The Rationality and Irrationality of Financing Green Start-Ups

Abstract

:1. Introduction

2. Methodological Approach and Structure of Paper

3. What are Green Start-Ups?

4. Exploration of the Relevance of Theoretical Concepts in Entrepreneurial Finance for Green Start-Ups

4.1. What is Entrepreneurial Finance?

4.2. Existing Literature on Green Start-Up Finance

4.3. Central Theories in the Entrepreneurial Finance Literature

4.4. Explanatory Value of Entrepreneurial Finance Theory for Green Start-Up Finance

4.5. Explanatory Deficit of Entrepreneurial Finance Theory for Green Start-Up Finance

| Overarching theoryand concepts | Explanatory value | Explanatory deficit | |

|---|---|---|---|

| Specification | Potential consequences | ||

| Asymmetrical information | -Investor knowledge about specific new, green industries, technologies and types of business activities is largely still lacking -Lower levels of knowledge “overlaps” between investor and entrepreneur -Differing understanding of what is central company information -Benchmarks are lacking | -Higher transaction costs -Increased required expected return -Complicated or impossible to conclude the deal | -Existing willingness of some (informal) investors to invest despite of lower expected returns |

| Adverse selection | -High level of externalities | -Lower future profitability | -Other meanings of “good” and “bad” investment prospects |

| Moral hazard | -Conflict of interest -Differing goals between entrepreneur and investor | -Conflictual interaction | -Potential consequence of “mission drift” due to contract design -Potentially higher trust in green start-ups due to “selfless” goals |

| Potential solutions | -Improving information exchange and investor knowledge | -Intermediaries with specialised knowledge -Use of relationship banking | -Misconstrued significance of “signaling” due to differing goals |

5. Going beyond the Entrepreneurial Finance Framework: Behavioural Finance

5.1. What is Behavioural Finance?

5.2. Behavioural Finance Theory’s Contribution to Explaining Entrepreneurial Finance

5.3. Overcoming Entrepreneurial Finance’s Deficit in Explaining Green Start-Up Finance

6. Questioning the Underlying, Implicit Assumptions of Entrepreneurial Finance Theory

7. Future Directions

7.1. Behavioural Finance’s Need for a More Substantial Departure from Modern Finance Theory

“Processes of opportunity discovery and opportunity creation [in entrepreneurship] evidence other, often neglected, aspects of rationality. Both processes require action, not just decision making. These processes give rise to an understanding of rationality as performative, not simply cognitive. Rather than being universal, rationality is situational; it responds contingently and creatively to the perceived exigencies of particular situations. Rational individuals pursue what is feasible, given their finite cognitive and physical capacities. Rationality is dynamic, rather than static; it is amenable to learning over time. Rationality includes critical reflection on values and learned preferences, rather than treating values and preferences as exogenously given and fixed. Rationality is subjective, not objective; only through personal commitment does it become normative. Norms of rationality emerge within communities of practitioners.”([99], p. 67, emphasis added)

“[…] both the ontology and the epistemology of financial economics are decidedly value-impregnated, however well the methodology masquerades as perfectly objective […] what we believe ought to be there leads to what we believe is there. And what we believe is there leads to how we can prove that it is, indeed, there, whether it is really there or not.”([103], pp. 159–160, emphasis in original)

