Analysis of Potential Factors Influencing China’s Regional Sustainable Economic Growth

Abstract

:1. Introduction

2. Literature Review

3. Material and Methods

3.1. Data Acquisition

3.2. Emprical Methods

4. Results

4.1. Correlation Analysis

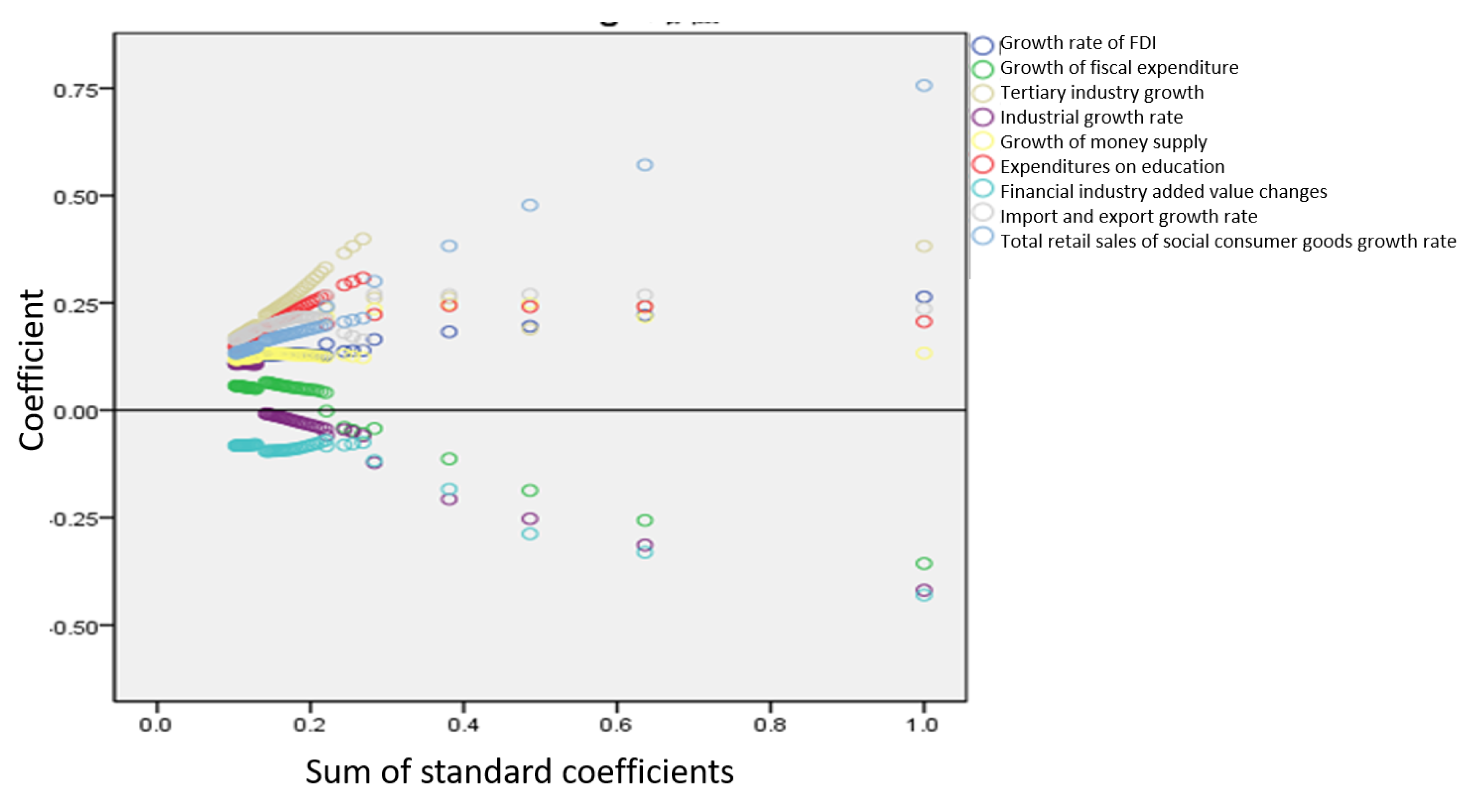

4.2. Variable Selection

4.3. Ordinary Least Squares Estimation

4.4. Stepwise Regression

4.5. Ridge Regression

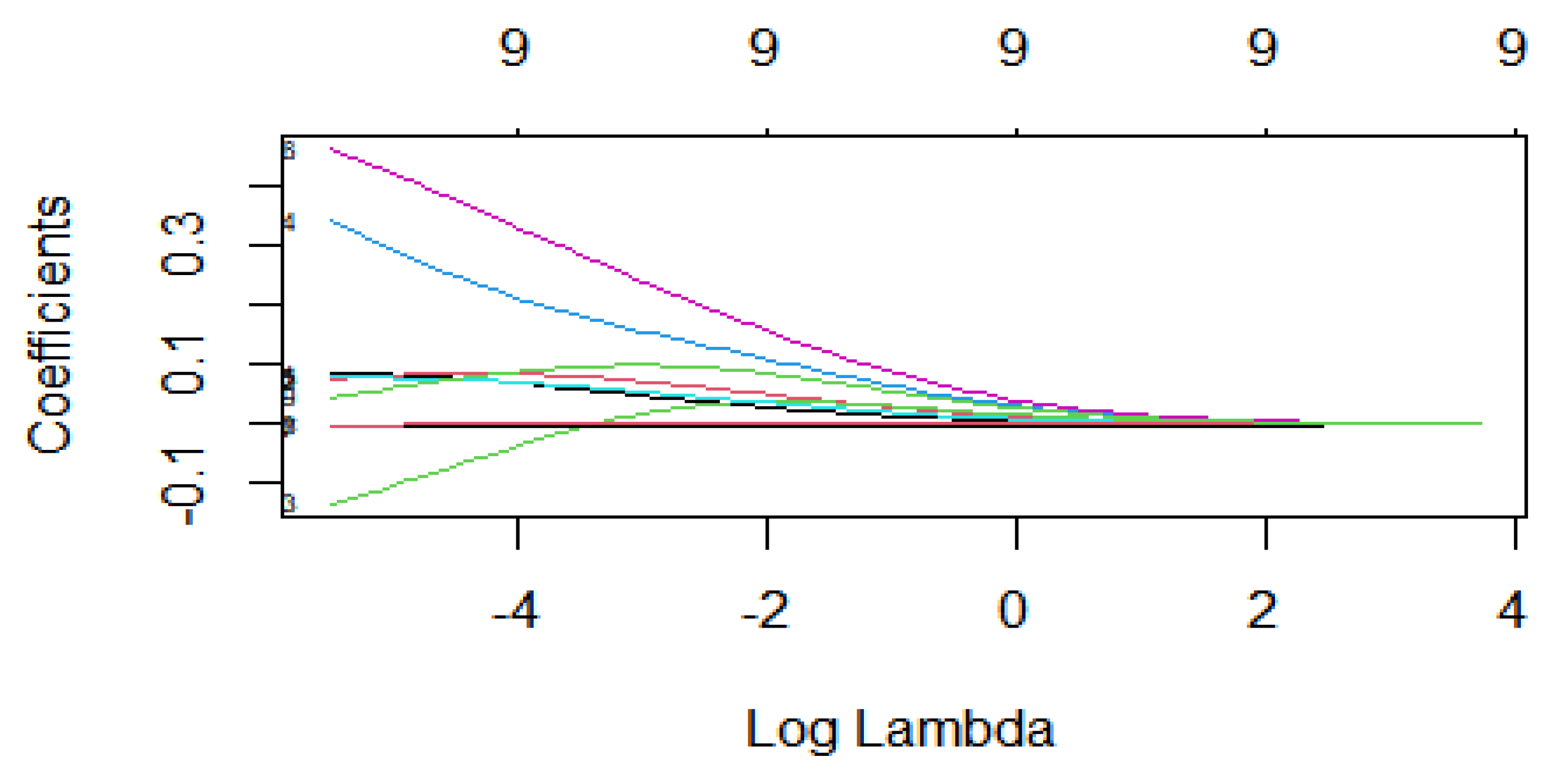

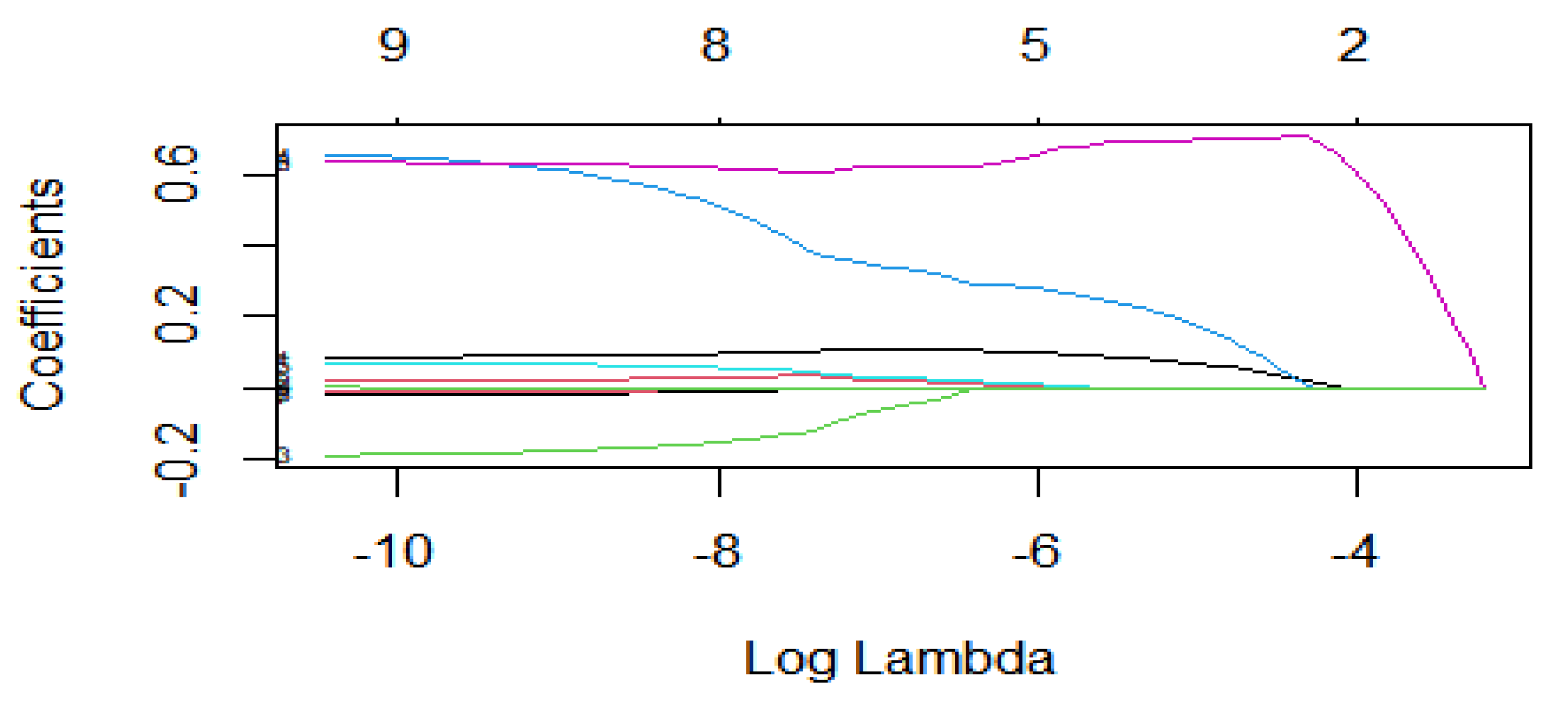

4.6. Lasso Regression

5. Comparative Analysis of the Variables Selected Based on the Four Methods

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Lucas, R.E.J. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Romer, P.M. The origins of endogenous growth. J. Econ. Perspect. 1994, 8, 3–22. [Google Scholar] [CrossRef] [Green Version]

- Kim, J.-I.; Lau, L.J. The sources of economic growth of the East Asian newly industrialized countries. J. Jpn. Int. Econ. 1994, 8, 235–271. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef] [Green Version]

- Wu, Y. Is China’s economic growth sustainable? A productivity analysis. China Econ. Rev. 2000, 11, 278–296. [Google Scholar] [CrossRef]

- Frolova, E.E.; Polyakova, T.A.; Dudin, M.N.; Rusakova, E.P.; Kucherenko, P.A. Information security of Russia in the digital economy: The economic and legal aspects. J. Adv. Res. L. Econ. 2018, 9, 89. [Google Scholar] [CrossRef]

