Monitoring of Time and Cost Variances of Schedule Using Simple Earned Value Method Indicators

Abstract

1. Introduction

2. Materials and Methods: Description of the Scheduled Examined

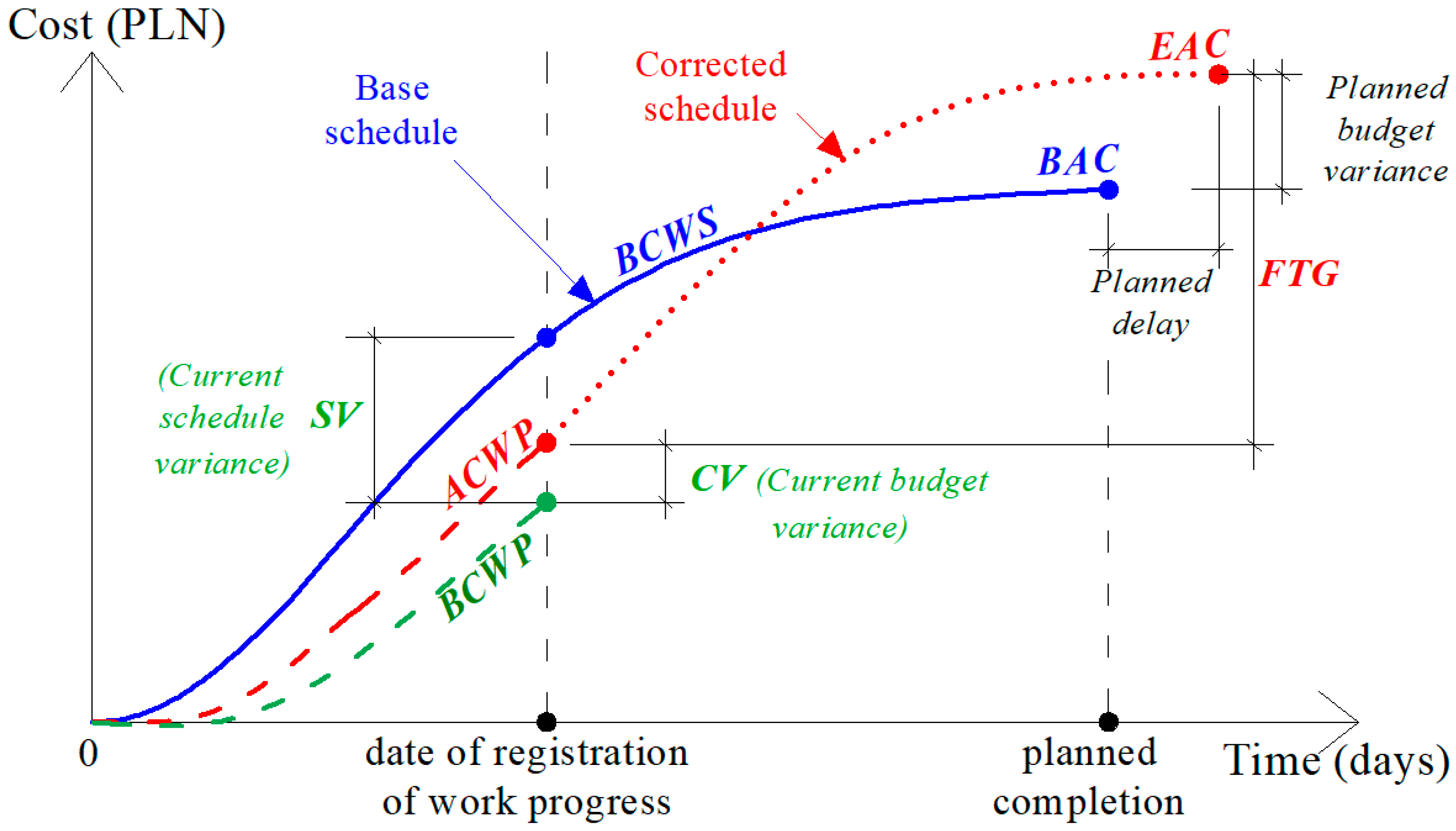

- Cost Variance (CV):

- Schedule variance (SV):

- Indicator for monitoring changes in the assumed financial liquidity due to arising time variances from the schedule (T/S):

