The lowest level of the SCPM3 model is Foundation, which includes the establishment of a base for the main processes [22]. This level aims to stabilize and document processes to avoid improvisation. The key business partners are identified, and best practices for order management are implemented, with both processes respecting capacity and customers’ needs. The level of process flexibility with which to meet special customer needs is relatively low, requiring alternative resources and creating additional costs. Process changes are slow and hard to implement. Delivery control and delivery performance are not satisfactory. Demand forecasting is inadequate; sales insufficiently consider production capacity and inventory due to the lack of integration among main business functions. Order, distribution, and procurement are not properly documented. The company insufficiently controls and improperly documents omissions. The information system does not support all supply chain processes. Product and service suppliers are not considered strategic partners, and the “service level with suppliers is not appropriately agreed, understood and documented“ [22], p. 209.

The second level of the SCPM3 model is Structure, which refers to structuring the main business processes, namely, demand management, production planning/scheduling, and distribution management [22]. Processes are documented and initiated such that they are better planned and controlled by specific metrics, and process changes are evaluated before implementation. Business functions start to coordinate the development of production plans (planning and scheduling), considering production capacity, demand management, and forecasting (based on previous orders and customer information). Demand forecasting and distribution planning use mathematical and statistical methods. The reliability of forecasting is higher due to regular updates and is the basis for the development of commitments to customers. Distribution is facilitated with measures, control, practices of automatic replenishment, and incentive rewards for participants. “Information systems start to support the operations and integrate with organizational processes” [22], p. 209.

The third level of SCPM3 Is Vision, wherein the company starts to adopt a broader SCM perspective in its business strategy [22]. Process owners (managers) and/or teams are identified and become responsible for managing the processes and their performance. The owners (managers) are set for the main processes (order commitment, supply chain network planning, demand planning, procurement, and operations). Two main teams are formed: the procurement and strategic planning teams. The procurement team members consider a strategic aspect of collaboration to facilitate the needs of marketing and operations and meet regularly with marketing and operation representatives. The strategic planning team (which consists of representatives from marketing, sales, operations, and logistics) meets periodically to deal with operative strategic planning issues and uses appropriate strategic tools to assess planned changes before they are implemented. Operative strategies and their adjustments are documented.

The fourth level of SCPM3 is Integration, wherein the company collaborates with its suppliers in the supply chain. This level has three main elements: customer integration, supply network management, and strategic behavior based on partnership [22]. The main processes of a company and its suppliers/customers are integrated. Supply chain partners develop the flexibility to respond to market needs (market pull). The demand forecast considers each customer. Sales, operations, and distribution cooperate with production planning and scheduling [22]. While developing the company’s plans, information on customer planning and supplier planning is considered. Relations with suppliers are strong and integrated. Inventory levels, production planning, and scheduling data are shared with suppliers, whereby the key suppliers have the broadest access. Monitoring of the process flow is based on specific measures and analytic tools. The company tries to develop a strategy responsive to the needs of the supply chain partners. The strategic planning team has several important tasks: assessing the impact of strategies based on supply chain performance measures, developing relationships with existing suppliers and customers, selecting new supply chain partners, assessing the profits generated by each customer and each product, and setting specific priorities for them. Process changes are implemented relatively easily as they are governed by a documented process.

The highest level of SCPM3 is Dynamics, wherein the company is strategically integrated with other partners in the supply chain [22]. Processes that enable high flexibility and responsiveness to the market and other changes in a business environment facilitate collaboration. The supply chain becomes dynamic and reacts promptly to improve business processes based on the continuous monitoring of the Key Performance Indicators. Sales, marketing, distribution, and planning collaborate in order to obtain commitments and forecast development. The process of demand management and the process of production planning and scheduling are fully integrated. At the same time, the process of order commitment “is integrated with the other supply chain processes” [22] (p. 2011). The company has a strong relationship with customers and is responsive to their needs by controlling the operative capacity and tracking the Key Performance Indicators. Supply times are perceived to be the key to production planning and scheduling, so they are perpetually updated.

3. Supply Chain Management Maturity and Balanced Scorecard Perspective: Hypothesis Development

3.1. Relationship between Supply Chain Maturity and Business Performance from the Financial Perspective of the Balanced Scorecard Framework

One of the basic premises in the existing SCMM models is that increased maturity will lead to improved financial results through improvements in supply chain performance [1,11,12,23,24].

Better financial results, in terms of profitability, cost reduction, and shareholders’ value, should result from supply chain processes carried out with more mature performance [25]. The ability to handle internal and external issues as the supply chain becomes more mature [26], lower internal costs, and higher customer satisfaction and value externally resulting from effective supply chain management can contribute to organizational profitability [27]. Financial performance affects the strength of supplier relationships, integration among strategic partners and their infrastructure, mutual trust, cooperation, and cross-functional work [28]. Moreover, results indicate that upstream collaboration towards suppliers and downstream towards customers can help reduce costs [29]. Expenditures related to the supply chain consume up to 75% of a business’s revenue [23]. Thus, the management of a firm’s supply chain directly affects its financial performance. Influence can also be indirect through operational excellence, leading to customer satisfaction, long-term loyalty, and financial gains [30]. Product quality and delivery are the outcomes of a supply chain that exhibits operational excellence, and these outcomes are significantly and positively associated with customer satisfaction [31]. In this sense, efficiency and leaner processes can lead to cost reduction and profitability [25].

Previous empirical research has indicated that SCM practices and supply management performance positively affect financial performance (e.g., [10,27,32,33,34,35]). An effective and efficient supply chain based on sophisticated supply chain plans can bring benefits in terms of better inventory turnover, costs of goods sold, and return on assets [36]. For instance, [23] show how SCM competency leads to higher shareholder value, while there is a higher supply chain fit associated with better financial results measured by return on assets [37]. Ref. [38] stress the importance of establishing an integrated ecological supply chain, which can result in better economic performance, including with respect to profit margins, sales, and market shares, as well as improve the competitiveness of an entire supply chain. Similar results were obtained by [27,29,39], whose research indicates that supply chain integration is positively correlated with financial results (measured as a firm’s profit).

Still, the results are not conclusive. For example, [40] did not manage to prove the direct impact of SCM practices on financial performance and only proved its influence through the mediating impact of enhanced competitive advantage. Ref. [41] investigated the impact of SCM integration (internal, process-related, and product-related) on financial performance. Their results reveal that internal integration and product integration have positive impacts on financial performance. However, the impact of process integration on financial performance is not supported by their research.

Empirical research is scarce concerning SCMM and financial performance, but previous studies mostly suggest that such a relationship is significant [42]. Studies generally indicate that maturity is related to supply chain performance [1,2,43] or cost reduction [44]. A study by [45] indicated that extensive integration and collaboration in the supply chain contribute significantly to corporate financial performance. At the same time, [33] demonstrate that enhancing supply chain logistics performance results in positive growth dividends. A few studies, such as [3,11,36], have revealed a positive relationship between maturity and financial outcome in small and medium-sized enterprises. Although scarce, the research indicates the financial benefits associated with SCMM. Therefore, the first hypothesis is defined as follows:

H1.

Supply chain management maturity is positively related to business performance from the financial perspective of the balanced scorecard framework.

3.2. Relationship between Supply Chain Maturity and Business Performance from the Customer Perspective of the Balanced Scorecard Framework

One of the greatest impetuses for implementing a supply chain and the management of its maturity is the market, in which businesses attempt to satisfy changing customer needs and achieve a competitive advantage over their main market competitors [46]. Offering products with high quality is no longer sufficient, as the impetus is to provide the right products and services to customers at the right time, cost, place, condition, and quantity [4].

Organizations must develop the processes and structures of their supply chain accordingly to meet changing customer demands and develop the corresponding knowledge and abilities [11]. Higher maturity reflects the organizational ability to satisfy customer needs concerning time and the rapid delivery of high-quality products and services, together with operational flexibility [30]. To achieve this, real-time advancements in terms of customer service and the internal operating efficiencies of supply chain organizations are sought [47]. The overall goal of SCM is to increase the quality of a company’s relationship with their customers [31]. Superior firm performance for organizations that seek to be responsive to changing customer needs is thus dependent on superior supply chain performance [34]. To ensure these higher performance levels, organizations, through their supply chain, develop corresponding abilities and knowledge that they use in their key supply chain processes [22].

Ref. [25] stress how the development of supply chain processes should be oriented towards customer satisfaction; for instance, flexibility and responsiveness of the supply chain can affect customers’ anticipation regarding response times, while transparency and visibility of order flow can lead to enhanced customer experiences. Ref. [27] also stress how satisfaction can be enhanced by facilitating shorter lead times, through constant communication with customers along the supply chain, and by providing reliable products or services. In the end, a chain with greater maturity that focuses on enhancing customers’ expectations can help create additional value for the chain.

Previous research indicates a connection between SCM and customer satisfaction, e.g., [10,48]. Concerning customers and supply chain performance, [23] show how superior SCM competency leads to higher levels of customer satisfaction, while [49] show how it results in fewer customer complaints. Ref. [50] stress the existence of a positive connection between supply chain integration and customer service. Ref. [51] show that customer integration affects customer satisfaction directly or indirectly through, for instance, product quality performance.

Ref. [52] indicated in their research that companies that have successfully advanced their supply chain by implementing IT in SCM have positively impacted customer relationship management through focused e-business solutions. Ref. [53] show that greater supply chain responsiveness (in terms of operations systems responsiveness and logistics process responsiveness) can affect the organizational ability to attract, satisfy, and retain customers. In addition, knowledge-sharing and collaboration practices in the supply chain can also significantly influence customer satisfaction [54]. Ref. [55] researched the relationship between green supply chain management and customer performance. They found out that companies that cooperate with their customers in the form of an in-depth, collaborative relationship to achieve environmental goals simultaneously increase customer satisfaction. Similar results were obtained by [31,56,57].

However, the research mentioned above regarding the customers’ perspective does not investigate the impact of the SCMM on customers; thus, the second hypothesis is formed:

H2.

Supply chain management maturity is positively related to business performance from the customer perspective of the balanced scorecard framework.

3.3. Relationship between Supply Chain Maturity and Business Performance from the Perspective of Innovation and Learning of the Balanced Scorecard Framework

Supply management presents the improvement and alteration of business processes [26] and, therefore, positively impacts innovation as in any business process management improvement [58]. Thus, SCM itself is a significant innovation in business operations; however, at the same time, SCM generates innovation in different business areas.

