Knowledge Management Practices and Innovation Outcomes: The Moderating Role of Risk-Taking and Proactiveness

Abstract

1. Introduction

2. Literature Review and Hypotheses

2.1. KMP and Innovation Outcomes

2.1.1. Creation

2.1.2. Storage

2.1.3. Transfer

2.1.4. Application

2.2. EO´s Dimensions as Moderating Variables in the KMP–Innovation Relationship

3. Materials and Methods

3.1. Data Source

3.2. Measurement and Variables

- During the period 2015–2017, the firm introduced products new to the market, or services incrementally improved.

- During the period 2015–2017, the firm introduced products new to the market, or services radically improved.

- During the period 2015–2017, the firm introduced products, or services incrementally improved in existing markets.

- During the period 2015–2017, the firm introduced products, or services radically improved in existing markets.

- There is a strong commitment to depend on internal R&D activities to develop or improve technologies.

- There is a strong investment in R&D activities to develop or improve technologies internally.

- There is a strong commitment to use proprietary technology to develop or improve product/process.

- There is a strong commitment to maintain a highly qualified R&D unit to internally develop or improve technologies.

- Organizational processes are codified and documented in manuals or other types of devices.

- There are databases that allow employees to use knowledge and experiences that have previously been loaded into the databases.

- There are phone or e-mail directories to find experts in specific areas.

- It is possible to access knowledge repositories, databases, and documents through some kind of internal computer network.

- There are databases with updated information about customers.

- Databases are frequently updated.

- There are procedural guidelines, manuals, or books including problems that have been solved successfully.

- Information technologies (internet, intranet, e-mail, etc.) are used in order to encourage information flows and improve employees’ communication.

- The firm’s objectives and goals are clearly communicated to all the organizational members.

- There are frequent, well-distributed internal reports that inform employees about the firm’s progress.

- There are periodical meetings in which employees are informed about the new initiatives that have been implemented.

- There are formal mechanisms that guarantee the best practices to be shared in the firm.

- There are projects with interdisciplinary teams to share knowledge.

- There are employees that compile suggestions from other employees, customers, and suppliers, and produce structured reports to distribute throughout the company.

- There are communities of practices or learning groups to share knowledge and experiences.

- All the employees have access to relevant information and key knowledge within the firm.

- There are interdisciplinary teams with autonomy to apply and integrate knowledge.

- Suggestions from employees, customers, or suppliers are frequently incorporated into products, processes, or services.

- Knowledge that has been created is structured in independent modules, which allow for its integration or separation to create different applications and new usages.

- It is quite common to use external experts with experience on a specific subject in order to solve particular problems.

- We seek to exploit anticipated changes in future market conditions ahead of our rivals.

- We look forward to seizing initiatives whenever possible in our target market operations.

- We act opportunistically to shape the business environment in which we operate.

- Our business, in general, tends to invest in high-risk projects.

- Our business shows a great deal of tolerance for venturing into the unknown.

- Our business strategy is characterized by a tendency to commit resources into projects with uncertain outcomes.

3.3. Methodology

4. Results

- A positive and significant effect of knowledge creation on all the innovation measured, with the exception of product innovation, was found.

- Storage practices fostered innovation only for the case of product innovation.

- Both knowledge transfer and knowledge application encouraged organizational innovations.

