Optimal Control of a Virtual Power Plant by Maximizing Conditional Value-at-Risk

Abstract

:1. Introduction

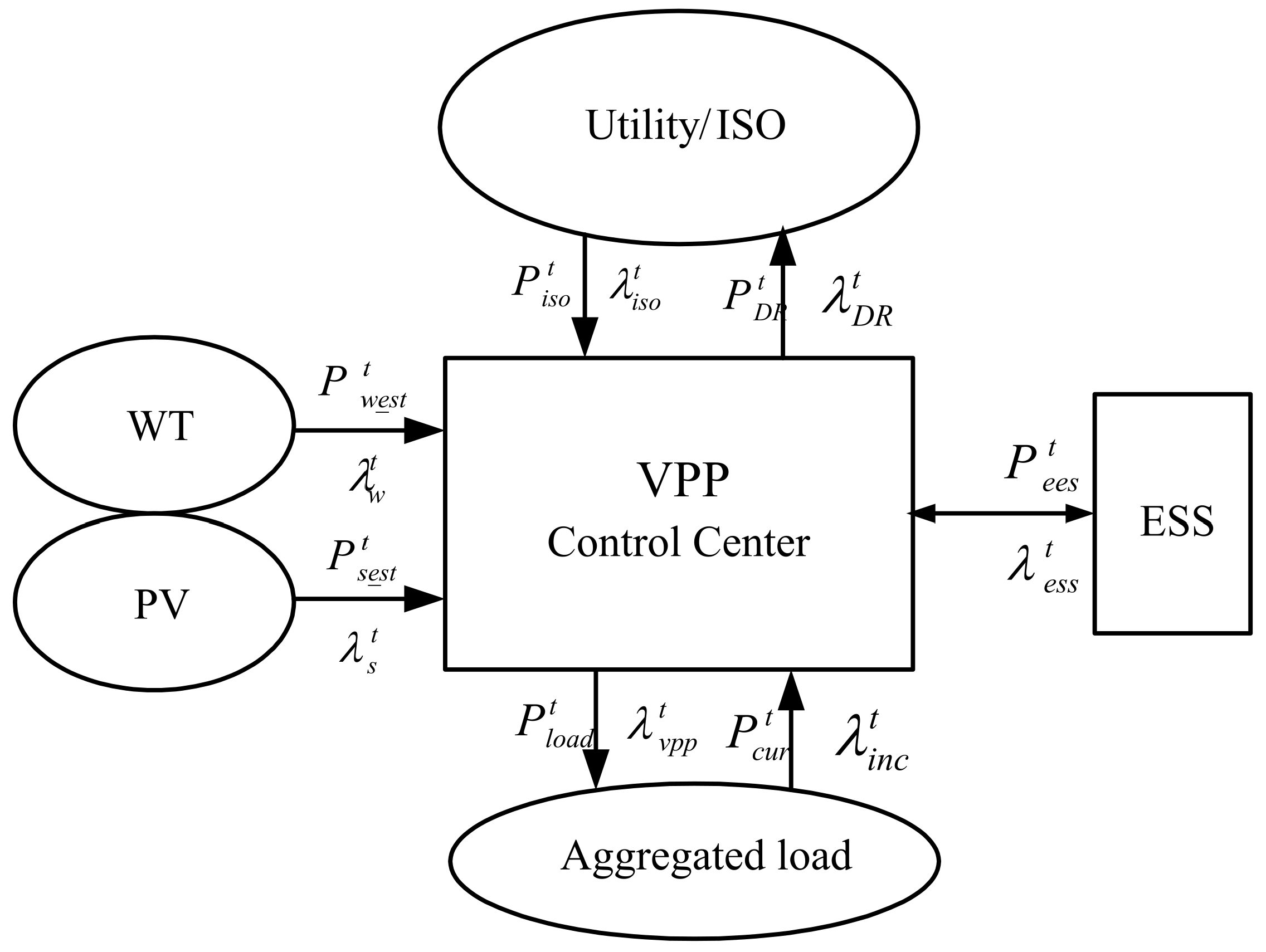

2. Problem Formulation

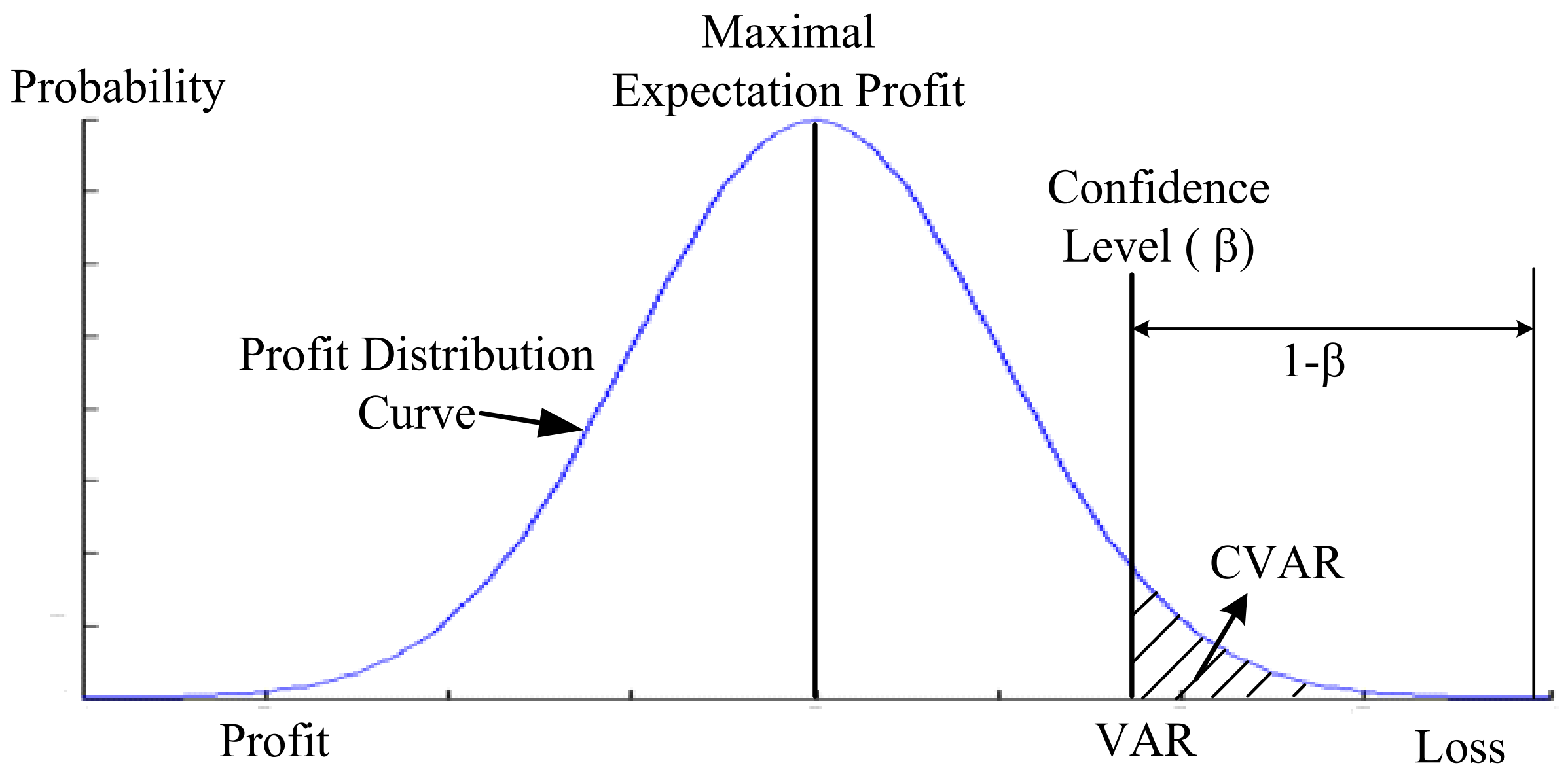

2.1. CVAR Model

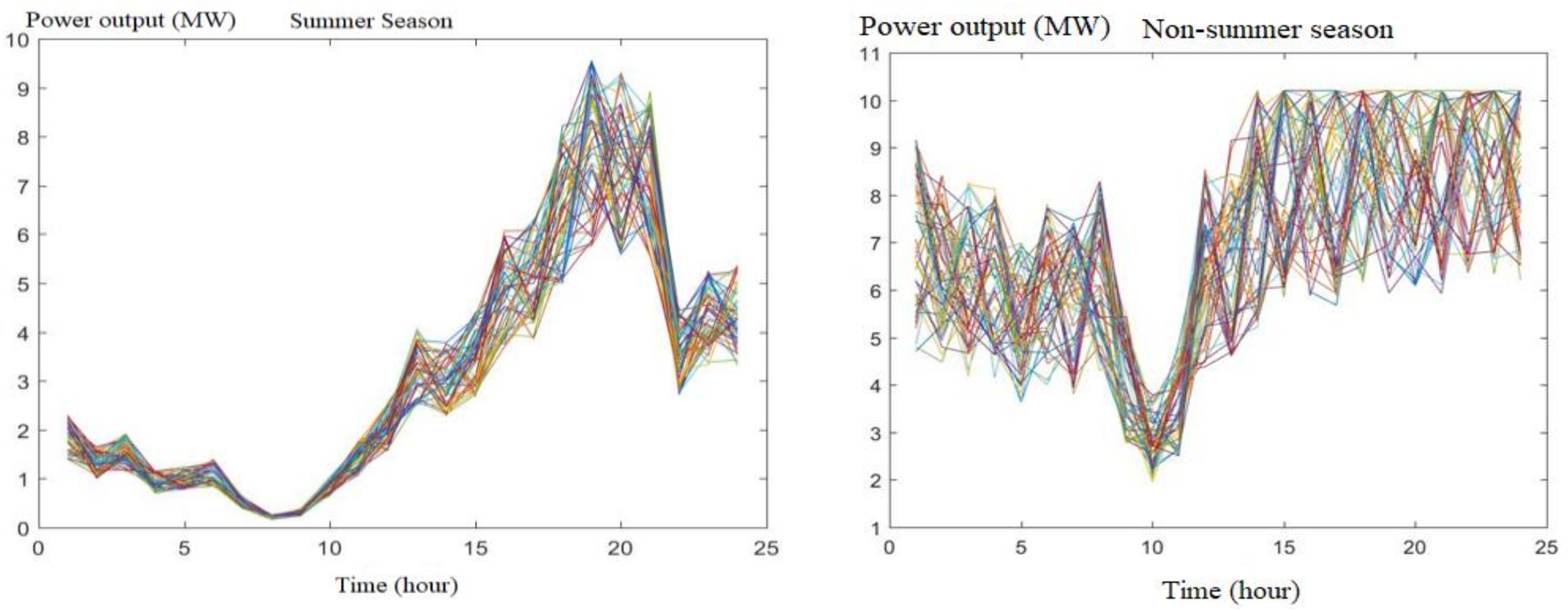

2.2. The Power Output of the PVs/WTs

2.3. The Model for the ESS

- If the battery is charging:

- If the battery is discharging:where and are charging efficiency and the discharging efficiency, both are brand-dependent. is the electrical power of the battery output at the h. is the aggregated capacity of the batteries at h. is the rated maximum storage energy. / is the maximum portion of the rated capacity that can be added to/withdrawn from storage in an h. is the scheduling hour. In this paper, was equal to 1 h.

