The Role of Latin American Universities in Entrepreneurial Ecosystems: A Multi-Level Study of Academic Entrepreneurship in Ecuador

Abstract

1. Introduction

2. Literature Review, Hypotheses, and Conceptual Framework

2.1. Entrepreneurial Ecosystems

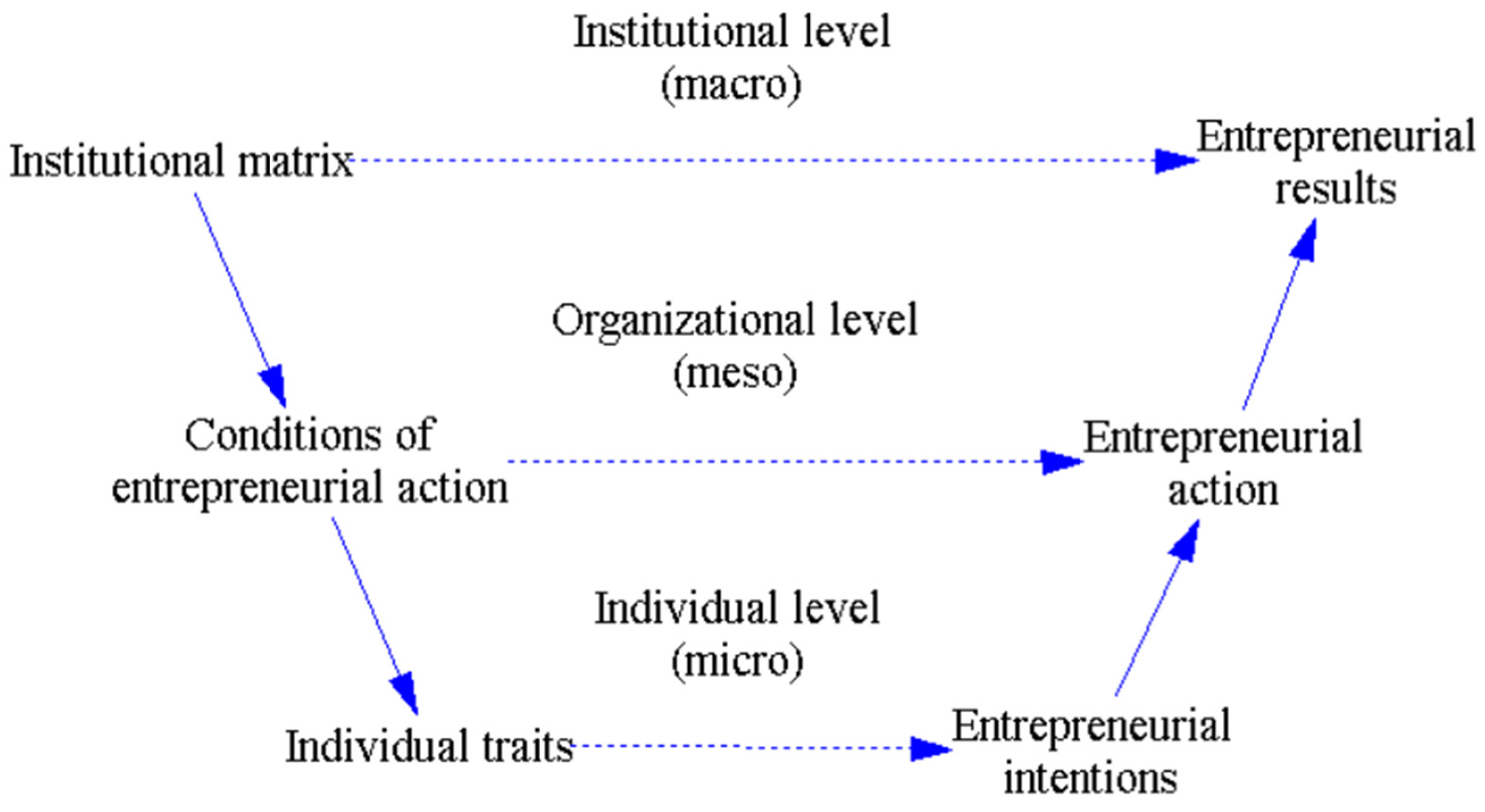

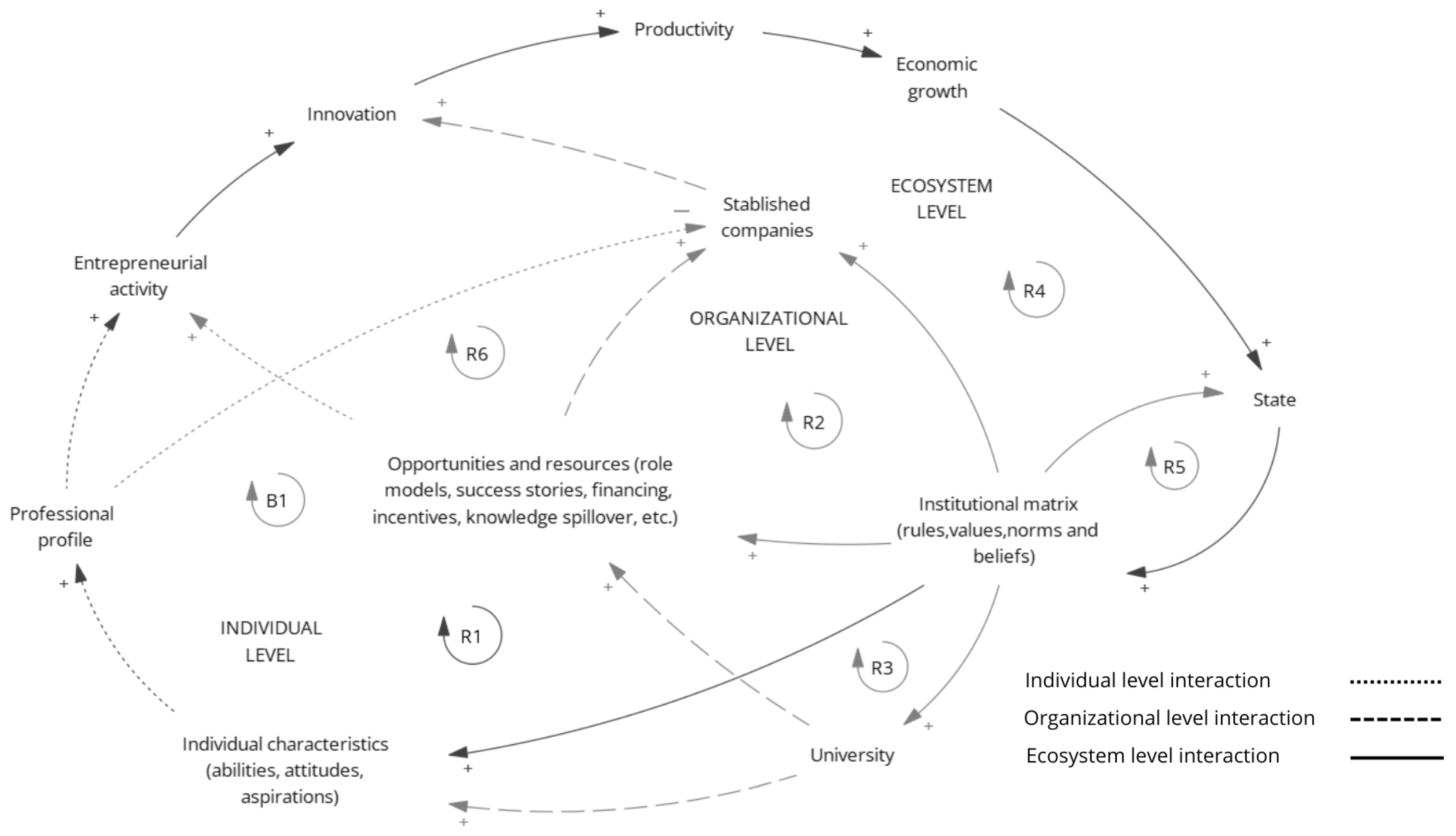

2.2. Institutions, Individuals, and Organizations

2.3. Academic Entrepreneurial Ecosystems

2.4. Individual Level (Micro)

2.5. Organizational Level (Meso)

2.6. Institutional Level (Macro)

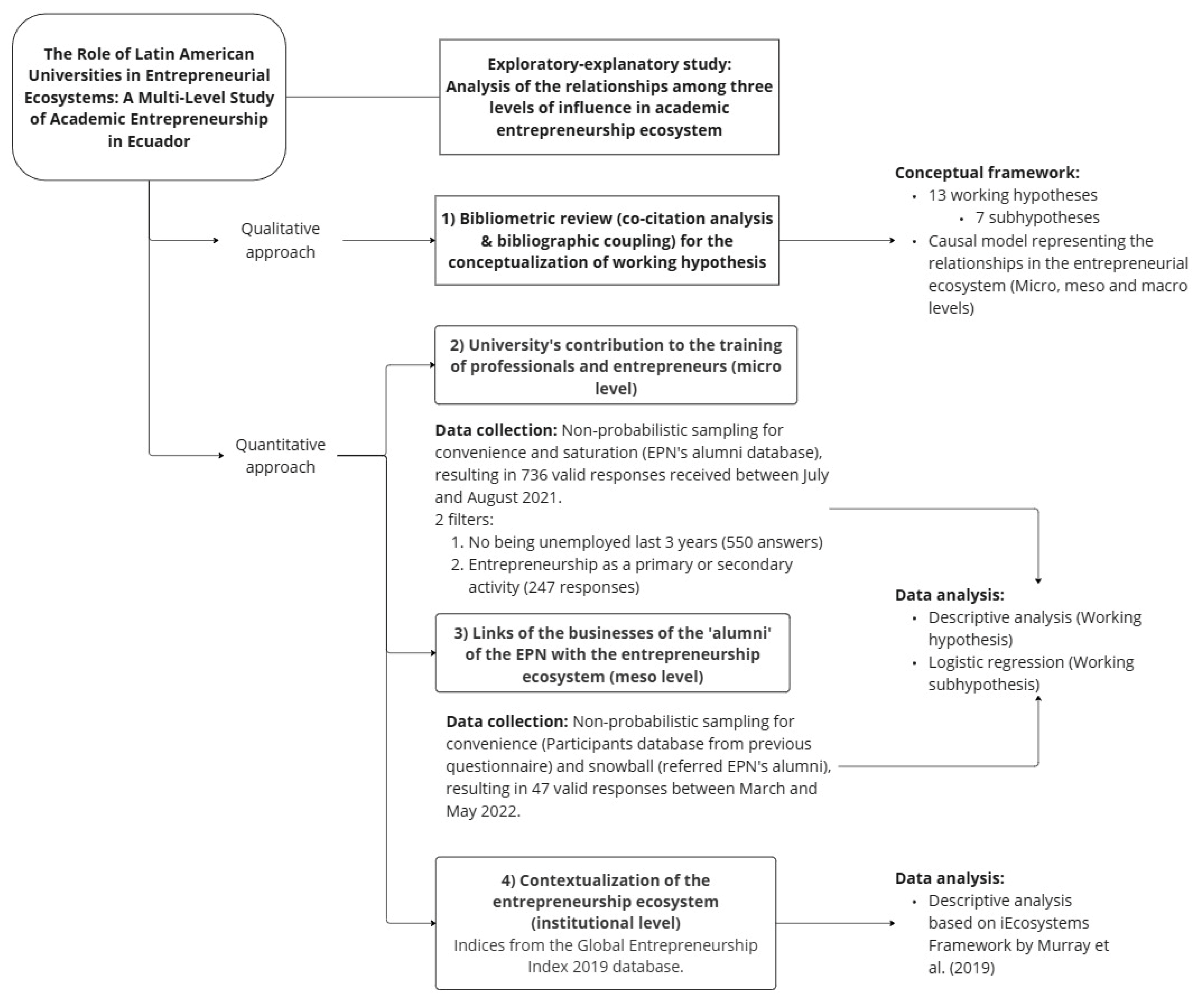

3. Methodology

3.1. Qualitative Approach

Bibliometric Review and Conceptualization of Working Hypotheses

3.2. Quantitative Approach

3.2.1. University’s Contribution to the Training of Professionals and Entrepreneurs

3.2.2. Links of the Businesses of the ‘Alumni’ of the EPN with the Entrepreneurship Ecosystem

3.2.3. Contextualization of the Entrepreneurship Ecosystem

3.2.4. Operationalization of Working Hypothesis