- Fani, H.; Jiang, E.; Bagheri, E.; Al-Obeidat, F.; Du, W.; Kargar, M. User community detection via embedding of social network structure and temporal content. Inf. Process. Manag. 2020, 57, 102056. [Google Scholar] [CrossRef]

- Chen, J.; Zheng, H.; Wei, L.; Wan, Z.; Ren, R.; Li, J.; Li, H.; Bian, W.; Gao, M.; Bai, Y. Factor diagnosis and future governance of dangerous goods accidents in China’s ports. Environ. Pollut. 2019, 257, 113582. [Google Scholar] [CrossRef] [PubMed]

- Wang, X.; Du, X. Affecting Factors and Path Selection of Transformation of Economic Growth Pattern in China. J. Beijing Inst. Technol. 2018, 6, 104–111. [Google Scholar] [CrossRef]

- Larionova, M. The G20, BRICS and APEC in the System of International Institutions: A Piece of Good News for Global Governance. Vestn. Mezhdunarodnykh Organ. Int. Organ. Res. J. 2018, 13, 7–33. [Google Scholar] [CrossRef]

- Wu, Y.; Tam, V.W.; Shuai, C.; Shen, L.; Zhang, Y.; Liao, S. Decoupling China’s economic growth from carbon emissions: Empirical studies from 30 Chinese provinces (2001–2015). Sci. Total Environ. 2019, 656, 576–588. [Google Scholar] [CrossRef] [PubMed]

- Bank, W. The Human Capital Index 2020 Update: Human Capital in the Time of COVID-19; The World Bank: Washington, DC, USA, 2021. [Google Scholar]

- Higgins, P.; Zha, T.; Zhong, W. Forecasting China’s economic growth and inflation. China Econ. Rev. 2016, 41, 46–61. [Google Scholar] [CrossRef] [Green Version]

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Financ. 2021, 66, 101889. [Google Scholar] [CrossRef]