2.4. Objective Function and Constraints

- (1)

- VPP energy balance constraint

- (2)

- demand response

- (3)

- rebate constraints

- (4)

- the expected return on investment

- (5)

- the rate of expected return on investment

- (6)

- the capacity of battery

3. Solution Algorithm

3.1. Bacterial Chemotaxis

3.2. Bacterial Reproduction

3.3. Elimination–Dispersal

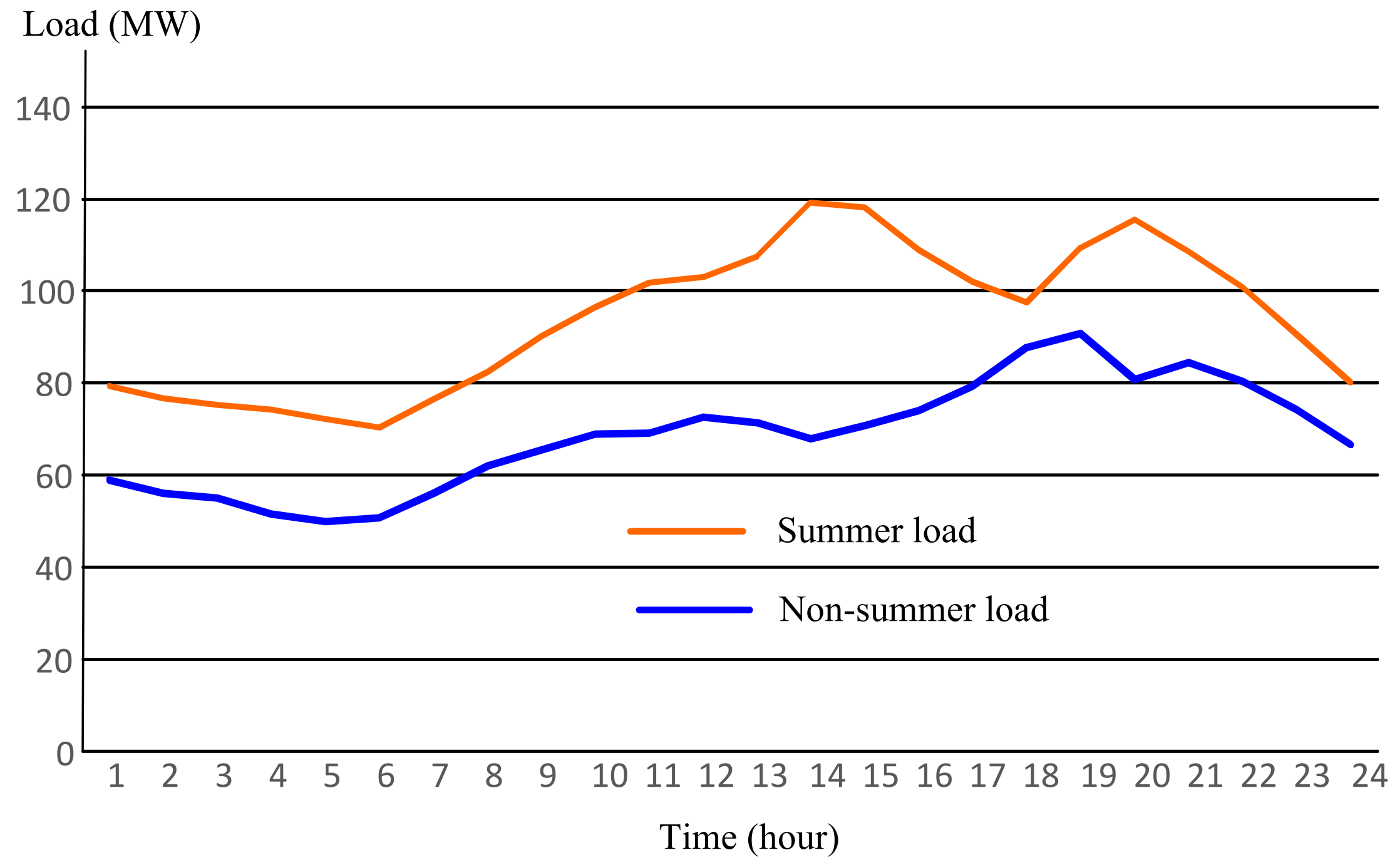

4. Simulation Results

4.1. The Power Output of the PVs/WTs in the Summer/Non-Summer

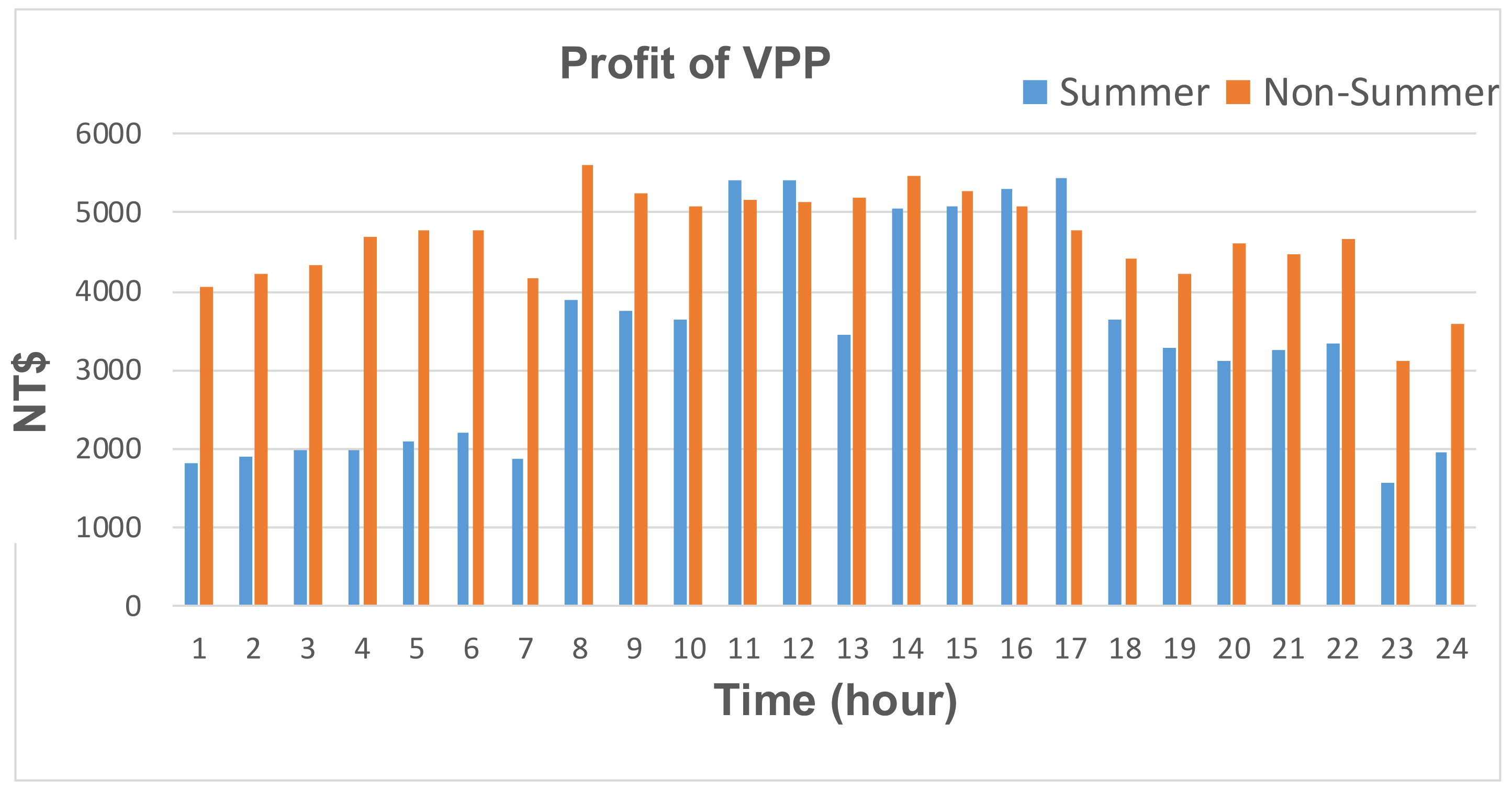

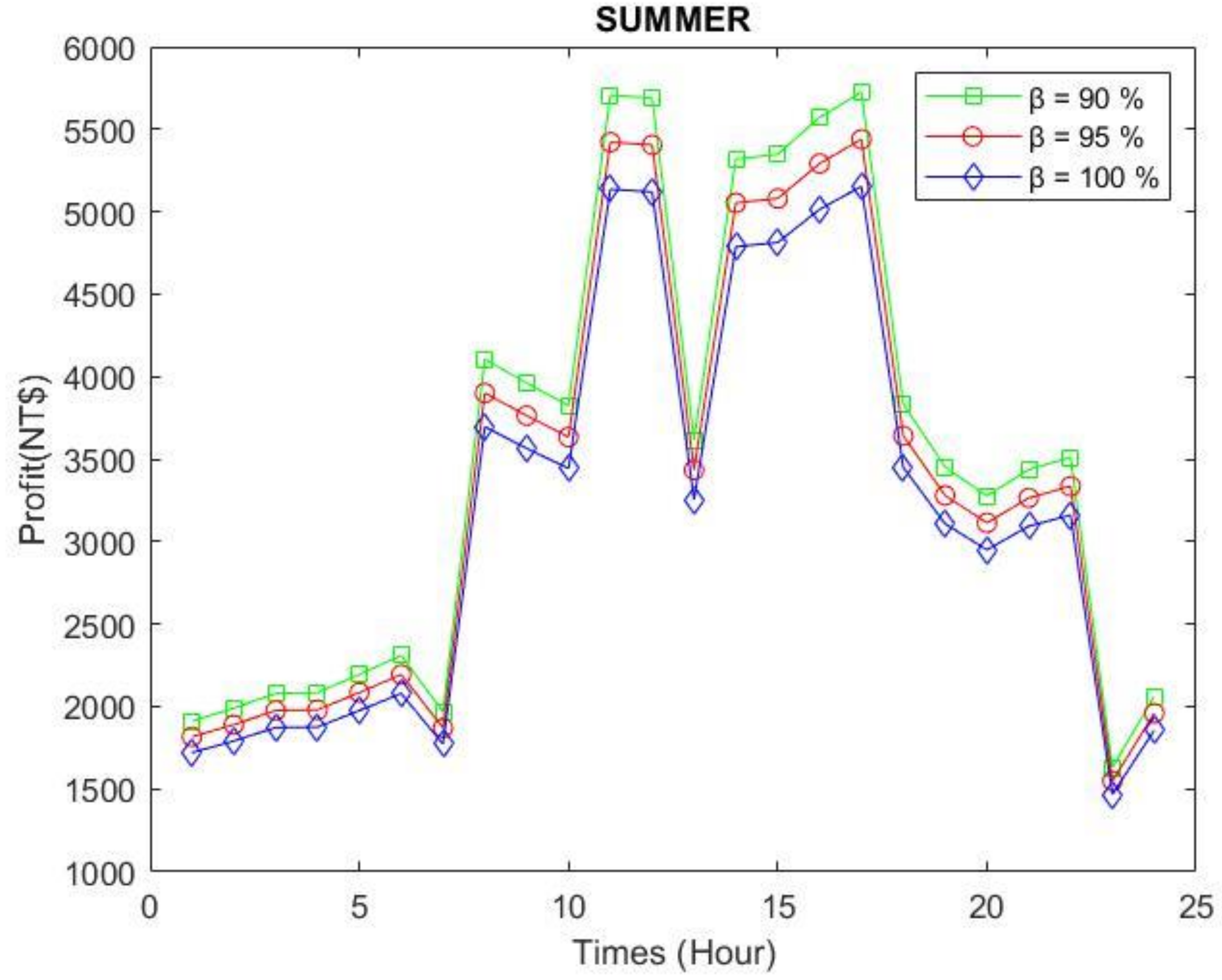

4.2. Results from Various Scenarios

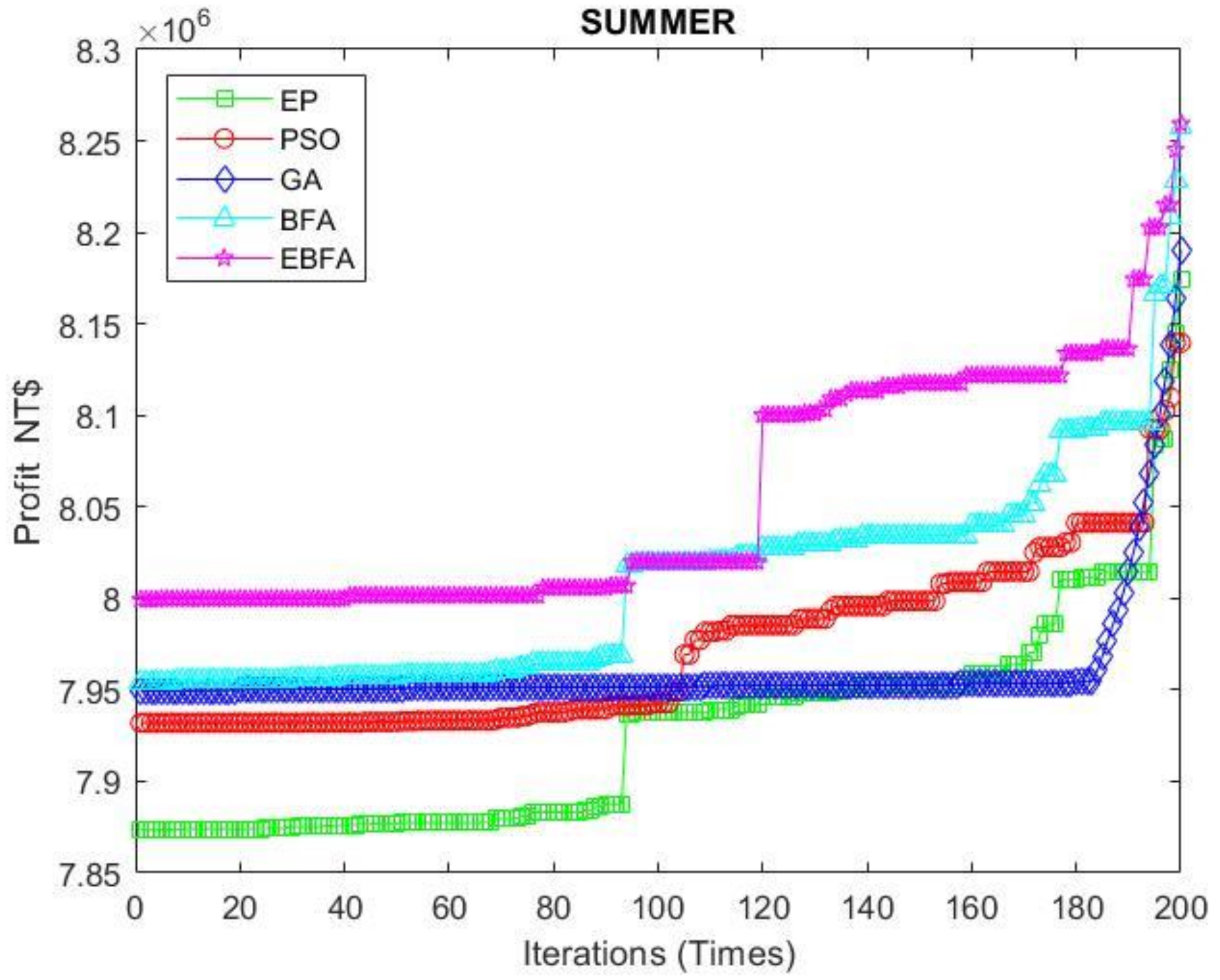

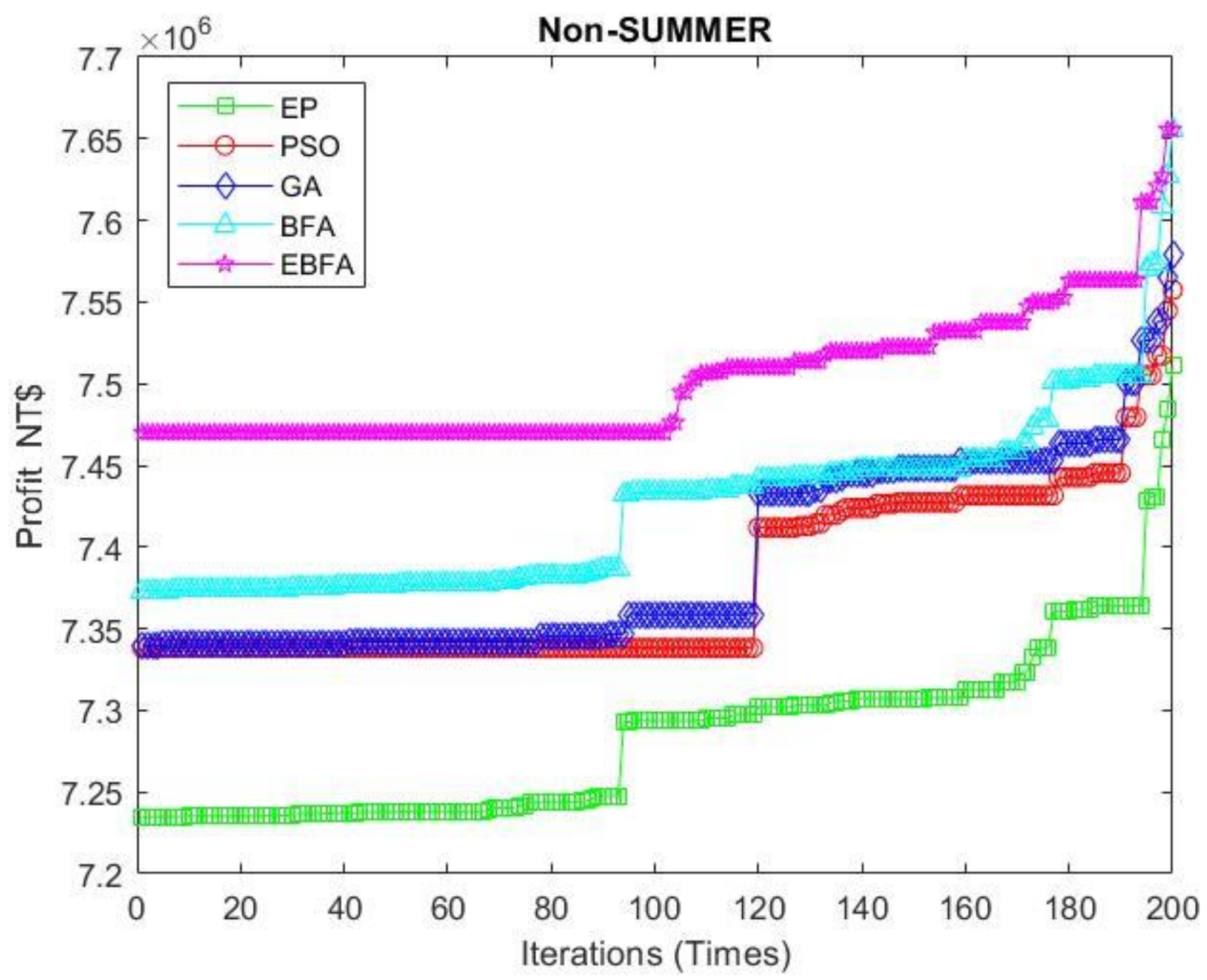

4.3. Convergence Test

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| Acronyms | |