4. Results and Discussion

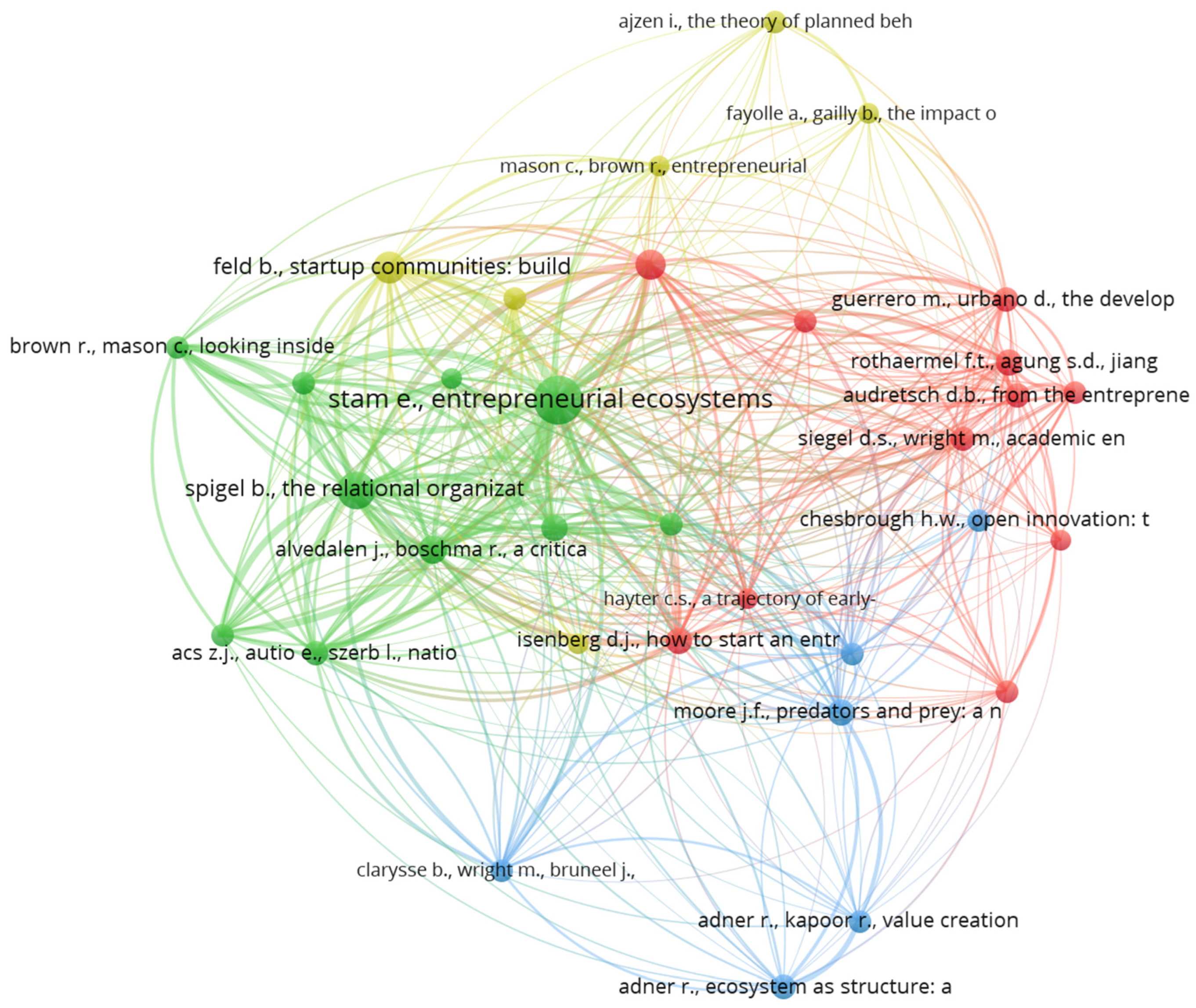

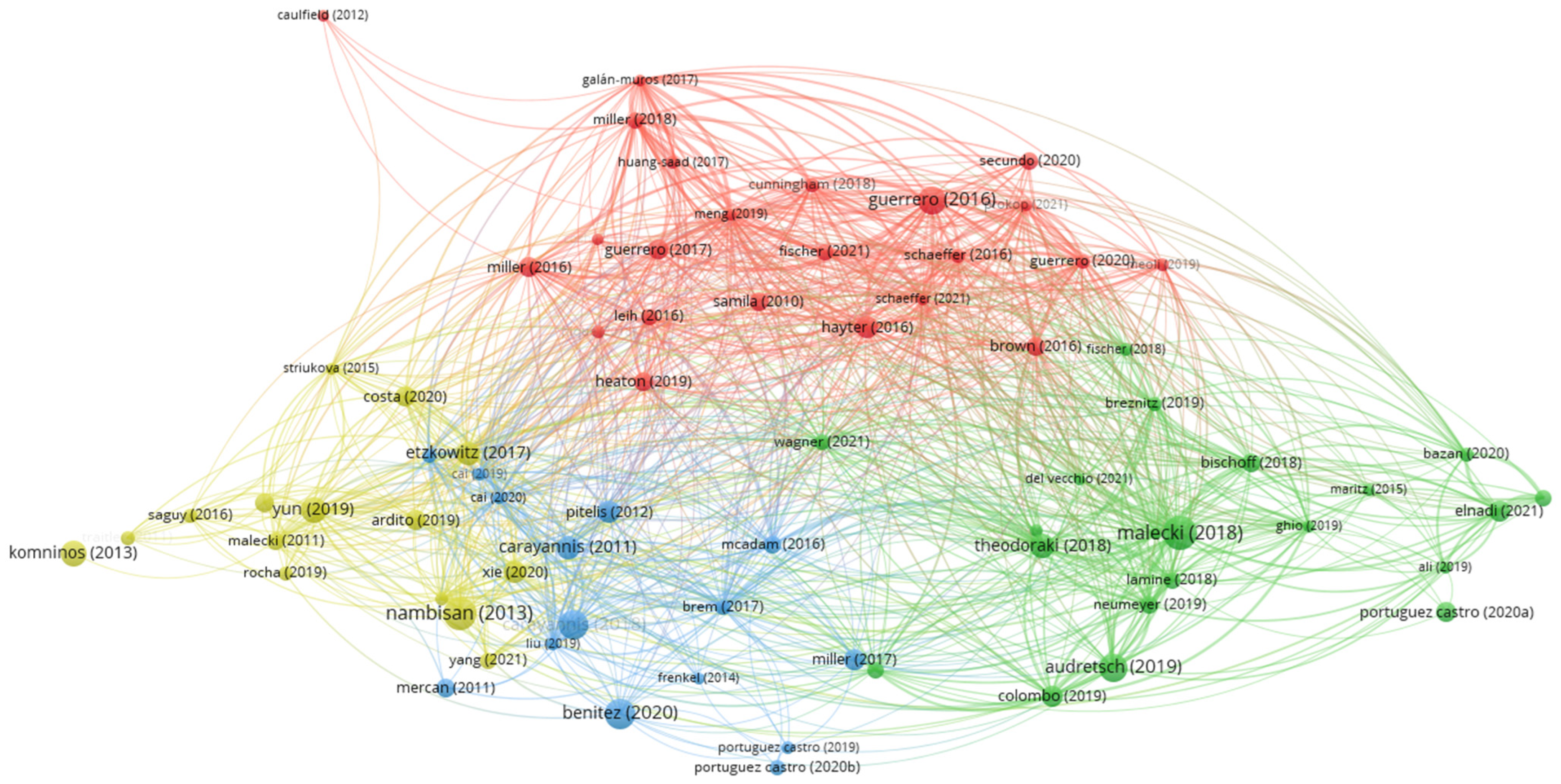

4.1. Bibliometric Review

- (1).

- Entrepreneurial universities and innovation ecosystems: Articles in this cluster highlight the university’s relevance to entrepreneurial and innovation ecosystems based on its potential to promote entrepreneurship education and the support to the creation of knowledge-based startups.

- (2).

- Entrepreneurial ecosystems and regional innovation: This cluster features the importance of understanding the dynamic nature of these ecosystems, the roles of various stakeholders, and the interactions between cultural, social, and material factors.

- (3).

- Business strategy and innovation ecosystems: These articles explore the concept of business and innovation ecosystems from a strategic view, analyzing the interdependencies between firms and other actors, including suppliers, customers, and policymakers.

- (4).

- Sustaining entrepreneurial ecosystems: Articles in this cluster emphasize the importance of creating favorable conditions for entrepreneurship while remarking the importance of a strategic, holistic approach to fostering growth and sustainability.

- (1).

- Universities and innovation ecosystems: Key themes in this cluster include the integration of universities into broader innovation ecosystems, the evolving role of academic entrepreneurs, and the management of these ecosystems to foster successful knowledge exchange and commercialization.

- (2).

- University influences entrepreneurial activity: The cluster stresses the importance of institutional and social factors, such as cultural attitudes and government support, in shaping entrepreneurial outcomes.

- (3).

- Innovation ecosystems and stakeholders’ integration: This cluster focuses on how various stakeholders, including universities, industry, and government, collaborate to drive innovation and entrepreneurship.

