1. Introduction

In 2010, the International Civil Aviation Organization (ICAO) decided to achieve Carbon neutral growth [

1]. In 2016, ICAO adopted the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), requiring airlines to purchase carbon offset credits for emissions above average 2019 levels on international flights starting in 2021. Carbon offset projects reduce or store carbon dioxide or other greenhouse gas emissions, by investing in renewable energy or the preservation of forests, for example, in order to compensate for emissions elsewhere. In aviation, carbon offsetting is a potential second best solution, because sectoral marginal abatement costs are relatively high and potential best solutions such as carbon taxes or cap and trade systems [

2] have not proven politically feasible.

CORSIA’s success will depend highly upon the offsets used. For example, storing global emissions by planting trees has become widely considered as challenging due to the lack of available land and the fact that the existence of large woodlands would have to be secured forever, or for at least 100 years [

3]. As a consequence, forest carbon credits have been kept out of several key carbon markets, such as the European Union’s Emission Trading Scheme [

4]. Instead of carbon storage, carbon reduction by increasing energy efficiency has become more popular for offsetting, although it is controversial as well. Frequently, carbon reduction projects do not depend on offsets and would have occurred anyway, which can induce adverse effects if policy makers do not implement policies to address emissions [

5].

Due to the ambiguous climate benefits of carbon offsetting, offset prices are important to incentivize emission reductions in the buying sector. It is expected that a carbon price of 40–80

$ per ton of CO

2e in 2020 would be consistent with achieving the Paris Agreement of keeping temperature rise below 2 degrees [

2]. Currently, the carbon offset market is characterized by a structural oversupply. Today, offsetting a ton of CO

2 under CORSIA would cost less than one US Dollar. The drop in air traffic from the COVID-19 pandemic makes it unlikely that the airline sector will be required to offset any emissions in the next several years [

6], resulting in a window of opportunity for improving CORSIA’s regulations.

This paper is motivated by these drawbacks of carbon offsetting. It tries to answer the question of whether CORSIA is a feasible second best solution for the ICAO’s carbon neutral growth goal. Therefore, we systematically identify critical offset characteristics. Based on these findings, we empirically analyze the carbon offset market supply that is currently eligible under CORSIA and discuss how the market will likely interact with airlines. We focus on offsets’ carbon reduction potential and adverse effects. Furthermore, given today’s high price variation of eligible carbon offsets (for example, a German nonprofit organization called Atmosfair offers voluntary offsets for USD 28 per ton under the CORSIA-eligible Gold Standard certification, whereas other Gold Standard offsets from other providers are available for USD 3), we evaluate whether prices are useful as a signal for climate and regulatory integrity.

While the basic economic idea behind carbon offsetting resembles cap and trade systems, differences in their realization are huge. In both cases, differences in marginal abatement cost allow cost-efficient emission reductions by trading CO2 permits. However, cap and trade systems are capped in absolute terms, closed, and balanced. Increases need to be counterbalanced by reductions, often in comparable general regulatory settings within countries, sectors, or economic areas. In most cases, carbon offsetting is uncapped in absolute terms and operates in segregated jurisdictions, potentially requiring extensive bureaucracies to guarantee net emission reductions. Carbon offsetting and cap and trade systems require monitoring, reporting, and verifying of emissions. However, offsetting projects need to fulfill further criteria such as additionality, permanency, non-leakage (climate integrity), and avoidance of adverse effects such as social oppression (regulatory integrity). Quality standards have emerged to certify that most of these important criteria are satisfied.

The complexity of carbon offsetting is expressed by its high transaction costs [

7]. Under CORSIA, projects verified by six organizations are eligible in order to offer a heterogeneous portfolio of offsets from all over the world, with different sizes, types, investment costs, developers, verifiers, and prices, even within standards. As a result, guaranteeing full compliance for all registered projects is challenging and the probability of adverse selection depends on project characteristics [

