1. Introduction

1.1. Research Background

Since the advent of the 21st century, there has been a marked increase in the level of interest in the field of corporate sustainability. This has resulted in a significant increase in the attention being paid to the management of Environmental, Social and Governance factors (ESG) by companies. In the aftermath of the United Nations’ Sustainable Development Goals (SDGs) being adopted in 2015, companies have been confronted with the challenge of pursuing social responsibility and environmental sustainability in a manner that transcends the mere generation of profit.

Research on the relationship between ESG and investment efficiency is also increasing.

R. Desai (

2025) presented empirical evidence that statutory ESG reporting has a positive effect on corporate investment efficiency. The extant literature suggests that ESG performance is a strategic factor that directly impacts core business performance, extending beyond mere social responsibility. This paradigm shift necessitates fundamental changes in corporate financial strategy, particularly in the context of tax strategy.

Conventional corporate tax strategies have centred on minimising corporate tax obligations. However, stakeholders have recently demonstrated a heightened interest in the formulation of sustainable tax strategies that will facilitate the corporation’s ongoing, sustainable growth.

McGuire et al. (

2012) provided the new theoretical foundation for how tax and accounting policies are perceived by the market. In their working paper,

McGuire et al. (

2013) introduced the concept of a sustainable tax strategy, arguing that the maintenance of consistent and predictable tax policies is of crucial importance for the long-term creation of corporate value. This finding indicates that the sustainability and transparency of tax strategies, rather than merely reducing the tax burden, enhance corporate credibility. This approach has the potential to engender stakeholder trust and enhance corporate value.

Recent studies have provided empirical evidence to support the notion that sustainable tax strategies can positively impact corporate performance (

Jacob et al., 2022;

Neuman et al., 2013;

Drake et al., 2019). Nevertheless, there is a paucity of research that has examined the specific pathways through which sustainable tax strategies positively influence firm value growth.

1.2. Research Objective

This study aims to empirically analyse the impact of sustainable tax strategies on investment scale and firm value, based on signalling theory. Specifically, utilising the concept of sustainable tax strategy proposed by

McGuire et al. (

2013), we measure the sustainability of tax strategy through the Cash Effective Tax Rate Coefficient of Variation. We then examine whether this sustainability affects the firm’s capital expenditure scale and corporate value. If it does affect corporate value, we analyse the pathways through which this influence occurs.

This study is expected to contribute academically and practically in several ways. Academically, it will expand existing literature by applying signalling theory to tax strategy research and strengthen the theoretical foundation of tax accounting by empirically identifying the economic effects of sustainable tax strategies. Practically, it will raise awareness among corporate executives about the importance of sustainable tax strategies, and suggest the need for establishing tax strategies from a long-term perspective rather than merely minimizing short-term tax burdens.

2. Literature Review

2.1. Theoretical Background

Signaling theory explains how informed parties convey credible information about their quality to market participants under information asymmetry.

Spence (

1973) pioneered this framework by demonstrating that observable characteristics like education serve as productivity signals in labor markets where employers cannot directly assess job seekers’ capabilities.

Ross (

1977) extended this concept to corporate finance, establishing that debt levels signal management quality and firm prospects.

Myers and Majluf (

1984) further developed signaling theory by providing a comprehensive framework explaining how financial structure choices convey information to markets under asymmetric information conditions.

The application of signaling theory to tax accounting has expanded significantly.

Myers (

1989) demonstrated that accounting information design mitigates signal distortion in investment decisions, proving that proper accounting rules and disclosures reduce information asymmetry and improve real investment efficiency.

M. A. Desai and Dharmapala (

2006) showed that when information asymmetry exists between managers and shareholders, tax planning can enable managers to pursue private interests, potentially creating a negative relationship with firm value. This highlighted the dual nature of tax strategies as signals they can convey either positive or negative information depending on their structure and transparency.

Hanlon and Heitzman (

2010) synthesized the informational role of tax disclosures and metrics such as effective tax rate (ETR) and book-tax differences (BTD). From a signaling theory perspective, they demonstrated that low ETR can be interpreted as either a positive signal of managerial capability or a negative risk signal, depending on the cost-reliability structure and transparency context

Xu et al. (

2017) provided direct theoretical grounding by demonstrating that under information asymmetry, accounting rules are endogenously optimized to promote investor learning, and tax-related accounting policy choices such as deferred tax liabilities, tax credits, and tax uncertainty disclosures can serve as signaling vehicles.