| CODIS | Central Weather Bureau Observation Data Inquiry |

| CVAR | conditional value-at-risk |

| DERs | distributed energy resources |

| DGs | distributed generations |

| DR | demand response |

| EBFA | enhanced bacterial foraging algorithm |

| ESS | energy storage systems |

| EP | evolutionary programming |

| GA | genetic algorithm |

| ISO | independent system operator |

| LSSVM | least square support vector machine |

| MAPE | mean absolute percentage error |

| PSO | particle swarm optimization |

| PV | photovoltaics |

| SWT | stochastic weight trade-off |

| VPP | virtual power plant |

| WT | wind turbine |

| Constraints | |

| Maximizing risk income | |

| / | Total income/cost in the context of samples |

| / | Aversion parameter/auxiliary parameter |

| / | The rate of return/expectation profit |

| / | Number of samples/confidence level |

| // | The sold price of VPP/WT/PV at time t |

| / | The load supplied by VPP/the generation supplied by ISO at time t |

| / | The generation of WT/PV at time t |

| / | The load curtailed of VPP/user at time t |

| Rebate money of customers by VPP at time t | |

| Rebate money of VPP by ISO at time t | |

| The price sold of ISO at time t | |

| Coefficient of elasticity at time t | |

| The operating cost of battery at time t | |

| The capacity of battery at time t | |

| / | The initial/maximal capacity of battery at time t |

| Variables | |

| Area covered by the rotor ( | |

| The area of the PV array () | |

| The performance coefficient of wind power | |

| The efficiency of PV | |

| The WT output power at time t | |

| The PV power output at time t | |

| The global radiation () at time t | |

| The probability of “lethargy” | |

| Random number between 0 and 1 | |

| Freak Factor | |

| Wind speed ( at time t | |

| The current wind speed ( at time | |

| The start wind speed ( | |

| The rated wind speed ( | |

| The stop wind speed ( | |

| Tip speed ratio | |

| Pitch angle of the rotor blades (deg.) | |

| Air density ( |

References

- Jiayi, H.; Chuanwen, J.; Rong, X. A review on distributed energy resources and Microgrid. Renew. Sustain. Energy Rev. 2008, 12, 2472–2483. [Google Scholar] [CrossRef]

- Liu, C.; Yang, R.J.; Yu, X.; Sun, C.; Wong, S.P.; Zhao, H. Virtual power plants for a sustainable urban future. Sustain. Cities Soc. 2021, 65, 102640. [Google Scholar] [CrossRef]