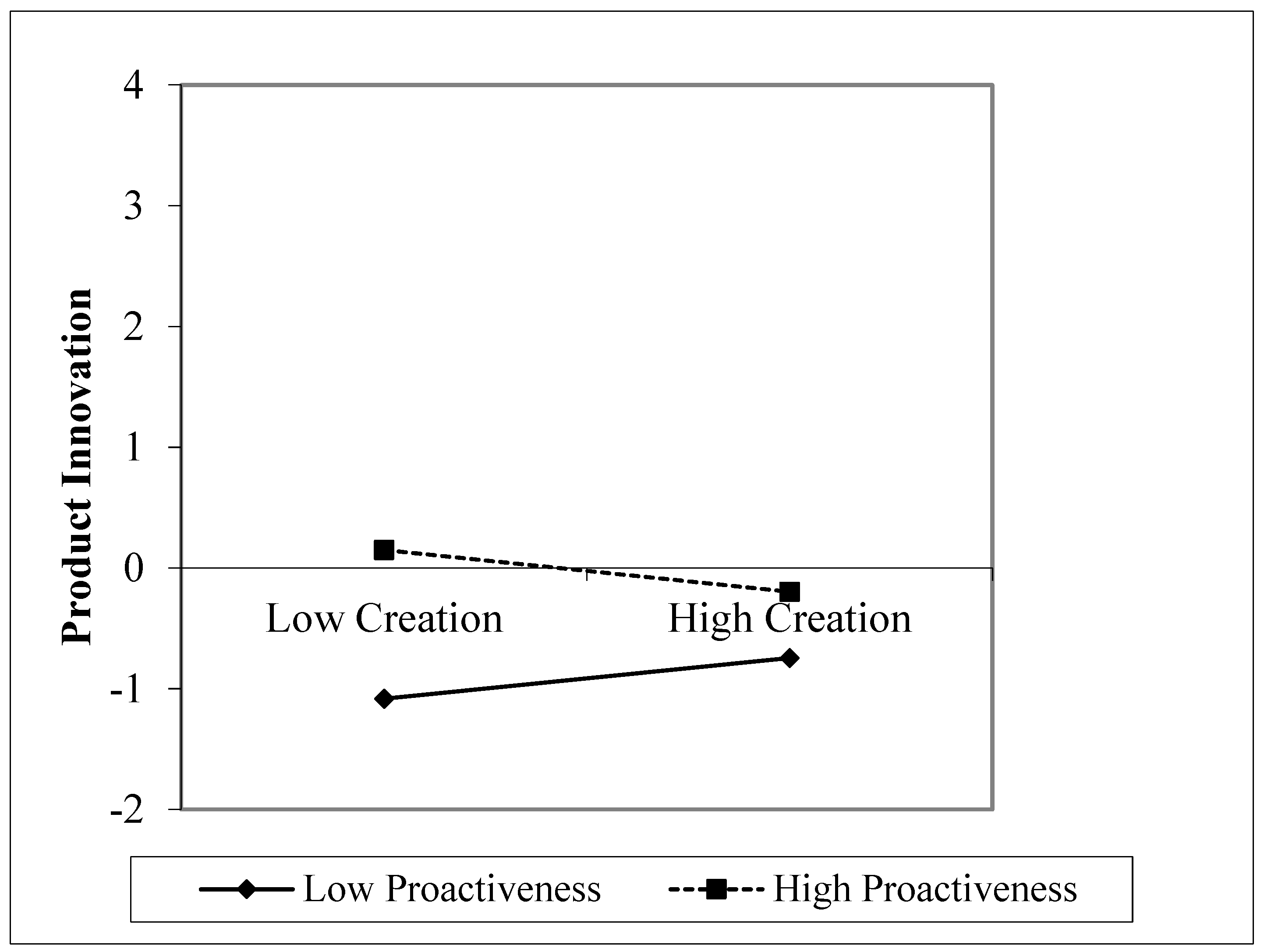

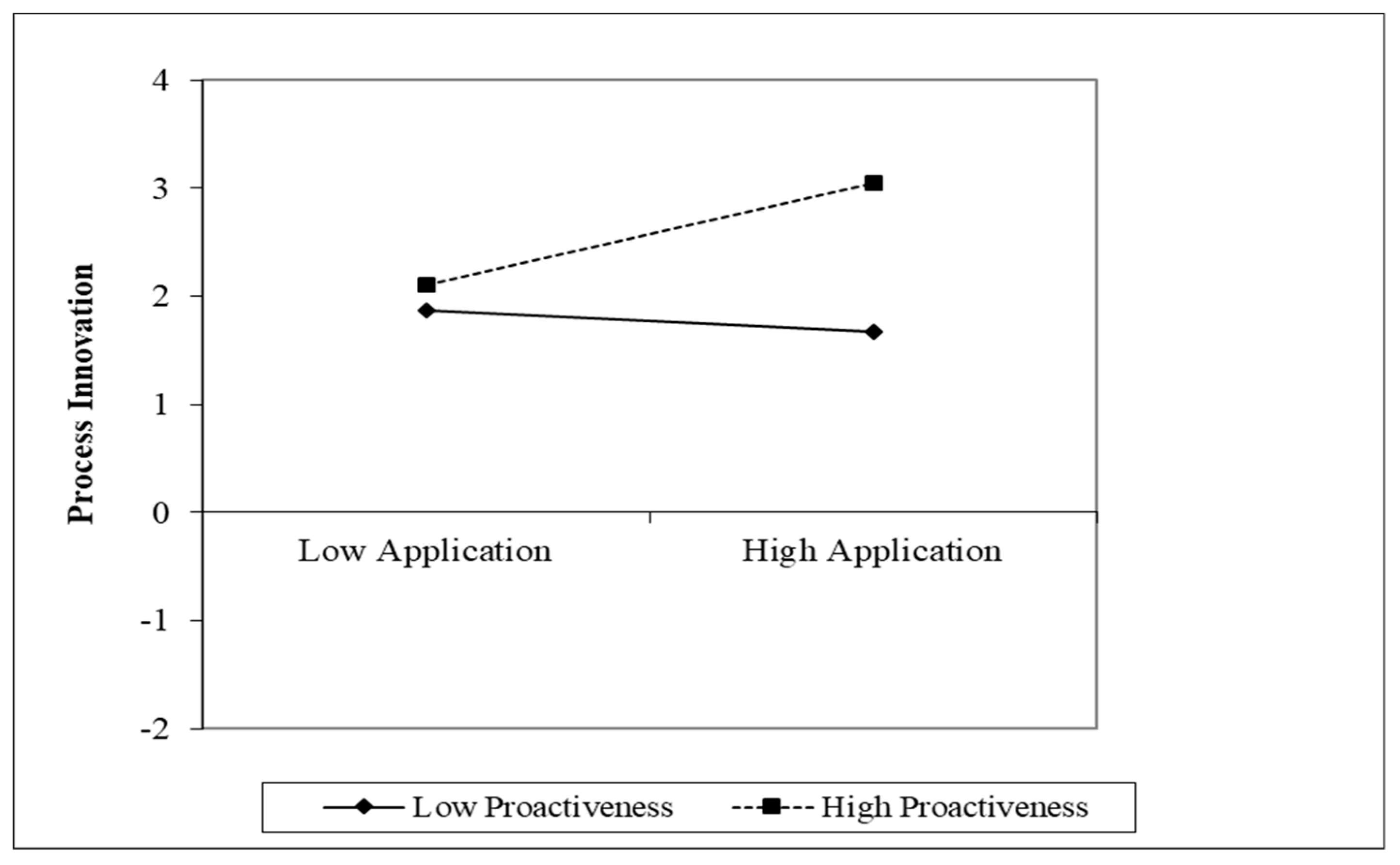

- Proactiveness negatively moderated the effect of knowledge creation on both product and process innovation.