- (4).

- Innovation ecosystems dynamics and governance: Documents in this cluster explore how universities contribute to knowledge transfer, co-creation, and the governance of innovation ecosystems.

4.2. University’s Contribution to the Formation of Professionals and Entrepreneurs (Individual—Micro-Level)

4.3. Links of the Businesses of the ‘Alumni’ of the EPN with the Entrepreneurship Ecosystem (Organizational—Meso-Level)

4.4. Contextualization of the Entrepreneurship Ecosystem (Institutional—Macro Level)

4.5. Hypotheses Analysis

- H2a. The logistic regression analysis results showed no statistically significant association (p-value = 0.548) between knowing someone who started a business in the past three years and considering the fear of failure as a limitation to starting a business. A weak causal effect might explain this result. Aparicio et al. (2021b) suggest that exposure to role models may reduce fear of failure. However, Wyrwich et al. (2016) argue that the relation between role models and fear of failure is mediated by the institutional context, consequently, a reduced effect of can be found when the institutional environment discourages entrepreneurial activity. Accordingly, observing failed experiences of entrepreneurship may induce fear of failure. This study collected data during the COVID-19 health crisis, in this context, negative experiences such as business’ closings, unemployment growth, difficulty accessing providers and markets fostered fear of failure (Kariv et al., 2022).

- H2b. The logistic regression analysis results indicate a statistically significant relationship (p-value = 0.00). Not knowing someone who started a business in the past three years reduces the probability of starting a business (odds decrease by 57.3%). In this sense, Soria-Barreto et al. (2017) and Urbano et al. (2019b) observe that role models motivate the decision to start a business.

- H3a. Not having started a venture reduces the probability of considering entrepreneurship as a good career alternative (represents 43.4% less odds of considering entrepreneurship as a good career alternative). Krueger (1993) argues that previous positive entrepreneurial experiences indirectly influence intentions through the aspiration to establish a business.

- H3b. The quantitative analysis indicated a statistically significant relationship (p-value = 0.00) and showed an odds ratio of 0.346, which suggests that not having started a business reduces the probability of having intentions to start a business (reduces by 63.4% the odds of having intentions to start a business). Krueger (1993) claims that the perception of feasibility mediates the influence of previous entrepreneurial experiences on entrepreneurial intentions.

- H6a. Not having the knowledge and skills to undertake reduces the odds of undertaking by 60.8%. A statistically significant relationship was found (p-value = 0.00) and an odds’ ratio of 0.392.

- H8a. Despite the above, no statistically significant association was found (p-value = 0.238) between the ventures of the alumni whose main business idea was associated with EPN and having products or services considered innovative at a national or international level. Lack of statistical significance may be explained due to a small size of the sample.

- H8b. No statistically significant association was found (p value = 0.761) between the ventures of the alumni whose main business idea was related to the EPN and the generation of a high level of annual sales (USD 100,001 to USD 1,000,000). This result might also be due to an insufficient size of the sample.

5. Conclusions, Study Implications, and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Acs, Z. J., Braunerhjelm, P., Audretsch, D. B., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30. [Google Scholar] [CrossRef]

- Acs, Z. J., Stam, E., Audretsch, D. B., & O’Connor, A. (2017). The lineages of the entrepreneurial ecosystem approach. Small Business Economics, 49(1), 1–10. [Google Scholar] [CrossRef]

- Acs, Z. J., Szerb, L., Lafuente, E., & Markus, G. (2019). The global entrepreneurship index 2019. The Global Entrepreneurship and Development Institute. Available online: https://www.researchgate.net/profile/Laszlo-Szerb/publication/338547954_Global_Entrepreneurship_Index_2019/links/5e20a855a6fdcc10156f76d8/Global-Entrepreneurship-Index-2019.pdf (accessed on 13 February 2025).

- Ács, Z. J., Autio, E., & Szerb, L. (2014). National systems of entrepreneurship: Measurement issues and policy implications. Research Policy, 43(3), 476–494. [Google Scholar] [CrossRef]

- Adner, R. (2017). Ecosystem as structure: An actionable construct for strategy. Journal of Management, 43(1), 39–58. [Google Scholar] [CrossRef]

- Adner, R., & Kapoor, R. (2010). Value creation in innovation ecosystems: How the structure of technological interdependence affects firm performance in new technology generations. Strategic Management Journal, 31(3), 306–333. [Google Scholar] [CrossRef]

- Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211. [Google Scholar] [CrossRef]

- Alberto Botello, H., & Guerrero Rincón, I. (2019). Competition, market concentration and innovation in Ecuador. Ecos de Economía, 23(48), 16–33. [Google Scholar] [CrossRef]

- Alvarado-Moreno, F. (2018). El Papel de las Oficinas de Transferencia Tecnológica (OTT) en las Universidades: Una perspectiva de la Última Década. Journal of Technology Management & Innovation, 13(3), 104–112. [Google Scholar] [CrossRef]

- Alvedalen, J., & Boschma, R. (2017). A critical review of entrepreneurial ecosystems research: Towards a future research agenda. European Planning Studies, 25(6), 887–903. [Google Scholar] [CrossRef]

- Amjad, T., Abdul Rani, S. H. B., & Sa’atar, S. B. (2020). Entrepreneurship development and pedagogical gaps in entrepreneurial marketing education. International Journal of Management Education, 18(2), 100379. [Google Scholar] [CrossRef]

- Aparicio, S., Audretsch, D., & Urbano, D. (2021a). Why is export-oriented entrepreneurship more prevalent in some countries than others? Contextual antecedents and economic consequences. Journal of World Business, 56(3), 101177. [Google Scholar] [CrossRef]

- Aparicio, S., Urbano, D., & Audretsch, D. (2016). Institutional factors, opportunity entrepreneurship and economic growth: Panel data evidence. Technological Forecasting and Social Change, 102, 45–61. [Google Scholar] [CrossRef]

- Aparicio, S., Urbano, D., & Stenholm, P. (2021b). Attracting the entrepreneurial potential: A multilevel institutional approach. Technological Forecasting and Social Change, 168, 120748. [Google Scholar] [CrossRef]

- Audretsch, D. B. (2014). From the entrepreneurial university to the university for the entrepreneurial society. Journal of Technology Transfer, 39(3), 313–321. [Google Scholar] [CrossRef]

- Autio, E., Kenney, M., Mustar, P., Siegel, D., & Wright, M. (2014). Entrepreneurial innovation: The importance of context. Research Policy, 43(7), 1097–1108. [Google Scholar] [CrossRef]

- Bae, T. J., Qian, S., Miao, C., & Fiet, J. O. (2014). The Relationship between entrepreneurship education and entrepreneurial intentions: A meta-analytic review. Entrepreneurship: Theory and Practice, 38(2), 217–254. [Google Scholar] [CrossRef]

- Baumol, W. J., & Strom, R. J. (2007). Entrepreneurship and economic growth. Strategic Entrepreneurship Journal, 1(3–4), 233–237. [Google Scholar] [CrossRef]

- Belitski, M., Caiazza, R., & Lehmann, E. E. (2021). Knowledge frontiers and boundaries in entrepreneurship research. Small Business Economics, 56(2), 521–531. [Google Scholar] [CrossRef]

