Internationalization and Performance of Vietnamese Manufacturing Firms: Does Organizational Slack Matter?

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Review

2.1.1. Concept of Internationalization

2.1.2. The Degree of Internationalization and Firm Performance

2.1.3. Organizational Slacks

2.2. Empirical Review

3. Methodology

3.1. Data

3.2. Model Estimation

| Y’ = a + b1X1 | Linear (Straight line) |

| Y’ = a + b1X1 + b2X12 | Quadratic (U-shaped) |

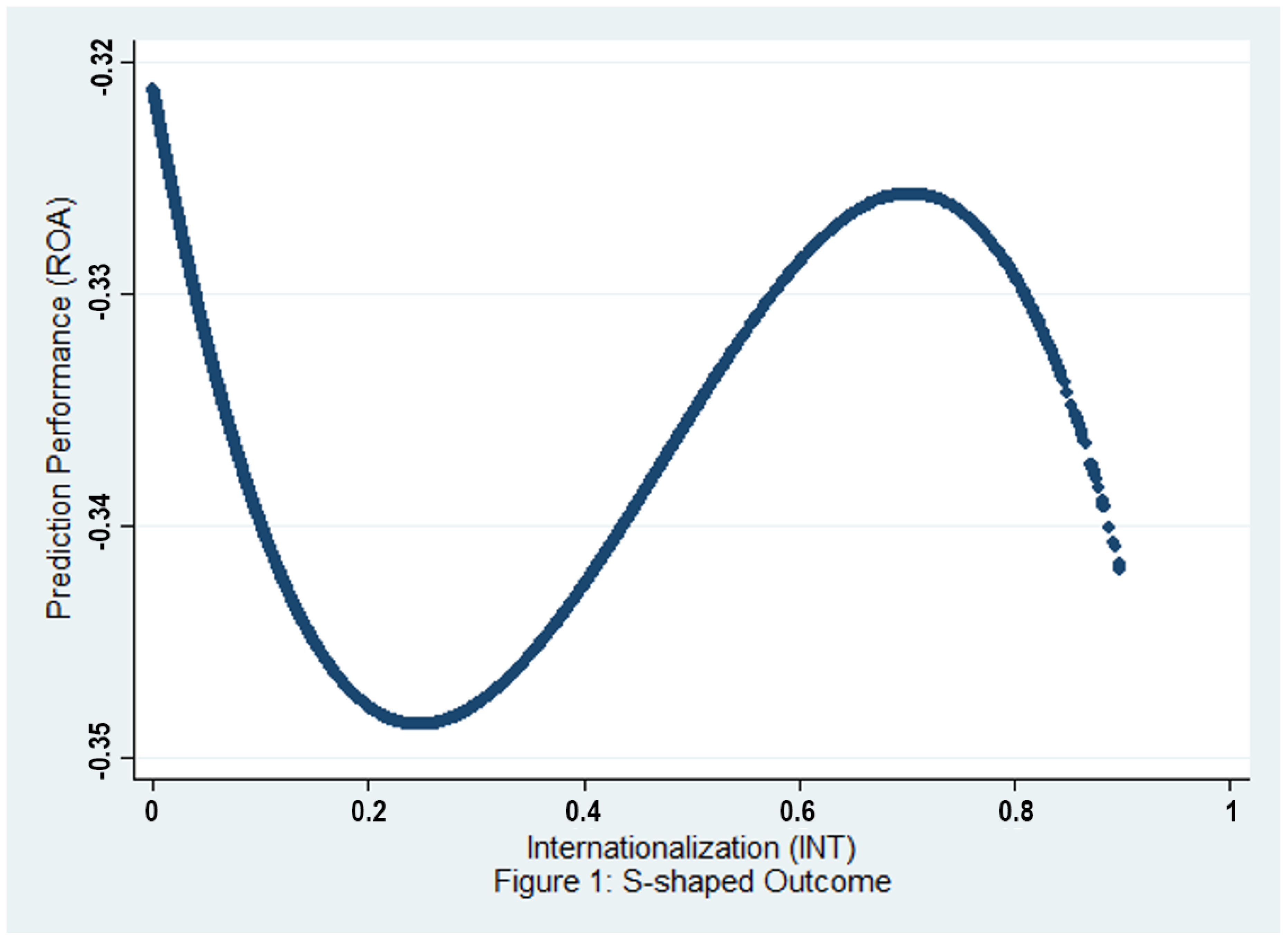

| Y’ = a + b1X1 + b2X12+ b3 X13 | Cubic (S-shaped) |

3.3. Regression Equation

3.4. Variable Measures

3.4.1. Dependent Variables

3.4.2. Independent Variables

3.4.3. Moderating Variables

3.4.4. Control Variables

4. Empirical Results

5. Conclusions and Discussions

5.1. Main Findings and Discussions

5.2. Recommendations

5.3. Limitations

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Assaf, A. George, Alexander Josiassen, Brian T. Ratchford, and Carlos Pestana Barros. 2012. Internationalization and Performance of Retail Firms: A Bayesian Dynamic Model. Journal of Retailing 88: 191–205. [Google Scholar] [CrossRef]

- Bobillo, Alfredo M., Felix López-Iturriaga, and Fernando Tejerina-Gaite. 2010. Firm performance and international diversification: The internal and external competitive advantages. International Business Review 19: 607–18. [Google Scholar] [CrossRef]

- Bourgeois, L. Jay, III. 1981. On the measurement of organizational slack. Academy of Management Review 6: 29–39. [Google Scholar] [CrossRef]

- Bourgeois, L. Jay, III. 2016. The Measurement of Organizational Knowledge Sharing. Academy of Management 6: 29–39. [Google Scholar]

- Brida, Juan Gabriel, Oana Driha, Ana B. Ramón-Rodriguez, and Maria Jesus Such-Devesa. 2016. The inverted-U relationship between the degree of internationalization and the performance: The case of Spanish hotel chains. Tourism Management Perspectives 17: 72–81. [Google Scholar] [CrossRef]