- Indicator for monitoring changes in assumed financial liquidity due to arising variances from planned costs (T/C):

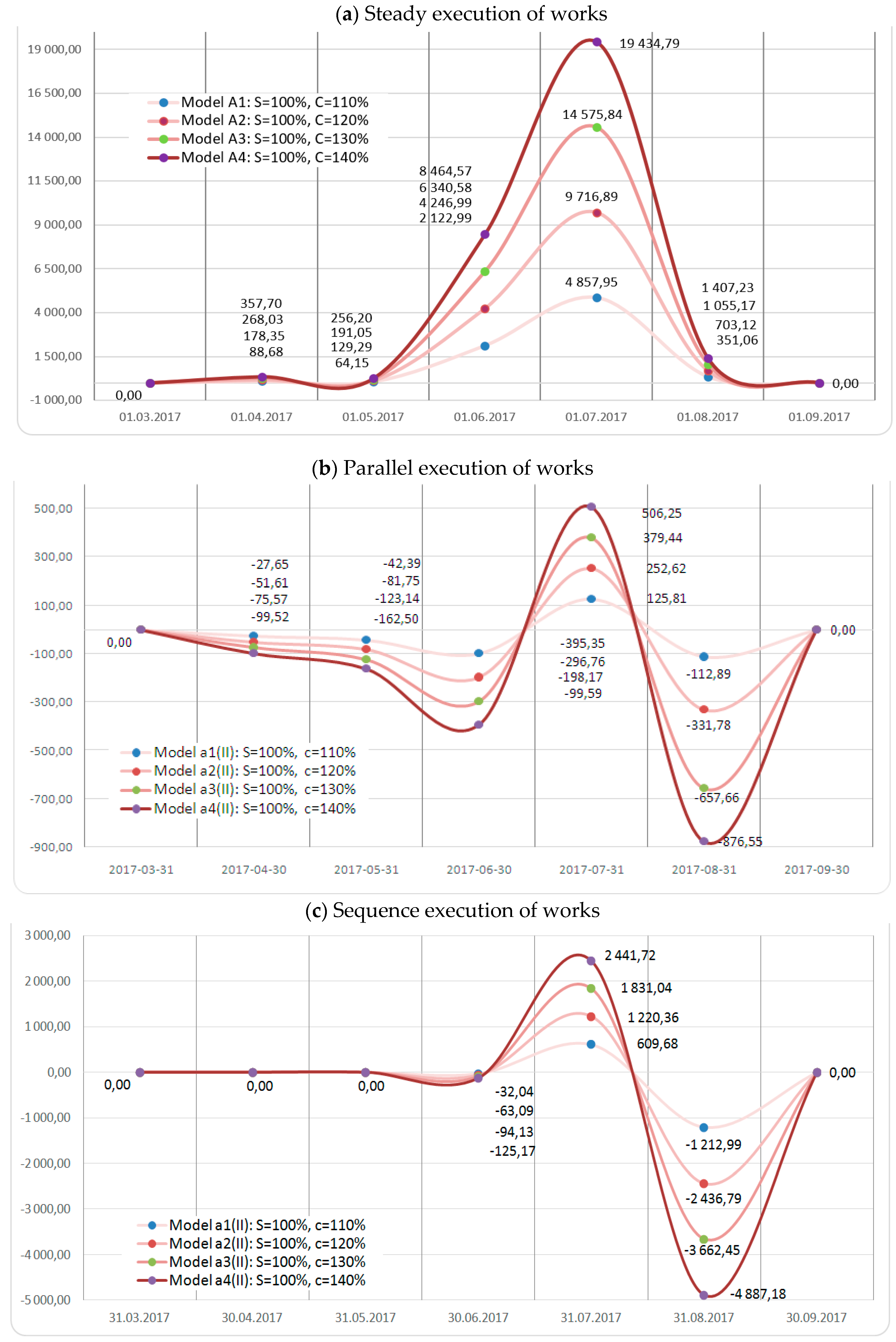

3. Results: Application of T/S and T/C Monitoring

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Czyżewski, A. Economic Analysis in the Implementation of Investment Projects; Publishing house of the Poznań University of Economics: Poznań, Poland, 2011. [Google Scholar]