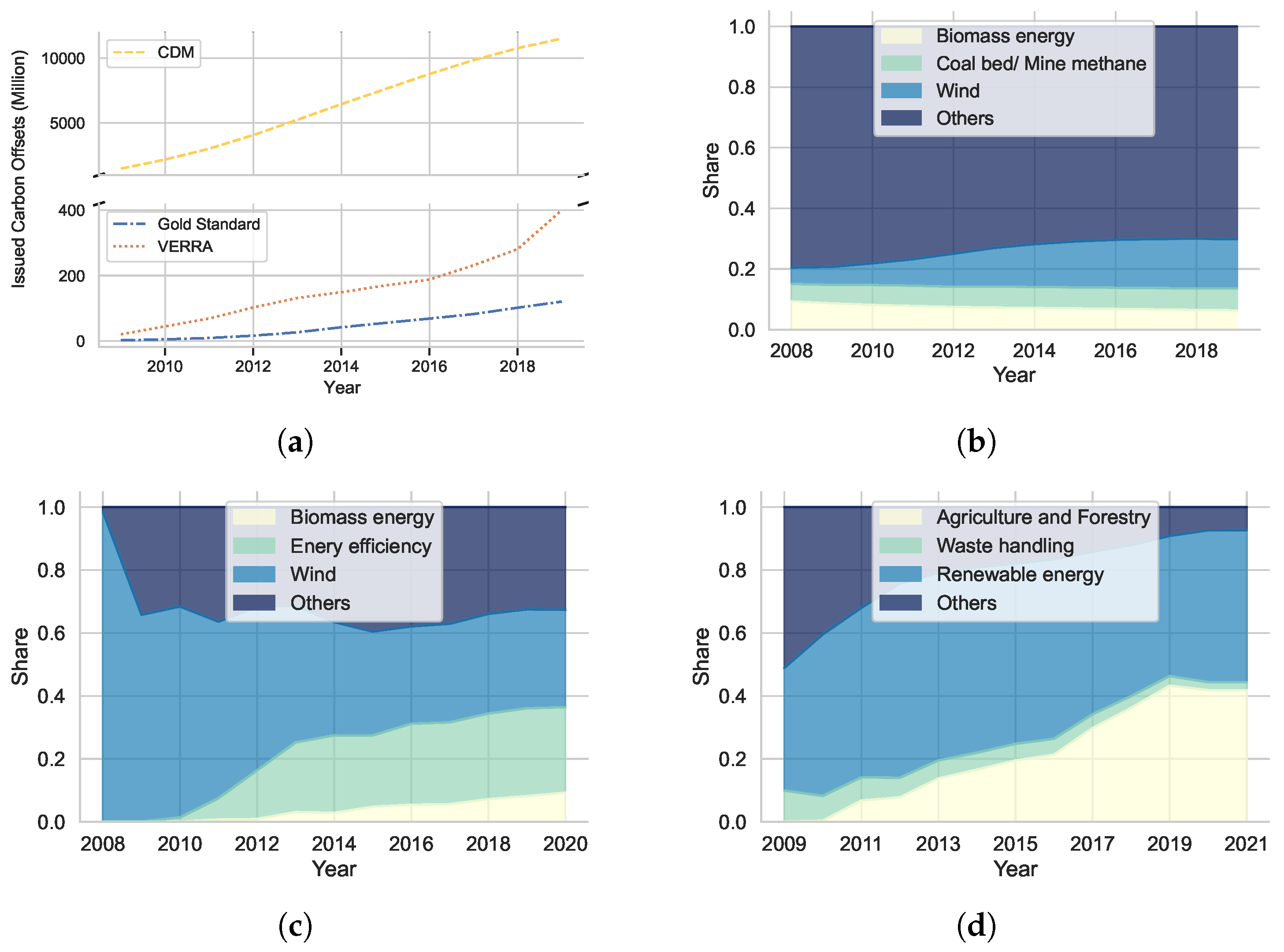

8]. In order to better understand the potential drawbacks of CORSIA-eligible offsets, we explain related critical characteristics and their consequences for climate and regulatory integrity. Considering critical characteristics, we evaluate the eligible offset supply using the registry data of the largest suppliers, Clean Development Mechanism (CDM), VERRA, and Gold Standard (GS), which together account for two thirds of all traded offsets [

9].

This paper adds to the literature by focusing on characteristics of CORSIA eligible offsets that jeopardize climate and regulatory integrity. In comparison with the related literature, we connect theoretical consideration of critical offset characteristics with the offset composition eligible under CORSIA using corresponding offset registry data. We then discuss how airlines will interact with this offset market. Based on these findings, we show how the eligibility criteria need to be adjusted in order to increase climate and regulatory integrity under CORSIA, and discuss alternative regulation.

