Abstract

To increase competitiveness, a country has to outperform its competitors in terms of research and innovation, entrepreneurship, competition, and education. In this paper, we aim to test the relationship between the quality of entrepreneurial activity and the economic competitiveness for the European Union countries by using panel data estimation techniques. Our research considers a sample of 28 EU countries over the period 2011–2017. For the empirical investigation we apply panel data regression models. The results obtained show that business, macroeconomic environment and the quality of entrepreneurship are significant determinants of economic competitiveness of EU countries. Thus, we identify significant positive relations between innovation rate, inflation rate, FDI and economic competitiveness, and significant negative relations between expectations regarding job creation, tax rate, costs and competitiveness. Our study completes the literature by analyzing the relationship between the quality of entrepreneurship and the competitiveness of countries, for an extensive sample formed by all the 28 countries members of the European Union for a period of seven recent years.

1. Introduction

The role of entrepreneurship for ensuring economic growth and development of countries has been highlighted in the literature (Wennekers and Thurik 1999; Toma et al. 2014; Meyer and Meyer 2017; Meyer and de Jongh 2018). These studies point out the role played by the development of small and medium enterprises sector for improving economic and social outlooks. Moreover, the role of innovative entrepreneurship is even greater for stimulating the economic development of countries (Bashir and Akhtar 2016; Doğan 2016). Countries with higher levels of innovative entrepreneurs are benefiting from higher levels of economic development.

Therefore, in the European countries the interest of policy makers in increasing national and regional competitiveness determines them to adopt different measures to support a more qualitative entrepreneurship.

Starting from those stated above, the main research question to be analyzed in this paper is how the quality of entrepreneurial activity measured by innovation and job creation can play a role in the promotion of national competitiveness. This is an important topic because, as presented above, countries are increasingly competing with each other and the improvement of competitiveness is seen as a way to sustain economic growth and development. Additionally, the influence of qualitative entrepreneurship, measured by innovation and job creation, on national competitiveness has been poorly discussed in the literature, so our paper aims at filling this gap by realizing an extensive study for all 28 member countries of the European Union, on a period of seven recent years, 2011–2017.

For testing our hypotheses, we use panel data estimation techniques choosing as a dependent variable of the econometric models the economic competitiveness of countries. As explanatory variables, we took into account three groups of indicators. The first a set comprises of indicators expressing the quality of entrepreneurial activity, namely: Innovation rate measured as percentage of Total early stage entrepreneurial activity and high job creation expectation rate measured as percentage of Total early stage entrepreneurial activity. The other two sets of indicators are used as control variables and comprise of a set of macroeconomic variables: Gross Domestic Product (GDP) growth, inflation rate, tax rate and foreign direct investments (FDI), and business environment indicators: The cost of business start-up procedures.

Our study contributes to the literature by considering for the analysis all the 28 European Union member countries, in comparison with other studies that have analyzed only one or several countries. Another novelty of our analysis is the fact that we have analyzed the relationship between the quality of entrepreneurship and national competitiveness. In the literature are only few studies that analyze the impact of several aspects of entrepreneurship on the level of economic competitiveness of countries, but, to our knowledge, there are no studies testing the relation between the quality of entrepreneurial activities and national competitiveness. Therefore, we intended to fill this literature gap. Moreover, we consider that our results could be of interest to policy makers from the European countries interested to enhance national competitiveness, because it points out the key role played by qualitative entrepreneurship, triggered by the innovative ideas and the creation of new jobs, for higher competitiveness.

This paper is structured as follows. The next section reviews the literature regarding the quality of entrepreneurship measured by innovation and job creation and economic competitiveness and reviews the main empirical studies integrating the relationship between entrepreneurial activity and competitiveness. Section three presents the methodology used for our empirical investigation, describing the sample, the variables considered and the methods used for analyzing the data. Section four summarizes the results obtained and several discussions regarding the results. The final section presents the conclusions and some future directions of research.

2. Literature Review

In the economic and business literature, there is no consensus regarding the concept of economic competitiveness. Even so, it is considered a very complex concept (Rusu and Roman 2018) which refers to “the favourable position of a country, especially in international trade, but also the ability to improve its position”.

We have found several approaches of the competitiveness according to different organizations. For instance, Organization for Economic Cooperation and Development (OECD) defines competitiveness by taking into account its two main reference levels—the firm and the nation. For our research it is important to clarify the concept of national competitiveness. Thus, according to OECD and to the fact that the objective of competitiveness for a nation is to maintain and improve its citizens’ living standards, competitiveness is considered to be “the ability of companies, industries, regions, nations or supranational regions to generate, while being and remaining exposed to international competition, relatively high factor income and factor employment levels on a sustainable basis” (Hatzichronoglou 1996).

A similar approach has the Institute for Management Development (IMD) which refers to competitiveness both as a tool and an objective of economic policy. Arturo Bris (IMD World Competitiveness Centre 2018a), the director of the IMD World Competitiveness Centre understands competitiveness as “the ability of countries, regions and companies to manage their competencies to achieve long-term growth, generate jobs and increase welfare”. Also, when defining economy’s competitiveness, “it cannot be reduced only to GDP and productivity” because enterprises also have to deal with political, social and cultural dimensions. Thus, governments need to provide “an environment characterized by efficient infrastructures, institutions and policies that encourage sustainable value creation by the enterprises” (IMD World Competitiveness Centre 2018b).

Our study is focused on European Union countries, so it is important to mention the position of European Commission regarding the economic competitiveness. European Competitiveness Report (European Commission 2014) considers a competitive economy as being that economy that has a consistently high rate of productivity growth. The Europe 2020 Strategy describes the seven pillars of competitiveness (enterprise environment, digital agenda, innovative Europe, education and training, labor market and employment, social inclusion and environmental sustainability) which has been combined in order to create the Europe 2020 Competitiveness Index (World Economic Forum 2012). In their research, Radulescu et al. (2018) investigated the implementation of Europe 2020 Strategy for six selected CEE countries (Romania, Bulgaria, the Czech Republic, Poland, Hungary and Slovakia) over the period 2004–2015, considering that fulfilling the Strategy objectives enhance the economic performance and competitiveness. Performing the study, they highlighted that the most important factor which contributes to economic performance and competitiveness is represented by the tertiary level of education, followed by the school dropout ratio, the share of renewable energy in final energy consumption, and the employment rate.

On the other hand, The World Economic Forum has been studying Europe’s competitiveness compared with that of the United Stated, beginning with 1979. According to the World Economic Forum (2014), “Competitive economies are those that are able to provide high and rising living standards, allowing all members of a society to contribute to and benefit from these levels of prosperity. In addition, competitive economies are those that are sustainable—meeting the needs of the present generation while maintaining the ability to meet those of future generations”.

Considering the definitions mentioned above, we can assert that competitiveness is a complex concept. All the definitions have something in common: Economic and sustainable growth in the context of a favourable business environment.

The objective of our paper is not to define the economic competitiveness, but to link the economic competitiveness of nations to entrepreneurial activity. Studies in the field showed that in the context of globalization, the global business environment, innovation and creativity are considered key ingredients in creating and sustaining economic competitiveness (Ojo et al. 2017; Baron and Tang 2011). A similar perspective is shared by Anastassopoulos (2007), who considers that the enterprises and the environment in which they operate are important determinants of economic competitiveness. In this context, a competitive strategy and performance is necessary to be defined and applied.

The quality of entrepreneurship is very important for the development of an economy, and the innovative entrepreneurs are seen as agents helping markets development and the increase of economic competitiveness. As shown by Bosma et al. (2012), the improvement of entrepreneurial environment of a country could be a key factor for increasing economic competitiveness. In this context, researchers tried to define and to measure the relationship between economic development and entrepreneurship because entrepreneurship has been recognized as a micro driver of innovation and economic growth (Wennekers et al. 2010; Hall et al. 2010; González-Pernía et al. 2015; Bashir and Akhtar 2016; Chowdhury et al. 2018). In their study, González-Pernía et al. (2015) highlighted the importance of innovative entrepreneurs. Even if they represent a small portion of the entire population of business founders, they have an extraordinary economic impact, as they develop new technologies, create new jobs and enhance the revitalization capacity of territories.