- Project Management Institute. A Guide to the Project Management Body of Knowledge (PMBOK GUIDE), 6th ed.; Project Management Institute (PMI): Newtown Square, PA, USA, 2017. [Google Scholar]

- Połoński, M. Management of Construction Investment Process; Wydawnictwo SGGW: Warszawa, Poland, 2018. (In Polish) [Google Scholar]

- Konior, J.; Szóstak, M. The S-Curve as a Tool for Planning and Controlling of Construction Process—Case Study. Appl. Sci. 2020, 10, 2071. [Google Scholar] [CrossRef]

- Konior, J.; Szóstak, M. Methodology of Planning the Course of the Cumulative Cost Curve in Construction Projects. Sustainability 2020, 12, 2347. [Google Scholar] [CrossRef]

- Al-Jibouri, S.H. Monitoring systems and their effectiveness for project cost control in construction. Int. J. Proj. Manag. 2003, 21, 145–154. [Google Scholar] [CrossRef]

- Lo, W.; Chen, Y.-T. Optimization of Contractor’s S-Curve. In Proceedings of the 24th International Symposium on Automation & Robotics in Construction (ISARC 2007), Kochi, India, 19–21 September 2007; pp. 417–420. Available online: https://www.irbnet.de/daten/iconda/CIB11259.pdf (accessed on 18 March 2020).

- Hsieh, T.-Y.; Hsiao-Lung Wang, M.; Chen, C.-W. A Case Study of S-Curve Regression Method to Project Control of Construction Management via T-S Fuzzy Model. J. Mar. Sci. Technol. 2004, 12, 209–216. [Google Scholar]

- Chen, H.L.; Chen, W.T.; Lin, Y.L. Earned value project management: Improving the predictive power of planned value. Int. J. Proj. Manag. 2016, 34, 22–29. [Google Scholar] [CrossRef]

- Trocki, M. Modern Project Management; P.W.E.: Warsaw, Poland, 2012. [Google Scholar]

- Dziadosz, A.; Kapliński, O.; Rejment, M. Usefulness and fields of the application of the Earned Value Management in the implementation of construction projects. Bud. Archit. 2014, 13, 357–364. [Google Scholar] [CrossRef]

- Waris, M.; Khamidi, M.F.; Idrus, A. The Cost Monitoring of Construction Projects through Earned Value Analysis. J. Constr. Eng. Proj. Manag. 2012, 2, 42–45. [Google Scholar] [CrossRef]

- Bhosekar, S.K.; Vyas, G. Cost Controlling Using Earned Value Analysis in Construction Industries. Int. J. Eng. Innov. Technol. 2012, 1, 324–332. [Google Scholar]

- Vandevoorde, S.; Vanhoucke, M. A comparison of different project duration forecasting methods using earned value metrics. Int. J. Proj. Manag. 2006, 24, 289–302. [Google Scholar] [CrossRef]

- Howes, R. Improving the performance of Earned Value Analysis as a construction project management tool. Eng. Constr. Archit. Manag. 2000, 7, 399–411. [Google Scholar] [CrossRef]

- Czemplik, A. Application of earned value method to progress control of construction projects. Procedia Eng. 2014, 91, 424–428. [Google Scholar] [CrossRef]

- Narbaev, T.; De Marco, A. Combination of growth model and earned schedule to forecast project cost at completion method. J. Constr. Eng. Manag. 2014, 140, 04013038. [Google Scholar] [CrossRef]

- Kim, Y.; Ballard, G. Is the earned-value method an enemy of work flow? In Proceedings of the Eighth Annual Conference of the International Group for Lean Construction (IGLC-8), Brighton, UK, 17–19 July 2000; pp. 142–144. [Google Scholar]

- Przywara, D. Time-Cost Analysis in Monitoring the Works of the Construction Schedule. Ph.D. Thesis, Opole University of Technology, Opole, Poland, 2019. [Google Scholar]

- Maravas, A.; Pantouvakis, J.-P. Project cash flow analysis in the presence of uncertainty in activity duration and cost. Int. J. Proj. Manag. 2012, 30, 374–384. [Google Scholar] [CrossRef]

- De Koning, P.; Vanhoucke, M. Stability of earned value management: Do project characteristics influence the stability moment of the cost and schedule performance index. J. Mod. Proj. Manag. 2016, 4, 8–25. [Google Scholar]