- Pratt, S. The challenge of betel nut consumption to economic development: A case of Honiara, Solomon Islands. Asia-Pac. Dev. J. 2015, 21, 103–120. [Google Scholar] [CrossRef]

- Brander, J.A.; Dowrick, S. The role of fertility and population in economic growth. J. Popul. Econ. 1994, 7, 1–25. [Google Scholar] [CrossRef]

- Xu, H.; Lai, M.; Qi, P. Openness, human capital and total factor productivity: Evidence from China. J. Chin. Econ. Bus. Stud. 2008, 6, 279–289. [Google Scholar] [CrossRef]

- Elgin, C.; Tumen, S. Can sustained economic growth and declining population coexist? Econ. Model. 2012, 29, 1899–1908. [Google Scholar] [CrossRef]

- Xu, Z.X.; Ding, R.Z. Measurement, Prediction and Path Selection of the Quality of Interprovincial Economic Development in China in the New Era. Political Econ. Rev. 2020, 172–194. [Google Scholar]

- Sibe, J.P.; Chiatchoua, C.; Megne, M.N. The long run relationship between population growth and economic growth: A panel data analysis of 30 of the most populated countries of the world. Análisis Económico 2016, 31, 205–218. [Google Scholar]

- De Jong, M.; Stout, H.; Sun, L. Seeing the People’s Republic of China through the Eyes of Montesquieu: Why Sino-European Collaboration on Eco City Development Suffers from European Misinterpretations of “Good Governance”. Sustainability 2017, 9, 151. [Google Scholar] [CrossRef] [Green Version]

- Sasaki, H.; Mino, K. Effects of Exhaustible Resources and Declining Population on Economic Growth with Hotelling’s Rule; 2021. Available online: https://mpra.ub.uni-muenchen.de/107787/ (accessed on 11 November 2021).