Grilo and Thurik (2005) consider that the entrepreneurial activity is at the heart of innovation, productivity growth, competitiveness, economic growth and job creation and this explain why entrepreneurship has become a key policy issue (Wennekers and Thurik 1999) and why policymakers have to take into consideration the relationship between entrepreneurship and economic development.

Recent studies (Amorós et al. 2013) reveal that entrepreneurship is very important for a country’s competitiveness and development because entrepreneurs create new businesses and in turn these generate new jobs, more competition, and may even increase productivity through innovation. The same opinion is shared by Gonzalez-Sanchez (2013) who considers that innovation and entrepreneurial activities have become increasingly important elements for economic growth and are also decisive factors in a country’s level of development. In their study on European countries they have found that the effects of innovation and entrepreneurial activity tend to be more positive for the economy of those countries when the economic scenario worsened.

A study (2001) applied to the province of Seville, one of the least developed areas in the European Union in the 2000′s, showed that entrepreneurship and the entrepreneurs who innovate are important for economic development.

To understand m Guzmán and Santos (2001) ore deeply how entrepreneurship can make its contribution to economic development, Pawitan et al. (2017) analyzed the relationship between entrepreneurial spirit, a subset of entrepreneurship, and global competitiveness at the national level for the case of Indonesia in 2015. The authors understand the term of entrepreneurial spirit to consist of two dimensions: Entrepreneurial attitudes (social value, personal attributes, and goal orientation) and entrepreneurial activities (total early entrepreneurial activities and rate of established business ownerships). Their results indicate that global competitiveness can be improved through personal attributes and goal orientation while the indicators of entrepreneurial activities are negatively correlated with global competitiveness.

In their empirical study, Bashir and Akhtar (2016) conducted a survey of more than 1500 entrepreneurs across the G20 countries in order to explore the relation of Innovative Entrepreneurship and economic growth and its role in economic development of G20 member countries. Their results show a positive relationship which demonstrates that it is possible to increase economic growth through innovative entrepreneurship.

In addition, several studies have investigated the impact of entrepreneurship on countries’ economic and competitiveness development. A recent one (Dhahri and Omri 2018) investigated the relationship between entrepreneurship and the three areas of sustainable development (economic, social and environmental) for the case of 20 developing countries (Argentina, Brazil, China, Colombia, Egypt, India, Indonesia, Iran, Malaysia, Mexico, Morocco, Nigeria, Pakistan, Peru, Philippines, Romania, South Africa, Thailand, Tunisia and Turkey) over the period 2001–2012. Dhahri and Omri (2018) provide results that confirm the positive contribution of entrepreneurship to the economic and social dimensions of sustainable development, while its contribution to the environmental dimension is negative.

In a different approach, Bosma et al. (2018) pointed out the impact of institutions on “productive entrepreneurship” and the effects of entrepreneurship on economic growth. The authors (Bosma et al. 2018) use the definition of Baumol (1993) for the concept “productive entrepreneurship” which refers to “any entrepreneurial activity that contributes directly or indirectly to net output of the economy or to the capacity to produce additional output”. This study is important because productive entrepreneurship includes entrepreneurship that generates innovation and economic growth and the results showed the contribution of productive entrepreneurship to economic growth for a sample of 25 European countries over the analyzed period 2003–2014. Thus, their study confirms also that innovation, as a channel of entrepreneurship may drive economies to economic growth.

European Union policy regards innovation as an important driver for the firms’ competitiveness, economic growth and job creation (European Commission 2014), aspect emphasized and demonstrated also by various research studies. Thus, we mention the research of Ciocanel and Pavelescu (2015) who analyzed the link between innovation and economic competitiveness in the EU context (EU countries and Norway) over the period 2008–2013. Their results concluded that improving of innovation performance leads to the increasing of national competitiveness. On the other hand, the correlation between innovation and economic growth, and, implicitly, competitiveness has been studied by Petrariu et al. (2013) for Central and Eastern European (CEE) countries. Even innovation is often considered to be a typical activity of the developed countries, Petrariu et al. (2013) showed for the group of CEE countries that innovation makes significant contribution to national competitiveness and economic growth. They also argue that the gap between the developed (Western) and developing (Eastern) economies can be reduced by investing in innovation.

Regarding the developed economies of the European Union, the research of Bartz and Winkler (2016) on German businesses tested if financial instability, such as 2009 crisis, is detrimental to entrepreneurship. Their results highlighted that entrepreneurial activity is riskier during crisis than in normal times, but the interesting fact is that small firms exhibit a relative growth advantage compared to larger firms in both stable and crisis times, and this is considered to be a flexibility advantage of small size firms. Developing economies and the role of innovation in stimulating competitiveness and economic growth was the subject of another recent paper (Terzić 2017). The study comprised 10 developing countries from European Union in order to determine the interconnections between the variables of innovation, competitiveness and growth. The results obtained showed that for the selected countries, innovation performance depends on a developed research system, improved conditions for entrepreneurship, and a higher degree of innovation performances. Through job creation and the development of new products and services, innovation contributes to the increase of competitiveness and represents a key factor leading countries’ economic growth (Kuhlman et al. 2017). Innovation represents an important pillar for global competitiveness (Ghoniem and El Khouly 2012) that contributes also to the improvement of international competitiveness as found by Özçelik and Taymaz (2004) in their study on Turkey. Thus, public authorities should apply appropriate policies and plans for actions that increase innovation which will enhance economic growth. Potluka and Dvoulety (2018) have emphasized that the policy makers from Czech Republic actively support companies from public budgets in order to sustain national competitiveness and to ensure higher levels of employment. Czechpublic programs are intended to support innovative companies and thus, increase competitiveness and employment. The authors have found a significant positive impact of the public programmes on employment, sales and profit.

Regarding emerging economies, there is limited research on entrepreneurship, and we cannot apply the findings about the world’s developed economies to them. Taking into consideration the fact that entrepreneurship plays a key role in the economic development, Bruton et al. (2008) suggest there is a strong need to develop an understanding of entrepreneurship in emerging economies.

Regarding European Union countries, the authors who have analyzed the relationship between entrepreneurship and national competitiveness (Bosma et al. 2018; Ciocanel and Pavelescu 2015; Szabo and Herman 2012) found also that innovative entrepreneurs contribute to economic growth and enhance economic competitiveness both in developed countries and in developing countries of the EU.

Bulat et al. (2018) conducted a comparative study on 50 member countries of the Eurasian Economic Union in order to identify the factors that most significantly affect the competitiveness of their economy. Using a multiple regression model, Bulat et al. (2018) demonstrated that the innovation index has a significant impact on the competitiveness of the economy. Starting from these results, the authors proposed several measures for the economy of Kazakhstan, measures designed to stimulate innovation, which can also help increase competitiveness.

A table representation of the literature analyzing the most important aspects related with our research is presented below in Table 1.

Table 1.

Authors included in the literature review and their findings.

Entrepreneurial activity and competitiveness have been the research topic of a large number of authors, enjoying increased attention on how entrepreneurs innovate and consequently contribute to higher levels of competitiveness. Reviewing the literature, we can assert that the quality of entrepreneurship, measured by innovation and job creation, is important in order to achieve economic competitiveness.

3. Materials and Methods

The main objective of our investigation is to determine the impact of the quality of entrepreneurship on host countries’ competitiveness. In order to achieve this goal, we consider the innovation rate of entrepreneurial activity and the potential creation of new jobs in the future as explanatory variables, besides some control variables, such as the level of economic growth, inflation, total tax rate, foreign direct investments and the costs of business start-up procedures. For measuring the level of national competitiveness, we use as proxy the Global Competitiveness Index.

The sample comprises information for the 28 European Union member countries between 2011 and 2017. We have chosen this period for analysis due to the availability of data. This period includes the years after the recent financial crisis and is marked by recession and recovery efforts from European economies. The effects of the recent financial crisis were felt with different intensities in different countries, so, we must specify that our results might be influenced by this situation. If we would have analyzed only years without difficulties in the EU economies, we might have obtained different results. But, as the economy is generally marked by cyclicality between positive phases and recession or crisis, we cannot make a separation, and we consider that is important to analyze the relationship between the quality of entrepreneurship and national competitiveness also in difficult economic times.