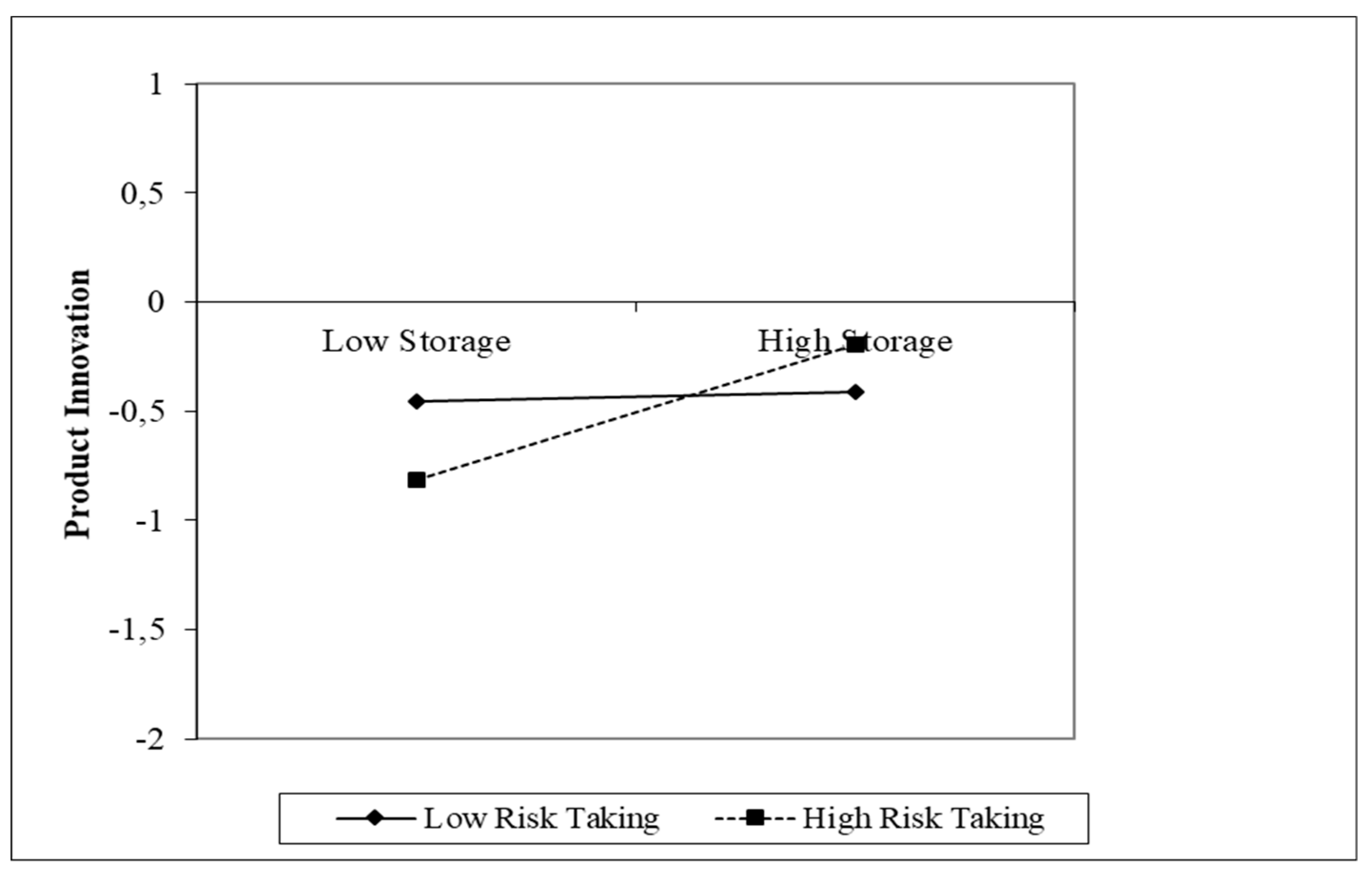

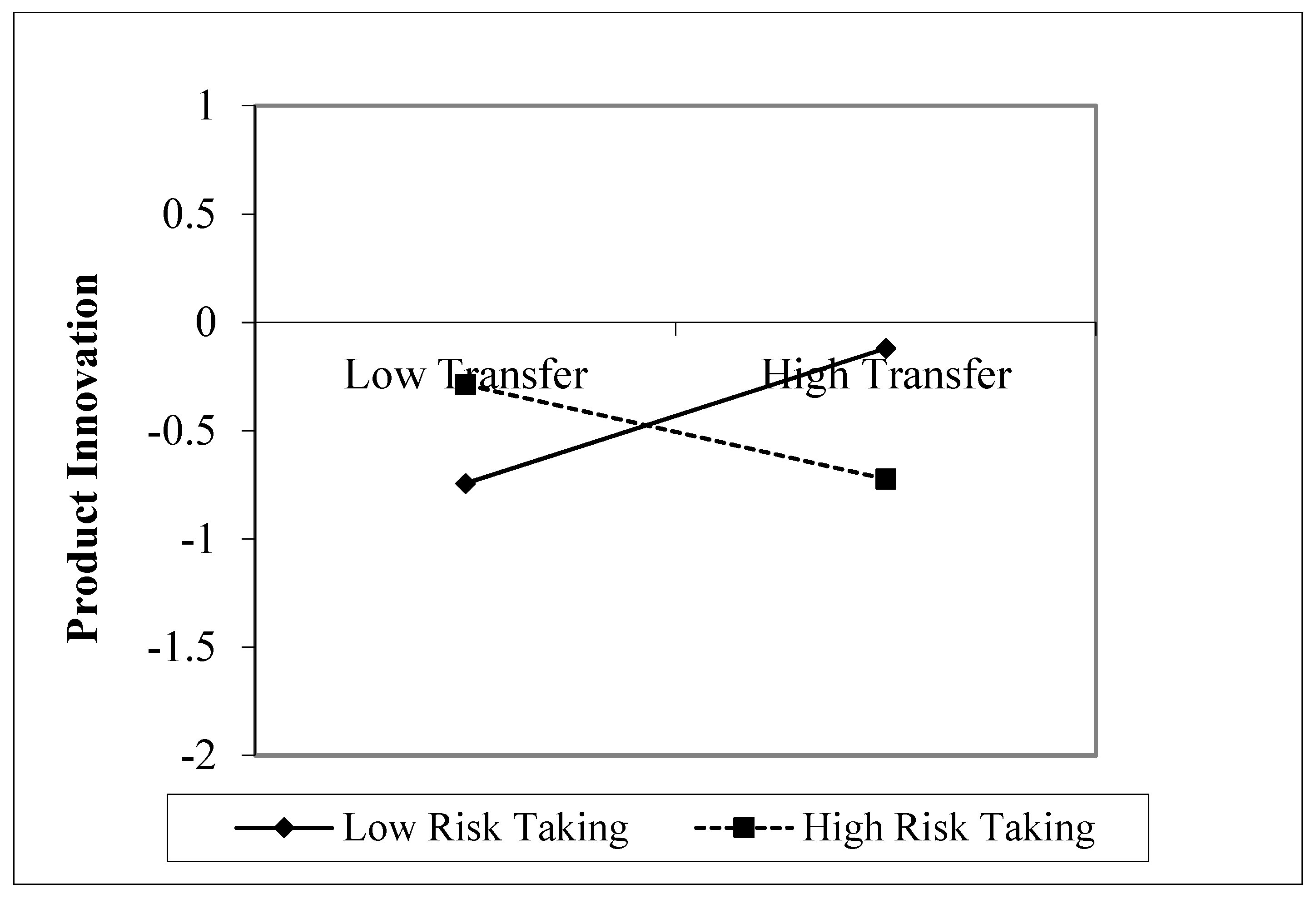

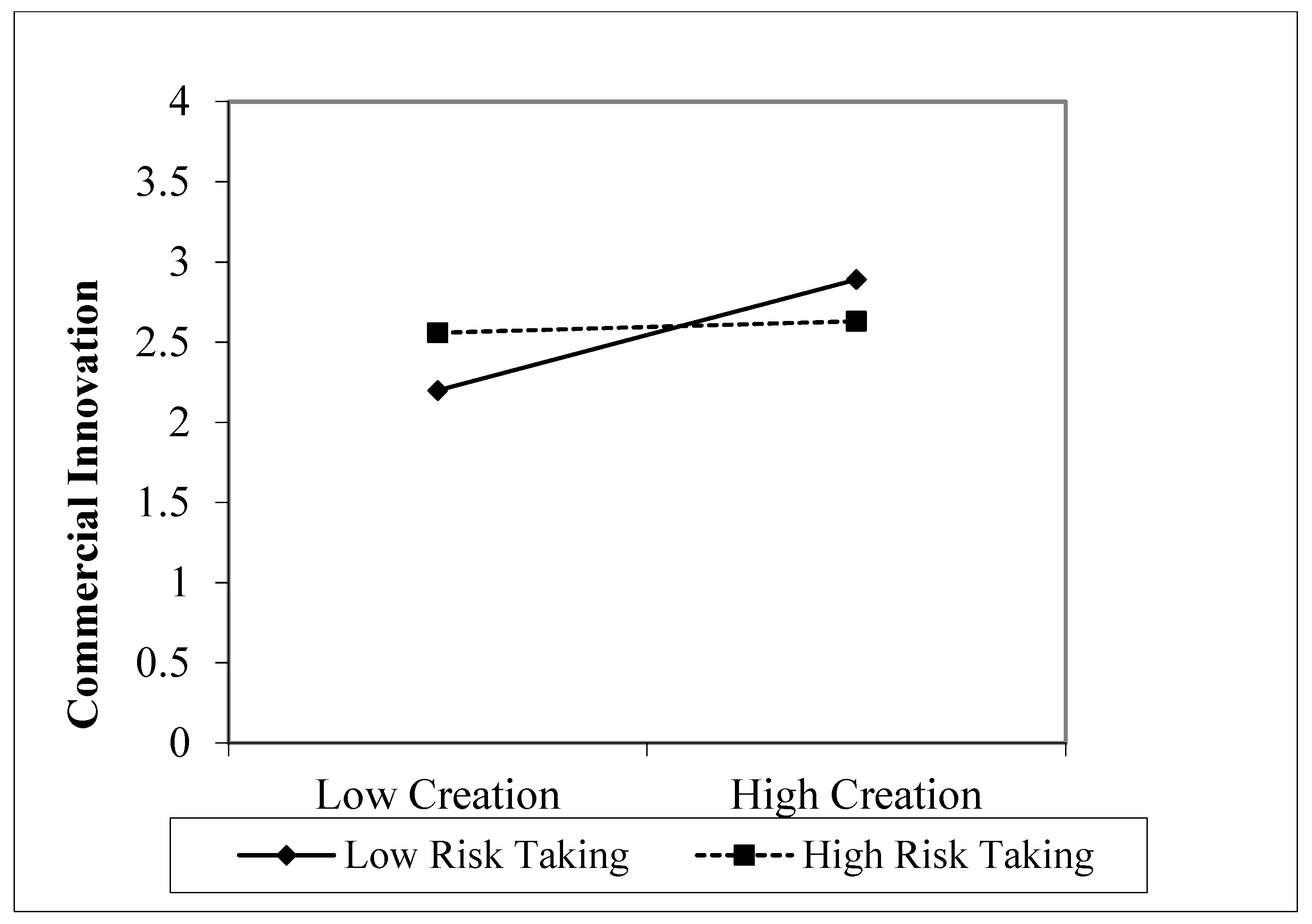

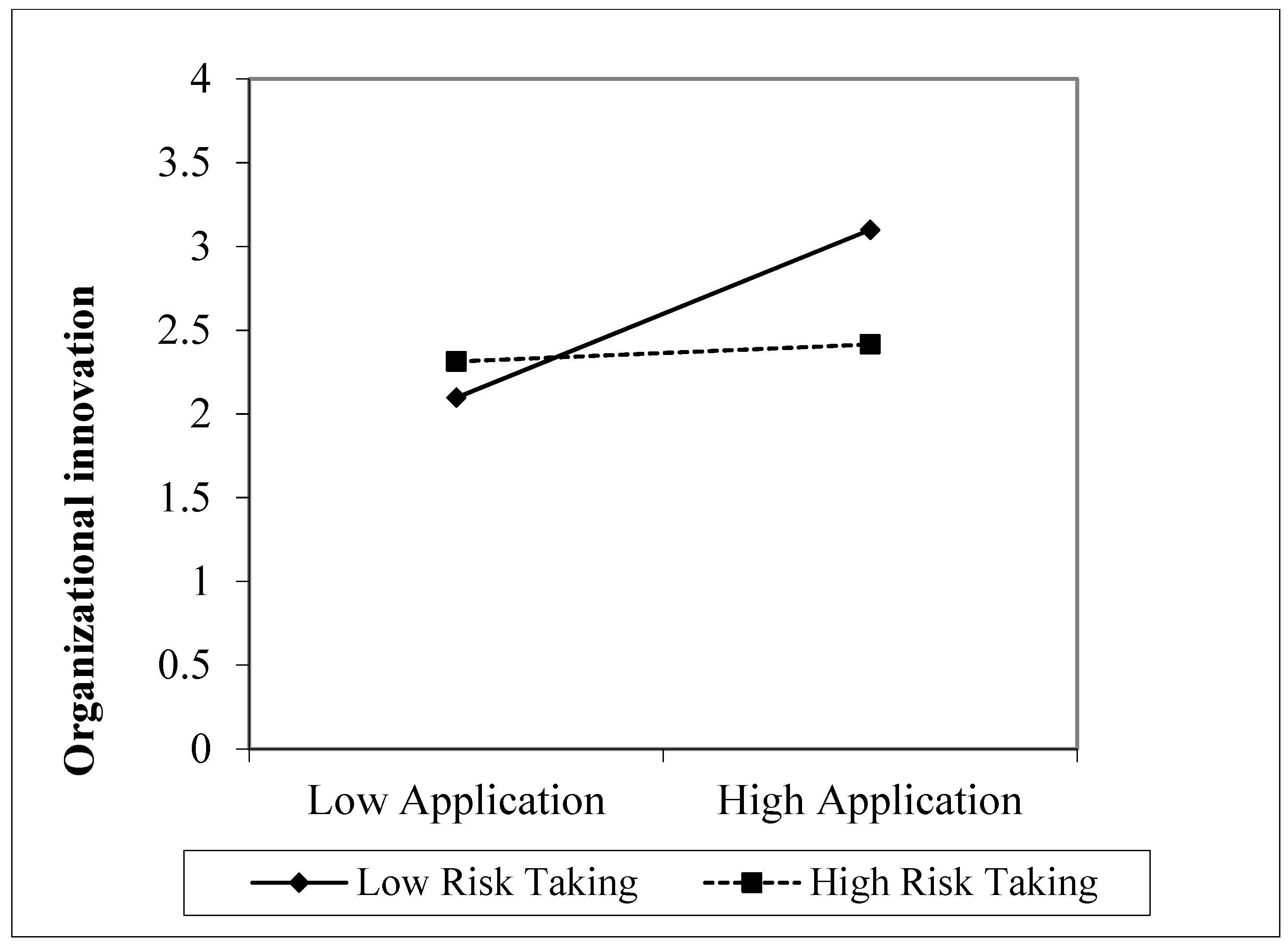

- Risk taking positively moderated the effect of knowledge storage on product innovation, while a negative moderator effect was found in the relationship between knowledge creation, transfer and application practices, and commercial, product, and organizational innovations.

5. Implications

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Alavi, Maryam, and Dorothy E. Leidner. 2001. Knowledge management and knowledge management systems: Conceptual foundations and research issues. MIS Quarterly 25: 107–36. [Google Scholar] [CrossRef]

- Alavi, Maryam, and Amrit Tiwana. 2003. Knowledge management: The information technology dimension. In Organizational Learning and Knowledge Management. Edited by Mark Easterby-Smith and Marjorie A. Lyles. London: Blackwell Publishing, pp. 104–21. [Google Scholar]

- Alegre, Joaquín, Kishore Sengupta, and Rafael Lapiedra. 2013. Knowledge management and innovation performance in a high-tech SMEs industry. International Small Business Journal 31: 454–70. [Google Scholar] [CrossRef]

- Amabile, Teresa M., Regina Conti, Heather Coon, Jeffrey Lazenby, and Michael Herron. 1996. Assessing the work environment for creativity. Academy of Management Journal 39: 1154–84. [Google Scholar]

- Andersén, Jim. 2015. The absorptive capacity of family firms: How familiness affects potential and realized absorptive capacity. Journal of Family Business Management 5: 73–89. [Google Scholar]

- Andreeva, Tatiana, and Aino Kianto. 2011. Knowledge processes, knowledge-intensity and innovation: A moderated mediation analysis. Journal of Knowledge Management 15: 1016–34. [Google Scholar] [CrossRef]

- Schiuma, Giovanni, Tatiana Andreeva, and Aino Kianto. 2012. Does knowledge management really matter? Linking knowledge management practices, competitiveness and economic performance. Journal of Knowledge Management 16: 617–36. [Google Scholar]

- Argote, Linda, and Paul Ingram. 2000. Knowledge transfer: A basis for competitive advantage in firms. Organizational Behaviour and Human Decision Processes 82: 150–69. [Google Scholar] [CrossRef]