7.2. Future Research on Green Start-Up Finance

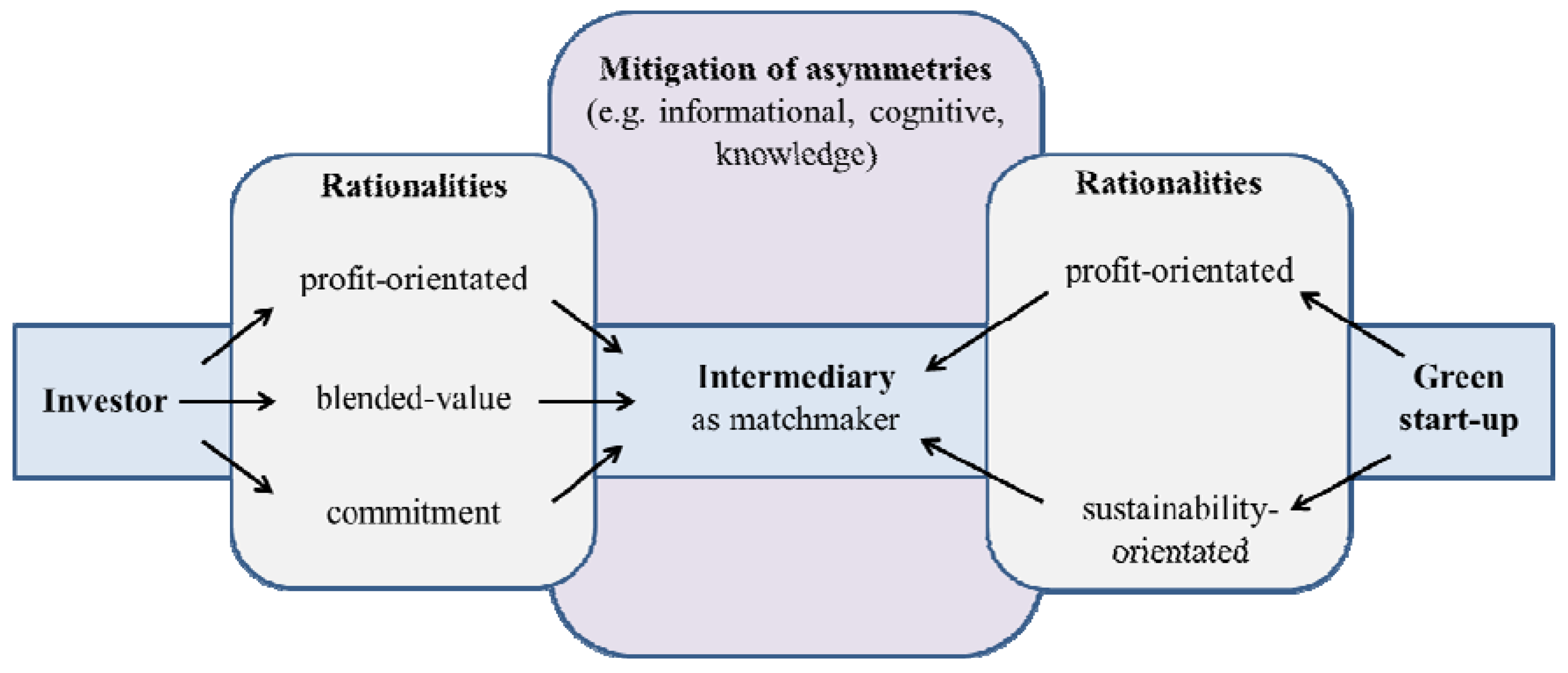

- Taking different forms of rationality into account will help reduce informational, cognitive and knowledge-based asymmetries between investors and green start-ups.

- Intermediaries can help mitigate the risks involved in green start-up finance by applying specialised knowledge and networks.

- Intermediaries can help reduce/avoid adverse selection and moral hazard through optimised matching between suitable investors and green start-ups.

8. Conclusions

Conflicts of Interest

References

- Bergset, L.; Fichter, K. Green Start-Ups—A New Typology as a Basis for Investigating and Understanding Sustainable Entrepreneurship and Innovation. J. Innovat. Manag. 2015. forthcoming. [Google Scholar]

- Schaltegger, S.; Wagner, M. Sustainable Entrepreneurship and Sustainability Innovation: Categories and Interactions. Bus. Strategy Environ. 2011, 20, 222–237. [Google Scholar] [CrossRef]

- Fichter, K.; Weiß, R. Start-Ups: Product Pioneers for a Green Economy; Borderstep Institute for Innovation and Sustainability: Berlin, Germany, 2013. [Google Scholar]

- Freimann, J. Über Die Schwierigkeiten Grüner Unternehmensgründungen—Gründungen Wie Andere Auch? Ökol. Wirtsch. 2005, 2, 12–13. [Google Scholar]

- Prahalad, C.K.; Hammond, A. Serving the World’s Poor, Profitably. Harv. Bus. Rev. 2002, 80, 48–59. [Google Scholar] [PubMed]

- Lehner, O.M. Crowdfunding Social Ventures: A Model and Research Agenda. Venture Cap. 2013, 15, 289–311. [Google Scholar] [CrossRef]