The general equation of our econometric model is described below by Equation (1):

where i represents the EU countries (i = 1, …, 28), and t represents time (t = 2011, …, 2017). GCIit is the dependent variable and represents the Global Competitiveness Index calculated by the World Economic Forum. β0 is the common intercept and β is the vector of coefficients associated with the explanatory variables. Xit is the vector of explanatory variables for country i at time t. Yit is the vector of explanatory variables for country i at time t. εit is the random term for country i at time t.

GCIit = β0 + β1 Xit + β2 Yit + αi + εit

The general equation adapted to our sample is described in the following by Equation (2):

GCIit = β0 + β1 innovit + β2jobsit + β3Macroecit + β3businessit + αi + εit

Since our sample combines time series and cross-sections, we will apply a regression model on a balanced panel data for analyzing the effects of the considered explanatory variables on competitiveness of EU member countries. In order to study a model with these characteristics, we can use two different models: A fixed effect model (FE) and a random effect model (RE). Fixed effect model explores the relationship between the predictor and outcome variables within an entity and assumes that the independent variables are fixed across observation units and that the fixed effects are computed from the differences within each unit across time. Differently, Random effect model is usually preferred when we think that there are no omitted variables or if we believe that the omitted variables are not correlated with the explanatory variables considered in the model. Using this model will determine unbiased estimates of the coefficients, use all the data available, and produce the smallest standard errors. The significant distinction between fixed and random effects is whether the unobserved individual effect incorporates elements that are correlated with the regressors in the model (Greene 2003; Baltagi 2005). For choosing between OLS, FE and RE we apply Hausman test and Redundant fixed effects test.

Also, when running the panel data regression models we determined the estimator variance–covariance matrix by the White cross method, treating the pool regression as a multivariate regression, to cope with the suspicion of transverse heteroscedasticity.

As previously mentioned, we consider as dependent variable of our model the competitiveness of European Union member countries. Since in the literature there is not an unanimous definition of the competitiveness of a country we decided to measure it by the Global Competitiveness Index (GCI), which is calculated by the World Economic Forum (WEF). WEF calculates GCI by taking into account twelve pillars, which are grouped into three sub-indexes. The first sub-index refers to basic requirements and comprise of institutions, infrastructure, macroeconomic environment and health and primary education. The second sub-index refers to efficiency enhancers and is considering higher education and training, goods and labor market efficiency, financial market development, technological readiness and market size. The last sub-index consists of two pillars, namely: Business sophistication and innovation. The GCI takes values from 1 to 7, if its value is higher it means that the country has a higher level of competitiveness.

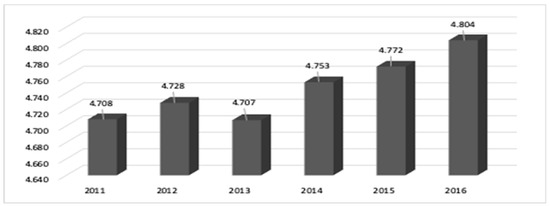

Analysing the average GCI for the European Union (see Figure 1) we observe that it had an increasing trend in the analyzed period, with a break-out point in 2013. The decrease in 2013 can be explained by a slowdown of European economic growth. In 2014, the competitiveness of EU countries registered a significant improvement, and continued the increasing trend in the following years, as a result of the new measures taken by the EU through the Europe 2020 Strategy in order to support entrepreneurship and national competitiveness (European Commission 2010). The Entrepreneurship 2020 Action Plan has the purpose to sustain entrepreneurial potential of the European citizens, and to remove existing obstacles and revolutionize the culture of entrepreneurship in the EU. This action plan intends to ease the creation of new businesses and develop a business environment much more supportive for existing entrepreneurs in order to simulate them to grow and be more innovative (European Commission 2013).

Figure 1.

The dynamics of average GCI for EU-28 countries. Source: own calculation.

The set of explanatory variables encompasses innovation rate and high jobs creation expectation rate, as well as several control variables. The variables, their measurement and their source are presented below in Table 2. We considered the innovation rate as an explanatory variable that can help measuring the quality of entrepreneurial activities. As shown by Kritikos (2014) radical innovations often lead to economic growth and the entrepreneurs who bring innovations to the market offer a significant contribution to economic progress. The author also highlight that innovative entrepreneurs are vital to the competitiveness of the economy. However, the gains of entrepreneurship are realized only if the business environment is receptive to innovation.

Table 2.

The variables of the model, their measurement and source.

In addition, the mentioned study has shown that entrepreneurial activities have positive effects on employment on a short and long term, but negative effects on a medium term. These relations were obtained for the US, for a number of European countries, and for 23 OECD countries and are explained by the fact that in the incipient stage a significant positive effect on employment appears because the newly created firms will generate new jobs. However, after the business passes the initial phase, usually a stagnation phase or even a negative effect on employment is noted because, in this phase, the new businesses are gaining market share from the companies that cannot compete and because a part of the new firms fail. After this middle phase, the increased competitiveness of suppliers leads to positive gains in employment once again. About ten years after start-up, the impact of new business formation on employment has finally faded away (Kritikos 2014).

Several others studies (Cantwell 2003; Özçelik and Taymaz 2004; Ghoniem and El Khouly 2012; Petrariu et al. 2013; Huggins et al. 2014; Ciocanel and Pavelescu 2015; Doğan 2016; Matos Ferreira et al. 2017; Herman 2018) also emphasize the significant direct relation between innovation of entrepreneurial activities and competitiveness, and describe the significant role played by the entrepreneurs that find new methods of production, create new products or better products at lower costs or use new ways of organizing their activity for the increase of national competitiveness. With the help of innovative activities, the entrepreneurs will obtain a competitive advantage and maintaining this advantage correlated with continuous development will determine the increase of national competitiveness. Therefore, innovation is seen as the motor that drives the progress of competitiveness and economic development of a country (Johansson et al. 2001; Romer 1994), and the competitiveness of a country depends on the capacity of its industry to apply innovation and increase its quality (Porter 1990). The study of Szabo and Herman (2012) also pointed out the need to increase innovation rate in order to enhance competitiveness especially in emerging countries of European Union. Nevertheless, we have to keep in mind also the fact that increased national competition creates pressure on entrepreneurs to be innovative.

For measuring the quality of entrepreneurial activities from the European Union countries we also have considered another variable: high job creation expectation rate. As argued by the European Commission (1994) competitiveness, growth and employment are closely interrelated. The white paper of the European Commission (1994) shows that increasing employment threshold means increasing the overall productivity of a country which will guarantee an increase of the international competitiveness of the country. The employment threshold represents the percentage change above which the growth rate of GDP leads to an increase in employment. Moreover, Regional competitiveness and employment was one of the three priority objectives of the European Union under European cohesion policy for 2007–13, and it aimed to strengthen the competitiveness and increase employment in the regions that were not included in the Convergence Objective. Among its main purposes it was the promotion of innovation and sustaining entrepreneurship in relation to the increase of regional competitiveness. In the current 2014–20 programming period, most of the regions previously covered by the Regional Competitiveness and Employment Objective receive funding in their quality as more developed regions or transition regions (European Commission 2019).

Other papers (Moser et al. 2010; Martus 2013; Rusek 2015; OECD 2016; World Bank Group 2017) also highlight the importance of job creation for ensuring economic growth and increased national competitiveness, identifying a positive correlation between employment and increase in competitiveness, although, in some countries this effect is small. Also, these papers emphasize the importance of supporting entrepreneurship and SMEs in order to promote growth and strengthening the local economic base. Martus (2013) pointed out that rising unemployment rates decrease regional living standards and competitiveness and is underlining the importance of keeping high rates of employment for ensuring regional competitiveness. The author also highlights the mutual determination relationship between employment and competitiveness, as ensuring low unemployment rates will increase competitiveness and higher level of national competitiveness are related with lower unemployment rate.