Ref. [59] developed a model to demonstrate how SCM positively impacts the company in which it was adopted and the supplying partners. Improvements in supply chain practices, for instance, measuring responsivity with respect to product development involving suppliers [25], can help businesses learn from and innovate the existing processes. Ref. [60] predict that SCM processes improve a firm’s competitive advantage through superior prices/costs, better quality, dependability inside the chain, lead time, and product innovation. A supply chain needs to ensure improvements and innovations in the existing supply chain practices and final products and create new value for the customers [27]. Ref. [25] consider how capabilities such as those related to information technology infrastructure, human resources and organizational capabilities, the adoption of a strategic orientation, and awareness, together with the use of modern technology and its vertical and horizontal integration across the supply chain, can support supply chains’ business processes and organizational performance in terms of growth and learning. Research suggests that supply chain integration and capabilities predict technological innovation performance, knowledge sharing [61], and innovational performance [62,63].

Ref. [64] (p. 205) stress that SCM positively impacts learning, especially in the adoption stage, in the forms of “knowledge acquisition and persuasion and learning, leading to the actual decision of adoption.” Knowledge sharing among members of the chain can enhance learning and generate competitive advantages for the whole supply chain [65]. Previous research proposes that the level of a supply chain’s competitiveness lies in the adequate governance of the inter-firm relationships that support knowledge exchange [66] and organizational performance. A study conducted by [67] shows that supplier and customer learning improve internal learning and operational performance.

However, the authors do not investigate the impact of SCMM on business performance from the perspective of innovation and learning. Therefore, we form the third hypothesis:

H3.

Supply chain management maturity is positively related to business performance from the perspective of innovation and learning of the balanced scorecard framework.

3.4. Relationship between Supply Chain Maturity and Business Performance from the Perspective of Internal Processes of the Balanced Scorecard Framework

SCM is seen as “a strategic approach to planning for and acquiring the organization’s current and future needs through effectively managing the supply base” [4], p. 7 and utilizes process orientation. Process maturity presents the backbone of SCMM [11], with higher levels of maturity in these business processes resulting in the better control of results; the improved forecasting of goals, costs, and performance; greater effectiveness with respect to reaching defined goals; and improved managerial ability in terms of proposing new and higher targets for performance [2].

Ref. [52] stress that using SCM positively impacts the redesign process, thus allowing companies to focus more on their respective core business models. The achievement of maturity can be seen as an opportunity to redesign existing internal processes such that they are fully integrated and structured throughout the chain [25], but also as an opportunity to structure internal activities for the effective and efficient use of existing resources and capabilities. This allows organizations to promptly release products on the market, resulting in optimum value for the organization and its customers [68]. Ref. [34] further argue that greater integration of a supply chain increases information efficiency, leading to improvements in firm performance as inventory levels and costs are reduced and on-time delivery increases.

Previous research also indicates a positive impact on the operational performance of an organization, including logistics performance [69,70,71], a better flow of coordination mechanisms among supply chain partners, and improvement in the overall effectiveness of supply chain processes. Ref. [51] also emphasize time-based improvements in the internal process, e.g., in terms of the time-to-market and time-to-product. Ref. [72] indicate that improvements in the green supply management processes can increase the operational efficiency of processes, allowing organizations to achieve lower costs associated with delivery time and supply levels, which leads to better operational performance. Effects can also be seen in terms of the greater resilience of innovation systems and supply chains [73].

Still, additional research is needed, as the current research has not investigated the relationship between SCMM and business performance from the perspective of internal processes. Therefore, the fourth hypothesis is as follows:

H4.

Supply chain management maturity is positively related to business performance from the perspective of the internal processes of the balanced scorecard framework.

3.5. Moderating Effects of Industry Characteristics on the Strength of the Relationship between Supply Chain Management Maturity and Business Performance of the Balanced Scorecard Framework

Ref. [74] (p. 2122) indicate that “firm-related factors (competitive strategies) do not significantly influence performance; instead, factors related to industry structure, technology dynamism, and business group membership are the strongest determinants of firm performance”. Many authors, such as [75,76,77], also stress that the existence of a competitive environment and technology are important elements in the performance of supply chains; specifically, information technology and digitization are recognized as particularly important for supply chains [78]. Research also suggests that technology minimizes costs and brings robustness, flexibility, and agility [79]. Supply chains need to be technology-based and quality-driven to reduce system-wide costs to the lowest possible level, reduce lead times and transit times, and improve customer service levels [80]. Ref. [81] identified technology as an essential success factor for obtaining supply chain excellence, while [82] and [83] revealed the positive effects of technology on supply chain performance. Furthermore, the adoption of new technologies is necessary to ensure competitiveness [84]. It helps boost performance by helping supply chains cope with the challenges of changing environments and a myriad of risks at various organizational levels [85].

Based on previous research, the fifth hypothesis was developed with five supporting hypotheses:

H5.

The relationship between supply chain management maturity and business performance is strengthened when an enterprise is operating in an industry with higher technological dynamism;

H5a.

The relationship between supply chain management maturity and business performance (financial perspective) is strengthened when an enterprise is operating in an industry with higher technological dynamism;

H5b.

The relationship between supply chain management maturity and business performance (customer perspective) is strengthened when an enterprise is operating in an industry with higher technological dynamism;

H5c.

The relationship between supply chain management maturity and business performance (innovation and learning perspective) is strengthened when an enterprise is operating in an industry with higher technological dynamism;

H5d.

The relationship between supply chain management maturity and business performance (internal processes perspective) is strengthened when an enterprise operates in an industry with higher technological dynamism.

Additionally, state support interacts with business group membership and positively affects productivity. Previous research shows that SCM is significantly influenced by institutional contexts [86,87]. Besides market pressures, research reveals that regulatory pressures can be seen as strong drivers of or barriers to supply chain implementation [29,88]. A lack of government support and policies is also recognized as being able to hinder supply chain performance [89,90].

Based on previous research, the sixth hypothesis was developed with five supporting hypotheses:

H6.

The relationship between supply chain management maturity and business performance is strengthened when an enterprise operates in an industry more supported by the State;

H6a.

The relationship between supply chain management maturity and business performance (financial perspective) is strengthened when an enterprise operates in an industry more supported by the State;

H6b.

The relationship between supply chain management maturity and business performance (customer perspective) is strengthened when an enterprise operates in an industry more supported by the State;

H6c.

The relationship between supply chain management maturity and business performance (innovation and learning perspective) is strengthened when an enterprise operates in an industry more supported by the State;

H6d.

The relationship between supply chain management maturity and business performance (internal processes perspective) is strengthened when an enterprise operates in an industry more supported by the State.

4. Methodology

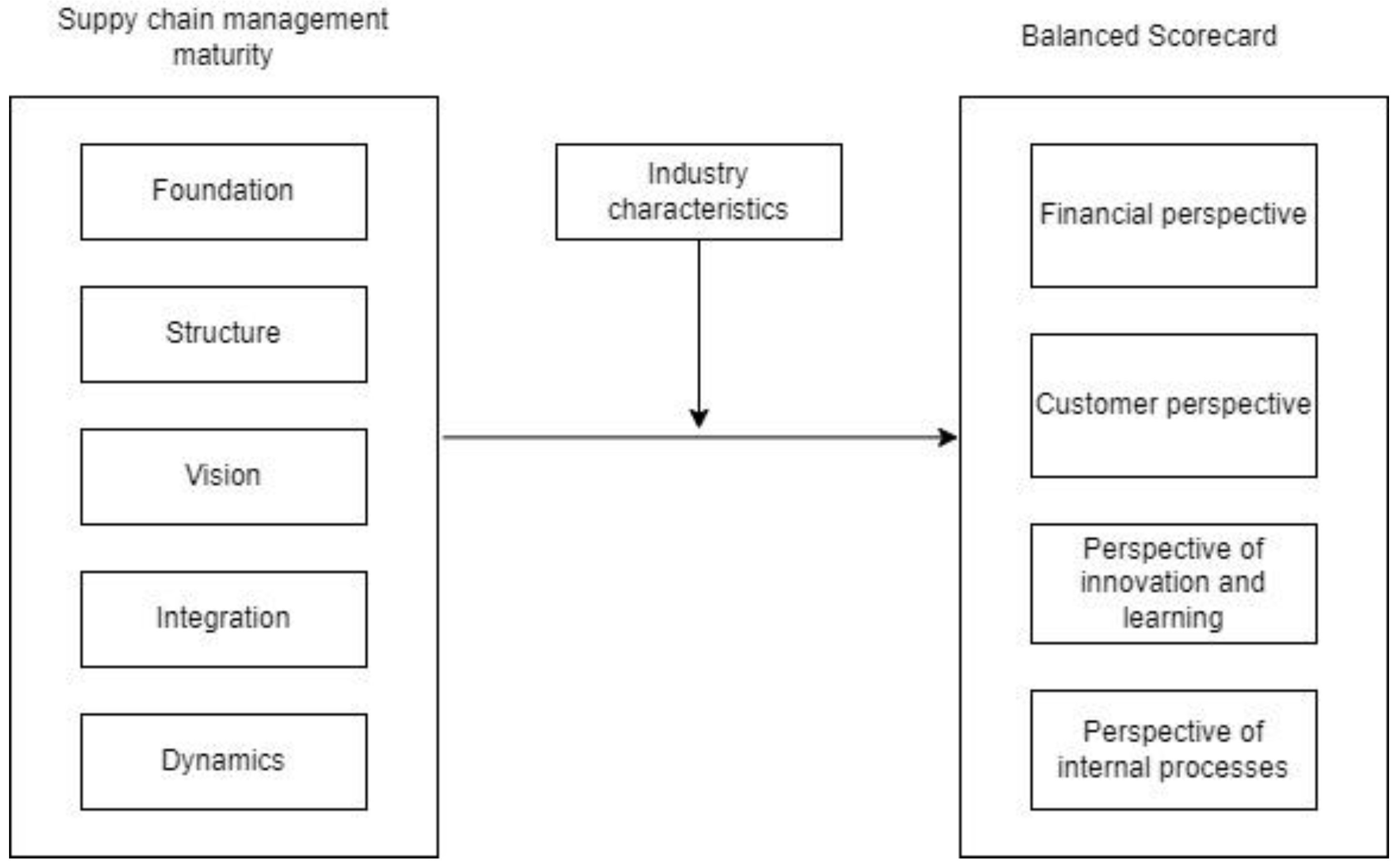

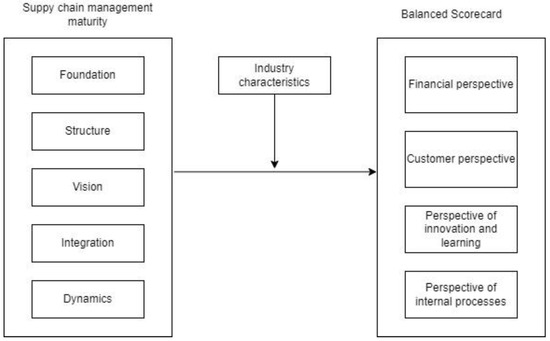

This study used a quantitative research methodology to investigate the relationship between independent variables corresponding to Supply Chain Management Maturity (SCMM) (Foundation, Structure, Vision, Integration, and Dynamics) with Balanced Scorecard (BSC) (Financial perspective, Customer perspective, Perspective of innovation and learning, and Perspective of internal processes) as a dependent variable. The following research model (Figure 1) has been developed.