- Choi, D.Y.; Gray, E.R. The Venture Development Processes of “sustainable” Entrepreneurs. Manag. Res. News 2008, 31, 558–569. [Google Scholar] [CrossRef]

- Nicholls, A.; Pharoah, C. The Landscape of Social Investment: A Holistic Topology of Opportunities and Challenges; Said Business School, Skoll Centre for Social Entrepreneurship: Oxford, UK, 2008. [Google Scholar]

- Vickers, I.; Lyon, F. Beyond Green Niches? Growth Strategies of Environmentally-Motivated Social Enterprises. Int. Small Bus. J. 2012. [Google Scholar] [CrossRef]

- Howard, P.H.; Jaffee, D. Tensions between Firm Size and Sustainability Goals: Fair Trade Coffee in the United States. Sustainability 2013, 5, 72–89. [Google Scholar] [CrossRef]

- Nicholls, A.; Paton, R. Emerging Resource Flows for Social Entrepreneurship: Theorizing Social Investment; University of Brighton: Brighton, UK, 2009. [Google Scholar]

- Gray, E.R.; Balmer, J.M.T. The Sustainable Entrepreneur; Working Paper 04(14); Bradford University School of Management: Bradford, UK, 2004. [Google Scholar]

- Denis, D.J. Entrepreneurial Finance: An Overview of the Issues and Evidence. J. Corp. Finance 2004, 10, 301–326. [Google Scholar] [CrossRef]

- Barry, C.B. New Directions in Research on Venture Capital Finance. Financ. Manag. 1994, 23, 3–15. [Google Scholar] [CrossRef]

- Singh, J.V.; Tucker, D.J.; House, R.J. Organizational Legitimacy and the Liability of Newness. Adm. Sci. Q. 1986, 31, 171–193. [Google Scholar] [CrossRef]

- Mac an Bhaird, C. The Modigliani–Miller Proposition after Fifty Years and its Relation to Entrepreneurial Finance. Strateg. Change 2010, 19, 9–28. [Google Scholar] [CrossRef]

- Berger, A.N.; Udell, G.F. The Economics of Small Business Finance: The Roles of Private Equity and Debt Markets in the Financial Growth Cycle. J. Bank. Finance 1998, 22, 613–673. [Google Scholar] [CrossRef]

- Steier, L. Variants of Agency Contracts in Family-Financed Ventures as a Continuum of Familial Altruistic and Market Rationalities. J. Bus. Ventur. 2003, 18, 597–618. [Google Scholar] [CrossRef]

- Chemmanur, T.J.; Fulghieri, P. Entrepreneurial Finance and Innovation: An Introduction and Agenda for Future Research. Rev. Financ. Stud. 2014, 27, 1–19. [Google Scholar] [CrossRef]

- Lam, W. Funding Gap, What Funding Gap? Financial Bootstrapping: Supply, Demand and Creation of Entrepreneurial Finance. Int. J. Entrep. Behav. Res. 2010, 16, 268–295. [Google Scholar] [CrossRef]

- Bhide, A. Bootstrap Finance: The Art of Start-Ups. Harv. Bus. Rev. 1991, 70, 109–117. [Google Scholar]

- Mason, C.; Harrison, R. Editorial. Venture Capital: Rationale, Aims and Scope. Venture Cap. 1999, 1, 1–46. [Google Scholar] [CrossRef]

- Petty, J.W.; Bygrave, W.D. What does Finance Have to Say to the Entrepreneur? J. Entrep. Finance 1993, 2, 125–137. [Google Scholar]

- Emerson, J. The Blended Value Proposition: Integrating Social and Financial Returns. Calif. Manage. Rev. 2003, 45, 35–51. [Google Scholar] [CrossRef]

- Hebb, T. Impact Investing and Responsible Investing: What Does It Mean? J. Sustain. Finance Invest. 2013, 3, 71–74. [Google Scholar] [CrossRef]

- Brettel, M. Business Angels. In Entrepreneurial Finance; Börner, P.D.C.J., Grichnik, D.D., Eds.; Physica-Verlag HD: Heidelberg, Germany, 2005; pp. 233–258. [Google Scholar]

- Bocken, N.M.P. Sustainable Venture Capital—Catalyst for Sustainable Start-up Success? J. Clean. Prod. 2015, 108, 647–658. [Google Scholar] [CrossRef]

- Randjelovic, J.; O’Rourke, A.R.; Orsato, R.J. The Emergence of Green Venture Capital. Bus. Strategy Environ. 2003, 12, 240–253. [Google Scholar] [CrossRef]

- John, R. Beyond the Cheque: How Venture Philanthropists Add Value. Skoll Centre for Social Entrepreneurship Working Paper. 2007. Available online: http://eureka.sbs.ox.ac.uk/id/eprint/732 (accessed on 9 June 2011).