Hanlon (

2005) empirically confirmed that signaling private information through accounting system design affects capital market valuation, and that tax policy choices and reporting systems function as credible signaling mechanisms.

This theoretical foundation establishes that tax strategies, particularly their consistency and predictability, serve as powerful signals about management quality, internal control effectiveness, and long-term strategic orientation core elements that influence investor perceptions and firm valuation.

2.2. Sustainable Tax Strategy

McGuire et al. (

2013) introduced the concept of sustainable tax strategy, challenging traditional tax research that focused solely on the level of effective tax rates. They defined sustainable tax strategy as maintaining a consistent effective tax rate over the medium to long term, measured by the coefficient of variation of cash effective tax rates over five years. Their empirical analysis demonstrated that firms with low ETR volatility signal superior predictability and stability of future earnings to the market, exhibiting higher profit persistence. This finding established that consistency in tax strategies carries greater signaling value than simple tax rate minimization.

Sustainable tax strategies are closely related to corporate transparency and governance frameworks

Hope et al. (

2013) analyzed the impact of tax disclosure transparency on corporate tax avoidance behavior, demonstrating how accounting policies signal private information to the market and thereby clarifying the relationship between transparency and tax avoidance. Their research showed that managers wanting to conceal tax avoidance behavior tend to reduce disclosure transparency, particularly regarding geographic earnings, highlighting the strategic use of disclosure choices as signaling mechanisms.

Fields et al. (

2001) conducted a comprehensive literature review to establish a theoretical foundation for signaling theory by examining the primary motivations behind accounting policy choices and their economic outcomes. Their framework provided critical insights into how firms strategically select accounting and tax policies to convey information to stakeholders, reinforcing the signaling role of consistent tax strategies.

The signaling mechanism operates through multiple channels affecting real investment decisions.

Jacob et al. (

2022) provided empirical evidence that firms with high tax volatility tend to delay major capital investments and exhibit lower overall investment levels, demonstrating that tax uncertainty directly constrains strategic investment decisions.

Drake et al. (

2019) showed that while investors positively evaluate tax avoidance activities, tax volatility moderates this positive evaluation, indicating that investors value stable and sustainable tax strategies more highly than aggressive short-term tax minimization.

Empirical research confirms strong linkages between sustainable tax strategies, corporate transparency, and governance quality.

Neuman et al. (

2013) reported that higher corporate information transparency correlates with greater sustainability in tax strategies. Their analysis further revealed that governance quality and transparency are interrelated firms with superior governance systematically select more sustainable tax strategies, demonstrating that Sustainable tax strategy are integral components of broader corporate governance frameworks.

Korean evidence supports these international findings.

Kim and Ma (

2018) confirmed results similar to

McGuire et al. (

2013) using Korean listed company data, demonstrating that the signaling value of sustainable tax strategies holds across different institutional contexts.

Park et al. (

2015) provided additional evidence that sustainable tax strategies have positive relationships with accounting transparency in Korean firms, further validating the governance-transparency-tax strategy nexus in emerging market contexts.

These studies collectively establish that sustainable tax strategies serve as multi-dimensional signals conveying information about cash flow predictability, internal control effectiveness, risk management capabilities, and long-term strategic orientation.

2.3. Research Gap and Theoretical Positioning

Despite the valuable insights from prior research, three important gaps remain. First, while

McGuire et al. (

2013) demonstrated that sustainable tax strategies are associated with earnings persistence, they did not examine the specific economic decisions (e.g., capital investment) through which this persistence is achieved.

Second, Korean studies have analyzed either the tax strategy-investment link (

Kim & Ma, 2018) or the investment-firm value link (

Park et al., 2015) in isolation, without integrating these relationships into a unified framework.

Third, methodologically, most prior studies rely on OLS estimation, which may suffer from endogeneity bias due to reverse causality or omitted variables.