Figure 1.

Research model; Source: Author’s work.

A well-structured questionnaire was distributed to respondents to obtain subjective opinions about their self-perception regarding the impacts of and the relationship between the variables SCMM and BSC. A five-point Likert scale was used (5—completely agree; 1—completely disagree).

Partial-least-squares structural equation modelling (PLS-SEM) was used to test the observant and latent variables; this approach has been used in many studies [91]. PLS-SEM incorporates path analysis to assess the contribution of latent variables. It also incorporates multi-linear regression to evaluate the loadings of independent variables and their explanation of the proposed dependent variable. Thus, PLS-SEM enables authors to fit more models in the same covariance matrix. For internal consistency, Cronbach’s Alpha, composite reliability, and inter-collinearity were used to evaluate the constructs’ reliability. Convergent and discriminant validity were also deployed to determine the model’s goodness of fit. PLS-SEM was used to test hypotheses H1, H2, H3, and H4. Moderating effects of industry characteristics on the strength of the relationship between supply chain management maturity and business performance of the balanced scorecard framework were investigated. Moderation analysis incorporated categorical variables indicating industry characteristics to test hypotheses H5 and H6. SPSS ver 28.0.0. software was used to obtain descriptive statistics, while Adanco ver 2.3.2. software was used for PLS-SEM analysis.

5. Results

5.1. Partial-Least-Squares Structural Equation Modelling

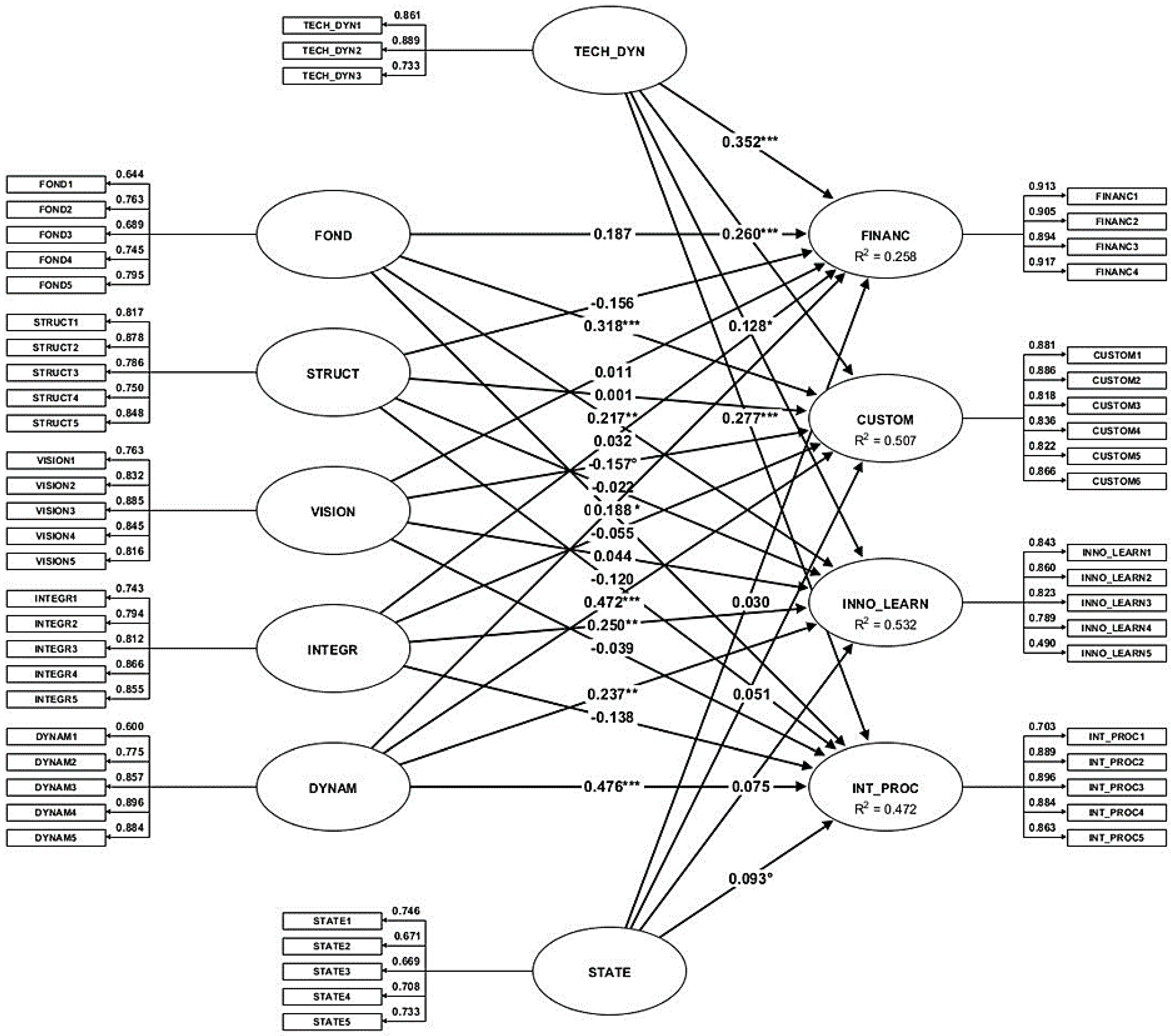

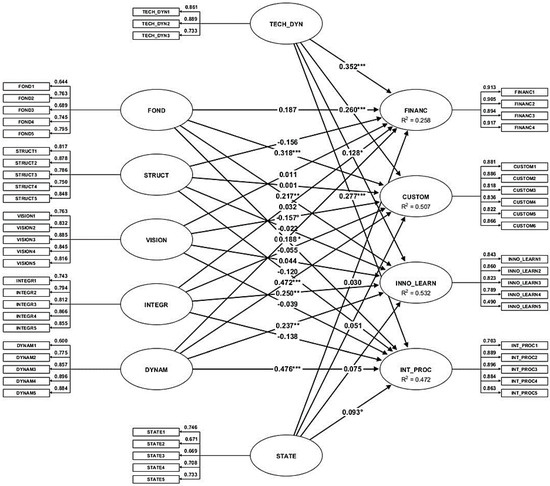

PLS-SEM analysis was used to evaluate the proposed model. Table 1 and Figure 2 reveal the obtained results of the PLS-SEM path analysis. When assessing a reflective measurement model, the factor loadings are examined first. An indicator loading above 0.70 assures acceptable item reliability [92]. The factor loadings show the degree to which a given factor affects each variable. Thus, loadings close to −1 or 1 denote that the factor strongly influences the variable. The factor loadings are shown in Table 2, Table 3 and Table 4. After determining the factor loading indicators, internal reliability is checked using Cronbach’s Alpha and the composite reliability of [93], judging values between 0.60 and 0.70 to be acceptable for exploratory research.

Table 1.

R Square of the constructs.

Figure 2.

PLS-SEM estimation; Source: Author’s work using Adanco 2.3.2. * p < 0.10, ** p < 0.05, *** p < 0.01.

Table 2.

Supply chain management maturity items loadings.

Table 3.

Organizational performance items loadings.

Table 4.

Industry characteristics items loadings.

Furthermore, convergent validity needs to be checked; this parameter will show the degree of closeness among the constructs, thus explaining the variance of their items. We calculate the average variance extracted (AVE) by squaring the loadings of each indicator on a construct. In the PLS-SEM approach, higher factor loadings denote sufficient variance from that variable. Discriminant validity is also used to determine the degree to which a construct differs from other constructs in the structural model. Ref. [94] suggested that each construct’s AVE should be compared to the squared inter-construct correlation, and the AVE values should be higher than those inter-construct correlations. The collinearity test shows whether the method and the construct items are biased, and low VIF values indicate that the construct is free from bias. The indication of collinearity is determined if a VIF value is greater than 3.3, at which point the model construct might be biased [95]. If all VIFs from the collinearity test are equal to or lower than 3.3, the model can be considered free of common method bias.

The path measurement shows that FINANCE R2 is 0.233, CUSTOM R2 is 0.491, INNO_LEARN R2 is 0.516, and INT_PROC R2 is 0.454. The R2 of the constructs explain the degree to which the exogenous latent variables explain the endogenous latent variables.

Table 2 shows the factor loadings for the FOND, STRUCT, VISION, INTEGR, and DYNAM items used in the first construct of SCMM as the independent variable.

As can be seen, most loadings are greater than 0.5., which is the recommended threshold of average variance extracted (AVE). The FOND construct items range from 0.664 to 0.795. The STRUCT construct items range from 0.750 to 0.878. The VISION construct items range from 0.763 to 0.885. The INTEGR construct items range from 0.743 to 0.866. The DYNAM construct items range from 0.600 to 0.896. All the items are over the recommended threshold value of 0.50, and the VIF values are lower than the recommended threshold of 3.3, except VISION3, INTEGR4, and DYNAM4, which are greater than the recommended threshold. However, the VIF values deviate moderately from the threshold and could be considered acceptable.

Table 3 reveals the factor loadings for the FINANCE, CUSTOM, INNO_LEARN, and INT_PROC items used in the second construct of BSC as a dependent variable.

As can be seen, the loadings for the FINANCE construct range from 0.894 to 0.917, CUSTOM loadings range from 0.818 to 0.886, INNO_LEARN loadings range from 0.490 to 0.860, and INT_PROC factor loadings range from 0.703 to 0. 896. All items are over the recommended threshold value of 0.50, except INNO_LEARN with a loading of 0.490, whereas FINANC1, FINANC3, FINANC4, CUSTOM1, CUSTOM2, INT_PROC3, and INT_PROC4 had values greater than the recommended threshold of 3.3.

The loadings for TECH_DYN range from 0.733 to 0.889, whereas the loadings for the STATE construct range from 0.671 to 0.746 (Table 4). As can be seen, most loadings are greater than 0.05., which is the recommended threshold of the average variance extracted (AVE). All items exceed the recommended threshold value of 0.50, and the VIF values are lower than the recommended threshold of 3.3.

5.2. Convergent Validity Testing

Convergent validity is used to show how close the items in a construct are to one another to explain the variance of its items. Thus, the AVE is used to evaluate a construct’s convergent validity for all items on each construct. The loadings are squared for each indicator, and the recommended threshold for AVE is 0.50 or higher.

Table 5 shows the AVE values for all the items ranging from 0.514 to 0.823, in line with the recommended threshold proposed by [94].

Table 5.