The results of our paper indicate that CORSIA’s eligibility criteria increase climate and regulatory integrity. However, a series of challenges remain to achieve carbon neutral growth. Nonetheless, there is high variation in eligible offsets, and many of them challenge climate and regulatory integrity with a high probability. The literature has shown that prices cannot be used as a signal for regulatory integrity [

10]. Our results also indicate that carbon offset prices cannot be used as a signal for climate integrity. Project characteristics such as project type are much more important; however, if price does not determine project integrity, then profit-maximizing airlines do not necessarily support offsets with low integrity.

The paper is structured as follows: in

Section 2, we present the institutional and technical background explaining the technical boundaries in aviation and critical offset characteristics. In

Section 3, we analyze the market for carbon offsets that are eligible under CORSIA using registry data.

Section 4 discusses our findings in light of alternative concepts.

Section 5 concludes the paper.

2. Institutional and Technical Background

This section highlights CORSIA’s institutional and technical background, which is important in understanding why it has been implemented and why it has often been criticized. We explain offset characteristics in more detail in order to increase awareness of potential conflicts with climate and regulatory integrity.

2.1. Scope of CORSIA and Eligible Offsets

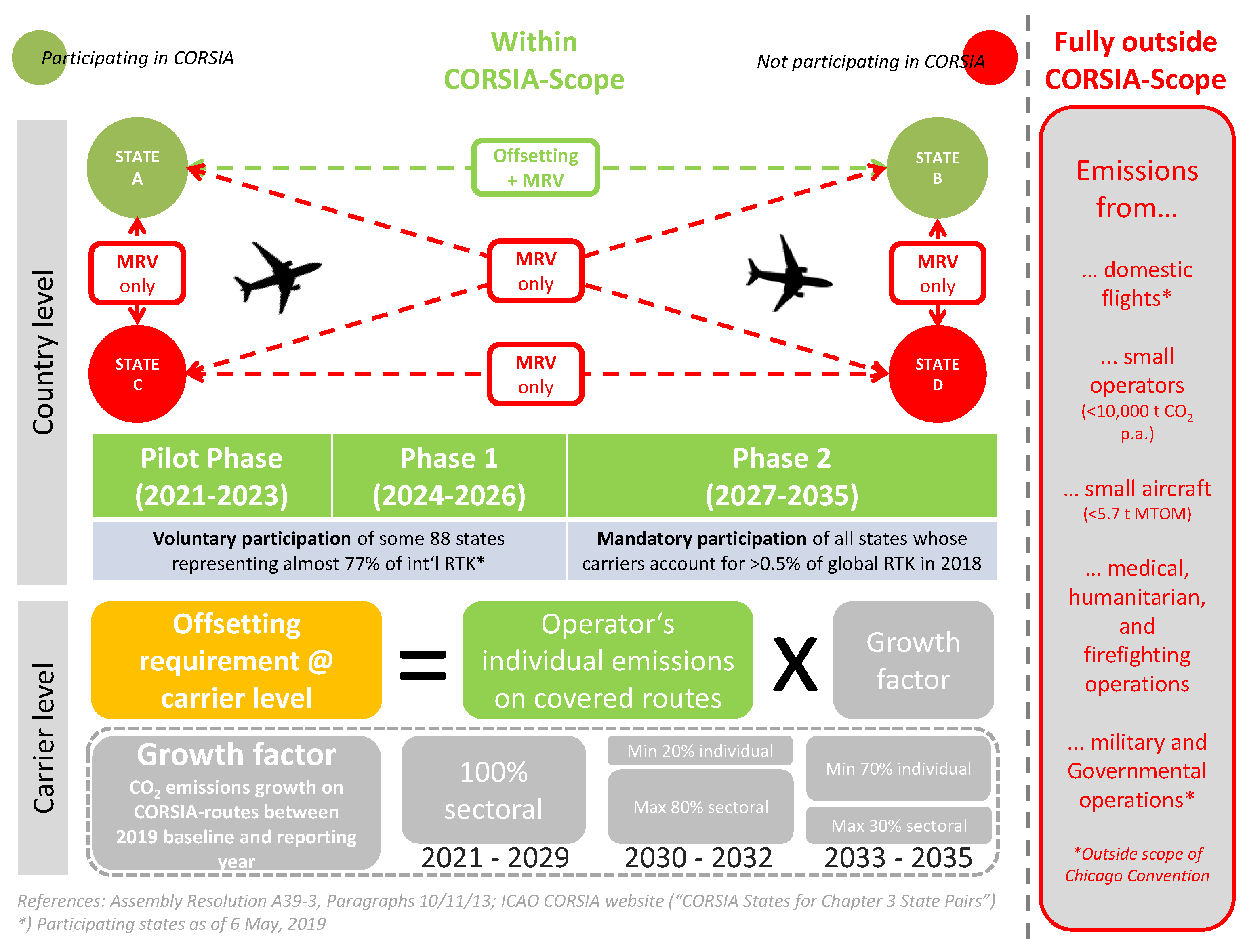

In October 2016, CORSIA was agreed at the 39th ICAO Assembly after decades of difficult international negotiations (Assembly Resolution A39-3). CORSIA aims at supporting ICAO’s Carbon Neutral Growth (CNG) goal from 2021 onwards. CORSIA is a baseline-and-credit scheme. The baseline above which emissions have to be compensated or abated was initially defined as the average total CO

2 emissions of all international flights under the scheme in the years 2019 and 2020, respectively. To reflect the COVID-19-related decline in 2020, this was changed in the meantime to 2019 only. CORSIA is the first global scheme for the limitation of aviation CO

2 emissions. However, criticism has been raised concerning CORSIA’s environmental ambitiousness, which we discuss below. CORSIA will capture an increasing number of participating states over time. In the medium term, roughly 90 percent of civil international air traffic will be included. CORSIA is a baseline-and-credit scheme, requiring offsets for all CO

2 emissions exceeding the 2019 emission baseline. Of course, a number of exemptions apply. For instance, CORSIA only applies to CO