- Bjørnskov, C., & Foss, N. J. (2016). Institutions, entrepreneurship, and economic growth: What do we know and what do we still need to know? Academy of Management Perspectives, 30(3), 292–315. [Google Scholar] [CrossRef]

- Boudreaux, C. J., & Nikolaev, B. (2019). Capital is not enough: Opportunity entrepreneurship and formal institutions. Small Business Economics, 53(3), 709–738. [Google Scholar] [CrossRef]

- Brem, A., & Radziwon, A. (2017). Efficient Triple Helix collaboration fostering local niche innovation projects—A case from Denmark. Technological Forecasting and Social Change, 123, 130–141. [Google Scholar] [CrossRef]

- Brown, R., & Mason, C. (2017). Looking inside the spiky bits: A critical review and conceptualisation of entrepreneurial ecosystems. Small Business Economics, 49(1), 11–30. [Google Scholar] [CrossRef]

- Bullough, A., & Renko, M. (2013). Entrepreneurial resilience during challenging times. Business Horizons, 56(3), 343–350. [Google Scholar] [CrossRef]

- Carvache-Franco, O., Carvache-Franco, M., & Carvache-Franco, W. (2022). Barriers to innovations and innovative performance of companies: A study from Ecuador. Social Sciences, 11(2), 63. [Google Scholar] [CrossRef]

- Castro, M. P., & Zermeño, M. G. G. (2020). Being an entrepreneur post-COVID-19–resilience in times of crisis: A systematic literature review. Journal of Entrepreneurship in Emerging Economies, 13(4), 721–746. [Google Scholar] [CrossRef]

- Casula, M., Rangarajan, N., & Shields, P. (2021). The potential of working hypotheses for deductive exploratory research. Quality and Quantity, 55(5), 1703–1725. [Google Scholar] [CrossRef]

- Chesbrough, H. W., & Teece, D. J. (2002). Organizing for innovation: When is virtual virtuous? Harvard Business Review, 80(8), 335–341. [Google Scholar] [CrossRef]

- Clarysse, B., Wright, M., Bruneel, J., & Mahajan, A. (2014). Creating value in ecosystems: Crossing the chasm between knowledge and business ecosystems. Research Policy, 43(7), 1164–1176. [Google Scholar] [CrossRef]

- Cohen, B. (2006). Sustainable valley entrepreneurial ecosystems. Business Strategy and the Environment, 15(1), 1–14. [Google Scholar] [CrossRef]

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. [Google Scholar] [CrossRef]

- Eisenhardt, K. M. (1989). Building theories from case study research. Academy of Management Review, 14(4), 532–550. [Google Scholar] [CrossRef]

- Elnadi, M., & Gheith, M. H. (2021). Entrepreneurial ecosystem, entrepreneurial self-efficacy, and entrepreneurial intention in higher education: Evidence from Saudi Arabia. International Journal of Management Education, 19(1), 100458. [Google Scholar] [CrossRef]

- Etzkowitz, H. (2008). The triple helix: University-industry-government innovation in action. Routledge. [Google Scholar] [CrossRef]

- Etzkowitz, H., & Leydesdorff, L. (2000). The dynamics of innovation: From National Systems and “mode 2” to a Triple Helix of university-industry-government relations. Research Policy, 29(2), 109–123. [Google Scholar] [CrossRef]

- Etzkowitz, H., Webster, A., Gebhardt, C., & Terra, B. R. C. (2000). The future of the university and the university of the future: Evolution of ivory tower to entrepreneurial paradigm. Research Policy, 29(2), 313–330. [Google Scholar] [CrossRef]

- Fayolle, A., & Gailly, B. (2015). The impact of entrepreneurship education on entrepreneurial attitudes and intention: Hysteresis and persistence. Journal of Small Business Management, 53(1), 75–93. [Google Scholar] [CrossRef]

- Feld, B. (2015). Startup communities: Building an entrepreneurial ecosystem in your city. John Wiley & Sons, Inc. [Google Scholar] [CrossRef]

- Fischer, B., Guerrero, M., Guimón, J., & Schaeffer, P. R. (2020). Knowledge transfer for frugal innovation: Where do entrepreneurial universities stand? Journal of Knowledge Management, 25(2), 360–379. [Google Scholar] [CrossRef]

- Fischer, B. B., Queiroz, S., & Vonortas, N. S. (2018). On the location of knowledge-intensive entrepreneurship in developing countries: Lessons from São Paulo, Brazil. Entrepreneurship and Regional Development, 30(5–6), 612–638. [Google Scholar] [CrossRef]

- Fuentelsaz, L., Maicas, J. P., & Montero, J. (2018). Entrepreneurs and innovation: The contingent role of institutional factors. International Small Business Journal: Researching Entrepreneurship, 36(6), 686–711. [Google Scholar] [CrossRef]

- Fuster, E., Padilla-Meléndez, A., Lockett, N., & del-Águila-Obra, A. R. (2019). The emerging role of university spin-off companies in developing regional entrepreneurial university ecosystems: The case of Andalusia. Technological Forecasting and Social Change, 141, 219–231. [Google Scholar] [CrossRef]

- Guaipatin, C., & Schwartz, L. (2014). Ecuador: Análisis del sistema nacional de innovación-hacia la consolidación de una cultura innovadora. Banco Interamericano de Desarrollo División de Competitividad e Innovación Ecuador. [Google Scholar]

- Guerrero, M., Liñán, F., & Cáceres-Carrasco, F. R. (2021). The influence of ecosystems on the entrepreneurship process: A comparison across developed and developing economies. Small Business Economics, 57(4), 1733–1759. [Google Scholar] [CrossRef]

- Guerrero, M., & Urbano, D. (2012). The development of an entrepreneurial university. Journal of Technology Transfer, 37(1), 43–74. [Google Scholar] [CrossRef]

- Guerrero, M., & Urbano, D. (2017). The impact of Triple Helix agents on entrepreneurial innovations’ performance: An inside look at enterprises located in an emerging economy. Technological Forecasting and Social Change, 119, 294–309. [Google Scholar] [CrossRef]

- Guerrero, M., Urbano, D., Fayolle, A., Klofsten, M., & Mian, S. (2016). Entrepreneurial universities: Emerging models in the new social and economic landscape. Small Business Economics, 47(3), 551–563. [Google Scholar] [CrossRef]

- Guerrero, M., Urbano, D., & Gajón, E. (2020). Entrepreneurial university ecosystems and graduates’ career patterns: Do entrepreneurship education programmes and university business incubators matter? Journal of Management Development, 39(5), 753–775. [Google Scholar] [CrossRef]

- Hayter, C. S. (2016). A trajectory of early-stage spinoff success: The role of knowledge intermediaries within an entrepreneurial university ecosystem. Small Business Economics, 47(3), 633–656. [Google Scholar] [CrossRef]

- Horowitz Gassol, J. (2007). The effect of university culture and stakeholders’ perceptions on university-business linking activities. Journal of Technology Transfer, 32(5), 489–507. [Google Scholar] [CrossRef]

- INEC. (2021). Encuesta Nacional de Empleo, Desempleo y Subempleo (ENEMDU). 2021 monthly report on labor statistics. Instituto Nacional de Estadísticas y Censos INEC. Available online: https://cuboenemdu.ecudatanalytics.com/ (accessed on 13 February 2025).