- Yu, S.; Fang, F.; Liu, Y.; Liu, J. Uncertainties of virtual power plant: Problems and countermeasures. Appl. Energy 2019, 239, 454–470. [Google Scholar] [CrossRef]

- Dabbagh, S.; KazemSheikh-El-Eslami, M. A profit sharing scheme for distributed energy resources integrated into a virtual power plant. Appl. Energy 2016, 184, 313–328. [Google Scholar] [CrossRef]

- Shafiekhani, M.; Badri, A.; Khah, M.; Catalao, J. Strategy bidding of virtual power plant in energy markets: A bi-level multi-objective approach. Int. J. Electr. Power Energy Syst. 2019, 113, 208–219. [Google Scholar] [CrossRef]

- Kardakos, E.G.; Simoglou, C.K.; Bakirtzis, A.G. Optimal Offering Strategy of a Virtual Power Plant: A Stochastic Bi-Level Approach. IEEE Trans. Smart Grid 2016, 7, 794–806. [Google Scholar] [CrossRef]

- Hu, H.; Jiang, C.; Liu, Y. Short-term bidding strategy for a price-maker virtual power plant based on interval optimization. Energies 2019, 32, 3662. [Google Scholar] [CrossRef] [Green Version]

- Sun, B.; Kong, X.; Yang, Q. Demand-responsive virtual power plant optimization scheduling method based on competitive bidding equilibrium. Energy Procedia 2019, 158, 3988–3993. [Google Scholar] [CrossRef]

- Nosratabadi, S.; Hooshmand, R.; Gholipour, E. A comprehensive review on microgrid and virtual power plant concepts employed for distributed energy resources scheduling in power systems. Renew. Sustain. Energy Rev. 2017, 67, 341–363. [Google Scholar] [CrossRef]

- Maanavi, M.; Najafi, A.; Godina, R.; Mahmoudian, M.; Rodrigues, E. Energy Management of Virtual Power Plant Considering Distributed Generation Sizing and Pricing. Appl. Sci. 2019, 9, 2817. [Google Scholar] [CrossRef] [Green Version]

- Duan, J.; Wang, X.; Gao, Y.; Yang, Y.; Yang, W.; Li, H.; Ehsan, A. Multi-Objective Virtual Power Plant Construction Model Based on Decision Area Division. Appl. Sci. 2018, 8, 1484. [Google Scholar] [CrossRef] [Green Version]

- Wu, H.; Liu, X.; Ye, B.; Xu, B. Optimal dispatch and bidding strategy of a virtual power plant based on a Stackelberg game. IET Gener. Transm. Distrib. 2020, 14, 552–563. [Google Scholar] [CrossRef]

- Tang, W.; Yang, H.T. Optimal operation and bidding strategy of a virtual power plant integrated with energy storage systems and elasticity demand response. IEEE Access 2019, 7, 79798–79809. [Google Scholar] [CrossRef]

- Nguyen, H.T.; Le, L.B.; Wang, Z. A bidding strategy for virtual power plants with the intraday demand response exchange market using the stochastic programming. IEEE Trans. Ind. Appl. 2018, 54, 3044–3055. [Google Scholar] [CrossRef]

- Sun, G.; Qian, W.; Huang, W.; Xu, Z.; Fu, Z.; Wei, Z.; Chen, S. Stochastic Adaptive Robust Dispatch for Virtual Power Plants Using the Binding Scenario Identification Approach. Energies 2019, 12, 1918. [Google Scholar] [CrossRef] [Green Version]

- Ko, R.; Kang, D.; Joo, S. Mixed integer quadratic programming based scheduling methods for day-ahead bidding and intrs-day operation of virtual power plant. Energies 2019, 12, 1410. [Google Scholar] [CrossRef] [Green Version]

- Zhang, J.; Xu, Z.; Xu, W.; Zhu, F.; Lyu, X.; Fu, M. Bi-Objective Dispatch of Multi-Energy Virtual Power Plant: Deep-Learning-Based Prediction and Particle Swarm Optimization. Appl. Sci. 2019, 9, 292. [Google Scholar] [CrossRef] [Green Version]

- Meng, C.; Qin, P.; Wang, Y.; An, X.; Jiang, H.; Liang, Y. A revenue-risk equilibrium model for distributed energy integrated virtual power plants considering uncertainties of wind and photovoltaic power. In Proceedings of the 5th Asia Conference on Power and Electrical Engineering (ACPEE), Chengdu, China, 4–7 June 2020; pp. 2032–2038. [Google Scholar]

- Dabbagh, S.R.; Sheikh-El-Eslami, M.K. Risk Assessment of Virtual Power Plants Offering in Energy and Reserve Markets. IEEE Trans. Power Syst. 2016, 31, 3572–3582. [Google Scholar] [CrossRef]

- Alahyan, A.; Ehsan, M.; Pozo, D.; Farrokhifar, M. Hybrid uncertainty-based offering strategy for virtual power plants. IET Renew. Power Gener. 2020, 14, 2359–2366. [Google Scholar]

- Castillo, A.; Flicker, J.; Hansen, C.; Waston, J.; Jhonson, J. Stochastic optimisation with risk aversion for virtual power plant operations: A rolling horizon control. IET Gener. Transm. Distrib. 2019, 13, 2063–2076. [Google Scholar] [CrossRef]

- Liang, Z.; Alsafasfeh, Q.; Jin, T.; Pourbabak, H.; Su, W. Risk-Constrained Optimal Energy Management for Virtual Power Plants Considering Correlated Demand Response. IEEE Trans. Smart Grid 2019, 10, 1577–1587. [Google Scholar] [CrossRef]

- Dahraie, M.; Kermani, A.; Moghaddam, A.; Siano, P. Risk-averse probabilistic framework for scheduling of virtual power plants considering demand response and uncertainties. Int. J. Electr. Power Energy Syst. 2020, 121, 106126. [Google Scholar] [CrossRef]