This study addresses these gaps by (1) empirically testing a complete mediation model where sustainable tax strategies influence firm value through enhanced investment scale; (2) applying rigorous 2SLS methodology to establish causal relationships; and (3) providing context-specific evidence from Korea’s distinctive institutional environment. By doing so, we contribute to both signaling theory and sustainable tax strategy literature by demonstrating that investment decisions serve as the critical transmission mechanism linking tax strategy consistency to value creation.

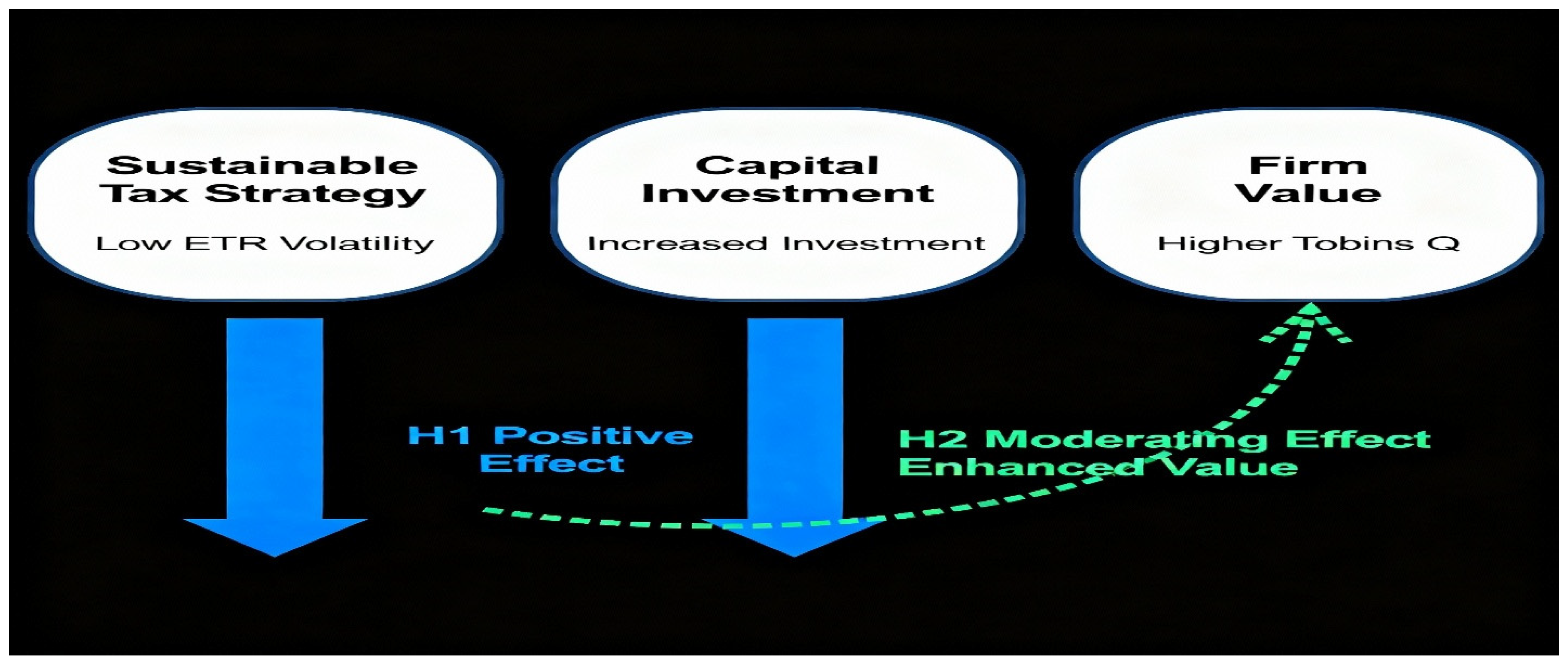

2.4. Hypothesis Development

Hypothesis 1. Companies with lower effective tax rate volatility (sustainable tax strategies) will likely have larger investment scales than those with higher volatility.

Drake et al. (

2019) showed that tax volatility moderates the positive evaluation of tax avoidance, suggesting investors value stability over mere tax minimization. Combining this with

McGuire et al. (

2013) persistence effect, we expect that investments by firms with sustainable tax strategies act as more credible signals, enhancing firm value.