- Vanhoucke, M.; Vereecke, A.; Gemmel, P. The project scheduling game (PSG): Simulating time/cost trade-offs in projects. Proj. Manag. J. 2005, 36, 51–59. [Google Scholar] [CrossRef]

- Przywara, D.; Rak, A. Analysis of time-cost of monitoring schedule by Earned Value Method. Tech. J. 2017, 2-B(6), 41–50. [Google Scholar]

- Dodson, M.; Defavari, G.; De Carvahlo, V. Quality: The third element of Earned Value Management. Procedia Comput. Sci. 2015, 64, 932–939. [Google Scholar] [CrossRef][Green Version]

- Chen, Q.; Jin, Z.; Xia, B.; Skitmore, M. Time and cost performance of design build projects. J. Constr. Eng. Manag. 2016, 142, 162–169. [Google Scholar] [CrossRef]

- Khamooshi, H.; Abdi, A. Project duration forecasting using Earned duration management with exponential Smoothing techniques. J. Manag. Eng. 2017, 33, 04016032. [Google Scholar] [CrossRef]

- Przywara, D.; Rak, A. Modeling of optimal timing transition of front production by the two-punctual network note schedule. Open J. Archit. Des. 2014, 2, 1–5. [Google Scholar] [CrossRef]

| Registration Stage/Variance Scenario | BCWP BCWS ACWP (PLN) | BCWP-BCWS (PLN) | BCWP-ACWP (PLN) | T/C T/S (−) |

|---|---|---|---|---|

| Models a1(II): s = 100%, c = 110% (for T/S)///a1b1(II): s = 105%, c = 110% (for T/C) | ||||

| 31.03.2017 | 736.965,50 | 0.00 | 0.00 | 0.000 |

| 736.965,50 | 0.000 | |||

| 736.965,50 | ||||

| 30.04.2017 | 2.578.038,90 | −29.918,27 | −97.036,77 | 0.647 |

| 2.607.957,17 | −27.65 | |||

| 2.675.075,67 | ||||

| 31.05.2017 | 5.249.292,03 | −68.492,99 | −208.625,09 | 0.672 |

| 5.317.785,02 | −42.39 | |||

| 5.457.917,12 | ||||

| 30.06.2017 | 8.433.684,65 | −102.503,09 | −310.400,95 | 0.661 |

| 8.536.187,74 | −99.59 | |||

| 8.744.085,60 | ||||

| 31.07.2017 | 14.919.855,83 | −217.637,82 | −642.776,04 | 0.661 |

| 15.137.493,65 | 125.81 | |||

| 15.562.631,87 | ||||

| 31.08.2017 | 18.636.591,14 | −292.093,49 | −725.935,68 | 0.653 |

| 18.928.684,63 | −112.89 | |||

| 19.362.526,82 | ||||

| 30.09.2017 | 19.785.464,08 | −321.387,89 | −964.163,67 | 0.667 |

| 20.106.851,97 | 0.00 | |||

| 20.749.627,75 | ||||

| Models a2(II): s = 100%, c = 120% (for T/S)///a2b2(II): s = 110%, c = 120% (for T/C) | ||||

| 31.03.2017 | 736.965,50 | 0.00 | 0.00 | 0.000 |

| 736.965,50 | 0.00 | |||

| 736.965,50 | ||||

| 30.04.2017 | 2.545.693,31 | −62.263,86 | −187.533,60 | 0.647 |

| 2.607.957,17 | −51.61 | |||

| 2.733.226,91 | ||||

| 31.05.2017 | 5.177.570,36 | −140.214,66 | −413.977,66 | 0.669 |

| 5.317.785,02 | −81.75 | |||

| 5.591.548,02 | ||||

| 30.06.2017 | 8.315.325,53 | −220.862,21 | −634.603,20 | 0.675 |

| 8.536.187,74 | −198.17 | |||

| 8.949.928,73 | ||||

| 31.07.2017 | 14.705.597,15 | −431.896,50 | −1.285.552,08 | 0.664 |

| 15.137.493,65 | 252.62 | |||

| 15.991.149,23 | ||||

| 31.08.2017 | 18.341.804,13 | −586.880,50 | −1.610.296,69 | 0.631 |

| 18.928.684,63 | −331.78 | |||

| 19.952.100,82 | ||||

| 30.09.2017 | 19.464.076,19 | −642.775,78 | −1.928.327,34 | 0.667 |

| 20.106.851,97 | 0.00 | |||

| 21.392.403,53 | ||||

| Models a3(II): s = 100%, c = 130% (for T/S)///a3b3(II): s = 115%, c = 130% (for T/C) | ||||