Convergent validity testing.

The composite reliability values range based on Jöreskog’s rho (ρc) range from 0.806 to 0.949, indicating that all the values exceed the recommended value of 0.70. The Cronbach’s alpha values range from 0.754 to 0.929, which exceed the proposed value of 0.60, denoting a very good level of reliability [96]. Moreover, [97] proposed the use of rho as another measure of construct reliability which lies in between Cronbach’s alpha and the composite reliability. The values for Dijkstra–Henseler’s rho range from 0.736 to 0.945. Thus, Dijkstra–Henseler’s rho is used as an alternative because Cronbach’s alpha is occasionally too conservative, while the composite reliability may be too liberal [92].

5.3. Discriminant Validity Testing

Discriminant validity is a test that assesses the extent to which a construct is close or distinct from other constructs in a structural model [98]. According to [94], each construct’s AVE needs to be compared to the squared inter-construct correlation. Any construct’s correlation items should not exceed the square root of the AVE in a single construct.

Table 6 shows that all the AVE values are higher than the inter-correlation values, thus supporting the discriminant validity of the model.

Table 6.

Discriminant validity testing.

5.4. PLS-SEM Model for Testing Hypothesis H1–H4

PLS-SEM was used to analyze the impact of SCMM on the FINANCE performance of businesses. For this purpose, the second-level factor SCMM was calculated (Table 7). The findings show that SCMM is positively and significantly related to business performance, with a path coefficient = 0.231, t = 2.939, and p < 0.003, indicating that H1 is supported at the 1% level.

Table 7.

Hypotheses testing.

The findings in Table 7 also show that SCMM significantly impacts CUSTOMER performance, with a path coefficient = 0.509, t = 2.052640, and p < 0.000, which supports H2 at the 1% level. SCMM has a greater impact on INNO_LEARN, with a path coefficient = 0.644, t = 12.845, and p < 0.000, thus indicating that H3 is supported at the 1% level. Moreover, the findings also showed that SCMM has a significant relationship with INT_PROC, with a path coefficient = −0.460, t = 6.730, and p < 0.000; thus, H4 is also supported at the 1% level.

5.5. Moderating Role of Industry Characteristics for Testing Hypothesis H5–H6

The moderating effect in PLS-SEM is determined by assigning values based on the construct. To determine a moderation effect of a relationship between an independent variable (IV) and a dependent variable (DV), which is moderated by a third variable, a regression analysis needs to be performed, and then the values from the independent variables, a moderator variable, and values from their interaction or the product valuable are used. A moderator effect can be present if there is a statistically significant change between two groups with respect to the χ2 value.

Figure 2 indicates the existence of a significant relationship between the variable TECH_DYN and BSC (Financial perspective, Customer perspective, Perspective of innovation and learning, and Perspective of internal processes). In contrast, the relationship with the variable STATE is not significant. Therefore, we focus solely on the moderating role of TECH_DYN.

The moderation effect of variable TECH_DYN on the relationship between SCMM and BSC is presented in Table 8.

Table 8.

Moderation effect of industry technology dynamics (TECH_DYN).

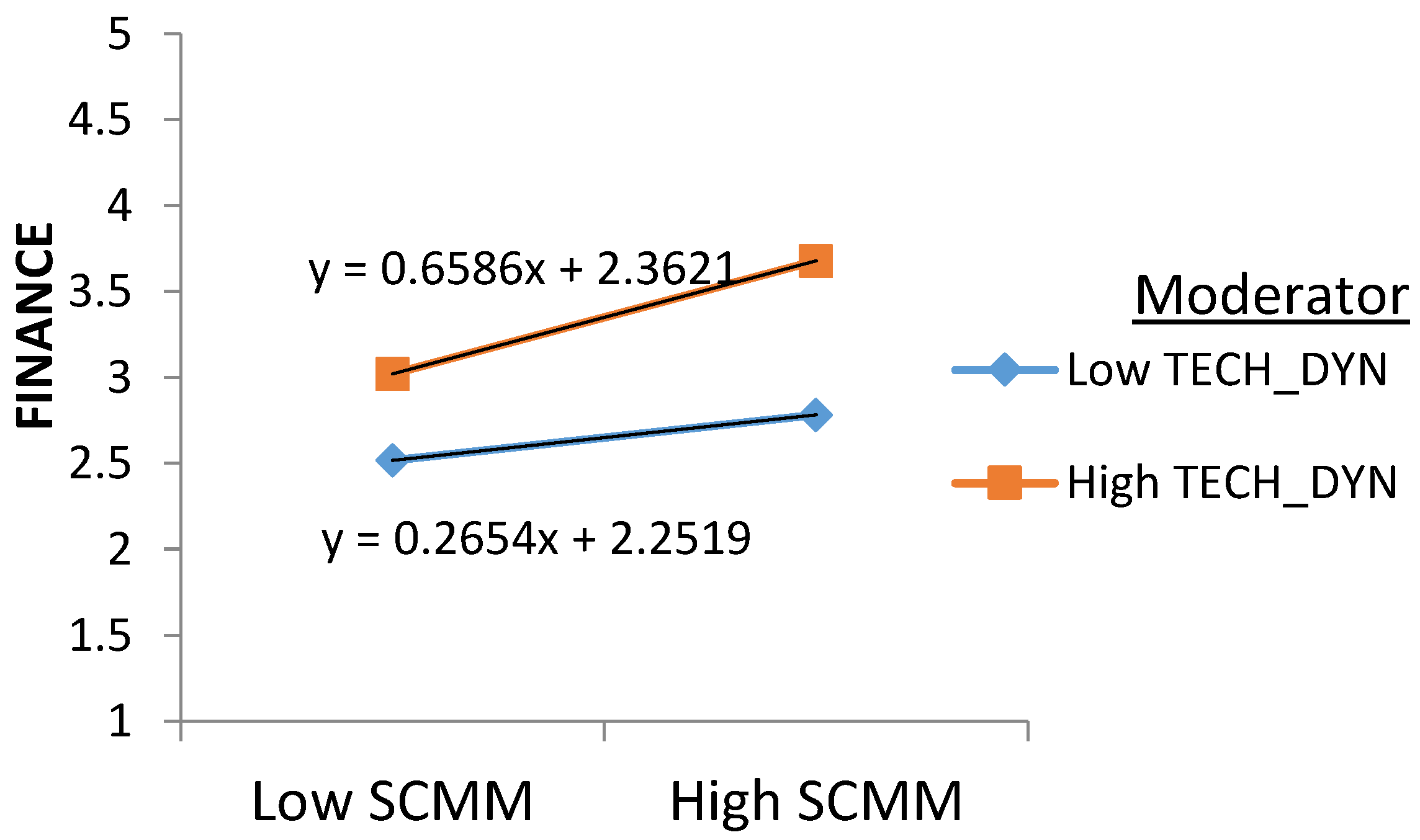

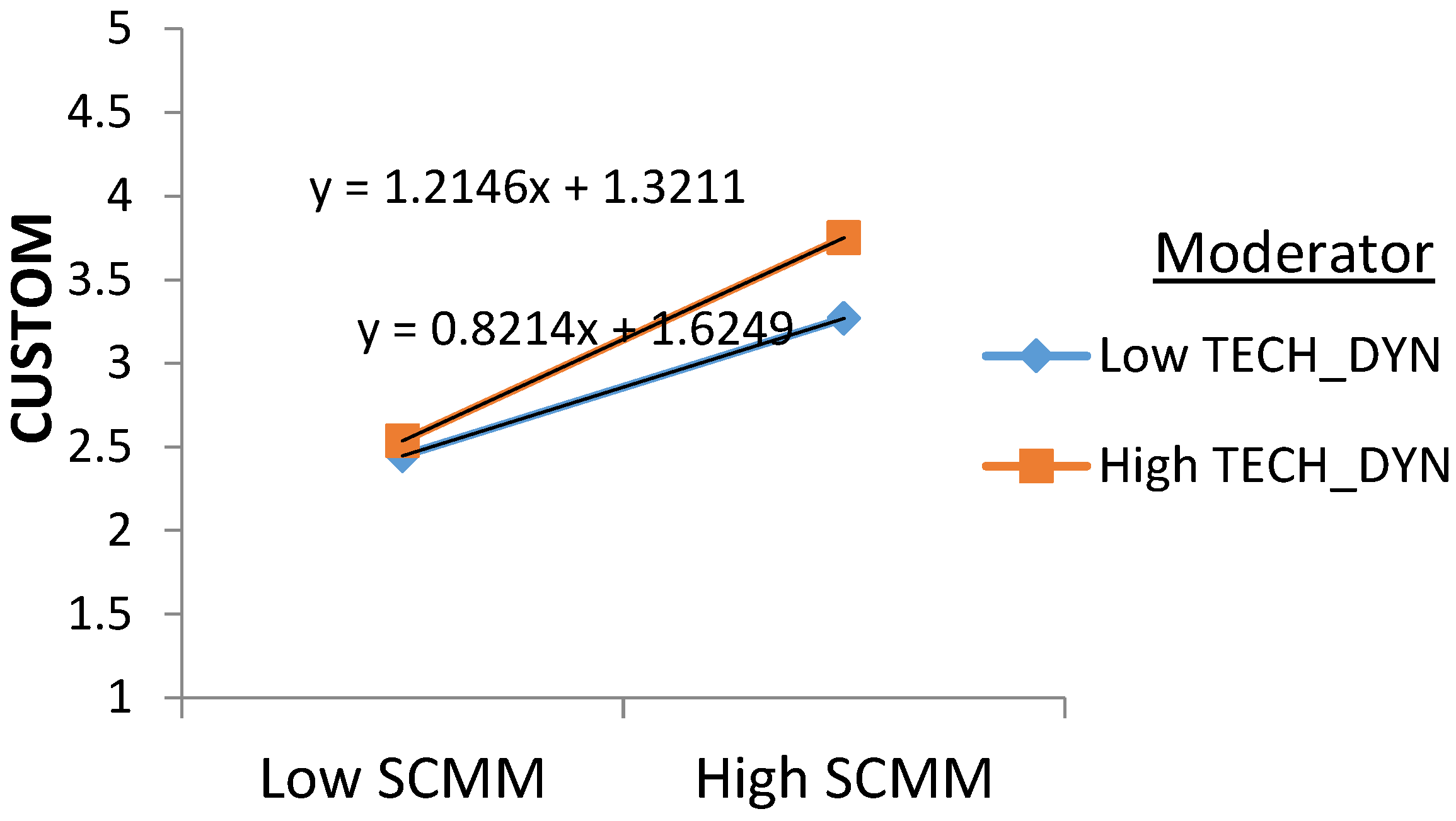

The product variable needs to be significant to be considered a moderating variable. H5a, H5b, H5c, and H5d examine the industry’s moderating effects on a company’s performance (assessed by the BSC framework). Figure 3, Figure 4, Figure 5 and Figure 6 indicate that the linear regression trend is an adequate proxy for the moderating equations, which was confirmed by testing several other forms, such as exponential and linear.