- Cowton, C.J.; Thompson, P. Financing the Social Economy: A Case Study of Triodos Bank. Int. J. Nonprofit Volunt. Sect. Mark. 2001, 6, 145–155. [Google Scholar] [CrossRef]

- Weber, O. Mission and Profitability of Social Banks. Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1957637 (accessed on 6 May 2012).

- Lehner, O.M. A Literature Review and Research Agenda for Crowdfunding of Social Ventures. In Research Colloquium on Social Entrepreneurship; Skoll Center of SAID Business School: Oxford, UK, 2012. [Google Scholar]

- Lehner, O.M.; Nicholls, A. Social Finance and Crowdfunding for Social Enterprises: A Public-private Case Study Providing Legitimacy and Leverage. Venture Cap. 2014, 16, 271–286. [Google Scholar] [CrossRef]

- Di Domenico, M.; Haugh, H.; Tracey, P. Social Bricolage: Theorizing Social Value Creation in Social Enterprises. Entrep. Theory Pract. 2010, 34, 681–703. [Google Scholar] [CrossRef]

- Patzelt, H.; Shepherd, D.A. Recognizing Opportunities for Sustainable Development. Entrep. Theory Pract. 2011, 35, 631–652. [Google Scholar] [CrossRef]

- York, J.G.; Venkataraman, S. The Entrepreneur-environment Nexus: Uncertainty, Innovation, and Allocation. J. Bus. Ventur. 2010, 25, 449–463. [Google Scholar] [CrossRef]

- Shepherd, D.A.; Patzelt, H. The New Field of Sustainable Entrepreneurship: Studying Entrepreneurial Action Linking “What Is to Be Sustained” with “What Is to Be Developed”. Entrep. Theory Pract. 2011, 35, 137–163. [Google Scholar] [CrossRef]

- Moore, M.L.; Westley, F.R.; Brodhead, T. Social Finance Intermediaries and Social Innovation. J. Soc. Entrep. 2012, 3, 184–205. [Google Scholar] [CrossRef]

- Bürer, M.J.; Wüstenhagen, R. Which Renewable Energy Policy Is a Venture Capitalist’s Best Friend? Empirical Evidence from a Survey of International Cleantech Investors. Energ. Pol. 2009, 37, 4997–5006. [Google Scholar] [CrossRef]

- Caprotti, F. The Cultural Economy of Cleantech: Environmental Discourse and the Emergence of a New Technology Sector. Trans. Inst. Br. Geogr. 2012, 37, 370–385. [Google Scholar] [CrossRef]

- Ghosh, S.; Nanda, R. Venture Capital Investment in the Clean Energy Sector. Business Harvard School Working Paper 11-020. 2010. Available online: http://core.ac.uk/download/pdf/6698655.pdf (accessed on 6 August 2015).

- Hargadon, A.; Kenney, M. Venture Capital and Clean Technology: Opportunities and Difficulties. In Proceedings of Berkeley Roundtable on the International Economy, University of California, Berkeley, CA, USA, 2011.

- O’Rourke, A.R. Venture Capital as a Tool for Sustainable Entrepreneurship. In Making Ecopreneurs: Developing Sustainable Entrepreneurship; Schaper, M., Ed.; Ashgate Publishing: Surrey, UK, 2005. [Google Scholar]

- Wüstenhagen, R.; Teppo, T. What Makes a Good Industry for Venture Capitalists? Risk, Return and Time as Factors Determining the Emergence of the European Energy VC Market; IWÖ Discussion Paper No. 114; Institut für Wirtschaft und Ökologie: St. Gallen, Switzerland, 2004. [Google Scholar]

- Cable, D.M.; Shane, S. A Prisoner’s Dilemma Approach to Entrepreneur-Venture Capitalist Relationships. Acad. Manage. Rev. 1997, 22, 142–176. [Google Scholar]