| 31.03.2017 | 736.965,50 | 0.00 | 0.00 | 0.000 |

| 736.965,50 | 0.00 | |||

| 736.965,50 | ||||

| 30.04.2017 | 2.505.066,94 | −102.890,23 | −313.913,81 | 0.672 |

| 2.607.957,17 | −75.57 | |||

| 2.818.980,75 | ||||

| 31.05.2017 | 5.089.287,12 | −228.497,90 | −700.919,66 | 0.665 |

| 5.317.785,02 | −123.14 | |||

| 5.790.206,78 | ||||

| 30.06.2017 | 8.196.966,41 | −339.221,33 | −1.097.445,08 | 0.689 |

| 8.536.187,74 | −296.76 | |||

| 9.294.411,49 | ||||

| 31.07.2017 | 14.494.399,50 | −643.094,15 | −1.925.267,09 | 0.666 |

| 15.137.493,65 | 379.44 | |||

| 16.419.666,59 | ||||

| 31.08.2017 | 18.050.078,17 | −878.606,46 | −2.491.596,65 | 0.611 |

| 18.928.684,63 | −657.66 | |||

| 20.541.674,82 | ||||

| 30.09.2017 | 19.145.749,34 | −961.102,63 | −2.889.429,97 | 0.667 |

| 20.106.851,97 | 0.00 | |||

| 22.035.179,31 | ||||

| Models a4(II): s = 100%, c = 140% (for T/S)///a4b4(II): s = 120%, c = 140% (for T/C) | ||||

| 31.03.2017 | 736.965,50 | 0.00 | 0.00 | 0.000 |

| 736.965,50 | 0.00 | |||

| 736.965,50 | ||||

| 30.04.2017 | 2.464.440,57 | −143.516,60 | −418.211,95 | 0.692 |

| 2.607.957,17 | −99.52 | |||

| 2.882.652,52 | ||||

| 31.05.2017 | 5.010.408,67 | −307.376,35 | −924.475,16 | 0.662 |

| 5.317.785,02 | −162.50 | |||

| 5.934.883,83 | ||||

| 30.06.2017 | 8.086.375,80 | −449.811,94 | −1.451.298,99 | 0.695 |

| 8.536.187,74 | −395.35 | |||

| 9.537.674,79 | ||||

| 31.07.2017 | 14.285.360,56 | −852.133,09 | −2.562.823,39 | 0.668 |

| 15.137.493,65 | 506.25 | |||

| 16.848.183,95 | ||||

| 31.08.2017 | 17.760.510,91 | −1.168.173,72 | −3.370.737,92 | 0.598 |

| 18.928.684,63 | −876.55 | |||

| 21.131.248,83 | ||||

| 30.09.2017 | 18.829.581,19 | −1.277.270,78 | −3.848.373,90 | 0.667 |

| 20.106.851,97 | 0.00 | |||

| 22.677.955,09 | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Przywara, D.; Rak, A. Monitoring of Time and Cost Variances of Schedule Using Simple Earned Value Method Indicators. Appl. Sci. 2021, 11, 1357. https://doi.org/10.3390/app11041357

Przywara D, Rak A. Monitoring of Time and Cost Variances of Schedule Using Simple Earned Value Method Indicators. Applied Sciences. 2021; 11(4):1357. https://doi.org/10.3390/app11041357

Chicago/Turabian StylePrzywara, Daniel, and Adam Rak. 2021. "Monitoring of Time and Cost Variances of Schedule Using Simple Earned Value Method Indicators" Applied Sciences 11, no. 4: 1357. https://doi.org/10.3390/app11041357

APA StylePrzywara, D., & Rak, A. (2021). Monitoring of Time and Cost Variances of Schedule Using Simple Earned Value Method Indicators. Applied Sciences, 11(4), 1357. https://doi.org/10.3390/app11041357