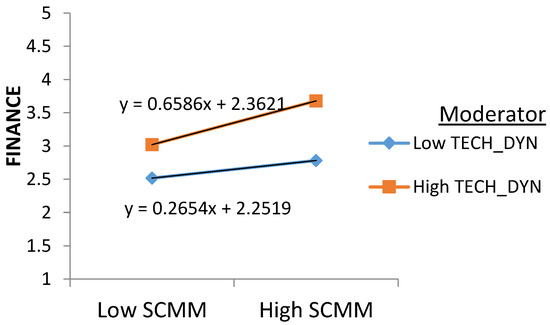

Figure 3.

Moderating effect of industry on financial perspective of BSC; Source: Author’s work, which was produced using SPSS 28.0.0.

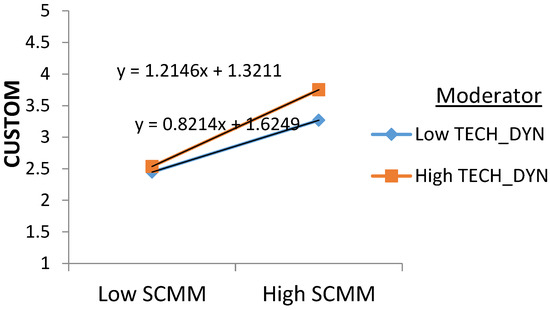

Figure 4.

Moderating effect of industry on customer perspective of BSC: Source: Author’s work, which was produced using SPSS 28.0.0.

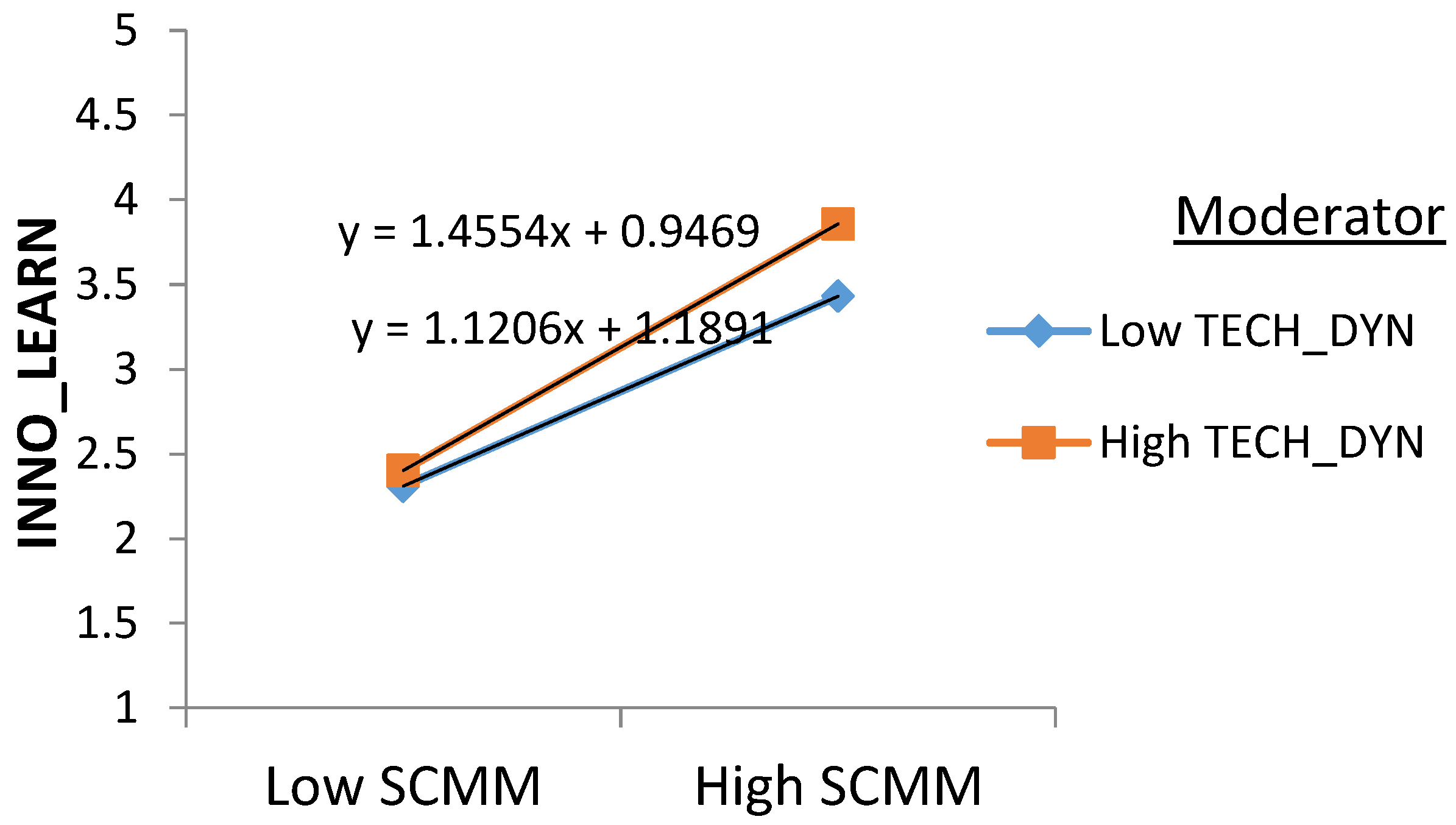

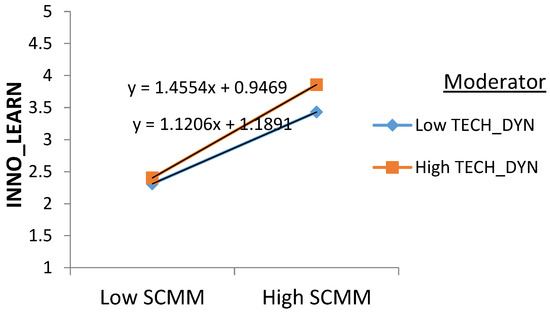

Figure 5.

Moderating effect of industry on innovation and learning perspective of BSC; Source: Author’s work, which was produced using SPSS 28.0.0.

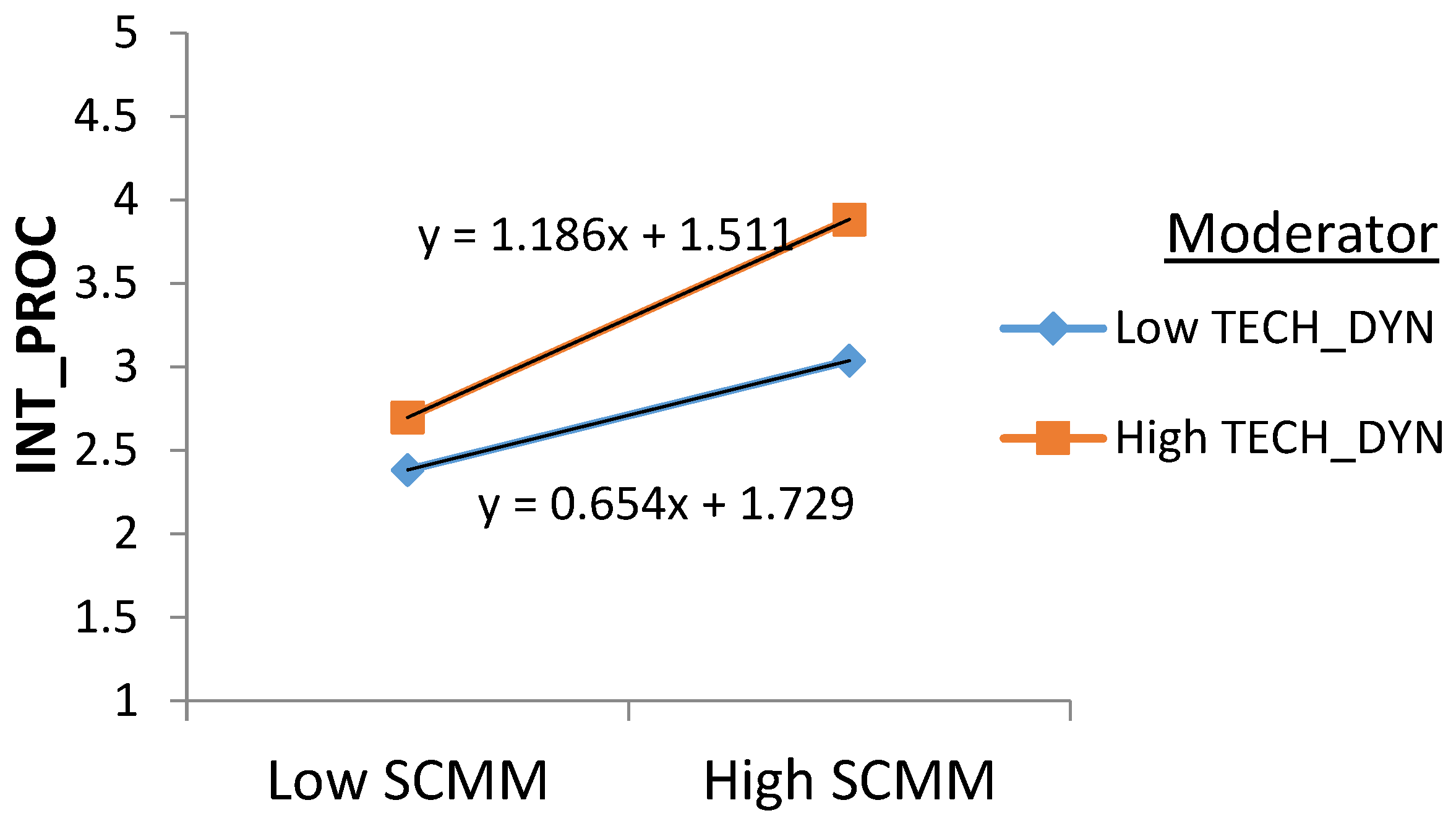

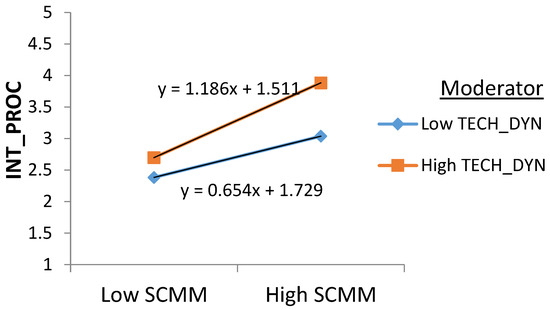

Figure 6.