Hypothesis 2. Investments in companies with low corporate tax rate volatility will have a more positive impact on corporate value.

Building on signaling theory and

McGuire et al.’s (

2013) persistence signal concept, we posit that sustainable tax strategies reduce tax risk and enhance cash flow predictability, enabling larger investment scales.

Jacob et al. (

2022) demonstrated that high tax volatility delays capital investments (see

Figure 1).

3. Research Methodology

To address potential endogeneity concerns arising from reverse causality and omitted variable bias, we employ a Two-Stage Least Squares (2SLS) regression approach. We use the contemporaneous cash effective tax rate (CashETR) as the instrumental variable for the endogenous variable CashETR_CV (the coefficient of variation of cash effective tax rates).

The instrumental variable satisfies the relevance condition as CashETR is directly incorporated in the calculation of CashETR_CV over the five-year period. The exclusion restriction is theoretically justified by signaling theory: while the level of tax rate in a given year (CashETR) may reflect various short-term factors, investment decisions and firm value are influenced specifically by the consistency and predictability of tax strategies (CashETR_CV), as this signals management’s systematic risk management capabilities to external stakeholders (

McGuire et al., 2013). The first-stage F-statistics (72.46 for Hypothesis 1 and 28.80 for Hypothesis 2) substantially exceed the conventional threshold of 10, confirming the strength of our instrumental variable.

Hypothesis 1 Research Model

Hypothesis 2 Research Model

3.1. Definition and Measurement of Key Variables

Hypothesis 1 The investment scale, used as the dependent variable, was measured by taking the logarithm of the sum of cash flows from the acquisition of tangible assets and intangible assets within the cash flows from investing activities in the statement of cash flows, as defined by

Seo and Kim (

2024).

This creates a limitation where the actual investment amount cannot be measured at the point of investment. Therefore, this study aims to enhance research reliability by measuring CAPEX as the amount expended on tangible and intangible assets at the point of investment expenditure, not at the asset acquisition point.

Hypothesis 2 Firm value, used as the dependent variable, was measured by dividing the sum of common equity market value and book debt by total assets, following the method defined by

Chung and Pruitt (

1994). Tobin’s Q indicates how efficiently a company creates value with its current assets. A high Q value is interpreted as a signal that management is operating in a direction that enhances shareholder value, while a low Q value is judged as inefficient capital use. This makes it suitable for this paper based on signalling theory.

The variable of interest, sustainable tax strategy, uses sustainable tax strategy, as defined by

McGuire et al. (

2013). We acknowledge that sustainable tax strategy in a broader ESG context encompasses multiple dimensions including transparency, governance, ethical practices, and social responsibility. However, this study focuses specifically on the stability/predictability dimension of sustainable tax strategy, measured through cash effective tax rate volatility, for the following theoretical and empirical reasons.

First, from a signaling theory perspective, tax rate stability serves as a credible, observable, and verifiable signal to external stakeholders about management’s risk management capabilities and long-term strategic orientation (

McGuire et al., 2013). Unlike voluntary disclosures or subjective ESG ratings, tax rate volatility can be objectively calculated from mandatory financial statements, ensuring comparability across firms and resistance to manipulation.

Second, our research focus is on the investment decision mechanism through which tax strategy affects firm value. Tax rate stability directly signals cash flow predictability, which is a primary determinant of capital budgeting decisions, making it the most relevant dimension for our research question.

Sustainable tax strategy was measured by multiplying the coefficient of variation of the cash effective tax rate over the five-year period from year T-4 to year T by (−1). Multiplying the coefficient of variation by (−1) allows for an intuitive confirmation of the impact on investment, scale, and firm value, as the volatility of the effective corporate tax rate decreases.

3.2. Data

This study obtained financial data from companies listed on the KOSPI market, using massive data provided by ValueSearch. The sample comprised 4188 companies listed on the KOSPI from 2010 to 2023 that had no accumulated losses and operated on a December fiscal year-end. From this group, 382 companies classified under the Korean Standard Industrial Classification (KSIC) medium-level categories of “Financial Services” and “Financial and Insurance Services” were excluded, along with 46 companies belonging to industries with fewer than 10 companies per year, based on the annual medium-level classification. Finally, 639 corporations lacking five consecutive years of cash payment data were excluded, finalising the sample at 3121 corporations.