- Ingram, P., & Silverman, B. S. (2002). Introduction: The new institutionalism in strategic management. Advances in Strategic Management, 19, 373–398. [Google Scholar] [CrossRef]

- Isenberg, D. J. (2011). The entrepreneurship ecosystem strategy as a new paradigm for economic policy. The Babson Entrepreneurship Ecosystem Project. Available online: http://www.innovationamerica.us/images/stories/2011/The-entrepreneurship-ecosystem-strategy-for-economic-growth-policy-20110620183915.pdf (accessed on 13 February 2025).

- Jiménez, A., & Alon, I. (2018). Corruption, political discretion and entrepreneurship. Multinational Business Review, 26(2), 111–125. [Google Scholar] [CrossRef]

- Kariv, D., Baldegger, R. J., & Kashy-Rosenbaum, G. (2022). “All you need is... entrepreneurial attitudes”: A deeper look into the propensity to start a business during the COVID-19 through a gender comparison (GEM data). World Review of Entrepreneurship, Management and Sustainable Development, 18(1–2), 195. [Google Scholar] [CrossRef]

- Kobylińska, U., & Lavios, J. J. (2020). Development of research on the university entrepreneurship ecosystem: Trends and areas of interest of researchers based on a systematic review of literature. Oeconomia Copernicana, 11(1), 117–133. [Google Scholar] [CrossRef]

- Kong, F., Zhao, L., & Tsai, C. H. (2020). The Relationship between entrepreneurial intention and action: The effects of fear of failure and role model. Frontiers in Psychology, 11, 229. [Google Scholar] [CrossRef] [PubMed]

- Kovács, A., Van Looy, B., & Cassiman, B. (2015). Exploring the scope of open innovation: A bibliometric review of a decade of research. Scientometrics, 104(3), 951–983. [Google Scholar] [CrossRef]

- Krueger, N. (1993). The impact of prior entrepreneurial exposure on perceptions of new venture feasibility and desirability. Entrepreneurship Theory and Practice, 18(1), 5–21. [Google Scholar] [CrossRef]

- Lasio, V., Amaya, A., Zambrano, J., & Ordeñana, X. (2020). Global entrepreneurship monitor. ECUADOR 2019–2020. ESPAE, Escuela de Negocios de La ESPOL. [Google Scholar]

- Liñán, F., & Fayolle, A. (2015). A systematic literature review on entrepreneurial intentions: Citation, thematic analyses, and research agenda. International Entrepreneurship and Management Journal, 11(4), 907–933. [Google Scholar] [CrossRef]

- Lopez, T., & Alvarez, C. (2018). Entrepreneurship research in Latin America: A literature review. Academia Revista Latinoamericana de Administracion, 31(4), 736–756. [Google Scholar] [CrossRef]

- Mack, E., & Mayer, H. (2016). The evolutionary dynamics of entrepreneurial ecosystems. Urban Studies, 53(10), 2118–2133. [Google Scholar] [CrossRef]

- Malecki, E. J. (2018). Entrepreneurship and entrepreneurial ecosystems. Geography Compass, 12(3), e12359. [Google Scholar] [CrossRef]

- Martin, B. C., McNally, J. J., & Kay, M. J. (2013). Examining the formation of human capital in entrepreneurship: A meta-analysis of entrepreneurship education outcomes. Journal of Business Venturing, 28(2), 211–224. [Google Scholar] [CrossRef]

- Mason, C., & Brown, R. (2014). Entrepreneurial ecosystems and growth oriented entrepreneurship. Final Report to OECD, Paris, 30(1), 77–102. [Google Scholar]

- Mayhew, M. J., Simonoff, J. S., Baumol, W. J., Wiesenfeld, B. M., & Klein, M. W. (2012). Exploring innovative entrepreneurship and its ties to higher educational experiences. Research in Higher Education, 53(8), 831–859. [Google Scholar] [CrossRef]

- Mcmullen, J. S., Bagby, D. R., & Palich, L. E. (2008). Economic freedom and the motivation to engage in entrepreneurial action. Entrepreneurship: Theory and Practice, 32(5), 875–895. [Google Scholar] [CrossRef]

- Menard, S. W. (2002). Applied logistic regression analysis. Series: Quantitative applications in the social sciences. Saga University Papers, 3. Sage Publications. [Google Scholar]

- Mendieta Muñoz, R., & Pontarollo, N. (2018). Territorial growth in ecuador: The role of economic sectors. Romanian Journal of Economic Forecasting, 21(1), 124–139. [Google Scholar] [CrossRef]

- Meyer-Brötz, F., Stelzer, B., Schiebel, E., & Brecht, L. (2018). Mapping the technology and innovation management literature using hybrid bibliometric networks. International Journal of Technology Management, 77(4), 235. [Google Scholar] [CrossRef]

- Midgley, G., & Lindhult, E. (2021). A systems perspective on systemic innovation. Systems Research and Behavioral Science, 38(5), 635–670. [Google Scholar] [CrossRef]

- Miller, D. J., & Acs, Z. J. (2017). The campus as entrepreneurial ecosystem: The University of Chicago. Small Business Economics, 49(1), 75–95. [Google Scholar] [CrossRef]

- Moore, J. F. (1993). Predators and prey: A new ecology of competition. Harvard Business Review. Available online: https://hbr.org/1993/05/predators-and-prey-a-new-ecology-of-competition (accessed on 13 February 2025).

- Murray, F., Budden, P., & Turskaya, A. (2019). A systematic MIT approach for assessing ‘innovation-driven entrepreneurship’in ecosystems (iEcosystems). MIT, Innovation Initiative. [Google Scholar]

- Nissan, E., Galindo Martín, M. Á., & Méndez Picazo, M. T. (2011). Relationship between organizations, institutions, entrepreneurship and economic growth process. International Entrepreneurship and Management Journal, 7(3), 311–324. [Google Scholar] [CrossRef]

- North, D. C. (2010). Understanding the process of economic change. Princeton University Press. [Google Scholar] [CrossRef]

- OCTS. (2018). Las universidades, pilares de la ciencia y la tecnología en América Latina. Ibero-American Observatory for Science, Technology and Society of the Organization of Ibero-American States OCTS-OEI. Available online: https://oei.int/wp-content/uploads/2018/04/las-universidades-pilares-de-la-ciencia-y-la-tecnologia-en-america-latina.pdf (accessed on 13 February 2025).