However, the World Bank report (World Bank Group 2017) points out that the interaction between competitiveness, expressed through productivity, and jobs is both conceptually and empirically more complex and depends both on the context and time of analysis. Thus, stimulating competitiveness through industrial upgrading can also induce dislocations as resources shift within and between sectors, which can determine unemployment and can destabilize some firms, industries, or whole regions. Moreover, the effort to restore and improve the competitiveness implies the improvement of the unit labor costs which in turn requires a higher productivity (Rusek 2015) but productivity creates unemployment on short and medium terms, and employment in the long run (Chen et al. 2007; Gallegati et al. 2014; Semmler and Chen 2017).

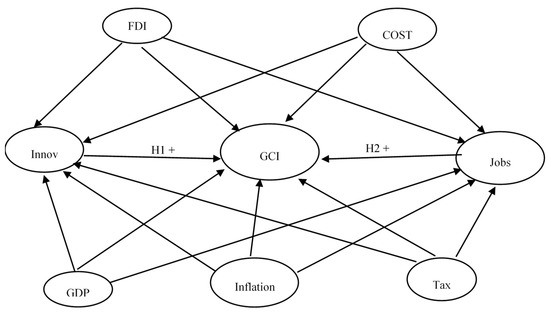

Starting from those stated above, we formulate several hypotheses. Our main hypothesis (H1) is that the quality of entrepreneurship is a significant factor that is directly influencing the national competitiveness. When the quality of entrepreneurial activity is rising will determine an increase of national competitiveness.

Also, starting from the two explanatory variables considered in our empirical analysis we formulate two sub-hypotheses, namely:

Hypothesis 1.1 (H1.1).

Innovation rate has a direct and positive impact on economic competitiveness of EU member countries.

Hypothesis 1.2 (H1.2).

High job creation expectation rate has a direct and positive impact on economic competitiveness of EU countries.

Besides the explanatory variables we also use several control variables for ensuring the robustness of our results. These control variables are measuring macroeconomic and business environment conditions and, as shown by previous studies, might influence both entrepreneurship (Grilo and Thurik 2004; Hoffmann et al. 2006; Vidal-Suñé and Lopez-Panisello 2013; Aparicio et al. 2016; Roman et al. 2017) and national competitiveness (Miller and Kim 2008; Knoll 2010; Podobnik et al. 2012; Vidal-Suñé and Lopez-Panisello 2013; Sayed and Slimane 2014; Dobrinsky and Havlik 2014; Korez-Vide and Tominc 2016; Rusu and Roman 2018). As highlighted by the mentioned studies, rich countries that have lower business regulations and higher inflows of foreign direct investments are more competitive than poor countries, with high level of tax rate, more regulations and a deficit of foreign investments.

Several studies (Podobnik et al. 2012; Dobrinsky and Havlik 2014; Korez-Vide and Tominc 2016) have emphasized the significant positive relationship between economic growth and national competitiveness showing that countries with higher levels of economic growth are more competitive. Also, higher economy growth has positive effects on entrepreneurship by creating new business opportunities.

The tax rate plays also a significant role for the national competitiveness because excessive tax burdens are considered to be responsible for the poor international performance of industries and high corporate tax rates are considered to undermine the international competitiveness of a country. The reduction of the corporate tax rates could be a way for attracting more investment capital and could increase firms’ productivity and investment incentives (Miller and Kim 2008; Knoll 2010). Contrariwise Summers (1988), those tax measures which might stimulate the attraction of funds from abroad can determine an appreciation in the real exchange rate and at the same time a reduction in the international competitiveness of national industries. Therefore, the relationship between tax rate and national competitiveness could be either negative or positive.

The relationship between inflation rate and competitiveness can also be analyzed from two points of view. An increase of inflation can determine an improvement of business opportunities explained by the fact that higher price levels can increase earnings expectations of entrepreneurs and can stimulated business development and implicitly enhance competitiveness (Vidal-Suñé and Lopez-Panisello 2013; Sayed and Slimane 2014). However, increased inflation also increases the costs for business start-up and activity and might affect negatively the entrepreneurs (Salman 2014). Regulations about doing business, often expressed by the higher level of costs for starting and running a business are negatively influencing the entrepreneurial activity and lower competitiveness (Iarossi 2009).

Foreign direct investments (FDI) stimulate the national competitiveness by the fact that inflows of foreign capital increase employment, offer more funds for the businesses and stimulates them to become innovative, determine the development of national industries and stimulate exports of goods. The positive effect of FDI on national competitiveness and entrepreneurship depends on the level of development of the country (Meyer and Sinani 2009; Kim and Li 2014).

Therefore, according to the empirical results from the literature the growth of GDP, inflation rate, tax rate, foreign direct investments inflows and costs for starting a new business are significantly influencing national competitiveness.

Starting from the aforementioned theoretical aspects in this paper we will address the following research model (see Figure 2).

Figure 2.

Research model with hypotheses.

4. Results and Discussions

The important descriptive statistics of global competitiveness index and of the independent variables are provided in Table 3. The number of observations obtained for the variables used for our model was different from country to country because of the lack of available data during the analyzed period of time. For some of the variables we have obtained a different number of observations because, for some countries were not available data for all the years considered in the analysis. The summary of the descriptive statistics emphasizes the fact that the GCI data are distributed between a minimum level of 3.85 (in Greece, 2012) and a maximum of 5.61 (in Sweden, 2011). The value of standard deviation shows relatively small variations of this index between the EU countries and for the analyzed period.

Table 3.

Descriptive statistics of dependent and explanatory variables.

As regards the explanatory variables, the innovation rate varies between a minimum of 8.62% from TEA (in Bulgaria, 2015) to a maximum of 54.1% (in Denmark, in 2011). The high jobs expectation rate registered a higher variation compared to previous variables, and is distributed between 4.3% (in Greece, in 2015) and 48.4% (Latvia, 2012).

The variations obtained for the control variables show that there are important differences between the EU countries regarding the macroeconomic and business environment indicators. This happens because among the 28 European Union economies, we have countries with different levels of economic development.

In order to obtain accurate results from the empirical analysis, we have also considered the problem of multicollinearity. The correlation test applied to our variables showed that it does not exist multicollinearity between the considered variables, mentioning that we used as the reference point the value of 0.80, similar to other studies (Bryman and Cramer 2001) (see Table 4).

Table 4.

The correlation matrix of the variables.

Thus, we proceed with the regression analysis. The regression analysis was carried out by applying three different models: Ordinary Least Squares, Fixed effects model and Random effects model. Since we have obtained different results when applying these mentioned models (see Table 5), further we have tested to see which model is better at explaining the relationships identified. Thus, we run two tests to choose between the fixed and random effects: The Hausman test and the redundant fixed effects test (see Table 6 and Table 7).

Table 5.

Effects of entrepreneurship performance on competitiveness.

Table 6.

Results of the Hausman test.

Table 7.

Results of the redundant fixed effects test.

Based on the present analysis, the results of the Hausman test indicate that the H0 hypothesis (H0: Random effect is preferred) is strongly accepted (p values = 1.000) which means that the random effects model is preferred. The results of the Hausman test are presented in Table 6.

On the other hand, the results obtained for the redundant fixed effects test strongly reject the null hypothesis (H0: The fixed effects are redundant) and indicate that the fixed effects are statistically significant (see Table 7).

Since the results of the two tests show a contradiction, the pooled OLS regression is favoured (Park 2009) and is better fitted for explaining the relations between our variables. The regression analysis was used to test the hypotheses of our empirical study. According to the results, both the considered independent variables measuring the quality of entrepreneurship had significantly influenced the economic competitiveness of EU member countries in 2011–2017. According to the results reported in Table 4, we conclude that the regression model fits the data and the whole model is statistically significant (R2 = 0.38 and p-value = 0.00). As shown in the table, adjusted R2 is 0.350 which means that about 35% of global competitiveness variation is explained by the independent variables chosen in the model. In other words, in the EU member countries, global economic competitiveness is influenced by the independent variables used in the model.