- Argote, Linda, Bill McEvily, and Ray Reagans. 2003. Managing knowledge in organizations: An integrative framework and review of emerging themes. Management Science 49: 571–82. [Google Scholar] [CrossRef]

- Arregle, Jean Luc, Michael A. Hitt, David G. Sirmon, and Philippe Very. 2007. The Development of Organizational Social Capital Attributes of Family Firms. Journal of Management Studies 44: 73–95. [Google Scholar] [CrossRef]

- Barney, Jay. 1991. Firm resources and sustained competitive advantage. Journal of Management 17: 99–120. [Google Scholar] [CrossRef]

- Barroso-Martínez, Ascensión, Ramón Sanguino Galván, and Tomás M. Bañegil Palacios. 2016. An empirical study about knowledge transfer, entrepreneurial orientation and performance in family firms. European Journal of International Management 10: 534–57. [Google Scholar]

- Beneito, Pilar. 2003. Choosing among alternative technological strategies: An empirical analysis of formal sources of innovation. Research Policy 32: 693–713. [Google Scholar] [CrossRef]

- Biscotti, Anna Maria, Eugenio D’Amico, and Filippo Monge. 2018. Do environmental management systems affect the knowledge management process? The impact on the learning evolution and the relevance of organisational context. Journal of Knowledge Management 22: 603–20. [Google Scholar] [CrossRef]

- Björnberg, Åsa, and Nigel Nicholson. 2007. The family climate scales—Development of a new measure for use in family business research. Family Business Review 20: 229–46. [Google Scholar] [CrossRef]

- Bojica, Ana Maria, María del Mar Fuentes-Fuentes, and Virginia Fernández Pérez. 2017. Corporate entrepreneurship and codification of the knowledge acquired from strategic partners in SMEs. Journal of Small Business Management 55: 205–30. [Google Scholar] [CrossRef]

- Branzei, Oana, and Ilan Vertinsky. 2006. Strategic pathways to product innovation capabilities in SMEs. Journal of Business Venturing 21: 75–105. [Google Scholar] [CrossRef]

- Cabrera-Suárez, Katiuska, Petra De Saá-Pérez, and Desiderio García-Almeida. 2001. The succession process from a resource- and knowledge-based view of the family firm. Family Business Review 14: 37–48. [Google Scholar] [CrossRef]