- Cardinal, Laura B., C. Chet Miller, and Leslie E. Palich. 2011. Breaking the cycle of iteration: Forensic failures of international diversification. Global Strategy Journal 1: 175–86. [Google Scholar] [CrossRef]

- Chen, Homin, and Chia-Wen Hsu. 2010. Internationalization, resource allocation and firm performance. Industrial Marketing Management 39: 1103–10. [Google Scholar] [CrossRef]

- Chen, Hsiang-Lan, Wen-Tsung Hsu, and Chiao-Yi Chang. 2016. Independent directors’ human and social capital, firm internationalization and performance implications: An integrated agency-resource dependence view. International Business Review 25: 859–71. [Google Scholar] [CrossRef]

- Chiao, Yu-Ching, Kuo-Pin Yang, and Chwo-Ming Joseph Yu. 2006. Performance, internationalization, and firm-specific advantages of SMES in a newly-industrialized economy. Small Business Economics 26: 475–92. [Google Scholar] [CrossRef]

- Chittoor, Raveendra. 2009. Internationalization of emerging economy firms-need for new theorizing. Indian Journal of Industrial Relations 45: 27–40. [Google Scholar]

- Contractor, Farok J., Sumit K. Kundu, and Chin-Chun Hsu. 2003. A three-stage theory of international expansion: The link between multinationality and performance in the service sector. Journal of International Business Studies 34: 5–18. [Google Scholar] [CrossRef]

- Contractor, Farok J., Vikas Kumar, and Sumit K. Kundu. 2007. Nature of the relationship between international expansion and performance: The case of emerging market firms. Journal of World Business 42: 401–17. [Google Scholar] [CrossRef]

- Daniel, Francis, Franz T. Lohrke, Charles J. Fornaciari, and R. Andrew Turner, Jr. 2004. Slack resources and firm performance: A meta-analysis. Journal of Business Research 57: 565–74. [Google Scholar] [CrossRef]

- Dutta, Dev K., Shavin Malhotra, and PengCheng Zhu. 2016. Internationalization process, impact of slack resources, and role of the CEO: The duality of structure and agency in evolution of cross-border acquisition decisions. Journal of World Business 51: 212–25. [Google Scholar] [CrossRef]