Table 1 shows the overall sample selection criteria, and

Table 2 details the sample distribution by year and industry.

3.3. Descriptive Statistics and Correlation Analysis

Table 3 presents the descriptive statistics for the variables used in the Ordinary Least Squares (OLS) multiple regression analysis and the Two-Stage Least Squares (2SLS) regression, to test the hypotheses of this study. The total sample size is 3121. To control for the influence of extreme values, Winsorization was applied to the top and bottom 1% of all continuous probability variables, excluding dummy variables. Hypothesis 1 The dependent variable, investment scale, was measured using CapEx (Capital Expenditure) as a proxy. CapEx is defined as the actual amount spent on investments, and was calculated by taking the log of the sum of cash outflows for the acquisition of tangible assets and intangible assets from the cash flow statement’s investing activities.

As a proxy for the sustainability tax strategy measure, used as a variable of interest, sustainable tax strategy, as defined by

McGuire et al. (

2013), was employed. Sustainable tax strategy was measured as the coefficient of variation of the cash effective tax rate over the five-year period from year T-4 to year T, multiplied by (−1).

Among the control variables, company size (Size) was measured using the log of assets. The debt ratio (LEV) was measured by dividing total debt book value by total assets. The cash flow from operations (CFO) was measured by dividing the cash flow from operations shown on the cash flow statement by total assets. Return on Assets (ROA) was measured by dividing net income from the income statement by total assets. The dummy variable for whether the company was audited by a Big Four accounting firm (BIG4) was measured as 1 if the company received an external audit from PwC, KPMG, Deloitte, or Ernst & Young, and 0 otherwise. Listing duration (AGE) was measured as the log value of the period a company has been listed on the stock exchange. Sales were measured using the log value of company sales.

Table 4 presents the Pearson coefficients between variables. Analysis results indicate a statistically significant positive (+) correlation at the 1% level between the dependent variable in Hypothesis 1 capital expenditures (CapEx), a proxy for investment scale and the variable of interest, Sustainable tax strategy. Variables mentioned in prior research as influencing CapEx firm size (Size), debt ratio (LEV), operating cash flow ratio (OFC), return on assets (ROA), the Big Four audit dummy variable (BIG4), and sales (Sales) showed statistically significant positive (+) correlations at the 1% level.

Hypothesis 2 A statistically significant positive (+) correlation at the 1% level was found between the dependent variable, Tobin’s Q (a proxy for firm value), and the variables of interest: Capital Expenditures (CapEx) and Sustainable tax strategy. LEV, CFO, ROA, BIG4 audit dummy variable, and Sales showed statistically significant positive (+) correlations at the 1% level. The SIZE variable showed a statistically significant negative (−) correlation at the 1% level.

4. Empirical Analysis

4.1. Hypothesis 1 Empirical Analysis Results

Hypothesis 1 states that firms with lower effective tax rate volatility will have larger investment scales than those without such volatility. To test this hypothesis, capital expenditures (CapEx) were used as a proxy for the dependent variable, investment scale, and sustainable tax strategy, as defined by

McGuire et al. (

2013), was used as the variable of interest.

Table 5 presents the empirical analysis results for Hypothesis 1. The regression coefficient value for A-1, sustainable tax strategy, was 0.19, statistically significant at the 1% level. To test for endogeneity, a Two-Stage Least Squares Regression was conducted, yielding the A-2 result. The regression coefficient value for A-2 Sustainable tax strategy was 4.21, which was statistically significant at the 1% level. This implies that companies with low corporate tax rate volatility can experience a significantly greater increase in capital expenditures (CapEx) compared to those without such volatility. In other words, the high predictability of cash flow achieved through a sustainable tax strategy suggests it can facilitate companies’ establishment of stable investment plans for the future.

Both Ordinary Least Squares Regression and Two-Stage Least Squares Regression results indicate a significant impact on investment expansion. This confirms that sustainable tax strategies can substantially influence real economic decisions, such as capital expenditures aimed at enhancing future corporate value, rather than merely increasing retained earnings within the company. These findings align with prior research, including

Jacob et al. (

2022).