Moderating effect of industry on internal processes perspective of BSC: Source: Author’s work, which was produced using SPSS 28.0.0.

H5a is based on a significant positive interaction of TECH_DYN with the relation between SCMM and FINANCE. According to the model and Table 8, the R2 for the regression without an interaction term is 0.231. For the regression, the interaction term is 0.357, which is significant at the 1% level (p-value = 0.000). The adjusted change of 0.126 means that the moderation effect of TECH_DYN explains 12.6% of the variations in SCMM with respect to FINANCE. Thus, TECH_DYN is a positive moderator between SCMM and FINANCE (Figure 3). In other words, companies with positive Industry characteristics could improve their FINANCE performance, whereas companies with negative Industry characteristics could lower their FINANCE performance. Therefore, technological dynamism strengthens the positive relationship between SCMM and financial performance, and thus H5a is supported.

H5b is based on a significant positive interaction of TECH_DYN with the relationship between SCMM and CUSTOM (Figure 4).

According to the model and Table 8, the R2 for the regression without the interaction term is 0.509, and for the regression with the interaction term is 0.609, which is significant at the 1% level (p-value = 0.000). The adjusted change of 0.100 means that the moderation effect of TECH_DYN explains 10% of the variations in SCMM with respect to CUSTOM. Thus, TECH_DYN acts as a positive moderator between SCMM and CUSTOM. In other words, companies with positive Industry characteristics could improve their CUSTOM performance, whereas companies with negative Industry characteristics could lower their CUSTOM performance. Therefore, technology dynamism strengthens the positive relationship between SCMM and customer performance, and H5b is supported.

H5c is based on a significant positive interaction of TECH_DYN with respect to the relationship between SCMM and INNO_LEARN (Figure 5).

According to the model and Table 5, the R2 for the regression without the interaction term is 0.644, and for the regression with an interaction term is 0.694, which is significant at the 1% level (p-value = 0.000). The adjusted change of 0.050 means that the moderation effect of TECH_DYN explains 5% of the variations in SCMM with respect to INNO_LEARN. Thus, TECH_DYN is a positive moderator between Supply Chain Management Maturity and INNO_LEARN. In other words, companies with positive Industry characteristics could improve their INNO_LEARN performance, whereas companies with negative Industry characteristics could lower their INNO_LEARN performance. Therefore, technological dynamism strengthens the positive relationship between SCMM and innovation and learning performance, and H5c is supported.

H5d is based on a significant positive interaction of TECH_DYN with respect to the relationship between SCMM and INT_PROC (Figure 6).

According to the model and Table 8, the R2 for the regression without the interaction term is 0.460, and the regression with the interaction term is 0.565, which is significant at the 1% level (p-value = 0.000). The adjusted change of 0.105 means that the moderation effect of TECH_DYN explains 10.5% of the variations in SCMM with respect to INT_PROC. Thus, TECH_DYN is a positive moderator between Supply Chain Management maturity and INT_PROC. In other words, companies with positive Industry characteristics could improve their INT_PROC performance, whereas companies with negative Industry characteristics could lower their INT_PROC performance. Therefore, technological dynamism strengthens the positive relationship between SCMM and internal process performance, and H5d is supported.

6. Discussion

This research aimed to explore the relationship between SCMM and company performance based on the BSC framework. This research also investigates the moderating effect of state and technological dynamism as industrial characteristics that might strengthen or weaken the relationship between SCMM as an independent variable and BSC as a dependent variable. Consistent with previous studies, such as [23,33,34,99,100], this research has indicated that SCM can be seen as a strong enabler of performance. In other words, as SCM improves the processes employed to handle internal and external issues more efficiently, it matures, and it is possible to expect higher levels of organizational performance. A strategic focus on supply chain processes helps organizations reach higher performance levels and a better work environment characterized by cooperation and low levels of conflict [2].

Table 9 provides a summary of the hypothesis-testing procedure. When analyzing different facets of performance, as suggested by the BSC model, research has shown that SCMM is positively related to business performance from the financial perspective of the BSC framework. A statistically significant relation was found between dynamics and financial performance, thus leading us to accept our first hypothesis. These results are consistent with previous similar research [11,36,39]. Operational excellence and more efficient and leaner supply chain processes should generate cost savings and improve financial performance [25,30]. Interestingly, integration, as an element of supply chain maturity, did not show a statistically significant connection with financial performance, unlike previous, similar research [27,29].

Table 9.

Summary of hypothesis testing.

Concerning the relationship between supply chain maturity and business performance from the customer perspective of the BSC framework, a statistically significant relation was found between foundation, dynamics, and customer perspectives. This led to the acceptance of the second hypothesis regarding the positive connection between SCMM and business performance from the customer perspective of the BSC framework. This result is expected and in line with previous research [10,23,48]. Today, customers seek high-quality, fast delivery at the lowest possible cost. This is possible through well-developed, managed supply chain processes, wherein there is a high level of integration between members of the chain and customers are included as important stakeholders. A supply chain, if properly designed so as to manage the flow of information and materials, can deliver enhanced customer service and positively influence organizational performance [101]. In the end, customer satisfaction can also increase market shares and profitability [23].

Further, this research has shown that SCMM positively relates to business performance from the perspective of innovation and learning of the BSC framework. A statistically significant relation was found between Foundation, integration, dynamics, and this performance perspective, thus leading us to accept our third hypothesis. SCMM casts processes as strategic assets that need constant development as they mature [1]. Research has indicated that the maturity of the supply chain indicates constant improvements and learning and innovation in the existing processes, thus leading to new and improved processes and new value for the customer [27]. Our results confirm previous findings on how knowledge sharing, learning, and integration between members positively influence performance, since inter-organizational knowledge sharing can enhance the whole supply chain [63,66].

Concerning the relationship between SCMM and business performance from the perspective of the internal processes of the BSC framework, the hypothesis regarding the positive connection between these variables has been accepted. A statistically significant relation was found between foundation, dynamics, and an internal perspective, thereby supporting our fourth hypothesis. SCMM incorporates knowledge and abilities to merge intra and inter-organizational operational and strategic capabilities along the supply chain to create a unique competitive supply chain process [101]. By implementing adequate organizational capabilities and cooperation with partners along the value chain [17], organizations can expect economic benefits and ensure improvements in internal processes. Previous research also indicates a positive connection between SCMM and improvements in the internal process, leading further on to increases in operational efficiency, including—but not limited to—the elimination of excess inventory, reductions in lead times, increased sales, improved customer service, and greater flexibility [49,51,72].

Research has shown that the relationship between SCMM and business performance is strengthened when an enterprise operates in an industry with higher technological dynamism. Similar to previous research [81], this study has highlighted how performance depends on the way in which technology is introduced and managed within the supply chain. Supply chains must adapt to changing technologies and customer expectations [102]. Research has shown that better performance can be achieved by adapting and implementing modern technological solutions that help organizations cope with changing environments [85].

Previous research has indicated a strong role of the government in supply chain performance [89,90]. Thus, we hypothesized that the relationship between SCMM and business performance is strengthened when an enterprise operates in an industry more supported by the State. However, our research results indicate that, in most cases, this independent variable did not have a statistically significant impact on the representativeness of the model, indicating that this hypothesis was not accepted. In other words, the results indicate that in a post-transition country such as BIH, the state does not influence the contribution of SCMM to business performance. Additionally, in today’s environment, this result confirms the importance of the structure of SCMM itself and environmental dynamism for overall business performance. The characteristics of the supply chain and its preparedness for changing market demands eventually lead to higher performance.

7. Conclusions

In general, this research has indicated that SCMM positively affects organizational performance, including its various perspectives proposed by the BSC framework. This relationship is further strengthened by technological dynamism. Despite expectations that in BiH, as a less-developed country, the role of the State and government with respect to performance will be highly emphasized, this research has indicated the need for a novel approach to understanding SCMM and its relation to performance in this and other similar post-transition countries.

This research has indicated that dynamics is one of the most important elements of supply chain maturity, and that it leads to better performance. On the one hand, changing customer demands and market competition require agile and flexible organizations. Still, it is necessary to emphasize that change must be planned, controlled, managed, and based on resources and capabilities that best support the supply chain process and generate value. Due to SCM’s complexity, the effective management of a supply chain’s maturity necessitates proper strategic vision and design. Ultimately, for the entire supply chain, it is crucial to develop synergy among the chain’s participants so that the aggregate performance exceeds the performance of each member. Research has also indicated that the BSC approach is a relevant framework for assessing the effects of SCMM on the organizational performance of BiH companies and similarly developed countries in this region. Understanding SCMM and its effects can help managers to more effectively guide their supply chains and take actions and decisions toward achieving higher performance.

However, several research limitations must be considered when these results are analyzed. The first relates to the small sample size and the specific national context in which the research was conducted. For the results to be generalized, future research should incorporate a wider sample size from different national contexts, which would be especially beneficial for analyzing the state’s effects and the government’s role in supply chain performance. The second limitation is related to the measures used and the cross-sectional approach, due to which the issue of subjectivity might be present. Future research based on mixed methods or qualitative approaches could overcome these issues.

Author Contributions

Conceptualization, M.P.B. and A.K.; methodology, M.P.B. and J.Z.; software, J.Z.; validation, A.A. and S.R.J.; formal analysis, M.P.B. and J.Z.; investigation, M.P.B.; resources, A.K.; data curation, A.K.; writing—original draft preparation, A.A., A.K. and S.R.J.; writing—review and editing, M.P.B., A.A., S.R.J. and J.Z.; visualization, J.Z.; supervision, M.P.B.; project administration, A.K.; All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available from the authors upon request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Lockamy, A.; McCormack, K. The development of a supply chain management process maturity model using the concepts of business process orientation. Supply Chain Manag. Int. J. 2004, 9, 272–278. [Google Scholar] [CrossRef]

- McCormack, K.; Ladeira, M.B.; de Oliveira, M.P.V. Supply chain maturity and performance in Brazil. Supply Chain. Manag. Int. J. 2008, 13, 272–282. [Google Scholar] [CrossRef]

- Guzmán, G.M.; Serna, M.D.C.M.; Ramírez, R.G. The relationship between supply chain management and competitiveness in the manufacturing SMEs of Aguascalientes. Merc. Neg. 2015, 16, 67–88. [Google Scholar]

- Monczka, R.M.; Handfield, R.B.; Giunipero, L.C.; Patterson, J.L. Purchasing and Supply Chain Management; South-Western Cengage Learning: Mason, OH, USA, 2009. [Google Scholar]

- Roblek, V.; Thorpe, O.; Pejić Bach, M.; Jerman, A.; Meško, M. The Fourth Industrial Revolution and the Sustainability Practices: A Comparative Automated Content Analysis Approach of Theory and Practice. Sustainability 2020, 12, 8497. [Google Scholar] [CrossRef]