- Calabro, Andrea, Tommaso Minola, Giovanna Campopiano, and Thilo Justus Pukall. 2016. Turning innovativeness into domestic and international corporate venturing: The moderating effect of high family ownership and influence. European Journal of International Management 10: 505. [Google Scholar] [CrossRef]

- Calvo-Mora, Arturo, Antonio Navarro-García, Manuel Rey-Moreno, and Rafael Periañez-Cristobal. 2016. Excellence management practices, knowledge management and key business results in large organisations and SMEs: A multi-group analysis. European Management Journal 34: 661–73. [Google Scholar] [CrossRef]

- Carnes, Christina Matz, and R. Duane Ireland. 2013. Familiness and Innovation: Resource Bundling as the Missing Link. Entrepreneurship Theory and Practice 37: 1399–419. [Google Scholar] [CrossRef]

- Carr, Chris. 2005. Are German, Japanese and Anglo-Saxon strategic decision styles still different in the context of globalization? Journal of Management Studies 42: 1155–88. [Google Scholar] [CrossRef]

- Chen, Chung-Jen, and Jing-Wen Huang. 2007. How organizational climate and structure affect knowledge-The social interaction perspective. International Journal of Information Management 27: 104–18. [Google Scholar] [CrossRef]

- Chen, Chung-Jen, Jing-Wen Huang, and Yung-Chang Hsiao. 2010. Knowledge management and innovativeness: The role of organizational climate and structure. International Journal of Manpower 31: 848–70. [Google Scholar] [CrossRef]

- Chen, Hsiang-Lan, and Wen-Tsung Hsu. 2009. Family ownership, board independence, and R&D investment. Family Business Review 22: 347–62. [Google Scholar]

- Chirico, Francesco. 2008. Knowledge accumulation in family firms: Evidence from four cases studies. International Small Business Journal 26: 433–62. [Google Scholar] [CrossRef]

- Chirico, Francesco, and Carlo Salvato. 2008. Knowledge integration and dynamic organizational adaptation in family firms. Family Business Review 21: 169–81. [Google Scholar] [CrossRef]

- Chirico, Francesco, and Carlo Salvato. 2016. Knowledge internalization and product development in family firms: When relational and affective factors matter. Entrepreneurship Theory and Practice 40: 201–29. [Google Scholar] [CrossRef]

- Cohen, Wesley M., and Daniel A. Levinthal. 1990. Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly 35: 128–52. [Google Scholar] [CrossRef]

- Corbetta, Guido, and Carlo Salvato. 2004. Self-serving or self-actualizing? Models of man and agency costs in different types of family firms: A commentary on “Comparing the agency costs of family and non-family firms: Conceptual issues and exploratory evidence”. Entrepreneurship Theory and Practice 28: 355–62. [Google Scholar] [CrossRef]

- Covin, Jeffrey G., and Danny Miller. 2014. International Entrepreneurial Orientation: Conceptual Considerations, Research Themes, Measurement Issues, and Future Research Directions. Entrepreneurship Theory and Practice 38: 11–44. [Google Scholar] [CrossRef]

- Covin, Jeffrey G., and Dennis P. Slevin. 1989. Strategic management of small firms in hostile and benign environments. Strategic Management Journal 10: 75–87. [Google Scholar] [CrossRef]

- Craig, Justin B., Mikko Pohjola, Sascha Kraus, and Soren. H. Jensen. 2014. Exploring Relationships among Proactiveness, Risk-Taking and Innovation Output in Family and Non-Family Firms. Creativity and Innovation Management 23: 199–210. [Google Scholar] [CrossRef]

- Cunningham, James, Claire Seaman, and David McGuire. 2016. Knowledge sharing in small family firms. Journal of Family Business Strategy 7: 34–46. [Google Scholar] [CrossRef]

- Darroch, Jenny, and Rod McNaughton. 2002. Examining the link between knowledge management practices and types of innovation. Journal of Intellectual Capital 3: 210–22. [Google Scholar] [CrossRef]

- De Clercq, Dirk, Dimo Dimov, and Narongsak Thongpapanl. 2013. Organizational social capital, formalization, and internal knowledge sharing in entrepreneurial orientation formation. Entrepreneurship Theory and Practice 37: 505–37. [Google Scholar] [CrossRef]

- De Massis, Alfredo, Federico Frattini, and Ulrich Lichtenthaler. 2013. Research on Technological Innovation in Family Firms: Present Debates and Future Directions. Family Business Review 26: 10–31. [Google Scholar] [CrossRef]

- Del Giudice, Manlio, and Vincenzo Maggioni. 2014. Managerial practices and operative directions of knowledge management within inter-firm networks: A global view. Journal of Knowledge Management 18: 841–46. [Google Scholar] [CrossRef]

- DiPasquale, Joanna, and Claire McInerney. 2010. Knowledge management in small-and medium-sized enterprises. Journal of Information and Knowledge Management 9: 341–53. [Google Scholar] [CrossRef]

- Donate, Mario J., and Jesús D. Sánchez de Pablo. 2015. The role of knowledge-oriented leadership in knowledge management practices and innovation. Journal of Business Research 68: 360–70. [Google Scholar] [CrossRef]

- Du Plessis, Marina. 2007. The role of knowledge management in innovation. Journal of Knowledge Management 11: 20–29. [Google Scholar] [CrossRef]

- Duran, Patricio, Nadine Kammerlander, Marc van Essen, and Thomas Zellweger. 2016. Doing More with Less: Innovation Input and Output in Family Firms. Academy of Management Journal 59: 1224–64. [Google Scholar] [CrossRef]

- Eddleston, Kimberly A., Franz W. Kellermanns, and Thomas M. Zellweger. 2010. Exploring the entrepreneurial behavior of family firms: Does the stewardship perspective explain differences? Entrepreneurship Theory and Practice 36: 347–67. [Google Scholar] [CrossRef]

- Eisenhardt, Kathleen M., and Jeffrey A. Martin. 2000. Dynamic capabilities: What are they? Strategic Management Journal 21: 1105–21. [Google Scholar] [CrossRef]

- Fang, Hanquing, Josip Kotlar, Esra Memili, James Chrisman, and Alfredo De Massis. 2018. The pursuit of international opportunities in family firms: Generational differences and the role of knowledge-based resources. Global Strategy Journal 8: 136–57. [Google Scholar] [CrossRef]

- Fuetsch, Elena, and Julia Suess-Reyes. 2017. Research on innovation in family businesses: Are we building an ivory tower? Journal of Family Business Management 7: 44–92. [Google Scholar] [CrossRef]

- Garud, Raghu, Philipp Tuertscher, and Andrew H. Van de Ven. 2013. Perspectives on Innovation Processes. The Academy of Management Annals 7: 775–819. [Google Scholar] [CrossRef]

- Grant, Robert M. 1996. Toward a knowledge based theory of the firm. Strategic Management Journal 17: 109–22. [Google Scholar] [CrossRef]

- Gold, Andrew H., Arvind Malhotra, and Albert H. Segars. 2001. Knowledge management: An organizational capabilities perspective. Journal of Management Information Systems 18: 185–214. [Google Scholar] [CrossRef]

- Gupta, Priya Dhamija, and Sonali Bhattacharya. 2016. Impact of Knowledge Management Processes for Sustainability of Small Family Businesses: Evidences from the Brassware Sector of Moradabad (India). Journal of Information and Knowledge Management 15: 1650040. [Google Scholar] [CrossRef]

- Hair, Joseph F., Rolph E. Anderson, Ronald L. Tatham, and William C. Black. 1998. Multivariate Data Analysis. Upper Saddle River: Prentice-Hall. [Google Scholar]