- Chen, Y.; He, H. Post project evaluation study on distribution network construction. Heilongjiang Electr. Power 2013, 01. [Google Scholar]

- Yang, X.Q.; Xiong, Q.Q.; Jiang, H. A Cointegration Analysis on the Relationship between Foreign Trade and Economic Growth in GuangDong Province. J. South China Agric. Univ. 2005, 2. [Google Scholar]

- Huang, Q.B.; Fan, H.M. Foreign Trade, Economic Growth and Upgrading of Industrial Structure:an Empirical Test Based on China, India, and Asian “Four Little Dragons”. J. Int. Trade 2010, 2, 38–44. [Google Scholar] [CrossRef]

- Peng, G.Z.W.; Li, G. Influence of International Trade on Regional Economic Growth Rate—Empirical Analysis Based on the Data of Prefecture-level Cities in China. Inq. Into Econ. Issues 2020, 10, 158–169. [Google Scholar]

- Tongbin, Z.; Liu, F. Trade Openness and Motive Force of Economic Growth-Reexamination Based on the Channels of Capacity Utilization and Capital Deepening. J. Int. Trade 2018. [Google Scholar] [CrossRef]

- Frankel, J.A.; Romer, D.H. Does trade cause growth? Am. Econ. Rev. 1999, 89, 379–399. [Google Scholar] [CrossRef] [Green Version]

- Jarreau, J.; Poncet, S. Export sophistication and economic growth: Evidence from China. J. Dev. Econ. 2012, 97, 281–292. [Google Scholar] [CrossRef] [Green Version]

- Belazreg, W.; Mtar, K. Modelling the causal linkages between trade openness, innovation, financial development and economic growth in OECD Countries. Appl. Econ. Lett. 2020, 27, 5–8. [Google Scholar] [CrossRef]

- Benita, F.; Bansal, G.; Tunçer, B. Public spaces and happiness: Evidence from a large-scale field experiment. Health Place 2019, 56, 9–18. [Google Scholar] [CrossRef]

- Šlander, S.; Ogorevc, M. Transport Infrastructure and Economic Growth: From Diminishing Returns to International Trade. Lex Localis-J. Local Self-Gov. 2019, 17, 17. [Google Scholar] [CrossRef]

- Ampofo, G.K.M.; Cheng, J.; Asante, D.A.; Bosah, P. Total natural resource rents, trade openness and economic growth in the top mineral-rich countries: New evidence from nonlinear and asymmetric analysis. Resour. Policy 2020, 68, 101710. [Google Scholar] [CrossRef]

- Mtar, K.; Belazreg, W. Causal nexus between innovation, financial development, and economic growth: The case of OECD countries. J. Knowl. Econ. 2021, 12, 310–341. [Google Scholar] [CrossRef]

- Guo, Y.H.Y.; Huang, Y.; Yang, Y.; Liu, S.; Wang, C.; Huang, X. Impact of foreign direct investment on Small Island States’ economic growth: An analysis based on the threshold effect of tourism. Resour. Sci. 2020, 42, 2132–2144. [Google Scholar] [CrossRef]

- Qiu, B.Y.W.; Yang, S. A Research on the Relationship between Enterprises’ Innovation and Economic Growth within the Global Production Network-A Summary of “the Symposium on the FDI, the Enterprises’ Internationalization and China’s Industrial Development”. Manag. World 2007, 12, 136–139. [Google Scholar] [CrossRef]

- Xiaohui, Z. An Empirical Study on the Impact of FDI on China’s Regional Economic Development. Mod. Manag. 2014, 1003–1154. [Google Scholar] [CrossRef]

- Dash, R.K.; Parida, P.C. FDI services trade and economic growth in India: Empirical evidence on causal links. Empir. Econ. 2013, 45, 217–238. [Google Scholar] [CrossRef]

- Zhang, G.; Zhang, M.-N. The Stability of Industry-University-Research Innovation Alliance Based on Evolutionary Game. Oper. Res. Manag. Sci. 2020, 29, 67–73. [Google Scholar] [CrossRef]

- Moore, C.; Mayer, D.M.; Chiang, F.F.T.; Crossley, C.; Karlesky, M.J.; Birtch, T.A. Leaders Matter Morally: The Role of Ethical Leadership in Shaping Employee Moral Cognition and Misconduct. J. Appl. Psychol. 2019, 104, 123–145. [Google Scholar] [CrossRef]

- Veselinovic, D. Problems of (Future) Financing the Local and Regional Economic Development. Lex Localis 2013, 11, 811. [Google Scholar] [CrossRef]

- Elkomy, S.; Ingham, H.; Read, R. Economic and political determinants of the effects of FDI on growth in transition and developing countries. Thunderbird Int. Bus. Rev. 2016, 58, 347–362. [Google Scholar] [CrossRef] [Green Version]

- Arvin, M.B.; Pradhan, R.P.; Nair, M. Uncovering interlinks among ICT connectivity and penetration, trade openness, foreign direct investment, and economic growth: The case of the G-20 countries. Telemat. Inform. 2021, 60, 101567. [Google Scholar] [CrossRef]