- Knežević, B.; Škrobot, P.; Žmuk, B. Position and role of social supermarkets in food supply chains. Bus. Syst. Res. Int. J. Soc. Adv. Innov. Res. Econ. 2021, 12, 179–196. [Google Scholar] [CrossRef]

- Kopanaki, E.; Stroumpoulis, A.; Oikonomou, M. The Impact of Blockchain Technology on Food Waste Management in the Hospitality Industry. ENTRENOVA—Enterp. Res. Innov. 2021, 7, 428–437. [Google Scholar] [CrossRef]

- Chen, F.H.; Tsai, Y.-T.; Oen, W.A. Configurations of green human resource management practices on supply chain integration. Int. J. Eng. Bus. Manag. 2022, 14, 18479790221146443. [Google Scholar] [CrossRef]

- Netland, T.H.; Alfnes, E.; Fauske, H. How mature is your supply chain?—A supply chain maturity assessment test. In Proceedings of the 14th International EurOMA Conference Managing Operations in an Expanding Europe, Ankara, Turkey, 17–20 June 2007; pp. 17–20. [Google Scholar]

- Chang, H.H.; Hung, C.-J.; Wong, K.H.; Lee, C.-H. Using the balanced scorecard on supply chain integration performance—A case study of service businesses. Serv. Bus. 2013, 7, 539–561. [Google Scholar] [CrossRef]

- Söderberg, L.; Bengtsson, L. Supply chain management maturity and performance in SMEs. Oper. Manag. Res. 2010, 3, 90–97. [Google Scholar] [CrossRef]

- Frederico, G. Supply Chain Management Maturity: A Comprehensive Framework Proposal from Literature Review and Case Studies. Int. Bus. Res. 2017, 10, 68. [Google Scholar] [CrossRef]

- Akyuz, A.G.; Erkan, E.T. Supply chain performance measurement: A literature review. Int. J. Prod. Res. 2010, 48, 5137–5155. [Google Scholar] [CrossRef]

- De Sousa, T.B.; Melo, I.C.; De Oliveira, P.H.; Lourenço, C.M.; Guerrini, F.M.; Esposto, K. Balanced Scorecard for evaluating the performance of supply chains: A bibliometric study. J. Eng. Res. 2020, 8. [Google Scholar] [CrossRef]

- Bhagwat, R.; Sharma, M.K. Performance measurement of supply chain management: A balanced scorecard approach. Comput. Ind. Eng. 2007, 53, 43–62. [Google Scholar] [CrossRef]

- Suša Vugec, D.; Bosilj Vukšić, V.; Pejić Bach, M.; Jaklič, J.; Indihar Štemberger, M. Business intelligence and organizational performance: The role of alignment with business process management. Bus. Process Manag. J. 2020, 26, 1709–1730. [Google Scholar] [CrossRef]

- Radosavljević, M. Process Orientation as a Basis for increasing supply chain Management Maturity. Econ. Themes 2015, 53, 398–414. [Google Scholar] [CrossRef]

- Fraser, P.; Moultrie, J.; Gregory, M. The Use of Maturity Models/Grids as a Tool in Assessing Product Development Capability. In Proceedings of the IEEE International Engineering Management Conference 2002, Cambridge, UK, 18–20 August 2002; Volume 1, pp. 244–249. [Google Scholar]

- Vaidyanathan, K.; Howell, G. Construction supply chain maturity model—Conceptual framework. In Proceedings of the IGLC-15, East Lansing, MI, USA, 18–20 July 2007; pp. 170–180. [Google Scholar]

- Zhou, H.; Benton, W.C., Jr.; Schilling, D.A.; Milligan, G.W. Supply chain integration and the SCOR model. J. Bus. Logist. 2011, 32, 332–344. [Google Scholar] [CrossRef]

- Lockamy, A.; McCormack, K. Linking SCOR planning practices to supply chain performance: An exploratory study. Int. J. Oper. Prod. Manag. 2004, 24, 1192–1218. [Google Scholar] [CrossRef]

- De Oliveira, M.P.V.; Ladeira, M.B.; McCormack, K.P. The supply chain process management maturity model–SCPM3. In Supply Chain Management—Pathways for Research and Practice; Önkal, D., Aktas, E., Eds.; Tech: Rijeka, Croatia, 2011; pp. 201–218. [Google Scholar]

- Ellinger, A.; Shin, H.; Northington, W.M.; Adams, F.G.; Hofman, D.; O’Marah, K. The influence of supply chain management competency on customer satisfaction and shareholder value. Supply Chain Manag. Int. J. 2012, 17, 249–262. [Google Scholar] [CrossRef]

- Liu, W.; Wei, W.; Si, C.; Xie, D.; Chen, L. Effect of supply chain strategic collaboration announcements on shareholder value: An empirical investigation from China. Int. J. Oper. Prod. Manag. 2020, 40, 389–414. [Google Scholar] [CrossRef]

- Frederico, G.F.; Garza-Reyes, J.A.; Kumar, A.; Kumar, V. Performance measurement for supply chains in the Industry 4.0 era: A balanced scorecard approach. Int. J. Product. Perform. Manag. 2021, 70, 789–807. [Google Scholar] [CrossRef]

- Souza, R.P.; Guerreiro, R.; Oliveira, M.P.V. Relationship between the maturity of supply chain process management and the organizational life cycle. Bus. Process Manag. J. 2015, 21, 466–481. [Google Scholar] [CrossRef]

- Wang, Z.; Sarkis, J. Investigating the relationship of sustainable supply chain management with corporate financial performance. Int. J. Prod. Perform. Manag. 2013, 62, 871–888. [Google Scholar] [CrossRef]

- Kim, J.; Rhee, J. An empirical study on the impact of critical success factors on the balanced scorecard performance in Korean green supply chain management enterprises. Int. J. Prod. Res. 2012, 50, 2465–2483. [Google Scholar] [CrossRef]

- Geng, R.; Mansouri, S.A.; Aktas, E. The relationship between green supply chain management and performance: A meta-analysis of empirical evidences in Asian emerging economies. Int. J. Prod. Econ. 2017, 183, 245–258. [Google Scholar] [CrossRef]

- Feng, M.; Yu, W.; Wang, X.; Wong, C.Y.; Xu, M.; Xiao, Z. Green supply chain management and financial performance: The mediating roles of operational and environmental performance. Bus. Strat. Environ. 2018, 27, 811–824. [Google Scholar] [CrossRef]

- Chavez, R.; Yu, W.; Feng, M.; Wiengarten, F. The Effect of Customer-Centric Green Supply Chain Management on Operational Performance and Customer Satisfaction. Bus. Strat. Environ. 2016, 25, 205–220. [Google Scholar] [CrossRef]

- Gandhi, A.V.; Shaikh, A.; Sheorey, P.A. Impact of supply chain management practices on firm performance: Empirical evidence from a developing country. Int. J. Retail. Distrib. Manag. 2017, 45, 366–384. [Google Scholar] [CrossRef]

- Goel, R.K.; Saunoris, J.W.; Goel, S.S. Supply chain performance and economic growth: The impact of COVID-19 disruptions. J. Policy Model. 2021, 43, 298–316. [Google Scholar] [CrossRef]

- Qrunfleh, S.; Tarafdar, M. Supply chain information systems strategy: Impacts on supply chain performance and firm performance. Int. J. Prod. Econ. 2014, 147, 340–350. [Google Scholar] [CrossRef]

- Wong, W.P.; Wong, K.Y. Supply chain management, knowledge management capability, and their linkages towards firm performance. Bus. Process. Manag. J. 2011, 17, 940–964. [Google Scholar] [CrossRef]

- Kordestani, A.; Bengtsson, L.; Farhat, F.; Peighambari, K. Supply chain process maturity and financial performance study of Swedish steel SMEs. International Annual EurOMA Conference. 2010. Available online: https://www.diva-portal.org/smash/get/diva2:1012084/FULLTEXT01.pdf (accessed on 21 January 2022).

- Wagner, S.M.; Grosse-Ruyken, P.T.; Erhun, F. The link between supply chain fit and financial performance of the firm. J. Oper. Manag. 2012, 30, 340–353. [Google Scholar] [CrossRef]

- Rao, P.; Holt, D. Do green supply chains lead to competitiveness and economic performance? Int. J. Oper. Prod. Manag. 2005, 25, 898–916. [Google Scholar] [CrossRef]

- Pakurár, M.; Haddad, H.; Popp, J.; Khan, T.; Oláh, J. Supply chain integration, organizational performance and balanced scorecard: An empirical study of the banking sector in Jordan. J. Int. Stud. 2019, 12, 129–146. [Google Scholar] [CrossRef]

- Koufteros, X.A.; Vonderembse, M.A.; Doll, W.J. Competitive capabilities: Measurement and relationships. Proc. Decis. Sci. Inst. 1997, 3, 1067–1068. [Google Scholar]

- Huo, B.; Qi, Y.; Wang, Z.; Zhao, X. The impact of supply chain integration on firm performance: The moderating role of competitive strategy. Supply Chain. Manag. Int. J. 2014, 19, 369–384. [Google Scholar] [CrossRef]

- Christensen, W.J.; Germain, R.N.; Birou, L. Variance vs. average: Supply chain lead-time as a predictor of financial performance. Supply Chain. Manag. Int. J. 2007, 12, 349–357. [Google Scholar] [CrossRef]

- Trisnawati, N.; Pujawan, I.N. Analysis of supply chain performance based on the supply chain management maturity level in manufacturing industry. In Proceedings of the International Conference on Industrial Engineering and Operations Management, Sao Paulo, Brazil, 5–8 April 2021; Available online: http://www.ieomsociety.org/brazil2020/papers/691.pdf (accessed on 20 January 2022).