- Hatak, Isabella, Teemu Kautonen, Matthias Fink, and Juha Kansikas. 2016. Innovativeness and family-firm performance: The moderating effect of family commitment. Technological Forecasting and Social Change 102: 120–31. [Google Scholar] [CrossRef]

- Hernandez, Morela. 2012. Toward an understanding of the psychology of stewardship. Academy of Management Review 37: 172–93. [Google Scholar] [CrossRef]

- Hernández-Linares, Remedios, and María Concepción López-Fernández. 2018. Entrepreneurial orientation and the family firm: Mapping the field and tracing a path for future research. Family Business Review 31: 318–51. [Google Scholar] [CrossRef]

- Hernández-Perlines, Felipe, and Nina Rung-Hoch. 2017. Sustainable Entrepreneurial Orientation in Family Firms. Sustainability 9: 1212. [Google Scholar] [CrossRef]

- Hofstede, Geert. 2001. Culture’s Consequences: Comparing Values, Behavior, Institutions, and Organizations across Nations, 2nd ed. Thousand Oaks: Sage Publications. [Google Scholar]

- Hussinki, Henri, Aino Kianto, Mika Vanhala, and Paavo Ritala. 2017. Assessing the universality of knowledge management practices. Journal of Knowledge Management 21: 1596–621. [Google Scholar] [CrossRef]

- Huybrechts, Jolien, Wim Voordeckers, and Nadine Lybaert. 2013. Entrepreneurial risk taking of private family firms: The influence of a nonfamily CEO and the moderating effect of CEO tenure. Family Business Review 26: 161–79. [Google Scholar] [CrossRef]

- Jaskiewicz, Peter, Klaus Uhlenbruck, David B. Balkin, and Trish Reay. 2013. Is nepotism good or bad? Types of nepotism and implications for knowledge management. Family Business Review 26: 121–39. [Google Scholar] [CrossRef]

- Jayasingam, Sharmila, Mahfooz Ansari, T. Ramayah, and Muhamad Jantan. 2013. Knowledge management practices and performance: Are they truly linked? Knowledge Management Research & Practice 11: 255–64. [Google Scholar]

- Kallmuenzer, Andreas, and Ursula Scholl-Grissemann. 2017. Disentangling antecedents and performance effects of family SME innovation: A knowledge-based perspective. International Entrepreneurship Management Journal 13: 1117–138. [Google Scholar] [CrossRef]

- Kazanjian, Robert K., Robert Drazin, and Mary Ann Glynn. 2010. Creativity and technological learning: The roles of organization architecture and crisis in large-scale projects. Journal of Engineering and Technology Management 17: 273–98. [Google Scholar] [CrossRef]

- Katila, Riitta. 2002. New product search over time: Past ideas in their prime. Academy of Management Journal 45: 995–1010. [Google Scholar] [CrossRef]

- Katila, Riitta, and Gautam Ahuja. 2002. Something old, something new: A longitudinal study of search behaviour and new product introduction. Academy of Management Journal 45: 1183–19. [Google Scholar]

- Kianto, Aino, Paavo Ritala, John-Christopher Spender, and Mika Vanhala. 2014. The interaction of intellectual capital assets and knowledge management practices in organizational value creation. Journal of Intellectual Capital 15: 362–75. [Google Scholar] [CrossRef]

- Kim, Changsu, and Jaeyong Song. 2007. Creating new technology through alliances: An empirical investigation of joint patents. Technovation 27: 461–70. [Google Scholar] [CrossRef]

- Klammer Adrian, Gueldenberg Stefan, Kraus Sascha, and O’Dwyer Michelle. 2017. To change or not to change—Antecedents and outcomes of strategic renewal in SMEs. International Entrepreneurship Management Journal 13: 739–56. [Google Scholar] [CrossRef]

- Kogut, Bruce, and Udo Zander. 1992. Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science 3: 383–97. [Google Scholar] [CrossRef]

- Kotlar, Josip, Alfredo De Massis, Federico Frattini, Mattia Bianchi, and Hanquing Fang. 2013. Technology Acquisition in Family and Nonfamily Firms: A Longitudinal Analysis of Spanish Manufacturing Firms. Journal of Product Innovation Management 30: 1073–88. [Google Scholar] [CrossRef]

- Kumar, Nirmalya, Louis W. Stern, and James C. Anderson. 1993. Conducting Interorganizational Research Using Key Informants. Academy of Management Journal 36: 1633–51. [Google Scholar]

- Lawson, Benn, Kenneth J. Petersen, Paul D. Cousins, and Robert B. Handfield. 2009. Knowledge sharing in interorganizational product development teams: The effect of formal and informal socialization mechanisms. Journal of Product Innovation Management 26: 156–72. [Google Scholar] [CrossRef]

- Lee, Voon-Hsien, Lai-Ying Leong, Teck-Soon Hew, and Keng-Boon Ooi. 2013. Knowledge management: A key determinant in advancing technological innovation? Journal of Knowledge Management 17: 848–72. [Google Scholar] [CrossRef]

- Letonja, Marina, and Mojca Duh. 2016. Knowledge trasnfer in family businesses and its effects on the innovativeness of the next family generation. Knowledge Management Research & Practice 14: 213–24. [Google Scholar]

- Li, Haiyang, and Kwaku Atuahene-Gima. 2001. Product innovation strategy and performance of new technology ventures in China. Academy of Management Journal 44: 1123–34. [Google Scholar]

- Li, Yuan, Xunfeng Liu, Longwei Wang, Mingfang Li, and Hai Guo. 2009. How Entrepreneurial Orientation Moderates the Effects of Knowledge Management on Innovation. Systems Research and Behavioral Science 26: 645–60. [Google Scholar] [CrossRef]

- Li, Ling, and Xiping Zhao. 2006. Enhancing competitive edge through knowledge management in implementing ERP systems. Systems Research and Behavioral Science 23: 129–40. [Google Scholar] [CrossRef]

- Li, Yuan, Yi Liu, and Yongbin Zhao. 2006. The role of market and entrepreneurship orientation and internal control in the new product development activities of Chinese firms. Industrial Marketing Management 35: 336–47. [Google Scholar] [CrossRef]

- Lin, Bou-Wen, and Chung-Jen Chen. 2006. Fostering product innovation in industry networks: The mediating role of knowledge integration. International Journal of Human Resource Management 17: 155–73. [Google Scholar] [CrossRef]

- Lumpkin, G. Tom, and Gregory G. Dess. 1996. Clarifying the Entrepreneurial Orientation Construct and Linking It to Performance. Academy of Management Review 21: 135–72. [Google Scholar] [CrossRef]

- Lumpkin, G. Thomas, and Gregory G. Dess. 2001. Linking two dimensions of entrepreneurial orientation to firm performance: The moderating role of environment and industry life cycle. Journal of Business Venturing 16: 429–51. [Google Scholar] [CrossRef]

- Madanoglu, Melih, Levent Altinay, and Xuan Lorna Wang. 2016. Disentangling the effect of family involvement on innovativeness and risk-taking: The role of decentralization. Journal of Business Research 69: 1796–800. [Google Scholar] [CrossRef]

- Mascarenhas, Briance. 1985. Flexibility: Its relationship to environmental dynamism and complexity. International Studies of Management & Organization 14: 107–24. [Google Scholar]

- Matsuo, Makoto. 2015. A framework for facilitating experiential learning. Human Resource Development Review 14: 442–61. [Google Scholar] [CrossRef]

- Messeni Petruzzelli, Antonio, Vito Albino, Nunzia Carbonara, and Daniele Rotolo. 2010. Leveraging learning behavior and network structure to improve knowledge gatekeepers’ performance. Journal of Knowledge Management 14: 635–58. [Google Scholar] [CrossRef]