- Oganisjana, K., & Matlay, H. (2012). Entrepreneurship as a dynamic system: A holistic approach to the development of entrepreneurship education. Industry and Higher Education, 26(3), 207–216. [Google Scholar] [CrossRef]

- Pacheco, D. F., York, J. G., Dean, T. J., & Sarasvathy, S. D. (2010). The coevolution of institutional entrepreneurship: A tale of two theories. Journal of Management, 36(4), 974–1010. [Google Scholar] [CrossRef]

- Pérez-Hernández, P., Calderón, G., & Noriega, E. (2021). Generation of university spin off companies: Challenges from mexico. Journal of Technology Management and Innovation, 16(1), 14–22. [Google Scholar] [CrossRef]

- Prokop, D. (2021). University entrepreneurial ecosystems and spinoff companies: Configurations, developments and outcomes. Technovation, 107, 102286. [Google Scholar] [CrossRef]

- Roberts, E. B., & Eesley, C. E. (2011). Entrepreneurial impact: The role of MIT—An updated report. Foundations and Trends® in Entrepreneurship, 7(1–2), 1–149. [Google Scholar] [CrossRef]

- Roberts, E. B., Murray, F., & Kim, J. D. (2019). Entrepreneurship and innovation at MIT: Continuing global growth and impact—An updated report. Foundations and Trends in Entrepreneurship, 15(1), 1–55. [Google Scholar] [CrossRef]

- Rodriguez-Gutierrez, P., Cabeza-Ramírez, L. J., & Muñoz-Fernández, G. A. (2020). University students’ behaviour towards entrepreneurial intention in ecuador: Testing for the influence of gender. International Journal of Environmental Research and Public Health, 17(22), 8475. [Google Scholar] [CrossRef] [PubMed]

- Rothaermel, F. T., Agung, S. D., & Jiang, L. (2007). University entrepreneurship: A taxonomy of the literature. Industrial and Corporate Change, 16(4), 691–791. [Google Scholar] [CrossRef]

- Saeed, S., Yousafzai, S. Y., Yani-De-Soriano, M., & Muffatto, M. (2015). The role of perceived university support in the formation of students’ entrepreneurial intention. Journal of Small Business Management, 53(4), 1127–1145. [Google Scholar] [CrossRef]

- Scott, W. R. (2014). Institutions and organizations: Ideas, interests, and identities (4th ed.). Sage Publications. [Google Scholar]

- Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25(1), 217–226. [Google Scholar] [CrossRef]

- Shirokova, G., Osiyevskyy, O., & Bogatyreva, K. (2016). Exploring the intention–behavior link in student entrepreneurship: Moderating effects of individual and environmental characteristics. European Management Journal, 34(4), 386–399. [Google Scholar] [CrossRef]

- Siegel, D. S., & Wright, M. (2015). Academic entrepreneurship: Time for a rethink? British Journal of Management, 26(4), 582–595. [Google Scholar] [CrossRef]

- Soria-Barreto, K., Honores-Marin, G., Gutiérrez-Zepeda, P., & Gutiérrez-Rodríguez, J. (2017). Prior exposure and educational environment towards entrepreneurial intention. Journal of Technology Management and Innovation, 12(2), 45–58. [Google Scholar] [CrossRef]

- Spigel, B. (2017). The relational organization of entrepreneurial ecosystems. Entrepreneurship: Theory and Practice, 41(1), 49–72. [Google Scholar] [CrossRef]

- Spigel, B., & Harrison, R. (2018). Toward a process theory of entrepreneurial ecosystems. Strategic Entrepreneurship Journal, 12(1), 151–168. [Google Scholar] [CrossRef]

- Stam, E. (2015). Entrepreneurial ecosystems and regional policy: A sympathetic critique. European Planning Studies, 23(9), 1759–1769. [Google Scholar] [CrossRef]

- Thornton, P. H., Ribeiro-Soriano, D., & Urbano, D. (2011). Socio-cultural factors and entrepreneurial activity: An overview. International Small Business Journal, 29(2), 105–118. [Google Scholar] [CrossRef]

- Urbano, D., Aparicio, S., & Audretsch, D. (2019a). Twenty-five years of research on institutions, entrepreneurship, and economic growth: What has been learned? Small Business Economics, 53(1), 21–49. [Google Scholar] [CrossRef]

- Urbano, D., Aparicio, S., & Audretsch, D. B. (2019b). Institutional antecedents of entrepreneurship and its consequences on economic growth: A systematic literature analysis. Springer. [Google Scholar] [CrossRef]

- Veciana, J. M., & Urbano, D. (2008). The institutional approach to entrepreneurship research. introduction. International Entrepreneurship and Management Journal, 4, 365–379. [Google Scholar] [CrossRef]

- Wyrwich, M., Stuetzer, M., & Sternberg, R. (2016). Entrepreneurial role models, fear of failure, and institutional approval of entrepreneurship: A tale of two regions. Small Business Economics, 46(3), 467–492. [Google Scholar] [CrossRef]

- Xia, J., Liu, W., Tsai, S. B., Li, G., Chu, C. C., & Wang, K. (2018). A system dynamics framework for academic entrepreneurship. Sustainability, 10(7), 2430. [Google Scholar] [CrossRef]

- Zamora-Boza, C. S. (2018). La importancia del emprendimiento en la economía: El caso de Ecuador. Espacios, 39(7), 15. [Google Scholar]

| Loop | Relation with Working Hypotheses |

|---|---|

| R1 | H1, H3, H6, H7, H9, H10 |

| R2 | H1, H2, H6, H7, H9, H10 |

| R3 | H1, H3, H5, H6, H7, H8, H9, H10 |

| R4 | H9, H10, H13 |

| R5 | H10, H11 |

| R6 | H10, H12, H9 |

| B1 | H1, H3, H4, H12, H9 |

| Working Hypotheses | Evaluation Method | Variables | Categories and Levels of Analysis |

|---|---|---|---|

| H1 | Descriptive analysis | Business risk, market dominance, globalization, depth of capital market | Fundamental institutions (macro), Capacities (i-Cap) (macro) |

| H2 | Descriptive analysis | Know entrepreneurs, risk perception, technology level | Capacities (e-Cap, i-Cap) (macro) |

| H2a * | Logistic regression | Fear of failure (ACT_FRAC—Dep.), Met entrepreneurs in recent years (ACT_INI- Ind.) | Involvement in entrepreneurship-related activities (micro) |

| H2b * | Logistic regression | Currently running a business (AEC_EMPR2—Dep.), Met entrepreneurs in recent years (ACT_INI—Ind.) | Characteristics of employability profile, Involvement in entrepreneurship-related activities (micro) |

| H3 | Descriptive analysis | Career status, opportunity motivation | Capacities (e-Cap, i-Cap) (macro) |

| H3a * | Logistic regression | Career status (ACT_BA—dep.), entrepreneurial experience (RE_INI—Ind.) | Involvement in entrepreneurship-related activities (micro) |

| H3b * | Logistic regression | Entrepreneurial intentions (ACT_BA—dep.), entrepreneurial experience (RE_INI—Ind.) | Involvement in entrepreneurship-related activities (micro) |

| H4 | Descriptive analysis | Market agglomeration, market dominance, informal investments | Fundamental institutions (macro), Capacities (i-Cap) (macro) |

| H5 | Descriptive analysis | Tertiary education, educational level | Fundamental institutions (macro), Capacities (e-Cap) (macro) |

| H6 | Descriptive analysis | Perceived capabilities | Capacities (e-Cap) (macro) |

| H6a * | Logistic regression | Currently running a business (AEC_EMPR2—Dep.), Knowledge and skills perception (ACT_HAB—Ind.) | Characteristics of employability profile (micro), Involvement in entrepreneurship-related activities (micro) |

| H7 | Descriptive analysis | Business strategy, staff training | Fundamental institutions (macro) |

| H8 | Descriptive analysis | Technology transfer | Fundamental institutions (macro) |

| H8a * | Logistic regression | Degree of innovation in product or service (EMPRE_INNO2—Dep.), Origin of the main business idea linked to EPN (IDEAP_EPN2—Ind.) | Innovation-related components (micro) |