- Zhile, S. An Empirical Study of the Factors Influencing Economic Growth in China. Stat. Decis. 2016, 13, 113–116. [Google Scholar] [CrossRef]

- Suxia, S. An Empirical Test of Urbanization, Tertiary Sector and Macroeconomic Stability. Stat. Decis. 2013, 10, 118–120. [Google Scholar] [CrossRef]

- Hui, L. Research on Tax Contribution of China’s Tertiary Industry. Tax. Econ. 2020, 2, 97–105. [Google Scholar]

- Yum, S. The interaction between knowledge-intensive business services and urban economy. Ann. Reg. Sci. 2019, 63, 53–83. [Google Scholar] [CrossRef]

- Domenech, J.; Escamilla, R.; Roig-Tierno, N. Explaining knowledge-intensive activities from a regional perspective. J. Bus. Res. 2016, 69, 1301–1306. [Google Scholar] [CrossRef]

- Lafuente, E.; Vaillant, Y.; Vendrell-Herrero, F. Territorial servitization: Exploring the virtuous circle connecting knowledge-intensive services and new manufacturing businesses. Int. J. Prod. Econ. 2017, 192, 19–28. [Google Scholar] [CrossRef] [Green Version]

- Cuadrado-Roura, J.R.; Maroto-Sanchez, A. Unbalanced Regional Impact of the Crisis in Spain. An Explorative Analysis through Structural Changes, Sectorial Specialization and Productivity. 2014. Available online: https://ideas.repec.org/p/wiw/wiwrsa/ersa14p322.html (accessed on 11 November 2021).

- Lee, J.-W.; McKibbin, W.J. Service sector productivity and economic growth in Asia. Econ. Model. 2018, 74, 247–263. [Google Scholar] [CrossRef] [Green Version]

- Wood, J.; Oh, J.; Park, J.; Kim, W. The relationship between work engagement and work-life balance in organizations: A review of the empirical research. Hum. Resour. Dev. Rev. 2020, 19, 240–262. [Google Scholar] [CrossRef]

- Wang, X.; Yang, X.; Zhou, X. The effect of Real Exchange Rate of RMB to US Dollar on China’s economic growth: Based on the Mediating Effect of the Balance of Payments. World Econ. Stud. 2020, 9, 52–64. [Google Scholar] [CrossRef]

- Ding-xiang, M. Cointegration Analysis on the Relationship between Monetary Policy, Fiscal Policy and Economic Growth in China. 2006. Available online: https://journals.sagepub.com/doi/full/10.1177/2277978720906066 (accessed on 11 November 2021).

- Gunasinghe, C.; Selvanathan, E.; Naranpanawa, A.; Forster, J. The impact of fiscal shocks on real GDP and income inequality: What do Australian data say? J. Policy Model. 2020, 42, 250–270. [Google Scholar] [CrossRef]

- Redding, S.J.; Rossi-Hansberg, E. Quantitative spatial economics. Annu. Rev. Econ. 2017, 9, 21–58. [Google Scholar] [CrossRef] [Green Version]

- Nsafoah, D.; Serletis, A. Monetary Policy and Interest Rate Spreads. Open Econ. Rev. 2020, 31, 707–727. [Google Scholar] [CrossRef]

- Donglin, X.; Yunnan, G. The Dynamic Analysis on the Economic, Growth Time Lag Effect of the R&D Investment. J. Zhongnan Univ. Econ. Law 2007, 6, 36–43. [Google Scholar]

- Lei, W.; Liu, L.; Hafeez, M.; Sohail, S. Do economic policy uncertainty and financial development influence the renewable energy consumption levels in China? Environ. Sci. Pollut. Res. 2021, 1–10. [Google Scholar] [CrossRef] [PubMed]

- Ouyang, Y.F.Y.; Wang, S. The Scale Effect and Evolution Mechanism of Resident Consumption. Econ. Res. J. 2016, 51, 56–68. [Google Scholar]

- Xu, J.L.W. Statistical Test on Change of Residents’ Consumption Willingness Under New Normal of Economy. Stat. Decis. 2019, 35, 95–98. [Google Scholar] [CrossRef]

- Tao, F.; Zhang, Y.; Cheng, Y.; Ren, J.; Wang, D.; Qi, Q.; Li, P. Digital twin and blockchain enhanced smart manufacturing service collaboration and management. J. Manuf. Syst. 2020. [Google Scholar] [CrossRef]

- Qiao, H.; Zheng, F.; Jiang, H.; Dong, K. The greenhouse effect of the agriculture-economic growth-renewable energy nexus: Evidence from G20 countries. Sci. Total Environ. 2019, 671, 722–731. [Google Scholar] [CrossRef]

- Cui, G.; Gao, T. Real Estate Investment, Resident Consumption And Urban Economic Growth. Syst. Eng. Theory Pract. 2020, 40. [Google Scholar] [CrossRef]

- Yang, L.X.J.; Zhang, N. Dynamics Estimates on the Contribution Rate of Fiscal Expenditure on Science and Technology to Provincial Regional Technology Innovation. Fisc. Sci. 2020, 49, 121–130. [Google Scholar] [CrossRef]

- Liu, J.Q.; Ru, S.F. Research on Factors of Economic Growth and Path Selection for High-Quality Development of Western China. Inq. Into Econ. Issues 2019, 9, 82–90. [Google Scholar]