- Miller, Danny. 1983. The Correlates of Entrepreneurship in Three Types of Firms. Management Science 29: 770–91. [Google Scholar] [CrossRef]

- Miller, Danny, Lloyd Steier, and Isabelle Le Breton–Miller. 2016. What can scholars of entrepreneurship learn from sound family businesses. Entrepreneurship Theory and Practice 40: 445–55. [Google Scholar] [CrossRef]

- Mustafa, Michael, Erik Lundmark, and Hazel Melanie Ramos. 2016. Untangling the relationship between human resource management and corporate entrepreneurship: The mediating effect of middle managers’ knowledge sharing. Entrepreneurship Research Journal 6: 273–95. [Google Scholar] [CrossRef]

- Nieto, Maria Jesus, Lluis Santamaria, and Zulima Fernandez. 2015. Understanding the Innovation Behavior of Family Firms. Journal of Small Business Management 53: 382–99. [Google Scholar] [CrossRef]

- Norrgren, Flemming, and Joseph Schaller. 1999. Leadership style: Its impact on cross-functional product performance. Journal of Product Innovation Management 16: 377–84. [Google Scholar] [CrossRef]

- Nunnally, Jum C. 1978. Psychometric Theory. New York: McGraw-Hill. [Google Scholar]

- Manual, Oslo. 2005. Proposed Guidelines for Collecting and Interpreting Technological Innovation Data: The Oslo Manual. Paris: Organization for Economic Development and Co-Operation. [Google Scholar]

- Lotti Oliva, Fabio. 2014. Knowledge management barriers, practices and maturity model. Journal of Knowedge Management 18: 1053–74. [Google Scholar] [CrossRef]

- Patel, Pankaj C., and James O. Fiet. 2011. Knowledge Combination and the Potential Advantages of Family Firms in Searching for Opportunities. Entrepreneurship Theory and Practice 35: 1179–97. [Google Scholar] [CrossRef]

- Pearson, Allison W., Jon C. Carr, and John C. Shaw. 2008. Toward a theory of familiness: A social capital perspective. Entrepreneurship Theory and Practice 32: 949–69. [Google Scholar] [CrossRef]

- Pittino, Daniel, Ascensión Barroso-Martínez, Francesco Chirico, and Ramón Sanguino-Galván. 2018. Psychological ownership, knowledge sharing and entrepreneurial orientation in family firms: The moderating role of governance heterogeneity. Journal of Business Research 84: 312–26. [Google Scholar] [CrossRef]

- Purvis, Russell L., Vallabh Sambamurthy, and Robert W. Zmud. 2001. Assimilation of knowledge platforms in organizations: An empirical investigation. Organization Science 12: 117–35. [Google Scholar] [CrossRef]

- Sethi, Rajesh, and Anju Seth. 2009. Can quality-oriented firms develop innovative new products? Journal of Product Innovation Management 26: 206–21. [Google Scholar] [CrossRef]

- Rauch, Andreas, Johan Wiklund, G. Tom Lumpkin, and Michael Frese. 2009. Entrepreneurial orientation and business performance: An assessment of past research and suggestions for the future. Entrepreneurship Theory and Practice 33: 761–87. [Google Scholar] [CrossRef]

- Ren, Yuqing, Kathleen M. Carley, and Linda Argote. 2006. The contingent effects of transactive memory: When is it more beneficial to know what others know? Management Science 52: 671–82. [Google Scholar] [CrossRef]

- Roberts, Peter W., and Raphael Amit. 2003. The dynamics of innovative activity and competitive advantage: The case of Australian retail banking, 1981 to 1995. Organization Science 14: 107–22. [Google Scholar] [CrossRef]

- Roed, Irina. 2016. Disentangling the family firm’s innovation process: A systematic review. Journal of Family Business Strategy 7: 185–201. [Google Scholar] [CrossRef]

- Saha, Kaustav, Rohit Kumar, Swarup Kumar Dutta, and Tanusree Dutta. 2017. A content adequate five-dimensional entrepreneurial Orientation. Journal of Business Venturing 8: 41–49. [Google Scholar] [CrossRef]

- Serrano-Bedia, Ana M., M. Concepción López-Fernández, and Gema Garcia-Piqueres. 2016. Analysis of the relationship between sources of knowledge and innovation performance in family firms. Innovation 18: 489–512. [Google Scholar] [CrossRef]

- Serrano-Bedia, Ana M., M. Concepción López-Fernández, Gema García-Piqueres, and María Obeso. 2018a. The role of family firm on the relationship between KMP and innovation. Paper presented at the 13th European Conference on Innovation and Entrepreneurship, ECIE, Aveiro, Portugal, September 20–21. [Google Scholar]

- Serrano-Bedia, Ana M., Manuel Palma-Ruiz, and Cinthya Flores-Rivera. 2018b. Innovation and Family Firms: Past and Future Research Perspectives. In Handbook of Research on Entrepreneurial Leadership and Competitive Strategy in Family Business. Hershey: IGI Global. [Google Scholar]

- Sirmon, David G., Michael A. Hitt, R. Duane Ireland, and Brett Anitra Gilbert. 2011. Resource Orchestration to Create Competitive Advantage Breadth, Depth, and Life Cycle Effects. Journal of Management 37: 1390–412. [Google Scholar] [CrossRef]

- Sirmon, David G., and Michael A. Hitt. 2003. Managing resources: Linking unique resources, management, and wealth creation in family firms. Entrepreneurship Theory and Practice 27: 339–58. [Google Scholar] [CrossRef]

- Spender, J.-C. 1996. Making knowledge the basis of a dynamic theory of the firm. Strategic Management Journal 17: 45–62. [Google Scholar] [CrossRef]

- Stanovcic, Tatjana, Sanja Pekovic, and Amira Bouziri. 2015. The effect of knowledge management on environmental innovation. The empirical evidence from France. Baltic Journal of Management 10: 413–31. [Google Scholar] [CrossRef]

- Subramaniam, Mohan, and Mark A. Youndt. 2005. The influence of intellectual capital on the types of innovation capabilities. Academy of Management Journal 48: 450–63. [Google Scholar] [CrossRef]

- Tabachnick, Barbara G., and Linda S. Fidell. 2012. Using Multivariate Statistics, 6th ed. Boston: Pearson Education. [Google Scholar]

- Teng, Bing-Sheng. 2007. Corporate entrepreneurship activities through strategic alliances: A resource-based approach toward competitive advantage. Journal of Management Studies 44: 119–42. [Google Scholar] [CrossRef]

- Thornhill, Stewart. 2006. Knowledge, innovation and firm performance in high- and low-technology regimes. Journal of Business Venturing 21: 687–703. [Google Scholar] [CrossRef]

- Tushman, Michael, and David Nadler. 1986. Organization for innovation. California Management Review 28: 74–92. [Google Scholar] [CrossRef]

- Van de Ven, Andrew H. 1986. Central problems in the management of innovation. Management Science 32: 590–607. [Google Scholar] [CrossRef]

- Vandekerkhof, Pieter, Tensie Steijvers, Walter Hendriks, and Wim Voordeckers. 2015. The Effect of Organizational Characteristics on the Appointment of Nonfamily Managers in Private Family Firms. Family Business Review 28: 104–22. [Google Scholar] [CrossRef]

- Wiklund, Johan, and Dean Shepherd. 2003. Knowledge-based resources, entrepreneurial orientation, and the performance of small and medium-sized businesses. Strategic Management Journal 24: 1307–14. [Google Scholar] [CrossRef]

- Woodfield, Paul, and Kenneth Hust. 2017. Intergenerational knowledge sharing in family firms: Case-based evidence from the New Zealand wine industry. Journal of Family Business Strategy 8: 57–69. [Google Scholar] [CrossRef]