4.2. Hypothesis 2 Empirical Analysis Results

Hypothesis 2 aims to determine whether increased investment in firms with low corporate tax rate volatility has a more positive impact on firm value. To this end, Tobin’s Q was used as a proxy for the dependent variable, firm value, and the interaction term Sustainable tax strategy × CapEx was employed as the variable of interest.

Table 5 presents the empirical analysis results for Hypothesis 2. The regression coefficient value for B-1, Sustainable tax strategy × CapEx, was 0.02, statistically significant at the 1% level. B-2 shows the results from the Two-Stage Least Squares regression conducted for endogeneity testing. The regression coefficient value for B-2 Sustainable tax strategy × CapEx was 0.01, statistically significant at the 1% level, consistent with the B-1 result. This suggests that companies with low corporate tax rate volatility can accelerate corporate value growth more effectively by increasing investment through systematic investment planning.

Both Ordinary Least Squares regression and Two-Stage Least Squares regression indicate that expanding investment scale in companies with low effective tax rate volatility significantly impacts corporate value growth (see

Table 6). This suggests that companies establishing sustainable tax strategies will implement high-level internal controls and risk management to proactively prepare not only for tax risks, but also for financial and non-financial risks. This signalling effect can enhance the trust of external information users in the company, potentially attracting more investment and serving as a driving force for corporate growth. These results align with those of prior studies, such as

Neuman et al. (

2013) and

Drake et al. (

2019).

4.3. Economic Significance and Managerial Implications

Investment Impact (Hypothesis 1): The 2SLS coefficient of 4.21 indicates that a one-standard-deviation improvement in Sustainable tax strategy (ΔCashETR_CV = 0.33) is associated with approximately 1.39-unit increase in log (CapEx). For a median-sized firm in our sample with approximately 48 billion KRW in total assets and assuming a typical capital investment ratio of 5%, this represents an additional 3.4–4.8 billion KRW in annual capital investment. This magnitude is economically substantial, comparable to the investment effects of major governance reforms and sufficient to fund significant strategic initiatives such as new production facilities, R&D centers, or digital transformation projects.

Firm Value Impact (Hypothesis 2): The interaction coefficient of 0.01 indicates that sustainable tax strategy enhances the value-relevance of capital expenditures. Specifically, a one-standard-deviation improvement in tax sustainability increases Tobin’s Q by approximately 0.077 points (6.2% from the sample mean of 1.251). For a firm with median market capitalization of 500 billion KRW, this translates to approximately 31 billion KRW increase in market value. This effect size is confirming that sustainable tax strategy is a material value driver.

These findings have direct implications for corporate executives. Chief Financial Officers should prioritize consistency and predictability in tax planning over aggressive short-term tax minimization. A stable effective tax rate—achieved through disciplined tax governance, prudent use of tax incentives, and avoidance of high-risk tax strategies—signals superior management quality to investors and creditors, thereby reducing information asymmetry, lowering the cost of capital, and facilitating larger-scale strategic investments that enhance long-term firm value.

4.4. Robustness Tests and Diagnostic Analyses

4.4.1. Multicollinearity Diagnostics

To ensure that our regression estimates are not biased by multicollinearity, we calculated Variance Inflation Factors (VIFs) for all independent variables. The results indicate no serious multicollinearity concerns. Our primary independent variable (CashETR_CV) has a VIF of 1.27, and the interaction term (CashETR_CV × CapEx) has a VIF of 1.19—both well below the conservative threshold of 5.0. Among control variables All control variables have VIF values below 10.0, confirming that multicollinearity does not threaten the validity of our coefficient estimates.

4.4.2. Alternative Dependent Variables

To verify that our findings are not sensitive to the specific measure of firm value, we re-estimated Hypothesis 2 using two alternative dependent variables: Market-to-Book Ratio (MTB) and Market Value Added (MVA)

Using MTB as the dependent variable, the 2SLS interaction coefficient remains positive and significant (p = 0.0344), with an adjusted R2 of 0.355. Similarly, with MVA as the dependent variable, the interaction term coefficient is 0.0126 (p = 0.0344), also significant at the 5% level. These results are highly consistent with our main findings using Tobin’s Q (p = 0.0033).