As explained in the previous section, the innovation rate is measuring the percentage of individuals involved in entrepreneurial activity who have introduced a new product on the market. Based on the results in table no. 4 (marked in bold), the innovation rate has a positive coefficient and statistically significant (at 1% level), which means the innovation rate is significantly influencing the economic competitiveness of the countries from the European Union. This result indicates that increased performance of the entrepreneurial activity, measured by the creation of new or improved products or processes by the entrepreneurs, is stimulating economic competitiveness of countries, since innovation determines progress and stimulates productivity growth which, in turn, drives prosperity.

This result is consistent with the findings of Cantwell (2003), Özçelik and Taymaz (2004), Ghoniem and El Khouly (2012), Petrariu et al. (2013), Kritikos (2014), Huggins et al. (2014), Ciocanel and Pavelescu (2015), Doğan (2016), Matos Ferreira et al. (2017), Herman (2018) who conclude that innovation is considered as a major force in economic growth and as a key pillar for enhancing global competitiveness.

The variable high job creation expectation rate measures the percentage of entrepreneurs who expect to create 6 or more jobs in 5 years. Our results emphasize that the expectation of creating new jobs in 5 years as a negative coefficient and statistically significant (at 1% level), which means the creation of new jobs is negatively influencing the economic competitiveness of EU countries. This result is inconsistent with the hypothesis that creation of a higher number of jobs in future years will enhance economic competitiveness.

This inconsistency with the previous studies can be related to the fact that increased employment rates can affect productivity, because the effort to restore and improve the competitiveness implies the improvement of the unit labor costs which in turn requires a higher productivity, but increased productivity creates unemployment on the short and medium terms, and employment in the long term. Also, higher rates of employment imply higher labor costs for the firms which might reduce their profits and the competitiveness, on short term. Moreover, in our case, the potential creation of new jobs is analyzed in relation with higher levels of entrepreneurial innovation, and process innovation is decreasing employment generating thus an inverse relationship between innovation and employment. Moderate levels of innovation can determine a higher natural rate of unemployment, because of increased job turnover from a decline in the length of each job and a time delay between the loss of a job and the acquisition of a new one. However, very high rates of innovation can reduce the natural unemployment rate, producing an inverted ‘U’ relationship between natural unemployment and innovation rates (Arundel and Kemp 1999).

Our findings are in line with those of Chen et al. (2007), Gallegati et al. (2014), Rusek (2015), Semmler and Chen (2017) and World Bank Group (2017).

Regarding the control variables, our paper is in line with the studies showing that rich countries, with lower regulations and higher level of foreign investments are more competitive than poor countries, with high level of tax rate, more regulations and a deficit of foreign investments. For the coefficient corresponding to inflation rate our findings are similar to those of Vidal-Suné and Lopez-Panisello (2013), Sayed and Slimane (2014) and Rusu and Roman (2018) who empirically found a positive and statistically significant (at 1% level) relation between inflation rate and national competitiveness. Thus, an increase of the inflation rate determines an increase in business opportunities, because higher level of prices for products and services determines the increase of the expectations of entrepreneurs regarding potential earnings, but also stimulate business development and economic competitiveness. Although, the countries with high rates of inflation will not be between the countries with the highest competitiveness, they could register an improvement of competitiveness but will stay between the countries from the bottom of ranking, as shown by Kristjánsdóttir (2017).

The coefficient for tax rate emphasizes a negative and statistically significant (at 5% level) relation between total tax rate and economic competitiveness. Our result is similar with the ones of other studies (Summers 1988; Gray and Holtz-Eakin 2009; Knoll 2010; Miller and Kim 2008; Ecorys 2014) showing that high corporate tax rates can increase the administrative costs of the enterprises, reduce the profitability of the firm, reduce investments and labor productivity and implicitly reduce the global competitiveness of the economy. Therefore, reducing the total tax rates will result in attracting more investments, would stimulate enterprises productivity and will increase competitiveness of EU economies. In our times the economies are considered competitive, when they have reasonable corporate tax rates and low inflation (Kristjánsdóttir 2017).

A positive coefficient and statistically significant at 1% level was obtained for the control variable that measures the inflows of foreign direct investments. Thus, higher inflows of FDI for a country reduce unemployment rate, stimulate the enterprises to use modern techniques and technologies and to introduce new products, facilitate exports, leading to the development of local industries and thus, stimulating the economic competitiveness of that country. Our results are in agreement with the findings of Fontagné and Pajot (1997), Javorcik (2004), Ocharo and Musyoka (2018), Domazet and Marjanović (2018), which also emphasized the positive effects of increased inflows of foreign capital on economic competitiveness of countries.

Cost of business start-up procedures is another control variable which has a negative and statistically significant influence (at 1% level) on competitiveness. The negative coefficient shows that higher costs for the creation of a new business reduce the competitiveness of the goods and services offered by the newly established firms and negatively affect the international competitiveness of the country because it makes it less attractive for foreign investors. The results are in agreement with previous studies (Iarossi 2009; Globerman and Georgopoulos 2012; Messaoud and El Ghak Teheni 2014), which emphasized that more regulations about doing business in a country determine higher costs and lower competitiveness.

5. Conclusions

In this study we have investigated the effects of the factors measuring the quality of entrepreneurial activities on national competitiveness in the 28 European Union member states. As the review of literature showed, innovation rate and job creation are factors that significantly influence the level of economic development of countries and their national competitiveness. Besides these two main factors, we also have included in the analysis several control variables measuring the characteristics of the economic and business environment of the countries in the panel.

The purpose of our study was to test the hypotheses and to show the relationship between several indicators expressing the quality of entrepreneurship and of the economic environment on the level of competitiveness of European Union countries. As concluding remarks of our empirical investigation, we can affirm that the economic and business environment and the quality of entrepreneurial activity are key factors influencing national competitiveness for the European Union members. The quality of entrepreneurship is very important for the development of an economy. The innovative entrepreneurs are helping the development of markets and stimulate the increase of economic competitiveness. Our empirical results highlight that innovative entrepreneurial activities are positively and significantly related to national competitiveness of the European Union countries.

On the other hand, we have expected that increased employment to stimulate economic competitiveness of countries, but our results indicate an opposite relationship on short term between high job creation expectation rate and national competitiveness. This relationship appears because higher competitiveness is related to higher productivity, but increased productivity creates unemployment on short and medium terms, and employment on a long term.

The empirical results obtained show that the considered indicators are significantly influencing the competitiveness of the European Union countries and they are in accordance with the results of other empirical studies. Thus, innovation rate, inflation rate and FDI inflows are positively related with economic competitiveness of countries. High job creation expectation rate, tax rate and the costs of starting new business are negatively related with economic competitiveness of analzsed countries.

The added value of our study results from including in the analysis all 28 countries members of the European Union. Another plus of our study is the fact that we have considered the quality of entrepreneurship and its relationship with national competitiveness. There are only a few studies that analyze the impact of several aspects of entrepreneurship on the level of national competitiveness, but, to our knowledge, there are no studies testing the relation between the quality of entrepreneurial activities and national competitiveness. So, through this research we intended to fill this literature gap. Moreover, our study could be of interest to European policy makers who intend to enhance national competitiveness, because it points out the key role played by entrepreneurship for national economies, especially when it comes to its qualitative feature that has the potential of creating new jobs on a long term. Our results should draw the attention to the need of policy makers to identify and implement the best policies needed to sustain the increase of entrepreneurship quality in order to enhance competitiveness of European economies.

The limitations of our study come from the availability of the data and from the reduced number of the variables considered. This study represents a starting point of our research regarding the effects of entrepreneurial quality on economic competitiveness of countries. The quality of entrepreneurship is very important for the economic development of countries and for increasing their national competitiveness. Taking into account that the business sector, and especially the sector represented by the small and medium enterprises is considered to be the engine of the economy, increasing its quality would have beneficial effects to the economy as a whole. So, the policy makers should focus on increasing the quality of entrepreneurial activity not only the numbers of entrepreneurs.