- Yang, Q.G.Y. A Study of the Relationship between Financial Development and Economic Growth in the “Belt and Road” Countries. J. Xiamen Univ. Arts Soc. Sci. 2020, 3, 79–91. [Google Scholar] [CrossRef]

- Jun, Z. Capital Formation, Industrialization and Economic Growth: Understanding China’s Economic Reform. Econ. Res. J. 2002, 6, 3–13. [Google Scholar]

- Cai, Z.; Hong, H.; Wang, S. Econometric modeling and economic forecasting. J. Manag. Sci. Eng. 2018, 3, 179–182. [Google Scholar] [CrossRef]

- Kiran, B.; Kumar, R.; Deshmukh, D. Perspectives of microalgal biofuels as a renewable source of energy. Energy Convers. Manag. 2014, 88, 1228–1244. [Google Scholar] [CrossRef]

- Ferreira-Lopes, A.; Linhares, P.; Martins, L.F.; Sequeira, T.N. Quantitative easing and economic growth in Japan: A meta-analysis. J. Econ. Surv. 2021. [Google Scholar] [CrossRef]

- Woo, Y.; Kim, E.; Lim, J. The impact of education and R&D investment on regional economic growth. Sustainability 2017, 9, 676. [Google Scholar]

- Hamermesh, D.S.; Meng, X.; Zhang, J. Dress for success—does primping pay? Labour Econ. 2002, 9, 361–373. [Google Scholar] [CrossRef]

- Haraguchi, N.; Martorano, B.; Sanfilippo, M. What factors drive successful industrialization? Evidence and implications for developing countries. Struct. Chang. Econ. Dyn. 2019, 49, 266–276. [Google Scholar] [CrossRef]

- Lim, C.Y. Economic Growth And Exchange Rate: A New Road Ahead For Indonesia. Singap. Econ. Rev. 2015, 60, 1550010. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, L.; Wang, S. Financial development and economic growth: Recent evidence from China. J. Comp. Econ. 2012, 40, 393–412. [Google Scholar]

- Rahman, A.; Khan, M.A.; Charfeddine, L. Regime-specific impact of financial reforms on economic growth in Pakistan. J. Policy Model. 2020, 43, 161–182. [Google Scholar] [CrossRef]

- Hsu, C.-C.; Quang-Thanh, N.; Chien, F.; Li, L.; Mohsin, M. Evaluating green innovation and performance of financial development: Mediating concerns of environmental regulation. Environ. Sci. Pollut. Res. 2021, 1–12. [Google Scholar] [CrossRef]

- Sghaier, I.M. Remittances and Economic Growth in MENA Countries: The Role of Financial Development. Econ. Altern. 2021, 43–59. [Google Scholar]

- Ren, H.; Folmer, H.; Van der Vlist, A.J. What role does the real estate–construction sector play in China’s regional economy? Ann. Reg. Sci. 2014, 52, 839–857. [Google Scholar] [CrossRef]

- Lester, T.W. Dedicating new real estate transfer taxes for energy efficiency: A revenue option for scaling up Green Retrofit Programs. Energy Policy 2013, 62, 809–820. [Google Scholar] [CrossRef]

- Han, Y.; Zhang, H.; Zhao, Y. Structural Evolution of Real Estate Industry in China: 2002–2017. Struct. Chang. Econ. Dyn. 2021, 57, 45–56. [Google Scholar] [CrossRef]

- Akinboade, O.A. The relationship between financial deepening and economic growth in Tanzania. J. Int. Dev. J. Dev. Stud. Assoc. 2000, 12, 939–950. [Google Scholar] [CrossRef]

- Henisz, W.J.; Mansfield, E.D.; Von Glinow, M.A. Conflict, Security, and Political Risk: International Business in Challenging Times; Springer: Berlin/Heidelberg, Germany, 2010. [Google Scholar]

- Samy, M.; Barakat, S.; Ramadan, H. Techno-economic analysis for rustic electrification in Egypt using multi-source renewable energy based on PV/wind/FC. Int. J. Hydrogen Energy 2020, 45, 11471–11483. [Google Scholar] [CrossRef]

- Machoski, E.; de Araujo, J.M. Corruption in public health and its effects on the economic growth of Brazilian municipalities. Eur. J. Health Econ. 2020, 21. [Google Scholar] [CrossRef]

- Fan, Q.; Sun, X. An Empirical Study Of The Factors Influencing Economic Growth In China Based On Principal Component Regression. Stat. Decis. 2012, 17, 144–146. [Google Scholar] [CrossRef]

- Ran-ran, W. Mechanism Analysis of Foreign Trade Structure Transformation to the Promotion of the Economic Growth Pattern Transformation. J. Shandong Inst. Bus. Technol. 2009, 1. [Google Scholar]

- Jinhua, Z. An Empirical Study of the Factors Influencing Economic Growth in Shanghai Based on the Lasso Method. Stat. Decis. 2013, 01, 154–156. [Google Scholar]

- Jennrich, R.I.; Sampson, P.F. Application of Stepwise Regression to Non-Linear Estimation. Technometrics 1968, 10, 63–72. [Google Scholar] [CrossRef]

- Cronbach, L.J. Statistical tests for moderator variables: Flaws in analyses recently proposed. Psychol. Bull. 1987, 102, 414–417. [Google Scholar] [CrossRef]