2 emissions from international flights, as ICAO is the UN Agency for international civil air transport while domestic operations are fully under responsibility of the individual states. Other exemptions refer to emissions from small aircraft with an MTOM below 5.7 tons, small emitters emitting less than 10,000 tons of CO

2 annually, and humanitarian, medical, and firefighting flights. As ICAO is responsible for civil operations only, military and governmental flights are completely excluded. However, monitoring, reporting, and verification (MRV) of CO

2 emissions under CORSIA is mandatory for all ICAO contracting states irrespective of any voluntary or mandatory participation. MRV obligations started in 2019. CORSIA consists of three phases: Pilot Phase (from 2021–2023), Phase 1 (2024–2026), and Phase 2 (2027–2035). Whereas the Pilot Phase and Phase 1 are voluntary, participation in Phase 2 is mandatory for all states with airlines accounting for more than 0.5 of global international RTK in the year 2018. Only least-developed countries, land-locked developing countries, and small island nations are exempted from this obligation. Of course, voluntary participation is possible for any ICAO contracting state. Offset requirements are defined by the routes flown. Only routes between participating states (‘CORSIA States’) are subject to these offsetting requirements.

Figure 1 summarizes CORSIA’s main characteristics.

In March 2019, the ICAO Council adopted Emission Unit Eligibility Criteria (EUCs) which specify the requirements for carbon offset credits to be eligible under CORSIA. Carbon-offsetting programs have to fulfil these requirements and need to be approved by the ICAO Council as eligible programs. Currently, six offset program standards are eligible: Clean Development Mechanism, Gold Standard, VERRA, American Carbon Registry (ACR), Climate Action Reserve (CAR), and China Greenhouse Gas Voluntary Emission Reduction Program (GHG). Among these programs, offsets are eligible from projects that started their first crediting period from 1 January 2016 and in respect of emissions reductions that occurred through 31 December 2020. Certain program specific offsets have been declared as non-eligible [

11].

2.2. Technical Boundaries Justifying Offsetting

In the past, fuel efficiency in aviation has increased by around two percent per year. These environmental benefits have been outpaced by sustained growth in air traffic, which is likely to double in the next decade [

12]. Under such growth scenarios, sector-wide net emission reductions are very ambitious, especially because advanced technologies for clean flying such as synthetic fuel are not yet in operation.