The stability of coefficient magnitude, sign, and statistical significance across three different firm value measures provides strong evidence that our findings are not an artifact of dependent variable choice. The positive moderating effect of sustainable tax strategy on the investment-value relationship is robust across multiple operationalizations of firm value.

While our main analysis includes industry fixed effects (41 industry dummies) to control for systematic industry differences

5. Conclusions

This study examined how sustainable tax strategies influence firm value through investment decisions, analyzing 3121 Korean firm-year observations using signaling theory and Two-Stage Least Squares methodology. Our empirical analysis reveals a complete two-stage mechanism with substantial economic significance. These effects remain robust across alternative firm value measures including Market-to-Book Ratio and Market Value Added, and VIF diagnostics confirm no multicollinearity concerns.

Our findings extend signaling theory by demonstrating that investment serves as the critical mediating mechanism through which tax strategy signals convert into firm value. Unlike prior studies focusing on direct tax-performance relationships, we trace the specific economic pathway sustainable tax strategies enhance cash flow predictability, which enables larger investment scales, which in turn improve investment efficiency, ultimately increasing firm value. This complete mechanism has not been documented in prior literature.

For corporate executives, these results carry direct implications. Chief Financial Officers should prioritize consistency over tax-minimization in tax planning. We recommend establishing 5-year tax strategy roadmaps targeting annual ETR variation within ±5 percentage points, integrating tax risk management into enterprise frameworks, and enhancing voluntary tax transparency disclosures to signal commitment to stakeholders.

Our findings also provide measurable pathways linking sustainable tax strategies to UN Sustainable Development Goals. For SDG 8 (Decent Work and Economic Growth), the 14–20% investment increase translates to 1.2–2.0 direct jobs per firm using Bank of Korea employment multipliers, aggregating to 3700–6200 jobs across our sample and contributing 0.09–0.12% to GDP growth. For SDG 9 (Industry, Innovation, Infrastructure), enhanced cash flow predictability enables long-term commitments of approximately 600–800 million krw per firm in innovation-related investment annually. Manufacturing and construction firms, comprising 70.65% of our sample, contribute significantly to resilient infrastructure development through tangible CapEx. For SDG 12 (Responsible Consumption and Production), the 6.2% market value premium demonstrates that investors reward responsible financial practices, creating strong economic incentives for efficient resource allocation.

However, our study has limitations. Our sustainable tax strategy measure focuses on stability and predictability through ETR volatility but does not capture broader dimensions such as tax transparency, governance quality, or ethical practices. Future research should develop multidimensional indices incorporating voluntary disclosure quality, board oversight of tax strategy, and avoidance of tax havens. Additionally, our Korean focus limits generalizability; future studies should examine whether effects vary across institutional contexts, particularly in developing economies where SDG challenges are most acute.

Author Contributions

Conceptualization, K.-J.B.; Methodology, K.-J.B.; Software, K.-J.B.; Validation, Y.-J.Y.; Formal analysis, K.-J.B.; Investigation, K.-J.B.; Resources, Y.-J.Y.; Data curation, Y.-J.Y.; Writing original draft, K.-J.B.; Writing review & editing, Y.-J.Y.; Visualization, Y.-J.Y.; Supervision, Y.-J.Y.; Project administration, Y.-J.Y.; Funding acquisition, Y.-J.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aydoğmuş, M., Gülay, G., & Ergun, K. (2022). Impact of ESG performance on firm value and profitability. Borsa Istanbul Review, 22(6), S119–S127. [Google Scholar] [CrossRef]

- Chung, K. H., & Pruitt, S. W. (1994). A simple approximation of Tobin’s Q. Financial Management, 23(3), 70–74. [Google Scholar] [CrossRef]

- Desai, M. A., & Dharmapala, D. (2006). Corporate tax avoidance and high-powered incentives. Journal of Financial Economics, 79(1), 145–179. [Google Scholar] [CrossRef]

- Desai, R. (2025). Statutory ESG reporting and investment efficiency: Evidence from India. International Journal of Law and Management, 67(2), 234–251. [Google Scholar] [CrossRef]