- Yusr, Maha Mohammed, Sany Sanuri Mohd Mokhtar, Abdul Rahim Othman, and Yaty Sulaiman. 2017. Does interaction between TQM practices and knowledge management processes enhance the innovation performance? International Journal of Quality & Reliability Management 34: 955–74. [Google Scholar]

- Zack, Michael, James McKeen, and Satyendra Singh. 2009. Knowledge management and organizational performance: An exploratory survey. Journal of Knowledge Management 13: 392–409. [Google Scholar] [CrossRef]

- Zahra, Shaker A., and Gerard George. 2002. Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review 27: 185–203. [Google Scholar] [CrossRef]

- Zahra, Shaker A., Donald O. Neubaum, and Bárbara Larrañeta. 2007. Knowledge sharing and technological capabilities: The moderating role of family involvement. Journal of Business Research 60: 1070–979. [Google Scholar] [CrossRef]

| V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | V11 | V12 | VIF | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| V1: Size | 1.126 | ||||||||||||

| V2: Manufacturers | 0.016 | 2.856 | |||||||||||

| V3: Services | 0.001 | −0.764 *** | 2.903 | ||||||||||

| V4: CEO Tenure | −0.088 | 0.112 | −0.043 | 1.112 | |||||||||

| V5: Fam Involvement | 0.181 *** | 0.045 | −0.060 | 0.026 | 1.063 | ||||||||

| V6: Coop University | 0.193 *** | −0.018 | 0.044 | −0.033 | −0.038 | 1.231 | |||||||

| V7: Coop Others | 0.156 *** | 0.039 | 0.003 | −0.048 | −0.038 | 0.270 *** | 1.117 | ||||||

| V8: Creation | 0.092 | 0.149 ** | −0.142 ** | 0.091 | 0.053 | 0.274 *** | 0.093 | 1.743 | |||||

| V9: Storage | 0.079 | 0.091 | −0.103 | −0.100 | 0.027 | 0.201 *** | 0.188 *** | 0.486 *** | 1.962 | ||||

| V10: Transfer | 0.060 | 0.047 | 0.019 | −0.086 | 0.009 | 0.214 *** | 0.188 *** | 0.470 *** | 0.632 *** | 3.100 | |||

| V11: Application | 0.048 | 0.040 | −0.016 | −0.030 | 0.063 | 0.240 *** | 0.177 *** | 0.416 *** | 0.584 *** | 0.798 *** | 2.887 | ||

| V12: Risk Taking | 0.009 | 0.085 | −0.081 | −0.124 | 0.034 | 0.121 *** | 0.075 | 0.402 *** | 0.260 *** | 0.293 *** | 0.347 *** | 1.393 | |

| V13: Proactiveness | 0.078 | 0.038 | 0.006 | −0.079 | 0.020 | 0.197 *** | 0.156 *** | 0.406 *** | 0.416 *** | 0.447 *** | 0.480 *** | 0.416 *** | 1.617 |

| Innoprod | Innoproc | Innorg | Innocom | |

|---|---|---|---|---|

| Control | ||||

| Size | 0.019 (0.084) | 0.125 (0.130) | 0.165 (0.118) | 0.110 (0.126) |

| Manufacturers | 0.325 (0.197) * | 0.063 (0.304) | −0.077 (0.275) | −0.087 (0.295) |

| Services | 0.298 (0.182) * | 0.174 (0.281) | −0.179 (0.254) | −0.066 (0.272) |

| CEO Tenure | 0.001 (0.005) | −0.003 (0.008) | −0.002 (0.007) | −0.005 (0.007) |

| Fam Involvement | 0.032 (0.023) | 0.029 (0.036) | −0.018 (0.032) | 0.024 (0.034) |

| Coop University | 0.350 (0.120) *** | 0.078 (0.185) | 0.210 (0.167) | 0.336 (0.179) * |

| Coop Others | −0.26 (0.118) | 0.150 (0.182) | 0.314 (0.164) ** | 0.053 (0.176) |

| KMP | ||||

| Creation | −0.002 (0.066) | 0.155 (0.102) * | 0.147 (0.092) * | 0.191 (0.099) ** |

| Storage | 0.165 (0.070) ** | 0.110 (0.109) | −0.008 (0.098) | −0.014 (0.105) |

| Transfer | 0.047 (0.074) | 0.013 (0.114) | 0.177 (0.103) * | 0.050 (0.110) |

| Application | 0.086 (0.095) | 0.186 (0.14) | 0.276 (0.133) ** | 0.158 (0.142) |

| Moderators EO | ||||

| Risk Taking | −0.037 (0.090) | −0.034 (0.138) | −0.117 (0.125) | 0.025 (0.134) |

| Proactiveness | 0.445 (0.067) *** | 0.403 (0.103) *** | 0.329 (0.093) *** | 0.318 (0.100) *** |

| Interactive terms | ||||

| Creation x Risk Taking | 0.020 (0.066) | 0.010 (0.102) | −0.085 (0.092) | −0.155 (0.099) * |

| Creation x Proactiveness | −0.171 (0.065) *** | −0.142 (0.101) * | −0.109 (0.091) | −0.048 (0.097) |

| Storage x Risk Taking | 0.145 (0.084) * | −0.031 (0.130) | 0.084 (0.118) | 0.114 (0.126) |

| Storage x Proactiveness | −0.026 (0.075) | 0.052 (0.116) | 0.048 (0.105) | 0.002 (0.112) |

| Transfer x Risk Taking | −0.265 (0.105) ** | −0.115 (0.163) | 0.068 (0.147) | 0.017 (0.158) |

| Transfer x Proactiveness | 0.067 (0.092) | −0.075 (0.143) | −0.063 (0.129) | −0.1469 (0.138) |

| Application x Risk Taking | 0.067 (0.095) | −0.116 (0.147) | −0.225 (0.133) * | −0.065 (0.143) |

| Application x Proactiveness | 0.028 (0.093) | 0.285 (0.143) ** | 0.150 (0.129) | 0.150 (0.139) |

| Constant | −0.469 (0.308) | 2.173 (0.475) *** | 2.481 (0.429) *** | 2.570 (0.460) *** |

| R | 0.662 | 0.516 | 0.568 | 0.503 |

| R2 | 0.439 | 0.266 | 0.323 | 0.253 |

| Adjusted R2 | 0.386 | 0.197 | 0.259 | 0.183 |

| F | 8.304 *** | 3.850 *** | 5.059 *** | 3.603 *** |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

García-Piqueres, G.; Serrano-Bedia, A.-M.; Pérez-Pérez, M. Knowledge Management Practices and Innovation Outcomes: The Moderating Role of Risk-Taking and Proactiveness. Adm. Sci. 2019, 9, 75. https://doi.org/10.3390/admsci9040075

García-Piqueres G, Serrano-Bedia A-M, Pérez-Pérez M. Knowledge Management Practices and Innovation Outcomes: The Moderating Role of Risk-Taking and Proactiveness. Administrative Sciences. 2019; 9(4):75. https://doi.org/10.3390/admsci9040075

Chicago/Turabian StyleGarcía-Piqueres, Gema, Ana-M. Serrano-Bedia, and Marta Pérez-Pérez. 2019. "Knowledge Management Practices and Innovation Outcomes: The Moderating Role of Risk-Taking and Proactiveness" Administrative Sciences 9, no. 4: 75. https://doi.org/10.3390/admsci9040075

APA StyleGarcía-Piqueres, G., Serrano-Bedia, A.-M., & Pérez-Pérez, M. (2019). Knowledge Management Practices and Innovation Outcomes: The Moderating Role of Risk-Taking and Proactiveness. Administrative Sciences, 9(4), 75. https://doi.org/10.3390/admsci9040075