- Okunlola, F.A.; Osuma, G.O.; Omankhanlen, E.A. Agricultural finance and economic growth: Evidence from Nigeria. Bus. Theory Pract. 2019, 20, 467–475. [Google Scholar] [CrossRef] [Green Version]

- Rao, C.; Yan, B. Study on the interactive influence between economic growth and environmental pollution. Environ. Sci. Pollut. Res. 2020, 27, 39442–39465. [Google Scholar] [CrossRef]

- Frame, J. Modelling national technological capacity with patent indicators. Scientometrics 1991, 22, 327–339. [Google Scholar] [CrossRef]

- Zhou, Y.; Wen, Y.; Yang, J. Study on Influencing Factors of Future Price Expectation Index of Urban Residents. Stat. Decis. 2020, 36. [Google Scholar] [CrossRef]

- Weng, K.; Liu, M.; Liu, Q. An Integrated Prediction Model of PM2.5 Concentration based on TPE-XGBOOST and LassoLars. Syst. Eng. Theory Pract. 2020, 40, 748–760. [Google Scholar] [CrossRef]

- Gu, Z.-T.S.Z.; Song, Z.F.; Li, Y. Study on the Construction of Enhanced Index Fund Based on LASSO Variable Selection and Multi-factor Model. J. Appl. Stat. Manag. 2020, 39, 417–428. [Google Scholar] [CrossRef]

- Brown, W.G.; Beattie, B.R. Improving estimates of economic parameters by use of ridge regression with production function applications. Am. J. Agric. Econ. 1975, 57, 21–32. [Google Scholar] [CrossRef]

- Hoerl, A.E.; Kennard, R. Ridge regression: Biased estimation for nonorthogonal problem. Technometrics 2000, 42, 80–86. [Google Scholar] [CrossRef]

- Hao, Y.; Zheng, S.; Zhao, M.; Wu, H.; Guo, Y.; Li, Y. Reexamining the relationships among urbanization, industrial structure, and environmental pollution in China—New evidence using the dynamic threshold panel model. Energy Rep. 2020, 6, 28–39. [Google Scholar] [CrossRef]

- Panagiotelis, A.; Athanasopoulos, G.; Hyndman, R.J.; Jiang, B.; Vahid, F. Macroeconomic forecasting for Australia using a large number of predictors. Int. J. Forecast. 2019, 35, 616–633. [Google Scholar] [CrossRef] [Green Version]

- Yüzbaşı, B.; Ahmed, S.E.; Aydın, D. Ridge-type pretest and shrinkage estimations in partially linear models. Stat. Pap. 2020, 61, 869–898. [Google Scholar] [CrossRef]

- Chan-Lau, M.J.A. Lasso Regressions and Forecasting Models in Applied Stress Testing; International Monetary Fund: Washington, DC, USA, 2017. [Google Scholar]

- Tibshirani, R. Regression shrinkage and selection via the lasso: A retrospective. J. R. Stat. Soc. Ser. B (Stat. Methodol.) 2011, 73, 273–282. [Google Scholar] [CrossRef]

- Rodríguez-Puebla, C.; Encinas, A.H.; García-Casado, L.A.; Nieto, S. Trends in warm days and cold nights over the Iberian Peninsula: Relationships to large-scale variables. Clim. Chang. 2010, 100, 667–684. [Google Scholar] [CrossRef]

- Schneider, U.; Wagner, M. Catching growth determinants with the adaptive lasso. Ger. Econ. Rev. 2012, 13, 71–85. [Google Scholar] [CrossRef] [Green Version]

- Cheung, A.; Hennebry-Leung, M. Exploring an ESL teachers’ beliefs and practices of teaching literary texts: A case study in Hong Kong. Lang. Teach. Res. 2020, 1362168820933447. [Google Scholar] [CrossRef]

- Bai, L.; Hu, J.W.; Ji, J.; Si, H. An Empirical Study on Deconstructing Economic Growth Dynamics Based on Industrial Electricity Big Data Backwards-Jiangsu Province as an Example. Acad. Bimest. 2020, 1150–1158. [Google Scholar] [CrossRef]

- Chu, J.; Zhu, H.L. Co-integration Test of the Relationship Between International Trade and Economic Growth in China. Stat. Decis. 2020, 36, 116–120. [Google Scholar] [CrossRef]

- Zhang, H.; Huo, G.q.; Wang, M.; Wu, Z. Strategic Performance Evaluation of Transformation of Scientific and Technology Achievements: An Empirical Study Based on National Progress Prize in Scientific. Sci. Sci. Manag. S. T 2020, 41, 7–25. [Google Scholar]

- Zeng, G.; Ma, Y.-J. The Influences of Financial Structure in Economic Growth of the East, Middle and West Regions: Empirical Analysis Based on China’s Province Panel Data. Econ. Probl. 2017, 9, 34–40. [Google Scholar] [CrossRef]

| Variable Classification | Variable Name | Meaning | Data Source |

|---|---|---|---|

| Explained variable | China’s economic growth rate | Economic growth level | GDP |

| Explanatory variables | Import and export growth rate | International trade development level | Total import and export of goods |

| Exchange rate | Exchange rate level | Exchange rate of RMB to US dollar | |

| The growth rate of FDI | The level of capital nationalization | Amount of world FDI utilized by China | |

| The growth of fiscal expenditure | Fiscal policy | Fiscal expenditure over the years | |