- Schiele, H. Supply-management maturity, cost savings and purchasing absorptive capacity: Testing the procurement–performance link. J. Purch. Supply Manag. 2007, 13, 274–293. [Google Scholar] [CrossRef]

- Zubairu, N.; Dinwoodie, J.; Govindan, K.; Hunter, L.; Roh, S. Supply chain strategies as drivers of financial performance in liquefied natural gas networks. Supply Chain Manag. Int. J. 2021, 26, 579–591. [Google Scholar] [CrossRef]

- Seuring, S.; Müller, M. From a literature review to a conceptual framework for sustainable supply chain management. J. Clean. Prod. 2008, 16, 1699–1710. [Google Scholar] [CrossRef]

- Hugos, M.H. Essentials of Supply Chain Management; John Wiley & Sons: Hoboken, NJ, USA, 2018. [Google Scholar]

- Adebiyi, S.O.; Adediran, A.S.; Shodiya, A.O.; Olusola, T. Supply Chain Management Practices and Manufacturing Firms Performance: Professionals’ Experience in Nigeria. Econ. Cult. 2021, 18, 28–40. [Google Scholar] [CrossRef]

- Shukla, R.K.; Garg, D.; Agarwal, A. Supply chain coordination competency and firm performance: An empirical study. Int. J. Supply Chain. Manag. 2013, 2, 64–70. [Google Scholar]

- Zhu, Q.; Krikke, H.; Caniëls, M.C. Supply chain integration: Value creation through managing inter-organizational learning. Int. J. Oper. Prod. Manag. 2018, 38, 211–229. [Google Scholar] [CrossRef]

- Afshan, N. The Performance Outcomes of Dimensions of Supply Chain Integration: A Conceptual Framework. Verslas Teor. Prakt. 2013, 14, 323–331. [Google Scholar] [CrossRef]

- Auramo, J.; Kauremaa, J.; Tanskanen, K. Benefits of IT in supply chain management: An explorative study of progressive companies. Int. J. Phys. Distrib. Logist. Manag. 2005, 35, 82–100. [Google Scholar] [CrossRef]

- Asamoah, D.; Nuertey, D.; Agyei-Owusu, B.; Akyeh, J. The effect of supply chain responsiveness on customer development. Int. J. Logist. Manag. 2021, 32, 1190–1213. [Google Scholar] [CrossRef]

- Haque, M.; Islam, R. Impact of supply chain collaboration and knowledge sharing onorganisational outcomes in pharmaceutical industry of Bangladesh. J. Glob. Oper. Strateg. Sourc. 2018, 11, 301–320. [Google Scholar]

- Laari, S.; Töyli, J.; Solakivi, T.; Ojala, L. Firm performance and customer-driven green supply chain management. J. Clean. Prod. 2016, 112, 1960–1970. [Google Scholar] [CrossRef]

- Lai, K.-H.; Wong, C.W.Y. Green logistics management and performance: Some empirical evidence from Chinese manufacturing exporters. Omega 2012, 40, 267–282. [Google Scholar] [CrossRef]

- Vachon, S.; Klassen, R.D. Environmental management and manufacturing performance: The role of collaboration in the supply chain. Int. J. Prod. Econ. 2008, 111, 295–308. [Google Scholar] [CrossRef]

- Solaimani, S.; Bounwman, H. A framework for the alignment of business model and business processes: A generic model for trans-sector innovation. Bus. Process Manag. J. 2012, 18, 655–679. [Google Scholar] [CrossRef]

- Kim, B. Coordinating an innovation in supply chain management. Eur. J. Oper. Res. 2000, 123, 568–584. [Google Scholar] [CrossRef]

- Li, S.; Ragu-Nathan, B.; Ragu-Nathan, T.S.; Rao, S.S. The impact of supply chain management practices on competitive advantage andorganisational performance. Omega 2006, 34, 107–124. [Google Scholar] [CrossRef]

- Yang, J.; Han, Q.; Zhou, J.; Yuan, C. The Influence of Environmental Management Practices and Supply Chain Integration on Technological Innovation Performance—Evidence from China’s Manufacturing Industry. Sustainability 2015, 7, 15342–15361. [Google Scholar] [CrossRef]

- Hong, J.; Liao, Y.; Zhang, Y.; Yu, Z. The effect of supply chain quality management practices and capabilities on operational and innovation performance: Evidence from Chinese manufacturers. Int. J. Prod. Econ. 2019, 212, 227–235. [Google Scholar] [CrossRef]

- Foli, S.; Durst, S.; Temel, S. The link between supply chain risk management and innovation performance in SMEs in turbulent times. J. Entrep. Emerg. Econ. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Wu, L.; Chuang, C.H. Examining the diffusion of electronic supply chain management with external antecedents and firm performance: A multi-stage analysis. Decis. Support Syst. 2010, 50, 103–115. [Google Scholar] [CrossRef]

- Cheng, J.H.; Yeh, C.H.; Tu, C.W. Trust and knowledge sharing in green supply chains. Supply Chain. Manag. Int. J. 2008, 13, 283–295. [Google Scholar] [CrossRef]

- Hernández-Espallardo, M.; Rodríguez-Orejuela, A.; Sánchez-Pérez, M. Inter-organisational governance, learning and performance in supply chains. Supply Chain. Manag. Int. J. 2010, 15, 101–114. [Google Scholar] [CrossRef]

- Haq, M.Z.U. Supply chain learning andorganisational performance: Evidence from Chinese manufacturing firms. J. Knowl. Manag. 2021, 25, 943–972. [Google Scholar] [CrossRef]

- Kazemkhanlou, H.; Ahadi, H.R. Study of performance measurement practices in supply chain management. In Proceedings of the the 2014 International Conference on Industrial Engineering and Operations Management, Bali, Indonesia, 7–9 January 2014; Available online: http://ieomsociety.org/ieom2014/pdfs/64.pdf (accessed on 20 January 2022).

- Germain, R.; Iyer, K.N.S. The interaction of internal and downstream integration and its association with performance. J. Bus. Logist. 2006, 27, 29–52. [Google Scholar] [CrossRef]

- Kankaew, K.; Yapanto, L.M.; Waramontri, R.; Arief, S.; Hamsir, H.; Sastrawati, N.; Espinoza-Maguiña, M.R. Supply chain management and logistic presentation: Mediation effect of competitive advantage. Uncertain Supply Chain Manag. 2021, 9, 255–264. [Google Scholar] [CrossRef]

- Stank, T.P.; Keller, S.B.; Daugherty, P.J. Supply chain collaboration and logistical service performance. J. Bus. Logist. 2001, 22, 29–48. [Google Scholar] [CrossRef]

- Lee, S.M.; Sung Rha, J.; Choi, D.; Noh, Y. Pressures affecting green supply chain performance. Manag. Decis. 2013, 51, 1753–1768. [Google Scholar] [CrossRef]

- Siagian, H.; Tarigan, Z.; Jie, F. Supply Chain Integration Enables Resilience, Flexibility, and Innovation to Improve Business Performance in COVID-19 Era. Sustainability 2021, 13, 4669. [Google Scholar] [CrossRef]

- Karabag, S.F.; Berggren, C. Antecedents of firm performance in emerging economies: Business groups, strategy, industry structure, and state support. J. Bus. Res. 2014, 67, 2212–2223. [Google Scholar] [CrossRef]

- Huo, B.; Zhao, X.; Zhou, H. The Effects of Competitive Environment on Supply Chain Information Sharing and Performance: An Empirical Study in China. Prod. Oper. Manag. 2014, 23, 552–569. [Google Scholar] [CrossRef]

- Narasimhan, R.; Kim, S.W. Effect of supply chain integration on the relationship between diversification and performance: Evidence from Japanese and Korean firms. J. Oper. Manag. 2002, 20, 303–323. [Google Scholar] [CrossRef]

- Shan, H.; Li, Y.; Shi, J. Influence of Supply Chain Collaborative Innovation on Sustainable Development of Supply Chain: A Study on Chinese Enterprises. Sustainability 2020, 12, 2978. [Google Scholar] [CrossRef]

- Attaran, M. Digital technology enablers and their implications for supply chain management. Supply Chain Forum Int. J. 2020, 21, 158–172. [Google Scholar] [CrossRef]

- Basheer, M.F.; Siam, M.R.A.; Awn, A.M.; Hussan, S.G. Exploring the role of TQM and supply chain practices for firm supply performance in the presence of information technology capabilities and supply chain technology adoption: A case of textile firms in Pakistan. Uncertain Supply Chain Manag. 2019, 7, 275–288. [Google Scholar] [CrossRef]

- Kuei, C.; Madu, C.N.; Lin, C.; Chow, W.S. Developing supply chain strategies based on the survey of supply chain quality and technology management. Int. J. Qual. Reliab. Manag. 2002, 19, 889–901. [Google Scholar] [CrossRef]

- Kuei, C.; Madu, C. Identifying critical success factors for supply chain quality management. Asia Pac. Manag. Rev. 2001, 6, 409–423. [Google Scholar]

- Zhang, X.; van Donk, D.P.; van Der Vaart, T. Does ICT influence supply chain management and performance? Int. J. Oper. Prod. Manag. 2011, 31, 1215–1247. [Google Scholar] [CrossRef]

- Al Kurdi, B.; Alzoubi, H.M.; Akour, I.; Alshurideh, M.T. The effect of blockchain and smart inventory system on supply chain performance: Empirical evidence from retail industry. Uncertain Supply Chain Manag. 2022, 10, 1111–1116. [Google Scholar] [CrossRef]

- Ardito, L.; Petruzzelli, A.M.; Panniello, U.; Garavelli, A.C. Towards Industry 4.0: Mapping digital technologies for supply chain management-marketing integratio. Bus. Process Manag. J. 2019, 25, 323–346. [Google Scholar] [CrossRef]

- Ben-Daya, M.; Hassini, E.; Bahroun, Z. Internet of Things and supply chain management: A literature review. Int. J. Prod. Res. 2019, 57, 4719–4742. [Google Scholar] [CrossRef]

- Hofman, P.S.; Blome, C.; Schleper, M.C.; Subramanian, N. Supply chain collaboration and eco-innovations: An institutional perspective from China. Bus. Strat. Environ. 2020, 29, 2734–2754. [Google Scholar] [CrossRef]

- Zhang, C.; Dhaliwal, J. An investigation of resource-based and institutional theoretic factors in technology adoption for operations and supply chain management. Int. J. Prod. Econ. 2009, 120, 252–269. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J.; Lai, K.-H. Green supply chain management: Pressures, practices and performance within the Chinese automobile industry. J. Clean. Prod. 2007, 15, 1041–1052. [Google Scholar] [CrossRef]

- Nkwabi, J.M. Supply chain management constraints in Tanzanian small and medium enterprises. Afr. J. Bus. Manag. 2019, 13, 564–570. [Google Scholar]

- Tanco, M.; Jurburg, D.; Escuder, M. Main difficulties hindering supply chain performance: An exploratory analysis at Uruguayan SMEs. Supply Chain Manag. Int. J. 2015, 20, 11–23. [Google Scholar] [CrossRef]

- Munshi, M.M.; Fateh, E.A.; Alam, F.; Khan, K. Assessing Psychometric Properties of Servqual and Evaluation of Students’satisfaction in King Abdulaziz University. Sci. Int. 2018, 30, 497–505. [Google Scholar]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Jöreskog, K.G. Statistical analysis of sets of congeneric tests. Psychometrika 1971, 36, 109–133. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Structural equation models with unobservable variables and measurement error: Algebra and statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Kock, N. Common method bias in PLS-PLS-SEM: A full collinearity assessment approach. Int. J. e-Collab. 2015, 11, 1–10. [Google Scholar] [CrossRef]