- Solvang, B.K.; Berg-Utby, T. The Role of Private Equity: From Focus on the Product to Focus on Value Creation. Int. J. Entrep. Innov. Manag. 2009, 9, 229–241. [Google Scholar] [CrossRef]

- Marlow, S.; Patton, D. All Credit to Men? Entrepreneurship, Finance, and Gender. Entrep. Theory Pract. 2005, 29, 717–735. [Google Scholar] [CrossRef]

- De Clercq, D.; Sapienza, H.J. The Creation of Relational Rents in Venture Capitalist-Entrepreneur Dyads. Venture Cap. Int. J. Entrep. Finance 2001, 3, 107–127. [Google Scholar] [CrossRef]

- Norton, E. Venture Capital as an Alternative Means to Allocate Capital: An Agency-Theoretic View. Entrep. Theory Pract. 1995, 20, 19–30. [Google Scholar]

- Hall, J.; Hofer, C.W. Venture Capitalists’ Decision Criteria in New Venture Evaluation. J. Bus. Ventur. 1993, 8, 25–42. [Google Scholar] [CrossRef]

- Phlips, L. The Economics of Imperfect Information; Cambridge University Press: Cambridge, UK, 1988. [Google Scholar]

- Revest, V.; Sapio, A. Financing Technology-Based Small Firms in Europe: What Do We Know? Small Bus. Econ. 2012, 39, 179–205. [Google Scholar] [CrossRef]

- Ang, J.S. Small Business Uniqueness and the Theory of Financial Management. J. Entrep. Finance 1991, 1, 11–13. [Google Scholar]

- Bonnet, C.; Wirtz, P. Investor Type, Cognitive Governance and Performance in Young Entrepreneurial Ventures: A Conceptual Framework. Adv. Behav. Finance Econ. J. Acad. Behav. 2011, 1, 42–62. [Google Scholar]

- Fluck, Z. Optimal Financial Contracting: Control Rights, Incentives, and Entrepreneurship. Strateg. Change 2010, 19, 77–90. [Google Scholar] [CrossRef]

- Yazdipour, R. What Can Venture Capitalists and Entrepreneurs Learn from Behavioral Economists? Strateg. Change 2009, 18, 241–247. [Google Scholar] [CrossRef]

- Van Auken, H.E. A Model of Small Firm Capital Acquisition Decisions. Int. Entrep. Manag. J. 2005, 1, 335–352. [Google Scholar] [CrossRef]

- Coelho, M.; de Meza, D.; Reyniers, D. Irrational Exuberance, Entrepreneurial Finance and Public Policy. Int. Tax Public Finance 2004, 11, 391–417. [Google Scholar] [CrossRef]

- Burke, A.E.; Hanley, A. How Do Banks Pick Safer Ventures? A Theory Relating the Importance of Risk Aversion and Collateral to Interest Margins and Credit Rationing. J. Entrep. Finance 2003, 8, 13–24. [Google Scholar]

- Prasad, D.; Bruton, G.D.; Vozikis, G. Signaling Value to Businessangels: The Proportion of the Entrepreneur’s Net Worth Invested in a New Venture as a Decision Signal. Venture Cap. Int. J. Entrep. Finance 2000, 2, 167–182. [Google Scholar] [CrossRef]

- Robbie, W.; Mike, K. Venture Capital and Private Equity: A Review and Synthesis. J. Bus. Finance Account. 1998, 25, 521–570. [Google Scholar]

- Brophy, D.J.; Shulman, J.M. A Finance Perspective on Entrepreneurship Research. Entrep. Theory Pract. 1992, 16, 61–71. [Google Scholar]

- Akerlof, G.A. The Market for “Lemons”: Quality Uncertainty and the Market Mechanism. Q. J. Econ. 1970, 84, 488–500. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the Firm: Managerial Behavior, Agency Costs, and Ownership Structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Leland, H.E.; Pyle, D.H. Informational Asymmetries, Financial Structure, and Financial Intermediation. J. Finance 1977, 32, 371–387. [Google Scholar] [CrossRef]

- Stiglitz, J.E.; Weiss, A. Credit Rationing in Markets with Imperfect Information. Am. Econ. Rev. 1981, 71, 393–410. [Google Scholar]