We intend to extend and develop our analysis in order to deepen the empirical investigation regarding the relationship between the quality of entrepreneurship and national competitiveness. Therefore, in further research we intent to add several explanatory variables measuring the quality of entrepreneurial activity which might influence the countries’ economic and competitiveness development. Secondly, we intend to test if there are differences regarding the relationship between entrepreneurial quality and competitiveness when grouping the countries by their level of economic development, or by region. Several studies have shown that the impact of entrepreneurship on economic development is different according to the level of development of the country. For instance, in the case of developing countries there is no effect (Rusu and Tudose 2018) or a negative relation (Dvouletý et al. 2018) between the level of entrepreneurship and economic development and national competitiveness. Further research will test the relations mentioned above according to the level of economic development of the countries.

Author Contributions

V.D.R. and A.D. contributed equally to the elaboration of the paper. Both authors contributed to the elaboration of introduction, literature review, methodology, results and discussions and conclusions.

Funding

This work was supported by a grant of the “Alexandru Ioan Cuza” University of Iasi, within the Research Grants program, Grant UAIC, code GI-UAIC-2017-02.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Amorós, Jose E., Niels S. Bosma, and Jonathan Levie. 2013. Ten Years of Global Entrepreneurship Monitor: Accomplishments and Prospects. International Journal of Entrepreneurial Venturing 5: 120–52. Available online: https://www.researchgate.net/publication/236618529_Ten_years_of_Global_Entrepreneurship_Monitor_Accomplishments_and_prospects (accessed on 4 December 2018).

- Anastassopoulos, George. 2007. Countries’ international competitiveness and FDI: An empirical analysis of selected EU member—Countries and regions. Journal of Economics and Business X: 35–52. [Google Scholar]

- Aparicio, Sebastian, David Urbano, and David Audretsch. 2016. Institutional factors, opportunity entrepreneurship and economic growth: Panel data evidence. Technological Forecasting and Social Change 102: 45–61. [Google Scholar] [CrossRef]

- Arundel, Anthony, and Rene Kemp. 1999. Employment and Innovation: Micro-macro links, indirect effects, and competitiveness. Available online: ftp.zew.de/pub/zew-docs/impress/MERIT.doc (accessed on 16 April 2019).

- Baltagi, Badi H. 2005. Econometric Analysis of Panel Data, 3rd ed. Chichester: John Wiley & Sons Ltd. [Google Scholar]

- Baron, Robert A., and Jintong Tang. 2011. The role of entrepreneurs in firm-level innovation: Joint effects of positive affect, creativity, and environmental dynamism. Journal of Business Venturing 26: 49–60. [Google Scholar] [CrossRef]

- Bartz, Wiebke, and Adalbert Winkler. 2016. Flexible or fragile? The growth performance of small and young businesses during the global financial crisis—Evidence from Germany. Journal of Business Venturing 31: 196–215. [Google Scholar] [CrossRef]

- Bashir, Hajam A., and Ali Akhtar. 2016. The Role of Innovative Entrepreneurship in Economic Development: A Study of G20 Countries. Management Studies and Economic Systems (MSES) 3: 91–100. [Google Scholar] [CrossRef]

- Baumol, William J. 1993. Entrepreneurship, Management and the Structure of Payoffs. London: MIT Press. [Google Scholar] [CrossRef]

- Bosma, Niels S., Sander Wennekers, and Jose E. Amorós. 2012. Global Entrepreneurship Monitor 2011, Extended Global Report: Entrepreneurs and Entrepreneurial Employees across the Globe. Babson Park: Babson College, Santiago, Chile: Universidad del Desarollo, Kuala Lumpur, Malaysia: Universiti Tun Abdul Razak, London: Global Entrepreneurship Research Association. [Google Scholar]

- Bosma, Niels S., Jeroen Content, Mark W. J. L. Sanders, and Erik Stam. 2018. Institutions, entrepreneurship, and economic growth in Europe. Small Business Economics 51: 483–99. [Google Scholar] [CrossRef]

- Bruton, Garry D., David Ahlstrom, and Krzysztof Obloj. 2008. Entrepreneurship in Emerging Economies: Where Are We Today and Where Should the Research Go in the Future. Entrepreneurship: Theory and Practice 32: 1–14. [Google Scholar]

- Bryman, Alan, and Duncan Cramer. 2001. Quantitative Data Analysis with SPSS Release 10 for Windows: A Guide for Social Scientists, rev. ed. London: Routledge. [Google Scholar]

- Bulat, Mukhamediyev, Ilyassova Zhansaya, and Kalieva Assem. 2018. Factors for Increasing the Competitiveness of the Countries of the Eurasian Economic Union and Other Integration Associations. Innovation Management and Education Excellence through Vision 2020 I–XI: 4179–91. [Google Scholar]

- Cantwell, John. 2003. Innovation and Competitiveness. In The Oxford Handbook of Innovation. Edited by Jan Fagerberg, David C. Mowery and R.R. Nelson. Oxford: Oxford University Press. [Google Scholar] [CrossRef]

- Chen, Pu, Armon Rezai, and Willi Semmler. 2007. Productivity and Unemployment in the Short and Long Run. Working Paper Series; New York: Schwartz Centre for Economic Policy Analysis and Department of Economics, The New School for Social Research. [Google Scholar]

- Chowdhury, Farzana, David B. Audretsch, and Maksim Belitski. 2018. Institutions and Entrepreneurship Quality. Entrepreneurship Theory and Practice 43: 51–81. [Google Scholar] [CrossRef]

- Ciocanel, Adrian B., and Florin M. Pavelescu. 2015. Innovation and competitiveness in European context. Procedia Economics and Finance. Emerging Markets Queries in Finance and Business 32: 728–37. [Google Scholar] [CrossRef]

- Dhahri, Sabrine, and Anis Omri. 2018. Entrepreneurship contribution to the three pillars of sustainable development: What does the evidence really say? World Development 106: 64–77. [Google Scholar] [CrossRef]

- Dobrinsky, Rumen, and Peter Havlik. 2014. Economic Convergence and Structural Change: The Role of Transition and EU Accession. Vienna: Wiener Institut für Internationale Wirtschaftsvergleiched, Available online: http://wiiw.ac.at/economic-convergence-and-structural-change-the-role-of-transition-and-euaccession-dlp-3357.pdf (accessed on 29 November 2018).

- Doğan, Ebru. 2016. The Effect of Innovation on Competitiveness. Ekonometri ve İstatistik Sayı 24: 60–81. [Google Scholar]

- Domazet, Ivana, and Darko Marjanović. 2018. FDI as a Factor of Improving the Competitiveness of Developing Countries: FDI and Competitiveness. In Foreign Direct Investments (FDIs) and Opportunities for Developing Economies in the World Market. Edited by Malepati Venkataramanaiah and Gowri Mangala. Research Essentials Collection. Hershey: Idea Group Inc., pp. 82–104. [Google Scholar]

- Dvouletý, Ondřej, Alisa Gordievskaya, and David A. Procházka. 2018. Investigating the relationship between entrepreneurship and regional development: Case of developing countries. Journal of Global Entrepreneurship Research 8. [Google Scholar] [CrossRef]

- Ecorys. 2014. Food Taxes and Their Impact on Competitiveness in the Agri-Food Sector. Final Report. Rotterdam: Ecorys, July 12, Available online: https://www.ecorys.com/sites/all/sites/default/files/files/Impact%20of%20Food%20Taxes%20-%20Final%20Report.pdf (accessed on 26 November 2018).

- European Commission. 1994. Growth, Competitiveness, Employment. The Challenges and Ways Forward into the 21st Century. White Paper. Luxembourg: Office for Official Publications of the European Communities. [Google Scholar]

- European Commission. 2010. Europe 2020. A Strategy for Smart, Sustainable and Inclusive Growth. Communication from The Commission. Brussels: European Commission. [Google Scholar]

- European Commission. 2013. Entrepreneurship 2020 Action Plan. Reigniting The Entrepreneurial Spirit in Europe. Communication from The Commission to The European Parliament, The Council, The European Economic and Social Committee and The Committee of the Regions. Brussels: European Commission. [Google Scholar]

- European Commission. 2014. European Competitiveness Report: Helping Firms Grow. Commission Staff Working Document SWD (2014) 277 Final. Brussels: European Union. [Google Scholar]

- European Commission Web Site. 2019. Available online: https://ec.europa.eu/regional_policy/en/policy/what/glossary/r/regional-competitiveness-and-employment-objective (accessed on 16 April 2019).