Offsetting seems to be particularly attractive for the air transport industry. This industry is considered to be a ‘hard(er)-to-abate sector’, both for technological and economic reasons. Marginal abatement costs in the aviation sector are considerably higher than in other (transport) sectors. This is because fuel costs have a share of about one third of total production costs in air transport; the sector has constantly been trying to cut fuel costs for decades. Therefore, it is reasonable to assume that reducing fuel costs has been in the very interest of the aviation industry for many years, and relatively less expensive solutions have mostly been implemented.

Hydrocarbons, which are the root cause of the carbon emissions of air transport, can be regarded for aviation applications as optimal energy carriers. They feature an optimal combination of chemical characteristics, first and foremost energy density, along with further properties (freezing point, handling safety, storability) and economic characteristics such as ubiquitous availability and affordability.

Alternative energy carriers and propulsion technologies, which can be introduced in ground transport with relative ease, do not work as technological equivalents in air transport. Batteries allow electrical aircraft for the foreseeable future to be operated with only a small payload over distances of less than 500 km. Unless not currently foreseeable progress in battery technology is made, long-haul flights will remain unfeasible on battery power.

While hydrogen would be technologically feasible, it is associated with numerous disadvantages. First, an enormous amount of green electricity would be required to produce hydrogen for the air transport sector alone. Second, storage and distribution is challenging due to its physical properties, such as the propensity to diffuse through tank walls. Third, the low overall efficiency measured as a proportion of final energy content available for propulsion to the energy input required to produce green hydrogen will likely lead to relatively high prices. Fourth, the size and weight of hydrogen tanks would reduce the energy efficiency of aircraft. Last, emissions of water vapor, contrails, and nitrogen oxides (in the case of direct hydrogen combustion in gas turbines) at high altitudes occur with hydrogen powered aircraft and contribute to so-called non-CO

2 climate effects. Aviation contributes to climate change by both CO

2 and non-CO

2 effects, such as ozone and methane changes from NOx emissions or contrails and contrail cirrus. The climate-relevant effects from non-CO

2 species can be even larger than the effects from CO

2 [

13]. Hence, even with an air transport sector hypothetically relying on hydrogen as energy carrier, the need to offset climate impacts will be present to a certain extent. This similarly applies to a situation where hydrocarbons synthetized from water and CO

2 captured from ambient air under utilization of green electricity would be utilized. While the CO

2 would be subject to a circular economy where the same amount of emitted CO

2 is captured and recycled to produce new hydrocarbon fuels, the non-CO

2 effects of water vapor, contrails, cloud-inducing ice crystals and nitrogen oxides would persist.

Hence, a completely climate-neutral aviation system is far from being realistic in the foreseeable future, and mitigation of climate impacts of aviation by other means remains a necessity.

2.3. Challenges for CORSIA’s Climate and Regulatory Integrity

Most challenges for regulatory and climate integrity differ by project type, region, and size, and some are unilateral. By implementing safeguard clauses and verification and monitoring procedures, CORSIA-eligible verification standards try to ensure the climate and regulatory integrity of carbon offsetting.

For a better understanding of the eligible carbon offset market under CORSIA, it is important to know that the CDM which laid the foundation of certified offsetting started as a cost-efficient scheme for developing countries to comply with emission reduction targets. Compared with today’s certification procedures, offsets were less regulated [

14,

15]. Moreover, no particular institutional or financial incentives have been implemented that benefit local communities. As a response, private programs such as the Gold Standard have developed project methodologies take sustainable development benefits and safeguard clauses into account [

16]. Offset portfolios and certification procedure have been adjusted in response to shortcomings in regulatory and climate integrity. For example, Gold Standard has decided to exclude controversial project types such as large dams from its portfolio [

17]. The CDM has regularly adjusted its monitoring and verification methodology. As a result, project-specific characteristics are much more important for integrity than differences between verification standards [

10]. However, challenges remain.