| Relationship with the university and entrepreneurship ecosystem (meso) | |||

| H8b * | Logistic regression | Sales level (EMPR_VENTAS2—Dep.), Origin of the main business idea linked to EPN (IDEAP_EPN2—Ind.) | Characteristics of the alumni businesses and economic contribution (meso), Relationship with the university and the entrepreneurship ecosystem (meso) |

| H9 | Descriptive analysis | Gazelle | Impacts (macro) |

| H10 | Descriptive analysis | Economic freedom | Fundamental institutions (macro) |

| H11 | Descriptive analysis | Corruption | Fundamental institutions (macro) |

| H12 | Descriptive analysis | New tech, tech absorption, staff training, Competitors | Fundamental institutions (macro), impacts (macro) |

| H13 | Descriptive analysis | Technology transfer, export, new product, new tech | Fundamental institutions (macro), impacts (macro) |

| Country | |||||

|---|---|---|---|---|---|

| Hypothesis | Variable | Ecuador | Colombia | Chile | Mexico |

| H1 | Risk of business | 0.09 (d) | 0.3 (c) | 1 (b) | 0.44 (c) |

| Market dominance | 0.33 (d) | 0.41 (d) | 0.41 (d) | 0.41 (c) | |

| Globalization | 0.25 (d) | 0.48 (c) | 0.48 (c) | 0.77 (b) | |

| Depth of capital market | 0.4 (c) | 0.68 (b) | 0.81 (b) | 0.61 (c) | |

| H2 | Knowledge of entrepreneurs | 0.6 (b) | 0.43 (d) | 0.72 (b) | 0.75 (b) |

| Risk perception | 0.64 (b) | 0.62 (b) | 0.74 (b) | 0.72 (b) | |

| Technology level | 0.32 (d) | 0.63 (b) | 0.6 (c) | 0.4 (d) | |

| H3 | Career status | 0.55 (c) | 0.65 (b) | 0.59 (c) | 0.31 (d) |

| Motivation by opportunity | 0.55 (c) | 0.48 (d) | 0.66 (b) | 0.74 (a) | |

| H4 | Market agglomeration | 0.17 (d) | 0.58 (a) | 0.79 (b) | 0.53 (c) |

| Market dominance | 0.33 (d) | 0.41 (d) | 0.41 (d) | 0.41 (c) | |

| Informal investments | 0.44 (c) | 0.44 (c) | 0.73 (a) | 0.29 (d) | |

| H5 | Tertiary education | 0.48 (d) | 0.51 (c) | 0.74 (b) | 0.33 (d) |

| Educational level | 0.44 (d) | 0.44 (c) | 0.74 (b) | 0.22 (d) | |

| H6 | Skills perception | 0.93 (a) | 0.73 (b) | 0.83 (a) | 0.6 (b) |

| H7 | Business strategy | 0.4 (d) | 0.49 (c) | 0.59 (b) | 0.51 (c) |

| Staff training | 0.44 (d) | 0.67 (b) | 0.62 (b) | 0.53 (c) | |

| H8 | Technological transfer | 0.45 (c) | 0.47 (c) | 0.52 (c) | 0.5 (c) |

| H9 | Gazelle (High-growth firms) | 0.3 (d) | 1 (a) | 0.94 (a) | 0.32 (d) |

| H10 | Economic freedom | 0.41 (d) | 0.37 (d) | 0.79 (a) | 0.45 (c) |

| H11 | Corruption | 0.36 (d) | 0.41 (c) | 0.79 (b) | 0.39 (d) |

| H12 | New technology | 0.54 (b) | 0.87 (a) | 0.76 (a) | 0.37 (d) |

| Technology absorption | 0.42 (c) | 0.38 (d) | 0.63 (b) | 0.45 (c) | |

| Competitors | 0.87 (a) | 0.72 (b) | 0.97 (a) | 0.53 (c) | |

| H13 | Technology transfer | 0.45 (c) | 0.47 (c) | 0.52 (c) | 0.5 (c) |

| Exports | 0.21 (d) | 0.96 (a) | 0.64 (b) | 0.32 (d) | |

| New product | 0.61 (b) | 0.84 (a) | 1 (a) | 0.32 (d) | |

| Variables | |||||||

|---|---|---|---|---|---|---|---|

| Working Hypotheses | Dependent | Independent | Cases | Category | Exp (B) (Odds Ratio) | Significance (p Value) | |

| H2a | The approach to successful business stories and role models fosters risk-taking attitudes. | Fear of failure (ACT_FRAC) | Met entrepreneurs in recent years (ACT_INI) | 550 | No. Ref = Yes | 1.144 | 0.548 |

| H2b | The approach to successful business stories and role models influences potential entrepreneurs to start their businesses. | Currently running a business (AEC_EMPR2) | Met entrepreneurs in recent years (ACT_INI) | 550 | No. Ref = Yes | 0.427 | 0.00 |

| H3a | Previous entrepreneurial experiences influence favorable attitudes and perceptions towards entrepreneurship. | Career status (ACT_BA) | Entrepreneurial experience (RE_INI) | 550 | No. Ref = Yes | 0.546 | 0.045 |

| H3b | Previous entrepreneurial experiences influence intentions to start a business. | Entrepreneurial intentions (EMPR_INT2) | Entrepreneurial experience (RE_INI) | 303 | No. Ref = Yes | 0.346 | 0.00 |

| H6a | People who consider having the necessary skills to start a business find greater motivation to carry out entrepreneurial actions | Currently running a business (AEC_EMPR2) | Knowledge and skills perception (ACT_HAB) | 550 | No. Ref = Yes | 0.392 | 0.00 |

| H8a | Ventures derived from EPN bring knowledge and innovation from the academy to the market. | Degree of innovation in product or service (EMPRE_INNO2) | Origin of the main business idea linked to EPN (IDEAP_EPN2) | 37 | No. Ref = Yes | 0.438 | 0.238 |

| H8b | Ventures derived from EPN promote productivity and economic growth. | Sales level (EMPR_VENTAS2) | Origin of the main business idea linked to EPN (IDEAP_EPN2) | 37 | No. Ref = Yes | 0.772 | 0.761 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vallejo-Imbaquingo, R.; Robalino-López, A. The Role of Latin American Universities in Entrepreneurial Ecosystems: A Multi-Level Study of Academic Entrepreneurship in Ecuador. Adm. Sci. 2025, 15, 108. https://doi.org/10.3390/admsci15030108

Vallejo-Imbaquingo R, Robalino-López A. The Role of Latin American Universities in Entrepreneurial Ecosystems: A Multi-Level Study of Academic Entrepreneurship in Ecuador. Administrative Sciences. 2025; 15(3):108. https://doi.org/10.3390/admsci15030108

Chicago/Turabian StyleVallejo-Imbaquingo, Roberto, and Andrés Robalino-López. 2025. "The Role of Latin American Universities in Entrepreneurial Ecosystems: A Multi-Level Study of Academic Entrepreneurship in Ecuador" Administrative Sciences 15, no. 3: 108. https://doi.org/10.3390/admsci15030108

APA StyleVallejo-Imbaquingo, R., & Robalino-López, A. (2025). The Role of Latin American Universities in Entrepreneurial Ecosystems: A Multi-Level Study of Academic Entrepreneurship in Ecuador. Administrative Sciences, 15(3), 108. https://doi.org/10.3390/admsci15030108