- Fontagné, Lionel, and Michaël Pajot. 1997. How Foreign Direct Investment Affects International Trade and Competitiveness: An Empirical Assessment. CEPII research center Working Papers no. 97–17. Available online: http://cepii.fr/PDF_PUB/wp/1997/wp1997-17.pdf (accessed on 16 April 2019).

- Gallegati, Marco, Mauro Gallegati, James B. Ramsey, and Willi Semmler. 2014. Does Productivity Affect Unemployment? A Time-Frequency Analysis for the US. In Wavelet Applications in Economics and Finance. Edited by Gallegati Marco and Semmler Willi. Dynamic Modeling and Econometrics in Economics and Finance. Cham: Springer International Publishing Switzerland, pp. 23–46. [Google Scholar] [CrossRef]

- Ghoniem, Abdulazim, and Sayed El Khouly. 2012. The Impact of Innovation and Entrepreneurship on Global Competitiveness and Economic Growth. Available online: https://www.researchgate.net/publication/256044326_The_Impact_of_Innovation_and_Entrepreneurship_on_Global_Competitiveness_and_Economic_Growth (accessed on 16 April 2019).

- Globerman, Steven, and George Georgopoulos. 2012. Regulation and The International Competitiveness of the U.S. Economy. Available online: https://cbe.wwu.edu/files/regulationandtheint%27lcompetitivenessoftheu.s.econ_.pdf (accessed on 28 November 2018).

- González-Pernía, José L., Andrés Jung, and Iñaki Peña. 2015. Innovation-driven entrepreneurship in developing economies. Entrepreneurship & Regional Development 27: 555–73. [Google Scholar] [CrossRef]

- Gonzalez-Sanchez, Victor M. 2013. Information and Communication Technologies and entrepreneurial activity: Drivers of economic growth in Europe. The Service Industries Journal 33: 683–93. [Google Scholar] [CrossRef]

- Gray, Gordon, and Douglas Holtz-Eakin. 2009. Global Competitiveness and the Corporation Income Tax, The Heritage Foundation. Available online: https://www.heritage.org/taxes/report/global-competitiveness-and-the-corporation-income-tax (accessed on 18 October 2018).

- Greene, William H. 2003. Econometric Analysis. Upper Saddle River: Prentice Hall by Pearson Education, Inc., vol. 5. [Google Scholar]

- Grilo, Isabel, and Roy Thurik. 2004. Determinants of Entrepreneurship in Europe. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=636815 (accessed on 30 November 2018).

- Grilo, Isabel, and Roy Thurik. 2005. Latent and Actual Entrepreneurship in Europe and the US: Some Recent Developments. The International Entrepreneurship and Management Journal 1: 441–59. [Google Scholar] [CrossRef]

- Guzmán, Joaquín, and F. Javier Santos. 2001. The booster function and the entrepreneurial quality: An application to the province of Seville. Entrepreneurship & Regional Development: An International Journal 13: 211–28. [Google Scholar] [CrossRef]

- Hall, Jeremy K., Gregory A. Daneke, and Michael J. Lenox. 2010. Sustainable development and entrepreneurship: Past contributions and future directions. Journal of Business Venturing 25: 439–48. [Google Scholar] [CrossRef]

- Hatzichronoglou, Thomas. 1996. Globalisation and Competitiveness: Relevant Indicators. OECD Science, Technology and Industry Working Papers 5. Paris: OECD Publishing, Organisation for Economic Co-operation and Development. [Google Scholar]

- Herman, Emilia. 2018. Innovation and entrepreneurship for competitiveness in the EU: An empirical analysis. Proceedings of the International Conference on Business Excellence 12: 425–35. [Google Scholar] [CrossRef]

- Hoffmann, Anders, Morten Larsen, and Anne S. Oxholm. 2006. Quality Assessment of Entrepreneurship Indicators. Copenhagen: National Agency for Enterprise and Construction’s Division for Research and Analysis (FORA). [Google Scholar]

- Huggins, Robert, Hiro Izushi, Daniel Prokop, and Piers Thompson. 2014. Regional competitiveness, economic growth and stages of Development. Zbornik radova Ekonomskog fakulteta u Rijeci, časopis za ekonomsku teoriju i praksu—Proceedings of Rijeka Faculty of Economics, Journal of Economics and Business 32: 255–83. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2554326 (accessed on 15 October 2018).

- Iarossi, Giuseppe. 2009. Benchmarking Africa’s Costs and Competitiveness. In World Economic Forum. The Africa Competitiveness Report. Geneva: World Bank and Africa Development Bank, pp. 83–107. Available online: https://www.afdb.org/fileadmin/uploads/afdb/Documents/Publications/Africa%20 Competitiveness%20Report%202009.pdf (accessed on 28 November 2018).

- IMD World Competitiveness Centre. 2018a. Pioneers in Competitiveness Since 1989. Available online: https://www.imd.org/wcc/world-competitiveness-center/ (accessed on 4 December 2018).

- IMD World Competitiveness Centre. 2018b. Methodology and Principles of Analysis. Available online: https://www.imd.org/wcc/world-competitiveness-center-mission/methodology/ (accessed on 4 December 2018).

- Javorcik, Beata S. 2004. Does foreign direct investment increase the productivity of domestic firms? In search of spill overs through backward linkages. The American Economic Review 94: 605–27. [Google Scholar] [CrossRef]

- Johansson, Borje, Charlie Karlsson, and Roger Stough. 2001. Theories of Endogenous Regional Growth. Lessons for Regional Policies. Berlin: Springer. [Google Scholar]

- Kim, Phillip H., and Mingxiang Li. 2014. Injecting demand through spill-overs: Foreign direct investment, domestic sociopolitical conditions, and host-country entrepreneurial activity. Journal of Business Venturing 29: 210–31. [Google Scholar] [CrossRef]

- Knoll, Michael S. 2010. The corporate income tax and the competitiveness of U.S. Industries Tax Law Review 63: 771–957. [Google Scholar]

- Korez-Vide, Romana, and Polona Tominc. 2016. Competitiveness, Entrepreneurship and Economic Growth. In Competitiveness of CEE Economies and Businesses. Edited by Trąpczyński Piotr, Łukasz Puślecki and Mirosław Jarosiński. Cham: Springer International Publishing, pp. 25–44. [Google Scholar]

- Kristjánsdóttir, Helga. 2017. Country Competitiveness: An Empirical Study. Baltic Region 9: 31–44. [Google Scholar] [CrossRef]

- Kritikos, Alexander S. 2014. Entrepreneurs and Their Impact on Jobs and Economic Growth. Bonn: IZA World of Labor. [Google Scholar] [CrossRef]

- Kuhlman, Caitlin, Karthikeyan Natesan Ramamurthy, Prasanna Sattigeri, Aurélie C. Lozano, Lei Cao, Chandra Reddy, Aleksandra Mojsilović, and Kush R. Varshney. 2017. How to foster innovation: A data-driven approach to measuring economic competitiveness. IBM Journal of Research and Development 61: 1–12. [Google Scholar] [CrossRef]

- Martus, Bettina. 2013. The Role of Unemployment in the Regional Competitiveness. In Regional Growth, Development and Competitiveness. Edited by Imre Lengyel and I. Vas Zsófia. Szeged: University of Szeged, pp. 126–40. [Google Scholar]

- Matos Ferreira, Joao J., Cristina Fernandes, and Vanessa Ratten. 2017. Entrepreneurship, innovation and competitiveness: What is the connection? International Journal of Business and Globalisation 18: 73–95. Available online: https://www.researchgate.net/publication/309736880_Entrepreneurship_innovation_and_competitiveness_what_is_the_connection%27 (accessed on 10 October 2018).