- Myers, S.C.; Majluf, N.S. Corporate Financing and Investment Decisions When Firms Have Information That Investors Do Not Have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Myers, S.C. The Capital Structure Puzzle. J. Finance 1984, 39, 574–592. [Google Scholar] [CrossRef]

- Donaldson, G. Corporate Debt Capacity: A Study of Corporate Debt Policy and the Determination of Corporate Debt Capacity; Division of Research, Harvard Graduate School of Business Administration: Boston, MA, USA, 1961. [Google Scholar]

- Bergset, L. Financing Innovation in Sustainable Start-Ups—An Exploration of Financial Access, Challenges and Opportunities. In Proceedings of ISPIM Conference, Dublin, Ireland, 2014.

- Pacheco, D.F.; Dean, T.J.; Payne, D.S. Escaping the Green Prison: Entrepreneurship and the Creation of Opportunities for Sustainable Development. J. Bus. Ventur. 2010, 25, 464–480. [Google Scholar] [CrossRef]

- Faber, A.; Frenken, K. Models in Evolutionary Economics and Environmental Policy: Towards an Evolutionary Environmental Economics. Technol. Forecast. Soc. Change 2009, 76, 462–470. [Google Scholar] [CrossRef]

- Parrish, B.D. Sustainability-Driven Entrepreneurship: Principles of Organization Design. J. Bus. Ventur. 2010, 25, 510–523. [Google Scholar] [CrossRef]

- Isaak, R. Green Logic—Ecopreneurship, Theory and Ethics; Greenleaf Publishing: Sheffield, UK, 1998. [Google Scholar]

- McWade, W. The Role for Social Enterprises and Social Investors in the Development Struggle. J. Soc. Entrep. 2012, 3, 96–112. [Google Scholar] [CrossRef]

- Hockerts, K.; Wüstenhagen, R. Greening Goliaths versus Emerging Davids—Theorizing about the Role of Incumbents and New Entrants in Sustainable Entrepreneurship. J. Bus. Ventur. 2010, 25, 481–492. [Google Scholar] [CrossRef]

- Petersen, H. Ecopreneurship Und Wettbewerbsstrategie; Metropolis Verlag: Marburg, Germany, 2003. [Google Scholar]

- Sapienza, H.J.; Gupta, A.K. Impact of Agency Risks and Task Uncertainty on Venture Capitalist-CEO Interaction. Acad. Manage. J. 1994, 37, 1618–1632. [Google Scholar] [CrossRef]

- Frankfurter, G.M.; McGoun, E.G. Resistance Is Futile: The Assimilation of Behavioral Finance. J. Econ. Behav. Organ. 2002, 48, 375–389. [Google Scholar] [CrossRef]

- Gilad, B.; Kaish, S.; Loeb, P.D. From Economic Behavior to Behavioral Economics: The Behavioral Uprising in Economics. J. Behav. Econ. 1984, 13, 1–22. [Google Scholar] [CrossRef]

- Rubaltelli, E.; Pasini, G.; Rumiati, R.; Olsen, R.A.; Slovic, P. The Influence of Affective Reactions on Investment Decisions. J. Behav. Finance 2010, 11, 168–176. [Google Scholar] [CrossRef]

- Subrahmanyam, A. Behavioural Finance: A Review and Synthesis. Eur. Financ. Manag. 2008, 14, 12–29. [Google Scholar] [CrossRef]

- De Bondt, W.; Muradoglu, G.; Shefrin, H.; Staikouras, S.K. Behavioral Finance: Quo Vadis? J. Appl. Finance 2008, 18, 7–21. [Google Scholar]

- Ritter, J.R. Behavioral Finance. Pac. Basin Finance J. 2003, 11, 429–437. [Google Scholar] [CrossRef]

- Shiller, R.J. From Efficient Markets Theory to Behavioral Finance. J. Econ. Perspect. 2003, 17, 83–104. [Google Scholar] [CrossRef]

- Shefrin, H.; Statman, M. The Contributions of Daniel Kahneman and Amos Tversky. J. Behav. Finance 2003, 4, 54–58. [Google Scholar] [CrossRef]

- Baker, H.K.; Nofsinger, J.R. Psychological Biases of Investors. Financ. Serv. Rev. 2002, 11, 97–116. [Google Scholar]