| The growth of money supply | Monetary Policy | The amount of money in circulation in a country | |

| The total retail sales of social consumer goods growth rate | Consumption level | Total retail sales of consumer goods | |

| Expenditure on education | Educational level | Financial expenditures for education | |

| The growth rate of expenditure on science and technology | Science and technology level | Financial spending on science and technology | |

| Tertiary industry growth | Tertiary industry development level | Added value of tertiary industry | |

| The financial industry added value changes | Financial development level | Added value of the financial industry | |

| Industrial growth rate | Degree of industrialization | Added value of financial industry | |

| The real estate industry added value | Real estate industry development level | Added value of real estate industry |

| China’s Economic Growth Rate | |||||

|---|---|---|---|---|---|

| Variables | Correlation Coefficient | p-Value | Variables | Correlation Coefficient | p-Value |

| Import and export growth rate | 0.567 ** | 0.009 | Expenditure on education | 0.721 ** | 0.000 |

| Exchange Rates | 0.181 | 0.444 | The growth rate of expenditure on science and technology | 0.111 | 0.640 |

| The growth rate of FDI | 0.629 ** | 0.003 | Tertiary industry growth | 0.906 ** | 0.000 |

| The growth of fiscal expenditure | 0.614 ** | 0.004 | Financial industry added value changes | −0.506 * | 0.023 |

| The growth of money supply | 0.682 ** | 0.001 | Industrial growth rate | 0.689 ** | 0.001 |

| The total retail sales of social consumer goods growth rate | 0.743 ** | 0.000 | Real estate industry added value | −0.418 | 0.067 |

| Beta | T | Sig. | |

|---|---|---|---|

| Constant term | 2.533 | 0.030 | |

| Import and export growth rate | 0.275 | 2.753 | 0.020 |

| Growth rate of FDI | 0.038 | 0.396 | 0.701 |

| The growth of fiscal expenditure | −0.238 | −1.768 | 0.108 |

| The growth of money supply | 0.005 | 0.054 | 0.958 |

| The total retail sales of social consumer goods growth rate | 0.578 | 4.241 | 0.002 |

| Expenditures on education | 0.201 | 1.668 | 0.126 |

| Tertiary industry growth | 0.519 | 3.642 | 0.005 |

| Financial industry added value changes | −0.539 | −2.825 | 0.018 |

| Industrial growth rate | −0.550 | −2.348 | 0.041 |

| Variables | Collinearity Statistics | |

|---|---|---|

| Tolerable Error | VIF | |

| Import and export growth rate | 0.255 | 3.921 |

| The growth rate of FDI | 0.280 | 3.577 |

| The growth of fiscal expenditure | 0.140 | 7.142 |

| The growth of money supply | 0.285 | 3.508 |

| Total retail sales of social consumer goods growth rate | 0.137 | 7.313 |

| Expenditures on education | 0.174 | 5.739 |

| Tertiary industry growth | 0.125 | 8.010 |

| Financial industry added value changes | 0.070 | 14.369 |

| Industrial growth rate | 0.046 | 21.658 |

| Least Squares Method | Stepwise Regression Coefficient | Ridge Regression Coefficient | Lasso Regression Coefficient | |

|---|---|---|---|---|

| Intercept | −0.034 | 0.05722 | 0.32174 | |

| Import and export growth rate | 0.275 | 0.116 | 0.08824 | 0.08820 |

| Growth rate of FDI | 0.038 | 0 | 0.07701 | 0.02303 |

| The growth of fiscal expenditure | −0.238 | 0 | −0.13236 | −0.18662 |

| The growth of money supply | 0.005 | 0 | 0.04712 | 0.00372 |

| The total retail sales of social consumer goods growth rate | 0.578 | 0.348 | 0.346094 | 0.65418 |

| Expenditures on education | 0.201 | 0 | 0.07951 | 0.07189 |

| Tertiary industry growth | 0.519 | 0.686 | 0.46481 | 0.63368 |

| Financial industry added value changes | −0.539 | 0 | −0.00432 | −0.01650 |

| Industrial growth rate | −0.550 | 0 | −0.00077 | −0.00703 |

| Error | 0.0001531214 | 0.000051017S53 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, M.; Sun, H.; Agyeman, F.O.; Heydari, M.; Jameel, A.; Salah ud din Khan, H. Analysis of Potential Factors Influencing China’s Regional Sustainable Economic Growth. Appl. Sci. 2021, 11, 10832. https://doi.org/10.3390/app112210832

Li M, Sun H, Agyeman FO, Heydari M, Jameel A, Salah ud din Khan H. Analysis of Potential Factors Influencing China’s Regional Sustainable Economic Growth. Applied Sciences. 2021; 11(22):10832. https://doi.org/10.3390/app112210832

Chicago/Turabian StyleLi, Mingxing, Hongzheng Sun, Fredrick Oteng Agyeman, Mohammad Heydari, Arif Jameel, and Hira Salah ud din Khan. 2021. "Analysis of Potential Factors Influencing China’s Regional Sustainable Economic Growth" Applied Sciences 11, no. 22: 10832. https://doi.org/10.3390/app112210832

APA StyleLi, M., Sun, H., Agyeman, F. O., Heydari, M., Jameel, A., & Salah ud din Khan, H. (2021). Analysis of Potential Factors Influencing China’s Regional Sustainable Economic Growth. Applied Sciences, 11(22), 10832. https://doi.org/10.3390/app112210832