2.3.1. Additionality

Additionality is a basic problem in identifying offsets’ net carbon reductions. The climate effect of carbon offsets hinges on whether the project would have occurred in its absence. If the project would have been conducted anyway, emissions are not reduced by the offset scheme, and are therefore not additional. All project types face the problem of additionality stemming from asymetric information and uncertainty. Due to asymmetric information, the opportunity costs of investors are private knowledge in the form of investment decisions, leading to a free-riders problem by generating additional revenues with carbon offsets. It can be argued that additionality is an inherently uncertain concept due to its dependence on an unobservable counterfactual scenario [

18]. Even if it were known that carbon offsets are necessary for today’s investments, there would be uncertainty as to whether tomorrow’s investors would have invested in the same project without carbon offsets. Later investments could be driven by changes in legislation or efficiency gains. For example, many countries have introduced legislation to support the use of efficient lighting, which has been within the scope of several offset projects [

19]. Ensuring additionality from nature-based solutions requires an accurate baseline that provides the volume of emissions that would have occurred in the absence of that project. In the case of forest-based carbon storage, the uncertainty of baselines is relatively high [

20]. Furthermore, inappropriate tree planting on natural grasslands and peatlands can represent an additional challenge by adding more carbon to the atmosphere than they take up as carbon-rich soils are disturbed [

21,

22]. In terms of additionality, small-scale projects outperform large-scale projects due to lower economic returns of scale. Most large-scale projects would have occurred independent of offsetting investments either due to their high profitability or due to public investment [

5].

2.3.2. Adverse Effects

Adverse effects can challenge carbon offsetting. From the perspective of policy makers, carbon offsetting is complex. It brings together subjects from very different jurisdictions, usually highly regulated carbon emitters and carbon savers that operate in less developed and regulated markets. Frequently, it is not only carbon that is traded, it is regulation of economic activity, which increases the risk of adverse effects such as social oppression or damage to biodiversity. In the case of adverse effects, risk factors include the location, project type, and project size. Furthermore, there is substantial variation in co-benefits and adverse effects across different project types [

23,

24,

25,

26,

27,

28,

29]. Biomass, land-use, and wind projects contribute more co-benefits and fewer adverse effects compared to projects targeted on industrial emissions or large dams [

14,

23,

30]. However, variation can be high even within the same project type. For example, the probability of social oppression or negative effects on biodiversity is higher for large-scale projects independent of the project type [

31,

32,

33,

34,

35].

Currently, small-scale energy efficiency projects targeted to local populations, such as cook stove projects which replace fireplaces with efficient stoves, tend to be the best offsetting practice, especially due to the context of high financial need. From an economic point of view, it appears counterintuitive to invest in inefficient projects. However, this is a simple mechanism to guarantee additionality, and is often used in carbon offset standards. The less profitable a project is, the less likely it is that a private investor would have invested in it anyway. However, the corresponding literature does not analyze how such inefficient investments affect the local economy in the longer term. In theory, they could crowd out more efficient and longer-lasting investments that would have been installed by the local government due to political pressure or by local businesses, thus reducing economic growth [

36].

For this reason, the current best practices in offsetting potentially induce a trade-off between additionality and adverse effects. While the importance of this might be limited today due to the small share of such projects, it could became sizable if offsetting increases in importance. More importantly, if projects have a negative impact on the local population they are less likely to be maintained as carbon stores in the long term [

37,

38].

2.3.3. Permanency and Carbon Leakage

Permanency and carbon leakage are two major challenges in ensuring effective net carbon reductions. However, non-permanency and carbon leakage are problems that are specific to certain project types, especially projects based on natural carbon storage such as reforestation. By declaring regions as protected, carbon leakage may occur if the agricultural industry simply shifts to unprotected locations. Non-permanency occurs, for example, if carbon releases are only delayed. Guaranteeing permanency of carbon storage is important, as it can only develop its climate effect if storage is guaranteed for at least 100 years, assuming that climate change will have been solved by that time [

3]. Ironically, climate change challenges natural carbon storage, as it increases the risk of wildfires or drought [

39]. Furthermore, human activity affects permanency if the stored biomass competes with other economic interests the economic value of which we do not yet know today [

40]. Therefore, the project region can have a sizable impact on the climate integrity, especially with respect to carbon leakage of land use projects. The more attractive the land used for reforestation is for agricultural production, the higher the probability of carbon leakage by cutting unprotected forests as a substitute. Thus, climate integrity is higher in areas with degraded peatlands, for example, which are no longer in agricultural use [

41]. The scale of activities matters for permanence risks and leakage as well. Large-scale forest programs, for example, are more difficult to control and predict considering the size of territories, political priority shifts, oscillations in price of agricultural commodities, and variations in government budgetary spending for forest protection [

4].