- Kong, X.; Xiao, J.; Liu, D.; Wu, J.; Shen, Y. Robust stochastic optimal dispatching method of multi-energy virtual power plant considering multiple uncertainties. Appl. Energy 2020, 279, 115707. [Google Scholar] [CrossRef]

- Gao, R.; Guo, H.; Zhang, R.; Mao, T.; Xu, Q.; Zhou, B.; Yang, P. A Two-Stage Dispatch Mechanism for Virtual Power Plant Utilizing the CVaR Theory in the Electricity Spot Market. Energies 2019, 12, 3402. [Google Scholar] [CrossRef] [Green Version]

- Ju, L.; Tan, Q.; Lu, Y.; Tan, Z.; Zhang, Y.; Tan, Q. A CvaR-robust-based multi-objective optimization model and three stage solution algorithm for a vritual power plant considering uncertainties and carbon emission allowances. Int. J. Electr. Power Energy Syst. 2019, 107, 628–643. [Google Scholar] [CrossRef]

- Lima, R.; Conejo, A.; Langodan, S.; Hoteit, I. Risk-averse formulations and methods for a virtual power plant. Comput. Oper. Res. 2018, 96, 349–372. [Google Scholar] [CrossRef]

- Alexander, C. Risk Management and Analysis—Volume 1 Measuring and Modeling Financial Risk; John Wiley & Sons Ltd.: London, UK, 2000. [Google Scholar]

- Marrison, C. Fundamentals of Risk Measurement; McGraw-Hill Companies, Inc.: New York, NY, USA, 2002. [Google Scholar]

- Available online: https://www.cwb.gov.tw/V7/observe/real/46744.htm (accessed on 15 December 2020).

- Suykens, J.A.K.; Vandewalle, J. Least square support vector machine. Neural Process. Lett. 1999, 9, 293–300. [Google Scholar] [CrossRef]

- Lin, W.M.; Tu, C.S.; Tsai, M.T. Energy Management Strategy of the Microgrids by using Enhanced Bee Colony Optimization. Energies 2016, 9, 5. [Google Scholar] [CrossRef] [Green Version]

- Passion, K.M. Biomimicry of bacterial foraging for distributed optimization and control. IEEE Control Syst. 2002, 22, 52–67. [Google Scholar]

- Chalermchaiarbha, S.; Ongsakul, W. Stochastic weight trade-off particle swarm optimization for nonconvex economic dispatch. Energy Convers. Manag. 2013, 70, 66–75. [Google Scholar] [CrossRef]

- Chaturvedi, K.T.; Pandit, M.; Srivastava, I. Self-organizing hierarchical particle swarm optimization for nonvex economic dispatch. IEEE Trans. Power Syst. 2008, 23, 1079–1087. [Google Scholar] [CrossRef]

- TPC. Time-of-Use Rate for Users. The Electricity Rate Structure of Taipower Company; TPC: Taipei, Taiwan, 2020. [Google Scholar]

| Unit | Number of Units | Capacity/Unit (MW) | Total Capacity (MW) |

|---|---|---|---|

| Wind turbine | 8 | 0.6 | 4.8 |

| Wind turbine | 6 | 0.9 | 5.4 |

| Solar power | 1 | 12.9 | 12.9 |

| Thermal turbine | 1 | 129.8 | 129.8 |

| EES | 1 | 30 | 30 |

| Summer Season | Non-Summer Season | |||

|---|---|---|---|---|

| Without DR | With DR | Without DR | With DR | |

| Total income (NT$) | 15,053,126 | 15,745,634 | 14,594,450 | 14,550,596 |

| Total cost (NT$) | 7,134,183 | 7,462,386 | 6,916,801 | 6,896,017 |

| Profit (NT$) | 7,918,943 | 8,283,248 | 7,677,649 | 7,654,579 |

| Summer | Non-Summer | |||

|---|---|---|---|---|

| Algorithm | Maximal Converged Profit (NT$) | Average Execution Times (s) | Maximal Converged Profit (NT$) | Average Execution Times (s) |

| EP | 8,174,430 | 238 | 7,623,943 | 245 |

| PSO | 8,139,733 | 227 | 7,639,699 | 234 |

| GA | 8,190,471 | 237 | 7,639,155 | 244 |

| BFA | 8,259,395 | 213 | 7,654,015 | 219 |

| EBFA | 8,283,248 | 227 | 7,654,580 | 234 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, W.-M.; Yang, C.-Y.; Wu, Z.-Y.; Tsai, M.-T. Optimal Control of a Virtual Power Plant by Maximizing Conditional Value-at-Risk. Appl. Sci. 2021, 11, 7752. https://doi.org/10.3390/app11167752

Lin W-M, Yang C-Y, Wu Z-Y, Tsai M-T. Optimal Control of a Virtual Power Plant by Maximizing Conditional Value-at-Risk. Applied Sciences. 2021; 11(16):7752. https://doi.org/10.3390/app11167752

Chicago/Turabian StyleLin, Whei-Min, Chung-Yuen Yang, Zong-Yo Wu, and Ming-Tang Tsai. 2021. "Optimal Control of a Virtual Power Plant by Maximizing Conditional Value-at-Risk" Applied Sciences 11, no. 16: 7752. https://doi.org/10.3390/app11167752

APA StyleLin, W.-M., Yang, C.-Y., Wu, Z.-Y., & Tsai, M.-T. (2021). Optimal Control of a Virtual Power Plant by Maximizing Conditional Value-at-Risk. Applied Sciences, 11(16), 7752. https://doi.org/10.3390/app11167752