- Eriksson, Kent, Jan Johanson, Anders Majkgård, and D. Deo Sharma. 2014. Experiential components knowledge and cost in the internationalization process. Journal of International Business Studies 28: 337–60. [Google Scholar] [CrossRef]

- García-García, Raquel, Esteban García-Canal, and Mauro F. Guillén. 2017. Rapid internationalization and long-term performance: The knowledge link. Journal of World Business 52: 97–110. [Google Scholar] [CrossRef]

- Glaum, Martin, and Michael-Jörg Oesterle. 2007. Introduction: 40 Years of Research on Internationalization and Firm Performance: More Questions than Answers? MIR: Management International Review 47: 307–17. [Google Scholar]

- Greene, William H. 2003. Models for Panel Data. In Econometric Analysis. Edited by Rod Banister and P. J. Boardman. Upper Saddle River: Prentice Hall, p. 283. [Google Scholar]

- Hutchinson, Karise, Nicholas Alexander, Barry Quinn, and Anne Marie Doherty. 2007. Internationalization Motives and Facilitating Factors: Qualitative Evidence from Smaller Specialist Retailers. Journal of International Marketing 15: 96–122. [Google Scholar] [CrossRef]

- Joensuu-Salo, Sanna, Kirsti Sorama, Anmari Viljamaa, and Elina Varamäki. 2018. Firm Performance among Internationalized SMEs: The Interplay of Market Orientation, Marketing Capability and Digitalization. Administrative Sciences 8: 31. [Google Scholar] [CrossRef]

- Johanson, Jan, and Jan-Erik Vahlne. 1977. The Internationalization Process of the Firm—A Model of Knowledge Development and Increasing Foreign Market Commitments. Journal of International Business Studies 8: 23–32. [Google Scholar] [CrossRef]

- Lin, Wen-Ting, and Yunshi Liu. 2012. Successor characteristics, organisational slack, and change in the degree of firm internationalisation. International Business Review 21: 89–101. [Google Scholar] [CrossRef]

- Lin, Wen-Ting, Kuei-Yang Cheng, and Yunshi Liu. 2009. Organizational slack and firm’s internationalization: A longitudinal study of high-technology firms. Journal of World Business 44: 397–406. [Google Scholar] [CrossRef]

- Lin, Wen-Ting, Yunshi Liu, and Kuei-Yang Cheng. 2011. The internationalization and performance of a firm: Moderating effect of a firm’s behavior. Journal of International Management 17: 83–95. [Google Scholar] [CrossRef]

- Lu, Jane W., and Paul W. Beamish. 2006. SME internationalization and performance: Growth vs. profitability. Journal of International Entrepreneurship 4: 27–48. [Google Scholar] [CrossRef]

- Marano, Valentina, Jean-Luc Arregle, Michael A. Hitt, Ettore Spadafora, and Marc van Essen. 2016. Home country institutions and the internationalization-performance relationship: A meta-analytic review. Journal of Management 42: 1075–110. [Google Scholar] [CrossRef]

- Oeconomica, Acta. 2014. Stages of internationalization: A contribution to the establishment of a theoretical framework. Akadémiai Kiadó 30: 13–30. [Google Scholar]

- Pangarkar, Nitin. 2008. Internationalization and performance of small- and medium-sized enterprises. Journal of World Business 43: 475–85. [Google Scholar] [CrossRef]

- Singla, Chitra, and Rejie George. 2013. Internationalization and performance: A contextual analysis of Indian firms. Journal of Business Research 66: 2500–6. [Google Scholar] [CrossRef]

- Stoker, Thomas, Ernst R. Berndt, Denny Ellerman, and Susanne Schennach. 2005. Panel Data Analysis. Journal of Econometrics 127: 131–64. [Google Scholar] [CrossRef]

- Tan, Justin. 2003. Curvilinear relationship between organizational slack and firm performance: Evidence from Chinese State enterprises. European Management Journal 21: 740–49. [Google Scholar] [CrossRef]

- Tsai, Huei-Ting. 2014. Moderators on international diversification of advanced emerging market firms. Journal of Business Research 67: 1243–48. [Google Scholar] [CrossRef]