2.3.4. Assessment Procedures

While assessment procedures improve the climate and regulatory integrity of carbon offset projects, they come with their own costs. Safeguard clauses have been developed to identify and reduce adverse effects and verification and monitoring processes have been implemented to ensure additionality, permanency, and avoidance of carbon leakage [

16]. However, assessment is partially subjective, as project characteristics are difficult to validate [

26] and core indicators can be subject to manipulation [

31]. Many certified offset projects are suspected of not being effective in terms of net GHG reduction [

5,

19]. A critical challenge is determining the optimal balance between compliance and supply. If quality standards are too stringent, desirable projects may not participate [

42]. Satisfying requirements with respect to additionality, permanence, and avoidance of adverse effects increases transaction and investment costs. For example, where there is a risk of non-permanence, verification standards require carbon offset projects to insure against it by making use of buffer accounts. Projects contribute a share of carbon credits to a buffer account and, in case of reversals, an equivalent number of buffer credits are canceled. This creates high opportunity costs. These may be reduced by simplifying validation processes, although at the cost of lower climate and regulatory integrity [

7]. As a result, adverse selection challenges offset standards [

43,

44]. Large-scale projects have lower transaction costs than small-scale projects, and transaction costs vary between project types. For example, they are on average lower for carbon storage compared to carbon reduction [

45].

2.3.5. Other Unsolved Issues

Outside the scope of verification standards, several additional unsolved issues remain. One example is double counting, where the same emissions reduction is counted by both the host country and the offset purchaser. Prior to the Paris Agreement this was less of a concern, because only developed countries had absolute emission reduction targets. As countries with a reduction target were able to purchase offsets from countries without such targets, the risk of double counting was less relevant. Under the Paris Agreement, all parties have absolute emissions reduction targets. Therefore, it must be ensured that emission reductions counted for offsets are not also counted by the host country’s Paris target as well. It remains unclear how such double counting can be avoided [

46].

Taken together, there are several trade-offs between additionality and adverse effects on the one hand and permanency and leakage on the other. Carbon reduction projects suffer more from additionality and adverse effects, while carbon storage schemes such as reforestation are more prone to permanency problems and carbon leakage. Furthermore, there is a trade-off between transaction costs and additionality with regard to project size. Transaction costs are low for large-scale projects; however, large-scale projects have a lower probability of being additional.

4. Discussion

Actual competition in the airline sector varies between different direct and indirect origin–destination markets [

56]. Competition may occur from other modes of transport (e.g., cars and trains) on short hauls, from other airlines operating on the same city pairs (or even airport pairs), and from other hub airlines operating alternative routings between a given origin and destination. Consequently, in many cases passengers have a choice between different travel options. Along with other factors (subsidization of carriers, political influence, overcapacities, seasonality of demand), this may partly explain why airlines tend to historically operate with low margins [

57].

As a result, it is reasonable to assume that under CORSIA airlines will have the incentive to buy the cheapest offsets available. While this is not per se ineffective from an environmental view, as our results have shown that the offset price is not a sufficient indicator for the offsets’ integrity, we can expect the demand for offsets (from the airline sector) to rise significantly once the COVID-19 crisis has been overcome and air transport begins to surpass 2019 (the baseline year) volumes. This will automatically mean that offsets with low integrity will be purchased, especially as there will hardly be any additional willingness to pay for a premium in offset quality.

While the issue of potentially low offset integrity is less critical for the private voluntary offset market, low offset integrity in a large-scale legally binding setting such as CORSIA lulls industries, policy makers, and eventually consumers into a false sense of integrity.

The only way to increase the effectiveness of CORSIA would hence be a drastic increase of offset requirements with regard to additionality, non-leakage, and permanence, along with improved monitoring and reporting standards. As a result, offset prices would significantly rise. This is unlikely to be accepted at the ICAO level.

However, from an environmental point of view, the situation is urgent now. The impacts of climate change are tangible and technological solutions are only feasible in the long term. In the short term, an alternative approach could be a ‘laissez-faire’ approach regarding CORSIA offset requirements and convincing or forcing a growing number of airlines to voluntarily buy additional better offsets from small-scale well curated projects, or to introduce more ambitious requirements at regional levels, e.g., in the EU.