- Miller, G.P.; Rosenfeld, G. Intellectual Hazard: How Conceptual Biases in Complex Organizations Contributed to the Crisis of 2008. Harv. J.L. Pub. Pol. 2010, 33, 807–840. [Google Scholar] [CrossRef]

- Fairchild, R. An Entrepreneur’s Choice of Venture Capitalist or Angel-Financing: A Behavioral Game-Theoretic Approach. J. Bus. Ventur. 2011, 26, 359–374. [Google Scholar] [CrossRef]

- Yazdipour, R.; Constand, R.L. Predicting Firm Failure: A Behavioral Finance Perspective. J. Entrep. Finance JEF 2010, 14, 90–104. [Google Scholar]

- Yazdipour, R. Decision Making in Entrepreneurial Finance: A Behavioral Perspective. J. Entrep. Finance 2009, 13, 56–75. [Google Scholar]

- Zacharakis, A.L.; Meyer, G.D. A Lack of Insight: Do Venture Capitalists Really Understand Their Own Decision Process? J. Bus. Ventur. 1998, 13, 57–76. [Google Scholar] [CrossRef]

- Franke, N.; Gruber, M.; Harhoff, D.; Henkel, J. What You Are Is What You Like—similarity Biases in Venture Capitalists’ Evaluations of Start-up Teams. J. Bus. Ventur. 2006, 21, 802–826. [Google Scholar] [CrossRef]

- Simon, H.A. Altruism and Economics. Am. Econ. Rev. 1993, 83, 156–161. [Google Scholar]

- Olsen, R.A. Cognitive Dissonance: The Problem Facing Behavioral Finance. J. Behav. Finance 2008, 9, 1–4. [Google Scholar] [CrossRef]

- Moskowitz, T.J.; Vissing-Jorgensen, A. The Returns to Entrepreneurial Investment: A Private Equity Premium Puzzle? Am. Econ. Rev. 2002, 92, 745–778. [Google Scholar] [CrossRef]

- McGoun, E.G.; Skubic, T. Beyond Behavioral Finance. J. Psychol. Financ. Mark. 2000, 1, 135–144. [Google Scholar] [CrossRef]

- Keltner, D.; Lerner, J.S. Emotion. In Handbook of social psychology; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2010. [Google Scholar]

- Miller, K.D. Risk and Rationality in Entrepreneurial Processes. Strateg. Entrep. J. 2007, 1, 57–74. [Google Scholar] [CrossRef]

- Olsen, R.A. Behavioral Finance as Science: Implications from the Research of Paul Slovic. J. Psychol. Financ. Mark. 2001, 2, 157–159. [Google Scholar] [CrossRef]

- Statman, M. Quiet Conversations: The Expressive Nature of Socially Responsible Investors. J. Financ. Plan. 2008, 40–46. Available online: http://www.scu.edu/business/finance/research/upload/SRI-Expressive-2.pdf (accessed on 5 November 2014). [Google Scholar]

- Sen, A.K. Rational Fools: A Critique of the Behavioral Foundations of Economic Theory. Philos. Public Aff. 1977, 6, 317–344. [Google Scholar]

- Frankfurter, G.M.; McGoun, E.G. Ideology and the Theory of Financial Economics. J. Econ. Behav. Organ. 1999, 39, 159–177. [Google Scholar] [CrossRef]

- Prentice, R.A. Ethical Decision Making: More Needed than Good Intentions. Financ. Anal. J. 2007, 63, 17–30. [Google Scholar] [CrossRef]

© 2015 by the author; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bergset, L. The Rationality and Irrationality of Financing Green Start-Ups. Adm. Sci. 2015, 5, 260-285. https://doi.org/10.3390/admsci5040260

Bergset L. The Rationality and Irrationality of Financing Green Start-Ups. Administrative Sciences. 2015; 5(4):260-285. https://doi.org/10.3390/admsci5040260

Chicago/Turabian StyleBergset, Linda. 2015. "The Rationality and Irrationality of Financing Green Start-Ups" Administrative Sciences 5, no. 4: 260-285. https://doi.org/10.3390/admsci5040260

APA StyleBergset, L. (2015). The Rationality and Irrationality of Financing Green Start-Ups. Administrative Sciences, 5(4), 260-285. https://doi.org/10.3390/admsci5040260