- Westhead, Paul, Mike Wright, and Deniz Ucbasaran. 2001. The internationalization of new and small firms: A resource-based view. Journal of Business Venturing 16: 333–58. [Google Scholar] [CrossRef]

- Yoon, Junghyun, Ki Keun Kim, and Alisher Tohirovich Dedahanov. 2018. The role of international entrepreneurial orientation in successful internationalization from the network capability perspective. Sustainability 10: 1709. [Google Scholar] [CrossRef]

- Zhou, Chao. 2018. Internationalization and performance: Evidence from Chinese firms. Chinese Management Studies. [Google Scholar] [CrossRef]

| Mean | SD | ROA | DOI | Firm_Size | High_Slack | Low_Slack | DOI_Highslack | DOI_Lowslack | Joinstock | |

|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 0.0096 | 0.0714 | 1.0000 | |||||||

| DOI | 0.0258 | 0.1057 | −0.0514 * | 1.0000 | ||||||

| Firm_size | 8.4111 | 2.5124 | 0.2220 * | 0.2989 * | 1.0000 | |||||

| High_slack | 1.6951 | 1.8701 | −0.1575 * | −0.1500 * | −0.6166 * | 1.0000 | ||||

| Low_slack | 0.7883 | 1.2615 | 0.0932 * | 0.0414 * | −0.0694 * | −0.0808 * | 1.0000 | |||

| DOI_highslack | 0.0142 | 0.0889 | −0.0309 * | 0.6315 * | 0.1498 * | −0.0357 * | 0.0332 * | 1.0000 | ||

| DOI_lowslack | 0.0259 | 0.1817 | 0.0436 * | 0.5812 * | 0.1614 * | −0.0853 * | 0.2383 * | 0.3894 * | 1.0000 | |

| Joint_stock | 0.1327 | 0.3392 | 0.0304 * | 0.2251 * | 0.3806 * | −0.1977 * | 0.0316 * | 0.1307 * | 0.1517 * | 1 |

| ROA | |

|---|---|

| Internationalization (INT) | −0.408 *** |

| (0.057) | |

| INT2 | 0.724 *** |

| (0.163) | |

| INT3 | −0.442 *** |

| (0.150) | |

| High-discretion slack (HS) | 0.001 ** |

| (0.001) | |

| Low-discretion slack (LS) | 0.007 *** |

| (0.001) | |

| INT × HS | 0.078 *** |

| (0.023) | |

| INT × LS | 0.106 *** |

| (0.032) | |

| INT2 × HS | −0.039 ** |

| (0.016) | |

| INT2 × LS | −0.076 *** |

| (0.025) | |

| INT3 × HS | 0.006 ** |

| (0.003) | |

| INT3 × LS | 0.013 *** |

| (0.005) | |

| Firm size | 0.036 *** |

| (0.002) | |

| Private | −0.002 |

| (0.009) | |

| Share | 0.016 * |

| (0.009) | |

| Industry risk | −0.000 * |

| (0.000) | |

| _cons | −0.325 *** |

| (0.023) | |

| N | 58,332 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Thi Ngoc Huynh, H.; V. Nguyen, P.; T. Tran, K. Internationalization and Performance of Vietnamese Manufacturing Firms: Does Organizational Slack Matter? Adm. Sci. 2018, 8, 64. https://doi.org/10.3390/admsci8040064

Thi Ngoc Huynh H, V. Nguyen P, T. Tran K. Internationalization and Performance of Vietnamese Manufacturing Firms: Does Organizational Slack Matter? Administrative Sciences. 2018; 8(4):64. https://doi.org/10.3390/admsci8040064

Chicago/Turabian StyleThi Ngoc Huynh, Hien, Phuong V. Nguyen, and Khoa T. Tran. 2018. "Internationalization and Performance of Vietnamese Manufacturing Firms: Does Organizational Slack Matter?" Administrative Sciences 8, no. 4: 64. https://doi.org/10.3390/admsci8040064

APA StyleThi Ngoc Huynh, H., V. Nguyen, P., & T. Tran, K. (2018). Internationalization and Performance of Vietnamese Manufacturing Firms: Does Organizational Slack Matter? Administrative Sciences, 8(4), 64. https://doi.org/10.3390/admsci8040064