- Drake, K. D., Lusch, S. J., & Stekelberg, J. (2019). Does tax risk affect investor valuation of tax avoidance? Journal of Accounting, Auditing & Finance, 34(1), 151–176. [Google Scholar] [CrossRef]

- Fields, T. D., Lys, T. Z., & Vincent, L. (2001). Empirical research on accounting choice. Journal of Accounting and Economics, 31(1–3), 255–307. [Google Scholar] [CrossRef]

- Fu, T., & Li, J. (2023). An empirical analysis of the impact of ESG on financial performance: The moderating role of digital transformation. Frontiers in Environmental Science, 11, 1256052. [Google Scholar] [CrossRef]

- Hanlon, M. (2005). The persistence and pricing of earnings, accruals, and cash flows when firms have large book-tax differences. The Accounting Review, 80(1), 137–166. [Google Scholar] [CrossRef]

- Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of Accounting and Economics, 50(2–3), 127–178. [Google Scholar] [CrossRef]

- Hope, O. K., Ma, M. S., & Thomas, W. B. (2013). Tax avoidance and geographic earnings disclosure. Journal of Accounting and Economics, 56(2–3), 170–189. [Google Scholar] [CrossRef]

- Jacob, M., Rohlfing-Bastian, A., & Sandner, K. (2022). Why do not all tax-efficient firms invest efficiently? Journal of Financial Economics, 145(2), 513–534. [Google Scholar] [CrossRef]

- Kim, W. Y., & Ma, H. Y. (2018). The effect of tax strategy sustainability on corporate investment. Review of Accounting and Policy Studies, 23(3), 65–91. Available online: https://kiss-kstudy-com-ssl.lib.jejunu.ac.kr/Detail/Ar?key=3886331 (accessed on 13 November 2025).

- Li, W., Zhu, J., & Liu, C. (2024). Environmental, social, and governance performance, financing constraints, and corporate investment efficiency: Empirical evidence from China. Heliyon, 10(22), e40401. [Google Scholar] [CrossRef]

- McGuire, S. T., Omer, T. C., & Sharp, N. Y. (2012). The impact of religion on financial reporting irregularities. The Accounting Review, 87(2), 645–673. [Google Scholar] [CrossRef]

- McGuire, S. T., Omer, T. C., & Sharp, N. Y. (2013). Sustainable tax strategies and earnings persistence. SSRN. [Google Scholar] [CrossRef]

- Myers, S. C. (1989). Financing decisions when firms have investment information that investors do not. NBER Working Paper Series, No. 2968. National Bureau of Economic Research. [Google Scholar]

- Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187–221. [Google Scholar] [CrossRef]

- Neuman, S. S., Omer, T. C., & Schmidt, A. P. (2013). Assessing tax risk: Practitioner perspectives. Working Paper. University of Akron. [Google Scholar]

- Park, J. K., Hong, Y. E., & Lee, M. Y. (2015). Sustainable tax avoidance and accounting transparency. Tax Accounting Research, 44, 85–103. Available online: https://kiss-kstudy-com-ssl.lib.jejunu.ac.kr/Detail/Ar?key=3342642 (accessed on 13 November 2025). [CrossRef]

- Ross, S. A. (1977). The determination of financial structure: The incentive-signalling approach. The Bell Journal of Economics, 8(1), 23–40. [Google Scholar] [CrossRef]

- Seo, B.-S., & Kim, K.-S. (2024). The impact of agency costs on tax avoidance, investment, and firm value. Korean Journal of Taxation and Accounting, 25(6), 101–131. [Google Scholar] [CrossRef]

- Spence, M. (1973). Job market signaling. The Quarterly Journal of Economics, 87(3), 355–374. [Google Scholar] [CrossRef]

- Xu, N., Jiang, X., & Yang, M. (2017). Corporate tax planning and investment efficiency. China Journal of Accounting Research, 10(4), 311–329. [Google Scholar] [CrossRef]

- Zhang, L.-S. (2025). The impact of ESG performance on the financial performance of companies: Evidence from China’s Shanghai and Shenzhen A-share listed companies. Frontiers in Environmental Science, 13, 1507151. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).