- Messaoud, Boudhiaf, and Zribi El Ghak Teheni. 2014. Business regulations and economic growth: What can be explained? International Strategic Management Review 2: 69–78. [Google Scholar] [CrossRef]

- Meyer, Natanya, and Jacques de Jongh. 2018. The Importance of Entrepreneurship as a Contributing Factor to Economic Growth and Development: The Case of Selected European Countries. Journal of Economics and Behavioral Studies 10: 287–99. [Google Scholar]

- Meyer, Natanya, and Danie Meyer. 2017. An econometric analysis of entrepreneurial activity, economic growth and employment: The case of the BRICS Countries. International Journal of Economic Perspectives 11: 429–41. [Google Scholar]

- Meyer, Klaus E., and Evis Sinani. 2009. When and where does foreign direct investment generate positive spillovers? A meta-analysis. Journal of International Business Studies 40: 1075–94. [Google Scholar] [CrossRef]

- Miller, Terry A., and Anthony Kim. 2008. High corporate taxes undermine U.S. global competitiveness. Web Memo: The Heritage Foundation 2065: 1–2. [Google Scholar]

- Moser, Christoph, Dieter M. Urban, and Beatrice Weder di Mauro. 2010. International competitiveness, job creation and job destruction—An establishment-level study of German job flows. Journal of International Economics 80: 302–17. [Google Scholar] [CrossRef]

- Ocharo, Kennedy N., and Ndanu Musyoka. 2018. Real Interest Rate, Inflation, Exchange Rate, Competitiveness and Foreign Direct Investment in Kenya. American Journal of Economics 3: 1–18. [Google Scholar]

- OECD. 2016. Job Creation and Local Economic Development 2016. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Ojo, Olu Dinesh, Petrescu Marius, Gabriela Anca, and Florentina Raluca Bîlcan. 2017. Impact of innovation on the entrepreneurial success: Evidence from Nigeria. African Journal of Business Management 11: 261–65. [Google Scholar]

- Özçelik, Emre, and Erol Taymaz. 2004. Does innovativeness matter for international competitiveness in developing countries? The case of Turkish manufacturing industries. Research Policy 33: 409–24. [Google Scholar] [CrossRef]

- Park, Hun M. 2009. Linear Regression Models for Panel Data Using SAS, Stata, LIMDEP, and SPSS. Working Paper. Bloomington: The University Information Technology Services (UITS) Center for Statistical and Mathematical Computing, Indiana University. [Google Scholar]

- Pawitan, Gandhi, Catharina B. Nawangpalupi, and Maria Widyarini. 2017. Understanding the Relationship between Entrepreneurial Spirit and Global Competitiveness: Implications for Indonesia. International Journal of Business and Society 18: 261–78. [Google Scholar]

- Petrariu, Ioan Radu, Robert Bumbac, and Radu Ciobanu. 2013. Innovation: A path to competitiveness and economic growth. The case of CEE countries. Theoretical and Applied Economics XX: 15–26. [Google Scholar]

- Podobnik, Boris M., Davor Horvatić, Dror Y. Kenett, and Eugene H. Stanley. 2012. The competitiveness versus the wealth of a country. Scientific Reports 2: 678. Available online: http://www.nature.com/articles/srep00678#abstract (accessed on 29 November 2018).

- Porter, Michael E. 1990. Competitive Advantage of Nations. Harvward Business Review, 73–93. [Google Scholar]

- Potluka, Oto, and Ondřej Dvoulety. 2018. Enhancement of innovations through the public programmes: Does it work? Public Policy Portuguese Journal 3: 75–85. [Google Scholar]

- Radulescu, Magdalena, Aleksandra Fedajev, Crenguta Ileana Sinisi, Constanta Popescu, and Silvia Elena Iacob. 2018. Europe 2020 Implementation as Driver of Economic Performance and Competitiveness. Panel Analysis of CEE Countries. Sustainability 10: 566. [Google Scholar] [CrossRef]

- Roman, Angela, Irina Bilan, and Cristina Ciumaș. 2017. What Drives the Creation of New Businesses? A Panel-Data Analysis for EU Countries. Emerging Markets Finance and Trade 54: 508–36. [Google Scholar] [CrossRef]

- Romer, Paul M. 1994. The origins of endogenous growth. Journal of Economic Perspectives 8: 2–22. [Google Scholar] [CrossRef]

- Rusek, Antonin. 2015. Competitiveness and Unemployment in the Eurozone. International Journal of Economics and Finance 7: 99–104. Available online: https://www.researchgate.net/publication/277553287_Competitiveness_and_Unemployment_in_the_Eurozone (accessed on 19 October 2018).

- Rusu, Valentina D., and Angela Roman. 2018. An empirical analysis of factors affecting competitiveness of C.E.E. countries. Economic Research-Ekonomska Istraživanja 31: 2044–59. [Google Scholar] [CrossRef]

- Rusu, Valentina D., and Mihaela B. Tudose. 2018. The role of entrepreneurship in promoting international competitiveness of CEE countries. A panel data approach. EURINT 2018 Proceedings, 44–62. [Google Scholar]

- Salman, Doaa M. 2014. Mediating role of research and development on entrepreneurial activities and growth: Evidence from cross-country data. World Journal of Entrepreneurship, Management and Sustainable Development 10: 300–13. [Google Scholar] [CrossRef]

- Sayed, Omer, and Sarra B. Slimane. 2014. An appraisal of the determinants of entrepreneurship in developing countries: The case of the Middle East, North Africa and selected Gulf cooperation council nations. African Journal of Social Sciences 4: 63–74. [Google Scholar]

- Semmler, Willi, and Pu Chen. 2017. Short and Long-Run Effects of Productivity on Unemployment. Available online: https://ssrn.com/abstract=2907539 or http://dx.doi.org/10.2139/ssrn.2907539 (accessed on 26 November 2018).

- Summers, Lawrence A. 1988. Tax policy and international competitiveness. In International Aspects of Fiscal Policies. Edited by Frenkel A. Jacob. Chicago: University of Chicago Press, pp. 349–86. [Google Scholar]

- Szabo, K. Zsuzsanna, and Emilia Herman. 2012. Innovative Entrepreneurship for Economic Development in EU. Procedia Economics and Finance 3: 268–75. [Google Scholar] [CrossRef]

- Terzić, Lejla. 2017. The Role of Innovation in Fostering Competitiveness and Economic Growth: Evidence from Developing Economies. Comparative Economic Research 20: 65–81. [Google Scholar] [CrossRef]

- Toma, Sorin George, Ana-Maria Grigore, and Paul Marinescu. 2014. Economic development and entrepreneurship. Procedia Economics and Finance 8: 436–43. [Google Scholar] [CrossRef]

- Vidal-Suñé, Antoni, and Maria-Belen Lopez-Panisello. 2013. Institutional and economic determinants of the perception of opportunities and entrepreneurial intention. Investigaciones Regionales 26: 75–96. [Google Scholar]

- Wennekers, Sander, and Roy Thurik. 1999. Linking entrepreneurship and economic growth. Small Business Economics 13: 27–55. [Google Scholar] [CrossRef]

- Wennekers, Sander, Andre van Stel, Martin Carree, and Roy Thurik. 2010. The Relationship between Entrepreneurship and Economic Development: Is It U-Shaped? Foundations and Trends in Entrepreneurship 6: 167–237. [Google Scholar] [CrossRef]

- World Bank Group. 2017. Industry Competitiveness and Jobs. An Evaluation of World Bank Group Industry-Specific Support to Promote Industry Competitiveness and Its Implications for Jobs. An Independent Evaluation. Washington: World Bank Group. [Google Scholar]

- World Economic Forum. 2012. The Europe 2020 Competitiveness Report: Building a More Competitive Europe, Geneva. Available online: http://www3.weforum.org/docs/CSI/2012/Europe2020_Competitiveness_Report_2012.pdf (accessed on 3 December 2018).

- World Economic Forum. 2014. The Europe 2020 Competitiveness Report: Building a More Competitive Europe, Geneva. Available online: http://www3.weforum.org/docs/WEF_Europe2020_CompetitivenessReport_2014.pdf (accessed on 3 December 2018).

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).