‘EcoLabelling’ for offsets could be a way to do this, as is known from animal welfare labelling in the meat industry in countries such as Germany, where labels differentiate between, e.g., a lowest score for meat meeting the legal requirements and a highest score for organic meat [

58]. Airlines under public ownership could be forced by their public shareholders to buy higher quality offsets, and other airlines might jump at the opportunity for marketing reasons.

However, the more relevant carbon offsetting becomes as an instrument for climate legislation and the more it becomes present in public awareness, the more important rebound effects become. Offsetting negative externalities of consumption increases its utility by lowering the shame of consumption, thereby increasing demand [

59]. Such rebound effects can become a serious problem in a situation where carbon offsetting does not hold its net carbon reduction promises, potentially resulting in a net carbon increase. CORSIA’s rebound effects should be addressed by future research.

5. Conclusions

In this paper, we show that carbon offsetting, even under well established program standards, can barely support its promise of climate neutral growth in aviation. This finding is based on a systematic review of carbon offset characteristics with regard to climate and regulatory integrity and an empirical analysis of the registry data of the most important offset standards under CORSIA.

These findings have implications for policy. Based on carbon offsets, CORSIA was launched to ensure climate-neutral growth in international flights from 2021 onwards. Thus, airlines need to compensate every additional ton above the 2019 baseline with one equivalent ton released by carbon offset projects. The eligibility criteria established by the ICAO Council specify the requirements for offsets that can be used, currently resulting in six eligible offset program standards.

CORSIA’s climate-neutral growth aspiration would require every offset to mirror net carbon reduction. Many offsets eligible under CORSIA cannot guarantee this, facing the three major challenges of additionality (carbon reductions would not have occurred without the offset project), non-leakage (carbon reduction somewhere does not increase carbon emissions somewhere else), and permanency (today’s reduction might be released tomorrow). Ensuring maximum climate integrity under CORSIA would dramatically reduce the carbon offset supply and increase transaction costs. This stems from the fact that while all eligible offset programs offer projects with high integrity, most of their offset supply is generated in large-scale projects considered to have low integerity, such as renewable energy projects. However, CORSIA’s financial attractiveness is based on these offsets.

Another critical characteristic of eligible carbon offsets are adverse effects. Program standards have considerably improved their regulatory integrity by implementing safeguard clauses which take effects on the local community into account. However, while direct effects on the local community, such as social oppression, can be reduced by monitoring compliance with safeguard clauses, indirect effects such as crowding out are more difficult to observe.

If airlines are not only interested in profit maximization, it would be interesting to know whether higher prices indicate higher offset integrity for them. On the contrary, if airlines are profit maximizers and favor the cheapest offsets, it would be important to know whether this would support offsets with minor climate impact. Our results show that offset prices cannot be used as a signal to maximize climate integrity. Projects with higher offset prices do not guarantee a higher likelihood of additionality.

To ensure the maximum climate and regulatory integrity of CORSIA, policy makers should consider prioritizing carbon reduction projects that are relatively small, aiming at energy efficiency at the consumer level and selected carbon storage projects. Positive examples exists among established climate programs. In the case of small energy-efficient projects, several climate programs have focused on such projects, including the World Bank’s Pilot Auction Facility for Methane and Climate Change Mitigation and the Norwegian purchase program. However, the current supply of such offsets is extremely low and does not meet CORSIA’s demand [

60]. Furthermore, it is unclear whether there is enough potential supply. Thus, we emphasize the importance of natural carbon storage under high standards despite its own major weaknesses in order to achieve urgent large-scale carbon reductions and mitigate climate change.

Taken together, our results reveal carbon offsetting as a weak second best solution to achieving carbon neutral growth, which should be considered as transitional. This is in line with the findings of the 2022 IPCC report arguing that CORSIA will not sufficiently decrease aviation carbon emissions in order to be consistent with the temperature goals of the Paris agreement [

61]. In order to move closer to the aspiration of carbon-neutral growth, CORSIA’s eligibility criteria need to improve. Moreover, airlines should be further encouraged to invest more in advanced technologies for clean flying. Carbon cap-and-trade schemes can provide important incentives for this.